95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci. , 06 February 2023

Sec. Environmental Economics and Management

Volume 10 - 2022 | https://doi.org/10.3389/fenvs.2022.1050488

Purpose: To timely manage supply chain disruptions, experts have focused their attention on the impact of COVID-19 on industries worldwide. Epidemic outbursts are a specific supply chain risk with long disruption propagation, disruption persistence, and high uncertainty. This study aimed to investigate the role of R&D investment and firm performance in mediating the relationship between disruption risk and supply chain performance in Pakistani manufacturing industries and supply chain employees during the recovery phase of the COVID-19 pandemic via the application of the dynamic capability theory.

Methodology: From 21 July 2020 to 23 August 2020, 318 employees from supply chains of manufacturing industries in Rawalpindi and Islamabad, Pakistan, participated in this cross-sectional online web-based survey. The four standard research scales were used to examine the research and development, disruption risk, firm, and supply chain performance. The response link was distributed to respondents via Facebook, WhatsApp, and email. The study analyzed the data using structural equation modeling and a partial least squares technique.

Results: The study’s findings suggest that disruption risk, research and development investment, and firm performance all improve supply chain performance, but the mediation effect is unsupported by the data. These measures help plan a better supply chain in the face of disruption risk. They provide one of the timely empirical conclusions on the role of R&D investment in mitigating risk disruptions and improving supply chain performance.

Every supply chain (SC) organization has confronted a vulnerable disruption at some point in their company’s life cycle, which is occasionally characterized by hurricanes, terrorism, floods, or earthquakes in an unpredictable environment (Abbas, 2021; Pilloni et al., 2022). Coronavirus disease (COVID-19), a recent global pandemic, has since emerged, wreaking havoc on the world’s supply chains. Businesses were unprepared to deal with disruptions caused by unexpected shutdowns and a lack of resources (both human and financial), which could be one of the causes of the adverse effects (Knemeyer et al., 2009; Soni, 2014). In addition to the anticipated shutdowns, the SC is also hampered by nation-to-nation lockdowns and border closures (Guan, 2020). With longer pandemic phases, these risks are more challenging to manage (Aqeel et al., 2022; E Gijsberts et al., 2021).

Because of the changing business environment, it is difficult to reduce risk by implementing standard SC controls. As a result, businesses, academics, and practitioners must manage SC interruptions (Handfield, 2007; Craighead, 2011). In 2013, World Economic Forum and Accenture empirical analysis confirmed that 80% of businesses’ priorities are flexible in the face of SC disruptions. Earlier studies revealed that, despite the resilience of the supply network, many companies can handle small disruptions (Chaman et al., 2022). As a result, many managers are reconsidering the state of SC hazard management, believing that it is highly viable to invest. However, current risk management procedures and practices are not inadequate to handle large-scale disruptions like COVID-19 (Azadegan et al., 2020; Abbas, Wang, et al., 2021).

Studies reported that with the increase in SC disruption hazards, the institutes have started focusing on developing SC resilience capabilities to meet these challenges (Nooraie et al., 2020). However, studies also conversed that even organizations want to be adaptive enough to respond to unexpected situations emerging from an organization’s SC (Ponomarov and Holcomb, 2009).

Researchers also discovered that businesses attempt to cope with the situations and develop resistance capacities for recovery (Sabatino, 2016; Ponomarov and Holcomb, 2009). A substantial number of studies also support the narrative that firm’s ability to cope with SC disruptions is critical to its success in modern times (Azizi et al., 2021). However, very little knowledge is available to assist firms in managing SC disruptions (Jüttner, 2011; Blackhurst, Dunn, and Craighead, 2011), specifically in developing economies (Remko, 2020).

Firms have focused on building specific capacities that increase a firm’s versatility, such as innovation, to mitigate SC disruptions (Kamalahmadi, and Parast, 2016). According to Su and Linderman (2016), novelty is one of the four pillars of the continued high-quality output indicator. According to the findings, SC that invests in R&D related to innovation can easily see a positive impact on SC performance (Abbas, 2021). Nevertheless, positive SC performance seems to have a more significant effect on manufacturing than service organization (Ehie and Olibe, 2010).

Prior research has looked into the impact of SC disturbance risks on firm efficiency and productivity, but no conclusive findings have been reported (Ponomarov and Holcomb, 2009). Furthermore, previous research has also focused on the impact of R&D investment in innovation on SC performance during the pandemic phase. However, the amount invested in R&D can significantly mitigate the various other adverse effects of disruption sources on SC outputs and performances. In addition, the studies failed to consider the role of R&D spending in mitigating the negative impact of SC disruptions on SC performance (Rahal et al., 2021).

Various studies have found that SC disruption causes changes in different organizational practices, such as a decrease in sales, an increase in product manufacturing costs, the inability of the company to provide services, and many others (Park, Min, and Min, 2016; Azadegan et al., 2020; Ivanov D., 2020). Therefore, the influence of SC risk disruptions on the overall survival of business scarcely explains that SC risk disruptions affect the overall organizational practices that influence the overall business efficiencies (Su et al., 2021). Similarly, better corporate practices can assist organizations in achieving better SC results (Sohail and Hoong, 2003). Thus, firms prepare themselves for the potential SC practices to meet those risks thoughtfully and, in good time, comply with security initiatives and reduce the frequency of these disruptions (Park, Min, and Min, 2016).

This research highlights the organization’s performance gap between risk disruptions and the SC. Moreover, the study also better explains how SC operations mitigate SC risk. With the firm’s performance acting as a mediator between the relationships of the independent and dependent variables, the current study examines the effect of risk disruption on SC performance. The present study’s second goal is to investigate the role of innovation-related R&D investments as a moderating factor on the study variables.

Previous research has found that over the past 20 years, the emphasis on innovation has increased by 235% (Parrast, 2020). Studies have established that companies must respond quickly to design and implement novel techniques for controlling SC interruptions, particularly when they can manage disruptions (Yoosefi Lebni et al., 2021) and, moreover, to prepare for such adverse circumstances even during natural disasters. Therefore, the principal research objectives include the following:

1) To investigate the effect of disruption risk on SC performance.

2) To explore the effect of disruption risk on SC performance when firm performance practices act as a mediator between these two variables.

3) To explore the mediating role of research and development investment on the relationship between disruption risk and SC performance.

The paper is organized as follows: Section 2 explains the relationship between investment in R&D for disruption risk hazard and an organization’s performance practice for the firm’s SC performance along with its hypotheses. Section 3 explains the methodology including the approach, the sample, and the assessment method to inspect our exploration queries. Section 4 provides the analysis and results addressing the significance of our discoveries to the conceptual philosophy and practices of SC hazards management and novel innovations. Finally, the study conclusion is provided in Section 7 with the managerial implications and future research direction in Section 8.

The COVID-19 pandemic has harmed every well-run business. The same was true for risk disruptions and SC management (Gijsberts et al., 2021; Yoosefi Lebni et al., 2021). It would not be incorrect to say that this was the hardest hit zone by the pandemic. In SC organizational activities, risk disruptions are considered and classified in a variety of ways, including demand disruptions, supply disruptions, process disruptions, and environmental disruptions (Barreto de Castro, 2010). The interruption risks and organizational performance practices have been directly related in long term (Knight, 1921). This is concluded in the following hypothesis.

H1: Disruption risk is positively and significantly related to the firm performance in the long term.This relationship was previously considered valuable only in financial markets, but it is now widely used in business decision-making. Risk management in SC is classified as the “identification and managing of risks for the SC, through a synchronized approach among SC members, to reduce SC exposure as a whole” (Jüttner et al., 2003). Organizations can only develop such an approach toward risk when the overall attitude toward risk management practices is favorable. So, managing risk disruptions in various essential facets is critical for the organization’s better performance. These facets include risk sources, risk identification through consequences, risk tracking throughout the chain, and risk mitigation (Iqbal Siddiqi et al., 2022).When attempting to manage these risks, the main issue is the environment’s unpredictability and the minor reliable sources of information for making future decisions and plans. The problems encountered by the various businesses involved in SC processes remained consistent throughout the COVID-19 period. External competition exists outside of organizational boundaries and within the SC that compels the organization to invest more in the development of the SC process (Suhong Lia, 2006). Therefore, the investment in the research and development process increases the chances of the organization to handle disruption risk (Kozhakhmet S. et al., 2020; Zhang & Dong, 2020). According to these findings in literature the following hypothesis is made.

H2: Investment in the research and development of the firm decreases the disruption risk of the organization.With the advancement of everything, the operative SCM has become a possibly helpful way of obtaining a competitive advantage in the market and improving complete organizational performance. Since the competition has shifted from organizations to different supply chains, the improvement in SC performance is the competitive edge in the new competition. The organization’s SC performance practices determine the better techniques for progressive SC performances (Toyin, 2012). The improvement in the company’s performance only becomes possible when it comes to competitiveness, and it becomes only possible when the companies adopt proper practices. The organization’s practice and performance are mutually interconnected; therefore, SC’s performance regularly depends on various interactions with supply chain partners. Whereby enhancing the operational process of the organizations, the overall SC performance advances and the external risk can be handled (Puska, Kozarevic, and Okicic, 2020). Hence, the study proposes (H3) hypothesis on the basis of aforementioned discussion.

H3: Performance of the supply chain is positively and strongly related with organizational capability for disruption risk.Based on the dynamic capability theory (a theory that adds value and innovation and creates value for the organization), this study establishes a simple relationship between risk disruptions, organizational performance practices, and SC performance. That is how risk disruptions force the organization’s practices and performances to be highly defined based on improving the organization’s competencies, resulting in better SC performances (Katkalo, 2010) and improving the organization’s performance practice. In complex situations, the dynamic capability theory is deemed adequate for relating an organization’s developments to its output processes and routines (Chowdhury, & Quaddus, 2017; Kumar, Subramanian, and Arputham, 2018).

The most recent empirical study also presented significant evidence of organizational performance on supply chain performance for Chinese internet businesses in terms of operational, environmental, and economic performance (Zeng et al., 2022). Additionally, there is a clear connection between operational success and supply chain networks, which over time increases the business’s efficiency (Govindan et al., 2020; Zhang et al., 2022) Thus, it can be concluded that a firm’s performance aligns the supply chain for better performance under normal conditions, but in the COVID-19 pandemic scenario, the online businesses have performed better than the physical businesses due to the abrupt shutdowns and significant fall in demand for their products, which have caused severe business risk (Pantano E. et al., 2020; Udofia et al., 2020). Hence, it is believed that the firm’s performance adds to the supply chain performance. The corresponding hypothesis is as follows:

H4: Firm performance is positively and significantly related to the supply chain performance.Firms, like SC management, usually need to collaborate with other firms to form strong SC partnerships and develop multi-dynamic capabilities for success. The dynamic capability theory backs this up, stating that if risk disruptions influence organizational performance practices, the SC’s overall performance improves. Firms that invest in R&D can manage risks more quickly, best implement them in their methods for better results, and build SC performance network-level capabilities (Wilding, Wagner, Gligor, & Holcomb, 2012). Therefore, the following hypothesis is deducted. H5: Investment in firm’s research and development is positively and significantly related to the firm performance.Moreover, the research and development for the supply chain operations has also been found as vital for the supply chains in the long term (Kozhakhmet S. et al., 2020). The pandemic situation has also compelled the organizations to reinforce the processes of the supply chain for the times when demand has vibrant fluctuations (Azadegan et al., 2020). Thus, the following hypothesis is proposed. H6: The investment in research and development of the organizational process is positively and significantly related to enhanced supply chain performance. The preceding discussion summarizes how various organizational performances and practices must be developed to manage risks and capitalize on opportunities for exiting the critical time, particularly during pandemics (Pitelis, & Teece, 2010; Kindstrom, Kowalkowski, & Sandberg, 2013), such as COVID-19, to effectively manage the SC. Various firms exhibit different levels of research and development that require innovations in handling issues. Most firms are heterogeneous in innovation, which makes them exhibit innovation and development at various levels (Hult, Hurley, & Knight, 2003). Multiple firms can respond to changes in the SC environment through research and development. As a result, organizations deal with these changes as soon as possible to respond to emerging risks such as COVID-19 and natural disasters. As a result, research and development initiatives promote the firm’s pioneering activities (Teece, 2007; Ellonen, 2009) to manage the risk disruptions for better performances and implementing such practices. The dynamic capability theory can best influence this relationship in managing the risk disruption for better SC performances. The firms that invest more in research and development can far well and effectively respond to the environmental uncertainties (Stevens & Dimitriadis, 2004). Thus, the following hypothesis is developed.

H7: Firm performance and research and development investment serially mediates the relationship between disruption risk and firm supply chain performance. Figure 1 shows the conceptual model of the study.

An online web-based cross-sectional survey was created and regulated to collect the primary data. Employees of supply chains of manufacturing industries from 21 July 2020 to 23 August 2020 participated in this study. The survey has been delivered to the target executives, operations managers, SC, logistics, transportation, sellers, and buyers affected during this tenure directly or indirectly. Initially, the questionnaire was distributed to 483 people, and we received back 318 questionnaires, which reduced the response rate to 65.83 per cent. G*Power has been used to determine the sample effect size. The results of G*Power software indicate that the current sample was proved to be appropriate for this study.

Table 1 lists the variables and definitions used in this study.

Considering the specific nature of the survey, the organizations with the nationwide distribution network were included in the study. The offices of the said organizations in Rawalpindi and Islamabad were approached, via email and phone, for the data collection. Moreover, the middle and top-level management was requested to fill the study survey.

We analyzed data using SmartPLS 3.6.2 software. The direct effects and specific direct effects for checking the mediation have been used for finding the results. Figure 2 shows the resultant measurement model of the constructs.

The data collection period of this study was from October 2020 to January 2021. In behavioral sciences, measurement methodologies could generate common biases during the data collection. These biases should be addressed during data collection because these biases threaten to clarify the association between the procedures (Podsakoff et al., 2003). The dependent and independent variables are gathered from the same respondents through an online survey in this study. Therefore, the variables may be subjected to common method biases (Sreen et al., 2018). Therefore, data ought to be designed for common scheme preconceptions. Table 2 shows the reliability, validity of the constructs.

Similarly, the study data need to be checked for discriminant validity through the average variance (AVE) square root. Fornell and Lacker explain this criterion (1981), stating that if the collective variance among the constructs was less than the square root of the AVE, the discriminant validity is appealed. Table 3 displays that the individual diagonal values were less than the corresponding square root of AVE values. Since the diagonal values shown in bold are greater than the values in their lower rows. It shows the discriminant validity has been established.

The convergent validity is also explained with AVE. The acceptable range of AVE is between 0.511 and 1. These numerical values are consistent with the recommended level of 0.05 in the literature (Fornell & Larcker, 1981). The composite reliability totals for the present study fluctuated between 0.810 and 1, as shown in Table 4. According to the previous statistical work, the resultant calculations are significantly more than the recommended level of 0.7 (Fornell & Larcker, 1981). Therefore, the study model is valid, good-fit, and reliable.

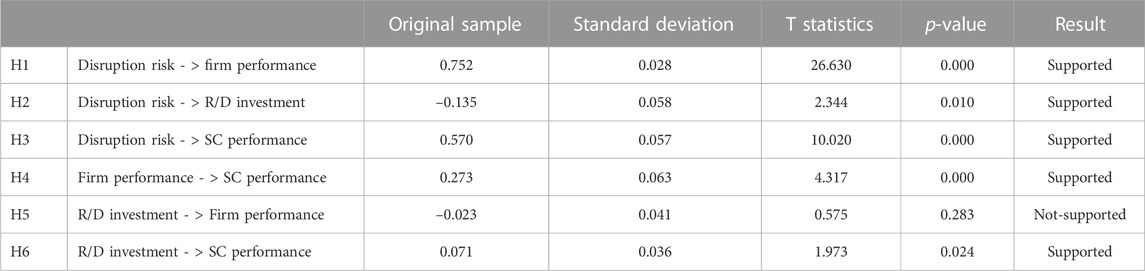

TABLE 4. Direct effect between independent variables and dependent variables with t-values and beta coefficients.

As per the literature, the VIF numerical score should be less than 3 for the multicollinearity problem (Grewal et al., 2004). The VIF for the outer model is between 0.85 and 2.29.

The deductions on the study relationships have been revealed based on the direct and indirect impact with beta values, t-values, and þ-values, measured using SmartPLS 3.6.2, keeping the confidence interval at 95% (Hair et al., 2011; Hair et al., 2019).

Table 4 explains in detail the results of the direct effect between independent variables and dependent variables. Therefore, hypothesis 5 is rejected based on the statistical criteria, and all other hypotheses are supported for the current study. Table 5 shows the specific indirect effects with the t-value and beta coefficient.

The aforementioned table explains the indirect effect of study variables for the serial mediation of R&D investment and the firm performance between the disruption risk and SC performance. The statistical criteria had revealed that the said relationship is found as insignificant on the basis of the þ-value (Sarstedt et al., 2020; Virabhakul & Huang, 2018) according to the study data.

The findings show that risk disruptions improve the organization’s SC performance. Furthermore, the design of organizations’ SCs can help mitigate negative effects caused by disruptions. As a result, organizations must improve their firm’s performance to successfully work in spite of disturbances caused by pandemic situations like COVID-19. Furthermore, when designing SC processes, organizations must consider the justifications, resilience, and effects of distractions on management and firm growth decision-making (Templar, 2011).

The literature and theory on SC risk management can greatly benefit from this study’s contributions, which show how risk interruptions affect SC performance significantly. First, the organization’s performance is supported by the relationship of risk disruption (Iqbal Siddiqi et al., 2022). According to the study data, firms now prefer to be sufficiently prepared for the risks associated with improving their firm’s performance, predominantly when operations are based on SC activities. Similarly, disruptions encourage organizations to invest in R&D to take the steps required to manage such risks (Iqbal Siddiqi et al., 2022).

The results of the study also conclude that firm performance increases SC performance. Likewise, the efficient activities of the firm SC activities increase, resulting in increased SC performances. However, in this study, the results do not support the usual observation that by investing in research and development, the performance and productivity of firms usually increase because maybe the organizations chosen for data sampling do not have certain research and development centers that could help them estimate their performance through the defined figures.

The study’s results also support that the SC performance increases by spending on research and development investment. During the COVID-19 pandemic, organizations have made up their minds to spend more on research purposes for arranging their SC setups before time to play in the market wisely.

Observing other study relationships, it is supported that risk disruptions affect the firm performance intrinsically and the SC’s performance extrinsically, whereas the R&D investment does not support the SC performance until aligned with organizational performance. The mediated relationship of the firm’s performance with R&D and SC performance has displayed a non-supportive association in the presence of organizational performance. Additionally, this study has added to the existing literature that the mediating effect of the firm’s R&D supports in mitigating the adverse effects of risk disturbances on SC activities. Mostly, these risks do not have high impact on the firms frequently, so they are not considered the risk factors creating impact on the environmental disruptions.

Furthermore, such disruptions are not measured as contextual variables, due to which the firms may not integrate them effectively in the SC decisions (Pettigrew, 1993). Undoubtedly, the investment in R&D offers a platform that helps improve communication and association across the organization (Chichester, 1987). For improving the overall responses toward the disruptions, the R&D investments play a great role of spillovers in supporting the firms. Through this study, firms can easily enhance their organizational capabilities to alleviate SC disturbances.

From that perspective, our study shows the association between risk disturbances and SC activities that supports the relationship strength. R&D investment is considered a way to improve risk disruption and firm performance, which can only be accomplished by introducing new products and amenities. Furthermore, R&D investment builds organization’s competencies, improving its responses to environmental fluctuations such as economic downturns (Jung, Hwang, & Kim, 2018). Therefore, the research and development investments are being considered with the dynamic capabilities that improve the organization’s capabilities for both the progressive and destructive changes. With the view of progressive changes, research and development investment enhances the organization’s innovation capabilities through the risk management processes and the firm’s performance (Alam, 2020) broadly recognized.

The delicate role of R&D in advancing the firm’s reactions toward the adverse changes is imperative in the COVID-19 situation. The negative changes are basically the forced changes implied on the firms by the business climate just because of the network disturbances, procedure disorders, supply disturbances, and the demand disturbances on organization performance. In contrast, the research and development investment also alleviates the effects of procedure disruptions and ecological distractions on SC activities and performances. Another explanation of this variation in the influence of R&D speculation is the variance between the measurement used for the organization’s enactment and the metrics cast-off for SC outputs and activities.

The organization’s performance can be analyzed using economic and non-economic methods such as ROA (return on asset), product excellence, marketplace stake, buyer facility, regular retailing amount, and general competitive point. So, the complete stress lies in the economic output. At the same time, the SC performance is analyzed by using non-economic consequences such as the capability to fill the order, satisfy customers in the SC, enhance speed, and manage deliveries. Due to this, we can see the variances between the consequence of R&D speculation on the organization’s output and activities and SC performance regarding various sources of disturbances, as the basic reason for R&D actions is to advance the long-lasting performance of the firm by improving the organizational competencies in the design and the expansion of latest products and the services that produces a market competitive advantage for the firm. Similarly, the R&D investment exerts a stronger impact on modifying the undesirable effects of SC disruptions on firm’s performance and productivities than SC performance alone. The interaction of R&D speculation with environmental risk adjustment and SC output based on activity change demonstrates the importance of monetary versus non-monetary measures. Regardless of the type of market disruption, such events have a negative impact on a company’s financial performance (Hendricks and Singhal, 2005). Nevertheless, R&D speculation has a solid association with hierarchical capacities like versatility, adaptability, agility, and readiness, which influences the authoritative procedures that create products and services (Ettlie, 1998; Liu, Yang, and Wang, 2012).

The effect of R&D efforts on mediating the impact of procedural disruptions on both organization’s performance and SC output and activities can be credited to the significance of organization cycles (Trkman et al., 2007; Pradabwong et al., 2017; Boon-Itt et al., 2017). Literature supporting the SC procedures is a basis for practical benefit and value formation during the mitigation process (Parast and Spillan, 2014; Ren et al., 2015). Research and development investment strongly impacts the new products and inter-organizational procedures to meet customers’ demand. It also enhances the internal-organizational procedures according to the business climate. Research and development venture upgrades the sensitive limit of an organization error (Cohen & Levinthal, 1990; Griffith et al., 2004) and advances the organization’s performance (Artz et al., 2010).

Moreover, organizational R&D investment plays a role in product and market novelty, improving the organization’s adaptability toward innovation and market variations (Wang and Ahmed, 2007). However, the R&D speculation does not support the mediation between risk disruptions and firm performances, while the impact of R&D investment is not similar for all the bases of disruption, either hazards or firm performances. So, it is highly important to consider the vital sources of risk disruptions for the SC and R&D investment strategies that could best meet the issues. Therefore, it is important to consider that advances in the disruption vindication approaches should be alarmed for the possible adjustment between different approaches at the SC and firm levels. Considering influences of SC disruptions on firm performance, managers should be well versed in strategies for dealing with challenges and risk management. These strategies will help improve the SC’s reputation as a hazard moderation approach and necessitate all members’ collaboration to address the SC’s interruptions (Chen et al., 2013). Even when the firm’s performance improves due to other factors, the risk of disruptions reduces its performance.

Moreover, managers at departmental level alone cannot find the resources to manage the disruptions smoothly for a longer period of time. The corporate and strategic levels should identify and maintain the human and operational resources, which can be used in the disruption situation. This will enable the managers to focus on routine operations according to the organization mission.

The study aimed to demonstrate the role of firm performance and R&D investment in mediating the relationship between risk hazards and SC performance. The findings demonstrated that risk disruptions enabled investors to invest in the research and development required to develop risk management strategies. By investing in R&D, organizations improve their ability to deal with such risks. In contrast, risk disruptions not only hit SC performance but also allowed organizations to mitigate the negative effects of risk disruptions. While investment in R&D does not improve firm performance, an improvement in SC performance improves overall performance. This study has debunked the widely held belief that investing in R&D increases company’s value.

Governments all across the world are more concerned about how to manage extreme natural catastrophes. The absence of statistics makes developing policies in this area a difficult task. Governments, on the other hand, can invest in resources and train people to work within a larger institutional structure that is prepared to deal with unusual disruption occurrences. On the other hand, private organizations can pool their resources to tackle the disruption problem at a collective level.

The study’s limitation includes using a cross-sectional data design for the survey; however, longitudinal data collection can reveal a better understanding of how the SCs adjust to disruptions. For more time sensitivity and wider generalizability, this research needs to be tested in different geographical regions with time-lagged studies. Furthermore, including moderating variables such as lockdown time and communication effectiveness can improve the study’s model. Additionally, the study instrument can be further refined with the use of different demographic scales for the explanation of different group behaviors in the study.

The raw data supporting the conclusion of this article will be made available by the authors, without undue reservation.

The studies involving human participants were reviewed and approved by Bahauddin Zakariya University. Written informed consent for participation was not required for this study in accordance with the national legislation and the institutional requirements.

NH, MI, and NU contributed to the conception and design of the study. ZM organized the database. AM performed the statistical analysis. NH and AU wrote the first draft of the manuscript. NH, MI, and NU wrote sections of the manuscript. All authors contributed to manuscript revision, read, and approved the submitted version.

The corresponding author acknowledges the efforts of the research team in this task which will help the reader’s better implement policies.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Abbas, J. (2021). Crisis management, transnational healthcare challenges and opportunities: The intersection of COVID-19 pandemic and global mental health. Res. Glob. 3, 100037–7. doi:10.1016/J.RESGLO.2021.100037

Abbas, J., Wang, D., Su, Z., and Ziapour, A. (2021). The role of social media in the advent of COVID-19 pandemic: Crisis management, mental health challenges and implications. Risk Manag. Healthc. Policy 14, 1917–1932. doi:10.2147/RMHP.S284313

Aqeel, M., Rehna, T., Shuja, K. H., and Abbas, J. (2022). Comparison of students’ mental wellbeing, anxiety, depression, and quality of life during COVID-19’s full and partial (smart) lockdowns: A follow-up study at a 5-month interval. Front. Psychiatry 13, 835585. doi:10.3389/fpsyt.2022.835585

Azadegan, A., Mellat Parast, M., Lucianetti, L., Nishant, R., and Blackhurst, J. (2020). Supply chain disruptions and business continuity: An empirical assessment. Decis. Sci. 51 (1), 38–73. doi:10.1111/deci.12395

Azizi, M. R., Atlasi, R., Ziapour, A., Abbas, J., and Naemi, R. (2021). Innovative human resource management strategies during the COVID-19 pandemic: A systematic narrative review approach. Heliyon 7 (6), 1–15. doi:10.1016/J.HELIYON.2021.E07233

Barreto de Castro, L. A. (2010). Climatic changes: What if the global increase of CO2 emissions cannot be kept under control?. Braz. J. Med. Biol. 43, 230–233.

Chaman, A., Shuja, K. H., and Rani, M. (2022). A web-based cross-sectional survey of coping mechanisms, psychological symptoms, and mental health in Pakistan during the covid-19 outbreak. Nature-Nurture J. Psychol. 2 (2), 1–10. doi:10.53107/NNJP.V2I2.26

Craighead, C. W., Ketchen, D. J., Dunn, K. S., and Hult, G. T. M. (2011). Addressing common method variance: Guidelines for survey research on information technology, operations, and supply chain management. IEEE Trans. Eng. Manag. 58 (3), 578–588.

E Gijsberts, M.-J. H., Kumar Kar, S., Amerio, A., Wang, D., Abbas, J., Wang, C., et al. (2021). Global financial crisis, smart lockdown strategies, and the COVID-19 spillover impacts: A global perspective implications from southeast asia. Front. Psychiatry | Www.Frontiersin.Org, 12, 643783.doi:10.3389/fpsyt.2021.643783

Fornell, C., and Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 18 (1), 39–50. doi:10.2307/3151312

Govindan, K., Rajeev, A., Padhi, S. S., and Pati, R. K. (2020). Supply chain sustainability and performance of firms: A meta-analysis of the literature. Transp. Res. Part E Logist. Transp. Rev. 137, 101923. doi:10.1016/j.tre.2020.101923

Grewal, R., Cote, J. A., and Baumgartner, H. (2004). Multicollinearity and measurement error in structural equation models: Implications for theory testing. Mark. Sci. 23 (4), 519–529. doi:10.1287/mksc.1040.0070

Guan, D., Wang, D., Hallegatte, S., Davis, S., Huo, J., Li, S., et al. (2020). Global supply-chain effects of COVID-19 control measures. Nat. Hum. Behav. 4 (6), 577–587.

Handfield, R. B., and Lawson, B. (2007). Integrating suppliers into new product development. Res. Technol. Manag. 50 (5), 44–51.

Iqbal Siddiqi, U., Zhuang, Q., Santos, V., Wang, D., Abbas, J., Li, Z., et al. (2022). Tourists’ health risk threats amid COVID-19 era: Role of Technology innovation, transformation, and recovery implications for sustainable tourism. Front. Psychol. 12, 769175. doi:10.3389/fpsyg.2021.769175

Ivanov, D. (2020). Predicting the impacts of epidemic outbreaks on global supply chains: A simulation-based analysis on the coronavirus outbreak (COVID-19/SARS-CoV-2) case. Transp. Res. Part E Logist. Transp. Rev. 136, 101922. doi:10.1016/j.tre.2020.101922

Jüttner, U., Peck, H., and Christopher, M. (2003). Supply chain risk management: outlining an agenda for future research. Int. J. Logist. Res. App. 6 (4), 197–210.

Knemeyer, A. M., Zinn, W., and Eroglu, C. (2009). Proactive planning for catastrophic events in supply chains. J. Oper. Manag. 27 (2), 141–153.

Kozhakhmet, S., Moldashev, K., Yenikeyeva, A., and Nurgabdeshov, A. (2020). How training and development practices contribute to research productivity: A moderated mediation model. Stud. High. Educ. 47, 437–449. doi:10.1080/03075079.2020.1754782

Nooraie, V., Fathi, M., Narenji, M., Parast, M. M., Pardalos, P. M., and Stanfield, P. M. (2020). A multi-objective model for risk mitigating in supply chain design. Int. J. Prod. Res. 58 (5), 1338–1361.

Pantano, E., Pizzi, G., Scarpi, D., and Dennis, C. (2020). Competing during a pandemic? Retailers’ ups and downs during the COVID-19 outbreak. Journal of Business Research, 116, 209–213. doi:10.1016/j.jbusres.2020.05.036

Pilloni, M., Kádár, J., and Abu Hamed, T. (2022). The impact of COVID-19 on energy start-up companies: The use of global financial crisis (GFC) as a lesson for future recovery. Energies 15 (10), 3530. doi:10.3390/en15103530

Podsakoff, P., MacKenzie, S., Lee, J. Y., and Podsakoff, N. (2003). Common method biases in behavioral research: A critical review of the literature and recommended remedies. J. Appl. Psychol. 88 (5), 879–903. doi:10.1037/0021-9010.88.5.879

Ponomarov, S. Y., and Holcomb, M. C. (2009). Understanding the concept of supply chain resilience. Int. J. Logist. Manag.

Rahal, F., Zennir, I., Alger, E., and Ehec Alger, A. (2021). The Impact of Green Supply Chain Management on Operational Efficiency. Case study: Unilever إدارة أثر سلسلة التوريد الخضراء على الكفاءة التشغيلية. اسة در حالة: يونيليفر. J. Econ. Sci. Inst.24, 677–696.

Remko, van H. (2020). Research opportunities for a more resilient post-COVID-19 supply chain – closing the gap between research findings and industry practice. Int. J. Operations Prod. Manag. 40 (4), 341–355. doi:10.1108/IJOPM-03-2020-0165

Sabatino, M. (2016). Economic crisis and resilience: Resilient capacity and competitiveness of the enterprises. J. Bus. Res. 69 (5), 1924–1927.

Soni, U., Jain, V., and Kumar, S. (2014). Measuring supply chain resilience using a deterministic modeling approach. Comput. Ind. Eng. 74, 11–25.

Sreen, N., Purbey, S., and Sadarangani, P. (2018). Impact of culture, behavior and gender on green purchase intention. J. Retail. Consumer Serv. 41, 177–189. doi:10.1016/j.jretconser.2017.12.002

Su, Z., McDonnell, D., Wen, J., Kozak, M., Abbas, J., Šegalo, S., et al. (2021). Mental health consequences of COVID-19 media coverage: The need for effective crisis communication practices. Glob. Health 17 (1), 4. doi:10.1186/S12992-020-00654-4

Udofia, E. E., Adejare, B. O., Olaore, G. O., and Udofia, E. E. (2020). Supply disruption in the wake of COVID-19 crisis and organisational performance: Mediated by organisational productivity and customer satisfaction. J. Humanit. Appl. Soc. Sci. 3, 319–338. doi:10.1108/JHASS-08-2020-0138

Yoosefi Lebni, J., Abbas, J., Moradi, F., Salahshoor, M. R., Chaboksavar, F., Irandoost, S. F., et al. (2021). How the COVID-19 pandemic effected economic, social, political, and cultural factors: A lesson from Iran. Int. J. Soc. Psychiatry 67 (3), 298–300. doi:10.1177/0020764020939984

Zeng, H., Li, R. Y. M., and Zeng, L. (2022). Evaluating green supply chain performance based on ESG and financial indicators. Front. Environ. Sci. 10, 1–13. doi:10.3389/fenvs.2022.982828

Zhang, X., and Dong, F. (2020). Why do consumers make green purchase decisions? Insights from a systematic review. Int. J. Environ. Res. Public Health 17 (18), 6607–6625. doi:10.3390/ijerph17186607

Keywords: disruption, supply chain performance, research and development, firm performance, multiple mediational model

Citation: Sulehri NA, Ullah N, Maroof Z, Uzair A, Murtaza A and Irfan M (2023) Employee associations with R&D investment, firm performance, disruption risk, and supply chain performance during the COVID-19 pandemic: A multiple mediational model. Front. Environ. Sci. 10:1050488. doi: 10.3389/fenvs.2022.1050488

Received: 21 September 2022; Accepted: 28 December 2022;

Published: 06 February 2023.

Edited by:

Gul Jabeen, Harbin Institute of Technology, Shenzhen, ChinaReviewed by:

Riaqa Mubeen, Harbin Institute of Technology, ChinaCopyright © 2023 Sulehri, Ullah, Maroof, Uzair, Murtaza and Irfan. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Muhammad Irfan, ZHIubWlyZmFuQGJ6dS5lZHUucGs=

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.