- 1School of Business, Anhui University, Hefei, China

- 2School of Economics, Anhui University, Hefei, China

The fulfillment of ESG responsibility by enterprises is crucial to achieving China’s “double carbon goal” and the sustainable development of the whole society. However, ESG development is facing financing constraints and information asymmetry, while the rapid development of fintech supports ESG development to improve quality and efficiency. Therefore, it is crucial to study the impact of fintech on corporate ESG development. Can financial technology (FinTech) “empower” traditional financial institutions with technology to improve corporate ESG performance? Based on this, this paper examines the relationship between regional FinTech development and corporate ESG performance and its underlying mechanisms from internal and external perspectives, using data from Chinese A-share listed companies from 2011 to 2020. The following were found: 1) The level of regional FinTech development significantly contributes to firms’ ESG performance, and the results remain robust after mitigating endogeneity using Bartik instrumental variables and difference-in-differences model estimation. 2) Mechanistic analysis finds that FinTech not only alleviates the internal financing constraints of firms, but also enhances the external government subsidies and tax rebates of firms. These significantly contribute to the improvement of firms’ ESG performance. 3) Heterogeneity analysis shows that the contribution of FinTech to improving corporate ESG performance is more pronounced in the eastern region, mature firms and firms with CEOs with unbanked financial backgrounds. Therefore, in the context of sustainable development, we should continue to promote the development of FinTech, use modern technology to “empower” finance, and help enterprises balance economic and social benefits to build a sustainable country.

1 Introduction

Friedman (2007) believes that the only social responsibility of a company is profit maximization. This view of maximizing corporate economic efficiency has many followers (Benabou and Tirole, 2010). However, this view has become controversial with the increasing prominence of sustainability issues, such as climate change, environmental pollution, and public health. In such an economic and social context, companies should actively implement environmental (E), social (S) and governance (G) development concepts, and seek solutions to the crisis at the corporate level by practicing ESG concepts (Hsueh, 2019; Cordazzo et al., 2020). ESG is currently receiving widespread attention from investors and government policies. Under the impact of the new crown epidemic, the scale of responsible global investment driven by the demand for green recovery is rising, and the number of institutions signing up to the UN-backed Principles for Responsible Investment will surge by 28% in 2020. Although China’s ESG development started late, the community is paying more and more attention to it. In particular, ESG policies and investments have increased significantly since General Secretary Xi proposed the goal of “2060 carbon neutrality” at the UN General Assembly.

However, there are still some potential problems and challenges with current corporate ESG practices. Corporate ESG practices have high capital needs and uncertainty (Broadstock et al., 2021), and the inherent information asymmetry can make it difficult for a large number of companies with sustainable development capabilities to receive policy leverage (Pedersen et al., 2021). These problems eventually lead to severe external financing challenges for corporate ESG development. In recent years, science and technology have fueled the development of financial markets, and financial technology (FinTech Financial Technology) has seen explosive growth (Haddad and Hornuf, 2019). FinTech and ESG share a common green gene, and corporate ESG investments will have more significant opportunities for development in the context of the widespread use of FinTech (Macchiavello and Siri, 2022). So, can fintech development contribute to improved ESG performance of actual firms? Moreover, what are its mechanisms of action? Established studies have mainly examined national economic development (Cai et al., 2016), industry category (Borghesi et al., 2014), social capital (Jha and Cox, 2015), contingencies (Ali et al., 2019), executive characteristics (Cronqvist and Yu, 2017), and institutional investor ownership (Dyck et al., 2019; Nofsinger et al., 2019) and other factors on corporate ESG performance, few scholars have explored the impact of fintech development on corporate ESG performance and its mechanisms. Therefore, clarifying the impact of fintech development on corporate performance and its mechanisms fills the current research gap and has far-reaching implications for promoting sustainable social and economic development.

Specifically, this paper takes Chinese A-share listed companies from 2011–2021 as a sample and refers to Su et al. (2021) to construct a regional FinTech development index by using Python crawler technology to crawl the FinTech keywords of each prefecture-level city (municipality directly under the central government) during 2011–2021. The impact of regional FinTech development on corporate ESG performance was examined. The regression results of the fixed-effects model indicate that the improvement of regional FinTech level significantly contributes to enterprises’ ESG performance. The above findings still hold after a series of robustness tests, such as controlling for regional financial development and changing the measure of corporate ESG performance. In this paper, to mitigate the possible endogeneity problem of the study, firstly, a double difference model is constructed to mitigate the potential endogeneity by using China’s Plan for Promoting Financial Inclusion Development (2016–2020) issued in December 2015 as a shock event. Second, this paper draws on Bartik (2006) to construct a “Bartik instrumental variable” to mitigate potential endogeneity by multiplying the growth rate of the national FinTech development index by the number of regional FinTech firms lagged by one order. The empirical results of mitigating endogeneity still support the conclusion that “the increase in regional FinTech levels significantly contributes to firms’ ESG performance.” This study also tests the mechanism through a mediating effects model. The empirical results of the mediating model indicate that FinTech not only alleviates the internal financing constraints of firms but also increases the external government subsidies and tax rebates of firms, which significantly contribute to the improvement of ESG performance. Heterogeneity analysis shows that the contribution of FinTech to improve corporate ESG performance is more pronounced in mature firms and firms whose CEOs have no banking and finance background.

Compared with the existing literature, the contributions of this paper are as follows. 1) In terms of research perspective, this paper innovatively incorporates the level of regional FinTech development into the ESG research framework, linking the field of sustainable finance with the field of FinTech (Macchiavello and Siri, 2022), which is an essential expansion of ESG research. 2) In terms of research objects, previous studies have mainly explored the impact of digital technology on sustainable development performance using regions and industries as research objects. Although some literature has examined the relationship between FinTech and sustainable development performance (Deng et al., 2019), the research objects have not focused on firms. They have not directly addressed the ESG performance of firms. This paper focuses on the study of FinTech development on the ESG performance of firms. 3) In terms of research mechanism, this paper provides an in-depth portrayal of the impact mechanism of FinTech development on the ESG performance of enterprises from the dual paths of internal financing constraints and external government fiscal incentives, which provides micro empirical evidence for promoting the deep integration of finance and technology, and formulating reasonable, sustainable development policies.

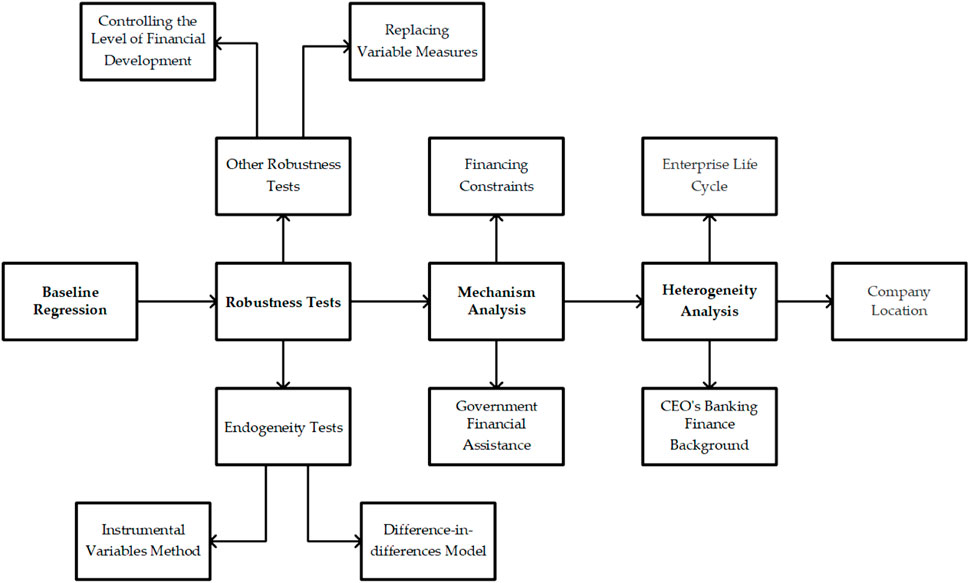

The following is organized as follows: Section 2 describes the theoretical analysis and research hypothesis. Section 3 explains the data sources, variable definitions, and Model Construction. Section 4 is the empirical results and their analysis. Section 5 is the robustness test. Section 6 is the mechanism analysis. Section 7 is the heterogeneity analysis. Section 8 is the conclusion and policy recommendations. Figure 1 shows the research framework.

2 Theoretical analysis and research hypothesis

2.1 FinTech and corporate environmental social and governance performance

A variety of factors influence the ESG performance of firms. From within firms, several scholars have studied executive characteristics (Ikram et al., 2019; Xu and Zhao, 2022), institutional investor ownership (Dyck et al., 2019; Nofsinger et al., 2019), and family firms (Abeysekera and Fernando, 2020), among others, have an impact on corporate ESG performance. From outside the firm, scholars have examined its impact on corporate ESG performance in terms of national economic development (Cai et al. (2016), industry category (Borghesi et al., 2014), and social capital (Jha and Cox, 2015). However, there is a lack of research on the relationship between FinTech and corporate ESG performance. As essential support for building green financial systems, FinTech will play a key role in effectively supporting the sustainable development of green financial services. The report Sustainable Finance and FinTech in Europe states that EU policymakers should focus on the synergies between sustainable finance and FinTech, and consider FinTech a key driver of sustainable development (Dell’Erba, 2021). This is because FinTech can not only accelerate the development of green and inclusive financial markets (Visconti and MicroFinTech, 2019) but also play a leading role in sustainable development by facilitating the green transformation of consumers and businesses through extensive data analysis and artificial intelligence (Duchêne, 2020).

In terms of environmental protection (Environmental)—Currently, companies are actively promoting the “green financial system” through financial technology (Muganyi et al., 2021). Technological advances can break enterprises’ resource dilemma and improve resource utilization efficiency, ultimately achieving the goal of improving environmental quality. From an industrial perspective, FinTech innovation mainly relies on technologies such as big data and artificial intelligence to optimize the industrial structure and thus improve the ecological environment by improving green credit capacity and increasing green investment (Zhou et al., 2022). From an enterprise perspective, FinTech can significantly promote enterprises’ environmental protection investment (Mi and Coffman, 2019; Xue et al., 2022).

In terms of social responsibility (Social)—Companies need a certain amount of capital to invest in social responsibility, and when they face strong financing constraints, they stop carrying out social responsibility activities (Chan et al., 2017; Leong and Yang, 2021), while FinTech can effectively alleviate financing constraints, which in turn enables companies to invest more money into corporate social responsibility (Xin et al., 2022). At the same time, relaxing financing constraints can help improve corporate performance (Cao and Leung, 2020; Impullitti, 2022). When firms show good performance, they will have more funds to invest in socially responsible activities, ultimately improving their social responsibility performance (Xin et al., 2022).

In terms of corporate governance (Governance)—The businesses of firms in regions with high levels of FinTech development are primarily digital, and firms’ digital operations are exposed to the risk of cyber-attacks and data theft by competitors (Treleaven, 2015). From a geographical perspective, Najaf et al. (2021) argued that firms with high levels of FinTech operate across geographical boundaries to a greater extent, and firms will face higher foreign exchange and political risks (Faccio, 2006). Higher operational risk makes firms improve the quality of their internal governance (Claessens and Fan, 2002; Sinnadurai, 2018). From an industry perspective, FinTech companies develop new applications and services for different industrial sectors, and therefore need to be familiar with the operational risk factors of these industries. Interaction with different industries may require different capital expenditures (Ali et al., 2018), and interaction with new industries may entail higher operational costs (Karuna, 2007). Evidence from the above suggests that while FinTech brings many benefits to firms, they are also taking higher operational risks associated with their business’s cross-industry and cross-regional nature. Therefore, firms with high levels of regional FinTech have better corporate governance performance than other firms.

Thus, a high level of FinTech development can catalyze corporate ESG development (Verhagen, 2020). Incorporating FinTech into the framework of economic, social, and environmental sustainability research can not only “empower” traditional financial institutions through technology and guide the green transformation of enterprises, thus promoting their ESG performance, but also has important practical implications for sustainable economic and social development (Varga, 2018). Based on the above analysis, this paper proposes:

2.2 FinTech, financing constraints, and corporate environmental social and governance performance

The current Chinese capital market is still imperfect, and ESG investment by firms is highly uncertain. Furthermore, ESG relies more on financing because of the significant upfront investment and difficulty in obtaining a quick return (Broadstock et al., 2021). However, there are severe information asymmetries between banks and firms and financial disincentives, which make firms suffer from financing constraints. In contrast, highly developed financial markets can reduce the financing constraints faced by firms and alleviate corporate financial distress, thus helping to improve their ESG performance. Anshari et al. (2019) found that FinTech-enabled digital markets can promote the sustainability of agricultural business processes, thereby improving access to financing (e.g., crowdfunding) and thus promoting sustainability in agriculture.

The development of FinTech can alleviate firms’ financing constraints by reducing the information asymmetry between banks and firms, thus contributing to the ESG performance of firms. FinTech empowers financial institutions through technology spillover effects and uses new information technologies, such as intelligent matching, ample data storage, and cloud computing, to process data at scale and deeply mine user information (Lapavitsas and Dos Santons, 2008), significantly improving the information acquisition capability of financial institutions. Financial institutions get comprehensive information about multiple companies by comparing the multidimensional data acquired by FinTech horizontally and vertically, to a certain extent smoothing the information gap between companies and investors and between companies, and effectively alleviating the corporate financing constraints of companies (Heiskanen, 2017). Meiling et al. (2021) using 11 Asia Pacific countries’ panel data, found that FinTech development does alleviate corporate financing constraints and thus promotes the sustainable performance of healthcare firms. This suggests that FinTech is vital in alleviating firms’ financing constraints and promoting sustainable performance.

FinTech can also ease the financing constraints of enterprises by optimizing financing channels, which in turn promotes their ESG performance. The characteristics of long-tail customers with low financial demand, long-term green finance funds, and challenging-to-evaluate environmental benefits will face a high ESG development cost. Based on a series of deep learning algorithms and portfolio models, FinTech promotes the expansion of financial services to long-tail groups lacking financial knowledge, helping to broaden financial consumers’ investment demand in the stock and bond markets and reducing ESG development costs. On the other hand, FinTech, with its technical advantages such as data information immutability and distributed fault tolerance, can fundamentally improve the infrastructure construction of securities registration, trading, clearing, and settlement (Chiu and Koeppl, 2019), and improve the capital market system with technology-driven improvement, through which the quality of capital market financing can be improved. Undoubtedly, improving the capital market financing degree and quality via FinTech will directly alleviate the financial constraints of enterprises in developing ESG. Based on the above analysis, this paper proposes:

2.3 FinTech, government subsidies, tax rebates, and corporate environmental social and governance performance

Currently, the upfront investment of companies in implementing ESG investments is significant, and it is challenging to obtain returns quickly (Broadstock et al., 2021), which manifests strong positive externalities to the market, and many companies lack the incentive to make ESG investments. Government subsidy-related positive externalities have price properties that can motivate firms to adhere to business operations with strong positive externalities. Therefore, fiscal incentive policies can motivate firms to make ESG investments and thus improve their overall ESG performance. However, information asymmetry can lead to a lack of complete corporate ESG data in government departments, which makes it impossible to accurately quantify the ESG investment process of enterprises and distinguish the merits of corporate ESG projects, making it difficult for a large number of enterprises with sustainable development capabilities to receive government policy tilts. The development of regional FinTech can effectively promote the government’s fiscal incentive policies and thus improve corporate ESG performance. Specifically, on the one hand, the government uses FinTech to exploit big data and blockchain technology to assess enterprise characteristics in a comprehensive manner ex-ante (Zhu, 2019), to make an accurate value assessment of enterprises, and to form a quick and accurate portrait of enterprise customers. Afterward, the government quickly grasps enterprises’ dynamic information, supervises enterprises’ operations, and improves the liquidity and security of government subsidies and tax rebate funds (Tasnia et al., 2020; Zhang, 2022). On the other hand, as ESG investment by enterprises is continuous and high-risk, enterprises that rely on government finance and tax incentives for a long time are prone to hedonistic thinking and corruption, which eventually produces a crowding-out effect. FinTech, with the help of artificial intelligence, big data, and other means, can help enhance the government’s ability to track and monitor ESG activities in real-time and reduce the hedonism of enterprises, thus improving the accuracy of fiscal tools and tax policies to stimulate the ESG performance of enterprises.

In addition, data sharing between government departments and financial institutions breaks down data barriers, which helps the government collect enterprise information and improve the efficiency of approving enterprise ESG investment projects. Banks transmit the relevant data of enterprises to the government, which then analyzes the massive amount of information of the enterprises based on machine learning and other algorithms, identifies enterprises with sustainable development potential, provides subsidies in a timely and efficient manner, and alleviates the problem of financing constraints faced by enterprises. At the same time, government subsidies to enterprises affirm ESG investment, and enterprises will thus be more motivated to carry out ESG investment. Government subsidies also control enterprise risks and credit, and FinTech provides more information about enterprise characteristics and business risks for government departments through deep data mining and analysis, which is conducive to specific government policies. Based on the above analysis, this paper proposes:

3 Research design

3.1 Data sources

This paper selects A-share listed companies in China from 2011–2021 as the primary research object. Enterprises’ financial data are mainly from the CSMAR database, and the ESG rating data are from the Wind Information Financial Terminal. Meanwhile, in order to ensure the accuracy and reliability of the empirical analysis results, this paper performs some treatments on the initial research sample, such as the following: 1) Excluding the sample of the financial industry because the financial status, asset status, and operation characteristics of listed companies in the financial industry are quite different from those of other industries. 2) Excluding companies treated as ST, *ST, and PT during the sample period because these companies have been losing money for years and their financial data are relatively abnormal. 3) Excluding data samples with gearing ratios not in the range of 0–1 and other abnormal financial indicators. In addition, to prevent the empirical results from being affected by extreme values, this paper enacts a 1% tail reduction on continuous variables. We finally obtained 18,455 firm-annual observations for 2011–2020, and the sample size will change in subsequent regressions due to missing values for some variables.

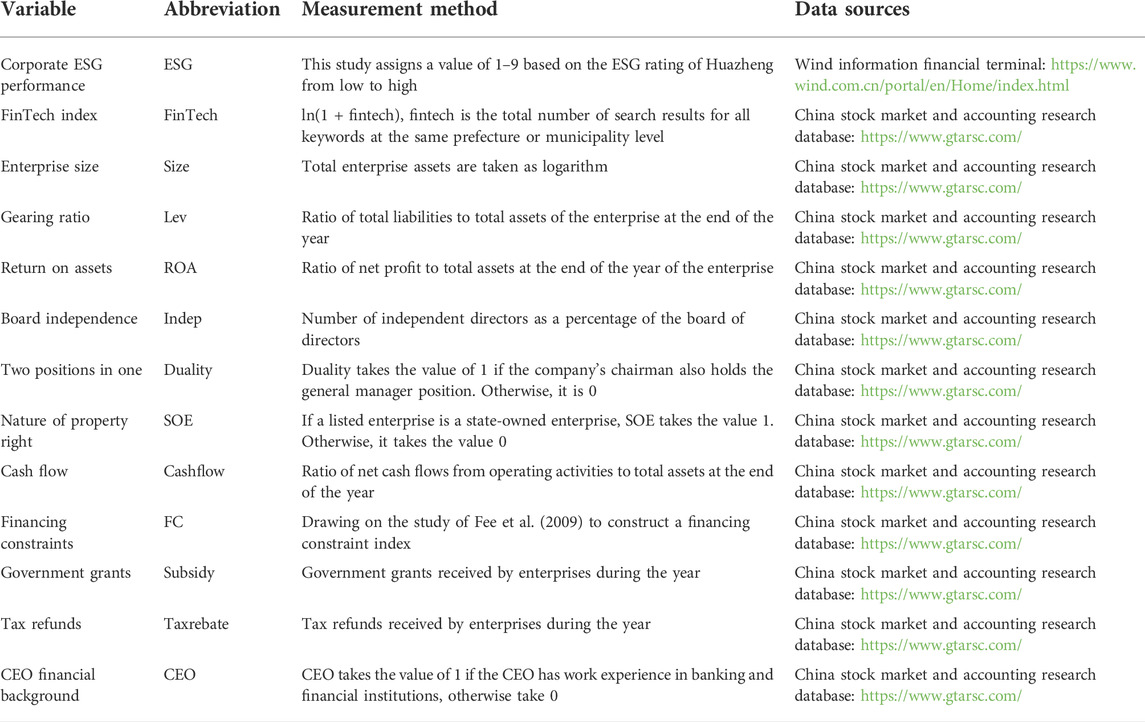

3.2 Variable definition

3.2.1 Explained variables

The explained variable is firm ESG performance. ESG is an acronym for Environmental Social and Governance (ESG), which includes a company’s environmental impact, social responsibility, and internal governance. Companies use ESG performance to regulate and monitor their behavior, and it is used by investors to measure the sustainability of their portfolio companies or assets. The ESG ratings in this article are derived from the ESG rating data of CSI. Concerning the mainstream international methodology and practical experience, CSI ESG ratings draw on the core elements of international ESG, and combine the national conditions and characteristics of China’s capital market to provide the market with the rating results of environmental, social, and corporate governance dimensions of Chinese A-share and bond issuers, as well as other securities issuers. Recently, the ESG rating data of Chinese securities have been widely recognized and applied by the business and academic communities (Lin et al., 2021). In this paper, we refer to similar literature to assign ESG ratings from low to high, and quantify corporate ESG ratings as continuous variables taking values from one to nine.

3.2.2 Explanatory variables

The explanatory variable is regional FinTech development. This paper refers to the research of Su et al. (2021) and Yao et al. (2021). It extracts the keywords related to financial technology (EB-level storage, blockchain, differential privacy technology, big data, third-party payment, secure multi-party computing, distributed computing, equity crowdfunding financing, Internet finance, machine learning, open banking, brain-like computing, quantitative finance, stream computing, green computing, memory computing, NFC payment, artificial intelligence, etc.). Second, this study matches these keywords with all prefecture-level cities or municipalities in China. In the Baidu News Advanced Search, it searches for prefecture-level cities or municipalities + keywords by year. For example, if you search for “Beijing + artificial intelligence,” Baidu News Advanced Search can give you the number of news pages containing both “Beijing” and “artificial intelligence” between 2011 and 2021. The number of news pages containing both “Beijing” and “artificial intelligence” between 2011 and 2021. Finally, we used Python web crawler technology to crawl the source code of Baidu news advanced search pages, extract the number of search results, and add up the number of search results for all keywords at the same prefecture or municipality level to obtain the total search volume. Since the distribution of this indicator is significantly right-skewed, this paper log-transforms this indicator as a measure of this indicator to measure the level of financial technology development (FinTech) at the level of the prefecture-level city or municipality directly under the central government.

3.2.3 Control variables

In this paper, we refer to the existing literature and add the following control variables that may affect the ESG performance of firms to the econometric model so as to alleviate the problem of model endogeneity due to omitted variables while improving the efficiency of regression estimation.

(1) Firm size (Size). Firm size is an essential factor affecting ESG performance. The larger the size, the more productive the firm’s products and the betters its reputation. For the sake of the ongoing development of enterprises, they are more inclined to make ESG investments and improve their risk management capabilities. This paper uses the logarithm of total corporate assets to measure firm size.

(2) Gearing ratio (LEV). The LEV represents the capital structure and corporate solvency of a company, reflecting the ability of a company to raise debt in order to operate. When a firm faces lower leverage, the firm’s investment in ESG investment is secured, and therefore the firm is more capable of making ESG investments. In this paper, we use the ratio of year-end liabilities to total year-end assets to measure the gearing ratio.

(3) Cash flow (Cashflow). Cash flow represents the current capital position of the enterprise. Enterprises with high cash flow generally have sufficient funds and are subject to lower financing constraints, which is conducive to smoother ESG investments.

(4) Nature of property rights (SOE). The nature of property rights of enterprises is divided into state-owned enterprises and private enterprises. If a listed enterprise is a state-owned enterprise, SOE takes the value 1. Otherwise, it takes the value 0. Compared with private enterprises, state-owned enterprises are subject to the rigid requirements of national development and policy documents, and may pay more attention to the ESG performance of enterprises.

(5) Return on Assets (ROA). Return on assets is one of the most critical indicators of a company’s profitability. A more significant return on assets means that a company can earn more profit per unit of assets. Increased corporate production profit can provide financial security for ESG investment and promote corporate ESG performance. This paper uses the ratio of year-end net profit to total year-end assets to measure a firm’s return on assets.

(6) Two concurrent positions (Duality). Duality takes the value of 1 if the company’s chairman also holds the general manager position. Otherwise, it is 0, which means that there is a severe agency problem within the company, the decision-making regarding significant corporate matters is often biased, and the ESG investment of the company may be affected.

(7) Independence of the board of directors (Indep). Independent directors are not interested in the company, and as such they can monitor corporate governance objectively and impartially, and their expertise and experience play an essential role in assisting the company’s decision-making. This paper uses the ratio of independent directors to the total number of board members to measure board independence.

3.3 Model construction

3.3.1 Baseline regression model

To examine the impact of regional FinTech development level on corporate ESG performance, the following econometric model is constructed for our empirical study.

where ESGi,t is the explanatory variable, indicating the ESG performance of firm i in year t. FinTech is the core explanatory variable in this paper, and its coefficient reflects the effect of regional financial technology level on the ESG performance of firms; when the coefficient is greater than 0, it indicates that the development of financial technology enhances the ESG performance of firms. The controls are a collection of control variables, including firm size (Size), gearing (LEV), cash flow (Cashflow), return on assets (ROA), two-term part-time (Duality), board independence (Indep) and nature of property rights (SOE). λi is the individual fixed effect at the firm level. In addition, a more stringent industry × year fixed effect (τj,t) is added in this paper to control for industry-level unobservables over time, with the subscript t denoting year, j denoting industry, and εi,t being the random disturbance term.

3.3.2 Endogeneity test model

This paper further mitigates the potential endogeneity problem through a double-difference approach. This paper uses China’s Plan for Promoting Inclusive Financial Development (2016–2020), issued in December 2015 as a shock event, and designs quasi-natural experiments to mitigate potential endogeneity. We borrowed the treatment from Vig (2013), and in this paper, cities are grouped according to each city’s median level of FinTech development in 2015. Cities below this median are set as the experimental group and assigned a value of 1. Cities above this median are set as the control group and assigned a value of 0. In terms of time nodes, the years 2016–2020 after the promulgation of the plan are assigned a value of 1. Based on this, a double difference model is set up, as follows:

Treat and Post represent the experimental group and the time point, respectively. Suppose the coefficient of the interaction term between the two is significantly positive. This indicates that the ESG performance of the firms in the experimental group has increased dramatically after the shock of this plan, confirming that regional FinTech development can indeed promote the ESG performance of the firms.

3.3.3 Mechanism test model

As mentioned in the previous theoretical analysis, FinTech may act on firms’ ESG performance through two channels: alleviating firms’ financing constraints and promoting government fiscal subsidies (government grants, tax rebates). Next, this paper proposes constructing the following econometric model to test mediating effects.

where Mi,t are the mediating variables, i.e., the mechanism variables in this paper, which are financing constraint (FC), government subsidy (Subsidy), and tax rebate (TaxRebate), and the rest of the variables have the same meanings as in the previous paper. The specific analysis steps are as follows:

1. The previous paper has verified that FinTech can enhance the ESG performance of firms;

2. Model (3) tests the effect of FinTech on the mediating variables;

3. We include both mediating and explanatory variables in model (4) to determine whether the mediation mechanism holds by testing the sign and significance of the coefficients of the mediating and explanatory variables.

3.3.4 Financing constraint index measurement model

In this paper, we refer to the study of Fee et al. (2009) and calculate the financing constraint (FC) of firms according to the following steps. First, we standardize the three variables of firm size, age, and cash dividend payout rate by year, and determine the financing constraint dummy variable QUFC based on the mean of the standardized variables. If the mean of the variables is above the one-third quantile, the financing constraint of the firm is less severe. The corresponding QUFC is taken as 0 if the mean of the variables is below the one-third quantile, meaning the financing constraint of the firm is more severe. The corresponding QUFC is taken as 2. The probability of occurrence of financing constraint for each year in the firm is fitted using the logit model and defined as the financing constraint index FC (taking values between 0 and 1). The larger the FC, the more serious the financing constraint problem of the firm. In model (6), CASH DIV denotes the cash dividends declared in the year, ta denotes the total assets, NWC denotes the net working capital, and EBIT denotes the earnings before interest and taxes. Table 1 shows the metrics and online links for the main variables.

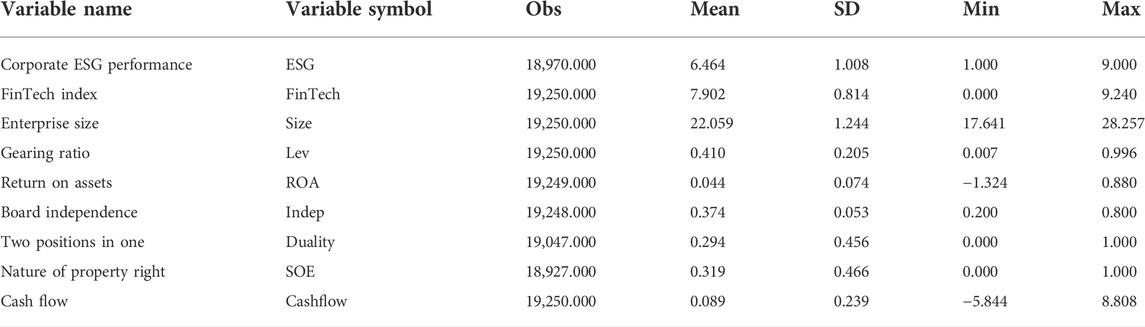

3.4 Descriptive statistics

Table 2 reports the basic statistical characteristics of the main variables.

4 Empirical results

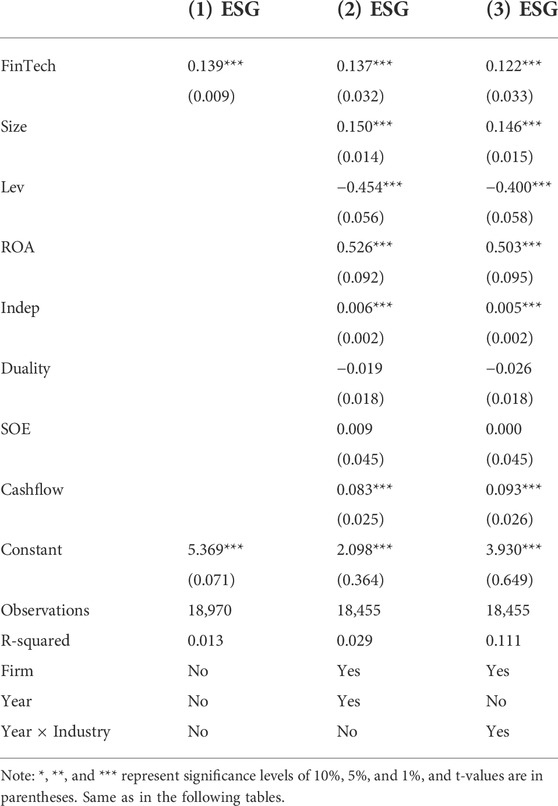

4.1 Baseline regression

Table 3 reports the effects of the benchmark regression of regional FinTech development on the ESG performance of enterprises. The empirical results show that the regression coefficients of FinTech are significantly positive in models (1) to (3), indicating that the FinTech development index constructed in this paper is significantly and positively related to the ESG performance of enterprises. In terms of economic significance, taking model (3) as an example, considering that the mean value of corporate ESG performance is 6.464, every 1% increase in the level of FinTech development in a city increases the ESG performance of local firms by about 0.789 items on average (6.464 × 0.122 = 0.789).

The relationship between the control variables in the regression results and firm ESG performance also meets theoretical expectations: the coefficient of firm size (Size) is positive. It reaches the 1% significance level, indicating that larger firms have better ESG performance. The coefficient of gearing (LEV) is significantly negative at the 1% level, indicating that operating with debt reduces the ESG performance of firms. The coefficient of return on assets (ROA) is significantly positive at the 1% level, indicating that the greater the return on assets, the higher the ESG performance of firms. The coefficient of board independence (Indep) is significantly positive at the 1% level, indicating that better corporate governance can contribute to the ESG performance of firms; the coefficient of cash flow is significantly positive at the 1% level. Cash flow represents a company’s current capital position, and companies with high cash flow generally have sufficient capital and are subject to fewer financing constraints, which is conducive to smoother ESG investments.

5 Robustness tests

5.1 Endogeneity tests

5.1.1 Difference-in-differences model

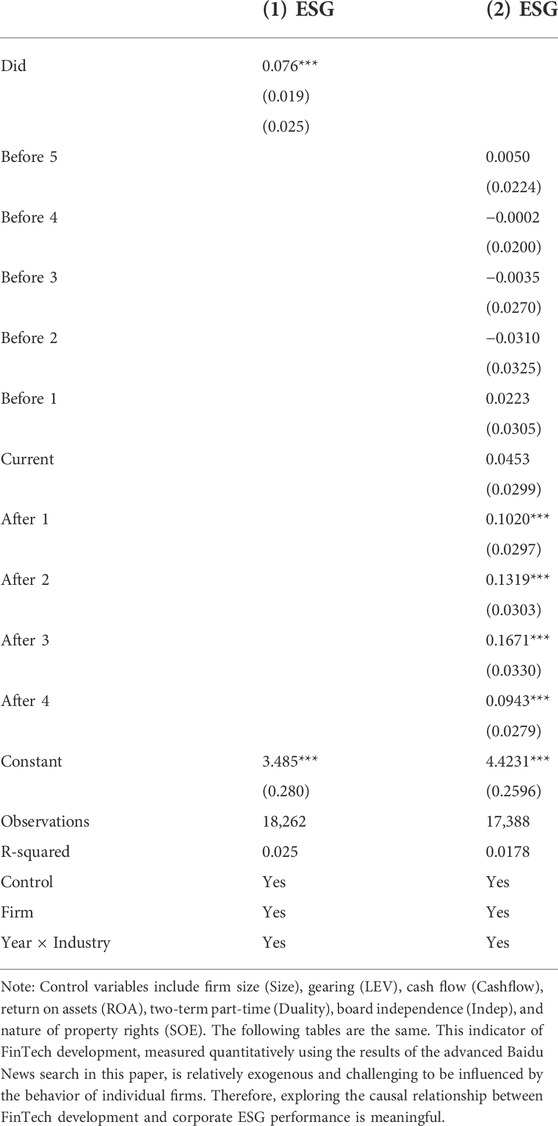

This paper further mitigates the potential endogeneity problem through a double-difference approach. This paper uses China’s Plan for Promoting Inclusive Financial Development (2016–2020), issued in December 2015 as a shock event, and designs quasi-natural experiments to mitigate potential endogeneity. Table 3 shows the estimation results of the double difference model. As seen in column (1) of Table 4, the coefficient of the interaction term between the two is significantly positive.

Next, this paper performs a parallel trend test by including the interaction term of the experimental group with the year dummy variable in the regression. The parallel trend test can be considered to be passed when all coefficients of the experimental group with the interaction term of the year dummy variable before the time node (2016) are insignificant, and at least one coefficient of the interaction term of the year dummy variable with the year after the time node is significant. As can be seen from column (2) of Table 4, the coefficients of the interaction terms of the dummy variables for the experimental group and the years 2011–2015 are all insignificant, indicating that there is no significant difference in the level of ESG performance between the experimental group and the control group before the implementation of the plan, which satisfies the parallel trend hypothesis. The coefficients of the interaction term of the experimental group with the dummy variables from 2016–2019 are significantly greater than 0, reflecting the promotion effect of the implementation of the plan on the ESG performances of enterprises in the experimental group.

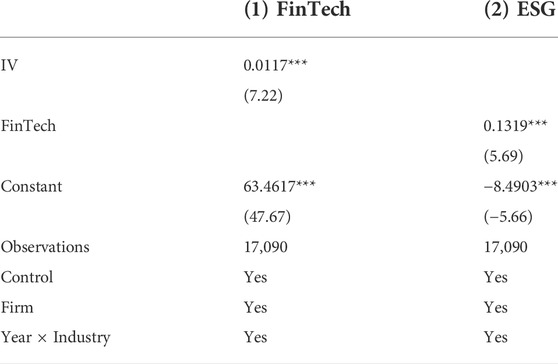

5.1.2 Instrumental variables method

This paper draws on Bartik (2006) to construct a “Bartik instrumental variable” (the product of the first-order difference in time between the FinTech development index FinTechm,t-1 and the national FinTech development index ΔFinTecht,t-1). The constructed Bartik instrumental variable can simulate the estimated value of the regional FinTech development level in all years, which is highly correlated with the actual value, but not with the residual term, satisfying the instrumental variable correlation and homogeneity requirements. The reasons are as follows: First, since the national FinTech development index comes from more than 200 prefectures, it is not significantly influenced by a particular prefecture, and the changes in the national FinTech development index are relatively exogenous to a specific prefecture. Second, demand shocks at the local level other than FinTech development may also lead to biased estimates. However, the Bartik instrument is valid as long as individual localities are not so important that their internal demand shocks are significantly correlated with the FinTech development of the whole country.

Table 5 reports the results of the two-stage regressions of the instrumental variables, wherein the first column shows the results of the first-stage regression and the second column shows the results of the second-stage regression. The results of the first-stage regression show that the coefficient estimates of Bartik-IV are significantly optimistic at the 1% level, validating the assumption of a correlation of the instrumental variables. The regression results of the second stage show that the coefficient of FinTech is significantly positive at the 1% level, indicating that, after mitigating the potential endogeneity, the conclusion of this paper still holds that FinTech can significantly contribute to the ESG performance of firms. In addition, this paper also tests the weak instrumental variable problem, and the results show that there is no weak instrumental variable problem.

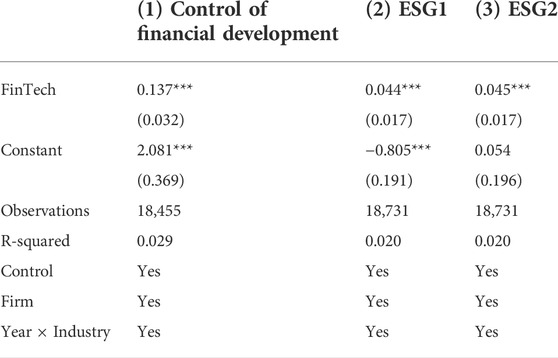

5.2 Controlling the level of financial development

The level of regional financial development tends to influence firms’ access to external financing (Claessens and Laeven, 2003). In regions with better financial development, firms have lower approval and monitoring costs to obtain financing, thus contributing positively to their ESG development. Therefore, the increase in corporate ESG levels brought about by regional FinTech development is likely to be enhanced by an increase in the level of regional financial development, rather than being driven by FinTech development. This paper adds the regional financial development level to the control variables, and re-runs the regression. In this paper, we calculate the number of commercial bank branches in each prefecture-level city each year based on the branch establishment and withdrawal records, and measure the level of regional financial development (Branch) using the unitization of the number of local NSS enterprises. The first column of Table 6 shows the regression results after adding regional financial development. After controlling for the effect of regional financial development level, FinTech development still makes a significant contribution to corporate ESG performance, which proves the reliability of the previous benchmark regression results.

5.3 Replacing variable measures

We are considering the effects of core explanatory variable measures. In this paper, we treat enterprises’ ESG performance data as follows: 1) We assign a value of one to companies with grades A and above and 0 to the rest of the grades. 2) We also assign grades C⁃CCC, B⁃BBB, and A⁃AAA to values 1, 2, and 3, respectively. The results in Table 6 show that the regression coefficients of financial technology on corporate ESG performance are significantly greater than 0 after replacing the ESG scoring indicators (ESG1 and ESG2), indicating that the different assignment and measurement method results obtained remain consistent with the primary findings.

6 Mechanism analysis

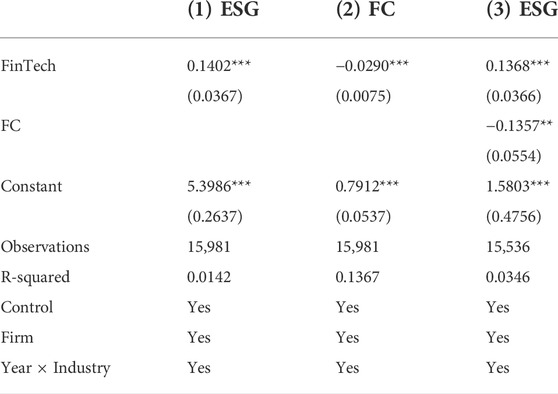

6.1 FinTech, financing constraints, and corporate environmental social and governance performance

The financing constraint problem can constrain the ESG development of a firm, and FinTech can reduce the financing constraint of a firm by mitigating information asymmetry through technology spillover effects. Table 7 reports the test results for mediating effects on financing constraints. The explained variables in columns (1) and (3) are the ESG performance of firms, and the explained variable in column (2) is the financing constraint of firms. The results show that the estimated coefficients of FinTech variables are significantly less than 0 in column (2), indicating that FinTech development alleviates corporate financing constraints. The estimated coefficients of FinTech variables are significantly positive in both column (1) and column (3), and they decrease relative to the estimated coefficients in Table 3. The estimated coefficient of the financing constraint index (Fc) is negative at the 5% level, indicating that the financing constraint mechanism of action does exist. The above empirical results suggest that financing constraints are the channel through which FinTech motivates firms’ ESG performance, thus validating Hypothesis 2.

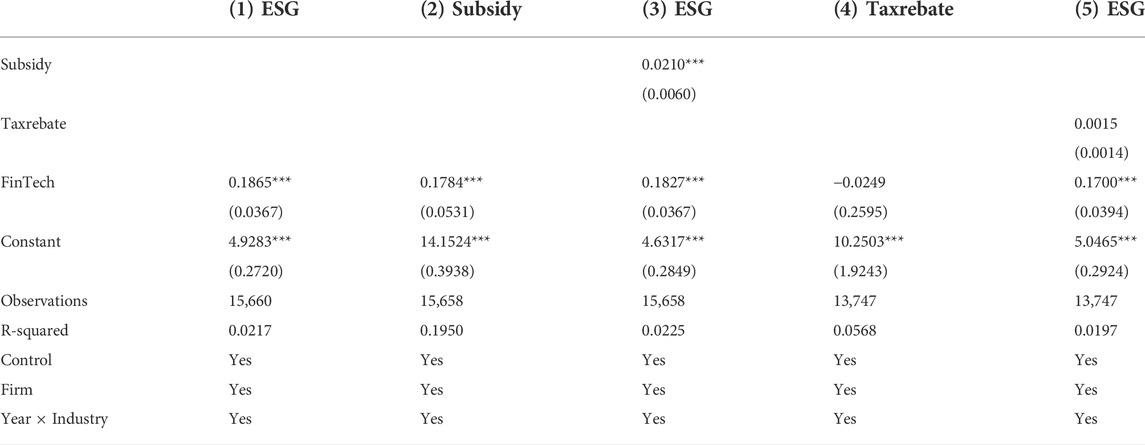

6.2 FinTech, government subsidies, tax rebates, and corporate environmental social and governance performance

ESG investment is a long-term and highly uncertain investment activity. The existence of information asymmetry makes it difficult for government agencies to obtain information about corporate R&D to evaluate the merits of ESG investment projects. At the same time, government subsidies and tax rebates for enterprises have a clear tendency, and enterprises that can create many jobs or advanced technology are more likely to receive government assistance. In contrast, many enterprises with sustainable development potential struggle to attain policy favors. Through deep data mining and analysis, combined with machine learning and other algorithms, FinTech can track credit risk in real-time and quickly generate a “portrait” of user characteristics, providing government departments with more information about the current operation of micro-enterprises and credit risks. It can efficiently identify companies in urgent need of innovation funds. Moreover, it can efficiently identify companies needing innovation capital with more innovation potential, and direct more resources towards these companies, increasing the financial support they receive from the government and improving their ESG performance. Therefore, to further investigate the mechanism of the impact of FinTech on the ESG performance of enterprises, this paper divides the funds received by enterprises from government departments into Subsidy and TaxRebate.

Table 8 reports the test results of mediating effects on the government’s fiscal subsidies. The explanatory variables in columns (1), (3), and (5) are the ESG performance of firms, while the explanatory variables in columns (2) and (4) are government subsidies (Subsidy) and tax rebates (TaxRebate). The results in the first column show that the coefficient of FinTech is significantly positive, indicating that FinTech can significantly improve the ESG performance of firms. The coefficients of FinTech in column (2) are all significantly positive at the 1% level, indicating that FinTech significantly improves government subsidies. The coefficient of FinTech in column (3) is significantly positive at the 1% level, and significantly lower in value than in the first column, indicating that the marginal effect of FinTech on corporate ESG performance decreases after controlling for government subsidies, which implies that government subsidies are a significant factor in the relationship between FinTech development and corporate ESG performance. This confirms the partial mediating effect between the development of FinTech and the improvement of corporate ESG performance. The results in columns four through five suggest that FinTech does not improve firms’ ESG performance through the path of tax rebates. This is mainly because tax rebates provided by the government to firms may be an inefficient rent-seeking activity between officials and entrepreneurs (Shleifer and Vishny, 1994), in addition to being based on the consideration of improving firm performance and promoting technological progress, which severely undermines the efficiency of resource allocation. Therefore, FinTech does not play a role in driving the conversion of tax rebates into ESG investments in the firm, and Hypothesis 3 is partially confirmed.

7 Heterogeneity analysis

7.1 A further test based on enterprise life cycle theory

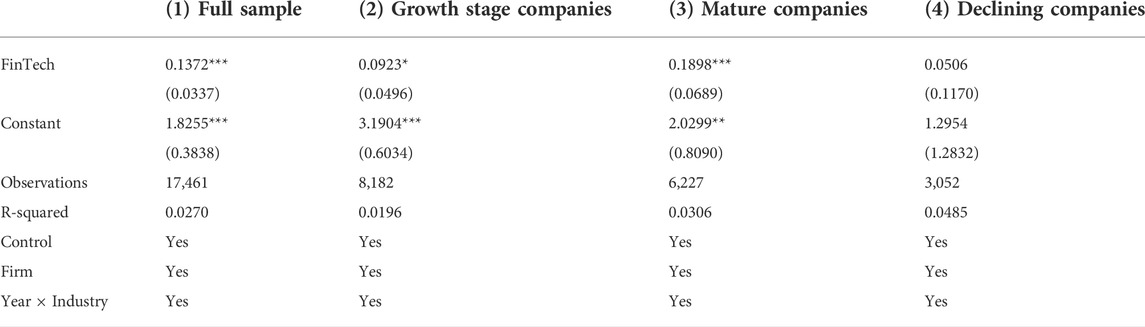

According to the enterprise life cycle theory, enterprises in different life cycle stages display significant differences in investment strategies, corporate governance, and financial performance. Moreover, the ESG investment of a firm needs to be made after a prudent decision via a summation assessment of the current resource endowment and external environment. Therefore, this paper further examines how the contribution of FinTech to corporate ESG performance varies across a firm’s life cycle. This paper chooses the cash flow model approach Dickinson (2011) to measure the corporate life cycle. There are many cash flow model-based, univariate, and composite indicator approaches to measuring the corporate life cycle. The cash flow model approach is chosen to measure the firm life cycle because it allows it to overcome intra-industry variation and avoid subjective assumptions about the sample distribution over the firm’s life cycle.

The regression results in Table 9 show that the enhancing effect of FinTech on firms’ ESG performance is mainly concentrated in mature-stage firms. Possible reasons for this include the fact that firms in the growth stage have a relative lack of internal capital. Although FinTech can effectively address the financing constraint challenge, firms prefer to spend their capital on projects that can generate high net worth returns for investors in the short term (Jovanovic, 1982). When a company reaches maturity, its increasingly stable market share ensures that it has sufficient capital flow. The enhancement of financial technology makes it easier for companies to obtain external support and find partners. Maturing companies are more capable of using financial technology to obtain richer or even private financial information, which creates conditions for improving the ESG development of companies, so financial technology will significantly contribute to the corporate ESG performance of maturing companies. When entering a recession, from the demand side, companies’ sales and profitability decay, cash flow shrinks, internal management mechanisms loosen, and companies abandon ESG projects that require long-term investment to survive.

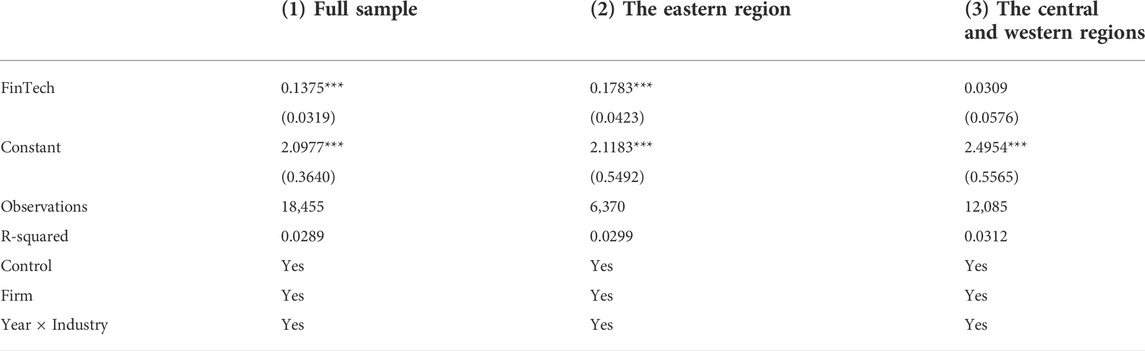

7.2 Further tests based on the region where the company is located

In recent years, FinTech has benefited from the overlapping upgrade and integration of related cutting-edge technologies and has received more and more attention and focus from the industry. Against the backdrop of the growing scale of FinTech investment, infrastructure, and talent pool, FinTech has achieved a long and steady development of innovation. However, the vast size of China and the uneven distribution of resources have led to significant differences in the level of economic development among regions. The economic environment, institutional policies, and industrial clustering phenomena vary significantly among regions. Therefore, in order to examine in depth the regional differences in the effect of FinTech on corporate ESG performance, this paper divides the whole sample into two subsamples: the eastern region (the eastern region includes ten provinces of Beijing, Tianjin, Hebei, Shandong, Jiangsu, Shanghai, Zhejiang, Fujian, Guangdong, and Hainan) and the central and western regions, according to the province in which the city is located.

Table 10 shows the regression results by region. This study finds that the development of FinTech significantly promotes the growth of ESG performance of enterprises in the eastern region. However, the promotion effect on the central and western regions is insignificant. The reason for the above phenomenon may be that, on the one hand, the eastern region has a developed economy, entire industries, and significant scale effect, with many financial institutions and a large volume of financial services. The fierce industrial competition and many segmentation competitions make enterprises urgently need funds to develop and grow and maintain their core competitiveness. There is an urgent need to enhance the efficiency of financial services further and improve financing channels between enterprise subjects and financial institutions. The integration application of financial technology has dramatically reduced the information cost and financing threshold between the central bodies of capital supply and demand, and the efficiency of capital matching and supply has been dramatically improved. In addition, many industry-leading FinTech companies and FinTech technology service providers have gradually formed a mature and perfect ecology of integration and interaction with the local industrial system through years of development and layout. Through the tandem and empowerment of FinTech within the served company and in the industry chain, real enterprises’ sustainable development performance capability is significantly enhanced.

On the other hand, the central and western regions have continued to accelerate their economic development in recent years under the boost of national strategies such as the rise of central China and the development of western China. However, due to the level of economic development, the financing needs of industrial development are still dominated by traditional lending from banks and other financial institutions, and the financial technology content is not high. In addition, traditional industries in central and western regions still account for a large proportion. Such enterprises may focus more on the production process and do not understand or even reject the emerging field of financial technology to a certain extent. The degree of financial technology embedding and participation is low, which also affects the effect of financial technology on the promotion of corporate ESG performance.

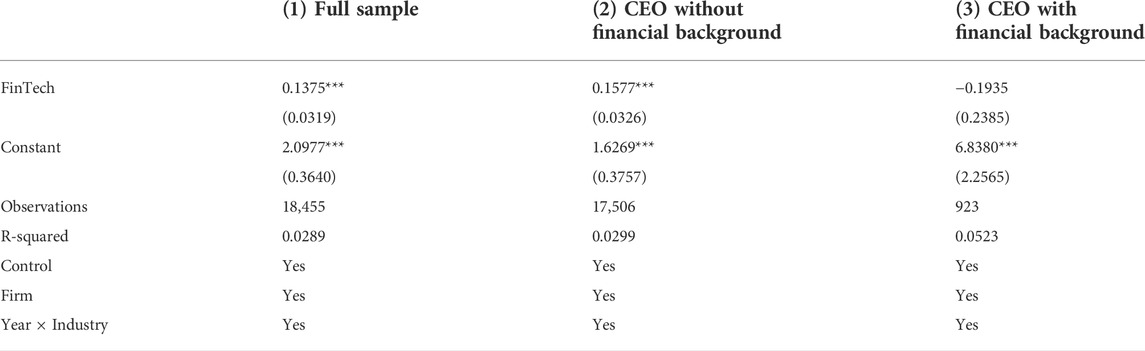

7.3 Further tests based on CEO’s banking finance background

To further explore the heterogeneous effect of FinTech on firms’ ESG performance, this paper regresses the sample by grouping the CEOs according to whether they have banking financial institution work experience or not, in order to verify the heterogeneous effect of FinTech on the ESG performance of firms whose CEOs have different banking financial backgrounds.

As can be seen from Table 11, there is no significant effect of FinTech on the ESG performance of firms with CEOs who have banking and finance backgrounds, which may be because firms with CEOs who have banking and finance backgrounds themselves encounter faceless financing constraints, and this work experience also facilitates the firms’ access to resources. Therefore, there is a marginal diminishing effect of FinTech on borrowing capacity for firms with CEOs who have banking and finance backgrounds. In contrast, FinTech can effectively alleviate financing constraints for firms with CEOs with no banking and finance backgrounds, which can contribute to firms’ ESG performance.

8 Conclusion and discussion

8.1 Conclusion and policy recommendations

It is an essential issue for Chinese companies to effectively improve their ESG level and change from “maximizing economic benefits” to “balancing economic and social benefits”. In this context, examining the impact of financial technology on the ESG performance of enterprises is essential. This paper examines the effect of regional FinTech development on corporate ESG performance using the data of Chinese A-share listed companies from 2011 to 2020. The results show that regional FinTech development significantly contributes to the ESG performance of firms. This finding still holds after considering a series of robustness tests, such as addressing endogeneity issues and controlling for the level of financial development. The mechanism analysis shows that FinTech not only alleviates the internal financing constraints of firms, but also increases the external government subsidies and tax rebates of firms, which significantly contributes to the ESG performance of firms. In addition, the impact of FinTech development in promoting corporate ESG performance is more pronounced in the eastern region, mature firms and firms with CEOs who do not have a banking and finance background.

The findings of this paper provide the following policy implications for promoting FinTech development and accelerating the construction of a sustainable country.

(1) During this critical period in which the economy is changing from high-rate growth to high-quality development, China should actively promote the ESG development of enterprises. At the same time, the government should give sufficient policy support to FinTech companies to encourage the integration of science and technology with finance and capital markets, and thus help finance development. In the future, the Chinese government should promote the construction of a diversified financial service industry and realize a precise balance between finance and SMEs. Only in this way can it lower the service threshold of finance, enable the majority of enterprises to obtain financial services at a lower cost, and facilitate FinTech development in protecting the environment, improving social and governance investment, and leading the development of new dynamics of economic growth.

(2) Government departments should view financial technology as a breakthrough in order to alleviate the financing problems of SMEs and strengthen the service function of finance in relation to the real economy. As the main body of the micro economy, enterprises are the essential promoters of the green transformation and development of the economy and society. They should have more responsibilities in terms of environmental protection, social aspects, and internal governance capacity improvement. However, enterprises have been plagued by the problems of “difficult” and “expensive” financing. Financial technology can optimize the efficiency of resource allocation between sectors and ease the financing constraints of enterprises. On the one hand, we should fully realize the complementary advantages of traditional financial institutions and financial technology companies to promote financial innovation. On the other hand, we should rely on FinTech to accelerate the construction of a multi-level, broad-coverage, and differentiated banking system, in order to develop personalized, differentiated and customized financial products and improve the inclusive nature of finance.

(3) We should not rely excessively or solely on fiscal policies to stimulate the ESG performance of enterprises. Increasing government subsidies and tax rebates can sometimes lead to “rent-seeking” behavior in ESG investments, which in turn encourages inertia in ESG investments by enterprises. In the future, governments and enterprises should actively explore how to improve sustainability through digital technology development. The government can use financial technology to more accurately screen companies with sustainable development capabilities and further determine which companies should receive financial and tax subsidies. At the same time, companies can also use digital technology to screen ESG investments with good prospects, and reduce the uncertainty of ESG investments. Overall, we can only effectively balance economic and social benefits and promote sustainable development nation-building by giving full play to the linkage effect between government and enterprises.

8.2 Research limitations and future prospects

Although this study explores the relationship between FinTech and corporate ESG performance at the theoretical and practical levels, there are shortcomings and limitations.

First, this study selects A-share listed companies in China for 2011–2021. The empirical study shows that regional FinTech development significantly improves the ESG performance of firms. However, the research sample in this paper only covers A-share listed firms in China, so the findings are somewhat limited. Future studies can further expand the sample to include firms in other countries. The heterogeneity of the relationship between FinTech and corporate ESG performance under different national conditions, economic development, and institutional environments is investigated.

Second, the ESG data in this paper uses ESG rating data from China Securities. Since the ESG rating of China Securities does not publish the E, S, and G scores of corporate ESG performance, this paper cannot examine the impact of regional FinTech development on ESG subscales in depth. Future related studies can explore the impact of regional FinTech development on corporate ESG performance subscales using different ESG measurement methods.

Finally, this study is limited to examining the linear relationship between regional FinTech development and corporate ESG performance. The exploration of FinTech development and corporate ESG performance should not be limited to a simple linear relationship. The excessive development of FinTech may also reduce the ESG performance of firms, i.e., FinTech and ESG performance show an inverted U-shaped relationship. Therefore, future related studies can explore the non-linear relationship between FinTech and corporate ESG performance in depth.

Data availability statement

The datasets presented in this study can be found in online repositories. The names of the repository/repositories and accession number(s) can be found below: https://www.wind.com.cn/portal/en/Home/index.html; https://www.gtarsc.com/.

Author contributions

Conceptualization: PD, SH, and YH. Methodology: SH, WW, and YH. Software: PD, SH, and YH. Validation: SH, WW, and YH. Writing—original draft preparation: SH and WW. Writing—review and editing: PD, SH, and WW. Funding acquisition: PD.

Funding

This work was supported in part by the National Natural Science Foundation of China under Grant 71872001, 72272001, and Anhui Province Soft Science Research Key Project under Grant 202106f01050025.

Acknowledgments

We sincerely thank Yun Cheng for comments and suggestions on an earlier version of this manuscript.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abeysekera, A. P., and Fernando, C. S. (2020). Corporate social responsibility versus corporate shareholder responsibility: A family firm perspective. J. Corp. Finance 61, 101370. doi:10.1016/j.jcorpfin.2018.05.003

Ali, A., Klasa, S., Yeung, E., Buchak, G., Matvos, G., Piskorski, T., et al. (2018). FinTech, regulatory arbitrage, and the rise of shadow banks. J. financial Econ. 130, 453–483. doi:10.1016/j.jfineco.2018.03.011

Ali, S., Zhang, J., Usman, M., Khan, F. U., Ikram, A., and Anwar, B. (2019). Sub-national institutional contingencies and corporate social responsibility performance: Evidence from China. Sustainability 11 (19), 5478. doi:10.3390/su11195478

Anshari, M., Almunawar, M. N., Masri, M., and Hamdan, M. (2019). Digital marketplace and FinTech to support agriculture sustainability. Energy Procedia 156, 234–238. doi:10.1016/j.egypro.2018.11.134

Bartik, T. (2006). How do the effects of local growth on employment rates vary with initial labor market conditions? Upjohn Institute Working Paper No. 09-148. Available at SSRN: https://ssrn.com/abstract=1372814 or http://dx.doi.org/10.2139/ssrn.1372814.

Bénabou, R., and Tirole, J. (2010). Individual and corporate social responsibility. Economica 77, 1–19. doi:10.1111/j.1468-0335.2009.00843.x

Borghesi, R., Houston, J. F., and Naranjo, A. (2014). Corporate socially responsible investments: CEO altruism, reputation, and shareholder interests. J. Corp. Finance 26, 164–181. doi:10.1016/j.jcorpfin.2014.03.008

Broadstock, D. C., Chan, K., Cheng, L. T., and Wang, X. (2021). The role of ESG performance during times of financial crisis: Evidence from COVID-19 in China. Finance Res. Lett. 38, 101716. doi:10.1016/j.frl.2020.101716

Cai, Y., Pan, C. H., and Statman, M. (2016). Why do countries matter so much in corporate social performance? J. Corp. Finance 41, 591–609. doi:10.1016/j.jcorpfin.2016.09.004

Cao, S., and Leung, D. (2020). Credit constraints and productivity of SMEs: Evidence from Canada. Econ. Model. 88, 163–180. doi:10.1016/j.econmod.2019.09.018

Chan, C.-Y., Chou, D.-W., and Lo, H.-C. (2017). Do financial constraints matter when firms engage in CSR? North Am. J. Econ. Finance 39, 241–259. doi:10.1016/j.najef.2016.10.009

Chiu, J., and Koeppl, T. V. (2019). Blockchain-based settlement for asset trading. Rev. Financial Stud. 32, 1716–1753. doi:10.1093/rfs/hhy122

Claessens, S., and Fan, J. P. (2002). Corporate governance in Asia: A survey. Int. Rev. Finance 3, 71–103. doi:10.1111/1468-2443.00034

Claessens, S., and Laeven, L. (2003). Financial development, property rights, and growth. J. Finance 58, 2401–2436. doi:10.1046/j.1540-6261.2003.00610.x

Cordazzo, M., Bini, L., and Marzo, G. (2020). Does the EU directive on non-financial information influence the value relevance of ESG disclosure? Italian evidence. Bus. Strategy Environ. 29, 3470–3483. doi:10.1002/bse.2589

Cronqvist, H., and Yu, F. (2017). Shaped by their daughters: Executives, female socialization, and corporate social responsibility. J. Financial Econ. 126 (3), 543–562. doi:10.1016/j.jfineco.2017.09.003

Dell’Erba, M. (2021). “Sustainable digital finance and the pursuit of environmental sustainability,” in Sustainable finance in Europe (Springer), 61–81.

Deng, X., Huang, Z., and Cheng, X. (2019). FinTech and sustainable development: Evidence from China based on P2P data. Sustainability 11, 6434. doi:10.3390/su11226434

Dickinson, V. (2011). Cash flow patterns as a proxy for firm life cycle. Account. Rev. 86, 1969–1994. doi:10.2308/accr-10130

Dyck, A., Lins, K. V., Roth, L., and Wagner, H. F. 2019, Do institutional investors drive corporate social responsibility?

Faccio, M. (2006). Politically connected firms. Am. Econ. Rev. 96, 369–386. doi:10.1257/000282806776157704

Fee, C. E., Hadlock, C. J., and Pierce, J. R. (2009). Investment, financing constraints, and internal capital markets: Evidence from the advertising expenditures of multinational firms. Rev. Financ. Stud. 22, 2361–2392. doi:10.1093/rfs/hhn059

Friedman, M. (2007). “The social responsibility of business is to increase its profits,” in Corporate ethics and corporate governance (Springer), 173–178.

Haddad, C., and Hornuf, L. (2019). The emergence of the global FinTech market: Economic and technological determinants. Small Bus. Econ. 53, 81–105. doi:10.1007/s11187-018-9991-x

Heiskanen, A. (2017). The technology of trust: How the Internet of Things and blockchain could usher in a new era of construction productivity. Constr. Res. Innovation 8, 66–70. doi:10.1080/20450249.2017.1337349

Hsueh, L. (2019). Opening up the firm: What explains participation and effort in voluntary carbon disclosure by global businesses? An analysis of internal firm factors and dynamics. Bus. Strategy Environ. 28, 1302–1322. doi:10.1002/bse.2317

Ikram, A., Li, Z. F., and Minor, D. (2019). CSR-contingent executive compensation contracts. J. Bank. Finance, 105655. doi:10.1016/j.jbankfin.2019.105655

Impullitti, G. (2022). Credit constraints, selection and productivity growth. Econ. Model. 111, 105797. doi:10.1016/j.econmod.2022.105797

Jha, A., and Cox, J. (2015). Corporate social responsibility and social capital. J. Bank. Finance 60, 252–270. doi:10.1016/j.jbankfin.2015.08.003

Jovanovic, B. (1982). Selection and the evolution of industry. Econometrica 50, 649–670. doi:10.2307/1912606

Karuna, C. (2007). Industry product market competition and managerial incentives. J. Account. Econ. 43, 275–297. doi:10.1016/j.jacceco.2007.02.004

Lapavitsas, C., and Dos Santos, P. L. (2008). Globalization and contemporary banking: On the impact of new technology. Contributions Political Econ. 27, 31–56. doi:10.1093/cpe/bzn005

Leong, C. K., and Yang, Y. C. (2021). Constraints on “Doing Good”: Financial constraints and corporate social responsibility. Finance Res. Lett. 40, 101694. doi:10.1016/j.frl.2020.101694

Lin, Y., Fu, X., and Fu, X. (2021). Varieties in state capitalism and corporate innovation: Evidence from an emerging economy. J. Corp. Finance 67, 101919. doi:10.1016/j.jcorpfin.2021.101919

Macchiavello, E., and Siri, M. (2022). Sustainable finance and FinTech: Can technology contribute to achieving environmental goals? A preliminary assessment of ‘green FinTech’and ‘sustainable digital finance. Eur. Co. Financial Law Rev. 19, 128–174. doi:10.1515/ecfr-2022-0005

Meiling, L., Yahya, F., Waqas, M., Shaohua, Z., Ali, S. A., and Hania, A. (2021). Boosting sustainability in healthcare sector through FinTech: Analyzing the moderating role of financial and ICT development. Inq. J. Health Care Organ. Provis. Financing 58, 004695802110281. doi:10.1177/00469580211028174

Mi, Z., and Coffman, D. (2019). The sharing economy promotes sustainable societies. Nat. Commun. 10, 1–3. doi:10.1038/s41467-019-09260-4

Muganyi, T., Yan, L., and Sun, H. (2021). Green finance, FinTech and environmental protection: Evidence from China. Environ. Sci. Ecotechnology 7, 100107. doi:10.1016/j.ese.2021.100107

Najaf, K., Chin, A., and Najaf, R. (2021). “Conceptualising the corporate governance issues of FinTech firms,” in The fourth industrial revolution: Implementation of artificial intelligence for growing business success (Springer), 187–197.

Nofsinger, J. R., Sulaeman, J., and Varma, A. (2019). Institutional investors and corporate social responsibility. J. Corp. Finance 58, 700–725. doi:10.1016/j.jcorpfin.2019.07.012

Pedersen, L. H., Fitzgibbons, S., and Pomorski, L. (2021). Responsible investing: The ESG-efficient frontier. J. Financial Econ. 142, 572–597. doi:10.1016/j.jfineco.2020.11.001

Shleifer, A., and Vishny, R. W. (1994). Politicians and firms. Q. J. Econ. 109, 995–1025. doi:10.2307/2118354

Sinnadurai, P. (2018). A vision for Malaysian and other ASEAN Researchers to contribute to the international agency theory-based literature. Asian J. Bus. Account. 11, 1–54. doi:10.22452/ajba.vol11no2.1

Su, Y., Li, Z., and Yang, C. (2021). Spatial interaction spillover effects between digital financial technology and urban ecological efficiency in China: An empirical study based on spatial simultaneous equations. Int. J. Environ. Res. Public Health 18 (16), 8535. doi:10.3390/ijerph18168535

Tasnia, M., AlHabshi, S. M. S. J., and Rosman, R. (2020). The impact of corporate social responsibility on stock price volatility of the us banks: A moderating role of tax. J. Financial Report. Account. 19, 77–91. doi:10.1108/jfra-01-2020-0020

Treleaven, P. (2015). Financial regulation of FinTech. J. Financial Perspect. 3. Available at SSRN: https://ssrn.com/abstract=3084015.

Varga, D. (2018). Triple-bottom-line impact analysis framework of FinTech companies. Veztud. 49, 24–34. doi:10.14267/veztud.2018.11.03

Verhagen, T. (2020). Catalysing FinTech for sustainability. Lessons from multi-sector innovation. A report of the BEI’s FinTechTaskforce. Preprint. Available at:https://www.researchgate.net/publication/328345987_Catalysing_FinTech_for_Sustainability_Lessons_from_multi-sector_innovation_A_report_of_the_BEI 1.

Vig, V. (2013). Access to collateral and corporate debt structure: Evidence from a natural experiment. J. Finance 68, 881–928. doi:10.1111/jofi.12020

Visconti, Moro, and MicroFinTech, R.: 2019, Outreaching financial inclusion with cost-cutting innovation. Available at SSRN 35338732019.

Xin, D., Yi, Y., and Du, J. (2022). Does digital finance promote corporate social responsibility of pollution-intensive industry? Evidence from Chinese listed companies. Environ. Sci. Pollut. Res. Int., 1–17. doi:10.1007/s11356-022-21695-9

Xu, H., and Zhao, J. (2022). Can Directors’ and officers’ liability insurance improve corporate ESG performance? Front. Environ. Sci. 10, 1288. doi:10.3389/fenvs.2022.949982

Xue, Q., Bai, C., and Xiao, W. (2022). FinTech and corporate green technology innovation: Impacts and mechanisms. MDE. Manage. Decis. Econ. doi:10.1002/mde.3636

Yao, Y., Hu, D., Yang, C., and Tan, Y. (2021). The impact and mechanism of fintech on green total factor productivity. Green Finance 3, 198–221. doi:10.3934/gf.2021011

Zhang, D. (2022). Do heterogenous subsides work differently on environmental innovation? A mechanism exploration approach. Energy Econ. 114, 106233. doi:10.1016/j.eneco.2022.106233

Zhou, G., Zhu, J., and Luo, S. (2022). The impact of FinTech innovation on green growth in China: Mediating effect of green finance. Ecol. Econ. 193, 107308. doi:10.1016/j.ecolecon.2021.107308

Keywords: FinTech, ESG, financing constraints, government grants and tax rebates, Bartik instrument variables

Citation: Du P, Huang S, Hong Y and Wu W (2022) Can FinTech improve corporate environmental, social, and governance performance?—A study based on the dual path of internal financing constraints and external fiscal incentives. Front. Environ. Sci. 10:1061454. doi: 10.3389/fenvs.2022.1061454

Received: 04 October 2022; Accepted: 17 October 2022;

Published: 01 November 2022.

Edited by:

Shigeyuki Hamori, Kobe University, JapanReviewed by:

Dadson Awunyo-Vitor, Kwame Nkrumah University of Science and Technology, GhanaRashid Latief, Xuzhou University of Technology, China

Shahid Ali, Nanjing University of Information Science and Technology, China

Copyright © 2022 Du, Huang, Hong and Wu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Shijun Huang, bTIxMjAxMDQ0QHN0dS5haHUuZWR1LmNu

Pengcheng Du1

Pengcheng Du1 Shijun Huang

Shijun Huang