- School of Management, China University of Mining and Technology-Beijing, Beijing, China

Geothermal energy is a renewable energy source, and geothermal heating is a livelihood project, so a resource tax can protect resources and regulate prices. Reasonable geothermal energy resource tax collection standards are conducive to high-quality industrial development. This paper takes 15 provinces and cities that clearly levy geothermal resource taxes in China as the research object, constructs an System Dynamics model of geothermal resource tax, and studies the impact of geothermal resource tax on the income of geothermal enterprises and CO2 emission reduction. Then, the forecast simulates the economic and environmental benefits brought about by the use of geothermal resources from 2021 to 2035. The research results show that using geothermal resources for heating can significantly reduce CO2 emissions, and the higher the proportion of geothermal use is, the greater the CO2 emission reduction before 2035. The fifteen provinces and cities that clearly levy geothermal resource taxes will find it difficult to achieve corporate profits at the current residential heating utilization price and geothermal energy resource tax rate; that is, to achieve a balance of income and expenditures for geothermal enterprises without financial subsidies, the price of geothermal heating will be significantly higher than the heating price of traditional central heating and the price of electric self-heating.

1 Introduction

The United Nations Intergovernmental Panel on Climate Change (IPCC): Geothermal resources are the second largest clean energy in the world and can be directly used for heating, hot water, hot springs, etc. At the same time, geothermal energy, as a clean and renewable energy source such as solar energy and wind energy, has significant emission reduction benefits. The development and utilization of geothermal resources can alleviate the crisis of energy shortages, increase the proportion of non-fossil energy use, and promote the construction of urban ecological civilization (Luo and Ren, 2021). China’s geothermal resources account for approximately one-sixth of the world’s geothermal resources. In recent years, driven by the trend of clean heating in the north, geothermal development and utilization have begun to develop rapidly. Especially in areas rich in geothermal resources, geothermal energy has become one of the main sources of central heating. However, the government not only subsidizes the geothermal industry relatively little but also imposes a resource tax.

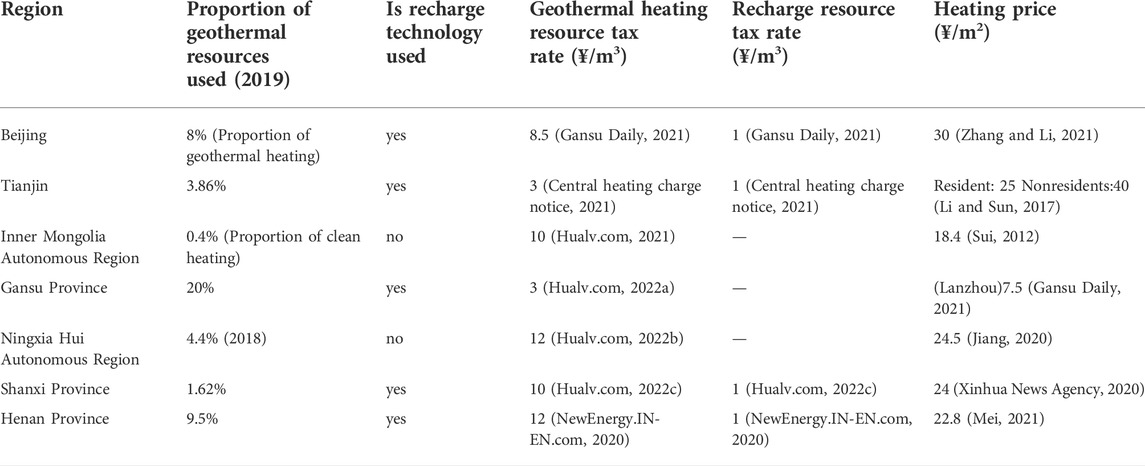

Resource tax is a tax policy tool levied on taxable natural resources that aims to adjust the difference between income and resource levels and improve the efficiency of resource development and utilization. The current geothermal development technology is mainly based on “hydrothermal type” mid-deep geothermal, that is, heat is obtained by pumping and irrigating deep groundwater. Therefore, when formulating the detailed rules for the collection of geothermal resources tax, all localities take the amount of water as the tax basis. Specifically, by sorting out the policies of various regions, it can be concluded that most of the regions implement the taxation method based on water consumption, which is classified by the use of geothermal water, but the specific standards are significantly different. For example, the general-purpose geothermal water tax rate in Beijing is 8.5 ¥/m3, the consumption-type geothermal water (such as hot springs, bathing, etc.) is 30 ¥/m3, and the recharge type is 1 ¥/m3; the consumption-type geothermal water in Henan Province is 12 ¥/m3, and the recharge type is 1 ¥/m3; the consumption-type geothermal water in Hebei Province is 30 ¥/m3, and the recharge type is 2 ¥/m3; southern regions such as Zhejiang and Jiangsu do not distinguish between uses, and each cubic meter of geothermal water is charged 3 ¥ and 10 ¥, respectively. The collection of resource tax can not only protect resources and adjust prices but also solve the intergenerational problem of resources. This means that it makes the development, utilization and allocation of natural resources more reasonable and effective, and at the same time, it can also promote local economic development and turn resource advantages into economic advantages.

The starting point of geothermal heating is clean heating, which is consistent with the original intention of the resource tax. However, the specific impacts of sustainability programs for clean heating are often clouded by the confounding effects of multiple socioeconomic, policy and environmental factors operating concurrently (Bryan et al., 2018). At present, the primary task of China’s geothermal enterprises is to meet the heating needs of the people, but when the tax revenue exceeds the enterprise’s ability to bear, they will inevitably fall into the predicament of survival, and other goals, such as achieving clean heating, will not be achieved. For example, in some northern regions, it is not uncommon for geothermal heating costs to be flat or even lower than that of ordinary coal-fired boilers, so that some projects are even operating at a loss. In other words, if preferential policies have not been fully implemented and high new taxes are levied on them, it is inevitable that the geothermal industry will not be able to bear the burden.

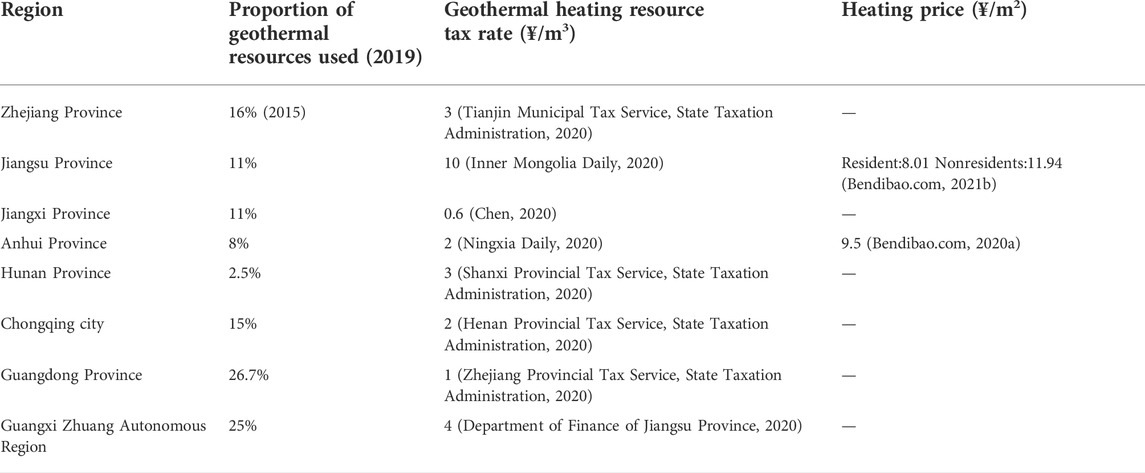

Nations require globally coordinated, national-scale, comprehensive, integrated, multisectoral analyses to support national target setting that prioritizes efficient and effective sustainability interventions across societies, economies and environments (Gao and Bryan, 2017). Reasonable geothermal energy resource tax collection standards are conducive to the sustainable and high-quality development of the industry. This paper takes the resource tax of geothermal energy as the research object and aims to analyze its reasonable charging standard and its influence on the optimization of the regional energy structure. This research has important practical significance for perfecting the formulation of resource tax policy. This paper focuses on the areas where geothermal resource taxes are currently levied nationwide. As of 2020, 15 provinces and cities in China, including Beijing, Henan, Zhejiang, Shanxi, Guangdong, Jiangsu, Jiangxi, Anhui, Hunan, Tianjin, Chongqing, Gansu, Inner Mongolia, Ningxia and Guangxi, have clarified the applicable tax rates for geothermal resources. That is, 15 provinces and cities are the research scope of this paper. Based on system dynamics, this paper establishes a geothermal resource tax model including the enterprise benefit subsystem, environmental benefit subsystem, regional economic subsystem and tax policy effect subsystem. The model simulates and analyses the impact of changes in the tax rate of geothermal resources on the economic benefits of geothermal enterprises to explore the price of geothermal energy and the reasonable collection standard of geothermal energy resource tax. This will provide a reliable basis for governments at all levels to scientifically formulate reasonable tax rates for geothermal energy resources and realize the rational development and utilization of geothermal resources. This research has important theoretical value for improving the relevant theories of resource economics and has important practical significance for improving resource tax policy formulation.

2 Literature review

In the related research of geothermal energy, many domestic and foreign scholars have made some contributions. Research on development and utilization. New Zealand has achieved 100% renewable electricity systems, with geothermal generation accounting for 12–14% (Mason et al., 2010). The exploitation of geothermal resources has an impact on the biological, chemical and physical characteristics of groundwater and the subsurface (Stefanie et al., 2013). Xi’an developed and utilized geothermal resources in the early days, resulting in problems such as ground subsidence and a rapid decline in the groundwater level (Feng, 2017). China’s geothermal energy industry system has shown its embryonic form. In the past 10 years, the direct utilization of hydrothermal geothermal energy in China has increased at an average annual rate of 10% (Zhou, 2018). The scientific development of geothermal energy is a reasonable choice to effectively alleviate energy shortages in Beijing, realize energy structure adjustment, build a safe, stable, clean and high-quality energy supply system, and cope with climate change (Qiang, 2018). Research on development potential. The development potential of deep geothermal energy and shallow geothermal energy resources in Beijing is large, and the utilization prospects are very broad (Huang et al., 2016). Payam stated that geothermal energy is an important potential and strategic area for renewable energy development and future research activities (2020). The production and consumption of national geothermal energy is one of the world’s top priorities, helping to reduce CO2 emissions in the atmosphere and air pollution levels (Chen, 2020). By 2030, 19.25% of the Chinese urban heating area will be provided by ground source heat pumps, which have great development potential (Wang et al., 2021).

Research on Resource Taxation Policy. Taking the geothermal hot springs in Yi Chun City as an example, Huang, G. R studied the collection of geothermal resource taxes (2013). Sam, M., and Basil, S. analyzed the sustainability of geothermal resource use in New Zealand using resource taxes rather than royalties (2015). It is actively suggested that the guiding and supporting functions of tax policies be used to promote the rational development and utilization of geothermal resources and setting different collection rates for geothermal resources for different purposes (Wu et al., 2016a). China needs to expand the scope of taxation of resource taxes and includes geothermal resources in the scope of regulation and control of resource taxes (Pan, 2017). The formulation of differentiated resource tax rates can effectively control the supply and demand of depletable resources, play a positive role in industrial restructuring, and coordinate regional economic development (Qiao, 2018). Tianjin Municipality takes 40°C as the temperature limit and determines the collection method (water resource tax or geothermal resource tax) according to the temperature level (Zhang and Li, 2021).

In summary, the development potential of the geothermal energy industry at home and abroad is very large. Geothermal resources were brought into the scope of resource tax collection in foreign countries earlier. However, there is no consensus in the academic community on the collection standards of geothermal energy resource taxes and the impact of geothermal energy resource taxes on energy structure optimization. Moreover, in the actual development process of the Chinese geothermal energy industry, there are still some problems, for example, the lack of implementation clauses and implementation rules for the relevant laws and regulations supporting geothermal energy fiscal and tax. The rationality of expropriation has been questioned by scholars. Compared with other clean energy industries, such as solar energy, the supportive policy of the geothermal energy industry is insufficient, and incentive policy standards such as preferential tax rates and subsidies are not unified and clear, which inhibits the high-quality development of the geothermal heating industry.

3 Data sources and methods

3.1 Data collection and accounting

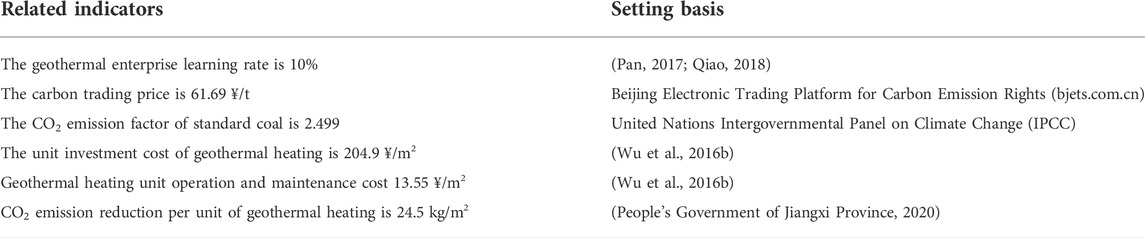

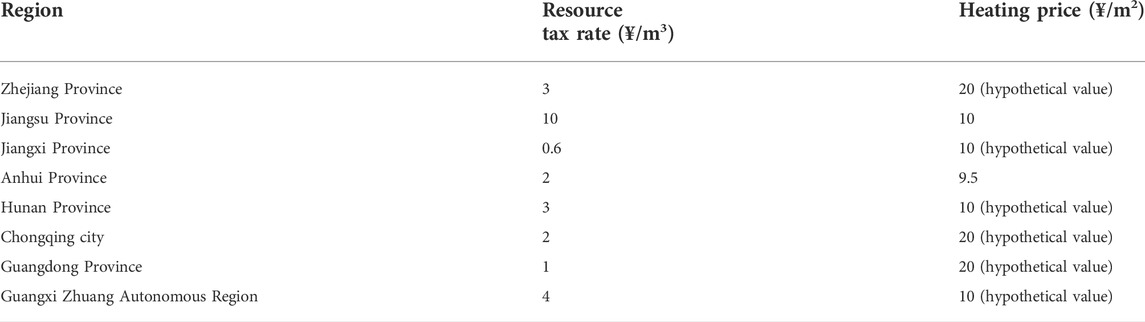

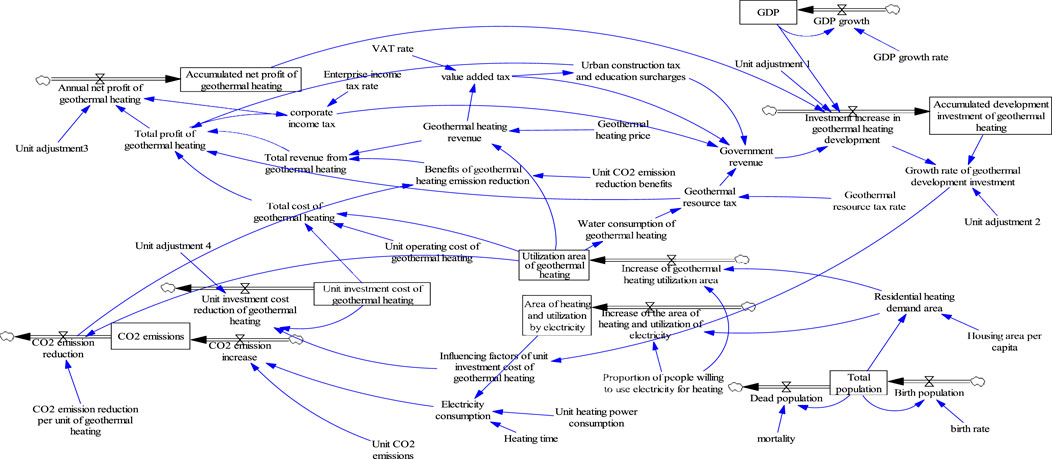

This article collects relevant data from the following yearbooks: 2005–2019 “Beijing Statistical Yearbook” and other provinces and cities’ yearbooks, 2005–2019 “China Statistical Yearbook”, 2005–2019 “Urban Planning Yearbook”, 2005–2018 “Land and Resources Bulletin”, “Statistical Bulletin of China’s Land, Mineral and Marine Resources in 2017”, “Statistical Bulletin of China’s Marine Economy in 2019”, “Clean Heating Plan in winter in Northern Region (2017–2021)", “Thirteenth Five-Year Plan for Geothermal Energy Development and Utilization”, “Thirteenth Five-Year Plan for Renewable Energy Development”, “China Mining Resources Report 2019”, “China Mining Resources Report 2020”, etc. In addition, some data were obtained from the official website, such as geothermal heating prices and geothermal resource tax rates. The relevant websites are from the provincial and municipal urban management committees, the provincial and municipal development and reform commissions, the National Development and Reform Commission, the National Bureau of Statistics, Provincial and municipal finance bureaus, carbon trading platform websites, etc. The data of other provinces and cities are also collected in the statistical yearbooks of the provinces and cities in each year, as well as in the relevant documents released, and some are collected from the official websites of the provinces and cities. Detailed data are shown in Tables 1–3. Based on residential heating area and total population data, a unitary regression equation between the provinces and cities in the central heating area is constructed, as shown in Table 4 (Note: Details of Tables 1–4).

TABLE 4. Regression equation of total population and residential heating area in other areas of central heating area.

This article assumes that the government and geothermal companies have no original investment. The learning rate of photovoltaic power generation costs in Northwest China from 2010 to 2015 was between 18% and 30% (Li and Sun, 2017). The learning rate of photovoltaic power generation costs varied from 15% to 25% from 2005 to 2010 (Sui, 2012). Due to the lack of relevant data of geothermal enterprises and the development and utilization of geothermal later than photovoltaic power generation, the hypothesis is made based on the learning rate of photovoltaic power generation cost. Suppose the cost learning rate for geothermal heating is 10%. This means that if the growth rate of geothermal development investment is greater than 0.1, the geothermal heating investment cost will decrease by 10%; otherwise, the geothermal heating investment cost will remain unchanged. The calculation of CO2 emissions in central heating areas requires the following data. In each heating season, geothermal heating can replace 9,710 tons of standard coal or 1,080 m3 of natural gas per 1 million m2 of buildings. It can also reduce CO2 emissions by 24,500 tons, SO2 emissions by 228 tons, NOX emissions by 151 tons, particulate matter emissions by 416 tons, and smoke and dust by 1.3*108 m3, increasing electricity sales by 30 million kWh (1.5*108 ¥) and adding 400 jobs (Pang et al., 2020). Therefore, every 10,000 m2 of the heating area can be converted into 97.1 tons of standard coal, and every 10,000 m2 of the heating area can reduce CO2 by 245 t. After consulting the Beijing carbon trading platform, the average price of carbon trading in Beijing in 2019 was 7.81 euros/ton, approximately 61.69 ¥/t. In areas where geothermal water is approximately 50°C, 2 m3 of geothermal water needs to be pumped per square meter of heating area, so the resource tax can be calculated based on the amount of geothermal water.

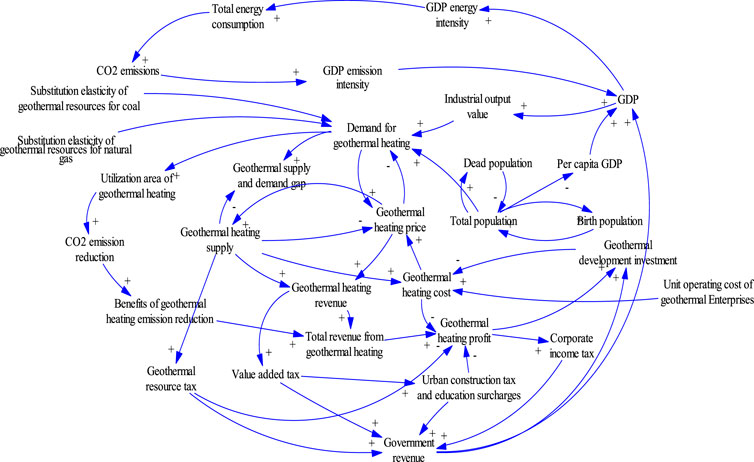

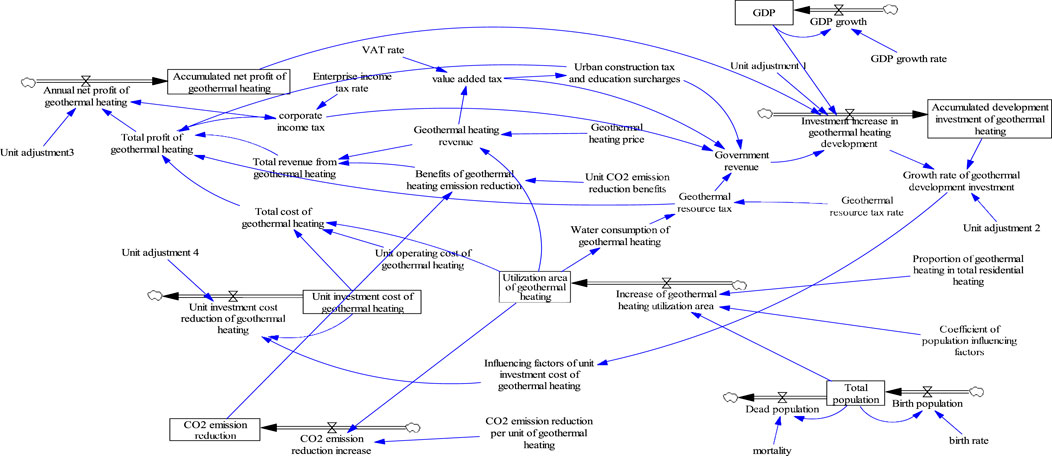

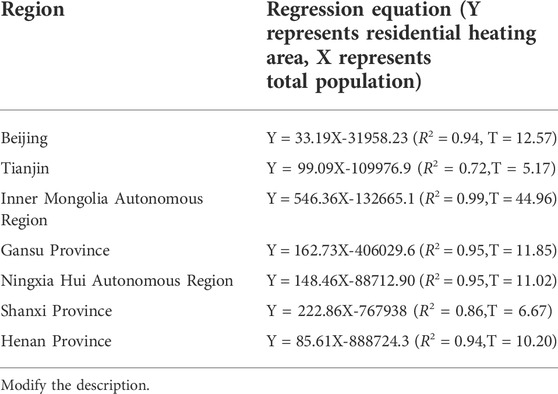

The collection of geothermal resource taxes could have a great range of impacts, including geothermal resource exploitation, government taxation, and greenhouse gas emissions. This paper establishes a taxation model of geothermal energy resource taxes, including SD models of the enterprise benefit subsystem, environmental benefit subsystem, regional economic subsystem, and tax policy effect subsystem. The model is used to study the impact of geothermal resource taxes on geothermal heating prices and the impact of geothermal prices on the economy and other subsystems. The causality diagram of this model is shown in Figure 1.

3.2 Build subsystems based on factors

3.2.1 Enterprise benefit subsystem

The enterprise benefit subsystem studies the corresponding benefits obtained by the geothermal enterprise. Assuming that the total population of the area is increasing at a certain growth rate and the demand for geothermal heating correspondingly increases, geothermal development and utilization will also increase, which is conducive to the development of the geothermal industry. With the advancement of science and technology, the cost of geothermal investment will show a downwards trend, which will lead to an increase in revenue for geothermal enterprises. At the same time, the increase in geothermal utilization area promotes an increase in geothermal revenue. An increase in geothermal revenue promotes an increase in corporate income tax, drives an increase in fiscal revenue, and affects the tax policy subsystem. The increase in the coverage of geothermal energy heating will lead to a reduction in the area of fossil energy heating, thereby reducing greenhouse gas emissions and affecting the environmental benefit subsystem.

The relevant indicators of the enterprise benefit subsystem include the geothermal heating utilization area, geothermal heating revenue, geothermal heating emission reduction revenue, geothermal heating price, geothermal heating cost, and geothermal resource tax rate.

1) The geothermal heating utilization area. This article believes that the geothermal heating utilization area has a linear relationship with the total population of the region. In this article, a unitary regression model with heating area as the explanatory variable and the total population of the region as the explanatory variable is constructed. The regression equation is shown in Eq. 1:

Y: the heating area of regional residential buildings; x: the total population of the region.

The geothermal heating utilization area is shown in Eq. 2:

Z: geothermal heating area; λ: proportion of geothermal heating area to total heating area.

2) Geothermal heating revenue.

W: the cumulative net profit of geothermal heating; c: the initial value of the cumulative net profit of geothermal heating; N: the annual net profit of geothermal heating; M: the total profit of geothermal heating; T: the corporate income tax.

3) Geothermal heating emission reduction revenue

R1: the income of geothermal heating emission reduction;

4) Geothermal heating price. The price of geothermal heating is based on the residential heating price set by the provincial, municipal and city management committees as the benchmark price. According to the relevant policies of the Beijing Municipal Management Committee, the unit price of heating for residents in Beijing is 30 ¥/m2, so this article uses 30 ¥/m2 as the benchmark price.

5) Geothermal heating cost. The annual operation and maintenance costs of geothermal utilization include depreciation, water, electricity, labor, repairs, etc. The water fee is the price of water multiplied by the amount of water used, the electricity fee is the price of electricity multiplied by the amount of electricity used, the labor cost is wages times the number of people, and the maintenance cost is based on the proportion of fixed asset equipment. This article includes ground source heat pump heating and hydrothermal geothermal heating. It is known that the unit investment cost of the ground source heat pump is 197.6 ¥/m2, and the operation and maintenance cost is 14.8 ¥/m2 per year; the initial investment cost of the hydrothermal geothermal utilization area is 212.2 ¥/m2, and the operation and maintenance cost is 12.3 ¥/m2 per year (Jiang, 2020).

C: the unit investment cost of geothermal heating; Ct: the unit investment cost of ground source heat pumps; C2: the unit investment cost of hydrothermal geothermal heating, which is the average of the two. Operation and maintenance costs are obtained in the same way.

6) Geothermal resource tax rate. According to the resource tax rate table announced by each region, the geothermal resource tax rate can be obtained (for example, the resource tax rate announced by Beijing is 8.5 ¥/m3).

3.2.2 Environmental benefit subsystem

In the environmental benefit subsystem, the utilization of geothermal resources will replace the utilization of fossil energy when heating the city and reduce the emission of the greenhouse gas CO2. The increase in CO2 emission reduction will affect the emission reduction revenue of geothermal heating and the enterprise benefit subsystem. The increase in CO2 emissions reduction will accelerate the increase in investment in geothermal development, promote the development of the geothermal industry, and affect the benefit subsystem of geothermal enterprises. Moreover, the increase in CO2 emissions will cause the government to invest more funds developing geothermal energy, reduce the investment cost of geothermal development, and affect the regional economic subsystem. In addition, the environmental benefits brought by geothermal resources will encourage the government to adopt various policies to encourage the development of geothermal enterprises. Tax policies should also be formulated to protect geothermal resources, prevent the excessive exploitation of geothermal resources, and affect the tax policy effect subsystem.

In this paper, indicators of the environmental benefit subsystem for central heating are CO2 emission reduction and CO2 emission reduction increase. Non-centralized heating uses indicators such as CO2 emissions, CO2 emissions increase, and CO2 emissions reduction.

1) CO2 emission reduction

2) CO2 emission reduction increase

The initial value d of CO2 emission reduction is determined by the base year energy consumption and the CO2 emission coefficient of standard coal. The formula is:

3) CO2 emissions

3.2.3 Regional economic subsystem

The development of the regional economy is an important indicator that reflects the status of regional development. The use of geothermal resources enables geothermal enterprises to develop more rapidly and drives the development of the entire city’s economy. At the same time, its use can reduce the import of resources and realize the green exploitation and utilization of local resources. An assumed increase in GDP would promote investment in geothermal development, increases in government expenditures, increases in subsidies for geothermal companies, and impacts on the corporate efficiency subsystem. An increase in GDP promotes an increase in energy consumption, which will increase greenhouse gas emissions and affect the environmental benefit subsystem. At present, government subsidies for the geothermal industry are realized through subsidies to geothermal companies, and price subsidies are given to geothermal companies to encourage them to develop the geothermal industry.

The relevant indicators of the regional economic subsystem include regional GDP, regional GDP growth rate, and regional geothermal heating development investment.

1) Regional GDP. Data were obtained according to the 2005–2019 statistical yearbooks of various regions.

2) Regional GDP growth rate. This article adopts a simplified method to calculate the average growth rate of GDP from 2005 to 2019 instead of the regional GDP growth rate.

3) Regional geothermal heating development investment. Regional geothermal heating development investment and related costs. The increase in investment in geothermal heating development is calculated based on GDP and government revenue; the proportion of R&D expenditure in government tax and GDP is calculated, and the two are added to obtain the increase in investment in geothermal heating development. This article assumes that all R&D funding investment is used for the development of the geothermal industry. The relevant formula is:

δ: the increase in investment in geothermal heating development; α: GDP; β: government revenue;

From the perspective of people’s livelihood, there are more heating areas in the north, such as Beijing, Tianjin and Inner Mongolia. Although Inner Mongolia’s regional GDP is much smaller than that of Beijing, the heating areas are similar.

3.2.4 The tax policy effect subsystem

The tax policy effect subsystem studies the changes in government taxes and revenues when resource tax rates change. Government revenue includes value-added tax, urban construction tax, geothermal resource tax, education surcharge and local education surcharge. The increase in fiscal and tax revenue increases GDP and affects the regional economic subsystem. The increase in fiscal and tax revenue allows the government to invest in the geothermal industry, thereby reducing the investment of the geothermal industry and promoting the increase in geothermal utilization area, which affects the enterprise benefit subsystem. The investment of the government in the geothermal industry increases the utilization area of geothermal resources, which drives the reduction in greenhouse gas emissions and affects the environmental benefit subsystem. The collection methods of resource tax are AD valorem and specific collection. The amount of resource tax payable is calculated based on the sales or sales volume multiplied by the tax rate of the corresponding resource. The levy of a resource tax will increase the price of resources and increase the cost of resource extraction and consumption, thereby reducing resource consumption, promoting the rational development of resources and improving the level of comprehensive utilization of resources.

Different tax rates or preferential taxation are set for different resource extraction areas. The formulation of such tax rates and preferential taxation policies gives miners the motivation to reduce the waste of resources, make comprehensive use of resources and protect the environment. There are many directions for the use of government taxation, but resource taxation will require special funds to be used for the exploitation and protection of related resources. At present, some places have not yet created special funds for special purposes. Therefore, the resource tax collected will be used in other ways, which will weaken the role of the resource tax in protecting the environment.

The related taxation subsystem includes urban maintenance, construction tax, value-added tax, corporate income tax, geothermal resource tax, education surcharge, local education surcharge, and government revenue. Assuming that all geothermal companies are located in the city, the urban maintenance and construction tax rate is 7%. The relevant calculation formula is as follows:

VAT: value-added tax revenue;

According to the relevant provisions of the value-added tax regulations, the low tax rate of 9% for geothermal use is levied on value-added tax, which is = 9%.

UCT: urban maintenance and construction tax;

ES: education surcharge and local education surcharge;

GRT: geothermal resource tax revenue; V: geothermal water consumption;

T: the corporate income tax;

M: the total profit of geothermal heating.

There are two methods for determining the tax rate of geothermal energy resources: determining tax revenue based on water resources and levying taxes based on thermal energy. At present, the 15 provinces and cities that clearly levy geothermal resource taxes all base these taxes on the consumption of water resources; only Tianjin proposes levying geothermal resource taxes based on heat, but the conditions are not yet met. In addition, for the use of geothermal resources using recharge technology, a lower tax rate is proposed, that is, 1 ¥/m3.

3.3 Building models based on regions

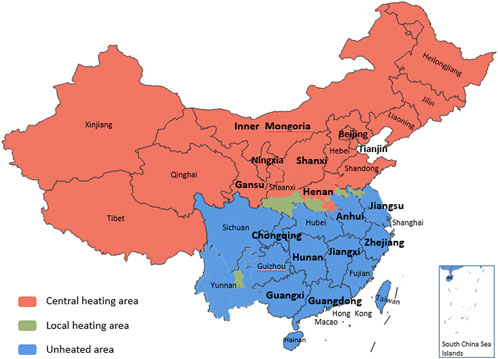

China’s heating boundary is located in the Qin Ling and Huai He Rivers near 33° north latitude, and the map of national heating areas is shown in Figure 2. According to the division of heating regions, the 15 provinces and cities that levy geothermal resource taxes are divided into two types: central heating areas and non-central heating areas.

3.3.1 Central heating areas

There are seven central heating area provinces and cities: Beijing, Tianjin, Inner Mongolia, Gansu, Ningxia, Shanxi, and Henan. This article assumes the following:

1) Central heating areas do not use electricity for heating;

2) The heating area of central heating areas is based on the heating area data of the relevant statistical yearbooks of various provinces and cities.

3) The central heating area discusses CO2 emission reduction

4) Both regional GDP and total population have been increasing at a constant growth rate.

5) The initial value of the accumulated net profit of geothermal enterprises is 0 million ¥.

Based on the above research hypotheses, geothermal energy resource tax SD models for central heating areas are constructed. The SD model of the central heating area flow diagrams is shown in Figure 3.

3.3.2 Non-central heating areas

There are 8 non-central heating area provinces and cities: Zhejiang, Jiangsu, Jiangxi, Anhui, Hunan, Chongqing, Guangdong, and Guangxi. This article assumes the following:

1) Residents in non-central heating areas use electricity for self-heating.

2) The heating population in non-central heating areas is fully covered, the heating area is estimated based on the population of each area, and the heating area is estimated based on the population of each region.

3) The non-central heating area discusses CO2 emissions, not CO2 emission reduction.

4) The total population has been increasing at a constant growth rate, and regional GDP has also increased at a certain growth rate.

5) The initial value of the accumulated net profit of geothermal enterprises is 0 million ¥.

Based on the above research hypotheses, geothermal energy resource tax SD models for non-central heating areas are constructed. The SD model of the central heating area flow diagrams is shown in Figure 4.

FIGURE 4. The dynamic flow diagram of the geothermal resource tax system in non-central heating areas.

4 Simulation scenario analysis of geothermal energy resource tax policy

Policy simulation time range: 2021–2035. Step size of simulation empirical analysis: quarter. There were 60 quarters in this study. The economic benefits and environmental benefits of the central heating district and non-central heating district in different scenarios are simulated. The scenarios include the BAU scenario and the non-BAU scenario. BAU scenario: Based on the current resource tax and heating prices of various provinces and cities to simulate and forecast. Non-BAU scenario: Adjust the geothermal resource tax rate and heating price to observe changes in economic benefits and environmental benefits, respectively.

4.1 BAU scenario analysis

4.1.1 Central heating areas

Simulation analysis of geothermal enterprise income and environmental benefits: Beijing, Tianjin, Inner Mongolia, Gansu, Ningxia, Shanxi and Henan central heating districts. In the BAU scenario, the geothermal resource tax rates in the above provinces are 8.5 ¥/m3, 3 ¥/m3, 10 ¥/m3, 3 ¥/m3, 12 ¥/m3, 10 ¥/m3, and 12 ¥/m3, and the heating prices are 30 ¥/m2, 25–40 ¥/m2, 18.4 ¥/m2, 7.5 ¥/m2, 24.5 ¥/m2, 24 ¥/m2, and 22.8 ¥/m2, respectively (Table 2).

1) Profit analysis of geothermal energy enterprises.

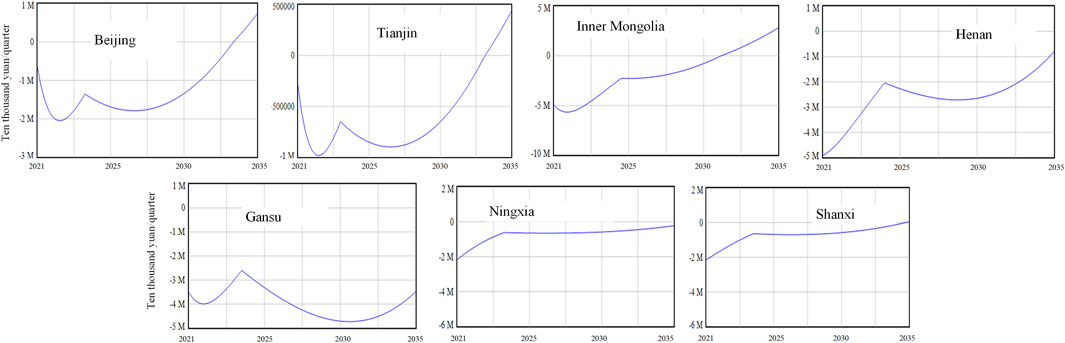

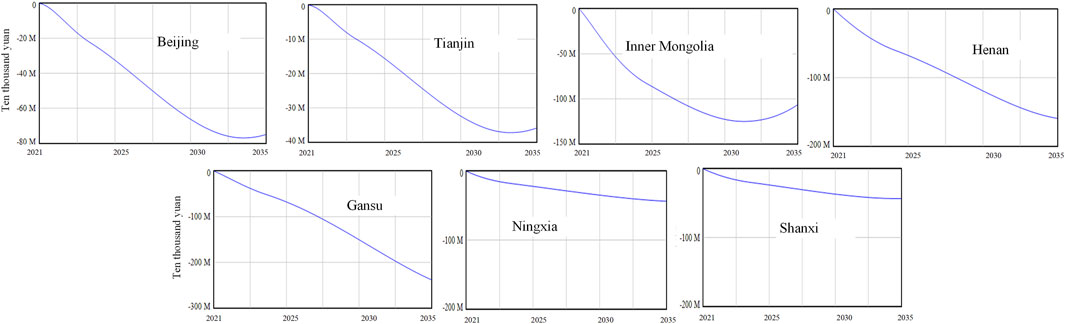

According to the current resource tax policies and residential heating prices of all provinces and cities, the annual net profit of geothermal heating enterprises is shown in Figure 5, and the cumulative net profit is shown in Figure 6. In the picture, the abscissa: 2021–2035. Ordinate: annual net profit and cumulative net profit of geothermal heating enterprises (M stands for millions).

FIGURE 5. BAU scenario of the annual net profit of geothermal heating companies in various provinces and cities in central heating areas.

FIGURE 6. BAU scenario of accumulated net profit of geothermal heating enterprises in various provinces and cities in central heating areas.

The simulation results: 1) under the benchmark scenario, the annual net profit of Beijing, Tianjin, the Inner Mongolia Autonomous Region, and Shanxi Province is greater than zero; Gansu Province, the Ningxia Hui Autonomous Region and Henan Province all have annual net profits less than zero. 2) The inflection point of annual net profit before 2025 is just the time when the unit investment cost of geothermal heating remains unchanged. Moreover, Table 5 shows that the unit investment cost of geothermal heating stabilized and remained unchanged before 2025. Table 5 shows the change process of the unit investment cost of each province and city in the central heating area. The inflection point in Figure 5 is the point where the unit investment cost begins to remain unchanged. 3) Under the benchmark scenario, the cumulative net profit of these seven provinces and cities is less than zero. The reason is that geothermal heating has a large amount of investment in the early stage, and the annual net profit is relatively late. Therefore, it is difficult to compensate for the cost.

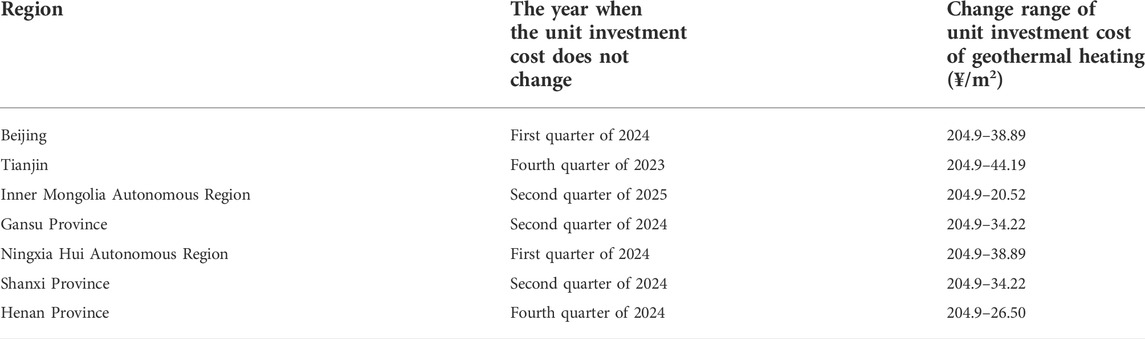

TABLE 5. Variation range of the unit investment cost of geothermal heating in central heating provinces and cities.

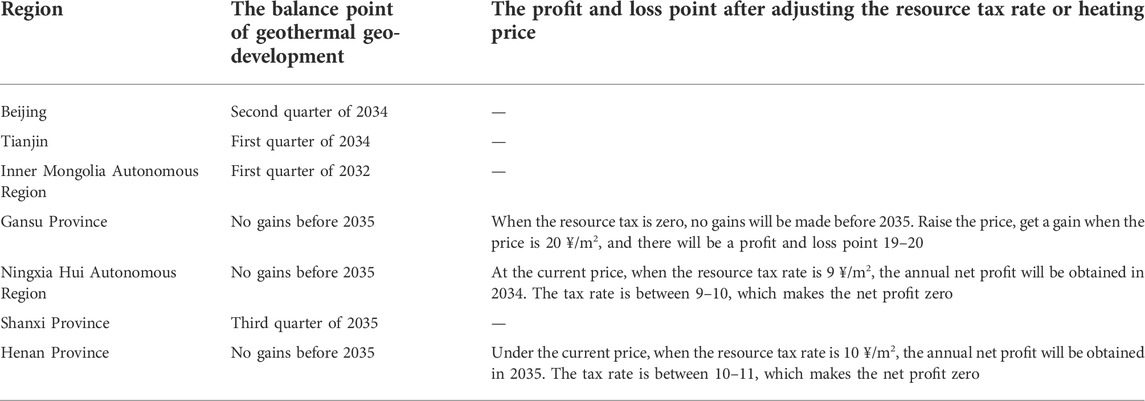

The balance point of the development gains and losses of geothermal refers to the point in time when the annual net profit of geothermal companies is zero. In the central heating area, it is difficult for geothermal companies to generate profits according to the current heating prices and resource tax policies. Table 6 shows the profit and loss balance points of the provinces and cities in the central heating district calculated by simulation. It can be found that Gansu, Ningxia and Henan will not be able to make profits from 2021 to 2035. Therefore, the resource tax rate and price are adjusted, and the profit and loss balance points of the three provinces and cities are calculated.

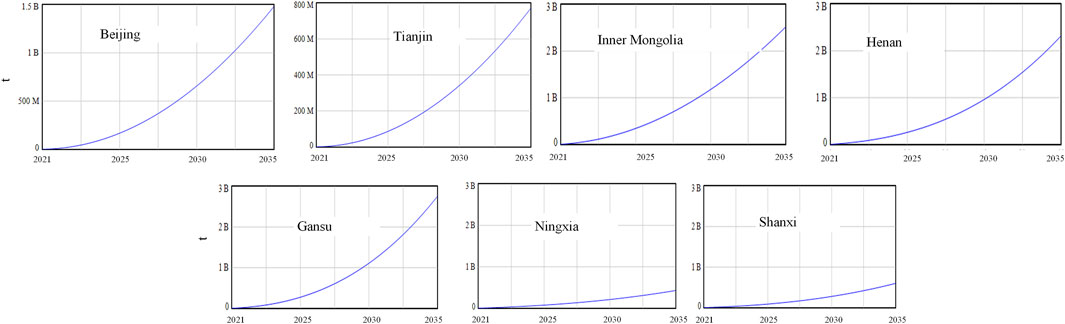

2) Analysis of CO2 emissions in central heating areas. In the BAU scenario, geothermal heating accounted for 8%, and the CO2 emission reduction was calculated after using geothermal heating in the central heating area, as shown in Figure 7. The horizontal axis represents the time from 2021 to 2035, and the vertical axis represents the CO2 emission reduction. At the same time, M on the vertical axis represents millions, and B represents billions.

The CO2 emission reductions of the seven provinces and cities in the central heating area exponentially increase, and the CO2 emission reductions in different regions are different, as shown in Figure 7. By 2035, Gansu Province has the largest CO2 emission reduction, while Tianjin City has the smallest CO2 emission reduction. The use of geothermal heating can significantly reduce CO2 emissions and contribute greatly to global emission reduction and the mitigation of greenhouse effects. Geothermal energy can replace coal and natural gas for heating (cooling), bring positive environmental benefits, and significantly affect the mitigation of greenhouse effects.

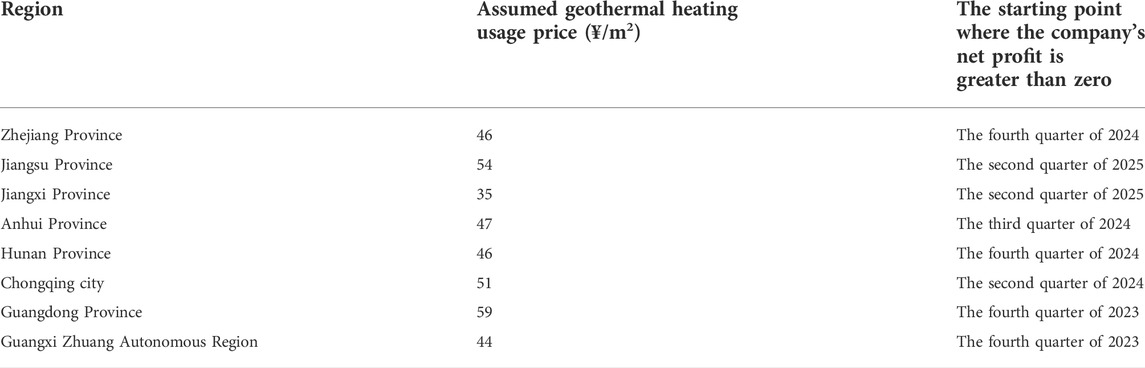

4.1.2 Non-central heating areas

At present, the policy of non-central heating areas is actively soliciting the public’s willingness to install, which has aroused their concern. The research includes the willingness of central heating to install central heating and related charges. The non-central heating areas with geothermal resource taxes are divided into eight regions: Zhejiang Province, Jiangsu Province, Jiangxi Province, Anhui Province, Hunan Province, Chongqing city, Guangdong Province, and the Guangxi Zhuang Autonomous Region. The eight provinces and cities all levy geothermal resource taxes according to water consumption, and all have recharge technology. However, none of them has set a special geothermal resource tax rate for exploiting geothermal resources using recharge technology, and there is no heating price in some areas. In this paper, based on the existing research of non-central heating charging standards, assumptions are made according to the different economic conditions of non-central heating. Assuming that 50% of the population is willing to adopt central heating in non-central heating areas, it can be assumed that 50% of the population currently adopts electric heating.

1) Profit analysis of geothermal energy companies.

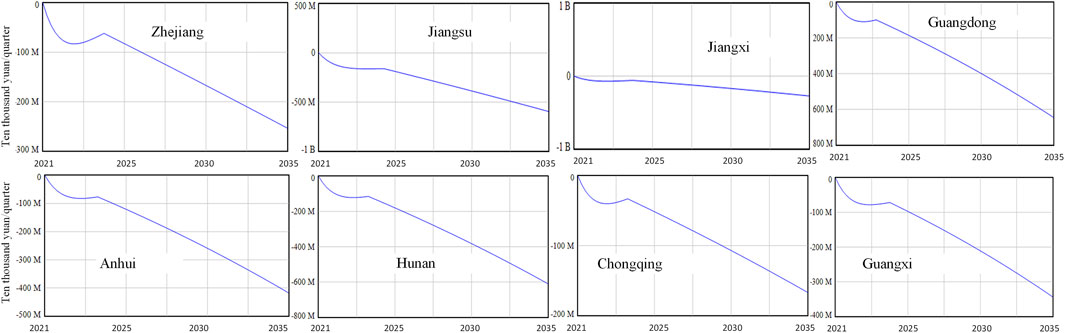

The geothermal resource tax rate and geothermal heating price of eight provinces and cities in non-central heating areas are shown in Table 7. The data that can be queried in various provinces and cities are copied from Table 3. There are no relevant data on heating prices in Zhejiang Province, Jiangxi Province, Hunan Province, Chongqing City, Guangdong Province, and Guangxi Zhuang Autonomous Region. Therefore, this study sets a hypothetical value of the geothermal heating price according to the economic development of these regions, as shown in Table 7. According to the geothermal resource tax rate and geothermal heating price data, a simulation analysis is carried out for eight provinces and cities with non-central heating, and the results are shown in Figures 8, 9. The horizontal axis represents the time year, from 2021 to 2035, and the vertical axis represents the annual net profit and CO2 emissions of geothermal heating enterprises. At the same time, M on the vertical axis represents million, and B represents billion.

FIGURE 8. BAU scenario of the annual net profit of geothermal heating in non-central heating districts.

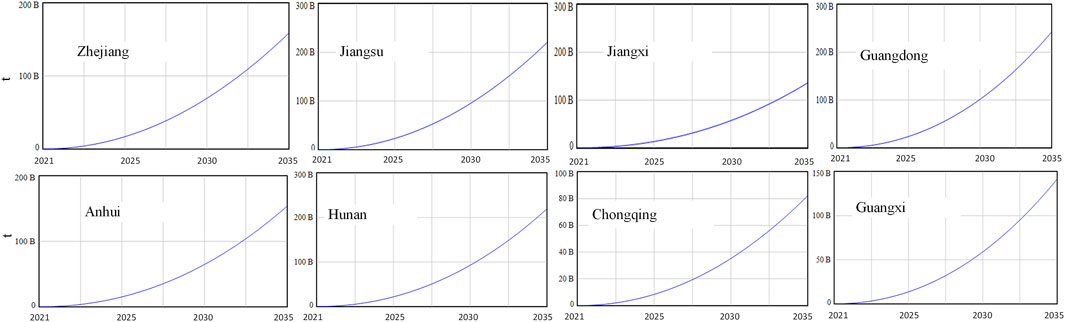

FIGURE 9. BAU scenario of CO2 emissions of various provinces and cities in non-central heating areas.

The simulation results in Figures 8, 9 are as follows: 1) The annual net profit of geothermal enterprises in non-central heating areas is declining. This shows that the current tax rate and heating price of resources are unfavorable to geothermal enterprises and affect the development of geothermal enterprises. 2) The CO2 emissions of various provinces and cities are different. According to Figure 9, by 2035, Guangdong Province will have the highest CO2 emissions, and Chongqing will have the lowest CO2 emissions. The analysis in Table 3 shows that Guangdong Province has the largest population, while Chongqing has the smallest population. Therefore, it is estimated that the CO2 emissions from each province and city are related to the population.

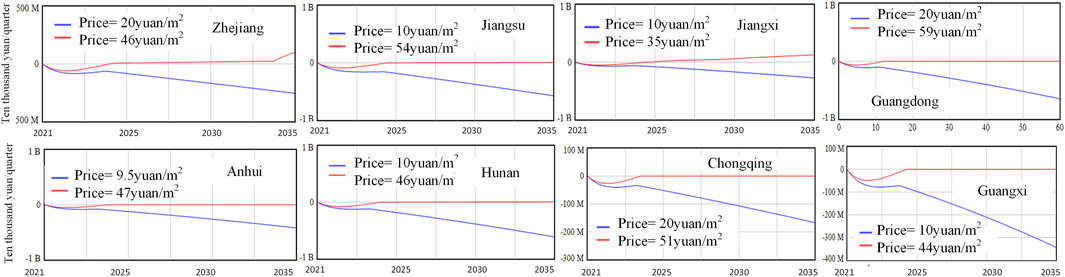

2) Keep the resource tax rate unchanged, and calculate the price at the breakeven point of the geothermal enterprise

The resource tax rate is a relevant policy that has been promulgated by various provinces and cities. This subsection, based on the current resource tax rate, studies the adjustment of geothermal heating prices under the condition that the resource tax rate remains unchanged and observes the time when the annual net profit of geothermal enterprises in each province and city is obtained. The simulation results are shown in Figure 10. The horizontal axis represents time from 2021 to 2035, and the vertical axis represents the annual net profit of geothermal heating enterprises. At the same time, M on the vertical axis represents million, and B represents billion. The assumptions are as follows: the heating price in the BAU scenario in Zhejiang Province is 20 ¥/m2; the heating price in the BAU scenario in Jiangsu Province is 10 ¥/m2; the heating price in the BAU scenario in Jiangxi Province is 10 ¥/m2; the heating price in the BAU scenario in Anhui Province is 9.5 ¥/m2; the price of geothermal heating in Hunan Province is 10 ¥/m2; the benchmark price of geothermal heating in Chongqing is 20 ¥/m2; the price of geothermal heating in Guangdong is 20 ¥/m2; and the price of geothermal heating in Guangxi Zhuang Autonomous Region is 10 ¥/m2. The price of geothermal heating is then gradually adjusted to find the balance point of profit and loss.

FIGURE 10. Simulation diagram of annual net profit and loss of geothermal heating in non-central heating areas.

All provinces and cities in non-central heating zones can obtain annual net profit by adjusting geothermal heating prices, as shown in Figure 10. When the price of non-central heating in 8 provinces and cities ranges from 35 ¥/m2 to 59 ¥/m2, the net profit of geothermal heating enterprises will be greater than zero in the fourth quarter of 2023 and the second quarter of 2025, as shown in Table 8. It can be seen that the use price of geothermal heating in various provinces and cities in non-central heating areas is generally higher.

4.2 Non-BAU scenario analysis

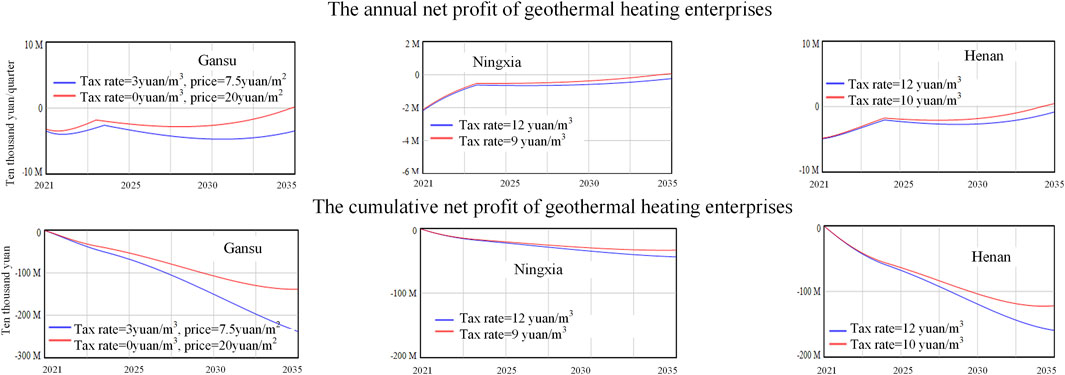

4.2.1 Reanalysis of geothermal energy utilization possibility in gansu province, ningxia hui autonomous region and henan province

The calculation under the BAU scenario shows that Gansu Province, Ningxia Hui Autonomous Region, and Henan Province cannot obtain net profit before 2035. Assuming that these three regions can obtain annual net profits before 2035, the geothermal resource tax rate or geothermal heating price is simulated, among which the geothermal resource tax rate in Gansu Province is adjusted from 3 ¥/m3 to 0 ¥/m3, and the heating use price is 20 ¥/m2; the geothermal resource tax rate of the Ningxia Hui Autonomous Region is adjusted to 12 ¥/m3 to 9 ¥/m3, and the heating price is 24.5 ¥/m2; the resource tax rate of Henan Province is 12 ¥/m3 to 10 ¥/m3; and the heating price is 22.8 ¥/m2. The results are shown in Figure 11.

FIGURE 11. Forecast of annual net profit and accumulated net profit in Gansu Province, Ningxia Hui Autonomous Region and Henan Province.

The simulation results: 1) Gansu Province is the province where the annual net profit of enterprises will be greater than zero before 2035 by adjusting both the resource tax rate and price. If the resource tax rate of Gansu Province is adjusted to 0 ¥/m3 and the geothermal heating price is 20 ¥/m2, the annual net profit can be obtained in 2035, and the profit and loss point is between 19–20 ¥/m2. This is because the resource tax rate and heating price under the BAU scenario in Gansu Province are relatively low, and it is difficult for geothermal enterprises to make profits. 2) Ningxia Hui Autonomous Region and Henan Province are the provinces where keeping the price unchanged and only adjusting the resource tax rate can make the annual net profit of enterprises greater than zero before 2035. When the geothermal heating price of the Ningxia Hui Autonomous Region remains unchanged at 24.5 ¥/m2, the annual net profit can be obtained by adjusting the resource tax rate to 9 m3 in 2034, and the profit and loss point appears at the geothermal resource tax rate of 9–10 ¥/m3. In Henan Province, when the geothermal heating price remains unchanged at 22.8 ¥/m2, the resource tax rate is adjusted to 10 ¥/m3, and the annual net profit can be obtained in 2035. The profit and loss point appears in the geothermal resource tax rate of 10–11 ¥/m3. The heating prices in these two areas are relatively high, but the resource tax rate is also relatively large; finally, there is no profit or loss point under the BAU scenario.

4.2.2 Environmental benefit analysis of non-central heating areas under geothermal energy utilization

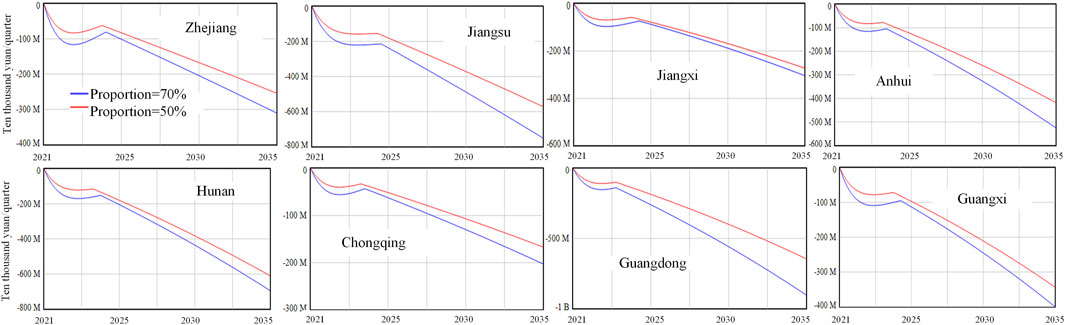

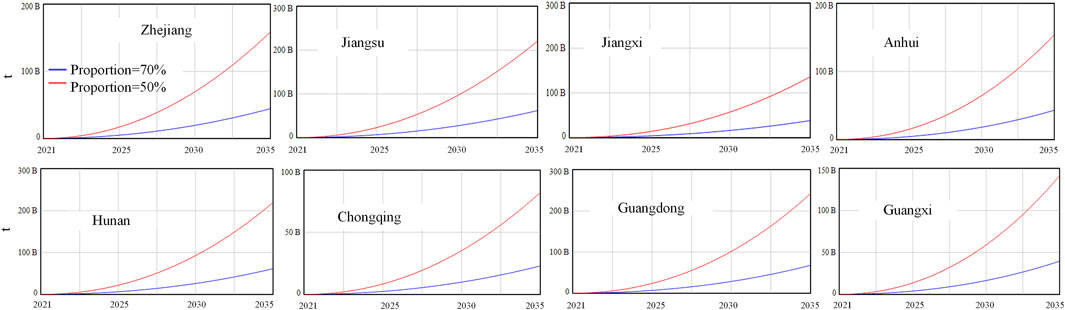

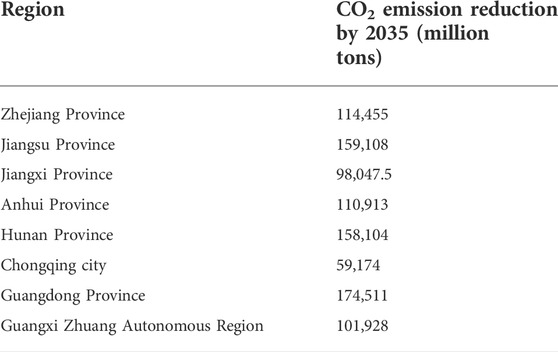

In this paper, it is assumed that the 8 non-central heating areas of Zhejiang, Jiangsu, Jiangxi, Anhui, Hunan, Chongqing, Guangdong, and Guangxi adjust the proportion of electricity heating to 30%, that is, increase the proportion of geothermal heating to 70%. Compared with the BAU scenario, the simulation results are shown in Figure 12. Figure 13 CO2 emission reductions in non-central heating provinces and cities are shown in Table 9. The horizontal axis represents time from 2021 to 2035, and the vertical axis represents the annual net profit and CO2 emissions of geothermal heating enterprises. At the same time, M on the vertical axis represents million, and B represents billion.

FIGURE 12. Annual net profit of non-central heating provinces and cities after adjusting heating proportions.

FIGURE 13. CO2 emissions of non-central heating provinces and cities after adjusting heating proportions.

TABLE 9. CO2 emission reduction after increasing the proportion of geothermal heating in non-central heating provinces and cities.

The simulation results: 1) after increasing the proportion of geothermal heating, the annual net profit and cumulative net profit of geothermal heating enterprises in eight provinces and cities have been reduced. This is because geothermal enterprises are already in a loss state. The more people use them, the more losses there will be, the lower the annual net profit compared with the BAU scenario, and all of these are in a state of increasing losses. 2) When the proportion of geothermal heating is increased to 70%, the CO2 emissions of non-central heating provinces and cities are significantly reduced, which indicates that increasing the proportion of geothermal heating can reduce CO2 emissions. Guangdong Province has the largest CO2 emission reduction of 174,511 million tons. Chongqing has the lowest CO2 emission reduction of 59,174 million tons. Through the comparison of data, the CO2 emission reduction is related to the population number of provinces and cities. The greater the population is, the greater the CO2 emission reduction.

4.3 Results discussion

4.3.1 Economic benefit analysis

1) According to the current heating price and resource tax policy, it is difficult for geothermal enterprises to obtain benefits.

From the perspective of annual net profit, in the BAU scenario, the annual net profit of central heating districts in Beijing, Tianjin, Inner Mongolia and Shanxi will be greater than zero from 2034. Gansu, Ningxia and Henan will not reap benefits in 2021–2035. By adjusting the resource tax rates and prices of Gansu, Ningxia and Henan, it can be concluded that Gansu Province will gain profits in 2035 when the resource tax remains unchanged and the price is 20 ¥. When the price remains unchanged and the resource tax rate is 9 ¥/m3, Ningxia will obtain annual net profit in 2034. Henan will make an annual net profit in 2035 when the price stays the same and the resource tax rate is 10 ¥/m3. Therefore, provinces and cities need to determine appropriate resource tax rates and prices based on the needs of local enterprises. In the non-central heating area, the annual net profit of geothermal enterprises in all provinces and cities under the BAU scenario is less than zero, and it is on a downwards trend. From the perspective of cumulative net profits, geothermal enterprises in all provinces and cities have achieved cumulative net profits less than zero regardless of the baseline scenario or after adjusting the resource tax rate or heating price.

In conclusion, the existing resource tax rate and heating price in non-central heating areas are not conducive to the development of geothermal enterprises. Keeping the resource tax rate unchanged and adjusting the price of geothermal heating, it can be concluded that the geothermal price is relatively high in provinces and cities in the non-central heating area. When the price is 35–59 ¥/m2, the enterprise can make a net profit in approximately 2024. At the same time, the investment in geothermal heating is large in the early stage, and the annual net profit is obtained relatively late; it is difficult to recover the cost.

2) When the utilization ratio increases, more initial investment is needed, and the time to obtain income is prolonged. Therefore, in the early stage of development, economic benefits may not be ideal.

4.3.2 Environmental benefit analysis

This study mainly analyses the environmental benefits of geothermal heating under different resource tax policies from the perspective of carbon emissions. The simulation results show that by 2035, in central heating areas, Gansu Province will have the largest carbon emission reduction, while Tianjin will have the smallest carbon emission reduction. For non-central heating areas, Guangdong Province will have the largest carbon emission reduction of 174.511 billion tons. Chongqing municipality will have the lowest carbon reduction of 59.174 billion tons. As the proportion of geothermal heating increases, carbon emissions decrease significantly, and CO2 emissions are different in different regions. The results show that both carbon emission and carbon emission reduction are affected by regional population.

Therefore, the use of geothermal resources can effectively reduce carbon emissions. The exponential growth trend of carbon emission reduction shows that the use of geothermal resources has a positive effect on mitigating the greenhouse effect and reducing greenhouse gas emissions.

5 Conclusion and policy implications

Conclusion: Increasing the utilization ratio of geothermal heating can improve the environmental benefits. The setting of the resource tax rate and heating price should consider both the benefits of enterprises and the needs of residents, which can maintain the balance of the geothermal heating market, improve the efficiency of resource utilization, and promote the construction of an ecological civilization. The policy recommendations are as follows: 1) For the government, geothermal heating price subsidies should be combined with local geothermal enterprises, economic conditions and residents’ willingness to pay for heating. The demand of geothermal enterprises and residents should be met simultaneously. Taking Beijing as a reference, the heating price subsidy is 30–50 ¥/m2. 2) Geothermal enterprises can obtain carbon emission reduction benefits through carbon trading. At the same time, the use of recharge technology is promoted to realize the recycling of resources and protect geothermal resources. 3) For residents, it is necessary to formulate reasonable promotion policies in combination with residents’ heating demand and willingness to pay. Such as the establishment of reasonable heating prices.

With the deterioration of the global environment and the shortage of resources, geothermal energy as a clean and renewable energy source for clean heating (cooling) meets the requirements of high-quality national economic development. It also has important prospects for the improvement of the environment. The policy evaluation of the geothermal resource tax rate and heating price in this paper is helpful to determine the direction of resource tax reform in the next stage. This means that it can provide a reference for the rationality of resource taxes in geothermal energy heating processes. Through formulating reasonable policies, enterprises can be guided to increase investment in technology R&D to achieve green development and safe production. At the same time, it can promote the formation of a green lifestyle and improve people’s quality of life. It can also promote the rational use of energy, promote ecological environmental protection, and promote the construction of an ecological civilization system. During the research, it is found that only a few areas have adopted recharge technology, and the rational application and promotion of recharge technology and the rationality of charging the geothermal energy resource tax according to water resources still need to be further discussed.

Author contributions

Yy: Methodology, Software, Writing–original draft. ZJ: Data curation, Formal analysis, Writing. HY: Investigation, Resources. KX: Writing–review & editing.

Funding

Supported by the Key Project of Beijing Social Science Foundation (19YJA001); the Fundamental Research Funds for the Central Universities (2021SKGL01; 2022YJSGL05).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Bendibao.com (2020a). How much is the heating fee per square meter in Hohhot? Available at: http://hu.bendibao.com/live/202098/41220.shtm.2020.10.21.

Bendibao.com (2021b). How much is the heating fee per square meter in Tianjin? The price list is attached. Available at: http://tj.bendibao.com/live/20191023/85091.shtm.

Bryan, B. A., Gao, L., Ye, Y. Q., Sun, X., Connor, J. D., Crossman, N. D., et al. (2018). amp; etcChina’s response to a national land-system sustainability emergency. Nature 559 (7713), 193–204. doi:10.1038/s41586-018-0280-2

Central heating charge notice (2021). Central heating charge notice. http://zwfw.nx.gov.cn/nxzw/newscontent.jsp?urltype=news.shtm.2021.04.06.

Chen, Y. H. (2020). Decision of the standing committee of the people's congress of Gansu province on the applicable tax rate of resource tax in Gansu province. Available at: http://www.ctaxnews.com.cn/2020-08/10/content_969644.html.2020-07-31.

Chic Org (2017). Beijing shallow geothermal heating survey report in winter-China Clean Heating Industry Net. Available at: http://www.chic.org.cn/Home/Index/detail?id=163.2019-01-17.

Department of Finance of Jiangsu Province (2020). Notice on the change of the fees for geothermal water and mineral water resources to the tax on resources. Available at: http://czt.jiangsu.gov.cn.html.2020.09.09.

Feng, X. J. (2017). Some thoughts on the development and utilization of geothermal energy in Xi'an. Shanxi coal 36 (S1), 8–12+29.

Gao, L., and Bryan, B. A. (2017). Finding pathways to national-scale land-sector sustainability. Nature 544 (7649), 217–222. doi:10.1038/nature21694

Guangdong Provincial Tax Service, State Taxation Administration (2020). Resource tax item tax rate table of Guangdong Province. Available at: http://www.canet.com.cn/guangdong/682522.html.2020.08.26.

Guangxi Zhuang Autonomous Region Tax Service, State Taxation Administration (2020). Guangxi Zhuang Autonomous Region's decision on the specific application of resource tax rates. Available at: http://guangxi.chinatax.gov.cn/xwdt/swxw/202008/t20200805_312224.html.2020.08.05.

Henan Provincial Tax Service, State Taxation Administration (2020). Decision of the Standing Committee of Henan people's Congress on the tax rate applicable to resource tax of Henan Province. Available at: https://henan.chinatax.gov.cn/pingdingshan/tzgg/tzgg/2020082000820112357003/index.html.2020.08.20.

Hualv.com (2022c). What is Anhui province heating standard? Available at: https://www.66law.cn/laws/765223.aspx.2022.01.05.

Hualv.com (2022a). What is Henan province heating standard? Available at: https://www.66law.cn/laws/748703.aspx.2022.01.05.

Hualv.com (2022b). What is Jiangsu province heating standard? Available at: https://www.66law.cn/laws/735151.aspx.2022.01.05.

Hualv.com (2021). What is the Shanxi heating bill standard in 2020? Available at: https://www.66law.cn/laws/744599.aspx. 2021.04.06.

Huang, G. R. (2013). Thoughts on Levying geothermal resources tax. Yi Chun Federation of Social Sciences in Jiangxi Province.

Huang, X. Q., Zheng, J., Wang, Y., Li, J., and Du, J. R. (2016). Beijing geothermal energy resources development and Utilization Report. Int. Clean. Energy Forum (Macao) 22.

Inner Mongolia Daily (2020). Decision on the applicable tax rate of mineral resource tax of inner Mongolia autonomous region and other authorized matters under the tax law.

Jiang, H. Y., Simonovic, S. P., Yu, Z., and Wang, W. (2021). What are the main challenges facing the sustainable development of China's yangtze economic belt in the future? An integrated view. Environ. Res. Commun. 3 (11), 115005. doi:10.1088/2515-7620/ac35bd

Jiang, Y. (2020). Simulation and selection of fiscal and tax policies for geothermal industry development based on system dynamics. Beijing): China University of Geology.

Li, P. Y., and Sun, S. (2017). Cost analysis of photovoltaic power generation in Northwest China based on learning curve. Energy Sav. Technol. 35 (05), 469–474.

Luo, N. N., and Ren, X. Q. (2021). Geothermal energy heating and cooling technology and its application. Clean. world 37 (10), 99–100.

Mason, I. G., Page, S. C., and Williamson, A. G. (2010). A 100% renewable electricity generation system for New Zealand utilising hydro, wind, geothermal and biomass resources. Energy Policy 38 (8), 3973–3984. doi:10.1016/j.enpol.2010.03.022

Mei, N. P. (2021). 2020-2021 Beijing heating charging standard. Available at: http://bj.bendibao.com/news/2019117/265859.shtm.2021.10.13.

NewEnergy.IN-EN.com (2020). The applicable rate of geothermal resource tax in Beijing was determined. Available at: https://newenergy.in-en.com/html/newenergy-390072.shtml,2020.08.03.

Ningxia Daily (2020). Decision of the standing committee of the people's congress of Ningxia Hui autonomous region on the applicable tax rate of resource tax in Ningxia Hui autonomous region and other related matters.

Pan, F. (2017). Study on the issue of levying geothermal resource tax in China. Shandong University of Finance and economics.

Pang, J., Xu, Y., Shi, Y. C., and Gao, X. M. (2020). The Effect of income Distribution on urban and rural residents in Energy resource Tax Reform: An analysis based on CGE Model. China Environ. Sci. 40 (06), 2729–2740.

Patrick, A., Chen, M. J., Ali, A. M., Azizallah, A., and Mahad, S. B. (2021). A review of geothermal energy status and potentials in Middle-East countries. Arab. J. Geosci. 14 (4), 245. doi:10.1007/s12517-021-06648-9

Payam, A. (2020). A review on geothermal wells: Well integrity issues. J. Clean. Prod. 275, 124009. doi:10.1016/j.jclepro.2020.124009

People’s Government of Hunan Province (2020). Hunan resource tax shall be determined by specific tax rate standards, calculation methods and tax reduction and exemption!. Available at: http://www.hunan.gov.cn/hnszf/hdjl/dczj/jgfk_97989/202007/t20200731_13688086.html.2020.05.31.

People’s Government of Jiangxi Province (2020). Resolution of the standing committee of JIANGXI provincial people's congress on the APPROVAL of the plan for the application of resource tax rates in Jiangxi province. Available at: http://jiangxi.gov.cn/art/2020/7/25/art_393_2650213.html.2020.07.25.

Qiang, H. Y. (2018). Research on the development and utilization of geothermal resources in Beijing. Land Resour. Shanghai 39 (01), 60–63.

Qiao, Y. P. (2018). “Analysis of the impact of resource tax burden on regional economy and industrial structure,” in 5th International Conference on Industrial Economics System and Industrial Security Engineering.

Sam, M., and Basil, S. (2015). Role of royalties in sustainable geothermal energy development. Energy Policy 85, 235–242. doi:10.1016/j.enpol.2015.06.023

Shanxi Provincial Tax Service, State Taxation Administration (2020). Decision of the Standing Committee of Shanxi Provincial People's Congress on the specific applicable tax rates of resource tax and other related matters. Available at: http://shanxi.chinatax.gov.cn/son/detail/xz-11422-545-1717778.2020.08.04.

Shen, H. M. (2019). Current situation and development trend of geothermal energy development and utilization in China. Sci. Technol. innovation 14, 20–21.

Shushan District Finance Bureau (2020). Implementation rules of resource tax of Anhui province. Available at: http://www.hfss.gov.cn/xxgk/sszc/11032293.html.2020.10.10.

Standing Committee of Chongqing Municipal People's Congress (2020). Decision of Standing Committee of Chongqing Municipal People's Congress on specific applicable tax rates of resource tax. Available at: http://www.ctaxnews.com.cn/2020-08/03/content_969226.html.2020.07.30.

Stefanie, H. L., Peter, B., Grant, F., and Philipp, B. (2013). Sustainability and policy for the thermal use of shallow geothermal energy. Energy Policy 59, 914–925. doi:10.1016/j.enpol.2013.04.040

Sui, L. H. (2012). Analyses of the development trend of photovoltaic power generation cost in China based on learning curve. Hydropower energy Sci. 30 (06), 209–211+215.

Tianjin Municipal Tax Service, State Taxation Administration (2020). Decision of the standing committee of the Tianjin municipal people's congress on the applicable tax rates, levying methods, reduction and exemption measures of resource tax in Tianjin. Available at: http://tianjin.chinatax.gov.cn. 2020.07.30.

Wang, G. L., Yang, X., Ma, L., Zhou, J. Q., Shen, G. H., and Wang, W. L. (2021). Application status and development trend of geothermal energy heating technology. Hua Dian Technol. 43 (11), 15–24.

Wu, H., Pan, F., and Gong, Y. Q. (2016a). Feasibility study on levying geothermal resource tax: A case study of Shandong province. J. Shandong Univ. Finance Econ. 28 (04), 96–102.

Wu, H., Pan, F., and Gong, Y. Q. (2016b). Policy suggestions on Levying geothermal resource tax. Econ. Res. reference 1 (66), 36–37.

Wu, L. N., Elshorbagy, A., and Alam, M. S. (2022). Dynamics of water-energy-food nexus interactions with climate change and policy options. Environ. Res. Commun. 4 (1), 015009. doi:10.1088/2515-7620/ac4bab

Xinhua News Agency (2020). Building on past achievements and embarking on a new journey in the global fight against climate change - speech at the climate ambition summit. Available at: http://www.gov.cn/gongbao/content/2020/content_5570055.htm.2020.12.12.

Zhang, J., and Li, X. (2021). Special research report on resource tax legislation in Tianjin. Tianjin Econ. 1 (06), 50–52.

Zhejiang Provincial Tax Service, State Taxation Administration (2020). Decision of the Standing Committee of Zhejiang People's Congress on the specific tax rate of resource tax. Available at: http://zhejiang.chinatax.gov.cn/art/2020/8/3/art_24101_471824.html.2020.08.03.

Keywords: geothermal energy, resource tax, carbon emissions, heating economy, ecological benefit

Citation: Yang Y, Jianmin Z, Yaya H and Xiaoxuan K (2022) Economic and ecological benefit evaluation of geothermal resource tax policy in China. Front. Environ. Sci. 10:1017923. doi: 10.3389/fenvs.2022.1017923

Received: 12 August 2022; Accepted: 13 September 2022;

Published: 19 October 2022.

Edited by:

Lei Gao, Commonwealth Scientific and Industrial Research Organisation, AustraliaReviewed by:

Elchin Suleymanov, Baku Enginering University, AzerbaijanXiaotian Ma, Shandong University, China

Copyright © 2022 Yang, Jianmin, Yaya and Xiaoxuan. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Zhang Jianmin, emhhbmdqaWFubWluQHN0dWRlbnQuY3VtdGIuZWR1LmNu

Yang Yang

Yang Yang Zhang Jianmin

Zhang Jianmin