- 1School of Business, Central South University, Changsha, China

- 2School of Public Management, Inner Mongolia University, Hohhot, China

- 3Inner Mongolia Business & Trade Vocational College, Hohhot, China

- 4School of Economics and Management, Inner Mongolia University, Hohhot, China

- 5Graduate School of Business, Mongolia University of Science and Technology, Baotou, China

Eliminating or reducing ecological risks can help to observably guarantee the national security. In this article constructs a regional ecological risk evaluation framework is constructed on the basis of the Pressure-state-response model from three dimensions: social, environmental and natural dimension, and the quantitative research method is taken to investigate the ecological risks in 30 Chinese provinces from 2006 to 2017. Taking the establishment of a carbon emission trading market as a quasi-natural experiment, the author further explores the impact of market-based environmental policies on regional ecological risks and their heterogeneity, channels of action, and the synergistic effects of government intervention. It is found that: 1) The implementation of market-based environmental policies can improve regional responsiveness to ecological risks and significantly reduce the level of regional ecological risks, meanwhile the research results pass the identification assumptions and robustness tests. 2) The effects of market-based environmental policies are affected by the operational characteristics of market prices, liquidity and relative transaction scale. (iii)There are two essential approaches for market-based environmental policies to reduce regional ecological risks, named industrial structure upgrading and technology development. 4) Moderate government intervention can produce synergistic effects in the process of regional ecological risk reduction by market-based environmental policies, and it is able to maintain intervention produces policy synergistic effects within a temperate condition. In a word, these findings can provide both an important basis for adjusting the implementation scope and operational structure of market-based environmental policies. On the other hand, it can also offer a significant policy insight for regional ecological risk evaluation and management.

1 Introduction

Eliminating or reducing ecological risks is of great necessity to maintain national ecological security. China’s economy grew at an average annual rate of 9.42% from 1978 to 2021, and its contribution to world economic growth exceeded 25% in 2021. But coal consumption accounts for 56% of total energy consumption and 33% of global carbon emissions. The trend of rapid economic growth has led to increasingly prominent conflicts between energy supply and demand, overstretched environmental carrying capacity, and posing severe challenges to maintaining ecological security and sustainable development. In 2015, China promulgated and implemented the National Security Law of the People’s Republic of China, which made ecological security one of the important tasks in maintaining national security. The 18th National Congress of the CPC has made “beautiful China” as the main goal of building a strong modern socialist country, which brings the maintenance of ecological civilization and environmental protection to a new strategic level once again. How to reduce regional ecological risks and ensure the structural stability and functional security of ecosystems to promote regional sustainable development has become a key task for human social development in the 21st century (Lu et al., 2018).

Ecological risk is the likelihood that an ecosystem will be exposed to a hazardous environmental condition. The effective implementation of regional ecological risk evaluation and management to predict and identify potential problems and threats to regional development is of great significance to grasp, which constructed and optimized regional ecological security patterns (Li et al., 2020). In 1983, the Red Book of the National Academy of Sciences proposed a four-step approach of “hazard identification, dose-response assessment, exposure assessment and risk characterization”, which initially established a framework for ecological risk assessment (Baram, 1983). Subsequently, the American Environmental Protection Agency defined the concept of ecological risk and issued the Ecological Risk Assessment Guide, which proposed a three-step approach of “problem formulation, risk assessment and risk characterization”, and became a commonly accepted framework for ecological risk assessment by researchers (Assessment, 1992; Assessment, 1996).

Based on the above research framework, Chinese scholars have also started to focus on ecological risk, including the concept, development process, evaluation steps and research methods of ecological risk (Chen and Liu, 2014; Liu et al., 2020), and gradually carrying out quantitative research, with the process involving the ecological footprint method (Bi et al., 2020), GIS (Wu et al., 2020), probabilistic risk method (Shi et al., 2016). The focus on risk stressors has expanded from single to multiple chemical substances and ecological events (Yang et al., 2018; Zhang et al., 2020), and the focus on risk receptors has expanded from populations to communities, watersheds (Wu et al., 2018), landscapes (Wu et al., 2020), representative regions (Huang et al., 2007; Bi et al., 2020), and other levels. In general, domestic ecological risk research in China lacks a unified evaluation standard and framework. Although the perspective of the relative researches has been expanded, the expanded scope is mainly focused on natural geographic systems and special ecological zones, and the boundary characteristics of regions are obvious and characterized by high sensitivity and vulnerability, etc. Few studies on regional ecological risk have been conducted at either the provincial or city level. Due to the limited scope of research, it is difficult to make global comparisons. In addition, most of the existing studies remain at the stage of regional ecological risk evaluation, and there is a scarcity of research on how to manage and prevent regional ecological risks.

The effect of environmental regulatory policies on environmental governance has been an important issue for scholars (Yu and Yin, 2022). The command-based environmental policies mainly form mandatory constraints through administrative standards such as laws and regulations, while market-based environmental policies form incentive constraints through economic instruments such as emission pricing and taxation. In response to environmental pollution, the Chinese government has issued a number of command-based environmental policies in recent years, such as pollution penalties and two control zones. Studies have found that the implementation of command-based policies can reduce pollution emissions (Xie et al., 2017; Wang et al., 2019) and improve regional sustainable development. However, most of the command-based policies are adopted by regulatory targets in pursuit of legitimacy and have not produced substantive environmental protection practices (Hu et al., 2020). With the improvement of markets, more and more studies have concluded that market-based policies can reduce social energy and transaction costs, and have a more flexible and long-term guiding effect on the environmental protection (Shen et al., 2017; Murray et al., 2020). Therefore, the market has shown more positive policy effects in promoting energy conservation and emission reduction, green technology innovation (Hu et al., 2020), industrial upgrading (Tan and Zhang, 2018) and promoting local economic development with high-quality (Shao and Li, 2022). Represented by carbon markets, studies have found that the establishment of carbon markets has a synergistic effect on SO2 and NOX emission reductions, and will reduce the economic cost of emissions (Cheng et al., 2015), but the effectiveness of policy implementation varies widely across pilots (Wu W. G. et al., 2021).

Market refers to the sum of information related to emissions, which can be reflected in the form of prices. In addition to establishing a trading rights market, optimizing the internal structure and operational efficiency of the market is essential for achieving emission reduction targets and risk management. Zhao et al. (2017) evaluated the operation efficiency of China’s carbon market based on Fama’s efficient market hypothesis theory. According to this study, China’s carbon trading market is still in an immature stage, with low operation efficiency. Problems such as low transparency of information within the market, inadequate infrastructure, pricing, regulation and reward and punishment mechanisms are prominent (Zhang et al., 2017). Poor liquidity leads to low participation of players, which in turn weakens the operational effectiveness of the carbon market.

In summary, the existing studies have indicated that both governments and markets play an important role in promoting regional environmental governance however, these studies only explored the environmental effects of policies from a single market or government perspective, thus the findings are one-sided. Wu Y. Y. et al. (2021) and Wang et al. (2021) examine the impact of policy synergy on pollution reduction, which play a complementary role, but regional ecological risk includes not only environmental elements but also covers social and economic dimensions. Moreover, in addition to policy effects, another major objective of policy evaluation is to adjust the internal structure of policies. In this paper, the author proposes to build an evaluation system for regional ecological risk, taking the establishment of China’s carbon emission trading rights market as a quasi-natural experiment and using a multi-period double difference method to explore the following questions: Does market-based environmental policy help reduce regional ecological risk? What are the approaches of its action? Does the efficiency of market operation affect the effectiveness of the policy? Can government interventions create synergies?

Compared with the existing studies, the possible marginal contributions of this paper are: Firstly, based on the PSR model, a regional ecological risk evaluation framework is constructed and the ecological risks in 30 Chinese provinces are measured quantitatively, which broadens the connotation and scope limitations of ecological risk evaluation and increases regional comparability, while providing a theoretical reference for national ecological security evaluation and management. Secondly, taking the pilot of China’s carbon trading rights as a quasi-natural experiment, we use a multi-period double difference method is used to examine the effects of market-based environmental policy implementation on regional ecological risks, which extends the scope of the study on the effect of market-based environmental policies. Thirdly, on the basis of whether the policy is implemented or not, this study further investigates impact of the internal operation characteristics of the carbon market on regional ecological risks from the three aspects of market price, liquidity and relative transaction scale, and the function channels are examined. The conclusions provide a reference for adjusting the internal structure of the market and sustaining the role of market-based environmental policies in maintaining social and environmental system security. Finally, at the stage of imperfect operation of the carbon trading rights market, the study considers the government’s additional factors to the market and examines the role of government intervention in the process of market policies’ impact on regional ecological risks. The findings have important implications for improving the efficiency of market operation and bringing policy synergies into play.

2 Theoretical basis and research hypothesis

2.1 Effects of market-based environmental regulation on regional ecological risk

Environmental pollution is characterized by negative externalities. Market-based environmental regulation guides enterprises to carry out environmental management activities in an economic economically by internalizing their external costs. The impact on regional ecological risk is manifested as follows. The first point is the behavioral constraint effect. Market-based environmental policies set emission standards for enterprises based on historical data, and set explicit pricing to emissions. Requiring enterprises to maintain production and emission demands through market transactions, which creates constraints on enterprises’ emission behavior. However, emission reduction should not be achieved at the expense of excessive economic growth. The market trading mechanism provides the necessary safeguards for enterprises to maintain normal production and business activities while restraining their emission reduction behavior. This helps to reduce the overall risk to the functioning of the ecosystem by mitigating the positive impact of pollution on business shutdowns and the resulting loss of jobs and quality of life (Liao et al., 2020). The second point is the behavioral incentives effect. Unlike mandatory orders, market encourages the enterprises to incorporate emissions into their production and consumption decisions, which allows them to weigh production and emission reduction costs and reduce emissions to obtain additional market benefits while control total emissions. This will also increase the spontaneous and proactive response behavior of enterprises to meet legal requirements, to prompt them to improve their production and operation models through innovation and transformation, reducing the destructive power of their production behavior on the environment, and thus decreasing ecological vulnerability and pressure. A virtuous cycle will be established in the long term, improving the current sustainable state of the ecosystem and its risk-carrying capacity. As a result, positive roles are necessary to be played in mitigating regional ecological risks.

In summary, this paper proposes H1: Market-based environmental policy implementation can reduce regional ecological risks.

2.2 Effects of carbon trading market characteristics on regional ecological risks

The effectiveness of market-based environmental policies on regional ecological risks depends not only on the establishment of a mechanism, but also on market efficiency factors such as market price, liquidity and scale of transactions (Zhao et al., 2016). China’s market emission policies are mostly based on historical emission data for quotas. The market is highly volatile, with lags in response to real-time information, and the intermittent phenomenon of “prices without transactions” and full trading time is expected in the market. First of all, the market price is an essential indicator of uncertainty (Bekaert and Hoerova, 2014; Saeed et al., 2021). Relatively low price for emissions results in low compliance costs, and firms tend to meet emission standards by purchasing allowances, with little incentive to reduce emissions themselves. Instead, they may use low price to expand production in the short term and increase pollution emissions. Moderate price increases send pressure signals to push the enterprises to innovate the production and reduce emissions, while fairly high prices discourage them from responding to the needs of the environment protection, making it difficult to utilize the cost-saving effects of the market. Secondly, liquidity reflects the activity and attitudes of market participants, which will affect the transparency of market information and price stability. Poor market liquidity affects market supply and demand, with difficulties in obtaining quotas on the demand side, which may restrict average production and business activities of enterprises. This in turn triggers social risks such as production cuts and unemployment, or leads to enterprise’s negligence to emission restrictions, negatively impacting compliance and increasing ecological pressure. Finally, the market transaction scale is a combination of market price, volume and liquidity. In comparison to the total amount of pollution emissions, the proportion of the market trading scale will be larger, the participation of market players will be higher, the market utilization of the market will be higher, and the role in reducing environmental pollution and business risks will be greater. In summary, the following research hypotheses are proposed in this paper:

H2: The efficiency of market operation will affect the role of market-based environmental policies played in regional ecological risks.

H2a: Changes in market will have an uncertain impact on regional ecological risk.

H2b: Increased market liquidity contributes to the positive impact of market-based environmental policies on reducing regional ecological risks.

H2c: Increased relative market size helps to enhance the positive impact of market-based environmental policies on reducing regional ecological risks.

2.3 Approaches of action of market-based environmental regulation on the impact of regional ecological risks

By promoting technological innovation, market-based environmental policies can reduce the level of regional ecological risk. Market-based environmental regulation follows the operation model of “Cap-and-Trade” that sets a price for pollution emissions. ITC theory suggests that changes in the relative price of factors will induce technological innovation behavior of regulators to save the input cost of factors (Hicks, 1963). On the one hand, total limits will crowd out the enterprises’ normal production investment activities and increase their pollution control costs. The resulting regulatory pressure can force the enterprises to engage in technological innovation, help them to reduce resource consumption in their production processes, and improve productivity and build long-term competitive advantage (Porter and Van der Linde, 1995). On the other hand, the behavior of the enterprises is guided by profit maximization. Price changes in the emissions market provide a shadow price for technological innovation, which can eliminate the positive externalities of firms’ scanty innovation. In the case of a single enterprises, if the marginal cost of emissions is higher than innovation, it will motivate companies to innovate the enterprise, thereby reducing uncertainty in its pollution behavior and increasing its bargaining power and profitability in the emissions market while meeting its emission target.

In a word, increased responsiveness of single enterprises to technological innovation will promote the overall technological innovation capacity of society, which will reduce pollution emissions and help to improve ecosystem resilience, thereby reducing the level of regional ecological risk. This paper proposes H3a: Market-based environmental policies can reduce regional ecological risks by enhancing technological innovation.

By optimizing the industrial structure, market-based environmental policies can reduce the level of regional ecological risks. Firstly, setting emission standards can help to external defense lines, which can enhance the entry barriers of high polluting and high energy consuming enterprises. Secondly, market cost options will compress the profit margins of firms, optimize the way enterprises allocate resources and eliminate excess capacity. Regulating the consumption structure of energy and resources and forming internal barriers by promoting process reorganization and re-engineering of the internal structure of industries the enterprises. Finally, the factor input structure, promote cleaner energy and production methods can be changed. The market choice brought about by policy guidance will stimulate the participation of enterprises and promote the green and sustainable development of the industry.

Generally speaking, market-based environmental policies can regulate and guide the behavior of polluters, which will optimize the way resources are allocated, promote the transformation and upgrading of industrial structures, and reduce environmental risks at source. Therefore, this paper proposes H3b: market-based environmental policies can reduce the level of regional ecological risks by optimizing the industrial structure.

2.4 Synergistic effects of government intervention

Classical economic theory suggests that perfectly competitive markets can achieve optimal resource allocation efficiency in the absence of government intervention. However, in imperfectly competitive markets, externalities and uncertainties can reduce resource allocation efficiency and even lead to market failure (Williamson, 1971). It is manifested by the neglect of environmental needs by enterprises in pursuit of profit maximization, resulting in excessive emissions and increasing the pressure of emission reduction on the ecological environment. At this time, government intervention may play an important role in market operation. On the one hand, government intervention can regulate the market operation process. It can improve the efficiency of market resource allocation, improve factor markets, stabilize transaction prices, further improve the efficiency of market operation and correct market failures by imposing emission fees and environmental taxes (Kallbekken et al., 2011). On the other hand, the implementation of government intervention policies can also mitigate regional ecological risks. The strength of government regulation is a sign of the importance attached to the environment, which will reduce fluke mind and avoidance of companies and increase its ability to take action to reduce environmental pollution. In addition, government incentives such as subsidies and tax cuts will guide enterprises to accelerate their technological innovation and optimize their energy mix, which will be more conducive to expedite their behavioral response to the environment and improve their ability to reduce pollution, meanwhile bring into play the synergy between government administrative and market policies in mitigating the ecological pressures.

Therefore, this paper proposes H4: Government intervention plays a synergistic role in the process of market-based environmental policies to reduce regional ecological risks.

3 Research design

3.1 Identification strategy

In this paper, a carbon emission trading pilot is used as proxies for the market-based environmental policies. A multi-period double difference method of estimation to portray differences in the timing of carbon market initiation, and examining whether there is a significant difference in ecological risk between the treatment and control groups before and after the establishment of the carbon market. The model is set up as follows:

where

3.2 Measurement of regional ecological risks

3.2.1 Construction of regional ecological risk evaluation index system

Pressure-state-response (PSR) model is refined by the Organization for Economic Cooperation and Development (OECD) and the United Nations Environment Programme (UNEP) in 1980. In this model, three categories of indicators are used to reflect and analyze the state and dynamics of things under the combined effect of multiple factors to explain the three aspects of why, what and how (Xie and Huang, 2017), where “pressure” (P) characterizes the ecological load imposed by human activities, “state” (S) characterizes the current resource status of the ecosystem and the economy and society, and “response” (R) characterizes the beneficial measures taken by humans to solve ecological problems. Due to the wide coverage and clear relationships of PSR model indicators, this model has been widely used in ecological and sustainable development evaluation in recent years.

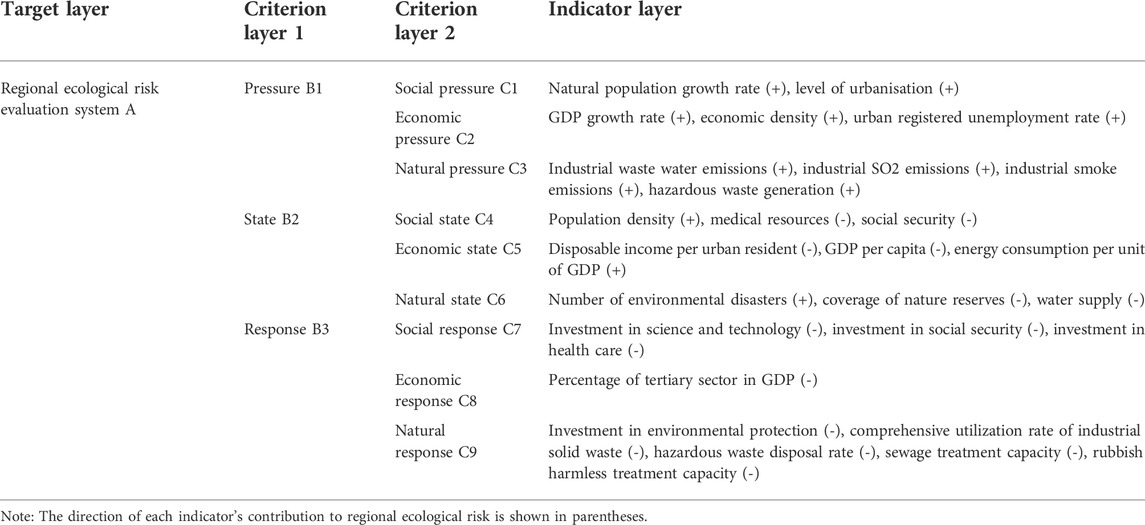

In this paper, in accordance with the principles of multidimensionality, wholeness, comparability and data availability, and on the basis of the PSR model, we refer to the studies of Ke et al. (2017) and Hu and Xie (2021) to construct a regional ecological risk evaluation system containing three levels and 27 indicators in three dimensions: social, economic and natural dimension. The indicator system is constructed as shown in Table 1.

3.2.2 Method of regional ecological risk evaluation

Determining the weight of indicators is an important part of comprehensive evaluation. Compared with other methods, the entropy weighting method calculates weights based on the amount of information of indicators, which is objective, flexible and simple to operate. It can overcome the interference of subjective bias in the comprehensive evaluation. Therefore, this paper adopts the entropy weight method to measure the comprehensive index of regional ecological risk, and the specific steps are as follows:

(i) Construct a judgment matrix. Construct a judgment matrix containing

3.3 Variable setting and basic description

3.3.1 Explained variable and core explanatory variable

The explained variable in this paper is the regional ecological risk composite index (

3.3.2 Channel variables

(i) Level of industrial structure transformation and upgrading. According to Yuan and Zhu (2018), Gan et al. (2011), the industrial structure rationalization index (

The industrial structure Thayer index is a reflection of the output value and employment structure of industries, where

(ii) Level of technological innovation. In according with the study of Qi et al. (2018), this paper takes regions as the data collection level, aggregates provincial green patent data from the National Patent and Intellectual Property Office, and adopts two indicators, the logarithm of the total number of green patent applications (

3.3.3 Government intervention

Government intervention reflects the government’s control and allocation of market resources. On the basis of the study of Wang et al. (2021), in this paper uses the amount of investment in environmental pollution control as a proportion of regional GDP is used to indicate the intensity of government intervention in environmental governance.

3.3.4 Market characteristics variables

According to Wu W. G. et al. (2021), 1) the Carbon price (

3.3.5 Control variables

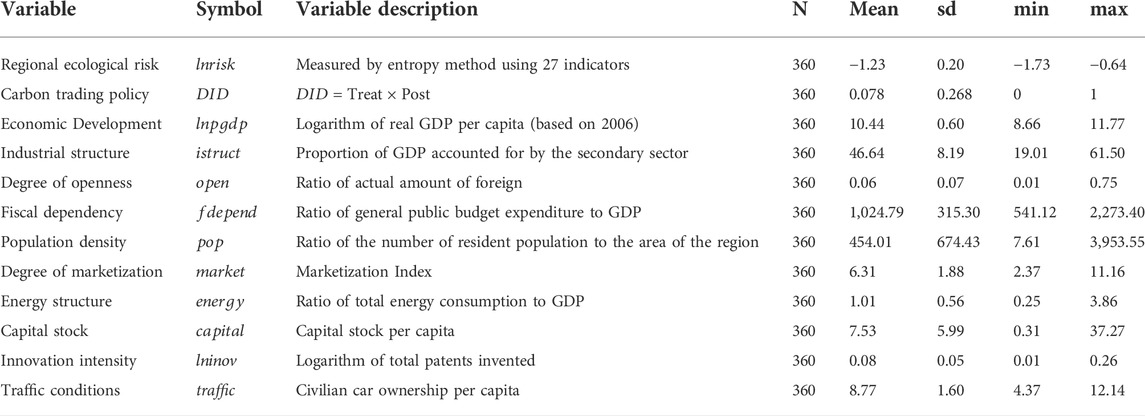

To control the effects of regional economic, environmental and demographic characteristics on policy effects, On the basis of the study of Wu Y. Y. et al. (2021) and Liu et al. (2019), such control variables as the level of economic development (

3.4 Data sources and sample selection

Samples from 30 provinces (municipalities or autonomous regions) in China from 2006 to 2017 are selected as the research sample (the samples from Hong Kong, Macao, Taiwan and Tibet are excluded due to data their unavailability). In December 2017, China announced the official launch of the national carbon emission trading market, and the pilot scale of the carbon trading market gradually expanded. The development of China’s carbon market enters a new stage, so this paper chooses 2017 as the end point of the sample time. The original data on the indicators of the ecological risk evaluation system, government intervention and control variables are obtained from the China Statistical Yearbook, China Environmental Statistical Yearbook, China Energy Statistical Yearbook, China Science and Technology Statistical Yearbook, and China Sub The data on carbon market characteristics are obtained from the China Carbon Emissions Trading Website (http://www.tanpaifang.com/). Some missing data are filled by using the moving average method. The definitions and descriptive statistics of each variable are shown in Table 2.

3.5 Comparison of ecological risk means between the treatment and control groups

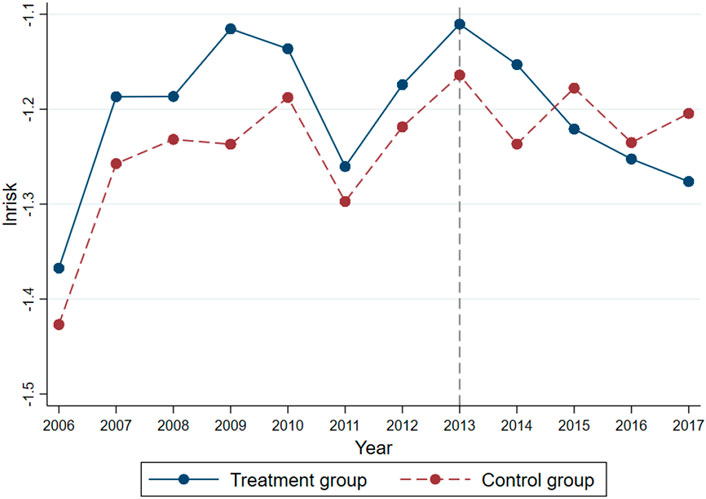

Figure 1 shows that before the implementation of the policy in 2013, the ecological risks in the pilot and non-pilot regions followed similar change trends, with the ecological risks in the pilot regions being significantly higher than those in the non-pilot regions. After the pilots were established, the level of ecological risk in both types of pilots decreased, but the decreasing trend in the pilot areas was continuous and more obvious, which initially showed the positive impact of the carbon emission trading market on reducing ecological risk. The regional ecological risks in the graph also showed a downward trend in 2011, probably due to the fact that the National Development and Reform Commission issued the Notice on the Launching of Carbon Emissions Trading Pilot Work in 2011 before the official opening of the pilots. Such preparatory work as the development of systems and trading rules was then started in the pilots, which had the expected effect of a policy pilot.

4 Empirical results

4.1 Baseline regression results

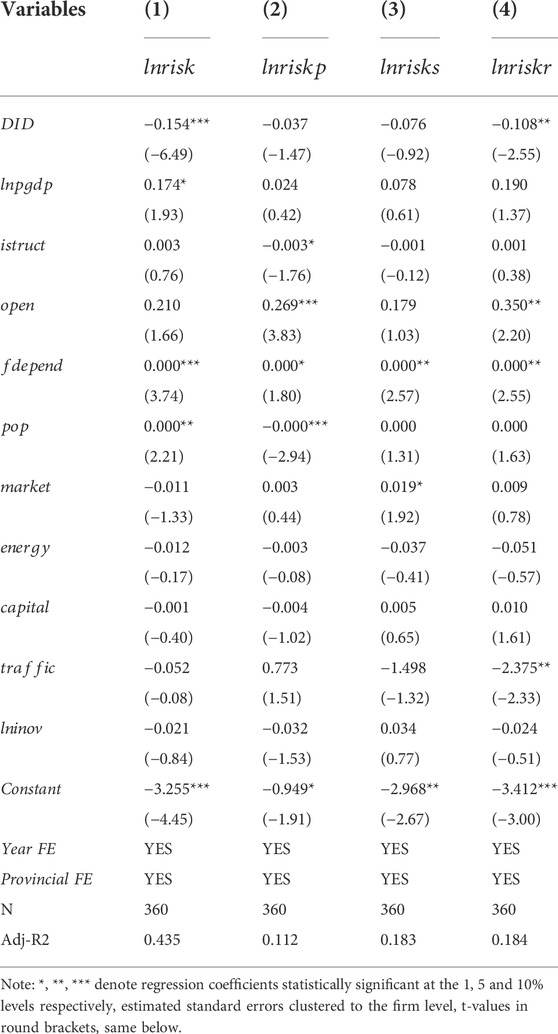

After the year fixed effects and related variables are controlled on a provincial basis, the results in Table 3 column 1) show that the DID coefficient is significantly negative at the 1% level, indicating that the level of regional ecological risk was significantly reduced after the implementation of the carbon emissions trading policy. The regressions of ecological risk pressure, status and response index as explanatory variables in column 2–4 of Table 3 were conducted to examine the direction of the impact of market-based environmental policy implementation on regional ecological risk, and it is found that the coefficients of DID in all three sets of regressions showed negative values, but only the DID coefficient of ecological risk response index passed the significance test.

The above regression results indicate that market-based environmental policy implementation can significantly reduce the level of regional ecological risk. In addition, H1 was verified. Specifically, the regression results for the three ecological risk sub-indices show that market-based environmental policies have a positive impact on the reduction of regional ecological risks mainly through improving the responsiveness of regulatory agents to ecological risks. The above results suggest that market-based environmental policies help to play the incentive effect of policies on enterprises’ emission reduction behavior, and that the micro-incentive effect is cumulative, which in turn has a positive impact on the macro-environment.

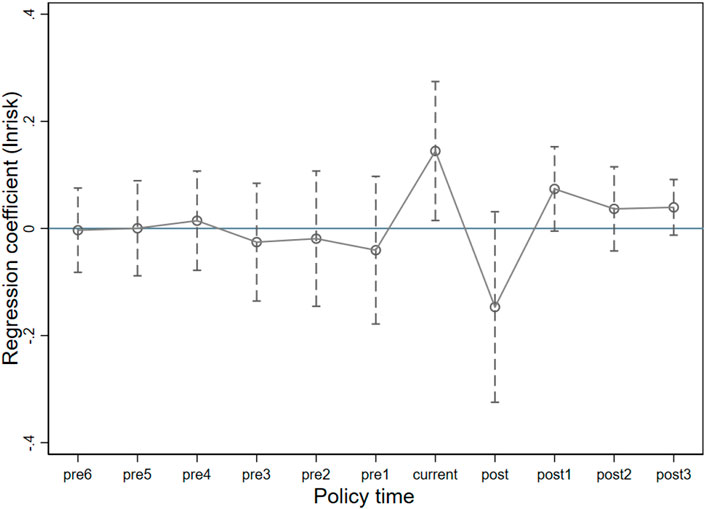

4.2 Parallel trend test

On the basis of the study of Zhang et al. (2019), we use event analysis is used to test the parallel trend before the policy was implemented. The model is constructed as follows:

When 2006 is taken as the base year,

4.3 Robustness test

To confirm the reliability of the baseline regression results, in this paper performs robustness tests are performed through three methods: propensity score matching-double difference method (PSM-DID), placebo test and change sample period.

4.3.1 Placebo test

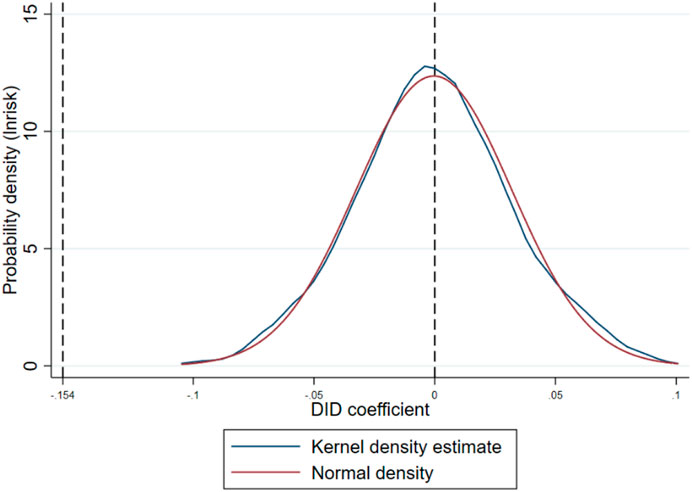

To ascertain that the above findings are not coincidental, this paper randomizes the provinces and time of carbon market establishment in this paper are randomized for a placebo test. On the basis of the study of Lu et al. (2021), a non-parametric substitution test was used to conduct the test. Specifically, within the 30 provinces and the sample period of 2006–2017, seven pseudo-pilot provinces and the corresponding pseudo-implementation time were randomly selected each time as the pseudo-treatment group, and then Eq. 1 was reset and estimated based on the extraction results. The process was repeated 500 times to obtain the estimated coefficients of the pseudo-DID. Figure 3 plots the probability density distribution of the 500 pseudo-estimated coefficients. It can be found that the actual regression coefficient values deviate from the probability density distribution curve, and the mean value of the 500 pseudo-regression coefficients is close to zero, which differs significantly from the actual regression coefficient values. This indicates that the results of this paper pass the placebo test and the establishment of the current carbon market does help reduce the regional ecological risks.

FIGURE 3. Probability density distribution of the estimated coefficients of the placebo test. Note: The vertical dashed line indicates the actual estimate of DID in column (1) of Table 2.

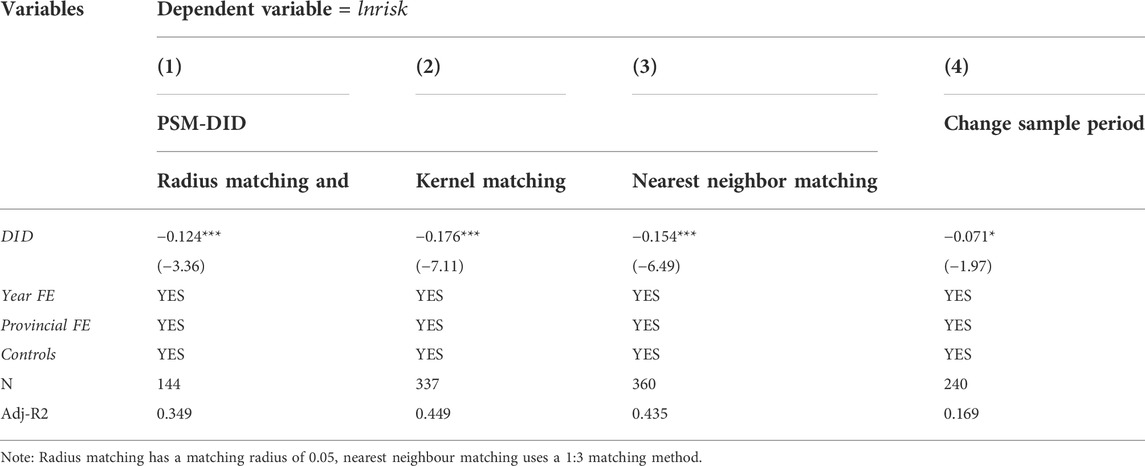

4.3.2 Propensity score matching - Double difference method

DID methodology requires that pilot and non-pilot areas meet a common trend assumption. The trends in ecological risk between pilot areas and other areas do not differ systematically over time if low carbon pilot policies are not implemented. However, if the low carbon pilots are not randomly selected, this may influence regional differences in ecological risk through other factors that are not time-varying and unobservable.

To overcome possible systematic differences in ecological risk changes between pilot and non-pilot areas, this paper uses the PSM-DID method is used in this paper to find treatment groups similar to pilot provinces among non-pilot provinces to eliminate the problem of sample selectivity (Liu and Zhao, 2015). The basic ideas include: (ⅰ) Using control variables to predict the probability of a province being selected as a pilot area, and use radius matching, kernel matching and nearest neighbor matching three methods to match the treatment group (pilot areas) with the control group respectively. Retaining the sample provinces that were not significantly different between the treatment and control groups before the policy implementation. (ⅱ) Using multi-period double difference methods to examine the impact of low carbon pilot policies on regional ecological risk, the regression results in column (1–3) in Table 4 show that the significance of the estimated coefficients of DID are consistent with the baseline regression results in Table 3. This indicates that the finding that market-based environmental policies can significantly help to mitigate regional ecological risks is robust.

4.3.3 Change sample period

The start point of the sample in this paper is 2006, and the first carbon trading policies started to be implemented in 2013. The long period before the policy implementation may affect the validity of the results. At the same time, to mitigate the negative impact of the economic crisis shock in 2008 on the economic aspects of ecological safety, this paper only retains the sample for the first 3 years of the policy implementation is retained. The re-regression results are shown in Column 4) in Table 4. The conclusions are not changed.

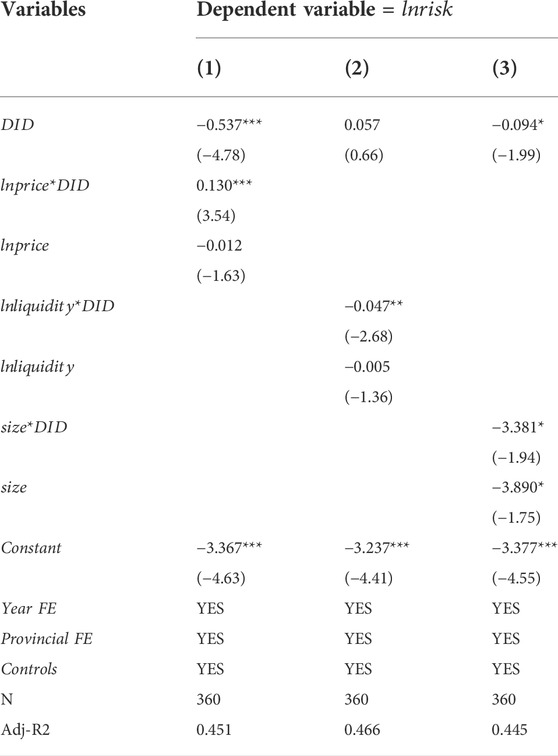

4.4 Impact of the operational efficiency of carbon markets on policy effects

To test the impact of the operational efficiency of the carbon market on the policy effect, in this paper introduces the carbon market characteristics variables are introduced into Eq. 1, resulting in the following model:

In the model,

The regression results in Table 5 show that the increase in the price of carbon market transactions weakens the positive impact of the market on mitigating regional ecological risks, while the increase in both market liquidity and relative market transaction size enhances the positive impact of the market on mitigating regional ecological risks. H2b and H2c are verified, and the direction of the effect of H2a is clarified. The result indicates that the increased activity of market participants in the early stages of market operation helps to increase the transparency of market information and reduce the uncertainty of market transactions. This also helps to facilitate transactions that reduce environmental pollution and reduce the negative impact of regulations on normal production and business activities of enterprises. This mitigates ecological risks at multiple levels, including social and environmental. However, price increases will limit the positive impact of the market on reducing regional ecological risks, indicating that enterprises’ decisions are based on cost-optimal criteria and profit maximization. Market-based environmental policies internalize the costs of pollution and increase additional expenditure for businesses, which indicates a low level of awareness and recognition of the current market operation mechanism, and also indicates that rationalized market prices play an important role in enhancing the efficiency of the operation of the market mechanism.

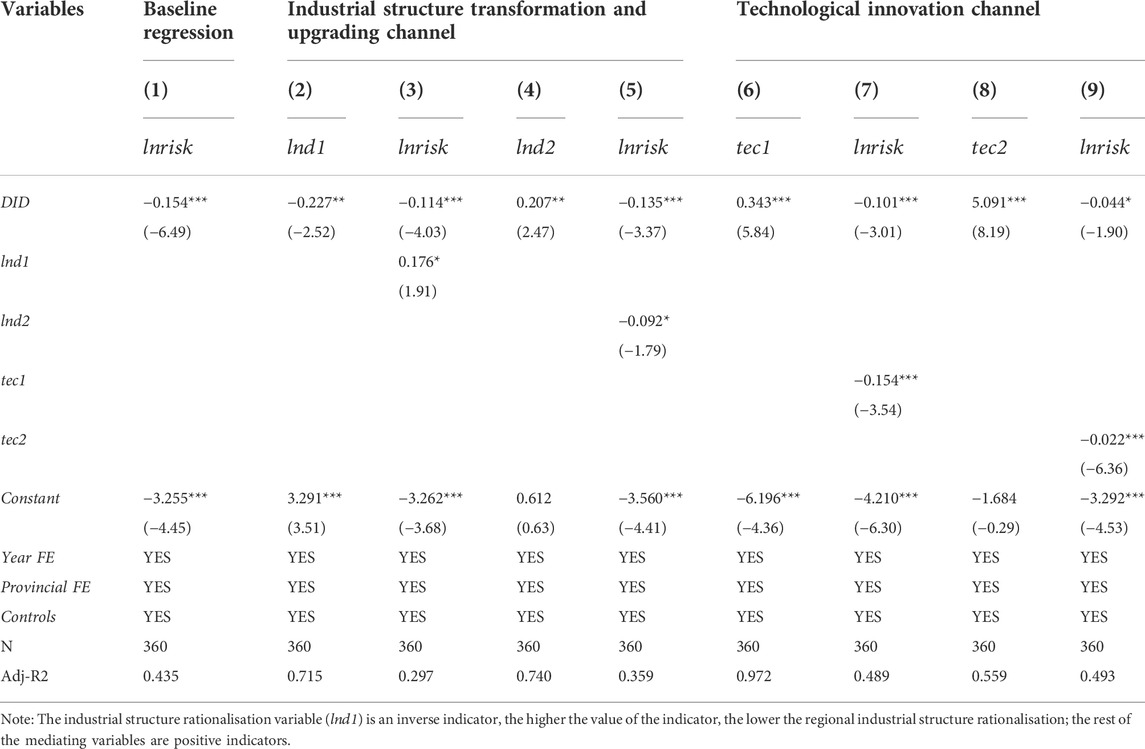

4.5 Channel of action test

According to the previous analysis, market-based environmental policies may have an impact on regional ecological risk through industrial structure upgrading and technological innovation. This is tested by using a mediating effects model:

In this model,

In this paper the channels of industrial structure transformation and upgrading are examined from two aspects. Rationalization of industrial structure emphasizes the degree of coordination of industrial development, which mainly refers to the state of achieving effective allocation of factors and promoting the continuous optimization. The results in Column (1–3) of Table 6 show that the operation of the carbon trading rights market can promote the rationalization of the regional industrial structure, thus having a positive impact on reducing the level of regional ecological risks. Unlike rationalization, advanced industrial structure is the evolution of industrial structure from low to high, and involves processes such as factor transfer and technological change. The results in Column (4–5) of Table 6 show that carbon trading rights markets can mitigate the level of regional ecological risk by promoting advanced industrial structure. In summary, the implementation of market-based environmental policies not only accelerates the transformation and upgrading of the industrial structure as a whole, but also promotes the coupling and coordination of resources within the industry, thus having a positive impact on reducing the level of regional ecological risk, H3b is verified.

In Column (6–9) of Table 6, the technological innovation channel is examined with the result that the operation of the carbon trading rights market not only enhances the total level of regional green technological innovation, but also improves the quality of regional green technological innovation (the level of invention-based patents increases), thus reducing the level of regional ecological risk, H3a is verified.

5 Discussion

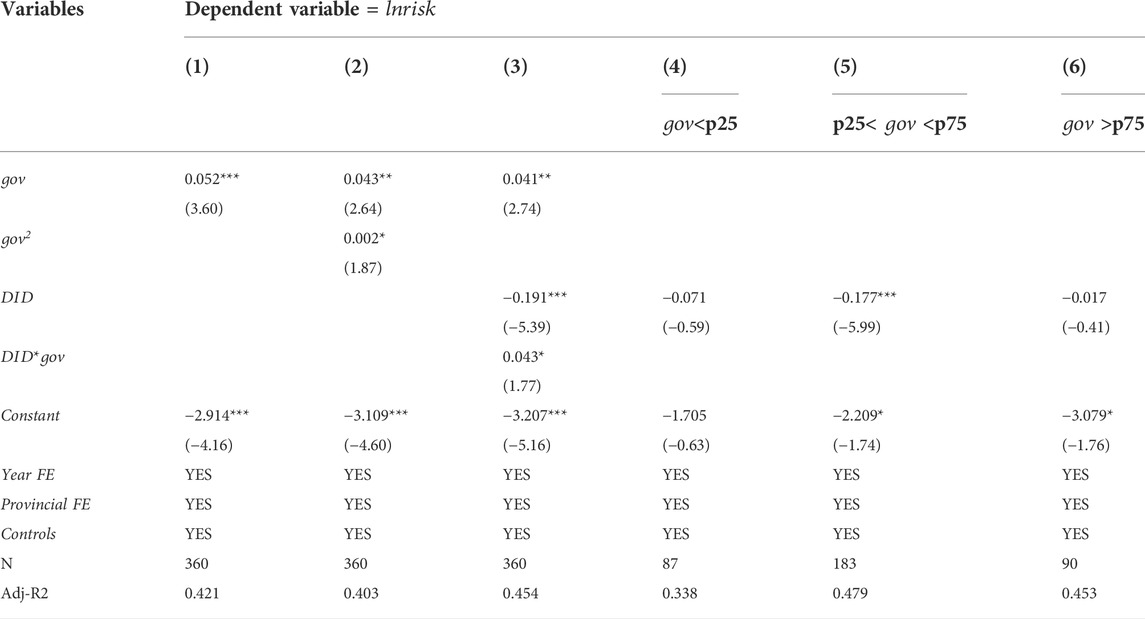

The results of government intervention on regional ecological risk are shown in Column (1–3) of Table 7. The regression coefficients of

To explore this effect, in this paper the ecological risk policy effect of markets is examined in three intervals: low, moderate and high government intervention, using the 0.25 and 0.75 quartiles of government intervention as bounds. The results in Column (4–6) of Table 7 show that market-based policies do not have a significant impact on regional ecological risk at either low or high levels of government intervention. Only in the moderate range can the government intervention and the market can play a synergistic policy role and have a positive impact on reducing regional ecological risk beyond the role of a single market. The conclusion is reached by the fact that the absolute value of the regression coefficient of DID in Column 5) of Table 7 is greater than that of the benchmark regression.

The above empirical results suggest that in the process of preventing regional ecological risks, moderate government intervention may regulate the market operation mechanism, improve the efficiency of factor allocation, stimulate the incentive of enterprises to reduce emissions and generate policy synergy effects. However, according to the theory of crowding, excessive pressure from the intervention may affect the self-determination of market agents and reduce their incentives to participate in environmental behavior (Frey and Jegen, 2001). In addition, it may disrupt the market enquiry mechanism, reduce pricing efficiency and lead to market distortions, reducing policy effects while increasing policy implementation costs, and therefore not generating policy synergies.

6 Conclusion, implications and limitations

6.1 Conclusion

Ecological risk evaluation and management are important for regions to achieve sustainable development. In this paper constructs a regional ecological risk evaluation framework is constructed on the basis of the PSR model in three dimensions: social, environmental and natural. And the regional ecological risk is measured via using the 2006–2017 Chinese provincial panel data. Further using a quasi-natural experiment with the establishment of a carbon emissions trading market, and a multi-period double difference method, we examined the effect of market-based environmental policy establishment on regional ecological risk is examined. The findings show that:

First, market-based environmental policy implementation can significantly reduce the regional ecological risk, making the ecological risk in pilot areas approximately 15.4% lower than that in non-pilot areas. Further research indicates that market-based environmental policy implementation mainly enhances regional ecological risk responsiveness, and the findings pass series of identification assumptions and robustness tests.

Second, the efficiency of market operations has a heterogeneous impact on regional ecological risk. Increased market prices will weaken the positive impact of market-based environmental policies on reducing regional ecological risks, while increased market liquidity and relative transaction size will have a positive policy effect.

Third, market-based environmental policies will reduce the level of regional ecological risk through two channels of action: promoting industrial structure upgrading and technological upgrading.

Finally, moderate government administrative intervention can significantly enhance the positive effects of market-based environmental policies on reducing regional ecological risks, showing synergy in this process. However, neither relative high interventions nor relative low interventions have positive effects.

6.2 Policy implications

These findings have the following policy implications:

Firstly, the implementation of market-based environmental policies should be based on summarize the experience of pilot operations and promote the formation of demonstration effects. At the same time, it should break down administrative and subject barriers should be removed to gradual expansion of the scope of policy implementation, and the promotion the integration and linkage of regional and sectoral markets. Efforts should be made to promote the willingness of subjects to participate through competition and price instruments, enhance market liquidity and transaction scale through active market transactions, and facilitate the formation of long-term price mechanisms to realize the beneficial impact of markets on reducing regional ecological risks.

Secondly, it is necessary to promote the synergistic development of regional green technology and industrial structure transformation, and forming a long-term mechanism for ecological risk management. For industrial restructuring, market-based environmental policy regions should improve the exit mechanism for highly polluting and energy-consuming enterprises. Then the regions will be able to ameliorate and gradually enhance the capacity for independent innovation to provide a new thrust for the advanced and rationalized industrial structure. For technological innovation, a science and technology innovation service platform should be actively established. Innovation incentive policies, cooperation and transformation mechanisms for results should be improved, and a favorable environment for technological innovation should be created for society through economic incentives such as tax reduction and subsidies. At the same time, technological quality standards should be improved to achieve simultaneous growth in the quantity and quality of technological innovation, and to promote green production and reduce the risk of pollution from the end.

Finally, importance should be attached to giving full play to the government’s supporting and regulating role in the implementation and operation of market policies, especially in the early stages of market creation. The government should change its role from providing passive services to giving active services and should take the initiative to solve practical problems in transaction performance. (i) The laws and regulations related to market transactions to make up for market failures caused by market’s own limitations should be improved. This can be done through tax relief and subsidies to reduce the transition pressure on areas and to include the enterprises in the market transactions, and to promote the smooth and orderly operation of the market. (ii) Effective market information services should be provided in response to the needs of enterprises. Efforts should be made to improve the market operation mechanisms and trading strategies through a combination of online and offline training, excellent case publicity and so on. Trading platform should be optimized to achieve price dynamics, a long-term pricing mechanism should be established to reduce information asymmetry, and the initiative of enterprises to should be encouraged to achieve emission reductions and gain additional revenue through the market, while enhancing the efficiency of market operation. However, the relationship between the government and the market should be balanced, the rules of market operation should be respected, and proper guidance should be given to avoid excessive government intervention.

6.3 Limitations and directions for future research

Based on the PSR model, this paper measures the level of regional ecological risk at the provincial level in China, and empirically analyzes the impact of market-based environmental policies on regional ecological risk. Although some new research results have been obtained based on the studies of domestic and foreign scholars, the conclusions are inevitably limited due to the authors’ limited knowledge and research conditions.

First, although our study expands the scope of current ecological risk measurement, it is still limited to the provincial level. With the depth of the study, more in-depth studies can be conducted at the micro level such as the local and municipal levels.

Second, the global warming and the frequent occurrence of extreme weather make the concept of regional ecological risk different from place to place. It will be difficult to adapt to global changes to use unified comprehensive indicators for regional ecological risk assessment. And the construction of indicators in regional ecological risk studies should be more diverse and unique, which will also become a trend for future research.

Third, this paper does not consider the impact of international environmental policies. The environmental carbon reduction policies in Europe, North America, and especially Southeast Asia will exert pressure on China’s environmental policies. The extreme environmental policies adopted by China for emission reduction targets will also have an impact on regional ecological risks, and it will be an important research direction to assess the regional ecological risks of low-carbon policies from a global perspective.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

LL contributed to conception and design of the study. All authors contributed to the article and approved the submitted version.

Funding

This research was funded by the Program of National Natural Science Foundation of China (72163023); Program of National Natural Science Foundation of China (71974209); Program of National Natural Science Foundation of China (72104114); Program of National Social Science Foundation of China (20BJY090).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Assessment, C. R. (1996). Proposed guidelines for carcinogen risk assessment. Fed. Regist. 61 (79), 17960–18011.

Baram, M. (1983). Report on reports: Risk assessment in the Federal Government: Managing the process. Environ. Sci. Policy Sustain. Dev. 25 (7), 25–27.

Bekaert, G., and Hoerova, M. (2014). The VIX, the variance premium and stock market volatility. J. Econ. 183 (2), 181–192. doi:10.1016/j.jeconom.2014.05.008

Bi, M., Xie, G., and Yao, C. (2020). Ecological security assessment based on the renewable ecological footprint in the Guangdong-Hong Kong-Macao Greater Bay Area, China. Ecol. Indic. 116, 106432. doi:10.1016/j.ecolind.2020.106432

Chen, Q., and Liu, J. (2014). Development process and perspective on ecological risk assessment. Acta Ecol. Sin. 34 (5), 239–245. doi:10.1016/j.chnaes.2014.05.005

Cheng, B., Dai, H., Wang, P., Zhao, D., and Masui, T. (2015). Impacts of carbon trading scheme on air pollutant emissions in Guangdong Province of China. Energy Sustain. Dev. 27, 174–185. doi:10.1016/j.esd.2015.06.001

Frey, B. S., and Jegen, R. (2001). Motivation crowding theory. J. Econ. Surv. 15 (5), 589–611. doi:10.1111/1467-6419.00150

Gan, C. H., Zheng, R. G., and Yu, D. F. (2011). An empirical study on the effects of industrial structural on economic growth and fluctuations in China(in Chinese). Econ. Res. J. 46 (05), 4–16+31.

Hu, D. B., and Xie, L. (2021). Ecological environment security evaluation based on cloud model and evidential reasoning (in Chinese). Operations Res. Manag. Sci. 30 (03), 130–136.

Hu, J., Pan, X., and Huang, Q. (2020). Quantity or quality? The impacts of environmental regulation on firms’ innovation–Quasi-natural experiment based on China's carbon emissions trading pilot. Technol. Forecast. Soc. Change 158, 120122. doi:10.1016/j.techfore.2020.120122

Huang, Q., Wang, R., Ren, Z., Li, J., and Zhang, H. (2007). Regional ecological security assessment based on long periods of ecological footprint analysis. Resour. Conservation Recycl. 51 (1), 24–41. doi:10.1016/j.resconrec.2006.07.004

Kallbekken, S., Kroll, S., and Cherry, T. L. (2011). Do you not like pigou, or do you not understand him? Tax aversion and revenue recycling in the lab. J. Environ. Econ. Manag. 62 (1), 53–64. doi:10.1016/j.jeem.2010.10.006

Ke, S. L., Xiang, M., and Feng, M. (2017). Research on ecological security evaluation of the core cities in Yangtze river economic belt based on grey clustering method(in Chinese). Resour. Environ. Yangtze Basin 26 (11), 1734–1742.

Li, Z. T., Li, M., and Xia, B. C. (2020). Spatio-temporal dynamics of ecological security pattern of the Pearl River Delta urban agglomeration based on LUCC simulation. Ecol. Indic. 114, 106319. doi:10.1016/j.ecolind.2020.106319

Liao, W. L., Dong, X. K., Weng, M., and Chen, X. Y. (2020). Economic effect of market-based environmental regulation: Carbon emissions trading, green innovation and green economic growth(in Chinese). Chin. Soft Sci. (06), 159–173.

Liu, C. M., Sun, Z., and Zhang, J. (2019). Research on the effect of carbon emission reduction policy in China's carbon emission trading pilot (in Chinese). China Popul. Resour. Environ. 29 (11), 49–58.

Liu, C. Y., Tian, A. M., Sun, F., and Yuan, P. (2020). Progress of ecological risk assessment methods and applications (in Chinese). Sci. Technol. Manag. Res. 40 (02), 79–83. doi:10.3969/j.issn.1000-7695.2020.2.010

Liu, R. M., and Zhao, R. J. (2015). Western development: Growth driver or policy trap - a study based on PSM-DID approach(in Chinese). China Ind. Econ. (06), 32–43. doi:10.19581/j.cnki.ciejournal.2015.06.004

Lu, J., Yan, Y., and Wang, T. X. (2021). The microeconomic effects of green credit policy – from the perspective of technological innovation and resource reallocation (in Chinese). China Ind. Econ. (01), 174–192. doi:10.19581/j.cnki.ciejournal.2021.01.010

Lu, S., Li, J., Guan, X., Gao, X., Gu, Y., Zhang, D., et al. (2018). The evaluation of forestry ecological security in China: Developing a decision support system. Ecol. Indic. 91, 664–678. doi:10.1016/j.ecolind.2018.03.088

Murray, B. C., Newell, R. G., and Pizer, W. A. (2020). Balancing cost and emissions certainty: An allowance reserve for cap-and-trade. Rev. Environ. Econ. Policy 3 (1), 84–103. doi:10.1093/reep/ren016

Porter, M. E., and Van der Linde, C. (1995). Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 9 (4), 97–118. doi:10.1257/jep.9.4.97

Qi, S. Z., Lin, D., and Cui, J. B. (2018). Do environmental rights trading schemes induce green innovation? Evidence from listed firms in China(in Chinese). Econ. Res. J. 12, 129–143.

Saeed, T., Bouri, E., and Alsulami, H. (2021). Extreme return connectedness and its determinants between clean/green and dirty energy investments. Energy Econ. 96, 105017. doi:10.1016/j.eneco.2020.105017

Shao, S., and Li, X. (2022). Can market-oriented low-carbon policies promote high-quality economic development? Evidence from the carbon emissions trading pilot(in Chinese). Soc. Sci. Guangdong (02), 33–45.

Shen, C., Jia, N. S., and Li, X. Y. (2017). Environmental regulation and industrial green total factor productivity-Empirical analysis based on CAC and MBI environmental regulations(in Chinese). R&D Manag. 29 (02), 144–154. doi:10.13581/j.cnki.rdm.2017.02.008

Shi, Y., Wang, R., Lu, Y., Song, S., Johnson, A. C., Sweetman, A., et al. (2016). Regional multi-compartment ecological risk assessment: Establishing cadmium pollution risk in the northern Bohai Rim, China. Environ. Int. 94, 283–291. doi:10.1016/j.envint.2016.05.024

Tan, J., and Zhang, J. H. (2018). Does China’s ETS force the upgrade of industrial structure—evidence from synthetic control method(in Chinese). Res. Econ. Manag. 39 (12), 104–119. doi:10.13502/j.cnki.issn1000-7636.2018.12.009

Wang, K. L., Zhao, B., Ding, L. L., and Miao, Z. (2021). Government intervention, market development, and pollution emission efficiency: Evidence from China. Sci. Total Environ. 757, 143738. doi:10.1016/j.scitotenv.2020.143738

Wang, L., Liu, X. F., and Xiong, Y. (2019). [Stereoscopic cardiopulmonary resuscitation, stereoscopic health and stereoscopic number: A "three-in-one" concept]. Zhonghua Wei Zhong Bing Ji Jiu Yi Xue 31 (10), 5–7. doi:10.3760/cma.j.issn.2095-4352.2019.01.002

Williamson, O. E. (1971). The vertical integration of production: Market failure considerations. Am. Econ. Rev. 61 (2), 112–123.

Wu, C. S., Huang, L., Liu, G. H., and Liu, Q. S. (2018). Assessment of ecological vulnerability in the yellow river delta using the fuzzy analytic hierarchy process(in Chinese). Acta Ecol. Sin. 38 (13), 4584–4595.

Wu, J., Wang, X., Zhong, B., Yang, A., Jue, K., Wu, J., et al. (2020). Ecological environment assessment for Greater Mekong Subregion based on Pressure-State-Response framework by remote sensing. Ecol. Indic. 117, 106521. doi:10.1016/j.ecolind.2020.106521

Wu, W. G., Zhu, Y. L., and Gu, G. T. (2021). Determinants of the effectiveness of China’s pilot carbon market. Resour. Sci. 10, 2119–2129. doi:10.18402/resci.2021.10.15

Wu, Y. Y., Qi, J., Xian, Q., and Chen, J. D. (2021). The carbon emission reduction effect of China's carbon market – from the perspective of the coordination between market mechanism and administrative intervention(in Chinese). China Ind. Econ. (08), 114–132. doi:10.19581/j.cnki.ciejournal.2021.08.007

Xie, R. H., Yuan, Y. J., and Huang, J. J. (2017). Different types of environmental regulations and heterogeneous influence on “green” productivity: Evidence from China. Ecol. Econ. 132, 104–112. doi:10.1016/j.ecolecon.2016.10.019

Xie, X. Q., and Huang, J. J. (2017). An evaluation analysis of urban entrepreneurial environment Based on PSR model: Case of Wuhan. China Soft Sci. (02), 172–182.

Yang, Q., Li, Z., Lu, X., Duan, Q., Huang, L., and Bi, J. (2018). A review of soil heavy metal pollution from industrial and agricultural regions in China: Pollution and risk assessment. Sci. total Environ. 642, 690–700. doi:10.1016/j.scitotenv.2018.06.068

Yu, Y. Z., and Yin, L. P. (2022). The evolution of Chinese environmental regulation policies and its economic effects: A summary and prospect(in Chinese). Reform337 (03), 114–130.

Yuan, H., and Zhu, C. L. (2018). Do national high-tech zones promote the transformation and upgrading of China's industrial structure(in Chinese). China Ind. Econ. (08), 60–77. doi:10.19581/j.cnki.ciejournal.2018.08.004

Zhang, D., Shi, X., Xu, H., Jing, Q., Pan, X., Liu, T., et al. (2020). A GIS-based spatial multi-index model for flood risk assessment in the Yangtze River Basin, China. Environ. Impact Assess. Rev. 83, 106397. doi:10.1016/j.eiar.2020.106397

Zhang, G. J., Tong, M. H., Li, H., and Chen, F. (2019). Evaluation of economic growth effects and policy effectiveness in pilot poverty allevation reform zone(in Chinese). China Ind. Econ. (08), 136–154. doi:10.19581/j.cnki.ciejournal.2019.08.008

Zhang, Y. J., Peng, Y. L., Ma, C. Q., and Shen, B. (2017). Can environmental innovation facilitate carbon emissions reduction? Evidence from China. Energy Policy 100, 18–28. doi:10.1016/j.enpol.2016.10.005

Zhao, X. G., Jiang, G. W., Nie, D., and Chen, H. (2016). How to improve the market efficiency of carbon trading: A perspective of China. Renew. Sustain. Energy Rev. 59, 1229–1245. doi:10.1016/j.rser.2016.01.052

Keywords: regional ecological risk, carbon trading policy, market-based environmental policy, government intervention, China

Citation: Li L, Jin X, Li Y, Chen H and Wang Y (2022) The impact of carbon trading policy on regional ecological risk: Synergy between market-based environmental policy and government intervention. Front. Environ. Sci. 10:1010522. doi: 10.3389/fenvs.2022.1010522

Received: 03 August 2022; Accepted: 31 August 2022;

Published: 29 September 2022.

Edited by:

Elie Bouri, Lebanese American University, LebanonReviewed by:

Jiuchang Wei, University of Science and Technology of China, ChinaBin Zhang, Beijing Institute of Technology, China

Copyright © 2022 Li, Jin, Li, Chen and Wang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yu Wang, d3k5MjMwQDE2My5jb20=

Linna Li

Linna Li Xiaolin Jin2,3

Xiaolin Jin2,3 Yu Wang

Yu Wang