95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci. , 19 January 2023

Sec. Environmental Economics and Management

Volume 10 - 2022 | https://doi.org/10.3389/fenvs.2022.1097181

In recent years, sustainable development has become a focal issue in the globalization process due to environmental uncertainty in the global context, which has attracted the extensive attention of scholars. This study explores the dynamic transmission mechanism and time-varying impacts among green finance, renewable energy and sustainable development in China on the basis of a stochastic volatile time-varying vector autoregressive (TVP-VAR-SV) model using time-series data from January 4, 2013, to October 14, 2022. The results revealed that there is an interaction among green finance, renewable energy and sustainable development in China, and the degree of influence and direction of action at different points in time show time-varying and heterogeneous characteristics. Further, this study subdivides renewable energy into hydro, wind, geothermal and solar energy. The dynamic impact of these types of energy on sustainable development is heterogeneous, and this relationship is affected by relevant economic events.

Rapid economic development has brought about massive amounts of harmful gas emissions and the depletion of natural resources, consequent ecological degradation and increased temperature causing frequent weather extremes and threatening biodiversity on Earth (Sperling et al., 2010), and the issue of sustainable development has thus become a growing concern. The World Commission on Environment and Development (WCED) defines sustainable development (SD) as development that meets the survival needs of the present without affecting the ability of future generations to meet their own survival needs (Østergaard and Sperling, 2014). Although the international community has proposed sustainable development goals, the progress up to this point has not been promising. The IRENA (2020) statistics show that there is a global investment gap of at least $2 trillion in sustainable development projects between 2021 and 2023 in the wake of the COVID-19 outbreak. In the face of enormous financing needs, green finance is emerging as a powerful financing tool and gaining increasing attention. Green finance focuses on the protection of the Earth’s ecology, pollution control, and the promotion of sustainable social development through the rational allocation of resources, and its emergence is beneficial to balancing the relationship between economic development and ecological protection and implementing monetary assistance for green development (Albino et al., 2014). Currently, green bonds and stocks, as the main green financial instruments, are the main means of financing sustainable development projects (Rusu, 2019); and green financial instruments will develop in a more diversified direction in the future. In short, in the context of global integration, it is difficult to separate the goal of achieving sustainable development by 2030 from green finance (Pfeifer et al., 2019).

The achievement of sustainable development requires that the issue of increasing energy demand, that is, minimizing resource pollution while improving living standards and meeting production needs, be confronted (Bhuiyan et al., 2021). Most countries today rely on fossil fuels for their energy needs, and as energy consumption continues to increase, carbon emissions remain high (Yousefi et al., 2019). Fossil fuel use leaves residues of various forms that are not reusable and have irreversible effects on the environment (Simon-Martín et al., 2019), while the use of renewable energy sources such as solar, wind, geothermal, and hydropower energy sources can help keep energy pollution at low levels (O’Riordan, 2022). On 20 November 2022, the 27th Conference of the Parties to the United Nations Framework Convention on Climate Change (COP27), that took place in the Egyptian coastal city of Sharm el-Sheikh, highlighted the importance of promoting the building of clean energy and called for increased use of renewable energy. Developing countries are expected to receive more financial and resource support to accelerate the development of renewable energy and the construction of low-carbon transition demonstration zones. Green finance, as a powerful tool to help finance green projects, is difficult to replace for the process of reducing the cost of renewable energy projects. Financial instruments and innovation are enablers of every energy transition, with the transition to renewable energy being no exception.

Since the 21st century, China’s industrialization and urbanization process has continued to advance. In 2021, China’s gross domestic product reached $ 16.642 trillion, with an annual growth rate of 8.5%. In the same year, the global GDP growth rate was 5.5%, China’s GDP growth rate above global average. However, with the rapid development of economy, the problem of air pollution hidden behind it has always been an unavoidable problem in the process of sustainable economic development (Yang et al., 2021; Jin et al., 2021). According to the “Report on the State of the Ecology and Environment in China” issued by the Ministry of Ecology and Environment of China, the ambient air quality of 121 cities in China exceeded the standard in 2021, accounting for 35.7% of all prefecture-level and above cities. Although the air quality has been greatly improved, solving the air pollution problem is still a major task to achieve the goal of sustainable and high-quality development of China’s economy. In October 2021, the Central Committee of the Communist Party of China (CPC) and the State Council formulated the “Opinions on the Complete, Accurate and Comprehensive Implementation of the New Development Concept to Do a Good Job in Carbon Peak and Carbon Neutrality,” taking 2030 and 2060 as important time points, making top-level design for achieving the “double carbon” target in ten aspects, such as deep adjustment of industrial structure and promoting comprehensive green transformation of economic and social development. At the same time, they issued the “Action Plan for Carbon Peaking by 2030,” making overall arrangements for promoting the “carbon peaking” work. This indicates that in order to achieve the goal of “double carbon,” China’s economic growth and carbon emissions should be gradually “decoupled,” so promoting the green upgrade of the economic system is the main theme of development in the coming decades. As an important way to achieve green development, green finance can guide the allocation of green resources and promote the high-quality development of a low-carbon economy. Therefore, the development of green finance is an important booster to realize the green upgrading of China’s economy and an important element of supply-side structural reform (Yu et al., 2021; Lee et al., 2022).

At present, China’s energy system is based on fossil energy, especially high—carbon coal, the available non—fossil energy is mainly renewable energy. In order to achieve the goal of “carbon peaking and carbon neutral” as soon as possible, the support of the energy during the 14th Five-Year Plan of China period will be gradually replaced by non-fossil energy, especially by renewable energy, which will usher in new opportunities for the development of renewable energy. In the future, the development of renewable and clean energy will be placed in a more prominent position, and the important role of renewable energy in China’s emission reduction path will be fully utilized to help achieve China’s energy revolution and sustainable development goals.

Green development is the focus of attention in the process of promoting sustainable development. Green finance is the key way to achieve green development. Renewable energy refers to non-fossil clean energy such as wind energy, solar energy, water energy and so on, which have less negative impact on the environment, thus contributing to sustainable development. The existing research mainly focuses on the impact of finance, energy, environment and other indicators on sustainable development, but less on the role of green finance and renewable energy in sustainable development. Among them, the most important point is that green finance and renewable energy have a significant impact on sustainable economic development. In recent years, many studies have shown that the green financial market with strong development momentum is crucial to the implementation of renewable energy plans (Soundarrajan et al., 2016; Huang et al., 2021; Zheng et al., 2022). A large number of scholars have concluded that the development of green finance contributes to the achievement of sustainable development goals (Liu et al., 2020; Kumar et al., 2022; Ibrahim et al., 2022), and generally there is a positive relationship between renewable energy and sustainable development (Lund and Henrik, 2007; Schwerhoff et al., 2017; Solangi et al., 2021). Energy transformation and upgrading help to achieve the sustainable development goals, while sustainable economic development promotes increased investment in renewable energy projects, thus promoting the transformation of energy structure. The above literature shows that both green finance and renewable energy have a positive impact on sustainable development. The innovation of this paper is to further evaluate the dynamic impact of green finance and renewable energy on sustainable development while empirically testing the impact of green finance and renewable energy on sustainable development, which has not been involved in early research.

Therefore, this study explores the interaction among green finance, renewable energy and sustainable development in China. Since green finance is considered as a regulator to promote renewable energy development and thus promotes sustainable development, it is of far-reaching significance to analyze the relationship between the three. Secondly, after subdividing renewable energy into hydro, wind, geothermal, and solar, this study explores the dynamic impact between them and sustainable development. The potentially time-varying nature of the impact of green finance, renewable energy and sustainable development and the potentially time-varying nature of the financial cycle itself imply that the analytical framework should take this potential time variability into account. Traditional quantitative analysis methods, such as VAR and SVAR, are suitable for studies in which the relationship between variables remains constant. However, in the case of China’s green and renewable energy markets, which are both distinctly cyclical and time varying, traditional methods are likely to ignore critical time-varying information. In view of this situation, this study selects a time-varying parametric vector autoregressive model (TVP-VAR-SV) with daily indices from 4 January 2013, to 12 October 2022, to explore the dynamic impacts of green finance and renewable energy on sustainable development and to specifically describe the dynamic relationship between renewable energy (solar, wind, geothermal, and hydro energy) and sustainable development in an attempt to identify the status of the specific impact of renewable energy sources on sustainable development.

The contribution of this study lies in three main aspects. First, this paper studies the dynamic impact of green finance, renewable energy and sustainable development, which is of pioneering significance to the study of sustainable development in China. The impact of green finance and renewable energy on sustainable development, which have only been discussed separately in previous studies, are analyzed simultaneously in this study on the impact of both factors on sustainable development in China. Second, the impact of renewable energy on sustainable development has always been a research hotspot among scholars. However, most studies either treat renewable energy as a whole as a complete influencer of sustainable development, or select only one or two renewable energy sources to study their impact on sustainable development. This study subdivides renewable energy into hydro, wind, geothermal and solar energy to study their dynamic impact on sustainable development. Finally, this paper examines the relationship between green finance, renewable energy and sustainable development through the latest dataset that fully considers the COVID-19 epidemic and the Russian-Ukrainian war period, which had a large impact on the development of green finance and renewable energy in China. This study also examines the impact of shocks on sustainable development with the help of a time-varying parametric vector autoregressive model (TVP-VAR-SV), and provide corresponding policy recommendations by analyzing the research results, which is of great significance to policymakers and researchers. In general, the volatility of variables such as green finance and renewable energy plays a positive or negative role in the realization of China’s sustainable development goals. The findings of this study will help provide more effective measures to promote the achievement of China’s sustainable development goals.

Section 2 of this paper presents the literature review, Section 3 presents the methodology and data, Section 4 presents the empirical analysis, and Section 5 draws the conclusion.

Green finance is a financial instrument that provides funding for projects that address climate change and improve environmental performance. Different from traditional finance, the development concept of green finance emphasizes ecological protection and sustainable development. The promotion of green finance as an emerging financial instrument is beneficial for controlling environmental pollution and balancing the relationship between economic development and ecological protection as much as possible (Taghizadeh-Hesary and Yoshino, 2019). Sachs et al. (2019) proposed green finance as a financing instrument with which to achieve the rational allocation of resources by supporting environmental protection projects and thus to respond to climate change in an orderly manner. Green finance differs from traditional finance in that its development philosophy emphasizes ecological protection and sustainable development (Yin et al., 2019). The promotion of green finance increases the sense of social responsibility of enterprises, is beneficial to strengthening their sense of environmental protection, and helps them better plan the use of environmental protection funds and promote the achievement of environmental, social, and governance (ESG) goals together with enterprises by helping environmentally friendly projects be implemented (Zhao et al., 2021; Liu et al., 2019). A large number of scholars have found that green finance has a positive effect on sustainable development. For example, Zhou et al. (2022) found that green credit provides significant financial support for national sustainable development if it meets the requirements of national environmental regulations, while Lee (2022) found that the promotion of green finance reduces the consumption of coal and thus boosts energy sustainability. Moreover, Shahzad et al. (2022) found that green finance has a significant inhibiting effect on carbon emissions in both the short and long term, which is conducive to ecological sustainability. However, some studies have suggested that green finance still has some negative effects on sustainable development. For example, Hafner et al. (2020) found that the heterogeneity of interest relationships among green finance participants leads to competition among them and thus has a dampening effect on sustainable development. Furthermore, Madaleno et al. (2022) showed that as green finance develops, its financing mechanism can negatively affect ecological improvement at a certain threshold. The positive impact of sustainable development on the development of green finance has largely become a consensus, with governments implementing various regulatory strategies to achieve sustainable development goals, companies subsequently increasing their own regulatory intensity, and companies’ increased sense of social responsibility for environmental protection playing an important role in driving the development of the green finance market (Taghizadeh-Hesary et al., 2020; Wang and Huang, 2021; Zhang et al., 2021). Market investors have expanded the demand for green bonds as a result of enhanced confidence in the green sector due to sustainable development strategies (Wang et al., 2020). Feyen et al. (2021) found that the large demand for clean energy from sustainable development strategies drives the development of green finance, while Yang et al. (2022) found that environmental regulations have a positive impact on the development of green finance in both the long and short term.

As a hot issue in current research, renewable energy has been studied more comprehensively, and many scholars have studied the relationship between renewable energy and green finance. Gross et al. (2003) pioneered the study of the correlation between clean energy stocks and technology stocks and found that investors tend to focus more on energy-based products, constructing a transmission chain between energy and finance. Pathania and Bose (2014) linked the support of green finance to the success of renewable energy projects and noted that the growth of solar energy technology is constrained by insufficient funding, further suggesting that the government should regulate the green finance system to increase the efficiency of such financing; otherwise, the unbridled growth of green finance can instead lead to the inefficiency of renewable energy. He et al. (2018) pointed out that to drive the development of renewable energy sources and to achieve sustainable and environmentally friendly development goals, attention must be paid to the establishment of green policies, mentioning that green bonds and credits are favorable financial tools with which to achieve sustainability goals. Academics have also studied the effect of green finance on renewable energy in different economic markets. Li et al. (2018) found that the development of green bond markets in the Asia-Pacific region has contributed to the financing of renewable energy, while He et al. (2019) linked the stock market with renewable energy consumption and concluded that the positive interaction between the two has a driving effect on future investments in the market. Tolliver et al. (2020) studied EU countries with a high number of renewable energy users and found that green finance development reduces domestic carbon emissions by promoting the use of renewable energy. Moreover, Liu et al. (2020) studied the top ten economies that support green finance development, and their analysis based on quantile regression results showed a negative correlation between green finance and CO2 emissions. Liu et al. (2021) studied data from thirty provinces in China and found that green finance has different degrees of positive effects on the use of renewable energy in provinces with different levels of economic development, while Zhang et al. (2022) reported the opposite result, finding that improvements in financial efficiency increase solid waste and sulfur dioxide emissions. Some literature has also demonstrated that investments in renewable energy drive economic development and indirectly lead to the development of green finance (Li et al., 2021; Mngumi et al., 2022; Ye et al., 2022). The COVID-19 epidemic has brought about both opportunities and challenges to the development of green finance and renewable energy. While the epidemic has put extreme pressure on the renewable energy industry, resulting in the shutdown of economic sectors, green credit and green securities have had a positive impact on renewable energy investments.

Another research aspect of renewable energy examines the role of renewable energy in achieving sustainable development and benefitting present and future generations, and currently, the ability of renewable energy to promote sustainable development is widely recognized by the international community (Lund et al., 2010; Dogan and Seker, 2016; Spiegel, 2018). Chung et al. (2018) found that the consumption of rare Earth resources has a strong impact on sustainable development and suggested that renewable energy technologies can be used to improve environmental issues, such as reducing ozone depletion and greenhouse gas emissions. Moreover, Kutan et al. (2018) explored the role of renewable energy in addressing climate change, emphasizing its role in achieving sustainable development. Furthermore, Sun et al. (2021) studied the relationships among environmental quality, economic development and renewable energy in Brazil, Russia, India, China, and South Africa (BRICS countries), the results of which showed that renewable energy is a prerequisite for sustainable development and emphasized the role of renewable energy in environmental protection. Wu et al. (2022) examined data from the Nordic countries and found that renewable energy and financial development reduced carbon dioxide emissions in the short and long term, and that financial development increased the correlation between carbon dioxide emissions and renewable energy consumption. Wang et al. (2023) studied the role of three clean energy sources, nuclear energy, hydropower and biomass energy, in achieving China’s carbon neutrality goals. The results show that the use of clean energy should be increased before the ecological footprint reaches its peak, otherwise its effectiveness in emission reduction will decline, which is not conducive to sustainable development. Adebayo et al. (2022) explored the interaction between renewable energy, non-renewable energy, trade development, and economic development, and found that trade development and renewable energy contribute to environmental sustainability, while non-renewable energy expands carbon emissions. Irfan et al. (2022) studied the dynamic relationship between financial development, economic growth and carbon emissions in the UK, and pointed out that pollution from fossil fuels will hinder the improvement of long-term productivity and policymakers should increase support for financial markets and green energy. Ramzan et al. (2022) investigate the role of green innovation and financial globalization on the sustainability of the environment and energy transition using a time-varying rolling window model based on quarterly data from 1995 to 2020 in the United Kingdom and found that innovation in green technologies and energy transition are both beneficial for environmental sustainability.

There have been in-depth and fruitful studies on green finance, renewable energy and sustainable development, but the literature has focused more on the effects of the bivariate variables and there is no literature that considers the overall relationship of the three. The previous literature has either treated renewable energy mostly as a complete influencer of sustainable development or covered only one or two aspects of renewable energy. This study further investigates the dynamic effects of various renewable energy sources and sustainable development, supplementing the gap in the literature. In terms of methodology, the literature has adopted mostly a traditional vector autoregressive model, which cannot analyze the dynamic interaction relationships among the variables. In this study, we use vector autoregressive models with time-varying parameters to systematically examine the dynamic time-varying relationships among green finance, renewable energy and sustainable development.

As a major green financial market and energy importer in the world, China is very concerned about environmental sustainability. Therefore, it is of great significance to study China’s sustainable development. Seven variables are used in this study, among which sustainable development is the main variable. This part introduces the theoretical basis for the interrelationships among the variables.

2A large amount of literature has proved the role of green finance in sustainable development. At present, most projects promoting sustainable development need to be financed through green finance, and a large number of countries have begun to build strong green finance markets to promote economic and environmental sustainability (Zhang et al., 2021; Zhang et al., 2021). By promoting the development of green finance, the government aims to achieve a win-win goal of economic growth and environmental sustainability. In addition, under the situation of insufficient market regulation ability, green finance is conducive to energy conservation and emission reduction, promoting sustainable economic development. Therefore, it can be assumed that there is a positive relationship between green finance and sustainable development. Renewable energy also has an impact on sustainable development (Chung et al., 2018; Chishti et al., 2021; Azam et al., 2021). In order to achieve sustainable development goals, the transition from traditional non-renewable energy to renewable energy is inevitable, and accelerating the energy transition can alleviate environmental pollution problems, such as reducing carbon dioxide emissions (Usman et al., 2021; Yoshino et al., 2021). However, the transition to renewable energy requires high costs, which may have some negative impact on economic development. According to Elavarasan et al. (2022), it was found that economies with higher levels of economic development will still increase their investment in renewable energy for sustainable development. Therefore, this study assumes that there is a positive correlation between renewable energy and sustainable development, and there is a positive correlation between the four renewable energy sources of water energy, wind energy, geothermal energy, and solar energy and sustainable development.

In addition to considering sustainability influences, it is also possible to link green finance to renewable energy, and there is a rich literature supporting the argument for a two-way causal relationship between green finance and renewable energy (Sadiq et al., 2021; Wang et al., 2021; Khan et al., 2022; Meo et al., 2022). Moreover, most renewable energy projects are financed through green financial instruments, and the demand for sustainable development further promotes the development of renewable energy. Therefore, it can be assumed that there is a positive correlation between green finance and renewable energy.

This study draws on the time-varying parametric vector autoregressive model with stochastic fluctuations (TVP-VAR-SV model) proposed by Primiceri (2005) and Del Negro and Primicrieri (2015) to investigate the impact of green finance and renewable energy on sustainable development in China and the connectivity effects of four types of renewable energy on sustainable development. The TVP-VAR-SV model allows its parameters to follow time and wander randomly by improving the SVAR model. The basic SVAR model equation can be expressed as follows:

where

Further simplifying Eq. 1 as follows:

where

All parameters in Eq. 5 are fixed values and do not vary with time, further extending the parameters to be estimated in Eq. 4 to a time-varying TVP-VAR-SV model as follows:

Parameters

as well as the following:

where

The empirical part of this paper is divided into three main steps: The first step tests the stationarity of the data and performs a cointegration test based on the stationarity test to ensure that there is a long-term stable equilibrium relationship between the variables. The second step is to use MATLAB to estimate the TVP-VAR-SV model. Firstly, the validity of the model estimation results is evaluated by MCMC method; secondly, the equal interval impulse response diagram of green finance, renewable energy and sustainable development is obtained, and the number of short, medium and long-term lead times is set to 1, 4, and 8, respectively; finally, the impulse response function is used to dynamically identify the connectivity effect, and three time points are set as April 2016 (energy supply-side structural reform), December 2019 (COVID-19 outbreak), and October 2022 (near term). In the third step, after subdividing renewable energy into hydro, wind, geothermal and solar energy, the correlation between them and sustainable development is further explored through the TVP-VAR-SV model. Firstly, the validity of the model estimation results was evaluated by MCMC method; secondly, the lead times of the equal interval impulse response diagram are set to 1, 4, and 8, respectively; Finally, the connectivity effect is dynamically identified, and the two time points are set to December 2019 (COVID-19 outbreak) and October 2022 (recent).

In this study, a time-varying parametric stochastic volatility vector autoregressive model is chosen to study the relationships among green finance, renewable energy and sustainable development. Moreover, the ChinaBond China Green Bond Index is chosen as a proxy variable for green finance (Dlngfi), the CSI Environmental Protection Industry 50 Index is chosen as a proxy variable for renewable energy (Dlnre), and the CSI CAITONG ECPI ESG China 100 Index is chosen as a proxy variable for sustainable development (Dlnesg). The daily indices from 4 January 2013, to 14 October 2022, are selected for this study, and the data are obtained from the Wind database.

Figure 1 shows the time series of green finance, renewable energy and sustainable development (taking the natural logarithm of the daily index values). It can be seen that during the observation period, the price series of the renewable energy and sustainable development indices fluctuate sharply, with the renewable energy index value remaining at a higher level and the green finance index fluctuating relatively little, with small fluctuations around zero. The fluctuation of the renewable energy index is actually the change of the supply and demand situation, coupled with the intermittent and unstable characteristics of renewable energy itself, resulting in violent fluctuations of the index. Affected by geopolitical tensions, extreme weather and the COVID-19 epidemic, the renewable energy index has shown more volatility than the sustainable development index and the green finance index. The sample stocks of the sustainable development index are the stocks of companies with higher ESG ratings. These companies are more resilient in the market downturn. Although they are also affected by the international situation, they are less volatile than the renewable energy index. With green development becoming one of the five major concepts in China, green finance has also been listed as an important issue in financial innovation and supply-side structural reform, and the issuance of green bonds has been vigorously promoted by all sectors of society. The rapid expansion of the market has increased investors’ recognition and enthusiasm for green bonds to a certain extent. In addition, due to the influence of China’s relatively accommodative monetary policy orientation, the overall volatility of the Green Bond Index is relatively small.

Figure 2 shows a time-series plot of green finance, four renewable energy sources (hydro Dlnhrr, wind Dlnwpr, geothermal Dlnger, and solar Dlnspr) and sustainable development, depicting the trend of the index from 2 January 2019, to 14 October 2022. It can be seen that index trends are more pronounced during the most recent economic event—the COVID-19 epidemic outbreak—with multiple volatility clusters for all time series except that of the green finance index, from which it can be inferred that investors can use green finance as a hedge asset when building their asset portfolios to protect them from excessive volatility in the energy market. Due to the obvious intermittence and instability of solar energy and wind energy, solving the stability of energy supply has become a key issue after increasing their proportion of energy use. The fluctuation of the two indexes is more severe than that of water energy and geothermal energy.

In this study, the TVP-VAR-SV model is selected to test the dynamic relationships among the variables. If the variables are non-equilibrium series, then there is a “pseudoregression” phenomenon; therefore, this work first conducts an ADF unit root test on the series of seven variables, the results of which are shown in Figure 3.

From the results in Figure 3, it can be seen that green finance, renewable energy and sustainable development are all first-order differential smooth series and that hydro, wind, geothermal and solar energy are smooth series, so the cointegration test is conducted for green finance, renewable energy and sustainable development. The optimal lag order chosen according to the AIC is second order, and the cointegration test results are shown in Figure 4.

The cointegration test results shown in Figure 4 indicate that there is a cointegration relationship among the three variables; i.e., there is a long-term more stable equilibrium relationship among green finance, renewable energy and sustainable development, and therefore, the original series can be used for simulation.

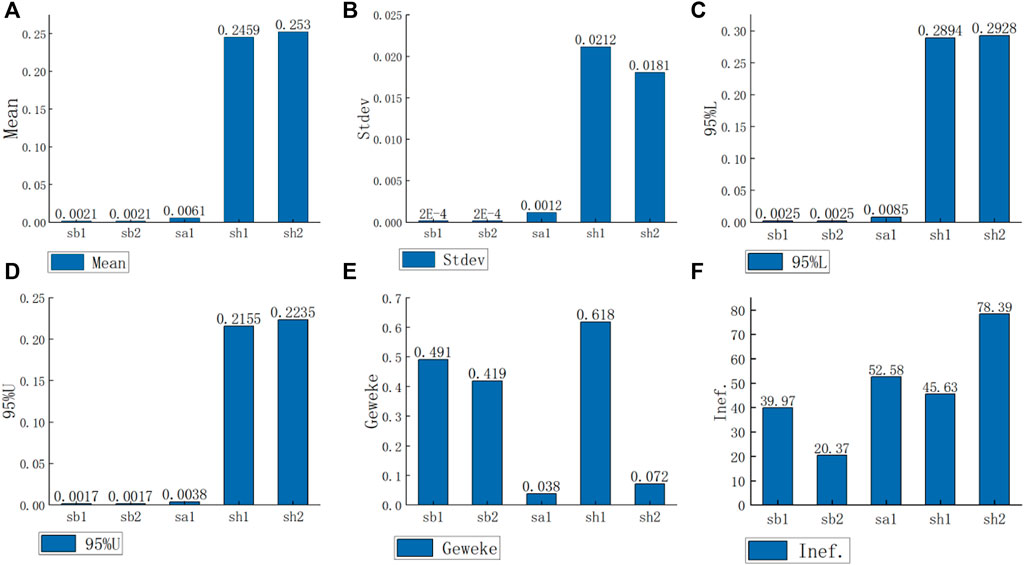

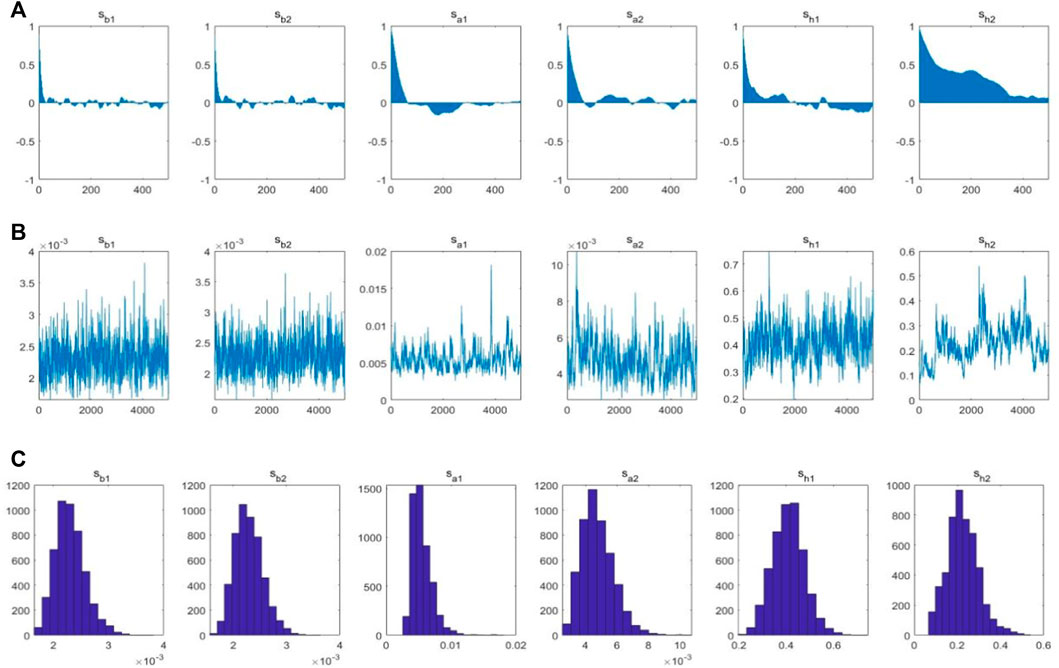

In this study, we use MATLAB to estimate the TVP-VAR-SV model and introduce the MCMC method to facilitate the parameter estimation of the model. The number of sampling times is set to 10,000, and the first 1,000 preburn samples are discarded because the preliminary iteration exhibits instability; finally, 9,000 effective sampling samples are obtained. Based on the lag order determination criterion in the VAR model, this work selects the second-order lags to construct the TVP-VAR-SV model. Figure 5 shows the parameter regression results, reporting the posterior distribution values, standard deviations, 95% confidence intervals, Geweke diagnostic values, and the invalid impact factor of the model estimation. The maximum value of Geweke’s test statistic is .618, the minimum value is .038, and the invalid factors are all at a small level. Furthermore, the maximum value is only 78.39, which is less than 100, and the estimation results of the model are shown to have validity.

FIGURE 5. Results of parameter estimation. (A) Mean, (B) Standard Deviation, (C,D) 95% confidence interval, (E) Geweke diagnostic values, and (F) invalid impact factor.

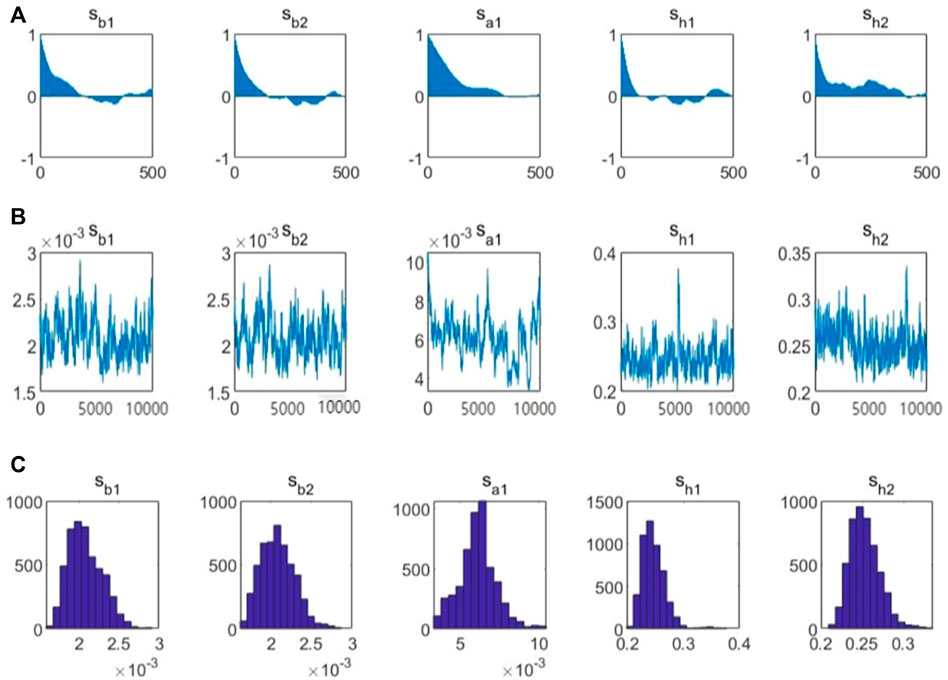

Compared with traditional econometric model estimation methods, the confidence level of the MCMC algorithm for the parameter estimation of the TVP-VAR-SV model depends on the path of the sample. Figure 6 is a plot of the parameter estimation results for the three variables, and the validity of these results is tested by analyzing whether the sampling converges to the posterior distribution based on the plotted results obtained from MCMC sampling.

FIGURE 6. Graph of parameter estimation results. (A) The autocorrelation coefficient of sampling, (B) dynamic path, and (C) posterior distribution graph.

The graph of the parameter estimation results in Figure 6 includes three parts: the autocorrelation coefficient of sampling, dynamic path and posterior distribution graph. Row A shows the plot of the autocorrelation coefficient of sampling, from which it is observed that the autocorrelation coefficient of each variable decreases rapidly and gradually tends to 0 as the number of samplings continues to increase, which indicates that the sampling results are not correlated. Row B shows the dynamic path of sampling of each variable, and it is observed from the figure that each sampling after the preburning of each variable fluctuates up and down around a certain mean value without an obvious temporal trend, which indicates that the posterior path of MCMC sampling is relatively smooth. Row C shows the posterior distribution density probability plot of each parameter, from which it can be clearly seen that the parameters are basically concentrated in a certain value range of distribution, indicating that the sampling converges to the posterior distribution. The above analysis shows that the MCMC simulation sampling results are smooth, converge to the posterior distribution and are not correlated; that is, the parameter estimation results obtained from the sampling are valid and stable, and thus, the model can be analyzed in more depth.

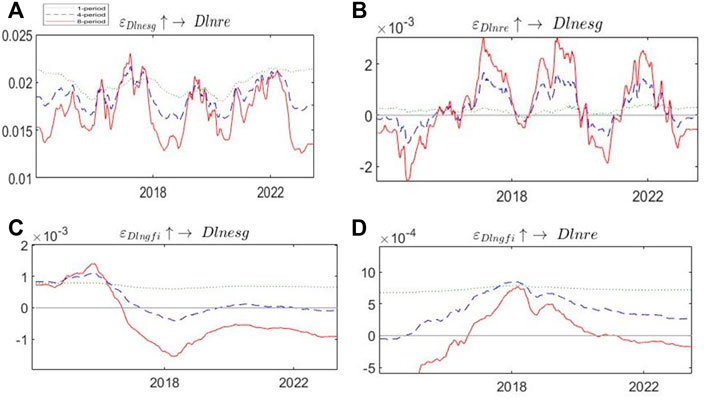

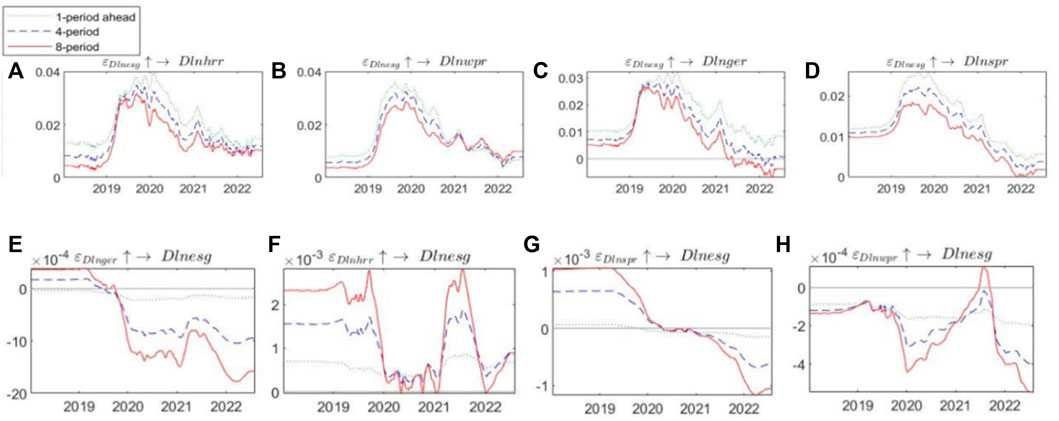

Figure 7 shows the equal-interval impulse response plots for green finance, renewable energy and sustainable development, with the number of lead periods being 1, 4, and 8 in the short, medium and long terms, respectively, the horizontal axis indicating the time nodes, and the vertical axis indicating the intensity of the impulse response.

FIGURE 7. Plot of the equal-interval impulse response function. (A) The equal-interval impulse response of sustainable development to renewable energy, (B) the equal-interval impulse response of renewable energy to sustainable development, (C) the equal-interval impulse response of green finance to sustainable development, and (D) the equal-interval impulse response of green finance to renewable energy.

From the figure, it can be seen that the impulse response curves of the three different lead time shocks have large differences, with the shocks of the 4 and 8 lead times being smaller and the shock of the 1 lead time having a larger impact. Figure A shows the equal-interval impulse response of sustainable development to renewable energy (εDlnesg→Dlnre), the influence of which is constant positive, and the impulse response curve of sustainable development to renewable energy is relatively smooth throughout the time axis. The lower response curves of 4 and 8 periods ahead indicate that the positive shock of sustainable development can improve the renewable energy index in the short term (1 period ahead); that is, the effect of the positive transmission mechanism of sustainable development on renewable energy is relatively smooth in the short term. Figure B plots the equal-interval impulse response of renewable energy to sustainable development (εDlnre→Dlnesg), where the shocks are both positive in advance 1 and the impulse response lines in advance 4 and advance 8 are gradually retraced after 2013, with a large decrease in both 2018 and 2021, which are more associated with the US‒China trade war in 2018 and the COVID-19 pandemic starting in 2020. The entire timeline exhibits strong time variability. The findings of this study are consistent with Abbas et al. (2021), who pointed out that the development of green finance promotes the transition from non-renewable to renewable energy sources, thus contributing to the reduction of carbon emissions and helping to achieve sustainable development goals. Godil et al. (2021) also found that the use of renewable energy reduces carbon emissions in various places and saves a lot of natural resources, thus contributing to the country’s sustainable development. Figure C plots the equal-interval impulse response of green finance to sustainable development (εDlngfi→Dlnesg), and its impulse response curve has a large difference in the trend of three different advance periods, with the largest impulse response being in advance period 1 and the impulse response in advance period 4 and advance period 8 exhibiting a substantial decrease in 2015. The impact of green finance on sustainable development is consistently positive in the short term, and the positive impact of green finance in the long term causes a decrease in the sustainability index, this finding is similar to that of Lubik et al. (2016) and Li et al. (2021). The high input cost and long payback period of green finance projects lead to the low motivation of enterprises to carry out green finance projects. And the Chinese government’s legal system on green finance is not yet perfect, which adds difficulties to the development of green finance business. Figure D shows the equal-interval impulse response of green finance to renewable energy (εDlngfi→Dlnre), which shows obvious time-varying characteristics. The impact on renewable energy is constant positive in 1 period ahead; that is, the growth of green finance can drive the increase of renewable energy, while this impact starts to produce a negative impact in 2020 after eight periods ahead, implying that it is difficult to explain the further growth of renewable energy simply by the expansion of green finance alone and that the effective transformation of the energy supply-side structure is more important. Madaleno et al. (2022) also conducted a similar study and found that renewable energy has higher volatility and stronger causality on green finance, while the impact of green finance on renewable energy in the long run is not obvious. Wu et al. (2022) study similarly found that increasing the green finance index can help promote the development of renewable energy and mitigate climate change.

From the above equal-interval impulse response plots, it can be seen that there is a certain time-varying relationship among the variables, and based on typical events, this study uses the impulse response function to dynamically identify the linkage effects of green finance, renewable energy and sustainable development. Time point 1 is April 2016, when China carried out energy supply-side structural reform, pointing out that to solve the outstanding problems faced by energy development under the new normal, such as the excess capacity of traditional energy, bottleneck constraints of renewable energy development, and overall operational efficiency of the energy system, it is necessary to innovate energy institutional mechanisms and vigorously promote energy supply-side structural reform. Time point 2 is December 2019, the start of the COVID-19 outbreak. A new coronavirus pneumonia case emerged in Wuhan in December 2019, and by January 2020, it had rapidly spread throughout the country. By March 2020, the epidemic had spread to several countries and became a global health event, which was defined by the International Health Organization as an international public health emergency (PHEIC). Time point 3 is more recent.

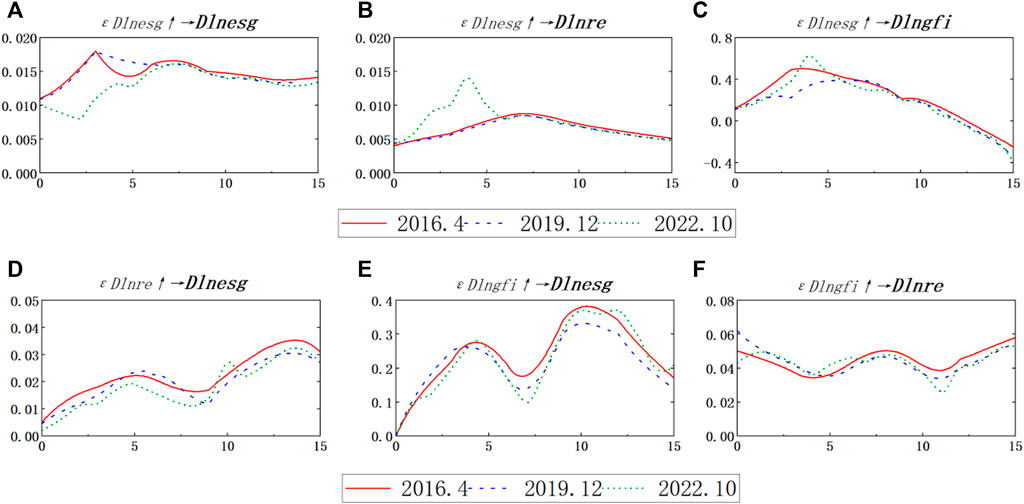

As seen in Figure 8, Figure A plots the time-point impulse response of sustainability (εDlnesg→Dlnesg), which has comparable initial impulse shock effects at three time points, with a positive shock of one standard deviation, creating a positive effect of approximately .02%. However, the convergence rate of time point 3 is significantly faster than that of time points 1 and 2, which reflects the time-varying characteristics of the convergence rate of sustainable development’s own shock effect. Figure B shows the time-point impulse response of sustainable development to renewable energy (εDlnesg→Dlnre). The shocks are constant positive at three time points, and the impulse plots at time points 1 and 2 show a longer time lag effect and a slower convergence rate, while the time variation at time point 3 is characterized by a short-term peak followed by a rapid convergence. Figure C shows the time-point impulse response of sustainable development to green finance (εDlnesg→Dlngfi). The shock converges rapidly after 5 periods and penetrates the 0 axis in the process of converging to 0 with a negative effect. Figure D shows the time-point impulse response of renewable energy to sustainable development (εDlnre→Dlnesg), and its shock direction is basically the same at the three time points, all of which show positive effects; that is, the development of renewable energy at the three time points causes a rise in the green financial index, among which the strongest shock effect is at time point 1. From the time-varying trend, the trend of imposing a positive shock of one standard deviation on renewable energy to cause the rise in the green financial index is gradually strengthened. The change in renewable energy can be transmitted to sustainable development in the short term, which further indicates that the transmission channel between the two is relatively smooth. Figure E shows the time-point impulse response of green finance to sustainable development (εDlngfi→Dlnesg), where the shock reaches its maximum in time period 2 and starts to retrace in time period 3; then, it tends to zero and shows a negative impact. The shock of structural reform in 2016 is more obvious than is that at the other two time points. Figure F shows the time-point impulse response of green finance to renewable energy (εDlngfi→Dlnre), the shocks of which are constant positive at the three time points; that is, the development of green finance drives the development of renewable energy at all three time points, with the strongest shock being at time point 3.

FIGURE 8. Time-point impulse response diagrams. (A) The time-point impulse response of sustainability, (B) the time-point impulse response of sustainable development to renewable energy, (C) the time-point impulse response of sustainable development to green finance, (D) the time-point impulse response of renewable energy to sustainable development, (E) the time-point impulse response of green finance to sustainable development, (F) the time-point impulse response of green finance to renewable energy.

The above studies show that renewable energy has a positive impact on sustainable development, and this section focuses on the correlation between individual renewable energy and sustainable development to explore its specific impact.

Figure 9 reports the plots of sample autocorrelation, path and posterior distribution, where the autocorrelation coefficient tends to decrease and eventually converges to 0. The sample path is relatively smooth, and the sample distribution shows good convergence, indicating that the sample is well sampled and that the model results are reliable.

FIGURE 9. Graph of parameter estimation results. (A) The autocorrelation coefficient of sampling, (B) dynamic path, and (C) posterior distribution graph.

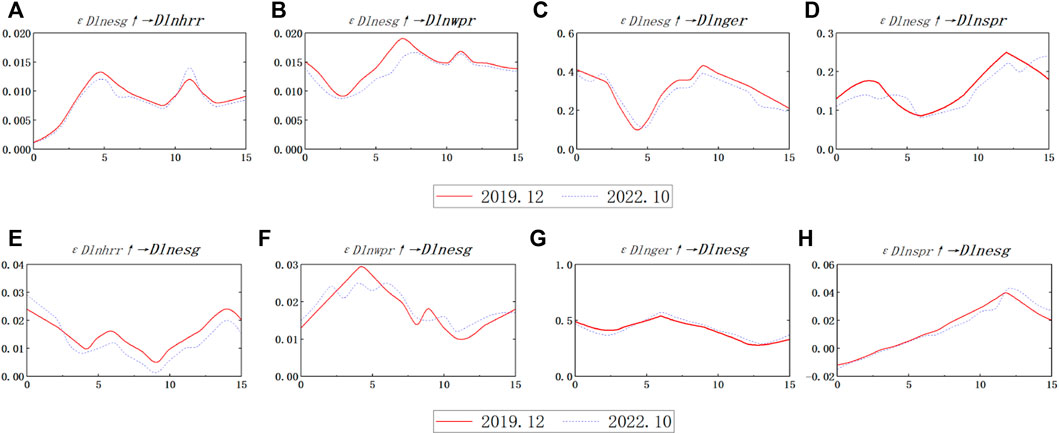

Figure 10 shows the equal-interval shock response functions for 1, 4, and 8 periods ahead, with the horizontal axis indicating the time nodes and the vertical axis showing the impulse response values of each variable.

FIGURE 10. Equally spaced impulse response function graphs. The isometric impulse responses of sustainable development to (A) geothermal, (B) hydro, (C) solar, and (D) wind energy, (E) the iso-interval impulse response of the geothermal energy shock to sustainable development, (F) the iso-interval impulse response of hydro energy shocks to sustainable development, (G) the iso-interval impulse response of solar energy to sustainability, and (H) the equally spaced impulse response of wind energy to sustainable development.

Figures 10A–D show the isometric impulse responses of sustainable development to geothermal, hydro, solar, and wind energy, respectively. It can be seen that the impact of sustainable development on each energy source is more obvious in the advance 1 period and that a positive impact is observed during all three advance periods, indicating that the improvement of the sustainable development level has an obvious driving effect on the renewable energy index. This driving effect is stronger in the short term, but this positive impact continues to decrease after the COVID-19 outbreak at the end of 2019, and the response value is almost 0 at the end of 2022. This situation reflects that the degree of China’s renewable energy market being affected by the changes in sustainable development gradually decreases after the COVID-19 outbreak and that the effect of the transmission mechanism of sustainable development on renewable energy gradually weakens. Sadorsky and Perry (2021) found that the level of sustainable development has a positive impact on the scale of hydropower, wind energy, solar energy and other renewable energy. Alola et al. (2022) and Bekun and Festus Victor (2022) similarly found a positive relationship between sustainable development and renewable energy through their analysis.

Figure 10E shows the iso-interval impulse response of the geothermal energy shock (εDlnger→Dlnesg) to sustainable development, where the shock is positive before the COVID-19 outbreak. This finding is also consistent with the conclusion verified in the previous paper, but the impact continues to decrease at the end of 2019, combined with the existing trend of a time-varying decrease in the impact of sustainable development on renewable energy. The reason for the decrease in the impact of geothermal energy may be related to the weakening of the transmission mechanism between the two aspects. This is consistent with Ullah et al. (2022) study that geothermal energy as a recyclable and clean energy source can provide a stable base energy source and contribute positively to the sustainable development of the country. Figure 10F shows the iso-interval impulse response of hydro energy shocks to sustainable development (εDlnhrr→Dlnesg), the shock of which is constant positive, reaching the maximum in the advance 8 period. However, this response shows a decreasing trend on the time axis from 2019, and the decline in the pulse effects in advance 1 period and advance 4 period are also more significant. Razmjoo et al. (2021) also studied the relationship between hydropower and sustainable development, and found that hydropower would hinder sustainable economic development. This result echoes the findings of Godil et al. (2021) and Zafar et al. (2021) that although hydroelectric power can replace non-renewable energy and reduce carbon emissions to some extent, the long-term effect is not obvious.

Figure 10G shows the iso-interval impulse response of solar energy to sustainability (εDlnspr→Dlnesg), where the shock is initially positive, but the response continues to decrease and crosses the 0 axis to become negative by the end of 2020. A negative impulse response implies that positive changes in solar energy cause negative changes in sustainability. This is similar to the findings of Kirikkaleli et al. (2021), where large-scale installation of solar panels by various commercial organizations reduces the use of fossil fuels and promotes sustainable economic development. Khan et al. (2021) also argue that solar energy, as a renewable energy source, derives its energy from the heat of the Sun, does not produce toxic waste, and its use is beneficial to the achievement of sustainable development goals.

Figure 10H plots the equally spaced impulse response of wind energy to sustainable development (εDlnwpr→Dlnesg), where the shocks always maintain relatively stable negative feedback, implying that the tendency of wind energy to heat up usually has a negative impact on sustainable development. Falcone et al. (2021) found that wind power does not release toxic gases or substances to harm the environment and therefore contributes to the sustainability of economic development. The difference in the results of this study may be related to the different research subjects. According to national policies encouraging the development of renewable energy, power grid enterprises must accept and fully acquire renewable energy power. However, because China’s most abundant wind energy resources are distributed mainly in the “three North” and other remote areas, most of them are at the end of the power grid. Because the grid construction can be relatively weak in areas away from the grid, the ability to accommodate wind power can very low. At the same time, compared to thermal power generation, wind power is less stable, which indirectly causes difficulties in terms of wind power access. As a capital-intensive industry, projects in the wind power generation industry have a long payback period, and wind power operating companies are under greater financial pressure compared to other types of companies. At present, wind power operating companies use mainly their own funds plus bank loans to raise project investment funds, financing channels are relatively scarce, and only a few listed wind power operating companies can further expand their financing channels through equity and other forms of financing.

From the graph of the equal-interval impulse response results, we can see that the correlations among the variables have more obvious time-varying characteristics. To further analyze the changes in the impact of each renewable energy source on sustainable development in the model at different time points, this section selects the COVID-19 outbreak (2019.12) and more recent times (2022.10) as two impulse response time points and obtains the impulse response results in Figure 11.

FIGURE 11. Time-point impulse response graphs. the point-in-time impulse responses of sustainable development to (A) geothermal, (B) hydro, (C) solar, and (D) wind energy, the impulse response of (E) hydro and (F) solar energy to sustainable development of the time-point impulse response plots, (G) the time-point impulse response of wind energy to sustainable development, and (H) the impulse responses of geothermal energy to sustainable development.

Figures A, B, C, and D show the point-in-time impulse responses of sustainable development to geothermal, hydro, solar, and wind energy, respectively. As seen from the graphs, sustainable development has a positive effect on each renewable energy source in the observed lag period, and in the long run, the long-term positive effect is greater than that of the short term and gradually converges after reaching a maximum. The reason for this is that in the short term, the increase in the level of sustainable development raises the demand for renewable energy, causing the renewable energy index to rise. However, after the period of time dealing with the COVID-19 pandemic, the demand for renewable energy decreases, and the market shrinks, thus causing its index value to fall. As the economy stabilizes and the risks in the market become manageable, investors refocus their attention on the renewable energy market, thus pushing it upward. Figures E and H show the impulse response of hydro and solar energy to sustainable development (εDlnhrr→Dlnesg, εDlnspr→Dlnesg) of the time-point impulse response plots, and the shock effects of both remain basically the same at two different time points. Both show an S-shaped curve, falling, then rising, and then falling again. The response coefficient of sustainability is negative when solar energy is subjected to a positive shock of one standard deviation, indicating that a rise in the solar energy index causes a decline in the sustainability index in the short term. In the case of December 2019 versus October 2022, the shock effect of hydro energy on sustainability starts to decay after reaching a peak in period 9, and that of solar energy on sustainability starts to decay after reaching a maximum. The shock effect is larger and more persistent in December 2019 than in October 2022. In the short term, the rise in hydro and solar energy indices affects sustainable development but, in the long term, can have a driving effect on sustainable development. Figure F shows the time-point impulse response of wind energy to sustainable development (εDlnwpr→Dlnesg) with all positive impulse effects, indicating that the development of wind energy has a significant pull effect on sustainable development and that the impact effect is greater in December 2019 than in October 2022. Figure G plots the impulse responses of geothermal energy to sustainable development (εDlnger→Dlnesg), and it can be seen that its impulse responses are all positive in December 2019, indicating that the development of the geothermal energy index has a significant pulling effect on sustainable development during this year. In October 2022, the impulse effect of geothermal energy on sustainable development shows a negative effect in period 4, which starts to turn positive after period 7 and reaches a maximum in period 15. The reason for this is that in the short term, geothermal energy development is highly sought after and contributes to the improvement of sustainable development. However, due to incomplete technology and facilities and the influence of related economic events, its excessive use in the initial stage inhibits sustainable development, and after a period of time, economic operations gradually stabilize, investors’ expectations improve, policies are supported, and geothermal energy development again contributes to the improvement of sustainable development.

This study explores the dynamic relationship among and response of green finance, renewable energy and sustainable development in China based on the TVP-VAR-SV model, selecting time-series data from 4 January 2013, to 14 October 2022. Then, an exploration of the dynamic relationship between four renewable energy sources (hydro, wind, geothermal, and solar energy) and sustainable development is carried out, selecting time-series data from 2 January 2019, to 14 October 2022, as the sample interval. The study conclusion are presented below.

First, green finance, renewable energy and sustainable development interact with each other, and the degrees and directions of their effects vary at different points in time, showing time-varying and heterogeneous characteristics.

Second, the relationship between sustainable development and renewable energy is a complex dynamic response process. The improvement of sustainable development has positive effects on the sustainable use of energy, as it can promote the development and application of renewable energy, while the impact of renewable energy on sustainable development is time-varying in different advance periods, and the impact of renewable energy on sustainable development is heterogeneous in two different time periods when renewable energy is subdivided.

Third, the impulse response of green finance to sustainable development has a constant positive impact in the short term; then, the positive shock of green finance in the long term causes a decline in the sustainable development index, which is related to the deficiencies in the development of green finance in China at this stage. The current development of green finance still faces problems such as a its single structure, imperfect information disclosure, low return rate, long maturity and high risk.

Fourth, the development of green finance and the promotion of renewable energy development in the short term are internally consistent, the impact of green finance on renewable energy is consistently positive at one period in advance, and a negative impact starts in 2020 after eight periods in advance. It is difficult to explain the sustainable growth of renewable energy simply by the expansion of green finance, and the effective transformation of the energy supply-side structure is more important for the sustainable development of renewable energy.

Combining theoretical analysis and empirical research, the following recommendations are set forth.

First, the green financial system should be improved, and the sustainable development of green finance should be promoted by constantly enhancing the implementation of such policies. The unified standards, norms and statistical system of green finance and other basic systems must be gradually refined and clarified in conjunction with the continuous development and improvement of market practice. Second, the use of policy publicity, subsidies, tax relief, etc., to guide all types of capital, especially social capital, into the green industry should be promoted to enhance the intrinsic motivation of social subjects to join green finance. Third, the innovation of green financial products and services should be encouraged, and diversified green financial products should be provided. The enthusiasm of market players to innovate green financial business models needs to be fully mobilized to effectively improve the performance of green financial business.

Moreover, an effective capacity market should be established as soon as possible, and the auxiliary service market should be improved to promote the gradual decline in and reasonable recovery of the costs associated with the development of renewable energy system costs. Through the effective capacity market and auxiliary service market, investors will be guided to adopt the most economical way to provide effective peaking and standby capacity to promote a decrease in the system costs associated with renewable energy development. After the establishment of the effective capacity market and the improvement of the auxiliary service market, the system cost will be borne by all customers according to their electricity consumption and the specific time period, and the cost of providing peaking and standby capacity by investors will be reasonably compensated. This situation will promote power generation enterprises to improve the peaking capacity of their generating units and actively build peaking power and energy storage facilities, thus promoting the development of renewable energy and the early realization of sustainable development goals. Anwar et al., 2022, Hammoudeh et al., 2020, Marini et al., 2014, Nawaz et al., 2021, Pata 2021, de Simón-Martín et al., 2019, Wu et al., 2021, Østergaard and Lund, 2011, Ibrahim et al., 2022b, Ma et al., 2021a, Ma et al., 2021b, Rusu, 2019b.

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

JC: Methodology, formal analysis, conceptualization, data curation, software validation and writing original draft. ZW: Project administration, and funding acquisition, writing—review and editing and visualization. LL: Writing original draft. DY: Writing original draft. All authors: Contributed to the article and approved the submitted version.

National Social Science Foundation Project “Research on the Risk and Management of Hidden Debt of County Governments in Ethnic Areas Based on Effect Evaluation” (Project No. 20XMZ061).

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

BRICS, Brazil, Russia, India, China, and South Africa; CSI, China securities index; ESG, environment, social and governance; MCMC, Markov chain Monte Carlo; PHEIC, public health emergency of international concern; SVAR, structural vector autoregression; SD, sustainable development; SDGs, sustainable development goals; TVP-VAR-SV, time varying parameter-stochastic volatility-vector auto regression; UN, United Nations; VAR, vector autoregression; WCED, World commission on environment and development.

Abbas, M. G., Wang, Z. Q., Bashir, S., Iqbal, W., and Ullah, H. (2021). Nexus between energy policy and environmental performance in China: The moderating role of green finance adopted firms. Environ. Sci. Pollut. Res. 28 (44), 63263–63277. doi:10.1007/s11356-021-15195-5

Adebayo, T. S., Bekun, F. V., Rjoub, H., Agboola, M. O., Agyekum, E. B., and Gyamfi, B. A. (2022). Another look at the nexus between economic growth trajectory and emission within the context of developing country: Fresh insights from a nonparametric causality-in-quantiles test,6 1–23. doi:10.1007/s10668-022-02533-xEnviron. Dev. Sustain.

Alola, A. A., and Adebayo, T. S. (2022). Are green resource productivity and environmental technologies the face of environmental sustainability in the Nordic region? Sustain. Dev. 34 doi:10.1002/sd.2417

Anwar, A., Sinha, A., Sharif, A., Siddique, M., Irshad, S., Anwar, W., et al. (2022). The nexus between urbanization, renewable energy consumption, financial development, and CO2 emissions: Evidence from selected asian countries. Environ. Dev. Sustain. 24 (5), 6556–6576. doi:10.1007/s10668-021-01716-2

Azam, A., Rafiq, M., Shafique, M., Zhang, H. N., and Yuan, J. H. (2021). Analyzing the effect of natural gas, nuclear energy and renewable energy on GDP and carbon emissions: A multi-variate panel data analysis. Energy 219, 119592. doi:10.1016/j.energy.2020.119592

Bekun, F. V. (2022). Mitigating emissions in India: Accounting for the role of real income, renewable energy consumption and investment in energy.23 doi:10.32479/ijeep.12652670216917

Bhuiyan, M. A., An, J., Mikhaylov, A., Moiseev, N., and Danish, M. S. S. (2021). Renewable energy deployment and COVID-19 measures for sustainable development. Sustainability 13 (8), 4418. doi:10.3390/su13084418

Chishti, M. Z., Ahmad, M., Rehman, A., and Khan, M. K. (2021). Mitigations pathways towards sustainable development: Assessing the influence of fiscal and monetary policies on carbon emissions in BRICS economies. J. Clean. Prod. 292, 126035. doi:10.1016/j.jclepro.2021.126035

Chung, M., Shin, K.-Y., Jeoune, D.-S., Park, S.-Y., Lee, W.-J., and Im, Y.-H. (2018). Economic evaluation of renewable energy systems for the optimal planning and design in Korea–a case study. J. Sustain. Dev. Energy, Water Environ. Syst. 6 (4), 725–741. doi:10.13044/j.sdewes.d.6.0216

de Simón-Martín, M., de la Puente-Gil, Á., Borge-Diez, D., Ciria-Garcés, T., and González-Martínez, A. (2019). Wind energy planning for a sustainable transition to a decarbonized generation scenario based on the opportunity cost of the wind energy: Spanish iberian peninsula as case study. Energy Procedia 157, 1144–1163. doi:10.1016/j.egypro.2018.11.282

Dogan, E., and Seker, F. (2016). Determinants of CO2 emissions in the European union: The role of renewable and non-renewable energy. Renew. Energy 94, 429–439. doi:10.1016/j.renene.2016.03.078

Elavarasan, R. M., Pugazhendhi, R., Jamal, T., Dyduch, J., Arif, M. T., Kumar, N. M., et al. (2021). Envisioning the UN Sustainable Development Goals (SDGs) through the lens of energy sustainability (SDG 7) in the post-COVID-19 world. Appl. Energy 292, 116665. doi:10.1016/j.apenergy.2021.116665

Falcone, P. M., Hiete, M., and Sapio, A. (2021). Hydrogen economy and sustainable development goals: Review and policy insights. Curr. Opin. Green Sustain. Chem. 31, 100506. doi:10.1016/j.cogsc.2021.100506

Feyen, E., Gispert, T. A., Kliatskova, T., and Mare, D. S. (2021). Financial sector policy response to COVID-19 in emerging markets and developing economies. J. Bank. Finance 133, 106184. doi:10.1016/j.jbankfin.2021.106184

Godil, D. I., Yu, Z., Sharif, A., Usman, R., and Khan, S. A. R. (2021). Investigate the role of technology innovation and renewable energy in reducing transport sector CO 2 emission in China: A path toward sustainable development. Sustain. Dev. 29 (4), 694–707. doi:10.1002/sd.2167

Gross, R., Leach, M., and Bauen, A. (2003). Progress in renewable energy. Environ. Int. 29 (1), 105–122. doi:10.1016/S0160-4120(02)00130-7

Hafner, S., Jones, A., Anger-Kraavi, A., and Pohl, J. (2020). Closing the green finance gap–A systems perspective. Environ. Innovation Soc. Transitions 34, 26–60. doi:10.1016/j.eist.2019.11.007

Hammoudeh, S., Ajmi, A. N., and Mokni, K. (2020). Relationship between green bonds and financial and environmental variables: A novel time-varying causality. Energy Econ. 92, 104941. doi:10.1016/j.eneco.2020.104941

He, L., Liu, R., Zhong, Z., Wang, D., and Xia, Y. (2019). Can green financial development promote renewable energy investment efficiency? A consideration of bank credit. Renew. Energy 143, 974–984. doi:10.1016/j.renene.2019.05.059

He, L., Zhang, L., Zhong, Z., Wang, D., and Wang, F. (2019). Green credit, renewable energy investment and green economy development: Empirical analysis based on 150 listed companies of China. J. Clean. Prod. 208, 363–372. doi:10.1016/j.jclepro.2018.10.119

Huang, Y. M., Xue, L., and Khan, Z. S. (2021). What abates carbon emissions in China: Examining the impact of renewable energy and green investment. Sustain. Dev. 29 (5), 823–834. doi:10.1002/sd.2177

Ibrahim, R. L., Al-mulali, U., Ozturk, I., Bello, A. K., and Raimi, L. (2022b). On the criticality of renewable energy to sustainable development: Do green financial development, technological innovation, and economic complexity matter for China? Renew. Energy 199, 262–277. doi:10.1016/j.renene.2022.08.101

Ibrahim, R. L., Ozturk, I., Al-Faryan, M. A. S., and Al-Mulali, U. (2022a). Exploring the nexuses of disintegrated energy consumption, structural change, and financial development on environmental sustainability in BRICS: Modulating roles of green innovations and regulatory quality. Sustain. Energy Technol. Assessments 53, 102529. doi:10.1016/j.seta.2022.102529

Irfan, M., Chen, Z. L., Adebayo, T. S., and Al-Faryan, M. A. S. (2022). Socio-economic and technological drivers of sustainability and resources management: Demonstrating the role of information and communications technology and financial development using advanced wavelet coherence approach. Resour. Policy 79, 103038. doi:10.1016/j.resourpol.2022.103038

Jin, Y., Gao, X., and Wang, M. (2021). The financing efficiency of listed energy conservation and environmental protection firms: Evidence and implications for green finance in China. Energy Policy 153, 112254. doi:10.1016/j.enpol.2021.112254

Khan, M. A., Riaz, H., Ahmed, M., and Saeed, A. (2022). Does green finance really deliver what is expected? An empirical perspective. Borsa Istanb. Rev. 22 (3), 586–593. doi:10.1016/j.bir.2021.07.006

Khan, S. A. R., Godil, D. I., Quddoos, M. U., Yu, Z., Akhtar, M. H., and Liang, Z. J. (2021). Investigating the nexus between energy, economic growth, and environmental quality: A road map for the sustainable development. Sustain. Dev. 29 (5), 835–846. doi:10.1002/sd.2178

Kirikkaleli, D., and Adebayo, T. S. (2021). Do renewable energy consumption and financial development matter for environmental sustainability? New global evidence. Sustain. Dev. 29 (4), 583–594. doi:10.1002/sd.2159

Kumar, L., Nadeem, F., Sloan, M., Restle-Steinert, J., Deitch, M. J., Naqvi, S. A., et al. (2022). Fostering green finance for sustainable development: A focus on textile and leather small medium enterprises in Pakistan. Sustainability 14 (19), 11908. doi:10.3390/su141911908

Kutan, A. M., Paramati, S. R., Ummalla, M., and Zakari, A. (2018). Financing renewable energy projects in major emerging market economies: Evidence in the perspective of sustainable economic development. Emerg. Mark. Finance Trade 54 (8), 1761–1777. doi:10.1080/1540496X.2017.1363036

Lee, C.-C., and Lee, C.-C. (2022). How does green finance affect green total factor productivity? Evidence from China. Energy Econ. 107, 105863. doi:10.1016/j.eneco.2022.105863

Li, M., Hamawandy, N. M., Wahid, F., Rjoub, H., and Bao, Z. (2021). Renewable energy resources investment and green finance: Evidence from China. Resour. Policy 74, 102402. doi:10.1016/j.resourpol.2021.102402

Li, Z., Liao, G., Wang, Z., and Huang, Z. (2018). Green loan and subsidy for promoting clean production innovation. J. Clean. Prod. 187, 421–431. doi:10.1016/j.jclepro.2018.03.066

Liu, N., and Liu, C. (2020). Co-Movement and lead–lag relationship between green bonds and renewable energy stock markets: Fresh evidence from the wavelet-based approach.21 doi:10.21203/rs.3.rs-105937/v1

Liu, N., Liu, C., Da, B., Zhang, T., and Guan, F. (2021). Dependence and risk spillovers between green bonds and clean energy markets. J. Clean. Prod. 279, 123595. doi:10.1016/j.jclepro.2020.123595

Liu, N. N., Liu, C. Z., Xia, Y. F., Ren, Y., and Liang, J. Z. (2020). Examining the coordination between green finance and green economy aiming for sustainable development: A case study of China. Sustainability 12 (9), 3717. doi:10.3390/su12093717

Liu, R., Wang, D., Zhang, L., and Zhang, L. (2019). Can green financial development promote regional ecological efficiency? A case study of China. Nat. Hazards 95 (1), 325–341. doi:10.1007/s11069-018-3502-x

Lubik, T. A., and Matthes, C. (2015). Time-varying parameter vector autoregressions: Specification, estimation, and an application.28 doi:10.21144/eq1010403Estim. Appl.

Lund, H. (2007). Renewable energy strategies for sustainable development. Energy 32 (6), 912–919. doi:10.1016/j.energy.2006.10.017

Ma, Q., Murshed, M., and Khan, Z. (2021a). The nexuses between energy investments, technological innovations, emission taxes, and carbon emissions in China. Energy Policy 155, 112345. doi:10.1016/j.enpol.2021.112345

Ma, Q., Murshed, M., and Khan, Z. (2021b). The nexuses between energy investments, technological innovations, emission taxes, and carbon emissions in China. Energy Policy 155, 112345. doi:10.1016/j.enpol.2021.112345

Madaleno, M., Dogan, E., and Taskin, D. (2022). A step forward on sustainability: The nexus of environmental responsibility, green technology, clean energy and green finance. Energy Econ. 109, 105945. doi:10.1016/j.eneco.2022.105945

Marini, S., Strada, C., Villa, M., Berrettoni, M., and Zerlia, T. (2014). ). How solar energy and electrochemical technologies may help developing countries and the environment. Energy Convers. Manag. 87, 1134–1140. doi:10.1016/j.enconman.2014.04.087

Meo, M. S., and Abd Karim, M. Z. (2022). The role of green finance in reducing CO2 emissions: An empirical analysis. Borsa Istanb. Rev. 22 (1), 169–178. doi:10.1016/j.bir.2021.03.002

Mngumi, F., Shaorong, S., Shair, F., and Waqas, M. (2022). Does green finance mitigate the effects of climate variability: Role of renewable energy investment and infrastructure. Environ. Sci. Pollut. Res. 29, 59287–59299. doi:10.1007/s11356-022-19839-y

Nawaz, M. A., Seshadri, U., Kumar, P., Aqdas, R., Patwary, A. K., and Riaz, M. (2021). Nexus between green finance and climate change mitigation in N-11 and BRICS countries: Empirical estimation through difference in differences (DID) approach. Environ. Sci. Pollut. Res. 28 (6), 6504–6519. doi:10.1007/s11356-020-10920-y

O’Riordan, T. (2022). COP 26 and sustainability science (Taylor & Francis), 64, 2–3. doi:10.1080/00139157.2022.1999748

Østergaard, P. A., and Lund, H. (2011). A renewable energy system in Frederikshavn using low-temperature geothermal energy for district heating. Appl. Energy 88 (2), 479–487. doi:10.1016/j.apenergy.2010.03.018

Østergaard, P. A., and Sperling, K. (2014). Towards sustainable energy planning and management. Int. J. Sustain. Energy Plan. Manag. 1, 1–6. doi:10.5278/ijsepm.2014.1.1, &

Pata, U. K. (2021). Linking renewable energy, globalization, agriculture, CO2 emissions and ecological footprint in bric countries: A sustainability perspective. Renew. Energy 173, 197–208. doi:10.1016/j.renene.2021.03.125

Pathania, R., and Bose, A. (2014). An analysis of the role of finance in energy transitions. J. Sustain. Finance Invest. 4 (3), 266–271. doi:10.1080/20430795.2014.929000

Pfeifer, A., Krajačić, G., Ljubas, D., and Duić, N. (2019). Increasing the integration of solar photovoltaics in energy mix on the road to low emissions energy system–Economic and environmental implications. Renew. Energy 143, 1310–1317. doi:10.1016/j.renene.2019.05.080

Ramzan, M., Razi, U., Quddoos, M. U., and Adebayo, T. S. (2022). Do green innovation and financial globalization contribute to the ecological sustainability and energy transition in the United Kingdom? Policy insights from a bootstrap rolling window approach. Sustain. Dev. 76 doi:10.1002/sd.2399

Razmjoo, A., Kaigutha, L. G., Rad, M. V., Marzband, M., Davarpanah, A., and Denai, M. (2021). A Technical analysis investigating energy sustainability utilizing reliable renewable energy sources to reduce CO2 emissions in a high potential area. Renew. Energy 164, 46–57. doi:10.1016/j.renene.2020.09.042

Rusu, E. (2019a). A 30-year projection of the future wind energy resources in the coastal environment of the Black Sea. Renew. Energy 139, 228–234. doi:10.1016/j.renene.2019.02.082

Rusu, L. (2019b). Evaluation of the near future wave energy resources in the Black Sea under two climate scenarios. Renew. Energy 142, 137–146. doi:10.1016/j.renene.2019.04.092

Sachs, J., Woo, W. T., Yoshino, N., and Taghizadeh-Hesary, F. (2019). Handbook of green finance: Energy security and sustainable development. Springer. Berlin, Germany doi:10.1007/978-981-13-0227-5

Sadiq, M., Nonthapot, S., Mohamad, S., Keong, O. C., Ehsanullah, S., and Iqbal, N. (2021). Does green finance matter for sustainable entrepreneurship and environmental corporate social responsibility during COVID-19? China Finance Rev. Int. 12, 317–333. doi:10.1108/CFRI-02-2021-0038

Sadorsky, P. (2021). Wind energy for sustainable development: Driving factors and future outlook. J. Clean. Prod. 289, 125779. doi:10.1016/j.jclepro.2020.125779

Schwerhoff, G., and Sy, M. (2017). Financing renewable energy in Africa - key challenge of the sustainable development goals. Renew. Sustain. Energy Rev. 75, 393–401. doi:10.1016/j.rser.2016.11.004

Shahzad, U., Ferraz, D., Nguyen, H.-H., and Cui, L. (2022). Investigating the spill overs and connectedness between financial globalization, high-tech industries and environmental footprints: Fresh evidence in context of China. Technol. Forecast. Soc. Change 174, 121205. doi:10.1016/j.techfore.2021.121205

Solangi, Y. A., Cheng, L. S., and Shah, S. A. A. (2021). Assessing and overcoming the renewable energy barriers for sustainable development in Pakistan: An integrated AHP and fuzzy TOPSIS approach. Renew. Energy 173, 209–222. doi:10.1016/j.renene.2021.03.141

Soundarrajan, P., and Vivek, N. (2016). Green finance for sustainable green economic growth in India. Agric. Econ. 62 (1), 35–44. doi:10.17221/174/2014-AGRICECON

Sperling, K., Hvelplund, F., and Mathiesen, B. V. (2010). Evaluation of wind power planning in Denmark–Towards an integrated perspective. Energy 35 (12), 5443–5454. doi:10.1016/j.energy.2010.06.039

Spiegel, T. (2018). Impact of renewable energy expansion to the balancing energy demand of differential balancing groups. J. Sustain. Dev. Energy, Water Environ. Syst. 6 (4), 784–799. doi:10.13044/j.sdewes.d6.0215

Sun, Y., Bao, Q., Siao-Yun, W., ul Islam, M., and Razzaq, A. (2022). Renewable energy transition and environmental sustainability through economic complexity in BRICS countries: Fresh insights from novel method of moments quantile regression. Renew. Energy 184, 1165–1176. doi:10.1016/j.renene.2021.12.003

Taghizadeh-Hesary, F., and Taghizadeh-Hesary, F. (2020). The impacts of air pollution on health and economy in Southeast Asia. Energies 13 (7), 1812. doi:10.3390/en13071812