- Research Institute of Petroleum Exploration and Development of Petro China, Beijing, China

Helium, as an important strategic resource, is widely used in medical and sophisticated high-tech, but its distribution is seriously imbalanced, mainly concentrated in the United States, Qatar, Algeria and Russia. In this paper, based on the systematic study of the global distribution and supply and demand of helium, the current situation and future trend of helium consumption in china were analyzed. In view of the shortage of helium resources in China and the high dependence on foreign countries, suggestions were put forward to strengthen the comprehensive research on domestic helium resources, enhance the investigation and utilization of associated helium resources, deepen the research on helium exploration and development technology, and promote the process of commercial exploration and development.

Introduction

At room temperature, helium is a colorless, odorless inert gas with inactive chemical properties, making it difficult to react with other substances under normal conditions. When the temperature after liquefaction drops to 2.174 K, it has the characteristics of low surface tension, strong thermal conductivity and extremely low viscosity (Editorial Board of Manual of Requirements for the Mineral Resources Industry, 2010). As it is widely used in aerospace, semiconductor, cutting-edge scientific research and other fields, it is an indispensable strategic material for national defense, military industry and high-tech development.

Helium has been produced and developed for over a century. Helium was discovered in the United States in 1903 in the Dexter oil well in Kansas and a national helium reserve was established in Texas in 1963 (Arkharov et al., 2013; Advameg Inc, 2021). The deep cooling method, known as condensation, is the most widely used method of helium extraction in the world. It takes advantage of the differences in the critical temperatures of the components of natural gas to separate the helium. Most of the helium extraction plants in the United States, including the recently commissioned helium processing plants in Qatar, Australia and Russia, and the upcoming helium extraction plant in Tanzania, are using the deep cooling method (Arkharov et al., 2013; Chen et al., 2020; Ryzhkov, 2020; Edison, 2021; European Commission, 2021; Ryzhkov, 2021).

China has very scarce helium resources, accounting for only 2% of the world’s reserves, and its external dependence is as high as 95%. So it mainly imports helium from Qatar, the United States and other countries. The United States has a global monopoly on helium resources and technology, because it not only has the world’s largest helium reserves (accounting for more than 40%), but also has the most advanced helium extraction technology (Geology in China Editorial Office, 2018; Gazprom, 2020; European Commission, 2021). Qatar, China’s main helium exporter, also relies on the United States for its helium extraction technology and equipment. Under this circumstance, once the United States imposes a “stranglehold” blockade on helium exported to China, China will be greatly restricted by the helium supply. Foreign-funded enterprises dominate the helium import market in China. In 2020, helium imported by wholly foreign-owned and joint ventures accounted for 84% of China’s total imports. China’s helium import and domestic sales market are mainly controlled by foreign companies, such as Linde Group of Germany, Praxair Company of the United States and Air Products Company of the United States. Moreover, the United States requires that helium can only be used for non-military purposes in its export to China, and this article shall be stipulated in the helium export contract to China, which seriously restricts the development of helium industry in China (Han et al., 2022).

According to the data released by energy departments, resource departments, large energy companies and import and export customs, we have statistically analyzed the global helium market. This paper analyzes the distribution characteristics, supply and demand of global helium resources, as well as the current situation and trend of China’s consumption, summarizes the helium resources and market pattern, and provides a reference for the government to formulate helium market policies and enterprises to explore and develop helium.

Distribution characteristics of helium resources

Global distribution of helium resources

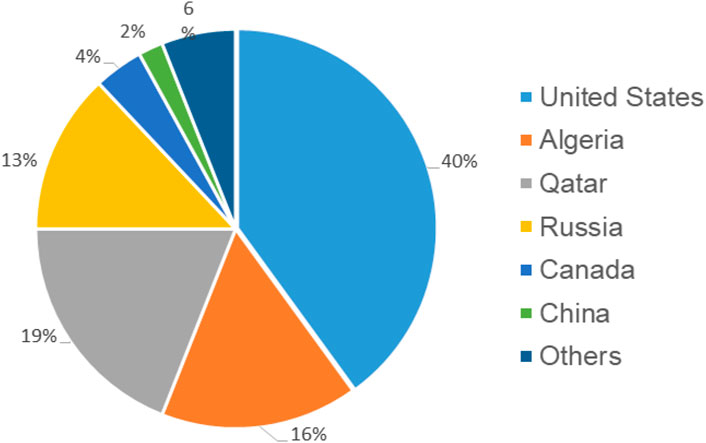

Helium resources are distributed unevenly around the world. According to the 2020 survey report from the United States Geological Survey (USGS), the global helium resource in 2020 was about 51.9 billion cubic meters, and the United States, Qatar, Algeria and Russia owned 88% of the global helium resource (National Research Council, 2010; National Archives, 2021; Qatargas, 2021; Thor Resources Inc, 2021). Specifically, the United States ranks first in terms of the amount of helium resource in the world, about 20.6 billion cubic meters, while Qatar (10.1 billion cubic meters) (National Research Council, 2010), Algeria (8.2 billion cubic meters) and Russia (6.8 billion cubic meters) rank second to fourth. China has 1.1 billion cubic meters of helium resources, ranking the sixth in the world (Figure 1).

FIGURE 1. Forecast of helium resources in the world (data from USGS, 2021) (Thor Resources Inc, 2021).

The remaining proven reserves of helium in the world are also very limited and are distributed in an extremely uneven manner. The United States has the largest volume of 3.9 billion cubic meters, while Algeria and Russia rank the second and third, with 1.8 billion cubic meters and 1.7 billion cubic meters respectively. Different natural gas fields have varied Helium content. For example, the helium content in US gas fields is the highest, with an average of about 0.8% (mole fraction), and the helium content in individual gas fields is as high as 7.5%.

Helium resource distribution in China

According to USGS evaluation data, China has helium resources of 1.1 billion cubic meters, accounting for 2% of the world. China has more than 15.0 × 1012 m3proved reserves of natural gas (Thor Resources Inc, 2021). Based on the commercial helium extraction standard for natural gas (0.3%), it is estimated that 10% natural gas has helium extraction potential, so the helium resource volume is estimated to be 45.0 × 108 m3.

According to the rough estimation based on component method, the geological resources of helium in Sinopec exceed 1.0 × 109 m3, and the proven natural gas reserves of CNPC are over 12.0 × 1012 m3, among which the proven natural gas reserves in Tarim, Sichuan, Erdos and Qaidam exceed 9.0 × 1012 m3, and the potential of helium resources is more than 2.7 × 109 m3. The exploration of helium resources in China should start with the main natural gas areas that have been found to contain helium. Great emphasis should be placed on the stable basins in the western and central regions. It is predicted that the available helium resources in China should be above 4.7 × 109 m3 (USGS, 2021).

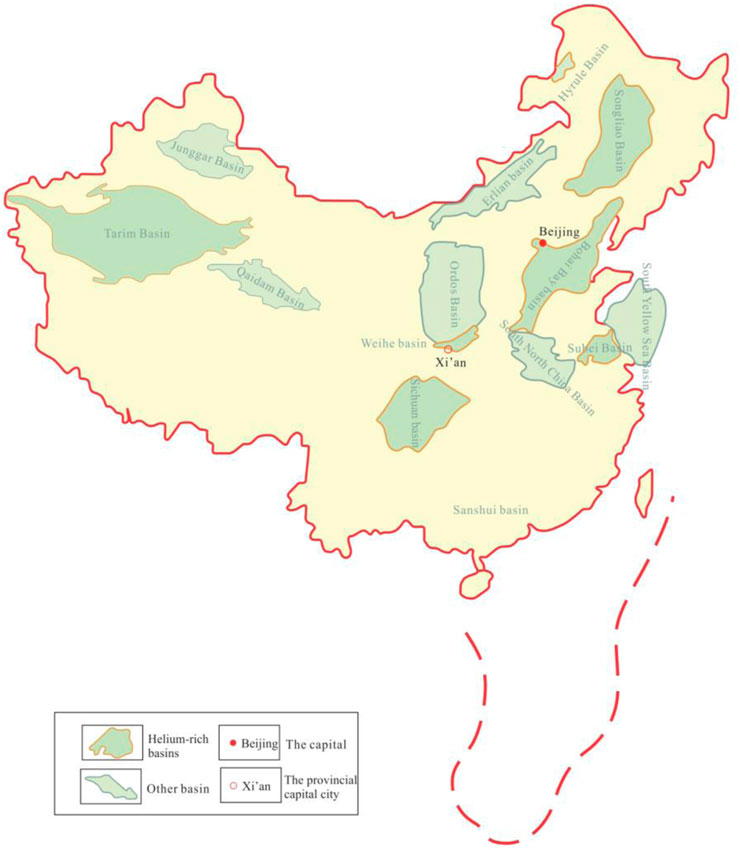

Helium resources are widely distributed in China. China has a large number of sedimentary basins, mainly small and medium-sized ones. According to the statistics of the Ministry of Land and Resources of China in 2010, China has a total of 424 continental sedimentary basins, 12 marine sedimentary basins and 69 marine-continental superimposed basins (Chen et al., 2021a; Chen et al., 2021b; Han et al., 2022). It is found that many basins in the east, west and middle have abundant helium-rich oil and gas reservoirs, including Hailaer Basin, Songliao Basin, Bohai Bay Basin, Subei Basin and Sanshui Basin in the east, Tarim Basin in the west, Sichuan Basin and Weihe Basin in the central region (Figure 2) (Zhang et al., 2019; Chen et al., 2021b).

FIGURE 2. Distribution of helium-rich basins in China (Zhang et al., 2018).

The distribution of helium resources in China is featured by full gas in small basins and partial gas in large and medium-sized basins (Chen et al., 2021a; Han et al., 2022). For example, in Hailaer Basin, Weihe Basin, Sanshui Basin and other small basins, helium is ubiquitous in the whole basin; In large and medium-sized basins, helium is locally enriched by structural units or regions, such as the Wanjinta structure in the north and south of Songliao Basin, the eastern Liaohe depression in Bohai Bay Basin, Huagou area in Jiyang depression, Huanghua depression and Dongpu depression, Huangqiao area in Dongtai depression, Qintong depression, Jinhu depression of Northern Jiangsu Basin and Xiqiao area in Jiangsu, Shaya uplift in the north of Tarim Basin, northwest of Maigaiti slope, Hetianhe gas field and Weiyuan gas field in Sichuan Basin (Dai, 2003; Li et al., 2018; Zhang et al., 2019; Peterson, 2020; Chen et al., 2021b; Zhang et al., 2022a; Dai et al., 2022; Feng et al., 2022; He et al., 2022; Li et al., 2022; Lu, 2022; Wang et al., 2022). According to the existing exploration and research results, China has the distribution of natural gas reservoirs rich in helium and high helium, and is qualified in geological conditions to form helium-rich and high-helium natural gas reservoirs (Zhang et al., 2022a; Lu, 2022).

In the future, China should focus on the research of crust-derived helium, give consideration to the research of mantle-derived helium. The helium in the central and western regions of China is mainly crust-derived on, and only a small amount or even a trace of mantle helium is mixed. The helium region in the eastern region is a mixture of crust and mantle, and the mantle-derived helium content is mainly about 20% and 50%, that is, the content of crust-derived helium is mainly about 80% and 50%. Crust-derived helium is widespread in the eastern, western and central China with high content. It is the main genetic type of helium in China (Dai, 2003; Peterson, 2020).

Global helium supply and demand

Major producers and exporters

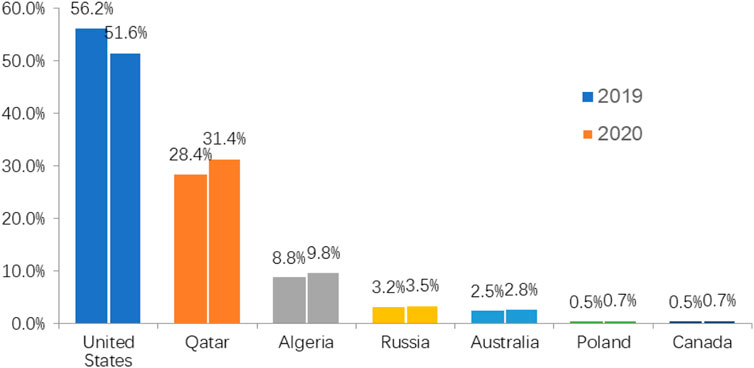

Global helium producers are mainly concentrated in North America and the Middle East. In 2020, the global production of helium gas was approximately 140 million cubic meters, representing a year-on-year decrease of 12.5%. Among them, the United States produced 74 million cubic meters, accounting for more than half of the world’s output. The United States, Qatar and Algeria accounted for 93% of the total global production. The United States is the first major producer of helium. Helium in the United States is mainly distributed in Cliffside, Hugo, Panhandle, Greenwood, Keyse and Riley Ridge gas fields. Qatar is the second largest producer of helium, which is mainly produced from the flash gas of liquefied natural gas (LNG) in the northern gas field. Algeria is the third largest producer of helium and the local helium is produced from liquefied natural gas, mainly from Hassi R’Mel gas field (Figure 3) (Zhang et al., 2022b).

FIGURE 3. Proportion of global helium production from 2019 to 2020 (data from USGS, 2021) (Thor Resources Inc, 2021).

Helium exporters in the world are mainly concentrated in the Middle East and CIS. Qatar and Algeria in the Middle East have relatively small demand, and the main output is exported to other countries. In Russia, helium-rich gas fields with high potential but low development level include Orenburg gas field, Chayanda gas field in Yakut region and Kovykta gas field in Eastern Siberia (Chen et al., 2020; Gazprom, 2020). In addition to meeting the demand of one million cubic meters per year, the rest can be exported to other countries after liquefaction. The helium in Poland is mainly produced in Odolannowg gas field. The annual production of helium in Poland can reach 1–3 million cubic meters, which is mainly exported to the European market (Qatargas, 2021).

Global helium supply and demand forecasts

Helium will continue to be in short supply in the world. Since 2007, with the development of high-tech industry and scientific research, the global demand for helium has increased year by year, especially from the high-end manufacturing, low-temperature superconductivity and the cooling gas of the fourth-generation nuclear reactor (Ryzhkov, 2020; Ryzhkov, 2021; Thor Resources Inc, 2021). Currently, the global annual demand for helium is about 200 million cubic meters, but the annual output is only about 160 million cubic meters. According to the predictions from relevant Russian agencies, the global demand for helium will reach 220–300 million cubic meters in 2030. If the exploration and exploitation of new blocks are not carried out, the world’s production of helium will drop to 134 million cubic meters in 2030, with a shortfall of more than 166 million cubic meters (Gazprom, 2020; Qin and Li, 2021; Thor Resources Inc, 2021).

As the demand for helium keeps increasing, the supply of helium may fluctuate greatly due to special events. For example, in 2017, when the helium supply in Qatar was cut off, due to political factors, many Arab countries closed their borders with Qatar, interrupting helium production and transportation for several weeks and affecting 30% of the global helium supply (National Research Council, 2010; Han et al., 2022). The Russian Far East helium extraction plant will be completed in 2025 and the helium supply will increase from 2% now to more than 25% in 2025. Helium supply may increase due to the increase of demand and price, and maintain a dynamic balance for a long time (Chen et al., 2020; Edison, 2021; European Commission, 2021).

The Asia-Pacific region will be the main driver of the helium market. According to the demand, it is predicted that the helium consumption will increase to 112 million cubic meters by 2040. Under appropriate selection, the basic consumption can reach 135 million cubic meters and the maximum consumption can reach 158 million cubic meters. The growth of demand is related to the dynamics of economic growth, but the growth rates of countries in the Asia-Pacific region are not uniform (Edison, 2021; National Archives, 2021). In China, for example, economic growth is forecast to slow down gradually from 7% to 8% per year in 2020 to 3%–4% in 2040, and the growth rate of demand for helium will correspondingly decrease. In South Korea, the demand growth will not exceed 1% per year. The stagnation of helium demand in Japan will be caused by the developed economic structure and saturated market. In other developing countries, demand growth will range from 5% in 2020 to 2% in 2040 (National Archives, 2021).

Russia is expected to become the new major helium exporter, because about 25% of the world’s helium reserves are concentrated in Russian mineral deposits. In 2021, the helium production in Orenburg, Russia decreased to 4.5 million cubic meters per year, and the helium production capacity of Amur processing plant in the Far East of Russia will be 60 million cubic meters per year (5.8 MMcf/d-Million cubic feet per day.) after completion. In 2022, INK (Irkutsk Oil) plans to build a helium treatment plant of 7.5 million cubic meters to treat natural gas from Yarakta Gas Field and to treat natural gas from Markovskoye Gas Field in 2025, with a helium production capacity of 4.5 million cubic meters. In the future, Russia’s helium production will be close to 80 million cubic meters per year, and if the production capacity of each processing plant can meet the standard, Russia’s helium production will be far greater than its helium consumption (4.8 million cubic meters per year) (Gazprom, 2020). In the future, Russia will have more helium resources reserves or exports, which is a great boon for China. If cooperation is reached in the future, the risk of China’s helium field being blocked by the United States will be lifted.

Current situation and trend of helium consumption in China

Sources of helium import in China

China is highly dependent on imports. In 2021, a total of 3,685 tons of helium were imported, a decrease of 0.6% over 2020. The average import price was about 76.5 USD/kg, 0.9% less than that in 2020. The major import locations include Qatar, the United States and Australia. In 2021, 3,005.9 tons of helium was imported from Qatar, accounting for 82%, 346.1 tons from the United States, accounting for 9%, 304.6 tons from Australia, accounting for 8%, and 24 tons from Russia, accounting for 1% (Han et al., 2022).

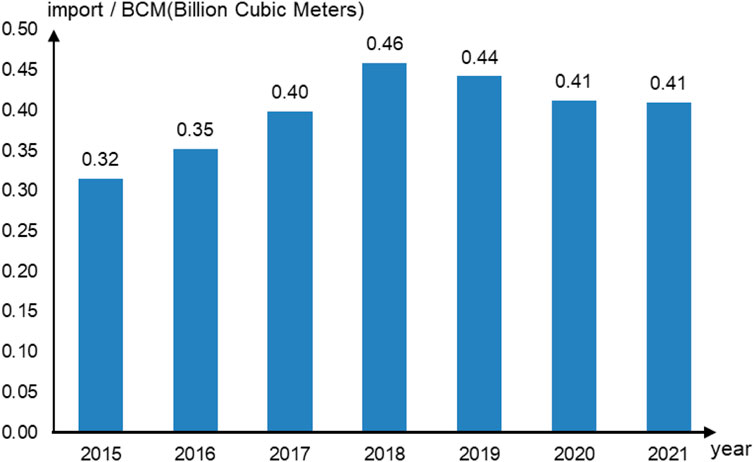

In the past 5 years, China’s helium imports have increased first and then decreased. Since 2018, China’s helium imports have decreased year by year, with a year-on-year decrease of 6.7% to 3,707.6t in 2020, but the proportion of imports to demand is as high as 97.7%. In 2021, 3,685 tons of helium were imported, representing a year-on-year decrease of 0.5%. In 2021, 3,005.9 tons of helium were imported from Qatar, accounting for 82%, 346.1 tons from the United States, accounting for 9%, 304.6 tons from Australia, accounting for 8%, and 24 tons from Russia, accounting for 1% (Li et al., 2022). Compared with 2020, the production, shipping and tariff in the United States have significantly restricted China’s helium import, and the import volume from the United States has further declined. The increase in the import volume from Qatar has compensated for the decrease in the import volume from the United States, so its proportion continues to increase, and the import volume from Australia is relatively stable (Figure 4).

FIGURE 4. China’s helium import volume from 2015 to 2021 (Source: General Administration of Customs) (Li et al., 2022).

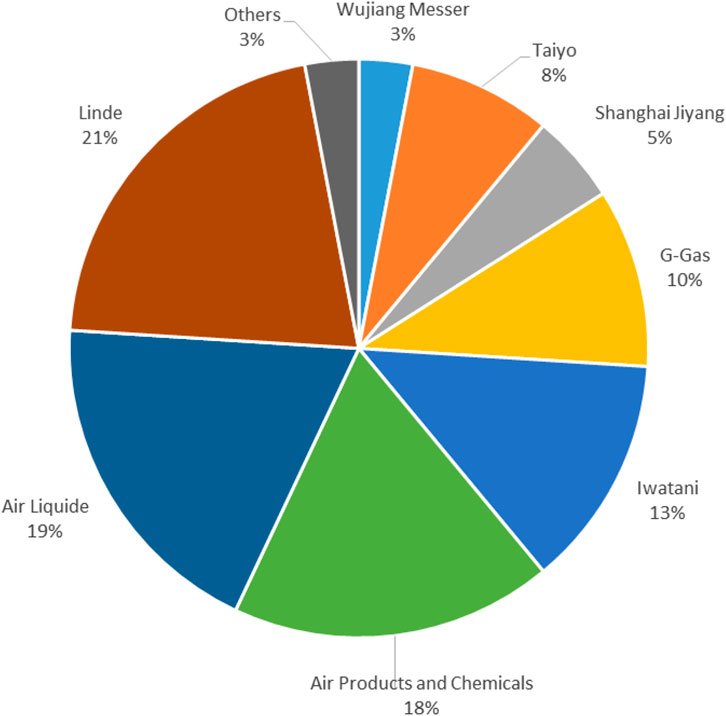

At present, there are more than a dozen helium gas importing enterprises in China, mainly foreign-funded enterprises, accounting for 82% of the total. Linde, Air Liquide and Air Products and Chemicals have higher imports, accounting for 21%, 19%, and 18% respectively, while Iwatani Corporation (Iwatani), G-Gas and Taiyo Nippon Sanso Group (Taiyo) account for 13%, 10%, and 8%, respectively. The only Chinese import enterprises are Guangzhou Guanggang Gas Energy Co., Ltd. (G-Gas) and Shanghai Jiyang Technology and Development Co., Ltd. (Shanghai Jiyang) (Figure 5) (Li et al., 2022).

FIGURE 5. Market share of import volume of helium enterprises in China in 2020 (Unit: %) (Source: General Administration of Customs) (Li et al., 2022).

Main consumption fields of helium in China

In recent 5 years, China’s helium consumption increased first and then decreased. From 2014 to 2018, the annual average growth rate of helium consumption reached 11%. It reached a peak of 23.46 million cubic meters in 2018, with a growth rate of 13.01%. From 2014 to 2018, the annual average growth rate of helium consumption was 11%. In 2020, due to the impact of the epidemic, the consumption of helium dropped to 21.3 million cubic meters, with a decrease rate of 6.89%. From January to August 2021, helium consumption increased by 4.4% year-on-year, with an obvious warming trend (Li et al., 2022).

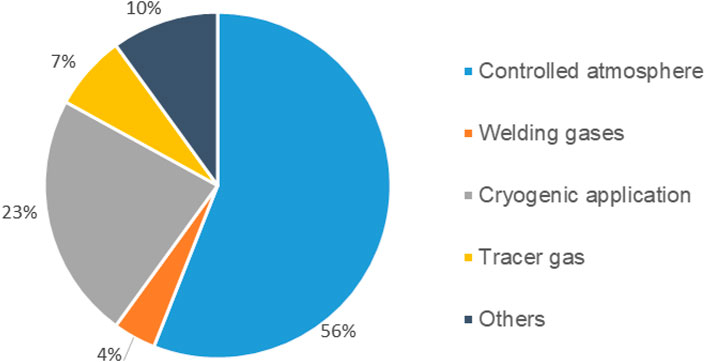

Controlled atmosphere and cryogenic application are the main application directions of helium, accounting for 56% and 23% respectively. Controlled atmosphere includes optical fibers, semiconductors, photovoltaics, etc., while the cryogenic application includes nuclear magnetic resonance, low-temperature superconductivity, national defense and military affairs, and big scientific research, etc. Helium consumption, as an indispensable strategic material for the development of national defense, military industry and high-tech industry, has become an important indicator to measure the level of national science and technology development (Zhang et al., 2022b; Han et al., 2022; Lu, 2022). With the rapid development of China’s semiconductor, optical fiber, photovoltaic and other industries, the demand of China’s helium will still maintain a stable growth (Figure 6) (Li et al., 2022).

FIGURE 6. Helium consumption structure in China in 2020 (Source: General Administration of Customs) (Li et al., 2022).

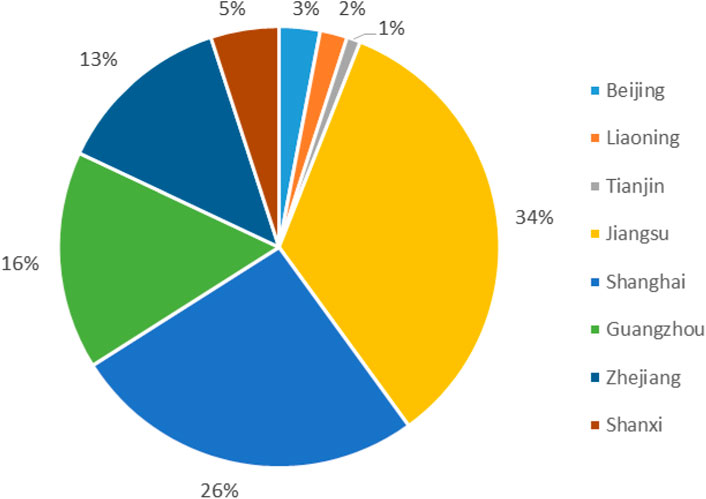

Helium consumption is closely related to regional economic and industrial structure. The regional distribution of helium consumption in China shows that Jiangsu, Guangdong and Zhejiang provinces and Shanghai account for 34%, 26%, 16%, and 13% respectively, accounting for 89% of the total national consumption. They generally have a very advanced secondary industry, and their industrial cores are high-end manufacturing such as semiconductors, optical fibers and photovoltaics (Figure 7) (Chen et al., 2021b; Zhang et al., 2022a; Zhang et al., 2022b; Qin and Li, 2021; Zhang et al., 2018).

FIGURE 7. Pie chart of helium consumption in China in 2020 (Source: General Administration of Customs) (Li et al., 2022).

Main consumption trends of helium in China

China has a high helium consumption, accounting for 11% of the global helium consumption, with a rapid growth rate. Along with the control of public health incidents and the steady development of downstream semiconductor, optical fiber, nuclear magnetic resonance and other fields, the overall demand for helium market in China will show an increasing trend. At present, the world is in the shortage of helium resources. During the “14th Five-Year Plan” period, China’s helium consumption will continue to grow rapidly and is expected to reach 2,500 × 104 m3 in 2025 (Li et al., 2022). With the continuous production of China’s helium extraction project, the amount of self-produced helium will continue to increase, but far below the demand, and the dependence on foreign countries will remain at a high level.

Conclusion and recommendations

Against the backdrop of profound and significant changes in the world landscape and geopolitics, the world’s helium supply chain may face significant changes and challenges, which will inevitably have a profound impact and influence on the world helium market in the future. At present, China’s helium dependence on external resources is very high. Under the influence of many factors, especially the trade friction between China and the US, the global economic hyperinflation caused by the global new crown epidemic and the rapid and significant increase in energy prices caused by the Russian-Ukrainian war, the global helium supply is relatively tight and the security of China’s helium supply is challenged to a certain extent (Li et al., 2022). Although China’s own helium production is increasing with the commissioning of helium extraction projects, China’s helium consumption will continue to grow rapidly during the 14th Five-Year Plan period, and is expected to reach 25 million cubic metres in 2025, which is much higher than its own production. It is very important for China to strengthen the exploration and development of helium resources, and the following suggestions are put forward.

Strengthening the comprehensive study on helium resources in China

On the premise of clearly recognizing that the origin type of helium in China is crust-derived helium, the main reservoir-forming factors of helium with different genetic factors should be mastered and the comprehensive research on different types of helium in the eastern, western and central regions of China should be carried out (Zhang et al., 2019; Chen et al., 2021a; Chen et al., 2021b; Han et al., 2022). Exploratory exploration can be carried out for new areas where no industrial helium has been discovered.

Strengthening the investigation and utilization of associated helium resources

Special investigation of helium resources, such as geothermal wells and natural gas wells (Li et al., 2022). It is necessary to actively promote and cooperate with the government authorities in the preparation of medium-and long-term development plans for the exploration and development of helium resources, study and issue operational and effective helium industry development policies, provide incentives and support such as tax relief, financial subsidies and land use for comprehensive utilization projects of helium resources, and guide participating enterprises and units for scientific and rational development.

Deepening research on helium exploration and development technology

The key geological problems, such as helium reservoir-forming theory and prospecting mode, and exploration techniques, such as geophysical and material exploration methods, logging series and interpretation models should be focused on, and specialized research on helium exploration and development theory and technology should be carried out to serve the investigation and evaluation of helium resources in China (Zhang et al., 2022a). Research and development of low-cost extraction/concentration/purification processes and equipment for associated helium should be carried out, and the technical system for helium exploration and development be improved, thus ensuring the large-scale and industrial development of helium resources in China.

Promoting the commercial exploration and development of helium

The Chinese government should be urged to formulate favorable policies for the allocation of helium mining rights (Han et al., 2022), guide relevant enterprises and units to actively follow up and participate, promote the commercial process of exploration and development of helium gas resources in China, and build a helium strategic security backbone as soon as possible.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author contributions

QC: conceptualization, writing—original Draft; YL: formal analysis, writing—review and editing; CF and HX: investigation; RL and SW: supervision. All authors contributed to the article and approved the submitted version.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Advameg Inc (2021). Made how: Helium. Available at: http://www.madehow.com/Volume-4/Helium.html#ixzz7BhY0tbi3.

Arkharov, A. M., Arkharov, I. A., Dolgopyatov, D. A., and Bondarenko, V. L. (2013). He supply crisis: Reasons and challenges. Chem. Pet. Eng. 49, 41–45. doi:10.1007/s10556-013-9701-0

Chen, J. F., Li, X., and Yan, L., (2021a). Characteristics, exploration and reserve strategy of helium resources in China. Available at: https://cpfd.cnki.com.cn/Article/CPFDTOTAL-ZGDW202110001189.html.

Chen, J. F., Liu, K. X., Dong, Q. W., et al. (2021b). Research status of helium resources in natural gas and prospects of helium resources in China. Nat. Gas. Geosci. 32 (10), 14. doi:10.11764/j.issn.1672-1926.2021.08.006

Chen, X. J., Geagea, A., Park, J., and Kwak, Y. (2020). Cultural modulation of early attentional responses to positive self-information: An ERP investigation of self-enhancement. Int. J. Psychophysiol. 33 (5), 34–44. doi:10.1016/j.ijpsycho.2020.09.008

Dai, J. S., Feng, H. J., Shi, K. F., Ma, X. J., Yan, Y., Ye, L., et al. (2022). Electrochemical degradation of antibiotic enoxacin using a novel PbO2 electrode with a graphene nanoplatelets inter-layer: Characteristics, efficiency and mechanism. Chemosphere 307, 135833. doi:10.1016/j.chemosphere.2022.135833

Dai, J. X. (2003). Pool-forming periods and gas sources of weiyuan gasfield. Petroleum Geol. Exp. 25 (5), 473–480. doi:10.3969/j.issn.1001-6112.2003.05.010

Edison (2021). A deep reservoir of primordial helium in the Earth. Available at: https://phys.org/news/2021-05-deep-reservoir-primordial-helium-earth.html.

Editorial Board of Manual of Requirements for the Mineral Resources Industry (2010). Manual of Requirements for the mineral resources industry. Beijing: Geological Publishing House.

European Commission (2021). Critical raw materials. Available at: https://ec.europa.eu/growth/sectors/raw-materials/areas-specific-interest/critical-raw-materials_en.

Feng, X., Yuan, B., Li, Y., Zhang, C., and Song, L. (2022). Distribution of helium resources in Weihe Basin, central China: Insight from 3D magnetic inversion. J. Earth Sci. 33 (4), 977–992. doi:10.1007/s12583-020-1080-9

Gazprom (2020). Alexey Miller: Gazprom to become one of major players in global helium market. Available at: https://www.gazprom.com/press/news/2020/september/article513742/.

Geology in China Editorial Office (2018). US Department of the Interior determines a complete list of 35 kinds of key mineral resources such as tungsten, rare Earth and lithium. Geol. China 45 (5), 1086.

Han, Y. H., Luo, H. Y., and Xue, Y. Z., (2022). Genesis and helium enrichment mechanism of geothermal water-associated gas in Weihe Basin. Nat. Gas. Geosci. 33 (2), 11. doi:10.11764/j.issn.1672-1926.2021.09.009

He, F. Q., Wang, F. B., and Wang, J., (2022). Helium distribution law of Dongsheng gas field in Ordos Basin and discovery of super-large helium-rich gas field. Pet. Exp. Geol. 44 (1), 1–10. doi:10.11781/sysydz202201001

Li, Y. H., Li, J. Y., and Zhou, J. L., (2022). Research progress and new views on evaluation of helium resources. J. Earth Sci. Environ. 44 (3), 11. doi:10.19814/j.jese.2021.11008

Li, Y. H., Zhou, J. L., and Zhang, W. (2018). Reservoir-forming conditions and resource prospect of helium in Weihe Basin. Beijing: Geological Publishing House.

National Research Council (2010). Selling the nation's helium reserve. Washington, DC: The National Academies Press, 47–48.

Peterson, J. B. (2020). Mineral commodity summaries-helium. Virginia: United States Geological Survey.

Qatargas (2021). Ras laffan helium. Available at: https://www.qatargas.com/english/operations/ras-laffan-helium.

Ryzhkov, S. V. (2021). Helium-3 as a fusion source: Low-radioactive fuel and big opportunities. AIP Conf. Proc. 2318 (1), 090008. doi:10.1063/5.0035861

Ryzhkov, S. V. (2020). Helium-3 as a perspective fuel for power generation through aneutronic thermonuclear fusion. Phys. At. Nucl. 83, 1434–1439. doi:10.1134/S1063778820090227

Thor Resources Inc (2021). Helium supply, helium demand, helium uses. Available at: https://www.thorres.com/helium-business-2.

U.S. Geological Survey (2021). Mineral commodity summaries. U.S. Geological Survey, 200. doi:10.3133/mcs2021

Wang, X. B., Hou, L. H., Li, J., Yang, C. X., Fan, L. Y., Chen, J. F., et al. (2022). Geochemical characteristics and gas source contributions of noble gases of the sulige large tight gas field of upper Paleozoic in ordos Basin China. Front. Earth Sci. (Lausanne). 10, 889112. doi:10.3389/feart.2022.889112

Zhang, X., Liu, J. C., and Li, R. X., (2018). Research status and progress of helium-rich natural gas resources in China. Geol. Bull. China 37 (2), 476–486.

Zhang, Y., Cai, X. L., and Zhang, G. Q., (2019). Imminent development and utilization of helium resources in China. China Pet. Enterp. 7, 5. doi:10.3969/j.issn.1672-4267.2019.07.008

Zhang, Y., Shi, X. H., Zhang, H. X., Cao, Y. J., and Terzija, V. (2022b). Review on deep learning applications in frequency analysis and control of modern power system. Int. J. Electr. power & energy Syst. 136, 107744. doi:10.1016/j.ijepes.2021.107744

Keywords: helium resources, helium development, helium import, strategic resources, global helium

Citation: Cao Q, Li Y, Fang C, Liu R, Xiao H and Wang S (2022) Status quo and utilization trend of global helium resources. Front. Environ. Sci. 10:1028471. doi: 10.3389/fenvs.2022.1028471

Received: 30 August 2022; Accepted: 16 November 2022;

Published: 28 November 2022.

Edited by:

Mukesh Kumar Awasthi, Northwest A&F University, ChinaReviewed by:

Sergei V. Ryzhkov, Bauman Moscow State Technical University, RussiaIrina Filimonova, Institute of Petroleum Geology and Geophysics (RAS), Russia

Copyright © 2022 Cao, Li, Fang, Liu, Xiao and Wang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Qian Cao, bTIwMTVjcUAxNjMuY29t

Qian Cao

Qian Cao Ying Li

Ying Li