- School of Finance, Zhongnan University of Economics and Law, Wuhan, China

Green merger and acquisition (Green M&A) is one of the ways of corporate environmental investment, which is vital for their green transformation and sustainable development. With the implementation of the newly revised Environmental Protection Law in 2015, this paper investigates the impact of environmental regulation on corporate green M&A using the Difference-in-Difference method with a sample of Chinese listed companies from 2007 to 2020. We found that firms’ green M&A increases significantly after the implementation of the new Environmental Protection Law. The promotion effect is more pronounced when the firm is state-owned or faces lower financing constraints. Further analysis reveals that green M&A significantly reduces firms’ environmental management costs, enhances green innovation, and has no effect on market performance. This result confirms that after the implementation of the new Environmental Protection Law, companies engage in green M&A for cost and innovation motives rather than market motives.

1 Introduction

The rapid development of urbanization and industrialization in China has led to the overexploitation of natural resources and severe pollution of the ecological environment. Environmental protection has become a vital issue limiting economic development (Zhu et al., 2019). As the central part of the low-carbon development economic system, enterprises are the micro-units of environmental governance. However, due to the externality of environmental protection, the private costs generated by the environmental behavior of enterprises are often greater than the private benefits, resulting in the low willingness of enterprises to participate in environmental behavior. Therefore, it is particularly important to impose external constraints and incentives to promote corporate environmental governance (Costantini and Crespi, 2008; Bi et al., 2014).

In 1989, China enacted its first Environmental Protection Law (EPL). The law was comprehensively revised in 2014 and formally implemented in 2015. Compared to the old law, the new EPL is more stringent and flexible. It takes more severe penalties, and when it comes to projects that are not regulated by the state, the law allows different regions to consider their own natural environmental conditions, develop local environmental quality standards, and take incentive measures for enterprises with outstanding results in pollution control, thus being called the toughest EPL. As an important object of regulation, the change in the behavior of enterprises is the key to measuring the effectiveness of environmental legislation.

The assessment of the effects of environmental regulation has long attracted extensive scholarly attention. There are multiple ways in which environmental regulation affects firm behavior, including driving firms to invest in technological innovation to reduce compliance costs (Porter hypothesis, Porter and van der Linde, 1995; Zhang et al., 2017; Peng et al., 2021), or inducing firms to trade-off the benefits between factor endowments and regulatory costs, ultimately resulting in different environmental governance behaviors (Factor endowment hypothesis, Copeland and Taylor, 2004; Pollution heaven hypothesis, Copeland and Taylor, 1994; Muhammad et al., 2020). In addition, many scholars have conducted studies on the impact of environmental regulation in terms of investment decisions (Leiter et al., 2011; Zhang and Wang, 2021), firm location (Wu et al., 2017; Chen et al., 2018), pollution emissions (Shapiro and Walke, 2018; Du and Li, 2020), production factor arrangements (Liu et al., 2017), and product import and export (Shi and Xu, 2018; Brandi et al., 2020).

As an important way for companies to participate in environmental governance, green M&A has received little attention. Green M&A has a significant speed advantage compared to normal environmental investments. Through green M&A, companies can quickly enter an industry, obtain green resources or energy-saving and emission reduction technologies of the target companies (Salvi et al., 2018), simultaneously conveying their determination of environmental protection and green transformation to the market. Therefore, it is reasonable for companies to choose green M&A as a way to meet policy requirements and support their long-term growth in the face of environmental regulation. For example, in order to adjust the power supply structure of traditional thermal power generation, Jidian, a Chinese listed company, has achieved new energy transformation by acquiring a number of wind and photovoltaic power enterprises in the past decade, which has improved the company’s profitability and risk resistance. Another listed company, Meijin Energy, mainly engaged in the production and operation of coke products, is involved in hydrogen fuel cell and hydrogen energy automobile industry by acquisition, gradually promoting the layout of the whole industrial chain of clean energy.

The new EPL has made sufficient improvements in both penalty measures and reward-punishment mechanism, providing an ideal quasi-natural experiment for us to study the relationship between environmental regulation and corporate green M&A. With the help of this exogenous event, we build a difference-in-difference model to study the impact of environmental regulation on corporate green M&A. The results show that there is a significant increase in corporate green M&A after the implementation of the new EPL. In further analysis, we examine the motivations of firms to implement green M&A and find that green M&A reduces environmental costs and enhances green innovation, but does not improve market performance that traditional M&A has. Therefore, we believe that to deal with the cost and green transformation pressure brought by the new EPL, firms are more likely to implement green M&A for cost and innovation motives.

The contributions of this paper are as follows: First, this paper studies the impact of environmental regulation on corporate environmental behavior from an M&A perspective, which enriches the literature related to corporate environmental behavior. Second, we study the impact of environmental regulation on corporate environmental investment with the help of exogenous events. Previous studies have used pollution costs or environmental expenditures (Shadbegian and Gray, 2005; Levinson and Taylor, 2008), etc., as proxy variables for environmental regulation. This paper conducts research based on the new Environment Protection Law as an exogenous shock that reduces the potential endogeneity problem. Third, based on the existing environmental economics and corporate M&A theories, we analyze the motivation of firms to engage in green M&A under environmental regulation and test them empirically, enriching the relevant theoretical and empirical studies and helping to understand how environmental regulation works.

2 Theoretical analysis and research hypothesis

2.1 Motivation for corporate environmental behavior

Corporate motives for green M&A are mainly divided into internal and external aspects. The internal motivation comes from the consciousness of taking social responsibility and the strategic consideration of sustainable development. Corporate citizenship theory assumes that companies are part of society and, like individual citizens, have both the rights and responsibilities (Valor, 2005). In addition, proper management of the relationship between the natural environment and corporate development which consistent with the concept of sustainable development, making companies more resilient in risk management and sustainable operation (Freeman and McVea, 2005; Husted and Allen, 2007; Abbas, 2020).

External incentives generated by environmental regulatory interventions are the most important external motivation. In 1920, Pigou conducted a pioneering study on the problem of externalities and pointed out that the primary contributor to environmental problems lies in their external effects (Pigou, 2002). Pollution emission allow companies to make short-term gains, but the resulting damages, such as climate change and environmental pollution, which last for tens or even hundreds of years, are borne by society. Such negative externalities distort the cost-benefit equation of corporate environmental behavior and give companies particularly little incentive to participate in addressing environmental issues, thus the role of market mechanisms is limited. To address the negative externalities of corporate pollution, policy authorities often develop environmental policies to compensate for the absence of market mechanisms (Féres and Reynaud, 2012).

2.2 Environmental regulation and corporate environmental behavior

Environmental regulation is based on public power and makes firms actively or passively bear the environmental costs generated by their product behavior. On the one hand, formal environmental regulation sets the bottom line for enterprises’ environmental behavior and impose penalties for violations of relevant laws and regulations, which increases the direct cost of enterprises’ production and operation (Gray and Shimshack, 2011; Ryan, 2012; Blundell et al., 2020). On the other hand, as China’s environmental policy system becomes more standardized and systematic, public awareness of environmental protection has increased, environmental factors are incorporated into investment decisions by investors (Edmans, 2011; Chordia et al., 2014; Matallín-Sáez et al., 2019), and environmental performance have become an important criterion for government evaluation (Heberer and Senz, 2011). In addition, the multifaceted monitoring from the public, media, and investors constitutes informal environmental regulation (Féres and Reynaud, 2012; Chen et al., 2022), which plays an implicit role in complementing formal environmental regulation by influencing key elements related to the firms’ development, such as the sale of products and services, the pricing of assets, and the cost of financing.

The constraints and incentives of environmental regulation ultimately translate into different environmental behaviors of firms. Zheng et al. (2020) analyzed the factors that affect the level of corporate environmental information disclosure and concluded that strict environmental regulation plays a vital role in improving the quality of corporate environmental information disclosure. Wang et al. (2020) and Rubashkina et al. (2015) get similar conclusions, which provides a realistic basis for the Porter hypothesis. Shapiro and Walker (2018) found that despite a significant increase in U.S. manufacturing output, air pollution emissions from manufacturing fell by 60%. Changes in environmental regulations drove these reductions. In summary, the existing literature on the microeconomic consequences of environmental regulation is less concerned with firms’ green M&A behavior, and even less research has been conducted from the perspective of the new EPL implementation. Additionally, the majority of studies focus on environmental regulations and directly explore their possible impacts, but there is not much research based on the motivational level.

2.3 Environmental regulation and corporate green M&A

Based on the previous introduction of the new EPL and the motives of corporate green M&A. This paper argues that the main reason why the new EPL promotes corporate green M&A is because green M&A can bring three development benefits.

First, through green M&A, enterprise can reduce their pollution costs. Under strict environmental regulations, compliance costs are subsequently increased (Suchman, 1995). Companies that fail to assume legal responsibility for pollution control will be subject to severe penalties. Green M&A can help enterprise achieve green transformation or industry chain reconstruction, which reduces pollution control costs. On the one hand, enterprises can extend the industrial chain through green M&A. For example, thermal power companies can incorporate low-sulfur coal producers into the group through green M&A, which not only obtains clean raw materials, but also reduces the dependence of business development on the upstream of the industry chain. On the other hand, green M&A can help companies transform to cleaner production. By incorporating the M&A target into the business, enterprises can make the environmental protection business a new track for enterprise development, enjoy the preferential policies of the state for environmental protection industry, seize the opportunity of green industry development and realize business diversification.

Second, green M&A has an “eye-catching effect” and can help companies gain market attention. As an important part of the environmental policy system, the new EPL is significant in improving the environmental policy system. Mullainathan and Shleifer (2005) show that companies might express their interest by making M&A announcements. Green M&A can convey the company’s environmental intentions, demonstrate its commitment to environmental protection and green transformation, and create a good image of actively taking social responsibility and protecting the environment. This positive signal will be effectively reflected in the market performance of the stock.

Third, green M&A can help enterprises enhance their green innovation capability. The ultimate goal of environmental regulation is to promote the green development of enterprises, and the core of green development lies in green innovation. Through green M&A, enterprises can quickly acquire the technology needed for energy saving and emission reduction through the target firms. Compared with traditional R&D investment, direct merger and acquisition of enterprises with environmental technology can save the R&D investment of the acquirer, avoid R&D risks, improve operational efficiency, and help enterprises to quickly occupy a favorable position in the process of industry transformation (Porter and Van der Linde, 1995; Li et al., 2020). In conclusion, enterprises have a motivation to pursue green M&A in light of the new EPL.

Hypothesis 1:. The implementation of the new EPL promotes the enterprises green M&A.

Hypothesis 2:. Under environmental regulation, companies engage in green M&A through cost, market, and innovation motives.

3 Methodology

3.1 Sample and data collection

This paper uses Chinese A-share listed companies from 2007 to 2020 as the research sample, and the following are the data sources and sample selection rules.

The M&A data were obtained from the CSMAR database, supplemented by the CNRDS and Wind databases. 1) To ensure that the empirical analysis is conducted from the perspective of listed firms as the acquirer, only M&A events in which the listed companies are “buyers” are maintained. 2) Multiple M&A transactions announced by listed companies on the same day in which the underlying assets belong to the same target enterprise are combined into one. 3) Only successful M&A sample is retained. The following steps are carried out for further screening when studying corporate M&A performance: 1) excluding M&A events where the M&A transaction amount is less than 1 million RMB; 2) retaining only the first M&A completed by listed companies in the same year.

The financial and corporate governance data are mainly from the CSMAR database, and the green patent data are from the CNRDS database. In the empirical analysis, all data are integrated and processed: 1) remove companies in finance, insurance, and real estate industries; 2) remove ST, PT, and insolvent companies; 3) remove samples missing key variables. A total of 5516 M&A cases and 24036 firm-year observations are obtained.

In order to avoid the influence of extreme values on the empirical results, all continuous variables are winsorized at the 1% level. Stata 17.0 econometric analysis software was used to process the data.

3.2 Definition of key variables

3.2.1 Green M&A

3.2.1.1 Identification of green M&A

Drawing on the studies of Salvi et al. (2018), this paper defines green M&A as M&A by firms to acquire energy-saving and emission-reducing technologies, improve environmental protection, and transform to low-pollution and low-energy industries. First, we collected the descriptions of target companies’ business scope, and roughly screened out the samples with keywords such as environmental protection, energy saving, emission reduction, sewage disposal, waste disposal, etc. in the business scope. Then, by manually collecting the M&A announcements from the Shanghai and Shenzhen Stock Exchange, we further analyzed the background and purpose of the M&A, the business scope of the acquirer company and the target company, and the impact of the M&A on the acquirer company to determine whether the M&A was green.

3.2.1.2 Green M&A variables

In this paper, we construct two variables to measure a firm’s green M&A decision. The first one is the likelihood of M&A, which is measured using the dummy variable GM_YN. The value of GM_YN is equal to 1 if firms make green M&A in a given year and 0 otherwise. The second one is the number of M&As, which is measured using the variable GM_n. The value of GM_n is the number of green M&As made by the firm in a given year.

3.2.2 Control variables

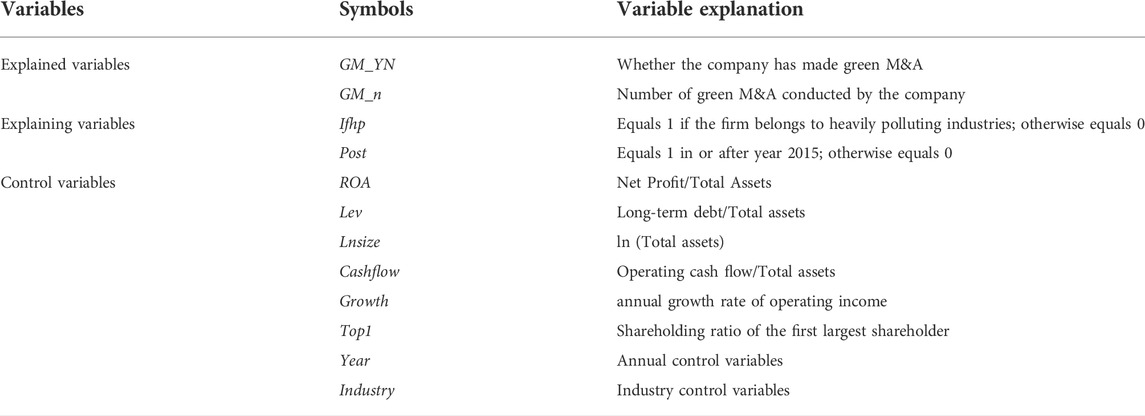

Drawing on related literature, this paper controls for the following variables, including Size (log of total assets), Lev (total debt divided by total assets), Growth (annual growth rate of operating income), ROA (return on total assets), Top1 (top shareholder ownership), Cashflow (net operating cash flow), and year and industry fixed effects. The specific variables are defined as shown in Table 1.

3.3 Model design

This paper constructs a difference-in-difference model with a quasi-natural experiment (the implementation of the new EPL in 2015). Since the policy is a uniform policy across the country, it is crucial to choose the appropriate treatment and control groups. Referring to the relevant literature design, the heavily polluting industries are more affected by the new EPL. Therefore, using heavy polluting enterprises as the treatment group and enterprises in other industries as the control group is beneficial to analyze the policy effects.

The identification of heavily polluting enterprises is based on the List of Listed Companies’ Environmental Protection Verification Industry Classification Management, Guidelines for Disclosure of Environmental Information of Listed Companies1 and 2012 SEC Industry Classification.

The variable Ifhp takes the value of 1 if the enterprise is a heavy polluter, otherwise, it takes the value of 0. Post is a policy dummy variable. The new EPL has been in effect since 1 January 2015, and Post equals 1 if the sample observations are in 2015 and later; otherwise equals 0.

Drawing on Shi and Xu (2018), we develops the following model to examine the impact of the new EPL on firms’ green M&A.

In model (1),

4 Empirical results

4.1 Descriptive statistics

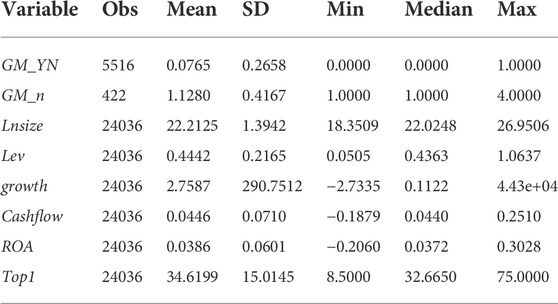

Table 2 reports the results of descriptive statistics for the main variables. It can be found that a total of 5,516 valid M&A events were screened during the sample period, of which 422 were green M&A, accounting for nearly 8%. The maximum number of green M&A by the same company in a year is 4. The distribution of control variables is consistent with the performance of companies in the Chinese market, and the data is relatively representative.

4.2 The impact of the new EPL on corporate green M&A

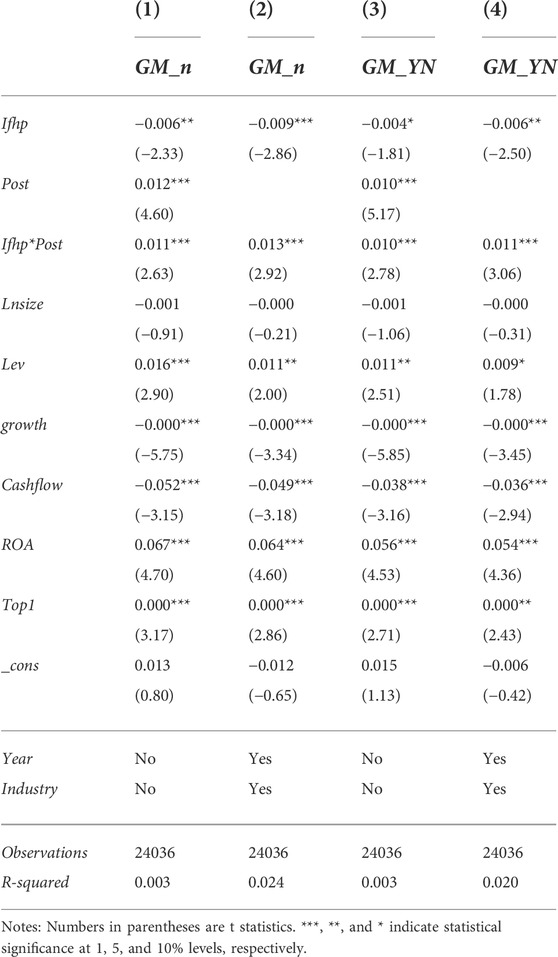

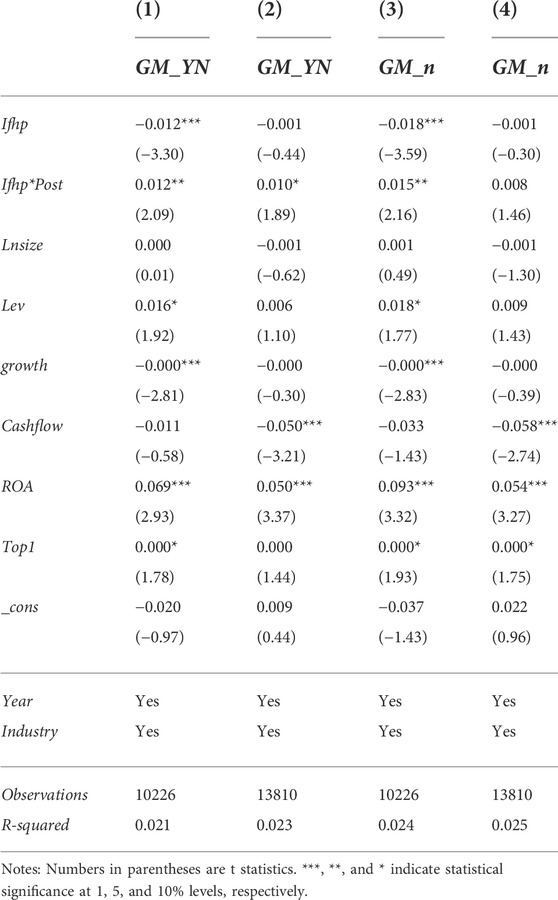

Table 3 shows the regression results between the implementation of the new EPL and the firms green M&A. The explanatory variables in columns 1) and 2) are the likelihood of green M&A. The explanatory variables in columns 3) and 4) are the number of green M&A. Columns 2) and 4) add industry and year control variables to the original regression model. The empirical results show that the coefficients of the interaction terms are significantly positive at the 1% level regardless of the inclusion of industry and year control variables, showing that the probability and frequency of green M&A increased after the implementation of the new EPL. In addition, it is worth noting that the coefficient of Ifhp is significantly negative, which means the main body who prefers green M&A changed from non-heavily polluting firms to heavily polluting firms (the total effect is the sum of the coefficients of the interaction term and Ifhp) as a result of the new EPL. The new EPL did have a significant impact on corporate Green M&A. The results of Table 3 confirm Hypothesis 1.

4.3 Robustness tests

The DID model is applied on the premise that the treatment and control groups should have the same trend before the policy. We employ the common trend test for model validation and construct a series of dummy variables. As shown in Table 4, Before1-Before3 are the dummy variables before policy implementation, and After1-After5 are the dummy variables after policy implementation. The classification of the control and treatment groups remains the same. For example, Before1 equals 1 when the year is 2014 and Ifhp equals 1. Current equals 1 when the year is 2015 and Ifhp equals 1. After1 equals 1 when the year is 2016 and Ifhp equals 1. Table 4 shows the results of the common trend test, the coefficients of after2-after5 are significantly positive. The coefficients of before1-before3 and current are insignificant, and the sample satisfies the common trend hypothesis.

In addition, we conduct some robustness tests on the main regression. First, we screen the M&A sample to retain the sample firms for green M&A, excluding the effect of other firm-level factors on the results. The regression results, which are shown in columns 1) and 2) of Table 5, continue to support the promotion of new EPL for green M&A. Second, we conduct a placebo test. By randomly classifying the sample firms, we obtain new treatment and control groups based on the proportion of the heavily polluting and ordinary firms in the previous regression. After that, we rerun the regressions, and the results are shown in columns 3) and 4) of Table 5, where the coefficients of the interaction terms are no longer significant. Combined with the findings of the main regression, this result indicates that firms that are highly affected by the new EPL show significant changes in green M&A behavior after the implementation of the new EPL, confirming that the environmental regulation has a facilitating effect on green M&A.

4.4 Heterogeneity test

4.4.1 Property heterogeneity

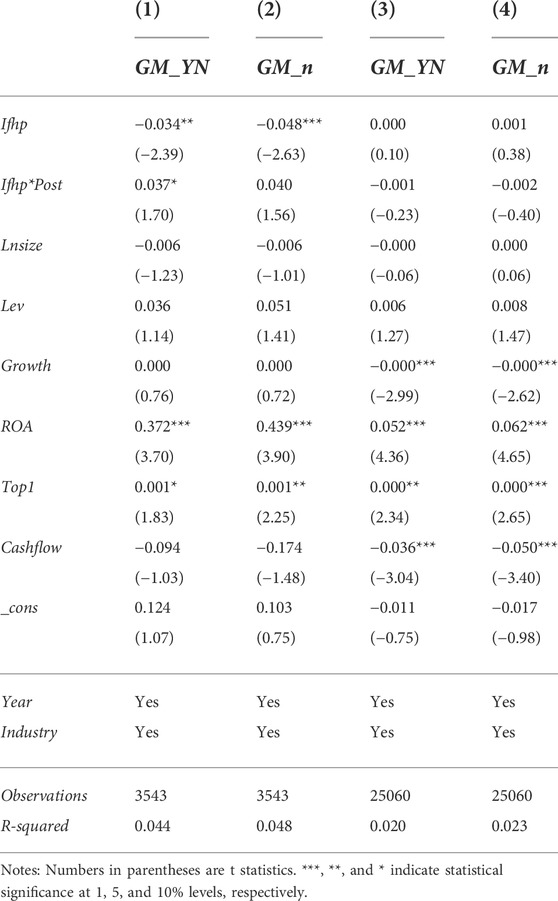

In addition to external policy effects, green M&A may also be influenced by the nature of the business. For example, politically connected companies are more likely to access valuable information about policy changes, making it easier to identify investment opportunities and reduce uncertainty. In addition, governments can provide direct assistance for their transactions (Brockman et al., 2013). Therefore, based on the nature of ownership, we divide the sample firms into two subsamples, state-owned and non-state-owned, and re-run the regression to test the effect of firm nature on the previous results. Table 6 shows that the interaction term exhibits higher significance and larger coefficients in the sample of state-owned enterprises, indicating that the promotion effect of the new EPL on corporate green M&A is more pronounced among state-owned firms.

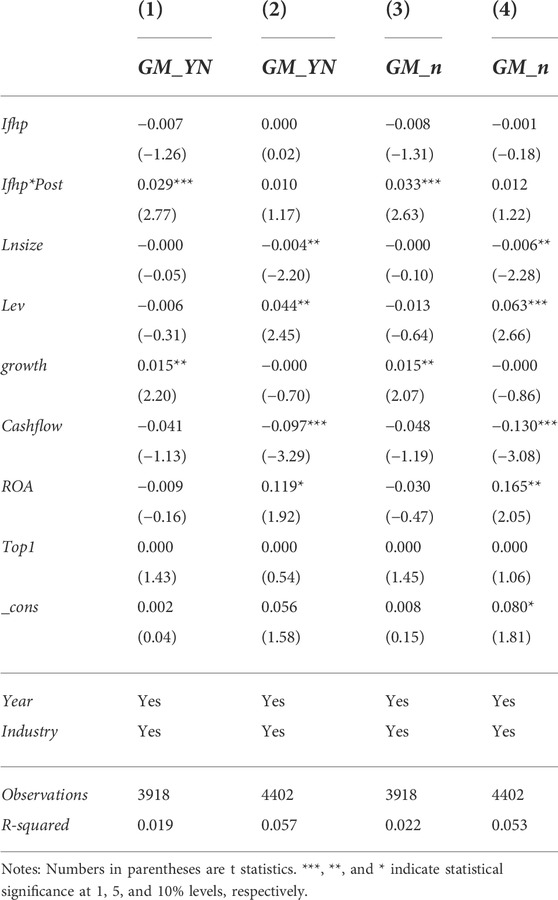

4.4.2 Financing constraints

Corporate M&A requires large amounts of financial support. Companies facing financing constraints are less likely to merge (Gorbenko and Malenko, 2018). Therefore, the condition of corporate financing constraints may affect the incentive effect of the new EPL. Based on this, we divide the sample into three groups by year according to the degree of corporate financing constraints (measured by the KZ index2). Among them, group 1 has the lowest corporate financing constraints and group 3 has the highest. We select group 1 and group 3 for regression to test the impact of financing constraints. The results in Table 7 show that the coefficients of the interaction terms are all significantly positive when companies face lower financing constraints. This means that firms with lower financing constraints are more likely to leverage their financial strengths to undertake M&A activities.

5 Motivation test

According to the analysis in the theoretical section, after the implementation of the new EPL, firms have three main motives for conducting green M&A. Green M&A may reduce the environmental protection cost (cost motive), improve the market performance (market performance motive), and increase innovation capacity (innovation motive). We will test each of these three motives.

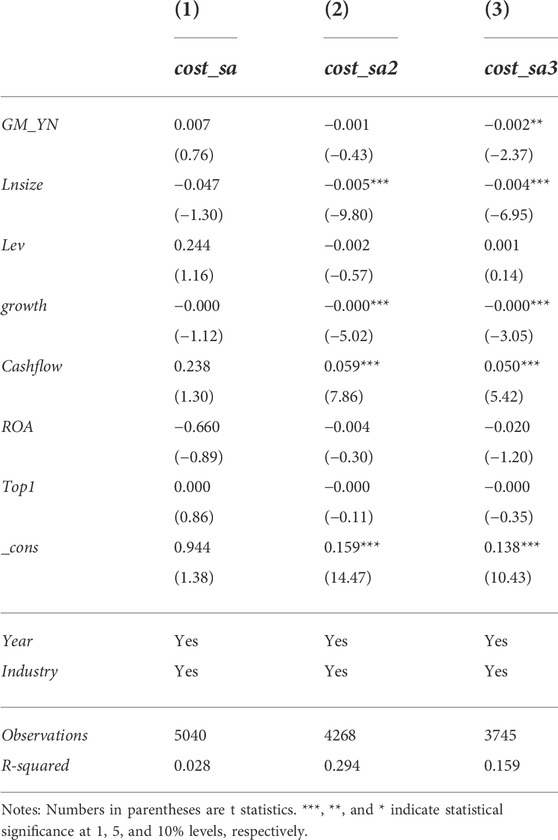

5.1 Cost motivation

Theoretical analysis suggests that companies can enter the field of cleaner production through green M&A and benefit from synergistic effects, thereby lowering the direct regulatory costs of environmental regulation. These will result in lower environmental costs and improved corporate financial performance.

According to the theoretical analysis, firms engage in green M&A after implementing the new EPL because companies can enter the field of cleaner production through green M&A and benefit from synergistic effects, thus reducing the direct regulatory costs associated with environmental regulation. Therefore, we need to test whether green M&A has a cost-reducing effect. If firms experience a significant decrease in pollution treatment costs after green M&A, then firms’ cost motive may be valid, and conversely, if green M&A does not affect pollution treatment costs, it proves that firms do not engage in green M&A for cost motive.

To test whether corporate green M&A has the above effects, we develop the following model.

Table 8 shows the regression results of green M&A with firms’ environmental cost. The results show that from the third year after green M&A, the environmental costs start to decrease, which means that the implementation of green M&A has obvious cost-reducing effects and can effectively exploit the green synergy effect.

5.2 Market performance motivation

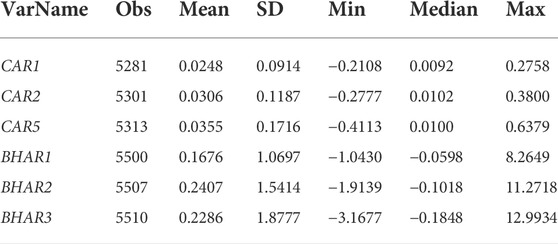

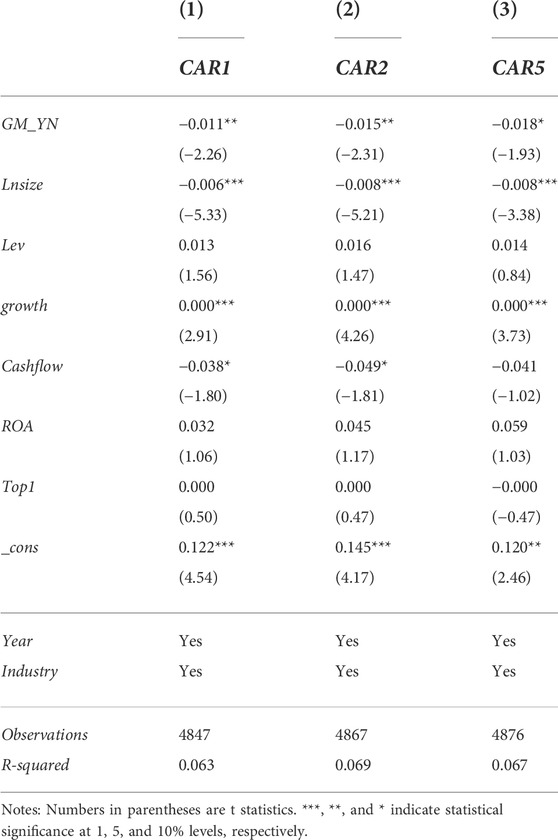

The market performance of M&A is divided into short-term and long-term. According to previous studies, the short-term market performance CAR is measured by the cumulative abnormal return of stocks during the window period around the first announcement date of the M&A. In this paper, the calculation is based on the market model proposed by Brown and Wamer (1985), where

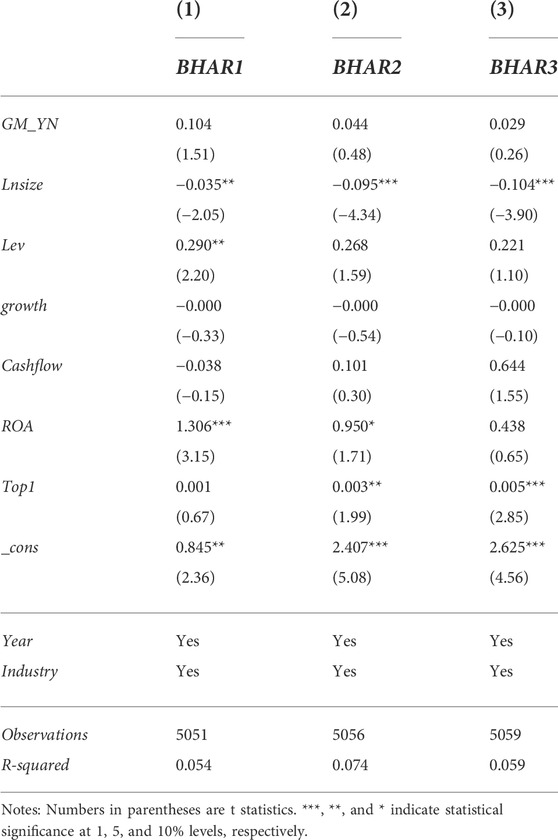

Long-term market performance BHAR is measured by the difference between the return on the stock of the acquirer and the return on the corresponding portfolio in a long period. Drawing on Gregory (1997), we calculate the BHAR for the [0, T] months after the M&A of the acquirer i as

We provide descriptive statistics for the above performance variables in Table 9. Overall, firms can achieve excess returns of 2.5%–3.6% on their stock price 1–5 days after the M&A announcement and 16.8%–24.1% in the 1–3 years after the M&A.

Then, we test the market performance motive. The test of market performance motivation is similar to that of cost motivation. By looking at the impact of green M&A on market performance, we can verify whether firms will engage in green M&A for market performance motivation. The regression model follows model 2) above,

Table 10 and Table 11 demonstrate the results of the tests of market performance motive. The results in Table 10 show that there is a significant decrease in the short-term market performance of firms after green M&A. Stock price is a reflection of investors’ expectations. In their view, as a complex systemic project, M&A involves risks from the selection of target in the preparation phase, the structure design in the transaction phase, and the realization of synergies between the two parties of the transaction in the integration phase. Moreover, green M&A is unique. It can be perceived by the public as either a forced transition to comply with stricter environmental regulatory policies or as an active investment in response to a new stage of development. Both passive transformation and active investment will face great uncertainty. As a result, the market is more cautious about green M&A, and it is less likely that companies will pursue better market performance through green M&A. Table 11 shows the regression results for long-term market performance. Although the coefficients are positive, they are not statistically significant and do not prove that long-term market performance is improved after green M&A. In summary, there is no market performance motivation for firms to implement green M&A.

5.3 Innovation motivation

Innovation is the fundamental driving force leading the development of enterprises. Under the effect of environmental regulation, enterprises are more likely to achieve green transformation through green innovation. In order to test the innovation motive, we replace

Table 12 shows the empirical results of the impact of Green M&A on green innovation. It can be found that when the explanatory variable is the total number of green invention patents, green M&A has a significant positive effect on green invention patents only in the current year. When the explanatory variable is green utility model patents, green M&A has a significant positive effect on the latter 2 years. This result confirms that green M&A by firms does promote their green innovation. For utility model patents, the promotion effect of green M&A by firms will be slightly lagged, and the result supports the innovation motive of green M&A.

6 Conclusion

The new EPL is an essential legal that regulates the environmental protection behavior of the whole society in the process of green development in China. Using a sample of Chinese listed companies from 2007 to 2020, we empirically examine the impact of the new EPL on corporate green M&A. The results show that: first, the implementation of the new EPL significantly increases firms’ probability and frequency of green M&A. Second, the promotion effect of the new EPL on green M&A is more significant among SOEs or firms with low financing constraints. Third, the main reason why environmental regulations can promote green M&A is that green M&A can reduce the environmental cost, improve financial performance, enhance green innovation, help firms better cope with environmental regulations and fit the concept of green development.

The policy implications of this paper are: 1) Empirical evidence suggests that the implementation of the new EPL will help promote green M&A and thus enhance green innovation. It means the “Porter hypothesis” exists in China and corporate environmental investments have an “innovation compensation” effect. Therefore, we should comply with the requirements of China’s green development trend, under the premise of unified standards and the correct exercise of discretionary administrative penalties, to develop environmental protection regulations suitable for the development of the region according to local conditions. At the same time, the government should improve the law enforcement ability of environmental regulation to provide external impetus for the green transformation of enterprises and drive high-quality economic development.

(2) Reduce the short-sighted behavior of corporate and combine environmental protection with long-term development. According to the study’s findings, it can be seen that corporate environmental protection investment cannot result in a short-term positive market performance or long-term stock price gains. However, it can reduce corporate environmental costs, which is beneficial to the company’s financial performance. As an important environmental governance entity, corporate management should understand the relationship between environmental preservation and sustainable development, organically combine corporate environmental governance with the core business, integrate both into a unified development framework, form a positive interaction between firms’ development and ecological civilization construction, and drive sustainable corporate progress with sustainable environmental development.

(3) In addition to promulgating environmental protection regulations, the government can give enterprises environmental protection subsidies or tax incentives to reduce their direct environmental costs. Moreover, the government should enhance the environmental protection awareness of residents, encourage the public to purchase products and services from environmental protection enterprises, give financial or reputational incentives to enterprises that contribute to the environment, and increase the implicit benefits of their environmental protection behaviors. Companies should optimize their internal governance structure, reflect flexibly on environmental policies, plan ahead for green transformation and development, and try various forms of environmental governance practices to improve overall operational efficiency.

Data availability statement

Publicly available datasets were analyzed in this study. This data can be found here: https://www.gtarsc.com/.

Author contributions

ZH and YW performed concept development, modeling analysis, and writing. JP performed writing-review and editing. All authors contributed to the article and approved the submitted version.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1Both documents were developed by the Ministry of Environmental Protection in 2008.

2Kz index = -3.429*cf-5.133*div-6.090*c+4.410*lev+0.483*tq, where cf equals net cash flow from operations/total assets, div equals cash dividends/total assets, c equals cash holdings/total assets, lev equals total debt/total assets and tq represents Tobin’s Q.

References

Abbas, J. (2020). Impact of total quality management on corporate green performance through the mediating role of corporate social responsibility. J. Clean. Prod. 242, 118458. doi:10.1016/j.jclepro.2019.118458

Agrawal, A., Jaffe, J. F., and Mandelker, G. N. (1992). The post-merger performance of acquiring firms: A Re-examination of an anomaly. J. Finance 47 (4), 1605–1621. doi:10.1111/j.1540-6261.1992.tb04674.x

Bi, G.-B., Song, W., Zhou, P., and Liang, L. (2014). Does environmental regulation affect energy efficiency in China's thermal power generation? Empirical evidence from a slacks-based DEA model. Energy Policy 66, 537–546. doi:10.1016/j.enpol.2013.10.056

Blundell, W., Gowrisankaran, G., and Langer, A. (2020). Escalation of scrutiny: The gains from dynamic enforcement of environmental regulations. Am. Econ. Rev. 110 (8), 2558–2585. doi:10.1257/aer.20181012

Brandi, C., Schwab, J., Berger, A., and Morin, J.-F. (2020). Do environmental provisions in trade agreements make exports from developing countries greener? World Dev. 129, 104899. doi:10.1016/j.worlddev.2020.104899

Brockman, P., Rui, O. M., and Zou, H. (2013). Institutions and the performance of politically connected M&As. J. Int. Bus. Stud. 44 (8), 833–852. doi:10.1057/jibs.2013.37

Brown, S. J., and Warner, J. B. (1985). Using daily stock returns: The case of event studies. J. Financial Econ. 14 (1), 3–31. doi:10.1016/0304-405X(85)90042-X

Chen, L., Li, W., Yuan, K., and Zhang, X. (2022). Can informal environmental regulation promote industrial structure upgrading? Evidence from China. Appl. Econ. 54 (19), 2161–2180. doi:10.1080/00036846.2021.1985073

Chen, Z., Kahn, M. E., Liu, Y., and Wang, Z. (2018). The consequences of spatially differentiated water pollution regulation in China. J. Environ. Econ. Manag. 88, 468–485. doi:10.1016/j.jeem.2018.01.010

Chordia, T., Subrahmanyam, A., and Tong, Q. (2014). Have capital market anomalies attenuated in the recent era of high liquidity and trading activity? J. Account. Econ. 58 (1), 41–58. doi:10.1016/j.jacceco.2014.06.001

Copeland, B. R., and Taylor, M. S. (1994). North-south trade and the environment. Q. J. Econ. 109 (3), 755–787. doi:10.2307/2118421

Copeland, B. R., and Taylor, M. S. (2004). Trade, growth, and the environment. J. Econ. Literature 42 (1), 7–71. doi:10.1257/.42.1.7

Costantini, V., and Crespi, F. (2008). Environmental regulation and the export dynamics of energy technologies. Ecol. Econ. 66 (2), 447–460. doi:10.1016/j.ecolecon.2007.10.008

Du, W., and Li, M. (2020). Assessing the impact of environmental regulation on pollution abatement and collaborative emissions reduction: Micro-evidence from Chinese industrial enterprises. Environ. Impact Assess. Rev. 82, 106382. doi:10.1016/j.eiar.2020.106382

Edmans, A. (2011). Does the stock market fully value intangibles? Employee satisfaction and equity prices. J. Financial Econ. 101 (3), 621–640. doi:10.1016/j.jfineco.2011.03.021

Féres, J., and Reynaud, A. (2012). Assessing the impact of formal and informal regulations on environmental and economic performance of Brazilian manufacturing firms. Environ. Resour. Econ. (Dordr). 52 (1), 65–85. doi:10.1007/s10640-011-9520-8

Freeman, R. E., and McVea, J. (2005). “A stakeholder approach to strategic management,” in The blackwell handbook of strategic management, 183–201. doi:10.1111/b.9780631218616.2006.00007.x

Gorbenko, A. S., and Malenko, A. (2018). The timing and method of payment in mergers when acquirers are financially constrained. Rev. Financ. Stud. 31 (10), 3937–3978. doi:10.1093/rfs/hhx126

Gray, W. B., and Shimshack, J. P. (2011). The effectiveness of environmental monitoring and enforcement: A review of the empirical evidence. Rev. Environ. Econ. Policy 5 (1), 3–24. doi:10.1093/reep/req017

Gregory, A. (1997). An examination of the long run performance of UK acquiring firms. J. Bus. Finance Account. 24 (7-8), 971–1002. doi:10.1111/1468-5957.00146

Heberer, T., and Senz, A. (2011). Streamlining local behaviour through communication, incentives and control: A case study of local environmental policies in China. J. Curr. Chin. Aff. 40 (3), 77–112. doi:10.1177/186810261104000304

Husted, B. W., and Allen, D. B. (2007). Strategic corporate social responsibility and value creation among large firms: Lessons from the Spanish experience. Long. Range Plan. 40 (6), 594–610. doi:10.1016/j.lrp.2007.07.001

Leiter, A. M., Parolini, A., and Winner, H. (2011). Environmental regulation and investment: Evidence from European industry data. Ecol. Econ. 70 (4), 759–770. doi:10.1016/j.ecolecon.2010.11.013

Levinson, A., and Taylor, M. S. (2008). Unmasking the pollution haven effect. Int. Econ. Rev. Phila. 49 (1), 223–254. doi:10.1111/j.1468-2354.2008.00478.x

Li, B., Xu, L., McIver, R., Wu, Q., and Pan, A. (2020). Green M&A, legitimacy and risk-taking: Evidence from China’s heavy polluters. Acc. Finance 60 (1), 97–127. doi:10.1111/acfi.12597

Liu, M., Shadbegian, R., and Zhang, B. (2017). Does environmental regulation affect labor demand in China? Evidence from the textile printing and dyeing industry. J. Environ. Econ. Manag. 86, 277–294. doi:10.1016/j.jeem.2017.05.008

Matallín-Sáez, J. C., Soler-Domínguez, A., de Mingo-López, D. V., and Tortosa-Ausina, E. (2019). Does socially responsible mutual fund performance vary over the business cycle? New insights on the effect of idiosyncratic SR features. Bus. Ethics A Eur. Rev. 28 (1), 71–98. doi:10.1111/beer.12196

Muhammad, S., Long, X., Salman, M., and Dauda, L. (2020). Effect of urbanization and international trade on CO2 emissions across 65 belt and road initiative countries. Energy 196, 117102. doi:10.1016/j.energy.2020.117102

Mullainathan, S., and Shleifer, A. (2005). The Market for News. American Economic Review. 95(4), 1031-1053. doi:10.1257/0002828054825619

Peng, H., Shen, N., Ying, H., and Wang, Q. (2021). Can environmental regulation directly promote green innovation behavior?— Based on situation of industrial agglomeration. J. Clean. Prod. 314, 128044. doi:10.1016/j.jclepro.2021.128044

Porter, M. E., and van der Linde, C. (1995). Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 9 (4), 97–118. doi:10.1257/jep.9.4.97

Rubashkina, Y., Galeotti, M., and Verdolini, E. (2015). Environmental regulation and competitiveness: Empirical evidence on the Porter Hypothesis from European manufacturing sectors. Energy Policy 83, 288–300. doi:10.1016/j.enpol.2015.02.014

Ryan, S. P. (2012). The costs of environmental regulation in a concentrated industry. Econometrica 80 (3), 1019–1061. doi:10.3982/ECTA6750

Salvi, A., Petruzzella, F., and Giakoumelou, A. (2018). Green M&A deals and bidders’ value creation: The role of sustainability in post-acquisition performance. Int. Bus. Res. 11, 96. doi:10.5539/ibr.v11n7p96

Shadbegian, R. J., and Gray, W. B. (2005). Pollution abatement expenditures and plant-level productivity: A production function approach. Ecol. Econ. 54 (2), 196–208. doi:10.1016/j.ecolecon.2004.12.029

Shapiro, J. S., and Walker, R. (2018). Why is pollution from US manufacturing declining? The roles of environmental regulation, productivity, and trade. Am. Econ. Rev. 108 (12), 3814–3854. doi:10.1257/aer.20151272

Shi, X., and Xu, Z. (2018). Environmental regulation and firm exports: Evidence from the eleventh Five-Year Plan in China. J. Environ. Econ. Manag. 89, 187–200. doi:10.1016/j.jeem.2018.03.003

Suchman, M. C. (1995). Managing legitimacy: Strategic and institutional approaches. Acad. Manage. Rev. 20 (3), 571–610. doi:10.5465/amr.1995.9508080331

Valor, C. (2005). Corporate social responsibility and corporate citizenship: Towards corporate accountability. Bus. Soc. Rev. 110 (2), 191–212. doi:10.1111/j.0045-3609.2005.00011.x

Wang, W., Li, Y., Lu, N., Wang, D., Jiang, H., and Zhang, C. (2020). Does increasing carbon emissions lead to accelerated eco-innovation? Empirical evidence from China. J. Clean. Prod. 251, 119690. doi:10.1016/j.jclepro.2019.119690

Wu, H., Guo, H., Zhang, B., and Bu, M. (2017). Westward movement of new polluting firms in China: Pollution reduction mandates and location choice. J. Comp. Econ. 45 (1), 119–138. doi:10.1016/j.jce.2016.01.001

Zhang, J., Liu, Y., Chang, Y., and Zhang, L. (2017). Industrial eco-efficiency in China: A provincial quantification using three-stage data envelopment analysis. J. Clean. Prod. 143, 238–249. doi:10.1016/j.jclepro.2016.12.123

Zhang, Y.-J., and Wang, W. (2021). How does China's carbon emissions trading (CET) policy affect the investment of CET-covered enterprises? Energy Econ. 98, 105224. doi:10.1016/j.eneco.2021.105224

Zheng, Y., Ge, C., Li, X., Duan, X., and Yu, T. (2020). Configurational analysis of environmental information disclosure: Evidence from China's key pollutant-discharge listed companies. J. Environ. Manag. 270, 110671. doi:10.1016/j.jenvman.2020.110671

Keywords: environmental regulation, green merger and acquisition (GMA), environmental management costs, green innovation, market performance

Citation: Han Z, Wang Y and Pang J (2022) Does environmental regulation promote green merger and acquisition? Evidence from the implementation of China’s newly revised Environmental Protection Law. Front. Environ. Sci. 10:1042260. doi: 10.3389/fenvs.2022.1042260

Received: 12 September 2022; Accepted: 12 October 2022;

Published: 21 October 2022.

Edited by:

Shiyang Hu, Chongqing University, ChinaReviewed by:

Ying Zhu, Xi’an University of Architecture and Technology, ChinaYahua Xu, Central University of Finance and Economics, China

Copyright © 2022 Han, Wang and Pang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Zhijie Han, MjAyMDAxMDQwMDA0QHN0dS56dWVsLmVkdS5jbg==; Yuwei Wang, d2FuZ3l1d2VpMTMxNDA2QDE2My5jb20=

Zhijie Han

Zhijie Han Yuwei Wang

Yuwei Wang Jing Pang

Jing Pang