- 1Faculty of Economics and Management, University of Szczecin, Szczecin, Poland

- 2Faculty of Economics, West Pomeranian University of Technology, Szczecin, Poland

- 3Institute of Economics and Finance, The John Paul II Catholic University of Lublin, Lublin, Poland

Introduction: ESG risk and the business sector are essential in the process of adapting business models towards sustainability. The article aims to analyze ESG risk, taking into account these business sectors that are most affected by ESG risk, and to identify the relationship between ESG risk and cooperation models of financial institutions and companies (Anglo-Saxon/German-Japanese). The original research approach was based on including the financial system model in the analysis of ESG risk impact and the companies’ methods of achieving sustainable business models with external funding.

Methods: The study is based on a two-stage analysis. First, fuzzy cognitive maps are used to evaluate the strength and direction of the relations between factors included in the companies’ sustainable business models according to the business sectors. At the second stage, a correspondence analysis was carried out to distinguish four groups of companies’ industries characterized by homogenous features related to the business sector, sustainable business model (SBM), and the way to transform to sustainability.

Results: Methods of achieving sustainability in companies’ business models differ depending on business sectors. The “financial institution—company” cooperation model and recommendations were proposed.

Discussion: Financial institutions play a crucial role in financing the transition into sustainable business models. However, their impact differs depending on the business sector and the model of the financial system (bank or market oriented). The study assumes that the financial system model determines the form of cooperation between financial institutions and companies in the process of financing costs towards sustainability.

1 Introduction

The risk of non-financial factors, also known as ESG risk (Environmental, Social, Governance risk), has now become the leading type of risk affecting the operating activities of business entities (Global Risks Report, 2022). The strength and direction of the impact of this risk depend, inter alia, on the specificity of the activity and the industry in which a given entity operates (Sustainalytics, 2022). The consequences of ESG risk translate into financial performance, including profitability and financial liquidity, which makes it necessary to mitigate this type of risk (Friede et al., 2015). Enterprises take a series of measures to reduce their exposure to ESG risk by adjusting their business models towards sustainable business models (Clementino and Perkins, 2021).

Adjustment measures that businesses apply towards sustainability require funding, the amount of which often exceeds the entities’ resources to be used for the purpose of such financing. Hence, the critical role of the financial market in ensuring financing of adjustment measures taken by businesses. Sectors that react to climate changes (e.g., agriculture, insurance) and changes in the natural environment, as well as industries that create negative externalities resulting in environmental degradation (e.g., mining, fuel, chemical industries), are particularly exposed to the impact of ESG risk (Sustainalytics, 2022). Similarly, business sectors sensitive to social threats, including health risk, which find it impossible to implement a remote form of work (tourism, hotel industry, gastronomy, construction) are exposed to ESG risk. Finally, the risk associated with digitalization and cybersecurity is worth mentioning, which applies to sectors using electronic service delivery channels and operating in the virtual space (Global Risks Report, 2022). Financial markets conditionally provide financial capital to businesses, which means that only businesses that meet specific criteria can obtain financing. Transformation and adjustment of business models of enterprises towards sustainability in terms of limiting the impact of ESG risk can be financed conditionally by the financial market in some cases (Urban and Wójcik, 2019; Clementino and Perkins, 2021).

Therefore, financial markets have a tangible impact on the adjustment measures taken by businesses. The conditions set by financial markets differ depending on the financial system model. In case of systems based on the financial capital of the banking sector, there are creditworthiness requirements, taking into account internal ESG-based ratings and ratings that incorporate ESG. In systems based on the money flowing from the capital market, the conditions apply to the disclosure of non-financial information and attitudes towards sustainability, reducing the carbon footprint expected by stakeholders (Urban and Wójcik, 2019).

There are the interlinkages between environmental, social, and governance risk and cooperation models between financial institutions and businesses. According to the law, regulations and recommendations, financial institutions and businesses are nowadays obliged to incorporate ESG factors and ESG risk in their decision making process. Being sustainable and spreading the sustainable behavior constitute a common goal of financial institutions and businesses. Sustainable financial institutions include ESG risk in their risk management system, strategies and policies, and as a result they mitigate ESG risk and create a sustainable value in their business models and impact on creation of the sustainable value of the companies’ business models. Generally, the Anglo- Saxon model supports creation of the sustainable value in stock companies that gain financial capital from the capital market. The German—Japanese model is dedicated generally to traditional businesses with a limited access to the capital market because of disadvantages of using private placements. Green financial institutions deliver green financial solutions to the companies that tend to be green, are undergoing the transformation process or develop the green value and strengthen green solutions they have implemented. At the same time, the dirty sector is under the pressure to adjust and become green because the cost of cooperation and financing is much higher for these institutions because of the negative ESG risk assessment. Socially responsible financial institutions are open to cooperation with socially friendly businesses and they support solutions dedicated to reduce social exclusion. Finally, the governance factor is critical in ethical and responsible financial institutions that cooperate with businesses based on ethical codes but also taking into account board composition, pay parity or gender issues. The common pool in the cooperation models between financial institutions and businesses includes spreading of the sustainable behavior, creation of the sustainable value and designing of sustainable business models to support the implementation of sustainable development goals. The key actors in this process are stakeholders, especially governments responsible for creating the legal framework for sustainable development policies, financial markets and their intermediation rule and impact on spreading of the sustainable behavior, companies, households and NGOs.

Based on literature review, only two studies searching for a link between financial institutions (financial markets), corporate sustainability and sustainable business models have been published:

• Orlitzky et al. (2015) have searched the problem to what extent financial markets foster and facilitate more sustainable business practices?

• Muñoz-Torres et al. (2018) carried out the research entitled: Can environmental, social, and governance rating agencies favor business models that promote a more sustainable development?

The paper aims to draw attention to the significant gap in the existing research, along with the issues of impact of financial institutions on sustainable business models of the companies. To the best of the authors’ knowledge, no study has examined the relative importance of financial institutions of the company to adapt its business model. The novelty of the study is expressed by an original research approach based on inclusion of the financial system model in the ESG risk analysis in the context of sectoral enterprise analysis.

The purpose of the article is to analyze the ESG risk, taking into account the business sector most affected by this risk (the ranking) and to identify the correlation between this risk and the financial system model (Anglo-Saxon/German-Japanese). The research hypothesis assumes that the impact of ESG factors on companies’ business models strongly depends on the type of financial markets (bank-based versus market-based) and the industry in which the company operates. The main objectives of the study include: 1. The analysis of the ESG risk by industry and financial systems models. 2. Development of a risk map and a cognitive map 3. Formulation of recommendations for the ESG risk management in the business sector 4. Development of a cooperation model between enterprises and financial institutions in the Anglo-Saxon and the German-Japanese models under the ESG risk conditions.

The paper is organized as follows: the introduction is Section 1; Section 2 contains a literature review. Section 3 presents the methodological approach, data collection procedure, description of the methods, and research results. Section 4 discusses the research results, and Section 5 offers cooperation models for “financial institutions and companies” in the ESG risk context. Section 6 is the conclusion.

2 Literature review

The Global Risks Report shows that the importance of environmental and social risk (i.e., non-financial risks) has increased in recent years compared to economic risk, and according to the latest report (World Economic Forum, 2022), this trend will continue to grow in the coming years. The concept of non-financial risk is defined in various ways in the literature. This risk is described as different from the financial risk and consisting of: operational risk, compliance risk, legal risk, model risk, strategic risk, IT risk, cybersecurity risk, third-party risk, and reputation risk (Deloitte, 2018). A similar approach was presented by Leo et al. (2019) who presented a risk taxonomy for banks. They distinguished financial and non-financial risk, where the latter includes: country risk, compliance risk, legal risk, conduct risk, model risk, business and strategic risk, strategic risk and operational risk, reputation risk. The risk of non-financial factors in the context of sustainable development should be interpreted more broadly, referring to the individual pillars of this development. In this context, non-financial risk is identified with ESG risk, i.e., risk caused by environmental, social and governance factors. With regard to financial institutions, the European Banking Authority defined ESG risk as “the risks of any negative financial impact on the institution stemming from the current or prospective impacts of ESG factors on its counterparties or invested assets” (EBA 2021).

Entities operating on the market are exposed to ESG risks to a different extent. The report “Understanding Materiality Lessons From Industries With High ESG Risk”, shows that the five highest-risk industries in terms of ESG issues are industrial conglomerates, steel, diversified metals, precious metals, and oil and gas producers. In turn, the “The ESG Risk Atlas: Sector And Regional Rationales And Scores” report, indicates oil and gas extraction, mining, chemicals manufacturing, agribusiness or transportation as industries with the highest ESG risk.

ESG factors affect the functioning of entities in the real and financial spheres. Regulatory and market pressure, the growing awareness of the importance of ESG factors among capital owners, and the importance of these factors in the valuation of entity risk make the financial sector institutions incorporate non-financial factors into the business model and into investment and financial processes (Eccles et al., 2017; Grim and Berkowitz, 2020; Signori et al., 2021). Including ESG factors in the business model translates into an increase in banks’ reputation (Dell’Atti et al., 2017; Forcadell and Aracil, 2017; Houston and Shan, 2019), financial stability (Chiaramonte et al., 2021) and better financial results (Brogi and Lagasio, 2019), e.g., an increase in ROA, ROE and Tobin’s Q (Cornett et al., 2016; Miralles-Quirós et al., 2019; Nizam et al., 2019; Buallay et al., 2020). Positive influence of ESG factors on financial performance of banks manifests in loan growth (Nizam et al., 2019), while including these factors in lending decisions of a bank results in better financial performance (Ahmed et al., 2018). Gangi et al. (2019) showed that banks taking into account ESG factors have a lower level of risk, and the involvement of banks in ESG issues reduces their risk of insolvency (Neitzert and Petras, 2019).

A growing number of financial institutions include ESG factors in their decision-making processes (Busch et al., 2016; Ahmed et al., 2018; Inderst and Stewart, 2018). Investors on the capital market are increasingly willing to invest capital in sustainable financial products. Xiong (2021) revealed that achieved returns for stocks with low ESG risk rating (green stocks) are higher and they also provide improved tail-risk protection comparing to stocks with high ESG risk rating (brown stocks), particularly for the period of crisis caused by COVID-19. Maiti (2021) showed that for all cases, portfolios formed on social and governance factors provide better investment performance than traditional portfolios based on size and value.

The availability of consistent, comparable and reliable ESG information has become a prerequisite for making investment decisions (Hübel and Scholz, 2020). ESG ratings are helpful for investors in the investment process (Avetisyan and Hockerts, 2017). Unfortunately, rating agencies evaluate the corporate sustainability performance of a large number of companies, however they use different sources of data and different methodology for analysis (Christensen et al., 2022). Chodnicka-Jaworska et al. (2021) showed a growing importance of the influence of ESG factors on credit ratings assigned to non-financial institutions by the leading credit agencies.

In the literature, there is a large number of studies devoted to the analysis of the impact (positive or negative) of ESG factors on the operations of enterprises (EBA 2021). The results of these studies show, that the inclusion of ESG factors in the business model has positive effect on the organization itself, i.e., operational efficiency (Whelan et al., 2021; Aroul et al., 2022), improvement of employee productivity (Henisz et al., 2019) and company’s reputation (Dhaliwal et al., 2012), and an increase of company’s competitiveness (Lundgren and Marklund, 2015). It also contributes to an increase of the market value of an enterprise (Ting et al., 2019; Wong and Zhang, 2022), higher stock price (Lo and Kwan, 2017; Bodhanwala and Bodhanwala, 2019), and higher financial ratios, such as ROA, ROE (Velte 2019; Peng and Isa, 2020). However, not all studies confirm a positive correlation between ESG factors and a company’s financial performance. Duque-Grisales and Aguilera-Caracuel (2019) on the example of data on 104 multinational companies from Brazil, Chile, Colombia, Mexico and Peru between 2011 and 2015 showed a negative relationship between ESG and financial performance. Lee et al. (2009) also found that ESG investment decreases financial performance and argued that the result could show that cost of social capital for companies with high ESG scores is lower.

Incorporating ESG factors into the business model means transforming the business model towards a sustainable one. In the literature on the subject, there are many studies devoted to the analysis of the concept of the sustainable business model (Bocken et al., 2014; Nosratabadi et al., 2019; Goni et al., 2021), business model innovation for sustainability (Evans et al., 2017; Geissdoerfer et al., 2018; Shakeel et al., 2020), and tools to design and transform to sustainable business model (Merrilees and Marles, 2011; Høgevold et al., 2015; Geissdoerfer et al., 2016; Lüdek- Freund and Dembek, 2017; Sousa-Zomer and Cauchick-Miguel, 2017; Heyes et al., 2018; Morioka et al., 2018). Activities and practices are often the most important parts of business models, and business models can be seen as templates connecting company’s strategy with practice, allowing to examine the value proposition, value creation, delivery, and capture (Osterwalder and Pigneur, 2010; Ritala et al., 2014).

The transition to a sustainable business model, very often requires to incur expenditures exceeding financial capabilities of an enterprise, hence the need for external financing. According to Schoenmaker (2017), the financial system which task is to allocate funding to its most productive use, plays a key role in allocation of investment funds and loans for the transformation of enterprises into sustainable ones. In cooperation with enterprises, financial institutions act as a capital provider (lender) and an intermediary on the financial market, supporting entrepreneurs in financing their economic projects. Previous research has focused on the analysis of the impact of ESG factors on the cost of raising capital. Henriksson et al. (2018) showed, that better ESG score allows companies to obtain cheaper loans, higher credit rankings and lower cost of equity capital. On a sample of 154 French ESG companies in the years 2015–2020, Chouaibi et al. (2021) showed that corporate social responsibility (CSR) activities lower the cost of equity capital, thus they are important to shareholders’ financing and investment decisions. According to the results of research conducted by Raimo et al. (2020) the increase of ESG disclosure reduces the cost of equity capital. Eliwa et al. (2019), based on a study of loan institutions in 15 European Union countries, showed that firms with better ESG performance have a lower cost of debt, and that the impact of ESG disclosure on the cost of debt is equal to the impact of ESG performance. Apergis et al. (2022), based on the analysis of firms within S&P 500 over the period 2010–2019, revealed the relationship between the cost of debt for borrowing firms and their ESG score/rating. Firms with low ESG scores are associated with higher riski, which is results from higher cost of unsecured debt in the primary bond market. Scatigna et al. (2021) on the example of social bonds and conventional securities issued by banks and corporates between 2016 and 2021, demonstrated that investors wish to pay a premium for holding social bonds and that companies with higher carbon emissions are associated with higher credit risk and have slightly higher risk-adjusted debt financing costs.

Banks, through the cost of capital (Chava and Roberts, 2008; Nini et al., 2012), and investors in the capital market, can influence the behavior of companies. However, there are no studies on the impact on transforming the business model of enterprises towards sustainability depending on the model of the financial system (Anglo-Saxon/German-Japanese).

3 Research methodology

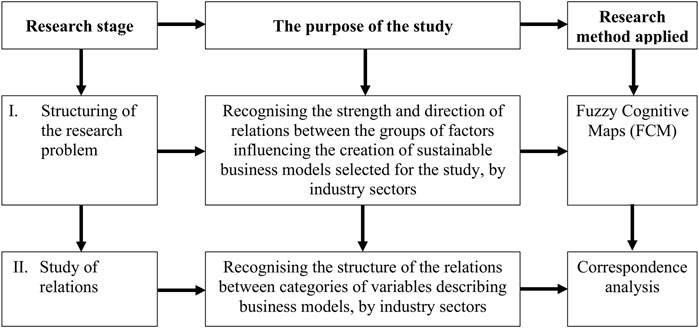

In this research on the impact of the ESG risk on the functioning and development of companies from the sectors selected for the survey, a two-stage research procedure was employed (Figure 1).

The first stage of the research involved structuring the research problem. It aimed at recognising the direction and strength of the relations between the factors included in the sustainable business models. For this purpose, the study used Fuzzy Cognitive Maps (FCM). A detailed description of this quite new method and examples of its implementation for structuring research problems can be found in the following publications: Andreou et al. (2003), Andreou et al. (2005), Tan and Ozesmi (2006), Wei et al. (2008), Salmeron et al. (2012), Papageorgiou et al. (2009), Furfaro et al. (2010), Song et al. (2010), Papageorgiou and Salmeron (2012), and Zioło et al. (2019). FCM is a tool that allows analyzing of dependencies (connections) between the main factors (variables) of the considered phenomenon. This method allows indicating, both the direct relations and indirect with other analyzed criteria. One of the main effects of this procedure is also the assessment of the impact of the system constructed in this way on the examined phenomenon. The identification of the relations is very often carried out using the expert approach, based on the Delphi method and some relatively simple calculation procedures (cf. Słoń and Yastrebov, 2011). In the first step, the list of starting factors explaining the examined phenomenon should be established based on the results of research conducted among employees of companies representing various sectors affected by the occurrence of ESG risk. In the next step, the selecting criteria of the greatest importance for the created final model of examining dependencies was carried out. Finally, a matrix of co-dependencies between the examined criteria was prepared. The relations between analyzed criteria were prepared in form of maps. The thus obtained maps were analyzed based on their density and types of factors presented on the maps. The density of the fuzzy cognitive map (D) is estimated by a connection index which shows the way in which the analyzed factors on the map are connected (Ozesmi and Ozesmi 2004). To determine the coefficient of grouping, the study used a formula in which the number of the existing connections on the map was divided by the maximum possible number of connections that can occur between the analyzed factors (Hage and Harary, 1983):

If the density of the map is high, one can observe a large number of relations between the factors. The map can show three types of factors: transmitter factors (T) which initiate relations with the remaining factors (enforcing functions); factors performing the role of receivers (R) to which the impact of enforcing functions is directed (utility factors); it is also possible to identify an independent set of factors made up of factors among which there are no relations. The complexity of the map is reflected by the total number of factors performing the role of a receiver (utility factors). If the map includes many factors and relations existing between them, its density is high. However, too large a number of factors playing the role of a transmitter could suggest an excessive “smoothness” of the map. It means a lack of relations among the factors and errors made in the process of identifying the factors describing the considered problem (Ozesmi and Ozesmi, 2004). To compare the complexity of the maps, the relations existing between the factors acting as receivers and transmitters are used:

In more complex maps, this coefficient would be larger due to the large number of relations between the examined factors.

In the second stage of the research, in order to identify the relations between the variables selected for the study which concern both sustainable business models and companies representing different sectors, a multiple correspondence analysis was used, which is a method from a group of multidimensional methods of examining coexistence. It can be successfully applied in questionnaire surveys because it solves one of the more difficult tasks, namely it allows to correctly recognize the structure of the answers, expressed by the frequencies of the coexistence of the individual categories of the characteristics measured on an ordinal or nominal scale, whilst not posing requirements as to the size of the set of statistical units. Its attractiveness results from the wide range of applications, and the possibility of a graphic presentation of the results. The starting point was the compilation of a complex contingency table (cross-tabulation), which contains the numerosity of occurrence of the individual categories of variables selected for describing n objects. These numbers can be written down in the form of a complex matrix of indicators, multidimensional contingency table or a combined contingency table. In practice tasks, the Burt matrix is a frequently employed way of recording data. The procedure is carried out in the following stages (Greenacre, 1994, 2007; Beh and Lombardo 2014; Ginanjar et al., 2019):

1) Preparation of the Burt matrix; based on a symmetrical block matrix in which, apart from the main diagonal, there are contingency tables corresponding to two different variables, containing the numbers of objects with the categories of these two features.

2) Determination of the dimension of the real space of co-occurrence of the categories of variables K based on the formula:

where.

Jq—number of categories of variable q (q = 1, 2, … , Q),

Q—number of variables;

3) Checking to what degree the eigenvalues (main inertias) of the space of a lower dimension, explain total inertia (λ)1; to this end the Greenacre criterion was used, which assumes that for the purposes of the research one accepts main inertias larger than a reciprocal of the number of the analyzed variables (

4) Increasing the quality of representation in a two-dimensional space through a modification of eigenvalues according to Greenacre’s proposal:

where.

Q—the number of analyzed variables;

5) Graphic presentation of the results of the correspondence analysis with the inclusion of the modification of eigenvalues. The new coordinate values are equal:

where:

F*—the matrix of original coordinate values for variable categories;

If the space larger than three is the best form to present the coexistence of characteristics, then we need to select another method for analysing the results. For such purpose, in the space of both smaller and larger size we can apply the methods of classification. The categories of all analysed characteristics shall be defined as objects and the values of projection coordinates of each category are the variables. The methods of classification are also useful when the number of all options of characteristics is significant and the dispersion of points in the graph makes it impossible to distinguish the classes unambiguously.

4 Study results

4.1 The result of the structuring of the research problem—stage 1

The study aimed at evaluating the strength and direction of the relations occurring between the factors included in the sustainable business models (stage 1), considered three basic groups of factors, namely:

• Social, including respecting employee right and human rights (F1, group 1),

Haseeb et al. (2019) highlighted the importance of social factors in achieving sustainable competitive advantage and sustainable business results. The management of the company as well as its employees determine the goals of the organization and the ways of achieving them, including the pace and scope of implementation of the sustainable development concept (Paais and Pattiruhu, 2020). One of the key elements of a sustainable business model is innovation (Geissdoerfer et al., 2018). Maier et al. (2014) emphasized the importance of the human factor in the process of creating and implementing innovations in enterprises. Enterprises adopt a variety of human resource management strategies in implementing sustainable development. These strategies can significantly contribute to the success of the change management program by creating obstacles or facilitating the process (Ulus and Hatipoglu, 2016). The introduction of technological changes may cause fear and resistance among employees. Such behavior may be dictated by the fear of losing a job (displacing human labor by machines) or the change itself, i.e., anxiety resulting from the need to adapt to new working conditions (retraining) (Birkel et al., 2019). Therefore, the social and technological aspects in organizations are very often contrasted with each other. As a rule, in organizations where the human factor is important, the technological aspect is of secondary importance, and the introduction of modern technologies (e.g., digitization of processes) is treated as a way to facilitate the work of employees (Khan et al., 2015; Fernández-Macías 2018). The social aspect also translates into the company’s product offer. There are two reasons for this, the first is the management staff and employees, who by creating the organizational culture, determine the company’s goals and operating strategies (Kiesnere and Baumgartner 2019; Roscoe et al., 2019). On the other hand, increasingly aware consumers expect the replacement of the current offer with sustainable products (Franceschelli et al., 2018). The company’s cooperation with financial institutions and CSR organizations is much less important for SBM.

• Organizational, including actions aimed at the digitalization of a company, elimination of energy waste, etc., (F2, group 2),

SDGs set ambitious priorities for governments and businesses to drive the implementation of sustainable development up to 2030. Norström (2013), points out that these ambitious goals alone will not generate change, and specific adjustment processes are necessary, decisions must take into account specific factors and the impact of global, national and individual levels should be taken into account. Lüdeke-Freund (2010) and Bocken et al. (2014) pointed out that sustainable business models (SBM), apart from sustainable social development, are also able to ensure environmental sustainability. The literature on the subject indicates that SBM have been effectively contributing to reducing the harmful effects of business activities on the environment and society through providing solutions to help firms and institution meet their economic and sustainability goals simultaneously. (Nosratabadi et al., 2019; Sehnem et al., 2019) The environmental factor becomes significant for value building, contributes to technological changes, and thus the use of clean energy, the maximization of materials and energy efficiency, with an emphasis on repair and maintenance, as well as on renewable processes, waste reuse, or rational environmental management in the circular economy. The results of research Palata et al. (2016) over SBM highlight the value provided to customers and society through the combination of direct economic benefits and environmental impact. Upward and Jones (2015) demonstrated the importance of the environmental factor by examining the ontology of business models. They also showed that sustainability factors (including the environmental factor) can contribute to sustaining the possibility of flourishing (strong sustainability). Current changes in business models take into account the innovation ecosystem, including environmental changes, as indicated by (Stasiškienė et al., 2021). Apart from a network of relationships combining actors and objects that establish connections, both complementary and substitute, the environment also has a special meaning for this ecosystem. Adner (2006) Taking ESG factors into account in their activities gives companies the opportunity to change their current approach, contribute to environmental protection and create business value. The conducted research confirmed the importance of not only the circular economy, which contributes to the protection of the natural environment or sustainable management of resources, but also indicates that the society chooses those products and services that have been produced or delivered with respect for the environment (Senthil Kumar and Saravanan, 2019; Ziolo et al., 2021). The influence of the environment on defining the canvas of business model is of particular importance for the construction of SBM. As the research shows, the environmental factor has an impact on all components of the business model. (Nosratabadi et al., 2019) The US Environmental Protection Agency (EPA) indicates “Reduce the environmental impacts of materials across their life cycle” as one of the four primary objectives of circular economy, and only then indicates “Increase socioeconomic benefits” as an effect of this reduction. (U.S. EPA, 2015; Singer, 2017) Focusing business models on sustainability in many cases means implementing the idea of a circular economy, which forces a new approach to SBM. Summing up, for many years the society has been more willing to buy environmentally-saving products, therefore SBM has to take into account the environmental factor.

• Technological, including the introduction of technological innovation, friendly to society and the environment (F3, group 3).

Research on the factors influencing sustainable business models indicate the positive role of technology in this process. Comin et al. (2020) point out that SBMs are focused on direct participation of the stakeholders, especially users, and their role in building sustainable value. Comin et al. (2020) also indicate that SBMs are technology-based, and in this type of models, the use of clean energy, the maximization of materials and energy efficiency, with an emphasis on repair and maintenance, as well as on renewable processes, waste reuse, or rational environmental management are very often the priority. Baden-Fuller and Haefliger (2013) indicate that SBMs are essentially linked with technological innovations, however, the construction of the business model is separated from the technology. They formulate the relationship between the business model and technology in two directions. First, their research shows that business models make a link between technology and performance of the company. Second, the development of the appropriate technology is a matter of the decision as regards the business model concerning openness and users’ involvement. Bidmon and Knab (2018) showed in their research that within social and technical regime, the existing business models hinder changes by strengthening the stability of the current system, as transitional products between a technological niche and the social and technical regime, business models drive the transition, facilitating the process of stabilizing technological innovations and their breakthrough from the niche to the regime level, and as a non-technological niche innovation, cutting-edge business models drive changes by building a significant portion of a new system without relying on technological innovations. Rantala et al. (2018) conducted research in which they investigated the relationship between sustainability and the adaptation of various innovation models. As a result, the research showed that a high rating of environmental sustainability reduces the contribution needed to adopt technological innovations, and the more an operator values institutional sustainability, the more likely it is to adopt the innovation in the business model. Carayannis et al. (2015) pointed to the effects that can be achieved thanks to business model innovations, in particular organizational durability. In addition, the research also took into consideration the policies implemented by the analyzed companies regarding:

• Offered products, including in their product range only those products which are friendly to society and the environment (F4, group 4),

• Cooperation with financial institutions, i.e., undertaking collaboration with environment-friendly financial institutions (F5, group 5),

• Cooperation with entities applying the strategy of corporate social responsibility (CSR), (F6, group 6).

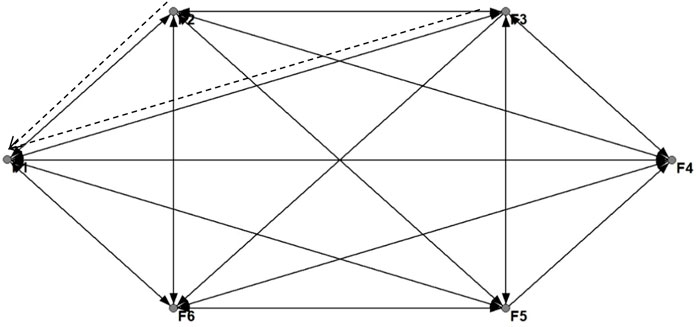

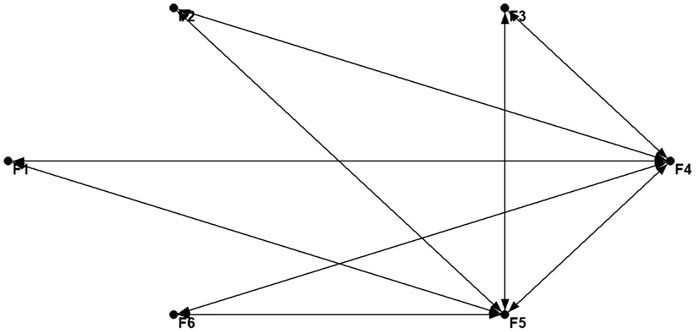

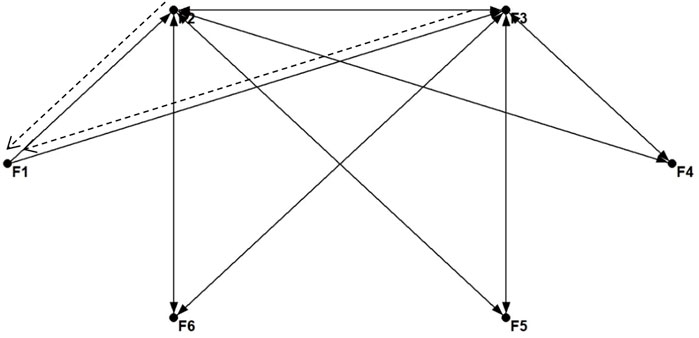

A few variants of cognitive maps were prepared: a collective map (comprehensive) based on the information obtained from all representatives of the companies participating in the survey (Figure 2), and maps involving a division into the agricultural sector (Figure 3) and the industrial sector (Figure 4), for which there were identified differences in the evaluation of the relations given by those representing the examined companies. The sectoral maps showed only the strongest relations between the factors, additionally marking with a dotted line the negative relations between the analyzed factors. In the case of the service sector, no strong and repetitive relations were identified in the majority of the examined examples of the relations between the individual factors.

To build FCM, the study used the software FCMapper_bugfix_28.1.2022. The presented maps show the relations and directions of impact between individual factors. The demonstrated relations can be interpreted in the following way:

1) In the opinion of the surveyed representatives of companies, all the analyzed factors describing different sectors of the economy are interconnected. This means that they are significant in the creation of sustainable business models, creating a network of connections of a cause-and-effect nature.

2) In the constructed collective map, in total there were identified 28 connections between factors out of a possible 36, and its density amounted to 0.78, which means that specialists participating in the survey identified 78% of the connections from among all the relations which could theoretically occur in this map.

3) The identified connections are mostly positive (of a positive character), which indicates that an improvement in terms of one factor will positively influence another with which it is connected. In the collective map, there were identified 26 relations of this kind out of the 36 possible.

4) The negatively charged connections refer mainly to companies from the industry sector, whereas in general they were not observed in the case of the two other sectors (services and agriculture).

5) Not all the identified relations are bilateral in character. The improvement regarding factor F5 (factors regarding cooperation with financial institutions, namely those which are environment-friendly) will strongly positively impact on changes in factor F4, describing included in the range of products offered by the company only those which are friendly for society and the environment. The reverse relation of F4 influencing F5 was not observed.

4.2 The result of the correspondence analysis—stage 2

Statistical data for the research were taken from a questionnaire survey on the subject of business models, conducted in companies located in the Zachodniopomorskie and Lubuskie voivodeships in Poland.

The following variables and their categories were assumed in the study:

1) S—social factor, score from 1 (lowest) to 5 (maximum);

2) O—organizational factor, score from 1 (lowest) to 5 (maximum);

3) TF—technological factor, score from 1 (lowest) to 5 (maximum);

4) PS—offered range of products and services which are friendly to the environment and society, score from 1 (lowest) to 5 (maximum);

5) CFI—cooperation with environment-friendly financial institutions, score from 1 (lowest) to 5 (maximum);

6) CSR—cooperation only with entities applying CSR strategy, score from 1 (lowest) to 5 (maximum);

7) Sectors: ONS—remaining sectors on non-material services (hairdressing, beautician, photography, and others), ONP—remaining sectors of material production (publications, films, information services and others), T—transport, TR—trade, C—construction, I—industry; H—healthcare and social security, HE—housing economy and non-material municipal services, OT—other sectors (finance and insurance, science and technology, physical culture, tourism and recreation, agriculture, arts and culture, municipal economy, schooling and education).

The correspondence analysis was carried out based on the Burt matrix sized 39 × 39 (number of variants of answers allocated to the seven selected questions in the survey). For the calculations and graphic presentation of the results, the study used the module Correspondence analysis in Statistica 13.0. The dimension of the actual space of coexistence amounted to 38—see Eq. 1. In the next step, it was checked to what degree the eigenvalues of a space with a lower dimension explain the total inertia (λ = 4.5714). In line with the Greenacre criterion, the main inertias larger than 1/Q = 1/7 = 0.1429 were accepted as relevant for the research. These were inertias for K assuming values up to 12, and this is why the results for K > 12 were omitted in the table, because for these dimensions the main inertias were not larger than 0.1429, and thus not relevant for the study.

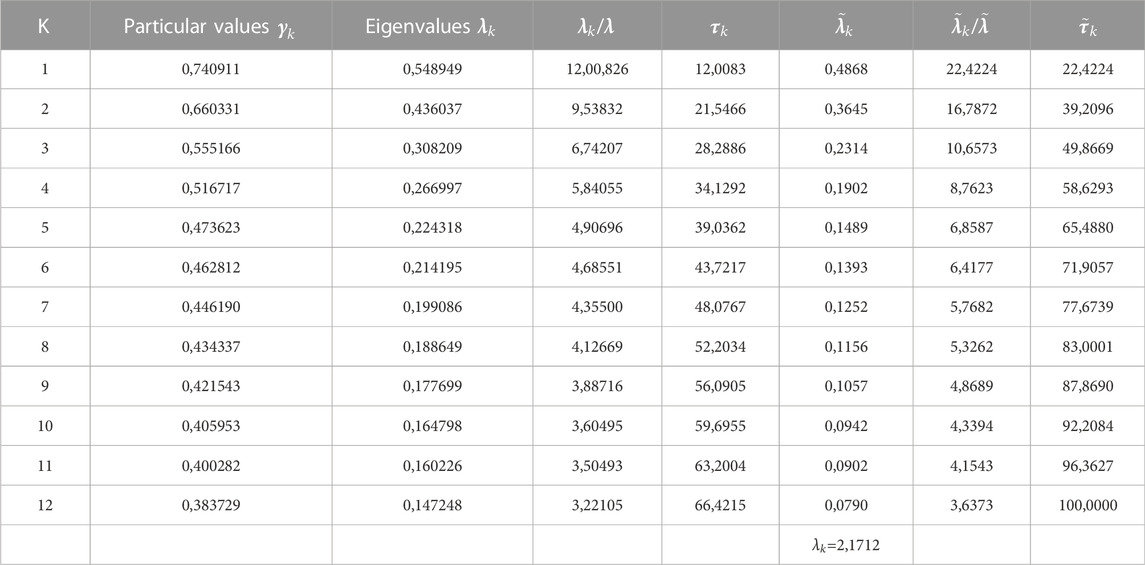

Next, the study analyzed the values of measure τk which describes the share of inertia of the selected measure (λk) in the total inertia (λ), and it emerged that the degree of explaining inertia in a two-dimensional space amounted to 21.55%, while in three-dimensional space it was 28.29%. In order to increase the quality of representation, the modification of the eigenvalues was conducted according to Eq. 2. The original and the modified eigenvalues, together with the degree of explanation for the total inertia, are given in Table 1.

TABLE 1. Particular values and eigenvalues, together with the degree of explanation of the total inertia in the original and in the modified version.

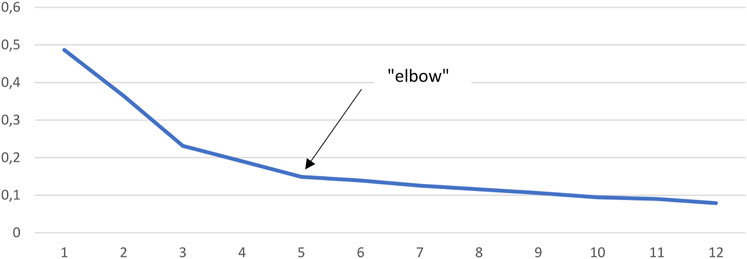

Following the conducted modification, the degree of explanation of total inertia for all the dimensions became clearly larger. In order to precisely define the dimension of the representation space, the graph of the eigenvalues was prepared, and using the “elbow” criterion it was shown that the space presenting the coexistence of the variants of the variables should be four-dimensional (Figure 5). The degree of explaining inertias in this space amounted to over 65.49%.

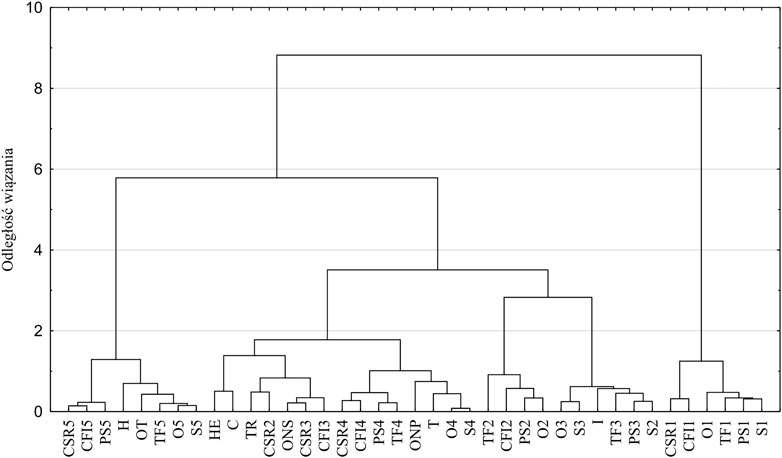

A direct interpretation of the results in a five-dimensional space is impossible. Such an interpretation can be made using the Ward method, which allows to establish connections among the variants of the variables. In Figure 6, showing the joining-up of categories into classes, the vertical line marks the stage in which this process was interrupted2. On the basis of the obtained classification, it was possible to distinguish four groups of sectors of the companies characterized by homogenous features (in brackets there are given variants of the categories of variables):

FIGURE 6. Diagram of a hierarchic classification of the categories of variables made according to the Ward method, Source: own elaboration.

Group 1 (CSR5, CFI5, PS5, H, OT, TF5, O5, S5) comprises companies involved in healthcare and other sectors of business activities (physical culture, tourism and recreation, science and development of technology, schools and education, finance and insurance, agriculture, municipal economy), which contribute in the highest degree to building a sustainable business model (maximum score) taking into consideration the following factors: social, organizational, and technological. Moreover, they offer products and services friendly to the environment and society, and also cooperate with financial institutions friendly to the environment and companies employing the CSR strategy.

Group 2 (HE, C, TR, CSR2, ONS, CSR3, CFI3, CSR4, CFI4, PS4, TF4, ONP, T, O4, S4) comprises companies from the following sectors: housing and non-material municipal services, construction, trade, other sectors of non-material services (hairdressing, beautician, photographic, and others), other sectors of material production (publications, films, information services, and others), transport. Companies from this group, when building sustainable business models, pay considerable attention to respect for the rights of employees (social factor), their organization is based on digitalization, they also introduce technological innovation friendly to the environment and society. They care about the cooperation with environment and society-friendly financial institutions and companies employing the CSR strategy.

Group 3 (TF2, CFI2, PS2, O2, O3, S3, I, TF3, PS3, S2) comprises industrial companies, which in building sustainable business models—at the most to an average degree—take into consideration the social, organizational and technological factors. Moreover, their range of products and services which are friendly to the environment and society and their cooperation with the environment-friendly financial institutions, were assessed as below-average.

In group 4 there were no companies identified which in building sustainable business models would not take into consideration the social, organizational and technological factors. Moreover, they do not offer products and services friendly to the environment and society, and do not cooperate with environment-friendly financial institutions or companies employing the CSR strategy.

The first group of enterprises that undertake activities aimed at transforming their business model towards a sustainable business model to the greatest extent, includes enterprises from the agricultural sector. The obtained results are in line with the results of Ulvenblad et al. (2019). They included companies from the agri-food sector among entities which are increasingly required to adopt a sustainable business model. The transformation of these entities towards a sustainable business orientation is based on optimization and organizational transformation. Franceschelli et al. (2018), on the basis of an analysis of start-ups from the food industry, showed that the process of building sustainable business models is based on innovation and appropriate relations with stakeholders. Basile et al. (2021) drew attention to the importance of relations with stakeholders in the process of transforming the company towards sustainability. The study was conducted on the Italian offshore platform (oil and gas industry) located in the Adriatic Sea.

The first group of companies also includes companies from the IT sector. The results of the study contradict the results of the study by Egorova et al. (2022). They proved that IT industry demonstrates weak environmental and social components, and average governance component in comparison to other industries.

Industrial enterprises have been qualified among companies which, when building sustainable business models, take into account technological, organizational and social factors to a medium degree. Kita and Šimberová (2018), analysing Czech companies from the chemical industry, showed that companies striving to achieve a sustainable business model try to optimize the structure of costs, implement technological changes, maintain appropriate relationships with customers, which includes providing a support, sharing B2B resources and centralized waste processing.

Belyaeva et al. (2020), based on the example of European SMEs, examined the motivations of entities to transform business models towards sustainable models. In the case of companies from Eastern European, the main motivation were economic factors. In Western Europe, however, these were socio-cultural factors.

5 Cooperation models B2 (financial institution—companies). ESG risk analysis and recommendations

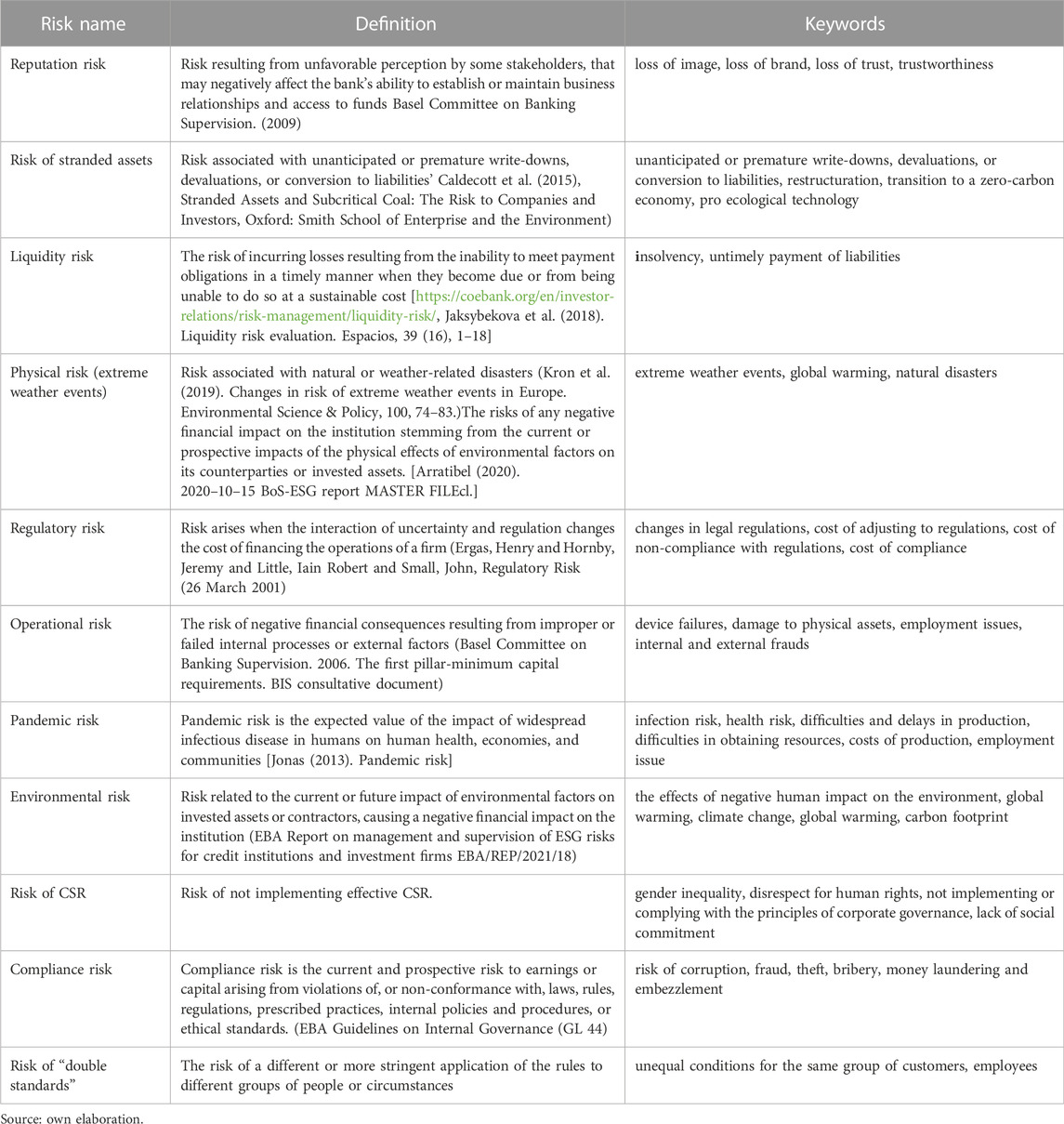

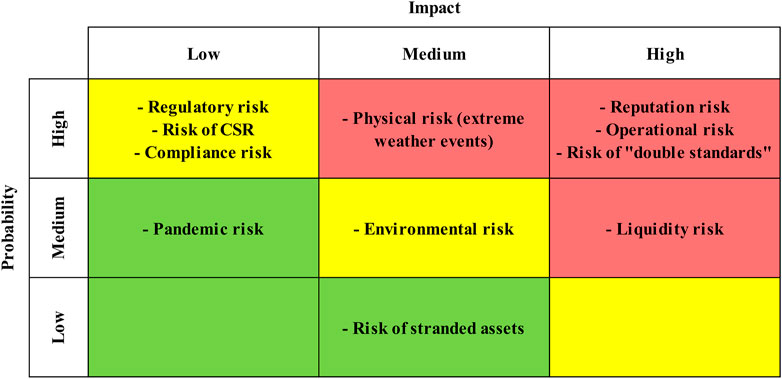

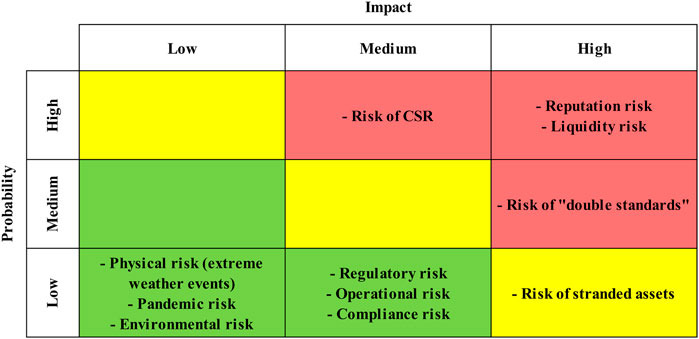

Risk maps were created to determine the probability and strength of the impact of ESG risks on enterprises. Definitions of risk types used to develop the risk maps are presented in Table 2. A total of 11 types of risk have been identified.

Using the types of risk presented in Table 2, separate risk maps were created for the German-Japanese and Anglo-Saxon banking systems. The risk map for the first one is shown in Figure 7.

In the German-Japanese banking system, the most important risks are reputational, operational, “double standards”, physical, and liquidity risks. Tree of them have high impact as well as high probability of occurrence. Environmental risk is of medium importance together with regulatory, CSR, and compliance risks. The group of low risk consists of pandemic and stranded assets risks.

The risk map for Anglo-Saxon banking system is shown in Figure 8. For this model, four risk types are in the high-risk group, of which three are common to both models of banking systems: reputational, liquidity, and double standards risks. These risks are therefore of greatest importance to banking systems regardless of the model. In the Anglo-Saxon model the only medium risk is the risk of stranded assets. All other risks, including environmental and physical risks are classified as low.

The comparison of the risk maps for both banking system models shows that the Anglo-Saxon model seems generally more resilient. In this model, as many as six risks are of low importance, while in the German-Japanese model there are only two such risks. In contrast, there are more high risks in the German-Japanese banking system, although only one more than in Anglo-Saxon system.

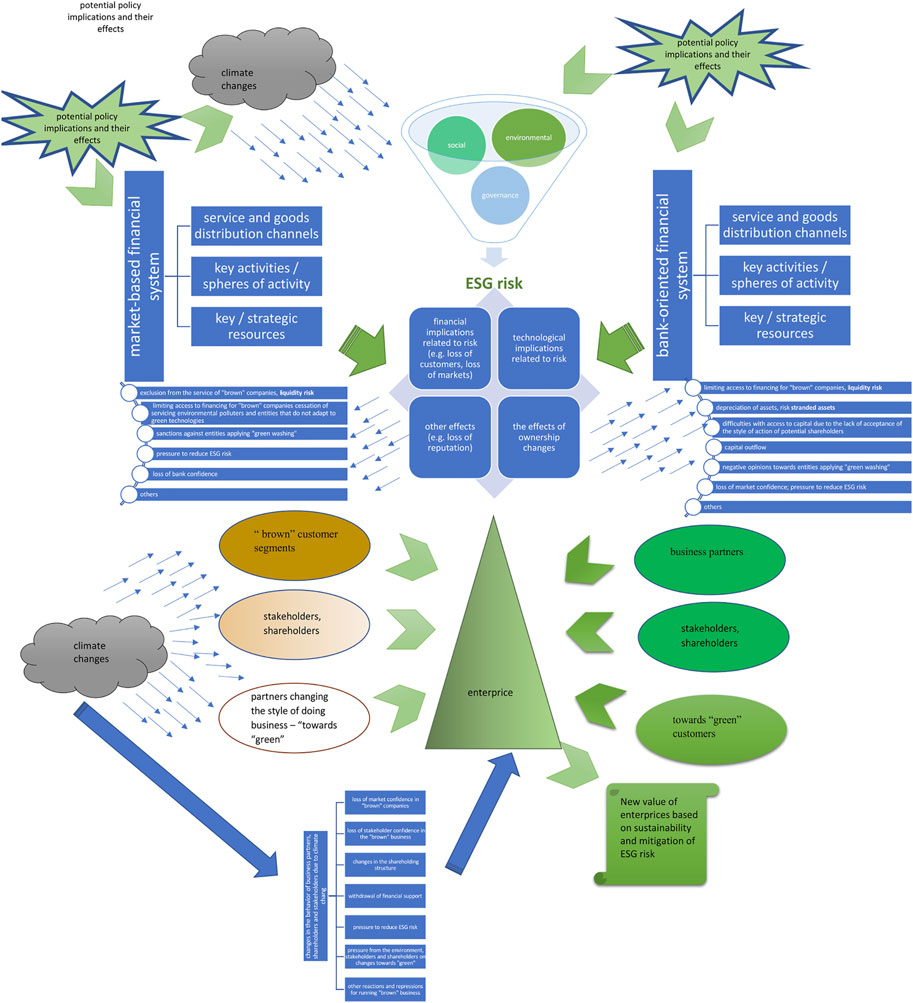

The impact of environmental factors, especially SDGs risk, forces change in the business models of both financial institutions, including banks, and changes customers’ business models. More and more often a business market advantage is perceived to be in sustainability, social responsibility or limiting ESG factors. Being sustainable is not only fashionable, but it also contributes to the fight against climate change. Both banks and their clients, when creating their business models and new values, perceive mutual cooperation as beneficial and are looking for common elements for running a business, or even a common ground of understanding for further cooperation, which is not always related to providing financing. These common elements are risk (including ESG risk as well as environmental and climate risk) and sustainability. Thus, the following spheres of influence of financial institution, which are represented both in the market-based financial system as well as in the bank-oriented financial system, on corporations should be seen from the viewpoint of changing and adjusting business models that result from canvas:

1) Typical (conventional) risk, which is assessed by financial institutions, including banks;

2) Environmental risk and ESG,

3) Business partners, including supplier policy;

4) Service and goods distribution channels;

5) Key activities/spheres of activity;

6) Customer segments;

7) Key/strategic resources.

Figure 9 presents the relationship between ESG risk—bank based model and ESG risk - market based model. The figure shows how the ESG risk affects the bank and market-based models and the company that must adapt to the changes caused by the ESG risk. The bank may stop servicing the enterprise and may also permanently limit access to its services and products. The market is open to enterprises, but there may be an outflow of capital from brown to green business. Lack of acceptance of the “brown” business may result in a reduction of assets. Financial institutions, in individual models, exclude from the market and service those enterprises that have the highest exposure to ESG risk. Thereby there is an influence on their behavior towards “green”. A significant force influencing the changes towards “green” are shareholders, stakeholders and customers of enterprises. It is they who support the mitigation of ESG eye and show the lack of acceptance for its occurrence.

FIGURE 9. Relationship between ESG risk—bank based model and ESG risk—market based model, Source: own elaboration.

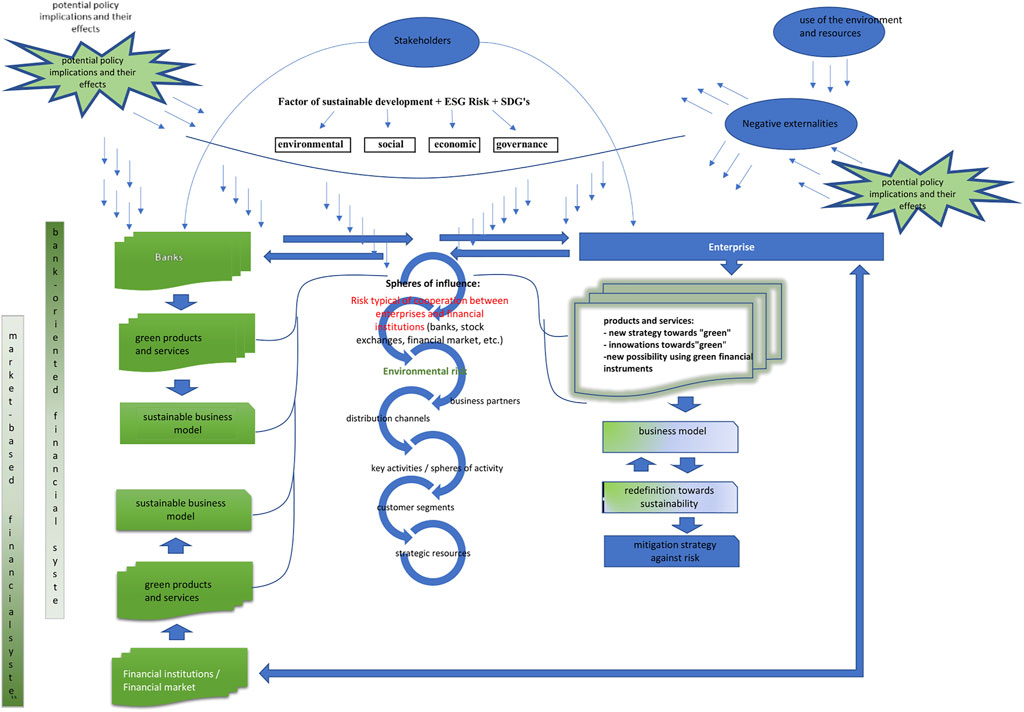

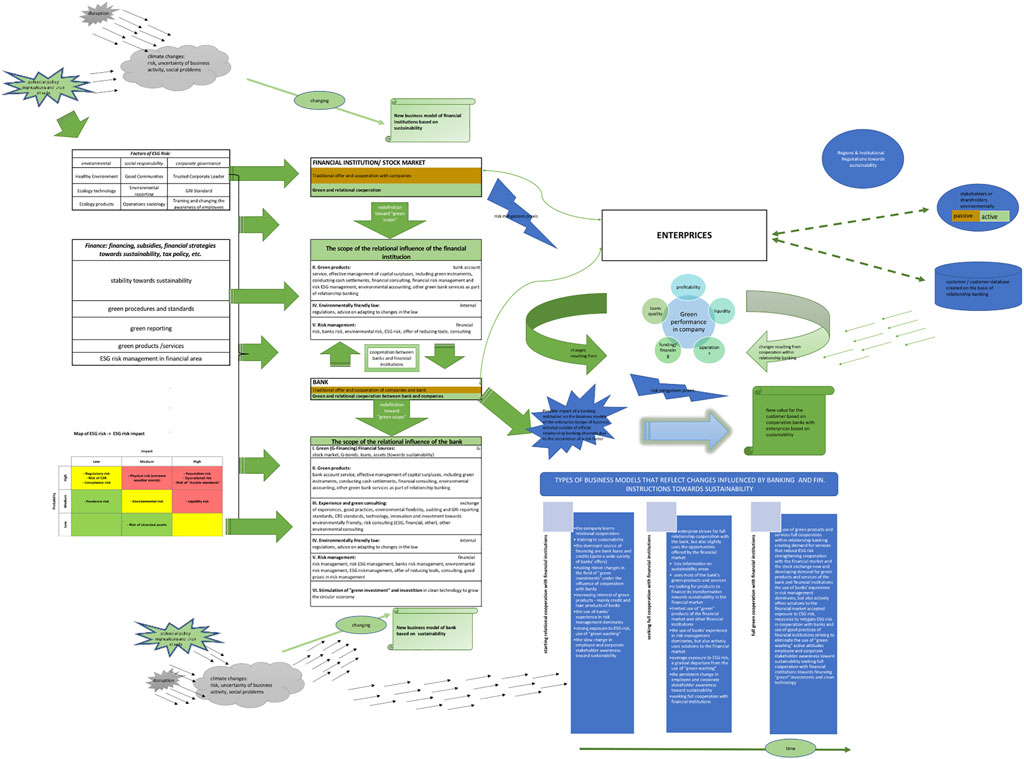

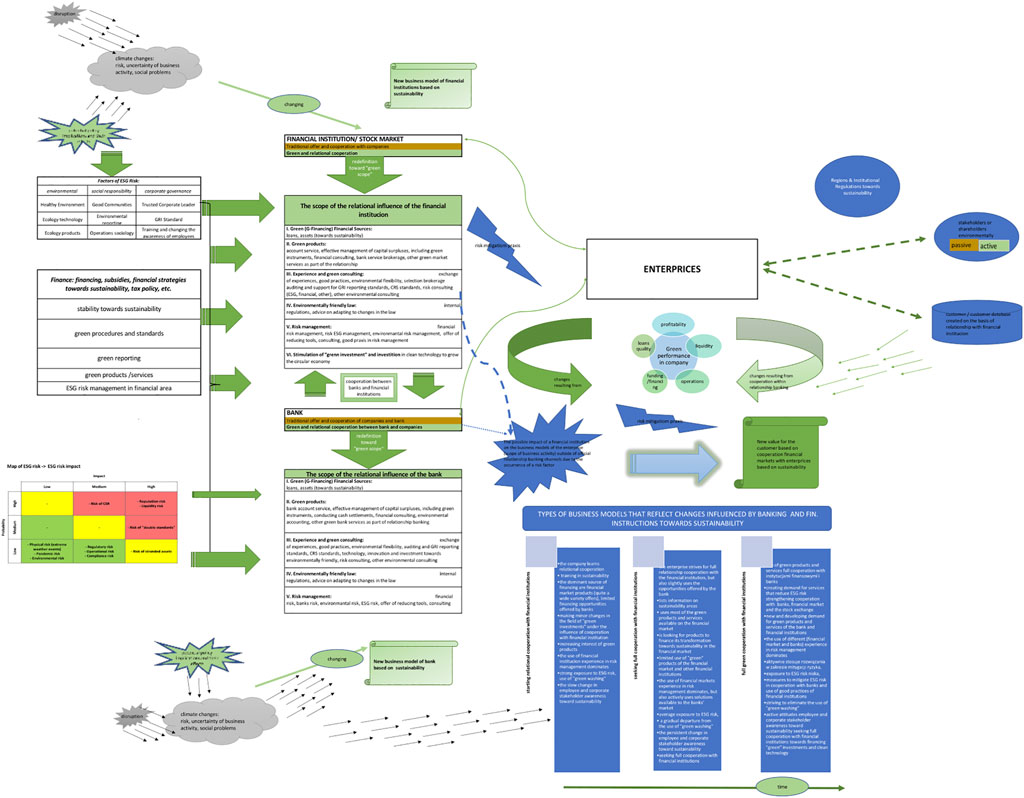

The indicated spheres of influence of financial institution on companies constitute this area, which becomes a kind of influence of the financial institution and banks on enterprises and enterprises on financial institution in the area of changes in the business model, in terms of sustainability. Mutual interactions between the financial system institutions and the enterprise, including stakeholders and risk in terms of the impact on business models are presented in Figure 10.

FIGURE 10. Mutual interactions between the financial institutions and the enterprise in terms cooperation towards sustainability, mitigation risk and change the business models, Source: own elaboration.

Figure 10 indicates that both financial institutions representing two financial systems (the market-based financial system as well as in the bank-oriented financial system) and clients (the enterprises) may influence the partner’s business models under the influence of various factors related to sustainability and risk. With the move towards sustainability, financial institutions need to consider ESG and environmental risks. Their client is also exposed to this spectrum of risk, and with the shift towards sustainability, he must not only redefine his business model, but also learn to manage risk. Financial institutions representing two financial systems (the market-based financial system as well as in the bank-oriented financial system) have extensive experience in risk management. It is through cooperation that they can transfer knowledge and methods of mitigating environmental risk or ESG to their clients. Collaboration is at the heart of qualitative changes related to environmental risk factors. The cooperation may imply changes both in the area of mentality and the perception of the importance of sustainability, as well as increase the sensitivity to ESG risk factors, social responsibility or the fulfillment of obligations resulting from the adopted SDG goals.

Previous research points to the importance of companies in creating green economic growth, circular economy, sustainability, as well as achieving SDG’s goals. Our research shows the importance and role of the risk of non-financial factors. As well as the impact of ESG factors and the ESG risk itself on the development of cooperation between enterprises and financial institutions, including banks. ESG risk has now become the leading type of risk affecting the operating activities of business entities as well as being taken into account in the business models of financial institutions and banks. Extending the types of risks analyzed by banks and financial institutions to include non-financial issues, including ESG, becomes important, and in view of climate change, it becomes crucial. Risk considerations ESG also points to the need to ensure that companies fulfil their role in sustainability innovation so they can continue to be a major contributing factor in the economy. The impact on climate change with the use of innovations is widely known, but it should be pointed out that the implementation of climate and environmental goals requires both appropriate procedures and capital at the level appropriate to the needs. Thus, there is a cooperative relationship between banks’ business models, sustainable financing, sustainable banking products and services supporting sustainability goals. To help companies accomplish this goal, financial institutions including banks should work to overcome the obstacles companies face in this regard, the companies main obstacle being access to and use of sources of finance, (Petersen and Rajan, 1994; Beck and Demirgüç-Kunt, 2006; Beck et al., 2008; Bruns and Fletcher, 2008; Wonglimpiyarat, 2015; Badaj and Radi, 2017; Shihadeh, et al., 2019). The interaction and even the creation of relations between global financial markets including banks and the economy influence sustainable development (Huang, 2011). For individual companies sustainability translates into corporate social responsibility, which is modelled in the direction of ESG risk reduction (Dahlsrud, 2008). Models of shaping the relations between enterprises and financial institutions, including banks, are more and more needed.

Therefore, it can be concluded that the strategy for the development of responsible business should therefore include patterns of cooperation between financial institutions, including banks and enterprises. These benchmarks should take into account: the economic (profit), ecological (planet) with ESG risk, social (people) dimensions, prosperity (economic, social and technological progress occurs in harmony with nature) and partnership. To ensure the indicated 5 “P”, it is important for sustainability, circular economy and environmental to finance their implementation, that is, developing relations between entireties and financial institutions, including with banks.

The literature on the subject also points to the special importance of the financial institution-client relational approach. The literature on the subject also indicates that these relations are shaped differently depending on the adopted basic models of the financial system were established - Anglo-Saxon model (market-based system) and the continental one (bank-oriented financial system). When building a model of cooperation for the financial institution-client, first of all the theoretical achievements in the field of shaping relations and cooperation should be taken into account. (Zioło et al., 2021) The relationship is based on two dimensions: time, which is the measure of the length of cooperation between the financial institution (important for risk assessment) and the companies (duration), and the scope of cooperation measured by the types of products and services used or wanted by the company (scope). At this point, it should be noted that ta cooperation may be of particular importance in developing a business based on sustainability and will also be of particular importance in reducing ESG risks for clients. One should look for strength in mutual relations and exchange of experience in the field of ESG risk mitigation, as well as a new value both for financial institutions, including banks, and for their clients (entireties, enterprises).

Figure 11 presents a proposed financial institution -enterprise cooperation model based on the bank-oriented financial system model, which takes into account the above assumptions. The scope towards “green” of the activities of banks towards “greening” is very wide and abounds in new products and services (full range). Financial institutions in this model have a limited scope towards “green”.

FIGURE 11. A proposed financial institution—enterprise cooperation model based on the bank-oriented financial system model, Source: own elaboration.

Banks may operate directly or indirectly in the insurance, investment and other areas of the financial system. Banks can also freely acquire stocks and shares in non-financial enterprises. They can also cooperate with financial institutions, conclude agreements with them and offer their products. As a result, they often act as both shareholder and lender of enterprises. Thus, they can force business changes towards sustainability and the use of “green” products. Cooperating enterprises have the opportunity to lower the financial risk, which favors the use of “green” products and changing their business models. The scope of “greening” depends on the time of cooperation, which translates into three model proposals for business models of enterprises. The problem of reducing non-financial risk and ESG risk is solved based on the use of the relationship with the bank. A specific problem that must be solved is “green washing”. In this case, banks as dominant institutions influence the elimination of this phenomenon through business strategies, products and services as well as the applicable procedures. An important stakeholder in the elimination of green washing is the stakeholder and the customer. These two groups of entities also contribute to the reduction of ESG risk, in particular the reputational risk.

As shown in Figure 9, in the part showing the risk map, banks are an important institution supporting corporate risk mitigation. On the one hand, the experience of banks allows enterprises to use good practices within the framework of cooperation, but on the other hand, the banking procedures themselves force enterprises to behave responsibly.

Banks are the dominant institution in terms of influencing the changes towards sustainability that are taking place in enterprises. They also try to integrate their business models towards sustainable development with the financial market. Banks imply the greening of their clients’ business models. Financial markets are not so active in creating “green” changes.

Figure 12 presents a proposed financial institution -enterprise cooperation model based on the market-based financial system model.

FIGURE 12. A proposed financial institution—enterprise cooperation model based on the market-based financial system model, Source: own elaboration.

The scope towards “green” of the activities of financial institution towards “greening” is very wide and abounds in new products and services (full range). Clients use the basic banking offer (limited scope, usually “brown-passive”). Banks in this model have a limited scope towards “green”. Investment banks become a separate institution, offering a new “green” quality of investment banking products towards sustainability. Financial institutions may operate directly or indirectly in the insurance, investment and other areas of the financial system. Financial institutions can cooperate and influence banks towards “greening”. The financial institution is becoming an institution creating new “green” products for customers and changing the approach to ESG risk factors. Banks change their offer under the influence of actions and pressure from financial institutions, just as insurers or entrepreneurs do. Financial markets influence not only changes in the scope of products, but also enforce ecological responsibility of the business. Offering finance for changes towards sustainability, they can force business changes towards “green” investment and the use of “green” products. Cooperating enterprises have the opportunity to lower the financial risk, which favors the use of “green” products and changing their business models. The scope of “greening” depends on the time of cooperation, which translates into three model proposals for business models of enterprises. The problem of reducing non-financial risk and ESG risk is solved based on the use of the relationship with the financial institution. Banks can use the rich experience of financial institutions in the field of risk management and mitigation. They can also learn naturally from “green” banks. A specific problem that must be solved is “green washing”. In this case, financial institution (all because their reputation depends on it) influence the elimination of this phenomenon through business strategies, products and services as well as the applicable procedures. An important stakeholder in the elimination of green washing is the stakeholder and the customer. These two groups of entities also contribute to the reduction of ESG risk, in particular the reputational risk. As shown in Figure 10, in the part showing the risk map, financial institution and banks (cooperating and exchanging experience) are important institution supporting corporate risk mitigation.

Financial market institutions and the stock exchange are dominant institutions in terms of influencing changes in the direction of sustainability that are taking place in enterprises. They also try to integrate their business models towards sustainable development with the financial market. Financial institutions imply greening the business models of their clients—enterprises. Banks play a complementary role in this process and are not as active in creating “green” changes.

Analysis of cooperation models, a financial institution, an enterprise allows for the formulation of the following recommendations:

• Financial institutions should clearly communicate and strive to unify the approach in terms of ESG risk management procedures and expectations so that entrepreneurs are aware of the evaluation criteria and terms of cooperation with a financial institution and are treated on the same terms ensuring comparability of the approach of financial institutions;

• Financial institutions should apply a uniform system of restrictions on the approach to handling the so-called “dirty business”, i.e., exclusion from service or increased cooperation costs as a risk premium;

• A register of greenwashing entrepreneurs should be established based on cases identified by financial institutions;

• ESG risk should be included in the customer segmentation in dynamic terms, allowing for monitoring changes in the customer-enterprise profile;

• A register of contractual clauses improving ESG risk management should be developed;

• Financial institutions should monitor the spread of green behavior among entrepreneurs and reach entrepreneurs with a sustainable product offer in the process of transforming business models towards sustainability in order to support them;

• Financial products and transaction collateral should be valued taking into account the ESG risk;

• Financial institutions should perform an advisory function in the field of transforming business models of enterprises towards sustainability.

Generally, we should also consider the two consequences of changes in business models in the context of our research. The appearance of political risk and the call to political risk. This translates into political implications on cooperation models between financial institutions and enterprises. The emergence of political risk, which can be understood as the execution of political power in a way that threatens a company’s value (Bekaert et al., 2015). Under the influence of international regulations or the European Union, it will be necessary to adjust in all sectors. On the one hand, this will cause protests (as indicated by Bekefi and Epstein, 2006), as well as an increase in the cost of raising capital for the planned changes towards sustainability (Belkhir et al., 2017). Thus, the risk of ESG will increase, especially in the “S" area. The profitability of enterprises will change, and there will be strong pressure from stakeholders to limit the “new value” towards the “S" area of ESG factors. The political factor may cause shocks in the financial market (in the Anglo-Saxon model of banking systems) and affect the profitability and behavior of banks (in the German-Japanese model of banking systems). However, it should be remembered that the political factor will have an impact as described by Bekefi and Epstein. (2006) the political factor will then have an impact on cooperation models between financial institutions and enterprises if there is a simultaneous influence: (a) government policies towards business, or (b) the firm’s current or future operations or value.

The literature on the subject highlights the influence of the political factor on green finance, green innovation and social globalization environmental quality (Kirikkaleli and Adebayo, 2022). This is an important element that manifests itself in the “G” risk factor of ESG and may create political risk. In addition, causality is indicated at various periods between political risk, green finance, green innovation, economic growth, social factors. This leads to the conclusion that the consideration of ESG factors serves as a reference point for governments and policymakers in terms of creating interventionist instruments targeting the financial market and banks to redirect their business models towards investing in eco-friendly technologies in order to improve environmental quality.

6 Conclusion

The ESG risk affects the operations of enterprises and financial institutions. Both entrepreneurs and financial institutions adjust their business models towards sustainability. Adjustment measures taken by financial institutions in the field of sustainable business models influence enterprises’ business models. This impact depends on the business sector and the financial system model. In the bank-oriented model, the role of banks as leading capital donors makes them crucial for entrepreneurs’ decisions regarding the transformation of business models towards sustainability. When assessing the risk, financial institutions define financial conditions for enterprises - the more stringent, the higher the ESG risk. The reputation risk, which banks consider as a risk related to listed companies, plays an important role here. In the market-oriented model, the stakeholders are of crucial importance for ensuring sustainability and influencing enterprises. While in the case of the bank-oriented model, the ESG risk transmission channel is mitigated mainly by credit risk management and creditworthiness assessment procedures, in the market-oriented model, the stakeholders and disclosure of information about ESG activities by companies are crucial. The article is one of the first to include the financial system model in the ESG risk analysis in the context of sectoral enterprise analysis. The paper uses fuzzy cognitive maps and the correspondence analysis to diagnose which ESG factors affect enterprises to the greatest extent. The fuzzy cognitive maps analyze the importance of the social, environmental, and technological factors in building sustainable business models for enterprises from the service sector, industry, and agriculture as a specific form of economic activity. A general fuzzy cognitive map for business has been built and proved that the analyzed factors are significant in creating sustainable business models, creating a network of connections of a cause-and-effect nature. At the same time, it has been presented that negatively charged relations refer mainly to companies from the industry sector. As a result of the correspondence analysis, four typological groups of enterprises were distinguished. The first group included enterprises from the healthcare sector and from other sectors of business activities, which are characterized by highly sustainable business models built on social, organizational, and technological factors. What is essential, enterprises from this group cooperate with environmentally-friendly financial institutions. The second group includes enterprises from housing and non-material municipal services, construction, trade, and other sectors of non-material services; they put emphasis on the cooperation with the environment- and society-friendly financial institutions and build their business models, based mainly on social aspects as employee-friendly and digitized organizations. The third group of enterprises has been assessed as being below the average and, to an average extent, considering the social, organizational, and technological factors while cooperating with financial institutions. The last group of enterprises does not implement sustainable business models, nor does it cooperate with sustainable financial institutions. Enterprises that implement sustainable business models cooperate with sustainable financial institutions. It is because of the influence of impulses from the financial sector, expecting their partners to meet the sustainability requirements specified, among other things, in risk assessment procedures. The study confirms that there is an exchange of experiences and the knowledge transfer from the financial institution to the enterprise. Therefore, the business models of enterprises and financial institutions interpenetrate in terms of ensuring sustainability. Entrepreneurs who do not work with environmentally friendly financial institutions have been assessed as being below the average, and reduced their distance to the competition. The study has limitations due to the availability of comparable public research data. The future work will concern a separate analysis of ESG factors for the bank-based model and the market-oriented model depending on the seat of the financial institution, i.e., the study will include the spatial context.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author contributions

MZ, BF, and IB contributed to conception and design of the study. IB and KC organized the database. IB and KC performed the statistical analysis. MZ, BF, and AS wrote the first draft of the manuscript. MZ, BF, AS, IB, and KC wrote sections of the manuscript. All authors contributed to manuscript revision, read, and approved the submitted version.

Funding

Research results are a part of research project financed by the National Science Centre Poland (NCN) OPUS16 2018/31/B/HS4/00570.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1Total inertia is a K sum of eigenvalues, where K is a measure of the real space of coexistence.

2To divide the dendrogram and determine the number of focal points, the following measure was used (Grabiński 1992): where di is i-th distance. The highest value qi indicates the place of the dendrogram’s division.

References

Adner, R. (2006). Match your innovation strategy to your innovation ecosystem. Harv. Bus. Rev. 84, 98–107 148.

Ahmed, S. U., Ahmed, S. P., and Hasan, I. (2018). Why banks should consider ESG risk factors in bank lending? Banks Bank. Syst. 13 (3), 71–80. doi:10.21511/bbs.13(3).2018.07

Andreou, A. S., Mateou, N. H., and Zombanakis, G. A. (2003). Evolutionary fuzzy cognitive maps: A hybrid system for crisis management and political decision making Munich, Germany University Library of Munich, Munich Personal RePEc Archive Paper 51482.

Andreou, A. S., Mateou, N. H., and Zombanakis, G. A. (2005). Soft computing for crisis management and political decision making: the use of genetically evolved fuzzy cognitive maps. Soft Comput. 9 (3), 194–210. doi:10.1007/s00500-004-0344-0

Apergis, N., Poufinas, T., and Antonopoulos, A. (2022). ESG scores and cost of debt. Energy Econ. 112, 106186. doi:10.1016/j.eneco.2022.106186

Aroul, R. R., Sabherwal, S., and Villupuram, S. V. (2022). “ESG, operational efficiency and operational performance: evidence from real estate investment trusts,” in Managerial finance.

Arratibel, O. (2020). 2020-10-15 BoS - ESG report MASTER FILEcl, European asylum support office. Available at: https://policycommons.net/artifacts/2054749/2020-10-15-bos/2807840/(Accessed December 15, 2022).

Avetisyan, E., and Hockerts, K. (2017). The consolidation of the ESG rating industry as an enactment of institutional retrogression. Bus. Strateg. Environ. 26, 316–330. doi:10.1002/bse.1919

Badaj, F., and Radi, B. (2017). Empirical investigation of SMEs’perceptions towards PLS financ-ing in Morocco. Int. J. Islam. Middle. 11, 250–273. doi:10.1108/IMEFM-05-2017-0133

Baden-Fuller, C., and Haefliger, S. (2013). Business models and technological innovation. Long. Range Plan 46 (6), 419–426. doi:10.1016/j.lrp.2013.08.023

Basel Committee on Banking Supervision (2009). Enhancements to the basel II framework. Bank for international settlements. Available at: https://www.bis.org/publ/bcbs157.pdf (accessed December 13, 2022).

Basile, V., Capobianco, N., and Vona, R. (2021). The usefulness of sustainable business models: Analysis from oil and gas industry. Corp. Soc. Responsib. Environ. Manag. 28 (6), 1801–1821. doi:10.1002/csr.2153

Beck, T., and Demirgüc ̧-Kunt, A. (2006). Small and medium-size enterprises: Access to financeas a growth constraint. J. Bank. Financ. 30 (11), 2931–2943. doi:10.1016/j.jbankfin.2006.05.009

Beck, T., Demirguc-Kunt, A., and Maksimovic, V. (2008). Financing patterns around the world:The role of institutions. J. Financ. Econ. 90, 467–487. doi:10.1016/j.jfineco.2007.10.005

Beh, E. J., and Lombardo, R. (2014). Correspondence analysis. Theory, practice and new strategies. Hoboken, NJ: John Wiley & Sons.

Bekaert, G., Harvey, C. R., Lundbladv, C. T., and Siegel, S. (2015). Political risk and international valuation. Columbia Business School Research Paper, 15–83, 13–91. Available at: http://dx.doi.org/10.2139/ssrn.2659257 (Accessed December 20, 2022).

Bekefi, T., and Epstein, M. J. (2006). Integrating social and political risk into management decision-making. The Society of Management Accountants of Canada and The American Institute of Certified Public Accountants, Canada.

Belkhir, M., Boubakri, N., and Grira, J. (2017). Political risk and the cost of capital in the MENA region. Emerg. Mark. Rev. 33, 155–172. doi:10.1016/j.ememar.2017.08.002

Belyaeva, Z., Rudawska, E. D., and Opatkova, Y. (2020). Sustainable business model in food and beverage industry – A case of Western and central and eastern European countries. Br. Food J. 122 (5), 1573–1592. doi:10.1108/BFJ-08-2019-0660

Bidmon, C. M., and Knab, S. F. (2018). The three roles of business models in societal transitions: New linkages between business model and transition research. J. Clean. Prod. 178, 903–916. doi:10.1016/j.jclepro.2017.12.198

Birkel, H. S., Veile, J. W., Müller, J. M., Hartmann, E., and Voigt, K. I. (2019). Development of a risk framework for Industry 4.0 in the context of sustainability for established manufacturers. Sustainability 11 (2), 384. doi:10.3390/su11020384

Bocken, N. M. P., Short, S. W., Rana, P., and Evans, S. (2014). A literature and practice review to develop sustainable business model archetypes. J. Clean. Prod. 65, 42–56. doi:10.1016/j.jclepro.2013.11.039

Bodhanwala, S., and Bodhanwala, R. (2019). Do investors gain from sustainable investing? An empirical evidence from India. Int. J. Bus. Excell. 19 (1), 100–118. doi:10.1504/ijbex.2019.10023219

Brogi, M., and Lagasio, V. (2019). Environmental, social and governance and company profitability: Are financial intermediaries different? Corp. Soc. Responsib. Environ. Manag. 26, 576–587. doi:10.1002/csr.1704

Bruns, V., and Fletcher, M. (2008). Banks’risk assessment of Swedish SMEs. Ventur. Cap. 10 (2), 171–194. doi:10.1080/13691060801946089

Buallay, A., Fadel, S. M., Al-Ajmi, J. Y., and Saudagaran, S. (2020). Sustainability reporting and performance of MENA banks: is there a trade-off? Meas. Bus. Excell. 24 (2), 197–221. doi:10.1108/MBE-09-2018-0078

Busch, T., Bauer, R., and Orlitzky, M. (2016). Sustainable development and financial markets. Bus. Soc. 55 (3), 303–329. doi:10.1177/0007650315570701

Caldecott, B., Dericks, G., and Mitchell, J. (2015). Stranded assets and subcritical coal: the risk to companies and investors. Oxford: Smith School of Enterprise and the Environment.

Carayannis, E. G., Sindakis, S., and Walter, C. (2015). Business model innovation as lever of organizational sustainability. J. Technol. Transf. 40, 85–104. doi:10.1007/s10961-013-9330-y