- 1School of Big Data Application and Economics, Guizhou University of Finance and Economics, Guiyang, China

- 2School of Business Administration, Zhongnan University of Economics and Law, Wuhan, China

- 3School of Economics,Hainan University, Haikou, China

- 4Institute of Open Economy, Haikou, China

- 5Department of Political Economy and Public Finance, Economic and Business Statistics and Economic Policy, University of Castilla-La Mancha, Ciudad Real, Spain

- 6Department of Applied Economics, University of Alicante, Alicante, Spain

The carbon emission trading scheme (ETS) is an important measure to implement China’s “double carbon” strategy.We use “China’s carbon emission trading pilot policy” as a quasi-natural experiment to identify theeffect of this market-based environmental regulation on a firm’s export and its impacting mechanisms.Based on the Propensity score matching and difference-in-differences (PSM-DID) method, we observe robust evidence that the carbon emissions trading pilot policy significantly increases the export of regulated firms. And also find that this policy positivelyaffects the exports of both SOEs and non-SOEs. Considering enterprise heterogeneity, the policy positivelyimpacts the exports of FDI firms, large firms, and low industrial concentrations. Moreover, we examine how environmental regulation could affect firmexport through technological innovation, productivity, and product research. The observable evidence leads us to cautiously conclude thatmarket-based environmental regulations in even developing countries could achieve export growth.Based on our findings, we suggest that: 1) policymakers should limit CO2 emissions quotas to ensure an appropriate increase in the price of CO2 emissions; 2) to design a unified carbon ETS market, researchers should explore ways to activate market-oriented environmental regulation tools based on the carbon emission price.

1 Introduction

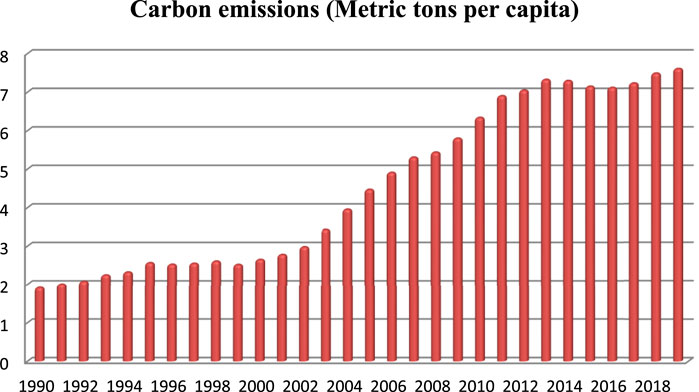

Since the reform and opening up in 1979, China’s foreign trade has developed rapidly and gradually become a vital driving force in promoting the development of China’s national economy. In 2020, China’s total imports and exports will equal more than 30% of GDP, a higher proportion than that of economies such as the United States and Japan. However, China’s reliance on exports to drive its economic development has also come with excessive energy consumption and substantial environmental problem (Li et al., 2018; Shi and Xu, 2018; Chen and Qiao, 2022; Jahanger et al., 2022). In 2013, China consumed almost as much coal as the rest of the world combined. This coal burning will result in China’s carbon dioxide (CO2) emissions reaching 1 billion tons, or 27% of global CO2 emissions (Friedlingstein et al., 2014). Such massive carbon emissions have put enormous pressure on China to reduce carbon emissions. It is challenging to realize the demand for green and sustainable development through traditional economic growth methods (Zheng and Kahn, 2017; Usman et al., 2022). In response to environmental challenges and climate change, the Chinese government has implemented various environmental regulation measures to combat environmental issues and promote sustainable economic growth. For Example, the law on the prevention and control of air pollution, the environmental protection act, and the environmental air quality standard. Besides the command-and-control regulatory approach, the Chinese government has attempted to achieve environmental governance and protection goals through a market-based environmental regulation tool.Notably, the CO2 emissions trading scheme aimed to provide economicincentives for polluters and change their behavior through market mechanisms to achieve emission reduction targets cost-effectively (Fang et al., 2019). Evidence indicates that market-based environmental regulation has played a significant role in environmental protection in China (Yu et al., 2019; Jiang et al., 2022), and CO2 emissions show a relatively steady decline (Hu et al., 2020).However, there is surprisingly little consensus on the impact of these environmental policies on economic activity, especially on exports. Therefore, it is worth exploring how environmental regulations affect export in Chinese firms and the potential mechanisms.According to the world bank (2021), the contribution of China nation to CO2 (per capitaboosts from 1.914in 1990 to 7.60in 2019 (WB, 2007). (Figure 1).

In recent years, with the gradual improvement of the ecological environment, people began to pay attention to the impact of environmental regulations on economic growth, among which the effect of environmental regulations on enterprise exports has become one of the focuses of attention. Neoclassical economic theory suggests that environmental regulations internalize the external pollution faced by firms, which can increase firms’ costs and reduce their international competitiveness, negatively impacting firms’ exports (Copeland and Tailor, 1994; Busse, 2015; Olivier, 2016; Pattnayak et al., 2022; Usman and Jahanger, 2021; Kamal et al., 2021).When a country has a lower level of environmental regulations than its trading partners, it has a comparative advantage in producing polluting products. However, in countries with stricter environmental regulations, the production costs of polluting industries are relatively high, thus discouraging exports and foreign capital flows to these industries. Copeland and Taylor (2004) call this the “pollution haven effect” (PHE).

Proponents of environmental regulation argue that, however, the environment and export can benefit from environmental regulations.It is believed that environmental regulation will force enterprises to innovate, actively adopt green technology, produce clean products, reduce technical barriers to international trade, gain comparative advantage, and ultimately benefit exports (Porter and Van Der Linde, 1995). Many empirical researchers support this hypothesis (e.g., Costantini and Mazzanti, 2012; Yang et al., 2012; Rubashkina et al., 2015; Zhang et al., 2017; Liu and Li, 2022).

In addition, others argue, based on empirical findings, that the impact of environmental regulation on exports is uncertain (Harris et al., 2002; Kolk, 2016; Bu and Wagner, 2016; Dong et al., 2022). It is argued that environmental regulation may not significantly impact firms’ export trade activities if the cost of environmental regulation is a small proportion of the firm’s total cost. In contrast, the Porter hypothesis suggests that only appropriate or effective environmental regulations can stimulate firms to choose technological innovation.

Overall, the existing literature provides the necessary foundation for the study in this paper. However, most of these studies focus on the impact of command-and-control environmental policies on export (Levinson and Taylor, 2008; Hanna, 2010; Millimet and Roy, 2013; Greenstone et al., 2012; Hering and Poncet, 2014; Shi and Xu, 2018; Zhang et al., 2020). However, the literature on the impact of carbon emissions trading, a typical market-based environmental regulatory policy, on exports is scarce. It is worth noting that, probably due to a lack of data, prior literature has explored the relationship between environmental regulation and firms’ exports at the macro level. In contrast, relatively few studies have been conducted at the micro level. Therefore, toachieve a rigorous empirical test on the causal relationship between market-oriented low-carbon policies and exports, this paper constructs a PSM-DID model based on the National Tax Survey database of China from 2010-2018 to examine the impact of China’s carbon emissions trading policies on exports and the mechanism.These results suggest that China’s carbon emissions trading policiessignificantly increase the export of regulated firms. Our results hold up to a battery of robustness tests, such as a placebo test with a random assignment of the pilot firms, the exclusion of other trading policies, and a counterfactual check for pre-existing trends. And alsofind that this policy positivelyaffects the exports of both SOEs and non-SOEs. Considering enterprise heterogeneity, the policy positively impacts exports of FDI firms, large firms, and low industrial concentrations. Moreover, we examine how environmental regulation could affect firm export through technological innovation, productivity, and product research.

This paper contributes to the literature in three important ways.First, to the best of our knowledge, this study constitutes the first attempt to investigate the impact of the emissions trading program on export in a developing country. The existing literature has focused on the effects of carbon trading pilot policies on carbon emissions, air pollution emissions, carbon intensity, and low-carbon technologies (Clarkson et al., 2015; Mo et al., 2016; Hu et al., 2020; Ji et al., 2021; Zhang et al., 2022). However, there is a lack of research on the linkages between market-oriented low-carbon policies represented by carbon trading pilot policies and exports. Second, in terms of the selection of the research sample, previous studies are mainly based on the perspectives ofthe macro-level data (Hering and Poncet, 2014; Shi and Xu, 2018), and there may be systematic measurement errors and potential endogenous biases (Berman and Bui 2001; Xie and Zhou, 2022).this paper chooses the National Tax Survey database of China, which is more helpful for studying the impact of carbon emission policies on exports at the micro level and, to a certain extent, avoids the possible aggregation bias of using regional and industry-level data.Finally, this paper also empirically identifies this pilot policy’s heterogeneity and mechanisms of action affecting firms’ exports, which further enriches the empirical evidence on the impact of market-based environmental regulations on firms’ exports.

The remainder of this paper is organized as follows: The next sectionsummarizes the related literature and background of China’s carbon emissions trading pilot. Section 3 introduces the data and the econometric methodology; Section 4 presents the regression results; The last section concludes the paper.

2 Related literature and institutionalbackground

2.1 Environmental regulation and firm exports

The impact of environmental regulation on firm export has received significant attention in the past decades. Theoretically, the effect of environmental regulation on export may exist from three research perspectives. First, the disadvantage theory is based on the pollution haven effect (PHE). It is argued that pollution cost is an essential element of enterprise production. If the pollution cost is small, the producer can fully use this production factor. In contrast, strict environmental regulations will increase the production cost of enterprises and weaken their international competitiveness, so regions with lax environmental regulations are more attractive to enterprises (Markusen et al., 1993; Christmann and Taylor, 2001; Copeland and Taylor, 2004; Shin, 2004; Ollivier, 2016). Blackman et al. (2010) used over 100,000 plant-level data from Mexico to analyze the impact of the National Clean Industry Program (NCIP) impact. They showed that although the NCIP attracted firms, it did not produce actual sustained environmental performance because environmental regulations increased firms’ production costs, thereby inhibiting further growth. Hering and Poncet (2014) conducted an empirical analysis from the perspective of the two control zone policies using data from 265 Chinese cities. They concluded that the environmental regulation policies in the two control zones significantly inhibit exports. Shi and Xu (2018) estimate the impact of environmental regulations on firms’ exports using a triple difference method and find that stricter environmental regulations in pollution-intensive industries reduce the likelihood of firms exporting and the volume of exports. Gao et al. (2019) assessed the effect of environmental tax shocks on Chinese exports. The results showed that it would boost the decline of China’s exports.

Second, the favorable theory is based on the idea of induced innovation. Porter and Linde (1995) claim that environmental regulation will force firms to innovate, actively adopt green technology, and produce clean products, which reduces technical barriers to international trade, acquires comparative advantage, and ultimately benefits exports. From a dynamic perspective, a reasonably designed environmental regulation can stimulate regulated firms to innovate technologically and achieve a “win-win” situation in which environmental improvement and competitiveness are enhanced (Porter, 1991).Indeed, many studies argue that environmental regulations positively impact firm export. For example, Costantini and Crespi (2008) used the gravity model to verify PH, arguing that environmental regulation and the national innovation system complemented each other. Strict environmental regulation was a key driving factor of export performance for energy technology enterprises (Costantini and Mazzanti, 2012). Rubashkina et al. (2015) found that environmental regulations did not negatively affect the export competitiveness of manufacturing industries and that environmental regulations promote technological innovation and increase trade size. Yang et al. (2012) found a robust positive relationship between environmental regulation and firm innovation, which significantly increases firm productivity resulting in increased export trade (Xie and Zhou2022Zhou 2022). found evidence of a positive and statistically significant impact of environmental information disclosure on firm export value and export intensity in cleaner production industries of cities with higher environmental information disclosure.

Third, the combined effect of “innovation compensation effect” and “compliance cost.” Recognizing the combined effect of pollution haven effect and induced innovation makes the dual effect of “race to the bottom” and “race to the top” co-exist (Greenstone et al., 2012; Kolk, 2016; Bu and Wagner, 2016; Yang et al., 2021). Environmental regulation will contribute to a positive export effect when the positive effect of technological innovation induced by environmental regulation is more significant than firms’ investment cost to meet environmental standards. Therefore, there is uncertainty about the effect of environmental regulation on firms’ export behavior.The “uncertainty hypothesis” is also supported by some research findings. For instance, Tobey (1990) first studied pollution-intensive industries in 23 countries using the HOV model and found that environmental regulation did not significantly affect trade patterns (Cole and Elliott 2005). find a limited impact of environmental regulations on trade flows using data from 60 countries in 1995. Arouri et al. (2012) also find that environmental regulations do not significantly affect total export trade and that there is not necessarily a statistically significant logical relationship between environmental regulations and export trade.

2.2 Institutional background

Over the past few decades, emissions trading systems have played an increasingly important role in environmental governance. As the most potent international carbon trading mechanism, the EU carbon emission trading system was established in 2005, covering all EU Member States and traders involved in about 11,000 factories.The EU carbon trading mechanism follows the principle of “limit and trade” and issues carbon emission quotas to enterprises according to the total amount of carbon emission specified yearly. As early as 2003, the United States established the Chicago Climate Exchange, which mainly provides trading services for ten states and voluntary emission reduction enterprises undertaking voluntary emission reduction tasks. As the world’s second-largest carbon trading market, the United States has established a relatively mature regional carbon trading market system, including all six greenhouse gases, such as sulfur dioxide. Japan, South Korea, Brazil, Mexico, and Chile have independent carbon trading systems. At present, 74 countries or regions in the world price carbon through a carbon emission trading system or carbon tax, covering 20% of the world’s 11 billion tons of carbon emissions, with a total carbon market value of US $44 billion (World Bank, state and trends of carbon pricing, 2019).

In 2011, the Chinese government approveda carbon emission trading pilot. Since 2013, carbon trading pilot projects have been officially launched in Beijing, Tianjin, Shanghai, Chongqing, Guangdong, Hubei, and Shenzhen to explore establishing carbon trading systems. In December 2016, Fujian and Sichuan were added as pilot provinces. At the end of 2017, China’s unified carbon emission market (power industry) was officially launched. As of December 2018, more than 20 industries and 3743 critical emission units have been included in China’s pilot carbon market. The cumulative carbon emission trading volume is close to 800 million tons, and the trading volume is more than 11 billion yuan, more than twice the European carbon market. China has become the world’s most extensive carbon trading system.Compared with other countries’ carbon emission trading markets, China’s carbon emission trading market comprises relatively independent carbon trading markets in various provinces. According to China’s “Interim Measures for the Administration of Carbon Emission Trading,” the State Council’s carbon trading authority formulates a national quota allocation plan, clarifying the amount of free allocation by provinces, autonomous regions, and municipalities directly under the Central Government, and the number of emission allowances reserved by the state. The critical emission units in this administrative region issue free assistance, and other remaining allowances are allowed to be used by the provincial carbon trading authority for paid allocation. The total quota control needs to be formulated according to the national and regional carbon emission control targets. At the same time, it is necessary to consider the integration of industry enterprise quotas with national industrial policies and industry plans. If it is deemed to include de-capacity and de-inventory conditions, it must, to a certain extent, Reflect the overall policy orientation of the country. In 2018, the administrative department of China’s carbon emissions trading management was transferred from the Development and Reform Commission to the Ministry of Ecology and Environmental Protection.

From a technical point of view, China’s carbon market has essentially formed a relative compromise distribution system, which follows the principles of “unified industry distribution standard,” “total quota of different regions,” and “flexible adjustment of reserved quota.” According to the factors such as greenhouse gas emissions, economic growth, industrial structure, energy structure, and emission control enterprises, the total regional quota is determined, and part of the quota is reserved for paid distribution, market regulation, and major project construction. In the initial stage, the local allocation was mainly distributed free of charge, the paid distribution was introduced timely, and the proportion was gradually increased. An emission reduction achieved by “the voluntary emission reduction project” beyond the coverage of the carbon market can be certified by the competent department and registered in the “national voluntary mission reduction transaction registry system” to obtain CCERs. To offset emission control enterprises’ emissions, carbon emission quotas can be traded on the carbon emission quota trading market. The primary function of introducing CCER into the carbon market is to encourage enterprises beyond the scope of the carbon market to carry out energy conservation and emission reduction to extend the role of the carbon market.

3 Data and empirical strategy

3.1 Data

The data used in this paper are from the National Tax Survey database of China during the 2010–2018 period, jointly collected by the State Administration of Taxation and the Ministry of Finance using a unique information system based on random sampling. The State Administration of Taxation and the Ministry of Finance generate stratified samples of the investigated taxpayer (company) from the annual tax declaration system and stratify them according to the type of total sales, industry, and taxpayer. Then the investigated enterprise will complete the corresponding investigation information with the assistance of the tax authorities. Compared with other microdata, it has the following characteristics. First, since the data set is jointly collected by the State Administration of Taxation and the Ministry of Finance, the goal is to control the tax base information better and assess the impact of tax policies. Therefore, the basic information on enterprise tax, finance, and performance obtained is very detailed, especially the tax information, which covers all tax information involved in the production and operation of enterprises. The accuracy of the relevant data is also very high as the tax authorities directly audit it. Second, the sample size of the data set is significant and includes large enterprises above the scale and covers a large number of small- and medium-sized enterprises and start-ups, which can reflect the heterogeneity of policy effects among enterprises of different sizes and ages. Finally, the dataset covers various industries, including manufacturing, agriculture, mining, construction, and service. It is more representative than the current mainstream micro-enterprise data set, with a long-time span, and can assess the effects of policies at different stages.

According to the enterprise name search, we found the carbon trading pilot enterprises’ organization code to understand complex exporting behavior in response to stringent environmental regulations. We then matched the organization code with the tax survey database to obtain the list of the carbon emissions trading pilot enterprises in the National Tax Survey database, which also became the foundation for subsequent empirical research data.

3.2 Empirical strategies

The identification strategy for the effect of the ETS on exports has been a matching-adjusted DID that proceeded in two steps, used for estimation of both the main policy effects and spillovers. For example, the same strategy has been used to evaluate the impact of NOX emissions trading in Southern California (Fowlie et al., 2012) and European Union ETS (Calel et al., 2016). The first step selected and matched ETS firms with similar non-ETS firms, conditional on their observable characteristics, to remove potential biases in sample selection caused by policy design or other confounding factors; the second step estimated the difference-in-differences between the matched ETS and no-ETS firms to account for firm-level heterogeneity and time trends. Matching was the preferred strategy to make the regulatory status under the ETS appear to be a random assignment, conditional on the observable characteristics of firms. The specific method is as follows:

The first step uses the 1:1 nearest neighbor propensity score matching (PSM) method. The logit model is used to match the sample year by year. Considering that the enterprises participating in the carbon emissions trading pilot are increasing yearly, we use 2011 as the benchmark.The specific steps are as follows: let A = {T, C}, which denotes all sample enterprises in 2011. T is the treatment group, which is the pilot enterprises participating in carbon emissions trading between 2014 and 2018; C is the control group, representing the pilot enterprises not participating in emissions trading. The matching method is to find enterprises from the control group (C) year by year that are incredibly close to the probability of participating in carbon trading behavior and not participating in carbon trading pilot behavior to construct a reasonable counterfactual framework. Thus, this ensures no significant difference between the treatment and control group firms and eliminates selectivity bias. It is assumed that the equation for the probability of an enterprise engaging in carbon trading behavior is:

Where P is the probability of enterprises’ participation in the carbon emissions trading pilot behavior and ∅{·} is a normal cumulative distribution function. Xit is a matching variable indicating the factors affecting enterprises’ participation in the carbon emissions trading pilot.

In the second step, a difference-in-differences model (DID) was estimated by using the treatment group and the propensity score-matched control group as samples, based on which the following difference-in-difference model was constructed:

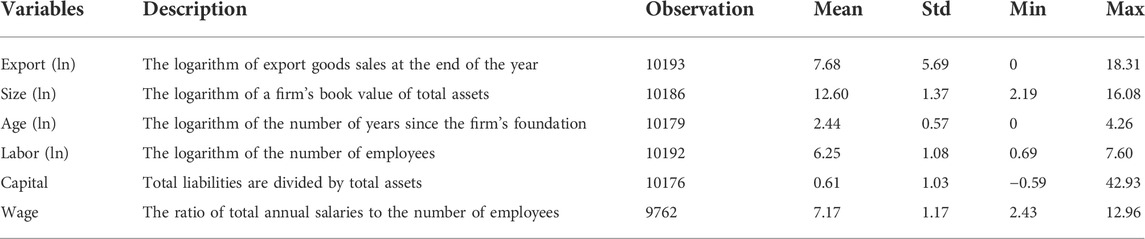

Where the explanatory variable Exportitdenotes the enterprise export of enterprise i in year t, Treat denotes whether enterprise i participates in the carbon emissions trading pilot in year t, Treat = 1 if it does, and 0 otherwise.X represents a series of control variables,ɑiis an enterprise fixed effect,φt is a time fixed effect, and εitdenotes a random error term.Table 1 presents the definition and summary statistics of key variables after matching.

4 Empirical results

In this section, we discuss the baseline results for the impacts of ETS on firms’ exports. To test the stability of the results, we conduct a series of robustness checks. Finally, we focus on unveiling the mechanism of how the ETS affects firms’ export.

4.1 Baseline results

Table 2 shows the estimated results of the PSM-DID model. In this table, we add firm fixed effects, time fixed effects, industry fixed effects, and region fixed effects to the model.The standard errors presented in the parenthesis are clustered at the firm level.

The results show that the estimated coefficients of the carbon emissions trading policy on a firm’s export are all positive and statistically significant at 1%, indicating that the carbon emission trading pilot policy benefits pilot enterprises to increase their exports.In column (1), we only include Treat, our regressor of interest, and firm and year fixed effects. The coefficient of the regressor is 0.0416 and statistically significant at the 1% level, indicating that compared with the non-ETS firm, the ETS policy increased firm exports. In columns (2)–(4), we add some time-varying firm characteristics that may correlate with our outcome variable and our regressor of interest. These variables include the firm’s debt capital ratio, the value of total assets, firm age, average wage, and the number of employees. The results illustrate that the effect of ETS policy on firm exports is still significantly positive and robust. This positive policy impact is around 3.35%, including further controlled industry-fixed effects, as shown in column 3) of Table 2. In column (4), the results show added region-fixed effects, and our interest coefficients remain positive and statistically significant at the 1% level. This result powerfully demonstrates that ETS policy avails the export of Chinese enterprises.

In the following part, we will do some robustness checks on the identifying assumption of the PSM-DID model we mainly applied in this paper.

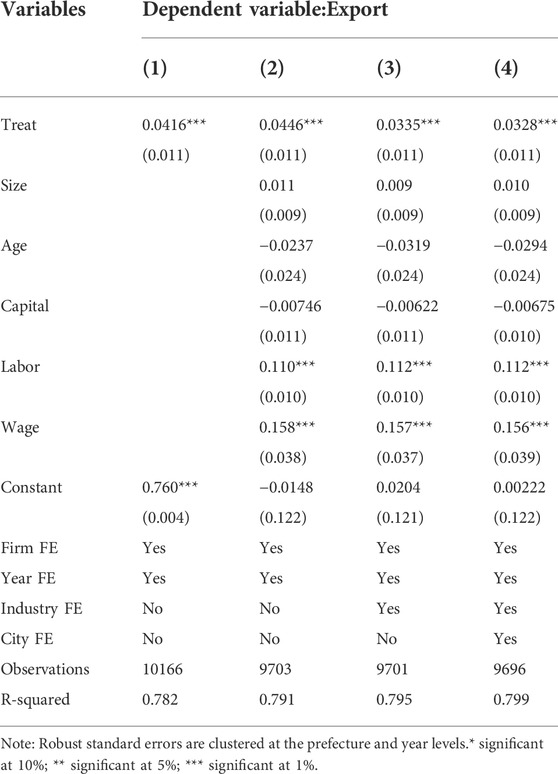

4.1.1 Common support assumption

A balance test on the matched variables is required to ensure the parallel hypothesis in the PSM-DID model, which requires that the treatment and control groups do not differ significantly on the post-matching characteristic variables. If the difference is significant, the chosen matching method is inappropriate, and the estimation results tend to be invalid. Figure 2 shows the kernel density function curves plotted with the nearest neighbor propensity score matching for the treatment and control groups. It can be seen that before the kernel matching, the distribution of the treatment group is loose, while the control group has a left-skewed and concentrated propensity score. The probability density distribution of the propensity score of the two groups is significantly different. After matching, the probability density distribution of the two groups converged, which indicated that the characteristics of the two groups were very close after matching, and the selectivity bias of the samples was eliminated.

4.1.2 Parallel trend assumption

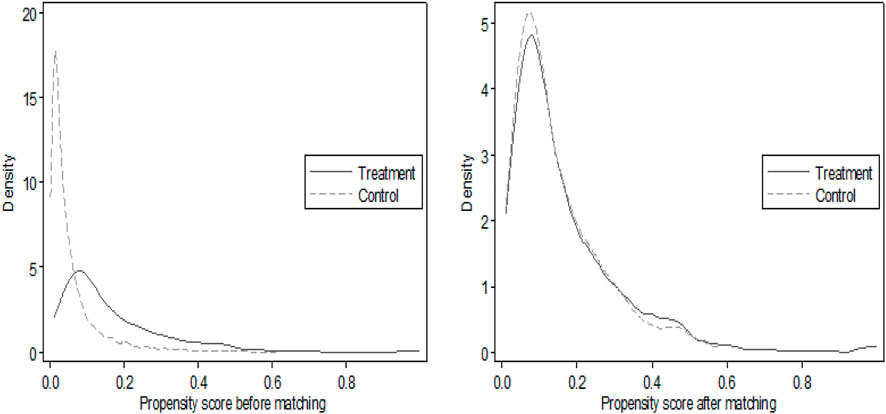

The validity of the results in Table 2 relies on the parallel trend hypothesis, which means that there is no significantly different change trend between the pre-reform treatment and control groups. Therefore, to verify the validity of the DID model, we followed Beck et al. (2010) and used the event analysis method to test the parallel trend hypothesis, setting the regression equation as follows:

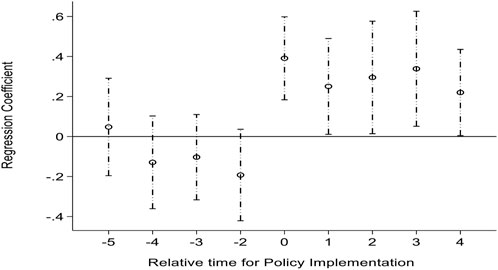

Where Ditk represents a set of dummy variables for whether or not the firm is a carbon trading pilot firm, the year in which a carbon trading firm participates will be defined as year 0, and the 4 years before and after its election are examined. Figure 3 shows parallel trend plots for this paper. The broken curves represent the trends within the 95% confidence interval.If they contain zero, they indicate no significant difference in exportsbetween the two groups before and after implementing the carbon emissions trading pilot.

As shown in Figure 3, before the implementation of the policy, the export of treatment and control groups have the same trend of change and do not differ significantly. After implementing the policy, the export of the carbon emissions trading pilot enterprises increased significantly compared to the non-participating carbon emissions trading pilot enterprises, which further proves the validity of the results of the difference-difference method.

4.1.3 Placebo test

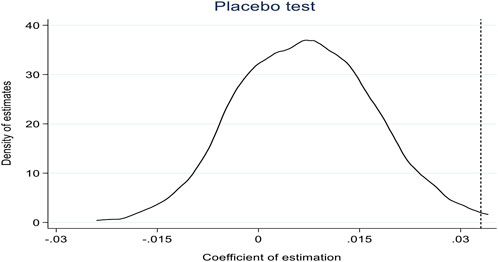

To further enhance the robustness of the results, we refer to Cai et al. (2016) to construct a dummy variable for the placebo test by randomly selecting firms participating in the carbon emissions trading pilot from the total sample of firms as the treatment group and the rest of firms as the control group. Since the dummy treatment group is randomly generated, the placebo test should not significantly affect the model-dependent variable such as β = 0. To avoid the interference of other small probability events on the estimation results, the regression is repeated 500 times with random sampling for the newly generated treatment and control groups. As shown in Figure 4, the regression coefficients of the counterfactual variables are mostly clustered around the value of zero. In contrast, the estimated coefficients are outliers in the estimated coefficients of the placebo test, implying that the dummy treatment effect constructed in this paper does not exist. That endogeneity, such as omitted variables or non-randomness in the selection of objects, does not significantly change the results. Thus, the rise in firm export is indeed brought about by the participation of enterprises in carbon emissions trading pilots rather than other opportunity factors or noise.

4.2 Robustness checks

In this section, to address other possible concerns, we further check the robustness of benchmark results.

4.2.1 Other matching methods

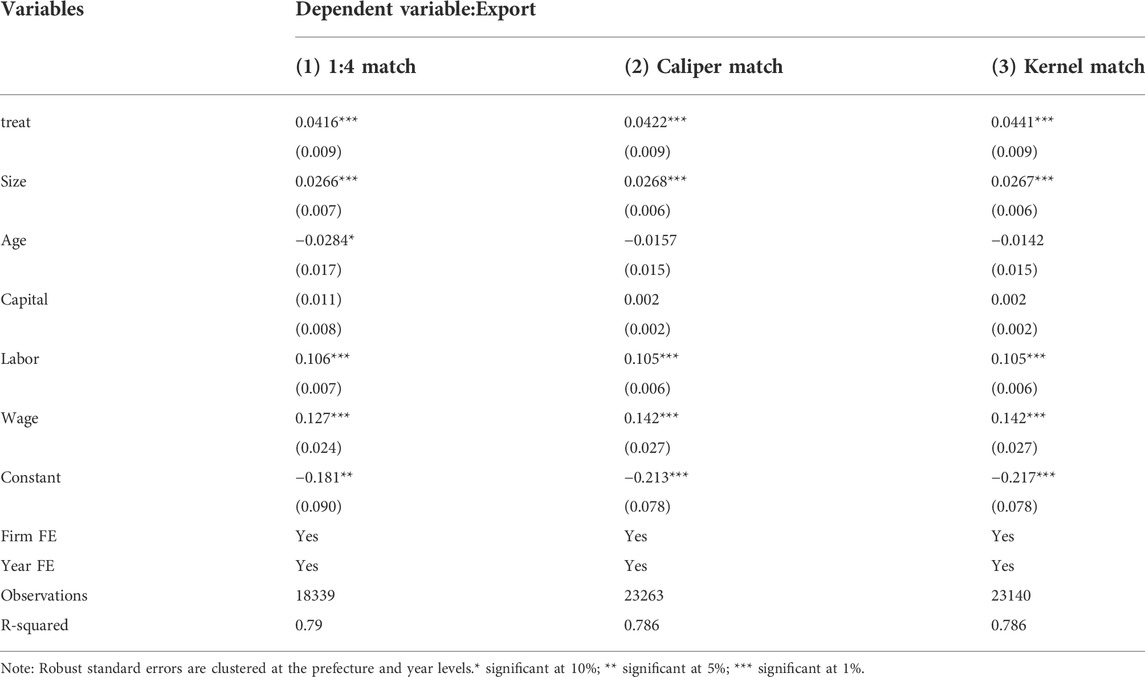

We try various matching methods to match, including a pair of four nearest neighbors, caliper matching, and kernel matching. Suppose there is no significant difference in the matching results obtained by different matching methods, the basic regression is not interfered with by specific matching methods, and the research conclusion is robust.

The corresponding results are shown in Table 3. Columns (1) report the matching results for a pair of four nearest neighbors. Columns (3) and (4) report caliper and kernel matching results. In all columns of Table 3, we document consistently positive and statistically significant estimates, supporting our baseline conclusions that carbon emissions trading promotes firm exports.

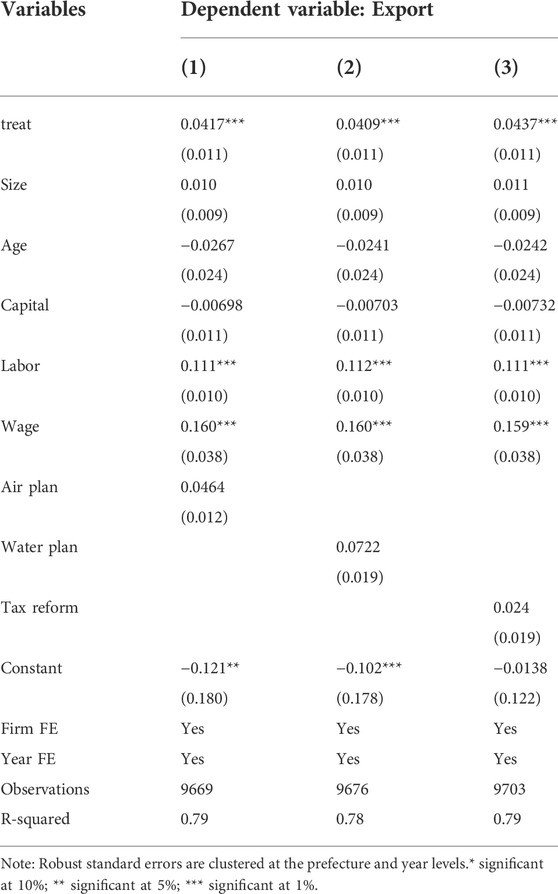

4.2.2 Ruling out the confounding effects of carbon emissions trading program

One might be concerned that the observed impacts from our analysis may come from other simultaneous environmental policies, such as the Air Pollution Prevention Action Plan, the Water Pollution Prevention Action Plan, and Replacing Business Tax with Value-added Tax.To mitigate this concern, we further control other simultaneous environmental policies based on the baseline DID model. Table 4 lists the results of a series of confounding effects tests.While controlling for the regional confounding factors, we still document the consistently positive coefficients on the policy variable of interest, indicating that our estimates are more robust and have not been affected by the confounding.

4.3 Heterogeneity discussion

The results of baseline estimates show that the EST policy has a positive impact on firm exports. In this section, we investigate the possible heterogeneous effects ofthe ETS policy on firm exports.

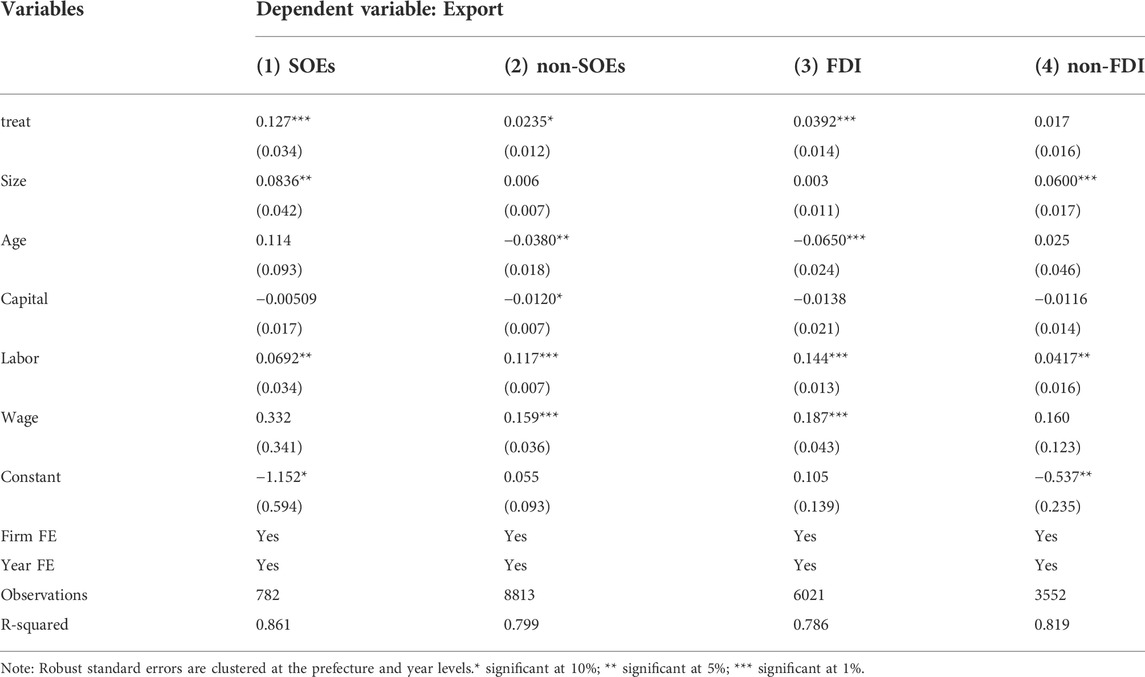

4.3.1 Heterogeneity in firm ownership

As the ownership structures may affect the impacts of the ETS policy, we construct two indicators of ownership: one is the SOE indicator equaling one if SOE enterprises and zero otherwise, and the other is the FDI indicator equaling one if enterprises receive FDI and zero otherwise.Columns (1) and (2) in Table 5 show the results of the two subsamples of SOEs and non-SOEs.The estimated coefficients are consistently positive and statistically significant at the 1% level for both SOEs and non-SOEs, confirming the carbon emissions trading impacts on export. However, the estimated coefficients are more prominent among the SOEsthanthe non-SOEs, suggesting that the carbon emissions trading policy has a more significant effect on promoting exports of SOEs. Columns (3) and (4) of Table 5 show the regression results for the FDI and non-FDI indicators, respectively. For the FDI indicator, the estimated coefficient is significantly positive, while for the non-FDI hand, the coefficient is not significant.This illustrates that the ETS policy positively affects enterprise exports for the FDI indicator.A possible reason is that FDI enterprises have more production efficiency, less environmental pollution, and continue to engage in production and export. Adversely, non-FDI enterpriseshave no significant impact.

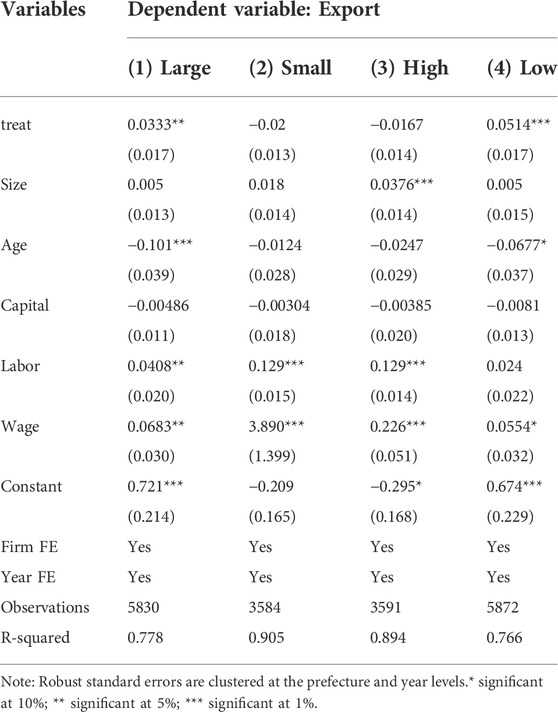

4.3.2 Heterogeneity in firm scale

Due to differences in business practices and financial capabilities, the ETS policy may affect the firm’s scale differently. Therefore, we divide the sample into large and small enterprises according to the median income value of theenterprises and run the regression separately.The results are reported in columns (1) and (2) of Table 6. For large-scale enterprises, the estimated coefficient is significantly positive, demonstrating that the EST policy has a promoted impact on the export of large enterprises. For Small-scale enterprises, the estimated coefficient isinsignificant, suggesting that the EST policy has no significanteffect.This may be because large firms can easily form economies of scale and their productivity-enhancing effects are more pronounced, thus making it easier to overcome the costs of accessing export markets and increasing exports.

4.3.3 Heterogeneity in industrial concentration

To further test the differences in the export effects of carbon emissions trading policy on firms in different industrial concentrations, we draw on Radecki (1998) and Levchenko (2007) to calculate the HHI index, which is

4.4 Mechanism discussion

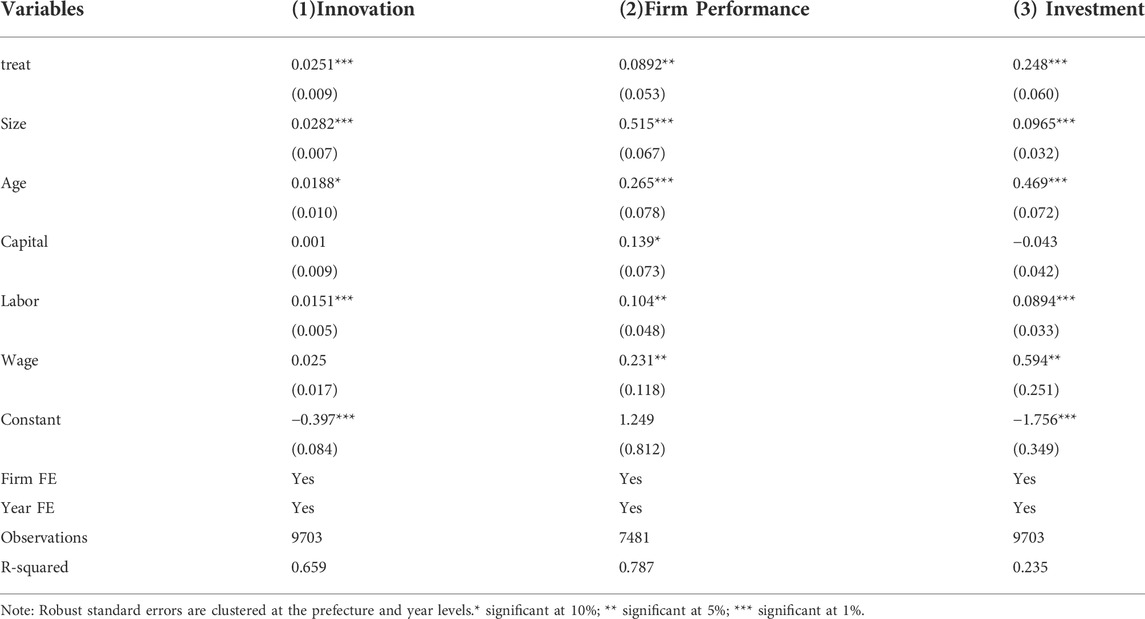

Our results show that the ETS policy significantly increases firmexport, which confirms the effects driven by environmental regulations, as we have discussed previously. In this section, we further explore the possible mechanisms of the ETS policy that affect firm export.

A carbon emission trading policy is a flexible market-based environmental regulation. According to Porter hypothesis, market-based environmental regulation can improve technological innovation and firm competitiveness (Porter and Van der Linde, 1995). First, the market-based environmental regulation could promote vitaltechnological innovation (Borghesi et al., 2015; Calel and Dechezlepretre, 2016), which is conducive toexpandingexport share. Second, the market-based environmental regulations could provide a competitive factor for firms (Yang et al., 2017), which can not only reduce emissions but also improve productivity. Third, the market-based environmental regulations could stimulate firms to introduce more advanced technology and product research investments (LIM, 2014; LIU, 2017), which helps firmsimprove product quality and enhance competitiveness.

Based on the previous studies, we investigated the potential mechanism of the EST policy on firm export in terms oftechnological innovation, productivity, and product research. A firm’s technological innovation and the firm number of patents are often closely related. We use the logarithm of the number of patents as a proxy variable for technological innovation. As reported in columns (1) in Table 7, the coefficients are positive and statistically significant at the 1% level, indicating that the EST policy promotes technological innovation. In Column (2), we adopted net profit as the proxy variable reflecting firm performance. The estimated coefficient is 0.0892 and significant at the 5% level, demonstrating that the EST policy increase firm performance. In addition, we also employ the firm’s R&D investment to proxy for product research. As shown in column (3). We find that the key coefficients are still statistically positive. It can be seen that financial constraints and production costs are essential channels for EST policies to affect firm exports.

5 Conclusion

Promoting carbon emission trading and building a carbon market is a central institutional innovation to control and reduce greenhouse gas emissions and promote green and low-carbon development using a market mechanism. It is also an important policy tool to promote the realization of carbon peaks and a carbon-neutral vision. This paper applies the PSM-DID model to test the effect of a carbon emission trading policy on exports in pilot and non-pilot firms.The main results are confirmed based on the robustness checks and a placebo test. The main conclusions derived from this paper are as follows.

(1) According to the PSM-DID model’s regression results, the carbon emission trading policy significantly expands the pilot firm’s export after controlling for several economic factors.Empirical results showed that, unlike traditional command-and-control approaches, the carbon emissions trading policy caused the pilot firm’s export to rise by more than 3.3% during the sample period. After eliminating or controlling other factors (including the transform matching method and excluding the influence of other interfering policies), the conclusion remains robust. It shows that the economic incentive environmental policy does produce the export effect.

(2) The impact of carbon emissions trading pilot policies on a firm’s exports has pronounced heterogeneity. The export effect in large-scale firms, FDI firms, andhigh industrial concentrations is positive. At the same time, firm ownership will influence the effect, which is more apparent in enterprises with SOEs.

(3) The impact of carbon emissions trading pilot policies on a firm’s exports will be driven by technological innovation, product research, and productivity. We found that the carbon emissions trading pilot policy has improved the economic performance of the pilot enterprises, which is further reflected in the increase in productivity and competitiveness. At the same time, it also encourages the pilot firms to increase their investment in R&D and innovation.

Therefore, the market-based environmental regulation policy, namely the carbon emission trading policy, is, to some extent, an important policy tool for China to relieve environmental pressure and achieve potential economic benefits and can also promote technological innovation and the transformation of a low-carbon society.

According to the conclusions of this paper, the following policy suggestions are put forward: (1) China needs to accelerate the pace of the construction of a unified carbon emission trading market in the whole country, improve the diversification of the carbon market, and bring more industries into the carbon market transactions, which will not only help to improve China’s ecological environment but also help to enhance the competitiveness and voice of Chinese export enterprises in the international market. (2) Adhere to the principle of classified management and fully consider the differences between high-carbon emission firms and low-carbon emission firms, state-owned firms and private firms, and foreign-funded firms and domestic-funded firms. Setting emission quotas should consider the principles of fairness and moderation and give full play to the role of the carbon trading system in optimizing investment portfolios, forcing enterprises to improve internal management efficiency to improve investment and production efficiency. Governments and banks should issue cleaner technology-oriented loans, especially to carbon-intensive firms, and draft a minimum wage for R&D executives to promote the firms’ transformation in production and operation. (3) Increasing support for energy conservation and emission reduction and clean energy technology innovation can not only improve the willingness of emission reduction enterprises to achieve their emission reduction through technological innovation. However, it also objectively reduces the demand for carbon emission reduction rights, avoids rapid price increases, and is conducive to the stable operation of the national carbon market. The policymaker should focus on the formulation of the regulations on intangible assets. It is confirmed that the rise of investment in intangible assets, such as technological innovation, productivity, and product research, can be the internal mechanism of the effect of carbon emission price on firm export.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding authors.

Author contributions

Conceptualization, SY and QS; methodology, SY and QS software, SY, AJ, and PY; formal analysis, SY and QS; data collection, AJ, SY, and QS; writingoriginal draft preparation, SY, AJ, PY, HZ, QS, and DB-L; Revised draft, SY, AJ, and QS; Writing, Review and Editing HZ, AJ, PY, and QS; supervision, AJ and DB-L; project Administration, SY and QS. All authors have read and agreed to the published version of the manuscript.

Funding

This work is supported by the National Social Science Fund of China (grant No.18CJY054).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Abbreviations

CO2, Carbon emissions; PSM, Propensity Score Matching; DID, Difference-in-Differences; ETS, Carbon emission trading scheme; FDI, Foreign direct investment; PHE, Pollution Haven Effect; abrNCIP. National Clean Industry Program.

References

Arouri, M. E. H., Caporale, G. M., Rault, C., Sova, R., and Sova, A. (2012). Environmental regulation and competitiveness: Evidence from Romania. Ecol. Econ. 81, 130–139. doi:10.1016/j.ecolecon.2012.07.001

Baumol, W. J., Baumol, W. J., Oates, W. E., Bawa, V. S., Bawa, W. S., Bradford, D. F., et al. (1988). The theory of environmental policy. Cambridge: Cambridge University Press.

Beck, T., Levine, R., and &Levkov, A. (2010). Big bad banks? The winners and losers from bank deregulation in the United States. J. Finance 65 (5), 1637–1667. doi:10.1111/j.1540-6261.2010.01589.x

Berman, E., and Bui, L. T. (2001). Environmental regulation and labor demand: Evidence from the south coast air basin. J. Public Econ. 79 (2), 265–295. doi:10.1016/s0047-2727(99)00101-2

Blackman, A., Lahiri, B., Pizer, W., Planter, M. R., and Piña, C. M. (2010). Voluntary environmental regulation in developing countries: Mexico’s clean industry program. J. Environ. Econ. Manag. 60 (3), 182–192. doi:10.1016/j.jeem.2010.05.006

Borghesi, S., Cainelli, G., and &Mazzanti, M. (2015). Linking emission trading to environmental innovation: Evidence from the Italian manufacturing industry. Res. Policy 44 (3), 669–683. doi:10.1016/j.respol.2014.10.014

Bu, M., and Wagner, M. (2016). Racing to the bottom and racing to the top: The crucial role of firm characteristics in foreign direct investment choices. J. Int. Bus. Stud. 47 (9), 1032–1057. doi:10.1057/s41267-016-0013-4

Busse, M. (2015). Trade, environmental regulations, and the world trade organization: New empirical evidence. Procedia - Soc. Behav. Sci. 186 (2), 1050–1054. doi:10.1596/1813-9450-3361

Cai, X., Lu, Y., Wu, M., and Yu, L. (2016). Does environmental regulation drive away inbound foreign direct investment? Evidence from a quasi-natural experiment in China. J. Dev. Econ. 123, 73–85. doi:10.1016/j.jdeveco.2016.08.003

Calel, R., and &Dechezleprêtre, A. (2016). Environmental policy and directed technological change: Evidence from the European carbon market. Rev. Econ. Statistics 98 (1), 173–191. doi:10.1162/rest_a_00470

Cave, L. A., and Blomquist, G. C. (2008). Environmental policy in the European Union: Fostering the development of pollution havens? Ecol. Econ. 65 (2), 253–261. doi:10.1016/j.ecolecon.2007.12.018

Chen, J., Gao, M., Cheng, S., Hou, W., Song, M., Liu, X., et al. (2020). County-level CO2 emissions and sequestration in China during 1997–2017. Sci. Data 7 (1), 1–12. doi:10.1038/s41597-020-00736-3

Chen, X., He, J., and &Qiao, L. (2022). Does environmental regulation affect the export competitiveness of Chinese firms? J. Environ. Manag. 317, 115199. doi:10.1016/j.jenvman.2022.115199

Christmann, P., and Taylor, G. (2001). Globalization and the environment: Determinants of firm self-regulation in China. J. Int. Bus. Stud. 32 (3), 439–458. doi:10.1057/palgrave.jibs.8490976

Clarkson, P. M., Li, Y., Pinnuck, M., and Richardson, G. D. (2015). The valuation relevance of greenhouse gas emissions under the European Union carbon emissions trading scheme. Eur. Account. Rev. 24 (3), 551–580. doi:10.1080/09638180.2014.927782

Cole, M. A., Elliott, R. J., and Shimamoto, K. (2005). Industrial characteristics, environmental regulations and air pollution: An analysis of the UK manufacturing sector. J. Environ. Econ. Manag. 50 (1), 121–143. doi:10.1016/j.jeem.2004.08.001

Copeland, B. R., and Taylor, M. S. (2004). Trade, growth, and the environment. J. Econ. Literature 42 (1), 7–71. doi:10.1257/.42.1.7

Copeland, B., and Taylor, S. (1994). North-south trade and the environment. Q. J. Econ. 109 (3), 755–787. doi:10.2307/2118421

Costantini, V., and &Mazzanti, M. (2012). On the green and innovative side of trade competitiveness? The impact of environmental policies and innovation on EU exports. Res. Policy 41 (1), 132–153. doi:10.1016/j.respol.2011.08.004

Dong, Z., Wang, S., Zhang, W., and Shen, H. (2022). The dynamic effect of environmental regulation on firms’ energy consumption behavior-Evidence from China's industrial firms. Renew. Sustain. Energy Rev. 156, 111966. doi:10.1016/j.rser.2021.111966

Fang, J., Liu, C., and Gao, C. (2019). The impact of environmental regulation on firm exports: Evidence from environmental information disclosure policy in China. Environ. Sci. Pollut. Res. 26 (36), 37101–37113. doi:10.1007/s11356-019-06807-2

Fowlie, M., Holland, S. P., and Mansur, E. T. (2012). What do emissions markets deliver and to whom? Evidence from southern California's NOx trading program. Am. Econ. Rev. 102 (2), 965–993. doi:10.1257/aer.102.2.965

Friedlingstein, P., Andrew, R. M., Rogelj, J., Peters, G. P., Canadell, J. G., Knutti, R., et al. (2014). Persistent growth of CO2 emissions and implications for reaching climate targets. Nat. Geosci. 7 (10), 709–715. doi:10.1038/ngeo2248

Gao, Y., Yao, X., Wang, W., and Liu, X. (2019). Dynamic effect of environmental tax on export trade: Based on DSGE mode. Energy & Environ. 30 (7), 1275–1290. doi:10.1177/0958305x19842380

Greenstone, M., List, J. A., and &Syverson, C. (2012). The effects of environmental regulation on the competitiveness of US manufacturing (No. w18392). Cambridge: National Bureau of Economic Research.

Hanna, R. (2010). US environmental regulation and FDI: Evidence from a panel of US-based multinational firms. Am. Econ. J. Appl. Econ. 2 (3), 158–189. doi:10.1257/app.2.3.158

Harris, M. N., Konya, L., and Matyas, L. (2002). Modelling the impact of environmental regulations on bilateral trade flows: OECD, 1990–1996. World Econ. 25 (3), 387–405. doi:10.1111/1467-9701.00438

Hering, L., and &Poncet, S. (2014). Environmental policy and exports: Evidence from Chinese cities. J. Environ. Econ. Manag. 68 (2), 296–318. doi:10.1016/j.jeem.2014.06.005

Hu, Y., Ren, S., Wang, Y., and Chen, X. (2020). Can carbon emission trading scheme achieve energy conservation and emission reduction? Evidence from the industrial sector in China. Energy Econ. 85, 104590. doi:10.1016/j.eneco.2019.104590

Jahanger, A., Usman, M., Murshed, M., Mahmood, H., and Balsalobre-Lorente, D. (2022). The linkages between natural resources, human capital, globalization, economic growth, financial development, and ecological footprint: The moderating role of technological innovations. Resour. Policy 76, 102569. doi:10.1016/j.resourpol.2022.102569

Ji, C. J., Hu, Y. J., Tang, B. J., and Qu, S. (2021). Price drivers in the carbon emissions trading scheme: Evidence from Chinese emissions trading scheme pilots. J. Clean. Prod. 278, 123469. doi:10.1016/j.jclepro.2020.123469

Jiang, T., Yu, Y., Jahanger, A., and Balsalobre-Lorente, D. (2022). Structural emissions reduction of China's power and heating industry under the goal of" double carbon": A perspective from input-output analysis. Sustain. Prod. Consum. 31, 346–356. doi:10.1016/j.spc.2022.03.003

Kamal, M., Usman, M., Jahanger, A., and Balsalobre-Lorente, D. (2021). Revisiting the role of fiscal policy, financial development, and foreign direct investment in reducing environmental pollution during globalization mode: Evidence from linear and nonlinear panel data approaches. Energies 14 (21), 6968. doi:10.3390/en14216968

Kolk, A. (2016). The social responsibility of international business: From ethics and the environment to CSR and sustainable development. J. World Bus. 51 (1), 23–34. doi:10.1016/j.jwb.2015.08.010

Levchenko, A. A. (2007). Institutional quality and international trade. The Review of Economic Studies 74 (3), 791–819. doi:10.1111/j.1467-937X.2007.00435.x

Levinson, A., and Taylor, M. S. (2008). Unmasking the pollution haven effect. Int. Econ. Rev. Phila. 49 (1), 223–254. doi:10.1111/j.1468-2354.2008.00478.x

Li, G., He, Q., Shao, S., and Cao, J. (2018). Environmental non-governmental organizations and urban environmental governance: Evidence from China. J. Environ. Manag. 206, 1296–1307. doi:10.1016/j.jenvman.2017.09.076

Lim, S., and Prakash, A. (2014). Voluntary regulations and innovation: The case of ISO 14001. Public Adm. Rev. 74 (2), 233–244. doi:10.1111/puar.12189

Liu, D., Ren, S., and Li, W. (2022). SO2 emissions trading and firm exports in China. Energy Econ. 109, 105978. doi:10.1016/j.eneco.2022.105978

Liu, M., Shadbegian, R., and Zhang, B. (2017). Does environmental regulation affect labor demand in China? Evidence from the textile printing and dyeing industry. J. Environ. Econ. Manag. 86, 277–294. doi:10.1016/j.jeem.2017.05.008

Markusen, J. R., Morey, E. R., and &Olewiler, N. D. (1993). Environmental policy when market structure and plant locations are endogenous. J. Environ. Econ. Manag. 24 (1), 69–86. doi:10.1006/jeem.1993.1005

Millimet, D., and Roy, J. (2013). Four new empirical tests of the pollution haven hypothesis when environmental regulation is endogenous. New Orleans: Tulane University.

Mo, J. L., Agnolucci, P., Jiang, M. R., and Fan, Y. (2016). The impact of Chinese carbon emission trading scheme (ETS) on low carbon energy (LCE) investment. Energy Policy 89, 271–283. doi:10.1016/j.enpol.2015.12.002

Ollivier, H. (2016). North–south trade and heterogeneous damages from local and global pollution. Environ. Resour. Econ. (Dordr). 65 (2), 337–355. doi:10.1007/s10640-015-9902-4

Pattnayak, S. S., and Chadha, A. (2022). Servicification and manufacturing exports: Evidence from India. Econ. Model. 108, 105756. doi:10.1016/j.econmod.2022.105756

Porter, M. E. (1991). America's green strategy. Sci. Am. 264, 168. doi:10.1038/scientificamerican0491-168

Porter, M. E., and Van der Linde, C. (1995). Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 9 (4), 97–118. doi:10.1257/jep.9.4.97

Radecki, L. J. (1998). The expanding geographic reach of retail banking markets. Economic Policy Review 4 (2).

Rubashkina, Y., Galeotti, M., and Verdolini, E. (2015). Environmental regulation and competitiveness: Empirical evidence on the Porter Hypothesis from European manufacturing sectors. Energy Policy 83, 288–300. doi:10.1016/j.enpol.2015.02.014

Shi, X., and Xu, Z. (2018). Environmental regulation and firm exports: Evidence from the eleventh Five-Year Plan in China. J. Environ. Econ. Manag. 89, 187–200. doi:10.1016/j.jeem.2018.03.003

Shin, S. (2004). Economic globalization and the environment in China: A comparative case study of shenyang and dalian. J. Environ. Dev. 13 (3), 263–294. doi:10.1177/1070496504268352

Tobey, J. A. (1990). The effects of domestic environmental policies on patterns of world trade: An empirical test. Kyklos 43 (2), 191–209. doi:10.1111/j.1467-6435.1990.tb00207.x

Usman, M., Balsalobre-Lorente, D., Jahanger, A., and Ahmad, P. (2022). Pollution concern during globalization mode in financially resource-rich countries: Do financial development, natural resources, and renewable energy consumption matter? Renew. Energy 183, 90–102. doi:10.1016/j.renene.2021.10.067

Usman, M., and Jahanger, A. (2021). Heterogeneous effects of remittances and institutional quality in reducing environmental deficit in the presence of EKC hypothesis: A global study with the application of panel quantile regression. Environ. Sci. Pollut. Res. 28 (28), 37292–37310. doi:10.1007/s11356-021-13216-x

Walter, I., and Ugelow, J. L. (1979). Environmental policies in developing countries. Ambio, 102–109.

World Bank (2007). Cost of pollution in China, economic estimates of physical damages. Washington, DC: The World Bank.

Xie, D., Li, X., and Zhou, D. (2022). Does environmental information disclosure increase firm exports? Econ. Analysis Policy 73, 620–638. doi:10.1016/j.eap.2021.12.012

Yang, B., Jahanger, A., and Ali, M. (2021). Remittance inflows affect the ecological footprint in BICS countries: Do technological innovation and financial development matter? Environ. Sci. Pollut. Res. 28 (18), 23482–23500. doi:10.1007/s11356-021-12400-3

Yang, C. H., Tseng, Y. H., and Chen, C. P. (2012). Environmental regulations, induced R&D, and productivity: Evidence from Taiwan's manufacturing industries. Resour. Energy Econ. 34 (4), 514–532. doi:10.1016/j.reseneeco.2012.05.001

Yang, Z., Fan, M., Shao, S., and Yang, L. (2017). Does carbon intensity constraint policy improve industrial green production performance in China? A quasi-DID analysis. Energy Econ. 68, 271–282. doi:10.1016/j.eneco.2017.10.009

Yu, Y., Yang, X., and Li, K. (2019). Effects of the terms and characteristics of cadres on environmental pollution: Evidence from 230 cities in China. J. Environ. Manag. 232, 179–187. doi:10.1016/j.jenvman.2018.11.002

Zhang, W., Li, G., and Guo, F. (2022). Does carbon emissions trading promote green technology innovation in China? Appl. Energy 315, 119012. doi:10.1016/j.apenergy.2022.119012

Zhang, Y., Cui, J., and Lu, C. (2020). Does environmental regulation affect firm exports? Evidence from wastewater discharge standard in China. China Econ. Rev. 61, 101451. doi:10.1016/j.chieco.2020.101451

Zhang, Y. J., Peng, Y. L., Ma, C. Q., and Shen, B. (2017). Can environmental innovation facilitate carbon emissions reduction? Evidence from China. Energy Policy 100, 18–28. doi:10.1016/j.enpol.2016.10.005

Keywords: Carbon emission trading program, market-basedenvironmentalregulation, firm exports, PSM-DID method, China

Citation: Yang S, Shen Q, Jahanger A, Ye P, Zhang H and Balsalobre-Lorente D (2022) The impact of carbon emission trading scheme on export: Firm-level evidence from China. Front. Environ. Sci. 10:1035650. doi: 10.3389/fenvs.2022.1035650

Received: 03 September 2022; Accepted: 15 September 2022;

Published: 10 October 2022.

Edited by:

Arshian Sharif, Sunway University, MalaysiaReviewed by:

Mohammad Haseeb, Wuhan University, ChinaKashif Abbass, Nanjing University of Science and Technology, China

Copyright © 2022 Yang, Shen, Jahanger, Ye, Zhang and Balsalobre-Lorente. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Atif Jahanger, YXRpZl9qYWhhbmdlckBob3RtYWlsLmNvbQ==; Qiangqiang Shen, c3Fxem51ZWxAMTYzLmNvbQ==

†ORCID: AtifJahanger, orcid.org/0000-0002-0270-1367; Daniel Balsalobre-Lorente, orcid.org/0000-0002-6099-7899

Shubo Yang

Shubo Yang Qiangqiang Shen2*

Qiangqiang Shen2* Atif Jahanger

Atif Jahanger Penghao Ye

Penghao Ye Daniel Balsalobre-Lorente

Daniel Balsalobre-Lorente