- 1School of Maritime Economics and Management, Dalian Maritime University, Dalian, China

- 2Shenzhen Research Institute of Dalian Maritime University, Shenzhen, China

In recent years, China’s equipment manufacturing industry has been actively embedded in the global value chain (GVC), but pollution emission has become an important factor hindering the industry from climbing to the high-end link of GVC. How to break through this restriction through green technology innovation is exactly urgent for the Chinese government and manufacturers. Therefore, using the panel data of China’s equipment manufacturing industry and its subsectors from 2007 to 2019, this paper constructs an econometric model to investigate the impact of green technology innovation on the GVC upgrading, and further examines the mediating effect through stepwise regression method. The results show that for the full samples of China’s equipment manufacturing industry, there is a U-shaped relationship between green technology innovation and the promotion of GVC status; and for basic metals and metal products manufacturing subsector and transport equipment manufacturing subsector, the conclusion is same with the whole industry; but for machinery equipment manufacturing subsector and electrical, electronic and optical equipment manufacturing subsector, the trend is opposite, that is, an inverted U-shaped relationship which first rises and then declines. Additionally, green technology innovation in China’s equipment manufacturing industry can promote GVC upgrading by reducing its dependence on GVC, optimizing export trade, reducing pollution costs, and promoting green product and process innovation. Based on the above, this paper finally proposes targeted policy implications to provide theoretical basis and experience reference for China’s equipment manufacturing industry to promote the GVC upgrading through green technology innovation.

1 Introduction

As a basic and strategic industry, equipment manufacturing industry’s position in the global value chain (GVC) directly affects a country’s profit distribution and value-added opportunities (Lu, 2017). In recent years, China’s equipment manufacturing industry has been embedded in GVC by relying on its advantages such as population and resource endowment (Xu et al., 2015). However, compared with developed countries, China’s equipment manufacturing industry is engaged in low-end expansion and low value-added production, resulting in the loss of core technologies and the lack of innovation ability (Li et al., 2020a). In addition, the “low-end locking” and “high-end blocking” in GVC dominated by developed countries have formed obstacles for China’s equipment manufacturing industry to jump to the high-end links, weakening China’s initiative and discourse power in international trade (Li et al., 2020b). Meanwhile, China has already become the world’s largest carbon emitter (Chen and Yin, 2022). Rapid development driven by large-scale use of disposable, high-emission energy sources such as oil and coal are predatory and comes at the expense of the environment (Dong et al., 2018; Li et al., 2021). Extensive economic development model has led to severe natural environmental problems in China, and the environmental carrying capacity has reached the upper limit. It is no longer possible to gain comparative advantages by relying on demographic dividend and resource endowment, and the huge energy consumption leads to a gradual shortage of resources. China’s economic rise is burdened by weak growth and severe pollution problems (Zhang and Da, 2015; Wang J et al., 2020).

In this context, resource and environmental rigidity have become important factors restricting China’s economic development, while breaking the traditional economic growth mode is more dependent on green technology innovation (Yu et al., 2021). The environmental policies such as “Made in China 2025”, “Carbon Peak” and “Carbon Neutral” issued by the Chinese government also mentioned the importance of green technology innovation (Wang S et al., 2020; Wang et al., 2021a). Compared with pure technology innovation, green technology innovation focuses more on environmental protection by replacing the original inherent production process and form with green technology, so as to reduce the environmental pollution caused in the production process and break the green trade barriers set by developed countries (Bi et al., 2015; Zou et al., 2022). With the gradual transformation of the world economic growth pattern and the rapid development of science and technology, it has become the necessary path for the China’s equipment manufacturing industry to actively participate in the international labor division and gain a jump on the GVC position (Wang et al., 2021b). Therefore, how to promote the GVC upgrading by carrying out green technology innovation has become a pressing matter of the moment for China’s equipment manufacturing industry.

Over the last decade, a number of research works regarding green technology innovation in the process of GVC embedding for developing countries have been undertaken (Olson, 2013; Yan et al., 2016; Song and Wang, 2017; Sun et al., 2020a). However, most of them mainly reflect the impact of the whole country or manufacturing industry rather than more detailed industry from the perspective of focusing on industry pertinence and heterogeneity. Therefore, this paper attempts to fill the research gap by taking the equipment manufacturing industry and its subsectors as the research object and explore the role and transmission path of green technology innovation in improving the status of GVC. The results could provide the reference for solving the relationship between economic development and ecological environment and help China’s equipment manufacturing industry seize the green trade market, break the green trade barriers set by developed countries, and enhance the position of GVC.

The remainder of this paper is structured as follows. The second part explains the econometric models, indicators, and data. Subsequently, the third part presents the regression analysis and finally, the fourth part presents the conclusion and policy implications.

2 Literature review

Compared with pure technology innovation, green technology innovation pays more attention to not only economic development but also environmental protection. In recent years, relevant studies begin to highlight on the effect of green technology innovation and divide it into inhibition and promotion.

On the one hand, most scholars believe that the restraining effect of green technology innovation can be divided into crowding-out effect, R&D risk effect and low-end locking effect. First of all, the green technology innovation needs to invest more funds, and firms will invest in green energy technologies only if these investments have an economic pay-off (Stucki, 2019). However, in order to meet the requirements of strict environmental regulations established by the government, green technology innovation will generate compliance costs at the initial stage of implementation, that is, increase the investment in pollution control (Gray and Shadbegian, 2019). This will cause the investment of actual production to be crowded out and soon increase the total cost, which will reduce the productivity and market competitiveness of enterprises (Bao and Chai, 2022). Second, R&D risk effect refers to the uncertainty of emerging green products, processes and technologies and the uncertainty of the external environment when enterprises carry out green technology innovation. Therefore, enterprises with weak risk tolerance tend to operate conservatively in order to avoid risks, thus hindering their sustainable development (Hasan and Habib, 2017). Finally, the low-end locking effect refers to that in the context of the GVC, if the developing countries want to promote the upgrading through green technology innovation, the developed countries will use various means to control and hinder the enterprises of the developing countries from carrying out green technology innovation, thus forcing the developing countries to be “locked” in the production and assembly links of the low-end (Zhang and Zheng, 2017).

On the other hand, most scholars believe that the promotion effect of green technology innovation mainly includes innovation compensation effect, energy saving and emission reduction effect and market demand effect. First of all, the innovation compensation effect means that in the long run, green technology innovation carried out by the reasonable environmental regulations encourage enterprises to provide greener, more environmentally friendly and low-carbon products, which is conducive to the development of green economy (Xu and Zhang, 2020). Secondly, the energy saving and emission reduction effect refers to that enterprises improve energy efficiency and reduce pollution emissions from the whole life cycle through green technology innovation. This could useful to innovate clean energy, green products and processes and reduce environmental pressure in the whole production process, which can realize the development of green economy (Li et al., 2022). Finally, the market demand effect refers to that while the market demand for green products increases, enterprises establish a green image and occupy the green market in order to form a good reputation and gain social recognition. This will help enterprises maintain long-term competitiveness in market competition, achieve core green technology breakthroughs through green technology innovation, and provide more green products from the whole life cycle (Guo and Shi, 2022).

On the basis of the above research around the economic effects of green technology innovation, some scholars began to study the relationship between green technology innovation and GVC and highlight their importance for the effective manufacturing (Marchi et al., 2013; Costantini et al., 2017; Yin et al., 2022). The research of Song and Wang (2017) shows that participation in the GVC can considerably improve the green technology levels in all enterprises, except state-owned ones. And Song et al. (2018) reach further conclusions using enterprise panel data, that the deeper the integration into the global supply chain, the looser the financing environment would be, and the stronger the green innovation abilities of the enterprises. The research of Meng et al. (2022) also highlights that increased GVC participation leads to improved green innovation performance of Chinese firms. However, Sun et al. (2020b) emphasized that although the development of green technology in manufacturing industry must rely on technological innovation, the process of implementing green innovation is full of high uncertainty and risk. More specifically, Sun et al. (2020a) summarizes and identifies the risk of green innovation in the manufacturing industry into four major kinds and 31 factors, based on the perspective of the global value chain. Therefore, some scholars find that the impact of green technology innovation on the GVC may be non-linear. Song and Wang (2018) perform a multi-index multi-factor constitutive model based on a sample of 468 Chinese industries and draw the conclusion that there is a U-shape relationship between green technology progress and comparative advantages. Wang S. et al. (2021)study the relationships among the degree of participation in GVC, technological progress, and environmental pollution from the perspective of industries in developing countries and find that there is a value chain threshold and only when the degree of participation in a value chain is higher than the threshold, technological progress can reduce emissions.

Relevant research on the effects of green technology innovation is relatively rich and lays a solid foundation for the study on the relationship between green technology innovation and GVC. However, most of the existing literatures have studied how participation in the GVC affects green technology innovation, but the reverse research is lacking. In particular, how green technology innovation in equipment manufacturing industry affects GVC upgrading has not attracted enough attention. The transmission path between green technology innovation and GVC upgrading is still unclear. Therefore, to fill the research gaps, this paper explores the effects of green technology innovation on GVC upgrading of China’s equipment manufacturing industry and its subsectors by firstly constructing a baseline regression model. Subsequently, some mediating variables and the stepwise regression method are introduced to verify the impact paths of green technology innovation on GVC upgrading. According to the empirical results, some policy implications are put forward to promote green technology innovation of China’s equipment manufacturing industry and realize GVC upgrading, for reference by government departments and enterprises.

3 Research and data methodology

3.1 Division of GVC upgrading direction for subsectors

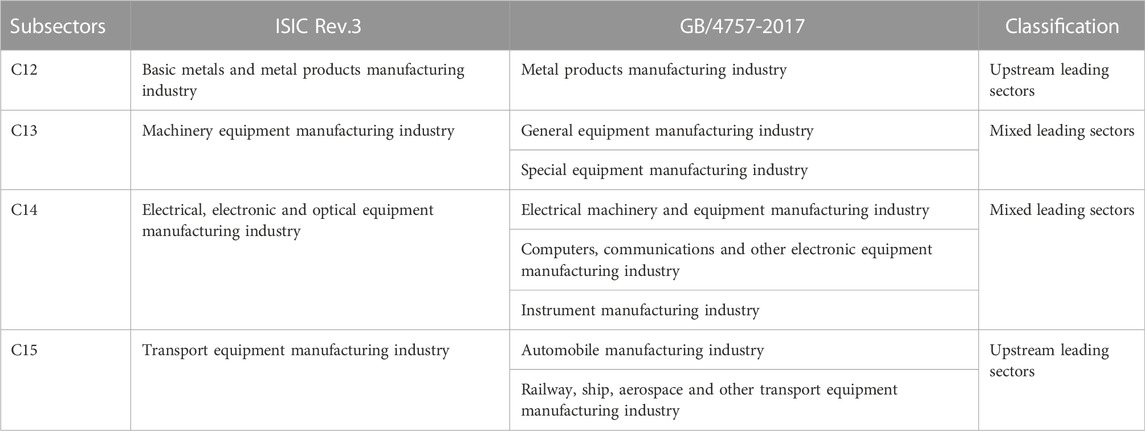

This paper selects China’s equipment manufacturing industry and its subsectors as the research object. Considering the industry classification standards of different databases, the equipment manufacturing industry involved in this paper can be divided into four subsectors, namely basic metals and metal products manufacturing subsector (C12), machinery equipment manufacturing subsector (C13), electrical, electronic and optical equipment manufacturing subsector (C14), and transport equipment manufacturing subsector (C15).

For the equipment manufacturing industry, the GVC upgrading refers to the improvement of the status of international division of labor, which is mainly manifested by the improvement of value-added ability and control ability. Based on the theory of “binary drive”, the producer-driven industries should take the upward climb of the GVC as the direction of industrial upgrading, and the purchaser-driven industries should pursue the downward climb of the GVC. This is consistent with the description of the smile curve, that is, the division of labor at both ends of the GVC are of a higher status, and both the upstream and downstream can be the choice of the upgrading direction for different industries. Therefore, it is the primary procedure of this study to determine the GVC upgrading direction of the four equipment manufacturing subsectors, which can provide the basis for the subsequent subsector heterogeneity analysis.

To achieve this, this paper measures the industrial embedding position and GVC upgrading using the indexes of upstream degree (

In the upstream leading group, the more to be near upstream position of the production chain, the industrial ability to obtain value-added stronger, namely that the upstream degree index has a significant promoting effect on the export technology complexity index, and subsectors in this group can enhance its GVC position and facilitate upgrading by moving closer to the upper reaches of the GVC; On the contrary, the upstream degree index has a significant inhibitory effect on the export technology complexity index in the downstream leading group, since subsectors in this group need to promote GVC upgrading by approaching the downstream of the GVC; And if there is no obvious correlation between the two indexes, it indicates that there are multiple high value-added links in the GVC for this subsector to improve the position of international labor division, who belongs to the mixed leading group.

The measurement method of the index of upstream degree (

where

where

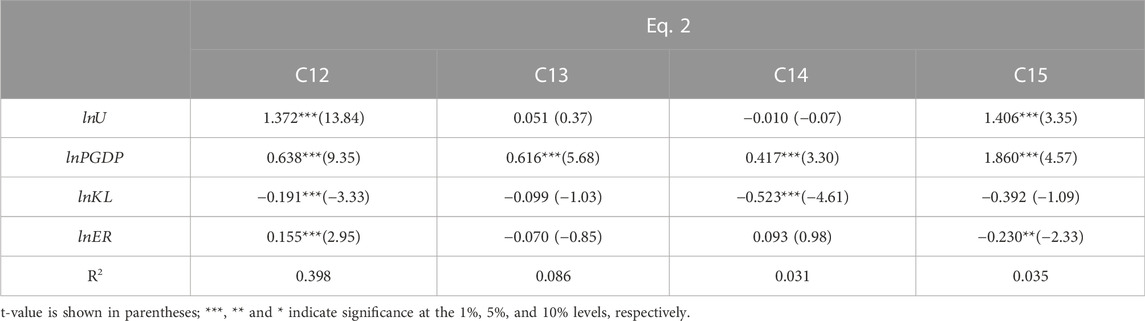

To make the upgrading direction of four subsectors more in line with their own industry characteristics, this paper expands the research object from China to 62 countries and Rest of the World in this part. Panel data of four subsectors of equipment manufacturing industry from 2007 to 2019 are used for regression. For ease of calculation, all indexes are taken as logarithms. Hausman test results show that the fixed effect model (FE) is more suitable for Eq. 2, and the results are shown in Table 1.

TABLE 1. Regression results of upstream degree and GVC upgrading in subsectors of equipment manufacturing industry.

The regression results show that for the four subsectors, the coefficients of upstream degree (

3.2 Econometric model design

This paper constructs an econometric model with green technology innovation (

where

Based on the baseline regression, this paper also further analyzes the possible impact paths of green technology innovation on GVC upgrading referring to stepwise regression method (Baron and Kenny, 1986). Because of its effectiveness in testing the mediating effect, the stepwise regression method is widely used in the empirical research of various mechanism analysis (Luo and Xie, 2021; Wang and Li, 2022). The mediating effect test model in this paper is constructed as follows.

where

3.3 Green technology innovation

Referring to the research of Yuan and Chen (2019), green technology innovation (

where the subscripts

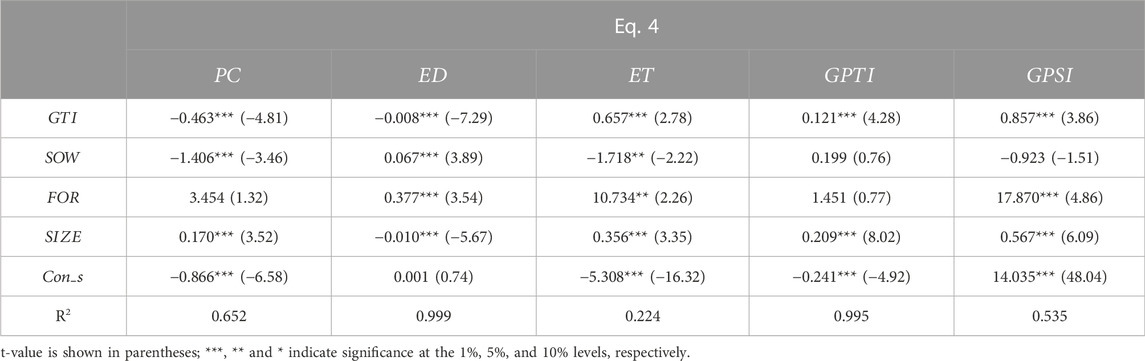

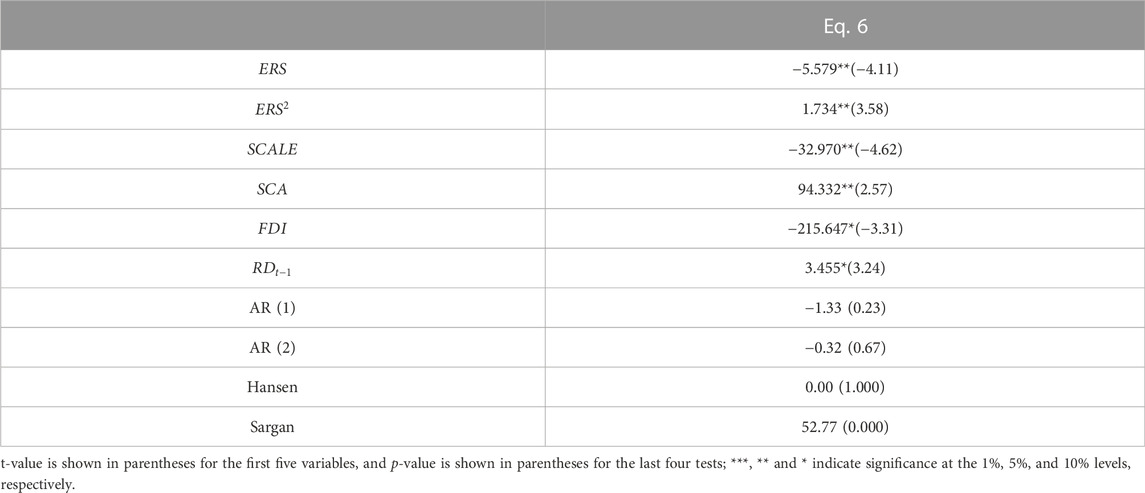

TABLE 3. Regression results of environmental regulation and R&D investment in China’s equipment manufacturing industry.

It can be seen that AR 1) test is significant while AR 2) test is not, that is, there is no second-order autocorrelation in the model, indicating that the SYS-GMM method is reasonable. At the same time, the general moment condition of the model holds, that is, the selection of instrumental variables is also effective according to the results of Hansen test and Sargan test. The coefficient of

Overall, the relationship between environmental regulation and R&D investment shows U-shaped according to the coefficients’ direction of

where the value of

3.4 Global value chain upgrading

Referring to the research of Wang and Wei (2017), this paper takes the index of export technology complexity (

where the subscripts

where

3.5 Data sources

The indexes identified above and those to be used in the future mainly come from three kinds of database: 1) the UIBE (University of International Business and Economics) GVC Indicators database, which is a derivative database processed based on different kinds of original world ICIO (Intercountry Input-output Tables) table. The world ICIO table used in this paper provided by ADB (Asian Development Bank). 2) the statistical yearbooks provided by China National Bureau of Statistics, included China Statistical Yearbook, China Statistical Yearbook on Science and Technology, China Statistical Yearbook on Industry and China Statistical Yearbook on Environment. 3) official websites of international organizations, included the World Bank, OECD (Organization for Economic Co-operation and Development), PWT (Penn World Table). One problem to be solved is that the division of equipment manufacturing industry in these three kinds of databases are inconsistent. In the ICIO provided by ADB, the industry classification follows the International Standard Industry Classification (ISIC Rev.3), while in the statistical yearbooks provided by China, it follows the National Economic Standard Industry Classification (GB/4757-2017). In order to facilitate the research, this paper classifies the industries divided by GB/4757-2017 according to ISIC Rev.3, and obtains four subsectors of equipment manufacturing industry. For details, please refer to Table 2.

4 Empirical results

4.1 Baseline regression

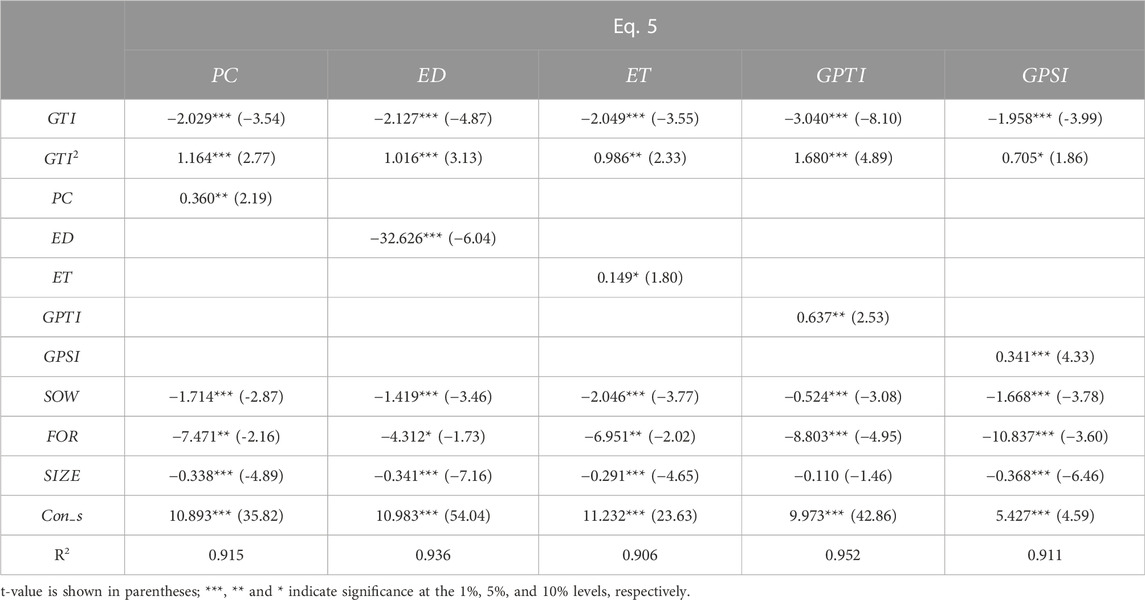

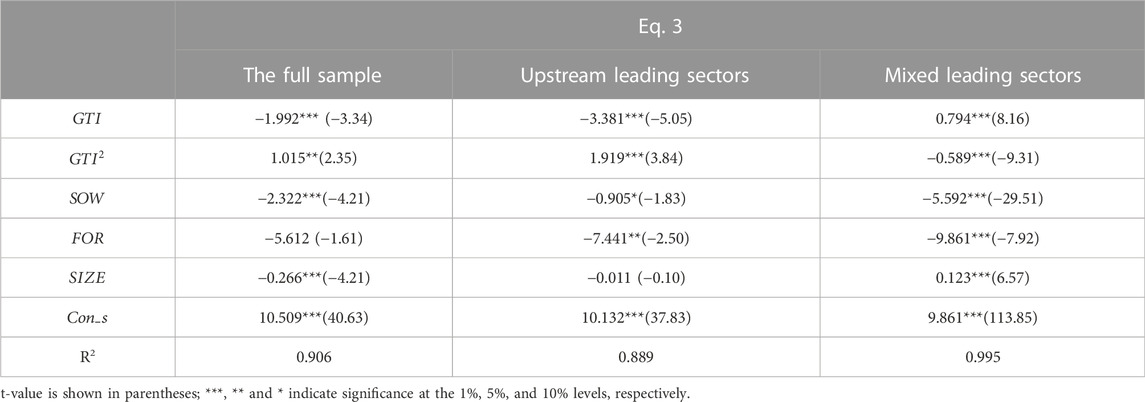

For Eq. 3, the benchmark regression results are shown in Table 4 together with the subsector heterogeneity analysis using Weighted Least Squares (WLS) regression method. It can be seen that for the full sample, the coefficient of

TABLE 4. Regression results of green technology innovation and GVC upgrading in subsectors of equipment manufacturing industry.

After analyzing the regression results of the full sample, this paper also discusses the heterogeneity of the two groups of equipment manufacturing subsectors. The results show that the relationship between green technology innovation and GVC upgrading for upstream leading sectors is similar to that of the full sample, with a U-shaped trend of declining first and rising subsequently. While for mixed leading sectors, there is an inverted U-shaped relationship between green technology innovation and GVC upgrading, indicating that green technology innovation can promote GVC upgrading in the short term, but in the long run, it is the opposite. This is because the GVC upgrading direction of the mixed leading sectors is not unique, and must be determined according to its value-added capacity in different GVC stages as well as its production conditions. The inverted U-shaped regression results indicate that at the present stage, green technology innovation in China’s machinery equipment manufacturing industry and electrical, electronic and optical equipment manufacturing subsector is not completely suitable for their GVC upgrading. Therefore, it is necessary to continue to explore more scientific and effective approaches of green technology innovation according to the characteristics of the industry.

As for the control variables, the ownership structure (

4.2 Robustness regression

In order to ensure the robustness of baseline regression results, this paper regresses Eq. 3 in three ways: a) in order to avoid the extreme values in the data calculation, the special samples that may affect the regression results are eliminated, and the export technology complexity (

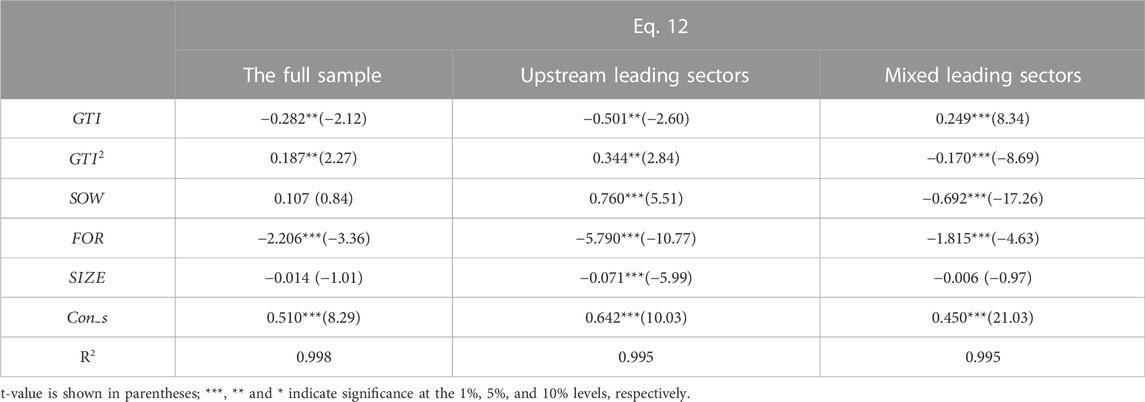

Next, this paper further tests the robustness of the sectoral heterogeneity analysis, by setting the index of GVC control capability (

where

TABLE 6. Robustness regression results of upstream degree and GVC upgrading in subsectors of equipment manufacturing industry.

The result is same as before. That is, the upstream leading sectors include basic metals and metal products manufacturing subsector (C12) and transport equipment manufacturing subsector (C15), and the mixed leading sectors include machinery equipment manufacturing subsector (C13) and electrical, electronic and optical equipment manufacturing subsector (C14). Subsequently, the explained variable of Eq. 5 is also be replaced to verify the robustness of the sectoral heterogeneity analysis. The new regression equation is shown as Eq. 12, whose regression results are represented in Table 7. According to the results, the empirical conclusions are found to be robust.

TABLE 7. Robustness regression results of green technology innovation and GVC upgrading in subsectors of equipment manufacturing industry.

4.3 Further analysis of impact paths

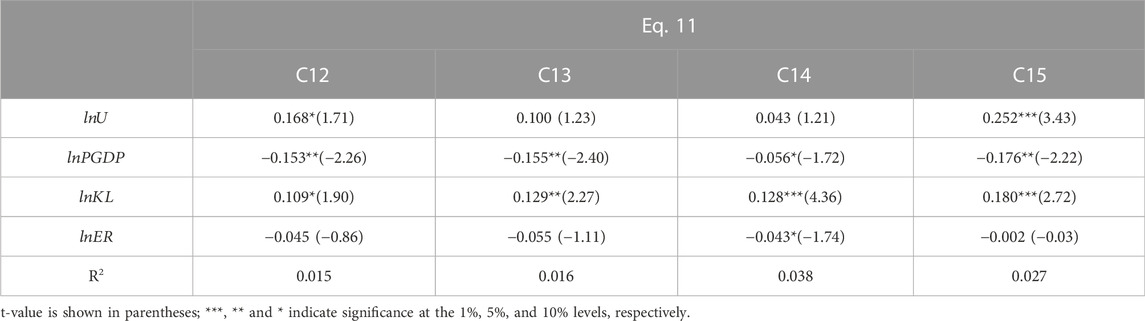

On the basis of the significant coefficients of the core explanatory variables in the benchmark regression results, it is feasible to further test if the mediating effect of green technology innovation on GVC upgrading for China’s equipment manufacturing industry exists through Eqs 6, 7. The test results of all five mediating variables, including pollution cost (

For pollution cost (

For embedded dependence (

For export scale (

For green product innovation (

5 Conclusion and policy implications

On the basis of existing research, this paper firstly defines the GVC upgrading direction for subsectors of equipment manufacturing industry using the ICIO provided by ADB database of 63 countries from 2007 to 2019. According to the effect of upstream degree index on GVC upgrading, the four subsectors of equipment manufacturing industry are classified as upstream leading sectors and mixed leading sectors respectively. Subsequently, the benchmark regression results of full samples and heterogeneity analysis in China’s manufacturing industry are discussed to study the relationship between green technology innovation and GVC upgrading. Furthermore, stepwise regression method and five mediating variables are introduced to verify the impact approaches of green technology innovation on GVC upgrading. In the whole process, the robustness test is carried out by replacing core explanatory variables. The regression results show that, 1) from the overall perspective of China’s equipment manufacturing industry, there is a U-shaped relationship between green technology innovation and the promotion of GVC status. That is, green technology innovation can play a positive role in promoting the GVC upgrading only after crossing an inflection point. Therefore, it is very important to create a good innovation environment and atmosphere and coordinate relevant policy about green technology innovation and development, which can help the industry to realize the transition from “demographic dividend” to “talent dividend”. At the same time, the establishment and improvement of the intellectual property protection system can strengthen the protection of enterprises’ green technology, which can actively encourage enterprises to carry out green technology innovation, reduce the GVC embedded dependence and optimize the export trade structure, and finally, promote the upgrading of the GVC status. 2) from the perspective of industry heterogeneity, for upstream leading sectors including basic metals and metal products manufacturing subsector and transport equipment manufacturing subsector, green technology innovation and GVC upgrading have a U-shaped relationship of first decline and then rise; but for mixed leading sectors including machinery equipment manufacturing subsector and electrical, electronic and optical equipment manufacturing subsector, the trend is opposite, that is, an inverted U-shaped relationship of first rise and then decline. This indicates that heterogeneity of China’s equipment manufacturing industry would need to get more attention, including fully stimulating the guide role of the market and the advantages of various types of environmental regulation tools. By improving the government’s environmental supervision system, enterprises are forced to reduce pollution costs and carry out green product and green process innovation, so as to enhance the value-added capacity when embedded in GVC. 3) from the perspective of impact paths, green technology innovation in China’s equipment manufacturing industry can promote GVC upgrading by reducing its dependence on GVC, optimizing export trade, reducing pollution costs, and promoting green product and process innovation. Therefore, the establishment and improvement of factor market supply system can provide green financial support and cultivate green innovative talents for China’s equipment manufacturing enterprises to carry out green technology innovation, and find a breakthrough for promoting the improvement of GVC labor division. According to the above conclusions, this paper puts forward the following three policy implications.

First, improve the government’s environmental regulation policy, and force enterprises to carry out green technology innovation. It is very important to make full use of and coordinate the advantages of different government regulation means and market mechanisms. According to the actual situation of China’s equipment manufacturing industry, appropriate policy mix should be made to drive enterprises to carry out green technology innovation through environmental regulation pressure and pollution control cost, so as to help the industry breakthrough the “low-end lock-in” and promote GVC upgrading. The government should strengthen the innovation of environmental regulation policies, and speed up the improvement and implementation of environmental tax, carbon tax and emission quota. By improving the supervision and implementation effect of environmental laws and regulations, the environmental protection needs of China’s economy and China’s equipment manufacturing industry for sustainable development can be met, and the coordination of green economic and ecological environmental protection can be promoted. At the same time, it is worth noting that the unlimited increase of environmental regulation will increase the crowding out of “compliance cost” to “compensation cost”, which can increase the total cost of enterprises, and then affect the development of green technology innovation as well as hinder the advancement of GVC status. In addition, environmental regulation policies should consider the industry characteristics and upgrading direction of China’s equipment manufacturing enterprises, and encourage enterprises to upgrade towards the leading link of GVC. On the one hand, for equipment manufacturing industry in upstream leading group, it is necessary to promote the upgrade of the industry to the GVC upstream by encouraging enterprises to carry out green technology innovation and training green innovation talents, so as to form a comparative advantage in R&D and design instead of population and resource endowment. On the other hand, for equipment manufacturing industry in mixed leading group, their labor division links that can generate higher value-added are not unique and have a trend of industrial integration. GVC upgrading plan should be formulated according to the characteristics of the industry, and the development pattern of a certain industry should not be completely copied.

Second, improve the market supply system for factors of production and strengthen the training of green and innovative personnel. The government should formulate scientific and reasonable financial and fiscal policies, increase financing channels and financial supply, increase investment in green technology innovation in the equipment manufacturing industry, and encourage enterprises to initiate green technology innovation. The government also should reduce the cost of green technology innovation for equipment manufacturing enterprises, including improving targeted subsidies, tax rebates and other policies, encourage enterprises to carry out green process and green product innovation and mobilize their enthusiasm. Financial institutions should actively cooperate with equipment manufacturing enterprises to lower the financing threshold and reduce the cost of green innovation. In order to change from “demographic dividend” to “talent dividend”, it is necessary to strengthen the investment in human capital, improve the personnel training policy, and increase the cultivation and training of green and innovative talents. At the same time, it is also necessary to improve the mode of production, education and research, strengthen the cooperation between universities, research institutes and enterprises, so as to better adapt to the market demand and the actual needs. On the one hand, the government should improve the talent introduction plan, actively introduce green and innovative talents, and attract well-known scholars and relevant talents at home and abroad to participate in the green technology research of the equipment manufacturing industry. On the other hand, the enterprise should cultivate the green innovation consciousness of employees in the enterprise, stimulate the green innovation spirit, and form a benign interaction between domestic and foreign talents.

Third, promote the green innovation-driven development strategy, shift from “factor driven” to “green innovation-driven”. To improve the GVC labor division status of China’s equipment manufacturing industry, the government must establish perfect market trading system and trading rules, guide and encourage enterprises to actively carry out green technology innovation, and implement relevant support measures for those enterprises to avoid research and development risks. The government should also supervise and restrict non-environmental innovation activities that may adversely affect the quality of the natural, ecological and environmental environment, eliminate enterprises with low technological level and great environmental damage, and reduce excess production capacity. China’s equipment manufacturing enterprises need to actively invest in master core and key technologies to realize independent, controllable and modern development of the industry. In terms of environmental regulation, the government should strengthen the construction of relevant laws and regulations, improve the environmental supervision system, strengthen the supervision of waste water, soil, exhaust gas and other waste discharge of enterprises, and standardize and guarantee the implementation of environmental protection policies. Big data, satellite remote sensing and other technologies can be used to monitor the pollution situation of various industries in real time and promote the improvement of the pollution control level of the whole industry. When granting patents, industry associations should also pay attention to the environmental and energy effects. Patent classification, setting and dynamic regulation can lay a solid foundation for the implementation of green technology innovation incentive mechanism. At the same time, enterprises should promote the innovation of green products and processes, and the continuous improvement of product production accuracy and product quality, and the emergence of new products and new processes, so as to form the industry scale and produce the industrial cluster effect, and increase export trade to drive the industrial upgrading.

To sum up, this paper takes China’s equipment manufacturing industry and four subsectors as the research object to verify the non-linear relationship between green technology innovation and GVC upgrading. The results show that the impact of green technology innovation on GVC upgrading is first decline and then rise, which is consistent with the research conclusions of Song et al. (2018) and Wang S. et al. (2021). On this basis, this paper also verifies the heterogeneity of the above non-linear relationship in different subsectors, which can provide targeted development reference for two types of equipment manufacturing subsectors with different upgrading directions of GVC. This is one of the important application contributions of this study. Moreover, this paper further explores the mediating mechanism of green technology innovation affecting the GVC upgrading, and find that pollution cost, embedded dependence, export scale, green product innovation and green process innovation play important roles in it. This can help China’s equipment manufacturing industry to select targeted forms and paths of green technology innovation when participating in the world division of labor, encourage enterprises to carry out green technology innovation, and further promote the GVC upgrading.

This study provides a theoretical basis and policy reference for China to promote green technology innovation and realize GVC upgrading in equipment manufacturing enterprises. Non-etheless, this study has the following limitations. First, because of the data limitations, the time span chosen in this study to examine the impact of green technology innovation on GVC upgrading is from 2007 to 2019, and the latest value chain division of labor cannot be analyzed. Second, the enterprise is the main element of green technology innovation, shouldering the important task of improving the level of green R&D in the industry. However, due to the restriction of ADB database, this paper only conducts research through industry panel data, without exploring typical cases or conducting research. In future research, we will seek breakthroughs in these aspects.

Data availability statement

Publicly available datasets were analyzed in this study. This data can be found here: http://rigvc.uibe.edu.cn/english/D_E/database_database/index.

Author contributions

YL: conceptualization, methodology; HY: data processing, and writing (original draft); XZ: data collection, validation, and writing (review and editing); QH: visualization, investigation, supervision, and writing (review and editing).

Funding

This study is supported by Shenzhen Key Research Base Project of Humanities and Social Sciences (2020 SZJD 07); Liaoning New Think Tank Project of Colleges and Universities (2020-10151-002); Major cultivation projects of humanities and social sciences of basic scientific research business expenses of central universities (3132022604).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Antràs, P., Chor, D., Fally, T., and Hillberry, R. (2012). Measuring the upstreamness of production and trade flows. Am. Econ. Rev. 102 (3), 412–416. doi:10.1257/aer.102.3.412

Bao, Q., and Chai, H. (2022). Environmental regulation, financial resource allocation, and regional green technology innovation efficiency. Discrete Dyn. Nat. Soc. 2022, 1–11. doi:10.1155/2022/7415769

Baron, R. M., and Kenny, D. A. (1986). The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. personality Soc. Psychol. 51 (6), 1173–1182. doi:10.1037/0022-3514.51.6.1173

Bi, K., Huang, P., and Ye, H. (2015). Risk identification, evaluation and response of low-carbon technological innovation under the global value chain: A case of the Chinese manufacturing industry. Technol. Forecast. Soc. Change 100, 238–248. doi:10.1016/j.techfore.2015.07.005

Chen, H., and Yin, K. (2022). The impact of global value chain embedding on carbon emissions embodied in China’s exports[J]. Front. Environ. Sci., 986.

Costantini, V., Crespi, F., Marin, G., and Paglialunga, E. (2017). Eco-innovation, sustainable supply chains and environmental performance in European industries 1 1We gratefully acknowledge the support by the European Union's Horizon 2020 research and innovation programme under grant agreement No. 649186 – ISIGrowth. The comments and suggestions by three anonymous referees are also acknowledged. The usual disclaimers apply. J. Clean. Prod. 155, 141–154. doi:10.1016/j.jclepro.2016.09.038

Dong, F., Yu, B., Hadachin, T., Dai, Y., Wang, Y., Zhang, S., et al. (2018). Drivers of carbon emission intensity change in China. Resour. Conservation Recycl. 129, 187–201. doi:10.1016/j.resconrec.2017.10.035

Gray, W. B., and Shadbegian, R. J. (2019). Environmental regulation, investment timing, and technology choice. Econ. Water Qual., 5–26.

Guo, L. L., and Shi, W. (2022). Research on the relational between environmental cost and firm performance: Evidence from listed companies in heavily polluting industries[J]. J. Manag. 35 (02), 87–102.

Hamamoto, M. (2006). Environmental regulation and the productivity of Japanese manufacturing industries. Resour. energy Econ. 28 (4), 299–312. doi:10.1016/j.reseneeco.2005.11.001

Hasan, M. M., and Habib, A. (2017). Corporate life cycle, organizational financial resources and corporate social responsibility. J. Contemp. Account. Econ. 13 (1), 20–36. doi:10.1016/j.jcae.2017.01.002

Hausman, J., Stock, J. H., and Yogo, M. (2005). Asymptotic properties of the Hahn–Hausman test for weak-instruments. Econ. Lett. 89 (3), 333–342. doi:10.1016/j.econlet.2005.06.007

Koopman, R., Powers, W., Wang, Z., and Wei, S. J. (2010). Give credit where credit is due: Tracing value added in global production chains. National Bureau of Economic Research.

Levinson, A. (1996). Environmental regulations and manufacturers’ location choices: Evidence from the census of manufactures. J. Public Econ. 62 (1), 5–29.

Li, X., Zhang, N., and Song, P. (2022). Research on energy saving and emission reduction effect and mechanism of carbon emission trading system: Empirical evidence based on synthetic control method[J]. Mod. Finance Econ. 42 (04), 96–113.

Li, Y., Sun, H., Huang, J., and Huang, Q. (2020a). Low-end lock-in of Chinese equipment manufacturing industry and the global value chain. Sustainability 12 (7), 2981. doi:10.3390/su12072981

Li, Y., Zhang, H., Liu, Y., and Huang, Q. (2020b). Impact of embedded global value chain on technical complexity of industry export—an empirical study based on China’s equipment manufacturing industry panel. Sustainability 12 (7), 2694. doi:10.3390/su12072694

Li, Z. Z., Li, R. Y. M., Malik, M. Y., Murshed, M., Khan, Z., and Umar, M. (2021). Determinants of carbon emission in China: How good is green investment?[J]. Sustain. Prod. Consum. 27, 392–401. doi:10.1016/j.spc.2020.11.008

Lu, Y. (2017). China’s electrical equipment manufacturing in the global value chain: A GVC income analysis based on world input-output database (wiod). Int. Rev. Econ. Finance 52, 289–301. doi:10.1016/j.iref.2017.01.015

Luo, T., and Xie, R. (2021). Supply chain power and corporate environmental responsibility: Mediation effects based on business performance. Int. J. Environ. Res. Public Health 18 (17), 9264. doi:10.3390/ijerph18179264

Marchi, V. D., Maria, E. D., and Micelli, S. (2013). Environmental strategies, upgrading and competitive advantage in global value chains. Bus. Strategy Environ. 22 (1), 62–72. doi:10.1002/bse.1738

Meng, S., Yan, H., and Yu, J. (2022). Global value chain participation and green innovation: Evidence from Chinese listed firms. Int. J. Environ. Res. Public Health 19 (14), 8403. doi:10.3390/ijerph19148403

Olson, E. L. (2013). Perspective: The green innovation value chain: A tool for evaluating the diffusion prospects of green products. J. Prod. Innov. Manage. 30 (4), 782–793. doi:10.1111/jpim.12022

Song, M., Chen, M., and Wang, S. (2018). Global supply chain integration, financing restrictions, and green innovation: Analysis based on 222, 773 samples[J]. Int. J. Logist. Manag. 29, 539–554. doi:10.1108/ijlm-03-2017-0072

Song, M., and Wang, S. (2018). Market competition, green technology progress and comparative advantages in China. Manag. Decis. 56 (1), 188–203. doi:10.1108/md-04-2017-0375

Song, M., and Wang, S. (2017). Participation in global value chain and green technology progress: Evidence from big data of Chinese enterprises. Environ. Sci. Pollut. Res. 24 (2), 1648–1661. doi:10.1007/s11356-016-7925-1

Stucki, T. (2019). Which firms benefit from investments in green energy technologies?–The effect of energy costs[J]. Res. Policy 48 (3), 546–555. doi:10.1016/j.respol.2018.09.010

Sun, Y., Bi, K., and Yin, S. (2020a). Measuring and integrating risk management into green innovation practices for green manufacturing under the global value chain. Sustainability 12 (2), 545. doi:10.3390/su12020545

Sun, Y., Wu, L., and Yin, S. (2020b). Green innovation risk identification of the manufacturing industry under global value chain based on grounded theory. Sustainability 12 (24), 10270. doi:10.3390/su122410270

Wang, J., Wu, H., and Chen, Y. (2020). Made in China 2025 and manufacturing strategy decisions with reverse QFD. Int. J. Prod. Econ. 224, 107539. doi:10.1016/j.ijpe.2019.107539

Wang, L., and Wei, L. (2017). Low end locking” or “crowding out effect”: Evidence from employment and wages of GVCs in China’s manufacturing industry[J]. J. Int. Trade 8, 62–72.

Wang, S., He, Y., and Song, M. (2021c). Global value chains, technological progress, and environmental pollution: Inequality towards developing countries. J. Environ. Manag. 277, 110999. doi:10.1016/j.jenvman.2020.110999

Wang, S., Wang, X., and Tang, Y. (2020). Drivers of carbon emission transfer in China—an analysis of international trade from 2004 to 2011. Sci. Total Environ. 709, 135924. doi:10.1016/j.scitotenv.2019.135924

Wang, W., and Li, Y. (2022). Can green finance promote the optimization and upgrading of industrial structures?-Based on the intermediary perspective of technological progress[J]. Front. Environ. Sci. 10, 919950. doi:10.3389/fenvs.2022.919950

Wang, Y., Guo, C., Chen, X., Jia, L., Guo, X., Chen, R., et al. (2021a). Carbon peak and carbon neutrality in China: Goals, implementation path and prospects[J]. China Geol. 4 (4), 720–746.

Wang, Y., Wang, Z., and Zameer, H. (2021b). Structural characteristics and evolution of the “international trade-carbon emissions” network in equipment manufacturing industry: International evidence in the perspective of global value chains. Environ. Sci. Pollut. Res. 28 (20), 25886–25905. doi:10.1007/s11356-021-12407-w

Xu, D. L., and Zhang, M. (2020). Impact of environmental regulation on the upgrading of global value chain: Promoting or inhibiting? -Mediation effects based on low carbon TFP[J]. J. China Univ. Geosciences Soc. Sci. Ed. 20 (03), 75–89.

Xu, X., Wang, X., and Zhang, R. (2015). The research on influence factors of the servitization of the equipment manufacturing industry under the global value chain (GVC) perspective. Int. J. Secur. Its Appl. 9 (5), 289–296. doi:10.14257/ijsia.2015.9.5.28

Yan, M. R., Chien, K. M., and Yang, T. N. (2016). Green component procurement collaboration for improving supply chain management in the high technology industries: A case study from the systems perspective. Sustainability 8 (2), 105. doi:10.3390/su8020105

Yin, S., Zhang, N., Ullah, K., and Gao, S. (2022). Enhancing digital innovation for the sustainable transformation of manufacturing industry: A pressure-state-response system framework to perceptions of digital green innovation and its performance for green and intelligent manufacturing. Systems 10 (3), 72. doi:10.3390/systems10030072

Yu, C. H., Wu, X., Zhang, D., Chen, S., and Zhao, J. (2021). Demand for green finance: Resolving financing constraints on green innovation in China. Energy Policy 153, 112255. doi:10.1016/j.enpol.2021.112255

Yuan, Y. J., and Chen, Z. (2019). Environmental regulation, green technology innovation and the transformation and upgrading of China’s manufacturing industry[J]. Stud. Sci. Sci. 37 (10), 1902–1911.

Zhang, B., Yang, S., and Bi, J. (2013). Enterprises’ willingness to adopt/develop cleaner production technologies: An empirical study in changshu, China. J. Clean. Prod. 40, 62–70. doi:10.1016/j.jclepro.2010.12.009

Zhang, J., and Zheng, W. P. (2017). The innovation effect of Chinese domestic firms under the global value chain[J]. Econ. Res. J. 52 (03), 151–165.

Zhang, Y. J., and Da, Y. B. (2015). The decomposition of energy-related carbon emission and its decoupling with economic growth in China. Renew. Sustain. Energy Rev. 41, 1255–1266. doi:10.1016/j.rser.2014.09.021

Keywords: equipment manufacturing industry, green technology innovation, global value chain upgrading, mesomeric effect, upstream degree

Citation: Li Y, Zhang X, Hao J and Huang Q (2022) The impact of green technology innovation on global value chain upgrading in China’s equipment manufacturing industry. Front. Environ. Sci. 10:1044583. doi: 10.3389/fenvs.2022.1044583

Received: 14 September 2022; Accepted: 29 November 2022;

Published: 14 December 2022.

Edited by:

Muhammad Mohiuddin, Laval University, CanadaReviewed by:

Ojonugwa Usman, Istanbul Commerce University, TurkeyShi Yin, Agricultural University of Hebei, China

Copyright © 2022 Li, Zhang, Hao and Huang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Qingbo Huang, aHVhbmdxaW5nYm9AZGxtdS5lZHUuY24=

Yan Li1

Yan Li1 Xiaohan Zhang

Xiaohan Zhang