- 1School of Economics and Management, Beihang University, Beijing, China

- 2AVIC International Holding Corporation, Shenzhen, China

The restructuring of global value chain restructuring has created both opportunities and challenges for Chinese manufacturers. In the process, OEM-ODM-OBM has been a typical upgrade path for manufacturing enterprises to integrate into the global value chain. However, this path may not be appropriate for Chinese midstream enterprises in the industry chain. This paper performs a longitudinal analysis of 30-year reform of Shennan Circuits, a typical midstream manufacturing business in the industry chain in China. Based on the smiling curve theory, we systematically analyzed how Shennan Circuit constantly scanned over the industry, its customers, competitors, and leveraged its own capability and resources against the background of global value chain restructuring to successfully integrate into the global value chain, enhance competitiveness while completing business transformation and upgrade. Given the case study, this paper proposes three types of transformation solutions with eight specific paths and the ICCA opportunity scanning analysis method for China’s midstream manufacturers in the industry chain as references.

1 Introduction

The global value chain witnesses an accelerating restructuring while its organization pattern is changing fast (Kaplinsky and Morris, 2001; Gereffi et al., 2005). The outbreak of COVID-19 in 2020 has created new challenges to the global industry development landscape (Baber, 2020; Strange, 2020; Alleyne et al., 2021). The topic of “global value chain reconstructing” has been the latest popular theme in the context of “accelerating changes unseen in a century” and “dual circulation” development pattern (Jie and Zhong, 2020; Xiang, 2020; Nanping, 2021). The outbreak of COVID-19 enlarged the gap between developed and developing economies. Under such circumstances, how to catch up as a late mover has become an important topic for enterprise transformation and upgrade in China.

Electronic information industry is a very important component in manufacturing industries of China. The electronic information industry is technology-intensive, capital-intensive and labor-intensive industrial field, it has high R&D investment and innovation risks. Its transformation and upgrading path under the background of global value chain reconstruction is worth further studying. With profound changes of the international environment in recent years, the transformation and upgrading of China’s manufacturing industry, especially electronic information manufacturing enterprises, has become particularly urgent. Since 2017, the long-term strategy of the United States has undergone significant adjustments, focusing on promoting the return of high-end manufacturing, and successfully sanctioned ZTE, HuaWei and other Chinese leading electronic information enterprises. The development of China’s electronic information industry is facing huge pressure of import substitution and self control, so the corresponding challenges of manufacturing enterprises facing the transformation and upgrading are growing. Taking the most representative integrated circuit industry as an example, China’s total imports reached 260 billion dollars in 2018 and 305.6 billion dollars in 2019, which has surpassed crude oil imports and become China’s largest import product for many years (Li and Liu, 2021). Since 2018, the economic and trade relations of China and US have become tense. The United States has continually enhanced its strategic containment of China in science and technology, economy and trade, finance, politics, international rules, talent exchanges and other fields. In the past 3 years, US has imposed sanctions on more than 200 Chinese enterprises, institutions and individuals, which has had a significant impact on China’s further integration into global industrial chain and trade system. In 2020, the COVID-19 broke out, affected by this, the global economy fell into a deep recession, and economic and social development is facing high uncertainty in the coming years. Under the current situation, how to achieve import substitution and independent control of core electronic components through transformation and upgrading has become a very urgent research topic.

For Chinese electronic information enterprises’ integration into the global value chain, it is a typical process where labor-intensive OEMs increase the value at both ends of the smiling curve by improving their technical strength, brand channels and design capabilities. Such upgrade paths can be summarized as OEM-ODM-OBM (Read, 1997; Lee and Chen, 2000; Kishimoto, 2004). However, this approach is not fully compatible with midstream enterprises in the industry chain. On the one hand, the transformation and upgrading path proposed in the existing research is mainly appropriate for the end-product manufacturers or their commissioned contract manufacturers. However, the midstream manufacturing enterprises do not directly contact the end customers, so this upgrading path is not fully appropriate. On the other hand, according to the classic “smiling curve” theory, the existing Chinese manufacturing enterprises constantly transfer lower-value manufacturing sectors overseas where labor costs are lower through the international division of labor. The outflow of Chinese manufacturing industry future results in industrial hollowing out and imbalance of domestic material production, which is contradicted with the current strategy of enhancing manufacturing competitive advantage and cultivating advanced manufacturing clusters. In terms of case study fields, relevant empirical research focuses more on traditional dominant enterprises such as household appliances and heavy mining, or labor-intensive enterprises such as electronics contract manufacturing (ECM), clothing, shoes and hats and toys. In comparison, electronic information industry is seldom studied, especially a large number of specialized manufacturing enterprises in the midstream of industry chain. In general, there are not adequate references for midstream manufacturers who try to transform and upgrade. To sum up, it is necessary to find out the transformation and upgrading model of manufacturing enterprises in the midstream of the industry chain through example analysis.

In view of this, this paper selects Shennan Circuits Co., Ltd (hereinafter referred to as “Shennan Circuits”) to analyze how the manufacturing enterprises in the midstream of industry chain realize transformation and upgrading in the context of global value chain restructuring. For representative midstream enterprise in the industry chain, like Shennan Circuits, their typical significance of integration into the global value chain and achievements in business transformation is reflected by their balanced capacity upgrading in the industry chain. To meet this end, Shennan Circuits actively grasps the market and customer opportunities brought about by the industry restructuring to take high-end, high-tech and high-level strategies and management measures based on its thorough understanding of the electronic information industry chain. Based on the longitudinal study on Shennan Circuits’ over 30 years reform process, this paper extracts the transformation and upgrading path of Chinese manufacturing enterprises in the midstream of the industry chain, providing management theory and insights for other midstream manufacturing enterprises seeking transformation and upgrading.

2 Literature review

2.1 Reconstruction of global value chain of electronic information industry

Electronic information industry is one of the indispensable sectors of manufacturing industry, and also the pillar industry of a country in the process of digitalization (Wei, 1998; Feng, 2014). The global electronic information industry originated in Germany followed by the United States gradually rose and became an industrial giant (Sheng, 1994). The US. has been the second largest semiconductor producer in the world (Guo and Xie, 2005; Liu and Guo, 2011). In the second half of the 20th century, Japan witnessed a fast growth in the electronics industry (Sun, 1983; Deng and Cui, 1994).

Compared with developed countries such as the United States, China was a late mover in this arena. In 1950, China set up the Telecommunications Industry Bureau. In 1983, China’s fourth Ministry of Mechanical Industry officially changed its name to the Ministry of Electronic Industry. At the beginning of the 21st century, China’s electronic information industry can basically meet the military needs. Economic globalization accelerated since 2001 when China joined the WTO and transnational corporations have adjusted their production area in the value chain. The production’s added value is lower than R&D and brand marketing. Transnational corporations have moved lower-value manufacturing overseas, particularly to East Asia where labor costs were lower (Zhu, 2016). Leveraging these advantages of low labor costs and intensive resources, China became the first destination and established huge production capacity. China’s soon became popular all over the world with its intensive human capital, abundant resources and cost advantages, but it is still at the low-end of the value chain (Dong, 2005; Zhong, 2006; Brandt and Rawski, 2008). The domestic and foreign economies experienced a golden period of rapid development from China’s accession to the World Trade Organization to the financial crisis in 2008, China’s electronic information industry has accumulated huge production capacity with the help of global industrial chain transfer (Adams et al., 2004; Zhao, 2018). The global financial crisis hit the world in 2008, pushing the industrial adjustment (Gao et al., 2015). The global economy restarted balance. Economic decline unveiled the problem of overcapacity in China’s electronic information industry (Lu and Li, 2004; Wang, 2013), so it is urgent to carry out industrial transformation and adjustment, especially the electronic information industry. At the same time, China’s electronic information industry has problems such as capital concentration, serious energy consumption, prominent environmental problems, and low industrial added value. Industrial transformation and adjustment are inevitable and imminent for Chinese manufacturing enterprises in midstream of the industry chain (Cai, 2013; Zhang, 2016).

The research on the transformation and upgrading of China’s enterprises mainly foced on traditional manufacturing industries, such as household appliances, clothing, shoes and hats, toys, heavy industry and mining. Many studies were based on the global value chain theory and the international division theory of labor of the “smiling curve” to improve the occupancy, some were targeted around enterprise capabilities and technological innovation. Study on the electronic information manufacturing industry is relatively less, especially on the upstream electronic component manufacturing industry. On the one hand, it is difficult to draw a conclusion with strong universality because of the wide range of industries and large product differences of the electronic information manufacturing industry; On the other hand, the development environment of the electronic information industry was relatively good from the 1990s to the beginning of this century, some enterprises achieved rapid development through technology catch-up and capacity expansion. The urgency of transformation and upgrading was relatively weak compared with the traditional manufacturing industry.

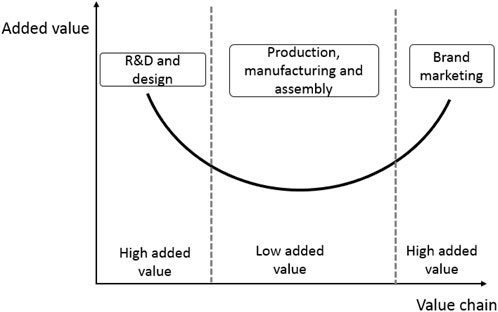

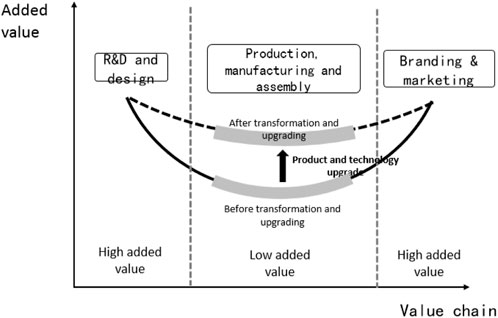

2.2 Transformation and upgrading path based on the smiling curve

As for the theory of enterprise transformation and upgrading, Amsden proposed that the typical upgrading path of enterprises in emerging industrialized countries was from Original Equipment Manufacturer (OEM) to Original Design Manufacturer (ODM) to Own Branding Manufacture (OBM) before the 1990s (Amsden, 1989). This path integrated with the “smiling curve” proposed by Stan Shih forming the classic path model of enterprise transformation and upgrading in the global value chain (Mao and Zheng, 2012). The “smiling curve” with an opening upward describes the added value of each electronic information segment. The left end of the curve represents the upstream, namely R and D and design, and branding and marking are at the right end of the curve (Yu et al., 2005). Leading multinationals are at both ends of the curve due to their advantages and gaining the highest value. In contrast, most of Chinese electronic information enterprises are in the middle section making up the midstream of the industry chain, with low profitability and added value. How to obtain higher added value is the key to the transformation and upgrading (Yang and Zeng, 2009).

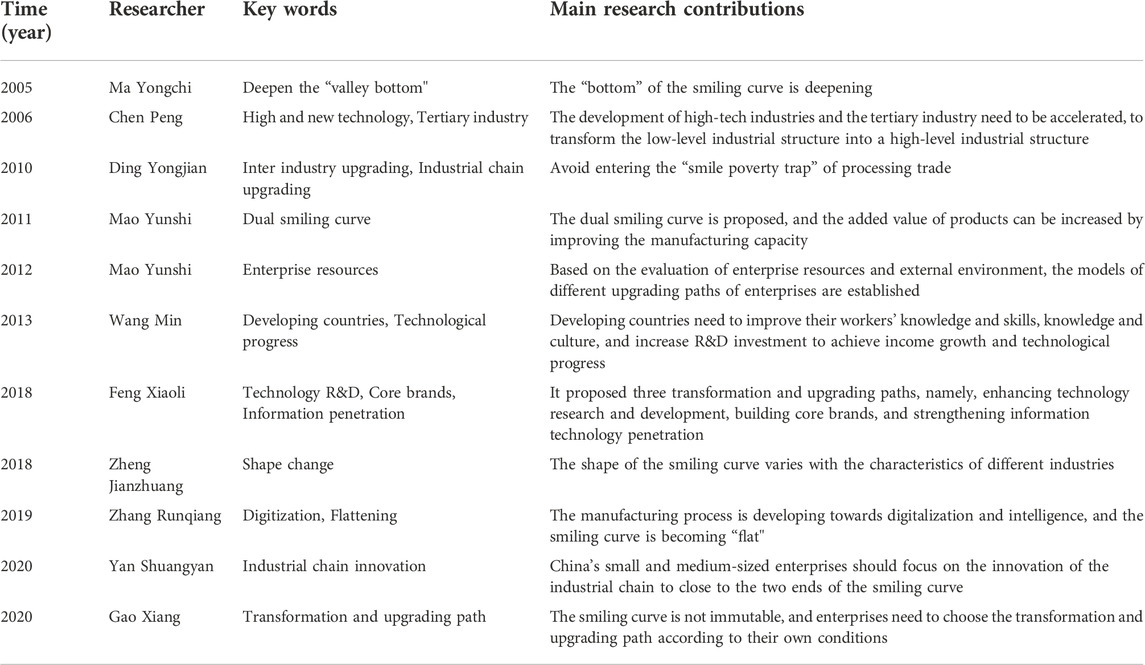

Ever since its inception, “smiling curve” has been improved by academics for the past 3 decades (Figure 1). Ma Yongchi believed that the bottom of the smiling curve is deepening while both ends are rising (Ma and Ji, 2005). Chen Peng pointed out that most products made in China are in the middle section with low added value, so the industry structure requires improvement and re-organization. Ding Yongjian (Ding, 2010) proposed that the transformation and upgrading of China’s manufacturing industry can be considered from two aspects, one is to improve the industrial structure of the manufacturing industry, the other is to upgrade from one industrial chain to another, so as to avoid companies entering the “smile poverty trap” of processing trade. The industrial smiling curve proposed by Chen Yingying (Chen, 2008) and the product smiling curve proposed by Mao Yunshi (Mao and Li, 2006) constructed the heterogeneous smiling curve models at the single industry and the single product level, respectively. Mao Yunshi (Mao and Xiong, 2011) proposed the dual smiling curve model, believing that improving manufacturing capacity and reducing resource consumption can enhance the added value in the industry chain. Wang Min (Wang and Feng, 2013) pointed out that in developing countries, enterprises need to improve the capital input and knowledge level of workers to get a better position along the smiling curve. Feng et al. (2018) proposed that Chinese manufacturing industry should enhance technology research and development, build core brands, and strengthen information technology. Zheng et al. (2018) found that the shape of the smiling curve varies for different industries. Zhang et al. (2019) suggested that manufacturing process is digitalized and smarter due to the new technological revolution, thus increasing the added value of the manufacturing and flattening the smiling curve. Yan (2020) analyzed the transformation and upgrading countermeasures based on the smiling curve from the perspective of a changing global value chain, and proposed that small and medium-sized enterprises in China should try to move towards the both ends of the smiling curve through innovation. Gao et al. (2020) emphasized that the smiling curve of Chinese manufacturing industry is always changing. As shown in Table 1.

In general, in terms of the study about the enterprise transformation and upgrading path, most of the research focused on how to improve the positioning of enterprises along the curve based the theory of global value chain and international division of labor, while some studies concerned enterprise capabilities and technological innovation. The transformation and upgrading path is mainly appropriate to end-product manufacturers or their commissioned contract manufacturers. Their upgrading path can be summarized as the classical OEM-ODM-OBM. According to this classical path, labor-intensive OEM enterprises increase the value at both ends of the smiling curve with stronger technical capability, brand channels and design. For specialized manufacturers with special techniques in the midstream of the industry chain, the effectiveness of traditional upgrading path model that tries to move towards both ends the “smiling curve” is limited. Suzhou Dongshan Precision Manufacturing Co., Ltd., whose main business was precision manufacturing of LED industry, is a typical manufacturing enterprise in the middle of the electronic information industry. Facing its sluggish development, it cannot move to the two ends of thesmiling curve. Therefore, it decided to achieve transformation and upgrading through mergers and acquisitions, finally entered the FPC industry, and quickly gain technical advantages, achieve technological upgrading and leapfrog, entered Apple industry chain. The merger and acquisition of external enterprises also brought great management risk, customer loss risk and market expansion risk, which puts forward higher management requirements for enterprises (Shao, 2019). Hon Hai Precision Industry Co., Ltd. Is the world’s largest technology manufacturing service provider in the electronic industry. Its transformation and upgrading path is not moving to the two ends of thesmiling curve, but in the direction of continuous upgrading of product services. It aimed at achieving long-term sustainable development and value added through four stages, processing on order, upgrading of product service solutions, upgrading of product service processes, and upgrading of product service intelligence (Shi, 2014; Lei, 2015). The typical OEM→ODM→OBM transformation and upgrading path is difficult to provide theoretical support for the transformation and upgrading practice of manufacturing enterprises in specific industries in the middle reaches of the industrial chain under the background of global value chain reconstruction.

2.3 Market segmentation theory

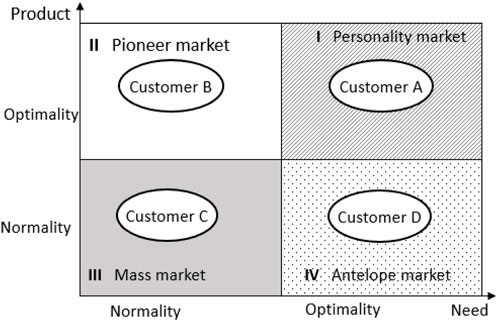

The transfer characteristics vary with different industries involved in the global value chain. The transformation process is faster for industries with shorter chains in the restructuring of the global value chain due to their weak transfer inertia, while industries with a longer industry chain usually have longer transformation process due to strong inertia. Therefore, it is necessary to scan industries to help enterprises seize the development opportunities of the target industry that are appropriate to their characteristics. In terms of the industry sector choice, Kotler (1997) proposed market segmentation theory, noting that market segments must be measurable, substantial, accessible, differentiable and actionable. For the access of market segments, Michael Porter put forward Five Forces Model (Yang and Li, 2005), emphasizing that the five forces, including the rivalry between competitors, potential new entrants, threat of substitute product, buyers’ bargaining power and suppliers’ bargaining power, determine the scale and degree of competition in a market. Market segmentation theory points out that enterprises should consider two factors: one is the overall attractiveness of market segments, the other is the enterprise’s resources and future planning. A market is divided into mass market, multiple market segment, single market segment and individual market segment (Figure 2). Enterprises need to choose different marketing strategies according to their own resources and positioning in different market segments. Market segmentation theory has gradually evolved into subdivision segmentation theory and anti-market segmentation theory ever since Philip Kotler created the theory. Wang (2004) pointed out that subdivision segmentation theory further divides the existing market segment into personal customized markets (Li and Wang, 2008). In practice, however, excessive subdivision of markets causes higher prices and lower sales, so the anti-market segmentation theory is proposed. Anti-market segmentation theory discourages excessive market segmentation, and advocates the market segments sharing the same or similar demands to merge, thus reducing marketing costs and increasing sales (Wei, 2021).

The existing market segmentation theory lays the foundation of the marketing theory, serving end product manufacturers who face the end customers directly and helping them choose their own target segments. However, for midstream manufacturing enterprises which are not end product manufacturers, their customers are more enterprises rather than end users, so existing market segmentation theory is not appropriate. Therefore, it is necessary to research the target market selection theory for manufacturing enterprises in midstream of the industry chain.

3 Research methodology and case selection

3.1 Research methodology and analysis framework

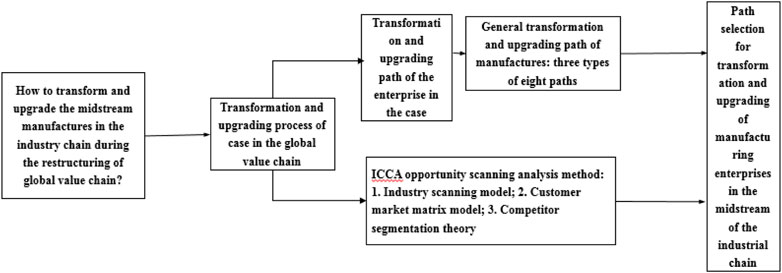

Case study is the main research method used in this paper. A case study is an empirical research method in which one or more case scenarios are examined in depth over an extended period of time, while data and information are systematically collected as a basis for summarizing, analyzing, and exploring the general patterns and particularities of the phenomenon (Eisenhardt, 1989; Yin, 1994). The research method used in this work is an exploratory case study, in which the researcher gathers data, builds a case, and then chooses theoretical hypotheses based on the empirical features of the case. This method is appropriate for examining the dynamic evolution (Graebner and Graebner, 2007) when it is difficult to identify the research hypothesis. This article refines the ICCA opportunity scanning analysis method by analyzing the transformation and upgrading history of Shennan Circuits, and summarizes the overall transformation and upgrading path for midstream enterprises in the industry chain as well as selection reasons.

Figure 3 demonstrates the analysis framework. First section analyzes the transformation and upgrading history of Shennan Circuits based on its transformation and upgrading. The section part concludes the transformation and upgrading path of Shennan Circuits according to the smiling curve, and summarizes the three types of eight particular paths. The final part proposes an ICCA opportunity scanning analysis method based on the abovementioned study, market segmentation theory and Porter’s Five Forces Model as references for midstream manufacturing enterprises in the industry chain.

3.2 Case selection

A classical case is essential for a case study. This paper selects Shennan Circuits, a company founded in 1984 and headquartered in Shenzhen City, Guangdong Province, China. Shennan Circuits built main production bases in Shenzhen, Wuxi and Nantong. Ever since its establishment, the electronic components manufacturer has been one of the midstream enterprises in the electronic information industry chain, focusing on electronic interconnection. Over 3 decades’ development, Shennan Circuits now operates in three major businesses: printed circuit board (PCB), substrate (SUB) and printed circuit board assembly (PCBA). In 2021, its operating revenue totaled RMB13.9 billion, earning a total profit of RMB1.6 billion. This paper selects Shennan Circuits for four reasons. First, Shennan Circuits did not follow the traditional transformation and upgrading path of OEM-ODM-OBM, but its scale and profits developed rapidly, so it is highly necessary to study its transformation and upgrading path. Second, the electronic components industry is an important node in the electronic information industry chain, and it is a typical specialized manufacturing midstream sector in the manufacturing industry chain. Shennan Circuits, as a leading electronic circuit components producer in China, serves as an example of the industry and a typical midstream case for the study. It would be easier to achieve our research goal by analyzing its development history. Third, years of development, Shennan Circuits has transformed and upgraded from a RMB500 million low-end market supplier of game consoles and electrical appliances to one of the world TOP 10 leading companies in the industry with more than RMB10 billion annual income and RMB1.5 billion profits. The company successfully integrated into the global value chain due to effective transformation and upgrading since 2005, so Shennan Circuits meets our research needs. Fourth, Shennan Circuits is listed on the Shenzhen Stock Exchange, so its data and operation are public information. The author is one of the planners and leaders engaged in Shennan Circuits’ transformation and upgrading, so he has high access to relevant data and information.

To sum up, this paper selects Shennan Circuits as a case to study how manufacturing enterprises transform and upgrade as the global value chain restructures to solve problems in existing theoretical research. In addition, Shennan Circuits is a typical and representative example as it highly matches with the research objective of the study. Last but not least, the author has access to relevant data and information from Shennan Circuits.

3.3 Data collection

The author has been engaged in Chinese electronic information industry for more than 20 years. Since 2005, he participated in the growth and development of Shennan Circuits in person, accumulating a large amount of first-hand data, including internal reports, procedure documents, and meeting materials. To carry out the research, the author sorted the first-hand data collected previously and collected latest data on demand of the research (as shown in the table) according to the case study method, including: 1) publicly disclosed information of listed companies; 2) a large number of reporting materials, special reports, financial data, business analysis report, annual summary reports involving the case enterprise; 3) third-party public information such as industry research reports and media opinion reports, as well as macroeconomic research reports and other relevant external background information; 4) special interview materials of relevant persons in other cases, including interviews of the management, relevant employees and industry insiders, and other relevant information. The above materials are decrypted in accordance with the information disclosure rules of listed companies and relevant business secret management regulations.

This paper presents an in-depth examination and collation of facts and information related to the case enterprise based on the information collected. Multiple sources of information are triangulated and evaluated. In particular, information and data from various sources are compiled, validated, and compared to ensure the validity of the data, so preventing unilateral bias from affecting the results and enhancing the authenticity and validity of the information and data. Through data analysis, the author explores how the case enterprise has transformed and upgraded in the restructuring of value chain, and summarizes the findings to develop a systematic theoretical model.

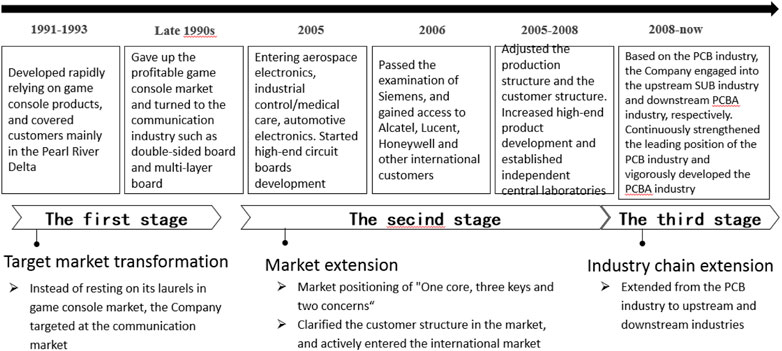

4 Case analysis

The transformation and upgrading process of Shennan Circuits (also as the “Company”) is divided into three stages (Figure 4). The first is the target market transformation stage when Shennan Circuits transformed from the game console market to the communication market. The second is the market extension stage when Shennan Circuits extended from the communication industry to a new positioning of “one core (communication equipment), three keys (aerospace electronics, industrial control/medical care and automotive electronics) and two concerns (computer and consumption)". The third is business extension stage when Shennan Circuits extends from the Printed Circuit Board (PCB) industry to the Substrate (SUB) and Printed Circuit Board Assembly (PCBA) industry.

4.1 Target market transformation

In the 1990s, the game console was popular in China. Due to simple production process and low technical requirements, game console circuit boards were always in short supply. Shennan Circuits grasped the opportunity and rode on the wave of game console circuit boards ' rapid development. At its peak, the Company realized that the game console market was not sustainable. Limited by the production capacity and production line, it had only one choice of the main profitable market, either continuing its focus on the game console market or finding new growth points. By then, Shennan Circuits made an in-depth analysis of the PCB application market. At the time, the communication market was just in its infancy. It was expected that the market demand for PCB market would exceed the demand for game console. Shennan Circuits decided to transform to the new market. Since then, communication market has become its core business. Furthermore, Shennan Circuits established a strategic partnership with other Chinese companies in communication industry. In 1997, while the game console market shrank and many PCB manufacturers suffered great loss and difficulty, Shennan Circuits had mitigated the market risk by transferring to the communication industry in advance. This decision also secured the opportunity for future development, consolidating the achievement of its first transformation and upgrading.

At the first stage of transformation and upgrading, Shennan Circuits identified the characteristics of the game console market through scanning analysis. First, the small market scale is unsustainable for the growth of enterprises. Second, low technical requirement of the industry means lower entry threshold and fiercer competition, making game console a red sea market where low cost was competitive advantage. Third, the fast iteration and rapidly changing customer demands for games exposed the industry with potential risks, while the competition caused by computers and other market players mean that it was easy to be replaced. Given the scanning analysis, Shennan Circuits started looking for new target markets. Through the panoramic scanning of the PCB users, Shennan Circuits found that the communication market has large market scale, great development potential, high product technical threshold and product added value, so the Company decided to transform to the communication market. This transformation raised the technical and stability requirements. To meet this end, Shennan Circuits increased the investment in research and development of manufacturing and assembly processes, and improved technical capabilities.

4.2 Market extension

The Company conducted a scanning analysis of the downstream PCB market, and determined its positioning according to the market size and the capability of itself. Its market positioning is “one core (communication equipment), three keys (aerospace electronics, industrial control/medical care and automotive electronics) and two concerns (computer and consumption)”. Guided by such clear market positioning, Shennan Circuits further clarified the customer structure, and conducted a comprehensive scanning over its PCB customers. It was found that the international market had huge potential, so the Company decided to enter the international market. Before 2006, Shennan Circuits mainly served domestic customers since international enterprises had stricter requirements on suppliers. In June 2006, Shennan Circuits was assessed by Siemens, a global leading enterprise in electronic and electrical engineering. In September 2006, Shennan Circuits passed the audit of Siemens, and became one of the suppliers this major international market player for the first time. Soon later, Shennan Circuits successively passed the audit of Alcatel, Lucent, and Honeywell who had particularly strict auditing in aerospace. In December 2007, it passed the audit of Rockwell Collins, another significant breakthrough in developing strategic customers. Due to customer structure upgrading, customers had higher requirements for products, and the demand for products above 10 floors increased significantly. For this, Shennan Circuits upgraded its technology to improve its ability to make multilayer boards, and adjusted the product structure while optimizing the market order structure. It increased the proportion of 10-layer and above products layers, and reduced the proportion of 2-layer products. A larger high-end customer base and products proportionally improve the Company’s profitability.

At the second stage of transformation and upgrading, Shennan Circuits performed combined scanning of industry and customer to further extend the target market and upgrade customer base. Based on the communication market, Shennan Circuits scanned other industries and included aerospace electronics, industrial control/medical care, automotive electronics as the key targets. These industries had technical requirements, for example, stronger stability, so the added value was relatively higher. Shennan Circuits then scanned segmented markets and finally identified specific customers in the industry, realizing the transformation and upgrading. Shennan Circuits further strengthened its own product technical capabilities according to the nature of the new industry, extended and improved its own product quality and internal operation ability according to customer needs. At this stage, Shennan Circuits still followed the transformation and upgrading path based on the manufacturing and assembly process.

4.3 Industry chain extension

In 2008, some PCB customers of Shennan Circuits had demands in SUB, the upstream product, and PCBA in the downstream of the industry chain. To this end, Shennan Circuits conducted a panoramic scan over the SUB and PCBA industries. After identifying the market capacity, main customers and competitors in 2008, it found that despite the demands for the upper and downstream products of PCB, domestic market players had strong presence in PCB industry extension. Given the market situation, Shennan Circuits decided to extend its business to SUB and PCBA, formulating a “3-In-One” strategy. The multi-business extension of Shennan Circuits demonstrated two characteristics: 1) Stepped out of the comfort zone of PCB only business to extend its industry chain based on existing businesses and key strategic customers, while closely monitoring merging industries to enter timely; and 2) the multi-business expansion centered on existing businesses while developing new fields in upstream and downstream industry which were closely related to existing business. The industry-chain-oriented strategy is designed to create value for customers by extending its coverage to new businesses. Adhering to a consistent, steady and efficiency-oriented approach, Shennan Circuits will conduct profound research and evaluation, especially the negative impact on the potential benefits and risks of main business before the new business extension. After transformation, upgrading and constant development, Shennan Circuits has become one of the top PCB manufacturers in China, and ranked the world’s eighth largest PCB company in 2021.

At the third stage of transformation and upgrading, Shennan Circuits decided to extend its business from PCB to SUB and PCBA as indicated by its panoramic scanning of the products and needs of existing customers. Thus, the third stage of transformation and upgrading is industry chain extension from PCB to SUB and PCBA (Table 2).

5 Research findings

5.1 Transformation and upgrading path of manufacturing enterprises in the midstream of the industry chain

5.1.1 Transformation and upgrading path of Shennan Circuits

Based on the industry, customer and opportunity scanning, Shennan Circuits completed the transformation and upgrading through three-stage process with different priorities. The first stage focuses on product technology upgrading, the second stage product technology upgrading, and the third stage industry chain extension. Driven by customer requirements and demands, Shennan Circuits developed strategic key customers in aerospace electronics, industrial control/medical care, and automotive electronics. Customer-oriented technology innovation makes the Company ready to serve its clients better by extending businesses from PCB to the SUB in the upstream and PCBA in the downstream of the industry chain. Throughout its transformation and upgrading process, Shennan Circuits adopted the strategy of “technology upgrading + industry chain extension”. According to the smiling curve, technology upgrading strengthen the price-competitiveness and the added value for products, thus raising the position of Shennan Circuits on the curve. Meanwhile, industry chain extension expands its business to SUB and PCBA, cultivating comprehensive capabilities including R&D, design, manufacturing and assembly, broadening the width of Shennan Circuits on the curve. The two paths increase the added value of products, and facilitate transformation and upgrading.

Shennan Circuits is in the midstream of the electronic information industry value chain, but has low added value. It is difficult for the Company to move to either end of the smiling curve. First, for midstream enterprises like Shennan Circuits (Guo and Huang, 2010; Ping, 2014), it is difficult to transform to brand marketing like end product manufacturers. Second, for technical safety reasons, most products are designed by customer while Shennan Circuits is outsourced to complete manufacturing and processing (Zhao, 2019), so it is not easy to upgrade to R&D and design. Given the situation, Shennan Circuits seeks added-value growth from two aspects. First, extend the production, manufacturing and assembly to the upstream and downstream industries and broaden the width of the smiling curve. Second, upgrade the product technology to increase the added value of the production, manufacturing and assembly, and heighten the smiling curve. For manufacturing enterprises in the midstream of the industry chain, their transformation and upgrading path is to extend the industry chain on top of product technology upgrading, rather than blindly transform to R&D and design at the left end or branding and marketing at the right end. This path is defined as the balanced path of Shennan Circuits (Figure 5).

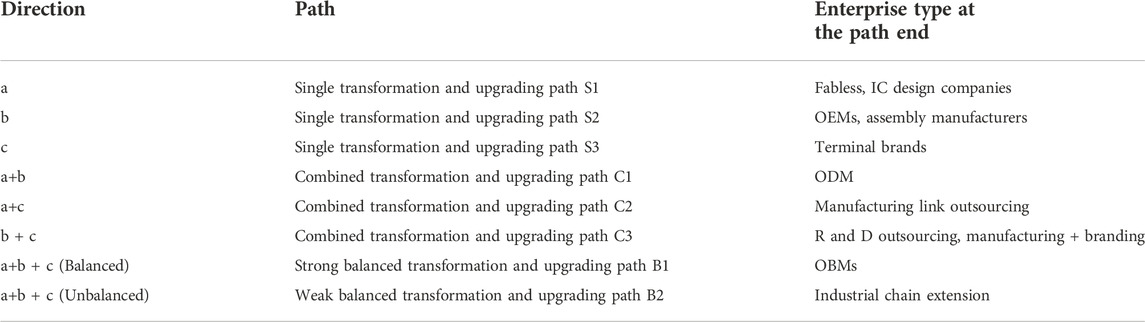

5.1.2 General transformation and upgrading path of manufacturing enterprises in the midstream of the industry chain

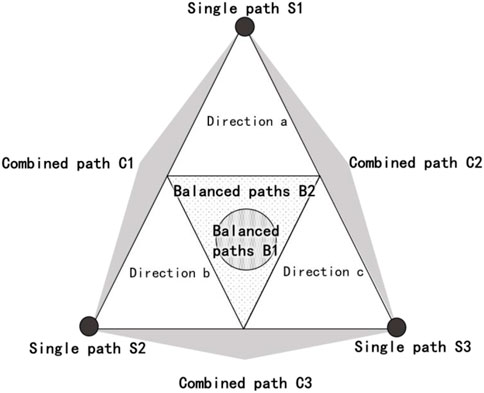

Through the case study, this paper finds that the transformation and upgrading path of Shennan Circuits is product technology upgrading plus industry chain extension. For Chinese manufacturing enterprises who are in the middle section of the smiling curve, most of them are engaged in low value-added business and striving towards the high value-added segments. As shown in Figure 6, on the basis of the theory of “smiling curve” proposed by Shi Zhenrong (Shi and Lin, 2005), the transformation and upgrading directions of enterprises include middle-to-left (Direction a: upgrading to R&D and design), up (direction b: enhancing production, manufacturing and assembly), middle-to-right (Direction c: transforming to branding and marketing). Different combinations in the three directions generate eight specific paths of transformation and upgrading. As shown in Figure 7.

5.1.2.1 Single transformation and upgrading path

Enterprises transform and upgrade from the middle to the left, up and right respectively, forming three single paths of transformation and upgrading, namely, S1, S2 and S3.

S1 refers to the transformation of an enterprise from a manufacturing enterprise to a R&D enterprise, for example, OEM to Fabless. Higher labor costs and greater pressure on the upstream supply chain will impair the profitability of manufacturing sector. To transform to designing sectors which have much higher profitability, enterprises with strong technological capability usually prefer path S1 to improve earnings by tapping into their own research talents and patents. This path is consistent with Mei Lixia’s theory that the main driving factors for transformation and upgrading have changed from production to technological innovation, achieving upgrading to a higher link of the value chain (Mei et al., 2005). Classical examples include AMD and Qualcomm, which gained high added product values depending on their technical barriers.

S2 refers to an enterprise that is deeply engaged in its own manufacturing and assembly, strengthens its OEM positioning, and does not shift to R and D, design or brand marketing. Such enterprises generally do not have enoughR and D strength to shift to the left end of the smiling curve, nor enough brand influence to shift to the right end. So they generally carry out product upgrading based on cost advantages to improve product quality, so as to meet customer needs. This path is consistent with Gao Xiang’s theory of raising the bottom of the smiling curve (Gao et al., 2020). For example, some assembly OEMs, such as Foxconn, improve the added value of manufacturing and assembly by reducing costs, improving efficiency and upgrading products, so as to achieve continuous profits.

S3 refers to the transformation from an OEM to a terminal seller, from the middle of to the right end of the smiling curve. Such enterprises generally are midstream product manufacturers with strong brand influence, whose products are for downstream customers. After transformation and upgrading, they turn to terminal product manufacturers, whose products are directed for terminal consumers. For example, Xiaomi is responsible for brand marketing of its smart home products and outsources the design and manufacturing, making high added value in the whole industry chain.

5.1.2.2 Combined paths of transformation and upgrading

Enterprises transform and upgrade from the middle to the left and upward at the same time, left and right at the same time, right and upward at the same time, forming three combined paths of transformation and upgrading, namely, C1, C2 and C3.

C1 refers to manufacturing and assembly enterprises that upgrades products as well as shifts to R and D and design at the left end of the smiling curve. Such enterprises are generally with weak brand influence, hence it is not suitable for them to transform to the terminal product manufacturers due to fierce competition of terminal products. At the same time, because they are committed to manufacturing and assembly, it is recommended to shift to R and D and design, namely the path of C1. The process of the transformation and upgrading of Chinese enterprises from OEM to ODM is to realize the combined transformation and upgrading through C1. For example, as a processing manufacturer of Apple earphones, Goethe has the ability to develop and manufacture products, but the final product brand is still Apple’s.

C2 refers to an enterprise that abandons manufacturing and assembly and turns to the high value-added R and D, design and brand marketing, so as to complement with the production mode of OEMs. Such enterprises generally have strong comprehensive strength, R and D and design capabilities and brand influence. They can choose to outsource the manufacturing and assembly link with low added value, and work on the high value-added R and D, design and brand marketing. This path is consistent with Yan Shuangyan’s theory that enterprises should move closer to the two ends of the smile curve around industrial chain innovation (Yan, 2020). Apple is a successful example, which out sources the low value-added manufacturing and assembly, focusing on the high value-added R and D, design and brand marketing.

C3 refers to manufacturing and assembly enterprises thatgradually shifts to brand marketing at the right end of the smiling curve while upgrading products in the manufacturing and assembly link. Such enterprises generally choose to carry out transformation and upgrading due to the low value-added manufacturing and assembly, but find it hard to shift to R and D and design due to R and D barriers. In contrast, it is easy for these enterprises to shift to the high value-added brand marketing linkwhile upgrading products in the manufacturing and assembly link.

5.1.2.3 Balanced paths of transformation and upgrading

Enterprises transform and upgrade from the middle to the left, upward and rightat the same time, forming two balanced paths of transformation and upgrading, namely, B1 and B2.

B1 refers to an manufacturing enterprises that improves the added value of manufacturing, and shifts to R and D, design and brand marketing in a balanced way. Such enterprises have strong strength in each section of the smiling curve, completely control the production process of the whole chain of production. They are scale enterprises with strong R and D and design capabilities and brand influence. Samsung is a typical example, which has an unbalanced layout in the whole smiling curve, allowing it to be powerfully resistant to risks and gain added value in the whole industrial chain on the smiling curve.

B2 refers to an enterprise that transforms and upgrades in three directions at the same time, but it focuses on one or two directions due to limited resources or industry barriers. When it is difficult for enterprises to shift to R and D and design because of high barriers of the industrial chain, they can choose to appropriately extend to the upstream of the industrial chain, from production and manufacturing to R and D and design with low technical barriers in the upstream. When it is difficult for enterprises to transform and upgrade to brand marketing at the right end of the smiling curve because their products are not oriented to terminal customers, they can choose to partially extend to the downstream of the industrial chain. This path is consistent with Zhu Haijing’s theory of transformation and upgrading based on the radiation development of homologous industrial technology to surrounding industries (Zhu et al., 2006). Shennan Circuits is an example of the weak balanced path of transformation and upgrading, mainly shifting to the direction b, while partially extending to the directions a and c (Table 3).

The general transformation and upgrading paths for manufacturing enterprises in the midstream industrial chain are classified, and Shennan Circuits is the weak balanced type. Shennan Circuits selected the communication, aerospace and other industries to enter through the industry scanning, and identified the key customers with a scanning of market segments and specific customers. According to the characteristics of market segments, customer needs and competitors, it extended its business from PCB to SUB and PCBA in the industrial chain, hence the weak balanced type of transformation and upgrading focusing onPCB product upgrading, while partially extending to SUB and PCBA in the upstream and downstream of the industrial chain.

5.2 ICCA opportunity scanning analysis

The restructuring of the global value chain brings opportunities and challenges for enterprises. Scanning analysis of external opportunities is vital for enterprises to seize the development opportunities, and turn them into development direction. In the process of Shennan Circuits’ transformation and upgrading, it is imperative to analyze the current situation of the industry, customers and competitors. Thus, Shennan Circuits conducted a scanning analysis of the industry, customers and competitors according to the needs in all stages of the transformation and upgrading. With Shennan Circuits’ practice, based on the market segmentation theory and Porter’s Five Forces Model, the ICCA (Industry, Customer, Competitor, Analysis) opportunity scanning analysis method, the method to transform opportunities into development opportunities for enterprises in the context of global value chain restructuring, namely, is obtained. ICCA scans the industry, customers and competitors, and seeks accessible industries and quality customers and competitors in the industry for enterprises, laying solid foundation for future transformation and upgrading.

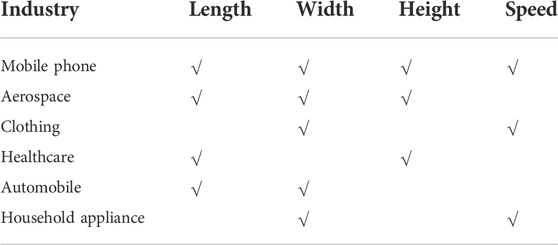

5.2.1 Industry scanning method

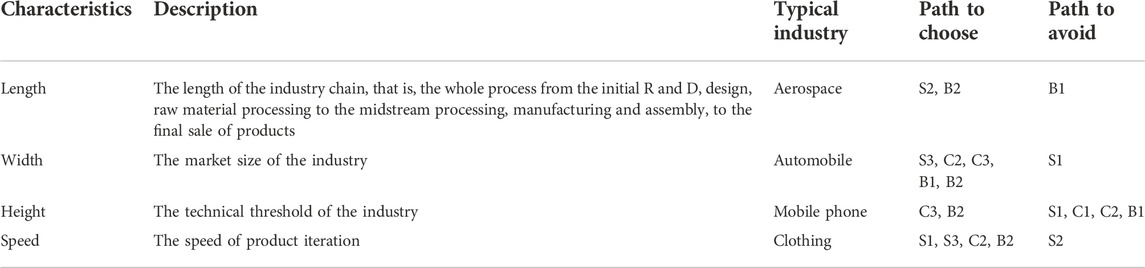

The industrial chain transfer in the context of global value chain restructuring involves many industries, including the electronic information industry that covers communications, consumer electronics, medical devices etc. The premise of successful transformation and upgrading is to find its own track. The first step is to scan and select the accessible industry, discover the industry opportunities, and determine the market goals. Panoramic industry scanning is carried out in industries that enterprises are suitable or are ready to enter. As most Chinese manufacturing industries are in the manufacturing and assembly link, this paper analyzes suitable transformation and upgrading path for enterprises in the market corresponding to the industry, and conducts industry scanning in “length, width, height, speed”.

Length refers to the length of the industry chain, that is, the whole process from the initial R and D, design, raw material processing to the midstream processing, manufacturing and assembly, to the final sale of products to end users. Width refers to the market size of the industry, and different industries vary. Height refers to the level of technical threshold, and it differs in different industries. Speed refers to product iteration, which differes in different industries.

Different industries have different “length, width, height, and speed” characteristics. Table 4 is the analysis of typical industry characteristics in terms of “length, width, height, and speed”, where their typical characteristics are marked. Such as, the mobile phone industry has all four characteristics, typical enterprise is Apple. The aerospace industry has “length, width, height” characteristics, with a slow iteration speed, typical enterprises are Airbus and Boeing, which have a long iteration cycle for their aircraft models. The clothing industry has “width, fast” characteristics, typical enterprises are Nike and Adidas, which have large target customer groups, large market scale, and rapid product update and iteration. The medical industry has two characteristics: long industrial chain and high technical barriers, typical enterprise is Mindray Medical. The automobile industry has two characteristics: long industrial chain and large market scale, typical enterprise is Toyota. The household appliance industry is characterized by large market scale and fast updating and iteration, typical enterprises are Midea and Gree.

Analysis of the “length, width, height, and speed” characteristics is a panoramic scanning of different industries, which helps enterprises to have a global understanding of the target industry. The next step is customer scanning and competitor scanning. Customer scanning is to determine the market segments and specific customers; competitor scanning is to the scan major competitors in the market segments. Upon the scanning, the target industry is determined as a red sea market or a blue sea market, providing a reference for the enterprise in its transformation and upgrading, as well as targeted competitive strategies.

5.2.2 Customer scanning method

With the industry selected, it is necessary to scan the market segments and specific customers. Philip Kotler’s market segmentation theory has a clear definition (Kotler, 1997) of market segments. On the basis of market segmentation theory, enterprises scan the market, from multiple market segments to single market segments to individual market segments, to determine the market segments and specific customers before entering. The long-term development of enterprises cannot be separated from customers because customers push the development of enterprises, so seeking the right customers is crutial. While cooperating with customers, enterprises need to constantly innovate product technology and improve customer management ability to meet customer needs. Customers are closely related to the market, so enterprises need to seek customers through appropriate market positioning.

This paper divides the market into four sub-markets based on customer needs and product technology. The longitudinal “product” refers to the level of technical ability, and the horizontal “need” the level of customer needs other than technology, such as product reliability, response speed to customers, punctuality of product delivery, etc. Optimality is the high requirements of market segments and specific customers for product technology or other needs, and normality the low requirements of market segments and specific customers for product technology or other needs. According to customer needs as well as the optimality and normality of product technology, Shennan Circuits divides the market into four quadrants: pioneer market, personality market, mass market and antelope market. Enterprises in the pioneer market are the future leaders of the industry, enjoying monopoly profits and having high requirements for product technology. Pioneer market is based on high-tech and high-level customer needs, and enterprises in it provide products and services with high gross profit. Enterprises in the personalized market are technology leaders, and customers are willing to use the most advanced technology without high requirements for other needs, and undertake the instability brought about by technology immaturity, which requires strong product development ability of enterprises. Enterprises in the mass market are industry followers with low requirements for product technology, and low customer needs, that is, low added value and threshold, which may lead to rapid elimination in the market. Enterprises in the antelope market have high customer barriers and profitability. This market is for the special need of customers, where customers have low requirements for product technology, but high requirements for other needs, such as reliable products and any needs in any given time. In a word, enterprises in this market is able to satisfy demanding requirements of customers in one area (Figure 8).

After selecting the suitable industry, enterprises determine the market positioning according to their characteristics and medium-and long-term planning, so as to pin down the target market segments. Then, the target customers are finalized according to their market strategies through the customer orientation analysis. Finally, scan the products produced by customers in the industry to get familiar with the product characteristics and technical needs, so as to realize customer-led product upgrading.

5.2.3 Competitor scanning method

After scanning the market and customers, enterprises need to scan the competitors to understand the technical product and positioning of major enterprises in the industry. Porter’s Five Forces Model proposes five measures (Yang and Li, 2005) for the degree of competition in the same industry. Based on the degree of competition, this paper subdivides the industry competitors into three categories: leaders, participants and entrants.

Leaders refer to enterprises that have the world’s strongest customer stickiness, as the first supplier of customers, whose certain product or service having the largest market share in the market. Such enterprises have the ability and influence to develop industry technical standards, and have industry pricing power. With the world’s best factory, technology, products and team, they usually play a leading role in price adjustment, product development and sales strategy. They have the ability to continuously identify market segments. Leaders are subdivided into main leaders and important leaders. Participants refer to enterprises that have a slightly weaker position than leaders in a certain product market, and often want to maintain their market share to achieve steady development. Participants are divided into important participants and ordinary participants. Entrants refer to enterprises that just entered or are preparing to enter the target market. Such enterprises have basic mass production capacity, but they have no competitive advantage in terms of price and product function. Entrants are subdivided into new entrants and ready entrants.

Enterprises form a competitor positioning matrix through product technology and competitor status in the industry, and position the main competitors in the industry on the matrix to form a panoramic picture of competitors. The matrix helps enterprises to understand the main technologies and capabilities of competitors in the market, and develop targeted competitive strategies. It also helps enterprises to identify their positioning in the industry, their advantageous products and technologies, and clarify the direction of transformation and upgrading, aiming to become the main leader in the market segment.

5.3 Application of transformation and upgrading path

5.3.1 Analysis of the transformation and upgrading of Chinese PCB enterprises

Shennan Circuits walks the weak balanced path of transformation and upgrading. After the analysis of enterprises of the electronic circuit industry using the general transformation and upgrading path of manufacturing enterprises, we draws the following conclusions. First, most Chinese PCB enterprises started from PCB business. As PCB business develops, most enterprises choose to remain committed to the business, and promote their development through customer extension, product upgrading, and operation optimization, turning intoa single business enterprise, with S2 as the main transformation and upgrading path for them. Typical examples are WUS Printed Circuit Co., Ltd. And sunshine Global Circuits Co., Ltd. Second, some enterprises choose to extend their business from PCB to SUB and PCBA in the upstream and downstream of the industrial chain, becoming double business enterprises. If they extend to upstream and form the PCB and SUB business model, their transformation and upgrading path is C1. Typical examples are Unimicron Technology Corporation and Shenzhen Kinwong Electronic Co., Ltd. If they extend to upstream and form the PCB and PCBA business model, their transformation and upgrading path is C2. Typical examples are Suzhou Dongshan Precision Manufacturing Co., Ltd. and Hon-Flex. Third, few enterprises extend to the upstream and downstream of PCBA and SUB business, forming a three-business model, with B2 as the main transformation and upgrading path. Typical examples are Shennan Circuits and Avary Holding (Shenzhen) Co., Ltd.

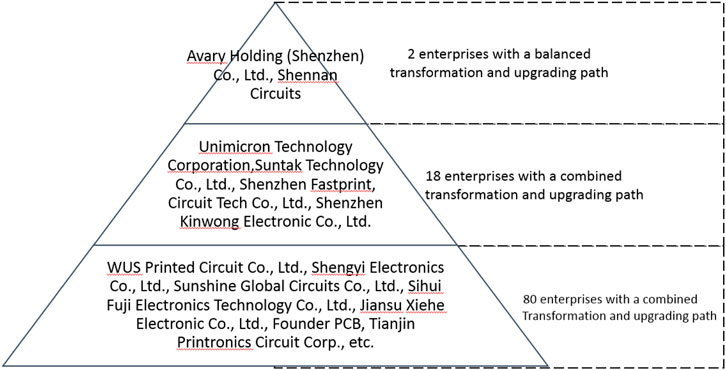

Among the top 100 Chinese electronic circuit enterprises, 80% of which choose a single transformation and upgrading path, which includes 80 enterprises, such as Shanghai Electric Power Co., Ltd. and Shengyi Electronics. 18% choose a combined path, which includes 18 enterprises, such as Youxinxing Electronics and Chongda Technology. 2% choose a balanced path, which are Pengding Holding and Shennan Circuits. The distribution forms a pyramid-shaped distribution (Figure 9). According to the revenue analysis of the three types of enterprises in 2020, the average revenue of enterprises with a balanced transformation and upgrading path is 20.73 billion yuan. For example, Avary Holding (Shenzhen) Co., Ltd. and Shennan Circuits have revenue of more than 10 billion yuan. The average revenue is 4.47 billion yuan for enterprises with a combined transformation and upgrading path and 1.8 billion yuan for enterprises with a single path. The focus of the three paths is different. The average development scale of enterprises with a balanced path or a combined path is greater than that of enterprises with a single path, which focus on a certain application field or characteristic technology products.

Among the top 100 Chinese PCB enterprises, there are 38 enterprises choose available 2015–2020 financial data from public channels (annual reports, enterprise official websites etc.). Among them, Suzhou Dongshan Precision Manufacturing Co., Ltd. Mainly relies on mergers and acquisitions to drive revenue and profit growth, which does not have reference significance for the transformation and upgrading of manufacturing enterprises. Therefore, this paper analyzes the remaining 37 enterprises.

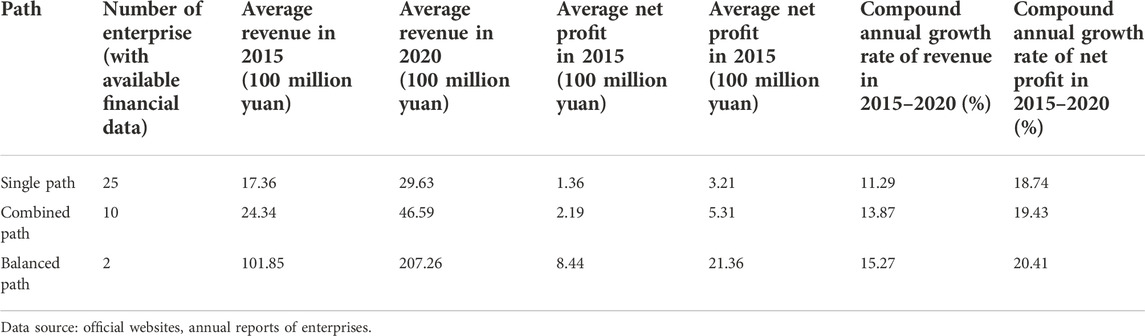

There are 25 enterprises walks a single transformation and upgrading path, and their average revenue and average net profit are 1.736 billion and 136 million respectively in 2015 and 2.963 billion and 321 million respectively in 2020, compound annual growth rate of revenue 11.29%, and compound annual growth rate of net profit 18.74%. In 2020, the three largest top enterprises are Tripod Technology Corporation, WUS Printed Circuit Co., Ltd., and Victory Giant Technology (HuiZhou) Co., Ltd., and their average growth rate of net profit is 36.6%, which is higher than that of enterprises with a single transformation and upgrading path, 18.74%. There are 10 enterprises choose a combined transformation and upgrading path. Their average revenue and average net profit are 2.434 billion and 219 million respectively in 2015 and 4.659 billion and 531 million respectively in 2020, compound annual growth rate of revenue 13.87%, and compound annual growth rate of net profit 19.43%. In 2020, the three largest top enterprises are Compeq Manufacturing Co., Ltd., Unimicron Technology Corporation, and Shenzhen Kinwong Electronic Co., Ltd., and their average growth rate of net profit is 25.75%, which is higher than that of enterprises with a combined type transformation and upgrading path, 19.43%.

There are two enterprises chose a balanced transformation and upgrading path, namely Avary Holding (Shenzhen) Co., Ltd. and Shennan Circuits. Avary Holding ranked first in the global PCB enterprises in 2020, with a compound annual growth rate of revenue of 12.16%, and the compound annual growth rate of net profit of 13.22%. Shennan Circuits has a compound annual growth rate of revenue of 26.72%, and the compound annual growth rate of net profit of 54.69% (Table 5).

Analysis of the growth of enterprises in the three paths finds that the number of enterprises in a balanced path is the least. The balanced path requires enterprises to have a certain revenue scale, market development and operation ability, and to extend to PCBA and SUB industries on the basis of mature and industry-leading PCB products, for instance, Shennan Circuits. The combined path is less demanding than the balanced path, requiring enterprises to transform and upgrade to PCBA or SUB industry with limited resources. The single path requires enterprises to be committed to PCB industry and form their own unique advantages.

5.3.2 Transformation and upgrading paths of other industries

The restructuring of the global value chain has brought about the location transfer and upgrading of industrial chains. Different industries have varied length of industrial chains, so the corresponding transformation and upgrading paths are also different, as shown in Table 6. The ICCA opportunity scanning analysis method is not only applicable to the electronic circuit industry, but also to other industries. For a specific industry, first, analyze the four characteristics of “length, width, height, and speed” to screen the possible transformation and upgrading path according to its characteristics. Then, determine the transformation and upgrading path suitable for its own capabilities and development positioning based on the results of customer and competitor scanning. Industry scanning in terms of “length, width, height, and speed” provides enterprises with the direction of transformation and upgrading path, but how to implement the path requires customer scanning and competitor scanning. Customer scanning refers to the scanning of market segments and specific customers in the industry to determine the market segments and specific customers. Competitor scanning refers to the scanning of main competitors in the industry in the market segment to determine whether the industry is a red ocean market or a blue ocean market, which provides a reference for the direction of transformation and upgrading, and helps enterprises to develop targetedcompetitive strategies.

Aerospace enterprises are typically with a long industrial chain, so it is very difficult for enterprises to carry out the whole industry chain manufacturing from raw materials to the whole machine. Thus, enterprises should choose B2 and avoid B1. Market size affects the choice of transformation and upgrading path. Enterprises of large target market scales, strong capability and abundant resourcesshould choose S3, C2, C3, C3, B1, B2, and avoid S1. Industries with high-tech threshold, for example mobile phone, are technically difficult in R and D and design, which requires a lot of capital, manpower and long-term time for re-entry. Thus, these enterprises should choose S1, C1, C2, B1, and avoid C3 and B2. Fast iteration speed indicates fast-changing needs of terminal users and high requirements for manufacturing and assembly link. Thus, these enterprises should choose S1, S3, C2, B2 and avoid S2.

Following industry scanning is customer scanning. Enterprises scan the products produced by their customers in the industry to get familiar with the product characteristics and technical needs. Customer scanning helps enterprises to have a deeper understanding of their customers, and decide their own route for product technology development according to customers’ product needs, so as to realize customer-led upgrading. Competitor scanning helps enterprises to understand the main technologies and capabilities of competitors in the market, and develop accurate competitive strategies. It also helps enterprises to find their positioning in the same industry, their advantageous products and technologies, and further clarify the direction of transformation and upgrading, aiming to become the main leader in the market segment.

6 Conclusion

This paper introduces the background of the global value chain restructuring of the electronic information industry, analyzes the overall process and effect, as well as its ideas and methods of transformation and upgrading of Shennan Circuits in thebackdrop. First of all, the transformation and upgrading stages of Shennan Circuits is analyzed based on case transformation and upgrading process. Then, according to the smiling curve, we extracted the transformation and upgrading path of Shennan Circuits, and summarized the three types (eight paths) of transformation and upgrading for manufacturing enterprises from their transforming and upgrading from the starting point to the left R and D and design, upward manufacturing and assembly, and right brand marketing respectively. Finally, according to market segmentation theory and Porter’s Five Forces Model, we proposed the ICCA opportunity scanning analysis method based on the transformation and upgrading process of Shennan Circuits.

6.1 Theoretical contribution

This paper analyzes the process and effect of the transformation and upgrading of Shennan Circuits in the context of the restructuring of the global value chain. The theoretical contributions of this paper are as follows:

6.1.1 Extend the transformation and upgrading path for manufacturing enterprises

Different from the upgrading path of OEM-ODM-OBM that typical manufacturing enterprises integrate into the global value chain, the traditional transformation and upgrading path from the manufacturing and assembly stage to the R&D design and brand marketing at both ends of the smile curve is no longer applicable for the manufacturing enterprises in the middle of the industrial chain such as Shennan Circuit. This paper describes the overall process and effectiveness of the transformation and upgrading of the case enterprises in reconstruction of the global value chain. Then the ideas and methods of the case enterprises in this process are analyzed. And the balanced path of transformation and upgrading of Shennan Circuits is condensed. This paper provides a weak balance type transformation and upgrading path with product upgrading as the main direction and industrial chain extension as the secondary direction. This is a feasible path for manufacturing enterprises in the middle of China’s industrial chain to adapt to the global value chain restructuring and grow. On the basis of the transformation and upgrading path of Shennan Circuit, expand and refine the general path for the transformation and upgrading of manufacturing enterprises in the middle of the industrial chain. Based on the smiling curve theory, most Chinese manufacturing enterprises are currently in the middle, mainly focusing on production, manufacturing and assembly with low added value. For enterprises’ transforming and upgrading from the starting point to the left R and D and design, upward manufacturing and assembly, and right brand marketing, this paper extracts three types of paths (eight paths), namely, single transformation and upgrading path, combined transformation and upgrading path and balanced transformation and upgrading path. Transforming and upgrading from the middle of the smiling curve to the left, upward and right forms three single transformation and upgrading paths; Transforming and upgrading from the middle of the smiling curve to left and upward at the same time, left and right at the same time; right and upward at the same time respectively forms three combined transformation and upgrading paths; Transforming and upgrading from the middle of the smiling curve to left, upward, and right at the same time forms two balanced transformation and upgrading paths, namely, strong balanced path focusing on three directions in a balanced way and weak balanced path focusing on one or two directions. The transformation and upgrading paths proposed in this paper reveals the general process for Chinese manufacturing enterprises in the middle of the industrial, systematically unify different transformation paths in the existing literature, contributes to the systematic research in the manufacturing industry based on the smiling curve and provides a reference for the choice of transformation and upgrading path of Chinese manufacturing enterprises in global value chain reconstruction.

6.1.2 Propose the ICCA opportunity scanning analysis method

This paper constructs the ICCA opportunity scanning analysis method for how to choose the transformation and upgrading path for manufacturing enterprises in the midstream of the industrial chain in global value chain reconstruction. Industry, customer and competitor scanning methods are proposed based on opportunity scanning, and industry scanning is carried out in terms of “length, width, height, and speed”, scanning and classifying industries for the different characteristics of the industry chain length, market size, technology barrier, and update iteration speed. The market segments and specific customers in the industry is scanned from multiple market segments, single market segments to individual market segments, and finally determine the specific market segments and customers to enter. This paper build a market positioning matrix model with the pioneer market, personality market, mass market and antelope market as the main areas to accurately target customers. The enterprises in the pioneer market are the future leaders of the industry, enjoying monopoly profits, and requiring high technology of their products. Enterprises in the personality market are technology leaders. Customers in this market are willing to use the most advanced technology, and have low demand for other aspects. They are willing to bear the instability caused by immature technology. Mass market enterprises are followers of the industry. They have low technical requirements for products, and customer needs are easy to meet, so their added value and threshold are low. Antelope market is a market with special needs of customers. Customers have low technical requirements for products, but other requirements are high. Scan competitors in the same industry to understand the technical product level and positioning of major enterprises in the industry. Subdivide competitors in the same industry into three categories: leaders, participants and entrants, and identify the positioning of enterprises among competitors. Competitor scanning helps enterprises to develop specific competitive strategies. ICCA provides a reference for the transformation and upgrading path for manufacturing enterprises. This study enriches the theory of transformation and upgrading path for a large number of specialized manufacturing enterprises with a certain technical strengthin the midstream of the industrial chain, it is an effective expansion of the market segmentation theory, which can be better applied to manufacturing enterprises in the middle of the industrial chain, and provides a reference for the choice of different paths for Chinese manufacturing enterprises in the context of the restructuring of the global value chain.

6.2 Management insights

The management enlightenment of this paper is as follows:

1) The transformation and upgrading path in the context of the restructuring of the global value chain is mainly applicable to terminal product manufacturers or their commissioned contract manufacturers. In this path, enterprises approach to the both ends of the smiling curve by improving their technical strength, branding and design capabilities. However, for a large number of specialized manufacturing enterprises with a certain technical strength in the midstream of the industrial chain, this theory does not provide a clear reference except for the implementation of manufacturing servitization. Therefore, for these enterprises, the traditional theoretical upgrading model approaching to the both ends of the global value chain “smiling curve” has a limited guiding significance for their transformation and upgrading in the global context of value chain restructuring. In the perspective of the “smiling curve” theory, the existing Chinese manufacturing enterprises constantly transfer lower-value manufacturing to overseas with lower labor costs through the international division of labor. It is essential to encourage the outflow of manufacturing rather than transformation on the basis of maintaining the high-end link of the value chain. The large outflow of the manufacturing industry leads to the outflow of Chinese manufacturing industry, resulting in industrial hollowing out and imbalanced production of domestic material, and reverse effect on China’s long-term development of manufacturing industry. Shennan Circuits realizes the balanced type of transformation and upgrading by grasping the opportunities brought about by the restructuring and taking high-tech and high-level strategies and management measures on the basis of fully understanding the industry chain.

2) Under the background of globalization, the restructuring of the global value chain can provide manufacturing enterprises with a greater international market. Some enterprises integrate into the global value chain, butsome are eliminated due to slow development. At the same time, the global value chain is constantly updated with the emergence of new demand and technology. So integration into the global value chain doesnot happennot overnight, which requires enterprises to constantly adapt to the change of the global value chain. Internal transformation and upgrading allows enterprises to adapt to the transfer of the global industrial chain and increasethe added value of enterprise products, and timely satisfy the needs of international customers. In recent years, with continuous Sino-US trade friction, the global spread of COVID-19, the world economy and industrial pattern are facing new challenges. Now the restructuring of the global value chain is more affected by geopolitical factors. For example, the United States is promoting the localization of the electronic information industry chain, which brings great challenges and opportunities to inmature Chinese enterprises. There are two opportunities. One is that large enterprises’ entry into the global value chain drives enterprises in the midstream link of the supporting industrial chain to the global value chain; the other is that enterprises take the initiative to seek foreign customers to enter the global industrial chain.

6.3 Limitations and prospects

As a single-case exploratory study, this study has some limitations. Shennan Circuits is unique to some extent, but different enterprises have different transformation and upgrading paths and choices. Hence, further validation on the application of the conclusions is needed. In the next step, case studies of other enterprises in the same industry and other industries can be conducted to compare the universality of the conclusions. In addition, the relevant elements of the transformation and upgrading model will be adjusted to form a theoretical model suitable for the characteristics of different industries.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

LY: Conceptualization; writing of the manuscript; MY: critical review of the manuscript. All authors contributed to the article and approved the submitted version.

Conflict of interest

LY was employed by AVIC International Holding Corporation.

The remaining author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Adams, F. G., Gangnes, B., and Shachmurove, Y. (2004). Why is China so competitive? Measuring and explaining China's competitiveness. World Economy, 29(2), 95-122. doi:10.1111/j.1467-9701.2006.00773.x

Alleyne, D., Mclean, S., Hendrickson, M., Tokuda, H., Pantin, M., Skerrette, N., et al. (2021). Economic survey of the caribbean 2020: Facing the challenge of COVID-19. Studies and perspectives. Santiago, Chile: ECLAC Subregional Headquarters for The Caribbean.

Amsden, A. H. (1989). Asia's next giant: How korea competes in the world economy. Technol. Rev. 92 (4), 46–53. doi:10.1093/0195076036.001.0001

Baber, H. (2020). Spillover effect of COVID19 on the global economy. Trans. Mkt. J. 8 (2), 177–196. doi:10.33182/tmj.v8i2.1067

Brandt, L., and Rawski, T. G. (2008). China's great economic transformation: China's. Embrace Glob. (16), 633–682. doi:10.1017/CBO9780511754234

Cai, Y. Z. (2013). Reflections on the transformation and upgrading of my country's electronic information industry clusters under the global value chain. Reform Econ. Syst. 5, 124–127.

Chen, Y. Y. (2008). Analysis of competitive advantage of taiwan bicycle industry. Yilan, Taiwan. Fo Guang University.

Deng, G., and Cui, X. F. (1994). Internationalization strategy of Japan's electronic industry. Riken, Japan, 4. Japanese Research.