- 1Department of Mathematics and Physics, School of Engineering, Australian University-Kuwait, Mishref, Kuwait

- 2Department of International Trade and Logistics, Faculty of Economics, Administrative and Social Sciences, Hasan Kalyoncu University, Gaziantep, Türkiye

- 3Management Department, Community College of Qatar, Doha, Qatar

Progress in financial inclusion has played a major role in economic development and poverty reduction. However, the environmental impact of financial inclusion calls for urgent implementation of environmental strategies to mitigate climate change. Financial inclusion forces the policies of developed countries to advance and not affect the present and future development of developing countries. Therefore, the current study aims to investigate the direct effects of information and communication technology (ICT) usage on environment as well as its moderating role on the association between financial inclusion and environmental degradation for six oil exporting countries (United Arab Emirates, Saudi Arabia, Russia, Kuwait, Canada, and the United States), using annual panel data from 1995 to 2019. We also analyze the validity of the environmental Kuznets curve (EKC) phenomenon for the entire sample, as well as the role of energy consumption and population. Employing the Method of Moments Quantile Regression (MMQR) with fixed effects, this study supported the existence of EKC phenomenon here as linkage amid human development index and carbon intensity. We find that energy consumption significantly increases carbon intensity. The empirical results showed that the application of internet- and mobile use as indicators of ICT usage lead to environmental preservation in the six oil exporting economies. Also, we observe that financial inclusion has mitigating effects on pollutant emissions, contributing to environmental preservation. Interaction between ICT usage and financial inclusion jointly reduces carbon intensity in all quantile distributions. A robustness check using an alternative proxy of the financial inclusion also confirms that ICT usage significantly and negatively moderates the association between financial inclusion and carbon intensity. Based on the findings of this study, the selected oil exporting countries should integrate financial inclusion with environmental policies to reduce carbon intensity.

1 Introduction

The natural-resources-based economies across the globe have witnessed remarkable and multifold economic growth and development in the last few decades. While the exploitation and depletion of their abundant natural resources would promote and accelerate economic and financial development (Bekun et al., 2022; Fareed et al., 2022), environmental quality would decline with such expansion in economic activities. This pressures countries to take special measures to address both the economic growth and environmental challenges under the umbrella of what is well-termed as green growth (Demissew Beyene and Kotosz, 2020; Jinqiao et al., 2021; Chen et al., 2022). Herein, the Climate Change Conference in Glasgow (COP26) claimed that a phase-down of coal power and a phase-out of inefficient fossil fuel subsidies can get the world on a more sustainable, low-carbon pathway forward. Grossman and Krueger (1995) have introduced the economic growth and environmental quality nexus with an inverted U-shaped relationship hypothesized by Kuznets (1955). The EKC denotes the major shift of the economic structure and the changes of production elements in an advanced technological economy (Lau et al., 2014). It is identified that the environment will be at stake with increased economic growth and, up to certain levels, the negative effects of economic growth on the quality of environment are reversed. In other words, the environmental degradation level is more likely to increase at the early stages of economic growth. However, once parameters such as income per capita rise to certain levels, then it is very likely that the growth level at this point of high income leads to enhanced environmental quality (Grossman and Krueger, 1992; Halkos and Managi, 2017; Alshubiri and Elheddad, 2019; Demissew Beyene and Kotosz, 2020).

Regardless of whether economic growth is a considered a crucial factor for the environment or an opportunity, the financial sector plays an important role in economic growth and consequently its influence on the environments. Based on Robinson’s (1952) demand side hypothesis of the growth-finance interconnection, an expansion of economic activities causes the financial sector to magnify its services and products based on the view that financial support creates consistent and sustainable growth. One of the major strategies to curb environmental degradation is the implementation of financial inclusion, while providing reasonable, green, and reliable energy services. Financial inclusion, as a component of sustainable economic and financial development, has been intensively discussed, and it is agreed that it promotes economic growth (Sethi and Acharya, 2018; Emara and El Said, 2021; Zaidi et al., 2021; Fareed et al., 2022). Financial inclusion is part of the 2030 Sustainable Development Goals (SDGs), and its financial inclusion principles are commonly established as agents for several developmental strategies. The inclusiveness of various groups of society in the financial system warrants, among others, capital allocations, circulation, pooling, and savings to fulfill their requirements (World Bank, 2018). In the era of globalization, the advancement of more sophisticated technological tools has increased the need for energy production and consumption, which, in turn, adds to the challenges and concerns around environmental issues (Ahmad et al., 2021; Satrovic et al., 2021; Beşe and Friday, 2022). In theory, financial inclusion could influence the environment negatively via easy access to financial products and services that increase production and industrial expansion, leading to environment degradation (Zhao et al., 2021). However, the financial sector may also play a significant role in the reduction of environmental concerns around energy emissions by promoting the use of more advanced and green technologies that mitigate the environmental effects of energy production, supply, and consumption (Le et al., 2020). State-of-the-art technologies that support a green and clean environment can foster economic development, and maintain and preserve the environment (Jordaan, 2017). Therefore, financial inclusion can be a vital factor in CO2 emissions reduction (Fareed et al., 2022). According to the IPA (2017), financial inclusion can alleviate hardship and constraints faced by poverty-stricken groups in society such as farmers who are in need of capital to invest and implement cost-effective and cleaner technology.

The rise of the information and communication technology (ICT) era has produced various advantages for economies (Zafar et al., 2022). ICT facilitates trade by allowing new markets to interact and creates growth opportunities for developed and developing economies. It also eases information transmission and enhances the tools of education, health, and production. Undeniably, ICT is a key success factor in achieving the Sustainable Development Goals (SDGs) (Chien et al., 2021). ICT comprehensively contributes to achieving all goals of sustainable development (Zhang et al., 2022), and has become pivotal for economic and business decisions with lower costs and enhanced productivity (Adedoyin et al., 2022; Zhong et al., 2022). The opportunities offered by ICT are numerous, with costs savings and convenience becoming buzzwords (Lee et al., 2022). According to Haldar and Sethi (2022), ICT can lead to energy efficiency through integrating renewable energy in all aspects of the so-called green ICT. ICT contributes significantly to enhancing energy efficiency goals through related artificial intelligence and grid optimization systems (Susam and Hudaverdi Ucer, 2019). However, the growth of ICT user-devices worldwide through mobile banking, e-government, and social media has a critical effect on energy consumption. The demand for energy is on the rise and in turn, the proportion of ICT to greenhouse gas emissions will ultimately increase, leading to environmental degradation (Zafar et al., 2022).

Despite the sizeable literature on the various aspects of environmental deterioration, there is a still a large gap in the literature with respect to the factors of environmental degradation for our study sample. Recently, more factors were introduced to analyze the reasons for environmental degradation. Considering the abovementioned point of view, the research problem identified in our paper states that no study to date analyzed whether ICT diffusion can moderate the relationship between the financial inclusion and environmental degradation for six oil exporting countries (United Arab Emirates, Saudi Arabia, Russia, Kuwait, Canada, and the United States). The current work accommodates this backdrop to significantly contribute to the existing pool of knowledge. This study contributes in four folds to the existing literature. First, the abundance of natural resources could be considered a factor in these countries’ rapid economic growth. Therefore, more environmental issues are expected to arise. Second, because the selected sample contains countries from different regions with more involvement with regard to financial development, financial technology, ICT, and human capital, the expectation is that the effects of these factors on environmental quality may vary significantly. Thus, environmental issues might be prioritized more in the case of countries that are not at the Frontier of development in various aspects. Thus, oil exporting countries might produce more and consume more energy with less financial development and inclusiveness; furthermore, their ICT development infrastructure is being far from the rest of the world. Therefore, the gain effects of using green ICT could be at a minimal level. Third, all prior research has focused on the impact of various indicators on environmental degradation; however, this study will further explore the beneficial effects of ICT-financial inclusion interaction on environmental quality. Fourth, this study adopts the Method of Moments Quantile Regression (MMQR) to spot the effects of various indicators by the conditional median of the response variable; hence, a robust and meaningful estimation can be achieved compared to the conditional mean valueThis study aims to answer two questions: 1) what is the impact of financial inclusion, economic growth, and ICT diffusion on environmental degradation in the six oil exporting countries? 2) Is ICT diffusion a moderater of the relationship between the financial inclusion and environmental degradation? The objectives of this study are to examine: 1) the impact of financial inclusion, economic growth, and ICT diffusion on environmental degradation in the six oil exporting countries; 2) whether ICT diffusion can moderate the relationship between the financial inclusion and environmental degradation.

This study is organized as follows. The next section reviews the existing literature review and the hypotheses of the study. Section 3 introduces the data and materials of the study. Section 4 presents and discusses the findings of the study. Finally, Section 5 concludes the paper and highlights the major policy implications.

2 Literature review and hypotheses development

2.1 Research on the relationship between financial inclusion and environmental degradation

The premise of financial inclusion falls under the debate on its role in reducing poverty levels and helping underprivileged people through promoting and inspiring economic growth (Beck et al., 2007; Makina and Walle, 2019; Li et al., 2021). There are two theoretical aspects of the impact of financial inclusion on environmental quality. On the one hand, from the theoretical point of view, financial inclusion assists various sectors of economies through raising funds for the purpose of expansion and growth (Rehman et al., 2021). The intensity of economic activities by way of encouraging companies to intensify their production causes energy consumption to surge, and, by implication, environmental degradation (Le and Quah, 2018; Le et al., 2020; Fareed et al., 2022). Zaidi et al. (2021) and Zhao et al. (2021) argue that achieving inclusiveness of financial services gives customers the ability to finance high-energy consumer goods such as cars, coolers, and air conditioners, with the resulting additional energy consumption magnifying the risk to the environment. Memduh Eren et al. (2022) have produced empirical evidence that financial development in Turkey has an adverse impact on environmental quality. Fareed et al. (2022) finds that environmental deterioration in the Eurozone is adversely affected by financial inclusion, although these negative effects are mitigated by the penetration of innovation. Zaidi et al. (2021) find that during the period 2004–2017, the OECD nations have experienced environmental problems due to increased energy consumption, which has unequivocally steered the CO2 emissions. Shahbaz et al. (2020) support the other findings of the negative impact of financial development on environmental quality in eight developing countries. Financial development increases CO2 emissions; as a result, the quality of the environment has worsened for the case of the United Arab Emirates. The results of Adebayo et al. (2022), Adebayo (2022), and Ganda (2021) might also support the assumption that financial globalization-induced inflow of FDI is likely to result in technology spillover.

On the other hand, other arguments have emerged in support of the positive role of financial inclusion in enhancing environmental quality. The financing activities of technological development that promote sustainable energy are key for environmental quality (Ganda, 2021). Making funds easily accessible with lower rates and more achievable financial requirements for various groups of society to finance the productive activities and initiating research and development in renewable energy play a positive function in environmental protection and help combat environmental degradation (Ganda, 2022; Kirikkaleli and Adebayo, 2021). Recent empirical studies conducted by Rahman et al. (2022), Zafar et al. (2022), and Du et al. (2022) support the positive impact of financial inclusion on environmental quality where more inclusiveness leads to better environmental quality; however, the findings of Rahman et al. (2022) are only supported for high-income countries. This might be in line with the EKC hypothesis. Therefore, this study hypothesizes the following:

H1. Financial inclusion is likely to present an ambiguous environmental impact.

Although financial inclusion might be detrimental to the environment, little empirical evidence has substantiated that the risk exposure of financial inclusion for the environment might be moderated by the diffusion of ICT (Haldar and Sethi, 2022). The latter study shows that the effects of financial inclusion on environmental quality, given the diffusion of ICT, are mixed. They found that the financial inclusion interaction with ICT diffusion, as proxied by mobile use, reduced emissions, but this not supported when internet use was applied as a proxy. Jinqiao et al. (2021) and Fareed et al. (2022) support the findings of Haldar and Sethi (2022) for the case of emerging countries. They argue that effective allocation of funds in a well-developed financial system leads to technology improvement that, in turn, reduces the environmental effects. In contrast, Zafar et al. (2022) finds that carbon emissions increase with an increase in financial development through a huge proliferation of investment in ICT equipment and infrastructure, which accelerates energy consumption and, therefore, leads to environmental deterioration. In view of the conflicting results on the moderation effect of ICT on the relationship between financial inclusion and environmental degradation, we hypothesize the following:

H2. Financial inclusion is expected to have an ambiguous influence on environmental deterioration with the penetration of ICT.

2.2 Research on the relationship between information and communication technology and environmental degradation

Information and communication technology (ICT) is a complex paradox that consists of various components including hardware, communication equipment, and software services, which has changed the lives of the people across the world (Stamopoulos et al., 2022). The proliferation of ICT helps to eradicate barriers in all aspects of businesses and enhances the flows of goods and services, which accelerates economic expansion and prosperity. One of the key areas in which ICT claims to have a major contribution is environmental quality and sustainability through the reduction of carbon emissions by shifting to more eco-friendly technology (Azam et al., 2021; Pradhan et al., 2021; Fareed et al., 2022; Zhong et al., 2022). Zhong et al. (2022) argue that efficient ICT investment reduces the energy and material input required for production and inspires a new path for energy conservation and carbon reduction. The simplification of intelligent design production tools reduces the demand for tools that are related to energy, and fosters the use of more advanced technology with cheaper costs and energy-saving (Danish, 2019; Yang and Lam, 2021; Zheng and Wang, 2021). This in turn will lead to environmental sustainability. Jinqiao et al. (2021) suggested that innovation nullifies the adverse environmental impacts of financial innovation, implying that technological innovation in the ICT sector allows the vulnerable groups of society to simultaneously access affordable financial products and adopt technological advancements to reduce pollutant emissions.

Rapid expansion of ICT and wireless ICT support renewable energy development, which can provide instrumental tools to curb emissions (Fareed et al., 2022). The findings of the study support the notion that eco-innovation offers protection against ecological problems, particularly in countries with high per-capita income. The results of Fareed et al. (2022) might also support the assumption of EKC for ICT diffusion, where ICT advancement can be beneficial only after a certain threshold of income (Haldar and Sethi, 2022). Evidence from China indicates the vital role of innovation in reducing environmental degradation (Azam et al., 2021).

Even though ICT usage facilitates the shift to low-carbon tools that are energy-saving, ICT diffusion can be considered a threat to the environment through the energy consumption of penetrated tools of ICT (Asongu et al., 2018). Recent studies have concluded that the innovation of ICT causes more environmental damage by increasing carbon emissions of intensity of ICT and its uses. Using wavelet tools, Kirikkaleli and Adebayo (2021) provide evidence that innovations lead to higher emissions in Japan. Other studies have confirmed the existence of the non-linear relationship between ICT and carbon emissions. That means that ICT’s positive impact on environmental quality occurs after a certain level of ICT development is achieved (Wu et al., 2021). Despite the conflicting results, we state the following hypothesis:

H3. ICT innovation reduces the environmental deterioration.

2.3 Research on the relationship between economic development and environmental degradation

The extant literature on environmental quality and economic growth is based on the theoretical assumption of the EKC hypothesis for the last few decades (Demissew Beyene and Kotosz, 2020). Under the EKC hypothesis, it is assumed that there is a nexus between economic growth and environmental deterioration, as reflected by an inverted U-shaped curve. The theory is based on the Kuznets (1955) linked the tendency of increasing per capita income and disparity. Kuznets’ (1955) theory has been applied later on by environmental economists such as Grossman and Krueger (1995). Grossman and Krueger (1995) examine the possible link between ecological deterioration and economic prosperity. Their approach has shown that economic expansion involves three stages, namely scale, structural, and composite effects. The scale effect occurs before the turning point, while the other two stages occur once the turning point is arrived at. According to Kirikkaleli and Adebayo (2021), the scale effect is more practical for emerging economies with non-renewable energy sources of production, while the other two stages are related to industrialized economies. Therefore, the EKC hypothesis underlines that degradation of environment is high in the preliminary stages of economic development, and after a certain threshold of prosperity, the trends return to being positive; in other words, environmental quality is enhanced with an increase in economic activities (Kuznets, 1955; Demissew Beyene and Kotosz, 2020; Memduh Eren et al., 2022).

Empirical evidence on the applicability of the EKC hypothesis has produced various findings (for instance, Alshubiri and Elheddad, 2019; Sultana et al. (2022) (. Using GDP per capita as a proxy for economic growth, the results of ARDL revealed by the study of show that economic growth leads to environmental degradation in both the short run and the long run, for the case of Bangladesh. The study also reports that human capital is negatively related to environmental degradation. Jain and Nagpal (2019) examine the impact of the human capital index on the environmental performance in South Asian nations (SANs) and India. The results of dynamic panel modelling indicate that the human capital index is positively related to environmental quality; however, they find the deviation from environmental Kuznets curve (EKC) hypotheses to link economic growth positively with climatic degradation. Their results are aligned with Demissew Beyene and Kotosz. (2020) for selected African countries, where the U-shaped inverted relationship between income per capita and environmental degradation does not exist; therefore, there is no evidence on the validity of the EKC hypothesis. Bano et al. (2018) used a long run ARDL cointegration method and found that human capital reduced CO2 emissions in Pakistan. Therefore, this study hypothesizes the following:

H4. The validity of EKC hypothesis is likely to be confirmed.

2.4 Gap in the literature

Several studies have examined the impact of financial inclusion on environmental degradation using a sample from various regions, economic and political alliance (Jinqiao et al., 2021; Fareed et al., 2022); however, to the best of our knowledge, none of these studies have examined this nexus in the case of oil exporting countries. Moreover, given the fact that oil exporting countries are unique in terms of variation in development in the area of economic and financial systems as well as technology, it is worthwhile to examine this relationship, because this would provide more insightful implications for these countries. Earlier studies have also examined the moderating role of financial inclusion and ICT on environmental degradation (for instance, Haldar and Sethi, 2022; Fareed et al., 2022); nonetheless, these studies are yet to provide conclusive results, given their unit of analysis. Therefore, reexamining the role of financial inclusion and ICT in environmental degradation in selected countries, including oil exporting countries from among advanced nations (Canada and United States) and other emerging economies (for instances Russia and Saudi Arabia) can significantly enrich the literature. Despite the long-standing interest of mainstream academic studies, the role of ICT diffusion in moderating the influence of financial inclusion on environmental degradation remains unknown. Furthermore, investigating the role of financial inclusion and ICT in countries that are among the top exporters of oil can generate further implications for these countries and contribute to policies that drive high growth in the energy sector. Herein, increased ICT diffusion may lead to the preservation of the environment, if the negative coefficient is proved with financial inclusion.

3 Materials and methods

This section of the study clarifies the theoretical framework and outlines the model construction. In addition, Section 3 discusses the data, along with the fundamental econometric procedures used to determine the effect of the human development index and its squared term, population, energy consumption, ICT diffusion, and financial inclusion on environmental degradation.

3.1 Theoretical framework and model construction

The theoretical underpinning behind the role of financial inclusion in fostering economic progress concentrates on an understanding that economic progress fosters poverty reduction through inclusive financial systems (Dahiya and Kumar, 2020; Adedokun and Ağa, 2021; Emara and El Said, 2021). There is no doubt that financial inclusion plays a major role in stimulating economic progress because it ensures the effective allocation of resources, mobilization and pooling of savings, and improves the evaluation of investments. Herein, a well-developed financial system ensures an increase in savings and investment opportunities that lead to economic progress. However, the environmental impact of financial inclusion poses a challenge and represents a new discourse to be elaborated within the framework of sustainable development goals. On the one hand, financial sector innovations ease access to technological advancements and reduce pollutant emissions by stimulating the efficient use of energy appliances. This clearly indicates that energy-efficient goods and technological advancement can be beneficial in combating environmental degradation. Moreover, by initiating research and development and increasing investment opportunities in renewable energy sources, financial inclusion reduces the spread of oil pollution (Satrovic and Abul, 2021; Du et al., 2022; Fareed et al., 2022). Financial inclusion is predominantly relevant for the vulnerable groups of society (e.g., farmers, low-income households), where access to affordable financial products may motivate them to invest in the latest technology advancements that will reduce pollution (Ahmad et al., 2022). On the other hand, financial inclusion can be detrimental to the environment by expanding the consumption of energy-intensive goods, which in turn results in more emissions in the environment. Increasing financial inclusion can also encourage companies to intensify their production, which also causes an upsurge in pollutant emissions and leads to an unfavorable environmental impact. The literature to date thus documents equivocal evidence of the interrelationship between financial inclusion and environmental degradation.

Theoretically, ICT can affect the environment in three major ways (Malmodin and Lunden, 2018): 1) the direct (primary) impacts refer to the environmental consequences of ICT production, consumption, and recycling; 2) indirect effects arise due to the environmental consequences of ICT for industry, transportation, or buildings, which leads to an increase in or reduces their pollutant emissions through technological advancements and increased energy efficiency. The indirect effects, also referred to as secondary effects, include the application of ICT towards innovation or for green energy. 3) The tertiary effects pertain to the consequences of long-term ICT adaptation that change economic structures or consumption patterns. Considering the tertiary effects, ICT can catalyze behavioral changes, because the increased efficiency reduces the prices of ICT, causing more intensified consumption. As a consequence, the consumption of energy-intensive products increases, which causes a rise in pollutant emissions. Thus, consumption patterns should be taken into consideration when developing environmental strategies directed at reducing pollutant emissions from the ICT sector (Haldar and Sethi, 2022). The positive effect of ICT and financial inclusion on economic growth has been justified by studies to date (Sassi and Goaied, 2013). ICT diffusion integrates the impact of financial inclusion on economic progress by reducing information and transaction costs. In addition, ICT infrastructure enables corporate control to be exerted, which is one of the major functions of financial intermediaries. Nonetheless, studies that explore whether ICT diffusion consolidates the impact of financial innovation on environmental degradation are scarce. Jinqiao et al. (2021) suggests that innovation nullifies the adverse environmental impacts of financial innovation, highlighting that technological innovation in ICT sector allows the vulnerable groups of the society to simultaneously access affordable financial products and adopt technological advancements to reduce pollutant emissions.

The relationship between financial inclusion and environmental degradation has also been elaborated under the umbrella of the environmental Kuznets curve (EKC) framework. Grossman and Krueger (1995) defined EKC, arguing that environmental degradation occurs during the early phase of economic emancipation whereas benefits from further economic progress are used for environmental protection. The studies to date have evaluated the validity of the EKC hypothesis by linking environmental degradation and real GDP per capita as a developmental indicator (Adedoyin et al., 2022; Satrovic et al., 2022). However, the quality of human life is not only dependent on improvements in the real GDP per capita but also on health care and education facilities. Herein, the human development index (HDI) is a better developmental indicator (Hussain and Dey, 2021). Along with an element of GDP, HDI also includes the other two dimensions of development, namely health and education; therefore, HDI is used as a developmental indicator in this current study. Energy is of crucial importance for economic activities, playing a major role in economic progress. As such, it has an adverse environmental impact. Therefore, an increase in energy consumption triggers economic progress, which in turn increases pollutant emissions. Many studies to date have suggested the positive relationship between energy consumption and environmental degradation (Muslija et al., 2019; Arshad et al., 2020; Alvarado et al., 2021; Özden and Beşe, 2021; Abul and Satrovic, 2022). Massive energy consumption due to urbanization increases environmental depletion. There is a growing consensus that population significantly promotes environmental degradation (Sultana et al., 2022).

This study looks at the financial inclusion status of six oil exporting countries in mitigating pollutant emissions. Based on the theoretical framework of the EKC phenomenon, the model specification for this study is given as (Eq. 1):

where HDI represents the human development index (HDI) as a measure of development and its squared term HDI2; EMPO indicates the employment to population ratio as a proxy for population, PECN refers to primary energy consumption as a proxy for energy consumption; ICTU stands for information and communication technology usage measured in terms of internet penetration and mobile cellular subscriptions; FI refers to the financial inclusion measured in terms of financial institutions index (INFII) and financial institutions depth index (INFID); ICDE depicts the indicator of carbon intensity measured by CO2/GDP using exchange rates kg CO2/USD (2015 prices). The basic measure of financial inclusion to be observed in this study is the financial institutions index, whereas the second measure is used for the sake of robustness. Specifying the logarithmic forms of each of the variables, the transformed layout is shown as (Eq. 2):

where i denotes the six oil exporting countries and t denotes the time period; L denotes the natural logarithm;

Among the different indicators of ICT, a boom in the spread of internet- and mobile use is witnessed in the countries investigated. To test the impact of mobile cellular subscriptions—MPH—the basic model (2) is replaced by (Eq. 3):

We further introduce the second indicator of information and communication technology usage, and replace the basic model as (Eq. 4):

where IUI refers to individuals using the internet (% of population).

In addition to the direct impact of ICT, this study also analyzes its indirect effects through interaction with financial inclusion. The model (3) is extended to (Eq. 5):

where Mod1 = MPH*INFII.

We hypothesize that the relationship between financial inclusion and environmental degradation strengthens with improvement in the ICT usage. Further, to test whether the interaction between individuals using the internet and financial inclusion jointly reduces environmental degradation, model (4) is replaced by (Eq. 6):

where Mod2= IUI*INFII.

3.2 Data

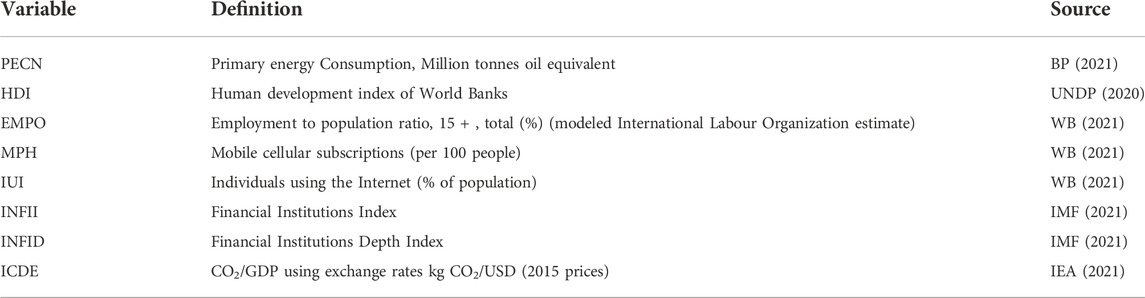

Our study explores the effect of the human development index and its squared term, population, energy consumption, ICT diffusion, and financial inclusion on environmental degradation by using annual balanced panel data of six major oil exporting countries (United Arab Emirates, Saudi Arabia, Russia, Kuwait, Canada, and the United States). These countries are selected for two reasons. First, oil exporting countries are blessed with oil reserves with lower crude oil prices. Second, because of the low price elasticity of crude oil demand, oil exporting countries are able to import more energy-intensive products thanks to more income. Considering these two reasons, the selected countries are likely to increase pollutant emissions. All data covered the period 1995–2019, with sourcing restricted by data availability. Table 1 offers detailed information on the variables used in this study.

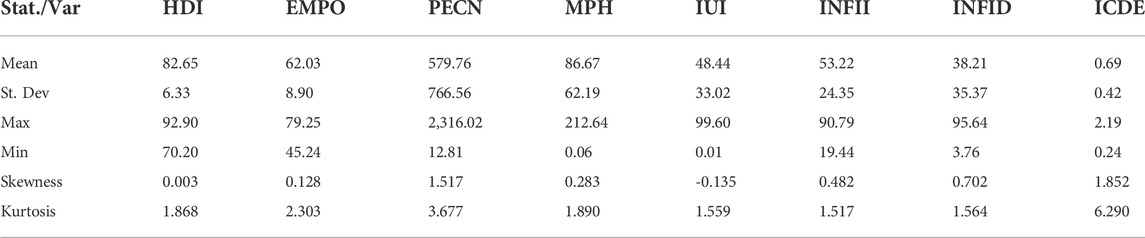

The annual HDI data were collected from the United Nations Development Programme (Hussain and Dey, 2021). The data on employment to population ratio, mobile cellular subscriptions, and individuals using the internet were gathered from the World Bank (Haldar and Sethi, 2022; Sultana et al., 2022). Following (Ahmad et al., 2022; Fareed et al., 2022), this study retrieved financial inclusion data from the International Monetary Fund. The data on primary energy consumption were collected from British Petroleum (Arshad et al., 2020), whereas the International Energy Agency provided the data for ICDE, as reported in the literature (Rahman et al., 2022). Table 2 presents the descriptive statistics.

As shown in Table 2, all variables have positive mean values. The highest human development index is reported for Canada in 2019, while the lowest human development index is reported for Russia in 1995. Considering the ICT indicators, the maximum value of MPH is reported for the United Arab Emirates in 2016 whereas Russia reports the minimum value in 1995; the maximum value of IUI is reported for Kuwait in 2018 whereas the minimum value is reported for Saudi Arabia in 1995. When the financial inclusion proxies are considered, the maximum value of the financial institutions index is reported for Canada in 2012, while Russia has the minimum value; the maximum value of INFID is reported for Canada in 2016 and the minimum value for Russia in 1995. Considering the carbon intensity, the maximum value is reported for Russia in 1996 whereas the minimum value is reported for the United States in 2019.

3.3 Panel estimation techniques

In this study, the fundamental procedures for determining the effect of the human development index and its squared term, population, energy consumption, ICT diffusion, and financial inclusion on environmental degradation were as follows: first, we start by checking for cross-sectional dependence (CD) in the variables. In the second step, second-generation unit root tests are used to obtain robust estimates. Third, after performing these initial investigations, the Method of Moments Quantile Regression (MMQR) with fixed effects for panel data is used to identify the conditional heterogeneous covariance impacts of the predictors of carbon intensity namely the human development index, human development index squared, population, energy consumption, information and communication technology diffusion, and financial inclusion.

We first determine whether there is cross-sectional dependency between the variables. Cross-sectional dependence is an important property of the variables to be checked—if it were ignored, it can cause size distortion and biased or spurious results. This study employs the Pesaran (2007) cross-sectional dependence (CD) test to identify the possible presence of the cross-sectional dependency problem. The test statistics for CD are explained using the following equation (Eq. 7):

where

It is also vital to perform a preliminary test to check for the stationary properties of the variables. In the presence of cross-sectional dependence, it is necessary to perform second-generation unit root tests to obtain robust estimates of the coefficients. To avoid biased results, this study employs the Im et al. (2003) cross-sectionally augmented (CIPS) panel unit test to address the impact of CD and heterogeneity. Pesaran (2007) explains the estimation of the CIPS unit root test using the following equation (Eq. 8):

For Eq. 8,

Under the specification in Eq. 2, the presence of the EKC phenomenon is certified if

For Eq. 9,

where Mod3 = MPH∗INFID, Mod4 = IUI∗INFID.

4 Empirical evidence and discussion

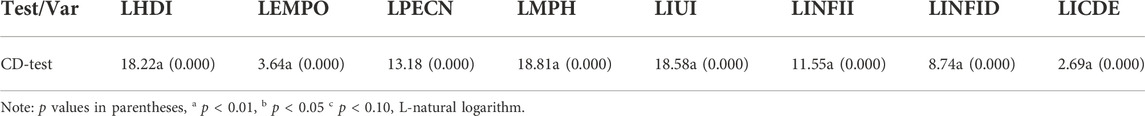

The analysis begins with diagnostic tests. We start by checking for cross-sectional dependence (CD) in the variables, employing the test first put forth by Pesaran (2007). Table 3 summarizes the initial cross-sectional dependence test for evaluating the interconnection between the selected countries.

Table 3 depicts a signal for the rejection of the null hypothesis of no cross-sectional dependence, implying that the variables under investigation exhibit CD. Based on these findings, it can be inferred that the selected six oil exporting countries have been interconnected through several channels, especially economic ones. This means that a shock in one oil exporting economy is transmitted to the other five countries. In other words, the unobserved common factors in financial inclusion and ICT diffusion in one examined country are transmitted to other countries. Nowadays, it is quite common for countries to hold cross-sectional dependence in longitudinal data. If unnoticed, it can considerably weaken the efficiency of panel data and lead to biased results.

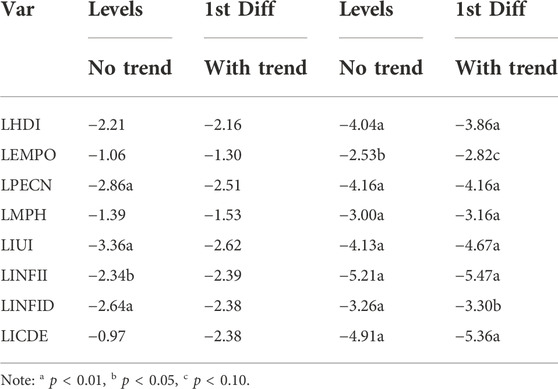

Given the presence of cross sectional dependence in all the variables in the study, we further use the second-generation unit root tests to obtain robust estimates. In order to inspect more precisely the integrating properties of the variables, our study employs the cross-sectionally augmented (CIPS) panel unit test of Im et al. (2003). Table 4 depicts second-generation unit-root test of the panel variables.

Table 4 clearly shows that human development index, employment to population ratio, mobile cellular subscriptions, and carbon intensity are non-stationary at levels, intercept included. The null hypothesis on unit root could not be rejected for all variables at their levels, intercept and trend included. The CIPS test was robust to cross-sectional dependence, further showing that all variables are stationary at their first difference. Given that we are able to reject the null hypothesis on unit root for all variables at their first difference, it can be concluded that this study’s variables are first-difference stationary and exhibit the same order of integration I (1).

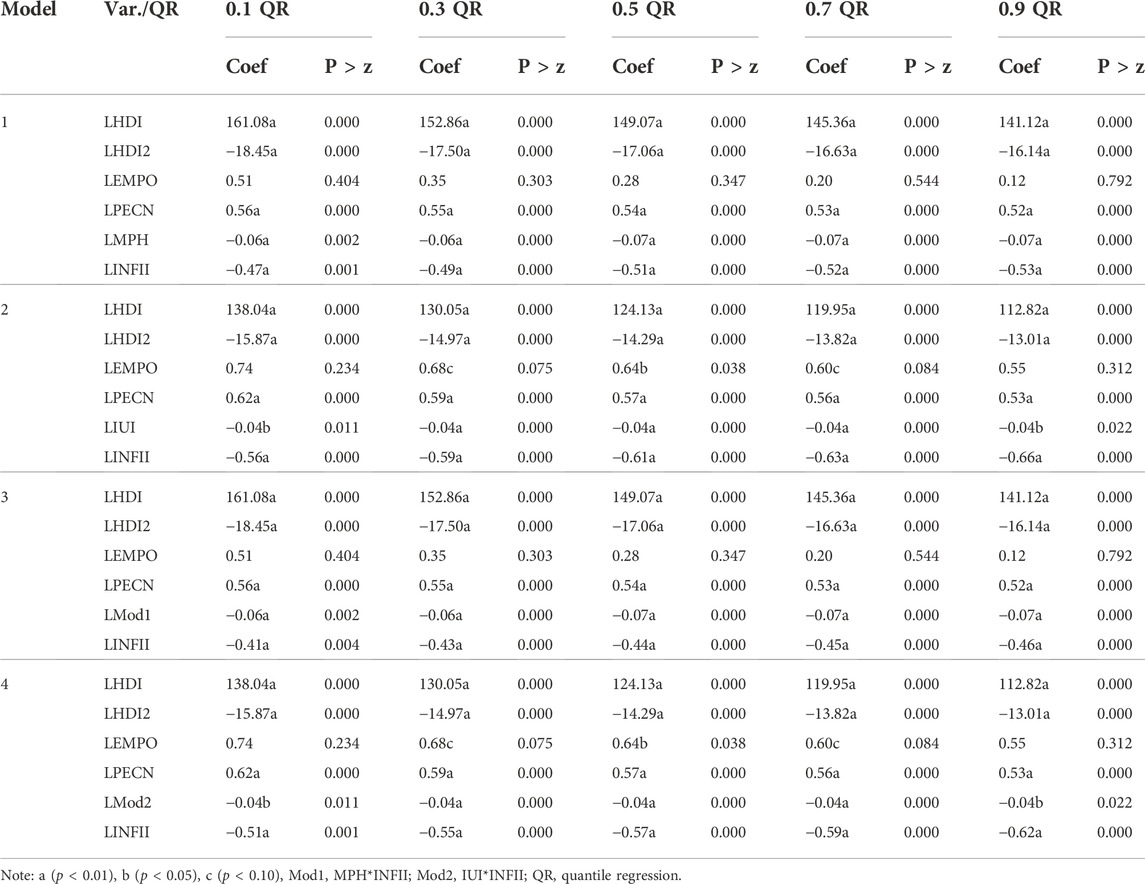

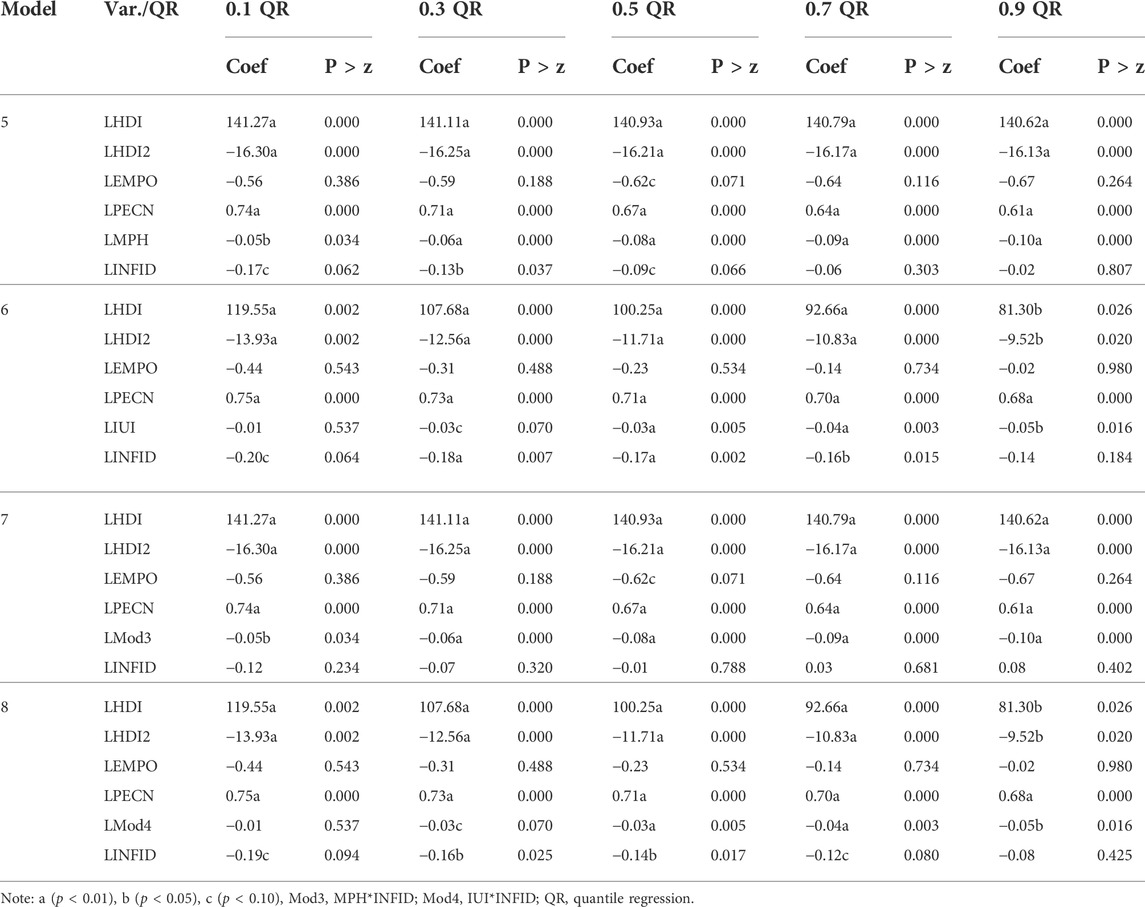

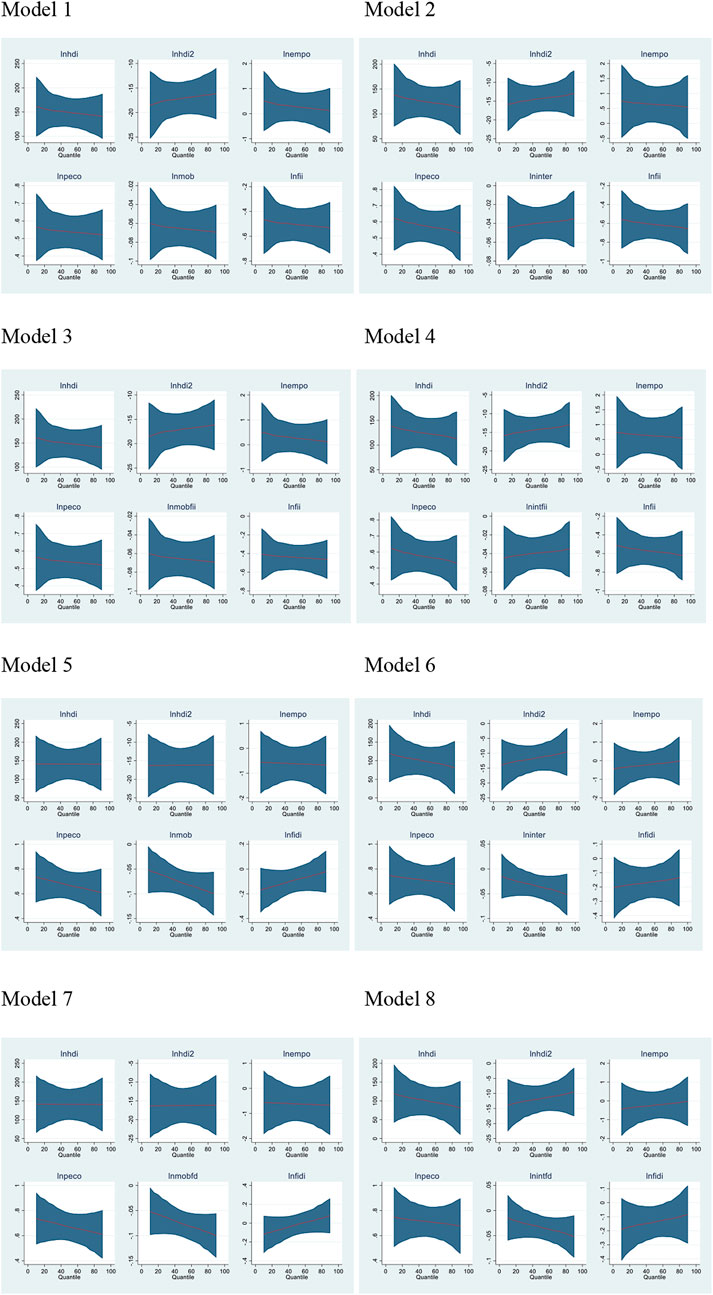

After performing these initial investigations, the Method of Moments Quantile Regression (MMQR) with fixed effects for panel data is used to identify the conditional heterogeneous covariance impacts of the predictors of carbon intensity namely the human development index, human development index squared, population, energy consumption, information and communication technology diffusion, and financial inclusion. The outcomes of the MMQR at the odd quantiles are presented in Table 5, whereas the graphical representations (Figure 1) visualize the impact of predictors on carbon intensity at the even quantiles (the voluminous output of MMQR estimation is available upon request). Table 5 and Figure 1 estimate the effects of the determinants of carbon intensity across the selected quantiles of 0.1, 0.2, 0.3, 0.4, 0.5, 0.6, 0.7, 0.8, and 0.90.

FIGURE 1. Plotting results from panel quantile regression. Note: lnhdi = LHDI, lnhdi2 = LHDI2, lnempo = LEMPO, lnpeco = LPECN, lnmob = LMPH, lninter = LIUI, lnfii = LINFII, lnfidi = LINFID, lnmobfii = LMod1, lnintfii = LMod2, lnmobfd = LMod3, lnintfd = LMod4.

The first finding reveals that the impact of economic development, captured by the human development index, on carbon intensity is significant across all quantiles, with the EKC hypothesis being confirmed for all quantiles in models 1–4, concurring with (Lai and Chen, 2020; Hussain and Dey, 2021; Li and Xu, 2021). There is strong statistically significant support for the EKC hypothesis for all countries. The outcomes of this paper hypothesize the inverted U-shaped relationship between economic development and environmental degradation (H4). It means that at the early stages of economic emancipation, both environmental degradation and income exhibit an increasing trend, because of the higher importance given to economic progress than to environmental protection. After a threshold level of economic emancipation, the developmental income is used for environmental protection, and environmental degradation would start to dwindle. Thus arrangement of economic development mimics environmental sustainability. In regard to the coefficient with human development index, Table 5 and Figure 1 depict a positive and significant association with carbon intensity for all quantiles exhibiting a decreasing trend. Considering the coefficient with human development index squared, the outcomes outline a negative and significant association with carbon intensity for all quantiles signaling an increasing trend. It can be inferred from these findings that the selected oil exporting countries have already reached a particular level of development, prioritizing environmental quality above economic progress. In contrast, (Jain and Nagpal, 2019), confirmed the deviation from environmental Kuznets curve (EKC) for the selected South Asian nations.

The second finding shows a positive relationship between population and environmental degradation. The coefficient estimates validate an adverse environmental impact of population proxied by employment to population ratio. Herein, models 1 and 3 reveal a positive linkage amid employment to population ratio and carbon intensity. The coefficients of LEMPO exhibit a decreasing trend in different quantiles and show a statistically insignificant impact. In contrast, models 2 and 4 suggest a statistically significant positive coefficient with LEMPO in the 30th–70th quantile that exhibits a decreasing trend. These findings can be reasoned based on the fact that economic progress increases with a rising employment to population ratio. Intensified economic progress leads to more intensive energy consumption and causes more anthropogenic emissions into the atmosphere. These findings outline that a higher level of employment to population ratio increase carbon intensity more in countries that have median or below median carbon intensity. The positive impact of population on environmental degradation is pertinent to some previous studies (Rehman et al., 2021; Verbič et al., 2021; Jena et al., 2022; Satrovic and Adedoyin, 2022; Sultana et al., 2022). The negative trend shows that the impact of the employment to population ratio on carbon intensity decreases when moving from the lower to the upper quantiles.

The third finding demonstrates that the effect of energy consumption on carbon intensity is statistically significant and positive for all quantiles in models 1–4. The coefficients of primary energy consumption show a decreasing trend in different quantiles for all models, meaning that the impact of energy consumption on carbon intensity reduces while moving from the lower to the upper quantiles. The finding that energy consumption exerts a positive effect on environmental degradation clearly indicates that energy consumption creates environmental pressure on the oil exporting countries. Energy exerts a negative environmental impact because the examined nations strongly depend on fossil fuel energy sources to meet their energy demands. Besides, an increase in energy consumption triggers economic progress, which in turn increases pollutant emissions. Given the fact that oil exporting countries mostly utilize fossil-fuel-based energy sources, the positive impact of primary energy consumption on environmental degradation is consistent with our expectations. This result echoes the major conclusion of Ahmad et al. (2021), who found that non-renewable energy consumption improves economic performance but has an adverse environmental impact in the case of the Organisation for Economic Co-operation and Development (OECD) countries. Similarly, Alvarado et al. (2021) justified a positive coefficient with energy consumption indicating that the reduction of fossil-fuel-based energy consumption is crucial in reducing greenhouse gases emissions. Despite the fact that both developed and developing countries are affected by anthropogenic emissions, Alvarado et al. (2021) outline that rich countries consume more non-renewable energy and, hereinafter, make a larger contribution to climate change in comparison with developing countries. Given that non-renewable energy is still in high demand, the achievement of sustainable development is more urgent than before and demands effort from the rich and developed countries.

The fourth finding includes the direct effects of ICT on carbon intensity (H3). In order to evaluate the effect of different indicators of ICT usage across different quantiles of carbon intensity, we employ the MMQR with fixed effects for panel data. The negative coefficient shows that the spread of mobile use decreases while moving from the lower to the upper quantiles. A 1% rise in mobile cellular subscriptions leads to a drop in carbon intensity equal to 0.060%–0.069% in model 1. Put differently, the negative coefficient signals that the spread of internet use increases when moving from the lower to the upper quantiles. A 1% rise in individuals using the internet (% of population) leads to a decline in carbon intensity equal to 0.035%–0.047% in model 2. The outcomes discovered for ICT diffusion intakes are negative and statistically significant across the observed quantiles, meaning that an increase in ICT usage will reduce the environmental degradation experienced in the studied oil exporting countries. The results of our study support the indirect impact of ICT usage on environmental degradation, indicating that ICT usage reduces pollutant emissions by increasing energy efficiency and supporting technological advancements. The indirect impact also refers to the application of ICT in renewable energy innovation projects. Our finding is consistent with the empirical study of Haldar and Sethi (2022), who confirmed that internet usage is found to reduce pollutant emission significantly. Besides, their results show that the use of mobile phones significantly reduce carbon emissions. The negative sign of the coefficient value of ICT usage echoes the major conclusion of Jinqiao et al. (2021) but contradicts Arshad et al. (2020) who found a positive impact of ICT usage on environmental degradation in Asian economies, clearly pointing at the low energy efficiency of ICT goods and services.

From Table 5 and Figure 1, our fifth finding revealed that the coefficient of financial inclusion is negatively and significantly related to the carbon intensity in models 1–4 (H1). Specifically, this means that a 1% rise in financial inclusion can reduce the carbon intensity in long term by 0.468%–0.656% in models 1 and 2. The results further indicate that the financial inclusion for all levels has a statistically significant effect on the carbon intensity and the estimated parameters follow a declining pattern, signaling that a higher level of financial inclusion can reduce carbon intensity more in the countries which have lower carbon intensity. This implies that the improvement in financial inclusion tends to contribute immensely to environmental quality in oil exporting economies. The negative sign of the coefficient value of financial inclusion may stem from the fact that improving financial inclusion stimulate energy-efficiency of products and services and ease the access to the technological advancements. Also, financial inclusion initiates renewable energy innovation projects and by that means significantly contribute to the environmental quality. Therefore it is consistent with Du et al. (2022) who posited the negative relationship between financial inclusion and carbon dioxide emissions on all the quantiles after the first. The negative coefficient with financial inclusion is reasoned for the fact that it improves the efficiency of money use, which may be directed towards low-carbon emitting technologies and be beneficial for the environmental quality. Put differently, our result differs from Zaidi et al. (2021) who confirmed that improvement in financial inclusion in OECD countries eases the purchase of energy-intensive goods (such as cars and air conditioners), which results in more pollutant emissions. For similar reasons, the findings of Fareed et al. (2022) support the negative environmental impact of financial inclusion in the Eurozone.

The final finding shows that the interaction effect between mobile use and financial inclusion measured by financial institutions is found to be statistically significant and negative in model 3, exhibiting a decreasing trend in different quantiles (H2). In model 4, the interaction of internet use with financial inclusion is found to significantly reduce carbon intensity, exhibiting an increasing trend. These findings indicate that the introduction of moderate ICT usage on financial inclusion in six oil exporting countries reduces environmental degradation. The interaction effect of ICT usage leads to the preservation of the environment, as proved by the negative sign of coefficient with financial inclusion. It is also worth mentioning that ICT usage improves the beneficial environmental impacts of financial inclusion. Both ICT usage and interaction-term were found to reduce carbon intensity significantly for all the panel-quantiles based on their carbon intensity levels. In other words, ICT usage and financial inclusion together interact to reduce carbon intensity, which was validated for both mobile- and internet use. Our findings correspond to those of Haldar and Sethi (2022) in the case of emerging economies. Also, Jinqiao et al. (2021) supported this view, suggesting that technological progress supports nations in replacing polluting resources with other environmentally friendly resources.

We check the robustness of our results using an alternative indicator of financial inclusion, namely the financial institutions depth index. Table A1 depicts the impact of the independent variables on carbon intensity. The outcomes in the table are robust to the findings presented in Table 5 and Figure 1 across all estimations. Specifically, the effect of economic development captured by HDI on carbon intensity is significant across all quantiles with the EKC hypothesis being validated for all quantiles. In addition, population has no significant effect on carbon intensity in models 6 and 8, whereas the negative coefficient with population is insignificant in models 5 and 7 (except for the 50th and 60th quantiles). The results based on energy consumption, however, show that its effect on carbon intensity is positive in all the quantiles and statistically significant in models 5–8. As expected, the impact of ICT usage and financial inclusion measured by the financial institutions depth index, as well as the moderation effects, are statistically significant and negative. Based on these findings, it can be concluded that the impact of financial inclusion on carbon intensity is strengthened by better ICT diffusion.

5 Conclusion and policy implications

This study examined a panel dataset for six oil exporting countries from 1995 to 2019 to determine how variables such as financial inclusion, ICT diffusion, and economic growth affect environmental degradation and whether ICT diffusion can moderate the relationship between financial inclusion and environmental degradation. The six oil exporting countries are among the world’s largest contributors to environmental degradation. With their abundance of resources, these nations have experienced very promising economic and financial development; therefore, one of their major challenges is to develop a clear vision in regard to environmental strategies and environmental change. In combating the negative consequences of such strong economic and financial development, ICT can serve as a pillar to moderate this relationship. Therefore, the moderating effect of ICT usage encourages improvement of policies related to preserving the environment in the six-oil exporting countries. This study strongly concluded in its findings the existence of an inverted U-shaped EKC hypothesis for all investigated six oil exporting counties. This main result unveils the achievement of some level of development in the sample of six oil exporting countries, beyond which the importance of the environment has been prioritized over economic growth. Furthermore, the findings of this study for the sample of six oil exporting countries demonstrates a negative impact of energy consumption on the environment across the quantiles. Results show that ICT and financial inclusion are significant factors that play a role in the improvement of the environmental quality. Remarkably, the interaction of both ICT and financial inclusion is very favorable because they exert a positive impact on the environment. Because economic growth plays a role in supporting the environmental quality of the examined nations, given the existence of EKC, it is strongly recommended that these countries take advantage of their natural resources to support and consistently drive their economic growth and hence reduce environmental degradation. Considering that economic growth and financial inclusion are likely to improve the environment in the six oil exporting countries, the energy consumption patterns in these countries promote environmental degradation. Therefore, it is recommended that these countries improve their energy consumption by executing activities based on natural and renewable energy resources to prevent environmental degradation through financing activities that are high-tech innovative and environment-friendly. Governments and policy-makers are highly encouraged to introduce policies aimed at educating people on managing and reducing energy consumption, and encouraging financial inclusion and ICT usage. Moreover, people in these countries should be made aware of the negative effects of energy consumption on the environment, and educated about the benefits of financial inclusion and given the appropriate skillsets to optimize on ICT usage for the environment. They should also introduce policies for businesses and enterprises to avoid pollution and ultimately conserve the environment. Additionally, these businesses should be environment friendly and implement environment-friendly technologies. Policy makers should keep in mind that attracting investments should always be aligned with green business vision to save the environment. Even though this study extends several vital contributions to the theoretical and empirical literature, some limitations may guide future research in the same domain. Firstly, since this study is limited to only oil exporting countries, future studies should include importing countries which might capture various effects regarding the ICT and financial inclusion on the environment. Secondly, this study incorporates Depth as the financial inclusion indicator, future studies should incorporate more comprehensive indicators including depth and access as well.

Data availability statement

Publicly available datasets were analyzed in this study. This data can be found here: UNDP WB IMF IEA BP.

Author contributions

Study conception and design: ES data collection and methodology, analysis, interpretation of results: ES conclusion and policy recommendation: SD and FS introduction, literature review and draft manuscript preparation: SD and FS. All authors reviewed the results and approved the final version of the manuscript.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Abbreviations

ARDL, autoregressive distributed lag model; CD, cross-sectional dependence test; CIPS, cross-sectionally augmented panel unit test; EKC, environmental kuznets curve; GDP, gross domestic product; ICT, information and communication technology; IPA, innovations for poverty actions; MMQR, method of moments quantile regression; OECD, organization for economic cooperation and development; SANs, south asian nations; SDG, sustainable development goals.

References

Abul, S. J., and Satrovic, E. (2022). Revisiting the environmental impacts of railway transport: Does EKC exist in South-eastern europe? Pol. J. Environ. Stud. 31, 539–549. doi:10.15244/pjoes/141329

Adebayo, T. S. (2022). 2022. Renewable energy consumption and environmental sustainability in Canada: Does political stability make a difference? Environ. Sci. Pollut. Res. 29, 61307–61322. doi:10.1007/s11356-022-20008-4

Adebayo, T. S., Awosusi, A. A., Rjoub, H., Agyekum, E. B., and Kirikkaleli, D. (2022). The influence of renewable energy usage on consumption-based carbon emissions in MINT economies. Heliyon 8, e08941. doi:10.1016/j.heliyon.2022.e08941

Adedokun, M. W., and Ağa, M. (2021). Financial inclusion: A pathway to economic growth in sub-saharan african economies. Int. J. Fin. Econ. doi:10.1002/ijfe.2559

Adedoyin, F. F., Satrovic, E., and Kehinde, M. N. (2022). The anthropogenic consequences of energy consumption in the presence of uncertainties and complexities: Evidence from World Bank income clusters. Environ. Sci. Pollut. Res. 29, 23264–23279. doi:10.1007/s11356-021-17476-5

Ahmad, M., Ahmed, Z., Bai, Y., Qiao, G., Popp, J., and Oláh, J. (2022). Financial inclusion, technological innovations, and environmental quality: Analyzing the role of green openness. Front. Environ. Sci. 10, 80. doi:10.3389/fenvs.2022.851263

Ahmad, M., Muslija, A., and Satrovic, E. (2021). Does economic prosperity lead to environmental sustainability in developing economies? Environmental Kuznets curve theory. Environ. Sci. Pollut. Res. 28, 22588–22601. doi:10.1007/s11356-020-12276-9

Alshubiri, F., and Elheddad, M. (2019). Foreign finance, economic growth and CO2 emissions nexus in OECD countries. Int. J. Clim. Chang. Strateg. Manag. 12, 161–181. doi:10.1108/ijccsm-12-2018-0082

Alvarado, R., Deng, Q., Tillaguango, B., Méndez, P., Bravo, D., Chamba, J., et al. (2021). Do economic development and human capital decrease non-renewable energy consumption? Evidence for OECD countries. Energy 215, 119147. doi:10.1016/j.energy.2020.119147

Arshad, Z., Robaina, M., and Botelho, A. (2020). The role of ICT in energy consumption and environment: An empirical investigation of asian economies with cluster analysis. Environ. Sci. Pollut. Res. 27, 32913–32932. doi:10.1007/s11356-020-09229-7

Asongu, S. A., Le Roux, S., and Biekpe, N. (2018). Enhancing ICT for environmental sustainability in sub-Saharan Africa. Technol. Forecast. Soc. Change 127, 209–216. doi:10.1016/j.techfore.2017.09.022

Azam, A., Rafiq, M., Shafique, M., and Yuan, J. (2021). Does nuclear or renewable energy consumption help to control environmental pollution? New evidence from China. Renew. Energy Focus 39, 139–147. doi:10.1016/j.ref.2021.08.002

Bano, S., Zhao, Y., Ahmad, A., Wang, S., and Liu, Y. (2018). Identifying the impacts of human capital on carbon emissions in Pakistan. J. Clean. Prod. 183, 1082–1092.

Beck, T., Demirgüç-Kunt, A., and Levine, R. (2007). Finance, inequality and the poor. J. Econ. GrowthBost. 12, 27–49. doi:10.1007/s10887-007-9010-6

Bekun, F. V., Adedoyin, F. F., Lorente, D. B., and Driha, O. M. (2022). Designing policy framework for sustainable development in Next-5 largest economies amidst energy consumption and key macroeconomic indicators. Environ. Sci. Pollut. Res. 29, 16653–16666. doi:10.1007/s11356-021-16820-z

Beşe, E., and Friday, H. S. (2022). The relationship between external debt and emissions and ecological footprint through economic growth: Turkey. Cogent Econ. Finance 10, 2063525. doi:10.1080/23322039.2022.2063525

BP (2021). The BP statistical review of world energy – main indicators. https://knoema.com/atlas/sources/BP (accessed March2022 20).

Chen, S., Zhang, H., and Wang, S. (2022). Trade openness, economic growth, and energy intensity in China. Technol. Forecast. Soc. Change 179, 121608. doi:10.1016/j.techfore.2022.121608

Chien, F., Anwar, A., Hsu, C. C., Sharif, A., Razzaq, A., and Sinha, A. (2021). The role of information and communication technology in encountering environmental degradation: Proposing an SDG framework for the BRICS countries. Technol. Soc. 65, 101587. doi:10.1016/j.techsoc.2021.101587

Dahiya, S., and Kumar, M. (2020). Linkage between financial inclusion and economic growth: An empirical study of the emerging Indian economy. Vision. 24, 184–193. doi:10.1177/0972262920923891

Danish, (2019). Effects of information and communication technology and real income on CO2 emissions: The experience of countries along Belt and Road. Telematics Inf. 45, 101300. doi:10.1016/j.tele.2019.101300

Demissew Beyene, S., and Kotosz, B. (2020). Testing the environmental Kuznets curve hypothesis: An empirical study for east african countries. Int. J. Environ. Stud. 77, 636–654. doi:10.1080/00207233.2019.1695445

Du, Q., Wu, N., Zhang, F., Lei, Y., and Saeed, A. (2022). Impact of financial inclusion and human capital on environmental quality: Evidence from emerging economies. Environ. Sci. Pollut. Res. 29, 33033–33045. doi:10.1007/s11356-021-17945-x

Emara, N., and El Said, A. (2021). Financial inclusion and economic growth: The role of governance in selected MENA countries. Int. Rev. Econ. Finance 75, 34–54. doi:10.1016/j.iref.2021.03.014

Fareed, Z., Rehman, M. A., Adebayo, T. S., Wang, Y., Ahmad, M., and Shahzad, F. (2022). Financial inclusion and the environmental deterioration in Eurozone: The moderating role of innovation activity. Technol. Soc. 69, 101961. doi:10.1016/j.techsoc.2022.101961

Ganda, F. (2022). The nexus of financial development, natural resource rents, technological innovation, foreign direct investment, energy consumption, human capital, and trade on environmental degradation in the new BRICS economies. Environ. Sci. Pollut. Res. Int. 1–16. doi:10.1007/s11356-022-20976-7

Ganda, F. (2021). The non-linear influence of trade, foreign direct investment, financial development, energy supply and human capital on carbon emissions in the BRICS. Environ. Sci. Pollut. Res. 28, 57825–57841. doi:10.1007/s11356-021-14704-w

Grossman, G. M., and Krueger, A. B. (1995). Economic growth and the environment. Q. J. Econ. 110, 353–377. doi:10.2307/2118443

Haldar, A., and Sethi, N. (2022). Environmental effects of Information and Communication Technology-Exploring the roles of renewable energy, innovation, trade and financial development. Renew. Sustain. Energy Rev. 153, 111754. doi:10.1016/j.rser.2021.111754

Halkos, G. E., and Managi, S. (2017). Measuring the effect of economic growth on countries’ environmental efficiency: A conditional directional distance function approach. Environ. Resour. Econ. (Dordr). 68, 753–775. doi:10.1007/s10640-016-0046-y

Hussain, A., and Dey, S. (2021). Revisiting environmental Kuznets curve with HDI: New evidence from cross-country panel data. J. Environ. Econ. Policy 10, 324–342. doi:10.1080/21606544.2021.1880486

IEA (2021). GHG emissions from energy. https://www.iea.org/data-and-statistics/data-product/greenhouse-gas-emissions-from-energy#ghg-emissions-from-fuel-combustion (accessed March 27, 2022).

Ike, G. N., Usman, O., and Sarkodie, S. A. (2020). Testing the role of oil production in the environmental Kuznets curve of oil producing countries: New insights from method of moments quantile regression. Sci. Total Environ. 711, 135208. doi:10.1016/j.scitotenv.2019.135208

Im, K. S., Pesaran, M. H., and Shin, Y. (2003). Testing for unit roots in heterogeneous panels. J. Econ. 115, 53–74. doi:10.1016/s0304-4076(03)00092-7

IMF (2021). Financial development index database. https://data.imf.org/?sk=F8032E80-B36C-43B1-AC26-493C5B1CD33B (accessed March 23, 2022).

IPA (2017). Climate change and financial inclusion. Available at: https://www.povertyaction.org/sites/default/files/publications/Climate-Change-Financial-Inclusion_Final.pdf (accessed June 26, 2022).

Jain, M., and Nagpal, A. (2019). Relationship between environmental sustainability and human development index: A case of selected South asian nations. Vision. 23, 125–133. doi:10.1177/0972262919840202

Jena, P. K., Mujtaba, A., Joshi, D. P. P., Satrovic, E., and Adeleye, B. N. (2022). Exploring the nature of EKC hypothesis in asia’s top emitters: Role of human capital, renewable and non-renewable energy consumption. Environ. Sci. Pollut. Res. Int. 1–20. doi:10.1007/s11356-022-21551-w

Jinqiao, L., Maneengam, A., Saleem, F., and Mukarram, S. S. (2021). Asymmetric effects of eco-innovation and human capital development in realizing environmental sustainability in China: Evidence from quantile ARDL framework. Econ. Research-Ekonomska Istraživanja, 3940–3960. doi:10.1080/1331677x.2021.2019598

Jordaan, J. A. (2017). Producer firms, technology diffusion and spillovers to local suppliers: Examining the effects of foreign direct investment and the technology gap. Environ. Plan. A 49, 2718–2738. doi:10.1177/0308518x17731942

Kirikkaleli, D., and Adebayo, T. S. (2021). Do renewable energy consumption and financial development matter for environmental sustainability? New global evidence. Sustain. Dev. 29, 583–594. doi:10.1002/sd.2159

Lai, S. L., and Chen, D. N. (2020). A research on the relationship between environmental sustainability management and human development. Sustainability 12, 9001. doi:10.3390/su12219001

Lau, L. S., Choong, C. K., and Eng, Y. K. (2014). Investigation of the environmental Kuznets curve for carbon emissions in Malaysia: Do foreign direct investment and trade matter? Energy Policy 68, 490–497. doi:10.1016/j.enpol.2014.01.002

Le, T. H., Le, H. C., and Taghizadeh-Hesary, F. (2020). Does financial inclusion impact CO2 emissions? Evidence from asia. Finance Res. Lett. 34, 101451. doi:10.1016/j.frl.2020.101451

Le, T. H., and Quah, E. (2018). Income level and the emissions, energy, and growth nexus: Evidence from Asia and the Pacific. Int. Econ. 156, 193–205. doi:10.1016/j.inteco.2018.03.002

Lee, C. C., Yuan, Z., and Wang, Q. (2022). How does information and communication technology affect energy security? International evidence. Energy Econ. 109, 105969. doi:10.1016/j.eneco.2022.105969

Li, A., Gao, L., Chen, S., Zhao, J., Ujiyad, S., Huang, J., et al. (2021). Financial inclusion may limit sustainable development under economic globalization and climate change. Environ. Res. Lett. 16, 054049. doi:10.1088/1748-9326/abf465

Li, X., and Xu, L. (2021). Human development associated with environmental quality in China. Plos One 16, e0246677. doi:10.1371/journal.pone.0246677

Machado, J. A., and Silva, J. S. (2019). Quantiles via moments. J. Econ. 213, 145–173. doi:10.1016/j.jeconom.2019.04.009

Makina, D., and Walle, Y. M. (2019). “Financial inclusion and economic growth: Evidence from a panel of selected african countries,” in Extending financial inclusion in Africa (Massachusetts, United States: Academic Press), 193–210.

Malmodin, J., and Lundén, D. (2018). The energy and carbon footprint of the global ICT and E&M sectors 2010–2015. Sustainability 10, 3027. doi:10.3390/su10093027

Memduh Eren, B., Katircioglu, S., and Gokmenoglu, K. K. (2022). The moderating role of informal economy on financial development induced EKC hypothesis in Turkey. Energy & Environ. 33, 1203–1226. doi:10.1177/0958305x211070775

Muslija, A., Satrovic, E., and Colakovic, N. (2019). Dynamic panel data analysis of the relationship between economic freedom and tourism. Çankırı Karatekin Üniversitesi İktisadi ve İdari Bilim. Fakültesi Derg. 9, 327–343. doi:10.18074/ckuiibfd.408287

Özden, C., and Beşe, E. (2021). Environmental Kuznets curve (EKC) in Australia: Evidence from nonlinear ARDL model with a structural break. Pol. J. Environ. Stud. 30, 2245–2254. doi:10.15244/pjoes/127555

Pesaran, M. H. (2007). A simple panel unit root test in the presence of cross-section dependence. J. Appl. Econ. Chichester. Engl. 22, 265–312. doi:10.1002/jae.951

Pradhan, R. P., Arvin, M. B., and Nair, M. (2021). Urbanization, transportation infrastructure, ICT, and economic growth: A temporal causal analysis. Cities 115, 103213. doi:10.1016/j.cities.2021.103213

Rahman, M. M., Ahmed, R., Mashud, A. H. M., Malik, A. I., Miah, S., and Abedin, M. Z. (2022). Consumption-based CO2 emissions on sustainable development goals of SAARC region. Sustainability 14, 1467. doi:10.3390/su14031467

Rehman, A., Ma, H., Ahmad, M., Irfan, M., Traore, O., and Chandio, A. A. (2021). Towards environmental Sustainability: Devolving the influence of carbon dioxide emission to population growth, climate change, forestry, livestock and crops production in Pakistan. Ecol. Indic. 125, 107460. doi:10.1016/j.ecolind.2021.107460

Satrovic, E., Ahmad, M., and Muslija, A. (2021). Does democracy improve environmental quality of GCC region? Analysis robust to cross-section dependence and slope heterogeneity. Environ. Sci. Pollut. Res. 28, 1–24. doi:10.1007/s11356-021-15020-z

Sassi, S., and Goaied, M. (2013). Financial development, ICT diffusion and economic growth: Lessons from MENA region. Telecommun. Policy 37, 252–261. doi:10.1016/j.telpol.2012.12.004

Satrovic, E., and Abul, S. J. (2021). Linking Electricity Consumption, tourism, and economic growth in OECD countries. Uprava 12, 27–43.

Satrovic, E., Abul, S. J., and Al-Kandari, A. (2022). Modeling the dynamic linkages between agriculture, electricity consumption, income and pollutant emissions for Southeastern Europe. Pol. J. Environ. Stud. 31, 4259–4267. doi:10.15244/pjoes/147825

Satrovic, E., and Adedoyin, F. F. (2022). An empirical assessment of electricity consumption and environmental degradation in the presence of economic complexities. Environ. Sci. Pollut. Res. Int., 1–15. doi:10.1007/s11356-022-21099-9

Sethi, D., and Acharya, D. (2018). Financial inclusion and economic growth linkage: Some cross country evidence. J. Financial Econ. Policy 10, 369–385. doi:10.1108/jfep-11-2016-0073

Shahbaz, M., Raghutla, C., Chittedi, K. R., Jiao, Z., and Vo, X. V. (2020). The effect of renewable energy consumption on economic growth: Evidence from the renewable energy country attractive index. Energy 207, 118162. doi:10.1016/j.energy.2020.118162

Stamopoulos, D., Dimas, P., and Tsakanikas, A. (2022). Exploring the structural effects of the ICT sector in the Greek economy: A quantitative approach based on input-output and network analysis. Telecommun. Policy 46, 102332. doi:10.1016/j.telpol.2022.102332

Sultana, N., Rahman, M. M., and Khanam, R. (2022). Environmental Kuznets curve and causal links between environmental degradation and selected socioeconomic indicators in Bangladesh. Environ. Dev. Sustain. 24, 5426–5450. doi:10.1007/s10668-021-01665-w

Susam, S. O., and Hudaverdi Ucer, B. (2019). Modeling the dependence structure of CO 2 emissions and energy consumption based on the Archimedean copula approach: The case of the United States. Energy Sources, Part B Econ. Plan. Policy 14, 274–289. doi:10.1080/15567249.2019.1671550

UNDP (2020). Human development report, 2020 statistical update. https://knoema.com/data/human-development-index (accessed March 22, 2022).

Verbič, M., Satrovic, E., and Muslija, A. (2021). Environmental Kuznets curve in southeastern europe: The role of urbanization and energy consumption. Environ. Sci. Pollut. Res. 28, 57807–57817. doi:10.1007/s11356-021-14732-6

WB (2021). World development indicators (WDI). https://knoema.com/WBWDI2019Jan/world-development-indicators-wdi (accessed March 12, 2022).

Wu, H., Hao, Y., Ren, S., Yang, X., and Xie, G. (2021). Does internet development improve green total factor energy efficiency? Evidence from China. Energy Policy 153, 112247. doi:10.1016/j.enpol.2021.112247

Yang, W., and Lam, P. T. (2021). An evaluation of ICT benefits enhancing walkability in a smart city. Landsc. Urban Plan. 215, 104227. doi:10.1016/j.landurbplan.2021.104227

Zafar, M. W., Zaidi, S. A. H., Mansoor, S., Sinha, A., and Qin, Q. (2022). ICT and education as determinants of environmental quality: The role of financial development in selected Asian countries. Technol. Forecast. Soc. Change 177, 121547. doi:10.1016/j.techfore.2022.121547

Zaidi, S. A. H., Hussain, M., and Zaman, Q. U. (2021). Dynamic linkages between financial inclusion and carbon emissions: Evidence from selected OECD countries. Resour. Environ. Sustain. 4, 100022. doi:10.1016/j.resenv.2021.100022

Zhang, C., Khan, I., Dagar, V., Saeed, A., and Zafar, M. W. (2022). Environmental impact of information and communication technology: Unveiling the role of education in developing countries. Technol. Forecast. Soc. Change 178, 121570. doi:10.1016/j.techfore.2022.121570

Zhao, H., Yang, Y., Li, N., Liu, D., and Li, H. (2021a). How does digital finance affect carbon emissions? Evidence from an emerging market. Sustainability 13, 12303. doi:10.3390/su132112303

Zhao, J., Zhao, Z., and Zhang, H. (2021b). The impact of growth, energy and financial development on environmental pollution in China: New evidence from a spatial econometric analysis. Energy Econ. 93, 104506. doi:10.1016/j.eneco.2019.104506

Zheng, J., and Wang, X. (2021). Can mobile information communication technologies (ICTs) promote the development of renewables?-evidence from seven countries. Energy Policy 149, 112041. doi:10.1016/j.enpol.2020.112041

Keywords: carbon intensity, financial inclusion, information and communication technology, oil exporting countries, panel quantile regression, carbon intensity, panel quantile regression

Citation: Damrah S, Satrovic E and Shawtari FA (2022) How does financial inclusion affect environmental degradation in the six oil exporting countries? The moderating role of information and communication technology. Front. Environ. Sci. 10:1013326. doi: 10.3389/fenvs.2022.1013326

Received: 06 August 2022; Accepted: 14 September 2022;

Published: 05 October 2022.

Edited by:

Munir Ahmad, Ningbo University of Finance and Economics, ChinaReviewed by:

Tomiwa Sunday Adebayo, Cyprus International University, TurkeyFortune Ganda, Walter Sisulu University, South Africa

Copyright © 2022 Damrah, Satrovic and Shawtari. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Sadeq Damrah, cy5kYW1yYWhAYXUuZWR1Lmt3

†ORCID: Elma Satrovic, 0000-0002-8000-5543

Sadeq Damrah

Sadeq Damrah Elma Satrovic

Elma Satrovic Fekri Ali Shawtari

Fekri Ali Shawtari