94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci., 18 October 2022

Sec. Environmental Economics and Management

Volume 10 - 2022 | https://doi.org/10.3389/fenvs.2022.1024681

This article is part of the Research TopicGlobal Excellence: Environmental Issues and Global Value Chain in AsiaView all 24 articles

Green innovation is a key variable in coordinating economic growth and ecological protection, and also the fundamental driving force for future economic development. Green innovation plays a crucial role in creating competitive advantages for companies. This paper investigates the impact of the interaction between strategic flexibility and managerial ties on green innovation in new firms, and explores ways to match strategic flexibility and managerial ties that are more appropriate for conducting green innovation practices. The results of the empirical study by using survey data from Chinese new firms indicate that different types of strategic flexibility and managerial ties can generate different synergies and thus have different impacts on green innovation. Specifically, for a new venture, it is more likely to use its ties with government to develop green innovation when it has greater resource flexibility. Conversely, a new venture with greater coordination flexibility is more capable of implementing green innovation through close ties with other firms. Our theoretical constructs and empirical results can better explain how different types of strategic flexibility use different kinds of managerial relationships to promote green innovation in new ventures.

With the rise of the global “low-carbon revolution”, green innovation has become a key variable in reconciling economic growth with ecological protection and a fundamental driver of future economic development (Arfi et al., 2018). As consumers become more concerned about the environment issues, and the expansion of government environmental regulations, more and more enterprise recognize the importance of green innovation and make green management an integral part of their corporate strategies (Chen, 2008; Peng & Lin, 2008; Chang, 2011). Overall, green management has become one of the key factors for companies to gain competitive advantage (Bocken et al., 2014; Przychodzen & Przychodzen, 2015), especially for new ventures in emerging economies.

In recent years, some scholars have called for attention to the specific processes and mechanisms of going green (Hojnik & Ruzzier, 2016; Wang et al., 2020), but mainly from the perspective of stakeholders, who believe that companies engage in green practices to meet their expectations and thus achieve improved financial and environmental performance (Ozaki & Sevastyanova, 2011). However, little research has been conducted on the specific processes and mechanisms by which companies use their own strategic resources to “go green”. At the same time, it has become increasingly important to identify the factors that influence green innovation (Cai & Zhou, 2014). While some studies suggest that green innovation may be influenced by certain internal and external organizational factors (Zhu et al., 2008; Huang & Wu, 2010), few studies have considered the composite role of strategic flexibility and organizational social capital in green innovation.

Among various drivers of green innovation, the priority for new ventures that always lack sufficient resources for implementing green innovation is to focus on the efficiency of the resources themselves and the utilization process of these resources, because value of resources may lose gradually with market environment change in highly uncertain environment (Ireland et al., 2003). Whereas early studies tend to focus on how specific static resources affect innovation in general, more recent research posits the importance of strategic flexibility on green innovation (Roy & Sivakumar, 2012; Huang & Li, 2015).

Due to the rapid changes in the environment, firms must be flexible (Dai et al., 2018), therefore, focusing on the issue of strategic flexibility has become a necessity. Strategic flexibility is a dynamic ability of a firm to reallocate organizational resources and adjust processes to deal with the changes in the environment (Li et al., 2017), and it is considered a source of competitive advantage. Strategic flexibility also has important innovative implications. However, prior studies paid more attention on the direct effects of strategic flexibility on firm performance or innovation in general (Sanchez, 1995; Katsuhiko & Hitt, 2004; Colombo et al., 2012), and largely ignored the influence of firm’s difference on the leverage of strategic flexibility. Rosenbusch, Brinckmann, and Bausch (2011) indicate that since new ventures always have limited resources and have to be more flexible and agile, this flexibility of new firms might enable them to induce radical change in industry themselves and better-adapted to a changing environments, and thus they could have a prolonged time in pioneering green innovations under a relative low competition condition. We further argue that the effects of various flexibilities on green innovation depend on not only firm’s characteristics, but also on the market environment. Thus, it is important to emphasize the relationships between strategic flexibility under specific context on green innovation. For example, in emerging economies such as China, new ventures lack sufficient internal resources for green innovation (Wright et al., 2005), and need to find and obtain external resources to improve the effect of strategic flexibility on green innovation. However, existing literature remains a key question: which kinds of external resources can help the new ventures achieve this goal more effectively in emerging economies such as China?

Further, highly uncertain market environment and incomplete formal regulation in emerging economies make the new ventures have to utilize informal institutions such as managerial ties to improve the effectiveness of strategic flexibility (Liu et al., 2009), and managerial ties have be viewed as specific contingent factor for Chinese firms (Li, et al., 2009). Thus, we argue that the new ventures in China can use managerial ties to improve the effects of strategic flexibility on green innovation. Unfortunately, existing literature still unexplained which kinds of interactive relationships between strategic flexibilities and managerial ties are more effective in improving green innovation of new ventures in emerging economies such as China, and thus we do not know how to combine their strategic flexibility with managerial ties to generate synergy effect for improvement of green innovation of the new ventures in China.

To address above issues, integrating social capital theory and strategic literature to develop a theoretical framework, we propose that resource flexibility and coordination flexibility can differently match with managerial ties and then facilitate green innovation of new ventures. Our contributions focus on two aspects. Theoretically, by introducing the managerial ties as a new contingency factor that conducts a firm’s boundary spanning interchanges, we argue that in order to reduce the negative influence of imperfect market system and to cope with the environmental pressure, new ventures in emerging economies such as China need to effectively combine strategic flexibility as important internal capability with managerial ties as one of the most efficient acquisition approaches of external resources to implement green innovation. Existing studies have noted that the boundaries of a firm in the traditional sense are continuously expanding (Gulati, Nohria, & Zaheer, 2000), and therefore a broader definition of organizational boundaries is needed (Zott & Amit, 2008). As a response, this study will emphasize the matching between different types of strategic flexibility and managerial ties, and explore the most effective fitting modes on fostering green innovation of new ventures in emerging economies. Empirically, using new venture samples from China as one of the largest emerging markets, we examine the different interaction effects of strategic flexibility and managerial ties on green innovation, and indicate that both the combination between coordination flexibility and ties with other firms and the combination between resource flexibility and ties with government have more effective effects on green innovation than other combinations.

Green innovation includes developing green products and green processes and modifying existing product designs to reduce harmful environmental impacts throughout every stage of business operations (Chen et al., 2006; Huang & Li, 2015). Recent study indicates that because of the flexibility and more innovative, new ventures often pioneer green innovations (Rosenbusch et al., 2011; Su, 2020). However, both insufficient resources and incomplete market system new ventures in emerging economies face can destroy their green innovation (Wright, et al., 2005; Lee et al., 2010). In this case, the economy is in transition phase and accompany with traditional business culture (Li & Peng, 2008), new ventures in China prefer to utilize managerial ties as the substitute of formal institution to reduce the high risks in green innovation (Peng & Luo, 2000; Hitt et al., 2001) and obtain external resources for the effective leverage of strategic flexibility.

From contingent theory, the contingency factors can influence the selection of strategy variables change (Zott & Amit, 2008), and the leverage of capability and resource can change with different environment (Sheng et al., 2011). Specifically, the effects of strategic flexibility are closely related to environmental factors (Grewal & Tansuhaj, 2001). Facing specific market environment, the new ventures in emerging economies such as China more emphasize the utilizing of managerial ties as the most important social resources (Peng & Luo, 2000). The existing studies also view managerial ties as specific contingency factors to examine the interactive effect with different business strategies on firm performance (Li et al., 2009). However, extant research does little work on whether and how new ventures strengthen green innovation by coordinating their strategic flexibility and managerial ties simultaneously. In this work, we argue that the fully exertion of strategic flexibility on fostering green innovation of the new ventures in China depends on the fitting relations with managerial ties.

The increased irregularity, complexity and uncertainty of modern society, especially in emerging economies, necessitates that firms develop the ability to navigate complex business environment and maintain competitive advantage through constant adaptation (Rindova & Kotha, 2001). Thus, strategic flexibility, the ability to deal with change (Wright & Snell, 1998; Zhou & Wu, 2010), has become an important organizational requirement to enable firms to thrive in such environment (Dai et al., 2018). Strategic agility is a dynamic ability to quickly adjust organizational processes and resource allocation, enabling companies to react quickly in a volatile environment and adjust resource allocation and combination within the organization promptly (Sanchez, 1995, 1997; Combe et al., 2012). The benefits of strategic flexibility come to the fore when it is needed. Strategic flexibility reduces risk and also increases resistance in times of institutional turmoil and crisis (Das & Elango, 1995; Levy and Powell, 1998).

Strategic flexibility also has important implications for firms’ innovation activities. First, strategic flexibility helps firms to conduct green innovation practices. Firm with strong strategic flexibility can better identify ideas and opportunities in the market that could lead to new green products or processes (Li et al., 2017). Conversely, when a firm lacks strategic flexibility, it may become rigid, trapped in existing products and technologies, making it difficult to conduct green innovation (Su, 2020). Second, strategic flexibility reduces the resistance firms encounter when engaging in green innovation, and move forward quickly (Zhou & Wu, 2010). Third, firms with higher strategic flexibility are more willing to take risks brought by green innovation, because flexible resources and coordination ability can play a good buffer role and reduce sunk costs (Dai et al., 2018). In general, strategic flexibility is of great significance to green innovation.

As Sanchez (1997) noted that, the essence of strategic flexibility is that a firm has flexible resources and can coordinate them promptly when required. Therefore, strategic flexibility can be considered to contain two core components, resource flexibility and coordination flexibility (Sanchez, 1995; Liu et al., 2009). Resource flexibility depends on the inherent properties of the resources, while coordination flexibility consists of the extent of agreement of how to deploy resources effectively among all units, and to which extent the firm can reconfigure or recombination the resources (Wright & Snell, 1998; Li et al., 2010).

Specifically, resource flexibility reflects the extent to which a resource has alternative uses, as well as the difficulty, the time and cost required to change the use of the resource, and is largely determined by the inherent attributes of the resource (Sanchez, 1995, 1997). Whereas coordination flexibility reflects the extent to which the firm can reconfigure the orchestration of resources, and the sharing degree in the process of using resources (Li et al., 2010).

Although extant research pays attention to the valuable function of strategic flexibility when implementing green innovation, the empirical evidence in this area suffers inconsistent results. The scholars hold positive viewpoints argue that, green innovation involves uncertain outcomes needs flexible management rather than rigid controls (Roy & Sivakumar, 2012). Specifically, the firm with high level of strategic flexibility will have wider usage of its resources and overcome organizational inertia, and thus it will be easier for the firm to adapt to changing environment, and then have successful green innovation (Zhou & Wu, 2010; Rosenbusch et al., 2011). Chang et al. (2012) further point out that, the firm focus on flexibility-enhancing will have better performance in green innovation. In contract, those researchers who have the opposite views point out that, the pursuit of flexibility will sacrificing distinctiveness, and thus may impede the green innovation (Kraatz & Zajac, 2001; Liu et al., 2009). Farjoun (2010) also indicate that stable mechanisms and institutions such as routines which lack of flexibility can also promote green innovation, and thereby the role of strategic flexibility may not be necessary in the green innovation.

Because some existing research on strategic flexibility has not distinguished between resource flexibility and coordination flexibility, it will inevitably lead to some conflicting results on the relationship between strategic flexibility and innovation. In the meantime, these studies ignored the effects of specific contingent factors that may match with different types of strategic flexibility on green innovation. According to contingency theory, contingent factors can change the roles of resources and capabilities in affecting firm performance (Zott & Amit, 2008). Based on Chinese context specific, managerial ties as important external resources have also been viewed as the most essential contingent factors (Zhang and Li, 2008; Li et al., 2009), and thus they should interact with different types of strategic flexibility to produce synergy influence on green innovation. To remedy this, in this paper, we explore the effects of strategic flexibility-managerial ties’ fitting relations on green innovation of the new ventures in emerging economies such as China.

The trend of environmentalism makes firms feel the regulatory pressure from the government, the growing awareness of consumers on environmental protection, and the concern of stakeholders on green innovation (Huang & Wu, 2010; Cai & Zhou, 2014). In this context, in order to overcome environmental challenges to better carry out green innovation activities, firms need to establish and maintain reasonable relationships with those stakeholders. (Wasko & Faraj, 2005; Vachon & Klassen, 2008). Managerial ties are also considered as an important strategic asset in addition to strategic flexibility (Ruef, 2002; Tsai, 2002).

According to social network theory, the establishment of social capital comes from the repeated and intensive interactions between the firm and its stakeholders (Dyer & Singh, 1998). Social capital represents the relational resources achieved by firms through managerial ties (Adler & Kwon, 2002). Many companies are attempting to integrate upstream and downstream partners, customers, into the green innovation process in order to gain competitive advantage (Vachon & Klassen, 2008).

Recent studies further emphasized that fast-changing environment can have a continuous impact on resource status and resource deployment of the firm, so it is necessary to regulate the role of the external environment in the process of resource management (Katsuhiko & Hitt, 2004; Sirmon, et al., 2007, 2011). Therefore, we need to explore how specific environment contingents influence the effects of strategic flexibility on green innovation of new ventures in emerging economies. In China, the market environment is highly uncertain, while the economy is growing rapidly and undergoing dynamic restructuring, which is a great challenge for new ventures (Peng, 2003; Li & Peng, 2008). Although reform has been occurred in many field of market system, further improvements are still necessary (Li et al., 2009). To eliminate the risk and withstand the turbulent environment, there is a long history for firms in China to use managerial ties to facilitate transaction (Peng & Luo, 2000; Liu et al., 2010).

In this study, following research of Geletkanycz and Hambrick (1997), managerial ties are defined as “executives’ boundary spanning activities and their associated interactions with external entities”. They can help firms to access scarce resources and manage environmental uncertainties induced by institutional voids (Li & Zhou, 2010; Li, et al., 2014). In accordance with social capital theory, managerial ties are more evident in emerging economies, where they help resources and information to be exchanged more smoothly, thereby reducing transaction costs and increasing transaction value (Luo, 2003). However, existing literature mainly focus on managerial ties’ direct contribution to its performance (e.g. Peng & Luo, 2000; Payne et al., 2010). The contingent effect of managerial ties on the process of utilizing firm’s internal strategic flexibility to green innovation is also an imperative but unresolved question.

According to Luk et al. (2008) and Peng and Luo (2000), we divide managerial ties into ties with other firms and ties with the government as two important types, and argue that they have different attributions. Thus, these two kinds of managerial ties may have different matching style with resource flexibility and coordination flexibility. Specifically, ties with other firms are horizontal that tend to be embedded in large networks, which include relations with upstream and downstream companies, peers, and customers (Li & Zhou, 2010). Meanwhile, as an emerging economy, China is going through a transition, where has volatile and complex environment, while the government holds significant resources and may conduct administrative interventions from time to time (Li et al., 2008). Under such circumstances, new ventures establish ties with government to better access the resources held by the government, and to deal with institutional voids and excessive administrative interventions (Peng & Luo, 2000; Baron & Tang, 2009).

Overall, managerial ties serve as important means for firms to obtain resources and facilitate exchanges are likely affect how firms fully utilize the potential of their strategic flexibility. More importantly, the difference of ties with other firms and ties with government makes them produce different effects of combination with different strategic flexibility types on green innovation of the new ventures.

Firms and their upstream and downstream partners often think and act together for a common environmental purpose (Zhu et al., 2012). When solving these environmental problems, managerial ties provide a channel and incentive for firms to exchange resources, information and knowledge (Phelps, 2010). Through building and maintaining managerial ties, firms increase their ability to collaboratively solve problems to get the inspiration and cultivate new knowledge that need for green innovation (Wincent et al., 2010).

Resource flexibility enables the firm to meet green innovation needs by transforming internal resources while laying the groundwork to respond to volatile consumer demands (Sanchez, 1995). For resource flexibility is inherently an important requirement for coping with changes, the new ventures prefer to improve their resource flexibility to guarantee that resource usage will cater to generating new ideas and implementing these ideas into commercial technologies for successful green innovation.

Kraatz and Zajac (2001) suggested that resource flexibility can buffer the impact of external environment changes on firms. The better resource flexibility that firms have makes it easier to cope with the possible uncertain factors. With strong ties with other firms, new ventures more emphasize their surviving, and prefer sustaining their condition rather than taking risks for implementing green innovation (Kang et al., 2007). Ties with other firms tend to last longer than ties with government (Sheng et al., 2011), and the possibly excessive duration of relations with buyers or suppliers may make the firm embedded in a relatively fixed network, and then hinder green innovation because of the diminishing heterogeneous resource (Nooteboom, 1999). Also, new ventures always have the liability of newness, and stuck with their size, thus, to build strong ties with other firms, specifically larger firms, may limit opportunities and alternatives for them to make synergy effect with resource flexibility in developing green innovation (Lee et al., 2010).

In contrast, government in emerging economy such as China still holds a large amount of resources and has the power to allocate them and approve projects (Park & Luo, 2001), and thus it is critical for new ventures to build close ties with government. Thus, we argue that ties with government can enhance the effectiveness of resource flexibility in strengthening green innovation of the new ventures. First, as risk and uncertainty in emerging markets are higher in China, stronger relations with government officials can keep new ventures more up-to-date with policy information and capture new market opportunities faster, which is benefit to the effective improvement of resource flexibility in affecting green innovation. Moreover, when operating in a market suffering transition and uncertainty, through building and maintaining ties with government, the new ventures can get more policy support, which is benefit to recombine current resources for strengthening their capabilities in innovation (Chen, et al., 2015). Thus, by leveraging resource flexibility, new ventures are better able to capture unexpected changes in the market and respond to them promptly (Wright et al., 2005). Especially, for new ventures that just entered in a market, close ties with government can help them gain legitimacy among peers in industry, which can avoid the cutthroat competition in some extent (Shaffer, 1995; Lu et al., 2010). Li and Zhang (2007) indicate that legitimacy gain from ties with government can bring more customers to firms, and also let the market information inflow into firms. In this case, with existing resource flexibility, the new ventures with close tie with government officers can have better sight and grasp market opportunity, and then better focus and highlight on distinct capabilities for pursing green innovation. Finally, during economic transitional period, one of the Chinese government’s core initiatives to promote economic development is to encourage green innovation among new ventures (Lee et al., 2010). The new ventures can get loan guarantee and financial support more easily through close ties with government (Park & Luo, 2001). This financial aid can integrate with firm’s existing resource flexibility and then generate synergy effect to advance green innovation which has higher cost. Therefore, we suggest:

Hypothesis 1. A new venture with high resource flexibility benefits more from ties with government than ties with other firms for fostering its green innovation.

When operating in highly uncertain environment, new ventures have to share and redeploy resources more efficiently to achieve target, seize market opportunity, and improve mobility and adaptively to cope with various difficult conditions (Liu et al., 2009). The new ventures with strong coordination flexibility can not only integrate and find the alternative use of the existing and newly gaining resources, but also increase the sharing degree of the resource, which enable them to put the inspiration of green innovation into action (Zahra & George, 2002). Moreover, new ventures with a high degree of coordinated flexibility are more likely to discover new resources, recombine them with existing resources, and put them into service rapidly to meet the needs of successfully implementing green innovations (Sanchez, 1997). Thus, when operating in Chinese market which characterized by transitioning, uncertainty, and incomplete market mechanism (Wright et al., 2005), the new ventures with stronger coordination flexibility can overcome the rigidity of operating process in generating breakthrough ideas, recognize and grasp more market opportunity in time for green innovation.

In this paper, we argue that a firm with strong coordination flexibility will be more profitable by maintaining ties with other firms than ties with government. The new ventures with stronger coordination flexibility emphasize that resources have various alternative uses, and transform quickly with low cost (Sanchez, 1995). But ties with government always have short time horizon, and lack an effective mechanism to maintain the stable relationships (Sheng et al., 2011). Thus, since the new ventures’ coordination flexibility emphasizes the redeploy, reconfiguration, and the sharing degree of resources among all departments, the short-term nature of ties with government will put pressure on the new ventures to exert their coordination flexibility to recombination or reallocate for green innovation.

In contrast, new ventures gain access to more market information and resources by building and maintaining ties with other firms (Luk et al., 2008), and overcome the organization rigid caused by existing internal resource (Kang et al., 2007), which provides more space for the new ventures in leveraging coordination flexibility to improve their green innovation activities. Specifically, through close contact with customers, firms can not only gain explicit knowledge such as current customer demand, but also get deeper level of tacit knowledge such as the potential needs of customers (Luo, 2003). Di Benedetto et al. (2008) stated that the identification of potential untapped markets is one of the key drivers of green innovation, and these resources from ties with customers may help the firm tap the underlying market demand and then guide a better utilize of coordination flexibility (Sinkula, 1994) for green innovation. Further, close contacts with suppliers can help firm get high quality materials, in time delivery, and even the other firms’ material requirement condition (Ahuja, 2000). These merits enrich the firm’s existing resource portfolio, and thus provide more space for the reconfiguration or redeploying of the existing and new gaining resources, which also improve the effectiveness of coordination flexibility in green innovation. Therefore, we suggest:

Hypothesis 2. A new venture with high coordination flexibility benefits more from ties with other firms than ties with government for fostering its green innovation.

We conduct empirical research through questionnaire survey. We randomly selected a sample of 300 new ventures, which are established less than 8 years, in China (Li & Zhang, 2007). China’s 14th Five-Year Plan clearly points out the need to vigorously develop green technology innovation and promote the green transformation of key industries and important fields. In order to adapt to the policy and gain more initiative and competitive advantage, more and more Chinese enterprises are practicing green innovation. Hence, it is appropriate to study green innovation issues in Chinese new ventures.

The questionnaire was originally designed based on existing literature. In order to ensure content validity, we selected three experienced entrepreneurs for in-depth interviews. To make the questionnaire clearer, we modified some questions based on the interview transcriptions and suggestions from the entrepreneurs. We then conducted a pretest with eight senior managers. The interviewers were involved the pretest throughout to ensure that the participants understood each question of the questionnaire accurately. After analyzing the pretest responses, the questionnaire was finalized. To avoid common method bias, two participants were selected from each tested firm: one top leader such as CEOs from a strategic perspective, and one middle manager from an operational perspective. We arranged trained interviewers to contact and confirm a meeting time with the respondent firm personnel. The interviewer assisted the participants to complete the questionnaires, and then collect them. A total of 228 new ventures completed the questionnaire validly, and their responses constitute the sample for this study. The comparison of respondents and non-respondents indicates no significant differences, which suggests no notable non-response bias.

We use a 5-point Likert scales (from 1 - strongly disagree, to 5 - strongly agree) to test all the multi-items variables. The majority of the measures involved in this study are drawn from existing literature, with additional individual measures were adjusted to adapt to the business environment faced by Chinese firms and the demands or suggestions of interviewees in pilot firms.

We adapt a measure of green innovation from Chen et al. (2006), and Chen (2008), which reflects innovations in products, processes, materials, etc. to reduce negative impacts on the environment throughout the product lifecycle. We measure it by five items. Referring to Sanchez’s definition of resource flexibility and its characteristics, we measure it with five items to reflect resource convertibility, conversion cost and time. Coordination flexibility is measured by six items, it capture the extent of agreement of how to deploy resources effectively among all units, and to which extent the firm can reconfigure or recombination the resources. We follow the measurements used by Peng and Luo (2000) and Luk et al. (2008) to measure managerial ties. Specifically, ties with other firms were measured by six items, and ties with government were measured by three items.

Considering that other factors may also have an impact on green innovation, the following control variables are selected in this paper. First, firm size represents the resourcefulness of a firm, while firm age is a significant characteristic of a firm, and both of them may influence green innovation (Huang & Li, 2015). Therefore, we choose them as control variables. We use the number of employees of the firm to measure Firm size. The respondent was asked to choose which is the range of the employee number of their company (1 = 1∼50, 2 = 51∼200, 3 = 201∼500, 4 = 501∼1,000, 5 = more than 1,000). We measure the Firm age by the number of years it has been founded. Second, because the market environment in which a firm operates has an impact on the maintenance of managerial ties and the implementation of green innovation, we selected seven industrial environment-related variables as control variables (Li et al., 2008). All of them were measured using a five-point Likert scale (1 = strongly disagree to 5 = strongly agree). Namely, the respondent was asked to rate to what extent for his/her firms that: demand always comes from new customers; are in a lucrative industry; Product and service have high profit; are easy to gain profit in our industry; the profit outlook of our industry is good; economic development plan give strong support; and resources are abundant in the market.

To ensure the reliability and validity of the data, we adopted several practical approaches. First, all of the constructs’ measures in this study were derived from existing studies and were validated in the literature. As can be seen in Table 1, Cronbach’s alphas ranged from 0.820 to 0.920, all of which are above the acceptable value of 0.7 (Cronbach, 1951). This indicates that the variables involved in this paper exhibit good internal consistency characteristics in the sample data used, from which we can assert that our measures are reliable.

Second, the construct validity tests of the variables are generally divided into two aspects, convergent validity and discriminant validity. Convergent validity can be tested by checking factor loading values and AVE (average variance extracted) values. Generally, a factor loading greater than or equal to 0.7 and an AVE greater than or equal to 0.5 can be considered as having convergent validity for the variable’s measurements (Fornell and Larker, 1981). Of the 25 item loadings presented in Table 1, 23 exceeded 0.7. The calculations results of AVE also showed that they all exceeded the recommended thresholds for each construct. Therefore, the measures used in this study are all valid and satisfy the convergent validity.

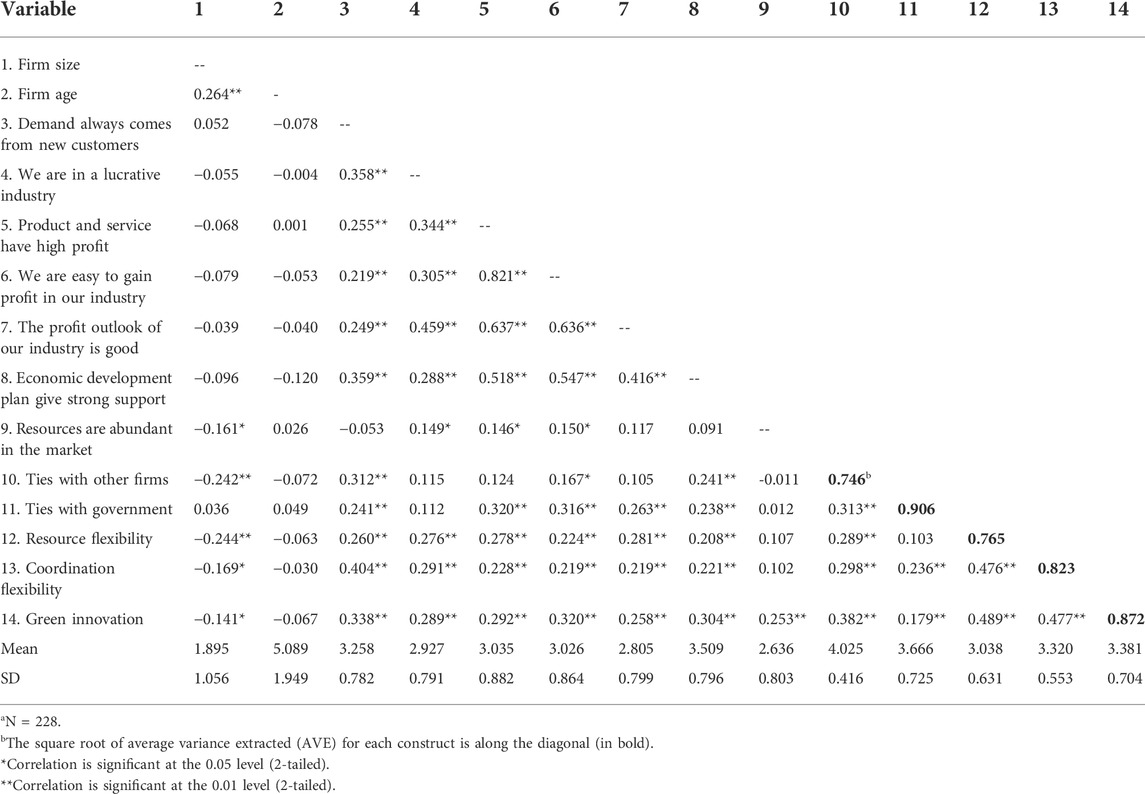

Discriminant validity was tested by examining whether the square root of the AVE of each construct (within-construct variance) was greater than the correlation between the constructs (between-construct variance) (Fornell & Larcker, 1981). Table 2 presents the correlation coefficients between all variables and the square root of the AVE for each construct (values on the diagonal line, in bold). As can be seen, the bold values on the diagonal lines are larger than all correlation coefficient values in their rows and columns, indicating discriminant validity among all constructs.

TABLE 2. Descriptive Statistics and Correlation Matrixa.

The descriptive statistics and Pearson correlations of the study variables are shown in Table 2. The results of the regression analysis are displayed in Table 3. We regress green innovation against the control variables in Model 1. Then we add resource flexibility, coordination flexibility, ties with other firms, and ties with government in Model 2. Then we add the interaction between resource flexibility and ties with other firms in Model 3, the interaction between resource flexibility and ties with government in Model 4, the interaction between coordination flexibility and ties with other firms in Model 5, and the interaction between coordination flexibility and ties with government in Model 6. In the last step, we put all variables and interaction terms into model 7. The VIF (variance inflation factor) of each variable in the model is less than 3, indicating that there is no strong multicollinearity among the independent variables.

In Hypothesis 1, we consider whether a new venture with resource flexibility benefits more from ties with government than from ties with other firms. The results indicate that the interaction between resource flexibility and ties with government is relates significant positively to green innovation (Model four in Table 3: β = 0.098, p < 0.01; Model 7: β = 0.130, p < 0.001). However, the coefficient of resource flexibility multiplied by ties with other firms is not that significant (Model 3: β = 0.090, p < 0.1; Model 7: β = 0.051, p > 0.1). These results support Hypothesis 1.

For Hypothesis 2, we predict that new ventures with coordination flexibility will benefit more from ties with other firms than ties with government for fostering their green innovation. Model three in Table 3 shows that, the interaction of coordination flexibility and ties with other firms is positively associated with green innovation (Model 5: β = 0.085, p < 0.1; Model 7: β = 0.087, p < 0.05). In contrast, the interaction of coordination flexibility and ties with government is negatively associated with green innovation (Model 6: β = -0.038, p > 0.1; Model 7: β = -0.087, p < 0.1). That is, a new venture with coordination flexibility gains more from the presence of tie with other firms than from ties with government, in support of Hypothesis 2.

The main purpose of this paper is to explore and explain the impact of the interaction between strategic flexibility and managerial ties on green innovation in new ventures. With a sample in China’s new ventures, and building on the strategic flexibility literature and social capital theory, we empirically examine all the above effects. This paper has the following contributions.

First, recent study calls for the identification of ‘green innovation’ that as an important driver of growth, especially for new ventures in emerging countries (Albort-Morant et al., 2016). Though previous studies have identified the impact of strategic flexibility on green innovation, this research field suffers from a conflicting views of empirical evidence (e.g., Colombo et al., 2012). Therefore, whether new ventures’ strategic flexibility actually benefit green innovations deserve the attention. In order to further advance this line of research, this paper proposes that in emerging economies such as China, in the process of green innovation implementation in new ventures, the key role of strategic flexibility (via resource flexibility and coordination flexibility) is generated through synergy with managerial ties (via ties with other firms and ties with government).

Our findings enrich existing research by investigating managerial ties as an important external resource gaining source, how to generate synergy effect with internal resource and coordination flexibility to better promote green innovations. In particular, researchers always focus on managerial ties’ direct impact on new ventures performance (Yli-Renko et al., 2002; Li & Zhang, 2007). We propose that managerial ties can not only impact firms’ green innovation directly, but also influence the exertion of internal resource and coordination flexibility. More interestingly, our findings indicate that a new venture with resource flexibility is more likely to conduct green innovations with ties with government rather than ties with other firms. On the contrary, a new venture with coordination flexibility is better able to achieve green innovation through building and maintaining ties with other firms rather than ties with government. These results reveal the importance of match between internal strategic flexibility and the way a new venture gain external resources. Our research provides a more nuanced understanding of how existing resource attributes which represent by resource flexibility and coordination flexibility and external resource gaining mechanisms which we focus on ties with other firms and ties with government in this paper jointly affect green innovation.

Second, our findings are different from some work which argue that ties with other firms is more useful than ties with government in transition economies such as China (e.g., Luk et al., 2008; Sheng et al., 2011). Different samples may lead to this inconsistency. For instance, new ventures and general firms. The possible explanation is that new ventures always suffer liability of newness and lack of resources, while government plays an essential role in developing and supporting new ventures growth in China. Thus, building and maintaining close ties with government to build legitimacy, gain scare resource and institutional support could generate synergy effect with new venture’s resource flexibility and then successfully implementing green innovations. On the other hand, as new entrant, new ventures always lack of bargaining power when facing mature incumbent firms, therefore, close ties with other firms may weaken the positive impact of resource flexibility on green innovation. Overall, our findings extend existing social capital theory by providing a profound understanding of the matching relations between different types of managerial ties and strategic flexibility.

The findings of this paper also have some implications for the management practices of new ventures. First, our study highlights the important role of strategic flexibility that managers should pay attention to in the process of implementing green innovation. Green innovation refers to innovations that are designed to reduce harmful environmental impacts, which has played a key role in driving industry toward sustainable manufacturing. Our empirical results strongly demonstrate that both resource flexibility and coordination flexibility can help new ventures to implement green innovation effectively. Therefore, new ventures in China should make their every effort to maintain their strategic flexibility. To achieve a relative high level of strategic flexibility, new ventures should foster an organizational culture that conducive to resource sharing and rapid deployment, set up a more flexible and organic organizational structure, and design a modular product manufacturing process (Sanchez, 1997; Christensen, 2006; Zhou & Wu, 2010).

Second, our findings indicate that strategic flexibility and managerial ties have different matching mechanisms to gain the maximum synergy effect on green innovation. Effective green innovation requires firms to maintain strategic flexibility and interplay with different types of managerial relationships. Specifically, to have better benefits from cultivating strategic flexibility and enhance green innovations, we suggest that a new venture with resource flexibility strengthen its ties with government; a new venture with coordination flexibility should endeavor to build and maintain ties with other firms such as its customers and suppliers.

Green innovation involves multiple functional areas (Noori & Chen, 2003; Huang & Li, 2015), thus requiring the integration of strategic resources from within and outside the firm to create synergies. For example, developers, designers, and environmental technicians work together to examine the possible environmental impacts of products and manufacturing processes (Noori & Chen, 2003). Leveraging the synergy of strategic flexibility and managerial ties aims to integrate the expertise of different participants in green innovation and enhance the dissemination of market and customer knowledge (Jansen et al., 2005; Huang & Wu, 2010), which in turn leads to green innovation. By matching resource flexibility, coordinating flexibility with ties with other firms and ties with government, firms can effectively integrate environmental issues in strategic planning to better promote green innovation.

Although this study has theoretical contributions and practical implications, there are still some limitations. The limitations of the study are analyzed for future more in-depth research in this area.

First, the sample of this empirical test is cross-sectional and context-specific. The cross-sectional data limit the test of the causal inferences of strategic flexibility and firms’ green innovation, while the context-specific issue requires the results should be viewed cautiously when extended to other or more general contexts. Therefore, future work may use a longitude and more general based sample to test our result and make a more convincible conclusion. Second, we investigate the matching relations between external managerial ties and internal strategic flexibility in this study. It is noteworthy that, research on the match of strategic flexibility with some other external factors such as demand uncertainty, technology turbulence, and competitive intensity may provide more comprehensive understanding of strategic flexibility and its effect on green innovation.

With the survey of Chinese new ventures, our empirical findings suggest that when new ventures’ strategic flexibility (via resource flexibility and coordination flexibility) match with their managerial ties (via ties with other firms and ties with government), they will more likely to conduct green innovation. We hope that this study will provide a little insight into the study of the matching of internal and external factors of new ventures, and their roles in the implementation of green innovation in the context of emerging economies, and contribute to the deeper development of this important area.

The raw data supporting the conclusion of this article will be made available by the authors, without undue reservation.

Ethical review and approval was not required for the study on human participants in accordance with the local legislation and institutional requirements. Written informed consent from the participants was not required to participate in this study in accordance with the national legislation and the institutional requirements.

The author confirms being the sole contributor of this work and has approved it for publication.

This work was supported by the National Natural Science Foundation of China under Grant 71702135.

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Adler, P., and Kwon, S. (2002). Social capital: Prospects for a new concept. Acad. Manage. Rev. 27 (1), 17–40. doi:10.5465/amr.2002.5922314

Ahuja, G. (2000). Collaboration networks, structural holes, and innovation: A longitudinal study. Adm. Sci. Q. 45 (3), 425–455. doi:10.2307/2667105

Albort-Morant, G., Leal-Millán, A., and Cepeda-Carrión, G. (2016). The antecedents of green innovation performance: A model of learning and capabilities. J. Bus. Res. 69 (11), 4912–4917. doi:10.1016/j.jbusres.2016.04.052

Arfi, W. B., Hikkerova, L., and Sahut, J. M. (2018). External knowledge sources, green innovation and performance. Technol. Forecast. Soc. Change 129, 210–220. doi:10.1016/j.techfore.2017.09.017

Baron, R. A., and Tang, J. (2009). Entrepreneurs’ social skills and new venture performance: Mediating mechanisms and cultural generality. J. Manag. 35 (2), 282–306. doi:10.1177/0149206307312513

Bocken, N. M. P., Farracho, M., Bosworth, R., and Kemp, R. (2014). The front-end of eco-innovation for eco-innovative small and medium sized companies. J. Eng. Technol. Manag. 31, 43–57. doi:10.1016/j.jengtecman.2013.10.004

Cai, W., and Zhou, X. (2014). On the drivers of eco-innovation: Empirical evidence from China. J. Clean. Prod. 79 (15), 239–248. doi:10.1016/j.jclepro.2014.05.035

Chang, C. H. (2011). The influence of corporate environmental ethics on competitive advantage: The mediation role of green innovation. J. Bus. Ethics 104 (3), 361–370. doi:10.1007/s10551-011-0914-x

Chang, Y., Chang, H., Chi, H., Chen, M., and Deng, L. (2012). How do established firms improve radical innovation performance? The organizational capabilities view. Technovation 32, 441–451. doi:10.1016/j.technovation.2012.03.001

Chen, H., Li, Y., and Liu, Y. (2015). Dual capabilities and organizational learning in new product market performance. Ind. Mark. Manag. 46, 204–213. doi:10.1016/j.indmarman.2015.02.031

Chen, Y. S., Lai, S. B., and Wen, C. T. (2006). The influence of green innovation performance on corporate advantage in Taiwan. J. Bus. Ethics 67 (4), 331–339. doi:10.1007/s10551-006-9025-5

Chen, Y. S. (2008). The driver of green innovation and green image—green core competence. J. Bus. Ethics 81 (3), 531–543. doi:10.1007/s10551-007-9522-1

Christensen, C. M. (2006). The ongoing process of building a theory of disruption. J. Prod. Innov. Manage. 23, 39–55. doi:10.1111/j.1540-5885.2005.00180.x

Colombo, M. G., Laursen, K., Magnusson, M., and Rossi-Lamastra, C. (2012). Introduction: Small business and networked innovation: Organizational and managerial challenges. J. Small Bus. Manag. 50 (2), 181–190. doi:10.1111/j.1540-627x.2012.00349.x

Combe, I. A., Rudd, J. M., Leeflang, P. S. H., and Greenley, G. E. (2012). Antecedents to strategic flexibility: Management cognition, firm resources and strategic options. Eur. J. Mark. 46, 1320–1339. doi:10.1108/03090561211248053

Cronbach, L. J. (1951). Coefficient alpha and the internal structure of tests. Psychometrika 16, 297–334. doi:10.1007/bf02310555

Dai, Y., Goodale, J. C., Byun, G., and Ding, F. (2018). Strategic flexibility in new high-technology ventures. Jour. Manage. Stud. 55, 265–294. doi:10.1111/joms.12288

Das, T. K., and Elango, B. (1995). Managing strategic flexibility: Key to effective performance. J. General Manag. 20, 60–75. doi:10.1177/030630709502000305

Di Benedetto, A. C., DeSarbo, W. S., and Song, M. (2008). Strategic capabilities and radical innovation: An empirical study in three countries. IEEE Trans. Eng. Manag. 55 (3), 420–433. doi:10.1109/tem.2008.922645

Dyer, J. H., and Singh, H. (1998). The relational view: Cooperative strategy and sources of interorganizational competitive advantage. Acad. Manage. Rev. 23 (4), 660–679. doi:10.5465/amr.1998.1255632

Farjoun, M. (2010). Beyond dualism: Stability and change as a duality. Acad. Manag. Rev. 35 (2), 202–225. doi:10.5465/amr.2010.48463331

Fornell, C., and Larcker, D. F. (1981). Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 18, 39–50. doi:10.2307/3151312

Geletkanycz, M. A., and Hambrick, D. C. (1997). The external ties of top executives: Implications for strategic choice and performance. Adm. Sci. Q. 4, 654–681. doi:10.2307/2393653

Grewal, R., and Tansuhaj, P. (2001). Building organizational capabilities for managing economic crisis: The role of market orientation and strategic flexibility. J. Mark. 65, 67–80. doi:10.1509/jmkg.65.2.67.18259

Gulati, R., Nohria, N., and Zaheer, A. (2000). Strategic networks. Strateg. Manag. J. 21 (3), 203–215. doi:10.1002/(sici)1097-0266(200003)21:3<203::aid-smj102>3.0.co;2-k

Hitt, M. A., Ireland, R. D., Camp, S. M., and Sexton, D. L. (2001). Strategic entrepreneurship: Entrepreneurial strategies for wealth creation. Strateg. Manag. J. 22, 479–491. doi:10.1002/smj.196

Hojnik, J., and Ruzzier, M. (2016). What drives eco-innovation A review of an emerging literature. Environ. Innovation Soc. Transitions 19, 31–41. doi:10.1016/j.eist.2015.09.006

Huang, J. W., and Li, Y. H. (2015). Green innovation and performance: The view of organizational capability and social reciprocity. J. Bus. Ethics 145 (2), 309–324. doi:10.1007/s10551-015-2903-y

Huang, Y. C., and Wu, Y. C. (2010). The effects of organizational factors on green new product success. Manag. Decis. 48 (10), 1539–1567. doi:10.1108/00251741011090324

Ireland, R. D., Hitt, M. A., and Sirmon, D. G. (2003). A model of strategic entrepreneurship: The construct and its dimensions. J. Manag. 29 (6), 963–989. doi:10.1016/s0149-2063(03)00086-2

Jansen, J. J. P., Van Den Bosch, F. A. J., and Volberda, H. W. (2005). Managing potential and realized absorptive capacity: How do organizational antecedents matter? Acad. Manage. J. 48 (6), 999–1015. doi:10.5465/amj.2005.19573106

Kang, S., Morris, S., and Snell, S. A. (2007). Relational archetypes, organizational learning, and value creation: Extending the human resource architecture. Acad. Manage. Rev. 32 (1), 236–256. doi:10.5465/amr.2007.23464060

Katsuhiko, S., and Hitt, M. A. (2004). Strategic flexibility: Organizational preparedness to reverse ineffective strategic decisions. Acad. Manag. Perspect. 18, 44–59. doi:10.5465/ame.2004.15268683

Kraatz, M. S., and Zajac, E. J. (2001). How organizational resources affect strategic change and performance in turbulent environments: Theory and evidence. Organ. Sci. 12 (5), 632–657. doi:10.1287/orsc.12.5.632.10088

Lee, S., Park, G., Yoon, B., and Park, J. (2010). Open innovation in SMEs—an intermediated network model. Res. Policy 39, 290–300. doi:10.1016/j.respol.2009.12.009

Li, H., and Zhang, Y. (2007). The role of managers’ political networking and functional experience in new venture performance: Evidence from China’s transition economy. Strateg. Manag. J. 28, 791–804. doi:10.1002/smj.605

Li, J. J., Poppo, L., and Zhou, K. Z. (2008). Do managerial ties in China always produce value? Competition, uncertainty, and domestic VS. Foreign firms. Strateg. Manag. J. 29, 383–400. doi:10.1002/smj.665

Li, J. J., and Zhou, K. Z. (2010). How foreign firms achieve competitive advantage in the Chinese emerging economy: Managerial ties and market orientation. J. Bus. Res. 63 (8), 856–862. doi:10.1016/j.jbusres.2009.06.011

Li, J. J., Zhou, K. Z., and Shao, A. T. (2009). Competitive position, managerial ties, and profitability of foreign firms in China: An interactive perspective. J. Int. Bus. Stud. 40, 339–352. doi:10.1057/jibs.2008.76

Li, Y., Chen, H., Liu, Y., and Peng, W. M. (2014). Managerial ties, organizational learning, and opportunity capture: A social capital perspective. Asia Pac. J. Manag. 31, 271–291. doi:10.1007/s10490-012-9330-8

Li, Y., Li, P. P., Wang, H., and Ma, Y. (2017). How do resource structuring and strategic flexibility interact to shape radical innovation? J. Prod. Innov. Manage. 34, 471–491. doi:10.1111/jpim.12389

Li, Y., and Peng, M. W. (2008). Developing theory from strategic management research in China. Asia Pac. J. Manage. 25 (3), 563–572. doi:10.1007/s10490-007-9083-y

Li, Y., Su, Z., and Liu, Y. (2010). Can strategic flexibility help firms profit from product innovation? Technovation 30, 300–309. doi:10.1016/j.technovation.2009.07.007

Liu, Y., Li, Y., and Wei, Z. (2009). How organizational flexibility affects new product development in an uncertain environment: Evidence from China. Int. J. Prod. Econ. 120, 18–29. doi:10.1016/j.ijpe.2008.07.026

Liu, Y., Li, Y., and Xue, J. (2010). Transfer of market knowledge in a channel relationship: Impacts of attitudinal commitment and satisfaction. Ind. Mark. Manag. 39 (2), 229–239. doi:10.1016/j.indmarman.2008.12.017

Lu, Y., Zhou, L., Bruton, G., and Li, W. (2010). Capabilities as a mediator linking resources and the international performance of entrepreneurial firms in an emerging economy. J. Int. Bus. Stud. 41, 419–436. doi:10.1057/jibs.2009.73

Luk, C. L., Yau, O. H. M., Sin, L. Y. M., Tse, A. C. B., Chow, R. P. M., and Lee, J. S. Y. (2008). The effects of social capital and organizational innovativeness in different institutional contexts. J. Int. Bus. Stud. 39 (4), 589–612. doi:10.1057/palgrave.jibs.8400373

Luo, Y. (2003). Industrial dynamics and managerial networking in an emerging market: The case of China. Strateg. Manag. J. 24, 1315–1327. doi:10.1002/smj.363

Noori, H., and Chen, C. (2003). Applying scenario-driven strategy to integrate environmental management and product design. Prod. Operations Manag. 12 (3), 353–368. doi:10.1111/j.1937-5956.2003.tb00208.x

Nooteboom, B. (1999). Innovation and inter-firm linkages: New implications for policy. Res. Policy 28, 793–805. doi:10.1016/s0048-7333(99)00022-0

Ozaki, R., and Sevastyanova, K. (2011). Going hybrid:an analysis of consumer purchase motivations. Energy Policy 39 (5), 2217–2227. doi:10.1016/j.enpol.2010.04.024

Park, S., and Luo, Y. (2001). Guanxi and organizational dynamics: Organizational networking in Chinese firms. Strateg. Manag. J. 22, 455–477. doi:10.1002/smj.167

Payne, G. T., Moore, C. B., Griffis, S. E., and Autry, C. W. (2010). Multilevel challenges and opportunities in social capital research. J. Manag. 37 (2), 491–520. doi:10.1177/0149206310372413

Peng, M. W. (2003). Institutional transitions and strategic choices. Acad. Manag. Rev. 28, 275–296. doi:10.2307/30040713

Peng, M. W., and Luo, Y. (2000). Managerial ties and firm performance in a transition economy: The nature of a micro-macro link. Acad. Manage. J. 43 (3), 486–501. doi:10.5465/1556406

Peng, Y. S., and Lin, S. S. (2008). Local responsiveness pressure, subsidiary resources, green management adoption and subsidiary’s performance: Evidence from Taiwanese manufactures. J. Bus. Ethics 79 (1), 199–212. doi:10.1007/s10551-007-9382-8

Phelps, C. C. (2010). A longitudinal study of the influence of alliance network structure and composition on firm exploratory innovation. Acad. Manage. J. 53 (4), 890–913. doi:10.5465/amj.2010.52814627

Przychodzen, J., and Przychodzen, W. (2015). Relationships between eco-innovation and financial performance—evidence from publicly traded companies in Poland and Hungary. J. Clean. Prod. 90 (1), 253–263. doi:10.1016/j.jclepro.2014.11.034

Rindova, V. P., and Kotha, S. (2001). Continuous ‘morphing’: Competing through dynamic capabilities, form, and function. Acad. Manage. J. 44, 1263–1280. doi:10.5465/3069400

Rosenbusch, N., Brinckmann, J., and Bausch, A. (2011). Is innovation always beneficial? A meta-analysis of the relationship between innovation and performance in SMEs. J. Bus. Ventur. 26, 441–457. doi:10.1016/j.jbusvent.2009.12.002

Roy, S., and Sivakumar, K. (2012). Global outsourcing relationships and innovation: A conceptual framework and research propositions. J. Prod. Innov. Manage. 29 (4), 513–530. doi:10.1111/j.1540-5885.2012.00922.x

Ruef, M. (2002). Strong ties, weak ties and islands: Structural and cultural predictors of organizational innovation. Industrial Corp. Change 11 (3), 427–449. doi:10.1093/icc/11.3.427

Sanchez, R. (1995). Strategic flexibility in product competition. Strateg. Manag. J. 16, 135–159. doi:10.1002/smj.4250160921

Sanchez, R. (1997). Preparing for an uncertain future. Int. Stud. Manag. Organ. 27, 71–94. doi:10.1080/00208825.1997.11656708

Shaffer, B. (1995). Firm-level responses to government regulation: Theoretical and research approaches. J. Manag. 21, 495–514. doi:10.1177/014920639502100305

Sheng, S., Zhou, K. Z., and Li, J. J. (2011). The effects of business and political ties on firm performance: Evidence from China. J. Mark. 75, 1–15. doi:10.1509/jmkg.75.1.1

Sinkula, J. M. (1994). Market information processing and organizational learning. J. Mark. 58 (1), 35–45. doi:10.2307/1252249

Sirmon, D. G., Hitt, M. A., Ireland, R. D., and Gilbert, B. A. (2011). Resource orchestration to create competitive advantage: Breadth, depth, and life cycle effects. J. Manag. 37 (5), 1390–1412. doi:10.1177/0149206310385695

Sirmon, D. G., Hitt, M. A., and Ireland, R. D. (2007). Managing firm resources in dynamic environments to create value: Looking inside the black box. Acad. Manage. Rev. 32 (1), 273–292. doi:10.5465/amr.2007.23466005

Su, Z. (2020). Institutional environment for entrepreneurship, strategic flexibility, and entrepreneurial orientation. IEEE Trans. Eng. Manag. 99, 1000–1010. doi:10.1109/tem.2020.2969479

Tsai, W. (2002). Social structure of ‘‘coopetition’’ within a multiunit organization: Coordination, competition, and intra-organizational knowledge sharing. Organ. Sci. 13 (2), 179–190. doi:10.1287/orsc.13.2.179.536

Vachon, S., and Klassen, R. D. (2008). Environmental management and manufacturing performance: The role of collaboration in the supply chain. Int. J. Prod. Econ. 111 (2), 299–315. doi:10.1016/j.ijpe.2006.11.030

Wang, J., Xue, Y., and Yang, J. (2020). Boundary-spanning search and firms’ green innovation:the moderating role of resource orchestration capability. Bus. Strategy Environ. 29 (2), 361–374. doi:10.1002/bse.2369

Wasko, M. M., and Faraj, S. (2005). Why should I share? Examining social capital and knowledge contribution in electronic networks of practice. MIS Q. 29 (1), 35–57. doi:10.2307/25148667

Wincent, J., Anokhin, S., O¨ rtqvist, D., and Autio, E. (2010). Quality meets structure: Generalized reciprocity and firm-level advantage in strategic networks. J. Manag. Stud. 47 (4), 597–624. doi:10.1111/j.1467-6486.2009.00882.x

Wright, M., Filatotchev, I., Hoskisson, R. E., and Peng, M. W. (2005). Strategy research in emerging economies: Challenging the conventional wisdom. J. Manag. Stud. 42 (1), 1–33. doi:10.1111/j.1467-6486.2005.00487.x

Wright, P. M., and Snell, S. A. (1998). Toward a unifying framework for exploring fit and flexibility in strategic human resource management. Acad. Manage. Rev. 23 (4), 756–772. doi:10.5465/amr.1998.1255637

Yli-Renko, H., Autio, E., and Tontti, V. (2002). Social capital, knowledge, and the international growth of technology-based new firms. Int. Bus. Rev. 11, 279–304. doi:10.1016/s0969-5931(01)00061-0

Zahra, S., and George, G. (2002). Absorptive capacity: A review, reconceptualization, and extension. Acad. Manage. Rev. 27 (2), 185–203. doi:10.5465/amr.2002.6587995

Zhang, S., and Li, X. (2008). Managerial ties, firm resources, and performance of cluster firms. Asia Pac. J. Manage. 25 (4), 615–633. doi:10.1007/s10490-008-9090-7

Zhou, K. Z., and Wu, F. (2010). Technological capability, strategic flexibility, and product innovation. Strategic Manag. J. 31, 547–561.

Zhu, Q., Sarkis, J., Cordeiro, J. J., and Lai, K. H. (2008). Firm-level correlates of emergent green supply chain management practices in the Chinese context. Omega 36 (4), 577–591. doi:10.1016/j.omega.2006.11.009

Zhu, Q., Sarkis, J., and Lai, K. H. (2012). Green supply chain management innovation diffusion and its relationship to organizational improvement: An ecological modernization perspective. J. Eng. Technol. Manag. 29 (1), 168–185. doi:10.1016/j.jengtecman.2011.09.012

Keywords: strategic flexibility, managerial ties, green innovation, new venture, China

Citation: Chen H (2022) The fitting effects between strategic flexibility and managerial ties on green innovation in new ventures. Front. Environ. Sci. 10:1024681. doi: 10.3389/fenvs.2022.1024681

Received: 22 August 2022; Accepted: 03 October 2022;

Published: 18 October 2022.

Edited by:

Heng Liu, Sun Yat-sen University, ChinaReviewed by:

Leinan Zhang, Beijing University of International Business and Economics, ChinaCopyright © 2022 Chen. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Haowen Chen, Y2h3MjM3QDE2My5jb20=

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.