- 1Business School, Zhengzhou University, Zhengzhou, China

- 2School of Politics and Public Administration, Zhengzhou University, Zhengzhou, China

Enterprise competition has been transformed into chain-to-chain competition, and green development is imperative under the promotion of policies. Horizontal cooperation between green and non-green manufacturers provides a new direction for the supply chain to improve its core competitiveness. This paper develops competition and cooperation models between two manufacturers for the green and non-green supply chain under two-way government intervention to explore the impact of manufacturers’ horizontal cooperation on decisions and profits of supply chain members. In particular, for a situation without cooperation, we consider a Stackelberg game between two manufacturers. Model solutions and numerical analysis have shown that: 1) Cooperation among manufacturers can not only improve their own profits, but also strengthen environmental welfare. However, cooperation will damage consumer surplus. 2) When consumers are more sensitive to product prices, manufacturers’ cooperative behavior is not conducive to retailers, but with the improvement of consumer environmental awareness, retailers will gradually support their upstream cooperation. 3) Under the simultaneous implementation of government subsidy and punishment strategies, whether green consumption can be promoted is related to the adjustment factor of government subsidies, while the relationship between the green level floor for subsidy and product greenness is affected by the adjustment factor of subsidies and manufacturers’ cooperation. 4) The impacts of fierce price competition and green level competition on supply chain members are opposite; when the price competition is moderate or the green level competition is weak, the manufacturers’ cooperation is also beneficial to the improvement of retailers’ profits. This provides ideas for the development of green supply chain, and provides a reference for the implementation of two-way government intervention policy.

1 Introduction

Competition among enterprises has already converted to supply chain competition in present market. For example, the competition between Tmall and JD.com is essentially supply chain competition which centers on them. As early as 1983, McGuire and Staelin (1983) conducted research on competitive supply chain, which has increasingly become a research hotspot of many scholars later. Zhu (2021) counted the journal papers with the theme of competitive supply chain from 2013 to 2020 and found that the number of relevant literatures increased year by year mainly through combining the eight directions of manufacturer competition, price competition and so on for research. However, with the rapid development of economy, human society is facing a series of problems such as resource depletion and environmental pollution, so it is urgent to achieve environmentally sustainable development (Wang et al., 2018; Wang et al., 2022; Zhang et al., 2022). In 2021, the 14th Five-Year Plan proposed to accelerate the promotion of green and low-carbon development, strengthen the policy guarantee of green development, support green technology innovation, and promote the comprehensive green transformation of economic and social development. The implementation plan for promoting green consumption issued in January 2022 also mentioned that enterprises should be guided to actively develop and introduce green low-carbon technologies, and vigorously promote green design and green manufacturing. In this context, some enterprises actively respond to the call and take the initiative to carry out green technology research and development (R&D) to improve the corporate image and enhance their core competitiveness. For instance, Pepsi Cola has added green and environment-friendly “Kemmett gas” in the production. And Hunan Yufeng Food Industry Co., Ltd. Has continuously carried out technology innovation and developed Spicy Prince that is green and healthy. In addition, TCL has focused on green manufacturing and produced green products. Many scholars such as Meng et al. (2021), Gao et al. (2021) and Liu et al. (2022) have also conducted in-depth research on green supply chain (GSC), which has attracted extensive attention of enterprises and academia.

However, manufacturers need to invest plenty of manpower, material and financial resources to green technology innovation in reality, which deter many manufacturers (Xu et al., 2020). As a result, the market presents a competitive situation between non-green supply chain (NGSC) and GSC. Therefore, its of great practical significance to discuss product pricing and green decision-making of supply chain members under this background. In order to improve the ecological environment and accelerate the development of a green and low-carbon circular economic development system, the government often formulates some subsidy or punishment policies to encourage manufacturers to proceed green technology R&D and reduce the production of non-green products (Wang and Song, 2017; Liu et al., 2022). To name only a few, Henan Province will give a one-time subsidy of two million yuan to enterprises that become green demonstration factories or green industrial parks, while subsidies will be given in Shanxi Province according to the star level of green architectures. In the third quarter of 2021, major pollutant emissions of Tanggang Veolia (Tangshan) water Co., Ltd. Seriously exceeded the standard, and the Ecology and Environment Bureau fined it 350 thousand yuan.

Some manufacturers will choose horizontal cooperation while competing so as to enhance competitiveness. A case in point is that JAC, a traditional car manufacturer, is the original equipment manufacturer (OEM) of NextEV that is a new power of electric vehicles. Meanwhile, a green manufacturer NextEV needs to pay the production cost to JAC that has larger power. There is competition and win-win cooperation in products between them. Furthermore, Rex lighting and Debon lighting competing with each other have achieved cooperation in product design, R&D, manufacturing and other fields. Volkswagen, a leader in the Chinese market, signed a strategic alliance agreement with Ford to cooperate in the fields of electrification, commercial vehicles, and autonomous driving by sharing R&D costs. Then, how does the manufacturer’s competition and cooperation strategy affect the decision-making of each member of the supply chain in the market where a non-green supply chain and a green supply chain coexist? Will the market competition degree affect decisions? What are the effects of government financial intervention on the decisions and profits of supply chain members?

To answer the above questions, we not only consider the impact of two-way government intervention in promoting green economic development, but also the competition and cooperation among manufacturers with master-slave relationship in the horizontal direction. Since the transformation of economy and society to green is inseparable from consumers’ environmental awareness and the government’s attention, we characterize consumers’ price preference and environmental awareness through the sensitive parameters of demand to product price and green level. Government subsidy to the green manufacturer or punishment to the non-green and low green manufacturer are expressed in terms of product greenness, the green level floor for subsidy and the government’s adjustment factor of offering a subsidy. In the competitive environment where non-green products and green products coexist, considering the competition and cooperation strategy of manufacturers, it is assumed that there is a Stackelberg game between the non-green manufacturer and the green manufacturer. The former is the leader, and the latter is the follower, and there is product price and green level competition between both chains. From the perspective of game theory, this paper discusses the impact of the cooperative behavior between manufacturers on SC members, and whether two-way government intervention, price and green level competition among products will affect the optimal decision-making of SC members, in order to provide some decision-making references for the pricing and green decisions of the node enterprises in the supply chain under this background, and also provide the basis for the implementation of the government financial intervention policy.

The remainder of this paper is organized as follows. The related research is reviewed in Section 2. The problem description is introduced in detail in Section 3. In Section 4, we establish mathematical models under non-cooperation and cooperation of two manufactures and obtain the equilibrium outcomes. The numerical example, analytical results and impacts of some parameters are provided in Section 5. Section 6 concludes and provides direction for future research. All the proofs are demonstrated in Supplementary Appendix SA.

2 Literature review

Combing the relevant literature on competitive supply chain, the literature related to this study can be divided into three subsections: the impact of competition degree among SCs, the competition and cooperation of SCs and the government intervention on GSCs. We will review these subjects in the following subsections.

2.1 The impact of competition degree among SCs

The impact of competition degree in the competitive supply chains has been included in the research scope by many scholars. Relevant studies mainly focus on price competition, quantity competition, service competition and greenness competition, etc. Jiang et al. (2020) found that if price competition between two suppliers is weak and their cost differences are large, only one party is willing to invest in RFID technology. Liu et al. (2021a) discussed the influence of SC competition on manufacturers’ introduction of clean development mechanism (CDM), which showed that the introduction of CDM is always beneficial without price competition of manufacturers, but the fierce competition among retailers will reduce the enthusiasm of manufacturers to introduce CDM. Furthermore, Li et al. (2022) concluded that strategic inventory will intensify the competition and be detrimental to all members when the competition is intense. Hafezalkotob (2018) considered the quantity competition between different products in the demand function but didn’t discuss the impact of the competition degree on his research. Moreover, Liu et al. (2021b) analyzed the impact of the service competition degree on the vertical cooperation decision-making from the perspective of game theory. It is found that competition degree determines the integration strategy of middlemen. And Yu et al. (2022) considered the greenness competition of two green products. As the government pays more and more attention to green development, considering simultaneously the price competition and green level competition between products has become the mainstream of research. Xu et al. (2020) proposed that greenness competition will affect the choice of green cost sharing strategies of the two GSCs. Liu and Ji (2017) studied the product selection strategy of competitive supply chains, and found that fierce competition will make a supply chain choose to produce green products, while the other choose to produce non green products. In addition, the price and greenness competition among products are also integrated into the demand function by Hafezalkotob (2017), Jamali and Rasti-Barzoki (2018), Yang et al. (2019).

2.2 The competition and cooperation of SCs

Supply chain cooperation has become a way to enhance competitiveness. In other words, co-opetition in competitive chains has become the norm, but most of the existing studies investigate the channel competition and cooperation strategy between supply chains. Li and Li (2016) developed three game models of two sustainable SCs to study the vertical competition and cooperation strategy of SC members. They stated that higher sustainability can be achieved by vertical integration. However, the supply chain has motivation for vertical cooperation only if competition degree is low. Hafezalkotob (2017) proved that the cooperation within or between GSCs is conducive for the government to achieve its goals, and also increases the profits of GSCs. Nevertheless, the impact of product price and energy-saving competition on SCs is ignored. Yang et al. (2017) analyzed the equilibrium solutions of three vertical structures and a horizontal cooperation model under the cap-and-trade scheme. They proposed that manufacturers’ horizontal cooperation will damage retailers’ profit and consumers’ welfare. Madani and Rasti-Barzoki (2017) considered the co-opetition model between GSC and NGSC and found that cooperation is conducive to promoting the production of green products. Moradinasab et al. (2018) developed a sustainable competitive multi-objective petroleum green supply chain model to minimize pollution while maximizing the profits and job creation. Considering the retailers’ extended warranties, Ma et al. (2019) constructed three competitive structures similar to Li and Li (2016) in order to explore SC members’ channel structure strategy and the contract design in the case of vertical cooperation. Comparing and analyzing the five competition and cooperation strategies of two chains, Yu and You (2019) observed that the R&D level under horizontal cooperation of manufacturers is the highest, while the profits of SCs are relatively low. Wang and Liu (2019) concentrated on vertical cooperation contract of two parallel shipping supply chains by establishing four game models. Cheng and Ding (2021) examined the CSR decisions of SCs from a dynamic perspective by exploratory study with the competition and cooperation of a general product supply chain and a CSR product supply chain. Zheng and Luo (2021) established a dynamic game model to illustrate how the bargaining power of shipping alliances affects strategies of ports. It is found that if the market competition is strongly intense under the shipping alliance, horizontal cooperation is the best choice for ports.

2.3 The government intervention on GSCs

Green development is a durable and reliable avenue for China’s long-term economic growth (Wang et al., 2021a). And the promotion of green development is inseparable from the government’s intervention policy. Some scholars believe that the government should provide subsidies to accelerate the development of energy-saving and emission reduction technology (Wang et al., 2021b). Wen et al. (2018) observed that manufacturers prefer the government subsidy based on their production costs, while retailers have a preference for the greenness subsidies through comparing the effects of the government greenness subsidies, production cost subsidies and R&D cost subsidies. Meng et al. (2021) examined the impact of government subsidies considering consumers’ green and channel preferences. They demonstrated that appropriate subsidies are conducive to the development of green products. Khosroshahi et al. (2021) discussed three different subsidies such as retail price, transparency cost, and manufacturing cost subsidies based on whether manufacturers pay attention to corporate social responsibility. Gao et al. (2021) explored the government subsidy policy that satisfies certain green standard, which can reduce all prices in the dual channel supply chains and improve demand, profits and environmental benefits. Li and Liu (2022) proposed that higher subsidies can coordinate the conflicts between price and greenness decisions, and between consumers and the supplier.

In addition, carbon tax is also a means of financial intervention often used by the government. Zhang et al. (2021) observed that manufacturers tend to produce low-carbon products when the government imposes higher carbon taxs by in-depth study with the production strategies of two manufacturers with coopetition relationship under the carbon tax policy. Huang and Zhang (2021) examined the impact of carbon tax on the optimal emission reduction level and retail price. They concluded that raising carbon tax is conducive to encouraging low-carbon emission enterprises to reduce emissions. Yu et al. (2022) verified that reasonable carbon tax can promote manufacturers to improve their emission reduction rate. Moreover, the two-way government intervention has also been welcomed by multitudinous scholars. The government’s tax or subsidy on products were denoted by the same parameter in the demand function in the research of Sinayi and Rasti-Barzoki (2018) and Hafezalkotob (2015). If this parameter is positive, it expresses the tax of the government; Otherwise, it means the subsidy. Nevertheless, Mahmoudi et al. (2021) characterized the subsidy to green producers and the tax to non-green producers with the positive and negative of a parameter in the profit function. Ma et al. (2021) utilized two parameters to express the carbon emission tax rate and subsidy rate respectively.

2.4 Research gap

In summary, most of the literature in SCs co-opetition is about channel competition and cooperation strategy (Li and Li, 2016; Ma et al., 2019; Cheng and Ding, 2021). Furthermore, Hafezalkotob (2017), Yu and You (2019) not only considered the channel competition and cooperation, but also considered the horizontal competition and cooperation between manufacturers. However, what they investigated is the R&D cooperation between manufacturers when two chains are vertically integrated. Few studies consider the impact of manufacturers’ cooperation in two decentralized supply chains. Yang et al. (2017) and Yu et al. (2022) discussed this situation, but they only explored the product greenness competition. What’s more, the former only focused on the cap-and-trade scheme, while the latter didn’t consider the impact of the government subsidies.

With respect to competition between NGSC and GSC, Hafezalkotob (2015), Madani and Rasti-Barzoki (2017) studied the game between SC and the government considering the supply chain channel co-opetition and the two-way government intervention, but did not examine the impact of greenness competition and manufacturer horizontal co-opetition. Hafezalkotob (2018) discussed four modes of government intervention, while the role of supply chain co-opetition, product price and greenness competition in decision optimization remains to be studied. Jamali and Rasti-Barzoki (2018) investigated the vertical competition and cooperation strategy of members in the green and non-green dual channel supply chains, without considering the role of the government and the impact of manufacturers’ cooperation. Yang et al. (2019) analyzed the co-opetition game of channel structure between two chains dominated by manufacturers in consideration of government subsidy and punishment policies, which didn’t explore the impact of cooperation behavior between manufacturers.

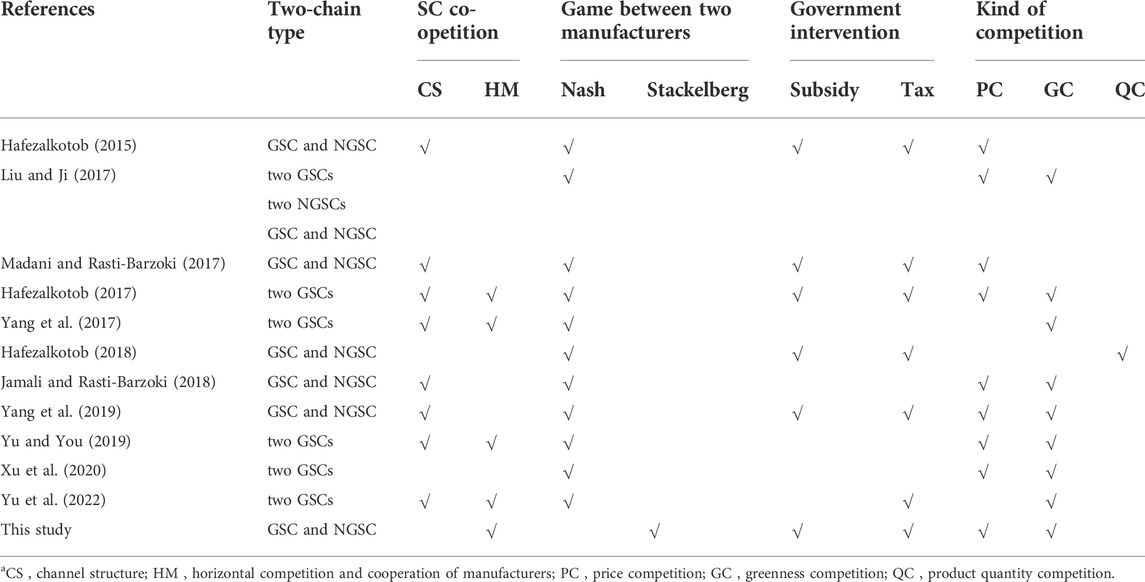

It is very important that the above literatures didn’t consider the different power structure between two manufacturers. To the best of our knowledge, no study has simultaneously considered the impact of two-way government intervention, co-opetition between manufacturers with master-slave relationship, and product price and greenness competition in the background of NGSC and GSC competition. We select some classical studies relevant to this paper to highlight the contributions of this research (see Table 1).

Thus, the main contributions of this paper are as follows. First, we assume that there is a Stackelberg game between a non-green manufacturer and a green manufacturer, and the non-green manufacturer is the leader. Second, we will discuss the horizontal cooperation between manufacturers in NGSC and GSC on the combination of two-way government intervention, and examine how the government’s adjustment factor of offering a subsidy and competition degree impact decisions and profits. Further, this paper will try to check whether retailers can benefit from cooperation. Eventually, the result shows that both of manufacturers and retailers will benefit from cooperation if certain condition is satisfied, like that consumers’ environmental awareness is strong enough. Our research will provide some useful management implications and insights for SC and the government decision makers.

3 Problem description

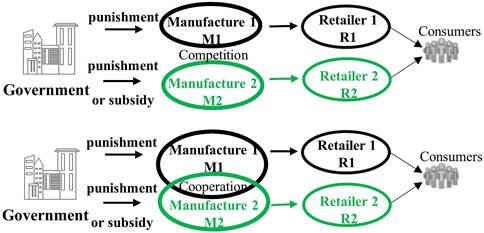

Considering the high cost of green R&D and the existence of consumer groups with weak environmental awareness, we assume that there are two competitive supply chains in the market: NGSC and GSC. Each supply chain is composed of a manufacturer and a retailer respectively. The manufacturer is the leader of Stackelberg game, and the retailer is the follower. Manufacturers produce alternative products (non-green or green products) and sell them to consumers through their respective retailers. In order to encourage manufacturers to develop green technologies and produce green products, the government takes different financial interventions in the supply chain: implement the unit subsidy strategy for manufacturers with high green level products and punish manufacturers with low green level or non-green products. The two supply chains compete on product price and green level. However, the high cost of the green manufacturer forces it to raise product prices to make up for the loss of profits, resulting in the decline of its competitiveness. In reality, some green manufacturers will seek to cooperate with leading non green manufacturers to enhance their core competitiveness and achieve win-win cooperation.

This paper discusses the manufacturers’ competition and cooperation strategy of green and non-green supply chains under the two-way government intervention, considers the dominant position of the non-green manufacturer, and focuses on the impact of government financial intervention and cooperation between manufacturers on the decision-making of supply chain members. Under the competition and cooperation strategy of manufacturers, both manufacturers and retailers make decisions on the green level and price of products on the premise of maximizing their own profits or the total profit after cooperation. The supply chain structure of this paper is shown in Figure 1.

FIGURE 1. Green and non-green supply chain structure in the case of two-way government intervention and manufacturer competition and cooperation.

3.1 Model notation

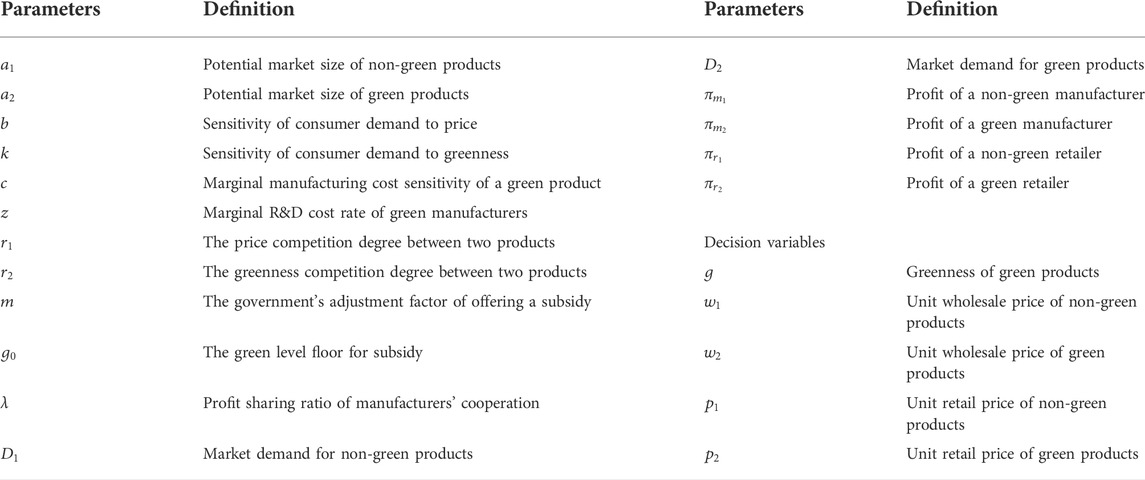

The related parameters and meanings are shown in Table 2.

3.2 Model assumptions

To clarify the model and make the problem clearer, we give the following assumptions referencing relevant literatures:

Assumption 1. There is price competition and green level competition between both SCs. Assuming that consumers have price preferences and green preferences, the demand for a product is negatively related to the retail price of the product itself but positively related to the retail price of the competing product. The green level of non-green products is 0, and the green level of green products is

Assumption 2. The cost of green R&D is

Assumption 3. In order to promote energy conservation, emission reduction and green manufacturing, the government often subsidizes products whose green level exceeds a certain standard, and the amount of subsidy is usually related to the green level of products. For example, the government subsidizes refrigerators with different energy efficiency labels. Referring to Yang et al. (2019) and Wen et al. (2018), it is assumed that the government implements financial intervention based on the green level of products, and the green level floor for subsidy is

Assumption 4. Assuming that product demand depends on its own product price, competitive product price, consumers’ price preference and green preference, greenness, price competition and greenness competition.

3.3 Demand functions

Based on the above assumptions, referring to Liu and Ji (2017), Yang et al. (2019), Huang and Zhang (2021), the demand functions of green and non-green products are as below:

where

3.4 Profit functions

The profits of the non-green manufacturer and the non-green retailer are as follows:

The membership profits of the green supply chain can be written as

4 Model formulation

This section discusses the optimal decisions and equilibrium profits of each member of the supply chains under the competition and cooperation model of the non-green manufacturer and the green manufacturer. Superscripts N and C are used to represent the equilibrium outcomes under the competition and cooperation of two manufacturers, respectively.

4.1 Supply chain game models without manufacturers’ cooperation

In our paper, a green supply chain and a non-green one with the same structure compete with each other. In addition, there is competition between supply chain members in both horizontal and vertical directions. In other words, there is Nash competition between retailers. Stackelberg competition between two manufacturers, and between the manufacturer and the retailer in each supply chain is established, in which the manufacturer plays the role of leader. Considering that non-green products occupy the mainstream in the current market, this paper assumes that the non-green manufacturer is a leader of Stackelberg game. In order to promote green consumption, the government conducts two-way intervention on manufacturers, that is, subsidizes the green manufacturer, and punishes the manufacturer who produces non-green products and products with greenness lower than a certain standard. Each member makes the optimal decision to maximize their own interests without manufacturers’ cooperation. First, the non-green manufacturer who is a leader announces its own wholesale price maximizing its profit. Secondly, the green manufacturer sets the wholesale price and greenness of products to obtain optimal profits after observing the decision of the non-green manufacturer. Finally, the two retailers determine retail prices simultaneously according to the principle of profit maximization. The model for this problem is formulated in Eq. 7.

The game model can be solved by using the backwards induction. The specific proof process is shown in Supplementary Appendix SA.

Lemma 1. The profit functions of the two retailers,

Lemma 2. Green manufacturer’s profit,

Theorem 1. Under non-cooperation, if

The specific certification process is detailed in Supplementary Appendix SA.

Inference 1. Impact of the green level floor for subsidy on the green level of products without cooperation of manufacturers:if

The values of

4.2 Supply chain game models under manufacturers’ cooperation

In reality, supply chain members may have cooperative behavior in a horizontal direction. The situation that two manufacturers jointly decide the wholesale prices and greenness of products to maximize the total profit will be considered in this subsection.

The total profit of two manufacturers is

When two manufacturers cooperate horizontally, the manufacturers are the leader of the supply chain, and jointly decide the product prices and greenness. On the basis of this, green and non-green retailers conduct Nash game, and determine retail prices of their own products with the goal of maximizing their own profits. The problem model is shown in Eq. 24.

Solving the model through using the backwards induction, we still obtain the Nash equilibrium solution between two retailers first, and then we can get the same conclusion as Lemma 1, that is.

By substituting it into the total profit function of green and non-green manufacturers,

Theorem 2. When retailers cooperate horizontally, if

The specific proof process and values of

Inference 2. Impact of the green level floor for subsidy on the green level of products under manufacture cooperation:If

The manufacturers after cooperation share the total profit in proportion

5 Numerical analysis

Because of the complication of the equilibrium solutions, it is difficult to qualitatively analyze their relationships. In this section, software MATLAB is used to analyze the relevant results. Combined with the reality of JAC and NextEV, and referring to the valuation ideas of Madani and Rasti-Barzoki (2017), Yang et al. (2019), Hafezalkotob (2015), as well as the above assumptions and the conditions for obtaining the optimal solution, we assume that the parameters are as follows:

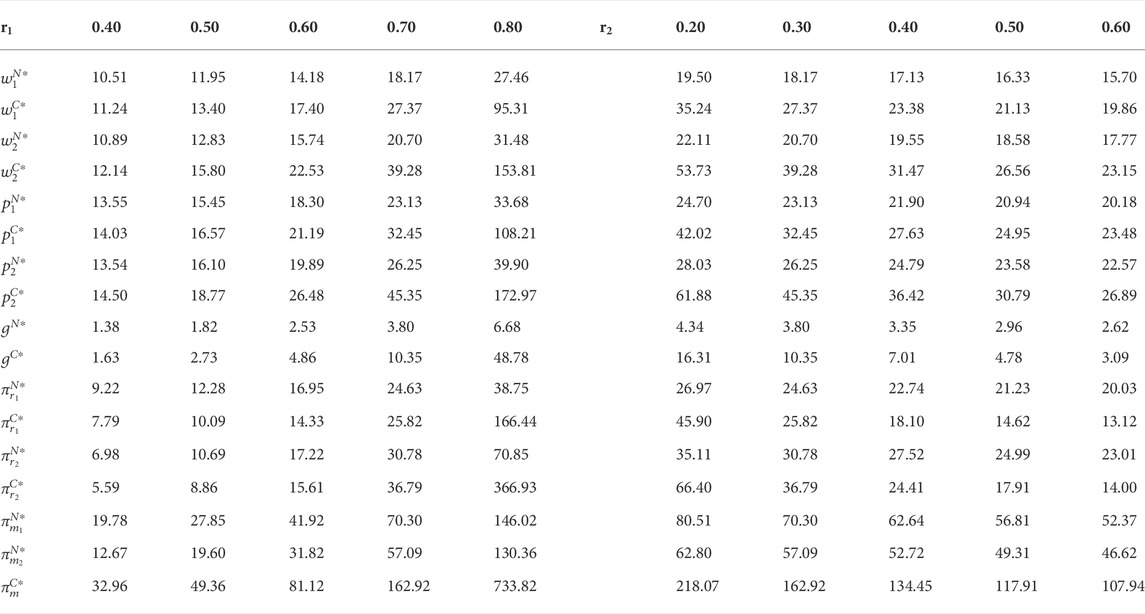

5.1 Effect of sensitivity coefficient on equilibrium decisions and profits

The wholesale prices, retail prices of two products and green level of green products increase with consumers’ green preferences and decrease with the increase of consumers’ sensitivity to product price. This is because price-sensitive consumers are reluctant to pay higher prices, forcing retailers to reduce product prices and thus hurting profits. Further, retailers put pressure on the upstream, resulting in the decline of manufacturers’ wholesale prices. Due to the high cost of green R&D, the green manufacturer has no choice but to reduce the green level of products to maintain its own profit. Besides, consumers’ green preference will stimulate the enthusiasm for green R&D of the green manufacturer, which promote it to actively improve the green level of products, and then the retail price will also increase. In this case, the competitiveness between SCs makes the NGSC hitchhike and also increase its retail price (see Supplementary Appendix SB for details).

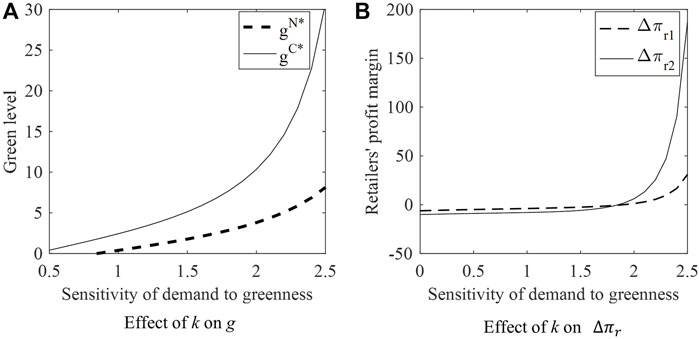

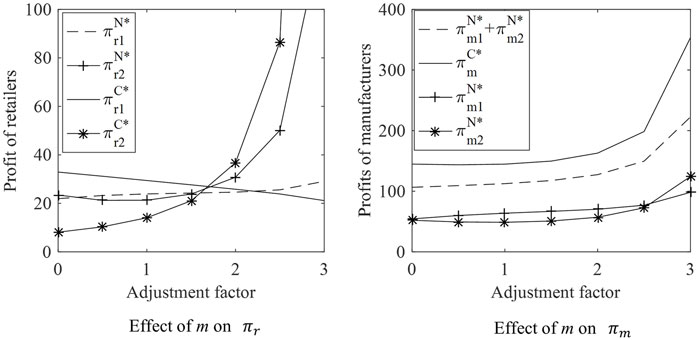

As shown in Figure 2A and Figure 3A, it is easy to find that the optimal price and green level for both types of products under cooperation are higher than those under non-cooperation with the enhancement of consumers’ price preference and green preference, that is,

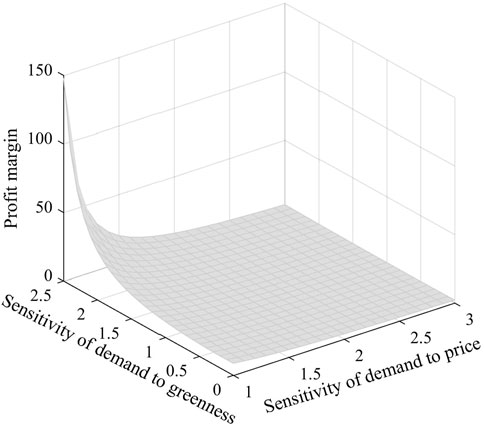

Figures 2B, 3B illustrate that with the enhancement of consumers’ price preference, two retailers’ profits suffer badly from cooperation of manufacturers, especially the green retailer. However, the damage degree of manufacturers’ cooperative behavior to two retailers’ profits gradually falls as consumers’ green preference increases. If the green preference of consumers is strong enough, cooperation will significantly promote the growth of two retailers’ profits. Additionally, from Figure 4, manufacturers’ total profit under cooperation is always higher than that under non-cooperation no matter how consumers’ price preference and green preference change, where

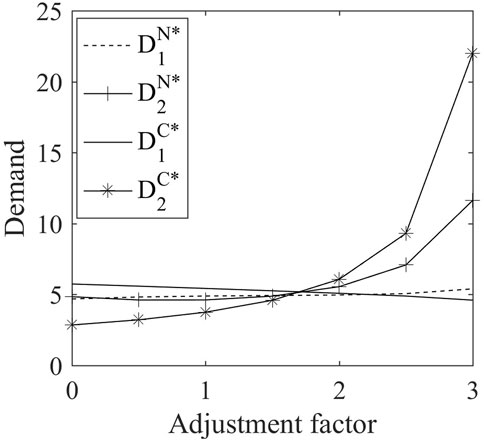

5.2 Effect of the government’s adjustment factor of offering a subsidy on supply chain

Figures 5–7 illustrate that if the government’s adjustment factor of offering a subsidy is low, the green manufacturer with no cooperation with the non-green manufacturer is less enthusiastic about green R&D due to high costs of green R&D, and even give up green innovation completely. Contemporarily, consumers with green preferences will turn to non-green consumption, giving rise to a slight decline in the profits of GSC members. With the increase of adjustment factor m, the green manufacturer’s pressure on green R&D is reduced and their enthusiasm is increased. The improvement of the product greenness further makes green products’ price rise, but consumers will still choose green products out of their love for green products (k = 2). The dual effects of demand and price increasing have led to a substantial increase in the green retailer’s profits. However, the profit growth rate of the green manufacturer is lower than that of the green retailer due to high R&D costs. Hafezalkotob (2015) believed that the increase of tariffs on SC products would reduce their own retail prices and increase the retail prices of competitors. Differently, it is found that the product retail prices of both chains increase with adjustment factor m when we take the Stackelberg game between manufacturers and the green level competition of both products into consideration. It means that the different power structure between two manufacturers and the greenness competition will bring about a free-riding effect. Madani and Rasti-Barzoki (2017) characterized government subsidy and tax policies by two parameters, respectively, and found that subsidies can improve the greenness, while changes in tax rates have no impact on it. This paper uses a parameter to characterize the two-way government intervention policy and draws a different conclusion: increasing subsidies to the green manufacturer or punishment to the non-green manufacturer can promote the improvement of product greenness. When two manufacturers cooperate in green R&D, the optimal decision variables, demand for green products, GSC member profits and non-green manufacturer’s profit all increase with adjustment factor m, but the demand and the retailer’s profit of non-green products change reversely. It shows that the cooperation between manufacturers under the two-way government intervention greatly increases the motivation of GSC to improve the product greenness and enhances the core competitiveness. In this case, the NGSC will hitchhike and raise the price of its own products. However, the profit of non-green retailer will decline because of the inability to compensate for the adverse impact of the decline in demand. Figure 6 also illustrates that if the government wants to promote green consumption, it is necessary to increase the government’s adjustment factor of offering a subsidy, that is, to increase the subsidies for the green manufacturer and increase the punishment for the non-green manufacturer.

We can also derive the following results from Figures 5–7. Comparing the optimal decisions and profits of each member of both SCs before and after manufacturers’ cooperation, we have

5.3 Effect of the degree of competition on supply chain

Considering that the degree of price competition in supply chains is generally higher than that of green level competition in real life, when we analyze the impact of

TABLE 3. Effect of the degree of price competition and green level competition on two supply chains.

According to Table 3, the following results can be drawn. First, regardless of cooperation or non-cooperation between manufacturers, the optimal decisions and profits of each member will increase with the increasingly fierce price competition between SCs. Nevertheless, the strongly intense green level competition will give rise to a fall in the prices, green decisions and profits. The fiercer the price competition, the more significant the impact of the rival price of a product on its own demand, which blurs consumers’ perception of product price and weakens the impact of product price on demand. Under this scenario, each member of SCs can appropriately raise product prices to maximize its profits, and the green manufacturer also has spare energy to invest more in green R&D. As the greenness competition is gradually intense, the green level of green products has an increasingly negative impact on the demand for non-green products. The NGSC has no choice but to reduce prices and achieve small profits but quick turnover to attract consumers. In this regard, the GSC can only reduce prices accordingly, and it is unable to invest higher costs in green R&D. If the greenness competition is weak, consumers’ perceptions of the greenness of green and non-green products are quite different, which causes that the GSC can continue to improve product greenness within the allowable range of cost, perform green publicity, implement differentiation strategy, and reduce the substitutability of products. Different from the finding by Liu and Ji (2017) that the wholesale price of products decreased as competition intensifies by characterizing the price and greenness competition with the same parameter, this paper assumes that the degree of price competition is higher than that of green level competition. Considering the master-slave relationship between two manufacturers and the government financial intervention, we derive that the fierce price and green level competition have the opposite impact on the supply chain.

Second, we obtain the same result as subsection 5.2, that is,

6 Conclusion

Considering the price and green level competition between two products and the leading position of the non-green manufacturer in the market, this study formulates two models derived from competitive and cooperative manufacturers for the NGSC and the GSC under the two-way government intervention to examine how two-way government intervention, horizontal cooperation of two manufacturers and competition degree between two supply chains influence decisions like greenness and prices and profits of SCs members. The main findings of this study are as follows:

Firstly, cooperation will increase the total profits of two manufacturers, but damage the interests of consumers, which is consistent with Yu et al. (2022). The difference is that this study shows that manufacturers’ cooperation could improve the green level of products, while Yu et al. (2022) found that cooperation reduced manufacturers’ enthusiasm for emission reduction when the government carried out the carbon tax policy. This indicates that the two-way government intervention policy considered in this paper can effectively promote manufacturers’ investment in green R&D. With the enhancement of consumers’ price preference, the cooperative behavior between manufacturers will damage the profits of retailers. However, improving consumers’ environmental awareness will alleviate the profit loss of retailers, and even promote the growth of retailers’ profits, so as to achieve a win-win situation between economic growth and ecological protection.

Secondly, as long as an appropriate profit-sharing contract is agreed, two manufacturers always tend to cooperate no matter how the government intervention policy changes. When the government’s adjustment factor of offering a subsidy is small, retailers will encourage manufacturers to cooperate to achieve higher product greenness through reasonable secondary distribution. Powerful two-way government intervention will promote green consumption. However, the cooperative behavior of manufacturers will influence the effect of the adjustment of the green level floor for subsidy on product greenness.

Finally, the enhancement of price competition is conducive to the optimal decisions and profits of SC members, while the fierce green level competition will have an adverse impact, which is similar to Yu and You (2019). Only when price competition degree is at a medium level or the green competition is not fierce, are retailers willing to support the cooperation of manufacturers.

This study puts forward the following implications: Implications for government. The government should first advocate the public’s preference for green products, encourage the media to publicize the importance of green and low-carbon products through some policies, raise public environmental awareness, and actively guide consumers to buy green products. On the other hand, the government should motivate enterprises to carry out green R&D and innovation through high subsidy and high penalty policies to improve product greenness. If the government wants to improve environmental benefits and has a lower expenditure budget, it can lower the green level floor for subsidy without cooperation of manufacturers, while increase the green level floor under manufacture cooperation.

Implications for enterprises. The findings of this study show that reducing consumers’ price sensitivity and enhancing their green preferences is not only beneficial to enterprises’ profit growth, but also to the environment. Therefore, consumers’ preferences have a great impact on decision-making and profits in the supply chain. It is useful for retailers to reduce consumers’ sensitivity to product prices by lowering the entry threshold of purchase or setting relative prices. Moreover, it is also feasible to implement differentiation strategy and improve the transfer cost of consumers to products. For green retailers, they can disclose product greenness information, enhance the transparency of green information, and strengthen the publicity and promotion of green products. For example, Tmall is committed to creating a low-carbon Double Eleven in 2021. Consumers who purchase a “green home appliance” logo can get Ant Forest energy, which attracted many enterprises such as Haier, Midea, Hisense, Xiaomi, TCL. In some emerging industries, enterprises can reduce risk through cooperation. In other words, cooperation may be a better way of survival. In reality, new powers of electric vehicles such as JAC, Xpeng, and LEADING IDEAL have the intention to cooperate with traditional car companies such as NextEV, Geely, and FAW. Traditional car companies have obvious advantages in manufacturing, while the high cost and long cycle of green R&D and lack of experience are the challenges faced by new powers of electric vehicles. Cooperation with traditional vehicles can not only improve investment efficiency, but also relieve financial pressure. However, although manufacturers’ cooperation improves both their profits and environmental benefits, their downstream retailers will suffer badly. In this regard, manufacturers can share the green marketing costs of retailers, cooperating with retailers to jointly promote consumers’ environmental awareness. And they can also continue to carry out green innovation to build barriers to weaken the green level competition among products, so that retailers can also benefit from cooperation. This may be one of the reasons why JAC cooperates with NextEV. If price competition is a little weaker or much stronger or greenness competition is strong, cooperation is not conducive to retailers. This is why Hisense, Oaks, Gree have little cooperation on greenness. Furthermore, when the government offers high subsidies to the green manufacturer, manufacturers’ cooperation will promote green consumption and increase the profit of the green retailer, while damage the profit of the non-green retailer. Under this circumstance, reasonable secondary distribution of profits can improve the profit of the non-green retailer, thereby achieving a win-win situation between economic growth and ecological protection.

Nevertheless, there are some limitations in this paper, such as not considering the two-way government intervention as an endogenous variable, nor considering the impact of the variability of demand in the real world and the situation when each chain produces multiple products. In the future, we will explore the decision-making optimization of competitive supply chains from these perspectives, so as to provide a more complete decision-making reference for the supply chain to enhance its core competitiveness and the government to accurately implement financial intervention policies.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author contributions

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

Funding

This research was funded by the Humanities and Social Sciences project of Ministry of Education (21YJC630140) and Project of Contemporary Capitalism Research Center of Zhengzhou University.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenvs.2022.1002124/full#supplementary-material

References

Cheng, H., and Ding, H. (2021). Dynamic game of corporate social responsibility in a supply chain with competition. J. Clean. Prod. 317, 128398. doi:10.1016/j.jclepro.2021.128398

Gao, J., Xiao, Z., and Wei, H. (2021). Competition and coordination in a dual-channel green supply chain with an eco-label policy. Comput. Ind. Eng. 153, 107057. doi:10.1016/j.cie.2020.107057

Hafezalkotob, A. (2015). Competition of two green and regular supply chains under environmental protection and revenue seeking policies of government. Comput. Ind. Eng. 82, 103–114. doi:10.1016/j.cie.2015.01.016

Hafezalkotob, A. (2017). Competition, cooperation, and coopetition of green supply chains under regulations on energy saving levels. Transp. Res. Part E Logist. Transp. Rev. 97, 228–250. doi:10.1016/j.tre.2016.11.004

Hafezalkotob, A. (2018). Direct and indirect intervention schemas of government in the competition between green and non-green supply chains. J. Clean. Prod. 170, 753–772. doi:10.1016/j.jclepro.2017.09.124

Huang, D., and Zhang, J. L. (2021). The impacts of carbon tax on emissions abatement level in a supply chain under different power structures. Chin. J. Manag. Sci. 29 (07), 57–70. doi:10.16381/j.cnki.issn1003-207x.2018.1761

Jamali, M. B., and Rasti-Barzoki, M. (2018). A game theoretic approach for green and non-green product pricing in chain-to-chain competitive sustainable and regular dual-channel supply chains. J. Clean. Prod. 170, 1029–1043. doi:10.1016/j.jclepro.2017.09.181

Jiang, Q. Y., Tao, F., Fan, T. J., and Lai, K. K. (2020). Research on decision-making of two supply chains with RFID technology. Chin. J. Manag. Sci. 28 (11), 120–129. doi:10.16381/j.cnki.issn1003-207x.2020.11.013

Khosroshahi, H., Dimitrov, S., and Hejazi, S. R. (2021). Pricing, greening, and transparency decisions considering the impact of government subsidies and CSR behavior in supply chain decisions. J. Retail. Consumer Serv. 60, 102485. doi:10.1016/j.jretconser.2021.102485

Li, J., and Liu, P. (2022). Modeling green supply chain games with governmental interventions and risk preferences under fuzzy uncertainties. Math. Comput. Simul. 192, 182–200. doi:10.1016/j.matcom.2021.08.020

Li, X., and Li, Y. (2016). Chain-to-chain competition on product sustainability. J. Clean. Prod. 112, 2058–2065. doi:10.1016/j.jclepro.2014.09.027

Li, X., Li, Y., and Chen, Y. J. (2022). Strategic inventories under supply chain competition. Manuf. Serv. Oper. Manag. 24 (1), 77–90. doi:10.1287/msom.2020.0954

Liu, H. Y., and Ji, S. F. (2017). Product selection and pricing policy of competitive supply chains considering consumers' green preference. Chin. J. Manag. 14 (03), 451–458. doi:10.3969/j.issn.1672-884x.2017.03.014

Liu, J. G., Xu, W. L., and Sun, R. (2021b). Vertical integration of shipping supply chain under service competition. Oper. Res. Manag. Sci. 30 (06), 55–62. doi:10.12005/orms.2021.0180

Liu, L., Feng, L., Jiang, T., and Zhang, Q. (2021a). The impact of supply chain competition on the introduction of clean development mechanisms. Transp. Res. Part E Logist. Transp. Rev. 155, 102506. doi:10.1016/j.tre.2021.102506

Liu, X., Zhou, W., and Xie, L. (2022). Dynamic competitive game study of a green supply chain with R&D level. Comput. Ind. Eng. 163, 107785. doi:10.1016/j.cie.2021.107785

Ma, J., Ai, X., Yang, W., and Pan, Y. (2019). Decentralization versus coordination in competing supply chains under retailers’ extended warranties. Ann. Oper. Res. 275 (2), 485–510. doi:10.1007/s10479-018-2871-6

Ma, J., Hou, Y., Wang, Z., and Yang, W. (2021). Pricing strategy and coordination of automobile manufacturers based on government intervention and carbon emission reduction. Energy Policy 148, 111919. doi:10.1016/j.enpol.2020.111919

Madani, S. R., and Rasti-Barzoki, M. (2017). Sustainable supply chain management with pricing, greening and governmental tariffs determining strategies: A game-theoretic approach. Comput. Ind. Eng. 105, 287–298. doi:10.1016/j.cie.2017.01.017

Mahmoudi, A., Govindan, K., Shishebori, D., and Mahmoudi, R. (2021). Product pricing problem in green and non-green multi-channel supply chains under government intervention and in the presence of third-party logistics companies. Comput. Ind. Eng. 159, 107490. doi:10.1016/j.cie.2021.107490

McGuire, T. W., and Staelin, R. (1983). An industry equilibrium analysis of downstream vertical integration. Mark. Sci. 2 (2), 161–191. doi:10.1287/mksc.2.2.161

Meng, Q., Li, M., Liu, W., Li, Z., and Zhang, J. (2021). Pricing policies of dual-channel green supply chain: Considering government subsidies and consumers' dual preferences. Sustain. Prod. Consum. 26, 1021–1030. doi:10.1016/j.spc.2021.01.012

Moradinasab, N., Amin-Naseri, M. R., Behbahani, T. J., and Jafarzadeh, H. (2018). Competition and cooperation between supply chains in multi-objective petroleum green supply chain: A game theoretic approach. J. Clean. Prod. 170, 818–841. doi:10.1016/j.jclepro.2017.08.114

Sinayi, M., and Rasti-Barzoki, M. (2018). A game theoretic approach for pricing, greening, and social welfare policies in a supply chain with government intervention. J. Clean. Prod. 196, 1443–1458. doi:10.1016/j.jclepro.2018.05.212

Wang, J., and Liu, J. (2019). Vertical contract selection under chain-to-chain service competition in shipping supply chain. Transp. Policy (Oxf). 81, 184–196. doi:10.1016/j.tranpol.2019.06.013

Wang, S., Chen, M., and Song, M. (2018). Energy constraints, green technological progress and business profit ratios: Evidence from big data of Chinese enterprises. Int. J. Prod. Res. 56 (8), 2963–2974. doi:10.1080/00207543.2018.1454613

Wang, S., He, Y., and Song, M. (2021a). Global value chains, technological progress, and environmental pollution: Inequality towards developing countries. J. Environ. Manage. 277, 110999. doi:10.1016/j.jenvman.2020.110999

Wang, S., and Song, M. (2017). Influences of reverse outsourcing on green technological progress from the perspective of a global supply chain. Sci. Total Environ. 595, 201–208. doi:10.1016/j.scitotenv.2017.03.243

Wang, S., Sun, X., and Song, M. (2021b). Environmental regulation, resource misallocation, and ecological efficiency. Emerg. Mark. Finance Trade 57 (3), 410–429. doi:10.1080/1540496X.2018.1529560

Wang, S., Wang, X., and Lu, B. (2022). Is resource abundance a curse for green economic growth? Evidence from developing countries. Resour. Policy 75, 102533. doi:10.1016/j.resourpol.2021.102533

Wen, X. Q., Cheng, H. F., Cai, J. H., and Lu, C. (2018). Government subside policies and effect analysis in green supply chain. Chin. J. Manag. 15 (04), 625–632. doi:10.3969/j.issn.1672-884x.2018.04.017

Xu, G. N., Chen, H. R., Wu, X. L., and Zhou, C. (2020). Game analysis on green cost-sharing between competing supply chains. J. Syst. Eng. 35 (02), 244–256. doi:10.13383/j.cnki.jse.2020.02.010

Yang, D., Wang, J., and Song, D. (2019). channel structure strategies of supply chains with varying green cost and governmental interventions. Sustainability 12 (1), 113. doi:10.3390/su12010113

Yang, L., Zhang, Q., and Ji, J. (2017). Pricing and carbon emission reduction decisions in supply chains with vertical and horizontal cooperation. Int. J. Prod. Econ. 191, 286–297. doi:10.1016/j.ijpe.2017.06.021

Yu, J., and You, D. M. (2019). Comparative study of supply chain co-opetition models considering risk aversion. Syst. Eng.-Theory Pract. 39 (08), 2091–2104. doi:10.12011/1000-6788-2018-2534-14

Yu, W., Wang, Y., Feng, W., Bao, L., and Han, R. (2022). Low carbon strategy analysis with two competing supply chain considering carbon taxation. Comput. Ind. Eng. 169, 108203. doi:10.1016/j.cie.2022.108203

Zhang, C., Wang, Y. X., and Liu, T. L. (2022). Analysis of financing decisions for green supply chain under the Chain-to-Chain competition. J. Ind. Eng./Eng. Manag. 36 (02), 159–172. doi:10.13587/j.cnki.jieem.2022.02.014

Zhang, H., Li, P., Zheng, H., and Zhang, Y. (2021). Impact of carbon tax on enterprise operation and production strategy for low-carbon products in a co-opetition supply chain. J. Clean. Prod. 287, 125058. doi:10.1016/j.jclepro.2020.125058

Zheng, S., and Luo, M. (2021). Competition or cooperation? Ports’ strategies and welfare analysis facing shipping alliances. Transp. Res. Part E Logist. Transp. Rev. 153, 102429. doi:10.1016/j.tre.2021.102429

Keywords: competitive supply chain, manufacturer competition and cooperation, two-way government intervention, competition degree, green supply chain

Citation: Shang W, Wang B and Xia D (2022) A game between green and non-green supply chains considering two-way government intervention and manufacturer competition. Front. Environ. Sci. 10:1002124. doi: 10.3389/fenvs.2022.1002124

Received: 24 July 2022; Accepted: 08 August 2022;

Published: 21 September 2022.

Edited by:

Shuhong Wang, Shandong University of Finance and Economics, ChinaReviewed by:

Xianpei Hong, Huazhong Agricultural University, ChinaLei Yang, South China University of Technology, China

Copyright © 2022 Shang, Wang and Xia. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Defeng Xia, eGlhZGVmZW5nQHp6dS5lZHUuY24=

Wenfang Shang

Wenfang Shang Bingyan Wang

Bingyan Wang Defeng Xia

Defeng Xia