- 1Physical Science College, Changsha Normal University, Changsha, China

- 2School of Economics and Management, Hunan Institute of Traffic Engineering, Hengyang, China

With the development of science and technology, digital inclusive finance has been widely used in various fields and has promoted the development of industrial structures. The development of the sports industry is a realistic option for improving public health problems and sustainable economic development. In this study, we understand the impact of digital inclusion finance on the sports industry from the perspective of upgrading the living standards of rural residents. Using relevant data from some domestic provinces in China from 2015–2019 as a sample, we explore the relationship between digital inclusion finance and the sports industry and analyse whether the living standards of rural residents play a mediating role. The study finds that: firstly, digital inclusive finance has a facilitating effect on the development of the sports industry. Secondly, digital inclusive finance can create a scale effect by increasing rural per capita disposable income, which in turn promotes the development of the sports industry. Thirdly, digital inclusive finance will use its digital and precise characteristics to precisely improve the consumption structure of rural residents, thus promoting the development of the sports industry. The study enriches the research related to digital economy represented by digital inclusive finance, and has important practical guidance significance for the development of China’s sports industry.

1 Introduction

With the gradual spread of the COVID-19 epidemic, economic development around the world has been seriously affected (Xiang et al., 2022). While the epidemic is being prevented and controlled, people’s health awareness has increased dramatically, and the demand for good sanitation and health services is rising, making the sports industry become a hot industry for economic development in the world today (Vega et al., 2020). According to the World Health Organization, by 2022, the number of participants in China’s sports industry will reach 450 million (Luo et al., 2022), yet the level of public health participation will only reach 56.3% of the global average, indicating that the development of China’s current sports industry is lagging behind and is not coordinated with the development of China’s public health. Therefore, in this context, how to transform and upgrade the traditional factor-driven sports industry, expand and extend the value chain of the sports industry, so that China’s sports industry can enter a new stage of high-quality development from high-speed growth, in order to solve the practical problems faced by social development, is the focus of the current development of China’s sports industry.

Due to the influence of industrial technology, the digital economy has increase sharply in the global landscape (Mpofu and Mhlanga, 2022). Among them, digital inclusive finance, as a product of the combination of the Internet and finance, is a special financial model that has emerged along with the rise of the digital economy, and its application in various fields has become a new norm. Unlike the “financing discrimination” of traditional finance, the fairness and efficiency of digital inclusive finance have weakened the financing constraints faced by enterprises (Zhang and Zhou, 2021), which can further stimulate the coupling effect and double-wheel drive of the market and the government in resource allocation (Liu et al., 2022). Potential to promote the digital transformation as well as the sustainability of the sports industry (Ren and Huang, 2021), solve the financial difficulties faced by the development of the sports industry and other problems, and inject new impetus into the high-quality development of the sports industry. At the same time, from an empirical perspective, digital inclusive finance focuses on areas where financial services are inaccessible and unaffordable, such as rural or remote cities, and can overcome financial exclusion in rural areas and improve problems such as the shortage of rural capital. Therefore, this paper will examine the mechanism and process of the role of digital inclusive finance on the development of the sports industry and verify the rural economic effects of digital inclusive finance on the development of the sports industry through a mediating effects model.

Currently, digital inclusive finance has been promoting the development of the sports industry for a relatively short period of time, and there is little literature directly analyzing the impact of digital inclusive finance on the development of the sports industry. Even so, the research findings on digital inclusive finance and industry structure are still worthy of consideration. Relevant studies are divided into two main areas: a theoretical framework or a direct relationship between the two. For example, Bruhn and Love (2014) found that digital inclusive finance can improve the efficiency of resource allocation and has positive implications for the upgrading of industrial structure. Li et al. (2022) found that digital inclusive finance has a positive effect on both the optimization of industrial structure and the rationalization of industrial structure. Second, the mechanism by which digital inclusive finance influences industrial structure. For example, Du et al. (2020) found that income disparity, capital accumulation, consumption demand and technological innovation are important intermediary channels for digital inclusive finance to promote the development of industrial structure, and contribute significantly to the rationalization and upgrading of industrial structure and the trend of internal industrial evolution. Li et al. (2021) found that digital inclusive finance can indirectly promote China’s green development by the coagglomeration degree of producer services and optimize and upgrade industrial structure.

In summary, research on digital inclusive finance and industrial structure development has produced relatively rich results in academia, and these studies help us to continue to deepen our research. However, there are still some imperfections in the existing studies. For one thing, the focus of digital inclusive finance is on rural areas or remote cities that cannot access and afford financial services, and existing studies have not yet focused on the rural economic effects of digital inclusive finance on the process of industrial structure development. Second, few studies have explored the deep-seated mathematical relationship and the internal mechanism of action between digital inclusive finance and the sports industry. In view of this, this study selects statistical data such as sports industry in some domestic provinces from 2015–2019 as panel data to construct a structural equation model of digital inclusive finance, rural residents’ living standards and sports industry, and to explore the mechanism of action between the three, so as to provide a theoretical basis and practical guidance for policy differentiation and implementation. The marginal contributions of this paper are divided into two main parts: firstly, exploring the relationship between digital inclusive finance and the sports industry expands the research related to digital inclusive finance. Secondly, it enriches the literature on the relationship between the digital economy and industrial structure by looking at the mediating paths through which digital inclusive finance affects the sports industry. In addition, by exploring the specific mechanisms of the role of digital inclusive finance in influencing the sports industry, this paper hopes to provide a theoretical basis and a reference for decision making in promoting digital inclusive finance to support the development of the sports industry in a global context.

The rest of the paper is structured as follows. In the second section, relevant theories are briefly reviewed and relevant hypotheses are put forward accordingly. In the third section, the data on the relevant variables and the treatment of the data used are produced. The forth section is the main part of the paper and reports the results of the analysis after data processing. Conclusions and responses are given in Part V.

2 Theoretical analysis and research hypothesis

2.1 The relationship between digital inclusive finance and the sports industry

According to the Solow model of economic growth (Zhong and Huang, 2018), digital inclusive finance can drive the development of sports industry from three aspects, first, increase the investment of production factors: as an important tool for the government to promote poverty reduction, digital inclusive finance reduces the financial threshold, and to a certain extent, it can alleviate the historical problem of “financing difficulty” in the sunrise industry (Zhang et al., 2022), which can promote the increase of input of production factors in the sports industry (Oswin et al., 2019). Second, change the allocation of resources: digital inclusive finance is the outcome of the digital economy. By promoting the sports industry to move towards the digital mode and accurately controlling the allocation of resources in the form of big data computing, it can effectively improve the resource distribute efficiency of the sports industry (David, 1990). Third, improve the production efficiency of all factors through technological progress: Digital inclusive finance uses big data processing technology to mitigate the problems of high transaction risks and costs of financial institutions, realize the upgrading of technology, and to a certain extent, provide financial support for technological upgrading, promote technological progress and improve industrial production efficiency (Oh, 2010). Accordingly, it is proposed that:

Hypothesis H1:. digital inclusive finance and sports industry are positively related, that is, digital inclusive finance will promote the development of sports industry.

2.2 The intermediary role of rural residents’ disposable income

Digital inclusive finance is different from the “financing discrimination” of traditional finance. It can effectively optimize the wealth allocation mode and asset appreciation effect of rural groups through low-cost, low threshold and high coverage digital financial services, and provide more diversified asset allocation modes for rural communities (Acemoglu and Guerrieri, 2008). At the same time, digital inclusive finance can also drive the development of rural small and micro enterprises, and agricultural economy, promote the development of rural secondary and tertiary industries, enable rural residents to obtain higher disposable income and provide continuous power by using the “Internet + agricultural supply chain finance” mode based on rural credit lending to provide financial support (Wu et al., 2021). In addition, digital inclusive finance allows financial resources to benefit more “long-tail customers”, broadens the investment and financing channels of rural residents, and creates a new way for rural households to gain more income. In view of the above, we propose that:

Hypothesis H2:. digital inclusive finance have a positive correlation with the disposable income of rural households, that is, digital inclusive finance will increase the disposable income of rural residents.According to Kuznets’ per-capita income impact theory, the increase of residents’ disposable income will boost the adjustment and evolution of industrial structure and promote the development of the tertiary industry (Ashokkumar et al., 2019). Therefore, as a part of the tertiary industry, the sports industry will be affected by the disposable income of residents. Specifically, in the short term, the increase of residents’ disposable income will improve residents’ immediate purchasing power, enhance residents’ Consumption Willingness, and strengthen the pulling effect of consumption on the economy (Firdausy and Tisdell, 1992). In the long run, under the background that national fitness and healthy China have become national strategies, people’s pursuit of physically and mentally healthy, quality of life will increase, and the investment in sports industry can meet people’s demand for physical and mental health and quality of life to a large extent, that is, there may be a long-term positive interaction between the increase of residents’ disposable income and the development of sports industry. The increase of residents’ disposable income is more conducive to making consumption a reliable support for the development of sports industry (Kucher et al., 2019). Therefore,

Hypothesis H3:. is put forward: the disposable income of rural residents is positively related to the sports industry, that is, the increase of the disposable income of rural residents will promote the development of the sports industry.

2.3 The intermediary role of rural residents’ consumption structure

Digital Inclusive Finance has a direct impact on the consumption structure of rural residents, and can promote the optimization process of rural residents’ consumption patterns from three levels. First, digital inclusive finance will reduce the “Preventive Savings” of rural residents’ consumers: in terms of the derivative functions of it, the financial services including funds and insurance have obvious asset protection effects, which can meet the buffer reserve needs of different periods, reduce the uncertainty risk of asset investment, improve the consumption confidence of rural residents’ consumers, thereby reducing the possibility of “Preventive Savings” (Choi et al., 2017; Bommier and Grand, 2019). Second, digital inclusive finance will increase the “wealth effect” of rural residents’ consumers: compared with traditional savings, digital inclusive finance can give rural consumers higher investment interest rates and more investment channels through the digital platform, and promote rural consumers to obtain more expected income and wealth appreciation (Paiella and Pistaferri, 2017). Third, digital Inclusive Finance will promote the optimization of “consumer services”: the audience of the traditional financial system is mainly large enterprises and relatively wealthy individuals, while digital inclusive finance relies on the consumer services provided by digital technology. Through in-depth analysis of the characteristics of different consumer groups, it can flexibly meet the consumer needs of different levels and achieve accurate and convenient consumer services, Thus promoting the optimization of rural residents’ consumption structure (Zhao et al., 2014; Paiella and Pistaferri, 2017). Accordingly, it is proposed that:

Hypothesis H4. Digital Inclusive Finance have a positive correlation with the optimization of rural residents’ consumption structure, that is, digital Inclusive Finance will promote the optimization process of rural residents’ consumption structure.As for the impact of the change of consumption structure on the sports industry, the academic circles have put forward the long tail effect. According to the long tail effect theory, with the change of the consumption structure, the tail effect of the demand curve will gradually transform, and finally exceed the head effect to form a tail effect. Thus, the optimization of the industrial structure of the sports industry is more inclined to the optimization of the tail structure (Li et al., 2016). At the same time, in consumer economics, the change of household consumption structure is often accompanied by the change of industrial structure. Therefore, under the condition that digital inclusive finance promotes the transformation of consumption structure, it will indirectly promote the change of sports industry structure and boost the sustainable development of sports industry (Shi, 2020). Based on these grounds:

Hypothesis H5. the optimization of the consumption structure of rural residents have a positive correlation with the sports industry, that is, the optimization of the consumption structure of rural residents will promote the development of the sports industry.

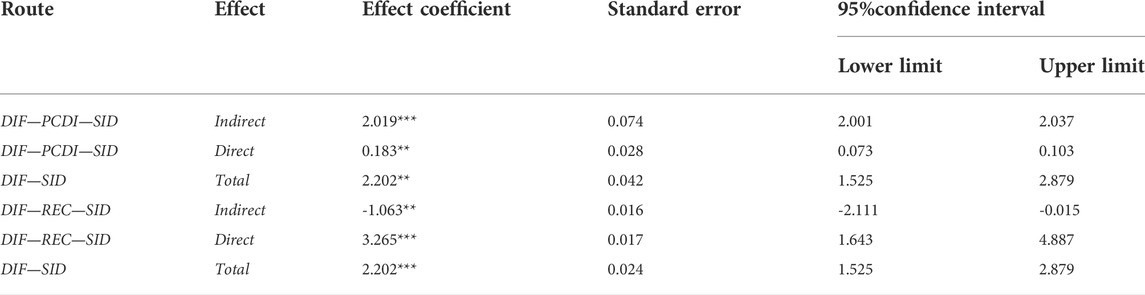

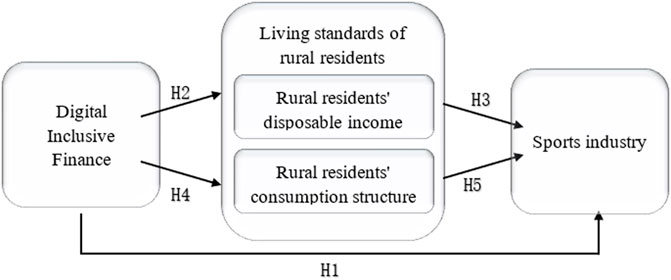

In summary, in addition to the direct structural upgrading effect of the sports industry, digital inclusive finance can also enhance the structural upgrading of the sports industry through the paths of rural residents’ disposable income and rural residents’ consumption structure, with the specific mechanisms shown in Figure 1.

FIGURE 1. Theoretical model diagram of the relationship between digital Inclusive Finance and sports industry.

3 Study design

3.1 Variable design

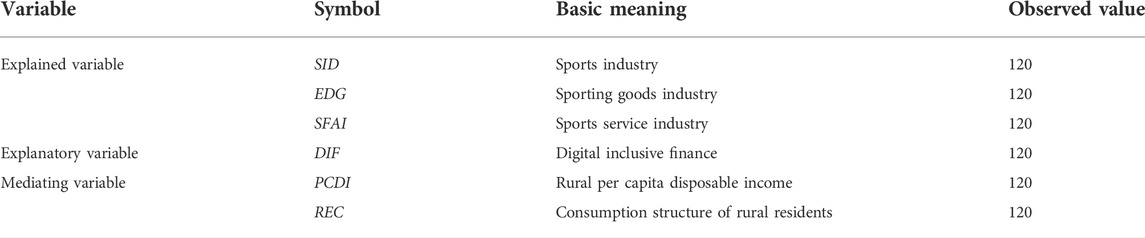

This paper mainly uses the following data: 1) Digital Inclusive Finance (DIF). The data comes from the digital inclusive finance index compiled by the digital finance research center of Peking University.2) The living standard of rural residents. There are many methods and indicators to reflect the living standards of rural residents. This text mainly adopts rural per-capita disposable income (PCDI) and rural residents’ consumption structure (REC) as auxiliary variables to reflect household living standard. Among them, the Engel coefficient of rural residents, as the only variable on behalf of the consumption structure of rural residents, is negatively related to the optimization of the consumption structure of rural residents. The relevant data are mainly from the statistical yearbooks of various provinces and are indexed based on the data in 2015. 3) The sports industry (SID). Referring to the existing literature and according to the division standard of China’s three industries (Yang, 2012), the sports manufacturing (EDG) and sports services (SFAI) are taken as auxiliary variables. Since some provinces in China did not conduct sports industry statistics from 2015 to 2019, the data of 24 provinces or municipalities directly under the central government, including Liaoning, Shanghai, Zhejiang, Shandong, Hunan, Guangdong, Chongqing, Sichuan, Guizhou, Jiangsu, Shandong, Hubei, Fujian, Anhui, Heilongjiang, Hebei, Shanxi, Henan, Jiangxi, Inner Mongolia, Shaanxi, Jilin, Ningxia and Gansu, with comprehensive sports industry statistics, were selected as samples.Among them, the relevant data of the sports industry in 15 provinces of Jiangsu, Shandong, Hubei, Fujian, Anhui, Heilongjiang, Hebei, Shanxi, Henan, Jiangxi, Inner Mongolia, Shaanxi, Jilin, Ningxia and Gansu are calculated based on the year-on-year growth mentioned in the reports of some years. The relevant data are mainly from the official websites of the sports bureaus of various provinces. The calculation method is based on the data in 2015 for index conversion. See Table 1 for variable design and variable definitions.

3.2 Model construction

3.2.1 Test methods for mediating effects

Consider the influence of the independent variable x on the dependent variable y. If independent variable x affects dependent variable y by influencing variable m, m is called an intermediate variable. Assuming that all variables are normalized, the relationship between mediating effect variables can be described by the following equation:

where, m is the total effect of independent variable X on dependent variable Y, a is the estimated coefficient of independent variable X on intermediate variable M, b is the effect of intermediate variable M on dependent variable Y after controlling the influence of independent variable X, and coefficient m' is the direct effect of independent variable X on dependent variable Y after controlling the influence of intermediate variable M, and n1、n2 and n3 are residual terms.

3.2.2 Construction of empirical models

In order to test the direct impact of digital inclusive finance on the development of sports industry, this text builds the following benchmark regression model:

where Xit represents explanatory variables, i represents provinces, t represents years, and j represents the number of control variables. α0、β1、φi is the estimation coefficient of the constant term, the explanatory variable Xit and the control variable Vijt, oi is the individual fixed effect, σi represents a time fixed effect, μit is a random disturbance term.

Based on the research results of Freedman and Schatzkin. (1992), an empirical model including multiple intermediary variables was established to test whether the intermediary effect of the growth of rural residents’ disposable income and the optimization of rural residents’ consumption structure on the development of sports industry exists, and its specific impact on the development of sports industry. Therefore, the following model of multiple mediating effects is constructed:

where c1 is the estimation coefficient of the independent variable X, φi is the estimation coefficient of the control variable Vijt, qi is the estimation coefficient of the intermediate variable M, and d1 and e1 are the estimation coefficients of the independent variable X on the two intermediate variables M1 and M2, respectively; γ1it、 γ2i、γ3it、γ5it is a random disturbance term, c0、do、e0、g0 are constant terms; g1 is the direct effect of independent variable X on dependent variable Y. All variable data are normalized to eliminate potential heteroscedasticity.

4 Empirical analysis

4.1 Descriptive statistical analysis

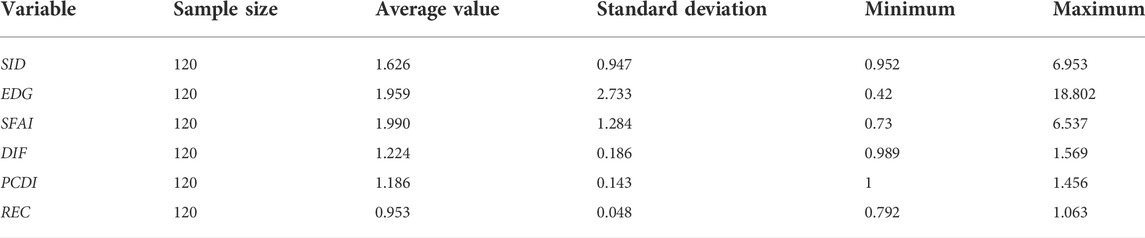

The descriptive statistics of all variables are listed in Table 2. The minimum values of multiple variables are the same mainly because the data of all variables are subject to exponential conversion in this study. From the perspective of standard deviation, all variables are uniformly distributed. From the perspective of minimum value, maximum value, average value and median value, all samples have no outlier problem. Therefore, it can be concluded that all variables have research reference value in combination with the data in the table.

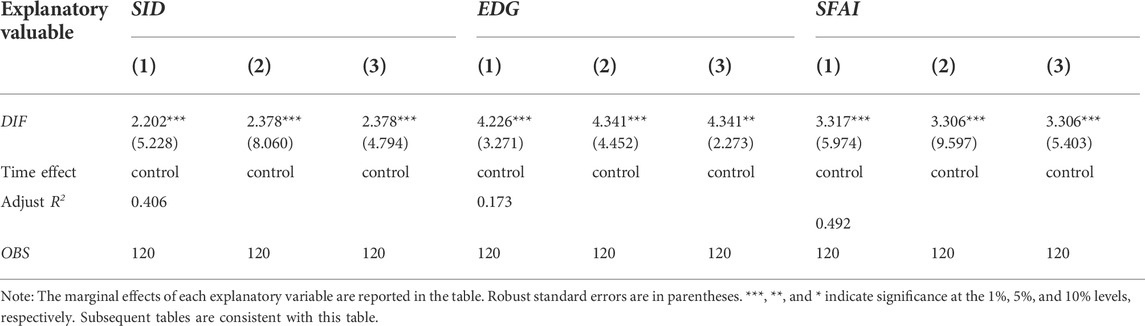

4.2 Benchmark regression

In order to more accurately describe the benchmark relationship between digital financial inclusion and the development of sports industry, clustering robust standard error fixed effect regression is adopted. The results of regression analysis show that there is a significant positive correlation between digital inclusive finance and sports industry, which is consistent with the expected assumptions. Thus, the relationship between variables supports the hypothesis of subsequent studies. The results of the benchmark regression analysis are shown in Table 3.

4.3 Intermediary effect test

4.3.1 Stepwise regression tests based on fixed-effects models

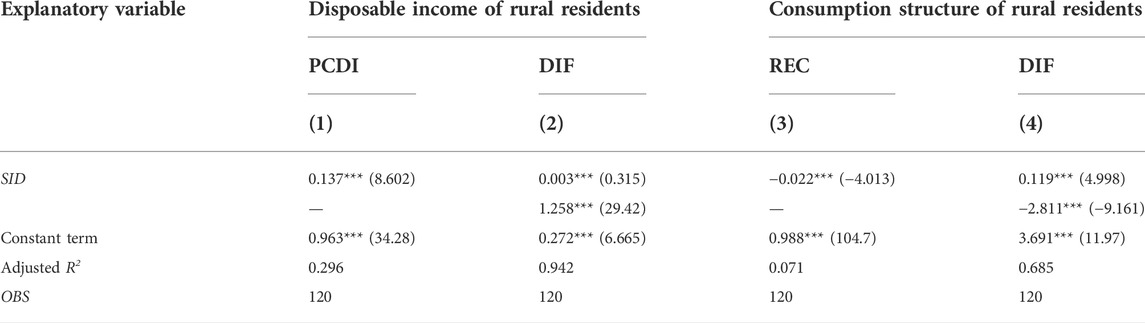

The regression models involved in the progressively test were analyzed by using fixed effects. The results show that the digital inclusive finance has a significant positive impact on the sports industry at the level of 1%, indicating that the digital Inclusive Finance will promote the development of the sports industry, and the hypothesis H1 is established; Digital Inclusive Finance has a significant positive impact on the disposable income of rural residents at the level of 1%, indicating that the development of digital inclusive finance will increase the disposable income of rural residents, and hypothesis H2 is established; The disposable income of rural residents has a significant positive impact on the sports industry at the level of 1%, which indicates that the increase of the disposable income will promote the development of the sports industry, and hypothesis H3 is established; Digital Inclusive Finance has a significant positive effect on the consumption structure of rural residents at the level of 1%, which indicates that the development of digital inclusive finance will improve the consumption pattern of rural residents, and hypothesis H4 is valid; The consumption structure of rural residents has a significant positive impact on the sports industry at the level of 1%, which indicates that the improvement of the consumption structure will promote the development of the sports industry. Hypothesis H5 is valid. Table 4 reports the results of the stepwise regression test for mediating effects.

4.3.2 Significance test of mediating effect

In order to determine the coefficient of the mediating effect of rural residents’ livelihood in the process of digital inclusive finance promoting the development of the sports industry, this paper introduces a deviation-corrected percentile Bootstrap method based on a stepwise regression test. The test results show that the deviation-corrected interval does not include 0. In terms of the mediating mechanism of rural residents’ disposable income, the size of the effect of digital inclusive finance on the sports industry is 0.183 without considering the mediating variable of rural residents’ disposable income, and after adding the variable of rural residents’ disposable income, the effect of digital inclusive finance on the sports industry is 2.202, with rural residents’ disposable income as part of the mediating effect with an effect size of 2.019, indicating that the disposable income of rural residents helps to promote the development of digital inclusive finance on the sports industry. In terms of the mediating mechanism of rural residents’ consumption structure, without considering the mediating variable of rural residents’consumption structure, the effect size of digital inclusive finance on the sports industry is 3.265. After adding the variable of rural residents’ consumption structure, the effect of digital inclusive finance on the sports industry is 2.202, with rural residents’ consumption structure as a partial mediating effect, and its effect size is −1.063. At the same time, due to the shortcomings of the linear, the mediating effect model in this study is mainly based on the linear regression model, so the positive and negative meanings of the linear regression method are still used here, which means that digital inclusive finance can promote the development of the sports industry by optimizing the consumption structure of rural residents. Table 5 reports the results of the Bootstrap analysis of the significance test for mediating effects.

5 Conclusion and countermeasures

By constructing a structural equation model, this study empirically analyses the mediating effect of the development of digital inclusive finance on the development of the sports industry, from which the following conclusions are drawn: Firstly, digital inclusive finance has a facilitating effect on the development of the sports industry, indicating that digital inclusive finance can drive the development of the sports industry. Second, from the mediation mechanism of rural residents’ disposable income, digital inclusive finance can form a scale effect by increasing rural per capita disposable income, which in turn promotes the development of the sports industry. Thirdly, from the intermediary mechanism of rural residents’ consumption structure, digital inclusive finance will use its digital and precise characteristics to precisely improve the consumption structure of rural residents, thus promoting the transformation and upgrading of the sports industry. The most significant mediating effect is on rural disposable income per capita, mainly because digital inclusive finance has a more significant impact on rural residents’ disposable income per capita, so the mediating effect radiates more. Overall, these findings are in line with our expectations.

Based on the above findings, the following recommendations are made: First, the integration of digital inclusive finance and the sports industry should be promoted. On the one hand, the sports industry model should be adjusted with the help of digital technology, and the industrial development model should be gradually changed from “international circulation” to “internal and external circulation”, and the concept of industrial development should be changed from “passive transformation” to “active transformation”. The concept of industrial development should be changed from “passive transformation” to “active transformation”, and the concept of expanding the “traditional elements” should be changed to the concept of expanding the “data elements”. On the other hand, digital technology can be used to promote the innovative development of the sports industry, based on the China’s 14th Five-Year Plan and other relevant policies, to accelerate the speed of innovative changes in the sports industry, to promote the sports industry across borders, to accelerate industrial upgrading, and to provide new elements for the sports industry, so that the sports industry can achieve a fierce collision of related elements the improvement of the production efficiency of the sports industry. Secondly, insist on increasing financial support for agriculture with precise supply. Continuing to adhere to policies related to financial support for agriculture will help to realize the transformation of the tail effect of the demand curve, which will positively promote the increase of disposable income of rural residents, the upgrading of the quality of consumption level of rural residents, and the development of rural economy; at the same time, we should insist on promoting differentiated policies for the development of digital economy, making precise supply according to the situation of different regions, and focusing on the synergistic effect of finance and finance in supporting agriculture, so as to ensure the rapid improvement and development of relevant infrastructure, thereby promoting the revitalization of rural industries and the development of sports industries. Third, optimize the sports consumption environment for rural residents and broaden their sports consumption channels. Firstly, the digital platform should be used to improve the internet skills of rural residents, establish multi-channel consumption channels and consumption modes, enrich consumption contents, and continuously meet the development needs of regional sports consumption; secondly, the publicity of “enjoyable consumption” can be increased, traditional consumption inertia can be weakened, a good consumption environment can be created, and the development of transportation and logistics in rural areas can be promoted, so as to continuously release the development of sports industry. Secondly, we can step up the promotion of “enjoyable consumption”, weaken the traditional consumption inertia, create a favourable consumption environment, promote the development of transportation and logistics in rural areas, and constantly release new consumption potential, with a view to promoting consumption upgrading by guiding rural residents to change their consumption concepts, and ultimately promoting the generation of the scale effect of sports industry. Fourthly, the digital management level of the sports industry should be improved. The digital platform should be used to co-ordinate the allocation of resources, promote the free flow of relevant sports production factors, optimize the efficiency of the flow of human, physical and digital resources, and avoid the negative impact of the “digital divide” and “information asymmetry” on the allocation of resources. At the same time, it is also necessary to make use of the market’s autonomy in order to eliminate the disadvantages of a single resource allocation method and to rationalize and maximize the effectiveness of resource allocation.

At the same time, there are some limitations in this study. Firstly, due to the relatively short period of development of digital inclusive finance, the statistics of the sports industry in some regions are incomplete, resulting in the study using a data index period of only 5 years and a relatively small sample size; future studies can expand the relevant data volume to avoid this shortcoming. Secondly, the study only considered the mediating variable of living standards of rural residents, but there may be other mediating variables in real life that need to be further explored in the future.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

HH: Conceptualization, methodology, software, investigation, Writing—Original draft; YZ: Data curation, Writing—Original draft, Formal Analysis.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Acemoglu, D., and Guerrieri, V. (2008). Capital deepening and nonbalanced economic growth. J. political Econ. 116 (3), 467–498. doi:10.1086/589523

Ashokkumar, K., Bairi, G. R., and Are, S. B. (2019). Agriculture E-commerce for increasing revenue of farmers using cloud and web technologies. J. Comput. Theor. Nanosci. 16 (8), 3187–3191. doi:10.1166/jctn.2019.8158

Bommier, A., and Grand, F. L. (2019). Risk aversion and precautionary savings in dynamic settings. Manag. Sci. 65 (3), 1386–1397. doi:10.1287/mnsc.2017.2959

Bruhn, M., and Love, I. (2014). The real impact of improved access to finance: Evidence from Mexico. J. Finance 69 (3), 1347–1376. doi:10.1111/jofi.12091

Choi, H., Lugauer, S., and Mark, N. C. (2017). Precautionary saving of Chinese and US households. J. Money, Credit Bank. 49 (4), 635–661. doi:10.1111/jmcb.12393

David, P. A. (1990). The dynamo and the computer: An historical perspective on the modern productivity paradox. Am. Econ. Rev. 80 (2), 355–361. doi:10.2307/2006600

Du, J., Wei, S., and Wu, W. (2020). Does digital financial inclusion promote the optimization of industrial structure? Comp. Econ. Soc. Syst. 36 (6), 38–49. doi:10.3969/j.issn.1003-3947.2020.06.010

Firdausy, C., and Tisdell, C. (1992). Rural poverty and its measurement: A comparative study of villages in nusa penida, bali. Bull. Indonesian Econ. Stud. 28 (2), 75–93. doi:10.1080/00074919212331336224

Freedman, L. S., and Schatzkin, A. (1992). Sample size for studying intermediate endpoints within intervention trials or observational studies. Am. J. Epidemiol. 136 (9), 1148–1159. doi:10.1093/oxfordjournals.aje.a116581

Kucher, A., Heldak, M., Kucher, L., Fedorchenko, O., and Yurchenko, Y. (2019). Consumer willingness to pay a price premium for ecological goods: A case study from Ukraine. Environ. Socio-economic Stud. 7 (1), 38–49. doi:10.2478/environ-2019-0004

Li, F., Wu, Y., Liu, J., and Zhong, S. (2022). Does digital inclusive finance promote industrial transformation? New evidence from 115 resource-based cities in China. Plos one 17 (8), e0273680. doi:10.1371/JOURNAL.PONE.0273680

Li, G., Fang, X., and Liu, M. (2021). Will digital inclusive finance make economic development greener? Evidence from China. Front. Environ. Sci. 9, 452. doi:10.3389/FENVS.2021.762231

Li, J., Zhang, Y., Ma, L., and Liu, X. (2016). The impact of the internet on health consultation market concentration: An econometric analysis of secondary data. J. Med. Internet Res. 18 (10), e276. doi:10.2196/jmir.6423

Liu, Y., Zhao, X., and Mao, F. (2022). The synergy degree measurement and transformation path of China's traditional manufacturing industry enabled by digital economy. Math. Biosci. Eng. 19 (6), 5738–5753. doi:10.3934/MBE.2022268

Luo, Y., Gao, S., Yan, X., and Cao, Y. (2022). Analysis and research on sustainable development factors of the sports industry based on chaos theory. J. Environ. Public Health 2022, 1–12. doi:10.1155/2022/1060639

Mpofu, F. Y., and Mhlanga, D. (2022). Digital financial inclusion, digital financial services tax and financial inclusion in the fourth industrial revolution era in africa. Economies 10 (8), 184. doi:10.3390/ECONOMIES10080184

Oh, D. H. (2010). A global Malmquist-Luenberger productivity index. J. Product. Anal. 34 (3), 183–197. doi:10.1007/s11123-010-0178-y

Oswin, A. A., Ma, Z., Li, M., Isaac, A. M., Ayamba, E. C., and Nana, K. N. (2019). The 1978 economic reforms of China and its impact on economic growth-A time series data analysis. J. Statistics Manag. Syst. 22 (8), 1511–1538. doi:10.1080/09720510.2019.1662582

Paiella, M., and Pistaferri, L. (2017). Decomposing the wealth effect on consumption. Rev. Econ. Stat. 99 (4), 710–721. doi:10.1162/REST_a_00629

Ren, B., and Huang, H. (2021). Theoretical logic, practical dilemma and implementation path of high quality development of sports industry driven by digital economy. J. Shanghai Univ. Sport 63 (07), 22–34+66. doi:10.16099/j.sus.2021.07.003

Shi, L. (2020). Industrial structure changes, spatial spillover and economic growth in the yangtze river delta. J. Coast. Res. 107 (SI), 377–382. doi:10.2112/jcr-si107-086.1

Vega, R., Almendros, L. J., Barquín, R. R., Boros, S., Demetrovics, Z., and Szabo, A. (2020). Exercise addiction during the COVID-19 pandemic: An international study confirming the need for considering passion and perfectionism. Int. J. Ment. Health Addict. 20 (2), 1159–1170. doi:10.1007/s11469-020-00433-7

Wu, Y., Li, X., Liu, Q., and Tong, G. (2021). The analysis of credit risks in agricultural supply chain finance assessment model based on genetic algorithm and backpropagation neural network. Comput. Econ. 2021, 1–24. doi:10.1007/S10614-021-10137-2

Xiang, X., Ma, M., Ma, X., Chen, L., Cai, W., Feng, W., et al. (2022). Historical decarbonization of global commercial building operations in the 21st century. Appl. Energy 322, 119401. doi:10.1016/J.APENERGY.2022.119401

Yang, Q. (2012). Analysis of China's sports industry structure and its benefits based on statistical data. J. Tianjin Univ. Sport 27 (01), 27–30. doi:10.13297/j.cnki.issn1005-0000.2012.01.012

Zhang, S., Ma, M., Xiang, X., Cai, W., Feng, W., and Ma, Z. (2022). Potential to decarbonize the commercial building operation of the top two emitters by 2060. Resour. Conservation Recycl. 185, 106481. doi:10.1016/j.resconrec.2022.106481

Zhang, Y., and Zhou, Y. (2021). Digital financial inclusion, traditional financial competition, and rural industry integration. J. Agrotechnical Econ. 40 (9), 68–82. doi:10.13246/j.cnki.jae.2021.09.005

Zhao, X., Sun, Q., Huang Fu, Y. H., and Li, C. R. (2014). Analysis of consumption of rural residents in Jilin province based on hidden markov model. Adv. Mat. Res. 971, 2281–2284. doi:10.4028/www.scientific.net/AMR.971-973.2281

Keywords: digital inclusive finance, living standards of rural residents, sports industry, intermediary effect, rural residents

Citation: Huang H and Zhang Y (2022) Digital inclusive finance and the development of sports industry: An empirical study from the perspective of upgrading the living level of rural residents. Front. Environ. Sci. 10:1033894. doi: 10.3389/fenvs.2022.1033894

Received: 01 September 2022; Accepted: 14 October 2022;

Published: 26 October 2022.

Edited by:

Kangyin Dong, University of International Business and Economics, ChinaCopyright © 2022 Huang and Zhang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Hui Huang, aHVhbmdodWlAY3NudS5lZHUuY24mI3gwMjAwYTs=

Hui Huang

Hui Huang Yunxuan Zhang

Yunxuan Zhang