- 1School of Business, Lingnan Normal University, Zhanjiang, Guangdong, China

- 2The Institute for Sustainable Development, Macau University of Science and Technology, Macau, China

- 3School of Business, Macau University of Science and Technology, Macau, China

Economic growth is fueled by financial development, which also takes the initiative in attaining green development and a low-carbon economy. The advanced industrial constitution is used as a moderator and mediator variable in this article to investigate whether there is a moderating effect and mediating effect between financial development and carbon emissions. This article chooses panel data from 283 Chinese cities from 2006 to 2019 to empirically analyze the impact of financial development on carbon emissions. The consequences indicate that financial development wields an evident active influence over carbon emissions. Additionally, the upgrading of industrial structures wields an evident positive impact on carbon emissions. There exists a medium impact of industrial structure upgrading. Results show that, first, when estimating carbon emissions demand, China’s financial expansion should be taken into consideration as a significant driver of rising carbon emissions. Second, although the extent of financial intermediation has a greater impact on carbon emissions than other financial development indicators, its effectiveness appears to have far less impact, even if it statistically has the potential to affect carbon emissions. Third, although the size of China’s stock market has a substantially greater impact on carbon emissions, the impact of its efficiency is quite little.

1 Introduction

In addressing global warming, the first legally binding document was the Kyoto Protocol, adopted by representatives of 149 nations and regions in 1997, together with the Paris Agreement in 2016, which requires all countries to meet certain regulations on emissions of greenhouse gas and commit themselves to the transformation of a green and sustainable growth mode. China, the largest developing nation in the world, has demonstrated its responsibility as a major country. In September 2020, China officially announced at the United Nations that it will reach the goal of a “carbon peak” by 2030 as well as “carbon neutral” by 2036. Achieving “carbon peaking,” together with “carbon neutralization” is just one complex system project, mainly because many factors affect emissions of carbon dioxide, such as technological innovation, economic growth, energy consumption, foreign direct investment, industrialization, etc. In the meanwhile, the reduction of carbon dioxide emissions demands the backup of policies, financial capital, technology, and other conditions (AhAtil et al., 2019; Zhou et al., 2019; Chontanawat, 2020; Baydoun and Aga, 2021; Hou et al., 2021; Mo, 2022).

In actuality, financial growth may be another factor influencing a nation’s carbon emissions in addition to its GDP level. Financial development tends to have a larger role in the rise in carbon emissions in an economy with progressively expanding financial systems for a variety of reasons. First, financial development may draw FDI from abroad, accelerating economic expansion and raising carbon emissions (Frankel and Romer, 1999). Second, thriving and effective financial intermediation appears to be supportive of consumer loan activities, which makes it simpler for consumers to purchase expensive products like cars, homes, refrigerators, air conditioners, washing machines, etc., leading to increased carbon dioxide emissions (Sadorsky, 2010; Ren and Hussain, 2022). Additionally, the growth of the stock market enables listed companies to cut financing costs, expand their sources of funding, spread operating risk, and optimize their asset/liability structures, resulting in an increase in energy consumption and carbon emissions (Dasgupta et al., 2001).

Authors that disagree with the reasons do exist, though. Claessens and Feijen (2007) found that companies with more sophisticated governance are frequently more inclined to embrace low-carbon development; hence, financial growth may boost companies’ performance, which in turn may lead to a decrease in energy use and carbon emissions. In addition, Tamazian et al (2009) note that financial development aids listed companies in fostering technological innovation and implementing new technologies, which in turn helps them progress in low-carbon economic development and boost energy efficiency. As a result, the carbon emissions intensity may be greatly reduced. As a result, it may be concluded that further empirical research is needed to clarify the relationship between financial development and carbon emissions. In reality, China has to do this sort of study in order to rationally assess the difficulties of achieving carbon emissions intensity decrease and scientifically design the road to do so. Three objectives will be covered in this paper: industrial constitution and financial development, industrial constitution and carbon emissions, and carbon emissions and industrial constitution.

As the driving force of economic growth, the correlation between financial development and carbon emissions has caught much attention. There exist dominantly three opinions. To begin with, it is supposed that the financial development will boost enterprise expansion, ascend the demand and consumption of energy, and then bring about a growth in carbon emissions; Next, it is supposed that the financial development could enhance the efficiency of the energy and fulfill the energy storage and emission decrease through boosting economic development, industrial upgrading and technological innovation; Third, we believe that financial development exerts no effect upon carbon emissions (Boutabba, 2014; Abbasi and Riaz, 2016; Dogan and Turkekul, 2016; Jamel and Maktouf, 2017; Tian et al., 2019; Acheampong et al., 2020; Bui, 2020; Guo and Hu, 2020; Hasan et al., 2021).

When discussing the correlations between carbon emissions and financial development, this article focuses on the perspective of industrial constitution promotion and tries to use the upgrading of the industrial constitution for moderator variable and mediator variables to verify the straightforward impact and indirect impact of the financial development upon the carbon emission and divides cities into four types of urban groups by the light of the combination of the level of the financial development and the level of industrial constitution promotion, discussing the difference between the moderating role and the mediating impact of industrial constitution upgrading in different types of urban agglomerations could offer an appropriate reference for the government for the sake of adopting different financial development policies when promoting green development and low-carbon economic transformation. The remaining sections of the article are arranged as follows. Section 2 provides an overview of the empirical evidence on how financial development and carbon emissions are connected. The definitions of research data and the empirical procedures used in this article are presented in Section 3. In Section 4, empirical findings are presented, and the paper is concluded in Section 5.

2 Literature review

Scholars choose different research objects for the purpose of empirically researching the effect of financial development and industrial constitution upon carbon emissions and draw different conclusions. This study will review the literature from three aspects: carbon emissions and financial development, industrial constitution and carbon emissions, and industrial constitution and financial development.

2.1 Financial development and carbon emissions

Researchers have not reached an agreement on the effect of financial development on carbon dioxide. Some scholars believe that financial development will increase carbon emissions, a few researchers suppose that financial development could decrease carbon emissions, and a few scholars believe that financial development and carbon emissions exert no effect.

The main reason why financial development is going to ascend carbon emissions is that financial development can enable enterprises to obtain funds to invest in new production lines, expand production scale, and purchase heavy machinery and equipment, which will cause more pollutant emissions; At the same time, financial development can also provide more consumer credit services, promoting personal consumption, such as the purchase of cars, household appliances, real estate, etc., which will also increase carbon dioxide emissions (Bui, 2020; Hasan et al., 2021). Boutabba (2014) found that the financial development inside India exerts a long-run active effect on carbon emissions. Moreover, financial development will aggravate environmental quality degradation; Hao found that in the period of rapid economic development in 29 provinces of China, financial development will damage the environment (Boutabba, 2014; Hao et al., 2016). Cetin and Ecevit found that financial development, economic growth, and trading openness exert an active influence on carbon emissions through Turkish data research; additionally, financial and economic advancement is at the expense of environmental quality degradation (Cetin and Ecevit, 2017).

The main reason why financial development is able to decrease carbon emissions is just that enterprises could use funds for technological innovation, Introduction of advanced technology, technology transfer and other means to enhance energy efficiency and decrease carbon emissions; It can also encourage governments and enterprises to invest in projects with a friendly environment and low-carbon equipment through low-cost capital to improve environmental quality (Tamazian et al., 2009; Tamazian and Bhaskara Rao, 2010; Abbasi and Riaz, 2016; Acheampong et al., 2020). Shahbaz found through data research on South Africa that the financial development is going to decrease carbon emissions; Saidi and Mbarek (2017) discovered, through data analysis of 19 innovative economies, including Mexico, Colombia, and Brazil, that financial development both limits the degradation of environmental quality and has a long-term negative impact on carbon dioxide emissions; Shahbaz and colleagues found that French financial development would reduce carbon dioxide emissions; Zaidi et al. (2019), in APEC member nations, financial development helps to decrease carbon emissions. The financial sector allocates financial resources to organizations and production units that protect the environment (Shahbaz et al., 2013) and support the use of green technologies (Saidi and Mbarek, 2017; Shahbaz et al., 2018; Zaidi et al., 2019).

In 12 countries in North Africa and the Middle East, Omri et al. (2015) found no causal relationship between carbon dioxide emissions and economic development; Dogan and Turkekul (2016) found no causal relationship between US financial development and carbon emissions; Jamel and Maktouf (2017) found no causal relationship between European financial development and carbon emissions. Acheampong discovered that in independent finance countries, the overall growth of the financial markets and its sub-indicators had no obvious influence on the intensity of carbon emissions (Acheampong et al., 2020).

2.2 Industrial structure and carbon emissions

Scholars construct different industrial constitution indicators such as industrial constitution upgrading, industrial constitution rationalization and industrial constitution transformation to explore the impact on carbon emissions (Li and Lin, 2017; Tian et al., 2019; Wang et al., 2019; Wu et al., 2021). The effect of industrial development on carbonous emissions counts on the structure for its industrial advancement. Resource-consuming industries are crucial elements impacting carbon emissions (Li et al., 2018; Tian et al., 2019). At present, the fact that China’s energy consumption mainly depends on coal resources is still difficult to change. Therefore, we can achieve the important strategy of reducing carbon emissions by optimizing as well as promoting the industrial constitution so as to decrease the depletion of the energy and improve energy utilization (Chuai and Feng, 2019; Zhang et al., 2020). Zhang et al. (2014) discovered that improving the development of the Chinese tertiary industry can significantly decrease carbon emissions, and the advanced industrial constitution conduces to reducing carbon emissions; Li et al. Found that the growth of the ratio of the secondary industry in the Yangtze River Delta will lead to the growth of carbon emissions in prefecture-level cities; Cheng et al. (2018), Feng and Wu (2022) reached the same conclusion that upgrading and optimizing China’s industrial constitution conduces to decreasing carbon emissions. Song’s (2019) research on 30 cities and provinces in the east, middle and west in China shows that different regions have different impacts on the efficiency of carbon emissions. The industrial promotion (molar index) in the east exert an active effect upon carbon emissions effectiveness, while it wields a negative effect over the carbon emissions effectiveness in the central region.

2.3 Financial development and industrial structure

Financial development serves to effectively allocate funds to various industrial sectors, which is an essential means and tool for industrial restructuring. Scholars have not reached a consensus on the study about the industrial structure and financial development. Zhang et al. (2019) found that financial efficiency is positively associated with the promotion of production structure among 121 Chinese cities; financial agglomeration and financial scale are negatively related to the promotion of manufacturing structure. Jiang et al. (2020) found that the regional financial development in eastern China wields an evident active effect over the promotion of the industrial constitution; The central regions and western regions exert no evident influence upon the promotion of the industrial constitution. Tao and Xu (2016) found that the effect of Chinese financial development level upon the promotion of industrial constitution is a non-linear correlation, showing a trend of promoting first and then inhibiting. Zhu and Ni (2014) pointed out a significant promotion effect between related financial ratios and industrial structure upgrading. In the meanwhile, there exists an inverted U-shaped correlation between the financial scale and the promotion level of tertiary and secondary industries.

From the perspective of current research, there are many studies on the correlation between carbon emissions and financial development, the correlation between financial development and industrial structure, and the correlation between industrial structure and carbon emissions. However, based on whether there are moderating effects and mediator effects of industrial structure concerning carbon emissions during financial development, namely, there are still preliminary studies on how financial development affects the mediating system of carbon emissions, which need to be discussed in depth. Therefore, one of the major benefits of this article is to position the research perspective in urban areas and break through the limitations of traditional provincial-level research; The second is to examine whether the industrial structure upgrading has moderating and mediator effects between carbon emissions and financial development, in addition what kind of mediator effects and possible regional differences.

3 Research methods

3.1 Data source

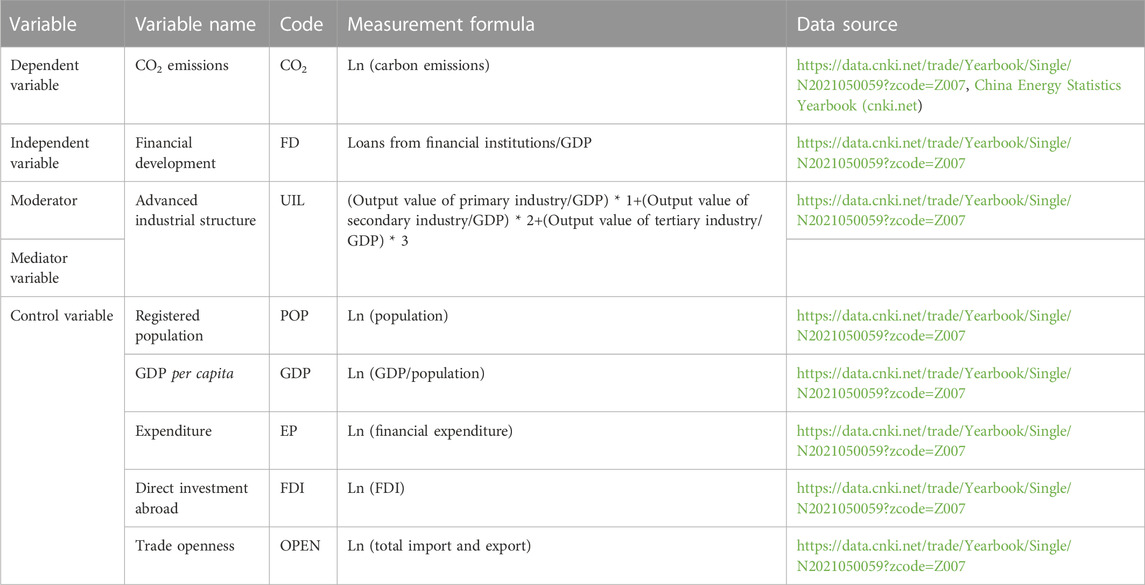

283 Chinese prefecture-level cities are considered in the article (including 279 prefecture-level cities, along with 4 municipalities straightforward under the Central Government) to be the object of study. By virtue of the incomplete data and inconsistent statistical calibre of a total of 14 cities, such as Suihua City, Qinzhou City, Sansha City, Danzhou City, Tongren City, Bijie City, Haidong City, Turpan City, Hami City, Lhasa City, etc. The yearly data of every city from 2006 to 2019 were collected and collated, including the percentage of energy, population, overseas direct invest, industry in GDP, year-end deposits, loans, total trade, and other data of financial institutions. Please see Table 1 for data source.

3.2 Selection and measurement of variables

3.2.1 Dependent variable

Of this article, the dependent variable is the natural logarithm for the total amount of carbon dioxide emissions. Its calculation method is mainly on the basis of the coefficient of carbon emissions offered by IPCC (2006) to figure out the urban carbon emissions indirectly. Its measurement expression is (Peng et al., 2018; Ren et al., 2020):

Including carbon dioxide emissions originating in the natural gas (c1), the liquefied petroleum gas (c2), the electricity consumption of the whole society (c3) and raw coal (c4); K1 is the carbon emissions coefficient of natural gas, E1 is natural gas consumption; K2 is the carbon emissions coefficient of liquefied petroleum gas, E2 is the consumption of liquefied petroleum gas; K3 is the carbon emissions coefficient of the whole society’s electricity consumption, E3 for the whole society’s electricity consumption; K4 is the carbon emissions coefficient of raw coal, and E4 is raw coal consumption.

3.2.2 Independent variable

The measurement of the financial development dominantly starts from the scale and efficiency of the financial development; Among them, the scale of the financial development is dominantly evaluated by the proportion of the loans from the banking institutions to GDP, the proportion of the deposits originating in the banking institutions to GDP, and the proportion of total deposits and the loans from the banking institutions to GDP; The major measure of financial development effectiveness is the proportion of loans to deposits coming from the financial institutions (Cetin and Ecevit, 2017; Peng et al., 2018). Drawing on the research of Odhiambo and Xu, this paper adopts the proportion of the loan balance of banking institutions at the end of the year to GDP as the assessment of financial development (Odhiambo, 2020; Xu et al., 2021).

3.2.3 Moderating variable and mediating variable

Scholars study the measurement methods of the industrial constitution, such as industrial distribution, industrial structure promotion, industrial structure rationalization, industrial agglomeration, etc (Peng et al., 2018; Wu et al., 2021). Concerning Wu and other studies, the advanced industrial structure is taken as the adjusting variable and mediator variable, and (Li et al., 2018) its measurement method is as follows:

The UIL is between 1 and 3. When the UIL tends to 1, it indicates a low degree of sophistication. When the UIL tends to 3, it indicates a high-caliber sophistication.

3.2.4 Control variables

We are employing the study by Yu et al. (2018). Moreover, this paper selected the number (Bui, 2020) of registered population, GDP per capita, fiscal expenditure, foreign direct investment and trade openness as control variables (Alotaish et al., 2019; Chuai and Feng, 2019).

3.3 Model settings

On the foundation of the STIRPAT model of Dietz and Rosa (1997) and York et al. (2003) this paper explores the affecting elements of carbon emissions. The pattern is:

Take the logarithm on both sides to obtain its t-variant:

Where I is the carbon emissions, P refers to population; A stands for GDP each capita, T means technology, a, b, c, and d are estimation parameters, i denotes the amount of individuals, t signifies time, additionally, e signifies the error term.

This paper extends the STIRPAT model and proposes the following models based on research assumptions:

With a view to testing if the industrial constitution exerts an mediator effect, this paper uses Baron and Kenny’s mediator effect model to build this model (Baron and Kenny, 1986):

Among them, coefficient c refers to the total effect of financial development on carbon emissions; coefficient a means the effect of financial development upon the upgrading of mediator variable industrial structure, the coefficient b stands for the effect of the upgrading of mediator variable industrial structure upon carbon emissions after managing the impact of financial development, and the coefficient c ' means the direct effect of financial development upon carbon emissions after managing the effect of the promotion of mediator variable industrial constitution. When c means significant, test whether coefficient a and coefficient b are significant. If both are significant, there is an indirect effect. Test whether c ‘refers to significant. When c′ means significant, it denotes a partial mediating impact; When c′ refers to not significant, it denotes a complete mediating effect.

4 Empirical analysis

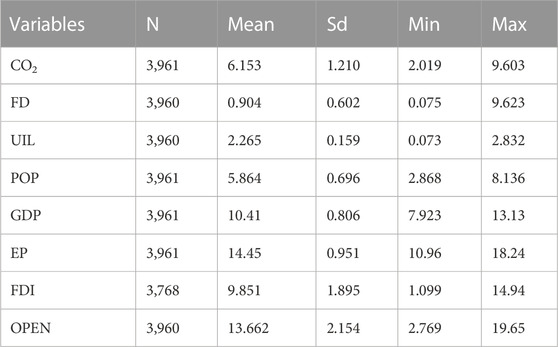

4.1 Sample descriptive analysis

This paper uses a descriptive statistics table (Table 2) to understand the characteristics of individual variables. The value of carbon emissions ranges from 9.603 to 2.019, with an average value of 6.153, indicating an evident distinction in carbon emissions between the cities. The value of financial development ranges from 9.623 to 0.075, with an average value of 0.904, indicating that there also exists considerable distinctions in financial development in the cities. The value of the industrial structure ranges from 2.832 to 0.073, with an average of 2.265, indicating that the city’s industrial constitution develops the industry from the secondary to the tertiary.

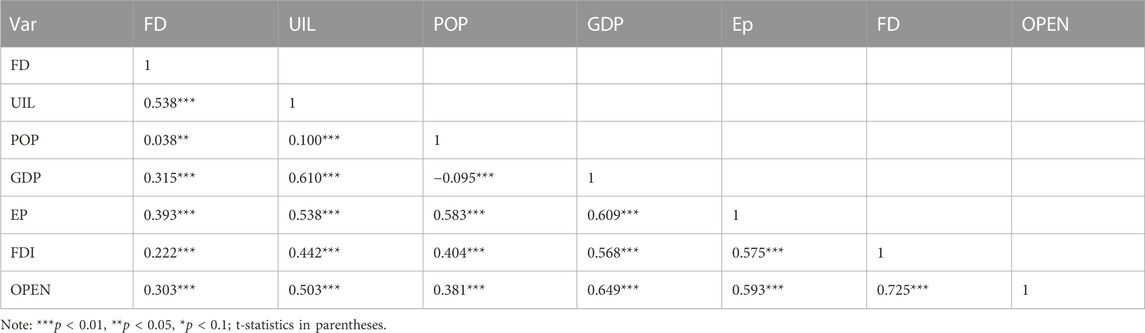

4.2 Correlation analysis

Table 3 exhibits consequences of the correlation dissection. The coefficient of the correlation between variables reaches less than 0.7, showing that there exists no collinearity between the variables.

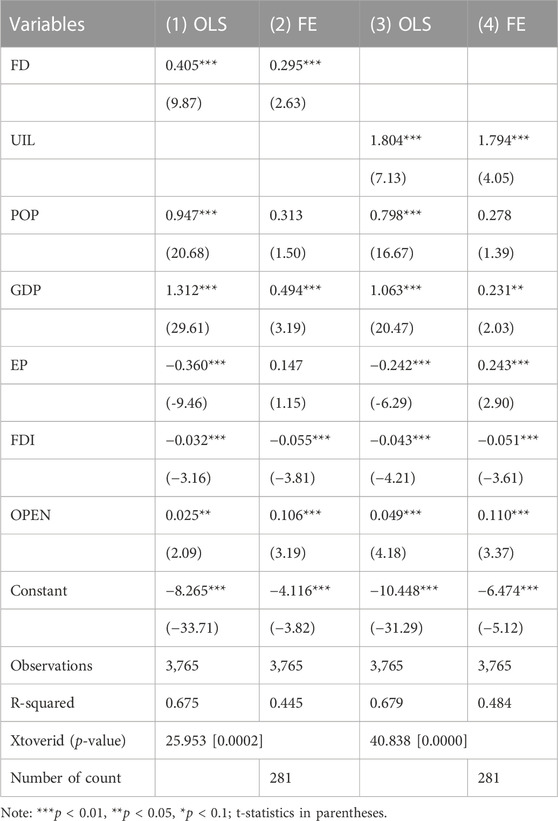

4.3 Analysis of the impact of financial development and industrial structure upgrading on carbon emissions

Table 4 displays the empirical results of the relationship between financial development and carbon emissions as well as the relationship between industrial structure improvement and carbon emissions using a blended regression pattern and a fixed effect design. The over identification test’s results show that the fixed effect pattern is preferable to the random effect pattern at the 1% level, rejecting the original hypotheses. Each unit gain in financial development will result in an increase in carbon emissions of 0.295 units, according to the fixed effect pattern’s coefficients for the financial development, which are clearly positive. Evidently positive industrial constitution promotion coefficients suggest that more carbon emissions will result from this strategy.

TABLE 4. Regression results of the impact of financial development and industrial structure upgrading on carbon emissions.

4.4 Impact of financial development on carbon emissions: Interaction effect of industrial structure

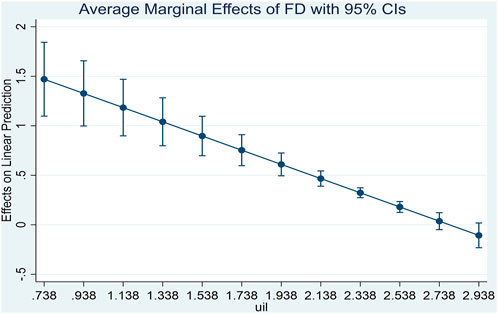

The consequences in Table 5 indicate that based on the model in Table 4, when the interaction term between financial development and industrial constitution promotion is added, coefficients of financial development are significantly positive, coefficients of upgrading of industrial structure are evidently positive, and the coefficient of interaction term is evidently passive, indicating that upgrading of the industrial constitution wields a prohibitive impact over financial development and carbon emissions.

TABLE 5. Regression results of the impact of interaction between financial development and industrial structure on carbon emissions.

Additionally, Figure 1 shows the marginal impact of industrial constitution upgrading upon carbon emissions, indicating that with the gradual increase of the financial development, the small impact of industrial constitution promotion upon carbon emissions decreases. When financial development exceeds 2.353, it is not statistically evidently; Figure 2 shows the marginal impact of the financial development upon carbon emissions, showing that as the industrial constitution promotion grows, the marginal impact of financial development upon carbon emissions gradually decreases; while the degree of industrial constitution upgrading is higher than 2.73, it is not statistically significant.

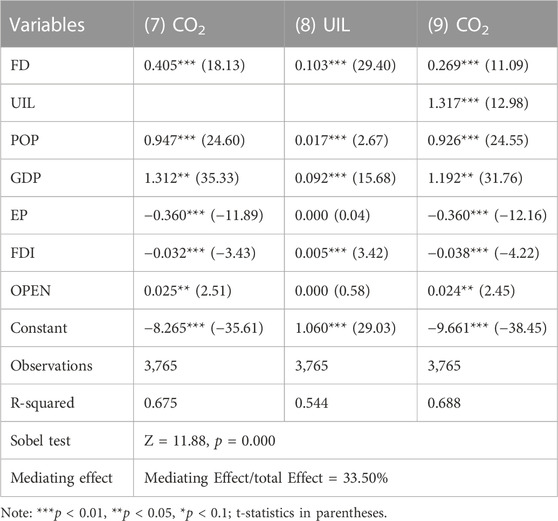

4.5 The impact of financial development on carbon emissions: The mediating effect of industrial structure

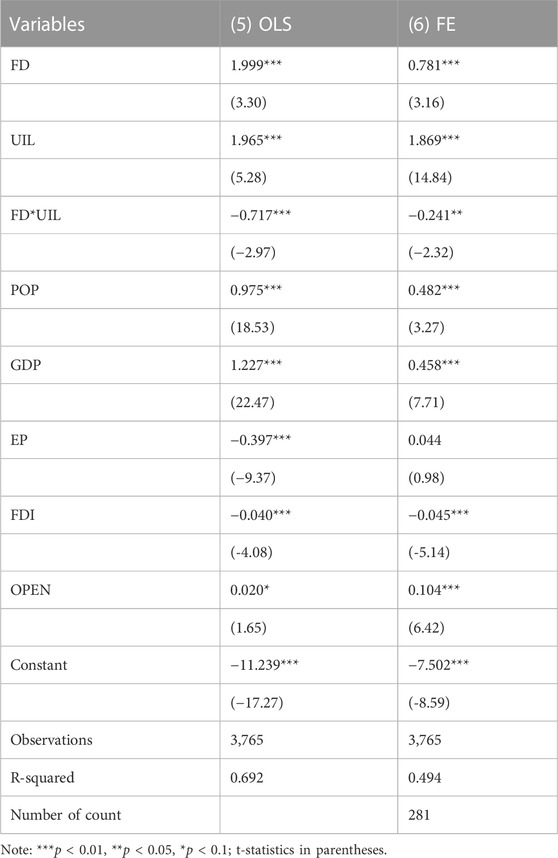

Financial development as well as industrial structure has interaction effects, which will affect each other. This paper further verifies whether this impact is affected through the mediating path through the mediating effect. Table 6 indicates the consequences of the mediating effect of the promotion of industrial constitution. The upgrading of industrial structure has some mediating effects in the effect of the financial development upon carbon emissions; Among them, the total effect is 0.405, the mediating effect reaches 0.1357; additionally the medium impact occupies 33.5% of the overall effect, which indicates that the financial development could be conducted through the industrial constitution upgrading, thereby affecting carbon emissions.

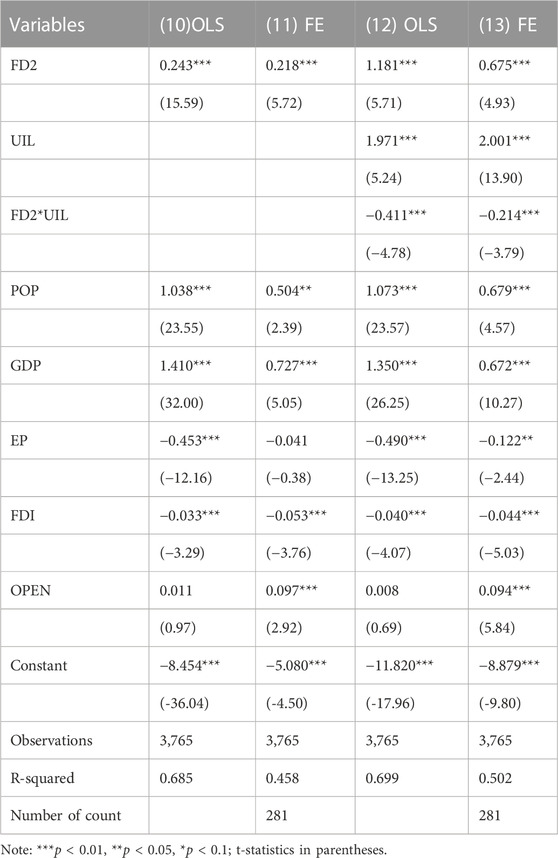

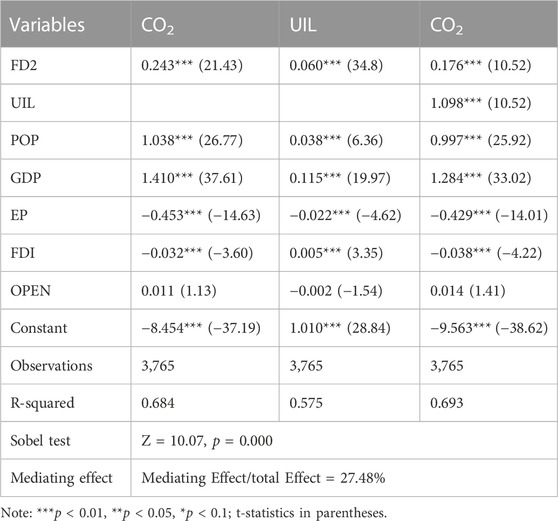

4.6 Robustness analysis

With a view to increasing the credibility of the empirical results and obtain further explanation, another indicator, FD2, is used to measure (loan amount + deposit amount)/GDP for robustness test. The same results can be obtained from Table 7 Robustness Test Regression Results Table and Table 8 Robustness Test mediating Effect Results Table.

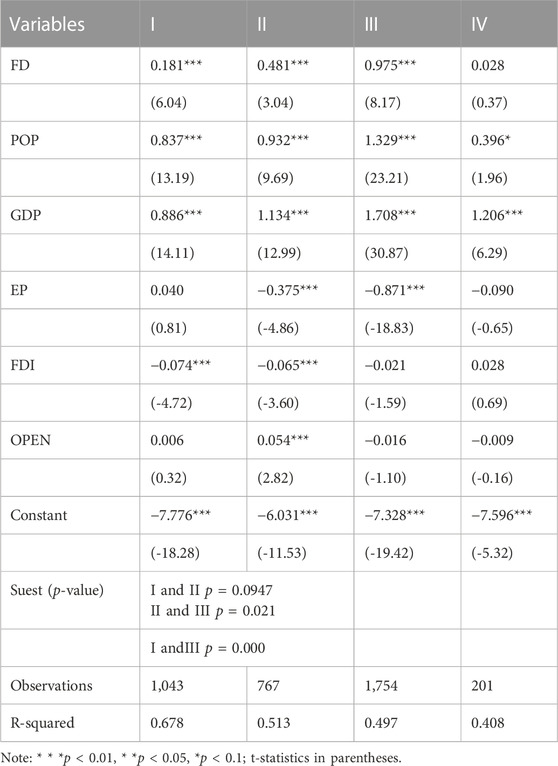

4.7 Discussion on heterogeneity

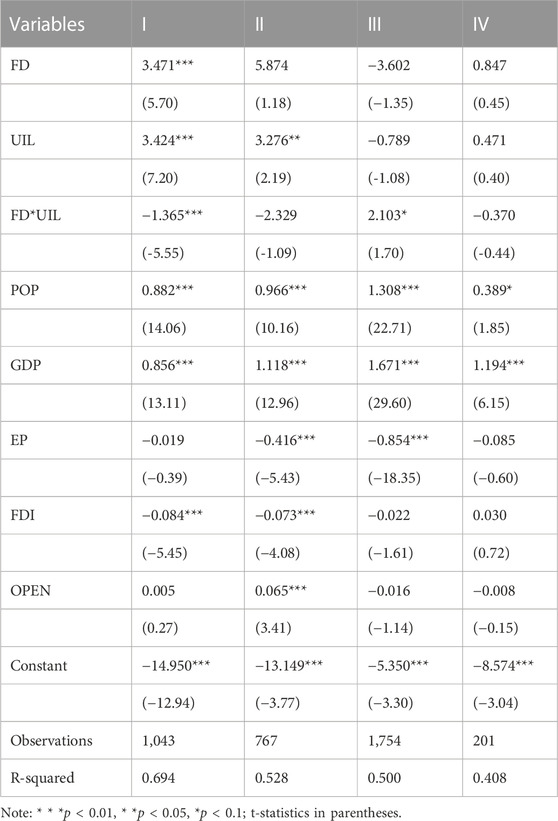

Considering the difference between the financial development level and the advanced degree of industrial constitution among different cities, this paper divides all cities into high financial development level, and high industrial structure advanced degree (I), low financial development level and high industrial structure advanced degree (II), low financial development level and low industrial structure advanced degree (III) 4 groups of urban agglomerations, including high financial development level and bad industrial constitution promotion (IV), are analyzed for heterogeneity.

According to Table 9, high-caliber financial development and high-caliber industrial structure (I), poor financial development and high-caliber industrial structure (II), poor financial development and poor industrial constitution (III) financial development of urban agglomeration has an evident active effect upon carbon emissions, whereas the high-caliber financial development and poor industrial constitution (IV) financial development of urban agglomeration exerts an active effect upon the carbon emissions, However, it is not statistically remarkable. Through the test of Suest coefficient, it is found that the financial development of urban agglomeration with poor financial development and poor industrial constitution promotion (III) exerts an energetic active effect upon carbon emissions than that of type I and II urban agglomeration.

According to Table 10, high-caliber financial development and high-caliber industrial constitution upgrading (I) The industrial constitution promotion in urban agglomeration exerts an inhibitory impact of financial development upon carbon emissions, while poor financial development and poor industrial constitution promotion (III) The industrial structure upgrading in urban agglomeration exerts a catalytic impact of financial development upon carbon emissions, but poor financial development and high-caliber industrial structure upgrading (II) High-caliber financial development and poor industrial structure upgrading (IV) Urban agglomeration does not have a moderating role.

TABLE 10. Regression results of impacts of heterogeneous financial development on carbon emissions (moderating effect).

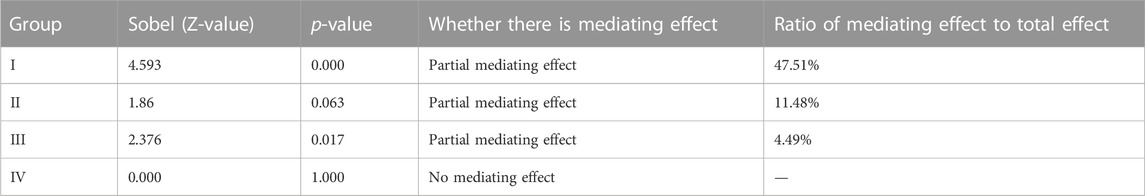

According to Table 11, high-caliber financial development and high-caliber industrial structure upgrading (I), poor financial development and high-caliber industrial structure upgrading (II), poor financial development and poor industrial constitution promotion (III) Urban agglomeration with high-caliber financial development and high-caliber industrial structure upgrading (I), the ratio of medium impact in overall effect is the highest. However, high-caliber financial development and poor industrial structure upgrading (IV) There is no mediating effect between the industrial constitution promotion of urban agglomeration and financial development upon carbon emissions.

5 Conclusions and suggestions

5.1 Research conclusion

Data concerning 283 Chinese cities from 2006 to 2019 is gathered in this article. We selected a more appropriate model to empirically analyze the effect of financial development on carbon emissions based on a series of spatial econometric tests. Synchronously, the advanced industrial constitution is looked on as the moderating variable and mediator variable to explore whether there is a moderating and conductive effect between carbonous emissions and financial development.

The results of empirical analysis show that the financial development measured by loans from financial institutions/GDP wields an active effect over carbon emissions, and the industrial constitution upgrading wields an active effect over carbon emissions. When the financial development and promotion of industrial constitution act as interaction items, upgrading of industrial constitution exerts a prohibitive impact upon financial development and carbon emissions. While the upgrading of industrial structure is used as a mediating channel, there exists a partial mediating effect between carbon emissions and financial development.

All cities are split into four parts of urban agglomerations in this paper, according to the degree of the industrial constitution upgrading and the level of the financial development. In addition, the heterogeneity is also analyzed. The financial development of urban agglomerations with high financial development level, along with high industrial constitution promotion (I), urban agglomerations with low financial development level, along with high industrial constitution promotion (II) and urban agglomerations with low financial development level, along with low industrial constitution promotion (III) wields an evident active effect over carbon emissions, especially in the domain of urban agglomerations of category III. Secondly, industrial structure upgrading of urban agglomeration (I) with high financial development level and high industrial constitution upgrading exerts a prohibitive impact upon financial development on carbon emissions, while the upgrading of industrial structure of urban agglomeration (III) with low financial development level and low industrial constitution promotion exerts a promoting effect on financial development on carbon emissions, but other urban agglomerations have no moderating effect. In addition, the high-caliber financial development and industrial structure upgrading of urban agglomeration (I), the poor financial development and the high-caliber industrial constitution promotion of the urban agglomeration (II), the poor financial development and the poor industrial constitution upgrading of urban agglomeration (III), the high-caliber industrial constitution of financial development and the poor industrial constitution promotion of urban agglomeration (III), have some mediator effects upon financial development and carbon emissions; additionally the mediator effects in category I urban agglomeration occupy the biggest percentage proportion of the total effects. However, high-caliber financial development and poor industrial structure upgrading (IV) There is no mediating effect between the industrial constitution promotion of urban agglomeration and the financial development upon carbon emissions.

5.2 Research recommendations

On the basis of the experienced consequences, this article propounds the policy recommendations below.

(1) Give play to the role of financial development in emission reduction

The interplay between industrial upgrading and financial development can inhibit carbon emissions. Financial institutions can lean towards low-carbon and green enterprises through the financial service channel of loans to help enterprises achieve industrial upgrading through technological innovation, advanced technology introduction, technology transfer and other means, with the aim of fulfilling the target of decreasing carbonous emissions. In addition, it also requires the active participation of the government, which can reduce the capital cost of enterprises by means of government subsidies, loan interest, etc., and encourage enterprises to invest in environmental pollution prevention, so as to reduce carbon emissions.

(2) Financial development should match with industrial development

Each city’s industry has its own characteristics, and financial development should be combined with local industrial development to carry out financial development with local characteristics. For cities with the poor financial development and poorly upgrading of industrial structure, we should strengthen financial development, formulate financing system policies, and promote the upgrading of industries to the advanced direction through the guidance of funds; Cities with poor financial development and high-caliber industrial structure upgrading, as well as cities with a high-caliber financial development and poorly industrial structure upgrading, have seen a mismatch between financial development and industrial development. Only through two-way adjustment and coordinated development can we better achieve the emission reduction goal through the mediating of industrial structure.

(3) Strengthen financial cooperation among cities

Cities can promote financial cooperation among cities through financial information sharing, financial market resource sharing, financial supervision cooperation and other ways of boosting the free flow and the best distribution of financial elements among cities. Developed cities can also help cities in backward areas and promote the coordinated development of cities through the radiation and driving role of some urban agglomerations.

Data availability statement

The raw data supporting the conclusion of this article will be made available by the authors, without undue reservation.

Author contributions

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

Funding

Humanities and Social Sciences Research Project of Lingnan Normal University (Grant Number: ZW2026).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abbasi, F., and Riaz, K. (2016). CO2 emissions and financial development in an emerging economy: An augmented VAR approach. Energy Policy 90, 102–114. doi:10.1016/j.enpol.2015.12.017

Acheampong, A. O., Amponsah, M., and Boateng, E. (2020). Does financial development mitigate carbon emissions? Evidence from heterogeneous financial economies. Energy Econ. 88, 104768. doi:10.1016/j.eneco.2020.104768

AhAtil, A., Bouheni, F. B., Lahiani, A., and Shahbaz, M. (2019). Factors influencing CO2emission in China: A nonlinear autoregressive distributed lags investigation [online]. Munich: MPRA.

Baron, R. M., and Kenny, D. A. (1986). The moderator-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. Personality Soc. Psychol. 51 (6), 1173–1182. doi:10.1037/0022-3514.51.6.1173

Baydoun, H., and Aga, M. (2021). The effect of energy consumption and economic growth on environmental sustainability in the gcc countries: Does financial development matter? Energies 14 (18), 5897. doi:10.3390/en14185897

Boutabba, M. A. (2014). The impact of financial development, income, energy and trade on carbon emissions: Evidence from the Indian economy. Econ. Model. 40, 33–41. doi:10.1016/j.econmod.2014.03.005

Bui, D. T. (2020). Transmission channels between financial development and CO2 emissions: A global perspective. Heliyon 6 (11), e05509. doi:10.1016/j.heliyon.2020.e05509

Cetin, M., and Ecevit, E. (2017). The impact of financial development on carbon emissions under the structural breaks: Empirical evidence from Turkish economy. Int. J. Econ. Perspect. 11 (1), 64–78.

Cheng, Z., Li, L., and Liu, J. (2018). Industrial structure, technical progress and carbon intensity in China's provinces. Renew. Sustain. Energy Rev. 81, 2935–2946. doi:10.1016/j.rser.2017.06.103

Chontanawat, J. (2020). Relationship between energy consumption, CO2 emission and economic growth in ASEAN: Cointegration and causality model. Energy Rep. 6 (1), 660–665. doi:10.1016/j.egyr.2019.09.046

Chuai, X., and Feng, J. (2019). High resolution carbon emissions simulation and spatial heterogeneity analysis based on big data in Nanjing City, China. Sci. Total Environ. 686, 828–837. doi:10.1016/j.scitotenv.2019.05.138

Claessens, S., and Feijen, E. (2007). Financial sector development and the millennium development goals. World Bank.

Dasgupta, S., Laplante, B., and Mamingi, N. (2001). Pollution and capital markets in developing countries. J. Environ. Econ. Manag. 42, 310–335. doi:10.1006/jeem.2000.1161

Dietz, T., and Rosa, E. A. (1997). Effects of population and affluence on CO2 emissions. Proc. Natl. Acad. Sci. U.S.A. 94 (1), 175–179. doi:10.1073/pnas.94.1.175

Dogan, E., and Turkekul, B. (2016). CO2 emissions, real output, energy consumption, trade, urbanization and financial development: Testing the EKC hypothesis for the USA. Environ. Sci. Pollut. Res. 23 (2), 1203–1213. doi:10.1007/s11356-015-5323-8

Feng, Y., and Wu, H. (2022). How does industrial structure transformation affect carbon emissions in China: The moderating effect of financial development. Environ. Sci. Pollut. Res. 29 (9), 13466–13477. doi:10.1007/s11356-021-16689-y

Frankel, J., and Romer, D. (1999). Does trade cause growth? Am. Econ. Rev. 89, 379–399. doi:10.1257/aer.89.3.379

Guo, M., and Hu, Y. (2020). The impact of financial development on carbon emission: Evidence from China. Sustainability 12 (17), 6959. doi:10.3390/SU12176959

Hao, Y., Zhang, Z. Y., Liao, H., Wei, Y. M., and Wang, S. (2016). Is CO2 emission a side effect of financial development? An empirical analysis for China. Environ. Sci. Pollut. Res. 23 (20), 21041–21057. doi:10.1007/s11356-016-7315-8

Hasan, H., Oudat, M. S., Alsmadi, A. A., Nurfahasdi, M., and Ali, B. J. A. (2021). Investigating the causal relationship between financial development and carbon emission in the emerging country. Jgr 10 (2), 55–62. doi:10.22495/jgrv10i2art5

Hou, F., Su, H., Li, Y., Qian, W., Xiao, J., and Guo, S. (2021). The impact of foreign direct investment on China's carbon emissions. Sustainability 13 (21), 11911. doi:10.3390/su132111911

Jamel, L., and Maktouf, S. (2017). The nexus between economic growth, financial development, trade openness, and CO2 emissions in European countries. Cogent Econ. Finance 5 (1), 1341456. doi:10.1080/23322039.2017.1341456

Jiang, M., Luo, S., and Zhou, G. (2020). Financial development, OFDI spillovers and upgrading of industrial structure. Technol. Forecast. Soc. Change 155, 119974. doi:10.1016/j.techfore.2020.119974

Li, K., and Lin, B. (2017). Economic growth model, structural transformation, and green productivity in China. Appl. Energy 187, 489–500. doi:10.1016/j.apenergy.2016.11.075

Li, L., Lei, Y., Wu, S., He, C., Chen, J., and Yan, D. (2018). Impacts of city size change and industrial structure change on CO2 emissions in Chinese cities. J. Clean. Prod. 195, 831–838. doi:10.1016/j.jclepro.2018.05.208

Mo, J. Y. (2022). Technological innovation and its impact on carbon emissions: Evidence from korea manufacturing firms participating emission trading scheme. Technol. Analysis Strategic Manag. 34 (1), 47–57. doi:10.1080/09537325.2021.1884675

Mohammed Saud M., M. S. M., Guo, P., Haq, I. u., Pan, G., and Khan, A. (2019). Do government expenditure and financial development impede environmental degradation in Venezuela? PLoS ONE 14 (1), e0210255. doi:10.1371/journal.pone.0210255

Odhiambo, N. M. (2020). Financial development, income inequality and carbon emissions in sub-saharan african countries: A panel data analysis. Energy Explor. Exploitation 38 (5), 1914–1931. doi:10.1177/0144598720941999

Omri, A., Daly, S., Rault, C., and Chaibi, A. (2015). Financial development, environmental quality, trade and economic growth: What causes what in MENA countries. Energy Econ. 48, 242–252. doi:10.1016/j.eneco.2015.01.008

Peng, Z. M., Xiang, N., and Xia, K. Y. (2018). Research on the relationship between financial development and carbon emissions of prefecture-level cities in the Yangtze River Economic Belt. Hubei Soc. Sci. 11, 32–38.

Ren, X. S., Liu, Y. J., and Zhao, G. H. (2020). The impact of economic agglomeration on carbon emissions intensity and its transmission mechanism. China’s Popul. Resour. Environ. 30 (4), 95–106.

Ren, Z., and Hussain, R. Y. (2022). A mediated-moderated model for green human resource management: An employee perspective. Front. Environ. Sci. 1538, 973692. doi:10.3389/fenvs.2022.973692

Sadorsky, P. (2010). The impact of financial development on energy consumption in emerging economies. Energy Policy 38, 2528–2535. doi:10.1016/j.enpol.2009.12.048

Saidi, K., and Mbarek, M. B. (2017). The impact of income, trade, urbanization, and financial development on CO2 emissions in 19 emerging economies. Environ. Sci. Pollut. Res. 24 (14), 12748–12757. doi:10.1007/s11356-016-6303-3

Shahbaz, M., Kumar Tiwari, A., and Nasir, M. (2013). The effects of financial development, economic growth, coal consumption and trade openness on CO2 emissions in South Africa. Energy Policy 61, 1452–1459. doi:10.1016/j.enpol.2013.07.006

Shahbaz, M., Nasir, M. A., and Roubaud, D. (2018). Environmental degradation in France: The effects of FDI, financial development, and energy innovations. Energy Econ. 74, 843–857. doi:10.1016/j.eneco.2018.07.020

Song, L. (2019). The influence of industrial structure upgrading on carbon emission efficiency in China. Ijidb 10 (2), 7–15. doi:10.13106/ijidb.2019.vol10.no2.7

Tamazian, A., and Bhaskara Rao, B. (2010). Do economic, financial and institutional developments matter for environmental degradation? Evidence from transitional economies. Energy Econ. 32 (1), 137–145. doi:10.1016/j.eneco.2009.04.004

Tamazian, A., Chousa, J. P., and Vadlamannati, K. C. (2009). Does higher economic and financial development lead to environmental degradation: Evidence from BRIC countries. Energy Policy 37 (1), 246–253. doi:10.1016/j.enpol.2008.08.025

Tao, A. P., and Xu, J. C. (2016). Research on nonlinear relationship between Financial development and industrial structure Upgrading: Empirical test based on threshold model. Econ. Fabr. 33 (2), 84–89.

Tian, X., Bai, F., Jia, J., Liu, Y., and Shi, F. (2019). Realizing low-carbon development in a developing and industrializing region: Impacts of industrial structure change on CO2 emissions in southwest China. J. Environ. Manag. 233, 728–738. doi:10.1016/j.jenvman.2018.11.078

Wang, K., Wu, M., Sun, Y., Shi, X., Sun, A., and Zhang, P. (2019). Resource abundance, industrial structure, and regional carbon emissions efficiency in China. Resour. Policy 60, 203–214. doi:10.1016/j.resourpol.2019.01.001

Wu, L., Sun, L., Qi, P., Ren, X., and Sun, X. (2021). Energy endowment, industrial structure upgrading, and CO2 emissions in China: Revisiting resource curse in the context of carbon emissions. Resour. Policy 74, 102329. doi:10.1016/j.resourpol.2021.102329

Xu, X., Huang, S., and An, H. (2021). Identification and causal analysis of the influence channels of financial development on CO2 emissions. Energy Policy 153, 112277. doi:10.1016/j.enpol.2021.112277

York, R., Rosa, E. A., and Dietz, T. (2003). STIRPAT, IPAT and ImPACT: Analytic tools for unpacking the driving forces of environmental impacts. Ecol. Econ. 46 (3), 351–365. doi:10.1016/S0921-8009(03)00188-5

Yu, Y., Deng, Y. r., and Chen, F. f. (2018). Impact of population aging and industrial structure on CO2 emissions and emissions trend prediction in China. Atmos. Pollut. Res. 9 (3), 446–454. doi:10.1016/j.apr.2017.11.008

Zaidi, S. A. H., Zafar, M. W., Shahbaz, M., and Hou, F. (2019). Dynamic linkages between globalization, financial development and carbon emissions: Evidence from Asia Pacific Economic Cooperation countries. J. Clean. Prod. 228, 533–543. doi:10.1016/j.jclepro.2019.04.210

Zhang, F., Deng, X., Phillips, F., Fang, C., and Wang, C. (2020). Impacts of industrial structure and technical progress on carbon emission intensity: Evidence from 281 cities in China. Technol. Forecast. Soc. Change 154, 119949. doi:10.1016/j.techfore.2020.119949

Zhang, X., Li, X., Ding, L., and Zhang, X. (2019). The impact of financial development on manufacturing structural upgrading: Quantity or quality. Ajibm 09 (12), 2112–2128. doi:10.4236/ajibm.2019.912140

Zhang, Y. J., Liu, Z., Zhang, H., and Tan, T. D. (2014). The impact of economic growth, industrial structure and urbanization on carbon emission intensity in China. Nat. Hazards 73 (2), 579–595. doi:10.1007/s11069-014-1091-x

Zhou, Y., Fang, Z., Li, N., Wu, X., Du, Y., and Liu, Z. (2019). How does financial development affect reductions in carbon emissions in high-energy industries?-A perspective on technological progress. Ijerph 16 (17), 3018. doi:10.3390/ijerph16173018

Keywords: financial development, carbon emissions, industrial structure, carbon peak, carbon neutralization

Citation: Yang W-J, Tan M-Z, Chu S-H and Chen Z (2023) Carbon emission and financial development under the “double carbon” goal: Considering the upgrade of industrial structure. Front. Environ. Sci. 10:1091537. doi: 10.3389/fenvs.2022.1091537

Received: 07 November 2022; Accepted: 30 December 2022;

Published: 30 January 2023.

Edited by:

Zeeshan Fareed, Huzhou University, ChinaReviewed by:

Ilyas Ahmad, University of Education Lahore, PakistanNajaf Iqbal, Anhui University of Finance and Economics, China

Copyright © 2023 Yang, Tan, Chu and Chen. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Meng-Zhuo Tan, dGFuX21lbmd6aHVvXzE5OTRAMTYzLmNvbQ==

Wen-Jie Yang1

Wen-Jie Yang1 Meng-Zhuo Tan

Meng-Zhuo Tan