- School of Economics and Management, University of Science and Technology Beijing, Beijing, China

Technological innovation in the CTL1 industry is an important direction for China’s future development. Taking the China’s listed CTL companies as samples, this study makes an empirical test on the relationship between technological innovation capabilities and corporate competitiveness of CTL companies, and explores the regulating effect of enterprise scales on the relationship between technological innovation capabilities and corporate competitiveness, as well as the mediating effect of product differentiation on this relationship. It is found that the investment capacity of CTL enterprises for technological innovation has a significant driving effect on their competitiveness (with the correlation coefficient of 0.017), the output capacity of technological innovation has no remarkable effect on the promotion of the enterprises’ competitiveness (with the correlation coefficient of 0.0298), enterprise scales have a positive regulating effect on the relationship between technological innovation input and output capabilities and corporate competitiveness (with the coefficient of the interaction term of 0.3870 and 0.0002 respectively), and product differentiation plays a mediating effect on this relationship (with the coefficient of the interaction term of 0.147 and 0.096 respectively). From the results, it can be said that increasing R&D expenses of enterprises, encourage the cultivation and introduction of high-end R&D talents as well as strengthen technological innovation and enhance product differentiation can help to improve CTL enterprises’ competitiveness. The conclusions of this study can provide theoretical bases for CTL enterprises to hike and improve their competitiveness in terms of technological innovation.

1 Introduction

The resource endowment of rich coal, insufficient oil and scarce gas determines that China’s energy structure dominated by coal would be difficult to change in the short term. It is of great strategic significance to address China’s oil resource shortage, reduce energy dependence on foreign countries and enhance the national energy security guaranteeing capabilities by utilizing China’s relatively abundant coal resources and developing the coal-to-liquids (CTL) industry. However, under the impact of low oil prices, CTL companies see not high overall competitiveness, which is manifested in large investment costs, simple product structures, low added values etc. Nevertheless, technological innovation is a huge driving force for improving the competitiveness of enterprises. Specifically, technological innovation can improve their competitiveness by increasing the stock of intangible assets and enhancing production factors, among other measures. Therefore, it has become an important and urgent issue to improve the technological innovation capability of CTL enterprises, so as to boost their product quality, lower their production costs and strengthening their competitiveness.

There have been many studies on ‘technological innovation’ since the concept come out in 1912. Scholars’ results are similar in these studies and most of them view it as a kind of ability which consists of some other capabilities. For example, Burgelman and M. A. Maidigue (1996) believe that technological innovation is an ability which covers technological development ability and strategic management ability. Xu and Li (2019) think that technological innovation consists of research ability, innovative decision-making ability, organizing ability, production ability and marketing ability. Fu (2000) thinks that technological innovation includes innovation management ability, R&D ability, resource investment ability, production ability and marketing ability.

Scholars at home and abroad have explored the relationship between technological innovation and corporate competitiveness to a certain extent. Shi (1995) maintains that technological innovation capabilities are the foundation for an enterprise to form its core competitiveness, and enhancement of the R&D intensity index in technological innovation capability can drive up corporate profits and thus boost corporate competitiveness. Prahalad and Gary (2000) believes that the innovation ability of enterprises can facilitate them to obtain a certain competitive position in the market. After a questionnaire survey on more than 200 manufacturing enterprises in Zhejiang, Ma et al. (2004) found a positive correlation between the technological innovation ability and the competitiveness of enterprises. In an empirical analysis on high-tech enterprises, Liang and Zhang (2005) observed a significant positive correlation between R&D investment and profitability from main operations. Jin and Cui (2008) found that innovation is the 6asis for enterprises to form their competitiveness. Jin (2011) believes that innovation capability is one of the core competitiveness of enterprises, so improving innovation capability is to enhance the corporate competitiveness. Xie and Gao (2013) found that original technological innovations are the strategic core to enhance the competitiveness of enterprises after studying 270 enterprises in China, including state-owned enterprises, private enterprises, and joint ventures. In a study on the relationship between technological innovation and corporate competitiveness, Zhan and Liu (2014) found that technological innovation behavior of enterprises plays an important role for the competitiveness of enterprises, and the process of technological innovation is just the process for them to continuously enhance their own competitiveness. Derek and Toshiyuki (2014) found that technological innovation can, at the right time, make a conscious response to the opportunities and threats faced by enterprises, so as to obtain or maintain their competitive advantage. Li and Liu (2017) identified technological innovation capability as the key for enterprises to hike their core competitiveness. In a regression analysis taking the high-end equipment manufacturing industry as a research object, Zhu et al. (2019) found that the impact of technological innovation capacity on the competitiveness of enterprises is significant and positive. By using hierarchical linear regression and structural equation model to analyze human resource service enterprises, Zhou et al. (2021) found that technological innovation delivers a significant positive impact on corporate competitiveness and shows a mediating effect among big data resource integration ability, predictive analysis ability and corporate competitiveness.

Coal-to-liquid is one of the most important manners to reduce carbon emission which of course contributes to the society moving forward to the carbon free status. At the demand side, buildings show the most significant potential in cost-effective emission reduction. Yan, Xiang et al. (2022) found that the operational carbon emissions released by residential buildings increased during 2000–2018, with an average rate of 4.53% per year in 30 samples. Xiang, Ma et al. (2022) found that the average carbon intensity of commercial building operations in 16 countries has maintained an annual decline of 1.94% throughout the period 2000–2019 and the total decarbonization of commercial building operations worldwide was 230.28 mega-tons of carbon dioxide per year, with a decarbonization efficiency of 10.05% in 2001–2019. Zhang, Ma et al. (2022) found that the historical annual carbon abatement intensity in China’s commercial building operations in 2001–2018 was 9.8 kg of carbon dioxide per square meter (kg CO2/m2) or 59.9 kg CO2/person, while the annual carbon abatement intensity in the US during the same time was 17.7 kg CO2/m2 or 353.7 kg CO2/person. All these research shows that Chinese carbon emissions needs to be taken seriously. In this situation, the improvement of coal-to-liquid companies’ competitiveness which could contribute to the reduce of carbon emission is worthy to be discussed.

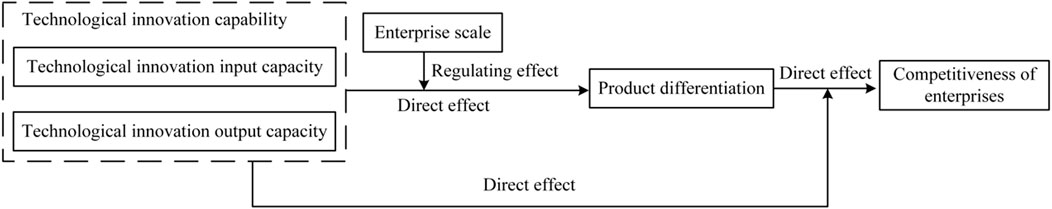

A review of the existing research shows that previous literature have analyzed the direct relationship between technological innovation and corporate competitiveness in such industries as manufacturing, high-tech, high-end equipment manufacturing, human resource services and others. However, knowledge gap still exists: there are few studies on the relationship between technological innovation capability and CTL enterprises’ competitiveness, and the regulating mechanism that affects the relationship between them is unclear. In addition, most of the existing research regards enterprises’ technological innovation and competitiveness as a directly acting process, seldom exploring the functions of mediating variables. In this situation, the essay aims to give solutions to these existed gaps. By exploring the listed CTL companies in China, this study will construct and verify the theoretical framework model of “Enterprises’ technological innovation capability–Enterprises’ scale/product differentiation -- Enterprises’ competitiveness,” with an attempt to explain the internal influence mechanism of technological innovation on the competitiveness of CTL enterprises. The main contributions of this study include: 1) It has enriched the research on the relationship between technological innovation and corporate competitiveness, and expanded the research field to the CTL industry, which is closely related to national energy security. So this study is conducive to the guarantee of national energy security. 2) The research models of the relationship between technological innovation capability and corporate competitiveness of CTL enterprises have been added enterprise scale and product differentiation as the regulating variable and mediating variable. And the effect of enterprises’ scale and product differentiation on the transformation efficiency between variables has been found and verified through the models. These break through the existing research’s limitations of ignoring processed and mechanisms.

In the following sections, the study will be divided into four parts. First, making a study design which including variables selection and measurement, theoretical analysis and research hypotheses. Second, making an empirical study with the samples of China’s listed CTL enterprises based on the design. Third, further discussing the limitations of the study. Fourth, making conclusions on the basis of the analysis and giving suggestions to improve the competitiveness of the enterprises.

2 Design of this study

2.1 Selection and measurement of variables

2.1.1 Explained variables

In this study, corporate competitiveness is regarded as the explained variable. For the measurement of corporate competitiveness, scholars such as Jin and Gong (2014) believe that the asset contribution rate reflects the profitability of enterprise assets and is also one of the core indicators to measure enterprises’ operating ability and profitability, so it can, to a large extent, describe the business performance and competitiveness level of enterprises. Therefore, this study will adopt the asset contribution rate of enterprises to measure their competitiveness.

Corporate competitiveness = (total profit + total tax + interest expense)/total average assets.

2.1.2 Explanatory variables

The explanatory variable in this study is the technological innovation ability of enterprises, which includes the technological innovation input capability and the technological innovation output capability (Kihoon and Byung, 2015). By studying the performance of technological innovation from these two perspectives, it is conducive to comprehensive analysis of the entire technological innovation process as well as the balance and coordination of related activities in a technological innovation strategy (Le, Lan and Jiang, 2008).

(1) Technological innovation input capability

Input in technological innovation includes “Knowledge” investment and “Capital” investment. This study adopts the ratio of the number of R&D personnel to the total number of employees to measure the “Knowledge” investment (Bi, Wang and Yang, 2014), and adopts the ratio of the R&D expenditure to the operating income to measure the “Capital” investment (Li, 2017).

(2) Technological innovation output capability

Currently, there is no unified measurement index for the technological innovation output capacity. Literature review shows that most researchers choose to use the number of patent applications to measure this capacity (Jiang and Kuang, 2015). Therefore, this study also adopts this number to measure the technological innovation output capability.

2.1.3 Regulating variables

Since the scales of enterprises can determine, to a certain extent, the resources that they can utilize and deploy in the innovation process (Gwanhoo, 2006), as well as the flow, integration and transformation of knowledge inside organizations, and furthermore their ability to solve innovation problems or seize business opportunities, this study will use enterprise scale as a regulating variable to examine its influence on the relationship between technological innovation capability and corporate competitiveness.

After the research of the existing relevant literature, this study selects the total number of employees of an enterprise to measure this variable. In order to meet the research needs, this study takes the logarithm of the total number of employees of an enterprise before data analysis, i.e., to take the natural logarithm of the number of employees to measure the regulating variable of enterprise scale (Su and Li, 2021).

2.1.4 Mediating variables

Product differentiation can help an enterprise’s products become distinct from other homogeneous products (Hoefele, 2016), gain preferences from consumers, and enhance the competitiveness of enterprises (Lin and Wu, 2007). Especially, in the context of increasingly diverse and personalized consumer demands (Munirul et al., 2017), product differentiation has widely become the main source of corporate competitiveness (Chen et al., 2015). Therefore, this study takes product differentiation as the mediating variable, while borrowing Xiao Zuoping’s (2004) method of measuring product differentiation, i.e., to use the ratio of sales expenses to operating income to measure the product differentiation.

2.2 Theoretical analysis and research hypotheses

2.2.1 Research on the relationship between the technological innovation input ability and the competitiveness of coal-to-liquids enterprises

Generally speaking, technological innovation input would improve the competitiveness of enterprises mainly in the following ways: first, to expand the market share of enterprises through technological innovation investment, which will lead to new products with higher quality and performance (Lei and Wang, 2014); second, to form new technologies through technological innovation investment, so as to reduce production costs or to copy and share products, thus creating scale effects to enhance the competitiveness of enterprises (Li et al., 2015); third, to form new technologies and equipment through technological innovation investment, so as to help enterprises relieve their dependence on human capital and diminish the negative impact of hiking labor costs on incorporate competitiveness (Zhu, 2017); fourth, investment in technological innovation can, as a signal, transmit to the market favorable news about an enterprise, thus attracting more investors and raise the competitive level of the enterprise (Ma, Gu and Lu, 2004). For CTL companies, input in technological innovation will help them manufacture cleaner and higher-purity oil products and achieve differentiated development against such competing products as petroleum. In addition, technological innovation can improve the production efficiency of CTL enterprises, reduce their production costs, and help them become more cost-effective in the competition against homogeneous products. Furthermore, input in technological innovation would help CTL companies improve their image. By boosting investment of technological innovation in a certain field, enterprises may solve technical problems that are difficult for other countries to tackle, thus enhancing images of the enterprises. Therefore, this study proposes the following hypotheses:

H1. The input in technological innovation has a significant positive impact on the competitiveness of CTL enterprises.

H1a. The proportion of the R&D personnel in the total number of employees of a CTL enterprise has a significant positive impact on its competitiveness.

H1b. The proportion of the R&D expenditure in the total assets of a CTL enterprise has a significant positive impact on its competitiveness.

2.2.2 Research on the relationship between the technological innovation output capability and the competitiveness of coal-to-liquids enterprises

There are few studies at home and abroad on the relationship between the technological innovation output capacity and the competitiveness of CTL enterprises, but most of the similar studies in other industries reveal a significant positive correlation between the two. For example, in the high-tech industry, the output of technological innovation by enterprises has a positive impact on the level of their competitiveness (Zhu and Yang, 2019). Similarly, in the telecommunications industry, financial industry, high-end equipment manufacturing industry, human resources service industry and other industries, the existing studies have proved the positive correlation between the two (Zhou, Chen and Li, 2021). For CTL enterprises, technologically innovative products can boost their performance in terms of energy- and water-saving, localization of critical equipment and materials, and safe, stable and clean operation of devices. These progresses will help them raise their market competitiveness and break through foreign technology monopoly, while playing a major supporting role in enhancing China’s independent energy security capability. Therefore, this study proposes the following hypotheses:

H2. The output of technological innovation has a significant positive impact on the competitiveness of CTL enterprises.

H2a. The number of patent applications of enterprises has a significant positive impact on the competitiveness of CTL enterprises.

2.2.3 The regulating role of enterprise scale

The scale of an enterprise is firstly reflected in the number of its employees. Generally, the larger the enterprise scale, the more conducive to attracting and retaining high-level scientific and technological talents, and the more favorable for the reserve of human capital required for enterprises’ innovation (Shi, 1995). At the meantime time, the strong resource advantages and market monopoly positions of large enterprises are also conducive to their massive technological innovation activities (Joseph, 1912). For example, only those large-size and powerful enterprises may afford the device-advanced laboratories, massive technicians and experimental assistants and other conditions necessary for technological innovation (Liang and Zhang, 2005). Moreover, according to the viewpoints of knowledge base structures and industrial organization theories, the larger the scale of an enterprise, the wider and deeper the knowledge base it owns on which the technological innovation depends (Ge, 2009), and the weaker the market competition it faces (Yu and Chen, 2022). Most of the China’s modern CTL enterprises are large-scale enterprises, which own relatively rich human capital, funds and knowledge bases, so they can better apply technological innovation in products’ development, design and manufacturing, thus transforming these factors into productivity and corporate competitiveness. Meanwhile, large enterprises have better ability to bear the risks of market competition than small ones, as well as higher tolerance for such risks as technological innovation failures and low up-front return of investment. This condition will also boost modern CTL enterprises’ drive for technological innovation.

Accordingly, this study proposes the following hypotheses:

H3. Enterprise scale plays a positive regulating role between the technological innovation capability and the competitiveness of CTL enterprises.

H3a. Enterprise scale plays a positive regulating role between the technological innovation investment capacity and the competitiveness of CTL enterprises.

H3b. Enterprise scale plays a positive regulating role between the output of technological innovation capability and the competitiveness of CTL enterprises.

2.2.4 The mediating role of product differentiation

Innovation-driven differentiation is a necessary condition for maintaining competitiveness (Elife, 2015). Enterprises can combat competitors by offering unique products that are distinct from competitors and seeking differentiation (Wen and Ye, 2014). Specifically, CTL enterprises can shape differentiation through product innovation, or through technological innovation, or through high-quality services. All kinds of such differentiation can help enhance the competition of enterprises, and they are all inseparable from the support of technological innovation capabilities (Dorothy, 2011). In summary, through technological innovation, enterprises can give their products some features distinct from competitors, gain differentiated advantages, and meet the consumption preferences of different consumers, thereby raising their competitiveness. During the “14th Five-Year Plan” period, product differentiation is the key direction of technological innovation for China’s modern CTL enterprises. Through technological innovation, the field of coal-to-ethylene glycol will be expanded to the production of glycolic acid, polycarbon materials and other products from coal through dimethyl oxalate and dimethyl carbonate, so as to deliver differentiation from petroleum products, reduce direct competition in the market, and meet the demands of different consumers, thereby lifting the competitiveness of CTL enterprises.

Accordingly, this study proposes the following hypotheses:

H4. Product differentiation plays a mediating role between the technological innovation capability and the competitiveness of CTL enterprises.

H4a. Product differentiation plays a mediating role between the technological innovation input capacity and the competitiveness of CTL enterprises.

H4b. Product differentiation plays a mediating role between the technological innovation output capacity and the competitiveness of CTL enterprises.To sum up, this study has a research framework as shown in Figure 1.

3 Empirical analysis

3.1 Sample selection and data sources

This study selects China’s listed CTL enterprises as samples. By May 2022, there were 4 listed CTL enterprises, the last of which was listed in 2016. This study takes these four enterprises as the research object. Considering the uniform of data, the research period is set to 2016–2021. Taking into account the current situation and limitations of the existing literature on the measurement of technological innovation made by CTL enterprises, and based on the research goals, this study chooses to use the second-hand data method to verify the hypotheses. In order to ensure the data integrity and credibility of the empirical analysis, the enterprises with missing data will be excluded. The financial data for the research variables come mainly from the Wind database, the patent data are mainly from the China Intellectual Property Right Net, and the data related to technological innovation input capacity and enterprise scale are mainly from the annual reports of the listed enterprises.

3.2 Research methodology

This study verifies the proposed hypotheses by using the hierarchical regression analysis function in the mathematical statistics software Stata. Based on the hypotheses put forward from CTL enterprises’ technological innovation capability to the scale of enterprises and then to the competitiveness of enterprises, this study takes the competitiveness of CTL enterprises as the dependent variable, takes the technological innovation input capacity and the technological innovation output capacity as independent variables, takes the enterprise size as the regulating variable, and takes product differentiation as the mediating variable.

3.3 Construction of the regression model

First, the relationship between the technological innovation input capability and incorporate competitiveness. Based on hypotheses H1 and H1a and H1b, Models 1 and 2 are constructed as follow

where EC is the competitiveness of enterprises, TI is the technological innovation input capacity of enterprises, RDPI is the R&D personnel input capacity of enterprises, RDEI is the R&D expenditure input capacity of enterprises, ε is the random disturbance term, i is an individual of the samples, and t is a year.

Second, the relationship between the technological innovation output capability and competitiveness of enterprises is tested. Based on hypotheses H2 and H2a and H2b, Models 3 and 4 are constructed as follows:

where EC is the competitiveness of enterprises, TO is the technological innovation output capacity of enterprises, PAV is the number of patent applications, ε is the random disturbance term, i is an individual of the samples, and t is the year.

Third, in order to test the regulating role of enterprise scale in the relationship between enterprises’ technological innovation capability and competitiveness, based on hypotheses H3 and H3a and H3b, Models 5 and 6 are constructed as follows:

where SCA is the scale of an enterprise, and TI*SCA and TO*SCA are the regulating effects of the scale of an enterprise on the relationships between the technological innovation input capability and the competitiveness and between the technological innovation output capability and the competitiveness of the enterprise, respectively.

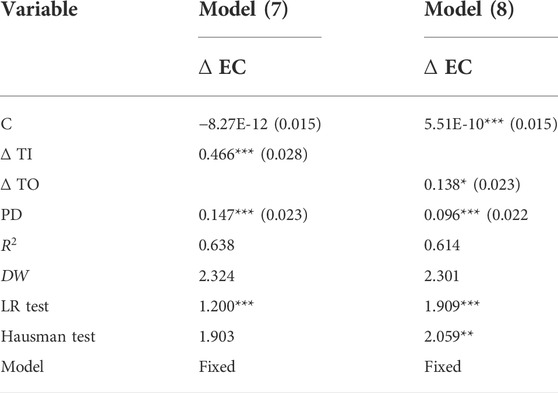

Finally, in order to test the mediating role of product differentiation in the relationship between an enterprise’s technological innovation capability and competitiveness, based on hypotheses H4 and H4a and H4b, Models 7 and 8 are constructed as follows:

where EC is the competitiveness of an enterprise, TO is the technological innovation output capacity of an enterprise, TI is the technological innovation input capacity of an enterprise, PD is the product differentiation, ε is the random disturbance term, i is an individual of the samples, and t is the year.

3.4 Descriptive statistics

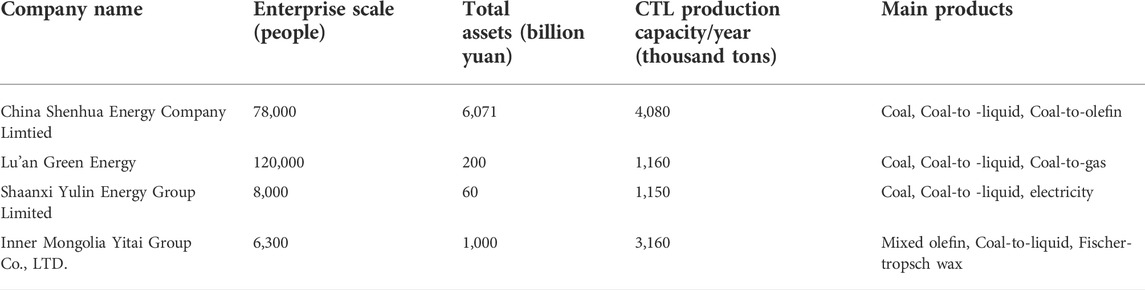

There four China’s listed CTL enterprises at present: China Shenhua Energy Company Limtied, Lu’an Green Energy, Shaanxi Yulin Energy Group Limited and Inner Mongolia Yitai Group Co., LTD. Table 1 shows their basic information at present.

Data source: Official website of each company.

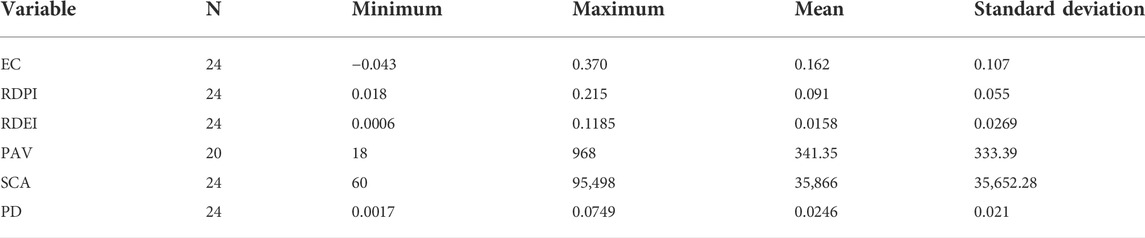

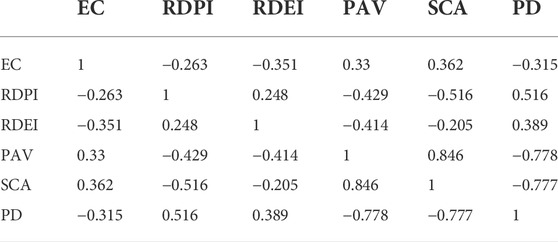

Table 2, 3 show the descriptive statistics of each variable as well as the correlation coefficients between variables. According to Table 2, data characteristics of minimum, maximum, mean and standard can be seen which helps to know the features of study objects. In Table 3, if the correlation coefficient between two variables is greater than 0.75, there may be a collinearity problem between the two variables. As observed in the research results, the correlation coefficients between variables SCA and PAV, between PD and PAV, and between PD and SCA are greater than 0.75. In order to actually test whether multicollinearity exists between these variables, we calculate the VIF value between each two variables. Generally speaking, a VIF value higher than 10 indicates the existence of collinearity. Calculation finds that the VIF values between variables SCA and PAV, between PD and PAV, and between PD and SCA are 1, 2.5 and 2.498, respectively, indicating that there is no multicollinearity between them.

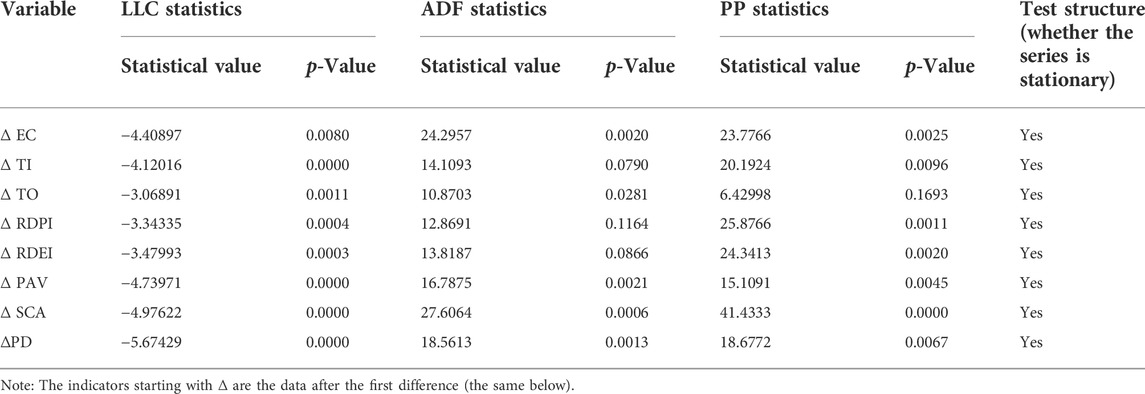

3.5 Unit root test for panel data

In order to avoid the spurious regression phenomenon in the regression results, before the regression analysis, this study firstly performs the unit root test on the collected panel data. If the result of a test exist an unit root, then the time series is not stationary and will cause a spurious regression. At present, a variety of methods can be adopted to make the unit root test, but each method has its own imperfections, and the final results may show quite big differences. Therefore, in order to improve the robustness of the unit root, this study adopts all the following three test methods for test, with the results shown in Table 4. As show in the research results, in the zero-order difference, all the variables reject the hypothesis of “existence of a unit root” (all the variables have passed the 1% significance test). Therefore, all zero-order differences are stationary, and each variable is zero-order integration which means there will not be a spurious regression and the variables are acceptable to have a regression analysis.

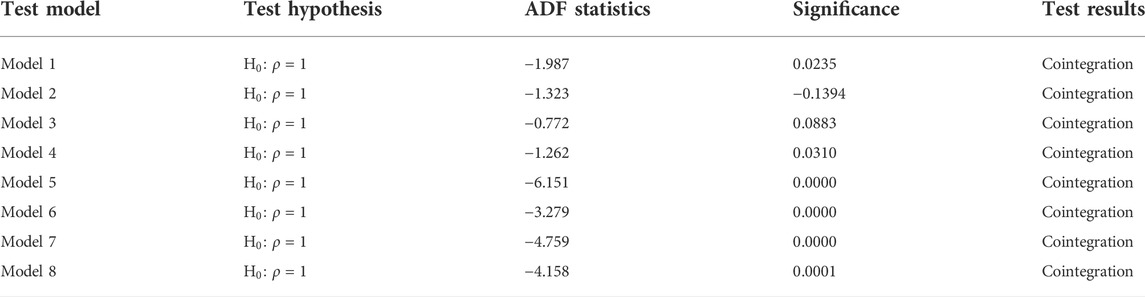

3.6 Co-integration test for panel data

As seen from the foregoing description, each variable is zero-order integration. Besides this premise, it is still necessary to check whether the relationship between the variables is in long-term equilibrium. Therefore, next, the cointegration test is used to test the cointegration between the variables. This study uses the KAO test method for the cointegration test of the model. The final results are shown in Table 5. As shown in the results, all the test statistics reject the null hypothesis (since all of the significance are below 0.1, which means there is 90% to reject). So, there is a long-term equilibrium relationship between the independent variables and dependent ones of the eight models in this study.

3.7 Regression analysis

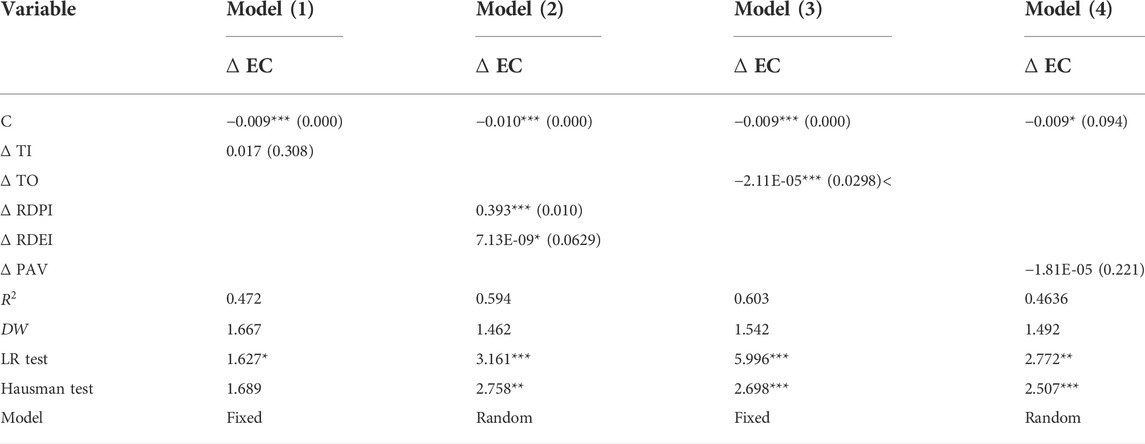

Table 6 shows the test results of the relationship between the technological innovation capacity and competitiveness of enterprises. As seen in Model (2), both the proportion of R&D personnel in the total number of employees and the proportion of R&D expenditures in the total assets of CTL enterprises are significantly positively correlated with their competitiveness (since both of them have asterisks on the top right corner and the correlation coefficients of them are positive). Therefore, Hypotheses H1a, H1b and H1 are supported. As seen in Model (4), there is no close correlation between the number of enterprises’ patent applications and their competitiveness (there is no asterisk shown), so Hypothesis H2a is not supported. The possible reason is that many enterprises do not pay enough attention to patents and is unable to make effective commercial development and protection of them, resulting in the insignificant effect of the technological innovation output capacity from patent applications on the competitiveness of enterprises.

Table 7 shows the test results of the model for the regulating effect of enterprise size. As seen in Model (5), the coefficient of the interaction term (ΔTI*ΔSCA) between technological innovation input capacity and enterprise scale is positive, indicating that enterprise scale has a positive regulating effect for the influence of technological innovation input capacity on enterprise competitiveness. However, the regression coefficient of the interaction term between technological innovation input capability and enterprise scale is not significant (there is no asterisk shown), so it can be found that HypothesisH3a is not supported. The possible reason is that some large enterprises have already secured sufficient profits from their existing business models and products. These established benefits drive them to maintain the status quo, so they have no strong willingness to invest in technological innovation, resulting in not obvious impact of enterprise scale on the technological innovation input capacity. It can be seen from Model (6) that the coefficient of the interaction term (ΔTO*ΔSCA) between the technological innovation output capacity and enterprise scale is positive, so Hypothesis H3b is supported. Models (5) and (6) indicate that enterprise size has some positive regulating effect on the impact of technological innovation on enterprises’ competitiveness.

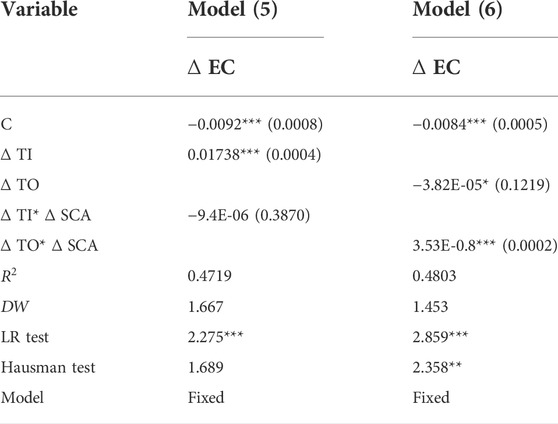

Table 8 shows the test results for the mediating effect of product differentiation. It can be seen from Model (7) that all the coefficients of product differentiation are positive, indicating that product differentiation is significantly positively correlated with corporate competitiveness. And the technological innovation input capacity has a significant positive correlation with corporate competitiveness, indicating that product differentiation plays a mediating role in the relationship between technological innovation input capacity and competitiveness of enterprises. Therefore, Hypothesis H4a is supported. Similarly, it can be found from Model (8) that Hypothesis H4b is supported. This conclusion demonstrates that by improving their technological innovation capabilities, enterprises can get differentiated advantages and thereby enhance their competitiveness.

4 Further discussion

This study explores the correlation between the technological innovation capacity and the competitiveness of CTL enterprises, as well as the regulating effect of enterprise scales. It broadens the technological innovation theory and corporate competitiveness theory by combing them with CTL companies and national energy security. Also, the study contributes to enhance the competitiveness of CTL companies by showing a way of improving its technological innovation capability. Unfortunately, the results are different form many other researches in the relationship between technological innovation output capability and corporate competitiveness. This might due to the special of CTL companies. In China, most of the listed CTL companies are owed by the state which means they are not in a completely market competition situation and their existence are not closely related with their technological innovation output and the benefits brought the outputs. This might have a negative impact on their patent application initiative and thus weaken the relationship between the number of patent applications and its competitiveness. Apart from the discuss above, this study still has many points that deserve further exploration, due to limitations of the author in terms of knowledge reserves, abilities and conditions.

First, the selection of regulating and mediating variables. This study is conducted only with enterprise sizes as the regulating variable and with product differentiation as the mediating variable. However, the competitiveness of enterprises may also be affected by other important regulating variables. The analysis of the regulating effect of enterprise scales shows that this effect is not significant in the relationship between enterprises’ technological innovation input capacity and competitiveness. This issue is worthy of further exploration.

Second, the selection of measurement indicators. This study explores the relationship between the technological innovation capability and the competitiveness of CTL enterprises in terms of input and output. However, there is little research on the measurement of technological innovation capability of CTL enterprises, and no unified views have been reached in this regard by scholars at home and abroad. As a result, the relevant measurement indicators have certain limitations. Further verification and adjustment are needed by virtue of a more scientific and comprehensive evaluation system for the technological innovation capability of CTL enterprises, so as to minimize the deviation between the measurement results and the reality as much as possible in the future.

Third, the selection of explained variables. This study selects corporate competitiveness as explained variable rather than other measures of corporate performance such as ROE, EVA and so on. This is because companies are part of market economy and their competitiveness is the determinant of existence in the market. Besides, corporate competitiveness is one of the elements of industrial and national competitiveness. Therefore, choosing corporate competitiveness as explained variable is meaningful and essential to improve the competitiveness of CTL industry and the state.

5 Conclusion and suggestions

In order to ensure energy security, one of the key concerns of China currently is to break through the development bottleneck of CTL enterprises and improve their competitiveness. This study explores the influence mechanism of CTL enterprises’ technological innovation capacity on their competitiveness from both theoretical and empirical perspectives. It is found that: 1) The impact of technological innovation output capacity on CTL enterprises’ competitiveness is not obvious, while technological innovation input capacity has a significant positive impact on their competitiveness. Specifically, more investment in R&D expenses and personnel of enterprises is conducive to hiking their competitiveness. 2) CTL enterprises can give full play to the mediating effect of product differentiation between technological innovation capabilities and corporate competitiveness, so as to enhance corporate competitiveness through technological innovation and differentiated products. These have certain enlightenment for driving enterprises to scientifically formulate technological innovation strategies, rationally allocate innovation resources and enhance their competitiveness.

(1) To reasonably hike the commitment intensity of R&D expenses of enterprises. As show in the research results, with continuous increase of R&D expenditure, the technological innovation capability of enterprises can be promoted. Therefore, CTL enterprises must correctly recognize this fact: By strengthening the investment in R&D expenses, the profitability and competitiveness of enterprise can be really improved, and this will play an important and positive role in the survival and development of enterprises. Therefore, enterprises can reasonably enhance the investment intensity of R&D expenses based on their own actual conditions. However, enterprises shall also understand that the input of R&D expenditure are not completely proportional to their competitiveness. Thus, enterprises shall perform according to their abilities, so as to continue to increase investment in R&D expenses and boost their competitiveness on the premise of maintaining a reasonable capital structure and sufficient cash flow.

(2) To encourage the cultivation and introduction of high-end R&D talents. According to the results of this study, the input of R&D personnel has a positive impact on the competitiveness of enterprises. Based on this finding, it is recommended to strengthen the training of professional CTL R&D talents. It is necessary to support institutions of higher learning and secondary vocational schools to launch the disciplines and majors urgently needed by CTL industry and attract students through government funding, employment policy guarantees, preferential admissions policies and other measures. This is beneficial for accelerating the training of CTL talents required by the market, so as to keeping up with the development pace of the CTL industry. In is necessary to accelerate the formulation of incentive policies for CTL talents to work in remote areas and realize the scientific and sustainable training and employment of CTL talents. A professional training mechanism shall be built with joint participation by enterprises, individuals and professional colleges, while establishing and improving the training, selection and incentive mechanism for CTL professionals.

(3) To strengthen technological innovation and enhance product differentiation. As found in this study, product differentiation plays a positive mediating role between the technological innovation capability and competitiveness of CTL enterprises. In other words, technological innovation capability can, through product differentiation, deliver an impact on the competitiveness of CTL enterprises. Therefore, in the process of technological innovation, CTL enterprises can enhance their competitiveness by enhancing product differentiation. Specifically, they can manufacture the oil products that are scarce in the market through technological innovation, so as to circumvent direct competition against other similar enterprises. Meanwhile, in the competition against equivalent products such as petroleum, CTL enterprises can take a strategy of making complementary products with petrochemical ones and extend their own industrial chains, so as to raise their economic efficiency and competitiveness.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author contributions

MS: conceptualization; writing the original manuscript; ZW: critical review of the manuscript; WW: formal analysis. All authors contributed to the article and approved the submitted version.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Bi, K. X., Wang, Y. H., and Yang, C. J. (2014). The impact of innovation resource input on the green innovation system and capability: An empirical research from the perspective of FDI inflow in the manufacturing industry. China Soft Sci. 3, 153–166.

Burgelman, R. A., and Maidigue, M. A. (1996). Strategic management of technology and innovation. McGraw-Hill Education.Chennai

Chen, Y. T., and Zhang, X. T. (2015). Research on the influence of internationalization and product differentiation on enterprises’ performance -- Based on the evidence from manufacturing firms listed in China. Int. Bus. J. Univ. Int. Bus. Econ. 4, 134–142.

Derek, W., and Toshiyuki, S. (2014). Radial and non-radial approaches for environmental assesment by Data Envelopment Analysis: Corporate sustainability and efective investment for technology innovation. Energy Econ. 14, 537–551.

Dorothy, L. (2011). Core capabilities and core rigidities: A paradox in managing new product development. Strategic Manag. J. 236, 11–27.

Elife, A. (2015). Innovation and competitive power. Procedia-Social and Behavioral Sciences,1 1311–1320.

Fu, J. J., Quan, Y. H., and Gao, J. (2000). Tecnological innovation. Tsinghua University Press.Beijing, China

Ge, H. Y. (2009). Research on synergy between technological innovation subjects based on enterprise competitiveness. Prod. Res. 11, 156–157.

Gwanhoo, L., and Weidong, X. (2006). Organizational size and it innovation adoption: A meta-analysis. Inf. Manag. 43 (8), 975–985.

Hoefele, A. (2016). Endogenous product diferentiation and international R&D policy. Int. Rev. Econ. Finance 41 (1), 335–346.

Jiang, B. B., and Kuang, H. B. (2015). Evaluation of enterprise innovation performance based on "Efficiency-Output": Literature review and conceptual framework. Sci. Res. Manag. 36 (3), 71–78.

Jin, B., and Gong, J. J. (2014). Economic trend and policy regulation as well as their impact on enterprises’ competitiveness -- an empirical analysis based on China's industry panel data. China Ind. Econ. 3, 5–17.

Jin, F. Z., and Cui, S. H. (2008). An empirical analysis of the impact of R&D investment on enterprises’ competitiveness. Statistics Decis. 23, 95–96.

Jin, X. (2011). Theoretical and empirical research on enterprise scale and R&D investment structure -- from the perspective of enterprise knowledge and product market. Stud. Sci. Sci. 29 (07), 1064–1070.

Joseph, S. (2017). Theory of economic development. Transaction PublishersLixin Accounting Press. Translated by Wang Yongsheng.231 China

Kihoon, L., and Byung, M. (2015). Green R&D for eco-innovation and its impact on carbon emisions and firm performance. J. Clean. Prod. 12, 534–542.

Le, Q., Lan, H. L., and Jiang, L. (2008). Technological innovation strategy and enterprise competitiveness -- A comparative analysis of local enterprises and foreign-funded ones in China's high-tech industry. Sci. Sci. Manag. S. Trans. 10, 47–52.

Lei, L., and Wang, X. (2014). Research on the relationship between technological innovation and competitiveness of technology-based enterprises. Acad. Forum 37 (8), 8593–8688.

Li, W. H. (2017). The spatiotemporal evolution and influencing factors of innovation output of China's provincial industrial green technology: An empirical study based on data from 30 provinces. J. Industrial Eng. Eng. Manag. 31 (2), 9–19.

Li, W. Q., and Liu, Y. (2017). Technological innovation, corporate social responsibility and corporate competitiveness -- an empirical analysis based on listed companies’ data. Sci. Sci. Manag. S. Trans. 38 (1), 154–165.

Li, Z. B., Wang, H. R., Wei, J. P., and Zheng, H. B. (2015). Research on the relationship between enterprises’ technology learning and competitiveness -- Taking Binhai New District as an example. Sci. Technol. Manag. Res. 35 (15), 8191–8286.

Liang, L. X., and Zhang, H. F. (2005). An empirical research on R&D investment performance of listed high-tech enterprises. J. Central South Univ. 4, 232–236.

Lin, L., and Wu, G. S. (2007). An empirical research on the differentiation mechanism for service enhancement of manufacturing enterprises in China. Manag. World 6, 103–113.

Ma, S. S., Gu, W., and Lu, Q. Y. (2004). An empirical research on the relationship between technological innovation capability and competitiveness of manufacturing enterprises in Zhejiang Province. Prod. Res. 8, 97156–97198.

Munirul, H., Viser, R., and Pasquale, M. (2017). Product diferentiation, research & development and IPR enforcement. Int. Rev. Econ. Finance 1, 427–435.

Prahalad, C., and Gary, H. (2000). The core competence of the corporation. Strategic Learn. A Knowl. Econ., 3–22.

Shi, P. G. (1995). Enterprise scale and technological innovation. Science of Science and Management of S. & T., Beijing 41–42.

Su, Y., and Li, G. P. (2021). Green technology innovation capability, product differentiation and corporate competitiveness. Chin. J. Manag. Sci. 4, 46–56.

Wen, Z. L., and Ye, B. J. (2014). Analysis of mediating effect: Development of methodology and models. Adv. Psychol. Sci. 22 (5), 731–745.

Xiang, X. W., Ma, M. D., Ma, X., Chen, Y. M., Cai, W. G., Feng, W., et al. (2022). Historical decarbonization of global commercial building operations in the 21st century. Appl. Energy 322, 1–15.

Xiao, Z. P. (2004). Influencing factors of capital structure and a dynamic model of two-way effect -- Evidence from panel data of Chinese listed firms. Account. Res. 2, 36–41.

Xie, Y., and Gao, S. X. (2013). The emergence and results of original technological innovation: A study on the relationship between entrepreneurial orientation, original technological innovation and corporate competitiveness. Sci. Sci. Manag. S. Trans. 34 (5), 116–125.

Xu, Q. R., and Li, Y. (2019). How does total innovation drive organizational platform transformation? --A case study on three major platforms of the haier Group. J. Zhejiang Univ. Humanit. Soc. Sci. 49 (6), 78–91.

Yan, R., Xiang, X. W., Cai, W. G., and Ma, M. D. (2022). Decarbonizing residential buildings in the developing world: Historical cases from China. Sci. Total Environ. 847, 1–12.

Yu, B., and Chen, C. P. (2022). Manufacturing servitization, environmental regulation and enterprise competitiveness. Statistics Decis. 38 (10), 170–174.

Zhan, S. G., and Liu, J. Z. (2014). Research on human resource management system based on knowledge management. J. Southeast Univ. (Philosophy Soc. Sci. 16 (S1), 38–41.

Zhang, S. F., Ma, M. D., Xiang, X. W., Cai, W. G., Feng, W., and Ma, Z. L. (2022). Potential to decarbonize the commercial building operation of the top two emitters by 2060. Resour. conservation Recycl. 185, 1–12.

Zhou, X. G., Chen, S. L., and Li, L. Q. (2021). Research on the relationship between big data capability, technological innovation and competitiveness of human resource service enterprises. Bus. Rev. 33 (07), 81–91.

Zhu, L. T., and Yang, R. (2019). R&D input, technological innovation output and international competitiveness of enterprises -- an empirical research based on China's high-tech enterprises. J. Yunnan Finance Trade Inst. 3, 105–112.

Keywords: technological innovation capability, enterprise scale, product differentiation, corporate competitiveness, CTL enterprises

Citation: Song M, Wang Z and Wang W (2022) An empirical study on technological innovation and corporate competitiveness of listed coal-to-liquids companies in China. Front. Environ. Sci. 10:1043094. doi: 10.3389/fenvs.2022.1043094

Received: 13 September 2022; Accepted: 31 October 2022;

Published: 14 November 2022.

Edited by:

Kazi Sohag, Ural Federal University, RussiaReviewed by:

Kangyin Dong, University of International Business and Economics, ChinaHamed Fazlollahtabar, Damghan University, Iran

Copyright © 2022 Song, Wang and Wang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Zhenqin Wang, d2FuZ3pxQG1hbmFnZS51c3RiLmVkdS5jbg==

Meihui Song

Meihui Song Zhenqin Wang

Zhenqin Wang Weicai Wang

Weicai Wang