- 1School of International Business, Guangdong University of Finance & Economics, Guangzhou, Guangdong, China

- 2Lazaridis School of Business and Economics, Wilfrid Laurier University, Waterloo, ON, Canada

- 3School of Accounting, Guizhou University of Finance and Economics, Guiyang, China

With the worldwide green revolution, especially “pollution prevention and control” as one major strategy, environmental issues have received more and more attention. Environmental regulations, as an institutional norm, directly or indirectly regulate corporate behavior. Therefore, it is significant to examine the relationship between corporate performance and environmental regulations. In this paper, we conduct an empirical study on the relationships among environmental regulations, R&D intensity, and enterprise profit rate. Our data are from the 395 A-share companies in heavy pollution industries listed on the Shanghai and Shenzhen Stock Exchanges in China from 2008 to 2017. Our methodologies include Ordinary Least Squares mixed regression, quantile regression, and Generalized Method of Moments estimation. Our main research findings include the following. First, environmental regulation and R&D intensity both have a positive impact on corporate profit rate at the 1% significance level. Second, there are “threshold” effects on the promotion of corporate profit rate by environmental regulations and R&D intensity. Third, the product of environmental regulation and R&D intensity has a positive impact on corporate profit margin at the 1% significance level. Fourth, the impacts of environmental regulations and R&D intensity on corporate profit rate vary at different quantiles. Finally, R&D intensity is a partial mediation variable in the relationship between environmental regulations and enterprise profit rate. In terms of policy insights, our results suggest that the government formulate appropriate environmental regulations and enhance the support for enterprise R&D to stimulate technological innovation in the heavy pollution industries.

1 Introduction

It is difficult to argue against the fact that global environmental pollution is closely related to the increasing level of worldwide industrialization. With the green revolution, the conflicts between environmental protection and economic development have been widely highlighted in the sustainable development of many countries (Albrizio et al., 2017). To solve these conflicts, environmental regulations are needed to provide appropriate policy tools. For example, in China, the rapid growth over the past 40 years has resulted in high environmental costs (Brolund and Lundmark, 2017; Awan et al., 2021). More specifically, resources have been overexploited with a low utilization rate, leading to ecological degradation and environmental pollution. Manufacturing practices that use high energy consumption, high pollution, and low efficiency have been detrimental to the sustainable development of developing countries. Hence, it is important to shift towards high-quality economic development. However, since environmental resources are public goods, governments need to formulate relevant environmental regulations and policies to restrain enterprise behaviors related to high pollution rates (Berman and Bui, 2001).

In the literature, firstly, scholars mainly focus on the impact of environmental regulation on total factor productivity, and there are relatively few studies on the relationship between environmental regulation and profit rate. However, the profit rate is the most concerning indicator of enterprises. If environmental regulation can improve profit margins, that will attract more companies to take the initiative to adopt environmentally friendly behaviors or increase technological innovation by increasing R&D intensity, reducing environmental pollution, or reducing the cost of environmental pollution treatment. Secondly, the literature mainly studies the impact of environmental regulation on R&D investment, R&D investment, operating performance, and profit margin of industry and manufacturing enterprises. Research on industry heterogeneity still needs to be strengthened. Different industries have different levels of pollution emissions, pollution treatment technologies, etc. As the key objective of environmental regulation, the heavily polluting sector deserves more research attention.

Despite years of research, researchers still have different views on the following three questions: 1) Can environmental regulations bring environmental benefits, stimulate technology innovation, and improve profitability? 2) Whether the enforcement costs of environmental regulations can be compensated? 3) Whether enterprise profits can be improved because of environmental regulations?

To help address these questions, this paper mainly conducts research from the following aspects: First, taking listed companies in China’s heavily polluting industries as an example, research the relationship between environmental regulation, R&D intensity, and corporate profit margins, and explore how heavily polluting industries can increase corporate profit margins under environmental regulations. The second is to further study the relationship between environmental regulation, R&D intensity, and corporate profit margins. Whether environmental regulation is conducive to improving corporate profit margins and through what path, this paper believes that environmental regulation, as a policy constraint behavior, stimulates companies to improve their profitability. R & D activities can help increase output, reduce the cost of pollution control and eventually improve corporate profit margins.

In this research, we focus on enterprises in the heavy pollution industries because they are the ones most impacted by environmental regulations. Collecting data from the listed companies in the heavy pollution industries, we analyze the direct impacts of environmental regulations on firm profit. We then analyze the indirect effects of environmental regulations on firm profit via R&D intensity and further assess the interdependence among these variables.

By formulating relevant policies and measures, environmental regulations directly or indirectly regulate environmental pollution generated by enterprises’ economic activities. It is a type of social, institutional norm which aims to adapt external behavior caused by environmental pollution so as to achieve the dual goals of environmental protection and economic development. Theoretically, as environmental regulations internalize external environmental costs, enterprises’ operating costs will increase. On the other hand, enterprises are guided to start technical innovation, adopt advanced equipment and processes, reduce environmental pollution, and enhance the capacity of pollution governance. Therefore, environmental regulations will generate environmental obedience costs and violation costs, thus inevitably increasing short-run costs, leading to low enterprise performance. However, in the long run, these costs incentivize enterprises to adopt advanced equipment and environmentally friendly measures for emission reduction and pollution control. Moreover, in an effort to decrease costs, enterprises will improve R&D intensity and strengthen technical innovation. In this paper, we contribute by testing the relationships among environmental regulations, R&D intensity, and enterprise profit ratio. In particular, we show whether environmental regulations affect enterprise profit rates through R&D intensity. Our second contribution is to provide managerial and policy insights when the government devises effective environmental regulations to incentivize firms to pursue R&D and innovation, especially those in the heavy pollution industries.

The rest of the paper is organized as follows. Section 2 presents a literature review, summarizing existing research on the relationships among environmental regulations, R&D intensity, and business profit ratio, and provides theoretical analysis. Section 3 details the variables, models, and data sources. Section 4 presents our main empirical results. Finally, Section 5 provides explanations of the empirical results and the associated policy insights, as well as possible future research directions.

2 Literature review and theoretical analysis

Will environmental regulations increase R&D input and enhance productivity and business profit for firms? Most academic research focuses on the “Porter Hypothesis,” but the conclusions are without consensus. Porter (1991) proposed the “Porter Hypothesis,” stating that proper implementation of environmental regulations will stimulate enterprises to increase technical input, enhance enterprise production efficiency and product quality, and ultimately reduce enterprise production costs (Dai et al., 2015). Hence, “innovative compensation” can entirely or partially offset “compliance cost,” enhance operation revenues and business performance, and reach a “win-win” result between environmental protection and competitiveness. Jaffe and Palmer (1997) divided the “Porter Hypothesis” into the “narrow Porter Hypothesis,” “weak Porter Hypothesis,” and “strong Porter Hypothesis”. “Narrow Porter Hypothesis” believes only suitable environmental regulations provide incentives for technical innovation in enterprises. Although environmental regulations can stimulate technical revolution to some extent, it is still uncertain whether the payoffs from technical innovation are big enough to offset the cost of environmental regulation compliance (Shen and Liu, 2012; Guo and Zhang, 2014). The “Strong Porter Hypothesis” states that environmental regulations can encourage enterprises to enhance production efficiency to some extent, offset environmental regulations compliance cost, improve competitiveness, stimulate R&D input, enhance total factor productivity, and significantly enhance enterprise production efficiency.

From static and dynamic perspectives, mainstream research focuses on the relationships among environmental regulations, technical innovation, R&D input, and productivity. From a dynamic perspective, appropriate environmental regulations improve not only environmental performance but also the technical innovation of enterprises so as to simultaneously achieve environmental and economic benefits. Also, by providing directions on technical innovation, environmental regulations increase green productivity and total factor productivity. Zhao and Gu (2015) analyzed the relationship among environmental regulations, technical innovation, and the total factor productivity and their findings show that environmental regulations enhance technical innovation, whereas R&D caused by non-environmental regulations can cause a greater impact on total productivity. Xie et al. (2016) utilized data from the heavy industry and demonstrated that environmental regulations promote R&D input. Moreover, technical innovation and environmental regulations play important roles in enterprise transformation. Peuckert (2014) studied the relationship between environmental regulations and enterprise competitiveness from short-run and long-run perspectives and found that in the short run, environmental regulations are not beneficial to enterprise competitiveness, but in the long run, they are. Yuan and Xie (2016) studied the relationship between the modes of environmental regulations and industrial green productivity, showing that the type and strength of environmental regulations together determine their impacts on productivity. Li et al. (2019) argued that a reasonable level of governmental environmental regulations could effectively improve the overall green production level. Considering the impacts of technical learning factors, enterprises are encouraged to enhance green production input to pursue long-run profit maximization.

From a static perspective, according to the traditional neo-classical theory, in the short run, implementing environmental regulations will inevitably generate extra costs and expenses by internalizing external environmental costs of enterprises. This can increase the enterprise cost and squeeze scientific research input, which impedes technical innovation and green productivity. Palmer et al. (1995) also questioned the “Porter Hypothesis” and showed that the “expensive supervision hypothesis” exists because the expenses of environmental supervision outweigh the earnings brought by stricter environmental regulations. Given that technical conditions, resource allocation, and consumption demands are fixed, environmental regulations can increase enterprise production costs. This can hurt production and weaken enterprise competitiveness. Ke and Lu (2011) argued that the promotion role of environmental regulations on technical innovation is insignificant. Moreover, they can restrain the increase of the short-run total factor productivity. Li et al. (2011) utilized data from China during 1978–2008 to study the agricultural total factor productivity growth under environmental regulations. Their findings reveal that environmental regulations restrain the increase of total factor productivity. Liu and Zheng (2013) studied the impacts of R&D caused by environmental regulations on total factor productivity and concluded that the stronger the environmental regulations, the higher the R&D expenditure of the industry will be. However, R&D induced by environmental regulations has no significant positive impact on total factor productivity. Similarly, although environmental regulations in the pollution-intensive industry increase R&D expenditure, they do not have significantly positive impacts on total factor productivity. A possible reason is that the R&D induced by environmental regulations accounts for a relatively low ratio and low efficiency in R&D expenditure.

In fact, there have been inconsistent results on whether the compliance cost of environmental regulations is compensated and whether enterprise profit or performance can be enhanced. Some scholars believe that environmental regulations’ compliance costs can be compensated, and they are beneficial to enterprise operating profit or performance. However, other scholars insist that the compliance cost of environmental regulations can’t be compensated sufficiently. Berman and Bui (2001) used data of the American petroleum smelting industry from 1982–1992 and found that total factor productivity of enterprises affected by environmental regulations can be enhanced significantly. That is, environmental regulations improve the financial performance of heavily polluting enterprises. These regulations can help enterprises identify opportunities for innovation and thus improve the business profit ratio. Jorgenson and Wilcoxen (1990) employed data from each industry in the United States from 1973 to 1985 and they empirically show that environmental regulations in chemical engineering, petroleum, ferrous metal, pulp, and papermaking industry result in slight reduction of business performance. Lanoie et al. (2008) also indicated that by technical innovation, environmental regulations cause an indirect positive effect on performance but a direct negative effect on business performance. Nevertheless, the combined total effect is negative, showing that the environmental regulations compliance cost can’t be sufficiently compensated, which impedes enterprise performance. Albrizio et al. (2017) argued that whether environmental regulations improve productivity is affected by the different growth ratios of industries. Strict environmental regulations increase the productivity growth for only enterprises which are ranked in the top 20% of the productivity list. Brolund and Lundmark (2017) studied the relationship of environmental regulations with productivity development and technical revolution in Europe’s pulp-making and paper-making industries. They show that regulation of nitric oxide has a 1-year hysteresis relation with productivity improvement, while regulations on sulfur dioxide and carbon dioxide have no statistically significant impacts. Kong and Zhang (2018) showed that more intensive environmental regulations lead to extra enterprise operating cost and lower the business profit ratio. There has been other research relating the potential benefits from environmental regulations with enterprise sizes and industrial types. For example, Long and Wan (2017) indicated that whether environmental regulations improve the business profit ratio can be affected by “compliance cost heterogeneity”. Environmental regulations can increase the profit ratio of large-scale enterprises with lower compliance cost but reduce the profit ratio of small-scale enterprises with higher compliance cost. Liu et al. (2019) inspected the impacts of environmental regulations on the R&D overflow effect, showing that China’s environmental regulation level is presently in an inverse N relationship with the international R&D overflow. Moreover, provinces with weaker environmental regulations restrain the international technical overflow. However, with the reinforcement of environmental regulations, international R&D overflow level rises. Besides, the application of different environmental regulations will affect the inverse N relationship between environmental regulations and international R&D overflow effect. Based on enterprise bargaining power and the data from heavy industries, Li and Chen (2019) studied the impacts of environmental regulations on enterprises’ green total factor productivity. Their results indicate that environmental regulations will cause negative impacts on enterprises’ green total factor productivity in the short run. In the long run, implementing environmental regulations helps achieve the win-win goals of improving enterprise competitiveness and protecting the environment.

In summary, there has been research focusing on the relationships among environmental regulations, R&D intensity, and enterprise productivity. Supporters and opponents of the “Porter Hypothesis” have conducted case and empirical studies. However, there are still research gaps. Firstly, researchers concentrate on the impacts of environmental regulations on total factor productivity, but seldom discuss the relationship between environmental regulations and profit ratio. In fact, the profit ratio is a top concern for enterprises. If environmental regulations can enhance the business profit ratio, it can be argued that more enterprises will actively enhance R&D intensity, improve technical innovation, reduce environmental pollution, or decrease environmental pollution governance cost. Secondly, there have been many more studies on the impacts of environmental regulations on R&D investment, business performance and profit ratio, but less on industrial heterogeneity. As argued before, different industries have differences in the degrees of polluting effects and pollution treatment technologies. In particular, the heavy pollution industries, as the key targets of environmental regulations, should be studied more. Thirdly, it is well recognized that the increase in business profit ratio under environmental regulations is due to R&D investment. However, it is typically ignored that environmental regulations can guide enterprises to pursue environmentally friendly behavior to decrease the external environmental cost and eventually improve the business profit ratio. Therefore, we can conclude that the “Porter Hypothesis” is applicable to China’s pollution-intensive manufacturing industry.

In this paper, we make the following contributions. First, we focus on the relationships among environmental regulations, R&D intensity, and business profit ratio in the heavy pollution industries, which are affected the most by environmental regulations. They are also critical to achieving environmental protection. Second, we seek to investigate reasons why environmental regulations raise the business profit ratio. It may be because enterprises improve R&D intensity to undergo technical innovation and reduce the cost of pollution control. It may also be due to the improved technology and output. Moreover, environmental regulations themselves belong to policy-restraint behavior and may guide enterprises to select environmentally friendly behavior. Our research seeks to shed light on these arguments in the heavy pollution industries.

3 Variables, models, and data source

3.1 Variables and models

In our research, the dependent variable is profit rate (PR), which is measured by the business revenue and net profit (the ratio of net profit to business revenue). The main independent variables are environment index (EI) and R&D intensity (RD). The control variables are enterprise size (SIZE), capital structure (LEV), organizational redundancy (OR), the scale of the board of directors (BOD), the scale of the board of supervisors (BOS) and equity concentration (EC). The definition of variables is as follows.

R&D intensity (RD) is measured as the proportion of enterprise R&D expenses to the total enterprise business revenue. Enterprise size (SIZE) is expressed as the natural logarithm of total enterprise assets. Capital structure (LEV) is calculated as the asset to liability ratio. Organizational redundancy (OR) is obtained by the sum of sales expenses, finance expense and management expenses divided by business revenue. The scale of the board (BOD) of directors is expressed as the natural logarithm of the total number of directors. The scale of the board of supervisors (BOS) is expressed as the natural logarithm of the total number of supervisors. Equity concentration (EC) is defined as the proportion of the shares owned by the largest shareholder.

In this study, the Chinese environment index (EI) is established based on the comprehensive environmental pollution emission index mentioned in related literature. First of all, it compares the emission intensity of different pollutants in different regions with the whole country’s pollutant emission situation and then the relative level of pollutant emission intensity through the weighted average method is determined. Lastly, the reciprocal of the pollutant emission intensity of the region where listed companies are located becomes the environment index. The main pollutants that shall be investigated are the amount of industrial wastewater emission, the amount of industrial SO2 emission, the amount of industrial smoke (powder) and dust emission. The environment index is defined as following:

In (Eq. 1),

In (Eq. 2),

3.2 Model construction

In order to verify the internal relationships among environment index, R&D intensity, and enterprise profit, we next construct models for empirical testing. Based on our literature review and theoretical analysis, the following model is constructed to verify the influence of environment index on enterprise profit:

In (Eq. 3),

In (Eq. 4),

In (Eq. 5),

3.3 Data source

In accordance with the Guidelines on Environmental Information Disclosure of Listed Companies disclosed by Shanghai Stock Exchange in 2008 and the Guide to Environmental Information Disclosure of Listed Companies disclosed by the Environment Protection Administration in 2010, the A-share listed companies in the heavy pollution industries that were listed on the Shanghai Stock Exchange and Shenzhen Stock Exchange from 2008 to 2017 are selected as the study samples. The samples are selected by the following methods: 1) Exclude ST, SST*, PT sample companies; 2) Exclude the companies whose research data is not complete or is missing, 3) Exclude the companies whose other variable information is missing. After this screening for data availability, 3,950 samples meeting all requirements were selected. All the finance data, firm management data and shareholder data of the listed companies mentioned are from CSMAR of GTAFE. All the R&D expenses data of the listed companies is from the Wind database. The data required for the environment index is mainly from China Statistical Yearbook, China Statistical Yearbook on Environment and China Statistical Yearbook on Industry and Economy. In order to eliminate the impact of price factor, deflation is conducted on other related indexes based on the Producer Price Index of 2008. The data processing is all completed in STATA version 15.1 and Microsoft Excel.

In addition, this article used the software Stata 16.0. The Stata commands used include winsor, sum, reg, sqreg, threshold, sgmediation, and ivreg2, which are used to conduct preliminary experiments and model estimation.

4 Empirical analysis

4.1 Descriptive statistics and analysis

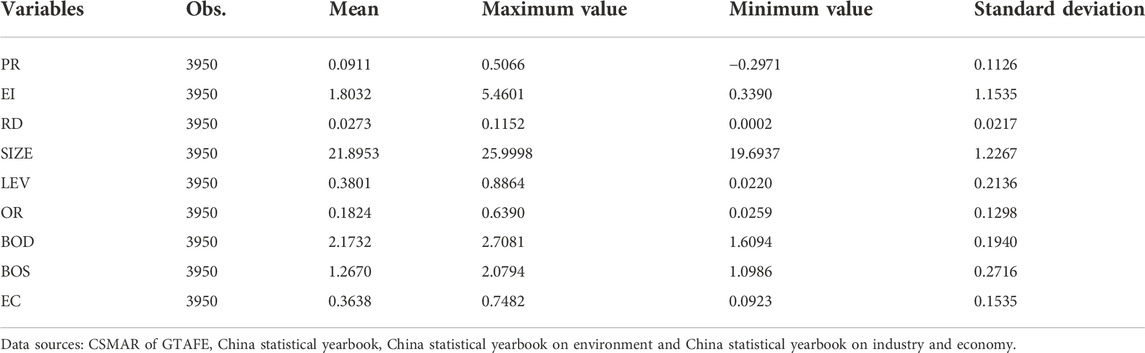

The descriptive statistics of relevant variables are summarized in Table 1 below. Moreover, Tables 2, 3 show the Pearson correlation matrix and the variance inflation factor (VIF) test for these variables.

In order to eliminate the influence of extreme values, the Winsorize treatment is conducted on some continuous variables with extreme values. It can be seen from Table 1 that the net profit and business revenue ratio of the Chinese companies listed in the heavy pollution industry is on average only 9.11%. The maximum value is 50.66% and the minimum value is −29.71%. This shows that net profit to operating income ratio of the companies in the heavy pollution industry differs greatly. The average environment index of all regions is larger than 1, which means the environment index is strict. The maximum value is 5.4601 and the minimum value is 0.3390 with standard deviation of 1.1535. This proves that the environment index of different regions varies greatly. The average R&D expense accounts for 2.73% of the business revenue, which means that the R&D degree is relatively low. In the aspects of control variables, the maximum natural logarithm of total assets is 25.9998 and the minimum natural logarithm of total assets is 9.6937. The standard deviation is 1.2267, which proves that the natural logarithm of total assets is greatly different. The minimum value of debt to asset rate is 2.20% and the maximum value is 88.64%, which is greatly different. The mean value of organizational redundancy is 18.24%, which means that the companies selected for this study have high organizational redundancy. The mean proportion value of the shares owned by the largest shareholder is 36.38%, which suggests that the companies selected to represent the heavy pollution industry have a high equity concentration.

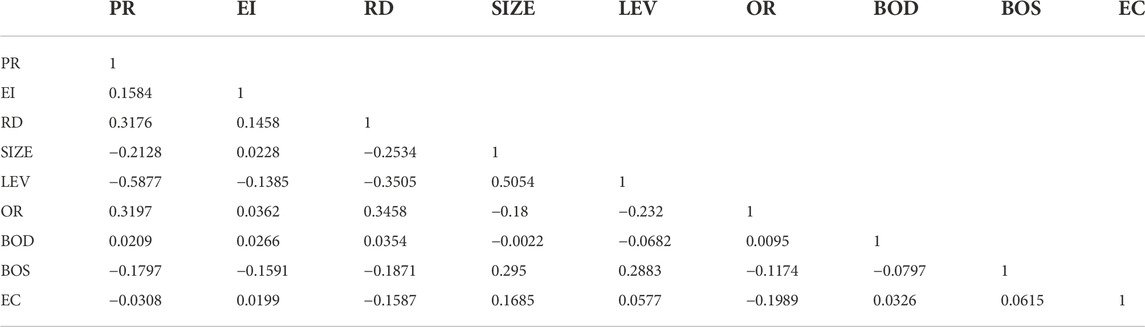

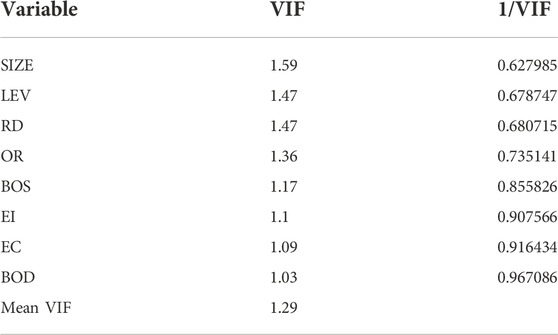

In addition, we use OLS mixed regression to conduct an empirical study on the relationship between environmental regulation, R&D intensity and corporate profitability. Pearson correlation matrix and Variance inflation factor (VIF) test are as follows:

It can be seen from the Pearson correlation matrix and Variance inflation factor (VIF) test that the VIF value of each variable are less than 2, indicating no multicollinearity problem among the variables.

4.2 Regression analysis

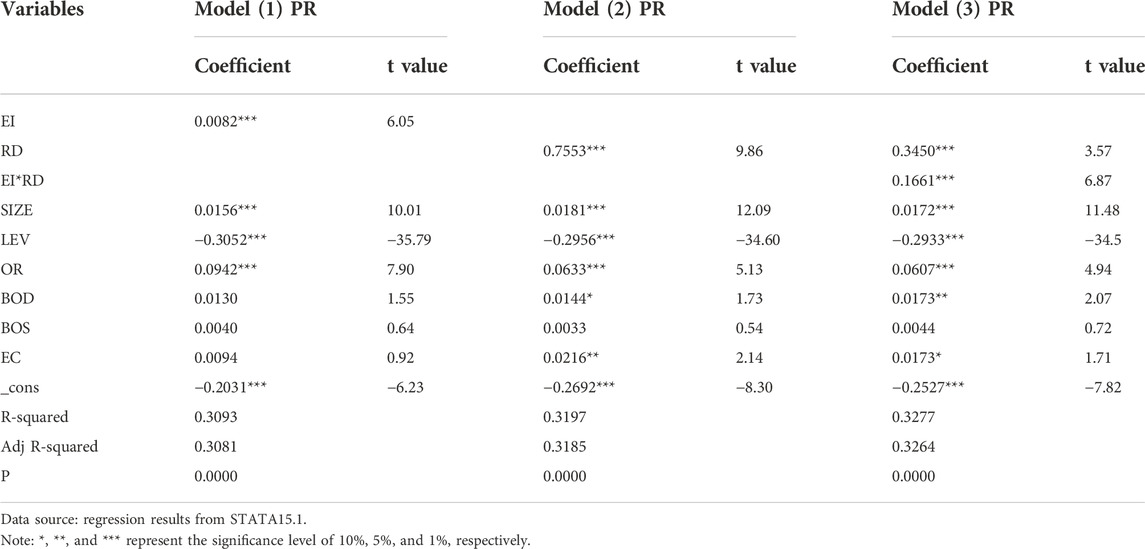

The regression analysis is conducted under the precondition that the endogenous relationship is not taken into consideration. OLS mixed regression analysis is performed on the three models to verify the influence of the environment index and R&D intensity on enterprise profit rate and to check whether the environment index can improve the impact of R&D intensity on enterprise profit rate. The regression results are provided in Table 4.

Model (1) is mainly established to verify the influence of the environment index on enterprise profit rate. The regression results suggest that the regression coefficient of environment index on enterprise profit rate is 0.0082 and the t-value is 6.05. Thus, at the 1% significance level, the environment index has positive influence on enterprise profit rate. It means that the higher the environment index in the place where the listed firm is located, the higher the enterprise profit rate is. The second model (2) is mainly used to analyze the influence of R&D intensity on enterprise profit rate. Based on the regression results, the regression coefficient of R&D intensity on enterprise profit rate is 0.7553, and the t-value is 9.86. At the 1% significance level, R&D intensity has positive influence on enterprise profit rate. In accordance with the regression results obtained from model (3), it can be found that the coefficient of the product term of environment index and R&D intensity is 0.1661 and the t-value is 6.87. At the 1% significance level, the product term of environment index and R&D intensity has a positive influence on enterprise profit rate. The results show that the environment index can improve the positive influence of R&D intensity on enterprise profit rate. The regression coefficient of R&D intensity on enterprise profit rate is 0.7553, which is higher than the coefficient of R&D intensity on environmental regulations (0.0082). This means that the direct effect of environmental regulations on profit rate needs to be strengthened further. The improvement of enterprise profit rate is mainly due to R&D and its resulted innovation. However, the coefficient of the product term between environmental regulations and R&D intensity is 0.1661. This indicates that strict environment index can prompt the firm to carry out technology innovation, strengthen R&D, to improve the firm’s production efficiency and product quality to some degree in order to reduce a firm’s cost and improve the overall enterprise profit rate.

Among all the control variables, the firm size and organizational redundancy have a positive influence on profit rate, which proves that the Chinese heavy pollution industry has moderate scale effect. Moreover, organizational redundancy can improve the enterprise’s profit rate to a certain extent. In addition, the firm’s asset to liability ratio has obvious negative influence on the enterprise profit rate. The scale of the board of directors and the equity concentration exhibits positive effects in model (2) and model (3). However, the scale of the board of supervisors exhibits insignificant and positive effects in the three models.

Our results above show that environmental regulations on the one hand can incentivize firms in heavy-pollution industries to engage in environmental protection and reduce the penalty from potential pollution. This can reduce operating cost and improve profitability. This is consistent with Mele and Magazzino (2020) which finds that firms in the steel industry improve their technology and management to minimize the pollution cost and penalty due to their steel production. On the other hand, environmental regulations can positively improve R&D intensity and, the resulted technology innovation can improve profitability. Therefore, environmental regulations can improve environmental performance and improve innovation and productivity. In particular, the external cost of environmental pollution can be reduced through R&D and technology innovation. This differs from fixed cost such as social insurance cost which will burden firms. Hence, the “Porter Hypothesis” has been further verified based on the listed companies in China’s heavily polluting industries.

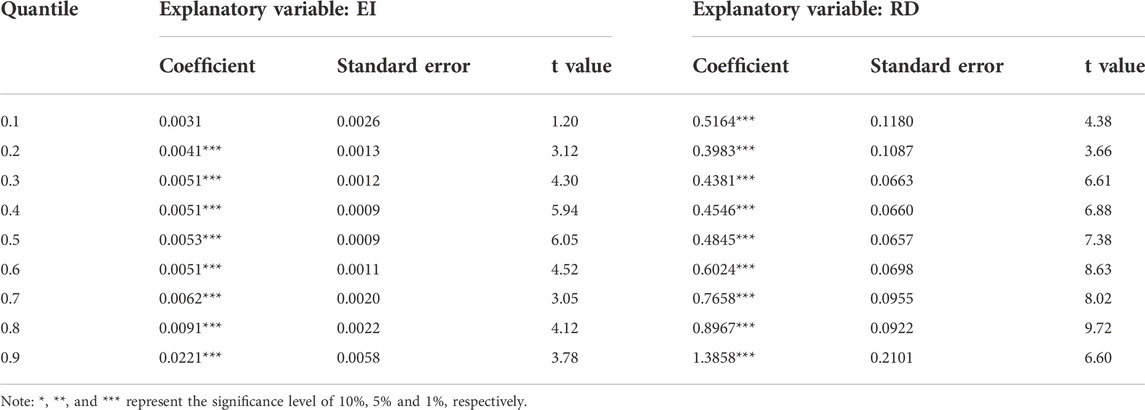

In Table 4, model (1) and model (2) examine the impact of environmental regulation and R&D intensity on corporate profit rate, respectively. Both impacts are positive on the corporate profit rate at the significance level of 1%. Since OLS assumes the same marginal output efficiency for all enterprises’ profit rates, it is impossible to describe the specific impact on enterprises’ profit rates accurately. As a result, the following quantile regression is employed to further analyze the impact of environmental regulation and R&D intensity on corporate profit rate. The ensuing regression results are shown in Table 5.

As shown in Table 5, under different quantiles, pronounced differences exist in the impacts of environmental regulations on enterprise profit rate. At 0.1 quantiles, the impact is insignificant, probably due to an apparent constraint of environmental regulations on enterprises with low profit rates. However, at 0.9 quantiles, the impact surges to the largest value, far higher than other quartiles. The reason is that environmental regulations will be more likely to stimulate enterprises with high profit rates by increasing R&D intensity and undergoing technological innovation. This can help them achieve pollution control cost reduction and output increase at the same time, and eventually improve the profit rates.

Nevertheless, the impacts of R&D intensity on enterprise profit rate also vary at different quantiles. The impact at 0.1 quantile is greater than that between 0.2 and 0.5 quantile. This is mainly because R&D intensity in enterprises with lower profit rates has a higher marginal effect on profit growth. The largest impact occurs at 0.9 quantile, probably because the profit growth of enterprises with higher profit rates is mainly supported by technological innovation.

The estimation results from quantile regression show that the effect of environmental regulations and R&D intensity on profitability differs at different quantiles. Depending on the profit rate, the relationship can be nonlinear. In order to better answer the question, we establish the following threshold model with enterprise profit rate as the threshold variable:

where

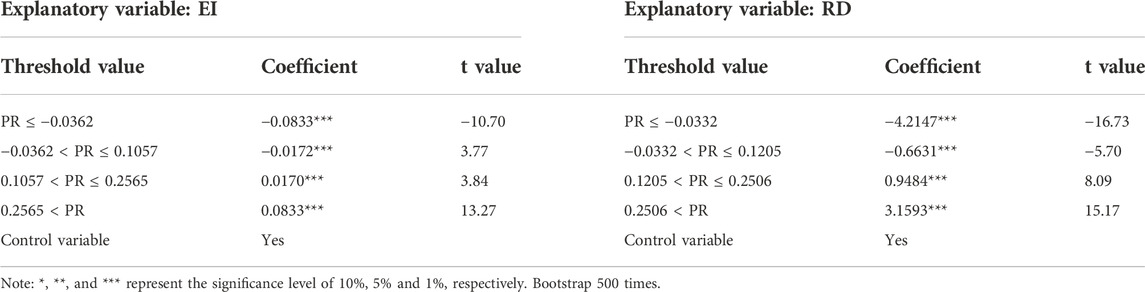

Table 6 shows that if the enterprise profit rate is taken as a threshold variable, only when it crosses a certain “threshold” can it be significantly promoted by environmental regulations. When the profit rate is at a low level (PR ≤ −0.0362 and −0.0362 < PR ≤ 0.1057), it is negatively correlated with environmental regulations. When it is at 0.1057 < PR ≤ 0.2565 and 0.2565 < PR, the impact of environmental regulations is significantly positive at 1% level of significance. Meanwhile, the coefficient in the fourth range is more significant than that in the third range. This indicates there is a “threshold” effect on the promotion of the enterprise profit rate by environmental regulations. On the one hand, the higher the enterprise profit rate, the more beneficial environmental regulations are for the enterprise profit rate. On the other hand, an enterprise with a low or negative profit rate, with its ensuing capital shortage, can fall into a vicious cycle. With binding environmental regulations, it is difficult for the enterprise to carry out technological innovation and production development after using limited capital to control enterprise pollution. Overall, we see that when the profit rate exceeds a certain threshold, environmental regulation can play a significant role in promoting higher profit rates.

A similar scenario occurs when we examine how R&D intensity influences enterprise profit rate. After a certain “threshold” is crossed, R&D intensity significantly promotes corporate profit rate. Specifically, when the profit rate is at a low level (PR ≤ −0.0332 and −0.0332 < PR ≤ 0.1205), R&D intensity negatively correlates with the enterprise profit rate. When it is at 0.1205 < PR ≤ 0.2506 and 0.2506 < PR, the impact of R&D intensity on enterprise profit rate is significantly positive at 1% level. At the same time, the coefficient in the third range is significantly smaller than that in the fourth range. This indicates there is a “threshold” effect on the R&D intensity’s promotional effect on enterprise profit rate. To be specific, the higher the enterprise profit rate is, the more conducive improvement of the R&D intensity on profit rate. Furthermore, when the profit rate exceeds a certain threshold, R&D intensity, just like environmental regulation, also acts significantly in improving profit rate. This also indicates that the findings in the literature are inconsistent and there is a need for the use of the threshold model.

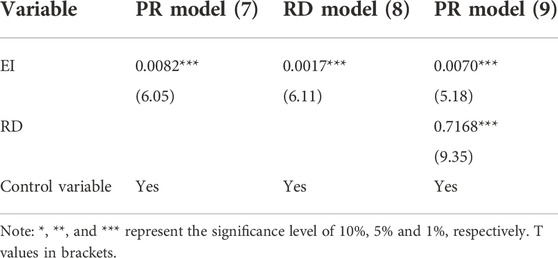

In Table 4, model (3) shows the positive impact of the interaction terms of environmental regulations and R&D intensity on enterprise profit rate. Regression results reveal that the product terms of environmental regulations and R&D intensity have a positive impact on enterprise profit rate at the significance level of 1%. Thus, another question can be raised: does R&D intensity have a mediation effect on the impact of environmental regulation on corporate profit rates? To answer this question, we build models (7-9) as described below:

Here,

The following steps were followed to test for mediation. First, we test the total effect of environmental regulation on enterprise profit rate, that is, to test the significance of the coefficient

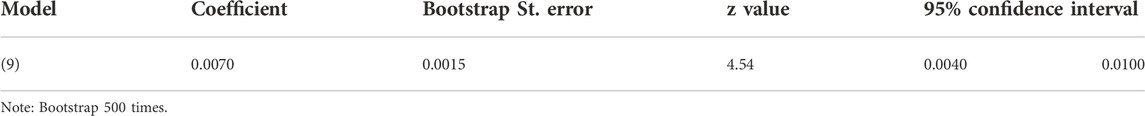

The mediation effect of R&D intensity is shown in Table 7. In models (7), (8) and (9),

As shown in Table 8, we test the significance of the coefficient product

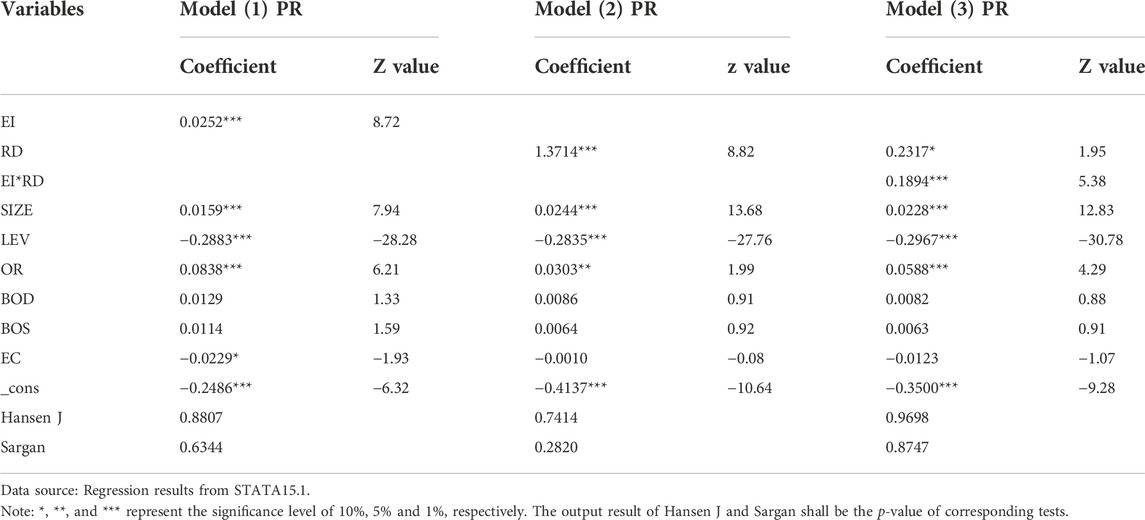

Considering that the main independent variables and the dependent variables may have interactive endogenous relationship and the missing variables may also cause the endogenous relationship, we employ the generalized method of moments (GMM) method as it can solve the autocorrelation and heteroscedasticity problems in a better way and can effectively control the endogenous problems [30–32]. Then the results are compared with those from the OLS mixed regression. The regression results are listed in Table 9.

The test results obtained by Hansen J and Sargan show that the p-value is always larger than 10%. This confirms that the model has no excessive identification problem and the variables included in the model are effective. The regression results obtained by models 1 to 3 show that the regression coefficient of the environment index on enterprise profit rate is 0.0252 and the t-value is 8.72. It means that the environment index significantly and positively impacts enterprise profit rate at the 1% level. The regression coefficient of R&D intensity on enterprise profit rate is 1.3714, and the t-value is 8.82. It means that the R&D intensity significantly and positively impacts the enterprise profit rate at the 1% level. The coefficient of the product term of environment index and R&D intensity is 0.1894 and the t-value is 5.38. It means that the product term of environment index and R&D intensity has a positive influence on enterprise profit rate at the 1% significance level and that the environment index can positively improve the promotion effect of R&D intensity on enterprise profit rate. Among all the independent variables, only regression coefficients are slightly increased. However, the regression direction and significance degree are the same as those from the OLS mixed regression. Among all the control variables, the firm size and organizational redundancy have a significant and positive influence on the enterprise profit rate, and the debt to asset rate has a significant and negative influence on the enterprise profit rate. In addition, the scale of the board of supervisors does not show a significant positive influence in the three models, which is the same as the OLS regression result.

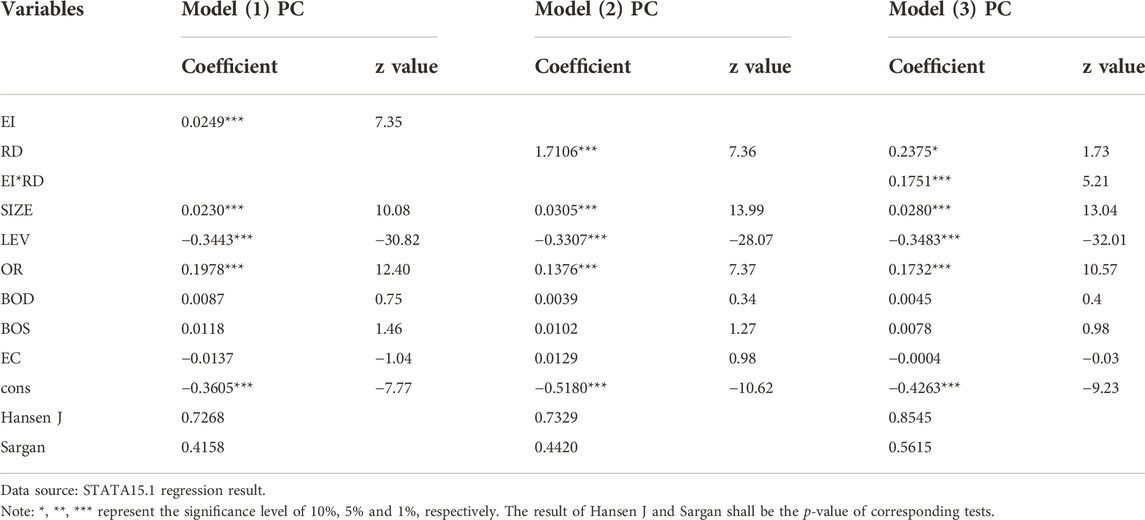

In order to verify the robustness of the regression result, the PR variable is replaced by the profit rate of cost (PC). The PC is included in the model and then the regression analysis is conducted on the model through the GMM method. The regression results are summarized in Table 10.

Based on the regression results shown in Table 10 and the test results obtained by Hansen J and Sargan, we can see that the p-value is always larger than 10%, which proves that the model has no excessive identification problem and the variables applied in the model are effective. Meanwhile, the regression coefficient direction and the significance degree of main independent variables are consistent with those listed in Table 9. The environment index and R&D intensity all have a positive influence on firm profit at the 1% significance level. The product term of environment index and R&D intensity has a positive influence on enterprise profit rate at the 1% significance level. In addition, the environment index can improve the positive influence of R&D intensity on enterprise profit rate. Therefore, the results show that the empirical results obtained in this research are robust.

5 Conclusion, policy insights and future research

5.1 Conclusion

In this paper, we conduct empirical research on the relationships among environmental regulations, R&D intensity, and enterprise profit rate. Our results show that environmental regulation itself has a positive impact on enterprise profit ratio at a significance level of 1%. R&D intensity also has a positive impact on enterprise profit rate at a significance level of 1%. Moreover, the product term of environmental regulation and R&D intensity has a positive impact on the enterprise profit rate at a significance level of 1%. We can argue that to a certain extent, stricter environmental regulation will encourage firms to carry out technological innovation, increase R&D intensity, improve the firm’s production efficiency and product quality, and further reduce the cost, which eventually improves the enterprise profit rate. Hence, our research results show that environmental regulations, on the one hand, can incentivize firms in the heavy pollution industry to pursue environmental protection, which can reduce the cost and penalty due to environmental pollution. In this way, environmental regulations can improve enterprise profit rate. On the other hand, environmental regulations can also directly result in more innovation and productivity improvement which is beneficial to profitability.

Based on the empirical results, we can conclude that stricter environmental regulations will encourage a company in heavily polluting industries to carry out technological innovation, increase R&D intensity, and improve production efficiency and product quality to a certain extent. This can reduce its costs and improve its profit margin. In practice, the government’s environmental regulatory tools may not be sufficiently targeted. Hence, pollution taxes, tradable pollution permits, and environmental subsidies should be set according to the type of industry. The regulation of heavy polluting and high-emission enterprises should be strengthened. The government can also strengthen key monitoring and surprise inspections and increase pollution charges for enterprises that violate environmental protection policies. At the same time, the government can incorporate environmental indicators into the performance assessment of local governments, increase the proportion of energy consumption and environmental pollution, strictly implement environmental regulation policies, and dynamically monitor the implementation of enterprises.

In this paper, the “Porter Hypothesis” has been further verified based on the listed companies in China’s heavily polluting industries. As stated earlier, companies in heavily polluting industries should adopt more targeted environmental regulation tools, and so on. To this end, they should carry out technological innovation, increase R&D intensity, and improve production efficiency and product quality.

Furthermore, our study shows that environmental regulations and R&D intensity at different quantiles have different degrees of influence on enterprise profit rate. Only when the enterprise profit rate exceeds a certain threshold can environmental regulations and R&D intensity play significant roles in improving profit. Meanwhile, the mediating effect model shows that R&D is a mediating variable between environmental regulations and enterprise profit rate. This implies that environmental regulations affect firm profitability indirectly through R&D intensity. To avoid a potential endogenous relationship, we also employ the GMM and obtain similar results. Furthermore, we confirm the robustness of our results by replacing the profit rate with the profit rate of cost.

5.2 Policy insights and suggestions

Stricter environmental regulations can encourage a firm to carry out technological innovation, increase R&D intensity, improve the firm’s production efficiency and product quality, and eventually raise firm profit ratio. Therefore, the government should devise regulations which are highly targeted and practical. For example, pollution taxes, tradable pollution permits, and environmental subsidies can be designed according to industry characteristics. The regulations of firms in the heavy pollution industries should be strengthened. Besides, pollution penalties should be increased for heavy pollution enterprises which violate environmental protection policies, especially the larger enterprises with higher levels of enterprise profit ratio. Furthermore, the government should pay more attention to environmental protection, strictly implement environmental regulation policies, and dynamically supervise the implementation of the policies by the enterprises. At the same time, the government needs to increase scientific research support, stimulate technological innovation behavior, and provide financing channels and tax returns for enterprises to carry out R&D activities. In particular, the heavily polluting enterprises, which are weak but pay attention to R&D input, should earn more funding, technology, and talent support. Enterprises should also set up a long-run vision, increase R&D intensity and investment in environmental protection, enhance independent innovation capability, and achieve the unity of economic, ecological, and social benefits. To conclude, we know that a green and low-carbon economy is the trend of sustainable development. Enterprises need to improve the technical level by increasing the investment on pollution control technology, to improve the utilization efficiency of resources, reduce pollution emissions and lower the burden on the environment. It is highly regarded to produce high value-added and environment-friendly products to meet the consumption upgrades.

In practice, the government’s environmental regulation tools are not sufficiently targeted, and the specific policies for heavily polluting industries are not sufficiently comprehensive. For companies in heavily polluting industries, the government should adopt more targeted environmental regulation tools, set stricter environmental standards, strengthen key monitoring and surprise inspections, and increase pollution charges for enterprises that violate environmental protection policies. However, after the pollution penalty reaches a certain amount, there will be a phenomenon where the pollution penalty is higher than the “revenue” of pollution discharge, which will incentivize firms to carry out technological innovation, strengthen research and development, and improve their production efficiency and product quality. This will reduce corporate costs and improve profit margins.

5.3 Deficiencies and prospects

Although this study provides valuable insights, to some extent, it omits the following issues. First, each region of the country has a different resource endowment, its environmental regulation is different, and its degree of social and economic development is not the same. Hence, heterogeneity analysis in this research is quite limited. Second, there are many types of environmental regulations, and the impact of each on enterprises will also be different. Third, environmental regulations and R&D intensity in various regions will affect the choice of enterprises to invest in setting up factories in the local region or otherwise, resulting in the spatial spillover effect.

5.4 Possible future research directions

In view of the above deficiencies, the following research directions can be pursued in the future. First, we can examine the heterogeneity between eastern, central, and western regions, coastal and non-coastal regions. By considering regional differences in future research, heavily polluting industries in different regions can be provided with more targeted policy recommendations. Second, future research can examine each individual type of regulation, expand research indicators, and analyze the impacts of different types of environmental regulations on corporate profit margins. Third, we can employ the spatial panel model to consider the spatial spillover effects of environmental regulation and R&D intensity, as well as the impacts on corporate profit margins.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author contributions

All authors listed have made a substantial, direct, and intellectual contribution to this paper and approved it for publication.

Funding

VS research is supported by The Natural Sciences and Engineering Research Council of Canada (Grant # 213090). MC research is supported by the Humanities and Social Science Youth Fund, the Ministry of Education of China (Project # 22C10592058).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Albrizio, S., Kozluk, T., and Zipperer, V. (2017). Environmental policies and productivity growth: Evidence across industries and firms. J. Environ. Econ. Manag. 81, 209–226. doi:10.1016/j.jeem.2016.06.002

Awan, U., Shamim, S., Khan, Z., Zia, N. U., Shariq, S. M., and Khan, M. N. (2021). Big data analytics capability and decision-making: The role of data-driven insight on circular economy performance. Technol. Forecast. Soc. Change 168, 120766. doi:10.1016/j.techfore.2021.120766

Berman, E., and Bui, L. T. M. (2001). Environmental regulation and productivity: Evidence from oil refineries. Rev. Econ. Statistics 83 (3), 498–510. doi:10.1162/00346530152480144

Brolund, J., and Lundmark, R. (2017). Effect of environmental regulation stringency on the pulp and paper industry. Sustainability 9 (12), 2323. doi:10.3390/su9122323

Dai, J., Chen, B., Hayat, T., Alsaedi, A., and Ahmad, B. (2015). Sustainability-based economic and ecological evaluation of a rural biogas-linked agro-ecosystem. Renew. Sustain. energy Rev. 41, 347–355. doi:10.1016/j.rser.2014.08.043

Guo, Y., and Zhang, L. (2014). The impact of environmental regulation on P & D of industrial enterprises in China. China Popul. Resour. Environ. 24 (S3), 104–107.

Jaffe, A. B., and Palmer, K. (1997). Environmental regulation and innovation: A panel data study. Rev. Econ. statistics 79 (4), 610–619. doi:10.1162/003465397557196

Jorgenson, D. W., and Wilcoxen, P. J. (1990). Environmental regulation and US economic growth. Rand J. Econ. 21, 314–340. doi:10.2307/2555426

Ke, J., and Lu, X. (2011). Environmental regulation and technological innovation: Based on the panel data of China from the year of 1997 to 2007. Sci. Res. Manag. 32 (7), 60–66.

Kong, H., and Zhang, Y. (2018). Environmental regulations, corporate profitability and industrial transfer. J. Southwest Minzu Univ. Humanit. Soc. Sci. 39 (12), 118–127.

Lanoie, P., Patry, M., and Lajeunesse, R. (2008). Environmental regulation and productivity: Testing the porter hypothesis. J. Product. Anal. 30 (2), 121–128. doi:10.1007/s11123-008-0108-4

Li, G., Chen, N., and Min, R. (2011). Growth and sources of agricultural total factor productivity in China under environmental regulations. Resour. Environ. 21 (11), 153–160.

Li, P., and Chen, Y. (2019). The influence of enterprises’ bargaining power on the green total factor productivity effect of environmental regulation—evidence from China. Sustainability 11 (18), 4910. doi:10.3390/su11184910

Li, Y., Lin, J., and Qian, Y. (2019). Manufacturer’s green production decision under environmental regulation and the influence of technology learning factors. Chin. J. Manag. 05, 721–727.

Liu, C., Wang, T., and Guo, Q. (2019). Does environmental regulation repress the international R&D spillover effect? Evidence from China. Sustainability 11 (16), 4353. doi:10.3390/su11164353

Liu, J., Zheng, G., Liu, L. T., Guan, J., Cai, L. L., et al. (2013). Effects of huannao yicong recipe extract on the learning and memory and related factors of Abeta generation in the brain of APP transgenic mice. J. Industrial Technol. Econ. 11, 90–94.

Long, X., and Wan, W. (2017). Environmental regulation, corporate profit rates and compliance cost heterogeneity of different scale enterprises. China Ind. Econ. 06, 155–174.

Mele, M., and Magazzino, C. (2020). A machine learning analysis of the relationship among iron and steel industries, air pollution, and economic growth in China. J. Clean. Prod. 277, 123293. doi:10.1016/j.jclepro.2020.123293

Palmer, K., Oates, W. E., and Portney, P. R. (1995). Tightening environmental standards: The benefit-cost or the no-cost paradigm? J. Econ. Perspect. 9 (4), 119–132. doi:10.1257/jep.9.4.119

Peuckert, J. (2014). What shapes the impact of environmental regulation on competitiveness? Evidence from executive opinion surveys. Environ. Innovation Soc. Transitions 10, 77–94. doi:10.1016/j.eist.2013.09.009

Shen, N., and Liu, F. (2012). Can intensive environmental regulation promote technological innovation? Porter hypothesis reexamined. China Soft Sci. 04, 49–59.

Xie, M., Guo, J., and Wang, J. (2016). Environmental regulation, technological innovation and enterprises' transformation. R&D Manag. 28 (1), 84–94.

Yuan, Y., and Xie, R. (2016). Environmental regulation and the ‘green’ productivity growth of China’s industry. China Soft Sci. 07, 144–154.

Keywords: environmental regulations, R&D intensity, enterprise profit rate, heavy pollution industry, green revolution, environmental economics

Citation: Chen M, Shi V and Wei X (2022) Environmental regulations, R&D intensity, and enterprise profit rate: Understanding firm performance in heavy pollution industries. Front. Environ. Sci. 10:1077209. doi: 10.3389/fenvs.2022.1077209

Received: 22 October 2022; Accepted: 24 November 2022;

Published: 08 December 2022.

Edited by:

Usama Awan, Inland Norway University of Applied Sciences, NorwayReviewed by:

Narongsak Sukma, Mahidol University, ThailandMatheus Koengkan, University of Aveiro, Portugal

Copyright © 2022 Chen, Shi and Wei. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Xiaobo Wei, MjAxODAxMDI4QG1haWwuZ3VmZS5lZHUuY24=

Meilan Chen1

Meilan Chen1 Victor Shi

Victor Shi