95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci. , 14 November 2022

Sec. Environmental Economics and Management

Volume 10 - 2022 | https://doi.org/10.3389/fenvs.2022.1056478

This article is part of the Research Topic Clean Energy Transition and Load Capacity Factors: Environmental Sustainability Assessment through Advanced Statistical Methods View all 18 articles

In the context of increasing uncertainty in the international economic environment and changes in the labor market, it is imperative to pay proper attention to the environmental quality and sustainability. This paper theoretically analyzes the impact of financial development and financial inclusion on the environmental sustainability. Based on the survey data of 2093 households in Xunyi and Yangling, Shaanxi Province, China, the 2SLS model, and the instrumental variable quantile regression model are constructed to test the association of variables. The results show that the development of financial inclusion and financial development have an inverted “U” shaped nonlinear effect on the environmental quality and efficiency; Only after the development of financial inclusion reaches a certain degree can the environmental quality and sustainability be effectively improved. The results of the quantile regression of instrumental variables show that financial inclusion significantly improves the environmental quality with medium and high degrees but does not have a significant effect on the environmental quality and sustainability with low degrees. After considering the endogeneity and robustness test, the above conclusion still holds. Further research shows that inclusive financial development improves environmental quality and results in sustainable development. Improving the convenience and depth of use of financial services is the key to effectively reducing rural household economic vulnerability and improve the environmental quality. The heterogeneity analysis shows that financial inclusion development has a stronger effect on improving the environmental quality. This study provides empirical evidence and policy implications to better promote financial inclusion to improve the economic vulnerability of rural households, improve environmental quality and achieve the sustainable development. These findings provide policy support to better promote financial inclusion to improve the economic vulnerability of rural households, improve environmental quality and achieve the sustainable development, which can ameliorate environmental degradation, and create a safe, healthy and sustainable environment for achieving sustainable development goals.

During global environmental change, the world is facing a huge loss or major blow to multiple natural resources and experiencing a significant reduction in biodiversity and a great threat of climate change (Fahad and Wang 2018). To prevent the rapid degradation of natural resources, users of resources and governments must strengthen the management of key environmental variables, and achieve sustainable social-ecological systems (Chen et al., 2022a; Fahad et al., 2022a). In social-ecological systems, human activities, social systems and natural resources are closely linked and interact with each other. Especially in rural areas, the frequent occurrence of natural disasters significantly impacts production and the economy. In the face of complex changes in the global environment, enhancing ecosystem services through adaptive management is a meaningful way to guarantee the sustainability of resources (Chen et al., 2022b; Han Yuan, 2022; Hu and Wang, 2022). Therefore, there is a need to analyze the relationship between resources, environmental quality and household resilience to effectively address the risks arising from global environmental change (Gaisie et al., 2021; Su et al., 2022a; Song et al., 2022).

Economic vulnerability is an essential indicator of household resilience, environmental quality and sustainability. With the uncertainty of the international external economic environment, repeated shocks from domestic and international epidemics, industrial restructuring, changes in the labour market, and births, illnesses and deaths have increased the number of risk events faced by rural households (Gutiérrez-Romero and Ahamed, 2021; Fahad et al., 2022b; Su et al., 2022b). In addition to environmental factors, the Medical expenses, death, unemployment, children’s education, household balance sheet structure, and weddings are the main risk to the family (Flores and O’Donnell, 2016; Fernández-Blanco, 2022). The higher the family’s economic vulnerability, the lack of the ability to properly handle the risk problems leads to the risk situation of income, and consumption, leading to or returning to poverty (Yue et al., 2021). According to [China Household Wealth Index Research Report (2020 Q1)]: Hit by the COVID-19 pandemic, 13.4% of the surveyed families said that their job stability had decreased significantly and 18.9% of the surveyed families’ wages had decreased a lot. The impact on vulnerable groups was more significant and 34.3% of families with an annual income of 50,000 yuan or less had their wages reduced significantly. Among households with annual revenues of 50,000 to 1,00,000 yuan and 1,00,000 to 3,00,000 yuan, 16.7% and 9.9%, respectively, saw their salaries cut significantly. In this context, the study of how to effectively reduce the economic vulnerability of families has become an important issue to prevent rural scaling back to poverty and consolidate the achievement of poverty alleviation.

Finance is considered the main component in reducing vulnerability and promoting sustainable development. Since China proposed the inclusive financial development strategy in 2015, financial inclusion services play a crucial role in improving rural household income and welfare, improving the ability to cope with and resist risks, improving household vulnerability, and promoting the adoption of clean energy in households (Yang and Fu, 2019; Pomeroy et al., 2020; Yan et al., 2022; Yang et al., 2022). In theory, inclusive finance is mainly relevant to poorer groups where farmers and peasants may not have the wealth or credit to invest in renewable energy sources, such as solar energy, which is cheaper and emits less carbon monoxide (Hashmi et al., 2021; Wang et al., 2022b; Shah et al., 2022). Therefore, financial inclusion may increase rural households’ adoption of healthier lifestyles for the environment, increasing affordability and adoption of healthy practices. However, current research has mainly documented the positive impact of financial inclusion on economic development. There are few empirical studies to demonstrate the impact of financial inclusion on household economic vulnerability and environmental sustainability. For example, Erlando et al. (2020) note that inclusive credit and insurance services can directly increases the access of rural families, especially the poor rural groups, to financial services. At the same time, inclusive financial services improve the level of family income by promoting entrepreneurial and innovative activities and alleviating educational poverty (Lensink et al., 2017; Camargo and Stein, 2022). Mina and Imai (2017) proposed that the level of coverage of banking institutions at the provincial and community levels can improve credit availability, financial service efficiency, and service quality and significantly reduce household economic vulnerability. Essel-Gaisey and Chiang, (2022) found that being financially included decreases households’ probability of being environmentally poor by about 4.2%–5.1%.

To our knowledge, this is the first attempt to explore the link between financial inclusion and environmental growth at the rural household level. From reviewing the existing literature, we found that the role of financial inclusion on economic vulnerability and environmental sustainability has not been explored in-depth and the empirical results obtained have not been conclusive. Most existing studies have been analyzed at the macro level. Moreover, China has a large population of rural residents, but there is a lack of practical research on the impact of financial inclusion on the economic vulnerability and environmental sustainability of Chinese rural households. Therefore, there is an urgent need to explore the impact of financial inclusion on the economic vulnerability and environmental sustainability of rural households.

Different from previous studies, this study contributes to the existing literature in the following three aspects. Firstly, the heterogeneous rural household vulnerability effects of inclusive financial development are investigated by using the 2SLS model, and the results of heterogeneous estimates of the economic vulnerability quantile of financial inclusion are considered using an instrumental variable quantile regression model. Secondly, to deepen the understanding about the impact of financial inclusion, four dimensions of financial inclusion are considered: breadth of coverage, convenience, depth of use, and satisfaction. Thirdly, we analyse the heterogeneity of the results across different modes of operation, different levels of education, different income levels, and different social capital in order to capture the idiosyncratic effects of financial inclusion. The study focuses on rural China, rather than China as a whole, as there are significant differences in the household vulnerability profiles of rural and urban residents in China, with rural residents being generally more vulnerable than urban residents, which is related to differences in income and infrastructure.

Financial inclusion can contribute to a country’s economic development and reduce the impact of extreme poverty and economic disparities. Still, it can have far-reaching effects on environmental quality and sustainable development that need to be explored. This study is an effort in this direction, and we have decided to examine the impact of financial inclusion on the economic vulnerability and environmental quality of rural households in China. We Use the data from rural Shaanxi, China, and apply the 2SLS model and instrumental variable quantile regression model to address the individual heterogeneity and potential endogeneity of rural households. Our data estimates suggest that environmental quality and sustainability can be effectively improved only after financial inclusion development reaches a certain level. Furthermore, we observed that increasing the ease and depth of financial service use significantly improved medium and high environmental quality but had no significant effect on low environmental quality. This suggests that issues of environmental quality and sustainability in rural China can be improved by increasing the ease and depth of use of financial services. Therefore, policies aimed at effectively improving environmental quality and sustainability in rural China may focus on improving the economic vulnerability of rural households by improving the ease and depth of financial service use, rather than solely emphasizing financial service coverage for rural households.

Our study is structured as follows. The next section introduces the theoretical analysis and Hypothesis. Section 3 introduces the data, variables, and empirical method, which are used to investigate the effect of inclusive finance on the household vulnerability, environmental quality and sustainability. Section 4 discusses the estimation results and our main findings. The last section concludes the study and provides policy implications according to our empirical findings.

The rural financial market has long-term problems of imbalance and inadequacy of supply and demand, lack of standard collateral, and imperfect credit information for rural households, which make them excluded from the traditional financial system for a long time (Schoofs, 2022). Promotion of financial inclusion aims to allow all social strata, especially vulnerable groups, to enjoy fair and equal rights to financial services, and rural families are critical service groups of financial inclusion. However, according to the theory of public policy, the implementation of policy, the promotion of execution organization, and the construction and improvement of the system are gradual processes. On the one hand, there is a certain threshold for access to financial services. So, in the early stage of the development of financial inclusion, it is difficult for low-income people to obtain financial support. Only when financial development becomes more mature can it effectively benefit the poor (Bolarinwa and Akinlo, 2021). On the other hand, capital has a profit-seeking nature. In the short term, when limited financial resources enter the rural market, social elites with high income, rich social connections, and political status occupy a dominant position in resource allocation. This leads to the phenomenon of “elite capture,” in which agricultural loan funds were appropriated by elites (Wen et al., 2016). For example, there is a serious phenomenon of “elite capture” in both “government bank-insurance” credit and urban and rural self-employment loans (Wang et al., 2021; Wang et al., 2022a). Affected by the loss of efficiency in resource propensity allocation and the lack of financial knowledge, improving the inclusion of banking services has not yet reflected the obvious benefit of poverty (Li and Han, 2019). Therefore, when the development of financial inclusion is relatively weak, the income and consumption gap between households without financial services and those with financial services may widen. In addition, financial inclusion helps nonpoor households prevent risks, smooth consumption, and accumulate factors, and exacerbates income inequality between poor and nonpoor households (Wang and Du, 2018). So, in theory, when the financial inclusion development level is at a low level, temporarily unable to overcome the rural financial market long-term existence of formal financial institutions, high threshold, high service costs, and adverse selection, the problem is captured by the “elite.” This leads to financial products and services not being able to effectively meet all kinds of main body and diversification of income group operation and different demand; It is not conducive to improving the economic vulnerability of rural households.

With the continuous improvement of financial inclusion, the product and service system of financial inclusion will gradually be optimized. On the one hand, financial diversity can promote competition in the financial industry, reduce barriers to entry, etc. This will improve the traditional factors of the rural financial market and product market efficiency, further correcting the conventional financial system of “little” features and improving the accessibility of inclusive financial services for rural households (Gomez et al., 2015). On the other hand, it can improve the efficiency of financial capital allocation, increase investment opportunities, promote rural economic growth, and optimize income distribution to promote development benefits to more disadvantaged rural families (Emara and El Said, 2021). By optimizing resource allocation, inclusive credit services can provide more credit capital for agricultural production and rural development. Reduce the impact of current capital liquidity constraints that residents face, smooth sudden household consumption, and thus improve the total utility level of intertemporal household consumption (Deidda, 2014). Diversified innovation and wide popularization of inclusive insurance services can provide risk protection tools for families, improving the risk handling ability of rural families. Effectively improve families’ financial vulnerability by avoiding the negative impact of risk impact on families (Contró et al., 2021), improve family welfare, and reduce the marginal effect of various risks on family economic vulnerability (Yue et al., 2021). Studies have shown that inclusive insurance can play complementary functions with financial services such as poverty alleviation microfinance, formal inclusive credit, and digital finance to jointly reduce household vulnerability to poverty. So, in theory, financial inclusion development, step by step, can enhance rural household savings, investment, and consumption ability. Improving rural households in consumer, health care, education, social security, employment, entrepreneurship, etc., and making them more economic conditions for the development of production and operation, doctor treatment, buy insurance against risks, improve the level of family education, etc. Finally, the structure of household income and consumption can be improved, which helps reduce the economic vulnerability of households. To sum up, our paper proposes the following hypotheses:

Hypothesis H1. Inclusive financial development has an inverted “U” shaped impact on the economic vulnerability of rural households.

Hypothesis H1a. When the development of financial inclusion is at a low level, it is not conducive to improving the economic vulnerability of rural households.

Hypothesis H1b. A higher level of financial inclusion can effectively reduce the economic vulnerability of rural households.

The economic vulnerability of rural households was caused by inter-village inequality, intra-village inequality, collaborative risk, heterogeneous risk, unexplained risk, and many other reasons (Ligon and Schechter, 2003; Zhang et al., 2016). Among them, inter-village and intra-village inequality is the primary indicator to measure household poverty or inequality; collaborative risk, heterogeneous risk, and unexplained risk are the changes of various risks affecting household economic vulnerability. Differences between rural spatial resources and initial household endowments (such as financial assets, social capital, human capital, etc.) will affect income and expenditure inequality within and between villages (Zhen and Ling, 2017). Additionally, inequality within villages is more severe than among villages (Xu et al., 2022). In this case, increasing the breadth and depth of inclusive financial services still helps alleviate consumption inequality in rural household goods, education, culture, transportation, and communication (Inoue et al., 2018; Urrea and Maldonado, 2011) and promote inclusive development. Therefore, financial inclusion development can improve the availability of financial services for rural households and focus on alleviating household economic vulnerability caused by inter-village and intra-village inequality by improving household consumption and welfare levels.

Thus, our paper proposes the following hypotheses:

Hypothesis H2. Financial inclusion development mainly improves household economic vulnerability caused by inter-village and intra-village inequality.

In addition, the development of financial inclusion has prominent regional differences characteristics (Demirguc-Kunt et al., 2015). This unbalanced development will cause different economic entities to get differentiated benefit opportunities from it. At the same time, due to differences in family resource endowment and educational background, the impact of financial inclusion development on the economic vulnerability of different types of families may also be different. For example, whether financial inclusion can play the role of risk management and reduce household economic vulnerability depends on whether vulnerable groups can obtain financial availability to meet financial credit needs and whether excluded individuals grasp the concept of financial knowledge (Lopus et al., 2019). Meanwhile, residents with higher education levels benefit more from developing financial inclusion (Grohmann et al., 2018). Therefore, due to differences in household resource endowments, the impact of financial inclusion on the economic vulnerability of different households may be heterogeneous. Based on the above, this paper proposes the following hypotheses:

Hypothesis H3. The effect of inclusive financial development on improving the economic vulnerability of different rural households is heterogeneous.

The data in this paper are from the rural field household survey with the theme of “Rural Inclusive financial development and Household economic vulnerability” carried out by the research group in Xunyi County and Yangling Demonstration Zone, Shaanxi Province, China, from July to August 2018 to 2019. We chose this location for two reasons. Firstly, it is one of the demonstration zones for China’s central financial support for inclusive financial development. Secondly, Xunyi County is located in the west of central Shaanxi, where droughts and floods coexist in the summer and some areas often experience catastrophic weather such as lightning, hail, heavy rain and high winds. Yangling is located in central Shaanxi and has a suitable climate. Therefore, farmers in the two areas are able to represent the differential characteristics of vulnerability under different environmental conditions.

We considered each township’s economic development and used a combination of multi-stage stratified and random sampling. In Xunyi County, three townships (towns) with leading economic development, namely Taicun Township, Chengguan Township, and Zhanghong Township. And two townships with average economic growth, namely Chidao Township and Yuandi Township, were selected for sampling. In Yangling Demonstration Zone, three representative townships (towns) reflecting different levels of economic development were selected, including Jiugu Township, Wuquan Township, and Dazhai Township, as shown in Figure 1. In each township (town), we first select three to four villages according to population density, type of industrial development, and other indexes. Second, 40–50 sample farmers (mainly heads of households) were randomly selected in each sample village for interviews to ensure the randomness and representativeness of the sample.

In this survey, a total of 2,215 questionnaires were distributed, covering 27 natural villages in eight townships (towns) in two regions of Shaanxi province, China. After eliminating abnormal samples and extreme values, 2093 valid questionnaires were screened, with an effective rate of 94.49%. The sample households represent the distribution characteristics of farmers with different economic conditions and different types of agricultural management in the county area, which has a good representation.

Household economic vulnerability reflects the impact of risk shocks on household consumption and welfare. There are three typical representative and mainstream measurement methods: First, the vulnerability-to-expected poverty (VEP) measurement method, which is an ex ante estimate and has often been used by scholars in poverty vulnerability research (Zhang et al., 2022), but this method depends on the setting of the poverty line and vulnerability line; Second, the vulnerability-of-risk exposure (VER) measurement method, which is an ex post estimation method, estimates the vulnerability through the risk shocks that have occurred. This method has strict requirements on data, so its utilization rate is not high. The third is the vulnerability to the expected utility (VEU) measure, which also belongs to ex-ante estimation. This measure reflects the subjective preferences of individuals or families in the choice of utility functions. It can objectively reflect the changes of risk shocks on family welfare according to household consumption or income changes (Ligon and Schechter, 2003).

Therefore, our paper uses the difference between household certainty equivalent utility and household expected utility (VEU) under risk shocks to measure the economic vulnerability of heterogeneous households.

The calculation process is as follows: first, set the expected utility vulnerability measure model; second, set the rural household utility function model. The model equation is as follows:

In Eq. 1,

Referring further to Ligon and Schechter (2003) decompose the household economic vulnerability indicator into a poverty component and a risk component:

Among them,

Among them, inter-village inequality represents the changes in family welfare caused by comparing households in different counties and villages. The inequality within the town represents the change in household consumption welfare affected by the comparison between the residents of the same village; Collaborative risk represents the impact of different living habits in other counties and villages on household consumption, including county and village dummy variables. The heterogeneity risk represents a series of variables that affect the consumption of sample households in period T and the characteristics of sample households, including personal characteristics of the head of the household and family characteristics, etc. Unexplained risk refers to the changes in household welfare caused by the remaining unobservable variables.

Household financial inclusion index. The government and academic departments have unanimously recognized financial inclusion’s multidimensional, comprehensive, and inclusive nature. Most existing studies construct the financial inclusion index at the provincial level and the county level (Sarma, 2015; Álvarez-Gamboa et al., 2021; Macedo et al., 2022), and there are few works of literature on the construction of the financial inclusion development index at the micro-home level. Compared to the macro-measurement index of financial inclusion, the micro-household financial inclusion index has apparent advantages because it can capture the determinants and influencing factors of access to financial services at the individual or household level (Zhang and Posso, 2019). Some scholars tried to construct the financial inclusion development index from the household level (Yin et al., 2019), which provides a reference for this paper. Combined with data availability, this paper constructs a family-level financial inclusion index system that includes four dimensions: breadth of coverage, convenience, depth of use, and satisfaction. Table 1 presents the meanings of each index. Further, referring to the practice of Sarma (2015) and Xu et al. (2020), the average Euclidean distance method was used to calculate the indexes, and the entropy weight method was used to weigh each index and each dimension. Finally, the rural inclusive financial development index (FI) has been synthesized. Given the space constraints, we will not describe the specific formula and calculation process in detail.

According to theoretical analysis and previous studies, the amount of household consumption, as a core indicator of household economic vulnerability, is influenced by internal factors such as personal characteristics of the household head and household characteristics (Wang et al., 2021) and external factors such as regional characteristics (Peng et al., 2021). Therefore, 15 variables, such as individual characteristics of household heads, household characteristics, and village characteristics, were selected as control variables in this paper. Table 2 shows the descriptive statistics of the variables. The personal characteristics variables include gender, age, education level, marital status, and health status. Household characteristics include variables such as household management, household dependency ratio, land management area, social capital, and severity of illness of household members in the current year. Regional characteristics are dummy variables for the location of the household.

Our paper first examines the aggregate effect of financial inclusion on household economic vulnerability, with the underlying empirical equation set as:

The essence of the OLS and 2SLS models is to use a function of the conditional mean of the explanatory variables to describe the mean of the explanatory variables dependent on each particular value of the explanatory variables without considering the more specific impact of financial inclusion development on rural households with lower or better household economic vulnerability.

To avoid the phenomenon of “average covering up the majority” and solve the parameter estimation problem when the endogeneity problem exists in the quantile regression model, we further used the linear instrumental variable quantile regression (IVQR) model proposed by Chernozhukov and Hansen (2005) to investigate the differential impact of financial inclusion development on the economic vulnerability of heterogeneous rural households. IVQR model set as follows:

In Eq. 6, Y is the dependent variable, D is the independent variable, X denotes exogenous variables, Z stands for tool variable,

In Eq. 7,

In Eq. 8,

Through Eq. 9, the estimated value of

By using the iterative method to make

To check whether unobserved factors influence, we computed the estimation effect of financial inclusion index and square term of financial inclusion index on household vulnerability variable using OLS model and 2SLS model, respectively. We further computed the quantile estimation effect of household vulnerability using the IVQR model. Finally, we further checked the robustness of the main results by substituting variables and winsorizing the data.

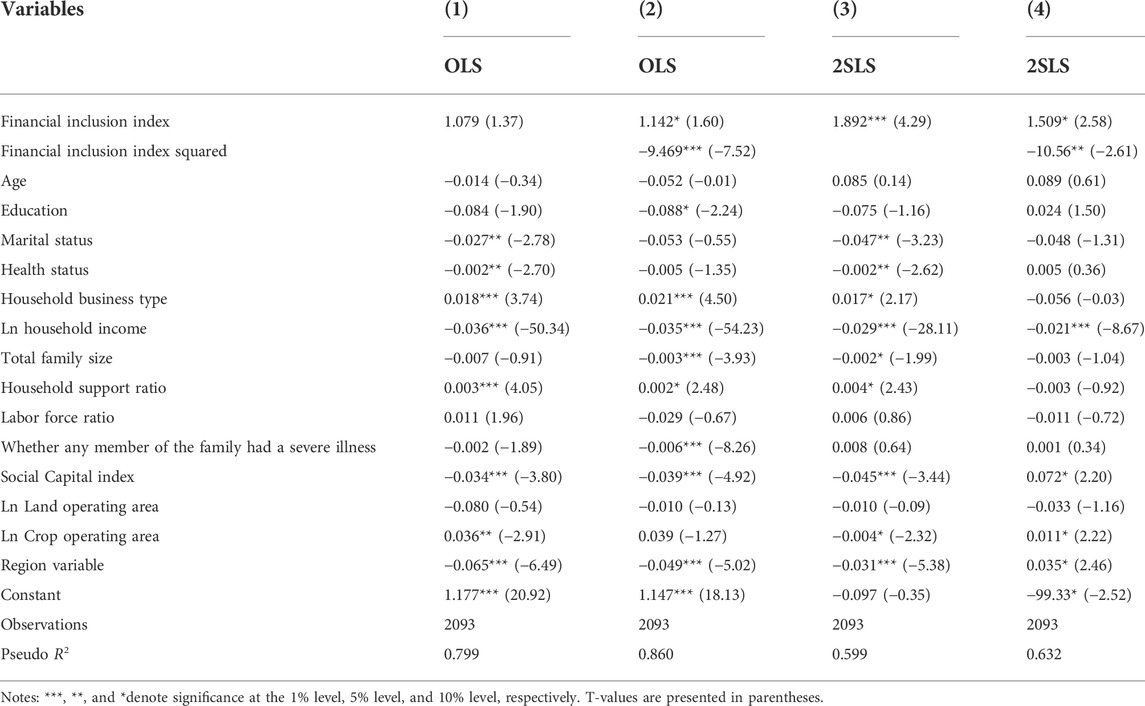

Firstly, ordinary least squares estimation is taken when endogeneity effects are not considered, and Eq. 1 is regressed by gradually adding the core independent variables and it is squared terms. Table 3 as (1) to (2) shown OLS results for the impact of financial inclusion development on rural households’ economic vulnerability. The result in column (1) shows a nonsignificant positive effect of financial inclusion development on rural households’ economic vulnerability. Based on Eq. 1, we added the squared term of the inclusive financial development index. The results were presented in column (2), and the estimated parameter of the squared term was found to be significantly negative at the 1% level. The above results suggest that there may be an inverted “U” nonlinear relationship between the impact of financial inclusion development on household economic vulnerability.

TABLE 3. Model fitting results of financial inclusion on economic vulnerability of rural households.

Further considering the possible endogeneity problems caused by mutual causality and omitted variables, we refer to Zhang et al. (2016) and choose “the mean value of the financial inclusion development index of farmers in other villages in the county where the sample is located” as the instrumental variable. The reasons are as follows: First, the average value of the inclusive financial development index of farmers in other villages within the county except their village does not directly impact the economic vulnerability of the sample farmers. Second, the impact of policy, planning, infrastructure, and other factors on the development of financial inclusion in all towns (villages) in the same county is basically the same. The inclusive financial development index of the sample must be strongly correlated with the inclusive financial development index of farmers in other villages in the county. Therefore, the instrumental variables selected in this paper meet the exogeneity and correlation conditions and are reasonable and effective.

The results of the endogeneity test also show that the Hausman endogeneity test rejects the original hypothesis at the 1% significance level, indicating that there is an endogeneity problem in the model. Considering that the Hausman test is no longer valid under the heteroskedasticity condition, this paper also adopts the DWH test, and the results show that both the Durbin and Wu-Hausman tests reject the original hypothesis at the 1% significance level, thus concluding that the financial inclusion development index variables are endogenous. Regarding the validity of the instrumental variables, in the one-stage estimation results, the t-value of the instrumental variables is 5.13, and the one-stage estimated F-value is 40.23, which rejects the original hypothesis of “weak instrumental variables.” Therefore, the instrumental variables selected in this paper can effectively solve the endogeneity problem.

Then we use the 2SLS two-stage least squares method for empirical tests, and the regression results are reported in columns (3) to (4) of Table 3. The regression results show that the primary term of the inclusive financial development index has a significant positive effect on the economic vulnerability of rural households. And the second term of the inclusive financial development index has a significant negative effect on the economic vulnerability of rural households. It reflects that when the development of financial inclusion is at a low level, it does not have an improving effect on economic vulnerability. Only when the development of financial inclusion reaches a certain level can it significantly improve household economic vulnerability, i.e., the development of financial inclusion has a nonlinear inverted “U” shape effect on rural household economic vulnerability. Thus, Hypothesis 1 is confirmed.

Thispaper further employs instrumental variable quantile regressions to analyze the impact of financial inclusion on households at different points of economic vulnerability. Table 4 presents the regression results for the entire sample of rural households in the quartiles 10, 25, 50, 75, and 90 of the economic vulnerability index. It can be found that, except for the Q10 quantile, the impact of the squared terms of the inclusive financial development index and the development index on the economic vulnerability of rural households at each point is all significantly negative and passes the significance level test, further confirming more fully the inverted “U” shape impact of inclusive financial development on household economic vulnerability. When the economic vulnerability is at the Q10 quantile, the household financial inclusion index and the squared term have a negative but insignificant effect on their economic vulnerability. Probably because the economic vulnerability of households is low at this time, households have relatively complete measures to cope with risks and have a solid ability to cope with risks. Hence, the effect of financial inclusion on the improvement of its economic vulnerability is not yet apparent.

Looking at the magnitude of the coefficients of financial inclusion and its squared term, we find that the coefficients at Q25 and Q50 are the largest, indicating that the development of financial inclusion has the most potent effect on improving economic vulnerability for moderately vulnerable households. On the contrary, the impact on improving economic vulnerability for highly vulnerable households is relatively weak.

The following three methods conduct robustness tests:

1. Using the equal-weight method to determine the weights, the financial inclusion index is remeasured, Eqs 1, 2 are re-estimated, and the regression results are presented in column (1) of Table 5.

2. Using the factor analysis method, the inclusive financial index is remeasured, and the regression results are reported in column (2) of Table 5.

3. Exclude extreme samples. The data were winsorized by 10% and 90%, respectively, and re-estimated. Columns (3) to (4) of Table 5 show the regression results.

We found that the direction of the impact of the inclusive financial development index and its squared term on the economic vulnerability of rural households are consistent with the benchmark regression among the three robustness tests. This result indicates that the fit of the benchmark regression model is more robust and verifies the previous findings that inclusive financial development has an inverted “U” nonlinear effect on rural households’ economic vulnerability.

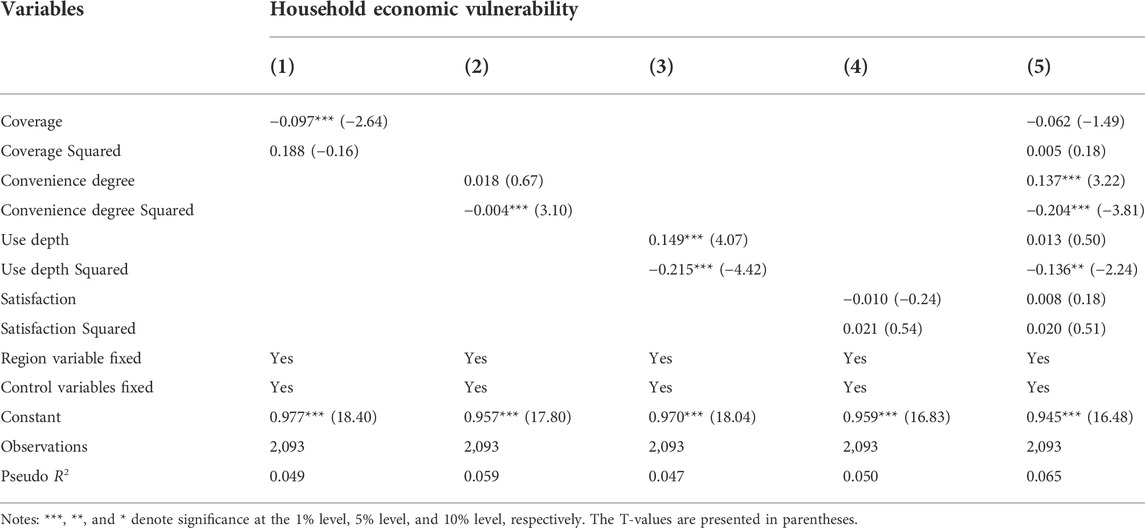

This paper further empirically analyzes the effects of different dimensions of financial inclusion on the economic vulnerability of rural households. In addition to the satisfaction index, the development indices of the three dimensions of the breadth of coverage, convenience, and depth of use are also measured by the average Euclidean distance method for indicators. The entropy weighting method is used to assign weights to each indicator and each dimension, and finally, the development indices of each dimension are derived. Table 6 reports the regression results. The results in column (1) show that the effect of coverage breadth on rural households’ economic vulnerability is negatively significant at the 1% level, indicating that coverage breadth can effectively reduce rural households’ economic vulnerability, which is consistent with the findings of Wang Bank. (2000). The results in columns (2)–(3) show that both convenience and depth of use have an inverted U-shaped significant effect on rural household economic vulnerability, indicating that only deepening convenience and depth of use of financial services can effectively reduce the economic vulnerability of rural households. The results in column (4) show that satisfaction has no significant effect on the economic vulnerability of rural households. Finally, in the regression in column (5), the impact of financial inclusion coverage, convenience, depth of use, and satisfaction on the economic vulnerability of rural households is investigated simultaneously. The regression results show that the effects of the breadth of financial inclusion coverage, convenience, and depth of use on rural households’ economic vulnerability are consistent with the previous paper, indicating that the regression results are powerfully robust. The above findings suggest that the key to financial inclusion to reduce the economic vulnerability of rural households is to make more efforts to improve the convenience and depth of use of inclusive financial services.

TABLE 6. Model fitting results of different dimensions of financial inclusion on the economic vulnerability of rural households.

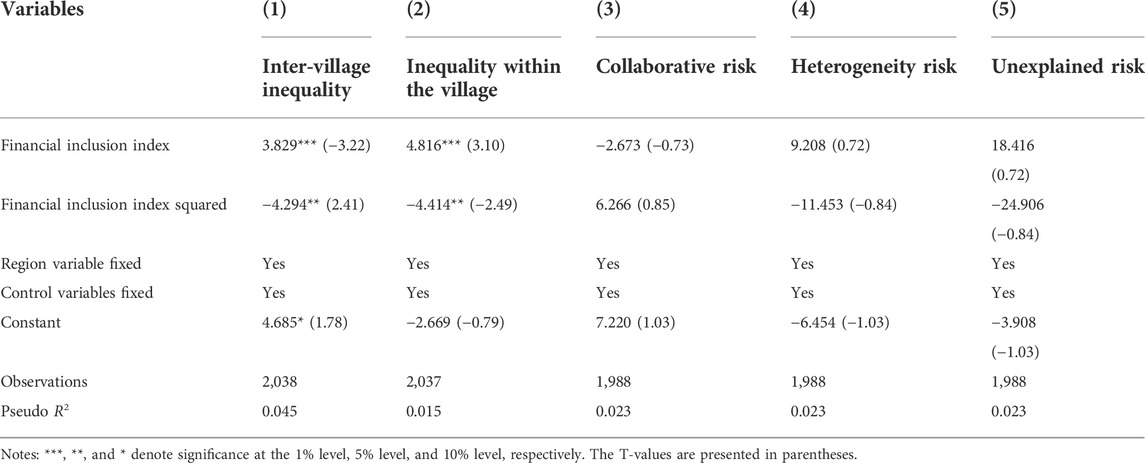

This paper also uses the 2SLS model to explore the economic vulnerability of households and, specifically, what types of risk and inequality are ameliorated by financial inclusion. Columns (1) to (5) of Table 7 report the empirical regression results of the development of financial inclusion on the five dimensions of household economic vulnerability: intra-village inequality, inter-village inequality, synergistic risk, heterogeneous risk, and unexplained risk, respectively. We found that the development of financial inclusion and its squared term significantly affected inter- and intra-village inequality at the 1% and 5% levels, respectively. On the contrary, it did not significantly affect synergistic, heterogeneity, or unexplained risk. An explanation was that the development of financial inclusion could effectively improve income distribution inequality and narrow the income gap (Li and Han, 2019), and at the same time, improve rural households’ capital accumulation and risk coping capacity using financial resource allocation and risk aversion, thus helping to reduce inter- and intra-village inequality. The reason for the insignificance of the latter three types of risks may be that the three types of threat are mainly caused by differences in geographical living habits, differences in individual characteristics, and unobservable factors. Accessibility and availability of rural financial inclusion services have not yet had a direct and significant impact on differences in living habits and individual differences between geographical areas. In summary, the development of financial inclusion mainly improves household economic vulnerability caused by inter- and intra-village inequalities. Thus, Hypothesis 2 was confirmed.

TABLE 7. Model results of financial inclusion on different dimensions of rural household economic vulnerability.

In this section, we introduce the interaction term between the core independent variables (financial inclusion development index and its squared term) and household-specific variables (household business type, education level of household head, household income level, and household social capital) in the original model. The purpose is to verify the heterogeneous effect of financial inclusion on the economic vulnerability of rural households.

Table 8 presents the heterogeneity effects of the inclusive financial development index and its squared and interaction terms on household economic vulnerability. The results show that the interaction terms of the inclusive financial development index and its squared term with the education level of the sample household head, the level of household income and the individual education level of the social capital of the household all pass the significance level test. And all impact directions are consistent with the previous benchmark regression, except for the introduction of the type of household business. This indicates that the inverted U-shaped effect of financial inclusion development on rural households’ economic vulnerability is consistent with the previous paper when differences in household characteristics are taken into account. In addition, the significance of the interaction term shows that financial inclusion development has a stronger effect on improving the economic vulnerability of households operating in agriculture, low income level, and with less abundant social capital. Thus, Hypothesis 3 is confirmed.

Financial inclusion is increasingly discussed as an essential means of improving household vulnerability and environmental quality and achieving sustainable development, especially in China. This paper estimates the impact of inclusive financial development on rural household vulnerability using survey data from 2,093 rural households in Xunyi County and Yangling District, Shaanxi Province, China, for 2018 and 2019. We apply 2SLS and IVQR models to address endogeneity due to bidirectional causality and unobservable factors.

We find that financial inclusion has an inverted “U”-shaped non-linear impact on the vulnerability of rural households; the vulnerability of rural households can only be effectively reduced when the development of financial inclusion reaches a certain level. Specifically, the development of inclusive finance is primarily concerned with improving household vulnerability caused by inter and intra-village inequalities. After endogeneity and robustness tests, the results are consistent. In addition, the effect of financial inclusion on mitigating household vulnerability is more pronounced among agricultural households, low-income households and households with insufficient social capital. Further analysis suggests that increasing the ease and depth of access is key to improving the vulnerability of rural households. We, therefore, conclude that the comfort and depth of access to financial inclusion can be essential and practical measures to improve vulnerability and environmental quality in rural areas. Based on this, policymakers can consider increasing innovation in inclusive financial products and services in poor rural regions and directing more financial resources to rural areas through fiscal and monetary policy instruments. By doing so, we can realise the benefits of financial inclusion in improving household vulnerability while simultaneously improving environmental quality and achieving sustainable development goals.

The results of our study have important practical and policy implications. Firstly, government departments should use monetary and fiscal policy tools to guide rural financial institutions to increase lending to rural areas, thereby providing financial capital to improve vulnerability and environmental quality.

Secondly, rural financial institutions can use digital and intelligent empowerment tools to achieve innovation in differentiated and personalized products and services for household groups with different endowment characteristics. Through the above improvements, it is possible to increase the coverage and depth of use of credit in rural areas, lower the barriers to entry to the rural financial market and help rural households improve their resilience to development across the board.

In addition, the research in this paper confirms that the development of inclusive finance can reduce household vulnerability, improve environmental quality and achieve sustainable development. However, farmers’ environmental awareness and behavior play a crucial role in environmental quality, so it is essential to promote institutional innovation to achieve sustainable development by regulating and guiding farmers’ environmental behavior.

However, this study also has some significant limitations. Firstly, this paper mainly examines the impact of financial inclusion development on environmental quality and sustainability from the perspective of household economic vulnerability, lacking analysis and examination of the mechanisms of action. Future research could use econometric methods such as structural equation modelling or mediating effect modelling to reveal the complex relationships between the relevant factors. Second, many variables measure environmental quality and sustainability, and this paper only measures them in terms of vulnerability. Future research will analyse the relationship between finance and environmental quality and sustainability in a multidimensional manner when data are available. In addition, this paper only uses data from Shaanxi Province, China. Considering that the financial environment and economic behaviour of different regions and households may differ significantly, this leads to various changes in farmers’ environmental behavior. So the heterogeneous effects of inclusive financial development on different types of households in different regions need to be further studied.

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Written informed consent from the participants was not required to participate in this study in accordance with the national legislation and the institutional requirements.

Conceptualization, YW and LW; Methodology,YW and LW; Software, YW and LW; Validation, YW, LW, and BL; Formal analysis, YW; Investigation, YW and LW; Resources, YW and LW; Data curation, YW; Writing—original draft preparation, YW, SF, and LW; Writing—review and editing, LW, BL and JL; Funding acquisition, JL. All authors have read and agreed to the published version of the manuscript.

This study is supported by “Research on the Dynamic Value Evaluation of Agricultural Biological Assets, Mortgage Financing Model and Risk Management Policy”, National Natural Science Foundation of China (NSFC) Grant No. (72273105); “Research on the Effectiveness Evaluation, Risk Control and System Construction of the Agricultural Credit Guarantee Policy”, National Natural Science Foundation of China (NSFC) Grant No. (71873100); “Rural revitalization financial policy innovation team”, Chinese Universities Scientific Fund Grant No. (2452022074); “Research on the Policy Orientation and Implementation Path of Financial Empowerment of Rural Revitalization”, the Soft Science Project of the Central Agricultural Office and the Rural Revitalization Expert Advisory Committee of the Ministry of Agriculture and Rural Affairs, Grant No. (rkx20221801).

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Álvarez-Gamboa, J., Cabrera-Barona, P., and Jácome-Estrella, H. (2021). Financial inclusion and multidimensional poverty in Ecuador: A spatial approach. World Dev. Perspect. 22, 100311. doi:10.1016/j.wdp.2021.100311

Bolarinwa, S. T., and Akinlo, A. E. (2021). Is there a nonlinear relationship between financial development and income inequality in africa? Evidence from dynamic panel threshold. J. Econ. Asymmetries 24, e00226. doi:10.1016/j.jeca.2021.e00226

Camargo, B., and Stein, G. (2022). Credit constraints and human capital policies. J. Public Econ. 208, 104624. doi:10.1016/j.jpubeco.2022.104624

Chen, D., Iqbal, N., Irfan, M., Shahzad, F., and Fareed, Z. (2022b). Does financial stress wreak havoc on banking, insurance, oil, and gold markets? New empirics from the extended joint connectedness of TVP-VAR model. Resour. Policy 77, 102718. doi:10.1016/j.resourpol.2022.102718

Chen, D., Zhao, Q., Jiang, P., and Li, M. (2022a). Incorporating ecosystem services to assess progress towards sustainable development goals: A case study of the yangtze river economic belt, China. Sci. Total Environ. 806, 151277. doi:10.1016/j.scitotenv.2021.151277

Chernozhukov, V., and Hansen, C. (2005). An IV model of quantile treatment effects. Econometrica 73 (1), 245–261. doi:10.1111/j.1468-0262.2005.00570.x

Contró, J. M. F., Henshaw, K., Loke, S. H., Arnold, S., and Constantinescu, C. (2021). Subsidising inclusive insurance to reduce poverty. arXiv preprint arXiv,2103,17255.doi:10.48550/arXiv.2103.17255

Deidda, M. (2014). Does portfolio diversification mitigate financial risk? Evidence from Italian survey data. Riv. Ital. degli Econ. 19 (3), 393–420. doi:10.1427/78243

Demirgüç-Kunt, A., Klapper, L. F., Singer, D., and Van Oudheusden, P. (2015). The global findex database 2014: Measuring financial inclusion around the world. United States: World Bank Policy Research Working Paper.

Emara, N., and El Said, A. (2021). Financial inclusion and economic growth: The role of governance in selected MENA countries. Int. Rev. Econ. Finance 75, 34–54. doi:10.1016/j.iref.2021.03.014

Erlando, A., Riyanto, F. D., and Masakazu, S. (2020). Financial inclusion, economic growth, and poverty alleviation: Evidence from eastern Indonesia. Heliyon 6 (10), e05235. doi:10.1016/j.heliyon.2020.e05235

Essel-Gaisey, F., and Chiang, T. F. (2022). Turning the tide on environmental poverty in Ghana: Does financial inclusion matter? Sustain. Prod. Consum. 33, 88–100. doi:10.1016/j.spc.2022.06.018

Fahad, S., and Wang, J. (2018). Farmers’ risk perception, vulnerability, and adaptation to climate change in rural Pakistan. Land Use Policy 79, 301–309. doi:10.1016/j.landusepol.2018.08.018

Fahad, S., Bai, D., Liu, L., and Dagar, V. (2022a). Comprehending the environmental regulation, biased policies and OFDI reverse technology spillover effects: A contingent and dynamic perspective. Environ. Sci. Pollut. Res. 29, 33167–33179. doi:10.1007/s11356-021-17450-1

Fahad, S., Nguyen-Thi-Lan, H., Nguyen-Manh, D., Tran-Duc, H., and To-The, N. (2022b). Analyzing the status of multidimensional poverty of rural households by using sustainable livelihood framework: Policy implications for economic growth. Environ. Sci. Pollut. Res. Int. 12, 1–14. doi:10.1007/s11356-022-23143-0

Fernández-Blanco, J. (2022). Unemployment risks and intra-household insurance. J. Econ. Theory 203, 105477. doi:10.1016/j.jet.2022.105477

Flores, G., and O’Donnell, O. (2016). Catastrophic medical expenditure risk. J. Health Econ. 46, 1–15. doi:10.1016/j.jhealeco.2016.01.004

Gaisie, E., Han, S. S., and Kim, H. M. (2021). Complexity of resilience capacities: Household capitals and resilience outcomes on the disaster cycle in informal settlements. Int. J. Disaster Risk Reduct. 60, 102292. doi:10.1016/j.ijdrr.2021.102292

Gomez, M. L. J., Hoyos, A. T., and Thoene, U. (2015). “Financial inclusion from the perspective of social innovation: The case of Colombia,” in Proceedings of Business and Management Conferences, 07 January 2015 (London: International Institute of Social and Economic Sciences), 1–10.

Grohmann, A., Klühs, T., and Menkhoff, L. (2018). Does financial literacy improve financial inclusion? Cross country evidence. World Dev. 111, 84–96. doi:10.1016/j.worlddev.2018.06.020

Gutiérrez-Romero, R., and Ahamed, M. (2021). COVID-19 response needs to broaden financial inclusion to curb the rise in poverty. World Dev. 138, 105229. doi:10.1016/j.worlddev.2020.105229

Han, M. S., Yuan, Q., Fahad, S., and Ma, T. (2022). Dynamic evaluation of green development level of ASEAN region and its spatio-temporal patterns. J. Clean. Prod. 362, 132402. doi:10.1016/j.jclepro.2022.132402

Hashmi, S. H., Fan, H., Fareed, Z., and Shahzad, F. (2021). Asymmetric nexus between urban agglomerations and environmental pollution in top ten urban agglomerated countries using quantile methods. Environ. Sci. Pollut. Res. 28, 13404–13424. doi:10.1007/s11356-020-10669-4

Hu, G., Wang, J., Fahad, S., and Li, J. (2022). Influencing factors of farmers’ land transfer, subjective well-being, and participation in agri-environment schemes in environmentally fragile areas of China. Environ. Sci. Pollut. Res. Int. doi:10.1007/s11356-022-22537-4

Inoue, T. (2018). Financial inclusion and poverty reduction in India. J. Financial Econ. Policy 11, 21–33. doi:10.1108/JFEP-01-2018-0012

Lensink, R., Servin, R., and Van den Berg, M. (2017). Do savings and credit institutions reduce vulnerability? New evidence from M exico. Rev. Income Wealth 63 (2), 335–352. doi:10.1111/roiw.12213

Li, J. J., and Han, X. (2019). Financial inclusion, income distribution and poverty alleviation-Policy framework choices that advance efficiency and equity. J. Financial Res. 45 (03), 129–148. (in Chinese).

Ligon, E., and Schechter, L. (2003). Measuring vulnerability. Econ. J. 113 (486), C95–C102. doi:10.1111/1468-0297.00117

Lopus, J. S., Amidjono, D. S., and Grimes, P. W. (2019). Improving financial literacy of the poor and vulnerable in Indonesia: An empirical analysis. Int. Rev. Econ. Educ. 32, 100168. doi:10.1016/j.iree.2019.100168

Macedo, M. D. C., Cruz-García, P., Hernández-Trillo, F., and Tortosa-Ausina, E. (2022). Constructing a financial inclusion index for Mexican municipalities. Finance Res. Lett. 2022, 103368. doi:10.1016/j.frl.2022.103368

Mina, C. D., and Imai, K. S. (2017). Estimation of vulnerability to poverty using a multilevel longitudinal model: Evidence from the Philippines. J. Dev. Stud. 53 (12), 2118–2144. doi:10.1080/00220388.2016.1265942

Peng, Y. L., Yanjun, R. E. N., and Li, H. J. (2021). Do credit constraints affect households' economic vulnerability? Empirical evidence from rural China. J. Integr. Agric. 20 (9), 2552–2568. doi:10.1016/S2095-3119(20)63557-2

Pomeroy, R., Arango, C., Lomboy, C. G., and Box, S. (2020). Financial inclusion to build economic resilience in small-scale fisheries. Mar. policy 118, 103982. doi:10.1016/j.marpol.2020.103982

Sarma, M. (2015). Measuring financial inclusion. Econ. Bull. 35 (1), 604–611. doi:10.1057/978-1-137-58337-6_1

Schoofs, A. (2022). Promoting financial inclusion for savings groups: A financial education programme in rural Rwanda. J. Behav. Exp. Finance 34, 100662. doi:10.1016/j.jbef.2022.100662

Shah, M. I., Foglia, M., Shahzad, U., and Fareed, Z. (2022). Green innovation, resource price and carbon emissions during the COVID-19 times: New findings from wavelet local multiple correlation analysis. Technol. Forecast. Soc. Change 184, 121957. doi:10.1016/j.techfore.2022.121957

Song, J., Geng, L., Fahad, S., and Liu, L. (2022). Fiscal decentralization and economic growth revisited: An empirical analysis of poverty governance. Environ. Sci. Pollut. Res. 29, 28020–28030. doi:10.1007/s11356-021-18470-7

Su, F., Chang, J., Li, X., Fahad, S., and Ozturk, I. (2022b). Assessment of diverse energy consumption structure and social capital: A case of southern Shaanxi province China. Energy 262, 125506. doi:10.1016/j.energy.2022.125506

Su, F., Liang, X., Cai, S., Chen, S., and Fahad, S. (2022a). Assessment of parent-subsidiary companies’ geographical distance effect on corporate social responsibility: A case of A-share listed companies. Econ. Research-Ekonomska Istraživanja 35 (1), 4922–4946. doi:10.1080/1331677X.2021.2019597

Urrea, M. A., and Maldonado, J. H. (2011). Vulnerability and risk management: The importance of financial inclusion for beneficiaries of conditional transfers in Colombia. Can. J. Dev. Studies/Revue Can. d'etudes. du Dev. 32 (4), 381–398. doi:10.1080/02255189.2011.647442

Wang, B., Bouri, E., Fareed, Z., and Dai, Y. (2022b). Geopolitical risk and the systemic risk in the commodity markets under the war in Ukraine. Finance Res. Lett. 49, 103066. doi:10.1016/j.frl.2022.103066

Wang, B., Yan, C., Iqbal, N., Fareed, Z., and Arslan, A. (2022a). Impact of human capital and financial globalization on environmental degradation in OBOR countries: Critical role of national cultural orientations. Environ. Sci. Pollut. Res. 29, 37327–37343. doi:10.1007/s11356-022-18556-w

Wang, R. J., and Du, F. L. (2018). Measurement and decomposition of economic vulnerability of typical grassland pastoralist households. J. Agrotechnical Econ. 10, 109–123. (in Chinese).

Wang, X. H., Han, L. S., and Wen, T. (2021). Study on elite capture and inclusive growth effect of “Huinongdai”. Chin. Rural. Econ. 15 (03), 106–127. (in Chinese).

Wen, T., Zhu, J., and Wang, X. H. (2016). The "elite capture" mechanism of agricultural loans in China: A stratified comparison between poor and non-poor counties. Econ. Res. J. 51 (02), 111–125. (in Chinese).

World Bank (2000). World development report 2000/2001: Attacking poverty the world bank. Beijing: China Financial & Economic Publishing House.

Xu, C., Wang, Q., Shah, F., Kagatsume, M., and Jin, Y. (2022). Impact of off-farm employment on farmland transfer: Insight on the mediating role of agricultural production service outsourcing. Agriculture 12 (10), 1617. doi:10.3390/agriculture12101617

Xu, X. Y., Li, J., and Jin, L. F. (2020). The alleviating effect of financial inclusion on rural education poverty. Chin. Rural. Econ. 9, 41–64. (in Chinese).

Yan, Y., Zhou, J., Zhou, S., Rao, D., Zhou, J., and Fareed, Z. (2022). Investigating the role of education, foreign investment, and economic development for sustainable environment in BRI countries: Application of method of movements quantile regression. Front. Environ. Sci. 10, 874275. doi:10.3389/fenvs.2022.874275

Yang, K., Fahad, S., and He, H. (2022). Assessing the cooking oil fume exposure impacts on Chinese women health: An influential mechanism analysis. Environ. Sci. Pollut. Res. 29, 53860–53872. doi:10.1007/s11356-022-19368-8

Yang, Y. L., and Fu, C. Y. (2019). Analysis of the ameliorating effect of rural inclusive financial development on multidimensional poverty of rural working age population in China. Chin. Rural. Econ. 3, 19–35. (in Chinese).

Yin, Z. C., Peng, C. Y., and Lyons., A. (2019). The development and impact of household financial inclusion in China. Manag. World 35 (02), 74–87. (in Chinese).

Yue, W., Wang, X., and Zhang, Q. (2021). Health risks, health insurance and household financial vulnerability. Chin. Ind. Econ. 10, 175–192. (in Chinese).

Zhang, J., Zhu, W., and Wang, Y. K. (2016). Household economic vulnerability and risk aversion. Econ. Res. J. 51 (06), 157–171. (in Chinese).

Zhang, Q., and Posso, A. (2019). Thinking inside the box: A closer look at financial inclusion and household income. J. Dev. Stud. 55 (7), 1616–1631. doi:10.1080/00220388.2017.1380798

Zhang, Y., Wang, W., and Feng, Y. (2022). Impact of different models of rural land consolidation on rural household poverty vulnerability. Land Use Policy 114, 105963. doi:10.1016/j.landusepol.2021.105963

Keywords: sustainable development, financial inclusion, environmental sustainability, environmental degradation, economic growth

Citation: Wang Y, Fahad S, Wei L, Luo B and Luo J (2022) Assessing the role of financial development and financial inclusion to enhance environmental sustainability: Do financial inclusion and eco-innovation promote sustainable development?. Front. Environ. Sci. 10:1056478. doi: 10.3389/fenvs.2022.1056478

Received: 28 September 2022; Accepted: 28 October 2022;

Published: 14 November 2022.

Edited by:

Zeeshan Fareed, Huzhou University, ChinaReviewed by:

Malkah Noor Kiani, National University of Modern Languages, PakistanCopyright © 2022 Wang, Fahad, Wei, Luo and Luo. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jianchao Luo, amNobHVvQG53c3VhZi5lZHUuY24=

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.