- 1Institute of Statistics and Applied Mathematics, Anhui University of Finance and Economics, Bengbu, China

- 2School of Finance and Public Administration,Anhui University of Finance and Economics, Bengbu, China

- 3School of Finance, Anhui University of Finance and Economics, Bengbu, China

- 4International Business School Suzhou, Xi’an Jiaotong-Liverpool University, Suzhou, China

- 5School of Statistics, Southwestern University of Finance and Economics, Chengdu, China

The entropy method measures the development level of green finance in 30 provinces and cities in China, and the spatial analysis method is used to describe the difference. Spatial pattern of the development level of green finance in China and empirically analyze the influencing factors of the development level of green finance. The results of the spatial econometric model show that the absolute difference in the development level of China’s green finance shows an overall increasing trend, and the relative difference shows a downward trend year by year. The level of financial development and environmental governance promote the development of green finance, while the level of economic growth and energy consumption inhibit the development of green finance. On this basis, we put forward countermeasures and suggestions from strengthening government functions and adjusting industrial structure according to economic growth, so as to promote the development of green finance in China.

1 Introduction

China’s economy has entered a stage of high-quality development, and environmental pollution and ecological problems have gradually become prominent. To accelerate the reform of the ecological civilization system and promote high-quality economic growth, we should accelerate the green development of China’s economy, especially by taking “developing green finance” as one of the ways to promote green development. At present, in the financial field, green finance has become an important direction of the development of the financial industry, which is of vital significance to promote the sustainable development of the economy (Fang and Lin, 2019a; He and Yan, 2020; Lee, 2020). Besides, from the perspective of the macro-economy, green finance is a powerful driving force to encourage the construction of ecological civilization and helps to optimize the energy structure and promote sustainable energy development (Zhang and Wang, 2019; Wang F. et al., 2021). Therefore, in the context of the new normal, how to promote the development of green finance has become an important issue (Jiao, 2017; Li and Tang, 2021). This research aims to study the development level and influencing factors of green finance, which is contribute to promoting the high-quality development of green finance.

In general, the development of green finance has attracted great attention from the government and widespread social. Green finance is also the focus of many experts and scholars at home and abroad. A large number of scholars have obtained many representative achievements in studying the development of green finance. Zhou et al. (2020) suggested that the development of green finance is an important way to coordinate economic development with ecological and environmental protection. At present, many scholars mainly study the impact of green finance on economic development and environmental development from a spatial perspective. Wu (2022) constructs a spatial econometric model and performs a regression empirical analysis to understand the impact of green finance on China’s ecological development. Besides, some scholars constructed a spatial Dubin model to analyze the impact of green finance on the ecological environment and its spatial spillover effects (Li and Gan, 2020; Huang and Chen, 2022; Li et al., 2022). And they find that the development of green finance in these regions promotes the improvement of the ecological environment and presents an obvious space spillover effect of green finance. However, due to the differences in economic and environmental aspects among the various regions in China, there is a certain gap between the development level of the green economy in different provinces. Provinces and cities with a good economic development level have a relatively high level of technology finance development (Jiang et al., 2022). The study on the inter-regional gap in green finance development indicates that the development of the green economy shows a polarization trend (Lv et al., 2021). Besides, there is regional heterogeneity in the effects of green finance development on environmental quality. Consequently, spatial econometric models are constructed to study the effects of green finance on green development (Ye et al., 2022; Zheng and Dong, 2022). In order to explore the regional gap and spatial model of China’s green finance development, it is of great significance to explore the influencing factors of the development level of green finance in a certain country or region. Zhang et al. (2018) have built green credit, green securities, green insurance, and green investment indicators to build a green finance development evaluation system to evaluate the regional development level of green finance. Zhang (2016) chose green insurance, green credit, green securities, carbon finance, and other indicators to measure the development level of green finance in the Beijing-Tianjin-Hebei region.

In summary, domestic and foreign-related research mainly measures the development level of green finance by constructing corresponding indicators and analyzing the spatial pattern and influencing factors of green finance development in a certain region. However, there is no comprehensive research on the spatial pattern and influencing factors of green finance development level in various provinces in China. Exploring the spatial pattern of regional green finance development and analyzing the main influencing factors, on the one hand, can help to promote the development of green finance in all provinces. On the other hand, it has a certain enlightenment significance to realize the sustainable development of China’s economy. In view of this, the article tries to use the entropy method to measure the development level of green finance and adopt the spatial measurement model to analyze the influencing factors of regional green finance development.

Firstly, this paper uses the entropy-right method to select six indicators related to the development of green finance from five aspects: green credit, green investment, green securities, green insurance, and carbon finance and establishes a more comprehensive green-finance index system. Secondly, this paper not only studies the differences in the development level of green finance from the regional level but also divides 30 provinces into eastern, central, and western regions and uses spatial analysis methods to study the spatial distribution characteristics of green finance development level in 30 provinces in China. Finally, using the SAR model with fixed effects, the affecting factors of the development of regional green finance are analyzed and discussed.

2 Literature review

2.1 The development level of green finance

Currently, with the rapid development of the global economy and society, environmental problems have become increasingly serious. The concept of green finance has been put forward and attracted great attention from the government and widespread social. Green finance is the financing tool for coping with climate change and promoting sustainable development (Zhang et al., 2019; Madaleno et al., 2022). Chen and Chen (2021) believe that the development of green finance can reduce carbon emissions and promote environmental improvement. Wang H. et al. (2021) found that green finance has a significant positive impact and spatial spillover effect on the high-quality development of energy. Besides, the development of green finance contributes to the transformation of energy consumption structure (Ji and Zhang, 2019; Wang X. Y. et al., 2021; Sun and Chen, 2022). Therefore, it is of great practical significance to study how to better promote the development of green finance (Yu, 2016). At present, the measurement of green finance statistics in China is mainly about the index construction and evaluation of the development level of green finance in a certain region or industry. At the macro level, most scholars evaluate the development level of green finance by using financial instruments such as green credit and bonds (Gilchrist et al., 2021; Zhang et al., 2021). Wang et al. (2022) select policy support, green development of financial institutions, green financial instruments, and green investment as comprehensive indicators to build the evaluation system of green finance development level and mainly use the decision-making laboratory analysis method (DEMATEL) and network analysis method (ANP) to measure the development level of green finance. Besides, some scholars mainly use the entropy-right method to measure the green financial index. Jiang et al. (2020) selected 18 indicators from three dimensions of economic development, financial development, social, and environmental development, and used the improved entropy method to measure the green finance development index of China’s 25 provinces and municipalities from 2004 to 2017. The conclusion is that the development level of green finance has a great difference in China’s 25 provinces and municipalities. Wang F. et al. (2021) use the relevant statistical indicators of China’s green credit from 2011 to 2019 and adopt the entropy method and improved Analytic Hierarchy Process (AHP) to determine the green finance development index weight. The results show that China’s green finance index has generally shown a rapid growth trend. To sum up, the development level of green finance is increasing at a high speed on the whole.

2.2 Factors influencing green finance

At present, the research on the development level of green finance mainly focuses on analyzing the factors affecting the development of green finance. The vast majority of scholars mainly measure the development level of green finance in a certain region or country. Yu et al. (2019) selected the urban economic data of 21 cities in Guangdong from 2010 to 2016 and analyzed the main factors affecting the development of green finance in depth. The conclusion is that the development level of Guangdong’s green finance presents regional imbalance characteristics. Xu-Chu and Nian-Yu, (2017) used the principal component analysis method to analyze the development level of green finance from four aspects: the proportion of education level, pollution-controlled investment, residents’ income level and finance level. Sun et al. (2021) used the principal component analysis (PCA) and factor analysis (FPM) to analyze the influencing factors and vulnerability of financial vulnerability in different development stages of emerging economies represented by developing countries. The conclusion is that influencing factors of financial fragility in emerging economies at different stages of development have great differences. Xu et al. (2022) selected the research sample of Chinese A-share polluting companies and used the ordinary least squares model and the seemingly unrelated regression model to analyze the impact of environmental regulations on the development of green finance. They found that corporate-level environmental regulations have an impact on the development of green finance, and the impact of environmental regulations has obvious regional differences. Zhang et al. (2018) selected the data of 21 cities in Guangdong Province from 2011 to 2016 and adopted a genetic algorithm optimization neural network model (GA-BP model) to measure the development level of green finance. They concluded that the factors affecting urban green finance include the government, social capital support, fund allocation efficiency, and environmental protection enterprise development situation. It can be seen that although scholars have chosen different areas and adapted different influence indicators, their conclusions are consistent. Therefore, the development of green finance has obvious regional differences resulting from certain influencing factors.

2.3 The spatial measurement of green finance

The focus of earlier studies was on the impact of green finance on the environment and on the economy. Some scholars mainly study coupling coordination and spatial correlation effect of the green finance and economic growth (Zhou et al., 2022a; Yin and Xu, 2022). Besides, Dong et al. (2021) investigate the coupling coordination relationship between green urbanization and green finance in China. Liu et al. (2021) found that the spatial evolution in China presents an obvious southwest-northeast pattern. However, Compared with existing research, we find that there is little literature analyzing the development of green finance within certain region in the spatial dimension. At present, the research on the spatial characteristics of green finance development level in some regions of China is the focus of researchers. According to the characteristics of regional differences in China’s economic development, some scholars provide rich theoretical achievements for measuring the spatial pattern and differential characteristics of green finance development by constructing spatial measurement-related models. It provides important research results for subsequent studies. Xie et al. (2020) select the urban economic data of the Yangtze River Delta region of China from 2011 to 2017 and explores the characteristics and influencing factors of green finance development by establishing a time-fixed effects Durbin model. They find that the development of green finance in these regions has a clear spatial cluster effect. Regional GDP, regional innovation level, and air quality are the main factors affecting the development of green finance. Dong and Fu (2018) used the spatial econometrics modeling method to study the spatial and temporal evolution characteristics of green finance development in Heilongjiang Province. Zhou et al. (2022b) analyzed the development of provincial green finance and its spatial and temporal heterogeneity of influencing factors. Lei et al. (2021) use the provincial-level panel dataset of China to investigate the spatial impacts of green credit on the green economy. Besides, they also establish spatial Dubin models to study the impact of green credit on the green economy. The results show that green credit exhibits a local-neighborhood effect on the green economy. That is, the green credit can not only improve the local green economy but also generate a spatial spillover effect to promote the development of the green economy in the surrounding areas.

3 Modle construction and variable selection

3.1 Entropy method

Considering the diversity of evaluation indicators of green financial development level, the entropy method is selected to determine the weight of each index objectively. Finally, the comprehensive green financial development index is obtained. The specific process is as follows:

Standardization of raw data:

Positive indicator,

Inverse indicator,

In the formula,

Calculate the proportion of the index (

In the formula,

Calculate the index entropy value (

In the formula,

Calculate the information entropy redundancy (

Calculate the index weight (

Calculation of Green Finance Development Index (

3.2 Coefficient of variation

The coefficient of variation is a common method for measuring data differences, which is used to measure the relative degree of difference in the development level of China’s green finance. The calculation formula is:

In the formula:

3.3 Spatial econometric model

3.3.1 Construction of spatial weight matrix

Considering the complexity of provincial green finance spatial correlation, this paper selects two kinds of spatial weight matrix: the first-order neighbor weight matrix based on queen (

The farther the distance is, the less the mutual influence is.

3.3.2 Model construction

This paper selects spatial autoregressive model (SAR) to analyze the impact of various factors on green finance.

Among the formula,

3.4 Data sources

This paper selects 30 provinces and cities (Tibet Autonomous Region and Hong Kong, Macao, and Taiwan regions data missing, not included) as the research object. The data used in this paper are from the statistical yearbook of various provinces and cities from 2015 to 2020, the China Environmental Statistical Yearbook, and the China energy statistical yearbook.

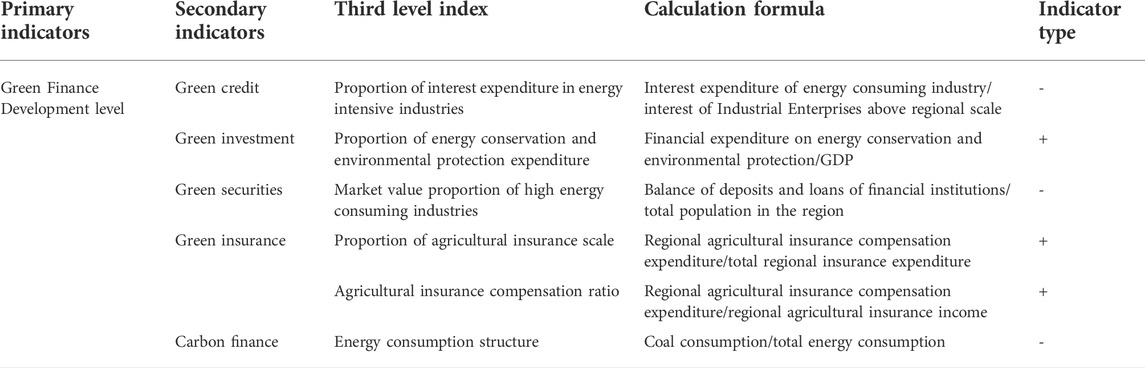

3.5 Index system and description

According to the connotation of the development level of green finance and referring to the existing relevant research results, a comprehensive evaluation system of China’s green finance development level is established by selecting six indicators from five aspects of green credit, green investment, green securities, green insurance, and Carbon Finance, For details, see Table 1 below.

4 Spatial difference analysis

4.1 Overall variance analysis

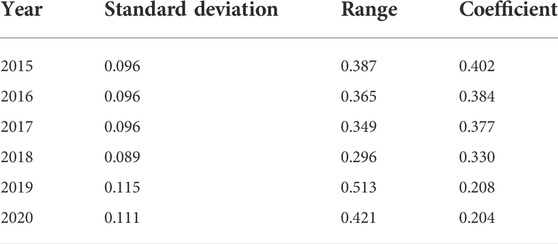

The comprehensive score of green finance of each Chinese province and city from 2015 to 2020 was calculated by the entropy evaluation method. What can be seen from Table 2 is that the overall absolute difference in the development level of green finance in China has widened. To be more specific, from 2015 to 2017, the standard deviation of the green finance development level was constant at 0.096, whereas the standard deviation decreased from 0.096 to 0.089 between 2017 and 2018. Moreover, from 2018 to 2020, the standard deviation firstly increased from 0.089 to 0.115 in 2019, reaching the maximum value, and then declined to 0.111 in 2020. According to the results of the comprehensive evaluation, in 2015, the highest score of green finance development level was in Qinghai Province (0.524), and the lowest was in Guizhou Province (0.137), with a range of 0.387. Furthermore, Qinghai still had the highest score on the green finance development level (0.468) in 2018, in contrast to the lowest score in Liaoning Province (0.172), and the range dropped to 0.296. The year 2019 witnessed that Heilongjiang province obtained the highest score of green finance development level, at up to 0.701, whereas Yunnan Province gained the lowest score at 0.188, and the range was as high as 0.513. In 2020, Heilongjiang Province still achieved the highest green finance development level (0.597), while Fujian Province earned the lowest score (0.175), with a range of 0.421. From the perspective of the expansion degree of absolute difference, from 2015 to 2018, it showed a trend of narrowing since the growth rate of standard deviation was -7.292% and the growth rate of the range was -23.514%. From 2018 to 2019, a sharp growth could be seen in the expansion degree as the growth rate of standard deviation was 29.213%, and the growth rate of the range was as high as 73.311%, after which the absolute difference showed a downward trend between 2019 and 2020 because the growth rate of standard deviation was -3.478% and the growth rate of the range was -17.934%. To sum up, the absolute difference in the development level of green finance in China from 2015 to 2020 has widened on the whole with some fluctuations.

As for the relative differences in the development level of green finance in China, it presented a downward trend year by year. From 2015 to 2018, the coefficient of variation decreased from 0.402 to 0.330, with a decrease of 17.910%. From 2018 to 2020, the variable coefficient declined from 0.330 to 0.204, with a decline of 38.182%, which was significantly larger than that in the previous period.

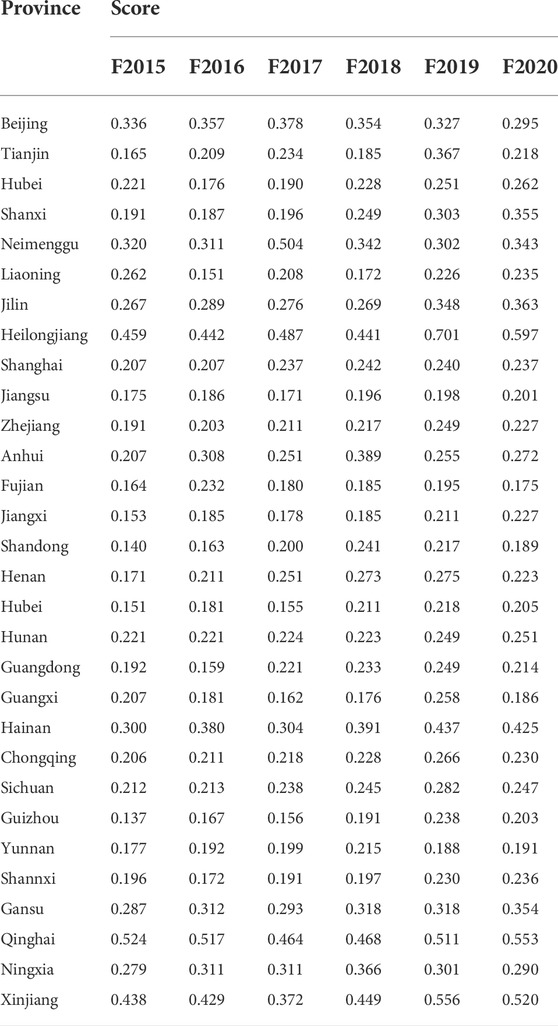

As we can be seen from Table 3, the development level of green finance in all provinces and cities showed steady growth from 2015 to 2020. By the end of 2020, the comprehensive score of most provinces and regions has reached above 0.200, indicating that overall the development level of green finance is good. In terms of the situation of specific provinces, the comprehensive score of green finance development level of Qinghai Province and Heilongjiang Province in 2015 was higher than 0.450, meaning that the development foundation of these two provinces was good. Meanwhile, the growth rate of these two provinces, especially Qinghai Province, changed slightly, and the growth of the score of these two provinces was relatively sluggish during the following 6 years from 2015 to 2020.

As for Guizhou and Shandong, the comprehensive score of the former was only 0.137 in 2015, and the score of the latter was also only about 0.140. This means that the overall score was low, and the development foundation was poor in these two provinces compared to other provinces during the same period. Although the development basis of green finance in these two provinces was not high, the development level has gradually improved with six-year efforts, and the score has been significantly improved. In 2020, the score of Guizhou Province exceeded 0.200. Shandong scored 0.189 at the end of 2020, but it still scored 0.241 in 2018. Therefore, in general, the development level of green finance in these two provinces has made great progress. By comparing the comprehensive score of these two provinces in 2015, it can be seen that the initial scores of these two provinces were much lower than those of Qinghai and Heilongjiang provinces. Thus, although their growth rate was very high, the increase in the actual aggregate is relatively limited.

As can be seen from Table 3, the development level of green finance in all provinces and cities showed steady growth from 2015 to 2020. By the end of 2020, the comprehensive score of most provinces and regions has reached above 0.200, indicating that the overall development level of green finance is good. In terms of the situation of specific provinces, the comprehensive score of green finance development level of Qinghai Province and Heilongjiang Province in 2015 was higher than 0.450, meaning that the development foundation of these two provinces was good. Meanwhile, the growth rate of these two provinces, especially Qinghai Province, changed slightly, and the growth of the score of these two provinces was relatively sluggish during the following 6 years from 2015 to 2020.

As for Guizhou and Shandong, the comprehensive score of the former was only 0.137 in 2015, and the score of the latter was also only about 0.140. This means that the overall score was low, and the development foundation was poor in these two provinces compared to other provinces during the same period. Although the development basis of green finance in these two provinces was not high, the development level has gradually improved with six-year efforts, and the score has been significantly improved. In 2020, the score of Guizhou Province exceeded 0.200. Shandong scored 0.189 at the end of 2020, but it still scored 0.241 in 2018. Therefore, in general, the development level of green finance in these two provinces has made great progress. By comparing the comprehensive score of these two provinces in 2015, it can be seen that the initial scores of these two provinces were much lower than those of Qinghai and Heilongjiang provinces. Thus, although their growth rate was very high, the increase in the actual aggregate is relatively limited.

4.2 Spatial pattern evolution

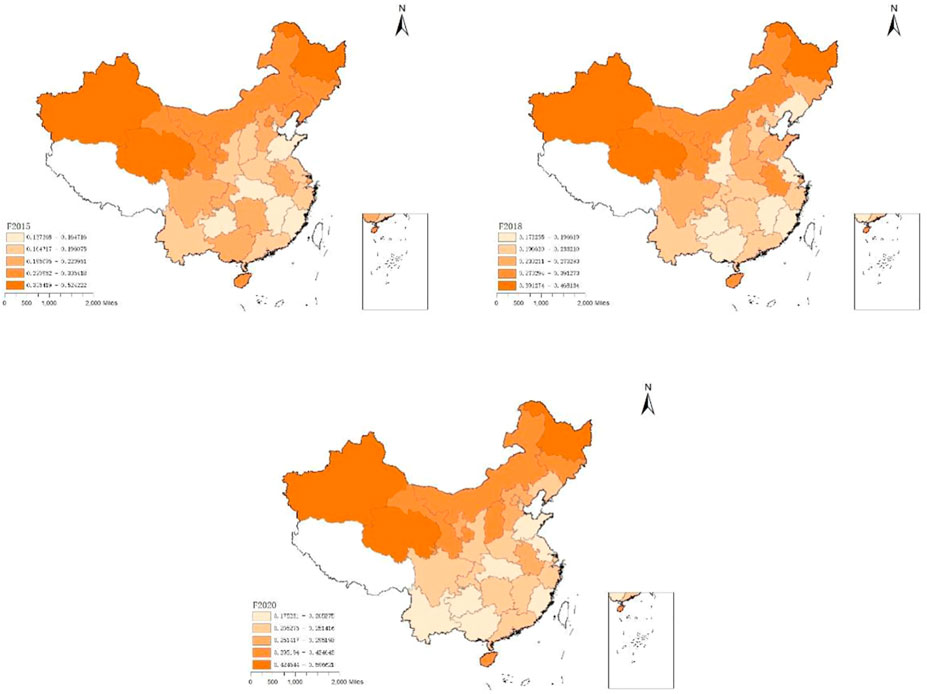

In order to more clearly reveal the spatial distribution characteristics of green finance development levels in 30 provinces in my country, the types were classified according to the natural fracture method, and a spatial distribution map of regional green finance development was created under ArcMap (Figure 1). The spatial characteristics of different time nodes are as follows:

In 2015, China’s green finance development generally presented a heterogeneous and heterogeneous spatial pattern of “eastern and western polarities and regional differentiation”. “East and west poles” is reflected in Xinjiang Uygur Autonomous Region and Qinghai Province at the westernmost end, and Heilongjiang Province at the easternmost end with the highest level of green finance development, forming a distribution trend of “eastern and western poles”. The reason is that its original ecological environment is good, and environmental protection investment has been valued for a long time; “regional differentiation” is mainly reflected in the industrial development of China’s eastern coastal areas, the early economic development at the expense of the environment, the lack of attention to environmental pollution control, and financial resources. The inflow of green industries is insufficient, so the development level of green finance is lower than that of western provinces where heavy industry is less developed and the primary industry accounts for a large proportion, forming a distinct spatial distribution characteristic of east-west differentiation.

In 2018, China’s green finance development generally showed a distribution structure of “the center of gravity northward shift and individual differentiation”. “The center of gravity northward shift” is reflected in the remarkable development of green finance development levels in provinces represented by Beijing, Shanxi, Shandong, Henan, and Anhui, while the development of green finance in provinces represented by Chongqing, Guangxi, and Hunan level has declined. The possible reason is that compared with the southern provinces, the northern provinces have more room for environmental improvement, more investment in governance, and greater inclination in green financial policies. The “individual differentiation” is mainly reflected in the fact that the overall spatial distribution pattern of the “a situation of tripartite confrontation” of China’s green finance development level has not changed, mainly because the development level of green finance in some provinces has been improved or decreased, which may be caused by the differences in the industrial structure, the development degree of the financial industry and the green policies of various provinces.

In 2020, China’s green financial development generally presents a distribution structure of “high in the north and low in the south, with widening differences”. “High in the north and low in the South” is mainly reflected in the seven provinces of Sichuan, Gansu, Shaanxi, Hubei, Henan, Anhui and Jiangsu, which are crossed by the Qinling Mountains and Huaihe River. The development level of green finance in the region shows a significant trend of low development level in the South and high development level in the north, which may be due to the strong foundation of heavy industry in the north, serious environmental damage in the early stage and heavy pollution control tasks. Therefore, the demand for green finance resources is large and the development is fast in the north provinces. At the same time, with the continuous promotion of China’s double carbon target strategy, the traditional heavy industrial areas in the North continue to increase their investment in green industries and environmental restoration. Therefore, compared with the southern areas dominated by light industries and service industries, the northern areas have a greater demand for green finance and develop more rapidly.

5 Analysis of influencing factors

5.1 Explained variables

Green finance index (GFI): based on the connotation of green finance, this paper constructs the development level of regional green finance from the five dimensions of green credit, green investment, green securities, green insurance, and carbon finance and takes them as explanatory variables.

5.2 Explanatory variables

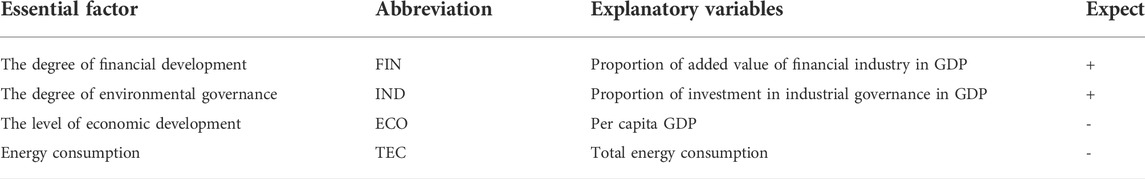

The development of green finance is affected by many factors, and academia has carried out extensive and in-depth research on it. Fang and Lin (2019b) think that the main influencing factors of green finance development in China are economic development, industrial structure, energy consumption structure, etc.; According to Qiao et al. (2021), the level of economic development, the development of regional financial industry, and environmental pollution have a significant impact on the development of green finance; Peng and Zheng, (2021) believed that carbon emission reduction could improve energy efficiency, develop green finance, and indirectly promote the growth of green total factor productivity. Based on the above research, this paper analyzes the following indicators (see Table 4): the degree of financial development (FIN) is expressed by the proportion of the added value of the financial industry and gross domestic product of each region; The degree of environmental governance (IND) is expressed by the proportion of industrial governance investment in GDP; The level of economic development (ECO) is expressed by GDP per capita of each region; Energy consumption (TEC) is expressed by the total energy consumption of each region. The data mainly comes from the statistical yearbook of cities at all levels, China’s energy statistical yearbook, and China’s environmental statistical yearbook.

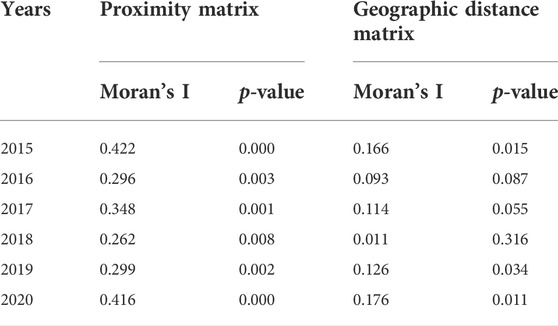

5.3 Spatial correlation analysis

According to the principle of spatial econometrics, in order to establish the spatial correlation of green finance development, the adjacent matrix, and geographic distance matrix as a spatial weight matrix to analyze the spatial correlation of green finance development, Moran’s I index is calculated by using the green financial indicators of each region from 2015 to 2020. As can be seen from Table 5, the Moran’s I index of green finance from 2015 to 2020 is positive, and most years have passed the significance test, and green finance shows a positive spatial correlation.

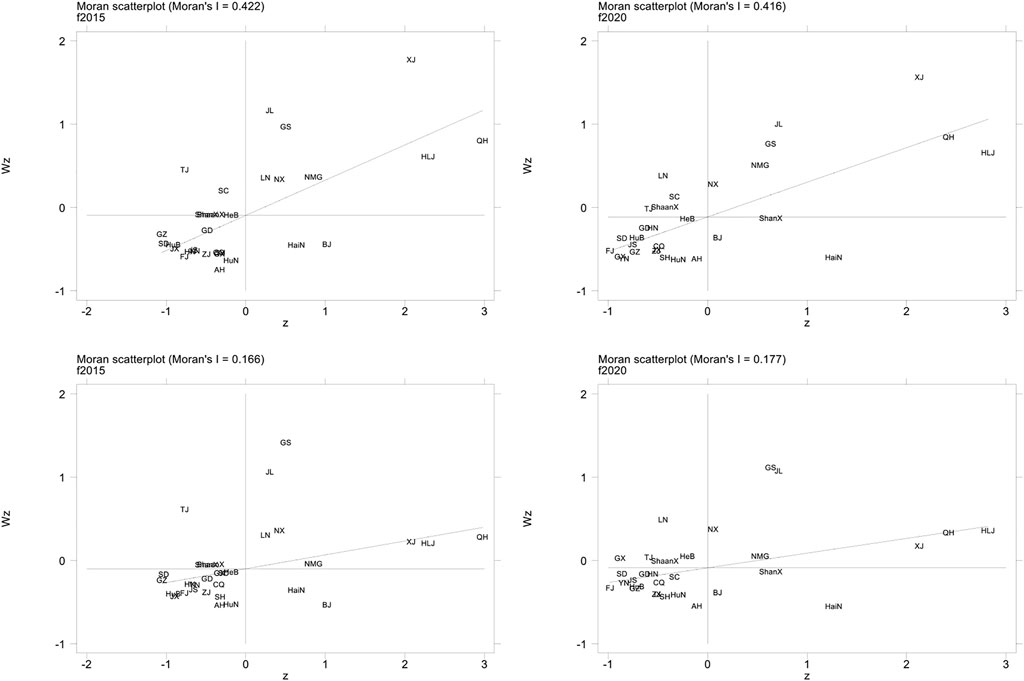

In order to further reflect the local correlation of regional green finance development, Figure 2 presents the Moran scatter plot of green finance development in 30 provinces across the country in 2015 and 2020 based on the proximity matrix and the geographic distance matrix, respectively. In general, the development of green finance in all parts of the country has obvious development conditions of high-level and low-level agglomeration. The possible reason (the first and third quadrants) is that some provinces have shortcomings in ecological health, income distribution, and low-carbon development. and constraints. The province’s economic development and green development are unbalanced.

6 Analysis of empirical results

6.1 Spatial correlation analysis

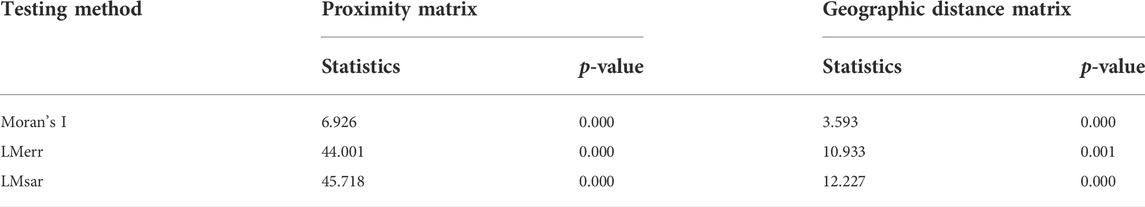

Firstly, the SAR model and SEM model are selected and judged. The spatial correlation test in Table 6 indicates that laser is more significant than mere statistics in both proximity matrix and geographical distance matrix, so the SAR model is selected for analysis. Secondly, fixed effect and random effect models are selected. According to Hausman test results and comprehensive analysis of time fixed effect, individual fixed effect, and bidirectional fixed effect model, the SAR model with fixed time should be selected as the optimal choice.

6.2 Spatial econometric analysis

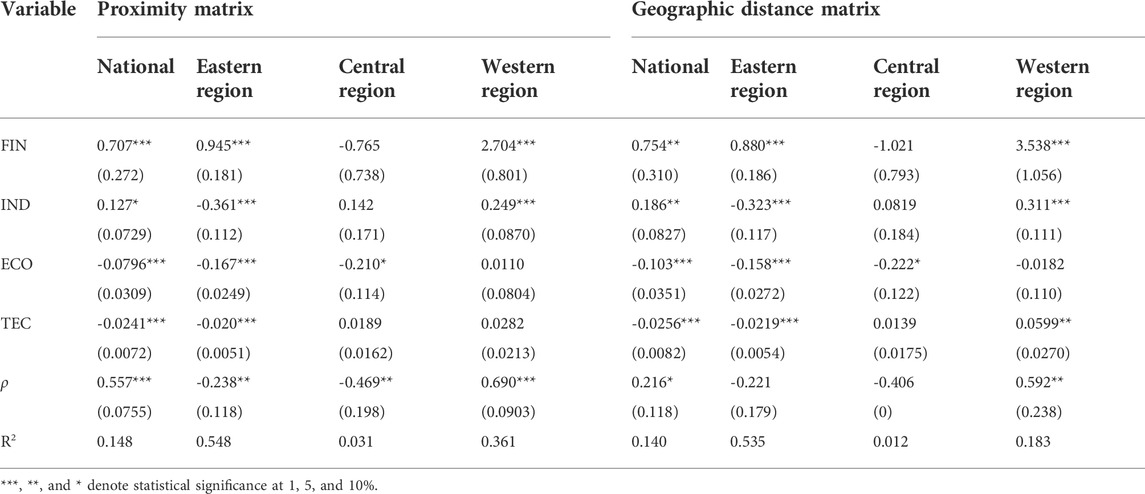

By using two weight matrices, this paper performs regional regression on the samples, and the results are shown in Table 7. The regression of the two weight matrices in the table is very close to the parameters of the model, indicating that the model is relatively stable and reliable. Taking the regression results of the proximity matrix as an example, in the process of green finance development, from a national perspective, the degree of financial development and environmental governance has a significant positive effect on the development of green finance, and the level of economic development and energy consumption have a significant negative effect on the development of green finance, in line with expectations. As far as the development of regional green finance is concerned, the eastern region has a high level of economic development, a relatively developed financial industry, strong financial strength and a solid foundation for green finance development. However, with the rapid economic development, the cost of industrial pollution control has increased energy consumption. The increase may lead to a marginal decrease in the level of green development in the eastern region. Only the economic development level of the influencing factors in the central region passed the significance test. The possible reason is that in the process of economic development, in recent years, the government and individual investment in various aspects of green finance has fewer benefits than the economic aggregate. The western region has a good environmental foundation and abundant natural resources, but its financial industry development and economic development level are relatively poor. Therefore, compared with the eastern region and the central region, the marginal contribution of the financial industry development and industrial pollution control is the highest in the western region. It is an important path to improve the development level of green finance in the western region.

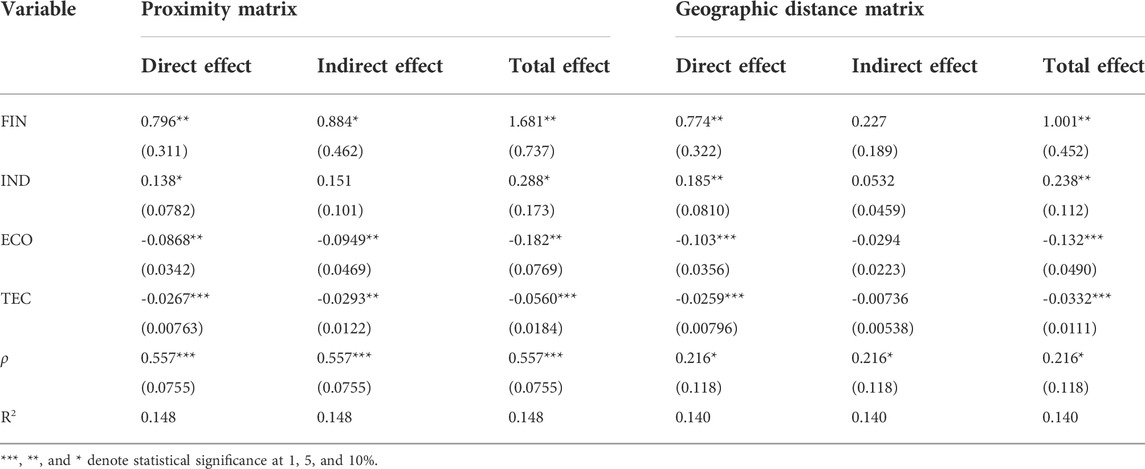

In order to better represent the impact of various factors on the development of green finance, this paper decomposes the effects of the coefficients in the SAR model, namely direct effects, indirect effects, and total effects, and examines their spillover effects and incremental effects on the region and adjacent regions respectively. And the decomposition results are shown in Table 8. It can be seen from Table 8 that the direct effect, indirect effect, and total effect coefficient of the two weight matrices for the influencing factors are similar. Taking the decomposition result of the proximity matrix as an example, only the direct effect, indirect effect, and total effect of the level of financial development on the development level of green finance are significantly positive, which indicates that the improvement of the level of financial development will not only benefit the development of green finance in the region but also contribute to the development of green finance. It will promote the development of green finance in adjacent areas, which is consistent with the phenomenon of high and high agglomeration and low and low agglomeration in Moran’s scatter diagram. In addition, the direct effect, indirect effect, and total effect of the level of economic development and energy consumption on the development level of green finance are significantly negative, which indicates that in the process of economic development, people’s green investment activities are not active, and environmental protection and economic development are in severe conflict. The effects of the level of economic development and energy consumption on the region and neighboring regions in the process of green finance development cannot be ignored. In addition, the impact of the degree of environmental governance on the development of green finance is mainly a direct effect, which indicates that it mainly promotes the development of green finance in the region, and the impact on neighboring regions is not obvious.

7 Conclusions and policy implications

In this study, 30 provinces in China are selected as research units, and a comprehensive evaluation system of the green finance development level is systematically constructed. The characteristics of spatial differentiation of green finance development level in China are analyzed, and the influencing factors of green finance development level differences are discussed by using the spatial measurement method. The main conclusions are as follows:

Firstly, from the perspective of the difference in the development level of green finance in China, there is an overall trend of expansion in the absolute difference in the development level of green finance in China from 2015 to 2020, including several fluctuations, while the relative difference shows a trend of narrowing year by year, whose speed increases. From 2015 to 2020, the development level of green finance is obviously different in China. The levels of Qinghai Province and Heilongjiang Province are much higher than the national average level, and a large gradient difference has been formed between them and the backward provinces. In addition, although Guizhou and Shandong, two provinces with a low development foundation of green finance, have made great progress in general, their total increases are limited.

Secondly, from the point of China’s green financial development level distribution pattern, in 2015, China’s green financial development on the whole presents “a situation of tripartite confrontation, east-west differentiation” heterogeneous spatial pattern, the most western end of Xinjiang Uygur Autonomous Regions and Qinghai Province, the eastern Heilongjiang and the southernmost Hainan are in the highest level, with the eastern coastal areas in the backward position. In 2018, the development of green finance in China generally indicated a distribution structure of “the center of gravity shifting to the north and individual differentiation.” The level of the provinces (municipalities) represented by Beijing, Shanxi, Shandong, Henan and Anhui has significantly developed, whereas the level of the provinces (municipalities) represented by Chongqing, Guangxi, and Hunan has decreased. Simultaneously, the overall spatial distribution pattern of “a situation of tripartite confrontation” remains unchanged. In 2020, China’s green financial development, on the whole, presents “lower from north to south, the difference to expand” distribution structure. Taking Sichuan, Gansu, Shanxi, Hubei, Henan, Anhui, and Jiangsu provinces, which pass through the Qinling Mountains and Huaihe River line as the dividing line, the development level of regional green finance shows a significant trend of low development level in the south and high development level in the north.

Thirdly, in the view of factors influencing the development level of green finance in China, the level of financial development and environmental governance have significant positive effects on the development of green finance in China, while the level of economic development and energy consumption have significant negative effects. In terms of regional green finance development, regional development is unbalanced. The eastern region has a high level of economic development and a good foundation for green finance development. However, with the rapid economic development, the increasing cost of industrial pollution control and energy consumption may lead to the marginal decline of the green development level in the eastern region. In the central region, only the level of economic development has passed the significance test. The possible reason is that in the process of economic development, the government and individuals’ investment in green finance produces small benefits compared with the total economic volume in recent years. The western region, where the environmental foundation is good, is rich in natural resources, but its levels of financial development and economic development are poor. Therefore, compared with the eastern and central regions, the marginal contribution of financial industry development and industrial pollution control degree is the highest in the western region, which are important ways to promote the green financial development level in the western region. Additionally, only the direct effect, indirect effect, and total effect of the degree of financial development on the level of green finance development are significantly positive, indicating that the improvement of the level of financial development is conducive to the development of green finance, not only in this region but in neighboring regions. The direct effect, indirect effect, and total effect of economic development level and energy consumption level on the development level of green finance are significantly negative, showing that in the process of economic development, people’s green investment activities are not active, and the contradiction between environmental protection and economic development is severe. The impact of environmental governance degree on green finance development is mainly a direct effect, meaning that it mainly promotes the development of green finance in this region and has little impact on neighboring regions.

Based on the above research conclusions, this study puts forward the following policy suggestions for the development of green finance in China.

First, the eastern region should strengthen environmental development. On the basis of a strong economy, the eastern region should make use of a better development foundation of green finance to speed up the development of green finance by solving the problems of increasing cost of industrial pollution control and increased energy consumption. It is necessary to fully implement the central government’s idea of ecological civilization, accelerate the improvement of the new pollution control system, promote capital in the field of industrial pollution control, and encourage commercial banks, securities companies, and other financial institutions to increase their loan support for industrial pollution control. At the same time, it is imperative to increase the publicity of green finance, strive to raise the awareness of environmental protection and low-carbon awareness, reduce energy consumption and involve all social entities in it.

Second, the central region is supposed to increase investment in green finance. It is suggested to formulate green finance incentive policies, give relevant preferences and subsidies, and guide people to make green investment activities. It is also essential to diversify green financial products and promote the development of green funds, green insurance and other products to match social needs. Meanwhile, the problem of information asymmetry between potential green investors and the green financial market should be resolved to enhance investors’ investment confidence and improve the efficiency of the green financial market. In addition, what should be done is to deepen the concept of green development, promote the green transformation of traditional industries, adjust the industrial structure, and increase the investment intensity in the green transformation of traditional industrial enterprises.

Third, with the advantage of a green environment, the western region should promote the development of the financial industry and increase the degree of industrial pollution control. Government departments shall strengthen the introduction of financial personnel and technology, improve the issuance of financial laws and regulations, and improve the operation mechanism of financial institutions at all levels. Furthermore, incentive policies are advised to be introduced to promote enterprises to actively reduce the production of industrial pollution from the source, implement clean production, take “zero emissions” as the goal, and establish ecological industrial parks to minimize waste production. Finally, the ecological compensation system can be established on a pilot basis in the eastern region. While the western region provides resources to the eastern region, the eastern region should make ecological compensation to the western region, provide funds, technical support, and preferential policies, and compensate the expenditure of environmental protection-related education and scientific research expenses in the western region, so as to achieve common and balanced development of the eastern and western regions.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

YZ: Conceptualization, Writing-Original Draft, Project administration. HL: Software, Methodology, Writing original draft. JW: Software, Methodology, Writing original draft. HY: Software, Methodology, Writing original draft. ZL: Software, Methodology, Writing original draft. GP: Conceptualization, Data curation, Writing review and editing.

Funding

This research was financially supported by the National Social Science Foundation of China (No. 21CTJ024), the Humanities and Social Sciences Program of the Ministry of Education (No. 20YJC790193), Key Projects of National Social Science Foundation (No. 19AZD010), Major national Statistical Scientific Research Projects (No. 2021LD05).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Chen, X., and Chen, Z. (2021). Can green finance development reduce carbon emissions? Empirical evidence from 30 Chinese provinces. Sustainability 13, 12137. doi:10.3390/su132112137 |

Dong, G., Ge, Y., Zhu, W., Qu, Y., and Zhang, W. (2021). Coupling coordination and spatiotemporal dynamic evolution between green urbanization and green finance: A case study in China. Front. Environ. Sci. 8. doi:10.3389/fenvs.2020.621846 |

Dong, X. H., and Fu, Y. (2018). Analysis of green finance development and influencing factors [J]. Statistics Decision-making (20), 5. doi:10.13546/j.cnki.tjyjc.2018.20.022 |

Fang, J. G., and Lin, F. L. (2019b). Study on the relationship of green finance and sustainable development of economy: Empirical analysis based on 30 provincial panel data in China. J. China Univ. Petroleum(Edition Soc. Sci. doi:10.13216/j.cnki.upcjess.2019.01.0003 |

Fang, J. G., and Lin, F. L. (2019a). Research on regional differences and influencing factors of green finance development in China [J]. Wuhan. Finance (07), 69–74. doi:10.3969/j.issn.1009-3540.2019.07.012 |

Gilchrist, D., Yu, J., and Zhong, R. (2021). The limits of green finance: A survey of literature in the context of green bonds and green loans. Sustainability 13 (2), 478. doi:10.3390/su13020478 |

Huang, Y. M., and Chen, C. (2022). The spatial spillover and threshold effect of green finance on environmental quality: Evidence from China. Environ. Sci. Pollut. Res. 29 (12), 17487–17498. doi:10.1007/s11356-021-16892-x |

Ji, Q., and Zhang, D. (2019). How much does financial development contribute to renewable energy growth and upgrading of energy structure in China? Energy Policy 128, 114–124. doi:10.1016/j.enpol.2018.12.047 |

Jiang, L. L., Wang, H., Tong, A. H., Hu, Z. F., Duan, H. J., Zhang, X. L., et al. (2020). The measurement of green finance development index and its poverty reduction effect: Dynamic panel analysis based on improved entropy method. Discrete Dyn. Nat. Soc. 2020, 1–13. doi:10.1155/2020/8851684 |

Jiang, L. L., Wang, H., Wang, S. W., Hu, Z. F., Tong, A. H., and Wang, Y. F. (2022). The spatial correlation between green high-quality development and technology finance. Front. Environ. Sci. 10, 888547. doi:10.3389/fenvs.2022.888547 |

Jiao, J. (2017). Problems and suggestions of green finance in China. DEStech transactions on social science education and human science(mess). doi:10.12783/dtssehs/mess2017/12110 |

Lee, J. W. (2020). Green finance and sustainable development goals: The case of China. J. Asian Finance Econ. Bus. 7 (7), 577–586. School of International Economics and Trade, Anhui University of Finance and Economics AUFE. doi:10.13106/jafeb.2020.vol7.no7.577 |

Lei, X. D., Wang, Y. L., Zhao, D. X., and Chen, Q. (2021). The local-neighborhood effect of green credit on green economy: A spatial econometric investigation. Environ. Sci. Pollut. Res. 28 (46), 65776–65790. doi:10.1007/s11356-021-15419-8 |

Li, C. G., Fan, X. B., Hu, Y. X., Yan, Y., Shang, G. F., and Chen, Y. Z. (2022). Spatial spillover effect of green finance on economic development, environmental pollution, and clean energy production across China. Environ. Sci. Pollut. Res. Int., 1–16. doi:10.1007/s11356-022-21782-x |

Li, C. G., and Gan, Y. (2020). The spatial spillover effects of green finance on ecological environment-empirical research based on spatial econometric model. Environ. Sci. Pollut. Res. 28 (4), 5651–5665. doi:10.1007/s11356-020-10961-3 | |

Li, X., and Tang, Q. (2021). Using big data technology to assist in the analysis of China's green finance development issues and path innovation. J. Phys. Conf. Ser. 1744 (4), 042053. doi:10.1088/1742-6596/1744/4/042053 |

Liu, Y. H., Lei, J., and Zhang, Y. H. (2021). A study on the sustainable relationship among the green finance, environment regulation and green-total-factor productivity in China. Sustainability 13 (21), 11926. doi:10.3390/su132111926 |

Lv, C., Bian, B., Lee, C. C., and He, Z. (2021). Regional gap and the trend of green finance development in China. Energy Econ. 102, 105476. doi:10.1016/j.eneco.2021.105476 |

Madaleno, M., Dogan, E., and Taskin, D. (2022). A step forward on sustainability: The nexus of environmental responsibility, green technology, clean energy and green finance. Energy Econ. 109, 105945. doi:10.1016/j.eneco.2022.105945 |

Peng, J., and Zheng, Y. (2021). Does environmental policy promote energy efficiency? Evidence from China in the context of developing green finance. Front. Environ. Sci. 9. doi:10.3389/fenvs.2021.733349 |

Qiao, Q., Fan, J., Sun, Y., and Song, Q. H. (2021). Research on the measurement and influencing factors of green finance in the provinces along the "Belt and Road” [J]. Industrial Technol. Econ. 40 (07), 120–126.

Sun, H., and Chen, F. (2022). The impact of green finance on China’s regional energy consumption structure based on system GMM. Resour. Policy 76, 102588. doi:10.1016/j.resourpol.2022.102588 |

Sun, Y., Gao, H., and Yuan, X. (2021). Influencing factors study on green development using principal component analysis and factor analysis. J. Phys. Conf. Ser. 1952 (4), 042120. doi:10.1088/1742-6596/1952/4/042120 |

Wang, F., Wang, R., and He, Z. (2021). The impact of environmental pollution and green finance on the high-quality development of energy based on spatial Dubin model. Resour. Policy 74, 102451. doi:10.1016/j.resourpol.2021.102451 |

Wang, H., Jiang, L., Duan, H., Wang, Y., Jiang, Y., and Lin, X. (2021). The impact of green finance development on China’s energy structure optimization. Discrete Dyn. Nat. Soc. 2021, 1–12. doi:10.1155/2021/2633021 |

Wang, Q. J., Wang, H. J., and Chang, C. P. (2022). Environmental performance, green finance and green innovation: What’s the long-run relationships among variables? Energy Econ. 110, 106004. doi:10.1016/j.eneco.2022.106004 |

Wang., X. Y., Zhao, H. K., and Bi, K. X. (2021). The measurement of green finance index and the development forecast of green finance in China. Environ. Ecol. Stat. 28 (2), 263–285. doi:10.1007/s10651-021-00483-7 |

Wu, G. S. (2022). Research on the spatial impact of green finance on the ecological development of Chinese economy. Front. Environ. Sci. 346. doi:10.3389/fenvs.2022.887896 |

Xie, H., Ouyang, Z., and Choi, Y. (2020). Characteristics and influencing factors of green finance development in the Yangtze River Delta of China: Analysis based on the spatial Durbin model. Sustainability 12 (22), 9753. doi:10.3390/su12229753 |

Xu, Y., Li, S. S., Zhou, X. X., Shahzad, U., and Zhao, X. (2022). How environmental regulations affect the development of green finance: Recent evidence from polluting firms in China. Renew. Energy 189, 917–926. doi:10.1016/j.renene.2022.03.020 |

Xu-Chu, X. U., and Nian-Yu, G. (2017). An empirical study on development influencing factors of green finance in China from a sustainable perspective. J. Jinling Inst. Technol. Sci. doi:10.16515/j.cnki.32-1745/c.2017.03.003 |

Ye, T. F., Xiang, X. L., Ge, X. Y., and Yang, K. L. (2022). Research on green finance and green development based eco-efficiency and spatial econometric analysis. Sustainability 14 (5), 2825. doi:10.3390/su14052825 |

Yin, X., and Xu, Z. (2022). An empirical analysis of the coupling and coordinative development of China’s green finance and economic growth. Resour. Policy 75, 102476. doi:10.1016/j.resourpol.2021.102476 |

Yu, F. J., Xu, F., and Ramp, G. (2019). Development and influencing factors of green finance in Guangdong province from the perspective of space: An empirical study based on fixed effect spatial Dubin model. Sci. Technol. Manag. Res. CNKI:SUN:KJGL.0.2019-15-010.

Yu, L. (2016). Research on green finance development and innovation [J]. Econ. Issues (1), 78–81. CNKI:SUN:JJWT.0.2016-01-014.

Zhang, B., and Wang, Y. (2019). The effect of green finance on energy sustainable development: A case study in China. Emerg. Mark. Finance Trade 57, 3435–3454. doi:10.1080/1540496X.2019.1695595 |

Zhang, D., Zhang, Z., and Managi, S. (2019). A bibliometric analysis on green finance: Current status, development, and future directions. Finance Res. Lett. 29, 425–430. doi:10.1016/j.frl.2019.02.003 |

Zhang, S. L., Wu, Z. H., Wang, Y., and Hao, Y. (2021). Fostering green development with green finance: An empirical study on the environmental effect of green credit policy in China. J. Environ. Manag. 296, 113159. doi:10.1016/j.jenvman.2021.113159 |

Zhang, Y., Dong, X., and Wu, J. (2018). Measurement of green finance development level in Guangdong province—Research of neural network model based on genetic algorithm optimization. Foreign Econ. Relat. Trade. CNKI:SUN:HLJW.0.2018-10-026.

Zhang, Y. (2016). Study on the development level of green finance in the Beijing-Tianjin-Hebei region [J]. China Mark. (21), 31–32.

Zheng, C. Y., and Dong, X. H. (2022). Spatial correlation analysis of green finance development between provinces and non-provinces along the Belt and Road in China. Bus. Intell. Inf. Technology,Lecture Notes Data Eng. Commun. Technol., 547–556. doi:10.1007/978-3-030-92632-8_51 |

Zhou, T., Ding, R., Du, Y. M., Zhang, Y. L., Cheng, S. H., and Zhang, T. (2022a). Study on the coupling coordination and spatial correlation effect of green finance and high-quality economic development-evidence from China. Sustainability 14 (6), 3137. doi:10.3390/su14063137 |

Zhou, T., Ding, R., Du, Y., Zhang, Y., Cheng, S., and Zhang, T. (2022b). Study on the coupling coordination and spatial correlation effect of green finance and high-quality economic development—Evidence from China. Sustainability 14, 3137. doi:10.3390/su14063137 |

Keywords: green finance, spatial pattern, influencing factors, comprehensive index, financial development

Citation: Zhou Y, Liu H, Wang J, Yang H, Liu Z and Peng G (2022) Spatial differentiation and influencing factors of green finance development level in China. Front. Environ. Sci. 10:1023690. doi: 10.3389/fenvs.2022.1023690

Received: 20 August 2022; Accepted: 29 August 2022;

Published: 16 September 2022.

Edited by:

Shuhong Wang, Shandong University of Finance and Economics, ChinaReviewed by:

Weichuan Yin, Beijing Union University, ChinaXueting Yu, Chongqing Technology and Business University, China

Copyright © 2022 Zhou, Liu, Wang, Yang, Liu and Peng. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Gang Peng, cGVuZ2dhbmcyMDE2QHN3dWZlLmVkdS5jbg==

Yuanxiang Zhou

Yuanxiang Zhou Huayan Liu1

Huayan Liu1 Jingxuan Wang

Jingxuan Wang Ziyun Liu

Ziyun Liu Gang Peng

Gang Peng