- 1Bucharest University of Economic Studies and Institute of National Economy, Bucharest, Romania

- 2Ghazi University, Dera Ghazi Khan, Pakistan

- 3Khon Kaen University, Khon Kaen, Thailand

- 4Szèchenyi Istvàn University, Győr, Hungary

This study investigates the relationship between economic growth, oil price, and circular economy through biomass energy consumption in South Asian countries, examining the possibility of biomass consumption by enhancing economic growth and decreasing oil price. Energy is the backbone of economic growth, while biomass energy resources being the best renewable energy resource alternative considering the production cost. There are no studies in the literature with regard to the influence of biomass consumption on economic growth and oil price; our study has been designed to fill this gap. For this, we used data for the period 2010–2020 and ARDL and Granger causality. The findings show that all elasticities are statistically significant in the short term for Pakistan, India, Bangladesh, and Sri Lanka. In the long term, coefficients of oil price for Pakistan and Sri Lanka are positively associated with significant elasticities, whereas biomass energy consumption is negatively associated with oil price in India and Bangladesh. Biomass energy consumption significantly impacts the economic growth of Pakistan and Bangladesh in the long term, whereas in the case of India and Bangladesh, an association between biomass energy consumption and GDP is shown. As a policy implication, governments can create and adjust policies in order to reduce costs in the energy system and protect the environment from pollution with the adoption of a biomass energy system because fossil oil and coal energy systems are unfavorable to economic growth, especially across South Asian countries.

1 Introduction

Energy is the backbone of economic growth and is considered to be vital for the generation of assets for a country. Energy resources are as important as food, clothes, and shelter all over the world. Fossil fuels are the primary source of carbon dioxide emissions and cause environmental issues. Correspondingly, countries are being encouraged to move toward alternative renewable energy resources (Cong and Shen, 2013). Moreover, fossil fuel is associated with carbon dioxide emissions (Bilgili, 2012), mold, and nonrenewable energy resources, such as oil and gas. There are inadequate reserves of oil and gas, and they present environmental threats. Khan et al. (2020) stated the relationship between energy consumption and economic growth. Oil consumption does not affect the economic growth of the resource-rich countries but causes it to retrogress in the resource-poor countries (Adekoya, 2021).

Oil crises in 1970s forced developed countries to focus on a long-term shift from fossil energy resources to inexhaustible and sustainable energy sources. To increase living standards and indigenous communal welfare, a circular economy is mandatory, requiring clean and renewable energy. Inexhaustible energy, especially biomass energy is a key element for steady global development (Bildirici and Ozaksoy, 2013; Vasa et al., 2018) and has a significant influence in a circular economy, both in terms of material products and the provision of energy (Czikkely et al., 2018; Magda et al., 2019; Sherwood, 2020). Policymakers in many countries are recommended to adopt and promote renewable energy sources that will help meet the increased demand for energy by replacing old traditional energy sources such as coal, gas, and oil. Renewable energy sources are reusable and can reduce CO2 emissions and also ensure sustainable economic development (Khan et al., 2020).

Biomass energy resources (BERs) are the best renewable energy resource alternative at a reasonable production cost (Nunes et al., 2020). Herbaceous crops grown for energy generation, planting of trees, agricultural residues, forest production, wood wastes, water powers, specialized wood, and residues for paper production are included in BER (Aslan, 2016). Biomass is solitary inexhaustible carbon energy, and with its rectitude of skimpy sulfur, skimpy ash, almost zero-net emission of carbon dioxide, and sufficient sources, economies are progressively considering and embracing its growth and utilization (Zhang et al., 2011). Biomass is highly significant in a circular economy in terms of material products and the provision of energy (Sherwood, 2020). Biomass consumption (BMC) is an incentive for GDP and leads to a decline in poverty in developing countries because full-time energy demands in all parts of the world can be met through it without costly transmogrification instruments (Bildirici et al., 2012).

Environmental pollution, rapid increase in global population, and economic pressure all prompt the world to move toward renewable energy resources and the use of biomass energy as an appropriate alternative to expensive energy resources (Bildirici and Ersin, 2015). Many South Asian countries are also affected by environmental pollution and economic burdens. Developing countries are struggling more to achieve sustainable economic growth (Mehmood, 2021). Therefore, revisiting renewable energy for economic gains could be an appropriate strategy for both environmental and economic sustainability. Developed and BRICS countries consume more natural resources due to higher economic development, as a result of environmental concern (Wu et al., 2017). While Asian economies can be developed at the same time as preserving the environment through more robust regional environmental policies and renewable energy resources (Mohsin et al., 2021), it is important to discuss the relationship between GDP and BMC in more detail, particularly for developing countries like Pakistan, India, Bangladesh, and Sri Lanka.

In this context, biomass energy systems can reduce energy costs and limit environmental pollution. Correspondingly, academics and researchers suggest that there is a need to pay more attention to the adoption of this energy system. Thus, the present research analyzes the relationship between BMC, oil price, and economic growth, filling the gap in the literature. To the best of our knowledge, there are no studies in the literature regarding the relation to the influence of BMC on economic growth and oil price. Ultimately, this research examines the possibility of BMC enhancing economic growth and decreasing the oil price across South Asian countries.

The rest of the study is structured as follows: Section 2 briefly discusses the literature and theoretical background; Section 3 discusses the data and methodology used in the research study; Section 4 documents the major results; and Section 5 concludes the study.

2 Literature review

Biomass energy consumption is influenced by GDP and oil prices (Hung, 2022). Aslan (201^) investigated the relationship between biomass energy and GDP and suggested that biomass energy positively impacts GDP of the United States, both in the short and long run. A positive relationship between GDP and BMC is also found in BRICS countries for the medium and long term and for the short term in the United States and the United Kingdom (Hung, 2022). As can be seen, the impact on the economy is different in terms of period and countries.

For developing countries, a biogas unit is much more cost-efficient than conventional fuels spent in Pakistan. Biomass energy generation systems are nowadays in demand, and over the time their number is registered as steadily increasing. Biomass energy involves low costs compared to other production systems, as it can be established with a small investment. It is argued that a biomass energy system should be applied in developing countries for many reasons. These include the low costs of biomass energy systems compared to other applied energy systems, the fact that in developing countries 70% of people are normally resident in rural areas and that the establishment of a biomass energy system creates another opportunity in the form of gas bottles.

Energy requirements play a vital role, especially in a rapidly growing economy (Kumar et al., 2010; Apostu et al., 2022; Panait et al., 2022; Panait et al., 2022). Energy requirements have steadily increased over the last 2 decades because of high consumption in growing economies like India. These requirements are expected to increase in the future by leaps and bounds. This is an alarming situation in India, and the government needs to pay attention to renewable energy to meet future demand and combat the risk of an energy crisis. Comparing the Indian economy to other South Asian countries, India’s policy has resulted in a better performance. In this context, India is adopting biomass energy techniques (Kumar and Lu., 2010).

In Sri Lanka, Perera et al. (2005) analyzed biomass energy consumption and calculated the energy resources in the period from 1997 to 2010. This research found that the Sri Lankan government produces only 8% TWh–10% TWh efficiency, and in fact, they can produce 25% efficiency. This is an alarming situation for the Sri Lankan government, with adverse implications for their GDP. Furthermore, the annual demand for energy in Sri Lanka is higher than their supply. So, the Sri Lankan government, policymakers, and energy departments need to consider an alternative energy system. A biomass energy system would also be helpful for their economy, and they can meet future energy requirements by adopting it in Sri Lanka. In the case of Bangladesh, Mozumder et al. (2011) found that energy consumption had a significant impact on GDP. Academics suggest that energy consumption can not only increase the GDP but also decrease the GDP in the case of Bangladesh. The magnitude of the economic impact depends on how the budgetary savings from the removal of electricity subsidy and the increased revenue due to the removal of indirect subsidies to natural gas are reallocated to the economy (Timilsina & Pargal, 2020). Moreover, there are shortages of energy that might precipitate an energy crisis in the future in Bangladesh. Additionally, the oil price has also changed due to energy consumption. Hence, the focus should be on low energy production and biomass adoption which would be favorable for the economy.

A recent literature on the relationship between biomass energy consumption and GDP suggests that, as BMC increases, there is a significant and positive impact on GDP (Solarin et al., 2018; Gao & Zhang, 2021). Effective energy policies to improve the infrastructure of biomass energy supply lead to economic growth (Bilgili & Ozturk, 2015). A major source of energy in poorer countries like sub-Saharan countries is woody biomass energy. Woody biomass energy is a renewable resource in that area and directly impacts the economic growth of these countries (Bildirici and Ozaksoy, 2016). Biomass energy is renewable energy (Bildirici and Ersin, 2015), and higher consumption of renewable energy boosts energy efficiency, thus developing technology which generates economic growth (Naseri et al., 2016; Oláh et al., 2021).

Previous studies adopt various techniques, for instance, fully modified OLS (FMOLS), panel co-integration tests, and panel unit root tests, to explore the relationship between BMC and economical factors (Gao & Zhang, 2021). Bildirici et al. (2012) examined the relationship between GDP and biomass energy consumption for seven countries using vector error-correction models , the bound testing method to check co-integration, and the ARDL approach. A unidirectional relationship between BMC and GDP and a co-integration between BE and GDP were identified in the case of five countries (Brazil, Colombia, Guatemala, Chile, and Bolivia), and no co-integration between BMC and GDP was identified in two countries (Jamaica and Argentina). Bildirici and Ozaksoy, (2013) investigated the relationship between biomass energy consumption and GDP in 10 European countries. The results indicated that there is a unidirectional causality from GDP to biomass energy consumption for Austria and Turkey and from biomass energy consumption to GDP for Hungary and Poland. Bidirectional causality was found in Spain, France, and Sweden. Strong and long-run causalities showed bidirectional causalities for all countries.

GDP growth can be predicted by nominal oil prices (Narayan et al., 2014). Thus, oil prices were used as an independent variable. GDP growth was not influenced by a continuous increase in oil prices, and a rise in oil prices tend to increase the production of goods and services, generating greater wealth for the economy (Idrisov et al., 2015). If an economy is not able to achieve significant demand elasticity, a change in the annual real oil price can be reached by 12%, and in the following year, production moves toward its peak. The long-term real oil prices are expected to be negative due to fundamental demand and supply until the production level is reached. Haugom et al. (2016) demonstrated that the oil price plays a major role in the rise or fall in domestic production which leads to economic growth.

Du et al. (2010) revealed that the crude oil price is co-integrated with global economic activity. These results also suggest that fluctuation in oil prices influences GDP growth. GDP growth is significantly affected by biomass energy consumption and population, reducing energy consumption which negatively affects GDP growth (Ozturk and Bilgili, 2015). Higher biomass energy consumption positively impacts GDP growth, and oil price variation also affects the economic growth rate. Payne (2011) and Bildirici (2014) used the ARDL method to investigate the relationship between biomass energy consumption and GDP growth.

The causal relationship between biomass energy consumption and GDP growth can be synthesized into four hypotheses which need to be tested for developing countries. First is the GDP growth hypothesis: biomass energy consumption has a significant impact on GDP growth (Bilgili and Ozturk, 2015). Second is the conservation hypothesis: there is a unidirectional causality from GDP growth to biomass energy consumption (Bildirici and Ozaksoy, 2016). Third is the feedback hypothesis: this hypothesis highlights the interdependent relationship between biomass energy consumption and GDP growth (Bildirici and Ersin, 2015). Fourth is the neutrality hypothesis: this hypothesis is supported by the absence of causality between biomass energy consumption and GDP growth (Bildirici and Ozaksoy, 2013).

In order to analyze the relationship between biomass energy consumption, GDP growth, and oil prices in South Asia, the present study represents the first attempt in the literature to use the co-integration technique. The demand function of biomass energy consumption is explained as follows:

Variables are denoted as BMC, real GDP (Y), and crude oil prices. In the following sections, econometric attributes are used to explain the relationship 1) in a long-linear form.

3 Data and methodology

The study aims to analyze the long-run and short-term relationship between BMC, GDP growth, and oil prices in countries, namely, Pakistan, India, Bangladesh, and Sri Lanka. Therefore, data were provided by the data stream for the period 2010–2020, and the causality was investigated by the ARDL co-integration technique of Pesaran et al. (2001) and the Granger causality test.

3.1 ARDL

The ARDL approach of co-integration, developed by Pesaran (1997) and Pesaran et al. (1999), is used to investigate the causality between BMC, GDP growth, and oil prices in countries, namely, Pakistan, India, Bangladesh, and Sri Lanka. The relationship of co-integration of Johansen (1988), Engle and Granger, (1987), and Johansen and Juselius, (1990) is associated with problems, which led to choosing ARDL for the current study. ARDL presents a number of advantages over other models. First, ARDL is used in the case when repressors are 1 (0) or 1 (1) which means unit root pretesting is not required, but all variables must be in equal sequence of integration for the application of the Johansen co-integration approach. Second, a large data sample is required for the Johansen co-integration approach for validity; in case, the data sample is small, ARDL is more effective for investigating a co-integration relationship. Third, different optimal lags of the variables are allowed by ARDL. Finally, to estimate a long-term relationship, ARDL uses a solitary minimized equation form, whereas other approaches use system equations.

Srinivasan et al. (2012) explained two steps of the ARDL method for co-integration for predicting a long-run relationship. The first step is to estimate the long-term relationship among all variables using the following equation:

In the present research, the Akaike information criterion has been used for the selection of lag terms. Furthermore, bound testing has also been used on the joint F-statistic to evaluate the null hypothesis of no-integration. In the second step, if co-integration is established, the conditional ARDL long-run model for BMC can be estimated as follows:

3.2 Granger causality

Granger causality analysis (Granger, 1969) is used to determine the causality between BMC, GDP growth, and oil price (OP) because ARDL is not a specific tool to determine causality. To investigate the causal relationship among variables vector error-correction (VEC) model is used:

where residuals

4 Empirical results

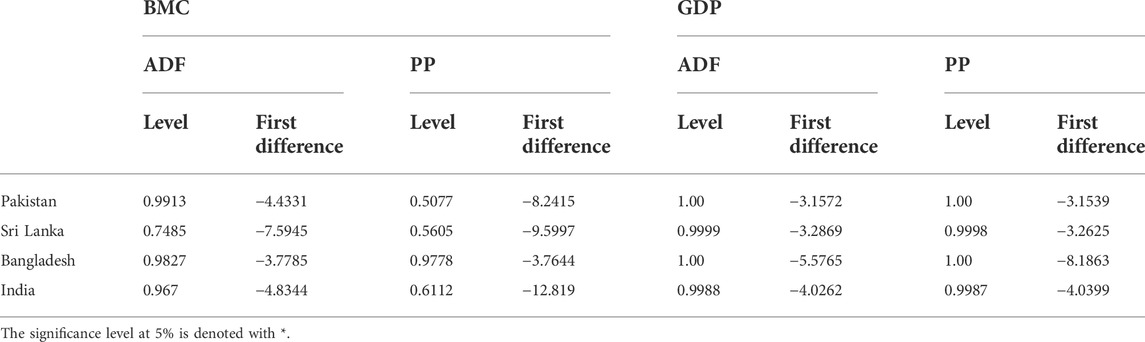

In the present research, a unit root test is used to determine the long-run relationship among the variables on the basis of the following tests: 1) the traditional ADF unit root test; and 2) Philips–Perron test.

According to Table 1, the ADF unit root test results suggested that BMC and Y series are I (1) processes, being stationary after the first difference for all countries analyzed. Furthermore, the Philips–Perron unit root test confirmed the results of the traditional ADF test.

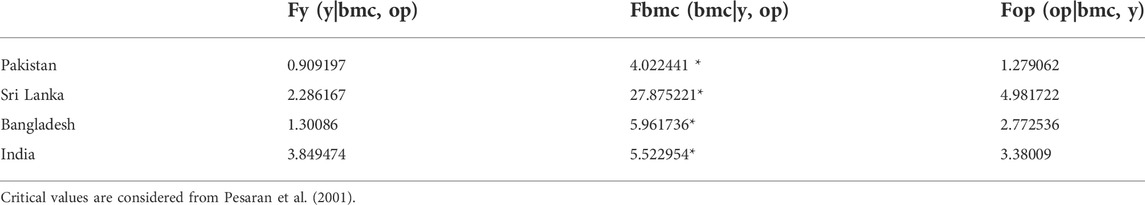

In order to evaluate the result of ARDL bound tests, dummy variables have been used to determine the breakpoint (Table 2).

The F-statistics critical upper bound of Pesaran indicated strong evidence to reject the null hypothesis of no-co-integration in favor of co-integration at a 5% significance level.

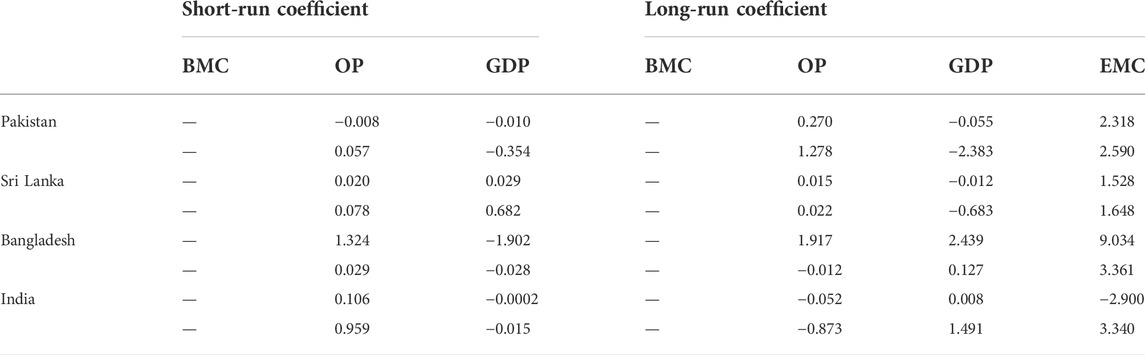

The results confirmed the presence of a unique co-integration vector. For Pakistan, India, Bangladesh, and Sri Lanka, the F tests suggested one co-integrating vector, the biomass consumption, being considered the dependent variable for these countries. Thus, the results in Table 2 suggested the existence of a unique ARDL long-run relationship among variables. Table 3 indicates the long-term and short-term elasticity of the ARDL model.

Based on the aforementioned results, there is strong evidence according to which a long-term relationship is found for the coefficient estimates. The elasticities are interpreted as usual, for instance, a 1% increase on international oil prices leads to a 0.008% decrease on the consumption of biomass energy in Pakistan. For Pakistan, India, Bangladesh, and Sri Lanka, all elasticities are statistically insignificant on the short run at a 5% level. For Pakistan, the coefficient of OP is negative, whereas BMC positively impacts oil prices in all remaining countries. The coefficient of GDP is positive for Sri Lanka, but the association between BMC and GDP is negative for Pakistan, Bangladesh, and India. Moreover, the growth hypothesis is not accepted in the short run for all South Asian countries.

In the long term, the coefficients of oil price for Pakistan and Sri Lanka are positive, whereas BMC is negatively associated with oil prices in India and Bangladesh. Elasticities of oil prices are insignificant in the long run for all the countries. India and Bangladesh show a positive association between GDP and BMC, but this association is negative for Pakistan and Sri Lanka. BMC significantly impacts GDP of Pakistan and Bangladesh in the long run, indicating that the growth hypothesis is accepted, but the elasticity of GDP is insignificant for India and Sri Lanka, rejecting the growth hypothesis.

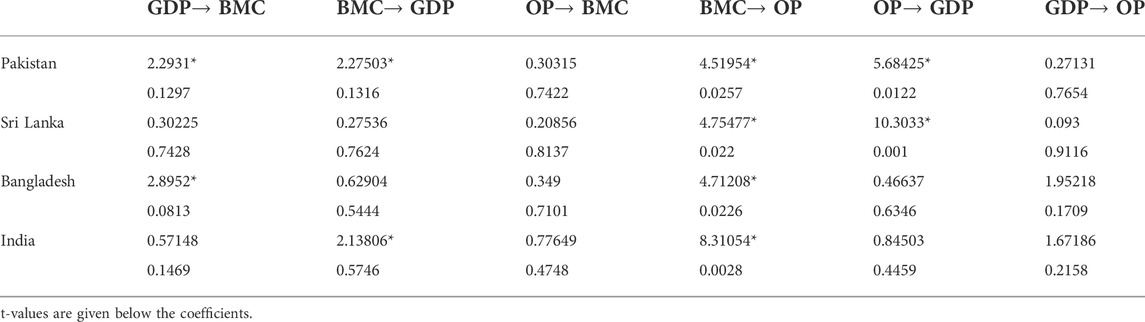

The autoregressive distributed lag model did not determine the direction of causality, although on the basis of the present research on oil prices, biomass energy consumption, and economic growth register a long-term relationship. Table 4 shows the results of the causality relationship among variables.

The Granger causality test results indicated that the conservation hypothesis has been accepted in Pakistan and Bangladesh. Based on the present research, we found that energy conservation policies have no significant impact on Y. The growth hypothesis was accepted for Pakistan and Bangladesh. This shows that an increase in BMC significantly increases GDP growth, confirming the third hypothesis. As for Sri Lanka, our research found that there is an opposite movement regarding the oil price to GDP growth and oil price to BMC. Thus, the fourth hypothesis was accepted only in the case of Pakistan.

Our results are similar to what we found in the literature. Regarding the growth hypothesis, Aydin (2019) found a positive and significant relationship between economic growth and biomass energy consumption in the case of BRICS countries. The same results were encountered by Shahbaz et al. (2016) in BRICS countries and Aslan (2016) in the United States. In the case of OECD countries, Güney and Kantar, (2020) demonstrated that the use of biomass energy sources generates sustainable development. Also, Konuk et al. (2021) indicated a significant relationship between economic growth and biomass consumption, but a negative relationship has been considered for Next-11 countries (except for Vietnam). In the case of European countries, this relationship was confirmed by Apostu et al. (2022).

The conservation hypothesis was also confirmed in the case of the countries in our sample, similar to the extant literature. According to Bildirici and Özaksoy, (2013), there is a unidirectional causality from GDP to biomass energy consumption in the case of Austria and Turkey, but there is also a unidirectional causality from biomass energy consumption to GDP for Hungary and Poland, whereas for Spain, Sweden, and France, the causality is bidirectional. A short-run unidirectional causality from GDP to biomass energy consumption was also detected for developing countries in Asia, determining the GDP role in the adjustment process (Gao and Zhang, 2021). The same results were indicated by Kim et al. (2020) in the case of the United States, being necessary to stimulate an increase of biomass production in order to reduce CO2 emissions and increase economic growth.

The interdependent relationship between biomass energy consumption and GDP growth was accepted in the case of the countries in our sample. Considering the United States, Payne (2011) indicated a unidirectional causality from biomass energy consumption to real output. Apergis and Payne, (2011) found a bidirectional causality between renewable energy consumption and economic growth in both short run and long run in Central America. Also, Bowden and Payne, (2010) provided evidence of unidirectional causality from residential renewable energy consumption to real output. Thus, our results are in good agreement with the results in the literature.

The neutrality hypothesis reflects the absence of causality between biomass energy consumption and GDP growth, being accepted in our study only in the case of Pakistan. Apergis and Danuletiu, (2014) analyzed 80 countries and detected that the interdependence between renewable energy consumption and economic growth was not applied, indicating that renewable energy is important for economic growth. Considering OECD countries, the long-term relationship between the variables is present, being mandatory to improve the biomass energy infrastructure as an important source of renewable energy to promote economic growth (Ajmi and Inglesi-Lotz., 2020).

5 Conclusion

The present research study concluded that the growth hypothesis has no support in the context of BMC with oil prices and GDP growth in the four countries taken as samples in South Asia. In contrast, in the case of the long-term context, the growth hypothesis was supported in Pakistan and Bangladesh. Moreover, as for the conservation hypothesis, strong evidence was found from long-run perspectives in India and Bangladesh. On the basis of these results, the research study suggests that the policy of BMC can be applied in such countries, suggesting no adverse movement in GDP growth.

Additionally, bidirectional causality was found only in Pakistan, and there was evidence to support the bidirectional causality for all the other countries. Based on these results, it is evident that BMC and GDP growth are complementary to each other, and an increase in energy consumption stimulates GDP growth and vice versa. In conclusion, the feedback hypothesis has been supported only in Sri Lanka.

Therefore, the present research study provides a clear picture of the relationship among BMC, oil prices, and GDP growth, providing useful insights for policymakers, government, decision-makers, and energy sectors to consolidate the energy system in South Asian countries. As a policy implication, the present research study suggests that South Asian countries should pay attention to biomass energy infrastructure to enhance the energy system and to avoid unfavorable movement in oil prices and GDP growth.

The current research study suggests that governments should consider the adoption of a biomass energy system for their economic growth and control over oil prices. Hence, there are two main benefits. The first one is the fact that governments can save costs and use more of their budgets on health and education. Second, governments can limit environmental pollution through the adoption of a biomass energy system because this system actually has a significant control over carbon dioxide emissions. Future research could extend the work of this study to other countries. Biomass energy studies should be explored in other developing countries because nowadays many countries face similar crises.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material; further inquiries can be directed to the corresponding authors.

Author contributions

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Adekoya, O. B. (2021). Revisiting oil consumption-economic growth nexus: Resource-curse and scarcity tales. Resour. Policy 70, 101911. doi:10.1016/j.resourpol.2020.101911

Ajmi, A. N., and Inglesi-Lotz, R. (2020). Biomass energy consumption and economic growth nexus in OECD countries: A panel analysis. Renew. Energy 162, 1649–1654. doi:10.1016/j.renene.2020.10.002

Apergis, N., and Danuletiu, D. C. (2014). Renewable energy and economic growth: Evidence from the sign of panel long-run causality. Int. J. Energy Econ. Policy 4 (4), 578–587.

Apergis, N., and Payne, J. E. (2011). The renewable energy consumption–growth nexus in Central America. Appl. Energy 88 (1), 343–347. doi:10.1016/j.apenergy.2010.07.013

Apostu, S. A., Panait, M., and Vasile, V. (2022). The energy transition in Europe—A solution for net zero carbon? Environ. Sci. Pollut. Res. Int. 2022, 1–22. doi:10.1007/s11356-022-20730-z

Aslan, A. (2016). The causal relationship between biomass energy use and economic growth in the United States. Renew. Sustain. Energy Rev. 57, 362–366. doi:10.1016/j.rser.2015.12.109

Aydin, M. (2019). The effect of biomass energy consumption on economic growth in BRICS countries: A country-specific panel data analysis. Renew. Energy 138, 620–627. doi:10.1016/j.renene.2019.02.001

Bildirici, M. E., Bakirtas, T., and Kayikci, F. (2012). Economic growth and electricity consumption: Auto regressive distributed lag analysis. J. energy South. Afr. 23 (4), 29–45. doi:10.17159/2413-3051/2012/v23i4a3176

Bildirici, M. E., and Özaksoy, F. (2013). The relationship between economic growth and biomass energy consumption in some European countries. J. Renew. Sustain. energy 5 (2), 023141. doi:10.1063/1.4802944

Bildirici, M. E. (2014). Relationship between biomass energy and economic growth in transition countries: Panel ARDL approach. Gcb Bioenergy 6 (6), 717–726. doi:10.1111/gcbb.12092

Bildirici, M., and Ersin, Ö. (2015). An investigation of the relationship between the biomass energy consumption, economic growth and oil prices. Procedia - Soc. Behav. Sci. 210, 203–212. doi:10.1016/j.sbspro.2015.11.360

Bildirici, M., and Özaksoy, F. (2016). Woody biomass energy consumption and economic growth in Sub-Saharan Africa. Procedia Econ. Finance 38, 287–293. doi:10.1016/s2212-5671(16)30202-7

Bilgili, F., and Ozturk, I. (2015). Biomass energy and economic growth nexus in G7 countries: Evidence from dynamic panel data. Renew. Sustain. Energy Rev. 49, 132–138. doi:10.1016/j.rser.2015.04.098

Bilgili, F. (2012). The impact of biomass consumption on CO 2 emissions: Cointegration analyses with regime shifts. Renew. Sustain. Energy Rev. 16 (7), 5349–5354. doi:10.1016/j.rser.2012.04.021

Bowden, N., and Payne, J. E. (2010). Sectoral analysis of the causal relationship between renewable and non-renewable energy consumption and real output in the US. Energy Sources Part B Econ. Plan. Policy 2010, 400–408. doi:10.1080/15567240802534250

Cong, R. G., and Shen, S. (2013). Relationships among energy price shocks, stock market, and the macroeconomy: Evidence from China. Sci. World J. 2013, 1–9. doi:10.1155/2013/171868

Czikkely, M., Oláh, J., Lakner, Z., Fogarassy, Cs., and Popp, J (2018). Waste water treatment with adsorptions by mushroom compost - the circular economic valuation concept for material cycles. Int. J. Eng. Bus. Manag. 10 (9), 184797901880986. doi:10.1177/1847979018809863

Du, L., Yanan, H., and Wei, C. (2010). The relationship between oil price shocks and China’s macro-economy: An empirical analysis. Energy policy 38 (8), 4142–4151. doi:10.1016/j.enpol.2010.03.042

Engle, R. F., and Granger, C. W. (1987). Co-Integration and error correction: Representation, estimation, and testing. Econometrica 55, 251–276. doi:10.2307/1913236

Gao, J., and Zhang, L. (2021). Does biomass energy consumption mitigate CO2 emissions? The role of economic growth and urbanization: Evidence from developing Asia. J. Asia Pac. Econ. 26 (1), 96–115. doi:10.1080/13547860.2020.1717902

Granger, C. W. (1969). Investigating causal relations by econometric models and cross-spectral methods. Econometrica 37, 424–438. doi:10.2307/1912791

Güney, T., and Kantar, K. (2020). Biomass energy consumption and sustainable development. Int. J. Sustain. Dev. World Ecol. 27 (8), 762–767. doi:10.1080/13504509.2020.1753124

Haugom, E., Mydland, Ø., and Pichler, A. (2016). Long term oil prices. Energy Econ. 58, 84–94. doi:10.1016/j.eneco.2016.06.014

Hung, N. T. (2022). Biomass energy consumption and economic growth: Insights from BRICS and developed countries. Environ. Sci. Pollut. Res. 29 (20), 30055–30072. doi:10.1007/s11356-021-17721-x

Idrisov, G., Kazakova, M., and Polbin, A. (2015). A theoretical interpretation of the oil prices impact on economic growth in contemporary Russia. Russ. J. Econ. 1 (3), 257–272. doi:10.1016/j.ruje.2015.12.004

Johansen, S., and Juselius, K. (1990). Maximum likelihood estimation and inference on cointegration—With appucations to the demand for money. Oxf. Bull. Econ. statistics 52 (2), 169–210. doi:10.1111/j.1468-0084.1990.mp52002003.x

Johansen, S. (1988). Statistical analysis of cointegration vectors. J. Econ. Dyn. control 12 (2-3), 231–254. doi:10.1016/0165-1889(88)90041-3

Khan, M. K., Khan, M. I., and Rehan, M. (2020). The relationship between energy consumption, economic growth and carbon dioxide emissions in Pakistan. Financ. Innov. 6 (1), 1–13. doi:10.1186/s40854-019-0162-0

Kim, G., Choi, S. K., and Seok, J. H. (2020). Does biomass energy consumption reduce total energy CO2 emissions in the US? J. Policy Model. 42 (5), 953–967. doi:10.1016/j.jpolmod.2020.02.009

Konuk, F., Zeren, F., Akpınar, S., and Yıldız, Ş. (2021). Biomass energy consumption and economic growth: Further evidence from NEXT-11 countries. Energy Rep. 7, 4825–4832. doi:10.1016/j.egyr.2021.07.070

Kumar, A., Kumar, K., Kaushik, N., Sharma, S., and Mishra, S. (2010). Renewable energy in India: Current status and future potentials. Renew. Sustain. energy Rev. 14 (8), 2434–2442. doi:10.1016/j.rser.2010.04.003

Kumar, K., and Lu, Y. H. (2010). Cloud computing for mobile users: Can offloading computation save energy? Computer 43 (4), 51–56. doi:10.1109/mc.2010.98

Magda, R., and Tóth, J. (2019). The connection of the methanol economy to the concept of the circular economy and its impact on sustainability. Environ. Sci. Pollut. Res. 8 (2), 58–62. doi:10.2478/vjbsd-2019-0011

Mehmood, U. (2021). Renewable-nonrenewable energy: Institutional quality and environment nexus in South asian countries. Environ. Sci. Pollut. Res. 28 (21), 26529–26536. doi:10.1007/s11356-021-12554-0

Mohsin, M., Kamran, H. W., Nawaz, M. A., Hussain, M. S., and Dahri, A. S. (2021). Assessing the impact of transition from nonrenewable to renewable energy consumption on economic growth-environmental nexus from developing Asian economies. J. Environ. Manag. 284, 111999. doi:10.1016/j.jenvman.2021.111999

Mozumder, P., Vásquez, W. F., and Marathe, A. (2011). Consumers' preference for renewable energy in the southwest USA. Energy Econ. 33 (6), 1119–1126. doi:10.1016/j.eneco.2011.08.003

Narayan, P. K., Sharma, S., Poon, W. C., and Westerlund, J. (2014). Do oil prices predict economic growth? New global evidence. Energy Econ. 41, 137–146. doi:10.1016/j.eneco.2013.11.003

Naseri, S. F., Motamedi, S., and Ahmadian, M. (2016). Study of mediated consumption effect of renewable energy on economic growth of OECD countries. Procedia Econ. Finance 36, 502–509. doi:10.1016/s2212-5671(16)30068-5

Nunes, L. J. R., Causer, T. P., and Ciolkosz, D. (2020). Biomass for energy: A review on supply chain management models. Renew. Sustain. Energy Rev. 120, 109658. doi:10.1016/j.rser.2019.109658

Olah, J., Tiron Tudor, A., Pashkus, V., and Alpatov, G. (2021). Preferences of Central European consumers in circular economy. Ekonomicko-Manazerske Spektrum/Econ. Manag. Spectr. 15 (2), 99–110. doi:10.26552/ems.2021.2.99-110

Ozturk, I., and Bilgili, F. (2015). Economic growth and biomass consumption nexus: Dynamic panel analysis for Sub-Sahara African countries. Appl. Energy 137, 110–116. doi:10.1016/j.apenergy.2014.10.017

Panait, M., Apostu, S. A., Vasile, V., and Vasile, R. (2022). Is energy efficiency a robust driver for the new normal development model? A granger causality analysis. Energy Policy 169, 113162. doi:10.1016/j.enpol.2022.113162

Panait, M., Janjua, L. R., Apostu, S. A., and Mihăescu, C. (2022). Impact factors to reduce carbon emissions Evidences from Latin America. K. (ahead-of-print). doi:10.1108/K-05-2022-0712

Payne, J. E. (2011). On biomass energy consumption and real output in the US. Energy Sources, Part B Econ. Plan. Policy 6 (1), 47–52. doi:10.1080/15567240903160906

Perera, F., Tang, D., Whyatt, R., Lederman, S. A., and Jedrychowski, W. (2005). DNA damage from polycyclic aromatic hydrocarbons measured by benzo [a] pyrene-DNA adducts in mothers and newborns from Northern Manhattan, the World Trade Center Area, Poland, and China. Cancer Epidemiol. biomarkers Prev. 14 (3), 709–714. doi:10.1158/1055-9965.epi-04-0457

Pesaran, M. H., Shin, Y., and Smith, R. J. (2001). Bounds testing approaches to the analysis of level relationships. J. Appl. Econ. Chichester. Engl. 16 (3), 289–326. doi:10.1002/jae.616

Pesaran, M. H., Shin, Y., and Smith, R. P. (1999). Pooled mean group estimation of dynamic heterogeneous panels. J. Am. Stat. Assoc. 94 (446), 621–634. doi:10.1080/01621459.1999.10474156

Pesaran, M. H. (1997). The role of economic theory in modelling the long run. Econ. J. 107 (440), 178–191. doi:10.1111/1468-0297.00151

Shahbaz, M., Rasool, G., Ahmed, K., and Mahalik, M. K. (2016). Considering the effect of biomass energy consumption on economic growth: Fresh evidence from BRICS region. Renew. Sustain. Energy Rev. 60, 1442–1450. doi:10.1016/j.rser.2016.03.037

Sherwood, J. (2020). The significance of biomass in a circular economy. Bioresour. Technol. 300, 122755. doi:10.1016/j.biortech.2020.122755

Solarin, S. A., Al-Mulali, U., Gan, G. G. G., and Shahbaz, M. (2018). The impact of biomass energy consumption on pollution: Evidence from 80 developed and developing countries. Environ. Sci. Pollut. Res. 25 (23), 22641–22657. doi:10.1007/s11356-018-2392-5

Srinivasan, P., Kumar, P. S., and Ganesh, L. (2012). Tourism and economic growth in Sri Lanka: An ARDL bounds testing approach. Environ. Urbanization Asia 3 (2), 397–405. doi:10.1177/0975425312473234

Timilsina, G. R., and Pargal, S. (2020). Economics of energy subsidy reforms in Bangladesh. Energy Policy 142, 111539. doi:10.1016/j.enpol.2020.111539

Vasa, L., Angeloska, A., and Trendov, N. (2018). Comparative analysis of circular agriculture development in selected Western Balkan countries based on sustainable performance indicators. Econ. Annals-XXI 168 (11-12), 44–47. doi:10.21003/ea.v168-09

Keywords: circular economy, economic growth, oil price, South Asian countries, ARDL, Granger causality

Citation: Apostu SA, Hussain A, Kijkasiwat P and Vasa L (2022) A comparative study of the relationship between circular economy, economic growth, and oil price across South Asian countries. Front. Environ. Sci. 10:1036889. doi: 10.3389/fenvs.2022.1036889

Received: 05 September 2022; Accepted: 21 September 2022;

Published: 10 October 2022.

Edited by:

Zahid Yousaf, Government College of Management Sciences Mansehra, PakistanReviewed by:

Asad Javed, Hazara University, PakistanMuhammad Yasir, Government of Khyber Pakhtunkhwa, Pakistan

Copyright © 2022 Apostu, Hussain, Kijkasiwat and Vasa. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Simona Andreea Apostu, c2ltb25hLmFwb3N0dUBjc2llLmFzZS5ybw==; Laszlo Vasa, bGFzemxvLnZhc2FAaWZhdC5odQ==

Simona Andreea Apostu

Simona Andreea Apostu Anwar Hussain

Anwar Hussain Ploypailin Kijkasiwat3

Ploypailin Kijkasiwat3 Laszlo Vasa

Laszlo Vasa