- 1School of Economics and Trade, Changzhou Vocational Institute of Textile and Garment, Changzhou, China

- 2School of Port and Shipping Management, Guangzhou Maritime University, Guangzhou, China

- 3Business School, Hohai University, Nanjing, China

The rapid growth of the renewable energy industry provides essential opportunities for China to achieve the goal of carbon peaking and carbon neutrality. A rising number of renewable energy companies are positively embracing digital transformation in the digital age. However, the relationship between digital transformation and the performance of renewable energy companies remains unclear. To fill this gap, leveraging the latest advances in textual analysis, we quantify the extent of a renewable energy enterprise’s digital transformation. Meanwhile, based on fixed effect model and mediating effect model, we investigate the influence of digital transformation on firm performance using a panel data of Chinese A-share listed renewable energy companies. The results indicate that digital transformation enhances a renewable energy enterprise’s performance. Further, the promotion effect of digital transformation is greater among state-owned enterprises and large firms and is only helpful for firms in the eastern area. Moreover, we document that when a renewable energy enterprise adopts digital transformation, it has higher operating efficiency, lower cost, and better innovation success resulting in better performance. This research elucidates the role of digital transformation in forwarding the development of renewable energy companies and bears significant policy implications.

1 Introduction

China, the world’s second largest economy, has experienced phenomenal economic growth over the last four decades. Nevertheless, this growth has come at the cost of massive factor inputs and high energy consumption, leading to increasing environmental pollution and a worsening energy crisis (Jalil and Feridun, 2011; Lin and Moubarak M, 2014). China’s energy consumption increased from 489.5 million tons of standard coal in 1981 to 5.24 billion tons in 2021 (China Bureau of Statistics, 2022). Furthermore, with a score of 28.4 in the 2022 World Environmental Performance Index, China ranks 160th among 180 countries and regions (Yale Center for Environmental Law & Policy and Center for International Earth Science Information Network, 2022). In addition, China’s CO2 emissions reached 10.523 billion tons, ranking first in the world (China Bureau of Statistics, 2022). Accordingly, China is facing not only a severe conflict between energy supply and demand but also environmental degradation and national security issues (Ji and Zhang, 2019; Ren et al., 2021). Promoting the energy structure transition and achieving energy conservation and emission reduction are now essential to China’s sustainable development strategy (Hao et al., 2018).

In 2020, China has announced to the world the goal of achieving carbon peaking by 2030 and carbon neutrality by 2060, which has been included in the overall construction of an ecological civilization. By changing the coal-based energy structure, advancing the energy transition and promoting the widespread use of renewable energy, the promise of energy conservation and emission reduction will be easy to achieve. Accelerating the growth of renewable energy industry is a crucial part of the world’s energy structure transformation and a critical path to achieving the global carbon neutrality target (Sheikh, 2010; Park et al., 2014; Shrestha, 2022). Moreover, industrial innovation and technological progress based on renewable energy have become significant drivers of global economic growth, and the focus of international competition will shift to control the value chain of low-carbon technologies represented by renewable energy (Ostergaard, 2022). China is vigorously promoting the strategic adjustment of its energy structure, actively developing renewable energy resources such as wind, solar, and hydro, and accelerating the cultivation of modern energy industries. In 2021, the total amount of renewable energy utilized in China reached 750 million tons of standard coal, accounting for 14.2% of total primary energy consumption (China Power Construction Group, 2022). The renewable energy industry’s rapid growth can contribute to constructing a clean, low-carbon, safe and efficient energy system in China.

As the leader of the renewable energy industry, listed companies have a critical mission to drive general enterprises to increase production and generate income, increase investment in renewable energy and enhance the healthy growth of the renewable energy industry. Meanwhile, their performance level represents the reality and growth prospects of the renewable energy industry. Considering the renewable energy industry’s strategic importance and development limitations, researchers have also performed an in-depth study on its driving forces, such as innovation, infrastructure, and economic and social factors (Gabriel et al., 2016; Wang et al., 2020; Accenture, 2021). Because of the deep technological and market adjustments brought about by the advent of the digital economy, more and more Chinese firms are adopting advanced digital technologies to encourage organizational optimization and accelerate innovation in products and services, thus creating new dynamics for China’s economic expansion (Wang et al., 2020). As digital technologies continue to be integrated into services and products, digital transformation (DT) has emerged as a major trend, attracting the interest of scholars and practitioners (Ritter and Pedersen, 2020). The existing literature refers to digital transformation as the use of digital technologies in production, innovation, or digital planning to provide economic benefits for a company (Singh et al., 2021; Verhoef et al., 2021). In China, digital transformation has become a strategic option for firms to create sustainable competitive strength and enhance corporate performance (Shrestha, 2022). In 2021, there were over 1,000 listed enterprises with the digital economy as the primary sector, with listed digital companies spanning almost all industries (China Listed Companies Association, 2022). An important survey believes that a tipping point will be reached if the share of renewable energy reaches 20%–30%. At this point, the model of relying on investment in core and ancillary elements to drive industry growth is at an unsustainable inflection point, requiring a breakthrough to the digital scene for sustained transformation (Accenture, 2021). Accordingly, digital technology should be integrated into the entire development process of renewable energy companies to completely fulfill their digital transformation strategy, thus enhancing renewable energy companies’ performance (Gabriel et al., 2016).

Local governments in China have been updating and enhancing their policies to provide sufficient support for renewable energy firms’ digital transformation. However, at the micro level, the majority of these transformations are only superficial, with a digital transformation strategy not penetrating enough to the system and business levels. Thus, it is unclear whether it would provide satisfactory returns to firms and increase enterprise value. In 2021, only 16% of firms were able to leverage digital transformation to achieve some economic benefits (Moretti and Biancardi, 2020). Moreover, theoretical studies have different views on this issue. Some scholars have demonstrated the significant impact of digital transformation on corporate performance (Nwankpa and Datta, 2017; Buttice et al., 2020; Andriushchenko el al, 2021; Shah et al., 2021; Taques et al., 2021). Specifically, through theoretical and empirical research, some scholars have argued that digital transformation may enhance corporate performance by boosting operating efficiency, decreasing costs, fostering innovation, and utilizing the internet of things (Yoo and Boland, 2012; Kaur and Sood, 2017; Galindo-Martín et al., 2019; Horvath and Rabetino, 2019; Ode and Ayavoo, 2020). In addition, several studies have discussed the effectiveness of digital transformation in driving corporate benefits, productivity, and market competitiveness (Bharadwaj, 2013; Nambisan, 2017; Kraus et al., 2021). Conversely, it has been suggested in the literature that digital transformation inhibits the improvement of corporate performance (Nwankpa and Datta, 2017; Buttice el al, 2020; Shah et al., 2021). Nevertheless, there are few studies on how digital transformation influences the performance of renewable energy companies. Consequently, one critical issue arises: has digital transformation contributed to the performance of Chinese renewable energy companies in the new digital economy?

The goal of this research is to examine the effects of a renewable energy enterprise’s digital transformation on the performance. We conduct a textual analysis of a renewable energy enterprise’s annual report and use this information to quantify the extent of its digital transformation. Then, we use Chinese A-share listed renewable energy firms as the research sample in our analysis. China is a developing market, and the economic consequences of Chinese renewable energy companies’ digital transformation practices provide valuable insights for other developing markets undergoing similar digital transformation strategies. Our results reveal that digital transformation adds to the improvement of renewable energy companies’ performance. The findings are robust to alternative explained variables (return on assets (ROA) or return on equity (ROE)). Different firms in the whole sample respond differently to digital transformation strategy, depending on ownership, scale, and location. Specifically, digital transformation has given an incredible boost to the performance of state-owned enterprises (SOEs) and large firms, whereas this boost is only significant for firms in the eastern region. Furthermore, in line with predictions, we find that when a renewable energy enterprise undergoes digital transformation, it has great operational efficiency, reduced costs, and enhanced innovation resulting in higher performance.

We make three contributions. First, this research presents a fresh perspective for investigating the correlation between digital transformation and renewable energy companies’ performance. Digital transformation is based on a new generation of digital technologies, with connectivity as a foundation, value unlocking as a goal, and data empowerment as a primary line of action, and has a catalytic effect on the improvement of enterprise performance (Zhai et al., 2022). The textual analysis method is used to search, identify, match and aggregate the keywords of a firm’s digital transformation adoption, providing a useful reference for evaluating a renewable energy enterprise’s digital transformation. Thus, using firm-level data, we explore the influence of digital transformation on a renewable energy firm’s ROA and ROE based on textual analysis. More importantly, our research on the crucial impact of digital transformation on renewable energy companies’ performance is more relevant and feasible than universal corporate performance research.

Second, this study helps understand whether digital transformation affects renewable energy companies’ performance differently across ownership types, regions, and scales. Differences in the operating characteristics of SOEs and private-owned enterprises (POEs), differences in the competitive environment and investment strategies of large and small firms, and the heterogeneity of China’s regional growth have crucial implications for corporate performance (Child and Tse, Int. Bus. Stud, 2001, 32, 5–21; Clarysse et al., Res. Pol, 2009, 38 (10), 1,517–1,533; Haider, J. Int. Financ. Mark. Inst. Money, 2018, 53, 76–93). This paper extends the existing literature to reveal the correlation between digital transformation and renewable energy companies’ performance.

Third, from the perspectives of operating efficiency, cost, and innovation, our study is dedicated to investigating the transmission mechanisms of digital transformation affecting a renewable energy firm’s performance. The findings can provide insights for government policies to promote the digital transformation of renewable energy firms, thereby promoting corporate performance and achieving the healthy growth of the renewable energy sector.

The rest of the research is organized as follows: Section 2 reviews the relevant literature and develops our hypotheses. Section 3 documents the data and research design. Section 4 provides the empirical results and discussion. Section 5 is the conclusions and policy implications.

2 Literature review and hypotheses development

2.1 Literature review

There is no consensus on the definition of digital transformation in academic circles (Peng and Tao, 2022). These definitions highlight the different characteristics of digital transformation (Vial, 2019). Agarwal et al. (2010) described it as an information technology application and its advantages and effects. Fitzgerald et al. (2014) defined it as using digital technologies to achieve significant business advancements, including optimizing operational processes, improving customer experience or developing new business models. Piccinini et al. (2015) and Majchrzak et al. (2016) described it in a similar way to Fitzgerald et al. (2014). Reis and Amorim (2018) stated that digital transformation was the use of digital technologies to achieve the business transformation, thus improving life quality of users. Matt et al. (2015) stated that strategic change was at the heart of digital transformation. Mergel et al. (2019) defined it as the requirement to be more competitive in the internet era by delivering goods and services online and offline using new technologies. Galindo-Martín et al. (2019) described it as using more digital technologies to improve a firm’s operational efficiency. In this research, we follow the digital transformation definition of Fitzgerald et al. (2014) and argue that the digital transformation of renewable energy companies is open, shared, collaborative and adaptable, focusing on how it can benefit a firm. Furthermore, this description is in line with current research on digital transformation, which refers to the application of cutting-edge digital technologies in operational management, business model innovation, and corporate strategy to improve enterprise performance.

Studies on whether digital transformation improves enterprise performance may provide a reference for exploring the correlation between digital transformation and renewable energy companies’ performance, and the conclusions also differ. Some scholars hold a positive opinion on this issue based on qualitative and quantitative analyses (Andriushchenko et al., 2020; Moretti and Biancardi, 2020; Taques et al., 2021). Meanwhile, it has been demonstrated that digital transformation brings more significant benefits, productivity, and competitiveness (Bharadwaj, 2013; Nambisan, 2017; Kraus et al., 2021). Moreover, digital transformation can improve enterprise performance by improving the operation ability, reducing operating costs, stimulating innovative motivation, and leveraging the architecture of the internet of things (Yoo and Boland, 2012; Kaur and Sood, 2017; Galindo-Martín et al., 2019; Horvath and Rabetino, 2019; Ode and Ayayvoo, 2020). Conversely, some studies have suggested that digital transformation could impede corporate performance (Nwankpa and Datta, 2017; Buttice et al., 2020; Shah et al., 2021). Buttice et al. (2020) argued that firms’ performance would be reduced to a certain extent if there were cognitive errors in digital technology. Shah et al. (2021) demonstrated that firms’ digital transformation could create market monopolies and reduce market competitiveness. It is also argued that the use of traditional digital technology did not affect enterprise performance (2018). In addition, the correlation between digital transformation and innovative performance has attracted a lot of attention from scholars. Bloom et al. (2013) proposed that digital technology might stimulate innovation by encouraging enterprises to spend less on obtaining knowledge and information and by improving the flow of internal resource elements. Paunov and Rollo (2016) examined the knowledge spillover impact of the Internet and came to the conclusion that it could make firms much more productive and innovative.

The literature implies that digital transformation can enhance corporate performance. However, the evidence is insufficient because of the one-sided research on corporate digital transformation in the literature. Meanwhile, existing research seldom analyzes the digital transformation of renewable energy firms and the mechanisms underlying its impact on enterprise performance. Therefore, there is still room to explore how digital transformation influences the performance of renewable energy companies.

2.2 Hypotheses development

We propose that if a renewable energy enterprise adopts digital transformation strategy, its performance is higher than a firm that does not for the following reasons. First, compared to information technology, digital transformation is convergent, leapfrogging, innovative, and environment-dependent (Sousa and Rocha, 2019). If a renewable energy enterprise’s business strategy chooses digital transformation, this firm seeks to enhance corporate performance by integrating various digital technologies into the operations, thus improving quality management capabilities and meeting customized needs (Hakala, 2011). In other words, a renewable energy enterprise adopting digital transformation strategy can maximize its corporate value.

Second, the critical features of digital technology include openness and sharing. As digital technology continues to permeate the daily operations of firms, the aim of digital transformation is gradually shifting towards minimizing the information asymmetry between demand and supply, thereby facilitating cost-cutting in renewable energy companies. Moreover, digital transformation can facilitate internal communication, including enhanced communication between managers and shareholders, managers and employees, and employees and among employees, reducing unneeded frictions in the process of production and management and enhancing firms’ overall operational efficiency (Lerenzo et al., 2019). In addition, enhancing digital transformation contributes to accumulating vast innovation potential, generating a virtuous cycle of technical and organizational change and enhancing corporate performance.

Third, digital transformation may assist renewable energy companies in constructing a new network. Overall, digital transformation can reduce organizational impediments (Lyytinen et al., Y. Inf. Syst. J, 2016, 261), 47–75). Thus, a firm bolstered by digital transformation strengthens access to new types of information and technology and, consequently, to more relevant information and guidance for technical innovation and market development (Corsi and Findeis, Eur. Rev. Agric. Econ, 2000, 27, 127–151; Llopis-Albert et al., 2021). Collectively, a digital transformation strategy improves operational efficiency, cost savings and innovation in a firm. As a result, a renewable energy enterprise that adopts digital transformation strategy has higher performance than one that does not. We hereby make the first assumption based on the above discussions.

Hypothesis 1. Digital transformation enhances renewable energy companies’ performance.The relative effects of barriers or drivers of business growth may vary depending on the regional growth level and the firm-related structural features such as ownership types and scales (Ayyagari et al., 2008). First, there are a variety of ownership types for firms in China (Child and Tse, 2001). Both SOEs and POEs play a crucial role in China’s economic and social advancement (Liu et al., 2008). Ownership theories mainly include social, political and agency theories (Sapienza, 2004). Specifically, in addition to maintaining the value of governmental assets, the social theory argues that SOEs have additional social responsibilities compared with POEs, such as resolving market weakness and increasing social welfare. The political theory asserts that SOEs are used by politicians to fulfill personal goals. Similar to the social view, the agency theory contends that SOEs are founded to improve social efficiency; meanwhile, it admits that SOEs have the potential to generate corruption and resource misallocation. All of them demonstrate the differences between SOEs and POEs. Moreover, scholars have argued that differences between SOEs and POEs can be found in terms of access to resources (Child and Tse, 2001), allocation (Luo et al., 2016), and the acquisition of government subsidies (Yang et al., 2015). The government’s direction in policy formulation will favor the development of SOEs; meanwhile, SOEs have more access to information on government policies and financial subsidies than private enterprises (Sheng and Song, 2013; Liu et al., 2019). Nevertheless, policy-related risks will further negatively affect the financing decisions of POEs. In addition, although banks increase the financing for the digital transformation investment of firms, they are likely to discriminate against some companies based on ownership types, allowing SOEs to leverage their natural advantages to develop digital transformation. Conversely, POEs find it hard to take advantage of outside investments, which impedes their progress toward digital transformation.Second, unlike young or small firms, large firms have more considerable assets and high profitability, and are characterized by clear development plans, standardized management systems, and strong teamwork (Haider et al., 2018). Thus, large firms are able to develop a digital mindset and are less likely to face financial obstacles in the digital transformation process. Specifically, they have sufficient resources to build digital infrastructures and cultivate independent innovation ability. Moreover, large firms have a stronger ability to dynamically adapt and innovate in terms of establishing digital management systems and overcoming critical technical challenges, allowing them to continuously improve their core competitiveness and build a sustainable competitive advantage by integrating internal and external resources and achieving interactive innovation around data, business processes, and organization. Conversely, small firms are far behind large firms in terms of capital, human resources, technology, and management, and maintaining their normal operations is the main objective of the business. Accordingly, under the pressure of fierce market competition, investment projects that can improve performance, such as the adoption of digital transformation, will be quickly eliminated in small firms (Liu et al., 2019), which results in the catalytic effect of digital transformation not being effective.Third, an essential feature of China is the uneven development across regions due to government policies, regional resource endowments, factor mobility, and the interplay among these factors (Todtling and Trippl, 2005; Clarysse et al., 2009; Buesa et al., 2010; Ren et al., 2021). Specifically, compared with the central and western areas, the eastern area is more developed, mainly in terms of infrastructural development, technological innovation, innovation environments, the intensity of government subsidies, and the industrial development environment (Clarysse et al., 2009; Min et al., 2020; Mubarak and Petraite, 2020; Wang et al., 2022). Moreover, the type and sophistication of digital technologies available to firms vary across regions (Adner et al., 2019). Considering the analysis presented above, we postulate the second hypothesis.

Hypothesis 2. Digital transformation has heterogeneous effects on the performance of renewable energy companies across firms’ ownership types, regions, and scales.Digital transformation not only includes data digitization but also a variety of new digital technologies to enhance product quality and productivity. Thus, the features of enterprise digital transformation define the mechanism by which it functions, that is, increasing operation efficiency, cutting costs and enhancing innovation to promote enterprise performance, which are reflected in better asset turnover (TURNOVER), lower cost (COST), and stronger innovation (INNOVATION), respectively. Overall, it is anticipated that firms will perform better after implementing digital transformation than before adopting it.The first is to improve renewable energy companies’ operating efficiency. The booming digital economy has given rise to digital technologies such as artificial intelligence, e-commerce, and cloud computing. These cutting-edge digital technologies can be continuously integrated into renewable energy companies’ research and development, production, and sales, thus driving widespread changes in their production methods and development models. Meanwhile, a renewable energy firm can benefit from digital transformation by articulating its business process, thus improving its resource utilization efficiency. In addition, digital transformation can facilitate communication efficiency between upstream and downstream of the industry chain, thus enhancing departmental collaboration among renewable energy companies and significantly promoting their operating efficiency.The second is to decrease renewable energy companies’ operating costs. The extensive use of digital technologies in the operations of renewable energy companies has made cost management more systematic and scientific while improving production efficiency and management quality. Thus, it helps reduce the labor and time costs of renewable energy companies’ operations and the costs of R&D, bargaining, search, and supervision.The third is to foster a culture of innovation and strengthen innovation power. First, digital transformation can provide advanced information technologies for renewable energy companies, accelerate the spread and diffusion of technologies in firms, foster a productive ecosystem for innovation, and improve the abilities of firms to digest, absorb, and apply new technologies, thus improving their innovation level. Second, through digital transformation, renewable energy companies can grasp innovative products’ latest situation in supply and demand and improve the match between technological innovation and market demand, thus reducing their R&D risk. Third, unlike closed innovation, renewable energy companies use new-generation information technologies to actively absorb external information, creating a paradigm of open innovation that blends a vast amount of innovation resources. Thus, innovation in renewable energy companies is greatly enhanced. Overall, with the continuous development of enterprise technological innovation, the factor structure of inputs and outputs and the ability to allocate resources will be improved in renewable energy companies, contributing to the improvement of corporate performance.

Hypothesis 3. Digital transformation can indirectly enhance renewable energy companies’ performance by increasing operation efficiency, cutting costs and enhancing innovation.

3 Methodology

3.1 Data

Based on the industry categorization of listed firms, this research surveys a panel data of Chinese A-share listed companies whose main business is related to the development and utilization of renewable energy. These firms’ financial information is collected from the database of China Stock Market and Accounting Research Database (CSMAR). CSMAR is one of China’s largest providers of economic data and includes precise financial data on Chinese firms. Thus, this database is suitable for our research on renewable energy companies. Considering the data availability, the criteria for selection are: 1) ST (Special Treatment, companies have suffered operating losses for two consecutive years. Risk warning) and *ST (companies’ operation losses for three consecutive years. Delisting warning) listed enterprises are excluded; 2) firms with missing financial data are deleted. Moreover, the new accounting standards started in 2007, the sample examination period is set to 2008–2021 to ensure the consistency of the caliber of financial data. Thus, our research sample has 69 renewable energy companies and 966 observations. The business scope of these companies mainly includes solar, hydro, wind, and geothermal. Table 1 shows the descriptive statistics.

3.2 Variables

3.2.1 Enterprise performance

Enterprise performance is the explained variable in this article. Drawing on the research of Hong et al. (2018), renewable companies’ performance is defined in terms of a results-based view, which considers enterprise performance as a tangible expression of business outcomes and as the ultimate goal of renewable energy corporate strategy. Instead of market-based measures like Tobin’s Q, accounting-based measures like ROA and ROE are used to represent enterprise performance. The key reason is that market-based variables are subject to investor expectations and earning manipulation by managers (Grenadier and Malenko, 2011). Moreover, accounting-based measures may more accurately represent a firm’s organizational capabilities (Hutchinson and Gul, 2004). In addition, as shown in previous studies, ROA and ROE have been extensively embraced in the literature on the performance of China’s listed companies (Jalil and Feridun, 2011; Gabriel et al., 2016). Thus, we use ROA (the ratio of net income to total assets) and ROE (the ratio of net income to shareholder equity) to measure a renewable energy enterprise’s performance.

3.2.2 Digital transformation (DT)

The studies on DT mainly stagnate in qualitative analysis, and there are insufficient quantitative analyses (Pan et al., 2022). Referring to the research of Gal et al. (2019), we measure a firm’s DT level in terms of both underlying technology and practical application.

There are three steps to collect a company’s DT information. Firstly, using Python software, we do textual analysis on the renewable energy firms’ annual reports to identify the keywords associated with DT. Specifically, we use a dictionary of 51 and 43 keywords relevant to the underlying technology and practical application for the textual analysis. Secondly, after identifying a renewable energy company’s annual report with the keywords, we use Python to count the number of distinct different digital technologies and business model innovations in a renewable energy company’s annual report. Finally, the natural logarithm of one plus the number of times “digital technologies” and “business model innovations” is used to proxy for a renewable energy company’s DT level.

3.2.3 Mediation variables

The mediating variables are TURNOVER, COST, and INNOVATION. In this paper, we contend that TURNOVER (ratio of firm’s total revenue to total assets), COST (ratio of firm’s total production cost to total revenue), and INNOVATION (natural logarithm of one plus the total number of patents held) are three transmission mechanisms for the influence of digital transformation on renewable energy companies’ performance. Specifically, TURNOVER is used to represent a renewable energy enterprise’s operating efficiency. COST is used to measure the savings from digital transformation in a renewable energy enterprise. INNOVATION is used to gauge a renewable energy enterprise’s innovation outcomes.

3.2.4 Control variables

In line with previous research (Zhai et al., 2022; Li et al., 2022), we control five variables believed to affect renewable energy companies’ performance in this research, including company size (CS), revenue growth rate (RGR), asset liquidity (AL), equity concentration (EC), and boardsize (BS). Precisely, CS is measured by the total assets at year-end. AL is defined as current assets divided by current liabilities. EC is represented by the proportion of shares held by the greatest shareholder. The number of directors in a board measures BS. In addition, we take the natural logarithm of CS and BS.

3.3 Econometric methods

This research provides a benchmark model to quantify the correlation between digital transformation and renewable energy companies’ performance (Peng and Tao, 2022; Li, 2022; Zhai et al., 2022). The specific mathematical expression is as follows:

where

To further assess the mediating effects of digital transformation on renewable energy companies’ performance from three perspectives: better asset turnover, lower cost, and stronger innovation, we use the successive test in Baron and Kenny (1986) to investigate Eq. 1 and two different equations below:

where

4 Empirical results

4.1 Baseline findings

Table 2 presents the baseline findings. In columns (1) and (2), when only the time and individual effects are fixed, the coefficients of digital transformation are significantly positive, demonstrating that a higher level of digital transformation leads to higher performance in renewable energy enterprises. From the findings in columns (3) and (4), we can infer that digital transformation continues to contribute significantly to corporate performance after adding all the control variables. In column (3), for example, the coefficient of digital transformation is 0.0412, suggesting that a one percentage point increase in the level of digital transformation increases a firm’s ROA by 0.0412 percentage points. The findings of the benchmark model support Hypothesis 1, showing that increased digital transformation will help to improve enterprise performance, which is similar to the research conclusions of Zhai et al. (2022) and Peng and Tao (2022).

4.2 Robustness checks

4.2.1 Excluding specific samples

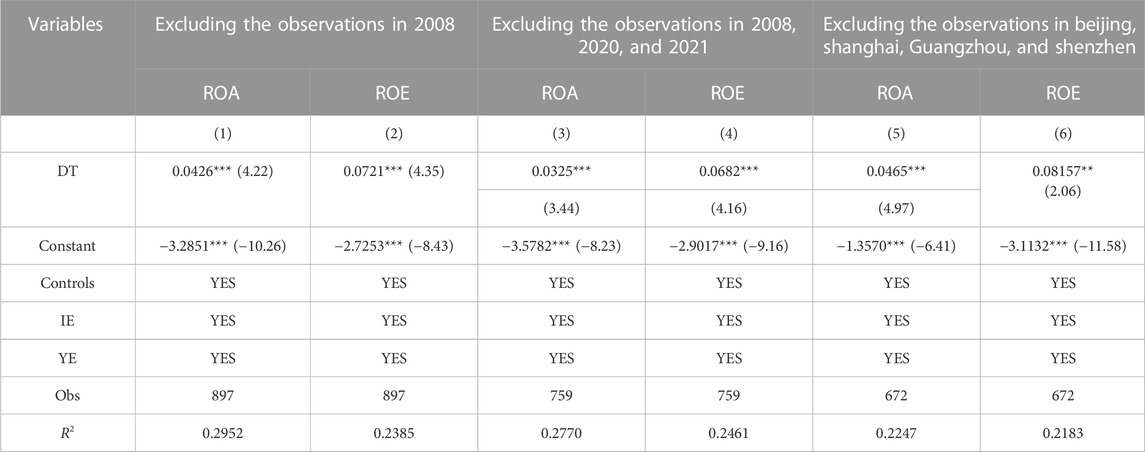

The occurrence of major financial issues may impede a firm’s digital transformation. In the past two decades, significant financial shocks have occurred overseas, with the global financial crisis in 2008 being the most influential. Thus, the sample data for 2009–2021 are preserved in the estimation for robustness. Moreover, the COVID-19 is not only a serious threat to our lives but also has a significant impact on the economic development of all sectors. Because of the ongoing influence of the COVID-19 pandemic on the renewable energy companies, observations for 2020 and 2021 are further excluded from the regression analysis in this study. Furthermore, the digital transformation of renewable energy companies is better supported in developed cities. We eliminate enterprises located in Beijing, Shanghai, Guangzhou, and Shenzhen. The findings are shown in columns (1) to (6) of Table 3. For the sake of concision, we will no longer provide the coefficients of control variables. Across all columns, the coefficients of digital transformation remain significantly positive, proving that the positive correlation between digital transformation and corporate performance is robust even when excluding specific samples.

4.2.2 Adding control variables

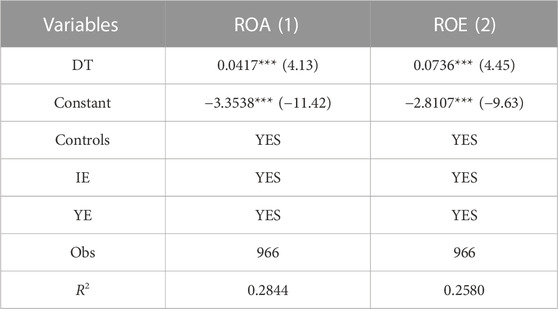

A firm’s profitability is affected directly by financial leverage (the ratio of total liabilities to total assets), while the firm’s level of innovation and vitality is somewhat influenced by its age. Therefore, this research adds the two control variables to the benchmark model to address endogeneity issues caused by missing variables. In Table 4, digital transformation still significantly drives a renewable energy enterprise’s performance. In a word, the results support the core conclusion of this paper.

4.2.3 Extending observation window

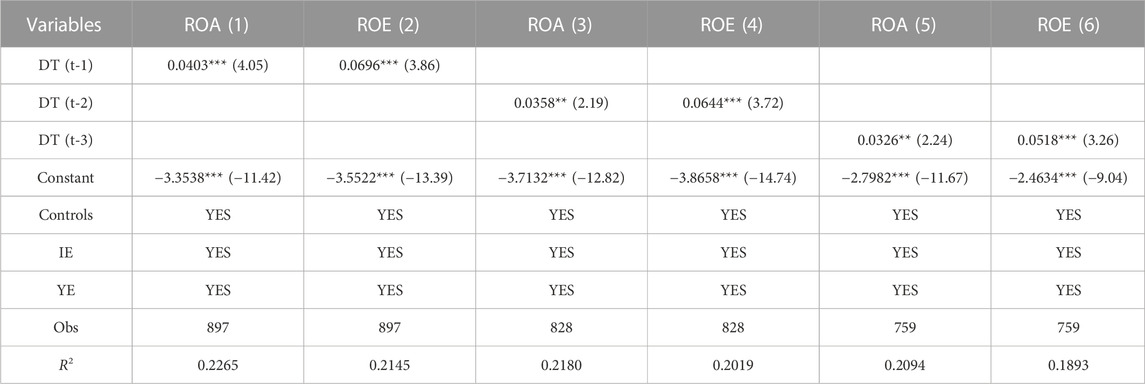

In Table 5, we select the digital transformation data by lagging 1, 2, and 3 for the benchmark regression model. The coefficients of digital transformation are significantly positive in all cases, demonstrating a promoting relationship between digital transformation and renewable energy companies’ performance. This contribution is unaffected by the extension of the observation time, providing more evidence that the benchmark regression results are robust.

4.2.4 Instrumental variable

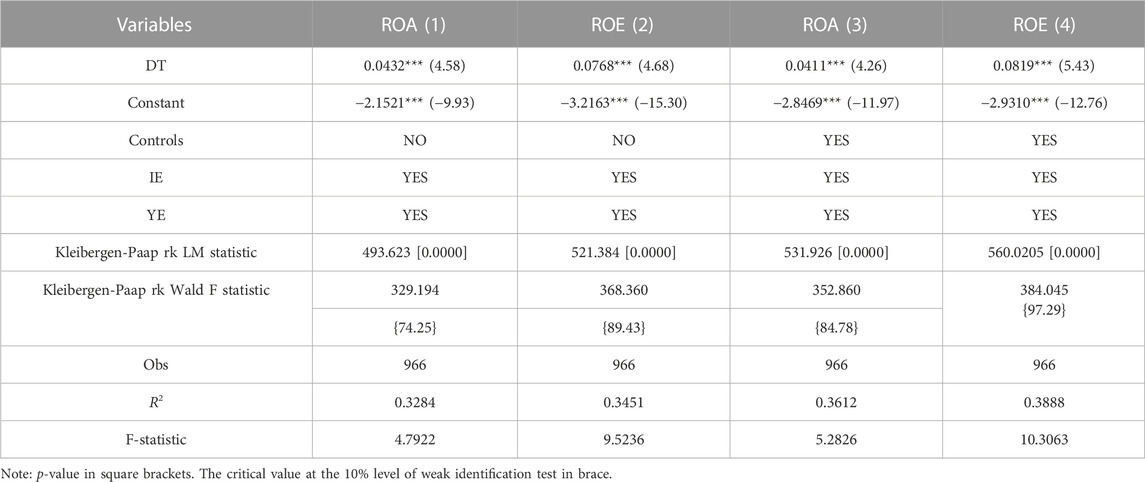

A renewable energy company with high performance is more likely to undergo digital transformation, and the improved performance may be the cause of the latter rather than the result. Therefore, an instrumental variable method is used to mitigate the potential endogeneity. By referring to prior studies (Arellano and Bond, 1991; Sun et al., 2020), we develop the interaction term (HD) as an instrumental variable. HD is measure as the number of post and telecommunications bureaus per million in 1984 and China’s internet users in the past year. We use the two stage least square method for estimation. As expected, in columns (1) to (4) of Table 6, the coefficients of digital transformation are significantly positive, suggesting a firm can improve its performance by adopting digital transformation. The Kleibergen-Paap rk LM statistic and the Kleibergen-Paap rk Wald F-statistic reject the null hypothesis, demonstrating that it has passed the endogenous test. Thus, the above results indicate that digital transformation contributes significantly to renewable energy companies’ performance.

4.3 Heterogeneous effects

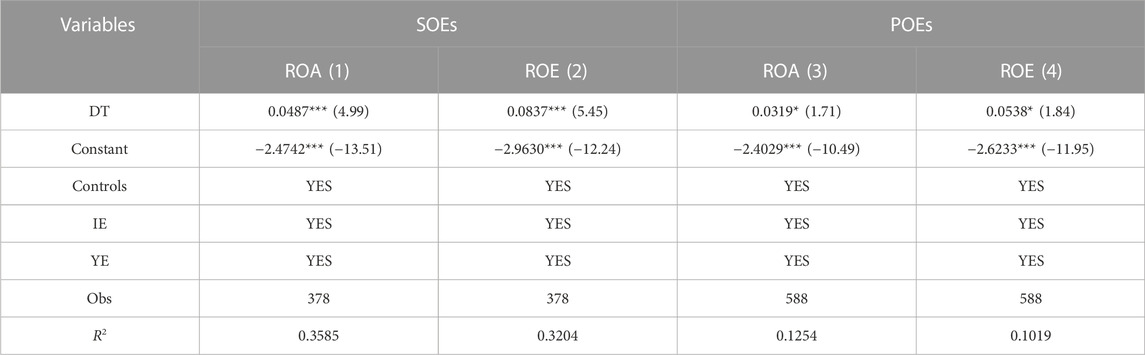

4.3.1 Ownership

In this part, to examine the influence of digital transformation on renewable energy companies’ performance based on ownership types, we split the enterprises into SOEs and POEs. The specific findings are shown in Table 7. In columns (1)–(4), we may deduce that digital transformation has a greater boost for state-owned renewable energy companies than for private enterprises. This is similar to the study findings of Wu and Huang (2022), who argue that digital finance has a stronger contribution to the financial performance of state-owned new energy companies. Facing the vast development opportunities in the renewable energy industry, SOEs can easily obtain government funds and bring in potential investment from outside, thus accelerating the pace of enterprise digital transformation. Nevertheless, POEs have an increased risk of financial difficulty and low capital turnover, which might limit their adoption of digital transformation and performance enhancement. In sum, unlike POEs, SOEs are more likely to benefit from performance enhancements brought on by digital transformation.

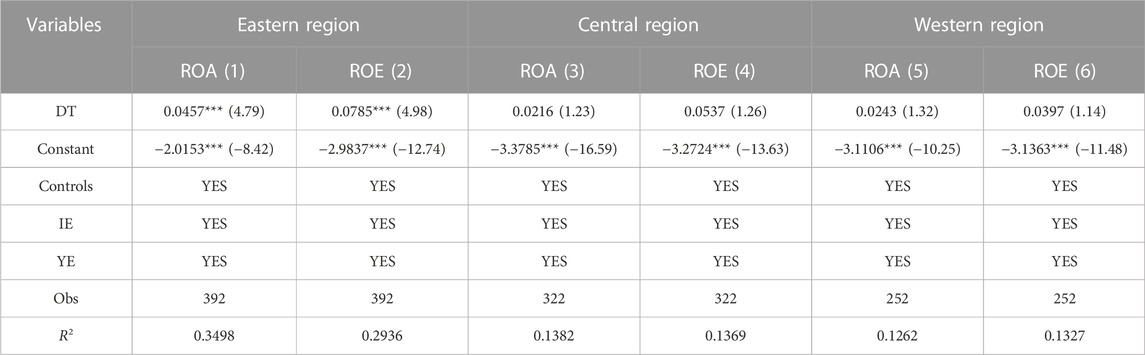

4.3.2 Region

To investigate the influence of regional heterogeneity, this research separates the samples into three subsamples: the eastern, central, and western regions. The findings in columns (1) and (2) of Table 8 are consistent with the benchmark results, demonstrating that digital transformation has a promoting effect on corporate performance in the east. Conversely, as can be seen from columns (3)–(6), digital transformation has no significant impact on firms in the central and western areas. In fact, renewable energy companies in the eastern area have more significant advantages in terms of policy, investment, and infrastructure, creating a competitive market environment that promotes innovation, all of which help firms in the region leverage the contribution of digital transformation to firm performance. In contrast, although the central and western areas are rich in renewable energy resources, they have poor infrastructure, a shortage of senior talents and low technology. Meanwhile, renewable energy companies in the central and western areas are less willing to adopt digital transformation. As a result, in the eastern region, digital transformation is very effective in improving renewable energy companies’ performance, but it is not the case in the central and western areas.

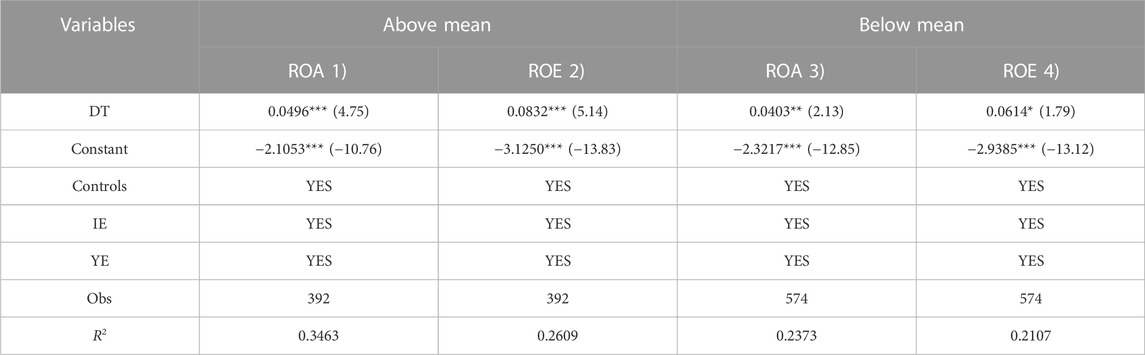

4.3.3 Enterprise scale

To test the heterogeneity impact according to enterprise scale, this study divides the samples into large companies and small companies based on the enterprises’ total assets. Table 9 reports the specific findings. In columns (1)–(4), digital transformation can significantly improve renewable energy companies’ performance regardless of their scale differences. Meanwhile, the findings indicate that the marginal effect of digital transformation is higher for large companies. Wu and Huang (2022) propose a similar conclusion that there is scale heterogeneity in the impact of digitalization of finance on the financial performance of new energy companies. This conclusion is in keeping with the fact that small companies are more vulnerable to financial and technical obstacles. However, large companies have sufficient funds for their daily operations, meeting the need to develop advanced technologies. Thus, the negative consequences of financial constraint and backward technology are weaker in large companies, contributing to highly efficient production and the digital transformation adoption. Hypothesis 2 is supported.

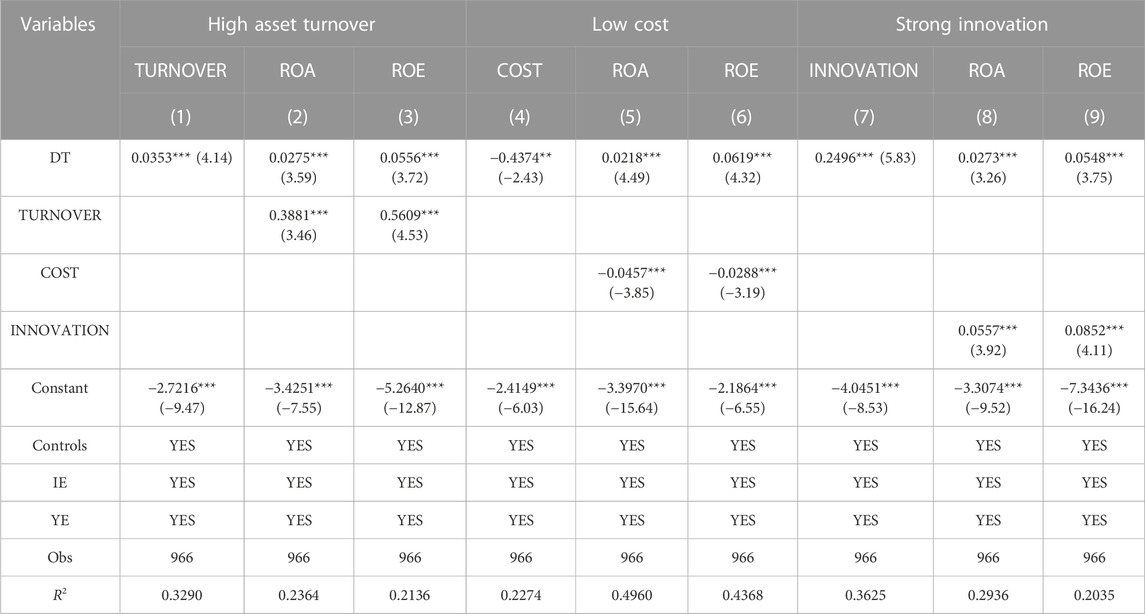

4.4 Transmission mechanisms

A further problem from the above empirical results is the transmission mechanisms through which digital transformation affects renewable energy companies’ performance. This section will analyze whether digital transformation affects the performance of renewable energy companies through asset turnover, cost and innovation. Table 10 presents the findings.

The coefficients of digital transformation in columns (1), (4), and (7) are significant at 1% or 5% and exhibit the predicted signs. In column (4), the impact coefficient of digital transformation is negative and significant, suggesting that a renewable energy enterprise that adopts a digital transformation strategy has a lower operating cost. The same coefficients are positive and significant in columns (1) and (7), indicating that a renewable energy enterprise that adopts a digital transformation strategy improves its operating efficiency and innovation capacity. Then, in columns (2), (3), (5), (6), (8), and (9), the regression coefficients for three mediating variables are all significant at 1% while the coefficients of digital transformation exhibit the expected signs. Especially, the finding that technology innovation promotes the performance of renewable energy companies is similar to the conclusions of Wang et al. (2021) and Luo et al. (2021). Thus, a renewable energy enterprise’s digital transformation can lower operating costs, enhance operational efficiency, and improve innovation ability, thereby contributing to improving firm performance. Hypothesis 3 is verified. With the widespread use of digital and intelligent technologies, we are vigorously promoting digital transformation in the renewable energy industry. Meanwhile, the deep integration of the renewable energy revolution and digital revolution is a major trend in the future. Specifically, applying digital technologies optimizes a renewable energy enterprise’s production processes, reducing friction in operations and effectively enhancing communication efficiency among firms and industrial chains. Moreover, it helps renewable energy enterprises save a lot of labor and time costs. In addition, digital transformation comes from the interaction between technological advances and enterprise development needs, which not only has a profound impact on the boundaries, internal organization, and competitive advantages of companies but also drives significant changes in the innovation models and increases innovation efficiency.

5 Conclusion and policy implications

In the era of digital economy, the top priority for the renewable energy industry is to bridge the vast digital divide and achieve digital transformation. We explore the influence of a renewable energy enterprise’s digital transformation on the performance. While the topic is explored in the literature on digital transformation, the emphasis is on the definition of digital transformation and its role in the performance of traditional industries.

Using the panel data of Chinese listed renewable energy enterprises from 2008 to 2021, we support this hypothesis with empirical research that digital transformation improves a renewable energy enterprise’s performance. The findings are robust to excluding specific samples, adding control variables, extending the time observation window, and accounting for endogeneity. Furthermore, digital transformation may have varying effects on renewable energy companies’ performance based on firms’ ownership types, locations, and scales. Particularly, the driving influence of digital transformation on corporate performance is higher among SOEs and large firms; meanwhile, the driving effect is significant only in the eastern area. In addition, we provide evidence that enhanced operating efficiency, cost savings, and innovation success are transmission channels for digital transformation affecting renewable energy companies’ performance.

This study provides crucial policy implications for better leveraging digital transformation. First, China’s renewable energy industry is typically a policy-oriented industry. Government policies play a crucial role in fostering a firm’s digital transformation, for instance, constructing a market-oriented investment and financing structure. Thus, government subsidies and policy assistance offer a favorable policy environment for the renewable energy industry. However, their purpose is limited and may result in long-term market distortions. Therefore, a crucial step is to establish an efficient, market-oriented investment and financing system, broaden access to finance to reduce financial restraints and build a diversified support system, thereby promoting the sustainable growth of the renewable energy industry. It is also essential for renewable energy companies to attract investment by minimizing policy risks and guaranteeing policy stability over the long term. Second, the government is expected to encourage renewable energy companies to develop a support platform based on digital technologies. Similar to enterprise innovation, digital transformation adoption is typically costly and challenging for renewable energy companies. We have argued that the implementation of digital transformation strategy assists firms in promoting operating efficiency, reducing costs, and fostering innovation. Nevertheless, the implementation of digital transformation is slow (Fitzgerald et al., 2014), leaving renewable energy companies with many barriers to initiating adoption. Therefore, it is in line with the long-term consideration of promoting economic development for the government to encourage and assist renewable energy companies in building a support platform for fundamental digital technologies, promoting business digitization, business integration and convergence, and business model innovation, thereby reducing the costs and learning curve of implementing a digital transformation strategy. Third, the heterogeneous impact of digital transformation must be taken into account to ensure the creation of targeted and dynamic policies that maximize the role of digital transformation. Using digital technology, financial institutions should accurately assess the operational and financial situations of different kinds of firms in order to offer personalized financial services and enhance the rational allocation of resources, thus fostering the vitality of small firms and ensuring the stability of large firms. In addition, to enable healthy growth of the renewable energy sector, government assistance should be skewed toward POEs and firms in less developed areas.

This research has its potential limitations. First, we draw our findings from China’s A-share listed renewable energy companies due to the lack of data. Domestic unlisted firms and firms not on the A-share market are not included in the examination. Using more renewable energy companies as research samples would be desirable to verify the results. Second, due to the ambiguous nature of digital transformation, there is a possibility that the variable we have selected might not adequately represent the actual degree of digital transformation. That’s why research on digital transformation uses a survey method to ask managers to evaluate it (Fitzgerald et al., 2014). We have demonstrated that it is feasible and informative to use a quantitative method to explore the influence of digital transformation on renewable energy companies’ performance. It would be excellent to quantify the depth of digital transformation or the critical influence of a specific dimension of digital transformation. Thus, in subsequent studies, we should establish a more accurate metric for measuring digital transformation. Third, to make the findings more general, it might be instructive to gauge how digital transformation affects renewable energy companies’ performance in other emerging countries.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

Conceptualization, YR and BL; methodology, YR and BL; validation, YR and DL; formal analysis, YR, BL, and DL; data curation, YR and DL; writing—original draft preparation, YR and DL; writing—review and editing, YR and DL; supervision, YR; project administration: YR; funding acquisition, YR.

Funding

Natural Science Research Project in Jiangsu Province Universities (20KJB630015), Philosophy and Social Science Research Project of Jiangsu Province Universities (2020SJA1278) and 2020 Outstanding Teaching Team of “Blue Project” of Jiangsu University (JS 2020).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Adner, R., Puranam, P., and Zhu, F. (2019). What is different about digital strategy? From quantitative to qualitative change. Strat. Sci. 4 (4), 253–261. doi:10.1287/stsc.2019.0099

Agarwal, R., Gao, G., DesRoches, C., and Jha, A. K. (2010). Research commentary—the digital transformation of healthcare: Current status and the road ahead. Inf. Syst. Res. 21 (4), 796–809. doi:10.1287/isre.1100.0327

Andriushchenko, K., Buriachenko, A., Rozhko, O., Lavruk, O., Skok, P., Hlushchenko, Y., et al. (2020). Peculiarities of sustainable development of enterprises in the context of digital transformation. Entrep. Sustain 7 (3), 2255–2270. doi:10.9770/jesi.2020.7.3(53)

Arellano, M., and Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev. Econ. Stud. 58 (2), 277–297. doi:10.2307/2297968

Ayyagari, M., Demirgüç-Kunt, A., and Maksimovic, V. (2008). How important are financing constraints? The role of finance in the business environment. World Bank. Econ. Rev. 22 (3), 483–516. doi:10.1093/wber/lhn018

Baron, R. M., and Kenny, D. A. (1986). The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Pers. Soc. Psychol. 51 (6), 1173–1182. doi:10.1037/0022-3514.51.6.1173

Bharadwaj, I. (2013). Organization sustainability. NHRD Netw. J. 6 (4), 30–35. doi:10.1177/0974173920130405

Bloom, N., Garicano, L., Sadun, R., and Van Reenen, J. (2013). The distinct effects of information technology and communication technology on firm organization. Manage. Sci. 60 (12), 2859–2885. doi:10.1287/mnsc.2014.2013

Buesa, M., Heijs, J., and Baumert, T. (2010). The determinants of regional innovation in europe: A combined factorial and regression knowledge production function approach. Res. Pol. 39 (6), 722–735. doi:10.1016/j.respol.2010.02.016

Buttice, V., Caviggioli, F., Franzoni, C., Scellato, G., Stryszowski, P., and Thumm, N. (2020). Counterfeiting in digital technologies: An empirical analysis of the economic performance and innovative activities of affected companies. Res. Policy 49 (5), 103959. doi:10.1016/j.respol.2020.103959

Child, J., and Tse, D. K. (2001). China’s transition and its implications for international business. Int. Bus. Stud. 32, 5–21. doi:10.1057/palgrave.jibs.8490935

China Listed Companies Association (2022). White paper on digital economy of Chinese listed companies.

Clarysse, B., Wright, M., and Mustar, P. (2009). Behavioural additionality of R&D subsidies: A learning perspective. Res. Pol. 38 (10), 1517–1533. doi:10.1016/j.respol.2009.09.003

Corsi, A., and Findeis, J. L. (2000). True state dependence and heterogeneity in off-farm labour participation. Eur. Rev. Agric. Econ. 27, 127–151. doi:10.1093/erae/27.2.127

Curran, D. (2018). Risk, innovation, and democracy in the digital economy. Eur. J. Soc. Theory 21 (2), 207–226. doi:10.1177/1368431017710907

Fitzgerald, M., Kruschwitz, N., Bonnet, D., and Welch, M. (2014). Embracing digital technology: A new strategic imperative. MIT Sloan Manag. Rev. 55 (2), 1–12.

Gabriel, C. A., Kirkwood, J., Walton, S., and Rose, E. (2016). How do developing country constraints affect renewable energy entrepreneurs? Energy Sustain. Dev. 35, 52–66. doi:10.1016/j.esd.2016.09.006

Gal, P., Nicoletti, G., Rüden, C. V., Sorbe, S., and Renault, T. (2019). Digitalization and productivity: In search of the holy grail: Firm-level empirical evidence from European countries. Int. Prod. Mon. 37, 39–71.

Galindo-Martín, M. A., Casta no-Martínez, M. S., and Mendez-Picazo, M. T. (2019). Digital transformation, digital dividends and entrepreneurship: A quantitative analysis. J. Bus. Res. 101, 522–527. doi:10.1016/j.jbusres.2018.12.014

Grenadier, S. R., and Malenko, A. (2011). Real options signaling games with applications to corporate finance. Rev. Financ. Stud. 24 (12), 3993–4036. doi:10.1093/rfs/hhr071

Haider, Z. A., Liu, M. H., Wang, Y. F., and Zhang, Y. (2018). Government ownership, financial constraint, corruption, and corporate performance: International evidence. J. Int. Financ. Mark. Inst. Money 53, 76–93. doi:10.1016/j.intfin.2017.09.012

Haider, Z. A., Liu, M., Wang, Y. F., and Zhang, Y. (2018). Government ownership, financial constraint, corruption, and corporate performance: International evidence. J. Int. Financ. Mark. Inst. Money 53, 76–93. doi:10.1016/j.intfin.2017.09.012

Hakala, H. (2011). Strategic orientations in management literature: Three approaches to understanding the interaction between market, technology, entrepreneurial and learning orientations. Int. J. Manag. Rev. 13 (2), 199–217. doi:10.1111/j.1468-2370.2010.00292.x

Hao, Y., Wang, L. O., and Lee, C. C. (2018). Financial development, energy consumption and China’s economic growth: New evidence from provincial panel data. Int. Rev. Econ. Financ. 69, 1132–1151. doi:10.1016/j.iref.2018.12.006

Hong, J. T., Zhang, Y. B., and Ding, M. Q. (2018). Sustainable supply chain management practices, supply chain dynamic capabilities, and enterprise performance. J. Clean. Prod. 172, 3508–3519. doi:10.1016/j.jclepro.2017.06.093

Horvath, K., and Rabetino, R. (2019). Knowledge-intensive territorial servitization: Regional driving forces and the role of the entrepreneurial ecosystem. Reg. Stud. 53 (3), 330–340. doi:10.1080/00343404.2018.1469741

Hutchinson, M., and Gul, F. A. (2004). Investment opportunity set, corporate governance practices and firm performance. J. Corp. Finan. 10 (4), 595–614. doi:10.1016/s0929-1199(03)00022-1

Jalil, A., and Feridun, M. (2011). The impact of growth, energy and financial development on the environment in China: A co-integration analysis. Energy Econ. 33 (2), 284–291. doi:10.1016/j.eneco.2010.10.003

Ji, Q., and Zhang, D. (2019). How much does financial development contribute to renewable energy growth and upgrading of energy structure in China? Energy Policy 128, 114–124. doi:10.1016/j.enpol.2018.12.047

Kaur, N., and Sood, S. K. (2017). An energy-efficient architecture for the internet of things (IoT). Ieee Syst. J. 11 (2), 796–805. doi:10.1109/jsyst.2015.2469676

Kraus, S., Schiavone, F., Pluzhnikova, A., and Invernizzi, A. C. (2021). Digital transformation in healthcare: Analyzing the current state-of-research. J. Bus. Res. 123, 557–567. doi:10.1016/j.jbusres.2020.10.030

Li, L. X. (2022). Digital transformation and sustainable performance: The moderating role of market turbulence. Ind. Mark. Manag. 104, 28–37. doi:10.1016/j.indmarman.2022.04.007

Lin, B. Q., and Moubarak, M. (2014). Renewable energy consumption – economic growth nexus for China. Renew. Sust. Energ, Rev. 40, 111–117. doi:10.1016/j.rser.2014.07.128

Liu, M. Z., Liu, L. Y., Xu, S. C., Du, M. W., Liu, X. X., and Zhang, Y. Q. (2019). The influences of government subsidies on performance of new energy firms: A firm heterogeneity perspective. Sustainability 11 (17), 4518. doi:10.3390/su11174518

Liu, X., Xiao, W., and Huang, X. (2008). Bounded entrepreneurship and internationalisation of indigenous Chinese private-owned firms. Int. Bus. Rev. 17 (4), 488–508. doi:10.1016/j.ibusrev.2008.02.014

Llopis-Albert, C., Rubio, F., and Valero, F. (2021). Impact of digital transformation on the automotive industry. Technol. Forecast. Soc. Change 162, 120343. doi:10.1016/j.techfore.2020.120343

Lorenzo, A., Carrillo-Hermosilla, J., Del Rio, P., and Pontrandolfo, P. (2019). Sustainable innovation: Processes, strategies, and outcomes. Corp. Soc. Responsib. Environ. Manag. 26 (5), 106–109.

Luo, G. L., Liu, Y. X., Zhang, L. P., Xu, X., and Guo, T. W. (2021). Do governmental subsidies improve the financial performance of China’s new energy power generation enterprises? Energy 227, 120432. doi:10.1016/j.energy.2021.120432

Luo, L., Yang, Y., Luo, Y., and Liu, C. (2016). Export, subsidy and innovation: China’s state-owned enterprises versus privately-owned enterprises. Econ. Polit. Stud-Eps. 4 (2), 137–155. doi:10.1080/20954816.2016.1180766

Lyytinen, K., Yoo, Y., and Boland, R. J. J. (2016). Digital product innovation within four classes of innovation networks. Y. Inf. Syst. J. 26 (1), 47–75. doi:10.1111/isj.12093

Majchrzak, A., Markus, M. L., and Wareham, J.Bentley UniversityESADE – Ramon Llull University (2016). Designing for digital transformation: Lessons for information systems research from the study of ICT and societal challenges. MIS Q. 40 (2), 267–277. doi:10.25300/misq/2016/40:2.03

Matt, C., Hess, T., and Benlian, A. (2015). Digital transformation strategies. Bus. Inf. Syst. Eng. 57 (5), 339–343. doi:10.1007/s12599-015-0401-5

Mergel, I., Edelmann, N., and Haug, N. (2019). Defining digital transformation: Results from expert interviews. Gov. Inf. Q. 36 (4), 101385. doi:10.1016/j.giq.2019.06.002

Min, S., Kim, J., and Sawng, Y. W. (2020). The effect of innovation network size and public R&D investment on regional innovation efficiency. Technol. Forecast. Soc. Change 155, 119998. doi:10.1016/j.techfore.2020.119998

Moretti, F., and Biancardi, D. (2020). Inbound open innovation and firm performance. J. Innov. Knowl. 5 (1), 1–19. doi:10.1016/j.jik.2018.03.001

Mubarak, M. F., and Petraite, M. (2020). Industry 4.0 technologies, digital trust and technological orientation: What matters in open innovation? Technol. Forecast Soc. 161, 120332. doi:10.1016/j.techfore.2020.120332

Nambisan, S. (2017). Digital entrepreneurship: Toward a digital technology perspective of entrepreneurship. Entrep. Theory Pract. 41 (6), 1029–1055. doi:10.1111/etap.12254

National Bureau of Statistics (2022). Statistical bulletin of national economic and social development (1982-2022).

Nwankpa, J. K., and Datta, P. (2017). Balancing exploration and exploitation of IT resources: The influence of digital business intensity on perceived organizational performance. J. Inf. Syst. 26 (5), 469–488. doi:10.1057/s41303-017-0049-y

Ode, E., and Ayavoo, R. (2020). The mediating role of knowledge application in the relationship between knowledge management practices and firm innovation. J. Innov. Knowl. 5 (3), 210–218. doi:10.1016/j.jik.2019.08.002

Ostergaard, P. A., Duic, N., Noorollahi, Y., et al. Duic, N., Noorollahi, Y., and Kalogirou, S. (2022). Renewable energy for sustainable development. Renew. Energ. 199, 1145–1152. doi:10.1016/j.renene.2022.09.065

Pan, W. R., Xie, T., Wang, Z. W., and Ma, L. S. (2022). Digital economy: An innovation driver for total factor productivity. J. Bus. Res. 139, 303–311. doi:10.1016/j.jbusres.2021.09.061

Park, S. R., Pandey, A. K., Tyagi, V. V., and Tyagi, S. K. (2014). Energy and exergy analysis of typical renewable energy systems. Renew. Sust. Energ, Rev. 30, 105–123. doi:10.1016/j.rser.2013.09.011

Paunov, C., and Rollo, V. (2016). Has the internet fostered inclusive innovation in the developing world? World Dev. 78, 587–609. doi:10.1016/j.worlddev.2015.10.029

Peng, Y. Z., and Tao, C. Q. (2022). Can digital transformation promote enterprise performance?-From the perspective of public policy and innovation. J. Innov. Knowl. 7, 100198. doi:10.1016/j.jik.2022.100198

Piccinini, E., Hanelt, A., Gregory, R., and Kolbe, L. (2015). Transforming industrial business: The impact of digital transformation on automotive organizations. Proc. ICIS.

Reis, J., and Amorim, M. (2018). Digital transformation: A literature review and guidelines for future research. World Conference on Information Systems and Technologies.

Ren, S., Hao, Y., Xu, L., Wu, H. T., and Ba, L. (2021). Digitalization and energy: How does internet development affect China’s energy consumption? Energy Econ. 98, 105220. doi:10.1016/j.eneco.2021.105220

Ren, X. H., Liu, Z. Q., Jin, C. L., and Lin, R. Y. (2021). Oil price uncertainty and enterprise total factor productivity: Evidence from China. Int. Rev. Econ. Financ. 83, 201–218. doi:10.1016/j.iref.2022.08.024

Ritter, T., and Pedersen, C. L. (2020). Digitization capability and the digitalization of business models in business-to-business firms: Past, present, and future. Ind. Mark. Manag. 86, 180–190. doi:10.1016/j.indmarman.2019.11.019

Sapienza, P. (2004). The effects of government ownership on bank lending. J. Financ. Econ. 72 (2), 357–384. doi:10.1016/j.jfineco.2002.10.002

Shah, S. H. H., Noor, S., Shen, L., Butt, A. S., and Ali, M. (2021). Role of privacy/safety risk and trust on the development of presumption and value co-creation under the sharing economy: A moderated mediation model. Inf. Technol. Dev. 27 (4), 718–735.

Sheikh, M. A. (2010). Energy and renewable energy scenario of Pakistan. Renew. Sust. Energ, Rev. 14 (1), 354–363. doi:10.1016/j.rser.2009.07.037

Sheng, Y., and Song, L. G. (2013). Re-estimation of firms' total factor productivity in China's iron and steel industry. Rev 24, 177–188. doi:10.1016/j.chieco.2012.12.004

Shrestha, A., Mustafa, A. A., Htike, M. M., You, V., and Kakinaka, M. (2022). Evolution of energy mix in emerging countries: Modern renewable energy, traditional renewable energy, and non-renewable energy. Renew. Energ. 199, 419–432. doi:10.1016/j.renene.2022.09.018

Singh, S., Sharma, M., and Dhir, S. (2021). Modeling the effects of digital transformation in Indian manufacturing industry. Technol. Soc. 67, 101763. doi:10.1016/j.techsoc.2021.101763

Sousa, M. J., and Rocha, A. (2019). Digital learning: Developing skills for digital transformation of organizations. Future Gener. Comp. sy. 91, 327–334. doi:10.1016/j.future.2018.08.048

Sun, C., Zhan, Y., and Du, G. (2020). Can value-added tax incentives of new energy industry increase firm’s profitability? Evidence from financial data of China’s listed companies. Energy Econ. 86, 104654. doi:10.1016/j.eneco.2019.104654

Taques, F. H., Lopez, M. G., Basso, L. F., and Areal, N. (2021). Indicators used to measure service innovation and manufacturing innovation. J. Innov. Knowl. 6 (1), 11–26. doi:10.1016/j.jik.2019.12.001

Todtling, F., and Trippl, M. (2005). One size fts all?: Towards a differentiated regional innovation policy approach. Res. Pol. 34 (8), 1203–1219. doi:10.1016/j.respol.2005.01.018

Verhoef, P. C., Broekhuizen, T., Bart, Y., Bhattacharya, A., Dong, Q., Fabian, N., et al. (2021). Digital transformation: A multidisciplinary reflection and research agenda. J. Bus. Res. 122, 889–901.

Vial, G. (2019). Understanding digital transformation: A review and a research agenda. J. Strateg. Inf. Syst. 28 (2), 118–144. doi:10.1016/j.jsis.2019.01.003

Wang, K. H., Su, C. W., Lobont, O. R., and Moldovan, N. C. (2020). Chinese renewable energy industries’ boom and recession: Evidence from bubble detection procedure. Energy Policy 138, 111200. doi:10.1016/j.enpol.2019.111200

Wang, P., Zhang, Z., Zeng, Y., Yang, S., and Tang, X. (2021). The effect of technology innovation on corporate sustainability in Chinese renewable energy companies. Front. Energy Res. 9, 638459. doi:10.3389/fenrg.2021.638459

Wang, Z. C., Li, X. Y., Xue, X. H., and Liu, Y. H. (2022). More government subsidies, more green innovation? The evidence from Chinese new energy vehicle enterprises. Renew. Energ. 197, 11–21. doi:10.1016/j.renene.2022.07.086

Wu, Y. L., and Huang, S. L. (2022). The effects of digital finance and financial constraint on financial performance: Firm-level evidence from China's new energy enterprises. Energ. Econ. 112, 106158. doi:10.1016/j.eneco.2022.106158

Yale Center for Environmental Law & Policy and Center for International Earth Science Information Network (2022). Environmental performance Index, 2022.

Yang, Y., Wei, J., Luo, L. J., Zhai, H. Y., Yang, M., and Chan, K. C. (2015). Who is using government subsidies to innovate? The combined moderating effect of ownership and factor market distortions. Manag. World 1Does digital transformation enhance a firm’s performance? Evidence from China. Technol. Soc. 68, 75101841–75101886. doi:10.1016/j.techsoc.2021.101841

Keywords: digital transformation, performance, renewable energy companies, operating efficiency, cost, innovation

Citation: Ren Y, Li B and Liang D (2023) Impact of digital transformation on renewable energy companies’ performance: Evidence from China. Front. Environ. Sci. 10:1105686. doi: 10.3389/fenvs.2022.1105686

Received: 23 November 2022; Accepted: 23 December 2022;

Published: 06 January 2023.

Edited by:

Aleksy Kwilinski, The London Academy of Science and Business, United KingdomReviewed by:

Izabela Jonek-Kowalska, Silesian University of Technology, PolandTetyana Pimonenko, Sumy State University, Ukraine

Copyright © 2023 Ren, Li and Liang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yangjun Ren, eWpyZW4yMDE5MTI1QDE2My5jb20=

Yangjun Ren

Yangjun Ren Botang Li2

Botang Li2