94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Sci., 28 October 2022

Sec. Environmental Economics and Management

Volume 10 - 2022 | https://doi.org/10.3389/fenvs.2022.1006274

This article is part of the Research TopicEco-Innovation and Green Productivity for Sustainable Production and ConsumptionView all 47 articles

To accomplish the goals of carbon mitigation, industrial green transformation is an inevitable requirement for achieving high-quality economic development. Based on the data of 30 provinces in China from 2007 to 2017, this paper uses projection pursuit model and entropy method to calculate the industrial green transformation and Chinese fiscal decentralization. It further employs static and dynamic spatial Durbin model to explore the impact of Chinese fiscal decentralization on industrial green transformation by the environmental fiscal policy. The study finds that: 1) China’s industrial green transformation presents an unbalanced state with high in the east and low in the west, which has a positive spatial spillover among provinces. 2) Fiscal decentralization is significantly conducive to the industrial green transformation, while the spatial spillover of fiscal decentralization is negative. Moreover, fiscal decentralization affects the industrial green transformation by environmental fiscal policy, in of which environmental fiscal expenditure is the main path. 3) From the perspective of heterogeneity of fiscal decentralization, the impact of fiscal expenditure decentralization in promoting industrial green transformation is significantly greater than that of fiscal revenue decentralization. In terms of heterogeneity of regional location, fiscal decentralization in the eastern and central regions plays a role in accelerating industrial green transformation, while it has an obstacle impact in the western region. In terms of market-based heterogeneity, Fiscal decentralization in high-market areas facilitates the green transformation of industry, while in low-market areas is the opposite.

In recent years, global warming and climate change have gradually threatened the safety of human survival. Rising temperatures are leading to a rapid depletion of freshwater supplies (Bhardwaj A. et al., 2022). At the same time, the frequent occurrence of hot weather leads to shortages of food crops (Bhardwaj M. et al., 2022). The main reason for global warming is the increasing carbon dioxide emission. Referring to a report published by the IEA (2011), more than 60% of greenhouse gas levels are due to carbon dioxide (Dagar et al., 2022). To combat the effects of climate change, leaders of more than 170 countries signed the Paris Agreement, committing to limit global temperature in 2016. China is the country with the highest carbon emission and largest energy consumption in the world. Therefore, China expressed its determination to reduce carbon emissions at the 75th United Nations General Assembly, striving to achieve the goal of peaking carbon dioxide emissions by 2030 and carbon neutrality by 2060. This target is also in line with the expectations of the Sustainable Development Goals. China’s industrial GDP dominates economic development with an average annual growth rate of 11.5%. However, at the same time, 40.1% of industrial GDP consumes 67.9% of China’s energy and emits 83.1% of China’s CO2 (Wang and Shao, 2019; Cai et al., 2019). The industrial carbon dioxide emissions of 30 provinces in China from 2007 to 2017 shown in Figure 1. In order to achieve the important goal of sustainable development, the industrial green transformation is an inevitable choice to achieve high-quality economic development in China (Li et al., 2011).

The industry sector has the fastest growth, the greatest reforming effort and the highest opening scale in China for a long time. Accelerating industrialization has great contributions on China’s sustainable economic growth. However, China’s economic growth and industrialization development mainly rely on the resource-based growth route, which is characterized by “high input, high consumption, high pollution, low quality, low efficiency, low output, pollution first and treatment later.” China extensive economic development model stems from the government behavior under the Chinese fiscal decentralization (Cai et al., 2008). China has established a system of fiscal decentralization since the implementation of the tax sharing reform in 1994. This system has greatly motivated local governments in China (Tian and Wang, 2018). Compared to other countries such as the United States, the European Union, India and Russia, China has implemented fiscal decentralization in a different political environment, where the typical vertical management system at all levels of government means that local government officials are primarily accountable to their superiors, resulting in the so-called Chinese style of fiscal decentralization (Yan, 2012; Fu, 2010). Fiscal decentralization gives local governments a priority on fiscal expenditure and resource allocation. To attract external investment and expand employment, local governments will compete to lower environmental standards, resulting in the decline of environmental quality (Zhang et al., 2011). However, with the intensity of environmental problems in recent years, the central government continuously polish the institute for evaluating and assessing the officials’ performance. Due pollution control will directly affect the promotion of Chinese officials, local governments may increase the supervision on local enterprises’ pollution discharge behavior and constantly encourage enterprises to reduce the pollution.

Industrial green transformation derives from green economy. The term “green economy” comes from the book “green economy blueprint” published by Pearce, a British environmental economist, in 1989 (Pearce et al., 1989). Subsequently, some studies defined “green economy” as “a resource-saving and low-carbon economic development mode, which should be conducive to the protection and improvement of natural resources, promoting sustainable consumption and production” (Morgera and Savaresi, 2013). So far, there is no unified definition of green economy, and most of the relevant definitions emphasize “jointly improving economic and environmental benefits, achieving sustainable growth through economic behaviors that are beneficial to the environment or that are not antagonistic to the environment” (Sustainable Development Strategy Study Group Chinese Academy of Sciences, 2010). The structural changes and transformation of economies (Shahzad et al., 2022), the sustainable use of material resources (Xie et al., 2022), the development of renewable energy sources and the constraints of non-renewable resources (Islam et al., 2022), and the use of wastewater treatment (Bhardwaj A. et al., 2022)will all have a significant positive impact on sustainable growth. Research group of institute of industrial economics CASS (Research group of institute of industrial economics CASS, 2011) defined the industrial green transformation as taking the intensive resources utilization and environmental friendliness as the guidance, green innovation as the core, following on the new road of industrialization, realizing the green and sustainable development in the whole process of industrial production, and achieving a win-win of economic and environmental benefits. Wang and Zhang (2019) regarded green transformation as the transformation of development mode to sustainable development led by the ecological civilization construction. It relied on circular economy, green management, resource conservation, environmental friendliness, ecological balance and harmonious development between human, nature and society. The theory of fiscal decentralization arose from the classic article “the pure theory of local expenditures” published by Tiebout in the Journal of political economy in 1956 (Tiebout, 1956). This article extended the research from local government expenditure to fiscal decentralization theory deeply. Colm and Musgrave (1960) and Oates (1972) developed the relevant theories from the perspective of local expansion effect of fiscal policy and fiscal decentralization under the federal system. The industrial green transformation has the dual attributes of a market economy and an environmental public good. The multiple attributes make the impact of fiscal decentralization on industrial green transformation uncertain. Large numbers of studies have argued that fiscal decentralization has a negative impact on industrial green innovation with both economic and environmental attributes (You and Ouyang, 2020; Dong et al., 2022). It is argued that under the “GDP tournament” assessment approach, local governments focus more on pursuing high economic growth and prefer to invest in projects with quick results in the short term at the expense of environmental protection (Zhang, 2016; Wu, 2017; Hou et al., 2018a). However, after the Chinese government proposed and improved the “green GDP” performance assessment, local governments are not obsessed with chasing economic growth and may invest more in the area of environmental protection (Kuai et al., 2019). This may make a positive change in the impact of fiscal decentralization on industrial green transformation, and therefore, the impact of fiscal decentralization on industrial green transformation needs to be further explored.

First, Industrial green transformation has a rich connotation, and it is difficult to accurately measure the nature of industrial green transformation by a single indicator, so it needs to be measured by multidimensional indicators. Studies have been conducted on the measurement of industrial green transformation mainly using the green total factor productivity method (Hou et al., 2018b; Chen and Golley, 2014), the elastic decoupling method (Tapio, 2002) and the comprehensive indicator method (Chen et al., 2016; Deng and Yang, 2019). Comparatively speaking, the composite indicator method can measure the connotation of indicators more comprehensively. And will continue to evolve with the development, the connotation and requirements of industrial green transformation are also enriched, we should continue to enrich the corresponding indicators. Second, the existing studies currently adopt single indicator of expenditure or revenue (Davoodi and Zou, 1998; Lin and Liu, 2000; Jin and Zou, 2005). In fact, fiscal decentralization is a comprehensive system includes both fiscal expenditure decentralization and fiscal revenue decentralization (Kuai et al., 2019). We should measure fiscal decentralization from the multidimensional perspective. Third, most scholars analyze the industrial green transformation from the aspects of environmental regulation and technology innovation. Magat and Viscusi (1990) took the pulp and paper products industry in Quebec, Canada as the research object, and used the least square method to demonstrate that environmental regulation can promote enterprises to reduce emissions by 20%. Telle and Larsson (2007) used enterprise panel data to identify that there is a significant positive correlation between the environmental regulation and green total factor productivity. Peng and Li (2016) employed the dynamic panel model and found out the nonlinear impact of various environmental regulations on China’s industrial green transformation. Yue et al. (2017) studied the effects of independent innovation, technology import and government support on the industrial green transformation. Shen et al. (2018) explored the influence of different environmental regulation modes on industrial environmental efficiency. Fahad et al. (2022) argue that environmental regulation and industrial policy are effective in promoting technology spillovers, which have a greater impact on industrial structure. But there is a lack of exploration of fiscal policy on the green transformation of industry. Environmental fiscal policy has the dual attributes of environmental policy and fiscal policy. The way in which it operates under a system of fiscal decentralization merits further discussion.

Based on this, this paper aims to answer three questions: 1) Given Chinese-style fiscal decentralization system, how does fiscal decentralization affect the industrial green transformation 2) How is the moderating impact of environmental fiscal policy on industrial green transformation. 3) Whether there is heterogeneity impact in different environment fiscal policy and. The resolution of these questions can help provide reference for similar economies to formulate a reasonable fiscal decentralization and fiscal policy in the context of economic transformation, it has a great practical significance for achieving sustainable development. Therefore, based on the definition of industrial green transformation and fiscal decentralization, this paper proposes to adopt the projection tracing method and entropy method to measure the industrial green transformation and fiscal decentralization, respectively. Meanwhile, we use the static and dynamic spatial Durbin model to comprehensively analyze the influence mechanism and spatial effect of fiscal decentralization on industrial green transformation from the perspective of environmental fiscal policy. It also further explores the analysis of the heterogeneity of fiscal decentralization on industrial green transformation from multiple perspectives, providing a novel way of thinking for us to analyze the above issues.

Compared with the established literature, the main contributions of this paper are as follows: Firstly, scientific industrial green transformation evaluation index system and measurement method are essential to identify the weak links in industrial transformation. Based on the definition, a complete set of industrial green transformation index is constructed. The system is based on a green growth strategy framework. It covers seven aspects, including pollution emissions, pollution control, resource intensity, green innovation, structural optimization, production and operation, and sustainable development. The weights are determined by the projection tracing method and the evaluation results are more robust. This provides a valuable reference for the industrial green development index system. Secondly, Different from the single fiscal decentralization indicator in most studies, this paper calculates the fiscal decentralization index from the dual dimension of fiscal revenue and expenditure decentralization. We consider information on on-budget and off-budget revenues and expenditures and central transfers and eliminate the confounding of population and economic size factors. Thirdly, based on the perspective of environmental fiscal policy, the influence mechanism of fiscal decentralization on Industrial green transformation is explored. it is argued that environmental fiscal policy is an important way for fiscal decentralization to influence industrial green transformation. Fourth, based on heterogeneity, we further explore the differences in the impact of fiscal decentralization on the green transformation of industry from multiple perspectives, it provides insight into the contribution of different fiscal decentralization and different regions to transformation.

The paper is arranged as follows. Section 2 presents the research hypotheses. Section 3 explains the models, data and econometric methods used in this paper. Section 4 presents the results of the empirical study. Section 5 presents a discussion between our main results with previous studies. Section 6 concludes the study as well as gives some policy recommendations.

As an important institutional arrangement, fiscal decentralization is the key to adjust the financial power between the central government and local governments and further divide the responsibility of fiscal expenditure. Compared with the central government, local governments have more information advantages and better understands the preferences and needs of residents in their jurisdiction (Tiebout, 1956). With the continuous strengthening of the green-performance assessment system, fiscal decentralization encourages local governments to focus on their information advantages and abolish policies serving for local development. Kuai et al. (2019) believed that fiscal decentralization is expected to give local governments greater financial resources and power (Cheng et al., 2020), so that local governments have more rights to deal with environmental problems. In terms of resource intensity, fiscal decentralization accelerates renewable energy consumption and reduces the use of non-renewable energy (Su et al., 2021; Zhang et al., 2022). Renewable energy is considered to be one of the most important ways to protect the environment. The decentralization has led to greater autonomy for local authorities. Local governments will increase subsidies for renewable energy in order to mitigate environmental problems, reducing the cost of sustainable energy use and thus contributing to an increase in the share of renewable energy consumption in energy consumption. In a word, fiscal decentralization gives full play to the local information dominance and reduce the cost of enterprises, which inspires enterprises to perform green innovation and realize the industrial green transformation. We made the following hypotheses:

Hypothesis 1. Fiscal decentralization benefits industrial green transformation.

On basis of fiscal decentralization, local governments often control regional pollution by environmental regulations. Environmental fiscal policy is a finance policy tool to advocate ecological protection and environment governance, mainly including environmental fiscal expenditure and environmental tax revenue. Environmental fiscal expenditure has the dual attributes of social investment and environmental regulation. It has the induced effect of general fiscal expenditure, which leads to more social capital and then affects the regional industrial structure, playing a regulatory role in pollution reduction (Jiang, 2018). It is also an input-oriented environmental regulation means, which encourages enterprises to implement green innovation. Environmental tax revenue internalizes the environmental cost (Pigou, 1932). By using the means of price, it adjusts the production cost and product price flexibly. Meanwhile, it effectively motivates the enterprises’ initiative to reach the optimal solution of pollution reduction, which promotes their green transformation (Bovenberg and Goulder, 1997).

With the improvement of fiscal decentralization, the division of fiscal expenditure responsibilities is clearer, which is conducive to bringing into full play to the advantages of fiscal decentralization and reaching the optimal allocation of financial resources. At the same time, make sure to continuously implement the green strategy, local governments increase financial investment in environmental expenditure, reduce industrial environmental protection cost, encourage local industrial enterprises to develop green technology, and push the green transformation of the overall industry. However, from the actual situation of China’s environmental tax, the special environmental tax settings sector is lacking. Scattered and small sewage charges provide local governments with limited financial support to perform the function of environmental pollution control. Thus, the following hypothesis is made:

Hypothesis 2. Fiscal decentralization has a positive impact on industrial green transformation through environmental fiscal policy. Moreover, Under the Chinese fiscal decentralization system, local governments are more inclined to adopt environmental fiscal expenditure policy to speed the industrial green transformation.

To get the goal of short-term economic growth, there is differentiated strategy interaction in fiscal decentralization among regions. When the local fiscal decentralization increases, local industrial green transformation improves. Then, there is a spillover to the industrial green technology and industry of neighbor regions. Neighbor regions choose a substitution strategy. They do not increase the expenditures of environmental protection to obtain revenues. This type of “free riding” behavior can easily lead to bottom-by-bottom competition, which is detrimental to the industrial green transformation of neighbor regions. Moreover, the regional environmental fiscal policy is not only affected by local factors, but also by that of neighbor regions. Some scholars believe that increasing environmental fiscal expenditure in a region will often lead to imitation by neighbor regions (Allers and Elhorst, 2005). By contrary, the environmental taxes are relatively scattered. It is difficult to generate fiscal revenue. The neighbor regions’ governments are more motivated to take “competition to the end” measures, such as tax incentives and reducing environmental thresholds, to make concessions for economic growth (He et al., 2016). Thus, the following hypothesis is made:

Hypothesis 3. The spatial spillover effect of fiscal decentralization on industrial green transformation is negative. Moreover, the spatial spillover of environmental fiscal expenditure and environmental tax revenues may be heterogeneous.In summary, the theoretical model of hypotheses constructed in this paper is shown in Figure 2.

This paper takes the data of 30 provinces in China (excluding Hong Kong, Macao, Taiwan and Tibet) from 2007 to 2017 as samples. The data of industrial green transformation and other model’s control variables are mainly from the China Statistical Yearbook, China Environmental Statistical Yearbook, China Energy Statistical yearbook, China Industrial Economic Statistical Yearbook, China Science and Technology Statistical Yearbook, Industrial Enterprise Science and Technology Yearbook, China High-Tech Industry Statistical Yearbook China Labor Statistics Yearbook, EPS database, Wind database and Guotai’an database. The model’s core explanatory variables of fiscal decentralization and environmental fiscal policy are mainly from China Tax Yearbook, China Fiscal Yearbook and forward-looking database.

(1) The Explained Variable. This paper draws on the definition of industrial green transformation by the research group of institute of industrial economics CASS (Research group of institute of industrial economics CASS, 2011). Combined with the main indicators of the industrial green development plan (2016–2020) issued by the Ministry of industry and information technology in 2016, and the “14th Five-year plan” of China’s industrial development strategy, we build an industrial green transformation index from seven aspects: pollution emission, pollution treatment, resource intensification, green innovation, structural optimization, production efficiency and sustainable development. The industrial green transformation index system is shown in Table 1.

(2) Core Explanatory Variables. Fiscal decentralization (FD) is divided into fiscal revenue decentralization (FDR) (He et al., 2016) and fiscal expenditure decentralization (FDE) (Kuai et al., 2019). Fiscal revenue decentralization refers to the distribution relationship between the central and local governments in fiscal revenue. The higher the fiscal revenue decentralization is, the greater the power of local governments to control fiscal revenue is. Fiscal expenditure decentralization refers to the distribution relationship between the central and local governments in fiscal expenditure. The higher fiscal expenditure decentralization means that local governments have greater autonomy in fiscal expenditure. In this paper, referring to Chu et al. (2018), the four indicators of fiscal revenue autonomy rate, fiscal revenue proportion, fiscal expenditure determining rate by itself and fiscal expenditure proportion are used to calculate the fiscal decentralization by using the entropy method. Fiscal decentralization index system is shown in Table 2.

(3) Moderating Variables. Environmental fiscal policy (EFT) is a moderating variable, including environmental fiscal expenditure (EF) and environmental tax revenue (ET). Environmental fiscal expenditure refers to Zhu and Lu (2017). It is measured by the proportion of environmental fiscal expenditure in GDP. Environmental tax revenue turns to Wang and Li (2018). It is measured by the proportion of resource tax, cultivated land occupation tax, consumption tax, vehicle purchase tax, urban maintenance and construction tax, vehicle and vessel tax, and urban land use tax in the sum of total taxes and sewage charges.

(4) Control Variables. Referring to Zhang et al. (2016) and Chen and Ma (2011), This paper selects the following indicators as the control variables (X): Population density (PD) is measured by the ratio of total population to administrative area at the end of the year. The higher the population density, the greater the demand for the social public environment. It forces local governments to improve environmental benefits. Natural conditions (NC) are measured by per capita forest area. Areas with good natural conditions have a good rate of forest greenery, which facilitates the adsorption of pollutants. Local governments may be inclined to reduce funding for environmental protection. Human capital (HC) is measured by the average number of education years. An increase in the tertiary educated working population will give the region a strong R&D capability and provide a growth engine for industrial transformation. Descriptive statistics of variables are shown in Table 3.

This paper uses projection pursuit method to determine the weight. The basic idea of projection pursuit method is to project high-dimensional data onto low-dimensional subspace through some combination, use projection objective function to measure the possibility of projection configuration exposing a certain data structure, set constraints, find out the projection direction vector that maximizes the projection objective function, and then analyze the structural characteristics of high-dimensional data in low-dimensional subspace according to the projection direction vector. The specific modeling process is as follows:

Step 1. Standardize original value. Set the sample as

Negative indicators:

Eqs 1, 2,

Step 2. Construct the projection objective function. Set

When optimizing the one-dimensional projection value, the projection value

Eq. 4,

Eqs 5, 6,

Step 3. Optimize the projection objective function. After the sample set is determined, the change of projection direction vector

This is a complex linear optimization problem with optimization variables

Step 4. Rank. After obtaining the best projection direction vector, take the best projection direction vector as the weight, multiply it by the standardized value of the corresponding evaluation indicator, and add all the evaluation index to obtain the projection value. According to the projection value in the sample, the superior and inferior of all the samples can be calculated.

To explore the spatial effect of fiscal decentralization on industrial green transformation, this paper first constructs the following static spatial Durbin model:

Eq. 9, i denotes province, t denotes time, LnUPgrade represents the industrial green transformation, LnFD represents the fiscal decentralization, W is the spatial weight matrix, X are other control variables,

Due to the spatial spillover and time lagging of industrial green transformation, this paper refers to Luo and Wang (2017), and adds the industrial green transformation of the previous period into the model to form a dynamic spatial Durbin model:

Eq. 10, LnUPgradeit-1 refers to the industrial green transformation of province i in the period t-1, Other symbols have the same meaning as Eq. 9.

In order to test the moderating mechanism of environmental fiscal policy on the relationship between fiscal decentralization and industrial green transformation, the interaction and spatial lagged term of fiscal decentralization and environmental fiscal policy are added to Eq. 10. The specific model is as follows:

The setting of spatial weight matrix is the key to the analysis of dynamic spatial panel model. Based on Zhang and Zhu (2010), this paper sets up a nested spatial weight matrix including geographical and economic factors. The formula is as follows:

Eq. 12, Wd is the geographical distance weight matrix, We is the economic distance weight matrix, then Wn is between 0 and 1.

We use projection pursuit method to calculate the industrial green transformation of 30 provinces in China from 2007 to 2017. The results are shown in Table 4, Figure 3. It is the development trend of China’s industrial green transformation from 2007 to 2017 on basis of Supplementary Appendix Table S4. It shows that the industrial green transformation is rising over the whole period.

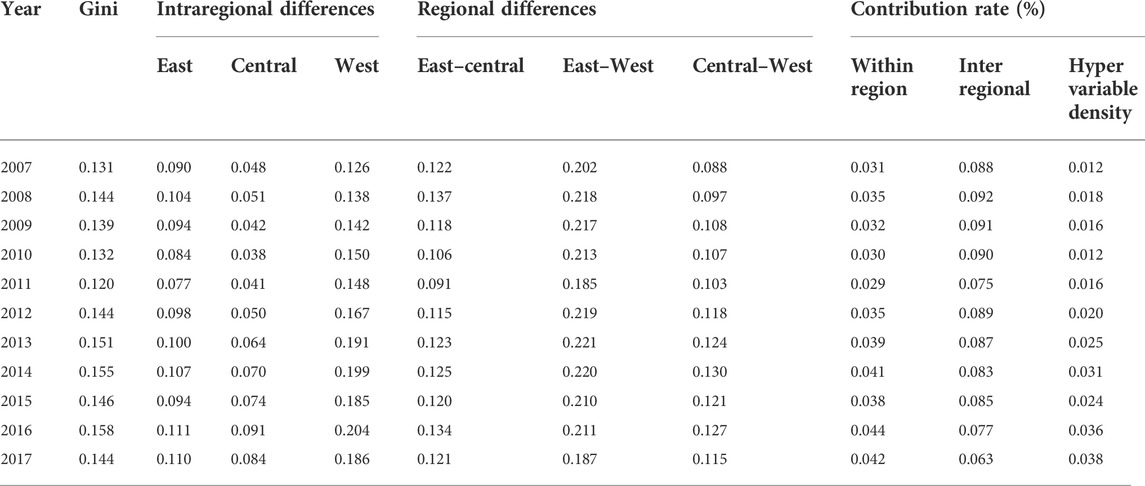

To analyze the change trend of industrial green transformation and its regional differences, this paper divides 30 provinces and province-level municipality into eastern, central and western region according to the national “Seventh Five Year Plan” economic and social development plan. This paper uses Dagum Gini coefficient decomposition to decompose the regional differences of China’s industrial green transformation. The results are shown in Table 5. The results show that: 1) China’s industrial green transformation gap increased from 0.1308 to 0.1435 during the period of 2007–2017. 2) The gap between the eastern, central and western regions of industrial green transformation expands year by year. 3) The gap between the eastern and the western regions is the largest. 4) The contribution rate of inter-regional gap to the industrial green transformation widening gap in China is always the highest. Therefore, narrowing the gap between regions is the key to solve the regional imbalance of industrial green development in China.

TABLE 5. Dagum Gini coefficient and its decomposition results of China’s industrial green transformation.

Table 6 reports the global Moran’s I index from 2007 to 2017. The results show that except for FD, which failed to pass the significance test in part years, other variables are significantly greater than zero. It indicates that there is an obvious spatial dependence between variables. Therefore, it is necessary to employ the spatial model to further investigate the relationship between fiscal decentralization and industrial green transformation.

Figure 4 is the scatter chart of Moran’s I index of industrial green transformation in 2007 and 2017. In the whole, the number of provinces in the low-low agglomeration mode of industrial green transformation has decreased, and the number of provinces in the high-high agglomeration has increased.

Before estimating the parameters of the model, we need to determine the specific form of the spatial model at first. In this paper, LM Test, LR test and Hausman test are carried out in turn. The test results are shown in Table 7. LM statistics are significantly positive, indicating that there is significant spatial autocorrelation. So it is appropriate to use spatial model. Further, in order to determine the form of spatial panel model, Wald is also used to test whether the spatial Durbin model can be weakened into the spatial lagged model or spatial error model. It can be seen that models have passed LR test, meaning that the model should be set as spatial Durbin model. Then the Hausman test is used to determine whether it is a fixed effect or a random effect. It can be found that the Hausman test statistics significantly reject the null hypothesis, so the double fixed effect model is selected for estimation.

In Table 7, models (1)–(2) are the regression results of fiscal decentralization affecting industrial green transformation using static fixed-effect spatial model and dynamic fixed-effect spatial model. The results show that the coefficient of fiscal decentralization is significantly positive, which reveals that fiscal decentralization is helpful to industrial green transformation. Due to the improvement of fiscal decentralization, local governments make better use of local information to optimize resource allocation and accelerate the upgrade of industrial green transformation. The spatial lagged coefficient in is significantly positive, which proves that the industrial green transformation has obvious spatial agglomeration characteristics. Therefore, the Hypothesis 1 is verified.

To test the moderating mechanism of environmental fiscal policy, the interactive term of environmental fiscal expenditure and fiscal decentralization (LnFD×LnEF) is introduced into the column (3) of Table 7, it can be found that the interaction coefficient is significantly positive. It indicates that fiscal decentralization can indeed affect the industrial green transformation through environmental fiscal expenditure. In column (4) of Table 7, the interaction term of environmental tax revenue and fiscal decentralization (LnFD×LnET) is introduced, we can get that the coefficient of the interaction term is significantly positive. It means that fiscal decentralization can indeed affect the industrial green transformation through environmental tax revenue. By comparing the coefficients of the interaction terms in column (3) and column (4), the coefficients of LnFD×LnEF is greater than that of LnFD×LnET. It shows that under the fiscal decentralization system, it is more likely for local governments to adopt environmental expenditure policies to push forward the industrial green transformation. Hypothesis 2 is verified.

Referring to Anselin (2007), this paper decomposes the spatial effects into direct and indirect effects. The direct and indirect effect is further divided into long-term (LR) and short-term (SR) effect. Columns (1)–(3) of Table 8 give the decomposition results based on the columns (2)–(4) of Table 7.

The results show that, no matter direct or indirect, the short-term effect of fiscal decentralization on industrial green transformation is more significant. Among that, the short-term direct effect is significantly positive and short-term indirect effect is significantly negative. It indicates that fiscal decentralization enhances local industrial green transformation, but it has an adverse impact on its neighbors’ industrial green transformation. The increase of fiscal decentralization in local intensifies the neighbors’ fiscal competition. Then the neighbors compete to relax fiscal policies, which is detrimental to the local industrial green transformation. Column (2) of Table 8 shows that the short-term effect of the interaction coefficient between fiscal decentralization and environmental fiscal expenditure is significantly positive, the long-term effect is not significant, and the coefficient of the short-term indirect effect is greater than the short-term direct effect. The environmental fiscal expenditure policy has a model effect, which prompts neighbors to strengthen the environmental fiscal expenditure. Thus, it positively regulates the adverse impact of fiscal decentralization on the neighbors’ industrial green transformation. Column (3) of Table 8 shows that the short-term direct effect of the interaction coefficient between fiscal decentralization and environmental tax revenue is significantly positive, while the short-term indirect effect is significantly negative. There is bottom-by-bottom competition in environmental tax among regions, which negatively regulates the impact of fiscal decentralization on industrial green transformation, but this effect is relatively small. It means that environmental tax policy restricts the industrial enterprises’ emission by imposing a fee on the pollutants. The low charging standard with poor supervision on China’s emission collecting institute inhibits its incentive role. The above analysis verifies Hypothesis 3.

The above comprehensive fiscal decentralization index calculated by entropy method is used to inspect the relationship between fiscal decentralization and industrial green transformation. Table 9 in Columns (1)–(3) use fiscal autonomy (fiscal revenue/total fiscal expenditure in the provincial budget) as an alternative variable for robustness test, and columns (1)–(3) are estimated by dynamic spatial Durbin model. The estimated parameter symbols and significance of fiscal decentralization and its interaction term with environmental fiscal policy are basically consistent with the above estimated results. This shows that the impact of fiscal decentralization on industrial green transformation is reliable and stable.

Columns (4)–(6) in Table 9 report the results of the dynamic spatial regressions under the economic weight matrix setting. the common practice of constructing economic weight matrices based on the inverse of the absolute difference of an economic indicator that produces a spatial effect. This paper uses the inverse of the gap in the level of industrial green transformation between the two provinces:

Furthermore, instrumental variable test can solve the endogenous problem to a certain extent. This paper draws on E Qu and Liu (2021) and uses the average value of the neighbors’ fiscal decentralization in the same year as the instrumental variable (fd_iv) of local fiscal decentralization. Only the regression results of the second stage are reported in Table 9 in columns (7)–(9). It can be found that the coefficients are basically consistent with the previous conclusions.

Due to the heterogeneity of fiscal decentralization, this paper divides fiscal decentralization into revenue decentralization and expenditure decentralization. Table 10 gives the estimated results. Column (1) of Table 10 shows the impact of revenue decentralization on industrial green transformation. The coefficient of revenue decentralization is significantly positive, which indicates that revenue decentralization is beneficial to the industrial green transformation. Column (2) of Table 10 introduces the interaction term between revenue decentralization and environmental fiscal expenditure (lnFDR×LnEF), and the coefficient of the interaction term and spatial lagged term of revenue decentralization and environmental fiscal expenditure is significantly positive. Column (3) of Table10 introduces the interaction term of revenue decentralization and environmental tax revenue (lnFDR×LnET), the coefficient of the interaction term is positive, which indicates that the environmental fiscal policy plays a positive moderating role between revenue decentralization and industrial green transformation. By comparing the interaction term coefficient of revenue decentralization and environmental fiscal expenditure, we can find that this coefficient is greater than that of revenue decentralization and environmental tax revenue, which is consistent with the previous analysis. That is, under the fiscal decentralization, local governments are more inclined to adopt environmental fiscal expenditure policies to boost the industrial green transformation.

Besides, Column (4) of Table 10 shows the impact of expenditure decentralization on industrial green transformation. The coefficient of expenditure decentralization is significantly positive, indicating that expenditure decentralization is useful to industrial green transformation. By comparing the coefficients of revenue decentralization and expenditure decentralization, we find that expenditure decentralization plays a greater role in advancing industrial green transformation. The reason is that local governments have greater control over the use of funds by the expenditure decentralization, which can better optimize the efficiency of resource allocation and promote the enhancement of industrial green transformation. Column (5) introduces the interaction item between expenditure decentralization and environmental fiscal expenditure (LnFDE×LnEF), the interaction coefficient is significantly positive. Column (6) introduces the interaction between expenditure decentralization and environmental tax revenue (LnFDE×LnET), the interaction coefficient is significantly positive. It can also be found that the coefficient of LnFDE×LnEF is significantly greater than that of LnFDR×LnEF, which shows that we can give full play to environmental fiscal policy on expenditure decentralization to drive industrial green transformation.

Due to geographical locations, natural resources and economic development difference, this paper divides the national sample into three regions: eastern, central and western region. It further examines the impact of environmental fiscal policies on industrial green transformation under fiscal decentralization in different regions. See Table 11 for the specific results. The coefficient of fiscal decentralization in the eastern and central regions is positive, and the coefficient of fiscal decentralization in the western regions is negative. This shows that the fiscal decentralization in the eastern and central regions can bolster the industrial green transformation, and the western fiscal decentralization is not promotive to the industrial green transformation. This is because the economic development in the western region is backward and the fiscal decentralization is increased, which will increase the political and economic incentives of local governments. Therefore, it is easy to fall into an extensive economic development mode, which is not helpful to the industrial green transformation. The eastern and central regions have a higher economic development, and governments have more power to develop the industrial green transformation under the decentralization in local.

In addition, From the perspective of the interaction coefficient of fiscal decentralization and environmental fiscal expenditure, the coefficient of the eastern region is significantly positive, the coefficient of the central region is significantly positive, and the coefficient of the western region is not significant. Compared with the eastern region, the interaction coefficient between fiscal decentralization and environmental fiscal expenditure in the central region is smaller. Due the high-tech industry in the central region remains in its infancy, and the environmental fiscal expenditure needs to be digested and then further transformed into green productivity. From the perspective of the interaction coefficient between fiscal decentralization and environmental tax revenue, the interaction coefficient in the eastern and central regions is positive, and the interaction coefficient in the central region is more significant, while that in the western region is negative. Moreover, the coefficient of LnFD×LnET is greater than that of LnFD×LnEF. It shows that it is more efficient for the central region to select environmental tax policies to enhance industrial green transformation under the fiscal decentralization.

The marketization degree have a positive impact on the green economy (Ren et al., 2022). Therefore, Referring to Fan et al. (2003), This paper classifies regions with market levels above or below the current median market level as high market level regions and low market level regions.Table 12 shows the results of the heterogeneity tests based on differences in marketability levels. Columns (1)–(3) show the results of dynamic spatial regressions for regions with high levels of marketization. The results show that fiscal decentralization in high marketization regions has a significant positive impact on the green transformation of industry, and the coefficient of the interaction term between fiscal decentralization and environmental fiscal expenditure is significantly positive. In contrast, the coefficient on the interaction term between fiscal decentralization and environmental taxes is insignificant. Columns (4)–(5) show the results of dynamic spatial regressions for low-market areas. The results show that fiscal decentralization in low-market areas has a negative impact on the green transformation of industry, and the interaction term between fiscal decentralization and environmental fiscal policy is not significant. The reason for this is that more market-oriented regions are able to open up further to the outside world, and the influx of advanced technology and other technologies reduces the cost of transformation and upgrading for enterprises and regions with a low level of marketisation lack effective resource allocation, which is thus detrimental to industrial transformation.

For China, industrial green transformation is necessary and important to achieve the win-win goals of sustainable economic growth and environmental protection. It is well known that fiscal decentralization has made an outstanding contribution to China’s rapid economic development. However, it has also been blamed for causing serious environmental problems. In recent years, the central government has imposed increasingly stringent requirements on environmental management, which inevitably affects the local governments. In this context, it is essential to re-examine the impact of fiscal decentralization on the green economy. Based on this, this paper gives an insight into the impact of fiscal decentralization on the green transformation of industry.

First, we measure the industrial green transition through a projection tracing model and provide a detailed analysis of the regional differences and spatial distribution of the industrial green transformation based on the decomposition of the Dagum Gini coefficient and the spatial Moran index. This makes our findings more in-depth than previous studies on industrial green transition measurement (Chen et al., 2016; Deng and Yang, 2019). From 2007–2017, the industrial green transformation in China is on the rise year by year. China’s industrial green transformation presents an unbalanced development state with high in the east and low in the west, and the internal gap among the three regions has been reduced. Industrial green transformation has significant “time inertia” and a positive spatial spillover on neighbor provinces.

Second, we think that fiscal decentralization is beneficial to the green transformation of industry. This result is inconsistent with many scholars (Song et al., 2018; Dong et al., 2022; Liu et al., 2022; You and Ouyang, 2020). This is because most previous studies have been derived from the premise that GDP growth is the only criterion for the performance of local officials in terms of promotion. However, with the introduction and improvement of China’s green GDP assessment mechanism since 2007, it has been clear that the previous conclusions do not quite match reality. In terms of research methodology, compared to You and Ouyang (Research group of institute of industrial economics CASS, 2011) who used a static spatial model, this study used both static and dynamic spatial models with the lagged effects of time, making the estimates more accurate and comprehensive. And this paper analyses the moderating role of environmental fiscal policy and finds that fiscal decentralization effectively promotes the role of environmental fiscal policy in the green transformation of industries, and that environmental fiscal expenditure has a greater role than environmental taxation. Unfortunately, this mechanism has rarely been discussed. It also differs from the study by You and Ouyang (2020), who argue that fiscal decentralization has a significant negative effect on the green innovation efficiency of provincial firms under different environmental regulatory instruments.

Third, we have tested the above results for heterogeneity. This part of the findings is a useful addition to existing research. The study by Wang and Li (2021) also distinguishes between revenue decentralization and expenditure decentralization, but their study ignores the information on internal and external budget revenues and expenditures in the selection of indicators, and they argue that revenue decentralization has a greater effect on curbing environmental pollution. Our research finds that expenditure decentralization can more fully exploit the positive regulatory mechanisms of environmental fiscal policy than revenue decentralization, effectively accelerating the green transformation of industry. And by testing for regional heterogeneity, we find that fiscal decentralization drives industrial green transformation in the east and central regions, while the west hinders it. The eastern region tends to work more through environmental fiscal spending, while the central region tends to work through environmental taxation and the western region has little role for environmental fiscal policy. The impact of regional heterogeneity is also discussed to provide policy considerations for regional fiscal strategy decisions. Based on a heterogeneity test of marketization, we find that fiscal decentralization in areas with high levels of marketization is conducive to a green transformation of industry, while the opposite is true for low marketization areas. This is similar to the findings of Ren et al. (2022).

This paper adopts the balanced panel data of 30 provinces in China from 2007 to 2017. It calculates the industrial green transformation and fiscal decentralization by using projection pursuit model and entropy method respectively. It employs static and dynamic spatial Durbin model to conduct empirical research. The conclusions drawn as follows.

First, the industrial green transformation in China is on the rise year by year. China’s industrial green transformation presents an unbalanced development state with high in the east and low in the west, and the internal gap among the three regions has been reduced. Industrial green transformation has significant “time inertia” and a positive spatial spillover on neighbor provinces. Besides, fiscal decentralization has a significant advancing effect on the local industrial green transformation, while it has a restraining effect on the neighbors’ industrial green transformation. The short-term effect is more significant than the long-term effect. That means we should deepen the reform of fiscal decentralization and implement differentiated fiscal decentralization strategies combined with local conditions.

Second, fiscal decentralization effectively promotes the industrial green transformation by the environmental fiscal policy, and the role of environmental fiscal expenditure is greater than that of environmental tax revenue. That indicates we should continue to increase the scale of environmental protection expenditure, enhance the utilization efficiency of waste generated in production and life, and add the comprehensive utilization value of waste. Meanwhile, we should improve China’s existing environmental tax institute and realize the integration of sustainable development and tax reform.

Third, compared with revenue decentralization, expenditure decentralization can more fully allocate resources, give full play to the positive moderating mechanism of environmental fiscal policy, and effectively speed industrial green transformation. The fiscal decentralization push for the industrial green transformation in the eastern and central regions, while that in the western region hinders the industrial green transformation. Under the fiscal decentralization, the environmental fiscal expenditure in the eastern region significantly boosts the industrial green transformation than the environmental tax revenue, and the environmental tax revenue in the central region better upholds the industrial green transformation, while the role of the environmental fiscal policy in the western region is not significant. Based on this, For the eastern regions, we should gradually expand fiscal decentralization and exploit economic, technological, talent and information advantages, which accelerate the speed of industrial green transformation. For the central region where heavy-pollution industry is concentrated, we should strengthen the government’s financial intervention, set the bottom line towards the ecological environment, and form effective constraints and incentives for industrial emission reduction. For the western region with relatively backward economy, we should appropriately delegate power, encourage local governments to develop the economy, and make corresponding environmental standards to supervise industrial pollution emissions. Fiscal decentralization in high-market areas facilitates the green transformation of industry, while in low-market areas is the opposite. Therefore, local governments should further deepen the reform of market mechanisms, stimulate market vitality and provide a good competitive environment for the green transformation of industry.

In addition, the research of this paper still has some work leaving behind. In the above analysis, it confirms the heterogeneity in the impact of revenue decentralization and expenditure decentralization on industrial green transformation. There may be vertical fiscal imbalance, so we will consider the impact of vertical fiscal imbalance in future research.

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

YQ designed the computational framework and wrote the manuscript. XZ designed the model and analyzed the data. MX conducted empirical research. All authors discussed the results and contributed to the final manuscript. All authors have read and agreed to the published version of the manuscript.

This research was supported by the National Natural Science Foundations of China (71763010 and 71803038), and Jiangxi Provincial Social science “14th Five-year” plan project (21YJ05), the characteristic and preponderant discipline of key construction universities in Zhejiang province (Zhejiang Gongshang University- Statistics).

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2022.1006274/full#supplementary-material

Allers, M. A., and Elhorst, J. P. (2005). Tax mimicking and yardstick competition among local governments in The Netherlands. Int. Tax. Public Financ. 12, 493–513. doi:10.1007/s10797-005-1500-x

Anselin, L. (2007). Spatial econometrics in RSUE: Retrospect and prospect. Regional Sci. Urban Econ. 37, 450–456. doi:10.1016/j.regsciurbeco.2006.11.009

Bhardwaj, A., Dagar, V., Khan, M. O., Aggarwal, A., Alvarado, R., Kumar, M., et al. (2022a). Smart IoT and machine learning-based framework for water quality assessment and device component monitoring. Environ. Sci. Pollut. Res. 29, 46018–46036. doi:10.1007/s11356-022-19014-3

Bhardwaj, M., Kumar, P., Kumar, S., Dagar, V., and Kumar, A. (2022b). A district-level analysis for measuring the effects of climate change on production of agricultural crops, ie, wheat and paddy: Evidence from India. Environ. Sci. Pollut. Res. 29, 31861–31885. doi:10.1007/s11356-021-17994-2

Bovenberg, A. L., and Goulder, L. H. (1997). Costs of environmentally motivated taxes in the presence of other taxes: General equilibrium analyses. Natl. Tax J. 50, 59–87. doi:10.1086/ntj41789243

Cai, F., Du, Y., and Wang, M. Y. (2008). The political economy of emission in China: Will a low carbon growth be incentive compatible in next decade and beyond? Econ. Res. J. 44, 4–11+36.

Cai, Wei, Lai, K. h., Liu, C., Wei, F., Ma, M., Jia, S., et al. (2019). Promoting sustainability of manufacturing industry through the lean energy-saving and emission-reduction strategy. Sci. Total Environ. 48, 23–32. doi:10.1016/j.scitotenv.2019.02.069

Chen, C. C., and Ma, H. Q. (2011). The relationship between dispersion, catch-up effect of human capital and economic growth. Quantitative Tech. Econ. Res. 28, 21–36+92. doi:10.13653/j.cnki.jqte.2011.06.004

Chen, C. F., Han, J., and Fan, P. L. (2016). Measuring the level of industrial green development and exploring its influencing factors: Empirical evidence from chinas 30 provinces. Sustainability 8, 153–172. doi:10.3390/su8020153

Chen, S., and Golley, J. (2014). ‘Green’productivity growth in China's industrial economy. Energy Econ. 106, 89–98. doi:10.1016/j.eneco.2014.04.002

Cheng, J. H., Dai, S., and Ye, X. Y. (2016). Spatiotemporal heterogeneity of industrial pollution in China. China Econ. Rev. 40, 179–191. doi:10.1016/j.chieco.2016.07.001

Cheng, S. L., Fan, W., Chen J, J. D., Meng, F. X., Liu, G. Y., Song, M. L., et al. (2020). The impact of fiscal decentralization on CO2 emissions in China. Energy 192, 116685. doi:10.1016/j.energy.2019.116685

Chu, D., Han, Y., Zhang, T., and He, P. (2018). Chinese decentralization and the efficiency of public service provision: Linear or inverted ‘U. China Econ. Q. 17, 1259–1288. doi:10.13821/j.cnki.ceq.2018.04.17

Colm, G., and Musgrave, R. A. (1960). The theory of public finance: A study in public economy. J. Finance 15, 118–120. doi:10.2307/2976491

Dagar, V., Ahmed, F., Waheed, F., Bojnec, S., Khan, M. K., and Shaikh, S. (2022). Testing the pollution haven hypothesis with the role of foreign direct investments and total energy consumption. Energies 15, 4046. doi:10.3390/en15114046

Davoodi, H., and Zou, H. (1998). Fiscal decentralization and economic growth: A cross-country study. J. Urban Econ. 43, 244–257. doi:10.1006/juec.1997.2042

Deng, H. H., and Yang, L. X. (2019). Haze governance, local competition and industrial green transformation. China Ind. Econ. 37, 118–136. doi:10.19581/j.cnki.ciejournal.2019.10.007

Dong, F., Yu, B., Hadachin, T., Dai, Y., Wang, Y., Zhang, S., et al. (2018). Drivers of carbon emission intensity change in China. Resour. Conservation Recycl. 129, 187–201. doi:10.1016/j.resconrec.2017.10.035

Dong, X. S., Wei, Y. Y., and Xiao, X. (2022). How does fiscal decentralization affect green innovation? China Popul. Resour. Environ. 32, 62–74. doi:10.12062/cpre.20220526

E Qu, X., and Liu, L. (2021). Impact of environmental decentralization on high-quality economic development. Stat. Res. 38, 16–29. doi:10.19343/j.cnki.11-1302/c.2021.03.002

Fahad, S., Bai, D., Liu, L., and Dagar, V. (2022). Comprehending the environmental regulation, biased policies and OFDI reverse technology spillover effects: A contingent and dynamic perspective. Environ. Sci. Pollut. Res. 29, 33167–33179. doi:10.1007/s11356-021-17450-1

Fan, G., Wang, X. L ., Zhang, L. W., and Zhu, H. P. (2003). Marketization index for China’s provinces. Econ. Res. 49, 9–18+89. doi:10.19932/j.cnki.22-1256/f.2005.05.002

Fu, Y. (2010). Fiscal decentralization, governance and non-economic public goods provision. Econ. Res. 16, 4–15.

He, J., Liu, L. L., and Zhang, Y. J. (2016). Tax Competition, revenue decentralization and China’s environmental pollution. China Popul. Resour. Environ. 26, 1–7. doi:10.3969/j.issn.1002-2104.2016.04.001

Hou, X. X., Chen, Q., and Zheng, T. D. (2018). Reinspection of the relationship between fiscal decentralization and environmental quality: The perspective of government preference. Finance Trade Res. 29, 87–98. doi:10.19337/j.cnki.34-1093/f.2018.06.008

Hou, J., Teo, T. S. H., Zhou, F. L., Lim, M. K., and Chen, H. (2018). Does industrial green transformation successfully facilitate a decrease in carbon intensity in China? An environmental regulation perspective. J. Clean. Prod. 184, 1060–1071. doi:10.1016/j.jclepro.2018.02.311

Huang, J., Xia, J., Yu, Y., and Zhang, N. (2018). Composite eco-efficiency indicators for China based on data envelopment analysis. Ecol. Indic. 85, 674–697. doi:10.1016/j.ecolind.2017.10.040

Islam, M., Ali, M., Ceh, B., Singh, S., Khan, M. K., and Dagar, V. (2022). Renewable and non-renewable energy consumption driven sustainable development in ASEAN countries: Do financial development and institutional quality matter? Environ. Sci. Pollut. Res. 29, 34231–34247. doi:10.1007/s11356-021-18488-x

Jiang, N. (2018). Will the fiscal expenditure on environmental protection help to achieve a win-win situation for both the economy and the environment? J. Central South Univ. Econ. Law 61, 95–103. doi:10.19639/j.cnki.issn1003-5230.2018.0010

Jin, J., and Zou, H. (2005). Fiscal decentralization, revenue and expenditure assignments, and growth in China. J. Asian Econ. 16, 1047–1064. doi:10.1016/j.asieco.2005.10.006

Kuai, P., Yang, S., Tao, A. P., Zhang, S. A., and Khan, Z. D. (2019). Environmental effects of Chinese-style fiscal decentralization and the sustainability implications. J. Clean. Prod. 239, 118089. doi:10.1016/j.jclepro.2019.118089

Li, P., Yang, D., Li, P., Ye, Z., and Deng, Z. (2011). A study on the green transformation of Chinese industry. China Ind. Econ. 29, 5–14. doi:10.22004/ag.econ.148900

Li, W. H., Bi, K. X., and Sun, B. (2013). Research on the effect of environmental regulation intensity on green technological innovation of pollution intensive industies——empirical test based on panel data of 2003-2010. Res. Dev. Manag. 25, 72–81.

Li, W., Wang, J., Chen, R., Xi, Y., Liu, S. Q., Wu, F., et al. (2019). Innovation-driven industrial green development: The moderating role of regional factors. J. Clean. Prod. 222, 344–354. doi:10.1016/j.jclepro.2019.03.027

Lin, J. Y., and Liu, Z. (2000). Fiscal decentralization and economic growth in China. Econ. Dev. Cult. change 49, 1–21. doi:10.1086/452488

Liu, R. C., Zhang, X. Y., and Wang, P. C. (2022). A study on the impact of fiscal decentralization on green development from the perspective of government environmental preferences. Int. J. Environ. Res. Public Health 19, 9964. doi:10.3390/ijerph19169964

Luo, N. S., and Wang, Y. Z. (2017). Fiscal decentralization, environmental regulation and regional eco-efficiency: Based on the dynamic spatial Durbin model. China Popul. Resour. Environ. 27, 110–118.

Magat, W. A., and Viscusi, W. K. (1990). Effectiveness of the EPA's regulatory enforcement: The case of industrial effluent standards. J. Law Econ. 33, 331–360. doi:10.1086/467208

Morgera, E., and Savaresi, A. (2013). A conceptual and legal perspective on the green economy. Rev. Eur. Comp. Int. Environ. Law 22, 14–28. doi:10.1111/reel.12016

Pearce, D. W., Markandya, A., and Barbier, E. (1989). Blueprint for a green economy. London: Earthscan.

Peng, X., and Li, B. (2016). On green industrial transformation in China under different types of environmental regulation. J. Finance Econ. 42, 134–144. doi:10.16538/j.cnki.jfe.2016.07.012

Ren, S., Hao, Y., and Wu, H. (2022). The role of outward foreign direct investment (OFDI) on green total factor energy efficiency: Does institutional quality matters? Evidence from China. Resour. Policy 76, 102587. doi:10.1016/j.resourpol.2022.102587

Research group of institute of industrial economics CASS (2011). A study on the green transformation of Chinese industry. China Ind. Econ. 29, 5–14. doi:10.19581/j.cnki.ciejournal.2011.04.001

Shahzad, U., Madaleno, M., Dagar, V., Ghosh, S., and Dogan, B. (2022). Exploring the role of export product quality and economic complexity for economic progress of developed economies: Does institutional quality matter? Struct. Change Econ. Dyn. 62, 40–51. doi:10.1016/j.strueco.2022.04.003

Shen, C., Li, S. L., and Huang, L. X. (2018). Different types of environmental regulation and the green transformation of Chinese industry: Path selection and mechanism analysis. Nankai Econ. Stud. 34, 95–114.

Song, M. L., Du, J. T., and Tan, K. H. (2018). Impact of fiscal decentralization on green total factor productivity. Int. J. Prod. Econ. 205, 359–367. doi:10.1016/j.ijpe.2018.09.019

Su, C. W., Umar, M., and Khan, Z. (2021). Does fiscal decentralization and eco-innovation promote renewable energy consumption? Analyzing the role of political risk. Sci. Total Environ. 751, 142220. doi:10.1016/j.scitotenv.2020.142220

Sustainable Development Strategy Study Group Chinese Academy of Sciences (2010). China's sustainable development strategy report 2009 -- green development and innovation. Beijing: science Press.

Tan, F., and Lu, Z. (2015). Interaction characteristics and development pattern of sustainability system in BHR (Bohai Rim) and YRD (Yangtze River) regions, China. Ecol. Inf. 30, 29–39. doi:10.1016/j.ecoinf.2015.09.008

Tan, F., and Lu, Z. (2017). Regional sustainability system as ecosystem: Case study of China’s two leading economic circles from a keystone perspective. Environ. Dev. Sustain. 21, 961–983. doi:10.1007/s10668-017-0068-9

Tapio, P. (2002). Towards a theory of decoupling: Degrees of decoupling in the EU and the case of road traffic in Finland between 1970 and 2001. Transp. policy 12, 137–151. doi:10.1016/j.tranpol.2005.01.001

Telle, K., and Larsson, J. (2007). Do environmental regulations hamper productivity growth? How accounting for improvements of plants' environmental performance can change the conclusion. Ecol. Econ. 67, 438–445. doi:10.1016/j.ecolecon.2006.03.015

Tian, J. G., and Wang, Y. H. (2018). Spatial spillover effects between FD, local governments competition and carbon emissions. China Popul. Resour. Environ. 28, 36–44. doi:10.12062/cpre.20180511

Tiebout, C. M. (1956). A pure theory of local expenditures. J. political Econ. 64, 416–424. doi:10.1086/257839

Wang, D., and Li, J. Y. (2021). Spatial effect of fiscal decentralization on environmental pollution. China Popul. Resour. Environ. 31, 44–51. doi:10.12062/cpre.20200607

Wang, F. Z., and Guo, X. C. (2016). Government governance, environmental regulation and green process innovation. Financial Res. 42, 30–40. doi:10.16538/j.cnki.jfe.2016.09.003

Wang, J., and Li, P. (2018). Quantity and quality effect of green tax policy on economic growth: The direction of China’s tax system reform. China Popul. Resour. Environ. 28, 17–26. doi:10.12062/cpre.20171224

Wang, M-X., Zhao, H. H., Cui, J. X., Fan, D., Lv, B., Wang, G., et al. (2018). Evaluating green development level of nine cities within the Pearl River Delta, China. J. Clean. Prod. 174, 315–323. doi:10.1016/j.jclepro.2017.10.328

Wang, X., and Shao, Q. (2019). Non-linear effects of heterogeneous environmental regulations on green growth in G20 countries: Evidence from panel threshold regression. Sci. Total Environ. 48, 1346–1354. doi:10.1016/j.scitotenv.2019.01.094

Wang, Z., and Zhang, Y. (2019). Green transformation research overview of resource-based cities domestic and overseas. Resources & Industries 20 (5), 9–15. doi:10.13776/j.cnki.resourcesindustries.20181113.001

Wu, Y. B. (2017). Distorted investment under Chinese style decentralization. Econ. Res. 52, 137–152.

Xiao, H. W., Li, Z. J., and Wang, H. Q. (2013). Research on the evaluation index system of China. Contemp. Econ. Manag. 41, 24–30. doi:10.13253/j.cnki.ddjjgl.2013.08.004

Xie, M., Irfan, M., Razzaq, A., and Dagar, V. (2022). Forest and mineral volatility and economic performance: Evidence from frequency domain causality approach for global data. Resour. Policy 76, 102685. doi:10.1016/j.resourpol.2022.102685

Xu, C. L., and Zhuang, G. Y. (2018). Dynamic structure and spatio-temporal effect of supply-side reform on industrial green development in China. Geogr. Sci. 38, 849–858. doi:10.13249/j.cnki.sgs.2018.06.003

Yan, W. J. (2012). Fiscal decentralization, government competition and environmental pollution disposal investment. Finance Trade Res. 23, 91–97. doi:10.19337/j.cnki.34-1093/f.2012.05.013

You, D. M., and Ouyang, L. Q. (2020). The impact of environmental regulation on the green innovation efficiency of industrial enterprises: An empirical analysis based on the spatial Durbin model. Reform 33, 122–138.

Yue, H. F., Xu, Y., and Wu, J. (2017). Empirical analysis of the choice of technology innovation mode and the green transformation of China’s industry. China Popul. Resour. Environ. 27, 196–206. doi:10.12062/cpre.20170902

Zhang, C. X., Zhou, D. Q., Wang, Q. W., Hao, D., and Zhao, S. Q. (2022). Will fiscal decentralization stimulate renewable energy development? Evidence from China. Energy Policy 164, 112893. doi:10.1016/j.enpol.2022.112893

Zhang, H. (2016). Strategic interaction of regional environmental regulation–an explanation on the universality of incomplete enforcement of environmental regulation. China Ind. Econ. 34, 74–90. doi:10.19581/j.cnki.ciejournal.2016.07.006

Zhang, K. Z., Wang, J., and Cui, X. Y. (2011). Fiscal decentralization and environmental pollution: From the perspective of carbon emissions. China Ind. Econ. 29, 65–75. doi:10.19581/j.cnki.ciejournal.2011.10.007

Zhang, K., Wang, D. F., and Zhou, H. Y. (2016). Regional endogenetic strategic interaction of environmental protection investment and emission. China Ind. Econ. 34, 68–82. doi:10.19581/j.cnki.ciejournal.2016.02.006

Zhang, Z. Y., and Zhu, P. F. (2010). Empirical study on heterogeneous dynamic path of local expenditure under inter-temporal budget constraints. Econ. Res. J. 45, 82–94.

Keywords: Chinese fiscal decentralization, industrial green transformation, environmental fiscal policy, heterogeneity analysis, static and dynamic spatial Durbin model

Citation: Qi Y, Zou X and Xu M (2022) Impact of Chinese fiscal decentralization on industrial green transformation: From the perspective of environmental fiscal policy. Front. Environ. Sci. 10:1006274. doi: 10.3389/fenvs.2022.1006274

Received: 29 July 2022; Accepted: 04 October 2022;

Published: 28 October 2022.

Edited by:

Zeeshan Fareed, Huzhou University, ChinaCopyright © 2022 Qi, Zou and Xu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Mo Xu, eHVtbzA1MDJAempzdS5lZHUuY24=

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.