- School of Management, Jiujiang University, Jiujiang, China

Environmental regulation and green technology innovation are the important driving forces to realize the peak of carbon and carbon neutralization strategy. However, whether environmental regulation can promote or inhibit green technology innovation, the existing literature research has not yet formed a consistent conclusion, and there is no literature to conduct a unified analysis of the relationship between the two. Based on 39 independent research papers published from 2006 to 2020, this paper integrates and analyzes the relationship between environmental regulation and enterprise green technology innovation and its corresponding dimensions in the context of China. The results show that there is a significant positive correlation between environmental regulation and enterprise green technology innovation overall. There is a significant positive correlation between command-control environmental regulation, tax-based environmental regulation, enterprise green product innovation, green process innovation, and green R&D investment, but there are differences in intensity. At the same time, this study also found that the types of environmental regulation, industry characteristics, and economic regions moderate the relationship between environmental regulation and enterprise green technology innovation. These findings further clarify the differences of understanding on the relationship between environmental regulation and green innovation of enterprises, provide a new perspective for the inconsistency of existing relevant research conclusions, and provide new supporting evidence for the Porter hypothesis, which has important implications for the government to optimize environmental regulation policies to promote the development of green economy.

1 Introduction

The Yale Center for Environmental Law Policy of Yale University and the Center for International Earth Science Information Network of Columbia University jointly released the Environmental Performance Index in 2022, China’s annual score was 28.4, ranking 160 out of more than 180 countries (China Environment, 2022). In 2020, China’s carbon emissions will reach 9.899 billion tons, with a year-on-year growth of .6% (BP China Environment, 2022). Although the carbon emission intensity in that year was 48.4% lower than that in 2005, 18.8% lower than that in 2015, exceeding the 40%–45% reduction target promised to the international community (Information Office of the State Council, 2021), the rapid growth of carbon emissions has been effectively controlled, China’s total carbon emissions remain high, and the performance of environmental regulation needs to be further improved. During the 13th Five-Year Plan period, China and local governments continuously introduced policies on green development. According to the public data of the National Bureau of Statistics, the National Development and Reform Commission and other departments, China’s fiscal expenditure on environmental protection has totaled 3 trillion yuan, with an average annual growth of 7.47%. In terms of energy conservation and emission reduction, China’s energy consumption per unit of GDP has decreased by 13.3% (Sun and Xi, 2022). The outline of the 14th Five-Year Plan further defined the need to accelerate green and low-carbon development, support green technology innovation. By the end of 2019, the total amount of green bonds issued in China had exceeded 840 billion yuan, becoming the largest and most active green bond market in the world (Wu et al., 2022). Therefore, it has become an important goal of China’s environmental regulation to build a market-oriented enterprise green technology innovation system and improve the supporting role of technology for the goal of carbon peaking and carbon neutralization.

Environmental regulation is the most effective institutional arrangement to promote enterprise green technology innovation. In the process of enterprise green technology innovation, how does the government choose an effective environmental regulation to mobilize the green innovation vitality of enterprises and promote green transformation and upgrading of enterprises, which has become an important issue in balancing corporate development and controlling carbon emissions. Environmental regulation can restrain pollution emissions and promote energy conservation and emission reduction of enterprises, but it also invisibly increases the economic cost of enterprises (Bi and Yu, 2016). In terms of incentive effect, according to the Porter Hypothesis Theory, environmental regulation can prompt enterprises to increase investment in green innovation and improve their ability to prevent and control pollution, thereby reducing the negative impact of environmental regulation on corporate economic benefits (Porter, 1995; Hamamoto, 2006; Zhang et al., 2020). In terms of the inhibitory effect, the Production Cost Theory believes that environmental regulation will increase the production cost of enterprises, squeeze the innovation funds of enterprises to a certain extent, and thus inhibit the green technology innovation behavior of enterprises (Wagner, 2007; Lanoie et al., 2008). Although the theoretical circle generally believes that environmental regulation has an important impact on the green innovation of enterprises, there is no consensus on the direction and intensity of the impact of green technology innovation.

At present, there is no large-scale meta-analysis to examine the correlation between environmental regulation and corporate green technology innovation and to deeply explore the reasons for the inconsistency of existing research conclusions. Based on the existing research status, the questions studied in this paper is whether the impact of environmental regulation on green technology innovation of enterprises is incentive effect or inhibition effect in China? How do command and control environmental regulations and tax-based environmental regulations affect companies’ green product innovation, green process innovation, and green R&D investment behaviors? Are there significant differences in the relationship between the two based on the type of environmental regulation, industry characteristics of the firm, and economic region? Aiming at these problems, this study integrates existing empirical research using a meta-analysis method based on the China context, systematically evaluates the impact of environmental regulation on corporate green technology innovation, and analyzes whether there is heterogeneity in the influence of environmental regulation types, enterprise industry characteristics, and economic regions, which provides theoretical basis and policy reference for environmental regulation to promote green technology innovation and reform of enterprises.

The remaining portions of this study are organized as follows: Section 2 contains theoretical background and hypothesis development. Section 3 presents the acquisition of data and methodology used in this study. Section 4 is the Meta-analytic results, and Section 5 discusses the conclusion.

2 Theoretical background and hypothesis development

2.1 Environmental regulation

Environmental regulation is a binding force that aims at environmental protection, targets individuals or organizations, and takes tangible institutions or intangible consciousness as its existence form (Zhao et al., 2009). Environmental economics divides environmental regulation into two types: economic incentive-based environmental regulation and command-and-control environmental regulation. Among them, environmental tax, as a market-based economic incentive-based environmental regulation method, can internalize the external costs of resources and the environment, which is the most effective institutional arrangement to promote enterprise green technology innovation (Yu et al., 2019). The environmental protection tax of developed countries mainly includes four categories: pollution tax, resource tax, energy tax, and transportation tax, a relatively complete environmental protection tax system has been formed, while China’s current environmental protection tax system is still in the stage of exploration and improvement (Liu et al., 2015). He and Li (2018) divided the environmental protection tax into three categories: one is the environmental protection tax in the narrow sense, that is, the environmental protection tax officially implemented in China on 1 January 2018; the second is the environmental protection tax, which only includes taxes directly related to environmental protection, such as resource tax, cultivated land occupation tax, etc. (Jia and Wang, 2000; Yu et al., 2019); the third is generalized environmental protection tax, which includes taxes indirectly related to environmental protection based on quasi-environmental protection, such as value-added tax. China’s pollution discharge fees before 2018 played the role of environmental protection tax. According to the views of existing scholars and the design of the explanatory variable of environmental protection tax in existing empirical research, this study adopts the connotation of generalized environmental protection tax, that is, all taxes and charges related to environmental protection, and incorporates tax-based environmental regulation as a substitute variable for economic incentive environmental regulation. Different environmental regulation policies have different impacts on enterprises, which has also become an evaluation criterion for environmental policies. Therefore, based on the existing literature that meets the standard of meta-analysis, this study divides environmental regulation into tax-based environmental regulation and command-and-control environmental regulation and examines the impact of these two environmental regulations on corporate green technology innovation and its different dimensions.

2.2 Enterprise green technology innovation

Green Technological Innovation (GTI) refers to following the law of ecological economic development in every production stage of the entire product life cycle and reducing energy consumption and pollution emissions through green technological innovation and green R&D activities. Different from traditional innovation, green technology innovation is a series of technological innovations that are conducive to the improvement of the ecological environment. From product design, procurement, production, and sales to final consumption, all technological innovations are required to develop in harmony with the ecological environment to eliminate technological innovations. Negative impact on the ecological environment (Herdt, 1987). For the classification of green technology innovation, according to the research of OECD (2005); Chen et al. (2006); Chang (2011), green technology innovation can be divided into green product innovation (GPTI) and green process innovation (GPSI). Among them, green product innovation refers to optimizing the design of products to minimize the damage to the ecological environment, while green process innovation refers to the entire process from raw material procurement, and product production to delivery, and the entire process adopts manufacturing that is conducive to energy conservation and emission reduction. Process (Chiou et al., 2011). According to the research of Xie et al. (2014), Sun and Yuan (2020), corporate green research and development investment (GRDI) is also an intrinsic factor that affects green technology innovation. Therefore, according to the existing literature on the different dimensions of enterprise green technology innovation, to more comprehensively and deeply analyze the impact of environmental regulation on enterprise green technology innovation, this study further refines green technology innovation into green product innovation, green process innovation, and green innovation investment in three dimensions.

2.3 Environmental regulation and enterprise green technology innovation

The relationship between environmental regulation and enterprise green technology innovation has always been a hot issue that scholars have paid close attention to, and it is also a controversial issue. Environmental regulation is an important means to reduce the negative externalities of corporate environmental pollution, including direct command and control regulation (such as market access, and environmental standards), market economic incentives (such as environmental protection tax, emissions trading), and information communication means (such as voluntary information disclosure) (He and Li, 2018). Since the Porter hypothesis was put forward, it has received extensive attention from academic circles. Since then, scholars have conducted empirical tests on the relationship between environmental regulation and corporate green technology innovation from various dimensions, measurement methods, and variable design. Reviewing the existing related research, three different theoretical viewpoints are formed:

The first point of view is that environmental regulation will stimulate the green technology innovation of enterprises, which confirms the existence of the Porter hypothesis. Porter, (1995) put forward the well-respected Porter Hypothesis under the framework of competitiveness analysis, they believe that environmental regulation can stimulate technological innovation of enterprises and gain competitive advantage by reducing the cost of products or increasing the value of products. Xepapadeas and De Zeeuw (1999) proved through the model that environmental regulation has two effects: productivity effect and profit effect, and believed that strict environmental regulation policy will bring about technological progress of enterprises. Cesaroni and Arduini (2001) studied the chemical industry in Europe and its relative competitive position through patent analysis, case analysis, and Internet analysis, and the results showed that strict environmental standards and clear environmental policies are conducive to stimulating technological innovation related to environmental protection, and at the same time Frondel et al. (2007) also believed that the stricter the environmental regulation policy, the greater the incentive effect on green technology innovation of enterprises. In China, He et al. (2018) analyzed the relationship between environmental regulation and ecological innovation by taking Chinese listed mineral resource companies as samples. The results show that environmental regulation has an incentive effect on enterprise ecological innovation in the short term. Wen and Zhong (2020) used the double-difference method to examine the impact of environmental protection tax reform on enterprise green technology innovation based on the adjustment and reform of China’s environmental tax and fee standards. The research results show that changes in environmental taxes and fees have a significant positive impact on the green technology innovation of enterprises, and the increase in environmental taxes and fees forces large and medium-sized enterprises to carry out green technology innovation.

The second view is that environmental regulation will inhibit the green technology innovation of enterprises, which confirms that Porter’s hypothesis is not valid. Environmental economics believes that environmental regulation will not only lead to an increase in the production cost of enterprises but also squeeze out the innovation funds of enterprises. The increase in enterprises’ investment in pollution reduction equipment will inevitably lead to a decrease in investment in production equipment, which will lead to a decline in the level of productivity of enterprises (Christainsen et al., 1980; Conrad and Morrison, 1989). Due to the crowding-out effect of environmental regulation on enterprise innovation and the constraint effect on investment, to meet the requirements of environmental regulation, enterprises will adopt a large number of end-of-line technologies (Jaffe and Palmer, 1997), which in turn inhibits green technology innovation of enterprises. In the study of tax-based environmental regulation, some scholars believe that the reduction of the environmental protection tax burden can help reduce the R&D cost of enterprises, which can increase the R&D innovation investment of enterprises, and bring more innovation output (Bloom et al., 2002; Czarnitzki et al., 2011). However, if the environmental protection tax burden increases, it will inhibit the innovation of enterprises (Howell, 2016; Mukherjee et al., 2017). For example, Wagner (2007) also found that the intensity of environmental regulation is negatively correlated with the number of patents related to green technology innovation. In China, Zhang et al. (2016) showed that environmental regulation based on taxes and fees had a significant crowding-out effect on technological innovation of enterprises, the collection of sewage charges increased the production cost of enterprises and inhibited technological innovation of enterprises. Lu et al. (2019) found that enterprises often offset the pressure of environmental protection tax by expanding production capacity based on the perspective of changes in China’s pollution discharge fee collection standards, which made the increase in environmental protection tax burden not only not produce the Porter effect but produces negative incentive on the green innovation ability of enterprises.

The third view holds that there is a non-linear relationship between environmental regulation and enterprise green technology innovation. Jaffe and Palmer (1997) studied the relationship between environmental expenditure and innovation in the manufacturing industry. They found that although lagging environmental regulation expenditure has a significant positive impact on R&D expenditure, there is no evidence that the industry’s innovation output is related to environmental regulation costs. Some studies have found that there is a U-shaped relationship between environmental regulation and enterprise green technology innovation, that is, as the intensity of environmental regulation increases, the output of green technology innovation first decreases, and after reaching the lowest point, it will increase with the intensity of environmental regulation. Large and increased. Lanoie et al. (2008) took the manufacturing industry in Quebec, Canada as an example, and conducted an empirical analysis of the relationship between environmental regulation and the rate of technological progress. The study found that environmental regulation had a negative impact on the rate of technological progress in the same period, while the lagging environment had a negative impact on the rate of technological progress. The impact of regulation on the rate of technological progress in the same period is positive, and Song et al. (2020) also found that there is a U-shaped relationship between environmental regulation and green technology innovation. He and Luo (2018) used the DEA-Malmquist method to examine the relationship between environmental regulation, technological innovation, and industrial total factor productivity. The results show that environmental regulation can improve total factor productivity by promoting technological innovation, but this can only be achieved when the intensity of environmental regulation reaches a certain threshold value. Similarly, Zhang et al. (2019) also found that there is a U-shaped relationship between environmental regulation and technological innovation. In contrast, some studies have found that there is an inverted U-shaped relationship between environmental regulation and corporate green technology innovation, that is, the output of green technology innovation first increases with the intensity of environmental regulation, and then increases with the intensity of environmental regulation. Decrease as the intensity of environmental regulation increases. Using data from various industrial sectors in China, Wang and Shen (2016) found an inverted U-shaped relationship between environmental regulation and environmental productivity in pollution-intensive industries. Wang et al. (2019) found that there is also an inverted U-shaped relationship between environmental regulation and green productivity in OECD countries. Pan et al. (2021) used China’s patent census database and industrial sector panel data of 30 provinces, and found that environmental regulation has no significant impact on green innovation in the central and western regions and areas with high pollution levels, while environmental regulation and green innovation have an inverted U-shaped relationship in provinces with a high proportion of state-owned enterprises. Therefore, this paper proposes the following two competing research hypotheses:

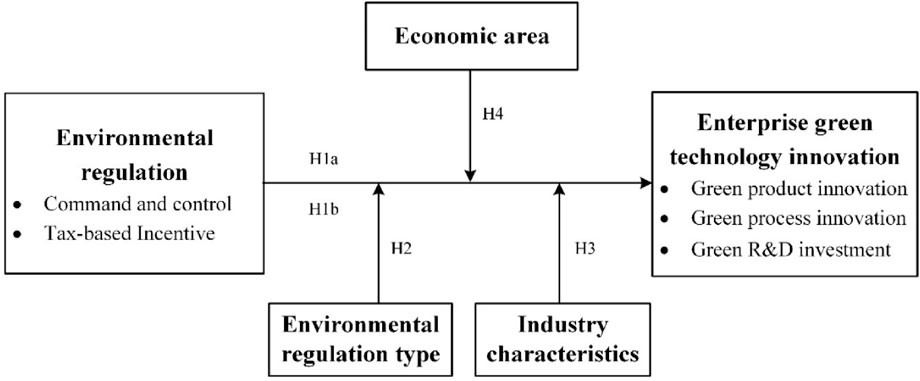

2.4 Moderating variables of the impact of environmental regulation on enterprise green technology innovation

Through literature review, we found that existing studies have reached inconsistent conclusions based on different environmental regulation policies, research samples, and variable dimensions of green technology innovation. From the perspective of the types of environmental regulation policies, different environmental policy tools have different impacts on technological innovation. For example, Montero (2002) found that the tax-based environmental regulation has the best positive incentive effect on technological innovation in a perfectly competitive market, and driven by the environmental tax, corporate investment is constantly changing to greening. Sun and Yuan (2020) took the data of listed companies with heavy pollution in China as samples and found that environmental protection tax can promote corporate upgrading by increasing corporate innovation investment. From the perspective of industries and regions, in highly polluting industries and regions where green tax policies are implemented, environmental taxes and fees play a particularly significant role in corporate green technology innovation (Wen and Zhong, 2020). Shen and Liu (2012) also found that there are regional differences in the role of environmental regulation in promoting technological innovation, the Porter hypothesis is difficult to reflect in the relatively backward central and western regions, while it is supported in the more developed eastern regions. An important function of meta-analysis is to examine whether there is heterogeneity in integrated effect sizes and to discover moderators. Based on the literature review, to further explore the reasons for the heterogeneity of the existing research results, and to test the moderating effects of the three variables of environmental regulation type, industry characteristics, and economic region, this study proposes the following three hypotheses:

H2: Different types of environmental regulation have significant differences in the impact of environmental regulation on enterprise green technology innovation;

H3: There are significant differences in the impact of environmental regulation on enterprise green technology innovation due to different industry characteristics of enterprises;

H4: There are significant differences in the impact of environmental regulation on the green technology innovation of enterprises in different economic regions.

The research model of this study is shown in Figure 1.

3 Research methods

Meta-analysis is a quantitative and systematically evaluated evidence-based analysis method, which scientifically integrates the existing relevant empirical research results in a certain field or topic to conclude the research topic, it has become a more systematic, rigorous, and reproducible method of accumulating evidence (Gurevitch et al., 2018). Since the introduction of integrative research methods in the 1970s, meta-analysis has revolutionized many fields of science, addressing conflicting findings based on evidence. Whether environmental regulation can motivate enterprises to carry out green technology innovation has not yet reached a consistent conclusion in the theoretical circle, and some research conclusions even contradict each other. Based on this, this study attempts to re-examine the meta-analysis method to further clarify the effect relationship between environmental regulation and green technology innovation.

3.1 Literature search

Looking back at China’s reform proposals for environmental protection tax, as early as 2006, a member of the Chinese People’s Political Consultative Conference proposed that the pollutant discharge fee levied on enterprises should be changed to environmental protection tax. In 2007, the Chinese government proposed for the first time that environmental tax legislation will be carried out. Accordingly, the research on environmental protection tax reform in the theoretical circle has mainly focused on the past 15 years. Therefore, this study set the period of literature search from January 2006 to December 2020. According to the criteria proposed by Moher et al. (2009), research literature search and acquisition went through the following four steps.

3.1.1 Search the literature

To ensure the integrity of the literature data in the meta-analysis of this study, two literature retrieval methods were used in this study. First, search for Chinese journals and literature on China National Knowledge Infrastructure (CNKI) and China Science and Technology Journal Database with the subject words of “environmental regulation, environmental tax, carbon tax, green tax system” and “green innovation, green technology innovation, and environmental protection technology innovation”; Search English literature in Web of Science and Sciencedirect databases with the subject words “environmental regulation, environmental tax, environmental policy” and “green innovation, green technological innovation”. Second, it supplements relevant empirical research literature by sorting out the research review of environmental regulation and green technology innovation and sorting out the references in the retrieval papers. A total of 1,777 documents were obtained, including 619 Chinese documents and 1,158 English documents.

3.1.2 Screening literature

This research mainly focuses on China’s environmental regulation and corporate green technology innovation. Based on the retrieved literature, through the relevant information such as title and abstract, the literature that meets the requirements is screened. Screening criteria include: 1) The research samples of the literature must be Chinese enterprises, and the research must include research variables related to environmental regulation and green technology innovation; 2) The literature conducts empirical analysis on the relationship between environmental regulation and green technology innovation or their related dimensions; 3) Only one of the papers published repeatedly; 4) The papers published in the journal after the conference paper are selected. A total of 115 pieces of literature were obtained, including 68 Chinese literature and 47 English literature.

3.1.3 Review the literature

Review the full-text content of the literature to determine whether the literature meets the requirements of meta-analysis. The research literature must report specific data on the relationship between environmental regulation and green technology innovation or their related dimensions, such as correlation coefficient, regression coefficient, standard error, standard deviation, sample size, or the corresponding statistics such as Z value, t value, χ2, etc. The total number of documents obtained is 40, including 25 Chinese documents and 15 English documents.

3.1.4 Include literature

During the process of document coding and data entry, one Chinese document was found to have obvious quality problems. After four steps of retrieval, screening, review, and research inclusion, a total of 39 pieces of literature that met the requirements of the meta-analysis were obtained, and the number of independent samples was 67,111. The simulation results of Guo et al. (1900) show that the meta-analysis results will be accurate, reliable, and consistent if the literature size is over 30 and the sample size is over 70. Therefore, the size of the pieces of literature and the sample of this study both meet the reliability requirements of the meta-analysis.

3.2 Information encoding

The two authors independently extracted and coded the key information of each literature according to the coding table, and then checked each other. The coding results are relatively consistent, and the Kappa coefficient is between .83 and .9. A small amount of inconsistencies shall be resolved by both parties through negotiation. The basic information extracted includes literature title, author information, literature type, environmental policy type, green technology innovation type, industry characteristics, economic region, research methods and other items. In terms of the types of environmental policy intervention, four types of environment can be identified from the original literature, namely, environmental regulation, environmental tax, command controlled environmental regulation, and tax based environmental regulation. This study further integrates environmental tax into tax based environmental regulation. In terms of the type of green technology innovation, the original literature include six kinds of green technology innovation, namely green product innovation, green technology innovation, ecological innovation, green innovation, green process innovation, and green R&D innovation. According to the number of literatures required by meta-analysis, the literatures related to variables that are not sufficient to the number of documents required by meta-analysis are deleted, and the green technology innovation of enterprises is further divided into green product innovation green process innovation and green R&D investment. In terms of industry characteristics, the research objects of the original literature include all industries, heavy pollution industries, resource enterprises, and mineral resource enterprises. In order to meet the quantitative requirements of the subgroup analysis and refer to the classification of existing relevant studies, this study further includes resource enterprises and mineral resource enterprises into the heavy pollution industries. In terms of regional attributes, the regions involved in the original literature are not only for the whole country, but also for some provinces or regions. This study further divides the regions into the whole country, the east, the middle and the west, and conducts a subgroup analysis of economic regions.

3.3 Data processing

This study followed the meta-analysis steps of Borenstein et al. (2021) and used Comprehensive Meta-Analysis (CMA) 3.3 software for data processing and analysis. The study selects the correlation coefficient r as the effect size. If the effect size of the literature is other statistical values, it will be converted into a correlation coefficient before entering the data. Among them, the literature that reported t value, standard error, and standard deviation, it was directly converted into correlation coefficient using CMA software. Since CMA does not directly convert the regression coefficient β, according to the conversion formula proposed by Peterson et al. (2005), the regression coefficient is first converted into a correlation coefficient and then entered into CMA for analysis. Some studies report effect sizes for multiple related outcomes, leading to within-study non-independence. As suggested by Borenstein et al. (2021), if multiple outcome variables of the same dimension are reported in a study, use its average. During the analysis, each ESr was converted into the corresponding Fisher Z value, and then the weighted average of the Fisher Z values was converted into a correlation coefficient to obtain the overall effect size.

4 Meta-analytic results

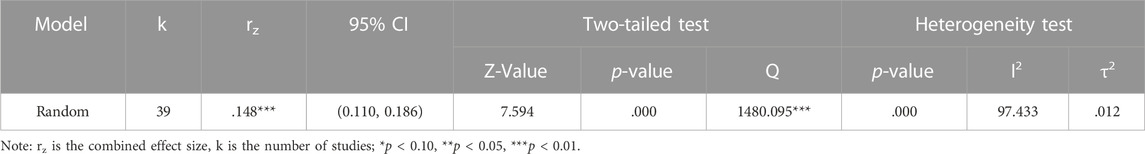

4.1 The heterogeneity test and main effect

In this study, the Q test was used to test for heterogeneity. If there was heterogeneity in the effect sizes of the studies, a random-effects model was used in the main effects analysis, otherwise, a fixed-effects model was used (Borenstein et al., 2021). Table 1 shows the heterogeneity test results of the effect value of the relationship between environmental regulation and enterprise green technology innovation. The results of the heterogeneity test of the relationship between environmental regulation and green technology innovation showed that the Q value was 1480.095 (p < .01), which indicated that there was heterogeneity among studies, and a random effect model should be used, and the potential moderating effect could be further tested. It can be seen from Table 1 that the overall correlation coefficient between environmental regulation and green technology innovation is .148 (p < .01), and the relationship between the two is slightly significantly positive, that is, environmental regulation will stimulate green technology innovation of enterprises, the research hypothesis 1a is supported, while hypothesis 1b was not supported. In addition, I2 was 97.433, indicating that about 97% of the observed variation was caused by the real difference between the effect sizes of the studies, and the observed variation caused by random error only accounted for about 3%, and the analysis results were relatively stable.

4.2 Analysis of the relationship between environmental regulation and enterprise green technology innovation in various dimensions

The green technology innovation of enterprises includes not only the improvement of process design, the realization of energy conservation and emission reduction through process innovation and equipment renewal, but also product innovation to reduce ecological environment damage, and involves increasing investment in green technology research and development. To observe the relationship between environmental regulation and enterprise green innovation more comprehensively and accurately, according to the variable design of existing research, we divide environmental regulation into two dimensions: command-and-control type and tax-based type, and enterprise green technology innovation as the three dimensions of green process innovation, green product innovation, and green R&D investment are tested and analyzed one by one. Some studies on environmental regulation and green technology innovation do not strictly follow the above dimensions in their research design, so they are classified into corresponding dimensions according to their variable descriptions, such as environmental protection tax, carbon tax, and other independent variables are classified into tax-based environmental regulation, the environmental protection technology innovation is classified into the green process innovation.

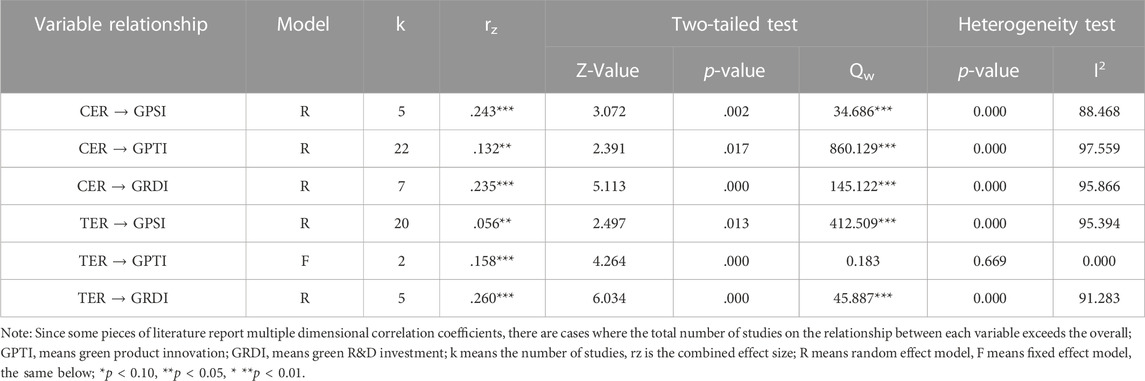

From the analysis results in Table 2, it is found that command and control environmental regulation can significantly stimulate enterprises’ green process innovation (r = .243, p < .01), green product innovation (r = .132, p < .05), and green R&D investment (r = .132, p < .05) r = .235, p < .01), but the effect size on green product innovation is relatively weak, the reason may be that industrial enterprises, especially resource-based enterprises, are built based on specific production process equipment, and the advanced nature of their green production process equipment and green technology R&D investment determine enterprise’s green product innovation and performance (Wang and Jiang, 2015). For tax-based environmental regulation, it can significantly stimulate green process innovation (r = .056, p < .05), green product innovation (r = .158, p < .01) and green R&D investment (r = .260, p < .01). However, compared with green process innovation and green product innovation, the impact on green R&D investment is relatively strongest, the reason may be that there is a mediation effect in green innovation investment, that is, tax-based environmental regulation improves enterprises’ green innovation investment by increasing enterprises’ green innovation investment (green process innovation and green product innovation), which will eventually force enterprises to green upgrade (Sun and Yuan, 2020).

TABLE 2. Effect value and heterogeneity test of each dimension of environmental regulation and enterprise green technology innovation.

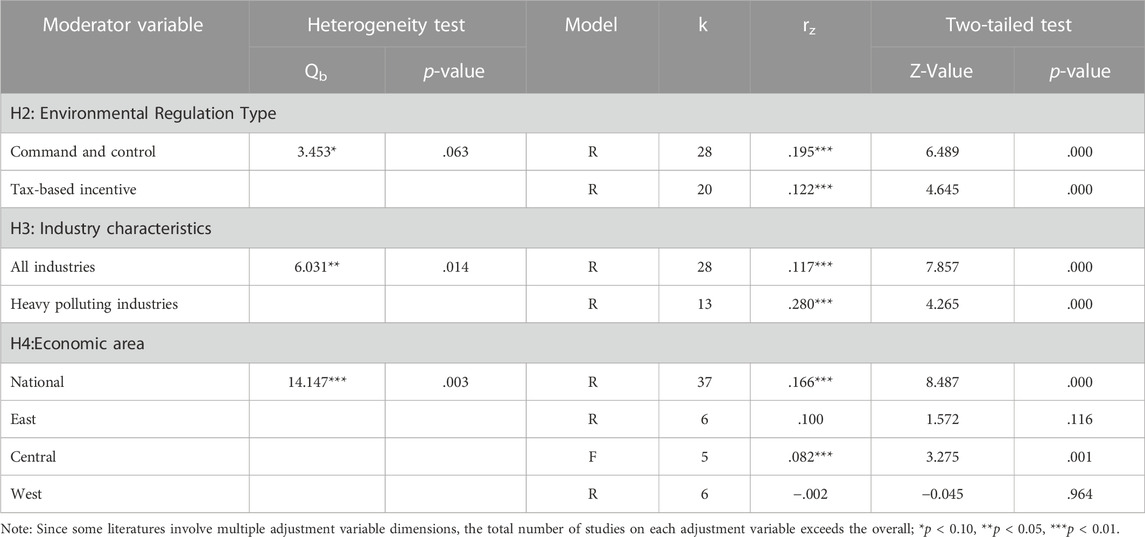

4.3 Moderating effect test

The meta-analysis of the main effects showed that there was some heterogeneity among independent studies, that is, the relationship between environmental regulation and green technology innovation was affected by some potential moderator variables. To further explore the reasons for the inconsistency of research conclusions between environmental regulation and green technology innovation, we will use the subgroup heterogeneity test method to analyze the moderating effect. According to the research hypothesis and the research design included in the meta-analysis literature, this study analyzes the types of environmental regulation (command-and-control environmental regulation and tax-based environmental regulation), enterprise industry characteristics (whole industries and heavily polluting industries), and economic regions (national, eastern, central and western) as moderating variables were included in the subgroup heterogeneity test, and the test results are shown in Table 3.

4.3.1 The moderating effect of environmental regulation types

From the test results in Table 3, it can be seen that the type of environmental regulation has a significant moderating effect on the relationship between environmental regulation and enterprise green technology innovation (Qb = 3.453, p < .10), and research hypothesis 2 is supported. Specifically, both the command-and-control environmental regulation (r = .195, p < .01) and the tax-based environmental regulation (r = .122, p < .01) have significant incentive effects on the green technology innovation of enterprises. However, compared with the tax-based environmental regulation, the command-and-control environmental regulation has a significantly higher incentive effect on green technology innovation, which may be because companies usually adopt new environmental strategies promptly, directly adopting government-designated pollution reduction technologies and environmental standards when implementing command-and-control environmental regulations (Song et al., 2013).

4.3.2 The moderating effect of industry characteristics

From the test results in Table 3, it can be seen that the industry characteristics of the sample significantly moderate the relationship between environmental regulation and corporate green technology innovation (Qb = 6.031, p < .05), and research hypothesis 3 is supported. Specifically, in the studies with all industries as samples (r = .117, p < .01) and heavily polluting industries as samples (r = .280, p < .01), environmental regulation has a significant effect on corporate green technology innovation. However, compared with all industries, the incentive effect of environmental regulation on green technology innovation of enterprises is significantly higher in high-pollution industries. This may be due to the relatively loose environmental supervision of lightly polluted secondary industries, which fails to achieve a strong innovation offset effect (Huang and Liu, 2019). Similarly, Cheng et al. (2019) also conducted a comparative analysis of different industries under different pollution intensities and found that heavily polluting industries are at the forefront of technological innovation in China’s manufacturing industry.

4.3.3 The moderating effect of the economic region

From the test results in Table 3, it can be seen that the economic region where the sample is located significantly moderates the relationship between environmental regulation and corporate green technology innovation (Qb = 14.147, p < .01), and research hypothesis 4 is supported. As a whole, environmental regulation has a significant incentive effect on green technology innovation of enterprises (r = .166, p < .01); In terms of economic regions, in the eastern region (r = .100, p > .01) and the central region (r = .082, p < .01), environmental regulation has an incentive effect on enterprise green technology innovation, but the incentive effect in the central region is slightly lower than that in the eastern region, while in the western region (r = −.002, p > .01), Environmental regulation has an inhibitory effect on enterprise green technology innovation, but it is not significant.

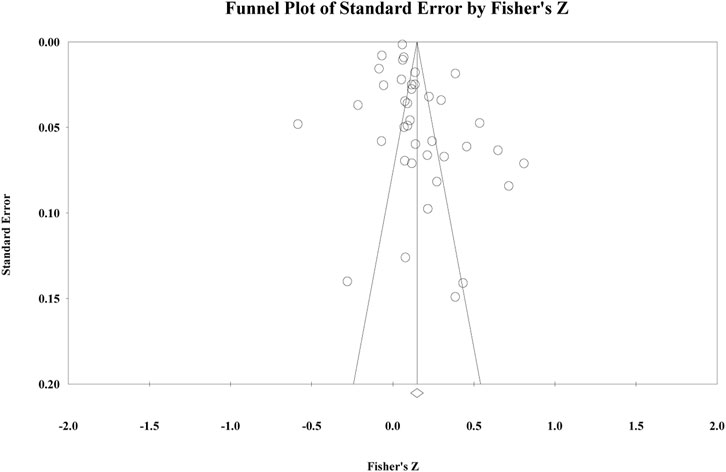

4.3.4 Publication bias test

Publication bias analysis is mainly based on two assumptions: first, studies with significant results are more likely to be published; second, published studies are more likely to enter meta-analysis. Therefore, publication bias needs to be assessed when evaluating meta-analysis results. Three methods were used in this study to examine whether the findings were subject to publication bias. One is the funnel plot. The funnel plot takes the combined effect size as the central axis, if the effect sizes of each study have a relatively symmetrical distribution, it means that publication bias has little influence on the meta-analysis results (Borenstein et al., 2011). The results are shown in Figure 2. The combined effect size of each study has good symmetrical distribution, with the combined effect size as the center line, and most of the effect sizes are concentrated at the top of the funnel plot, which indicates that publication bias has little effect on the results of this study.

The second is the Fail-safe N. The Fail-safe N assumes that due to the existence of unpublished studies with small effect sizes, if these studies are included in the meta-analysis, the current combined effect size may not be significant, and how many studies are needed to zero the combined effect size (Rosenberg, 2005). It is generally believed that the conservative estimate of the number of unpublished studies should be 5k + 10, where k is the number of studies included in the meta-analysis, and the greater the Fail-safe N than the conservative estimate, the smaller the publication bias. In this study, the Rosenthal Fail-safe N (Rosenthal, 1979) was used for evaluation. From the test results in Table 4, the Fail-safe N was 6,950, which was much larger than the conservative estimate of 205 (5*39 + 10), which indicated that publication bias had little effect on the results.

The third is Kendall’s τ coefficient. The τ coefficient is used to evaluate the correlation between the standardized effect size and its variance. If the correlation between the two is not significant, it indicates that publication bias has little effect on the results (Begg and Mazumdar, 1994). The τ coefficient in this study was .120, p = .282, indicating that publication bias had little effect on the results. The test of the above three methods shows that the results of this study have good stability and are less affected by publication bias.

5 Conclusion and policy implications

5.1 Conclusion

Based on 39 independent empirical studies published at home and abroad from 2006 to 2020, this study uses quantitative meta-analysis to re-examine the relationship between environmental regulation and corporate green technology innovation and its corresponding dimensions in the Chinese context, and the moderating variables that affect the relationship between the two under different research characteristics are further discussed, attempting to explore the reasons for the inconsistent results of the existing research, to reach a consistent theoretical consensus based on integrating the inconsistent results of the existing research. The research results show that there is a slight positive correlation between environmental regulation and corporate green technology in the Chinese context, and there is also a significant positive correlation between different types of environmental regulation and corporate green technology innovation in different dimensions, that is, whether it is a command-and-control environmental regulation or a tax-based environmental regulation, it has a positive incentive effect on enterprises’ green product innovation, green process innovation, and green R&D investment. This result also provides new supporting evidence for the Porter hypothesis. In addition, the subgroup analysis results of the meta-analysis show that the type of environmental regulation, enterprise industry characteristics, and economic region will moderate the relationship between environmental regulation and enterprise green technology innovation, and the incentive effect of command and control environmental regulation on enterprise green technology innovation is higher than tax-based environmental regulation; environmental regulation in heavily polluting industries has a higher incentive effect on corporate green technology innovation than other industries; environmental regulation in the eastern region has a higher incentive effect on corporate green technology innovation than in the central region, while the environmental regulation has a certain inhibitory effect on enterprise green technology innovation in the western region.

Overall, consistent with previous studies, the findings of this study further clarify the effect relationship between environmental regulation and corporate green technology innovation. Meanwhile, we theoretically explain the reasons for the inconsistency of existing research conclusions, which provides a new perspective and empirical basis for future research from the heterogeneity of environmental regulation types and industrial characteristics. Furthermore, these findings have important policy implications for the environmental regulation practice of various countries.

5.2 Policy implications

5.2.1 Promoting the improvement and innovation of environmental regulations

In order to improve the governance performance of environmental regulations and successfully achieve China’s goal of carbon peaking and carbon neutrality, the country should constantly promote the improvement and innovation of environmental regulations, encourage enterprises to strengthen green technology innovation in multiple dimensions, and promote the low-carbon environmental transformation of enterprises. First, strengthen the innovation of market environment regulation instruments. At the present stage, China should improve the carbon emission trading system, optimize the internal design of the carbon emission trading system, limit the total carbon emission within a controllable range, and improve the liquidity of carbon market trading. Second, the country will explore ways for multi-party environmental governance. Different types of environmental regulation all have their advantages and limitations. In fact, government regulation, market mechanism and public supervision alone cannot effectively maintain an order with the highest production efficiency, the optimal allocation of resources and the best behavioral constraints of market players. Therefore, it is necessary to combine administrative and market-based environmental regulations to build an environmental governance system dominated by the government and participated by market entities, so as to give full play to the resources and advantages of various entities to achieve the optimization of environmental governance effects.

5.2.2 Optimize the combination of different environmental regulations

When using environmental regulation to promote enterprise green technology innovation, the government should consider using different types of environmental regulation means and tools in different situations, or implement different types of environmental regulation in combination according to the specific local conditions, so as to give full play to the best effect. Compared with developed economies, developing country like China still lacks the market-based regulatory experience advocated by Porter, and the current environmental regulation tools are relatively simple, mainly command-and-control environmental regulation, which is also confirmed by the conclusions of this study. The key question is not which type of environmental regulation is best, but which combination of environmental regulation is best. Therefore, developing countries like China should strengthen the supporting use of different types of environmental regulations and establish a balanced environmental regulation portfolio system to promote more positive corporate green competitiveness synergies. In the aspect of command-and-control environmental regulation, this study found that it has the greatest incentive effect on enterprises’ green process innovation, countries should continuously improve and optimize relevant legal systems, encourage enterprises to adopt pollution control technology at the source, and carry out green process innovation in the production process, it is not to carry out pollution treatment at the end of production to minimize the negative impact of enterprise production on the environment. In the future, environmental supervision should also be strengthened, industry standards should be improved, and enterprises should be encouraged to carry out comprehensive green technological innovations in green research and development, green processes, and green products, and cross the regulatory inflection point as soon as possible. It is necessary to give full play to the role of environmental regulation in promoting green product innovation and improve the enterprise exit mechanism.

This study found that the incentive effect of tax-based environmental regulation on corporate green R&D investment is the largest among all dimensions, which means that economic measures are more conducive to corporate green innovation than the formulation of mandatory environmental standards and emission limits. Therefore, countries should pay attention to the reform and innovation of the environmental regulation system, make the market mechanism play a better role, and use the market-incentive environmental regulation as the main policy tool for pollution control. Actively apply market-oriented environmental regulations, improve the market platform for regional industries, and improve and implement the emission trading system. For enterprises with outstanding performance in energy conservation and emission reduction under the premise of following national energy efficiency standards, the government should give certain incentives and subsidies to guide social investment and technical resources to flow to these enterprises to a certain extent. At the same time, the environmental protection tax system should be improved, and the tax policy design should reduce the R&D cost of enterprises through tax incentives while controlling the pollutant emissions of enterprises, and encourage enterprises to increase investment in green R&D.

5.2.3 Design differentiated environmental regulation policies for enterprises in different industries

This study finds that the incentive effect of environmental regulation on corporate green technology innovation is higher in heavily polluting industries than in other general industries. It can be seen that the incentive effect of environmental regulation on green technology innovation may be different in different industries. Therefore, the government needs to fully consider the gap between industries, establish a green technology innovation promotion system for different industries, and realize green sustainable growth by strengthening the optimal combination of innovation-driven and environmental regulations. For heavily polluting industries, command-and-control environmental regulation will have a significant effect, and the intensity of environmental regulation on heavily polluting industrial enterprises should be increased. In industries with larger elastic coefficients, environmental regulations should be stricter, and strengthening supervision will prompt these enterprises to optimize cleaner production technologies and production processes. The environmental protection tax should further consider the differences between different enterprises and the tax bearing capacity, take into account the quantity and quality, efficiency and fairness, and fully stimulate the green technology innovation power of enterprises.

At the same time, incentives must be increased. High-polluting industries, especially coal mining and chemical fiber production enterprises, lack initiative in establishing cleaner production processes, and remove technical barriers to cleaner production by providing knowledge sharing, information acquisition, financing, and increasing market demand. For industries with almost zero elasticity, such as ferrous metal mines and oil and gas exploration, the government should flexibly use tools such as environmental protection tax, carbon emission cap and trade system, and cleaner production certification. For monopolistic industries such as oil and gas exploration and industries with high market concentration, environmental agreements and information disclosure not only help reduce emissions and increase environmental productivity but also help rebuild government-business cooperation. For non-heavy polluting industries, the government should focus on subsidies and ignore management, reduce direct policy intervention, provide incentives through economic compensation and other means, increase tax incentives for green research and development, and give full play to the guiding role of market mechanisms in the innovation and development of green products.

5.2.4 Give local governments sufficient discretion to choose environmental regulations

The results of this study show that the incentive effect of environmental regulation on corporate green technology innovation in the eastern region of China is higher than that in the central region, while in the western region, environmental regulation has a certain inhibitory effect on corporate green technology innovation. It can be seen that simply shutting down production or shutting down polluting enterprises is not an effective way to reduce pollution, especially in the central and western regions of China where pollution levels are generally high. Therefore, environmental regulation should implement precise policies based on regional differences, and explore the innovative design of market incentive systems, to more effectively stimulate green technology innovation of enterprises. In the eastern region of China, all provinces should vigorously develop pollution trading based on controlling the total amount of pollutants and standards, appropriately raise the environmental protection tax standards for water pollutants and air pollutants within the national range, and internalize the externalities of regional economic development through market mechanisms. At the same time, improve the mechanism for public participation in environmental governance, and encourage enterprises to disclose environmental information and apply for environmental labels. In the central region of China, provinces should speed up the establishment of pollutant emission and disposal standards, and rely on the pilot emission trading pilots established in Shanxi and other provinces to strengthen the market trading mechanism for carbon emission rights. In the western region of China, formulate pollutant discharge standards in line with the level of economic development, and reduce the density of high-polluting enterprises. On this basis, explore the establishment of an emission rights trading market, improve the preferential tax policies for environmental protection tax, and establish a system for the public and enterprises to voluntarily participate in environmental protection.

In addition, economically developed cities should reduce direct market incentive regulations such as fiscal subsidies and rely more on indirect means such as green finance to promote green technology innovation. Due to the large scale of economy, it is difficult for developed cities to fully promote the development of green innovation of enterprises through public finance, and excessive fiscal subsidies will even crowd out the investment of enterprises in green innovation. The government can use the leverage of financial funds to leverage a larger scale of financial capital, and guide enterprises to carry out green technology innovation by vigorously developing green guarantee, green bond and green fund. Meanwhile, the country should optimize the intensity of command-and-control regulation, prevent excessive environmental regulation from leading to the transfer of industry and pollution, provide enterprises with supporting conditions for transformation and upgrading and essential conditions for green technology innovation, and combine management and support, so as to leave enough time and space for enterprises to develop green innovation, improve their awareness of green innovation, and give play to their initiative in green innovation to promote the upgrading and transformation of enterprises.

This study re-clarifies the relationship between environmental regulation and corporate green technology innovation based on integrating existing research. Although there are important discoveries and new arguments revealed by these studies, there are also some limitations. First, because the meta-analysis needs to include the effect size of each study, and some high-quality studies have not been published or reported computable effect values, they were not included in this study, and there may be some bias in the research conclusions. Second, due to data limitations, this study only classifies command-and-control environmental regulation and tax-based environmental regulation and does not cover public participation and voluntary action-based environmental regulation. Third, during the literature search, only studies with China as the sample were selected, and studies with other countries and regions as the object were not included, and the sample data may have certain deviations. Future research can further refine the research on the impact of environmental regulation on corporate green technology innovation based on more types of environmental regulations and the characteristics of different countries and regions, to provide a more theoretical basis and policy reference for the environmental regulation reform of countries.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author contributions

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

Funding

This research was funded by the Project of Jiangxi Social Science (No.20YJ25), the Project of Jiangxi Culture and Art Science(No.YG2021166), and the Science and Technology Research Project of Jiangxi Education Department (GJJ221808).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Begg, C. B., and Mazumdar, M. (1994). Operating characteristics of a rank correlation test for publication bias. Biometrics, 1088–1101. doi:10.2307/2533446

Bi, Q., and Yu, L. C. (2016). Relationship between environmental taxes and enterprise green investment behavior: A panel quantile regression approach. China population. Resour. Environ. 26, 76–82.

Bloom, N., Griffith, R., and Van Reenen, J. (2002). Do R&D tax credits work? Evidence from a panel of countries 1979–1997. J. Public Econ. 85, 1–31. doi:10.1016/S0047-2727(01)00086-X

Borenstein, M., Hedges, L. V., and Higgins, J. P. (2021). Introduction to meta-analysis. New York: John Wiley & Sons.

Cesaroni, F., and Arduini, R. (2001). Environmental technologies in the European chemical industry. Pisa, Italy.: Laboratory of Economics and Management. Working Paper. 9.

Chang, C. H. (2011). The influence of corporate environmental ethics on competitive advantage: The mediation role of green innovation. J. Bus. Ethics 104, 361–370. doi:10.1007/s10551-011-0914-x

Chen, Y. S., Lai, S. B., and Wen, C. T. (2006). The influence of green innovation performance on corporate advantage in Taiwan. J. Bus. Ethics 67, 331–339. doi:10.1007/s10551-006-9025-5

Cheng, M., Shao, Z., Yang, C., and Tang, X. (2019). Analysis of coordinated development of energy and environment in China’s manufacturing industry under environmental regulation: A comparative study of sub-industries. Sustainability 11, 6510. doi:10.3390/su11226510

China Environment (2022). Yale and Columbia university jointly released the environmental performance index for 2022. China: China Environment.

Chiou, T. Y., Chan, H. K., Lettice, F., and Chung, S. H. (2011). The influence of greening the suppliers and green innovation on environmental performance and competitive advantage in Taiwan. Transp. Res. Part E Logist. Transp. Rev. 47, 822–836. doi:10.1016/j.tre.2011.05.016

Christainsen, G., Gollop, F. M., and Haveman, R. H. (1980). Environmental and health/safety regulations, productivity growth, and economic performance: An Assessment. United States: US Government Printing Office.

Conrad, K., and Morrison, C. J. (1989). The impact of pollution abatement investment on productivity change: An empirical comparison of the U. S., Germany, and Canada. South. Econ. J. 55, 684–698. doi:10.2307/1059582

Czarnitzki, D., Hanel, P., and Rosa, J. M. (2011). Evaluating the impact of R&D tax credits on innovation: A microeconometric study on Canadian firms. Res. Policy 40, 217–229. doi:10.1016/j.respol.2010.09.017

Frondel, M., Horbach, J., and Rennings, K. (2007). End-of-pipe or cleaner production? An empirical comparison of environmental innovation decisions across OECD countries. Bus. strategy Environ. 16, 571–584. doi:10.1002/bse.496

Guo, C. Y., Zhu, Y., and Wang, Q. Z. (1900). A simulated comparative study of significance t-test and meta-analysis. Acta Psychol. Sin. 2, 155–159.

Gurevitch, J., Koricheva, J., Nakagawa, S., and Stewart, G. (2018). Meta-analysis and the science of research synthesis. Nature 555, 175–182. doi:10.1038/nature25753

Hamamoto, M. (2006). Environmental regulation and the productivity of Japanese manufacturing industries. Resour. Energy Econ. 28, 299–312. doi:10.1016/j.reseneeco.2005.11.001

He, N., and Li, X. J. (2018). Enterprise heterogeneity, environmental protection tax and technological innovation: A study from the perspective of tax system greening. Tax. Res. 3, 74–80. doi:10.19376/j.cnki.cn11-1011/f.2018.03.014

He, Y. M., and Luo, Q. (2018). Environmental regulation, technological innovation and industrial total factor productivity of China: Reexamination of the strong potter hypothesis. Soft Sci. 32, 20–25. doi:10.13956/j.ss.1001-8409.2018.04.05

He, Y. M., Luo, Q., and Zhu, X. W. (2018). Environmental regulation, ecological innovation and enterprise competitiveness: An analysis based on data of mineral resources enterprises. Commer. Res. 3, 132–137. doi:10.13902/j.cnki.syyj.2018.03.017

Herdt, R. W. (1987). A retrospective view of technological and other changes in Philippine rice farming, 1965-1982. Econ. Dev. Cult. Change 35, 329–349. doi:10.1086/451588

Howell, A. (2016). Firm R&D, innovation and easing financial constraints in China: Does corporate tax reform matter? Res. Policy 45, 1996–2007. doi:10.1016/j.respol.2016.07.002

Huang, X., and Liu, X. (2019). The impact of environmental regulation on productivity and exports: A firm-level evidence from China. Emerg. Mark. Finance Trade 55, 2589–2608. doi:10.1080/1540496x.2019.1584556

Information Office of the State Council (2021). White paper on China's policies and actions to address climate change. China: Information Office of the State Council.

Jaffe, A. B., and Palmer, K. (1997). Environmental regulation and innovation: A panel data study. Rev. Econ. Statistics 79, 610–619. doi:10.1162/003465397557196

Jia, K., and Wang, G. J. (2000). Discussion on improving and perfecting my country's environmental tax system. Tax. Res. 9, 43–48.

Lanoie, P., Patry, M., and Lajeunesse, R. (2008). Environmental regulation and productivity: Testing the porter hypothesis. J. Prod. Analysis 30, 121–128. doi:10.1007/s11123-008-0108-4

Liu, J. H., Zhou, Z. B., and Liu, Y. (2015). Research on the construction of China's environmental tax system from the perspective of double dividends: Based on international comparative analysis. Macroeconomics 2, 68–77. doi:10.16304/j.cnki.11-3952/f.2015.02.008

Lu, H. Y., Liu, Q. M., Xu, X. X., and Yang, N. N. (2019). An environmental protection tax achieves reducing pollution and economic growth? Based on the change perspective of China's sewage charges. China Popul. Resour. Environ. 29, 130–137.

Moher, D., Liberati, A., Tetzlaff, J., and Altman, D. G.PRISMA Group (2009). Reprint-preferred reporting items for systematic reviews and meta-analyses: The PRISMA statement. Phys. Ther. 89, 873–880. doi:10.1093/ptj/89.9.873

Montero, J. P. (2002). Market structure and environmental innovation. J. Appl. Econ. 5, 293–325. doi:10.1080/15140326.2002.12040581

Mukherjee, A., Singh, M., and Žaldokas, A. (2017). Do corporate taxes hinder innovation? J. Financial Econ. 124, 195–221. doi:10.1016/j.jfineco.2017.01.004

Pan, X., Cheng, W., Gao, Y., Balezentis, T., and Shen, Z. (2021). Is environmental regulation effective in promoting the quantity and quality of green innovation? Environ. Sci. Pollut. Res. 28, 6232–6241. doi:10.1007/s11356-020-10984-w

Peterson, R. A., and Brown, S. P. (2005). On the use of beta coefficients in meta-analysis. J. Appl. Psychol. 90, 175–181. doi:10.1037/0021-9010.90.1.175

Rosenberg, M. S. (2005). The file-drawer problem revisited: A general weighted method for calculating fail-safe numbers in meta-analysis. Evolution 59, 464–468. doi:10.1111/j.0014-3820.2005.tb01004.x

Rosenthal, R. (1979). The file drawer problem and tolerance for null results. Psychol. Bull. 86, 638–641. doi:10.1037/0033-2909.86.3.638

Shen, N., and Liu, F. C. (2012). Can intensive environmental regulation promote technological innovation: Porter hypothesis reexamined. China Soft Sci. 4, 49–59.

Song, M., Wang, S., and Zhang, H. (2020). Could environmental regulation and R&D tax incentives affect green product innovation? J. Clean. Prod. 258, 120849. doi:10.1016/j.jclepro.2020.120849

Song, M., Zhang, L. L., An, Q. X., Wang, Z. Y., and Zhen, L. (2013). Statistical analysis and combination forecasting of environmental efficiency and its influential factors since China entered the WTO: 2002–2010–2012. J. Clean. Prod. 42, 42–51. doi:10.1016/j.jclepro.2012.11.010

Sun, S. J., and Xi, F. R. (2022). Analysis and countermeasures of green technology market development: Based on panel data of technology contracts in Shanghai from 2016 to 2020. Sci. Technol. Industry 22, 202–208.

Sun, Y. P., and Yuan, Z. M. (2020). Will environmental protection tax force enterprises to upgrade? Based on the analysis of the mediation effect of innovation investment. Tax. Res. 4, 95–102.

Wagner, M. (2007). On the relationship between environmental management, environmental innovation and patenting: Evidence from German manufacturing firms. Res. Policy 36, 1587–1602. doi:10.1016/j.respol.2007.08.004

Wang, F. Z., and Jiang, T. (2015). The impact of environmental regulation on green technology innovation in resource-based industries: Based on the perspective of industry heterogeneity. Res. Financial Econ. Issue 8, 17–23.

Wang, Y., and Shen, N. (2016). Environmental regulation and environmental productivity: The case of China. Renew. Sustain. Energy Rev. 62, 758–766. doi:10.1016/j.rser.2016.05.048

Wang, Y., Sun, X., and Guo, X. (2019). Environmental regulation and green productivity growth: Empirical evidence on the Porter Hypothesis from OECD industrial sectors. Energy Policy 132, 611–619. doi:10.1016/j.enpol.2019.06.016

Wen, H. W., and Zhong, Q. M. (2020). Environmental protection taxes and green technology innovation of enterprises: Evidence from the adjustment of pollution charges standard in China. J. Guizhou Univ. Finance Econ. 3, 91–100.

Wu, S. L., Zhou, Y. C., and Tang, G. P. (2022). Green bonds: Green innovation, environmental performance and corporate value. J. Xiamen Univ. 72, 71–84.

Xepapadeas, A., and De Zeeuw, A. (1999). Environmental policy and competitiveness: The porter hypothesis and the composition of capital. J. Environ. Econ. Manag. 37, 165–182. doi:10.1006/jeem.1998.1061

Xie, M. H., Wang, J., and Liu, D. M. (2014). Environment regulation, technological innovation and corporate performance. Nankai Bus. Rev. 17, 106–113.

Yu, L. C., Zhang, W. G., and Bi, Q. (2019). Can environmental taxes force corporate green innovation? J. Audit Econ. 34, 79–90.

Zhang, J., Geng, H., Xu, G. W., and Chen, J. (2019). Research on the influence of environmental regulation on green technology innovation. China Popul. Resour. Environ. 29, 168–176.

Zhang, N., Deng, J., Ahmad, F., and Draz, M. U. (2020). Local Government competition and regional green development in China: The Mediating role of environmental regulation. Int. J. Environ. Res. Public Health 17, 3485. doi:10.3390/ijerph17103485

Zhang, P., Zhang, P. P., and Cai, G. Q. (2016). Comparative study on impacts of different types of environmental regulation on enterprise technological innovation. China Popul. Resour. Environ. 26, 8–13.

Keywords: environmental regulation, green technology innovation, environmental regulation type, industry characteristics, economic area, meta-analysis

Citation: Ren G and Chen Y (2023) Is the impact of environmental regulation on enterprise green technology innovation incentives or inhibitions? A re-examination based on the China meta-analysis. Front. Environ. Sci. 10:1038607. doi: 10.3389/fenvs.2022.1038607

Received: 07 September 2022; Accepted: 23 December 2022;

Published: 06 January 2023.

Edited by:

Ming Chuan Yu, Shanghai Normal University, ChinaReviewed by:

Syed Tauseef Hassan, Nanjing University of Information Science and Technology, ChinaElchin Suleymanov, Baku Enginering University, Azerbaijan

Copyright © 2023 Ren and Chen. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Gaofei Ren, Z2FvZmVpX3JlbkBqanUuZWR1LmNu

Gaofei Ren

Gaofei Ren Yaoyao Chen

Yaoyao Chen