- 1School of Economics, Zhejiang University, Hangzhou, China

- 2College of Business, Valparaiso University, Valparaiso, IN, United States

- 3School of Economics, Zhejiang University of Finance and Economics, Hangzhou, China

This study focuses on exploring the relationship between industrial intelligence and capacity utilization based on the perspective of green development. Based on a fixed effect model, using data from the International Federation of Robotics (IFR) and China’s A-share listed enterprises from 2011 to 2019, this study empirically analyzes the influence of industrial intelligence on enterprises’ capacity utilization. The benchmark regression results reveal that industrial intelligence has a negative effect on enterprises’ capacity utilization. The results are robust to several econometric concerns. Moreover, mechanism analysis indicates that industrial intelligence affects enterprises’ capacity utilization through the productivity effect, the green innovation effect, and the scale expansion effect. When considering the heterogeneity at regional levels, we find that enterprises in the central and western regions are more affected by industrial intelligence. Our findings provide guidance to enterprises and policymakers in addressing industrial overcapacity and green development issues in China.

1 Introduction

Green development is the core of sustainable development, but there is a serious problem of overcapacity in the world. China is also facing a severe challenge from industrial overcapacity. The reasons for overcapacity are complex and atypical. Market forces and institutional factors related to the economic transition characterize China’s overcapacity (Han and Han, 2017). Overcapacity leads to environmental pollution, market competition, unemployment, low economic benefits, which could adversely affect the long-term growth of the country (Lin et al., 2010; Liu and Wang, 2022).

The COVID-19 pandemic developed new challenges for consumers, organizations, and enterprises (Al Halbusi et al., 2022), and there is a growing trend towards developing a more sustainable way of sustainability performance among the manufacturing enterprises (Awan et al., 2020) and the households (Geng et al., 2022). Sustainability is an important role in balancing the relationship between economic, environmental, and social aspects (Awan and Sroufe, 2019; Li et al., 2022). The transformation of economic growth model from low efficiency and high pollution to high efficiency and environmental protection is essential. Improving capacity utilization and clearing the backward capacity is a necessary way for China to achieve sustainable development. The Chinese government has actively formulated policies and measures to address overcapacity and improve capacity utilization. In 2013, the State Council of China issued the “Guiding Opinions of the State Council on Resolving the Contradiction of Severe Overcapacity,” which pointed out the importance of preventing the blind expansion of the capacity. The Notice on Doing a Good Job of Resolving Excess Capacity in Key Areas in 2020 emphasized that “use market-oriented and legal methods to adjust and optimize the stock under the premise of controlling the total production capacity.”

Industrial intelligence is an essential part of China’s new industrialization efforts. Economic initiatives like the Belt and Road aim to create high-efficiency and low-cost opportunities, enhance energy conservation, reduce emissions, improve product quality, and boost enterprise performance. The 18th National Congress of the Communist Party of China emphasized the need to “promote the simultaneous development of industrialization, informatization, urbanization and agricultural modernization.” Industrial intelligence is also a step towards deeper integration of the new generation of intelligence technology and industrialization. In 2021, the Robot Industry Development Plan for the 14th Five-Year Plan Period (hereinafter referred to as “Robot Industry Plan”) was issued. The Robot Industry Plan proposes, “…by 2025, China will become the source of global robotics technology innovation and high-end manufacturing agglomeration.”

Industrial intelligence improves enterprise performance (Graetz and Michaels, 2018; Bonfiglioli et al., 2020; Koch et al., 2021), promotes innovation, and enhances product and service quality (Dixon et al., 2021). Inevitably, industrial intelligence has some adverse effects. These include crowding out in the labor market, unemployment (Acemoglu and Restrepo, 2020), blind expansion, and intensifying market competition, which could cause pressure on enterprises’ capacity utilization. We take the new energy vehicle industry as an example, which is one of the strategic emerging industries in China. The new energy vehicle industry has high requirements for high flexibility, intelligence, and digitization. There are many applications of intelligent technology in this industry, while the production capacity utilization rate was just 58.4% in 2021. The rapid development of the new energy vehicle industry is accompanied by the risk of overcapacity (Zhang, 2018). The industry has rapidly formed a large amount of production capacity in a short period, thus laying a major hidden danger for overcapacity. The crazy production expansion of enterprises results in a vicious circle of “capacity expansion—market oversupply—profit margin reduction—production expansion to increase scale and reduce costs”. In the face of the pressure of greater market uncertainty and rising prices of upstream raw materials, the blind expansion might exacerbate the continued decline in capacity utilization. Therefore, comprehensively understanding industrial intelligence’s role in capacity utilization is critical. However, the current theoretical and empirical state of the art falls short of in-depth research on this issue. Especially at a micro level, the current research lacks an understanding of the impact of industrial intelligence on enterprises’ capacity utilization.

This paper provides a framework to combine industrial intelligence with enterprises’ capacity utilization. Our results show that industrial intelligence has a negative effect on enterprises’ capacity utilization. We further explore the impact mechanism of industrial intelligence affecting enterprises’ capacity utilization. Specifically, we investigate the impact mechanism through using micro-enterprise-level data for empirical analysis, revealing the productivity effect, the green innovation effect, and the scale expansion effect. We find that the net impact of industrial intelligence on capacity depends on the relative magnitude of factors listed above. We perform heterogeneity analyses at regional levels in China. Our results show that, compared to other regions, enterprises in the central and western regions are more affected by industrial intelligence.

The contributions of our research fall in the following three aspects. First, we view industrial intelligence and capacity utilization from a novel perspective and study the impact of industrial intelligence on enterprises’ capacity utilization. We incorporate industrial intelligence and capacity utilization into a unified analysis framework and contribute by revealing the impact mechanism through which industrial intelligence affects enterprises’ capacity utilization. The impact mechanism explores three channels: namely, productivity effect, green innovation effect, and scale expansion effect. Second, unlike related literature that focuses on country and industry levels, we measure the level of industrial intelligence at the enterprise level. The measure is based on data from the International Federation of Robotics (IFR) and China’s A-share listed enterprises. Ours is the first study that examines the impact at the micro-enterprise level. To address endogeneity and test the robustness of the benchmark model, we use instrumental variables constructed based on the American industrial robot data. Third, this paper enriches the research on China’s overcapacity governance mechanisms and provides guidance for green development strategies.

The findings have implications for industrial and governmental policymakers. In addressing excess capacity, policymakers should improve differentiated green development policies. Specific recommendations emerging from our research include strengthening the management of industrial energy consumption in the central and western regions, optimizing the structure of industrial energy use, increasing the proportion of clean energy and non-fossil energy use, and focusing on promoting the green industries. Our findings could also guide the managers. Enterprises should put efforts into finding the appropriate production scale, perform detailed market research before formulating production plans, optimize business processes, decide on the adoption of industrial intelligence based on prevailing economic factors and the external competitive environment, and avoid the adverse consequences of excessive intelligence.

The rest of the paper is organized as follows: Section 2 presents the literature review; Section 3 provides a theoretical foundation and builds the hypotheses; Section 4 introduces the methodology and data; Section 5 analyses the empirical results and robustness tests; Section 6 explores the impact mechanism, and Section 7 discusses heterogeneities at the regional levels; Section 8 provides discussion; Section 9 presents implications and the last part is conclusion.

2 Literature review

2.1 Overcapacity and capacity utilization

A section of the literature focuses on the causes and overcapacity formation mechanism. Some scholars have studied capacity utilization at the macro-level. Lin et al. (2010) pointed out that industries in developing countries often have the characteristics of low value-added and are located at the lower end of the industrial chain, i.e., at a low technical threshold. Therefore, enterprises in developing countries are prone to the wave phenomenon, which leads to overcapacity. Jiang and Cao (2009) concluded that, in China, overcapacity stems from incomplete marketization and improper government intervention. Some studies have also attributed China’s overcapacity to the tenure of local governments (Gan et al., 2015), official turnover (Xu and Ma, 2019), and subsidized competition (Geng et al., 2011).

A stream of scholars has begun to examine capacity utilization from the micro-level. Benoit and Krishna (1987) studied an oligopoly market and pointed out that overcapacity is a competitive strategy behavior. Banerjee (1992) concluded that enterprises might misjudge the external environment and lead to overcapacity from the perspective of incomplete information.

Factors influencing capacity utilization have been covered in the literature. Yang and Sun (2017) established a relationship between foreign capital entry liberalization and enterprises’ capacity utilization. They found foreign investment liberalization significantly improves capacity utilization. The export expansion helps improve enterprises’ capacity utilization (Zhang and Zhang, 2019). Others have discussed enterprises’ capacity utilization from the perspectives of informatization (Wang et al., 2017), the proportion of zombie enterprises (Shen and Chen, 2017), environmental regulation (Du and Li, 2019; Cheng et al., 2020), and credit support (Ma et al., 2020).

2.2 Industrial intelligence and capacity utilization

The current state of the art is deficient in a targeted exploration of the relationship between industrial intelligence and capacity utilization of enterprises. Some studies have explored related relationships. For example, some scholars have studied the impact of industrial intelligence on the economic and environmental performance. Industry 4.0 technologies have been found to help enterprises reduce energy resource consumption and develop the circular economy (Dantas et al., 2021). Luan et al. (2022) found that using industrial robots leads to air environment deterioration.

The use of industrial robots is the main form of industrial intelligence, and literature on this relationship focuses on micro-level analysis. Large-scale enterprises and those with high productivity are more likely to use robots (Koch et al., 2021). Enterprises tend to be more productive after adopting robots (Graetz and Michaels, 2018; Acemoglu et al., 2020), which can improve the quality of products and services (Cai and Qi, 2021; Dixon et al., 2021) and thus warrant a larger market share (Bonfiglioli et al., 2020) and improve enterprise performance (Mubeen et al., 2022). Schoenberger’s (1989) analysis indicates that using advanced automation technology might bring enterprises the advantages of reducing labor costs, reducing material costs, improving product quality, shortening the production cycle, and shortening capital turnaround time, and at the same time, it might increase pressure on new areas such as capacity utilization and non-production labor costs.

Industrial intelligence affects the labor force, impacting enterprises’ capacity utilization. In developed countries, using industrial robots has led to unemployment, labor substitution, and employment destruction (Acemoglu and Restrepo, 2020). Due to the risk of low-skilled labor being replaced by advanced technology (Yu et al., 2021), the low-skilled labor market may be squeezed out (Balsmeier and Woerter, 2019). Industrial intelligence prefers skilled workers with high-level cognitive and social skills. Graetz and Michaels (2018) used industry-level robot data and found that increased robot usage density increases labor productivity and wages. With the massive struck of the COVID-19 pandemic and the lockdown at the national level, there has been an increase in the use of digital tools and people started using social media more often than usual (Li et al., 2021; Yu et al., 2022). The epidemic has also accelerated the exposure of existing vulnerabilities and structural distortions in the global economy, and the market faces greater uncertainties. These seem to intensify the negative effects of industrial intelligence.

The literature lacks a micro-data study to examine the impact of industrial intelligence on the capacity utilization of Chinese enterprises. In this paper, we use China’s A-share listed enterprises data to measure the capacity utilization, innovatively analyze the impact of industrial intelligence on enterprises’ capacity utilization, and enrich the research from the perspective of China’s economic policy and industrial intelligence.

3 Research hypothesis

We build a framework to assess the impact of industrial intelligence on enterprises’ capacity utilization. Industrial intelligence affects capacity utilization through the productivity effect, the green innovation effect, and the scale expansion effect. In general, productivity and green innovation has a positive impact on enterprises’ capacity utilization. In contrast, the scale expansion negatively affects enterprises’ capacity utilization rate. The net effect of industrial intelligence on enterprises’ capacity utilization depends on the summation of the above three effects.

3.1 Productivity effect

Technological progress drives productivity. Industrial robots are the main form of industrial intelligence. Enterprises advance their technical know-how and innovation abilities through using robots. Enterprises can also absorb advanced technologies and cutting-edge knowledge through “learning by doing” (Burstein and Alexander, 2009), thereby improving production efficiency and increasing output (Graetz and Michaels, 2018; Acemoglu et al., 2020).

Industrial intelligence may improve the capacity utilization through productivity effects because of the following two reasons: First, enterprises with higher productivity have higher resource utilization efficiency, which helps enterprises reduce waste and improve capacity utilization (Wang et al., 2017); Second, high productivity enterprises are more likely to experience high market demand. Faced with uncertainty in demand, such enterprises invest cautiously to avoid risks (Yu et al., 2018). Therefore, we expect industrial intelligence to promote enterprises’ capacity utilization through productivity improvement channels.

3.2 Green innovation effect

Industrial intelligence promotes dataization, transparency, and intelligence in all aspects of innovative production, which can identify value demands in a timely manner and effectively solve them. Industrial intelligence promotes the dissemination of knowledge, which is beneficial to the innovators to enhance their ability to obtain information, integrate internal and external resources (Gopalkrishnan, 2013). Industrial intelligence also provides new technical tools, means, and resources for enterprises to carry out green innovation activities, creating more possibilities and growth space.

Green innovation has a positive impact on capacity utilization. With the deepening of the concept of green development, green technologies and green standards have been further promoted and applied. First, green innovation is conducive to improving the clean production process of enterprises, which accelerates the replacement and renewal of backward production capacity by green production capacity (Liu et al., 2021). Second, the demand intensity for low-end industrial production capacity in the end-consumer market continues to decline, forcing companies to adjust their production scale and product mix. Enterprises expand the supply of green products and services through green technology innovation, which is conducive to expanding the market share of enterprises, increasing production demand, thereby resolving the problem of excess capacity, and improving sustainable development (Awan and Sroufe, 2019). Third, green innovation enables enterprises to integrate environmental goals into their business goals, helps enterprises reduce production costs and time, and provides more efficient products (Begum et al., 2022), which helps enterprises reduce waste and improve capacity utilization.

3.3 Scale expansion effect

Industrial intelligence can increase productivity. Therefore, enterprises that adopt industrial intelligence will have higher output levels, be more competitive, and command a higher market share (Koch et al., 2021). Low-productivity enterprises will be forced out of the market, and high-productivity enterprises will gain market.

Scale expansion negatively affects the capacity utilization rate. Zhai (2013) pointed out China’s overcapacity is skewed by “excessive low-end products and insufficient high-end products.” According to the Schumpeter model, to accumulate modern production capacity, it is necessary to have a healthy production capacity metabolism process, which means continuously acquiring cutting-edge capacity and eliminating traditional/outdated production capacity. Ma and Shen (2021) found that enterprises’ scale expansion helps promote the progress of cutting-edge technologies. Scale expansion also inhibits the efficiency of cutting-edge technologies. Enterprises are often effective at introducing advanced production capacity during scale expansion; however, they are ineffective at eliminating outdated production capacity. The scale expansion aids capacity utilization by improving Frontier technological progress. At the same time, scale expansion leads to a decline in capacity utilization by suppressing technical efficiency. We expect the second effect to be stronger, so scale expansion causes excess capacity.

Building on the reasons and arguments above, we propose the following hypotheses:

Hypothesis 1:. Industrial intelligence has a negative impact on enterprises’ capacity utilization.

Hypothesis 2:. Industrial intelligence promotes enterprises’ capacity utilization through the productivity effect and the green innovation effect.

Hypothesis 3:. Industrial intelligence inhibits enterprises’ capacity utilization through the scale expansion effect.

4 Methodology and data

4.1 Model

The regression function to examine the impact of industrial intelligence on enterprises’ capacity utilization is:

Firm

4.2 Variable definition and description

4.2.1 The dependent variable

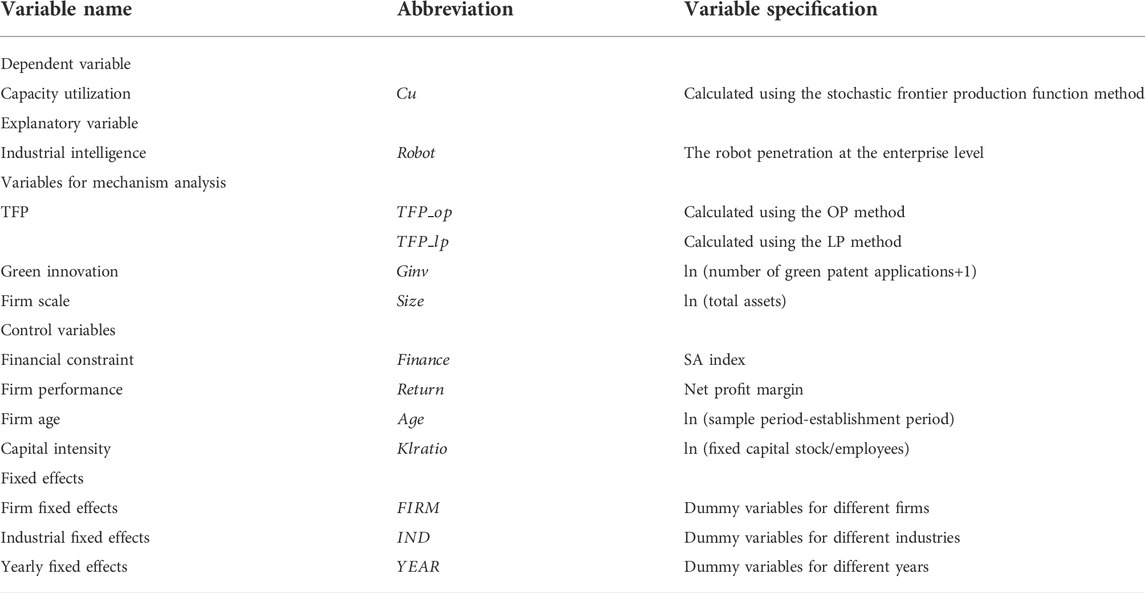

Capacity utilization

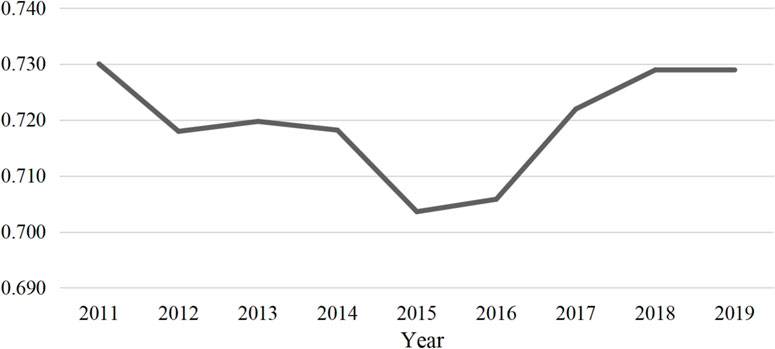

Figure 1 reports capacity utilization in double-digit industries. From 2011 to 2019, the average capacity utilization of China’s manufacturing industry was about 0.72. The curve is U shaped, indicating a declining and then a rising trend. From 2011 to 2015, the capacity utilization decreased from 0.73 to 0.7036; after 2015, it steadily increased to 0.7289 in 2019. The trends could be attributed to The Central Economic Work Conference held at the end of 2015. The conference outlined the key tasks of “cutting overcapacity, reducing excess inventory, deleveraging, lowering costs, and strengthening areas of weakness.” Based on the “Report on the Work of the Government 2017,” in 2016, capacity shrunk by over 65 million tons in steelmaking and over 290 million tons in coal mining industries.

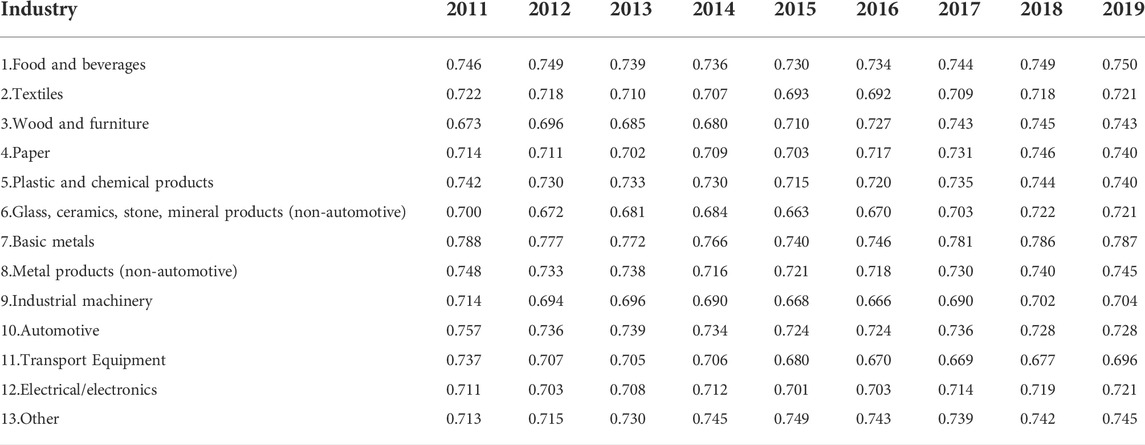

From 2011 to 2019, the capacity utilization in most industries ranged between 70% and 80%. See Table 1. Further examination reveals that the capacity utilization is relatively high in basic metals (Industry 7), food and beverages (Industry 1), and automotive (Industry 10). At the same time, it is relatively low in glass, ceramics, stone, mineral products (non-automotive, Industry 6), industrial machinery (Industry 9), and transport equipment (Industry 11).

4.2.2 Core explanatory variable

Industrial intelligence

4.2.3 Variables for mechanism analysis

(1) TFP: The OP method and the LP method are mainstream methods for measuring total factor productivity. The OP (LP) method uses investment (intermediate inputs) as the proxy variable of productivity to calculate TFP. We employ OP and LP methods, with the corresponding TFP represented by

(2) Green innovation refers to the innovation that takes ecological priority as the principle, considers economic benefits and environmental quality, and achieves goals such as energy conservation and emission reduction, low-carbon recycling, and clean production (Begum et al., 2021). Drawing on most of the existing literature, we use the number of green patent applications to measure the green innovation level (

(3) Firm scale

4.2.4 Control variables

Following the literature on industrial intelligence and capacity utilization, we choose variables to control for various characteristics. Precisely, the following variables are controlled: 1) Financial constraint

4.3 Data sources and processing

The industrial enterprise database is suitable for studying the behavior of Chinese companies. However, the data required for this paper is missing from 2007 onwards; moreover, the use of industrial robots in China accelerated after 2010. Therefore, instead of the industrial enterprise database, we mainly rely on the A-share enterprises listed in the Shanghai and Shenzhen Stock Exchanges of China for the years 2011–2019. Specifically, we use two types of data: 1) Industrial Robot Data is built using world robot statistics at the annual industry level in the International Federation of Robotics (IFR) from 2011 to 2019. IFR provides the most authoritative robot statistic in the world. 2) Enterprise and industry data come from the Wind Economic and China Stock Market & Accounting Research (CSMAR) databases. The employment data of China’s manufacturing industry is derived from the China Industrial Statistical Yearbook, and the employment data of the United States comes from the NBER-CES Manufacturing Industry Database. Since databases differ in their definitions of manufacturing sub-sectors, we match and organize industries with the same category and obtain a set of listed company data belonging to 13 manufacturing sectors. Based on the original samples, all enterprises with special treatment such as ST and *ST during the sample period or with missing data were eliminated. The main continuous variables are winsorized to reduce the possibility of spurious outliers. The final dataset contains 13917 observations for the period from 2011 to 2019.

5 Results

5.1 Descriptive statistics

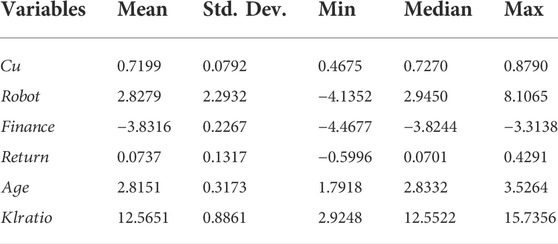

The summary statistics of the main variables are listed in Table 3. The mean

5.2 Analysis of the benchmark regression

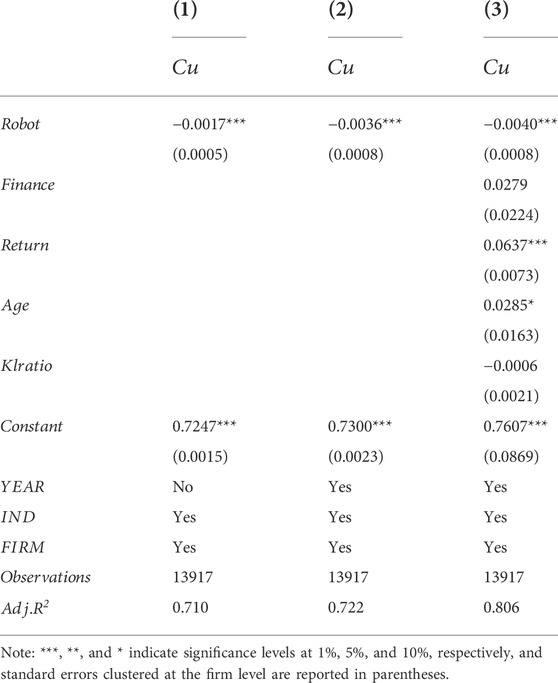

In regression model 1, the fixed-effect model was used to test the impact of industrial intelligence on enterprises’ capacity utilization. The results are shown in Table 4. Column 1 presents the net effect of industrial intelligence on enterprises’ capacity utilization while considering the firm and industry fixed effects. The coefficient of industrial intelligence (

5.3 Robustness tests

5.3.1 Endogenous test

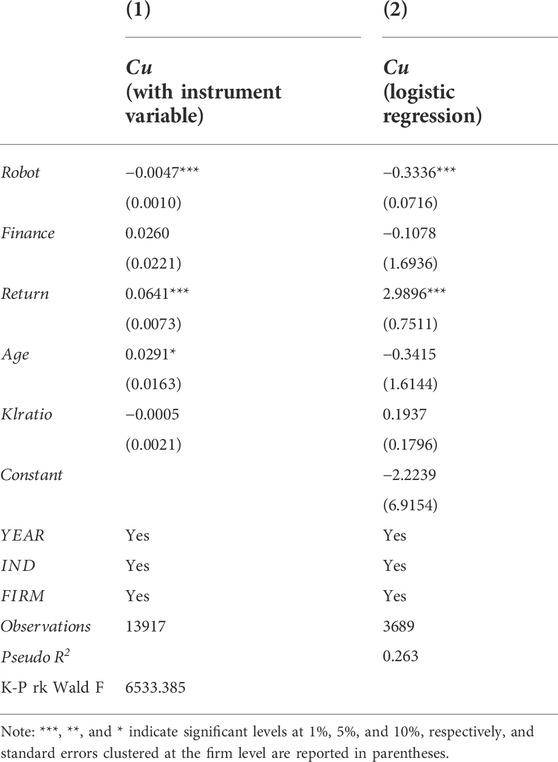

The impact of industrial robots on capacity utilization may suffer from endogeneity issues. Firstly, enterprises with high capacity utilization may use industrial robots to improve production efficiency, which leads to the problem of two-way causality. Secondly, although we control variables that affect capacity utilization, it is impossible to rule out the omission of some relevant variables. Therefore, we use instrumental variable regression to reduce the estimation bias caused by the endogeneity problem.

Based on prior studies (Acemoglu and Restrepo, 2020; Wang and Dong, 2020), we employ American industrial robot data to construct an instrumental variable using data from the United States. The expression for the instrument variable is

5.3.2 Regression model replacement

Since China has not yet established a standard for determining overcapacity, we draw on the practice of Han et al. (2011) and use the criteria for judging overcapacity in Europe, the United States, and other countries. If the capacity utilization of enterprises is equal to or higher than 79% (high capacity utilization),

6 Mechanism analysis

The benchmark regression revealed that industrial intelligence has inhibitory effects on enterprises’ capacity utilization; however, it did not reveal the impact mechanism. Therefore, in this section, we introduce and analyze the means through which industrial intelligence affects enterprises’ capacity utilization.

6.1 Productivity effect

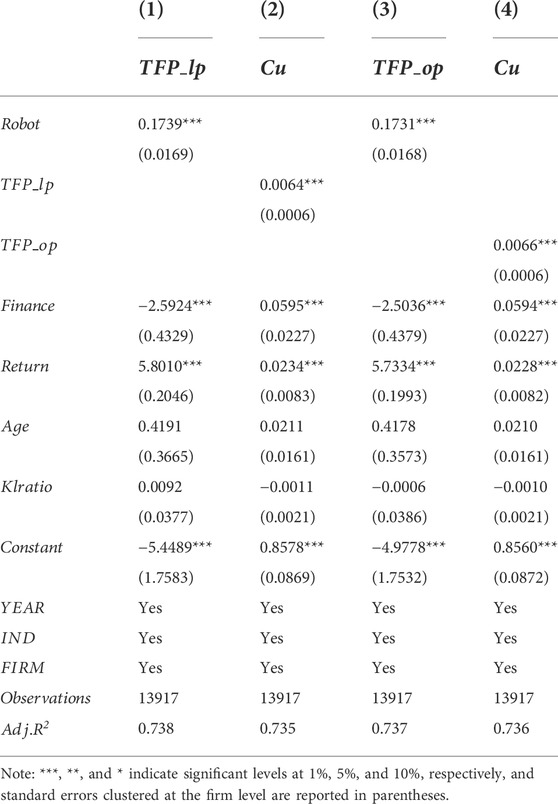

Theoretical arguments point to the productivity effect whereby industrial intelligence helps enterprises save costs and increase productivity, leading to a significant positive effect on their capacity utilization. Accordingly, the TFP is used as the explained variable to test the productivity effect empirically. Columns 1 and 3 in Table 6 present the industrial intelligence’s estimation effects on enterprises’ TFP employing

Column 2 and 4 in Table 6 investigates the impact of productivity on enterprises’ capacity utilization, and the results show enterprises with higher productivity achieve relatively higher capacity utilization. Thus, there is a potential positive impact path through which industrial intelligence helps productivity improvement, thereby increasing capacity utilization.

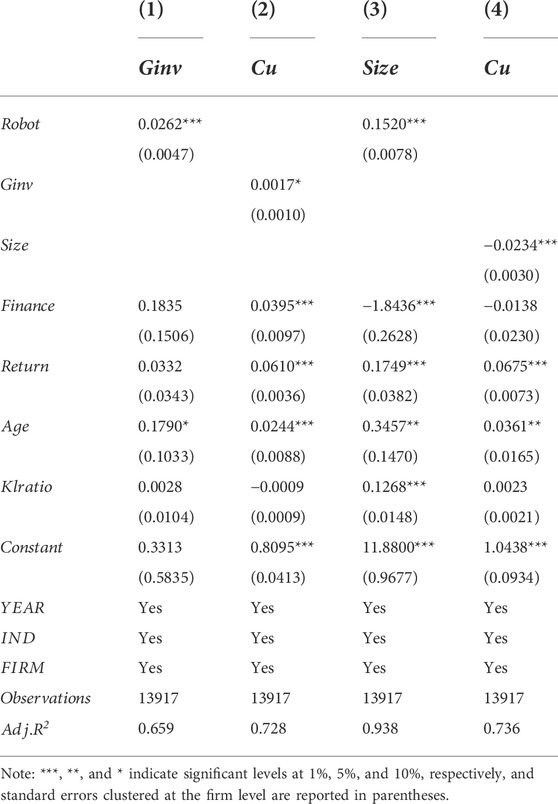

6.2 Green innovation effect

Enterprises adopting industrial intelligence promote green innovation. Column 1 in Table 7 reports the regression of industrial intelligence on the green innovation. The coefficient of the industrial intelligence (

6.3 Scale expansion effect

Enterprises adopting industrial intelligence can improve productivity and achieve scale expansion. Column 3 in Table 7 reports the regression of industrial intelligence on the firm scale, which indicates industrial intelligence has a significant positive effect on the firm scale. Column 4 in Table 7 includes

7 Heterogeneity analysis

The industrial intelligence level varies in regions across China. Therefore, the impact of industrial intelligence on capacity utilization may vary across regions. A heterogeneity analysis based on different regions is now presented to investigate the different effects of industrial intelligence on enterprises’ capacity utilization.1

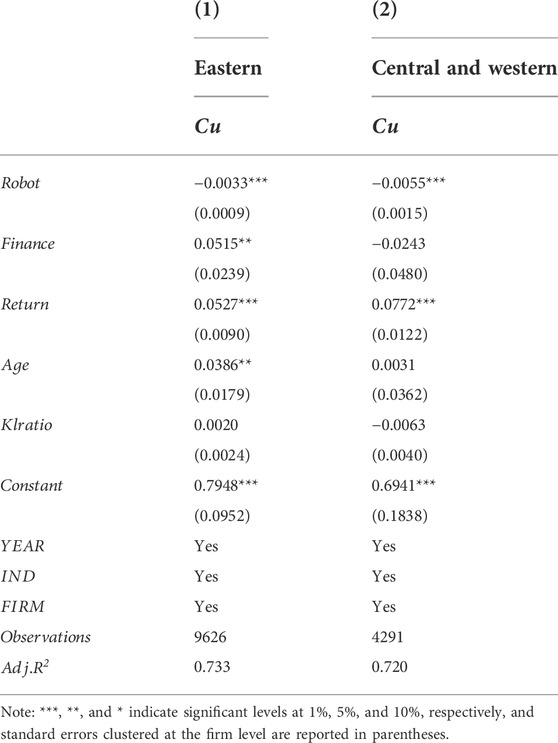

The regions are mainly divided based on the level of economic development. The eastern region refers to the provinces that were first to implement the opening-up policy and have a high level of economic development. The central and western regions include economically less developed areas. Columns 1 and 2 in Table 8 present the estimation results of enterprises in the eastern, the central and western regions, respectively. The negative impact of industrial intelligence on enterprises’ capacity utilization is more negative in the central and western regions. That is, a relatively high economic development level limits the inhibitory effects of industrial intelligence on capacity utilization. This may be due to effectual property rights protection and superior infrastructure in regions with a high level of economic development, which provides enterprises with sound market competition mechanisms and reduce business environment uncertainty. In summary, enterprises in regions with a high level of economic development are less negatively affected by industrial intelligence.

8 Discussion

Improving capacity utilization is the core concern of green development, and an important starting point for China to deal with climate change and environmental pollution. The arrival of COVID-19 posed environmental, financial, public health, and social challenges worldwide (Zhou et al., 2022; Su et al., 2021). Social distancing measures have made it difficult for some employees to return to work. Enterprises have more unstable expectations for the labor force, which may further increase the level of industrial intelligence, and the trend of automation equipment replacing labor may intensify. There is a lack of research that theorizes and tests the effects of industrial intelligence on capacity utilization. The mechanisms through which industrial intelligence affects capacity utilization also remain unclear. Applying the multi-dimensional fixed-effects model, we empirically investigate the effects, mechanisms, and heterogeneity of industrial intelligence on enterprises’ capacity utilization for the first time.

The estimation results indicate that industrial intelligence may significantly inhibit capacity utilization. It enriches the literature on the influencing factors of enterprises’ capacity utilization. This finding seems different from the literature that found intelligence technology is beneficial to improving enterprise performance (Hu and Wang, 2020; Zhang and Zhou, 2020). Based on the mechanism analysis, we examine the mechanism of the role of industrial intelligence in enterprises’ capacity utilization from three aspects: productivity, green innovation, and scale expansion. We find that industrial intelligence increases productivity, which is consistent with other research conclusions (Graetz and Michaels, 2018; Acemoglu et al., 2020). Enterprises with higher productivity have higher resource utilization efficiency and larger market demand, thereby improving capacity utilization. Industrial intelligence can also promote green innovation. Green innovation helps enterprises improve the clean production process, expand market share, and reduce production costs and time (Begum et al., 2021; Liu et al., 2021), thereby resolving the problem of excess capacity. At the same time, we find a special negative effect, which is an important factor explaining the negative impact of industrial intelligence on enterprises’ capacity utilization. Though industrial intelligence helps enterprises expand the scale, scale expansion may lead to a decrease in capacity utilization rate by inhibiting technical efficiency (Ma and Shen, 2021). Furthermore, we discover that the negative impact of industrial intelligence on enterprises’ capacity utilization is more negative in the central and western regions, which is in line with China’s actual national conditions.

Although this research provided some valuable findings and enlightenment for the research in the field of green development, it inevitably has certain limitations. First, our research only considers the effects of industrial intelligence in China and ignores the effects in other countries or regions, which makes the research conclusions limited in scope. Second, due to the limitations of methods and data, it is difficult to measure the industrial intelligence level of enterprises and market uncertainty accurately. Therefore, we do not incorporate these into the benchmark model. In this regard, future research can try to improve on the following aspects: Firstly, follow-up research can try to investigate the effects in other countries or regions and analyze and compare the effects of industrial intelligence in China. Secondly, future studies could focus on constructing a comprehensive indicator of industrial intelligence, combined with other policy goals, and incorporate market uncertainty for a deeper exploration into the domain.

9 Implications

The findings of our research have the following implications: (1) Industrial intelligence can improve capacity utilization through the productivity effect and green innovation effect, but it will also exacerbate excess capacity through the scale expansion. Overusing intelligence technology may lead to a massive replacement of labor, causing a double whammy to the economy in terms of production efficiency and labor (Acemoglu and Restrepo, 2020). However, most of the existing policies only focus on improving the level of intelligence or improving capacity utilization, ignoring the coordination of industrial intelligence and capacity utilization. In policy design, policymakers should focus on both the development of industrial intelligence and overcapacity control. When dealing with overcapacity in enterprises, the government should improve the mechanism for reducing outdated production capacity and develop advanced production capacity. The government should also implement differentiated green development strategies according to local conditions.

(2) Deeply excavate the incentive factors of enterprises’ green innovation and enhance the green innovation power of enterprises. The government should further promote the concept of green development and guide enterprises to change to the path of green and sustainable development. Enterprises should make full use of the policy dividends of green development, optimize internal governance, increase the development of green products and technologies, and establish core competitive advantages, to realize the improvement of enterprise value.

10 Conclusion

We apply the fixed-effects model to assess the impact of industrial intelligence on the capacity utilization of Chinese enterprises from 2011 to 2019. Using data from IFR and China’s A-share listed enterprises, we constructed an industrial intelligence variable based on the stock of industrial robots at the industry level. A series of robustness tests were proposed to verify the robustness of the results. We also investigated the impact mechanisms and regional heterogeneity. The key findings are as follows: 1) Benchmark estimates and robustness tests show industrial intelligence inhibits enterprises’ capacity utilization rate. 2) The mechanism tests show industrial intelligence has significant productivity effect and green innovation effect, which, in turn, positively affects the enterprises’ capacity utilization. Industrial intelligence has a significant scale expansion effect, inhibiting enterprises’ capacity utilization. 3) The heterogeneity test shows that industrial intelligence has a stronger inhibitory effect on capacity utilization in China’s central and western regions.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author contributions

YZ contributed to conceptualization and methodology. YY contributed to data curation, formal analysis and wrote the first draft of the manuscript. LY wrote sections of the manuscript. SK contributed to review, editing, and supervision.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1China’s 31 provinces and cities are divided into the eastern, central, and western regions, in which the eastern region includes Beijing, Tianjin, Hebei, Liaoning, Shanghai, Jiangsu, Zhejiang, Fujian, Shandong, Guangdong, and Hainan. The central region includes 8 provinces and regions of Shanxi, Jilin, Heilongjiang, Anhui, Jiangxi, Henan, Hubei, and Hunan. Western region includes Sichuan, Chongqing, Guizhou, Yunnan, Tibet, Shaanxi, Gansu, Qinghai, Xinjiang, Ningxia, Guangxi, and Inner Mongolia.

References

Acemoglu, D., Lelarge, C., and Restrepo, P. (2020). Competing with robots: Firm-level evidence from France. AEA Pap. Proc. 110, 383–388. doi:10.1257/pandp.20201003

Acemoglu, D., and Restrepo, P. (2020). Robots and jobs: Evidence from US labor markets. J. Political Econ. 128 (6), 2188–2244. doi:10.1086/705716

Al Halbusi, H., Al-Sulaiti, K., and Al-Sulaiti, I. (2022). Assessing factors influencing technology adoption for online purchasing amid COVID-19 in Qatar: Moderating role of word of mouth. Front. Environ. Sci. 10, 942527. doi:10.3389/fenvs.2022.942527

Ali, S., Rehman, R. U., Sarwar, B., Shoukat, A., and Farooq, M. (2021). Board financial expertise and foreign institutional investment: The moderating role of ownership concentration. Rev. Int. Bus. Strategy 32, 325–345. doi:10.1108/ribs-02-2021-0032

Awan, U., Kraslawski, A., Huiskonen, J., and Suleman, N. (2020). “Exploring the locus of social sustainability implementation: A south asian perspective on planning for sustainable development,” in Universities and sustainable communities: Meeting the goals of the agenda 2030. Editors W. Leal Filho, U. Tortato, and F. Frankenberger (Cham: Springer International Publishing), 89–105.

Awan, U., and Sroufe, R. (2019). Interorganisational collaboration for innovation improvement in manufacturing firms’s: The mediating role of social performance. Int. J. Innov. Mgt. 24 (05), 2050049. doi:10.1142/s1363919620500498

Balsmeier, B., and Woerter, M. (2019). Is this time different? How digitalization influences job creation and destruction. Res. policy 48 (8), 103765. doi:10.1016/j.respol.2019.03.010

Banerjee, A. V. (1992). A simple model of herd behavior. Q. J. Econ. 107 (3), 797–817. doi:10.2307/2118364

Begum, S., Ashfaq, M., Xia, E., and Awan, U. (2022). Does green transformational leadership lead to green innovation? The role of green thinking and creative process engagement. Bus. Strategy Environ. 31 (1), 580–597. doi:10.1002/bse.2911

Benoit, J., and Krishna, V. (1987). Dynamic duopoly: Prices and quantities. Rev. Econ. Stud. 54 (1), 23–35. doi:10.2307/2297443

Bonfiglioli, A., Crinò, R., Fadinger, H., and Gancia, G. (2020). Robot imports and firm-level outcome. CESIFO Work. Pap. 8741. doi:10.2139/ssrn.3744604

Burstein, A. T., and Alexander, M. N. (2009). Foreign know-how, firm control, and the income of developing countries. Q. J. Econ. 124 (1), 149–195. doi:10.1162/qjec.2009.124.1.149

Cai, Z., and Qi, J. (2021). Does the adoption of industrial robots upgrade the export product quality —Evidence from Chinese manufacturing enterprises. J. Int. Trade 10, 17–33. doi:10.13510/j.cnki.jit.2021.10.002

Cheng, Z., Liu, J., Li, L., and Gu, X. (2020). The effect of environmental regulation on capacity utilization in China’s manufacturing industry. Environ. Sci. Pollut. Res. 27 (13), 14807–14817. doi:10.1007/s11356-020-08015-9

Dantas, T., de-Souza, D., Destro, I., Hammes, G., Rodriguez, C., and Soares, S. (2021). How the combination of circular economy and industry 4.0 can contribute towards achieving the sustainable development goals. Sustain. Prod. Consum. 26, 213–227. doi:10.1016/j.spc.2020.10.005

Dixon, J., Hong, B., and Wu, L. (2021). The robot revolution: Managerial and employment consequences for firms. Manag. Sci. 67 (9), 5586–5605. doi:10.1287/MNSC.2020.3812

Du, W., and Li, M. (2019). Can environmental regulation promote the governance of excess capacity in China’s energy sector? The market exit of zombie enterprises. J. Clean. Prod. 207, 306–316. doi:10.1016/j.jclepro.2018.09.267

Gan, C., Zou, J., and Wang, J. (2015). Term of local officials, enterprise resource acquisition and excess capacity. China Ind. Econ. 3, 44–56. doi:10.19581/j.cnki.ciejournal.2015.03.004

Geng, J., Ul Haq, S., Ye, H., Shahbaz, P., Abbas, A., Cai, Y., et al. (2022). Survival in pandemic times: Managing energy efficiency, food diversity, and sustainable practices of nutrient intake amid COVID-19 crisis. Front. Environ. Sci. 13, 945774. doi:10.3389/fenvs.2022.945774

Geng, Q., Jiang, F., and Fu, T. (2011). Policy-related subsides, overcapacity and China’s economic fluctuation—Empirical testing based on RBC model. China Ind. Econ. 5, 27–36. doi:10.19581/j.cnki.ciejournal.2011.05.003

Gopalkrishnan, S. (2013). A new resource for social entrepreneurs: Technology. Am. J. Manag. 13 (1), 66–78.

Graetz, G., and Michaels, G. (2018). Robots at work. Rev. Econ. Stat. 100 (5), 753–768. doi:10.1162/rest_a_00754

Han, B., and Han, X. (2017). The formation and countermeasures of China’s overcapacity. Reform 4, 59–69.

Han, G., Gao, T., Wang, L., Qi, Y., and Wang, X. (2011). Research on measurement, volatility and causes of excess production capacity of Chinese manufacturing industries. Econ. Res. 46 (12), 18–31.

Hu, B., and Wang, L. L. (2020). Innovation of enterprise organizational structure in IoT environment. Manag. World 36 (8), 202–210+232+211. doi:10.19744/j.cnki.11-1235/f.2020.0128

Huang, X., Yu, L., and Yuan, Y. (2022). Industrial robots and enterprises innovation——based on the view of human capital. Stud. Sci. Sci., 1–20. doi:10.16192/j.cnki.1003-2053.20220516.006

Jiang, F., and Cao, J. (2009). Market failure or institutional distortion: The argument, defect and new development in the research of redundant construction formation mechanism. China Ind. Econ. 1, 53–64. doi:10.19581/j.cnki.ciejournal.2009.01.005

Koch, M., Manuylov, I., and Smolka, M. (2021). Robots and firms. Econ. J. 131 (638), 2553–2584. doi:10.1093/ej/ueab009

Li, X., Dongling, W., Baig, N. U. A., and Zhang, R. (2022). From cultural tourism to social entrepreneurship: Role of social value creation for environmental sustainability. Front. Psychol. 13, 925768. doi:10.3389/fpsyg.2022.925768

Li, X., Zhao, C., and Nie, J. (2017). OFDI and corporations’ heterogeneous capacity utilization. J. World Econ. 40 (5), 73–97.

Li, Z., Wang, D., Hassan, S., and Mubeen, R. (2021). Tourists' health risk threats amid COVID-19 era: Role of technology innovation, transformation, and recovery implications for sustainable tourism. Front. Psychol. 12, 769175. doi:10.3389/fpsyg.2021.769175

Lin, Y., Wu, H., and Xing, Y. (2010). “Wave phenomenon” and formation of excess capacity. Econ. Res. 45 (10), 4–19.

Liu, D., and Wang, D. (2022). Evaluation of the synergy degree of industrial de-capacity policies based on text mining: A case study of China’s coal industry. Resour. Policy 76, 102547. doi:10.1016/j.resourpol.2021.102547

Liu, S., Yang, D., and Jin, D. (2021). The impact of environmental regulation on capacity utilization: Analysis of moderating mediating effect based on technological innovation. Reform 8, 77–89.

Luan, F., Yang, X., Chen, Y., and Regis, P. (2022). Industrial robots and air environment: A moderated mediation model of population density and energy consumption. Sustain. Prod. Consum. 30, 870–888. doi:10.1016/j.spc.2022.01.015

Ma, H., Mei, X., and Tian, Y. (2020). The impacts and potential mechanisms of credit support with regard to overcapacity: Based on theoretical and empirical analyses of steel enterprises. Resour. Policy 68, 101704. doi:10.1016/j.resourpol.2020.101704

Ma, H., and Shen, G. (2021). Scale expansion, “creative destruction” and overcapacity: an empirical analysis of China’ iron and steel enterprises. China Econ. Q. 21 (1), 71–92. doi:10.13821/j.cnki.ceq.2021.01.04

Mubeen, R., Han, D., Abbas, J., Raza, S., and Bodian, W. (2022). Examining the relationship between product market competition and Chinese firms performance: The mediating impact of capital structure and moderating influence of firm size. Front. Psychol. 12, 709678. doi:10.3389/fpsyg.2021.709678

Schoenberger, E. (1989). Some dilemmas of automation: Strategic and operational aspects of technological change in production. Econ. Geogr. 65 (3), 232–247. doi:10.2307/143837

Shen, G., and Chen, B. (2017). Zombie firms and over-capacity in Chinese manufacturing. China Econ. Rev. 44, 327–342. doi:10.1016/j.chieco.2017.05.008

Su, Z., McDonnell, D., Li, X., Bennett, B., Segalo, S., Abbas, J., et al. (2021). COVID-19 vaccine donations-vaccine empathy or vaccine diplomacy? A narrative literature review. Vaccines (Basel) 9 (9), 1024. doi:10.3390/vaccines9091024

Wang, Y., and Dong, W. (2020). How the rise of robots has affected China’s labor market: Evidence from China’s listed manufacturing firms. Econ. Res. 55 (10), 159–175.

Wang, Y., Kuang, X., and Shao, W. (2017). Informatization, firm’s flexibility and capacity utilization. J. World Econ. 1, 69–92.

Xu, Y., and Ma, G. (2019). Local officials’ turnover and enterprises’ overcapacity. Econ. Res. 5, 129–145.

Yang, G., and Sun, P. (2017). Can foreign entry deregulation improve capacity utilization? J. Quantitative Tech. Econ. 34 (6), 3–19. doi:10.13653/j.cnki.jqte.2017.06.001

Yu, L., Wei, X., Sun, Z., and Wu, C. (2021). Industrial robots, job tasks and non-routine capability premium: Evidence from “enterprise-worker” matching data in manufacturing industry. Manag. World 37 (1), 47–59+4. doi:10.19744/j.cnki.11-1235/f.2021.0004

Yu, M., Jin, Y., and Zhang, R. (2018). Capacity utilization rate measurement and productivity estimation for industrial firms. Econ. Res. 53 (5), 56–71.

Yu, S., Draghici, A., Negulescu, O. H., and Ain, N. U. (2022). Social media application as a new paradigm for business communication: The role of COVID-19 knowledge, social distancing, and preventive attitudes. Front. Psychol. 13, 903082. doi:10.3389/fpsyg.2022.903082

Zhai, D. (2013). Analysis of “Chinese-Style” overcapacity. Macroecon. Manag. 7, 34–35. doi:10.19709/j.cnki.11-3199/f.2013.07.012

Zhang, H. M. (2018). Research on the causes and countermeasures of the overcapacity crisis in China’s new energy vehicle market. Sci. Manag. Res. 36 (3), 28–30+35. doi:10.19445/j.cnki.15-1103/g3.2018.03.008

Zhang, H., and Zhang, M. (2019). The learning effect of China’s enterprises’ export trade——Based on the perspective of capacity utilization. J. Shanxi Univ. Finance Econ. 7, 77–92. doi:10.13781/j.cnki.1007-9556.2019.07.006

Zhang, L. P., and Zhou, D. (2020). Information technology usage and productivity improvement in service industry: Empirical research on Chinese enterprises. Financ. Trad. Res. 31 (6), 1–13. doi:10.19337/j.cnki.34-1093/f.2020.06.001

Zhang, X., Husnain, M., Yang, H., Ullah, S., and Zhang, R. (2022). Corporate business strategy and tax avoidance culture: Moderating role of gender diversity in an emerging economy. Front. Psychol. 13, 827553. doi:10.3389/fpsyg.2022.827553

Keywords: industrial intelligence, green development, capacity utilization, green innovation, scale expansion

Citation: Yuan Y, Yu L, Kumar S and Zhang Y (2022) How does industrial intelligence affect capacity utilization?—Analysis based on green development perspective. Front. Environ. Sci. 10:1006630. doi: 10.3389/fenvs.2022.1006630

Received: 02 August 2022; Accepted: 14 September 2022;

Published: 30 September 2022.

Edited by:

Usama Awan, Lappeenranta University of Technology, FinlandReviewed by:

S. Bano, Shanghai University of Sport, ChinaTehreem Fatima, The University of Lahore, Pakistan

Copyright © 2022 Yuan, Yu, Kumar and Zhang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yi Zhang, emhhbmd5aTM0QHp1ZmUuZWR1LmNu

Yiming Yuan

Yiming Yuan Liuming Yu

Liuming Yu Sanjay Kumar2

Sanjay Kumar2 Yi Zhang

Yi Zhang