- 1School of Management, Shandong University, Jinan, China

- 2Laboratory of Social Supernetwork Computation and Decision Simulation, Shandong University, Jinan, China

Recently, core enterprises are compelled to invest in the environmental responsibility of upstream suppliers, since their brand image and market share will be significantly impacted when suppliers fail to comply with environmental regulations. However, the effectiveness of the core enterprises’ investment efficiency is limited by insufficient environmental knowledge. Although cooperating with the knowledge-advantaged environmental non-governmental organization (ENGO) may be an effective solution, we observe from the recent examples that not all core enterprises are willing to cooperate in a competitive market. Within this context, we develop a theoretical model to investigate whether competitive core enterprises can benefit from cooperating with the knowledge-advantaged ENGO to motivate the supplier’s environmental responsibility. Our results show that cooperation incentivizes core enterprises’ investments in the supplier’s environmental responsibility, which in turn motivates better environmental responsibility of the supplier. However, we illustrate that cooperation is not necessarily the optimal strategy for core enterprises in the duopoly scenario. Specifically, as the knowledge absorption ability increases, a core enterprise may free-ride on another’s investment, shifting its strategic preference from cooperating to not cooperating. In addition, competition may stimulate the core enterprises’ investments and cooperation motivation, thus improving the total environmental effort and supply chain members’ profits. Our findings provide insights into the competitive core enterprises’ strategic choice regarding suppliers’ environmental responsibility management.

1 Introduction

In recent years, core enterprises have become more energized to improve the environmental responsibility of suppliers when they realize that their brand image and market share may be greatly impacted if their upstream suppliers commit environmental violations (Fang and Cho, 2020). For example, Xiaomi’s initial public offering (IPO) was hampered by its poor oversight of the supply chain, after a list of its suppliers with repeated environmental violations was published (IPE, 2021). A typical approach that core enterprises use to promote upstream suppliers’ environmental responsibility performance is the investment (Lee et al., 2018). However, the limited information about suppliers’ environmental practices and insufficient expertise in environmental sustainability technology contribute to the poor outcomes of core enterprises’ investments (Tachizawa and Wong, 2014). Therefore, it is essential for core enterprises to gain a better understanding of suppliers’ environmental information and obtain more expertise resources, thus improving their investment efficiency to motivate better environmental responsibility of suppliers.

Facing this challenge, cooperating with knowledge-advantaged environmental non-governm ental organizations (ENGOs) to implement environmental responsibility management of suppliers is one measure adopted by some core enterprises. By providing the supplier list and further establishing a cooperative relationship with the ENGO, core enterprises can obtain environmental information about suppliers, which will improve their decision-making in investment activities. For example, the Institute Public & Environmental Affairs (IPE), a famous ENGO registered in china, created the Azure Map to provide participating core enterprises with the real-time environmental violations and regulatory information about suppliers (IPE, 2021). GreenBlue, an ENGO specialized in science-based decision tools, created Material IQ aiming at sharing suppliers’ sensitive chemical toxicity data with downstream core enterprises (Karaer et al., 2017). Other than the cooperation on environmental information, some core enterprises also cooperate with ENGO to improve the investment efficiency in a series of environmental responsibility programs focusing on environmental management capabilities (Tong et al., 2022). For example, to achieve the aims of “Project Gigaton”, Walmart has strengthened its partnership with Environmental Defense Fund (EDF) to help suppliers initiate emissions reduction plans. This cooperation has made great progress. On the one hand, the EDF has helped Wal-Mart develop environmentally sustainable consumption guidelines and incentives for consumers. On the other hand, the two parties have worked on a range of initiatives to reduce fertilizer use in Walmart’s produce supply chain, develop pollution control technology, and improve energy efficiency at suppliers. It is reported that suppliers participating in Walmart’s “Project Gigaton” have reduced more than 186 million tons of CO2 emissions as of 2020 (Walmart, 2021).

Despite enjoying some success, core enterprises’ cooperation initiatives with ENGOs have reportedly not scaled well (EDF, 2022). For example, Apple has actively partnered with IPE and used the knowledge provided by IPE to push upstream suppliers to rectify environmental violations, thereby promoting environmentally sustainable production and procurement in their supply chains (IPE, 2021). However, Xiaomi has not actively partnered with IPE and has chosen to free rides on Apple’s risk management of common supplier’s environmental violations. Accordingly, one potential explanation for core enterprises’ reluctance to participate in alliances may involve their competitors. Specifically, two external forces may affect the core enterprises’ cooperation decisions. First, core enterprises may prefer not to cooperate because they can benefit from the positive externality caused by the others’ increased investment when they have a common supplier that commits environmental violations to manage. Second, the core enterprises can benefit from improved investment efficiency by cooperating with knowledge-advantaged ENGO. Thus, this benefit may push the core enterprises to cooperate and increase their investment to differentiate themselves and gain a competitive advantage.

The existing research mainly focuses on core enterprises’ incentives to improve the supplier’s environmental responsibility under an ENGO’s pressure monitoring strategy (Caro et al., 2018), but few studies have focused on the particular characteristics and effectiveness of the cooperation strategy. Compared to the pressure monitoring strategy, Tachizawa and Wong (2014) suggest that the emerging cross-sectoral cooperation strategy will create additional value and yield different incentives and knowledge-sharing mechanisms. Thus, the effectiveness of the cooperation strategy in motivating suppliers’ environmental responsibility warrants exploration. Furthermore, prior research has explored the incentives for competitive core enterprises to invest and cooperate in terms of government regulation (Yang et al., 2021), consumer awareness (Shi et al., 2020), information asymmetry (Wang J. et al., 2021), and supply chain structure (Letizia and Hendrikse, 2016). Our focus is different, as we provide insights into how competition affects the cooperation motivation of the core enterprise when taking knowledge-sharing by ENGO into consideration. Although Kraft et al. (2013) study how ENGO affects competitive core enterprises’ investments in reducing the risk of environmental violations, their model does not take into account the investment externality, nor do they extend the study to a supply chain setting. Therefore, it is important to investigate how the competition affects the core enterprise’s incentive to cooperate considering investment externality.

Based on the aforementioned background, this study contributes to the debate on whether competitive core enterprises are willing to cooperate with ENGO to motivate supplier environmental responsibility. We focus on the following major research questions:

i) Can the cooperative strategy effectively incentivize the core enterprise’s investment and thus motivate better environmental responsibility of the supplier?

ii) Under what conditions are core enterprises more profitable when they cooperate with the ENGO? What are the equilibrium outcomes that core enterprises will reach?

iii) What are the impacts of competition on total environmental efforts and the profits of the supplier, ENGO, and core enterprises?

To address these questions, our study resorts to the game-theoretic approach in a framework that consists of one knowledge-advantaged ENGO, two competitive core enterprises with symmetric market size, and one supplier that is prone to environmental violations. To analyze the effects of competition, we consider monopoly and duopoly scenarios, in each scenario, we classify different cases based on whether the ENGO and the core enterprises cooperate or not. We summarize our main insights in the following several aspects:

First, our study shows that the cooperation strategy can effectively increase the core enterprise’s investment and the supplier’s environmental responsibility regardless of monopoly or duopoly scenarios. Intuitively, the core enterprise is motivated to increase investment because they gain an efficiency advantage in investment with cooperation. This result also translates that there is no substitution between the knowledge sharing effort of the ENGO and investment effort of the core enterprise, thus cooperation does not mitigate or replace the core enterprise’s investment effort. However, in the duopoly scenario, although cooperation improves the total investment level, one of the core enterprises may be prone to free ride the investment from the other core enterprise due to the complementarity of investment.

Second, we illustrate that cooperation is not necessarily the optimal strategy for core enterprises in the duopoly scenario, and it depends on knowledge absorption ability, investment efficiency and consumer environmental awareness. In particular, the increased knowledge absorption ability may reduce the incentive for core enterprises to cooperate with ENGO, shifting the cooperation strategy from a symmetric equilibrium with two core enterprises cooperating (denoted by CC) to an asymmetric equilibrium with only one core enterprise cooperating (denoted by NC/CN). In addition, we find that both cooperative cases in which one or two core enterprises cooperate with the ENGO can align the ENGO’s goal, supplier’s profit and environmental benefit, while the cooperative case that only one core enterprise cooperates with ENGO dominates that two core enterprises cooperate with ENGO in terms of supply chain profit.

Third, our analysis reveals that moderate downstream competition can actually increase to the total environmental effort and the core enterprise’s willingness to cooperate. This is because when the competition intensity is at a moderate level, the environmental benefit dominates the competition loss associated with the investment, which in turn induces the core enterprise to invest more. Moreover, for core enterprises, the interaction between cooperation intensity and competition intensity will have an impact on their equilibrium decisions. When the competition intensity is not too large, each core enterprise can benefit from enlarged market demand and improved investment efficiently, more likely resulting in cooperation equilibrium.

We make three primary contributions to the existing literature. First, from the perspective of resource complementarity and agency theory, we discuss the cross-sectoral cooperation strategy of ENGO and core enterprises to motivate supplier environmental responsibility by virtue of the power of the supply chain, a topic that has rarely been studied. Second, in our model setting, two motivations for core enterprises to make investments are considered, that is, gaining a market competitive advantage and reducing environmental violation loss, which enables us to capture the competitive effect and externality effect simultaneously. Third, we demonstrate that the core enterprise’s free-rider behavior will shift its strategic preference from cooperating to not cooperating, while moderate competition is instead conducive to improving the investment of core enterprises.

The remainder of the paper is organized as follows. Section 2 provides a literature review. Section 3 describes the model formulation and derives the equilibrium decisions and profits. Section 4 analyzes the conditions for cooperation between the ENGO and core enterprises, and discusses the impact of competition on total environmental effort and core enterprises’ strategy preferences. Section 5 extends the model by altering the assumptions of symmetric core enterprise and perfect product substitution. Section 6 concludes the study and outlines directions for future research.

2 Literature review

Our work is related to three streams of literature: core enterprise levers to motivate supplier environmental responsibility, “ENGO + core enterprise” levers to motivate supplier environmental responsibility, and the investment of competitive core enterprises.

2.1 Motivate supplier environmental responsibility by core enterprise levers

Environmental management has become an important part of sustainable operations management for core enterprises. Existing literature has analyzed strategies or mechanisms of core enterprise from various perspectives, including environmental audits to address the risk of supplier non-compliance (Caro et al., 2018; Chen et al., 2020), incentive contracts to improve suppliers’ capability and performance (Karaer et al., 2017; Yang and Chen, 2018; Wang et al., 2022), the design of information disclosure and communication mechanism (Wang et al., 2016; Cho et al., 2019; Kraft et al., 2020), and strategic sourcing basing on environmental sustainability standards (Chen et al., 2017; Agrawal et al., 2019; Wu et al., 2019). We focus on the effect of core enterprise’s investment strategy in motivating supplier’s environmental responsibility. This is because a few studies suggest that punitive strategies can squeeze suppliers’ profits, so they may backfire, leading suppliers to retreat to a low environmental responsibility level to contain costs (Plambeck and Taylor, 2016). Moreover, investment strategy are more efficient in reducing environmental speculation, promoting green technology adoption, and easing financing pressures (Kraft et al., 2020). Prior studies are mostly concerned with the factors affecting retailers’ investment in supplier’s environmental responsibility in terms of government regulation, consumer preferences, information asymmetry and supply chain structure. To address the challenges posed by carbon neutrality, Zhang et al. (2022) and Xiang et al. (2022) analyze the potential for corporate emissions reduction from the perspective of government regulation, using the residential and commercial building operations as the target. Based on this, (Yan et al., 2022), improve the method of decarbonization of building operations, which is helpful for the governments to investigate the decarbonization potential of buildings. Yang and Chen (2018) illustrate that whether under revenue-sharing or cost-sharing arrangements, retailer’s incentives for investment are completely consistent as long as there is consumer environmental awareness. Kraft et al. (2020) examine how can the retailer invest in the supplier’s capabilities when it has incomplete information about the supplier’s environmental responsibility information. Letizia and Hendrikse (2016) examine downstream firms’ environmental social responsibility (ESR) investments under different supply chain structures from the viewpoint of property ownership. Guo et al. (2016) compare two supply chain structures with dedicated and shared supplier, and they find that downstream firms are more compelled to act responsibly when common suppliers are shared. More recently, Feng et al. (2021) apply a multilateral bargaining framework to coordinate environmentally responsible investments among firms in the retailer-driven supply networks, they find that the retailer can benefit more from directly managing all suppliers than delegating the responsibility to the higher-tier suppliers.

Our paper differs from the aforementioned studies in this stream in two ways. First, similar to Letizia and Hendrikse (2016) and Guo et al. (2016), we also focus on the investment strategy of core enterprises and consider a supply chain structure consisting of a supplier and two competitive core enterprises, however, we investigate the role of retailer’s investment in both gaining market competitiveness and reducing the loss of environmental violations simultaneously. Second, most of the previous papers consider how the government and consumers influence the investment strategies of core enterprises. By contrast, we consider how the external stakeholder, namely ENGO, can affect the investment strategies of core enterprises by knowledge sharing from a resource complementarity perspective. Different from the engagement mechanisms of government and consumers, ENGO’s participation will create additional value and yield different incentive mechanisms.

2.2 Motivate supplier environmental responsibility by “ENGO + Core enterprise” levers

Prior studies in this stream mostly focus on the impact of the ENGO’s pressure monitoring strategy on suppliers’ environmental responsibility (Kraft et al., 2013; Karaer et al., 2017; Chen et al., 2019; Orsdemir et al., 2019). Chen et al. (2019) point out that the disclosure of supplier information by core enterprises affects the ENGO’s audit level. They find that improving the ENGO’s audit efficiency can motivate core enterprises to disclose supplier information and improve the sustainability of the supply chain. Orsdemir et al. (2019) analyze the impact of the ENGO’s environmental audit and reporting policies on vertical integration and horizontal procurement decisions. Recently, there is a growing interest in the cooperation strategies between the knowledge-advantaged ENGO and core enterprises. Karaer et al. (2017) study when GreenBlue advises downstream enterprises to implement Material IQ as an opportunity to cooperate with suppliers. They find that the strategy of GreenBlue is limited when there is competition among suppliers. Note that many theoretical studies in economics and environmental sciences have investigated the factors that affect core enterprises’ cooperation motivation and the effectiveness of cooperative strategies between ENGO and core enterprises; see, for example, Rodriguez et al. (2016); Zeimers et al. (2019); Harangozo and Zilahy (2015); Tevapitak and Helmsing (2019). They find that cooperation could help core enterprises obtain resources to implement corporate social responsibility (CSR), improve their corporate image, and enhance their reputation. However, existing studies in sustainability operations and knowledge management mainly focus on peer-to-peer interactions among firms under the ENGO’s or government’s knowledge sharing (Chen et al., 2015; Zhou et al., 2021), and less deal with the cross-sectoral cooperation mechanism between the core enterprises and the ENGO. Moreover, few studies develop a game model to analyze ENGO-core enterprise interactions about the supplier’s environmental responsibility. Murali et al. (2019) study the impact of voluntary ecolabels provided by the ENGO on green product development among competing firms. They find that a more credible firm adopts the certification only if its credibility is sufficiently low. Kraft et al. (2013) study how the ENGO that incorporates firms’ profits into its objective, influence competing firms to replace a potentially hazardous substance. They find that ENGO is supposed to leverage the firm’s competition as its pragmatism increases.

Compared to the aforementioned related studies, especially the studies of the Karaer et al. (2017) and Kraft et al. (2020), our work fills this stream by designing a cross-sectoral cooperation strategy between the ENGO and core enterprises in which the ENGO’s knowledge sharing decision is endogenously determined and the core enterprise’s cooperation incentives are influenced by its competitor. Note that Kraft et al. (2020) study the strategic interactions between the core enterprises and ENGO without extending the study to the supply chain setting by considering supplier’s environmental responsibility; Karaer et al. (2017) study a competitive model in which the ENGO’s information sharing decision is exogenously given.

2.3 The investment of competitive core enterprises

Most previous studies in this stream analyze one of the following competition forms of core enterprises’ quantity competition, price competition, the greenness competition. By analyzing a bargaining model, Wang X. et al. (2021) prove that the firm’s bargaining power and the intensity of downstream competition paly a vital role in the influence of downstream competition on upstream innovation. Wang et al. (2016) develop a global game model to investigate the interactions between the intensity of regulation and the green adaptation across competitive firms. Yang et al. (2021) illustrate how government can incentive competing firms’ investment and find that green innovation cost is an important factor affecting the green technology innovation of competitive firms. Liu et al. (2012) develop a two-stage game model to determine the interactions between the supply chain members and show that the higher downstream competition intensity may help the manufacturers with inferior environmental friendliness benefit from increasing consumer awareness. Zhu and He (2017) and Guo et al. (2020) develop a supply chain model consisting of a manufacturer and two competitive retailers to analyze how competition affects green product development. Zhu and He (2017) find that price competition has a positive impact on product greenness, while greenness competition has a negative impact on product greenness. Guo et al. (2020) illustrate that a more competitive market leads to a lower optimal greenness level in the fashion apparel industry. Wang et al. (2020) illustrate that by introducing competition, a system can obtain higher effective CSR-investment efforts and lower prices in the case of no collaboration or only CSR-investment collaboration. Shi et al. (2020) capture both price and environmental effort competition, and explore the impact of competition on CSR in supply chains. They note that compared to the monopoly scenario, the total level of cooperate social responsibility effort always decreases in the duopoly scenario.

Our study differs from these previous studies in the following two aspects. First, most prior papers study the competitive and cooperative interactions of the two core enterprises’ decisions, whereas we focus on competitive core enterprises’ motivation to cooperate with the knowledge-advantaged ENGO, where knowledge sharing can effectively improve core enterprises’ investment efficiency and thus help them gain competitive advantages. Second, different from the study of Shi et al. (2020), whose focus is on one downstream core enterprise entry decision and assumes that the entrant knows the incumbent’s investment decision information, we consider that two competitive core enterprises make investment decisions simultaneously, which is more in line with the reality that investment decisions are generally confidential. With the core enterprise’s investment decision determined simultaneously, we find that the core enterprises’ investment efforts and the total environmental effort do not necessarily decrease as the intensity of competition increases.

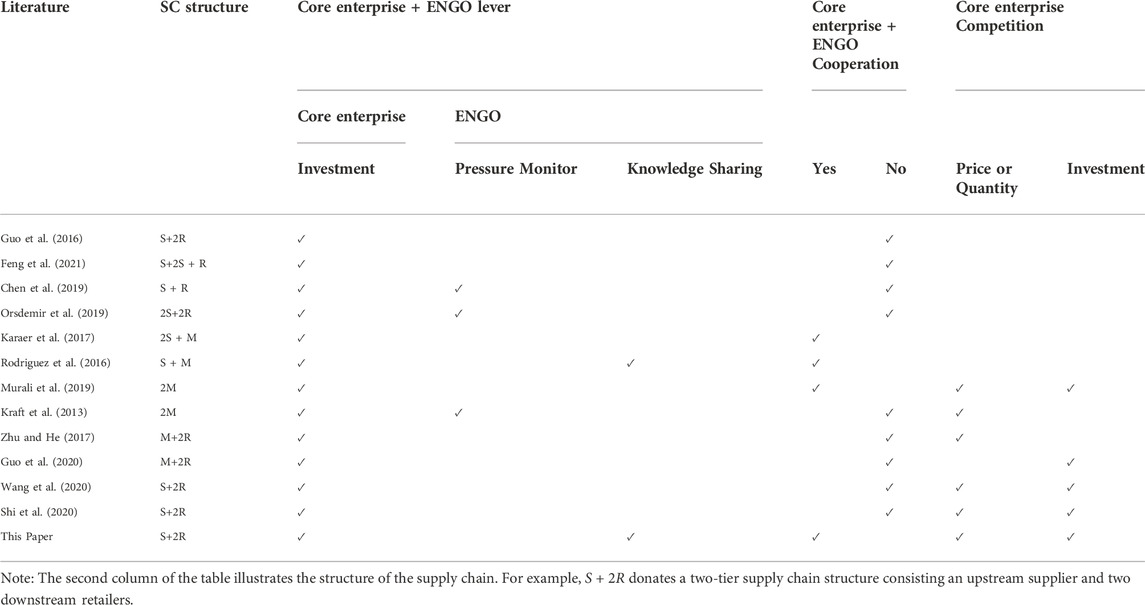

To highlight the research gap and contributions, Table 1 summarizes the comparison between previous related studies and our present study.

3 Model setting

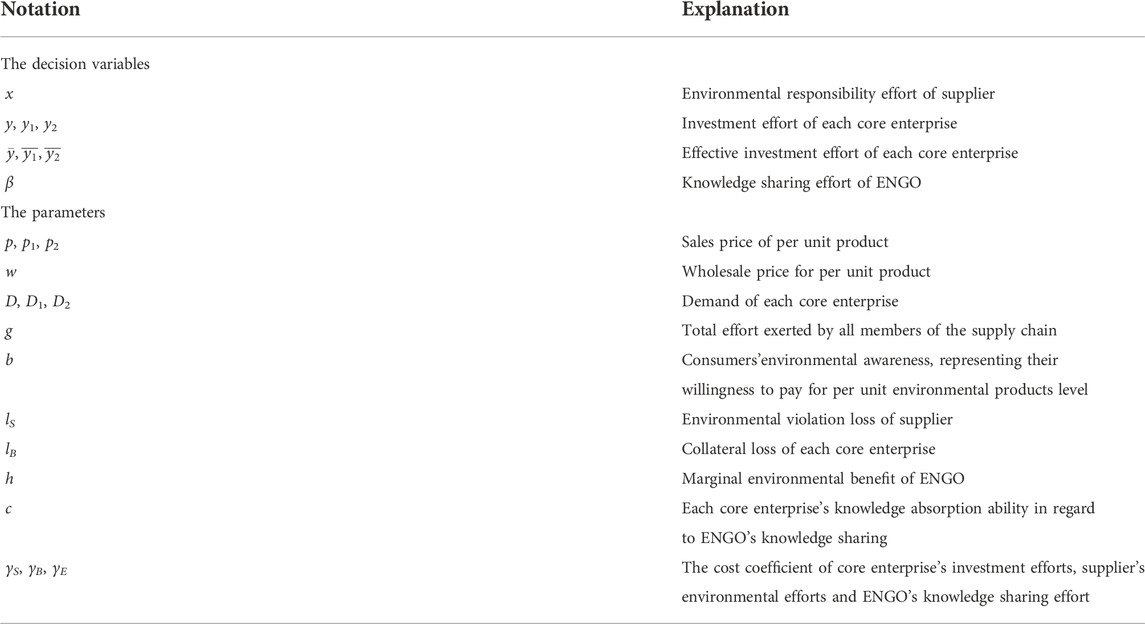

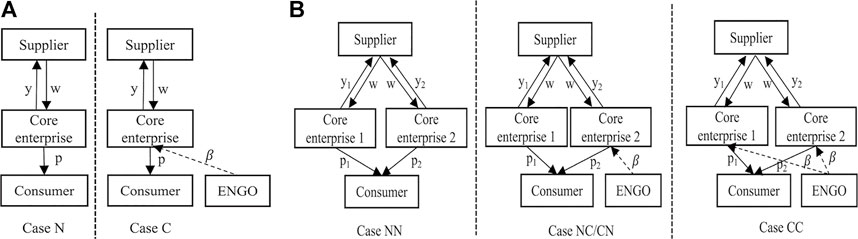

We analyze two supply chain settings. One is a downstream monopoly consisting of an supplier(S) and a core enterprise(B), which is denoted as a structure without competition; the other is a downstream duopoly consisting of an supplier (S) and two core enterprises (Bi, i = 1, 2), which is denoted as a structure with competition. The supplier is subject to environmental violations due to poor environmental management capability. The core enterprise, the giant firm in the downstream of the supply chain, is assumed to be more powerful than the supplier, and requires resources to improve its investment efficiency. The ENGO, a third-party organization with professional environmental knowledge and technology, is willing to pursue cooperation with core enterprise to improve the supplier’s environmental sustainability. We focus on the interactions among the core enterprises, supplier and ENGO. For convenience, the notations used throughout this paper are summarized in Table 2.

3.1 Demand functions

Each core enterprise procures the raw materials from the supplier at the uniform wholesale price w and sells the end product to consumers at its own sales price pi. Without loss of generality, we normalize the supplier’s marginal production cost to zero. We assume that the wholesale price of products in the mature stage is exogenous and reasonably steady, for that our focus is on competitiveness in firms’ environmental activities (Caro et al., 2018; Shi et al., 2020). The supplier selects environmental responsibility effort x to improve its environmental performance. The core enterprise selects its investment effort y to improve supplier’s environmental responsibility. If core enterprises cooperate with ENGO, the ENGO exerts knowledge sharing effort β to improve core enterprises’ investment efficiency. The costs associated with the supplier’s environmental responsibility effort, the core enterprises’ investment effort and knowledge sharing effort are

We model the core enterprise’s effective investment level as

In the duopoly scenario, the consumers compare the two core enterprises’ sales prices and care about the differences in effective investment efforts between them. Thus, two core enterprises compete in the sales price and effective investment effort. We assume that the two products sold by different core enterprises are imperfect substitutes for consumers (Murali et al., 2019; Wang Y. et al., 2021). In Section 5, we relax this assumption to verify the robustness of our result. Following prior literature (Tsay et al., 2000; Liu et al., 2012; Lai et al., 2022), we adopt a reduced-form sales price and investment effort competition model, the demand function of each core enterprise is given by:

where i = 1, 2, i ≠ j. The constant b represents the consumers’ willingness to pay for per unit of investment efforts. For each unit increase in a core enterprise’s investment effort, β consumer exits the market, and its competitor gains β consumer. Similarly, for each unit decrease in a core enterprise’s sales price, one consumer exits the market, and its competitor gains one consumer. As b increase, the competition become more intense, and core enterprise i‘s demand decrease if it has a competitive advantage than core enterprise

3.2 Environmental violations

Following the study of Huang et al. (2022) and Lee et al. (2018), we assume that efforts made by the supplier and core enterprise are complementary and that the total supply chain effort is

3.3 Supplier, core enterprise and ENGO objectives

In the monopoly scenario, the profit functions of the supplier and the core enterprise are given by:

If the core enterprise cooperates with ENGO, the payoff function of ENGO is given by:

In the duopoly scenario, since the core enterprises are homogeneous and source from the common supplier, considering the redundancy of knowledge sharing (Chen et al., 2015; Xiao et al., 2020), we assume that the knowledge the ENGO shares with the two core enterprises is completely substitutable. That is, if both core enterprises cooperate with the ENGO, their total level of investment acting on the supplier’s violations adds up to y1 + y2 + cβ and the total supply chain effort is g = x (y1 + y2 + cβ). The ENGO’s payoff function follows the same form as Eq. 5, and the profit functions of the supplier and each core enterprise are as follows:

3.4 Cooperation strategies

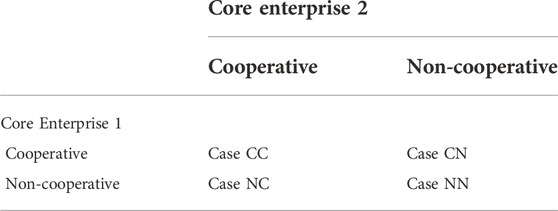

Each scenario is divided into different cases based on whether the core enterprises cooperate with the ENGO, and C and N represent cooperating and not cooperating with the ENGO, respectively. In the monopoly scenario, there are two cases of C and N. In the duopoly scenario, three cases are considered, as summarized in Table 3. Note that the equilibrium outcomes of Case NC and Case CN are symmetric due to the symmetric of two core enterprises. Thus, we only derive the equilibrium outcomes in Case NC and the equilibrium outcomes in Case CN can be calculated in the same way. The system structures of two scenarios are illustrated in Figure 1.

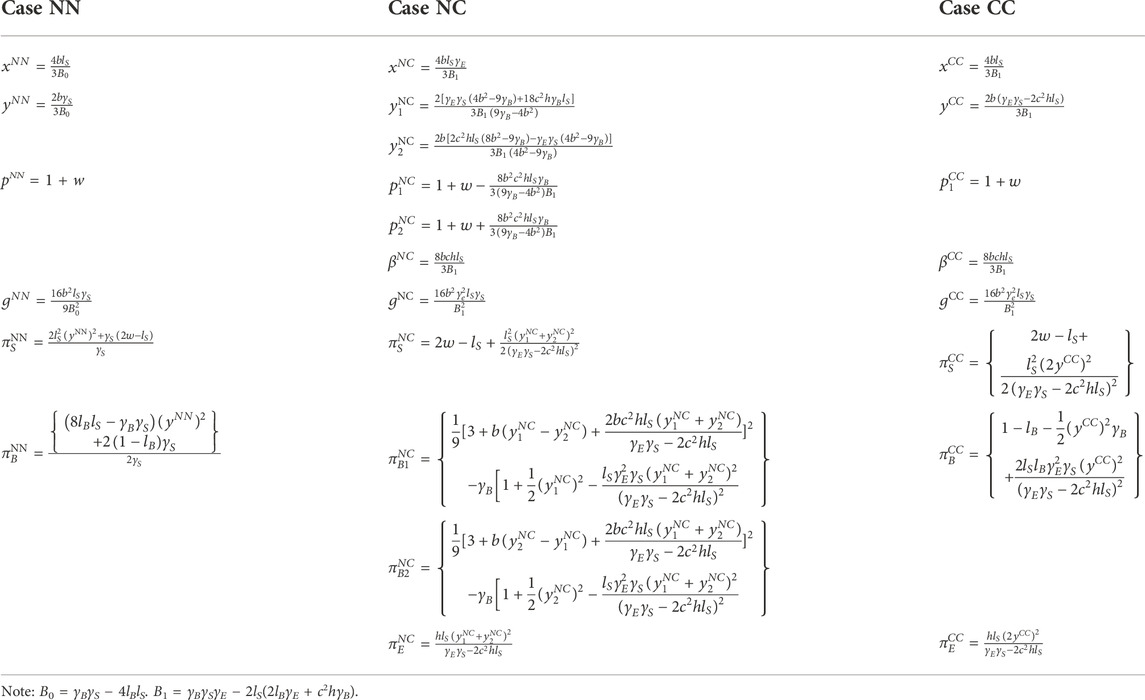

The sequence of events in the monopoly scenario is as follows. 1) The core enterprise decides whether to cooperate with the ENGO. 2) If the core enterprise cooperates with the ENGO, the core enterprise determines its investment and the ENGO determines its knowledge sharing effort simultaneously; otherwise, the core enterprise determines its investment effort independently. 3) After observing the core enterprise’s and ENGO’s efforts, the supplier decides its environmental responsibility effort to maximize its expected profit. 4) The core enterprise finalizes its order quantity from the supplier and decides its own sales price. The sequence of events in the duopoly scenario is similar to that in the monopoly scenario. Note that we assume that the two core enterprises compete in a static game of complete information. That is to say, the two core enterprises make their investment effort and sales price decisions simultaneously without observing each other’s actions. To avoid trivial outcomes, we assume that the core enterprise’s investment is costly and sufficiently substantial relative to the environmental benefit, that is, 4b2 − 9γB < 0. By solving the games in the different cases by backward induction, we can obtain the equilibrium outcomes presented in Tables 4, 5. The proofs of these equilibrium outcomes and all the following propositions in this paper are given in Supplementary Appendix A1.

4 Analysis

In this section, we investigate whether core enterprise can benefit from cooperating with the knowledge-advantaged ENGO to motivate the supplier’s environmental responsibility in monopoly and duopoly scenarios, respectively. Specifically, we analyze the cooperation conditions between the core enterprise and ENGO in Section 4.1, and further explore the impacts of competition on the total supply chain environmental level and each member’s profit in Section 4.2.

4.1 Analysis of cooperation conditions

In this subsection, we compare the environmental efforts in different cases and then explore the conditions under which the core enterprise is willing to cooperate with the ENGO in the monopoly and duopoly scenarios. Furthermore, we analyze the consistency of the environmental benefits and economic benefits of different cases in these two types of scenarios.

4.1.1 Monopoly scenario

We first compare the equilibrium decisions and profits across Case N and Case C in Proposition 1 and Proposition 2.

Proposition 1. In the monopoly scenario, the relationship between the equilibrium decisions in Case N and Case C are: xN < xC, yN < yC, gN < gC.Proposition 1 indicates that in the absence of competition, a cooperation strategy can always increase the environmental efforts of supply chain members. The reason is that the investment efficiency of core enterprise is improved when cooperating with ENGO. That is, its market demand expands and environmental violation loss is reduced given a lower investment cost. Accordingly, compared to Case N, the core enterprise can afford a higher investment effort level in Case C, which will in turn motivate the supplier to improve the environmental responsibility effort, and thus increase the total environmental effort. This result suggests that cooperation with the ENGO does not reduce or replace the investment effort of core enterprises, but rather incentivizes the core enterprise to exert greater investment effort.

Proposition 2. In the monopoly scenario, the relationship between the equilibrium profits in Case N and Case C are:

4.1.2 Duopoly scenario

We then compare the equilibrium decisions and profits across Case NN, Case NC and Case CC in the following propositions. The comparisons of each member’s environmental effort in different cases are illustrated in Proposition 3.

Proposition 3. In the duopoly scenario, the relationships between the envirronmental effort decisions of each member in the different cases are as follows:

i)xNN<xNC=xCC,

ii)

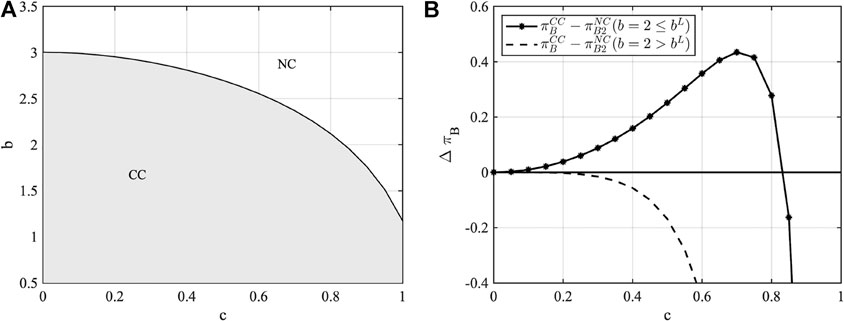

Proposition 4. In the duopoly scenario, the equilibrium results of core enterprises are as follows:

i) When b > bL, then Case NC(CN) is the Nash equilibrium.

ii) When b ≤ bL, there exists a threshold cL, such that

a.if c > cL, then Case NC(CN) is the Nash equilibrium;

b.if c ≤ cL, then Case CC is the Nash equilibrium, where

FIGURE 2. The core enterprise’s strategies preference and the effect of c on the core enterprise’s strategy preference. Notes. With the constraint satisfied, we set lB = 0.8; γB = 4; lS = 0.4; γS = 1; h = 0.75. (A) Preferred strategies of core enterprise. (B) The effect of c on core enterprise’s strategies preference..

Proposition 5. In the duopoly scenario, the relationships between the supplier’s and the ENGO’s profits in different cases are as follows:

i)

ii)

Proposition 6. In the duopoly scenario, the relationships between the supply chain profits in the different cases are:

4.2 The impact of core enterprise competition

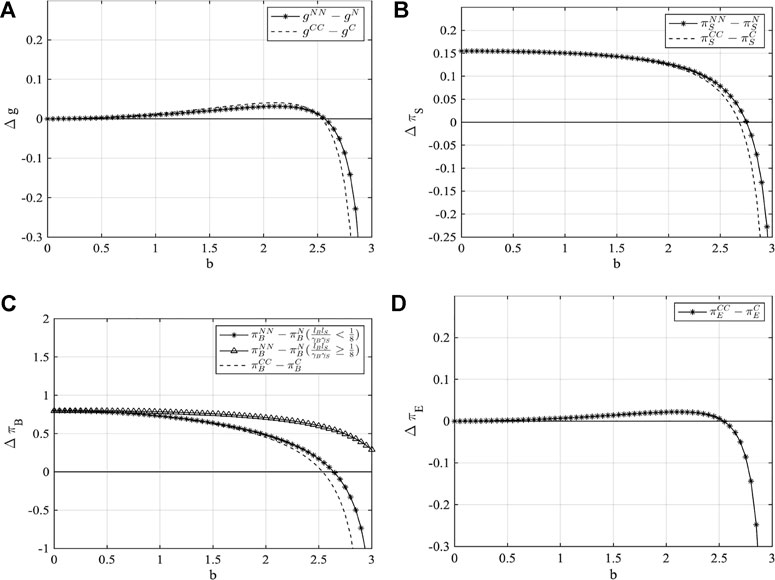

To analyze the influence of competition on each member’s environmental effort and profit, this subsection presents a cross-sectional comparison of the strategies in the two scenarios. Noteworthy, the larger the consumer environmental awareness, the more intense the investment competition among core enterprises, as we discussed in the model setting. Then, we focus on the effect of the b on the equilibrium results in the following propositions and we illustrate our results in Figure 3.

FIGURE 3. Comparison of total environmental efforts and profits of members. Notes. With the constraint satisfied, we set w = 0.1; c = 0.8; lB = 0.2; γB = 5; lS = 0.15; γS = 1; h = 0.6. (A) Comparison of total environmental efforts. (B) Comparison of suppliers’ profits. (C) Comparison of core enterprises’ profits. (D) Comparison of ENGOs’ profits.

4.2.1 The impact of core enterprise competition on total environmental effort

The impact of core enterprise competition on the total environmental effort is illustrated in Proposition 7. Note that since the total environmental effort is driven by each member’s environmental effort, the comparative results of each member’s environmental effort across different cooperation cases are congruent with Proposition 7.

Proposition 7. There exist thresholds b1 and b2, such that the total environmental efforts possess the following properties:

i) If b < b1, gN < gNN; otherwise, gN ≥ gNN.

ii) If b < b2, gC < gCC; otherwise, gC ≥ gCC.

A previous study suggests that compared to the monopoly scenario, the total supply chain effort decreases when two core enterprises compete on their CSR efforts in the duopoly scenario (Shi et al., 2020). This is because their study assumes that the two core enterprises act successively and the core enterprises’ investments are complementary in terms of improvement the supplier’s environmental responsibility. Consequently, there exists a first-mover disadvantage in which the second-mover may respond to invest less anticipating a first-mover’s high investment. However, in reality, the investment decisions of core enterprises are confidential information, and it is difficult for this kind of information to be shared between core enterprises through contracting. To fill this gap, this study discusses the investment decisions of two core enterprises in a static game framework. In contrast to the results in previous studies, here, in Proposition 7, we demonstrate that, regardless of the core enterprises’ decisions regarding cooperation with the ENGO, moderate competition can improve the total level of environmental effort. We can interpret this result as follows. Since the investment decision of the other is not observed, competitive core enterprises are motivated to invest more to gain a greater market advantage, which will increase the total market demand. Therefore, when the consumer environmental awareness is low so that investment competition is low, compared to the monopoly scenario, each core enterprise can benefit more from the investment externality created by each other in the duopoly scenario. In other words, both the investment cost and environmental benefit are shared between two core enterprises, which enables the core enterprise to afford to invest more in the duopoly scenario. However, as competition intensity further increases, the competitive loss dominates the environmental benefit, and the core enterprise can achieve higher profit through exclusive market ownership than in the duopoly. This result suggests that information asymmetry may partly attenuate the first-mover disadvantage in a market with two core enterprises compete, and thus the moderate competition is conducive to stimulating market dynamics and motivating the core enterprises to increase investments.4.2.2 The impact of core enterprise competition on the profits of each member

In this section, we analyze the impact of core enterprise competition on the profits of the supplier, ENGO and core enterprises.

Proposition 8. The impact of core enterprise competition on the profits of supplier, ENGO and core enterprises are

i) There exist thresholds

(a) if

(b) If

ii) There exist thresholds bE, such that if

iii) There exist thresholds

(a) when

(b) if

5 Extensions

In this section, we verify the robustness of our main findings by considering the symmetrical market size in Section 5.1 and extending to the imperfect product substitution in Section 5.2.

5.1 Asymmetric core enterprises

In this subsection, we assume that the two core enterprises have different potential market sizes, and investigate whether the main result in our base model still holds. Accordingly, the inverse demand functions in the duopoly scenario of the enterprises is given as:

where, M is total market size in terms of revenue, ϕi is market share percentage of core enterprise i (

The remaining model settings remain the same as that in the baseline model in Section 4. We use backward induction to solve this problem and obtain equilibrium solutions (see Supplementary Appendix B for details). Through analysis and comparison, we can obtain Proposition 9.

Proposition 9. In the duopoly scenario, the equilibrium results of core enterprises are as follows:

i) When

ii) When

a) if c > cA, then case NC(CN) is the Nash equilibrium;

b) if c ≤ cA, then case CC is the Nash equilibrium, where,

5.2 Imperfect product substitution

In this subsection, we assume that the products sold by the two core enterprises are imperfect substitutes. Accordingly, the demand and profit functions have not changed in the monopoly scenario, and the inverse demand function in the duopoly scenario of core enterprise is:

where, θ is the substitution rate between the core enterprises’ products and can measure the product competition intensity. That is, the higher θ is, the higher the competition intensity between the two core enterprises’ products.

The remaining model settings remain the same as in the base model in Section 4. We obtain equilibrium solutions by backward induction (see Supplementary Appendix C for details). Through analysis and comparison, we can obtain Proposition 10.

Proposition 10. When the products are imperfect substitutes, the relationships between investment efforts of different cases in the duopoly scenario are as follows:

i) xNN<xNC≤xCC,

ii)

6 Conclusion

Nowadays, ENGO is participating in the environmental governance of suppliers in a more diversified way, and the relationships between core enterprises and ENGO have shifted from conflict-based to cooperative-based. Existing research still focuses on ENGO’s pressure monitoring strategies, and less on how ENGO and core enterprise can cooperate to create value in environmentally sustainable supply chains. It is worth noting that not all core enterprises are willing to work with ENGO in a competitive market. For example, both Apple and Xiaomi source their products from a common supplier, Apple is willing to proactively cooperate with IPE, yet Xiaomi is reluctant to work with IPE. Based on these observations, we develop a game model to examine under what conditions competitive core enterprises should cooperate with knowledge-advantaged ENGO to motivate supplier environmental responsibility.

6.1 Main findings and managerial insights

Our analysis reveals the following novel findings and bears important implications.

i) First, we show that in the duopoly situation, the cooperation strategy dominates the non-cooperation strategy in terms of total environmental effort level and core enterprise’s profit. Therefore, in a duopoly market in which there is no competition, it is wise for the core enterprise to cooperate with ENGO and increase investment, which will help them enlarge the potential market demand and decrease supplier’s environmental violation loss. This suggest indicates that knowledge sharing by ENGO can improve the efficiency of core enterprise’s investments and thus improves the total environmental effort level.

ii) Second, in a monopoly scenario, core enterprises do not necessarily choose to cooperate with ENGO. Specifically, when consumer awareness is high or knowledge absorption ability is high, if one of core enterprises cooperates with ENGO, the other is better to choose non-cooperation; otherwise, cooperation is the optimal choice for both core enterprises. This insight reveals that although one core enterprise may free-riding on the positive benefit created by the other core enterprise, this behavior may coordinate investment decisions among core enterprises, and thus reduce the competition loss in the supply chain system. This implication seems to be consistent with the cooperation decision that we observed in certain industries. That is, although ENGO, an environmental-benefit maximizer, can provide core enterprises with effective knowledge resources for free, not all core enterprises actively seek to establish cooperative relationships with ENGOs.

iii) Third, we illustrate how competition among core enterprises affects core enterprises’ investment motivations: the increase of competition intensity motivates core enterprises’ investment motivations and encourages them to invest more once the competition intensity is low, but may discourage a firm from cooperation when the competition intensity is sufficiently high. This insight reminds a core enterprise that it should consider the market competition intensity carefully when making cooperation decision because the benefit from cooperating with ENGO may be reduced. In addition, the core enterprises can benefit from the case in which core enterprises make investment decisions simultaneously for that the potential first-mover disadvantage can be partly alleviated. Therefore, this result suggests that the proactive disclosure of investment information in sustainability reporting by core companies may be detrimental to enhancing investment in the industry as a whole.

Consequently, our work provides useful managerial insights for core enterprises’ strategies choosing, especially when their investment efficiency is limited by insufficient information and resources. What is important for managers of core enterprises is that they need to consider investment efficiency (such as, existing knowledge level and technology absorption ability) and industry competition structure (such as, the number of core enterprises, consumer willingness to pay, and investment effort competition) when choosing to cooperate with ENGO or not.

6.2 Future research directions

There are a few directions for further research. First, we could consider the effect of the combination of incentive and punitive strategies in motivating supplier environmental responsibility, and this carrot-and-stick mechanism may be more efficient. Second, we have analyzed two factors, that is asymmetric core enterprises and imperfect product substitution that influence the competition structure in our extensions section. We find that the larger the core enterprise market size and the higher the product substitution, the more favorable the cooperation strategy will be. Future investigations could consider more alternative competitive structures, such as downstream competition with multiple core enterprises and vertical integration of core enterprises. Third, our study is based on a symmetric information framework, and future research can be extended to studies of incomplete information frameworks, such as information asymmetry between ENGO and core enterprises regarding environmental violations by suppliers.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author contributions

QM contributed to the conception and framework building. YJ performed the model construction and wrote the draft of the manuscript. JP conducted the software drawing and model solving. All authors have made a substantial, direct, and intellectual contribution to manuscript and approved the submitted version.

Funding

This research is supported by the National Nature Science Foundation of china under grant numbers 71974115, 71901199, and 72273135.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2022.1012036/full#supplementary-material.

References

Agrawal, V., and Lee, D. (2019). The effect of sourcing policies on suppliers’ sustainable practices. Prod. Oper. Manag. 28 (4), 767–787. doi:10.1111/poms.12943

Awasthy, P., Gouda, S., Ghosh, D., and Swami, S. (2022). Analyzing product greening spillovers in multi-product markets. Transp. Res. Part E Logist. Transp. Rev. 158, 102586. doi:10.1016/j.tre.2021.102586

Caro, F., Chintapalli, P., Rajaram, K., and Tang, C. S. (2018). Improving supplier compliance through joint and shared audits with collective penalty. Manuf. Serv. Oper. Manag. 20 (2), 363–380. doi:10.1287/msom.2017.0653

Chen, J., Qi, A., and Dawande, M. (2020). Supplier centrality and auditing priority in socially responsible supply chains. Manuf. Serv. Oper. Manag. 22 (6), 1199–1214. doi:10.1287/msom.2019.0790

Chen, L., and Lee, H. L. (2017). Sourcing under supplier responsibility risk: The effects of certification, audit, and contingency payment. Manage. Sci. 63 (9), 2795–2812. doi:10.1287/mnsc.2016.2466

Chen, S., Zhang, Q., and Zhou, Y. P. (2019). Impact of supply chain transparency on sustainability under NGO scrutiny. Prod. Oper. Manag. 28 (12), 3002–3022. doi:10.1111/poms.12973

Chen, Y. J., Shanthikumar, J. G., and Shen, Z. J. M. (2015). Incentive for peer-to-peer knowledge sharing among farmers in developing economies. Prod. Oper. Manag. 24 (9), 1430–1440. doi:10.1111/poms.12328

Cho, S. H., Fang, X., Tayur, S., and Xu, Y. (2019). Combating child labor: Incentives and information disclosure in global supply chains. Manuf. Serv. Oper. Manag. 21 (3), 692–711. doi:10.1287/msom.2018.0733

EDF (2022). Our work with business and industry. Available at: https://www.edf.org/partnerships/business-and-industry (Accessed July 27, 2022).

Fang, X., and Cho, S. H. (2020). Cooperative approaches to managing social responsibility in a market with externalities. Manuf. Serv. Oper. Manag. 22 (6), 1215–1233. doi:10.1287/msom.2019.0837

Feng, Q., Li, C., Lu, M., and Shanthikumar, J. G. (2021). Implementing environmental and social responsibility programs in supply networks through multiunit bilateral negotiation. Manage. Sci. 68, 2579–2599. doi:10.1287/mnsc.2021.4034

Guo, R., Lee, H. L., and Swinney, R. (2016). Responsible sourcing in supply chains. Manage. Sci. 62 (9), 2722–2744. doi:10.1287/mnsc.2015.2256

Guo, S., Choi, T. M., and Shen, B. (2020). Green product development under competition: A study of the fashion apparel industry. Eur. J. Oper. Res. 280 (2), 523–538. doi:10.1016/j.ejor.2019.07.050

Harangozo, G., and Zilahy, G. (2015). Cooperation between business and non-governmental organizations to promote sustainable development. J. Clean. Prod. 89, 18–31. doi:10.1016/j.jclepro.2014.10.092

Huang, L., Song, J. S., and Swinney, R. (2022). Managing social responsibility in multitier supply chains. Manuf. Serv. Oper. Manag. doi:10.1287/msom.2021.1063

IPE (2021). 2021 green supply chain CITI evaluation report? Green transformation through synergistic reductions of pollution and carbon emissions. Available at: http://wwwen.ipe.org.cn/reports/Reports_18334_1.html (Accessed July 27, 2022).

Karaer, O., Kraft, T., and Khawam, J. (2017). Buyer and nonprofit levers to improve supplier environmental performance. Prod. Oper. Manag. 26 (6), 1163–1190. doi:10.1111/poms.12612

Kraft, T., and Raz, G. (2017). Collaborate or compete: Examining manufacturers’ replacement strategies for a substance of concern. Prod. Oper. Manag. 26 (9), 1646–1662. doi:10.1111/poms.12710

Kraft, T., Valdes, L., and Zheng, Y. (2020). Motivating supplier social responsibility under incomplete visibility. Manuf. Serv. Oper. Manag. 22 (6), 1268–1286. doi:10.1287/msom.2019.0809

Kraft, T., Valdes, L., and Zheng, Y. (2018). Supply chain visibility and social responsibility, Investigating consumers’ behaviors and motives. Manuf. Serv. Oper. Manag. 20 (4), 617–636. doi:10.1287/msom.2017.0685

Kraft, T., Zheng, Y., and Erhun, F. (2013). The NGO’s dilemma: How to influence firms to replace a potentially hazardous substance. Manuf. Serv. Oper. Manag. 15 (4), 649–669. doi:10.1287/msom.2013.0440

Lai, G., Liu, H., Xiao, W., and Zhao, X. (2022). Fulfilled by amazon”: A strategic perspective of competition at the e-commerce platform. Manuf. Serv. Oper. Manag. 24, 1406–1420. doi:10.1287/msom.2022.1078

Lee, H. H., and Li, C. (2018). Supplier quality management, Investment, inspection, and incentives. Prod. Oper. Manag. 27 (2), 304–322. doi:10.1111/poms.12802

Letizia, P., and Hendrikse, G. (2016). Supply chain structure incentives for corporate social responsibility: An incomplete contracting analysis. Prod. Oper. Manag. 25 (11), 1919–1941. doi:10.1111/poms.12585

Liu, Z. L., Anderson, T. D., and Cruz, J. M. (2012). Consumer environmental awareness and competition in two-stage supply chains. Eur. J. Oper. Res. 218 (3), 602–613. doi:10.1016/j.ejor.2011.11.027

Murali, K., Lim, M. K., and Petruzzi, N. C. (2019). The effects of ecolabels and environmental regulation on green product development. Manuf. Serv. Oper. Manag. 21 (3), 519–535. doi:10.1287/msom.2017.0703

Orsdemir, A., Hu, B., and Deshpande, V. (2019). Ensuring corporate social and environmental responsibility through vertical integration and horizontal sourcing. Manuf. Serv. Oper. Manag. 21 (2), 417–434. doi:10.1287/msom.2018.0744

Plambeck, E. L., and Taylor, T. A. (2016). Supplier evasion of a buyer’s audit: Implications for motivating supplier social and environmental responsibility. Manuf. Serv. Oper. Manag. 18 (2), 184–197. doi:10.1287/msom.2015.0550

Rodriguez, J. A., Giménez, C., and Arenas, D. (2016). Cooperative initiatives with NGOs in socially sustainable supply chains: How is inter-organizational fit achieved? J. Clean. Prod. 137, 516–526. doi:10.1016/j.jclepro.2016.07.115

Shi, X., Chan, H. L., and Dong, C. (2020). Impacts of competition between buying firms on corporate social responsibility efforts: Does competition do more harm than good? Transp. Res. Part E Logist. Transp. Rev. 140, 101985. doi:10.1016/j.tre.2020.101985

Stekelorum, R., Laguir, I., and Elbaz, J. (2020). Cooperation with international NGOs and supplier assessment: Investigating the multiple mediating role of CSR activities in SMEs. Ind. Mark. Manag. 84, 50–62. doi:10.1016/j.indmarman.2019.04.001

Tachizawa, E. M., and Wong, C. Y. (2014). Towards a theory of multi-tier sustainable supply chains, a systematic literature review. Supply Chain Manag. Int. J. 19, 643–663. doi:10.1108/scm-02-2014-0070

Tevapitak, K., and Helmsing, A. B. (2019). The interaction between local governments and stakeholders in environmental management: The case of water pollution by SMEs in Thailand. J. Environ. Manage. 247, 840–848. doi:10.1016/j.jenvman.2019.06.097

Tong, X., Linderman, K., and Zhu, Q. (2022). Managing a portfolio of environmental projects: Focus, balance, and environmental management capabilities. J. Ops. Manag. doi:10.1002/joom.1201

Tsay, A. A., and Agrawal, N. (2000). Channel dynamics under price and service competition. Manuf. Serv. Oper. Manag. 2 (4), 372–391. doi:10.1287/msom.2.4.372.12342

Walmart (2021). Product supply chains, sustainability overview. Available at: https://corporate.walmart.com/esgreport/esg-issues/product-supply-chain-sustainability#approach (Accessed May 2, 2022).

Wang, F., Li, H., Cao, Y., Zhang, C., and Ran, Y. (2022). Knowledge sharing strategy and emission reduction benefits of low carbon technology collaborative innovation in the green supply chain. Front. Environ. Sci. 751. doi:10.3389/fenvs.2021.783835

Wang, J., Shin, H., and Zhou, Q. (2021). The optimal investment decision for an innovative supplier in a supply chain. Eur. J. Oper. Res. 29 (23), 967–979. doi:10.1016/j.ejor.2020.11.040

Wang, S., Sun, P., and de Véricourt, F. (2016). Inducing environmental disclosures: A dynamic mechanism design approach. Oper. Res. 64 (2), 371–389. doi:10.1287/opre.2016.1476

Wang, X., Cho, S. H., and Scheller-Wolf, A. (2021). Green technology development and adoption: Competition, regulation, and uncertainty? A global game approach. Manage. Sci. 67 (1), 201–219. doi:10.1287/mnsc.2019.3538

Wang, Y., Ha, A. Y., and Tong, S. (2021). Sharing manufacturer’s demand information in a supply chain with price and service effort competition. Manuf. Serv. Oper. Manag. 24, 1698–1713. doi:10.1287/msom.2021.1028

Wang, Z., Wang, M., and Liu, W. (2020). To introduce competition or not to introduce competition: An analysis of corporate social responsibility investment collaboration in a two-echelon supply chain. Transp. Res. Part E Logist. Transp. Rev. 133, 101812. doi:10.1016/j.tre.2019.11.006

Wu, J., Wang, H., and Shang, J. (2019). Multi-sourcing and information sharing under competition and supply uncertainty. Eur. J. Oper. Res. 278 (2), 658–671. doi:10.1016/j.ejor.2019.04.039

Xiang, X., Ma, M., Ma, X., Chen, L., Cai, W., Feng, W., et al. (2022). Historical decarbonization of global commercial building operations in the 21st century. Appl. Energy 322, 119401. doi:10.1016/j.apenergy.2022.119401

Xiao, S., Chen, Y. J., and Tang, C. S. (2020). Knowledge sharing and learning among smallholders in developing economies: Implications, incentives, and reward mechanisms. Oper. Res. 68 (2), 435–452. doi:10.1287/opre.2019.1869

Yan, R., Xiang, X., Cai, W., and Ma, M. (2022). Decarbonizing residential buildings in the developing world: Historical cases from China. Sci. Total Environ. 2022, 157679. doi:10.1016/j.scitotenv.2022.157679

Yang, H., and Chen, W. (2018). Retailer-driven carbon emission abatement with consumer environmental awareness and carbon tax, Revenue-sharing versus cost-sharing. Omega 78, 179–191. doi:10.1016/j.omega.2017.06.012

Yang, R., Tang, W., and Zhang, J. (2021). Technology improvement strategy for green products under competition: The role of government subsidy. Eur. J. Oper. Res. 289 (2), 553–568. doi:10.1016/j.ejor.2020.07.030

Yu, X., Lan, Y., and Zhao, R. (2021). Strategic green technology innovation in a two-stage alliance: Vertical collaboration or co-development? Omega 98, 102116. doi:10.1016/j.omega.2019.102116

Zeimers, G., Anagnostopoulos, C., Zintz, T., and Willem, A. (2019). Examining collaboration among nonprofit organizations for social responsibility programs. Nonprofit Volunt. Sect. Q. 48 (5), 953–974. doi:10.1177/0899764019837616

Zhang, S., Ma, M., Xiang, X., Cai, W., Feng, W., and Ma, Z. (2022). Potential to decarbonize the commercial building operation of the top two emitters by 2060. Resour. Conserv. Recycl. 185, 106481. doi:10.1016/j.resconrec.2022.106481

Zhou, J., Fan, X., Chen, Y. J., and Tang, C. S. (2021). Information provision and farmer welfare in developing economies. Manuf. Serv. Oper. Manag. 23 (1), 230–245. doi:10.1287/msom.2019.0831

Keywords: competitive core enterprises, knowledge-advantaged ENGO, cooperation, environmental responsibility, investment, supply chain management, game theory

Citation: Meng Q, Jiang Y and Pan J (2022) Cooperate or not with knowledge-advantaged ENGO: Motivating supplier environmental responsibility of competitive core enterprises. Front. Environ. Sci. 10:1012036. doi: 10.3389/fenvs.2022.1012036

Received: 05 August 2022; Accepted: 31 August 2022;

Published: 23 September 2022.

Edited by:

Kangyin Dong, University of International Business and Economics, ChinaCopyright © 2022 Meng, Jiang and Pan. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yumei Jiang, eXVtZWlqMDgxMUAxNjMuY29t

Qingchun Meng1,2

Qingchun Meng1,2 Yumei Jiang

Yumei Jiang