95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

REVIEW article

Front. Environ. Sci. , 04 January 2023

Sec. Environmental Economics and Management

Volume 10 - 2022 | https://doi.org/10.3389/fenvs.2022.1087493

This paper offers an overview of the status of and emerging trends in environmental, social, and governance (ESG) research through a bibliometric approach using CiteSpace. In particular, our study aimed to elucidate the overall intellectual structure of the environmental, social, and governance academic field. To this end, we performed a topic search related to the environmental, social, and governance field and gathered published articles (2007–2021) from the Web of Science. Subsequently, we identified productive authors, institutes, and countries/regions to determine main research forces in the environmental, social, and governance field. Additionally, we conducted a co-citation analysis to identify highly cited authors, journals, and literatures in the environmental, social, and governance field. Furthermore, we performed a literature-co-citation-based cluster analysis and literature citation burst analysis to confirm the main themes and hotspots of the environmental, social, and governance field. These analyses can contribute to the investigations of key contributing forces in the environmental, social, and governance field at the author, institution, country/region, and journal levels and provide insights into the knowledge structures and orientations of the environmental, social, and governance field for future research.

The environmental, social, and governance (environmental, social, and corporate governance; ESG) concept involves three components: the environment, social responsibility, and corporate governance. Among these, the environment indicates the need for enterprises to improve their environmental performance and decrease the environmental costs associated with their production and operation (Brooks and Oikonomou, 2018). Social responsibility implies that an enterprise adheres to high legal standards and business and social ethics and considers human rights and relationships with the external society important (Lee et al., 2016; Gao et al., 2021). Corporate governance is interpreted as a scientific management system in which the rights of shareholders and the management of the board of directors must be reasonably divided, centering on those who can be delegated responsibilities (Aguilera et al., 2007; Gao et al., 2021).

Notably, a United Nations Global Compact (2004) report first postulated the ESG approach, which highlighted that companies should develop guidelines on the incorporation of the ESG concept into asset management and security brokerage services. This point of view was supported by large banks, asset owners, asset managers, and others (Lim et al., 2022a). Additionally, the United Nations Environment Programme Finance Initiative (2005) proposed a report discussing the fiduciary duty of employing ESG-related information in making investing decisions and simultaneously offering groundbreaking evidence on the financial relevance of the ESG concept. As noted by Eccles et al. (2020), the aforementioned two reports formed the basis of the United Nations Principles for Responsible Investment released in 2006.

As indicated by Atkins (2020), 63 investment enterprises with 6.5 trillion dollars in assets under management (AUM) have signed up to integrate ESG concerns. Since then, over 2,450 signatories have signed above 80 trillion dollars in AUM. Furthermore, as reported in the paper authored by Lim et al. (2022a), a number of enterprises have been involved in ESG reporting and are attempting to make an impact through numerous other associated initiatives (e.g., Global Reporting Initiative).

In line with this trend, the number of ESG-related studies has increased. Additionally, some scholars (Gao et al., 2021; Singh et al., 2022) have conducted bibliometric review research to identifying the intellectual structure of the ESG field. However, these studies only involve citation analyses to analyze the citation performance in this field. As indicated by Boyack and Klavans (2010) and Kleminski et al. (2022), in addition to a citation analysis, researchers should also conduct a co-citation analysis to facilitate a better understanding of the citation performance. Therefore, to address the limitations of prior bibliometric studies of ESG, we primarily conducted several co-citation-based analyses in the ESG area.

Specifically, following the guidelines stipulated by previous studies (Abbas et al., 2019; Chen and Liu, 2020; Azam et al., 2021; Sun et al., 2022), we conducted the following analyses. First, we explored key research forces by identifying productive authors, institutes, and countries/regions. Second, we investigated highly cited authors, journals, and literatures by conducting a co-citation analysis. Third, we investigated primary themes by employing a literature-co-citation-based cluster analysis. Fourth, we explored hot and emerging research topics in this field by performing a literature citation burst analysis. Overall, these analyses can address the following research questions (RQs).

RQ1: Who are the most productive scholars, institutes, and countries/regions in the ESG area?

RQ2: What are the most impactful authors, journals, literatures in the ESG area?

RQ3: What are the major and hot research topics in the ESG area?

We believe that these analyses can elucidate the intellectual framework of the ESG field (see Di Vaio et al., 2022; Zhang et al., 2022), thereby providing a reference for ESG development to aid scholars and stakeholders in easily understanding the basics of this field.

Typically, a bibliometric review objectively assesses performance and maps science across domains (Lim et al., 2022b). Compared with other review types (e.g., systemic review), a bibliometric review analysis is more objective and less prone to bias because it is based on automated or semi-automated quantitative data and tools (Donthu et al., 2021; Paul et al., 2021; Lim et al., 2022b). Thus, in addition to the general contributions made by other review types such as a systemic literature review (Mukherjee et al., 2022), a bibliometric analysis makes some original theoretical and practical contributions. Therefore, unlike Lim et al. (2022a), who conducted a systemic literature review related to the ESG concept, we selected a bibliometric analysis to explore performance, influence, and map science in the context of ESG research.

Along with the rapid development in the ESG field, several scholars have conducted numerous bibliometric reviews related to the ESG concept to provide insights into this academic area. The representative studies can be summarized as follows.

Galletta et al. (2022) conducted a bibliometric analysis on ESG-related performance in the context of the banking industry. Ellili. (2022) explored the knowledge structure of ESG disclosure by performing a bibliometric analysis. These studies have, indeed, enhanced our understanding on the development status of ESG in the context of a specific area (e.g., banking industry).

Furthermore, unlike the above-mentioned review studies, Singh et al. (2022) and Gao et al. (2021) provided an overall understanding of the ESG concept in the academic field via a bibliometric approach. Based on the outcomes of bibliometric analyses, both Singh et al. (2022) and Gao et al. (2021) implied that the ESG concept was derived from socially responsible investment (SRI), and it evolved from corporate social responsibility (CSR). However, these two studies only employed citation analyses to identify citation performance in the ESG area. As implied by Boyack and Klavans (2010) and Kleminski et al. (2022), to better understand citation performance in specific fields, both citation analysis and co-citation analysis are essential. Therefore, to address the limitations of these prior studies, we conducted a co-citation analysis on the status of ESG research. Additionally, unlike Singh et al. (2022) and Gao et al. (2021), we performed a literature citation burst analysis to explore the emerging trends and hot topics in the ESG field.

The Web of Science (WOS) is a representative source of citation data typically used for bibliometric analyses because it is a reliable bibliographic-indexing tool for scientific knowledge (Chen, 2006; Chen and Liu, 2020; Azam et al., 2021). Thus, based on the guidelines provided by existing studies (Chen and Liu, 2020; Azam et al., 2021), the WOS was considered as the source of ESG-related literature data in this study. Note that the data collection date was 5 October 2022.

Specifically, the main data sources used in our study were the Social Science Citation Index (SSCI), Science Citation Index Expanded (SCIE), Emerging Science Citation Index (ESCI), and Arts & Humanities Citation Index (A&HCI) provided by the WOS Core Collection (WOSCC) databases.

The keywords used for the topic search were as follows: “environment* social* and govern*” OR “environment* social* govern*” OR “environment* social* corporate govern*” OR “environment* social* and corporate govern*.” Articles containing these words in their titles, abstracts, or keywords were collected. Unlike Singh et al. (2022) and Gao et al. (2021), we additionally considered keywords such as “environment* social* corporate govern*” and “environment* social* and corporate govern*” to gather exhaustive data (see Karwowski and Raulinajtys-Grzybek, 2021).

For document types, we selected “Article” and “Review Article.” In addition, only articles written in English were selected. To offer more precise bibliometric analysis results, an entire year’s data were evaluated (Kumar et al., 2021), and thus, only articles published between 2007 and 2021 were selected, and articles published after 2021 (in 2022) were excluded.

According to the points mentioned above, we searched for documents on the WOS (see Table 1). Then, following the guidelines of prior studies (Chhabra et al., 2021; Di Vaio et al., 2022; Hassan et al., 2022), we executed the process outlined in Figure 1 to collect 849 ESG articles for our analysis.

CiteSpace is one of the most prominent information visualization tools (Abbas et al., 2019; Ye et al., 2020). This tool is designed to highlight the structure and dynamics of a specific field (Chen, 2016). Furthermore, compared with other bibliometric software such as Vosviewer and Gephi, CiteSpace provides a wide range of functions for network analysis and visualization (Cobo et al., 2011; Che et al., 2022).

Notably, the latest version of CiteSpace (CiteSpace 6.1. R3.) was used in this study. Table 2 lists the parameter settings employed in our analysis. After setting the parameters for our co-citation analysis, CiteSpace was used to obtain information on networks and details regarding authors, literatures, and journals with citation counts.

As already indicated by several scholars (Chen and Liu, 2020; Azam et al., 2021), the key research forces in a specific field can be identified as productive authors, institutions, and countries/regions. From this viewpoint, this study first attempted to investigate the core research forces in the ESG field at the author, institutional, and national levels.

The top 11 most productive authors ranked based on the number of published papers are listed in Table 3. Among these, Amina Buallay, Maria Angeles Fernandez-Izquierdo, and Maria Jesus Munoz-Torres contributed eight papers each in the ESG field. These results indicate that the aforementioned three authors are the most productive scholars in the ESG field. Particularly, the studies conducted by Amina Buallay focused on examining the role of the ESG concept in the banking and financial industries (e.g., Buallay, 2018; Buallay et al., 2020).

The top 13 affiliations of authors ranked by the number of published papers are listed in Table 4. The results revealed that the Sapienza University of Rome ranked first, contributing 16 articles, followed by the University of Oxford (13 articles), the University of Zaragoza (13 articles), and the University of Queensland (11 articles).

The top 10 countries/regions ranked by the number of published papers are reported in Table 5. The United States (USA) had the highest number of published papers (179), followed by England (102), Italy (75), Australia (67), and Spain (60). These results indirectly reveal the Frontier status of Western academic fields in the ESG area. We also discovered that most of these countries/regions were economically developed. This phenomenon could be attributed to active business operations and the high density of educational institutes (Zemigala, 2019; Ye et al., 2020).

Typically, when two or more articles, journals, and authors are simultaneously cited by a third article, they exhibit a co-citation association (Chang et al., 2015). In this regard, co-citation analysis is a method adopted to construct a structure of specialties and investigate the level of interrelationships between these specialties (Small, 1973; Sun et al., 2022). In the current research, we conducted a co-citation analysis at the journal, author, and literature levels in the ESG field.

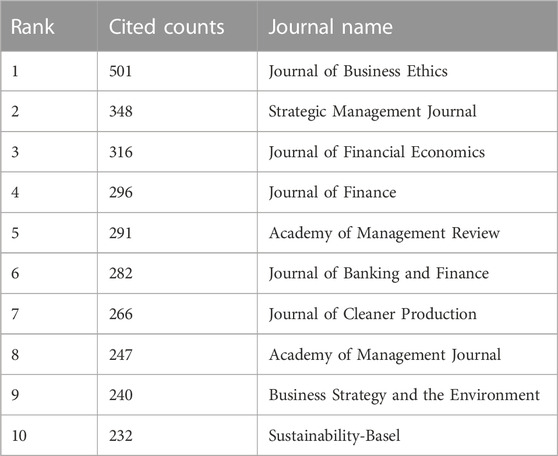

Two journals are considered co-cited if at least one of their respective articles is simultaneously cited in the citing article (McCain, 1991). In our research, applying CiteSpace, a journal co-citation network analysis was performed, and the top 10 journals ranked based on the citation counts are presented in Table 6. The Journal of Business Ethics had the highest citation counts (501) in the ESG field. This journal was followed by the Strategic Management Journal (348), Journal of Financial Economics (316), and Journal of Finance (296). Therefore, the Journal of Business Ethics is one of the most crucial journals in the ESG area.

TABLE 6. Results of the journal co-citation analysis: top 10 journals ranked based on the citation counts.

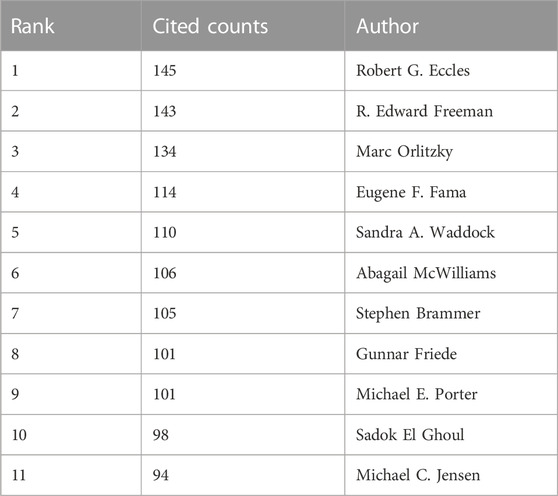

Author co-citation analysis is one of the most representative methods adopted for investigating the layout of highly cited authors (influential authors) in a particular field. Typically, the high citation counts of an author indicate that the author is an influential scholar in a specific academic area. In this study, applying CiteSpace, the author co-citation network analysis was performed, and the top 11 authors ranked based on their citation counts are listed in Table 7. The results indicate that the listed 11 authors made critical contributions to the ESG field, paving the way for the upcoming development in the ESG area. Among these authors, Robert G. Eccles (145) made the most critical contributions in the ESG area, followed by R. Edward Freeman (143) and Marc Orlitzky (134). Thus, these authors are the most influential scholars in the ESG field. In particular, an article authored by Robert G. Eccles was identified among the highly cited papers in our literature co-citation network and literature burst citation analyses (see Section 4.2.3 and Section 4.2.5). Robert G. Eccles, affiliated with the Oxford University (previously affiliated with Harvard University), is a leading scholar working on the integration of ESG elements with resource allocation decisions made by enterprises and investors.

TABLE 7. Results of the author co-citation analysis: top 11 authors ranked based on the citation counts.

Notably, literature forms the major component of knowledge databases. Literature co-citation analysis is a methodology widely employed for investigating the knowledge framework of a specific academic area (Chen and Liu, 2020; Sun et al., 2022). In Figure 2, the literature co-citation network of the ESG area is plotted, and literature with 25 or more citations are highlighted. Here, a node indicates a literature/article, whereas the connected line between two nodes denotes a co-citation association between two articles. Note that the larger the node size, the more numerous the citation counts for an article. A close gap between two nodes indicates a high co-citation frequency for the articles.

The top 12 highly cited literatures are listed in Table 8. These 12 articles strongly influenced the ESG area. Specifically, the paper authored by Friede et al. (2015) was cited 50 times. This was followed by papers authored by Fatemi et al. (2018), Cheng et al. (2014), and Khan et al. (2016), with citation counts of 45, 42, and 40, respectively.

Based on a review of core articles in the ESG area (see Table 8), our major findings can be summarized as follows:

First, the article authored by Friede et al. (2015) had the highest citation count in the ESG field. In that study, the authors examined the association between the ESG concept and corporate financial performance (CFP). Consequently, they discovered a non-negative association between the two, indicating that ESG generally has a positive influence on CFP. Furthermore, Garcia et al. (2017), ranked sixth in Table 8, investigated the association between the ESG concept and CFP. In line with the notion that the topics addressed in highly cited papers indirectly indicate significant research topics in an academic area (Abbas et al., 2019), we propose that exploring the association between the ESG concept and CFP constitutes one of the most significant research topics in the ESG academic area.

Second, Fatemi et al. (2018), ranked second in Table 8, investigated the effect of ESG performance on firm values. Specifically, their investigation indicated that ESG strengths resulted in greater firm values and that ESG weaknesses resulted in lower firm values. Thus, examining the association between the ESG concept and firm values is also among the noteworthy topics in the ESG field.

Third, Lins et al. (2017), Cheng et al. (2014), Chatterji et al. (2016), and Ferrell et al. (2016) focused on CSR. Their findings indicated that CSR and ESG were strongly related. This close association can be explained as follows. CSR is a precursor of ESG. In particular, ESG represents the manner in which enterprises and investors integrate the ESG concept into their business models. CSR refers to the activities of enterprises aimed at making the enterprises socially responsible and enterprising citizens. Thus, ESG directly includes governance, whereas CSR indirectly includes governance issues related to environmental and social concerns. Therefore, the ESG concept is highly related to CSR and can be considered a more expansive term than CSR. This perspective was adopted by Gillan et al. (2021) and Garcia et al. (2017).

Fourth, Khan et al. (2016) and Eccles et al. (2014) focused on corporate sustainability. The results of their studies revealed a notable association between corporate sustainability and the ESG concept. This association can be explained as follows. Corporate sustainability aims at developing long-term stakeholder values via the fulfillment of business strategies with a concentration on diverse aspects such as ethical, social, environmental, cultural, and economic aspects (Ashrafi et al., 2019). Moreover, corporate sustainability can be estimated based on indicators such as environmental, social, and corporate governance (Dočekalová and Kocmanová, 2016). Therefore, ESG is highly related to and can be considered as a component of corporate sustainability.

Fifth, Amel-Zadeh and Serafeim (2018) and Van Duuren et al. (2016) focused on ESG investing, whereas Lokuwaduge and Heenetigala (2017) focused on ESG reporting. Therefore, these two topics can also be considered as primary research topics in the ESG area.

Sixth, although the Global Finance Journal is an ESCI journal (based on Journal Citation Reports 2020), an article published in this journal (Fatemi et al., 2018) was found to represent a core study in the ESG area. This result indicates that the Global Finance Journal is likely to be a crucial journal in the ESG research field in the future, despite not being identified as a highly cited journal in our co-citation analysis.

To explore the primary themes of the ESG area, we conducted a cluster analysis on a literature co-citation network and discovered 13 clusters (Figure 3). The labels of these clusters were generated based on the log-likelihood ratio (LLR) algorithm (Chen, 2006; Pestana et al., 2020; Che et al., 2022). Particularly, note that this methodology is capable of generating high-quality clusters with high intra-class variability, low inter-class similarity, and similarity between classes (Chopra et al., 2021).

Among the generated clusters, Cluster #1 (banking industry), Cluster #2 (sustainable investment), and Cluster #4 (board gender diversity) are deemed to be the most significant clusters in the ESG area (see Table 9). The reasons for this are as follows: first, all their silhouette values are greater than 0.8, which indicates that their clusters have excellent fits (Chen et al., 2014; Pestana et al., 2020). Second, the size of these clusters is ranked among the top five of all the clusters. Overall, based on the results, we propose that ESG roles in banking industry (Cluster #1; e.g., Miralles-Quirós et al., 2019; Bătae et al., 2021), ESG roles in sustainable investment (Cluster #2; e.g., Escrig-Olmedo et al., 2017), and relationships between board gender diversity and ESG performance (Cluster #4; e.g., Cucari et al., 2018) constitute the major themes of the ESG area.

Typically, the dynamic characteristics of an academic field are represented by enhancements in literature citations (Abbas et al., 2019). These enhancements are referred to as “burst citations.” As noted by Chen (2016) and Abbas et al. (2019), burst citations identify areas with the most significant research interest (i.e., research hotspot). Thus, scholars and stakeholders can identify core research topics or areas at a particular point in time by investigating temporal trends in the burst citations. The associated fields and topics vary in intensity and in the duration of bursts, and the content of their research continues to evolve and change. The results of our literature citation burst analysis on ESG research are reported in Figure 4.

The main findings of our literature burst analysis can be summarized as follows:

First, evidently, the burst of ESG-related studies began in 2013. This result implies that from 2013, the field of ESG has evolved as the focus of the underlying research community, making significant academic achievements.

Second, the topic of the study conducted by Cheng et al. (2014) was identified as the hottest, with the strongest burst strengths (14.37) and longest burst time (2016–2019). The authors demonstrated that enterprises with better CSR performance encountered fewer capital constraints. This finding is consistent with ESG ratings being employed as a shock to CSR performance. That is, Cheng et al. (2014) implied that ESG ratings should be considered when exploring the role of CSR performance. Moreover, an investigation into the role of ESG ratings in influencing CSR performance forms one of the hottest research topics in the ESG research area.

Third, the paper authored by Eccles et al. (2014) had the second highest burst strength. Eccles et al. (2014) focused on corporate sustainability. They discovered that the ESG disclosure score had a significant and positive relationship with corporate sustainability. This indicated that companies with high ESG scores may possess high sustainability.

Fourth, the paper authored by Friede et al. (2015) had the third highest burst value (11.24). The authors examined the connection between the ESG concept and CFP. Hence, considering that the paper authored by Friede et al. (2015) presented burst improvements in the recent 3 years (2019–2021), we infer that exploring the connection between the ESG concept and CFP may become one of the hottest research topics in the future.

This study aimed at investigating the knowledge structure of the ESG field using bibliometric analysis. Based on the outcomes, the main findings can be summarized as follows:

At the author level, Amina Buallay, Maria Angeles Fernandez-Izquierdo, and Maria Jesus Munoz-Torres were identified as the productive scholars, and Robert G. Eccles, R. Edward Freeman, and Marc Orlitzky were identified as highly cited scholars. At the institutional level, the major research forces were the Sapienza University of Rome, University of Oxford, and University of Zaragoza. At the country/region level, United States and England contributed core research forces.

At the journal level, the Journal of Business Ethics, Strategic Management Journal, and Journal of Financial Economics were identified as the core journals in the concerned field. Notably, we also discovered that although the Global Finance Journal is an ESCI journal (based on Journal Citation Reports 2020), one of its published articles (Fatemi et al., 2018) was identified as a highly cited article in the ESG area. This indicates that the Global Finance Journal is likely to become a crucial journal in the ESG research field in the future, despite not being identified as a highly cited journal in the co-citation analysis of our research.

Additionally, we discovered that exploring the influence of ESG performance on CFP and firm values forms a significant research topic in the ESG area (see Friede et al., 2015; Fatemi et al., 2018). In particular, exploring the relations between ESG performance and CFP may constitute the hottest research topics in the ESG area in the future (see Section 4.2.5). Moreover, exploring ESG roles in the banking industry may be identified as one of the most significant themes in this area (see Section 4.2.4).

Furthermore, considering that existing bibliometric studies focusing on ESG (Gao et al., 2021; Singh et al., 2022) only conducted citation analysis to evaluate citation performance in the area, our study notably contributes to our understanding of the knowledge structures of the ESG field by employing several co-citation analyses (i.e., author co-citation analysis, journal co-citation analysis, literature co-citation analysis, literature-co-citation-based cluster analysis, and literature citation burst analysis).

In terms of theoretical implications, we identified that the concepts of corporate sustainability, ESG, and CSR are related (see Section 4.2.3). That is, they are conceptually complementary and influence one another. These results imply that academic research related to ESG must consider the notions and roles of CSR and sustainability (see Eccles et al., 2014; Lins et al., 2017). In summary, our study identified notable relationships among the concepts of corporate sustainability, ESG, and CSR from a bibliometric perspective. Considering that ESG is derived from SRI (Gao et al., 2021; Singh et al., 2022), this finding also indicates that the ESG concept plays a role in connecting these three concepts (corporate sustainability, CSR, SRI) from the viewpoint of knowledge structure.

With regard to practical implications, our research provides additional insights for companies and investors to effectively engage with productive and influential institutions or academics in the ESG field to help develop more effective ESG strategies.

Despite the evident significance of the findings of our study, they have the following limitations. As the data were sourced from the SSCI, SCIE, A&HCI, and ESCI of the WOSCC databases, and only papers written in English were considered, a linguistic bias and negligence of other data sources could have resulted in some discrepancies. Additionally, considering that sustainability is highly related to the ESG concept (Eccles et al., 2014), and sustainable development has long been considered a major global trend (Lim, 2022a; Lim, 2022b), future research can focus on exploring the knowledge structure of the ESG field in the context of sustainable development.

XZ: conceptualization, methodology, formal analysis, writing-original draft, writing-review and editing DN: conceptualization, methodology, writing-original draft, Writing-review and editing CC: Methodology, Writing-review and editing SZ: writing-original draft, writing-review and editing SC: methodology, formal analysis JK: conceptualization, methodology, writing-original draft, supervision.

This research was supported by a National Research Foundation of Korea (NRF) grant funded by the Korean Government (NRF2020R1A2C1014957).

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Abbas, N. N., Ahmed, T., Shah, S. H. U., Omar, M., and Park, H. W. (2019). Investigating the applications of artificial intelligence in cyber security. Scientometrics 121 (2), 1189–1211. doi:10.1007/s11192-019-03222-9

Aguilera, R. V., Rupp, D. E., Williams, C. A., and Ganapathi, J. (2007). Putting the S back in corporate social responsibility: A multilevel theory of social change in organizations. Acad. Manage. Rev. 32 (3), 836–863. doi:10.5465/amr.2007.25275678

Amel-Zadeh, A., and Serafeim, G. (2018). Why and how investors use ESG information: Evidence from a global survey. Financial Analysts J. 74 (3), 87–103. doi:10.2469/faj.v74.n3.2

Ashrafi, M., Acciaro, M., Walker, T. R., Magnan, G. M., and Adams, M. (2019). Corporate sustainability in Canadian and US maritime ports. J. Clean. Prod. 220, 386–397. doi:10.1016/j.jclepro.2019.02.098

Atkins, B. (2020). Demystifying ESG: Its history and current status. Available at https://www.forbes.com/sites/betsyatkins/2020/06/08/demystifying-esgits-history–current-status/.

Azam, A., Ahmed, A., Kamran, M. S., Hai, L., Zhang, Z., and Ali, A. (2021). Knowledge structuring for enhancing mechanical energy harvesting (MEH): An in-depth review from 2000 to 2020 using CiteSpace. Renew. Sustain. Energy Rev. 150, 111460. doi:10.1016/j.rser.2021.111460

Bătae, O. M., Dragomir, V. D., and Feleagă, L. (2021). The relationship between environmental, social, and financial performance in the banking sector: A European study. J. Clean. Prod. 290, 125791. doi:10.1016/j.jclepro.2021.125791

Boyack, K. W., and Klavans, R. (2010). Co-citation analysis, bibliographic coupling, and direct citation: Which citation approach represents the research front most accurately? J. Am. Soc. Inf. Sci. Technol. 61 (12), 2389–2404. doi:10.1002/asi.21419

Brooks, C., and Oikonomou, I. (2018). The effects of environmental, social and governance disclosures and performance on firm value: A review of the literature in accounting and finance. Br. Account. Rev. 50 (1), 1–15. doi:10.1016/j.bar.2017.11.005

Buallay, A. (2018). Is sustainability reporting (ESG) associated with performance? Evidence from the European banking sector. Manag. Environ. Qual. Int. J. 30, 98–115. doi:10.1108/meq-12-2017-0149

Buallay, A. M., Wadi, R. M. A., Kukreja, G., and Hassan, A. A. (2020). Evaluating ESG disclosures of islamic banks: Evidence from the organization of islamic cooperation members. Int. J. Innovation Sustain. Dev. 14 (3), 266–287. doi:10.1504/ijisd.2020.10028979

Chang, Y. W., Huang, M. H., and Lin, C. W. (2015). Evolution of research subjects in library and information science based on keyword, bibliographical coupling, and co-citation analyses. Scientometrics 105 (3), 2071–2087. doi:10.1007/s11192-015-1762-8

Chatterji, A. K., Durand, R., Levine, D. I., and Touboul, S. (2016). Do ratings of firms converge? Implications for managers, investors and strategy researchers. Strateg. Manag. J. 37 (8), 1597–1614. doi:10.1002/smj.2407

Che, S., Kamphuis, P., Zhang, S., Zhao, X., and Kim, J. H. (2022). A visualization analysis of crisis and risk communication research using citespace. Int. J. Environ. Res. Public Health 19 (5), 2923. doi:10.3390/ijerph19052923

Chen, C. (2006). CiteSpace II: Detecting and visualizing emerging trends and transient patterns in scientific literature. J. Am. Soc. Inf. Sci. Technol. 57 (3), 359–377. doi:10.1002/asi.20317

Chen, C., Dubin, R., and Kim, M. C. (2014). Emerging trends and new developments in regenerative medicine: A scientometric update (2000–2014). Expert Opin. Biol. Ther. 14 (9), 1295–1317. doi:10.1517/14712598.2014.920813

Chen, X., and Liu, Y. (2020). Visualization analysis of high-speed railway research based on CiteSpace. Transp. Policy 85, 1–17. doi:10.1016/j.tranpol.2019.10.004

Cheng, B., Ioannou, I., and Serafeim, G. (2014). Corporate social responsibility and access to finance. Strateg. Manag. J. 35 (1), 1–23. doi:10.1002/smj.2131

Chhabra, M., Dana, L. P., Ramadani, V., and Agarwal, M. (2021). A retrospective overview of journal of enterprising communities: People and places in the global economy from2007 to 2021 using a bibliometric analysis. J. Enterprising Communities People Places Glob. Econ. 16, 1033–1059. doi:10.1108/jec-06-2021-0091

Chopra, M., Saini, N., Kumar, S., Varma, A., Mangla, S. K., and Lim, W. M. (2021). Past, present, and future of knowledge management for business sustainability. J. Clean. Prod. 328, 129592. doi:10.1016/j.jclepro.2021.129592

Cobo, M. J., López-Herrera, A. G., Herrera-Viedma, E., and Herrera, F. (2011). Science mapping software tools: Review, analysis, and cooperative study among tools. J. Am. Soc. Inf. Sci. Technol. 62 (7), 1382–1402. doi:10.1002/asi.21525

Cucari, N., Esposito de Falco, S., and Orlando, B. (2018). Diversity of board of directors and environmental social governance: Evidence from Italian listed companies. Corp. Soc. Responsib. Environ. Manag. 25 (3), 250–266. doi:10.1002/csr.1452

Di Vaio, A., Hassan, R., Chhabra, M., Arrigo, E., and Palladino, R. (2022). Sustainable entrepreneurship impact and entrepreneurial venture life cycle: A systematic literature review. J. Clean. Prod. 378, 134469. doi:10.1016/j.jclepro.2022.134469

Dočekalová, M. P., and Kocmanová, A. (2016). Composite indicator for measuring corporate sustainability. Ecol. Indic. 61, 612–623. doi:10.1016/j.ecolind.2015.10.012

Donthu, N., Kumar, S., Mukherjee, D., Pandey, N., and Lim, W. M. (2021). How to conduct a bibliometric analysis: An overview and guidelines. J. Bus. Res. 133, 285–296. doi:10.1016/j.jbusres.2021.04.070

Eccles, R. G., Ioannou, I., and Serafeim, G. (2014). The impact of corporate sustainability on organizational processes and performance. Manag. Sci. 60 (11), 2835–2857. doi:10.1287/mnsc.2014.1984

Eccles, R. G., Lee, L. E., and Stroehle, J. C. (2020). The social origins of ESG: An analysis of Innovest and KLD. Organ. Environ. 33 (4), 575–596. doi:10.1177/1086026619888994

Ellili, N. O. D. (2022). Bibliometric analysis and systematic review of environmental, social, and governance disclosure papers: Current topics and recommendations for future research. Environ. Res. Commun. 4, 092001. doi:10.1088/2515-7620/ac8b67

Escrig-Olmedo, E., Rivera-Lirio, J. M., Muñoz-Torres, M. J., and Fernández-Izquierdo, M. Á. (2017). Integrating multiple ESG investors' preferences into sustainable investment: A fuzzy multicriteria methodological approach. J. Clean. Prod. 162, 1334–1345. doi:10.1016/j.jclepro.2017.06.143

Fatemi, A., Glaum, M., and Kaiser, S. (2018). ESG performance and firm value: The moderating role of disclosure. Glob. Finance J. 38, 45–64. doi:10.1016/j.gfj.2017.03.001

Ferrell, A., Liang, H., and Renneboog, L. (2016). Socially responsible firms. J. financial Econ. 122 (3), 585–606. doi:10.1016/j.jfineco.2015.12.003

Friede, G., Busch, T., and Bassen, A. (2015). ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. J. Sustain. Finance Invest. 5 (4), 210–233. doi:10.1080/20430795.2015.1118917

Galletta, S., Mazzù, S., and Naciti, V. (2022). A bibliometric analysis of ESG performance in the banking industry: From the current status to future directions. Res. Int. Bus. Finance 62, 101684. doi:10.1016/j.ribaf.2022.101684

Gao, S., Meng, F., Gu, Z., Liu, Z., and Farrukh, M. (2021). Mapping and clustering analysis on environmental, social and governance field a bibliometric analysis using Scopus. Sustainability 13 (13), 7304. doi:10.3390/su13137304

Garcia, A. S., Mendes-Da-Silva, W., and Orsato, R. J. (2017). Sensitive industries produce better ESG performance: Evidence from emerging markets. J. Clean. Prod. 150, 135–147. doi:10.1016/j.jclepro.2017.02.180

Gillan, S. L., Koch, A., and Starks, L. T. (2021). Firms and social responsibility: A review of ESG and CSR research in corporate finance. J. Corp. Finance 66, 101889. doi:10.1016/j.jcorpfin.2021.101889

Hassan, R., Shahza, A., Fox, D., and Hasan, S. (2022). A bibliometric analysis of journal of international women’s studies for period of 2002-2019: Current status, development, and future research directions. J. Int. Women's Stud. 22 (1).

Karwowski, M., and Raulinajtys-Grzybek, M. (2021). The application of corporate social responsibility (CSR) actions for mitigation of environmental, social, corporate governance (ESG) and reputational risk in integrated reports. Corp. Soc. Responsib. Environ. Manag. 28 (4), 1270–1284. doi:10.1002/csr.2137

Khan, M., Serafeim, G., and Yoon, A. (2016). Corporate sustainability: First evidence on materiality. Account. Rev. 91 (6), 1697–1724. doi:10.2308/accr-51383

Kleminski, R., Kazienko, P., and Kajdanowicz, T. (2022). Analysis of direct citation, co-citation and bibliographic coupling in scientific topic identification. J. Inf. Sci. 48 (3), 349–373. doi:10.1177/0165551520962775

Kumar, S., Sureka, R., Lim, W. M., Kumar Mangla, S., and Goyal, N. (2021). What do we know about business strategy and environmental research? Insights from business strategy and the environment. Bus. Strategy Environ. 30 (8), 3454–3469. doi:10.1002/bse.2813

Lee, K. H., Cin, B. C., and Lee, E. Y. (2016). Environmental responsibility and firm performance: The application of an environmental, social and governance model. Bus. Strategy Environ. 25 (1), 40–53. doi:10.1002/bse.1855

Lim, W. M., Ciasullo, M. V., Douglas, A., and Kumar, S. (2022a). Environmental social governance (ESG) and total quality management (TQM): A multi-study meta-systematic review. Total Quality Management & Business Excellence, 1–23.

Lim, W. M., Kumar, S., and Ali, F. (2022b). Advancing knowledge through literature reviews:‘what’, ‘why’, and ‘how to contribute. Serv. Industries J. 42 (7-8), 481–513. doi:10.1080/02642069.2022.2047941

Lim, W. M. (2022b). The sustainability pyramid: A hierarchical approach to greater sustainability and the united Nations sustainable development goals with implications for marketing theory, practice, and public policy. Australas. Mark. J. 30 (2), 142–150. doi:10.1177/18393349211069152

Lim, W. M. (2022a). Ushering a new era of Global Business and Organizational Excellence: Taking a leaf out of recent trends in the new normal. Glob. Bus. Org. Exc. 41 (5), 5–13. doi:10.1002/joe.22163

Lins, K. V., Servaes, H., and Tamayo, A. (2017). Social capital, trust, and firm performance: The value of corporate social responsibility during the financial crisis. J. Finance 72 (4), 1785–1824. doi:10.1111/jofi.12505

Lokuwaduge, C. S. D. S., and Heenetigala, K. (2017). Integrating environmental, social and governance (ESG) disclosure for a sustainable development: An Australian study. Bus. Strategy Environ. 26 (4), 438–450. doi:10.1002/bse.1927

McCain, K. W. (1991). Mapping economics through the journal literature: An experiment in journal cocitation analysis. J. Am. Soc. Inf. Sci. 42 (4), 290–296. doi:10.1002/(sici)1097-4571(199105)42:4<290::aid-asi5>3.0.co;2-9

Miralles-Quirós, M. M., Miralles-Quirós, J. L., and Redondo-Hernández, J. (2019). The impact of environmental, social, and governance performance on stock prices: Evidence from the banking industry. Corp. Soc. Responsib. Environ. Manag. 26 (6), 1446–1456.

Mukherjee, D., Lim, W. M., Kumar, S., and Donthu, N. (2022). Guidelines for advancing theory and practice through bibliometric research. J. Bus. Res. 148, 101–115. doi:10.1016/j.jbusres.2022.04.042

Paul, J., Lim, W. M., O’Cass, A., Hao, A. W., and Bresciani, S. (2021). Scientific procedures and rationales for systematic literature reviews (SPAR-4-SLR). Int. J. Consum. Stud. 45 (4), O1–O16. doi:10.1111/ijcs.12695

Pestana, M. H., Wang, W. C., and Parreira, A. (2020). Senior tourism–a scientometric review. Tour. Rev. 75, 699–715. doi:10.1108/tr-01-2019-0032

Singh, A. K., Zhang, Y., and Anu, (2022). Understanding the evolution of environment, social and governance research: Novel implications from bibliometric and network analysis. Eval. Rev., 1–38. doi:10.1177/0193841x221121244

Small, H. (1973). Co-citation in the scientific literature: A new measure of the relationship between two documents. J. Am. Soc. Inf. Sci. 24 (4), 265–269. doi:10.1002/asi.4630240406

Sun, S., Nan, D., Che, S., and Kim, J. H. (2022). Investigating the knowledge structure of research on massively multiplayer online role-playing games: A bibliometric analysis. Data and Information Management. doi:10.1016/j.dim.2022.1000

United Nations Environment Programme Finance Initiative (2005). A legal framework for incorporating environmental, social and governance issues into institutional investment. London, United Kingdom: Freshfields Bruckhaus Deringer.

United Nations Global Compact (2004). Who cares wins: Connecting financial markets to a changing world. New York, United States: United Nations Global Compact.

Van Duuren, E., Plantinga, A., and Scholtens, B. (2016). ESG integration and the investment management process: Fundamental investing reinvented. J. Bus. Ethics 138 (3), 525–533. doi:10.1007/s10551-015-2610-8

Widziewicz-Rzońca, K., and Tytła, M. (2020). First systematic review on PM-bound water: Exploring the existing knowledge domain using the CiteSpace software. Scientometrics 124 (3), 1945–2008. doi:10.1007/s11192-020-03547-w

Ye, N., Kueh, T. B., Hou, L., Liu, Y., and Yu, H. (2020). A bibliometric analysis of corporate social responsibility in sustainable development. J. Clean. Prod. 272, 122679. doi:10.1016/j.jclepro.2020.122679

Zemigala, M. (2019). Tendencies in research on sustainable development in management sciences. J. Clean. Prod. 218, 796–809. doi:10.1016/j.jclepro.2019.02.009

Keywords: environmental social and governance (ESG), citespace, co-citation analysis, literature-co-citation-based cluster analysis, literature citation burst analysis

Citation: Zhao X, Nan D, Chen C, Zhang S, Che S and Kim JH (2023) Bibliometric study on environmental, social, and governance research using CiteSpace. Front. Environ. Sci. 10:1087493. doi: 10.3389/fenvs.2022.1087493

Received: 02 November 2022; Accepted: 30 November 2022;

Published: 04 January 2023.

Edited by:

Rohail Hassan, Universiti Utara Malaysia, MalaysiaReviewed by:

Luigi Aldieri, University of Salerno, ItalyCopyright © 2023 Zhao, Nan, Chen, Zhang, Che and Kim. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jang Hyun Kim, YWxvaGFraW1Ac2trdS5lZHU=

†These authors have contributed equally to this work and share first authorship

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.