- 1School of Economics and Management, Shihezi University, Shihezi, China

- 2Beibu Gulf University, Qinzhou, China

- 3Qinzhou Structural Health Monitoring Engineering Technology Research Center, Qinzhou, China

- 4Zhengzhou University of Industry Technology, Zhengzhou, China

The ultimate goal of business development is to achieve sustainable corporate growth and maximize shareholder wealth. Whether and how ESG disclosure affects sustainable growth needs to be further explored. Combining stakeholder theory and signaling theory, a panel data test based on 300 listed companies in Shanghai and Shenzhen in China finds that ESG disclosure can positively promote sustainable growth compared with companies that do not disclose ESG disclosure, and the higher the level of ESG disclosure, the greater the promotion effect on sustainable growth; and ESG disclosure further enhances sustainable growth by reducing financing constraints and enhancing human capital. In addition, the positive relationship between ESG disclosure and corporate sustainable growth is particularly pronounced for non- environmentally sensitive industries and when external environmental uncertainty intensifies. Our findings enrich the research related to ESG disclosure, provide motivation to motivate firms to consciously practice ESG disclosure from a sustainable growth perspective, and contribute to a more detailed understanding of the mechanisms of ESG disclosure and sustainable corporate growth.

Introduction

In recent years, with the introduction of the United Nations “2030 Sustainable Development Goals”, the concept of responsible investment, which implements environmental, social and governance principles, has been gaining popularity. ESG is an acronym for Environment, Social and Governance, an investment concept and corporate evaluation standard that focuses on the environmental, social and governance performance of companies rather than financial performance. Investors can assess the contribution of companies in promoting sustainable economic development and fulfilling social responsibility by observing corporate ESG. Among them: Environment (E) focuses on the impact of enterprise operation and investment activities on the environment, such as resource utilization and pollutant emission. Social (S) focuses on the relationship between the company, focuses on the coordination and balance between the company and its stakeholders. Governance (G) focuses on the internal governance structure and governance rules of the company (Duuren et al., 2016; Liu et al., 2022). ESG investment is highly compatible with China’s goal of green and low-carbon transformation and is a powerful tool to promote low-carbon transformation and sustainable development of enterprises. Therefore, studying the relationship between ESG disclosure and sustainable corporate growth is the basis for implementing the development of ESG concept. Based on the current background of significantly increased environmental uncertainty, combined with the importance and inevitability of ESG development in China, the study of ESG disclosure is of great practical significance (Li et al., 2022; Zhang et al., 2022).

Compared with the ESG development process in foreign countries and Hong Kong, China, ESG construction in mainland China is relatively backward and still in the initial stage of development, mainly because mainland China adopts the voluntary principle for ESG report disclosure, while the Hong Kong Stock Exchange follows mandatory disclosure requirements (Luo et al., 2022). In recent years, stock exchanges and the Securities and Futures Commission have also made further regulations on corporate environmental, social as well as governance disclosure and proposed a core index system for measuring ESG performance of listed companies to further promote the development of ESG in China. According to the White Paper on ESG Development of Chinese Listed Companies (2021), a total of 1092 A-share listed companies in China have issued ESG reports for 2020 (Chen, 2021). Compared with the ESG disclosure of listed companies in Europe and the US, which has exceeded 60% in the same period, the number of companies issuing ESG disclosure reports in China only accounts for 25.3% of the number of all A-share listed companies, which It is significantly behind the European and American countries. This indicates that the ESG concept of some listed companies in China has been gradually improved, but the overall level is not yet high. How to stimulate the autonomy of corporate ESG disclosure and provide endogenous motivation for corporate ESG disclosure is an urgent issue to be solved at present.

Studies have been conducted to explore the basic logic of information disclosure from the perspective of the results brought by ESG disclosure, and there are mainly two views on the spillover and loss effects of ESG disclosure; 1) ESG disclosure strengthens links with stakeholders and brings spillover effects. Based on stakeholder theory, on the one hand, ESG disclosure conveys more information about corporate attributes to external investors, and timely disclosure of environmental information by enterprises will gain government support, public recognition, and good competitiveness among peers, help investors understand corporate operations and sustainable development, reduce information asymmetry between insiders and external investors, and lay the foundation for sustainable growth of enterprises (Lins et al., 2017; Xie et al., 2019). On the other hand, ESG disclosure strengthens consumers’ understanding of the company and enhances customer stickiness, thus improving corporate performance (Clemons et al., 2017; Lin et al., 2015). Furthermore, actively practicing ESG and timely disclosure will attract excellent employees, enhance corporate social influence, and improve corporate reputation (Broadstock et al., 2020; Su et al., 2021). 2) ESG disclosure is also accompanied by certain risks and costs, which bring loss effects. In a competitive market, information disclosure may lead to leakage of core technologies, and competitors may make appropriate strategies to take advantage of the company’s competitive advantage based on the information obtained, resulting in damage to corporate value (Xi, 2010); Not only that, but despite the increasing use of environmental, social and governance (ESG) ratings, It can also have a negative impact. Christensen et al. (2022) conclude that ESG disclosures often exacerbate the divergence in ESG ratings. In addition, information disclosure may also intensify the “irrational” behavior of managers and lower monitoring costs lead to a higher likelihood of overregulation by shareholders (Hahn and Kühnen, 2013), while managers may engage in activities that reduce corporate value in order to demonstrate their capabilities and take away corporate resources for their private benefit, resulting in the destruction of the trust relationship between managers and shareholders and the reluctance of shareholders to invest in high cost innovation activities, which ultimately has a negative impact on sustainable corporate growth (Hermalin and Weisbach, 2012).

The above studies have deepened the consequences of ESG disclosure, but there is no consistent conclusion on the impact of ESG disclosure on business operations, and the question of whether there is spillover effect or loss effect of ESG disclosure needs to be further explored. China is still in the early stages of ESG development, and investors and firms do not yet have a clear understanding of the specific effects of ESG activities on corporate performance and the mechanisms of their interactions. Therefore, it is of practical value to provide endogenous motivation for companies to actively invest in ESG by studying the sustainable growth consequences of ESG disclosure (Wu et al., 2021; Zhao et al., 2022). Based on the above analysis, this paper takes China, a representative emerging market country, as an example to study the impact of ESG disclosure on sustainable corporate growth and its intrinsic impact mechanism; on this basis, it further explores the differences in its impact under different industry types and external environments. The contribution and significance of this study are mainly reflected in the following four aspects. First, socially responsible investment as an important implementation tool for sustainable development, scholars have explored the impact of responsible investment on corporate business activities from different perspectives, but no study has explored the impact of ESG disclosure from the perspective of sustainable growth, and this study innovatively explores the impact of ESG disclosure on corporate sustainable growth. Second, current findings on the impact of ESG disclosure are inconsistent. This paper examines the effect of ESG disclosure on corporate sustainable growth based on a cross-period perspective combined with a double difference approach (DID), and the findings further support the incentive effect of ESG disclosure and provide empirical evidence for the positive effect of ESG disclosure. Third, further analysis yields the mechanisms of the role of financing constraints and human capital in ESG disclosure to influence the sustainable growth of firms to play, and explores the effects of external environmental uncertainty and industry heterogeneity in order to more clearly understand the intrinsic mechanisms and external conditions of ESG disclosure to influence sustainable growth of firms. Fourth, this study also has some practical value, and the findings provide empirical evidence for enterprises to actively disclose ESG information and improve ESG performance to enhance corporate sustainable growth, and provide new ideas to promote enterprises to practice the concept of green development and achieve high-quality development.

Institutional background and hypothesis development

The institutional background of ESG disclosure in China

Globally, ESG disclosure is mainly divided into mandatory disclosure and voluntary disclosure (He et al., 2019). Mandatory disclosure requirements make companies improve their environmental, social responsibility and corporate governance to provide a good environment for socioeconomic development (Jannis and Hloger, 2013). In terms of global sustainability reporting tools, about two-thirds are mandatory disclosure tools and about one-third are voluntary disclosure tools. The reason for the low disclosure of ESG information for listed companies in China at present may be that regulators have not yet introduced mandatory ESG disclosure for all listed companies, and the specific requirements for environmental, social and governance dimensions are not uniform. For the environmental level, the CSRC revised the content and format of semi-annual and annual reports in 2017 and introduced a mandatory environmental information disclosure system for some listed companies. For the governance level, it revised the Code on Governance of Listed Companies in 2018 and revised the format and guidelines for periodic reports of listed companies again in 2021 to further improve the relevant requirements; however, the environmental information mandatory disclosure requirements still do not cover all listed companies, and there is no unified disclosure framework and rules; there is no mandatory disclosure at the social and governance levels; and the overall disclosure framework of ESG still needs to be improved (Tsang et al., 2021). As of 15 April 2022, China Securities Regulatory Commission issued the “Guidelines on Investor Relations Management for Listed Companies (2022)", which includes “ESG information” for the first time in the communication content of investor relations management. The next step is for the Chinese government and regulators to further improve relevant laws and regulations, strengthen the mandatory disclosure of environmental and climate information, actively learn from international disclosure experience, and promote the formation of easy to understand, applicable and comparable information disclosure guidelines or standards.

Literature reviews and hypothesis development

With the advancement of digital technology, the dissemination of Internet information is more effective in playing the role of ESG disclosure, urging companies to improve energy production efficiency and reduce energy consumption in order to achieve green and sustainable development (Hao et al., 2022; Ren et al., 2022). The ESG disclosure system is an important basic system for the capital market to implement the goals of carbon peaking and carbon neutrality. Currently, most ESG reports of Chinese A-share listed companies are voluntary disclosures, and a small number of constituent companies have social responsibility reporting requirements. Driven by policies and the market, ESG disclosure by Chinese listed. However, from an overall perspective, the quantity of ESG information disclosure by listed companies has increased, but the quality varies widely and is uneven. The quality of ESG disclosure varies widely and unevenly. Therefore, in order to solve the worries of ESG investment, we should pay attention to whether ESG disclosure can bring sustainable growth of enterprises under the complex and changing external environment and the continuous impact of the COVID-19 (Tampakoudis and Anagnostopoulou, 2020).

From the existing studies on the enhancing effect of ESG on business performance (Friede et al., 2015; Hakan and Peng, 2021), it can be hypothesized that ESG disclosure helps to promote sustainable corporate growth. In terms of the direct impact effect, ESG reporting serves as a commitment tool to constrain firms to adopt ethical behavior (Barkó et al., 2021), and this ethical behavior serves as an insurance policy that the share price of a firm will fall less even when it is involved in a related scandal (Godfrey, 2005); In addition, ESG disclosure can bring about increased information transparency, which helps stakeholders to better understand the operations and future development of the firm, reducing adverse selection risk (Kaiser and Welters, 2019; Lagasio and Cucari, 2019) and improving corporate performance (Brooks and Oikonomou, 2017). In terms of indirect effects, ESG disclosure can exert a signaling effect that helps firms obtain support from the government, bondholders, and investors, and helps broaden corporate financing channels and reduce corporate financing constraints (Hamrouni et al., 2020; Jia et al., 2021). Secondly, ESG disclosure as a response to stakeholder expectations (Ma et al., 2022) and is beneficial for firms to gain the recognition of key stakeholders, which can create a good working atmosphere for internal employees, thus attracting and retaining talented employees, who can make more valuable contributions to the development of the firm when they are more volved in business decisions (Turban and Greening, 1997; Mao and Weathers, 2019). Overall, ESG disclosure creates a socially responsible image for companies in order to enhance their responsiveness in the face of crises, and in the current context of heightened external environmental sexual uncertainty, this responsiveness is an important guarantee for sustainable corporate growth, the improvement of corporate performance is an important manifestation of sustainable growth, the reduction of financing constraints is a key aspect of sustainable corporate growth, and the participation of knowledge employees is the basic support for sustainable growth (Hong et al., 2022). In summary, the research hypothesis can be formulated as follows.

H1a:. ESG disclosure promotes sustainable growth by reducing corporate financing constraints and enhancing corporate human resource reserves.Of course, every coin has two sides, and ESG disclosures can also inhibit sustainable growth by increasing dedicated costs, creating the impression of “greenwashing” and increasing operating costs. First, for information users, if they use the information disclosed by the firm strategically, it may have a negative effect on the business performance of the firm, which is usually referred to as “Proprietary Cost” because the information disclosed by the firm will be observed and used by competitors, thus reducing the firm’s competitive advantage and having a negative effect on the sustainable growth of the firm (Darrough, 1993). Second, Brammer et al. (2006) argue that the main purpose of corporate disclosure is to gain the trust of stakeholders rather than a genuine desire to contribute to society. Not only that, when companies intentionally disclose information on environmental and social responsibility, it also leads to questions about the completeness and reliability of the company’s disclosure (Simnett and VanstaelenChua, 2009; Moser and Martin, 2012), thus ESG disclosure can create the impression of “greenwashing”; In the long run, “greenwashing” behaviors adopt inconsistent management practices, which can eliminate companies from long-term value competition. In particular, once the “greenwashing” behavior is exposed, the capital market will react the most quickly, the stock price will fall, and the enterprise value will be damaged (Li et al., 2022); at the same time, as the government environmental protection departments and community organizations continue to strengthen supervision, it will force the enterprise management to pay for the “greenwashing” behavior. The social trust crisis caused by the exposure will also increase the management risk, which is not conducive to the sustainable development of enterprises (Yang et al., 2021). Third, ESG disclosure is a complex and systematic effort that requires capital and personnel to measure, collect, and report relevant information (Cormier and Magnan, 1999), which is necessarily costly and the disclosure effort distracts managers from the core business of the firm, thus negatively impacting sustainable growth. In summary, the research hypothesis is proposed.

H1b:. ESG disclosures inhibit sustainable growth by increasing costs, creating “greenwash” perception, and distracting managers.

Model and data

Data source and samples

Starting from the above analysis, this paper investigates the impact of ESG disclosure on corporate sustainable growth using a sample of 300share listed companies in Shanghai and Shenzhen from 2015-2019. The CSI 300 Index is an index of 300 stocks that reflects the comprehensive movement of A-share prices, which was jointly released by the Shanghai and Shenzhen stock exchanges on 8 April 2005. In order to facilitate the tracking and portfolio of investors, the index also has a certain degree of stability and operability, and is characterized by high liquidity and large size. The specific sample selection process is as follows:1) excluding listed companies such as finance and insurance, which are significantly different from other listed companies in China in terms of main business, company size, and information disclosure;2) excluding (*) ST listed companies, which are significantly different from other companies in terms of financial indicators and information disclosure.3) excluding companies listed in the current year, because the companies listed in the current year have been listed for a shorter period of time and have a shorter duration of historical information, so there are large differences between them and other companies in terms of information disclosure. To mitigate the impact of extreme values on the empirical results, this paper uses winsor2 to shrink the tails at the 1% level above and below the continuous variables. The ESG data are obtained from the SynTao ESG rating index, and since the database has been published since 2015 and the available data are available until 2019, the time span is 2015-2019, and all other data are from the CSMAR database.

Research model

To verify the impact of ESG disclosure on corporate sustainable growth, model 1) is constructed for empirical testing, drawing on Ruan and Liu (2021) study, in order to weaken the endogeneity problem arising from reverse causality, lagged one-period values are used for both independent and control variables Among them, i and t represent the firm and year, respectively; SGR is the explanatory variable sustainable corporate growth; ESG is the core explanatory variable rating of corporate environmental, social and governance disclosure; controls represent the firm control variables; Industry is the industry dummy variable and Year is the year dummy variable; ε is the residual term of the model, which contains other factors outside the model variables that affect the sustainable growth of the firm. Specifically set up the following model:

Variables

Dependent variable: Sustainable Growth Rate(SGR), Calculating SGR of firm according to Higgins (1977) sustainable growth model, SGR = net sales margin*total asset turnover*equity multiplier*retained earnings ratio. The sustainable growth rate used in the robustness test is calculated according to Van Horne (1988) sustainable growth models SGR = net sales margin*earnings retention rate* (1 + equity ratio)/(1/total asset turnover net sales margin*earnings retention rate × (1 + equity ratio)). The Higgins sustainable growth model, although only a static model, is more applicable to calculate the sustainable growth rate of Chinese listed companies; the Van Horne sustainable growth model is further subdivided into static and dynamic in its calculation. The Higgins and Van Horne models share the same theoretical logic and both use the maximum growth rate of sales as the sustainable growth rate. Both of them are influential and representative dynamic models for measuring the sustainability of companies so far.

Independent variable: ESG disclosure (ESG), The ESG data are obtained from the SynTao Green Finance ESG rating index (Ruan and Liu, 2021), There are 10 grades of D, C, C, C+, B, B, B+, A, A, A+, and they are assigned a value of 1–10 in this way. The SynTao Green Finance ESG rating index has developed an effective ESG assessment method specifically for China, combining global ESG standards and Chinese market characteristics, and has accumulated a large amount of data. The ESG rating system consists of three levels of indicators: Level 1 indicators are environmental, social and corporate governance dimensions; Level 2 indicators are 13 categorized issues under environmental, social and corporate governance; Level 3 indicators cover specific ESG indicators. There are 127 three-level indicators. The ESG rating is weighted according to industry characteristics, and industry-specific indicators are assigned to each industry in order to better grasp the characteristics of different industries. The ESG ratings used in the robustness test were obtained from the HuaZheng database, and the nine ratings from C to AAA were assigned from 1 to 9, while the mean value of each quarterly rating was taken to measure the annual ESG disclosure.

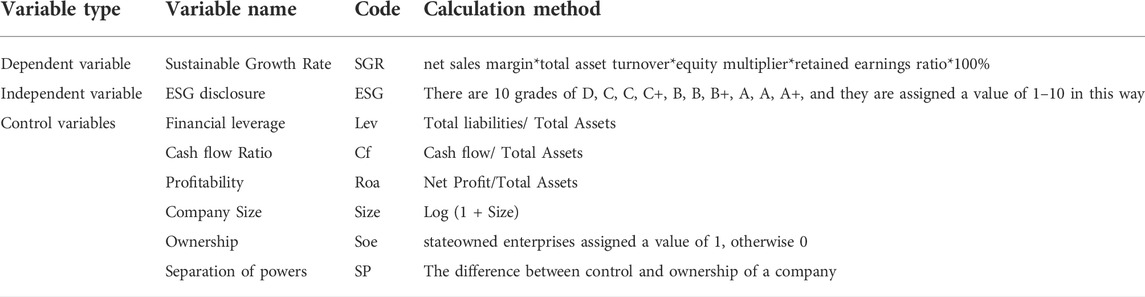

Control variables: Drawing on the studies of existing scholars, the balance sheet ratio (Lev), cash flow ratio (Cf), profitability (Roa), firm size (Size), nature of ownership (Soe), and degree of separation of powers (SP), were selected as control variables in a comprehensive manner, and the detailed variable definitions and measures are shown in Table 1.

Descriptive statistic

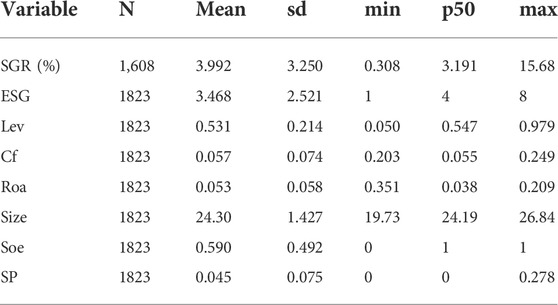

Table 2 shows the results of the descriptive statistical analysis of the dependent, independent and control variables. The mean value of ESG is 3.468, the minimum and maximum values are 1 and 8, respectively, and the standard deviation is 2.521, indicating that the ESG ratings of the companies in the sample differ significantly and the level of ESG disclosure needs to be improved. The mean value of SGR is 0.0399, and the minimum and maximum values are 0.0308 and 0.1568, respectively, which are similar to existing studies (Luo et al., 2022), indicating that there is great variability in the sustainability level of the sample companies; Individual differences were also observed in the sample for the main control variables, and the distribution of the control variable values were within a reasonable range. Overall, the sample was well differentiated.

Results

Tests for differences in means and medians of variables in the ESG rating subgroup sample

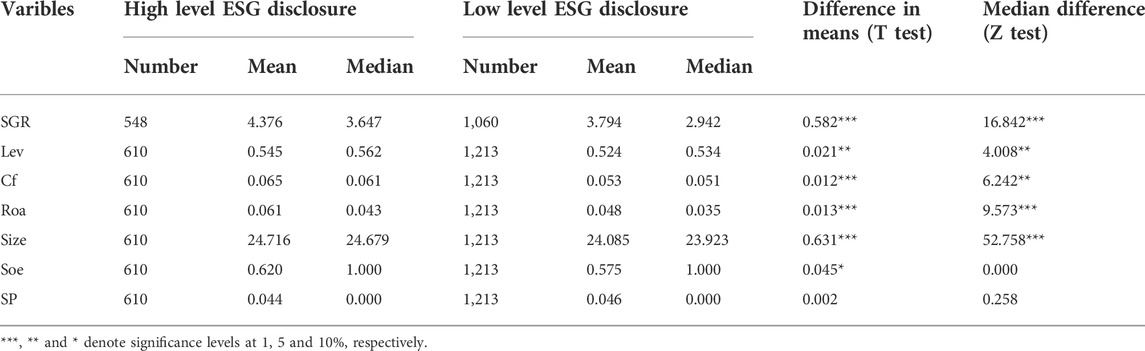

Since the measurement of ESG disclosure takes positive integers within 1-10 for assignment, ESG disclosure is a discrete variable, so in order to avoid errors caused by discrete variables and to initially explore the trend relationship of ESG disclosure on sustainable corporate growth. Prior to regression, this paper tests for differences in the means and medians of the dependent and control variables in two samples of high and low level ESG disclosure. The results are shown in Table 3, the means and medians of sustainable growth in the sample group with high level ESG disclosure are 4.376 and 3.647, respectively, which are higher than those in the sample group with low level ESG disclosure (3.794 and 2.942) and significantly different at the 0.01 level, indicating that the sustainable growth rate in the group with high level ESG disclosure is higher than that in the group with low level ESG disclosure, which was basically consistent with existing research (Grewal et al., 2019). The test for the difference between the mean and median of Lev, Cf, Roa, and Size in the two sample groups; it can be seen that the financial level and company size of the high ESG disclosure sample group are clearly higher than those of the low ESG disclosure group, which lays the foundation for the underlying regressions in the later section.

Benchmark regression analysis

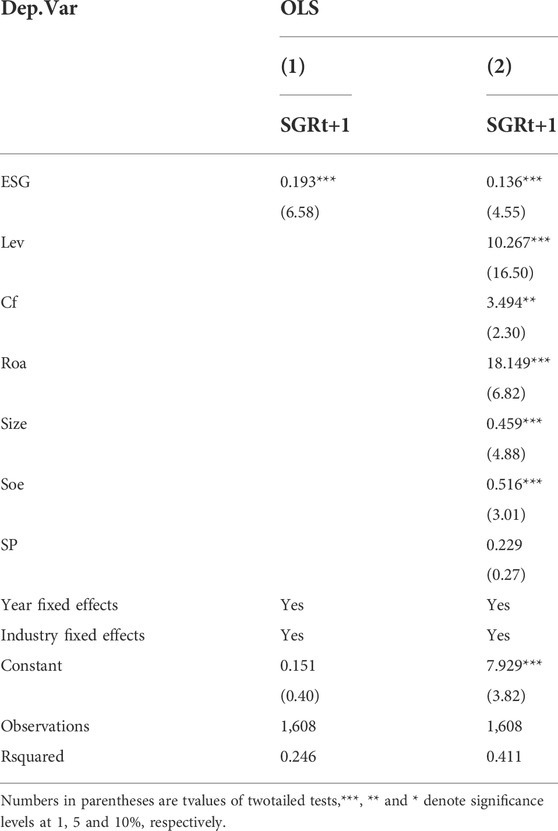

To verify the effect of ESG disclosure on corporate sustainable growth, a cascade regression is used to test the results, which are shown in Table 4. First, the independent and dependent variables are regressed by controlling for industry and year under the panel fixed effects model, and the results are shown in column 1) of Table 4, which shows that ESG disclosure plays a positive role in promoting sustainable corporate growth. Second, to further exclude the interference caused by the firm’s own factors, further control variables are added to further analyze the main effects, and the results are shown in column 2) of Table 4, where ESG disclosure positively affects firm sustainable growth (β1 = 0.136,p < 0.01), and the marginal coefficient of ESG is 0.136, which means that, all else being equal, on average, each unit increase in ESG disclosure unit increase in ESG disclosure will consistently increase the sustainable growth rate by 13.6%, thus validating hypothesis H1a that ESG disclosure significantly and positively affects sustainable corporate growth.

Quantile regression

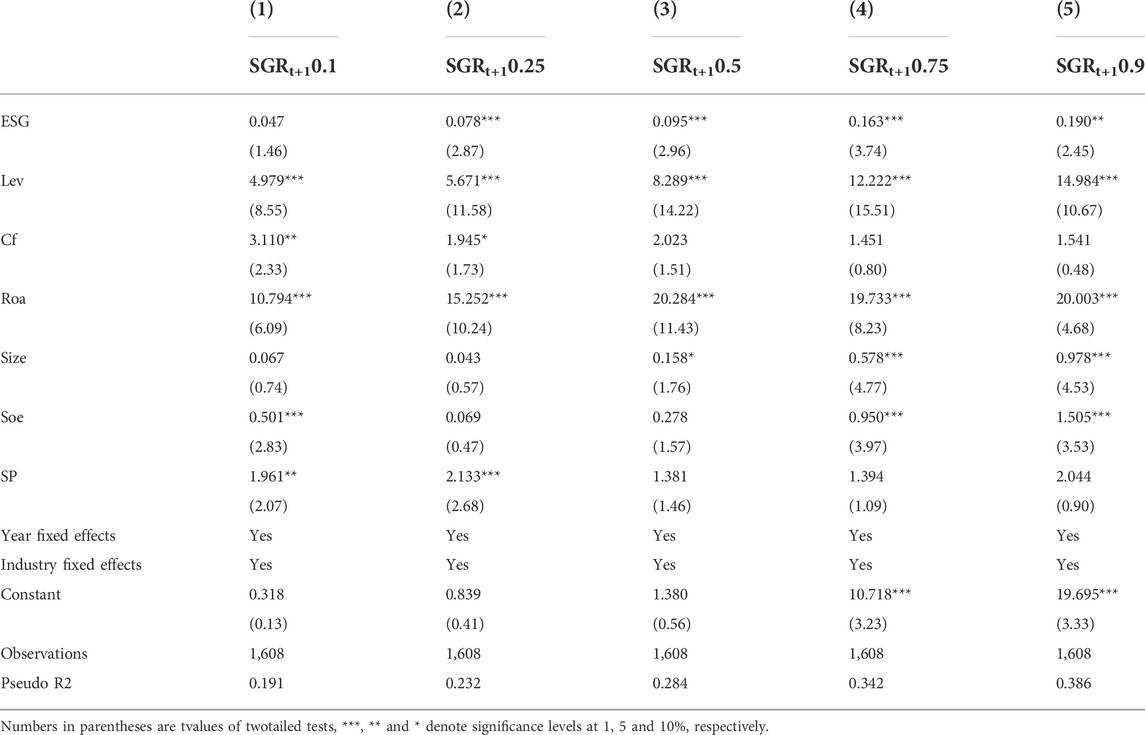

The traditional ordinary least squares method calculates the magnitude of the coefficients from an average perspective and is unable to capture the differential impact of ESG disclosure on the future growth opportunities of companies. In contrast, quantile regression is a regression method that estimates the coefficients of independent variables based on the conditional distribution of the explanatory variables and is able to use diverse information from different quantile groups for regression analysis of the model (Teng et al., 2021), and Table 5 presents the results of using quantile regression. Five quartiles of sustainable corporate growth were selected from small to large, namely 10, 25, 50, 75 and 90%. The regression coefficient of ESG disclosure is 0.047 at the 10% quantile of sustainable growth rate, which is not significant; at the 25% quantile, the regression coefficient of ESG disclosure is 0.078, which is significant at 1% confidence level; at the 50% quantile, the regression coefficient of ESG disclosure is 0.095, which is significant at 1% confidence level; at the 75% quantile The regression coefficient of ESG disclosure is 0.163, which is significant at the 1% confidence level; the regression coefficient of ESG disclosure is 0.190; at the 90% quantile, which is significant at the 1% confidence level. The coefficient of ESG disclosure increases gradually as the quantile increases, indicating that ESG disclosure has a greater impact on the sustainable growth rate of companies with strong future growth capacity, this finding is consistent with that of Hodder-Webb et al. (2009).

Robustness check

In order to make the findings more reliable, a series of robustness tests were conducted using the replacement variable method, replacement of the study sample, propensity score matching, reverse causality test, and difference in difference method, and the results of various tests indicated that ESG disclosure to enhance sustainable corporate growth is not randomly correlated and the results are reliable.

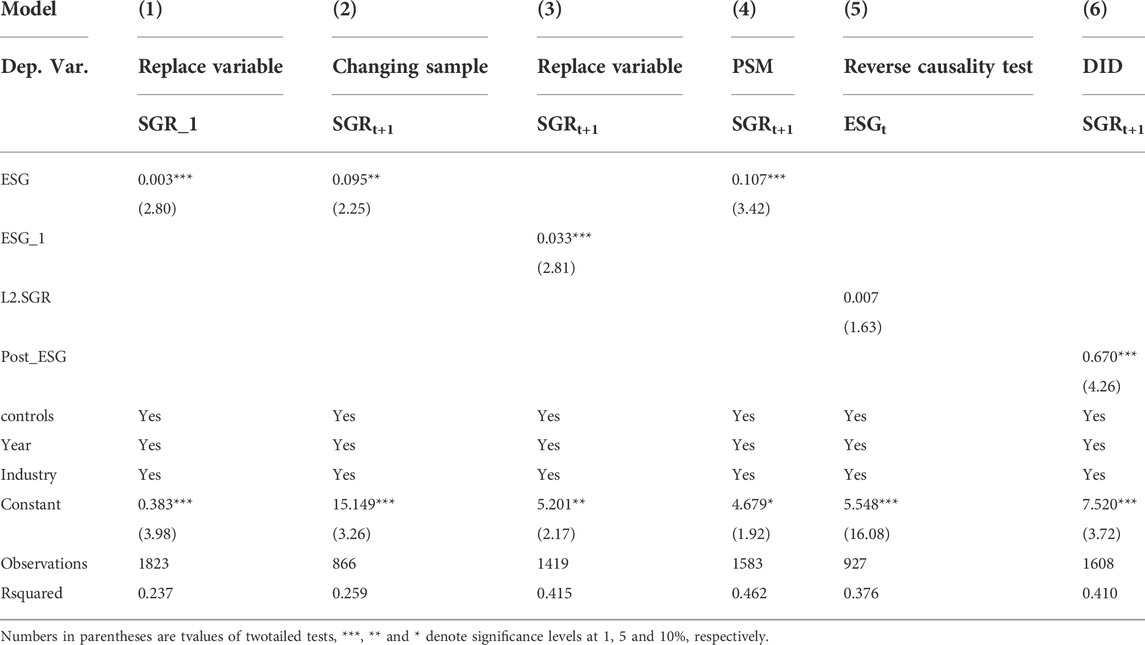

1. Replace the dependent variable. To mitigate the causal differences due to measurement error, replace the measurement of the dependent variable and thus test the robustness of the results, recalculate the firm’s sustainable growth rate according to Van Horne’s sustainable growth model (Van Horne, 1988), SGR_1 = net sales margin*earnings retention rate* (1 + equity ratio)/(1/total asset turnover net sales margin*earnings retention rate × (1 + equity ratio)), The specific results are shown in column (1) of Table 6, the regression coefficient of ESG is 0.003 and is significantly positive at the 1% level, Validating H1a.

2. Changing the study sample. Compared with general prefecture-level cities, municipalities directly under the central government enjoy better central policy support and tax benefits, and have set up bonded zones with a high degree of reform and openness, which can make better investment attraction and economic development. It is more advanced in terms of financial support and talent attraction and cultivation, and its degree of influence on the sustainable development of enterprises is relatively deep. In order to avoid the influence of the special economic attributes of the municipality on the estimation results. This study removes the sample of municipalities directly under the central government for subsample testing, and the regression results are shown in column (2) of Table 6, The coefficient of ESG performance is 0.095, which is significant at 1% confidence level, again validating H1a and the results are robust.

3. Replace the independent variable. There is no uniform standard for ESG assessment methodology due to differences between institutions in the specific content of the ESG framework, industry “best practices” and weighting of subsections. In order to avoid the error caused by the scoring of one institution, we select the Huazheng ESG rating (ESG_1) as the robustness of ESG disclosure. The reason is that it refers to the mainstream Huazheng ESG rating framework abroad and combines the characteristics of the Chinese capital market, subdividing the three pillars of environment, society and governance into 14 themes and 26 key indicators, covering all listed companies, with good continuity and availability of data. As shown in column (3) of Table 6, and the results are robust.

4. Propensity score matching. In order to solve the problem of possible sample selection bias, this study divided ESG disclosure into high and low groups according to their mean values and matched according to the more widely used kernel matching method, so that the treatment and control groups were as similar as possible in terms of other characteristics Lev、Cf、Roa、Size、Soe、SP, except for the differences in ESG disclosure, and the absolute values of bias in the specific paired samples. The maximum value of percentages does not exceed 5%, and none of the differences in variables after matching are significant, indicating that there is no significant difference between the treatment and control groups after matching, satisfying the requirements of the balanced hypothesis test for propensity score matching. The matched data were subjected to regression analysis, and the specific results are shown in column (4) of Table 6, where the effect of ESG disclosure on corporate sustainable growth remains significantly positive (β1 = 0.107, p < 0.001), and the results still support H1a.

5. Reverse causality test. Considering the possibility of reverse causality between ESG disclosure and sustainable growth, for example, a higher sustainable growth rate implies better business performance, which in turn may lead to a greater willingness to invest in ESG and make higher levels of ESG disclosure. Thus, if there is a reverse causality between ESG disclosure and sustainable growth, then sustainable growth may have an impact on corporate ESG disclosure with period lag. Based on this, this paper runs regressions with sustainable growth as the independent variable and ESG disclosure with two lags as the dependent variable, and the results are shown in column (5) of Table 6. It can be found that corporate sustainable growth does not have an impact on ESG disclosure, and therefore, there is no reverse causality problem.

6. Difference in difference test. To address the endogeneity problem arising from firm heterogeneity, DID approach is used to compare ESG disclosure with or without ESG disclosure and firm sustainable growth over time, drawing on Tsang et al. (2021) and the regression model (2) is shown below. Where Post_ESG is a dummy variable, that is, assigned a value of 1 if the SynTao Green Finance ESG rating index disclosed ESG information in the current and subsequent years and 0 otherwise. β1 is a DID estimate that captures the incremental change in sustainable growth of firms that adopted ESG disclosure (treatment group) relative to firms that did not ESG disclosure (control group) over the same period. Column (6) of Table 6 reports the results of the DID regression with a coefficient of 0.670 for Post_ESG, which is significantly positive at the 1% level, indicating that firm disclosure of ESG information can significantly and positively affect the sustainable growth rate of firms compared to no disclosure of ESG information.

Further analysis

Channel analysis

In this section, we explore potential channels through which ESG disclosures can contribute to sustainable corporate growth. Following the previous analysis, the aim is to test whether ESG disclosure enhances sustainable corporate growth by reducing corporate financing constraints and enhancing human resource pools.

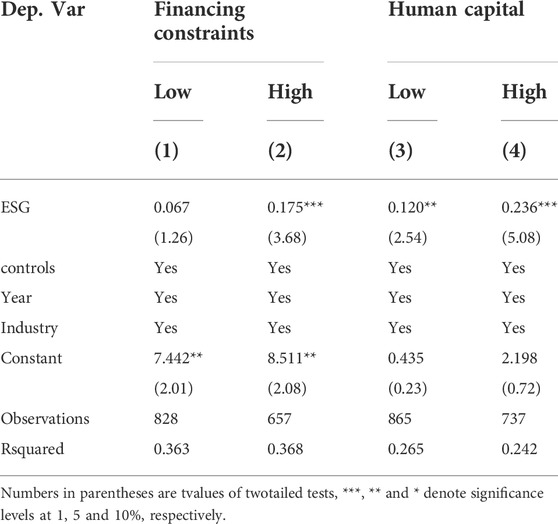

As mentioned in the previous theoretical analysis, ESG disclosure promotes sustainable growth by improving information transparency and thus reducing corporate financing constraints, conveying the construction of good corporate governance, which in turn reduces financing constraints and improves human resource reserves. To further clarify the mechanism of the impact of ESG disclosure on sustainable corporate growth, drawing on Kaplan and Zingales' (1997) measure of financing constraints, the corporate financing constraint is measured using the KZ index, KZ = -1.002*Cf/Ta + 3.139*Lev+39.368*Div/Ta+1.315*Cash/Ta + 0.283*Tq, where Cf, Div, and Cash are the net cash flow from operations, cash dividends, and cash holdings, respectively, and Ta are normalized by the total assets at the beginning of the period, and Lev and Tq are the corporate gearing ratio and Tobin’s Q, respectively; Drawing on the measurement of human capital in the study of Khan et al. (2020), the proportion of employees with master’s degree or above is used as a proxy for human capital (Labor).

According to the annual median of financing constraints and human capital, the sample was divided into " high financing constraints” and " low financing constraints” groups, “high human capital” and “low human capital” groups. The model 1) is tested by dividing the sample into “financing constrained” and “financing constrained” groups, “high human capital” and “low human capital” groups. If ESG disclosure affects sustainable growth through the financing constraint channel, then ESG disclosure has a greater impact on sustainable growth for firms with high financing constraints, mainly because firms with high financing constraints have a stronger willingness to attract internal and external investors by improving ESG disclosure compared to firms with low financing constraints, which in turn provides the necessary financial support for sustainable growth. Therefore, the incentive effect of ESG on sustainable growth is more pronounced in the subgroup of firms with high financing constraints (Cao et al., 2021). In addition, ESG disclosure improves corporate information transparency, conveys responsible and good corporate governance through signaling effects, and highlights a good corporate image, thus attracting and retaining talented employees, improving their job satisfaction, and increasing their commitment to their jobs, and such talented, satisfied, and dedicated employees tend to be more involved in corporate business decisions and can make more valuable contributions to corporate development. The impact of ESG disclosure on sustainable growth is more pronounced in the high human capital group as a result of the involvement of high level human capital in corporate decision making, which is necessary for sustainable growth (Syed et al., 2020; Yang et al., 2021). The specific grouping regression results are shown in Table 7. Comparing the regression results in columns 1) and 2) of Table 7, the effect of ESG disclosure on sustainable growth of firms with high financing constraints is significant relative to the low financing constraints group; comparing the regression results in columns 3) and 4) of Table 7, the effect of ESG disclosure on sustainable growth of firms under the two subsample groups are significantly positive, and the effect of ESG disclosure on corporate sustainable growth is more significant in the high human capital group relative to the low human capital group; thus supporting the impact mechanism that ESG disclosure affects corporate sustainable growth through financing constraints and human capital.

Analysis of heterogeneity

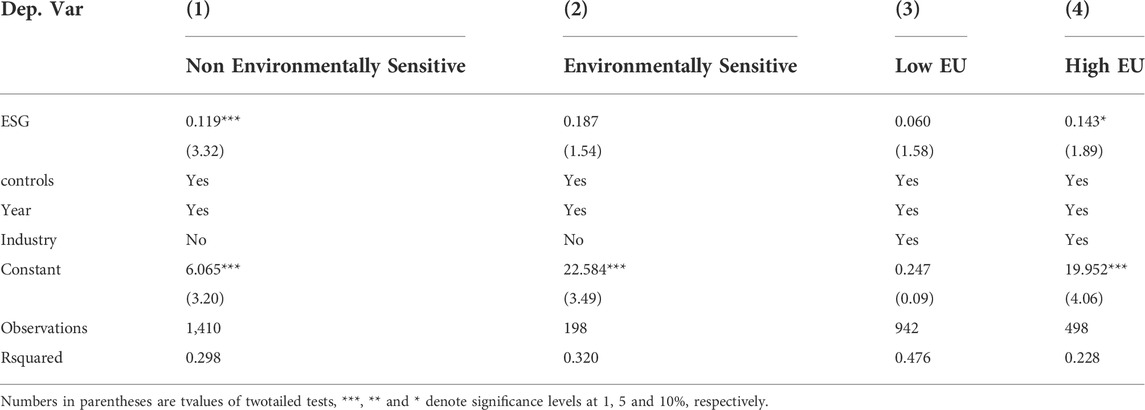

Previous studies have shown that different industry attributes and external environment may influence the relationship between ESG disclosure and sustainable corporate growth, especially in the current volatile world political situation, industry attributes and environmental uncertainty grouping are more meaningful (Zhang et al., 2021). In order to assess the impact of different influencing factors on the findings of this paper, this paper regressed the environmentally sensitive and non-environmentally sensitive industry groups, the high environmental uncertainty group and the low environmental uncertainty group, and conducted group regressions. Referring to Teng et al. (2021), the consequences of ESG disclosure impact are closely related to the type of industry. Among them, environmentally sensitive companies were standardized by the heavy pollution industries identified in China’s “Guidelines for Environmental Information Disclosure of Listed Companies” in 2010. Companies in 11 industries, B07, B08, B09, C25, C26, C28, C29, C30, C31, C32 and D44, were considered as environmentally sensitive industries, while the rest of the industries were considered as non-environmentally sensitive industries. The environmental uncertainty refers to the study of Ghosh and Olsen (2009) and the standard deviation of the nonnormal sales revenue of enterprises in the past 5 years is divided by the average of the past 5 years’ sales revenue, and the above calculation results are divided by the industry environmental uncertainty to finally arrive at the industry adjusted environmental uncertainty (EU), the specific results are shown in Table 8.

From column (1) (2) of Table 8, it can be seen that ESG disclosure of environmentally sensitive industries has no significant effect on corporate sustainable growth, and the coefficient of ESG disclosure of non-environmentally industries on corporate sustainable growth is 0.119 and is significantly positive at the 1% level. The reason for this is not difficult to understand; ESG disclosure of non-environmentally sensitive industries may play a signaling and reputation mechanism, which in turn promotes sustainable corporate growth. With the increase in national environmental management in recent years, environmentally sensitive industries are facing more stringent environmental regulation, and disclosure of relevant ESG information not only fails to attract stakeholders, but also may bring about a “greenwashing”, which in turn is not significant for corporate sustainable growth (Ren et al., 2022). Consistent with the findings of Gull et al. (2022), the best-in class companies in environmental performance have higher financial performance compared to the worst and average companies in their category.

As shown in column (3) (4) of Table 8, ESG disclosure under low environmental uncertainty has no significant effect on corporate sustainable growth, and the coefficient of ESG disclosure of firms with high environmental uncertainty on corporate sustainable growth is 0.143 and is significantly positive at the 10% level. Analytically, the higher the environmental uncertainty, the higher the production and operation risk of enterprises will be, in order to gain a place in the fierce market competition, enterprises are more motivated to improve their ESG performance in order to show their sound operation level and financial reserves, so they will actively disclose ESG information to send positive signals to the outside world, which can not only build a good corporate image and gain a good reputation in the fierce competition from employees and consumers, thus enhancing corporate human resource reserves, and also, attracting financial institutions and investors to broaden corporate financing channels, reduce corporate financing constraints, and further enhance sustainable growth (Utomo et al., 2020).

Discussion and policy recommendations

Practicing ESG responsibility is an inevitable requirement to adhere to sustainable development, an important initiative to implement the new development concept, and significant to achieve carbon capping by 2030. This paper investigates the impact of ESG disclosure on corporate sustainable growth using a sample of Chinese listed companies with 300 shares in Shanghai and Shenzhen from 2015-2019, and draws the following findings: first, ESG disclosure can enhance corporate sustainable growth, the findings further support the spillover effect of ESG disclosure and provide new evidence to explore the uncertain consequences of information disclosure from a sustainable growth perspective, The quantile regression analysis found that the higher the sustainable growth quantile of the firm, the greater the contribution of ESG disclosure, which is similar to the study of Teng et al. (2021), which both concluded that the role of ESG is more pronounced in the upper quantile of SGR. Second, ESG disclosure enhances sustainable growth by improving human resource pool and reducing financing constraints; human resources, as a core competency of firms, can effectively buffer external shocks, improve operational performance, and enhance sustainable growth, a finding that corroborates the study of Hahn and Kühnen (2013), that sustainability disclosure increases transparency, improves corporate reputation, and achieves the goal of motivating employees and thus employee support the goal of dedication to the firm; Third, the heterogeneity analysis found that ESG disclosure of non-environmentally sensitive firms can promote sustainable growth compared to environmentally sensitive firms; ESG disclosure with high environmental uncertainty can help firms grow sustainably compared to low environmental uncertainty; previous studies have also supported the idea that ESG disclosure promotes more for non-environmentally sensitive firms as well as high environmental uncertainty from different perspectives, for example, Wu et al. (2020) study argues that green development and environment-friendly development can enhance development efficiency; Kumar (2022) study argues that as uncertainty increases, high levels of ESG disclosure by tourism firms can build good relationships and good reputation with various stakeholders, especially during the COVID-19 period and during the global financial crisis, ESG disclosure can moderate the negative impact of economic uncertainty on corporate value; in the context of increased uncertainty in the external environment, ESG disclosure can play a signaling and reputation effect, which can bring confidence and hope to stakeholders and thus promote sustainable growth.

Combined with the findings of this paper, the following management insights can be obtained: first, good ESG practices and complete ESG information disclosure can help enhance corporate value, and the concept of ESG development should be implemented from top to bottom; for industries with high external environmental uncertainty and environmental sensitivity, ESG information disclosure can give full play to its value and play an important role in promoting sustainable growth. Therefore, as a strategic tool for long-term development, companies should establish ESG management departments and clarify the responsibilities of relevant personnel to truly assume the role of fulfilling ESG practices, strengthening ESG information disclosure and attracting external ESG investment, so as to lay the foundation for long-term corporate development. Second, in the current environment of increased uncertainty, investors should pay more attention to corporate ESG disclosure; highly rated ESG disclosure has greater advantages in human resource reserves and financing, providing inexhaustible power to achieve sustainable growth, and for investors, ESG disclosure is an important reference for their investment. Third, the government should promote the construction of market-oriented process, create an open and competitive market environment, further implement the relevant regulations and policies on ESG disclosure, objectively promote the level of ESG disclosure of Chinese listed companies, and also dovetail with international standards to build an ESG rating system construction with Chinese characteristics.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

Methodology, NW; writing—original draft, NW; writing—review and editing, NW and DL; data analysis, DL and NW; resources, DL; conceptualization, DL and DC; formal analysis, DC and MX; supervision, DC and MX. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Key Projects of Social Science Fund of Xinjiang Production and Construction Corps of China (No., 19ZD02); The project of Middle-aged and Young Teachers’ Basic Ability Promotion Project of Guangxi (No., 2020KY10026); The Qinzhou Structural Health Monitoring Research Center of Engineering Technology (No., 2017ZRKT06).

Acknowledgments

I thank the referees for valuable comments. All remaining errors are my own responsibility.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Barkó, T., Cremers, M., and Renneboog, L. (2021). Shareholder engagement on environmental, social, and governance performance. J. Bus. Ethics 7. doi:10.1007/s10551-021-04850-z

Brammer, S., Brooks, C., and Pavelin, S. (2006). Corporate social performance and stock returns: UK evidence from disaggregate measures. Financ. Manag. 35, 97–116. doi:10.1111/j.1755-053x.2006.tb00149.x

Broadstock, D. C., Chan, K., Cheng, L., and Wang, X. (2020). The role of ESG performance during times of financial crisis: Evidence from covid19 in China. Finance Res. Lett. 38, 101716. doi:10.1016/j.frl.2020.101716

Brooks, C., and Oikonomou, I. (2017). The effects of environmental, social and governance disclosures and performance on firm value: A review of the literature in accounting and finance. Br. Account. Rev. 50, 1–15. doi:10.1016/j.bar.2017.11.005

Cao, J., Law, S. H., Samad, A. R. B. A., Mohamad, W. N. B. W., Wang, J., and Yang, X. (2021). Impact of financial development and technological innovation on the volatility of green growth—Evidence from China. Environ. Sci. Pollut. Res. 28 (35), 48053–48069. doi:10.1007/s11356-021-13828-3

Chen, J. (2021). The Securities times released "China ESG development white paper[N]. Shenzhen: Securities Times, 20220422.

Christensen, D. M., Serafeim, G., and Sikochi, A. (2022). Why is corporate virtue in the eye of the beholder? The case of esg ratings. Account. Rev. 97, 147–175. doi:10.2308/tar-2019-0506

Clemons, E. K., Dewan, R. M., Kauffman, R. J., and Weber, T. A. (2017). Understanding the information-based transformation of strategy and society. J. Manag. Inf. Syst. 34, 425–456. doi:10.1080/07421222.2017.1334474

Cormier, D., and Magnan, M. (1999). Corporate environmental disclosure strategies: Determinants, costs and benefits. J. Account. Auditing Finance 14, 429–451. doi:10.1177/0148558x9901400403

Darrough, M. N. (1993). Disclosure policy and competition: Cournot vs. Bertrand. Account. Rev. 68, 534561.

Duuren, E. V., Plantinga, A., and Scholtens, B. (2016). ESG integration and the investment management process: Fundamental investing reinvented. J. Bus. Ethics 138, 525–533. doi:10.1007/s10551-015-2610-8

Friede, G., Busch, T., and Bassen, A. (2015). ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. J. Sustain. Finance Invest. 5, 210–233. doi:10.1080/20430795.2015.1118917

Ghosh, D., and Olsen, L. (2009). Environmental uncertainty and managers’use of discretionary accruals. Account. Organ. Soc. 34, 188–205. doi:10.1016/j.aos.2008.07.001

Godfrey, P. C. (2005). The relationship between corporate philanthropy and shareholder wealth: A risk management perspective. Acad. Manage. Rev. 30, 777–798. doi:10.5465/amr.2005.18378878

Grewal, J., Riedl, E. J., and Serafeim, G. (2019). Market reaction to mandatory nonfinancial disclosure. Manag. Sci. 65, 3061–3084. doi:10.1287/mnsc.2018.3099

Gull, A. A., Saeed, A., Suleman, M. T., and Mushtaq, R. (2022). Revisiting the association between environmental performance and financial performance: Does the level of environmental orientation matter? Corp. Soc. Responsib. Environ. Manag. 116, 1647–1662. doi:10.1002/csr.2310

Hahn, R., and Kühnen, M. (2013). Determinants of sustainability reporting: A review of results, trends, theory, and opportunities in an expanding field of research. J. Clean. Prod. 59, 5–21. doi:10.1016/j.jclepro.2013.07.005

Hakan, K., and Peng, X. (2021). Does corporate social performance lead to better financial performance? Evidence from Turkey[J]. Green Finance 3 (4), 464–482.

Hamrouni, A., Uyar, A., and Boussaada, R. (2020). Are corporate social responsibility disclosures relevant for lenders? Empirical evidence from France. Manag. Decis. 58, 267–279. doi:10.1108/md-06-2019-0757

Hao, Y., Li, Y., Guo, Y., Chai, J., Yang, C., and Wu, H. (2022). Digitalization and electricity consumption: Does internet development contribute to the reduction in electricity intensity in China? Energy Policy 164, 112912. doi:10.1016/j.enpol.2022.112912

He, J., Plumlee, M. A., and He, W. (2019). Voluntary disclosure, mandatory disclosure and the cost of capital. J. Bus. Finance Acc. 46, 307–335. doi:10.1111/jbfa.12368

Hermalin, B. E., and Weisbach, M. S. (2012). Information disclosure and corporate governance. J. Finance 67, 195–234. doi:10.1111/j.1540-6261.2011.01710.x

Higgins, R. C. (1977). How much growth can a firm afford[J]. Financ. Manag. 6 (3), 7–16. doi:10.2307/3665251

Hodder-Webb, L., Cohen, J. R., Nath, L., and Wood, D. (2009). The supply of corporate social responsibility disclosures among US firms. J. Bus. Ethics 84, 497–527. doi:10.1007/s10551-008-9721-4

Hong, M., Drakeford, B., and Zhang, K. (2022). The impact of mandatory CSR disclosure on green innovation: Evidence from China. Green Finance 2 (3), 302–322. doi:10.3934/gf.2020017

Jannis, B., and Hloger, D. (2013). Mandatory disclosure, voluntary disclosure, and stock market liquidity: Evidence from the EU bank stress tests. J. Account. Res. 51, 997–1029. doi:10.1111/1475-679x.12029

Jia, S., Qiu, Y., and Yang, C. (2021). Sustainable development goals, financial inclusion, and grain security efficiency. Agronomy 11, 2542. doi:10.3390/agronomy11122542

Kaiser, L., and Welters, J. (2019). Risk mitigating effect of ESG on momentum portfolios. J. Risk Finance 20, 542–555. doi:10.1108/jrf-05-2019-0075

Kaplan, S. N., and Zingales, L. (1997). Do investment cash flow sensitivities provide useful measures of financing constraints? Q. J. Econ. 112, 169–215. doi:10.1162/003355397555163

Khan, Z., Hussain, M., Yang, S., and Jiao, Z. (2020). Natural resource abundance, technological innovation, and human capital nexus with financial development: A case study of China. Resour. Policy 65, 101585. doi:10.1016/j.resourpol.2020.101585

Kumar, D. (2022). Economic and political uncertainties and sustainability disclosures in the tourism sector firms. Tour. Econ. 16, 135481662211134. doi:10.1177/13548166221113434

Lagasio, V., and Cucari, N. (2019). Corporate governance and environmental social governance disclosure: A meta‐analytical review. Corp. Soc. Responsib. Environ. Manag. 26, 701–711. doi:10.1002/csr.1716

Li, W., Li, W. N., Seppänen, V., and Koivumaki, T. (2022). Effects of greenwashing on financial performance: Moderation through local environmental regulation and media coverage. Business strategy and the environment, 1–22.

Li, Z., Yang, C., and Huang, Z. (2022). How does the fintech sector react to signals from central bank digital currencies? Finance Res. Lett. 50, 103308. doi:10.1016/j.frl.2022.103308

Lin, C. S., Chang, R. Y., and Dang, V. T. (2015). An integrated model to explain how corporate social responsibility affects corporate financial performance. Sustainability 7, 8292–8311. doi:10.3390/su7078292

Lins, K. V., Servaes, H., and Tamayo, A. (2017). Social capital, trust, and firm performance: The value of corporate social responsibility during the financial crisis. J. Finance 72, 1785–1824. doi:10.1111/jofi.12505

Liu, X., Zhang, W., Zhao, S., and Zhang, X. (2022). Green credit, environmentally induced R&D and low carbon transition: Evidence from China. Environ. Sci. Pollut. Res. Int., 1–24. doi:10.1007/s11356-022-21941-0

Luo, D., Mathur, I., and Neely, C. J. (2022). ESG, liquidity, and stock returns. J. Int. Financial Mark. Institutions Money 78, 101526. doi:10.1016/j.intfin.2022.101526

Ma, A., Rm, A., Bk, B., and Bosek-Rak, D. (2022). Do institutional investors encourage firm to social disclosure? The stakeholder salience perspective. J. Bus. Res. 142, 674–682. doi:10.1016/j.jbusres.2021.12.064

Mao, C. X., and Weathers, J. (2019). Employee treatment and firm innovation. J. Bus. Finance Acc. 46, 977–1002. doi:10.1111/jbfa.12393

Moser, D. V., and Martin, P. R. (2012). A broader perspective on corporate social responsibility research in accounting. Account. Rev. 87, 797–806. doi:10.2308/accr-10257

Ren, S., Li, L., Han, Y., Hao, Y., and Wu, H. (2022). The emerging driving force of inclusive green growth: Does digital economy agglomeration work? Bus. Strategy Environ. 31 (4), 1656–1678. doi:10.1002/bse.2975

Ruan, L., and Liu, H. (2021). Environmental, social, governance activities and firm performance: Evidence from China. Sustainability 13, 767. doi:10.3390/su13020767

Simnett, R., Vanstaelen, A., and Chua, W. (2009). Assurance on sustainability reports: An international comparison. Account. Rev. 84, 937–967. doi:10.2308/accr.2009.84.3.937

Su, Y., Li, Z., and Yang, C. (2021). Spatial interaction spillover effects between digital financial technology and urban ecological efficiency in China: An empirical study based on spatial simultaneous equations. Int. J. Environ. Res. Public Health 18, 8535. doi:10.3390/ijerph18168535

Syed, M. W., Li, J. Z., Junaid, M., and Ziaullah, M. (2020). Relationship between human resource management practices, relationship commitment and sustainable performance. Green Finance 2 (3), 227–242. doi:10.3934/gf.2020013

Tampakoudis, I., and Anagnostopoulou, E. (2020). The effect of mergers and acquisitions on environmental, social and governance performance and market value: Evidence from EU acquirers. Bus. Strategy Environ. 29, 1865–1875. doi:10.1002/bse.2475

Teng, X., Wang, Y., Wang, A., Chang, B. G., and Wu, K. S. (2021). Environmental, social, governance risk and corporate sustainable growth nexus: Quantile regression approach. Int. J. Environ. Res. Public Health 18, 10865. doi:10.3390/ijerph182010865

Tsang, A., Wang, K., Liu, S., and Yu, L. (2021). Integrating corporate social responsibility criteria into executive compensation and firm innovation: International evidence. J. Corp. Finance 70, 102070. doi:10.1016/j.jcorpfin.2021.102070

Turban, D. B., and Greening, D. W. (1997). Corporate social performance and organizational attractiveness to prospective employees. Acad. Manage. J. 40, 658–672. doi:10.5465/257057

Utomo, M. N., Rahayu, S., Kaujan, K., and Irwandi, S. A. (2020). Environmental performance, environmental disclosure, and firm value: Empirical study of non-financial companies at Indonesia stock exchange. Green Finance 2 (1), 100–113. doi:10.3934/gf.2020006

Wu, H., Hao, Y., and Ren, S. (2020). How do environmental regulation and environmental decentralization affect green total factor energy efficiency: Evidence from China. Energy Econ. 91, 104880. doi:10.1016/j.eneco.2020.104880

Wu, H., Xue, Y., Hao, Y., and Ren, S. (2021). How does internet development affect energy-saving and emission reduction? Evidence from China. Energy Econ. 103, 105577. doi:10.1016/j.eneco.2021.105577

Xi, L. (2010). The impact of product market competition on the quantity and quality of voluntary disclosures. Rev. Account. Stud. 15, 663711.

Xie, J., Nozawa, w., Yagi, M., Fujii, H., and Managi, S. (2019). Do environmental, social, and governance activities improve corporate financial performance?[J]. Bus. Strategy Environ. 28, 286–300. doi:10.1002/bse.2224

Yang, X., Wang, J., Cao, J., Ren, S., Ran, Q., and Wu, H. (2021). The spatial spillover effect of urban sprawl and fiscal decentralization on air pollution: Evidence from 269 cities in China. Empir. Econ. 63, 847–875. doi:10.1007/s00181-021-02151-y

Yang, X., Wang, W., Wu, H., Wang, J., Ran, Q., and Ren, S. (2021). The impact of the new energy demonstration city policy on the green total factor productivity of resource-based cities: Empirical evidence from a quasi-natural experiment in China. J. Environ. Plan. Manag., 1–34. doi:10.1080/09640568.2021.1988529

Zhang, J., Lyu, Y., Li, Y., and Geng, Y. (2022). Digital economy: An innovation driving factor for low-carbon development. Environ. Impact Assess. Rev. 96, 106821. doi:10.1016/j.eiar.2022.106821

Zhang, J., Wang, J., Yang, X., Ren, S., Ran, Q., and Hao, Y. (2021). Does local government competition aggravate haze pollution? A new perspective of factor market distortion. Socio-Economic Plan. Sci. 76, 100959. doi:10.1016/j.seps.2020.100959

Keywords: ESG disclosure, corporate sustainable growth, financing constraints, human capital, environmentally sensitive industries

Citation: Wang N, Li D, Cui D and Ma X (2022) Environmental, social, governance disclosure and corporate sustainable growth: Evidence from China. Front. Environ. Sci. 10:1015764. doi: 10.3389/fenvs.2022.1015764

Received: 11 August 2022; Accepted: 15 September 2022;

Published: 03 October 2022.

Edited by:

Xiaodong Yang, Xinjiang University, ChinaReviewed by:

Cunyi Yang, Sun Yat-sen University, ChinaShikuan Zhao, Chongqing University, China

Jinning Zhang, Shandong University, China

Copyright © 2022 Wang, Li, Cui and Ma. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Dayao Li, bGR5QGJiZ3UuZWR1LmNu

Nannan Wang

Nannan Wang Dayao Li2,3*

Dayao Li2,3*