- 1School of Economics and Management, Anhui Normal University, Wuhu, China

- 2Chinese Academy of Sciences (CAS), Beijing, China

- 3Economics and Management School, Wuhan University, Wuhan, China

Due to incomplete legal regulation, enterprises have the motive of selective environmental information disclosure (EID), and such selective disclosure strategy may result in stock price crash risk. In this study, the EID scores of China’s 1,010 polluting listed companies between 2007 and 2017 are first measured by employing the text analysis approach. Subsequently, we empirically examine the impacts of corporate’s selective EID on the stock price crash risk. The results indicate that EID of China’s polluting listed companies has significantly increased their stock price crash risk, rather than reducing it. Specifically, the EID of polluting companies with lower information efficiency, higher inefficient investment, higher degree of government control, and location in lower marketization areas is more likely to increase their stock price crash risk. Additional analyses reveal that the EID of polluting listed companies in China cannot reduce their stock price synchronization, which means that the selective disclosure of environmental information of China’s polluting listed companies is useless, and thus cannot reduce the risk of stock price crash.

Introduction

To cope with the worsening environmental problems, countries all over the world are strengthening environmental regulations (Shi and Xu, 2018). Environmental information disclosure (EID) is one of the regulations which can transmit the environmental information to the users (Trumpp et al., 2015). Regulators are aware of the importance of EID, which has been practiced as an important measure of environmental regulations (Zhang et al., 2016a). More and more countries in the world have established their own EID system (Li et al., 2021). More importantly, the environmental information disclosed by enterprises is more and more concerned by stakeholders (Jiang et al., 2021).

EID has obvious benefits for both enterprises and the society. It helps enterprises establish an environment-friendly image (Aragon-Correa et al., 2016). EID transfers the legitimacy of enterprises to the public, reduces the investment risk of external shareholders, and ultimately improves the financing ability of enterprises (Dhaliwal et al., 2011). Moreover, EID makes it easier for polluters to obtain green credit and reduce the cost of credit (Liu and Anbumozhi, 2009; Xu et al., 2020). Therefore, EID can further improve the financing ability of polluting enterprises (Wu et al., 2017). In addition, EID can enable consumers to obtain the information of environment-friendly products (Dejan et al., 2019) so as to attract green consumers and cultivate their loyalty (Lev et al., 2010), thus improving the market share and financial performance of enterprises (Wang et al., 2020). The disclosure of environmental information forces polluters to adopt environmentally friendly production methods, which also helps reduce pollution (Jiang et al., 2021).

However, EID may increase the supervision pressure of high-polluting enterprises. Therefore, EID also has costs (Fisman and Wang, 2015). The more transparent a company is, the more scrutinized it will be, especially on environmental issues (King, 2008). The environmental information disclosed by companies is strictly reviewed by environmental protection organizations, which will bring pressure to them to solve environmental problems (Lyon and Maxwell, 2011). They may even boycott and protest against these companies. Therefore, EID will strengthen the supervision of enterprises and increase the accountability of polluters (Bromley and Powell, 2012). For instance, when environmental disasters occur, companies with poor environmental records attract more media attention (Luo et al., 2012). Furthermore, investors have a preference for companies with good environmental performance (Abdullah et al., 2020). They may use environmental information disclosure to assess a company’s risk, just like financial disclosure (Chang et al., 2020). Eventually, enterprises may adopt strategic environmental information disclosure.

Due to incomplete legal regulation, enterprises have the discretion to disclose environmental information. For example, Kim and Lyon (2011) found that companies selectively disclose their greenhouse gas emissions to the U.S. government. Especially in developing countries, the problem of environmental information disclosure is more prominent and selective disclosure is more serious (Fonseka et al., 2019). Martins and Gomes (2021) defined selective environmental information disclosure as corporate impression management. Enterprises voluntarily choose environmental information disclosure to distort investors’ evaluation (Neu et al., 1998). The result is that the EID is not neutral and unfair so as to avoid the environmental responsibility of enterprises (Merkl-Davies and Brennan, 2007). “Greenwash” has been described as a common type of selective environmental disclosure in which companies mislead the public by giving a false impression of their true environmental performance (Marquis et al., 2016).

What are the consequences of corporate’s selective environmental information disclosure? Can it help polluting companies to access more external support, or will it mislead investors and even distort the allocation of resources in the capital market? According to the hypothesis of “hiding bad news” proposed by Jin and Myers (2006), the bad news withheld by the company eventually caused the company’s stock price to crash. Therefore, this article mainly studies the actual impact of selective environmental information disclosure on stock price crash risk of polluting enterprises. We try to contribute to the literature from the following two aspects: first, this study sheds some light on the relationship between nonfinancial information disclosure and corporate’s stock price crash risk. It demonstrates that not only the financial disclosure but also the nonfinancial information disclosure, such as the disclosure of environmental information by polluting enterprises, will impact corporate’s stock price crash. Second, based on the principle of substance over form, this study objectively evaluates the economic consequences of environmental information disclosure of polluting enterprises. We should not only pay attention to whether polluting listed companies disclose environmental information but also pay attention to the specific content of their disclosure. Selective disclosure of environmental information can be worse than nondisclosure.

The remainder of this article is organized as follows: Mechanism Analysis and Hypotheses Development probes the theoretical mechanism of selective EID impacting corporate’s stock price crash risk and puts forward the research hypothesis; Empirical Research Design introduces the empirical designs and dataset; Empirical Results and Discussions reports the empirical results and discusses them; and Conclusions and Implications concludes the article.

Mechanism Analysis and Hypothesis Development

Literature Reviews

Stock price crashes are the sharp and continuous collapse of stock prices, which have become a hot issue of financial institutions and regulators (Chen et al., 2001). Concerning the reasons of stock price crash, scholars have put forward their own opinions from different perspectives. For example, Black (1976) believed that a company’s leverage structure may have an adverse impact on its stock price and even cause the stock price to crash. Zeira (1999) proposed that fundamental changes lead to investors’ overreaction, which results in stock market fluctuations from prosperity to a crash. According to Jin and Myers (2006), information asymmetry enables managers to hide bad news for various reasons, such as maximizing compensation or protecting employment (Cai et al., 2019). Once the negative information is disclosed, the stock price of the company may fall sharply (Habib et al., 2018).

Following Jin and Myers (2006), numerous studies have examined the impact of financial information disclosure on the stock price crash. For example, Hutton et al. (2009) argued that firms with a substantial amount of discretionary accruals are prone to stock price crash. Kim and Zhang (2016) demonstrated that firms with less conservative accounting practices are associated with a higher likelihood of future stock price crash risk. Moreover, firms with high unreliable accruals (Zhu, 2016) and high earning smoothing behavior (Chen et al., 2018) tend to exhibit increased stock price crash risk. Jung et al. (2019) find a statistically significant and positive association between U.S. banks’ delayed expected loss recognition and the subsequent period stock price crash when managers have high discretion in concealing bad news. Jin et al. (2019) found that economic policy uncertainty affects crash risk through managers’ concealment of bad news and investors’ heterogeneous beliefs.

As we summarize from existing studies, we see that they have discussed the impacts of financial information disclosure on the risk of stock price crash, but little attention has been paid to the impacts of nonfinancial information disclosure on the risk of corporate’s stock price crash. However, investors not only pay attention to financial information but also to nonfinancial information, such as the environmental information disclosed by polluting enterprises. In what follows, we deeply probe the theoretical mechanism by which selective EID impacts corporate’s stock price crash.

EID and Stock Price Crash

EID is an important regulation to reduce the information asymmetry of the pollution industry (Zhu and Zhang, 2012). On the one hand, it allows external and internal information systems to make comprehensive assessments on companies’ environmental performance (Jenkins and Yakovleva, 2006). On the other hand, it can alleviate the information asymmetry between management and investors, thus reducing the agency problem in the environments characterized (Martinezferrero et al., 2016). EID aims to alleviate the negative economic consequences such as the conflict of interest caused by information asymmetry (Yan et al., 2017). For instance, Du (2018) found that EID could alleviate the information asymmetry between domestic and foreign investors, thus attracting overseas financing. Ni (2016) found that high-quality EID can reduce the environmental information asymmetry between creditors and high-polluting enterprises.

In addition, EID is valuable for reducing the investment risk of enterprises and improving the risk assessment of investors (Ashbaugh-Skaife et al., 2010). Enterprises with higher environmental information quality may also have higher ethical standards (Kim et al., 2014). The value correlation of EID reduces the uncertainty of corporate valuation (Dhaliwal et al., 2011). Therefore, high-quality EID can help investors make effective investment decisions and improve the pricing efficiency of the capital market (Chang et al., 2020). Therefore, EID has always been treated as a useful signal for investors (Wu and Hu, 2019).

Overall, as EID reduces the environmental information asymmetry and improves the pricing efficiency of polluting enterprises (Zhu and Zhang, 2012), it may ultimately reduce the stock price crash risk (Defond et al., 2015; Kim and Zhang, 2016). Therefore, the following hypothesis is proposed:

H1a: The EID of polluting listed companies will reduce their stock price crash risk.

However, from the perspective of agency cost, firms may be strategic in environmental information disclosure to avoid or minimize negative reactions from investors (Gleason et al., 2020). According to the selective disclosure, enterprises with better environmental performance are more willing to disclose high-quality environmental information; however, enterprises with poor environmental performance choose to disclose more soft information on environmental performance.

The management’s self-interest and information asymmetry ultimately lead to selective disclosure of environmental information (Benmelech et al., 2010; Kim et al., 2016). Some polluting companies even hide some key environmental information with the excuses of “national security, public security, economic security, or social stability” (He et al., 2014). The result is that positive environmental information is disclosed and negative environmental information is hidden (Huang et al., 2011; Habib and Hasan, 2017). For instance, Jin et al. (2019), Petrovits (2006), and Prior et al. (2008) demonstrated that managers use corporate social responsibility to seek rents, protect their jobs, and manage earnings. Hemingway and Maclagan (2004) and Kim et al. (2014) believed that management may use corporate social responsibility to cover up their misconducts and divert shareholders’ attention from their misconducts.

Polluting enterprises are facing serious political and social pressures, which threatens their legitimacy (Meng et al., 2013). As a result, they will be expected to provide more positive environmental information disclosures to the public in their annual reports (Clarkson et al., 2008). Altuwaijri et al. (2004) refer to this as “greenwashing,” in which management puts its best “spin” on what otherwise might be a lackluster environmental performance.

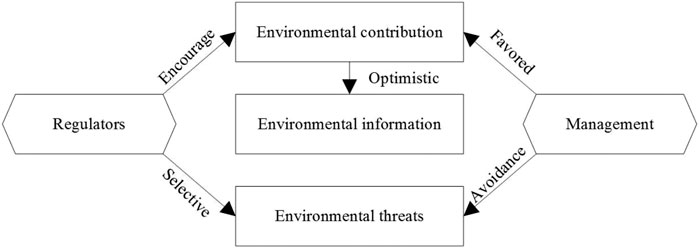

Thus, EID is seen as a means used by management to hide unethical behavior (Wu and Hu, 2019), which ultimately increases the risk of a stock price crash. Figure 1 further illustrates the asymmetry of the EID system.

Among them, the regulators hope to force enterprises to take necessary environmental protection measures by requiring them to disclose their environmental contributions (Zhang et al., 2016b). However, enterprises with ulterior motives may selectively disclose their environmental contributions and avoid disclosing their environmental threats, thus leading to bias in the disclosure of environmental information (Altuwaijri et al., 2004).

This asymmetry of environmental information disclosure will weaken the effectiveness of environmental regulation. Selective EID means more information opacity, which creates more opportunities for polluting enterprises to withhold bad news. With the accumulation of hidden negative information, the stock price will probably collapse in the future (Jin and Myers, 2006).

Therefore, this study proposes the following hypothesis:

H1b: The selective EID of polluting listed companies will increase their stock price crash risk.

EID and Stock Price Synchronization

Stock price synchronization is an important index for measuring the information efficiency of stock price (Morck et al., 2000), which refers to the correlation between stock volatility and market volatility. High stock price synchronization will seriously damage the efficiency of capital allocation (Jin and Myers, 2006). The higher the synchronization of stock price, the lower the information efficiency of stock price (Heng and Ting, 2011; Song, 2015), which will ultimately increase the risk of stock price crash (Jin et al., 2016).

The disclosure of useful information is an important measure to reduce the stock price synchronization (Wurgler, 2000). When a company’s disclosure quality improves, investors are able to accurately predict its future firm-specific earnings (Farooq and Hamouda, 2016; Didar et al., 2018). Therefore, the firm’s shares will be embedded with more firm-specific information, and there will be low stock price synchronicity (Song, 2015; Zhou et al., 2019). EID also has the function of information transmission (Qiu et al., 2016). For instance, Plumlee et al. (2015) found that EID would affect the cash flow and equity financing cost of enterprises, thus affecting the enterprise value. Nor et al. (2016) demonstrated that in order to attract investors’ attention, the management would pay more attention to the disclosure of environmental information. Dai et al. (2018) believed that when corporates’ social responsibility reports enable investors to have more firm-specific information, the synchronization of stock prices is lower.

Therefore, firms adopt an appropriate disclosure of environmental information, and external investors can collect information on corporates’ environmental responsibility and finally reduce the stock price synchronization and stock price crash risk (Jin et al., 2016).

For these reasons, the following hypothesis is proposed:

H2a: The EID of polluting listed companies will reduce the stock price crash risk by reducing their stock price synchronization.

However, due to the selective EID, companies actively disclose their environmental contributions while avoiding disclosing the environmental threats (Zhang et al., 2016a). Even excessive or exaggerated disclosure of uncritical information will mislead investors, thus reducing the information efficiency of the stock market. Especially in some emerging markets where market mechanisms are not so perfect, firms are more likely to speculate (Fonseka et al., 2019). They will use EID as a self-interested tool to release low-quality CSR reports to cover up their negative operating conditions (Dai et al., 2018). As a result, the EID of polluting listed companies may not be able to reduce their stock price crash risk by reducing their stock price synchronization.

In this situation, this study proposes the following hypothesis:

H2b: The EID of polluting listed companies cannot reduce the stock price crash risk by reducing their stock price synchronization.

Empirical Research Design

Measurement of Stock Price Crash Risk

In order to measure the risk of corporate’s stock price crash, Chen et al. (2001) constructed two indicators, NCSKEW and DUVOL, which were further improved by Hutton et al. (2009). They have been widely used in the study of crash risk of stock prices, such as Defond et al. (2015), Si and Zhan (2019), and Xu et al. (2021). Therefore, NCSKEW and DUVOL are also used as stock price crash risk indicators in this study. We first estimate the firm-specific weekly returns for each firm and year as follows:

where Ri,t is the company’s t-week return and Rm,t is the market’s t-week return. The firm-specific weekly return for firm i in week t is measured by the natural log of one plus the residuals in Eq. 1:

The crash risk proxies, NCSKEW and DUVOL, are then calculated:

where NCSKEWi,T is the skewness of the firm-specific weekly returns, DUVOLi,T is the asymmetric volatility of negative vs. positive returns, ni,t is the number of trading weeks, ni,t,Up is the frequency with which the ith company’s abnormal weekly return is higher than the average abnormal weekly return, and ni,t,Down is the frequency with which the ith company’s abnormal weekly return is lower than the average abnormal weekly return. The greater the NCSKEWi,T and DUVOLi,T, the greater the risk of stock price crash (Chen et al., 2001).

Measurement of EID

Text content analysis is a very popular method of collecting environmental information from relevant reports. Given that China’s listed companies are all required to disclose their annual social responsibility reports, this study adopts the method of text analysis to measure the quality of enterprise EID (Chen et al., 2018; Xu et al., 2020).

Specifically, the quality of corporate’s environmental information disclosure is measured by the number of items of environmental information disclosed in the corporate social responsibility report. First, we download the statistical table of the listed companies’ social responsibility reports from the CSMAR database. Second, we select environment and sustainable development information from the statistical table. Third, we calculate the number of environment and sustainable development information disclosed by each company every year.

Model Design

To test whether selective EID impacts companies’ stock price crash risk, this study builds the following econometric model referring to Defond et al. (2015):

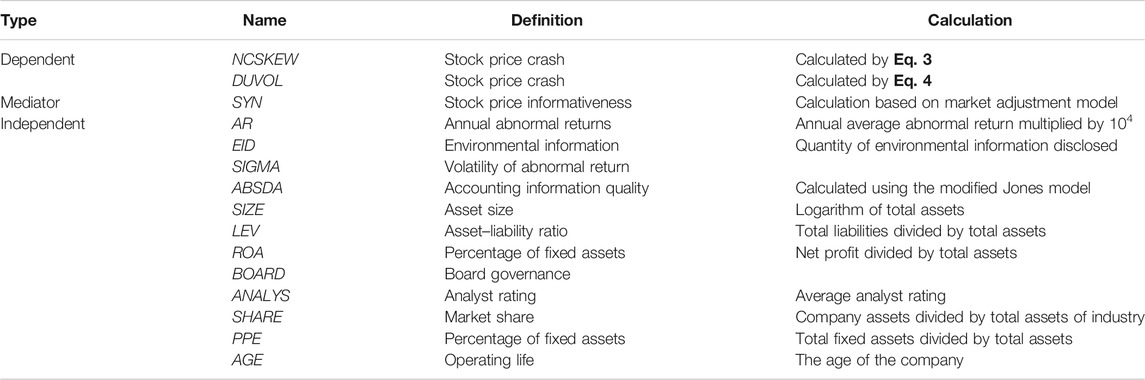

In Eq. 5, NCSKEW and DUVOL are the indicators for stock price crash risk (Chen et al., 2001; Hutton et al., 2009; Defond et al., 2015). EID is an indicator for the company’s environmental information disclosure, and ρ is the impact of EID on the stock price crash risk. CVs represents the control variables, including the average analyst’s rating (ANALYS), annual average abnormal return (AR), volatility of abnormal returns (SIGMA), fixed assets proportion (PPE), logarithm of total assets (SIZE),the leverage ratio (LEV), accounting information quality (ABSDA), enterprise age (AGE), board size (BOARD), and return on total assets (ROA). Here, η represents the dummy variable of the year, μ represents the dummy variable of the province, and φ represents the dummy variable of the industry, controlling the year effect, province effect, and industry effect, respectively. Table 1 provides definitions of variables in this study.

Description of Samples and Variables

With the remarkable economic growth in the past 4 decades, China is currently facing various serious environmental problems (Zeng et al., 2010; Peng et al., 2018). In order to cope with these severe environmental problems, the Chinese government is increasingly emphasizing green development and striving to achieve a win-win situation between economic growth and environmental protection (Wang et al., 2015). Regulators are aware of the importance of corporate environmental information disclosure (EID) (Zhang et al., 2016a), which has been practiced as an important measure of environmental regulations in China (Clarkson et al., 2008).

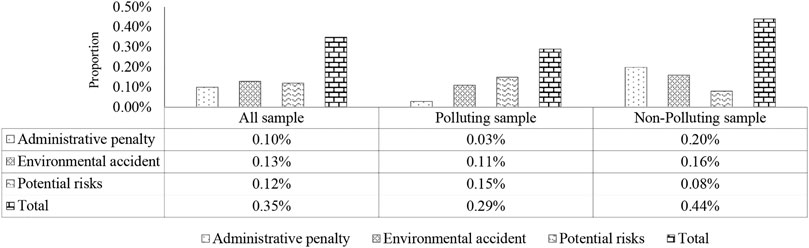

Due to the incompleteness of EID policy, China’s listed companies are encouraged to disclose their environmental contributions, rather than environmental threats such as environmental accidents or risks (Zhang et al., 2016b). Figure 2 shows the statistical results of environmental responsibility information disclosed by Chinese A-share listed companies from 2007 to 2017. It can be seen that the proportion of negative environmental information disclosed by Chinese listed companies is less than 0.5%.

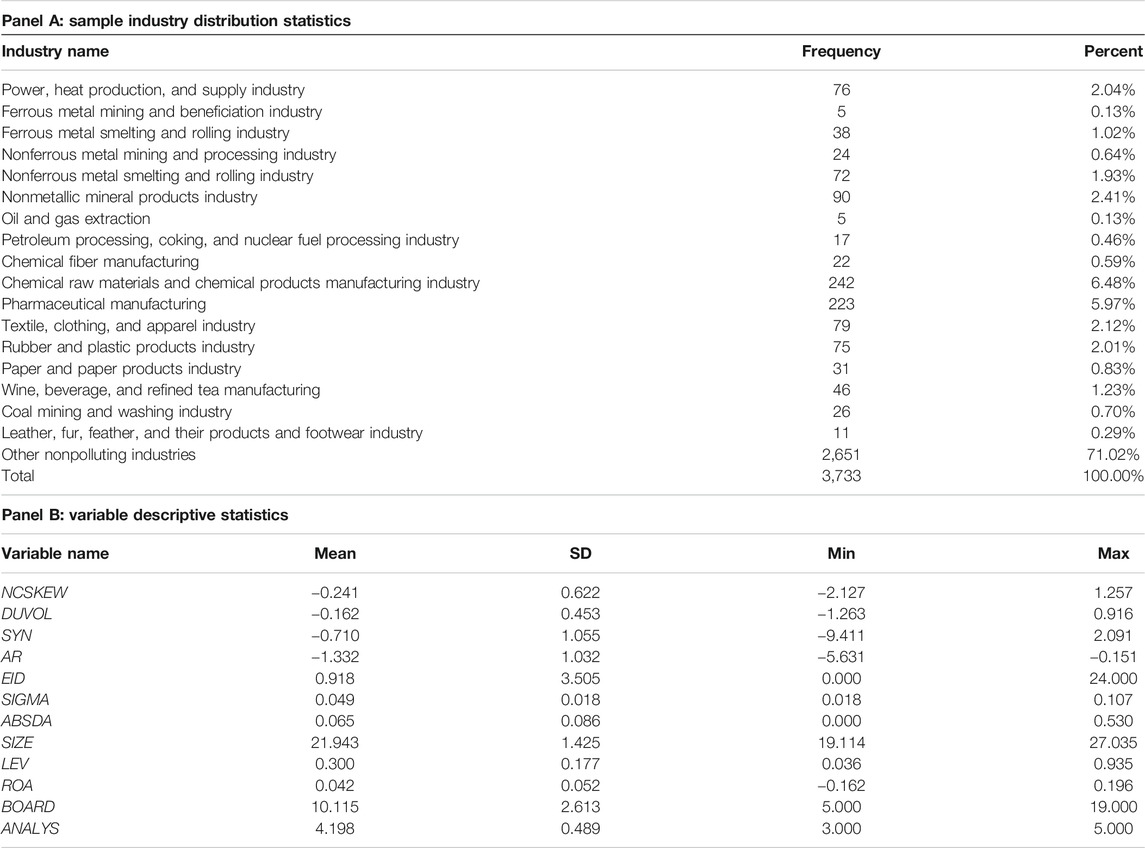

Consequently, this study takes Chinese A-share listed companies from 2007 to 2017 as research samples. Polluting companies are selected as experimental samples, while nonpolluting companies are taken as control samples. Following Chen et al. (2018), companies in the heavy pollution industry are categorized as polluting firms. According to the Guidelines for Environmental Information Disclosure for Listed Companies issued by China’s Ministry of Environmental Protection in 2010, there are 16 heavy pollution industries: electrical power, steel, cement, electrolytic aluminum, coal, metallurgy, building materials, mining, petrochemical, chemicals, pharmaceutical, brewing, paper-making, fermentation, textile, and leather-making. The industry distribution statistics are shown in Panel A of Table 2.

The financial statement information, CSR report information, and stock price information are collected from the CSMAR database. The CSMAR is one of the most authoritative databases of listed companies in China (Chen et al., 2018). Descriptive statistics of variables are shown in Panel B of Table 2.

Empirical Results and Discussions

Benchmark Empirical Results

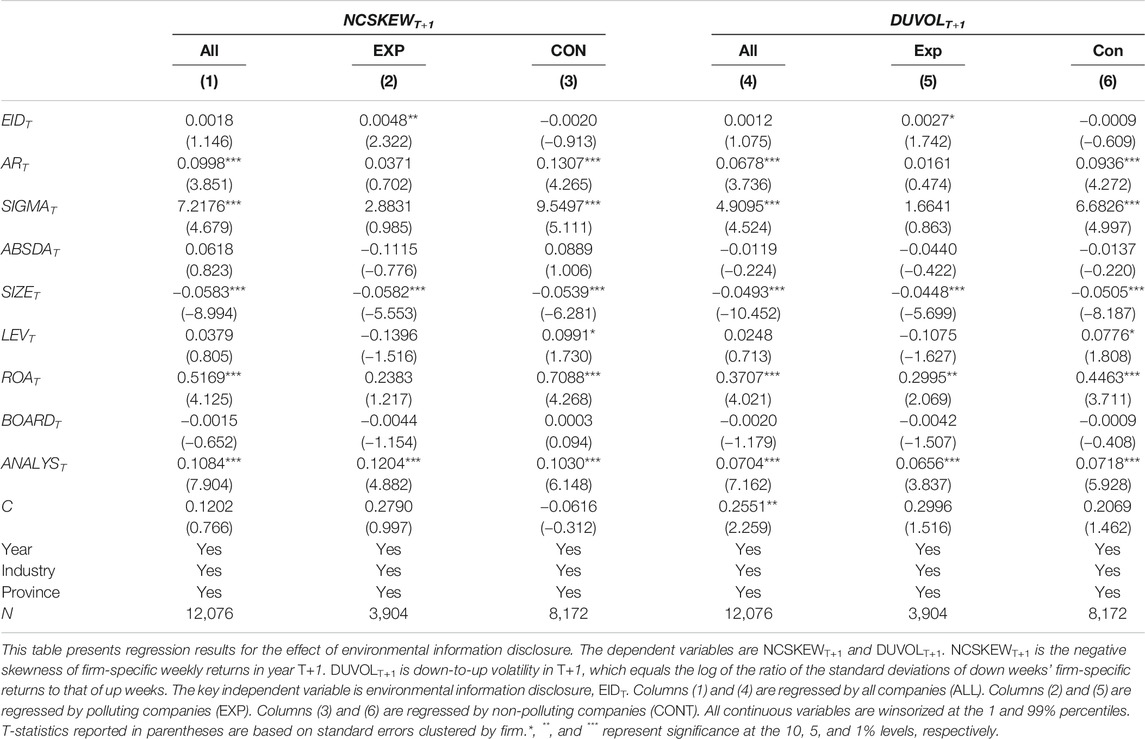

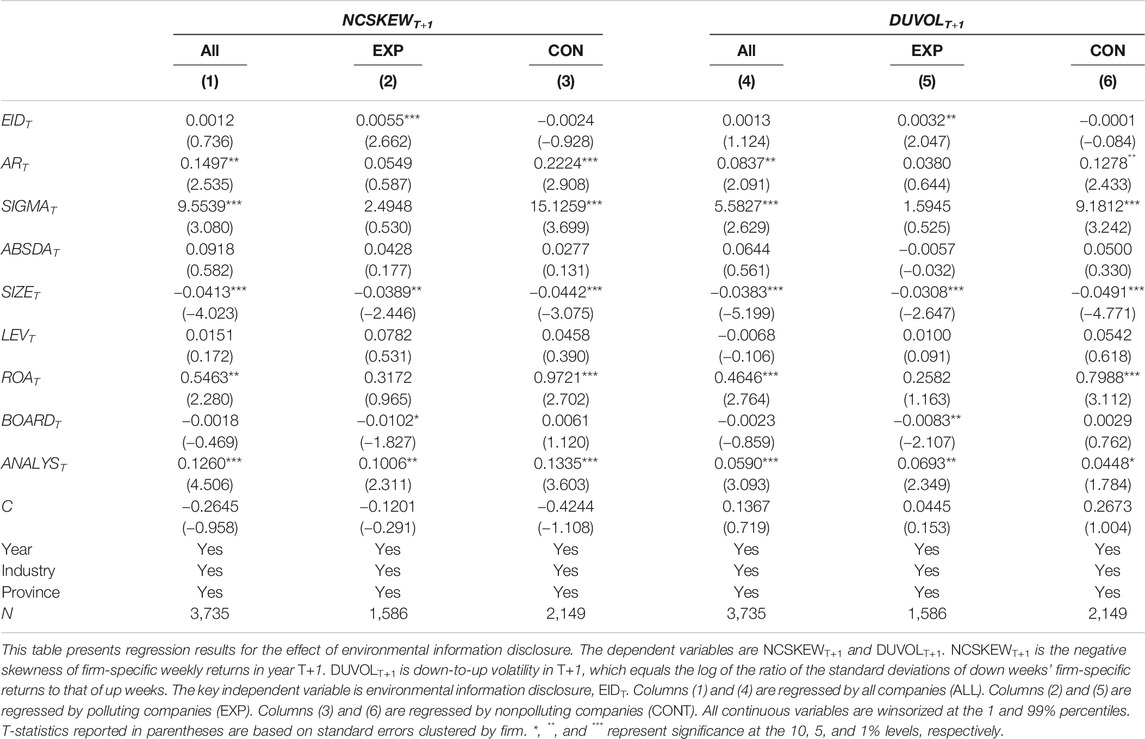

Table 3 presents the impacts of corporates’ selective EID on the stock price crash risk, with NCSKEWT+1 and DUVOLT+1 as the dependent variables, respectively. For all samples, the parameter estimations of EID in Columns (1) and (4) are positive but not statistically significant at the 10% level. Furthermore, the samples are divided into polluting companies (EXP) and nonpolluting companies (CON). For polluting companies, the regression coefficients of EID in Columns (2) and (5) are both positive and statistically significant. In contrast, for nonpolluting companies, the regression coefficients of EID are negative but not statistically significant at the 10% level. It can be concluded that corporate’s selective EID can significantly increase the stock price crash risk of polluting companies (H1b).

The results indicate that the quality of EID of Chinese enterprises is low. Companies disclose especially favorable environmental information and hardly disclose problematic (i.e., accidents and emissions above standards) and quantitative data (Zhang et al., 2016a). According to Liu and Anbumozhi (2009) and Zeng et al. (2010), nearly 40% of the sampled companies in China disclosed no substantial environmental information; they are selectively disclosing their environmental information. Polluting companies often use “public security and economic security” as arguments for continuing confidentiality of environmental information (He et al., 2014), which goes against the authenticity and integrity of the disclosure and finally increases the stock price crash risk.

Regarding the control variables, stock price crash risk is positively correlated with annual average abnormal returns (ARt), volatility of abnormal returns (SIGMAt), return on total assets (ROAt), and average analysts’ ratings (ANALYSt). On the contrary, it is negatively correlated with the logarithm of total assets (SIZEt). It suggests that firms with higher returns, greater volatility, higher analyst rating, and smaller size are more likely to be crash-prone (Chen et al., 2019).

Subsample Analyses

The management’s ability to hide bad news is limited (Jin and Myers, 2006; Hutton et al., 2009). The more bad news is hidden, the greater the risk of stock price crash (Kim et al., 2016). Therefore, this part further discusses the impact of information efficiency, ownership, inefficient investment, and marketization for enterprises, which may influence the ability of management to hide bad news.

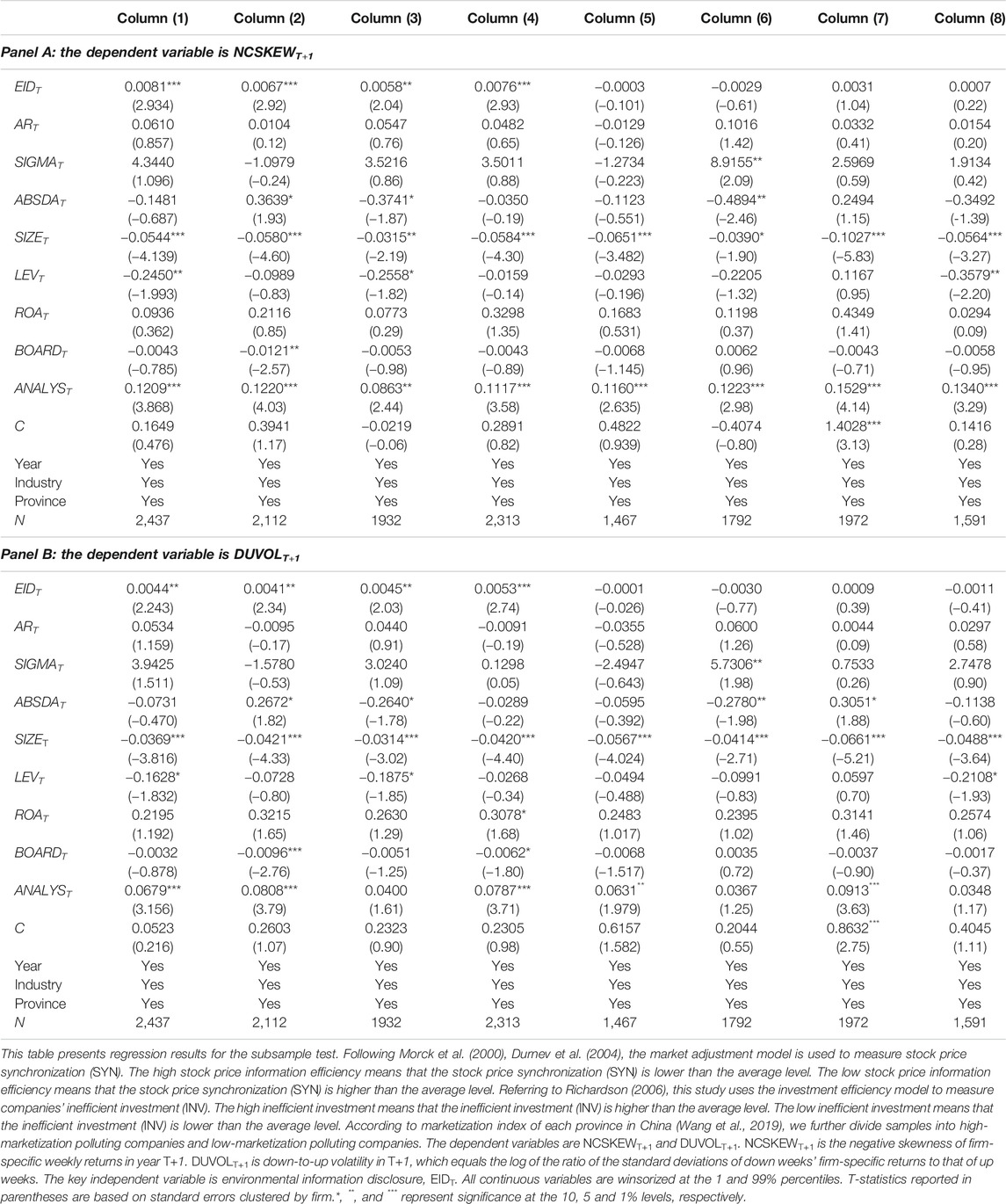

The empirical results are reported in Table 4. The samples in Columns (1–4) are low–information efficiency polluting companies, state-owned polluting companies, high–inefficient investment polluting companies, and polluting companies in low marketization areas, respectively. The samples in Columns (5–8) are high–information efficiency polluting companies, non–state-owned polluting companies, low–inefficient investment polluting companies, and polluting companies in high marketization areas, respectively.

It can be seen that environmental information disclosure (EID) of low–information efficiency polluting companies, state-owned polluting companies, high–inefficient investment polluting companies, and polluting companies in low-marketization areas will significantly increase their stock price crash risk [Columns (1–4)], while the regression results of other polluting companies are not statistically significant [Columns (5–8)]. It suggests that the stock price information efficiency will reduce the ability of the management to conceal bad news, thus reducing the risk of stock price crash triggered by selective environmental information disclosure (Jin and Myers, 2006; Jin et al., 2016). But the state-owned companies, inefficient investment companies, and the companies in lower marketization areas are more likely to report an artificially “green” environment (Zeng et al., 2010; Kim et al., 2016; Habib and Hasan, 2017; Zhou et al., 2019), which results in a higher stock price crash risk.

Further Analyses

In this section, we try to further probe the inner mechanism by which corporate’s selective EID impacts its risk of stock price crash. Due to the selectivity of information disclosure, EID cannot improve the informativeness of stock prices, which ultimately reduces the information efficiency of the capital market. Therefore, we further constructed the following models:

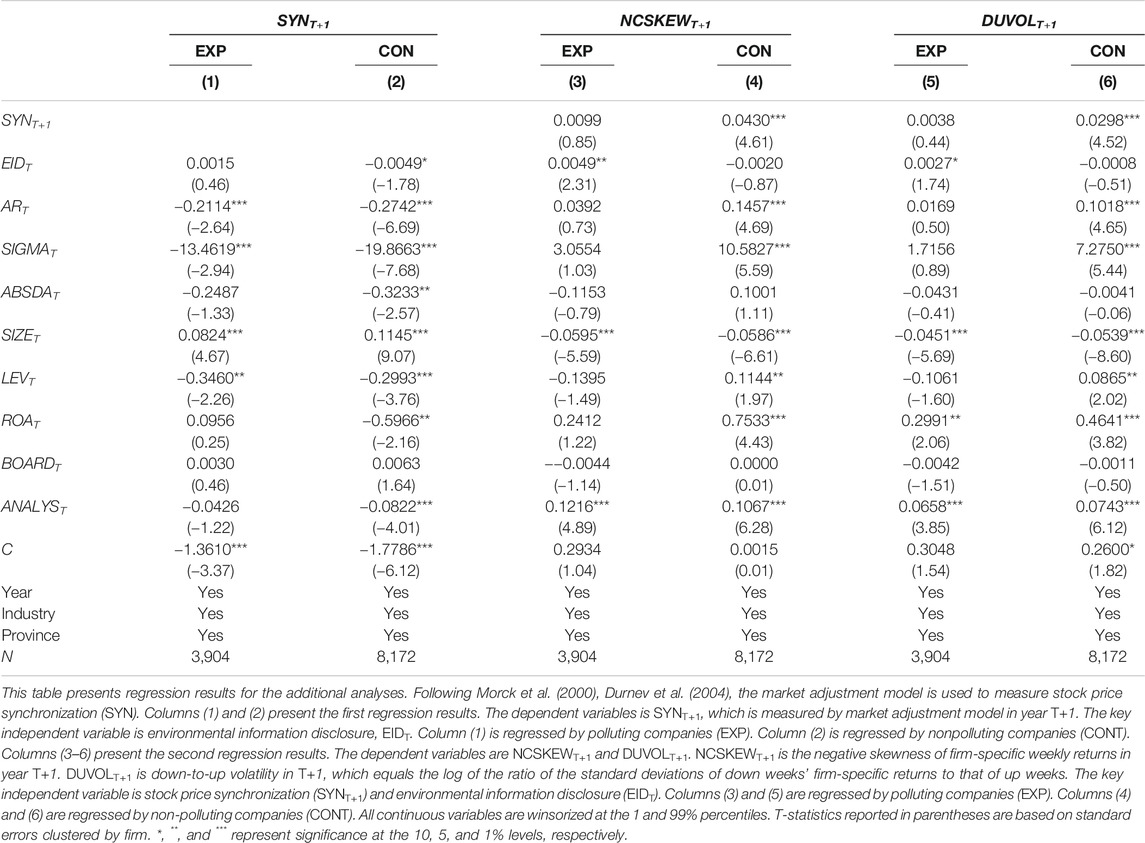

In Eqs 6, 7, SYN is companies’ stock price synchronization, which indicates the stock price information efficiency (Morck et al., 2000; Durnev et al., 2004). If the coefficients κ and π are significantly different from 0 at the same time, it means that EID may affect the stock price crash risk by influencing their stock price synchronization. Otherwise, EID cannot affect the stock price crash risk by influencing their stock price synchronization. The empirical results are reported in Table 5.

The results show that there are significant negative impacts of environmental information disclosure (EID) on the stock price synchronization (SYNT+1) within the nonpolluting companies. In contrast, environmental information disclosure (EID) has no significant impact on polluting companies’ stock price synchronization. Furthermore, the results show that stock price synchronization (SYNT+1) will only significantly increase the nonpolluting companies’ stock price crash risk.

Overall, it can be seen that EID of polluting companies in China cannot reduce their stock price crash risk by reducing their stock price synchronization (H2b). This confirms that the selective disclosure of environmental information of China’s polluting listed companies is useless.

Robustness Tests

In this section, we use the disclosure-scoring method to measure the EID quality of the listed companies for robustness test (Altuwaijri et al., 2004; Plumlee et al., 2015). The disclosure-scoring rules are as follows: one point for text description, two points for simple quantified information, and three points for detailed quantification. By identifying the contents of environmental information disclosure item by item, the environmental information disclosure score (EIDS) of the listed companies is further calculated.

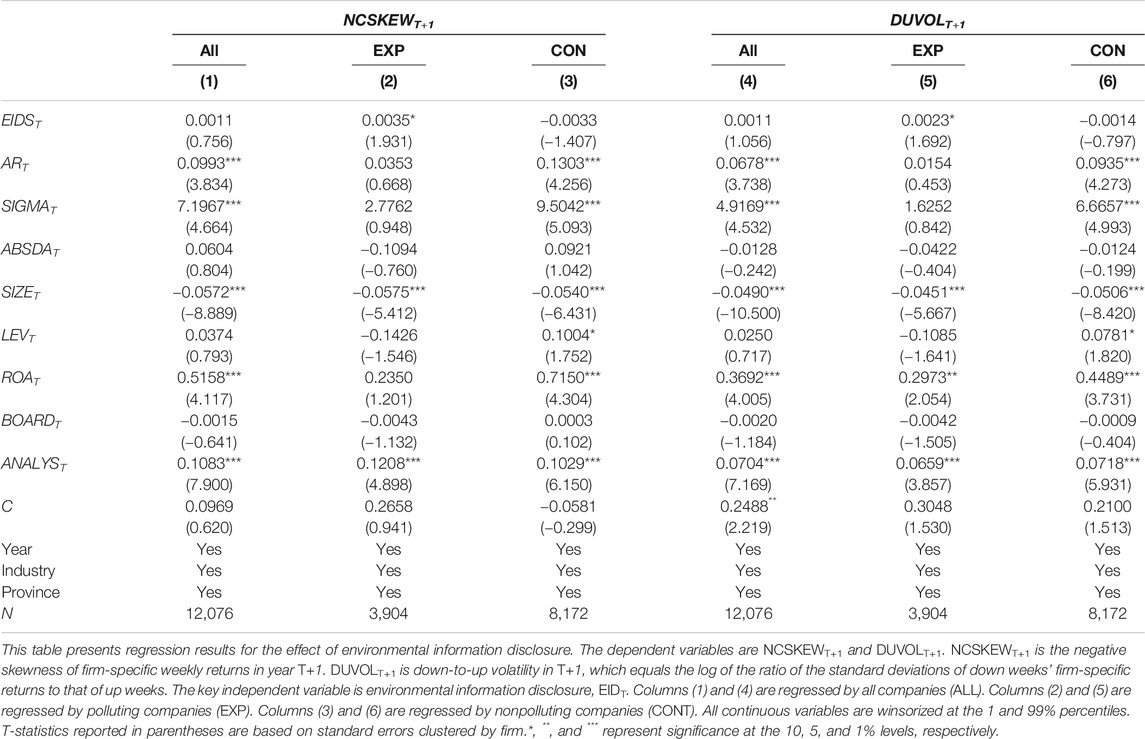

Table 6 presents the impact of EIDS on the stock price crash risk, with NCSKEWT+1 and DUVOLT+1 as dependent variables, respectively. The results are similar to those in Table 3. For all companies [Columns (1) and (4)], the coefficients on EIDS are positive but not statistically significant at the 10% level. For polluting companies [Columns (2) and (5)], the coefficients on EIDS are positive, with the statistical significance at the 10% level. For nonpolluting companies [Columns (3) and (6)], the coefficients on EID are negative but not statistically significant at the 10% level. It is further confirmed that the environmental information disclosure of Chinese polluting enterprises will increase their stock price crash risk.

Companies are not forced to disclose environmental information in China, so there may be selective bias between companies that disclose environmental information and companies that do not. For this reason, we further adopt the PSM method for robustness test. The steps are as follows: first, whether a listed company discloses at least one piece of environmental information is taken as the selection variable, and the Probit model is used to calculate the possibility score of environmental information disclosure of the listed companies. Then, the experimental group and the control group are matched using the 1:1 proximity principle to obtain the final matching sample.

Table 7 presents the PSM test of EID on the stock price crash risk, with NCSKEWT+1 and DUVOLT+1 as dependent variables, respectively. The results are similar to those in Table 3. For all companies [Columns (1) and (4)], the coefficients on EID are positive but not statistically significant at the 10% level. For polluting companies [Columns (2) and (5)], the coefficients on EID are all positive, with statistical significance at the 1% level. For nonpolluting companies [Columns (3) and (6)], the coefficients on EID are negative but not statistically significant at the 10% level. It is further confirmed that the environmental information disclosure of Chinese polluting enterprises will increase their stock price crash risk.

Conclusion and Implications

Environmental information disclosure has become an important environmental regulation which requires companies to disclose complete environmental information so as to reduce information asymmetry. It is a key measure to improve the effectiveness of environmental governance. However, there is a selective space for enterprises to disclose their environmental information. The managers can choose to disclose the environmental contributions of a company and meanwhile hide the environmental threats. This study sheds some light on the effects of selective environmental information disclosure on the efficiency of China’s stock market.

The study has drawn three main conclusions: first, the environmental information disclosed by China’s polluting companies cannot reduce their stock price crash risk but instead increases it. Second, the environmental information disclosed by the polluting companies with high information efficiency, high inefficient investment, high degree of government control, and low degree of marketization is more likely to increase the risk of stock price crash. Third, the environmental information disclosed by China’s polluting companies cannot reduce their stock price crash risk by reducing their stock price synchronicity.

These findings suggest that there is a need to reassess the regulation designs of environmental information disclosure in China. Inappropriate environmental information disclosure policies not only fail to deliver useful information to the market but may also be used by enterprises with ulterior motives to exaggerate their contribution to the environment (Altuwaijri et al., 2004). As a result, the allocation of resources in capital markets is distorted, and the risk of stock price crash is heightened.

For regulators, they should improve the regulation of environmental information disclosure, which will bring great external regulatory pressure to enterprises. Strengthening the effective implementation of environmental protection policies can force enterprises to disclose high-quality environmental information (Zhang et al., 2016a).

For the management, they should fulfill the responsibility of environmental protection and play their governance role of environmental information disclosure. The board of directors and the legal committee shall strengthen their supervisory role in the disclosure of environmental information and enhance their consciousness in the disclosure of environmental information.

For investors, they should correctly evaluate the environmental information disclosure of enterprises and avoid overreacting to negative environmental information, which will hinder the disclosure of environmental threats by enterprises. The capital market should guide enterprises to correctly fulfill the responsibility of environmental information disclosure.

This article further reveals the consequences of selective environmental information disclosure by enterprises. Further research can be conducted on how to improve the quality of environmental information disclosure. For example, consider building effective environmental information disclosure policies to guide enterprises to disclose high-quality environmental information and reduce the discretionary power of enterprises to disclose selective environmental information.

Data Availability Statement

The original contributions presented in the study are included in the article/Supplementary Material; further inquiries can be directed to the corresponding author.

Author Contributions

FX: methodology, visualization, and writing—original draft. QJ: software, data curation, and writing—original draft. MY: investigation, supervision, validation, and writing—review and editing.

Funding

Financial supports from the National Natural Science Foundation of China (Grant Nos. 71903002, 72073105, 71774122, and 718740642) and the Natural Science Foundation of Anhui Province (Grant No. 1908085QG309) are greatly acknowledged.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

References

Abdullah, M., Hamzah, N., Ali, M. H., Tseng, M.-L., and Brander, M. (2020). The Southeast Asian Haze: The Quality of Environmental Disclosures and Firm Performance. J. Clean. Prod. 246 (10), 118958. doi:10.1016/j.jclepro.2019.118958

Al-Tuwaijri, S. A., Christensen, T. E., and Hughes, K. E. (2004). The Relations Among Environmental Disclosure, Environmental Performance, and Economic Performance: A Simultaneous Equations Approach. Account. Organizations Soc. 29 (5), 447–471. doi:10.1016/s0361-3682(03)00032-1

Aragón-Correa, J. A., Marcus, A., and Hurtado-Torres, N. (2016). The Natural Environmental Strategies of International Firms: Old Controversies and New Evidence on Performance and Disclosure. Amp 30 (1), 24–39. doi:10.5465/amp.2014.0043

Ashbaugh-Skaife, H., Collins, D. W., and Lafond, R. (2010). The Effect of SOX Internal Control Deficiencies on Firm Risk and Cost of Equity. J. Account. Res. 47 (1), 1–43. doi:10.1111/j.1475-679X.2008.00315.x

Benmelech, E., Kandel, E., and Veronesi, P. (2010). Stock-Based Compensation and CEO (Dis)Incentives. Q. J. Econ. 125 (4), 1769–1820. doi:10.1162/qjec.2010.125.4.1769

Black, F. (1976). “Stuedies of Stock price Volatility Changes,” in Proceedings of the 1976 Meetings of the American Statistical Association, Business and Economics Section, 177–181.

Bromley, P., and Powell, W. W. (2012). From Smoke and Mirrors to Walking the Talk: Decoupling in the Contemporary World. Acad. Manag. Ann. 6 (1), 483–530. doi:10.1080/19416520.2012.684462

Cai, G., Xu, Y., Yu, D., Zhang, J., and Zheng, G. (2019). Strengthened Board Monitoring from Parent Company and Stock price Crash Risk of Subsidiary Firms. Pacific-basin Finance J. 56 (6), 352–368. doi:10.1016/j.pacfin.2019.06.009

Chang, Y., Du, X., and Zeng, Q. (2020). Does Environmental Information Disclosure Mitigate Corporate Risk? Evidence from China. J. Contemp. Account. Econ. 17 (1), 100239. doi:10.1016/j.jcae.2020.100239

Chen, J., Hong, H., and Stein, J. C. (2001). Forecasting Crashes: Trading Volume, Past Returns, and Conditional Skewness in Stock Prices. J. Financial Econ. 61 (3), 345–381. doi:10.1016/s0304-405x(01)00066-6

Chen, J., Tong, J. Y., Wang, W., and Zhang, F. (2019). The Economic Consequences of Labor Unionization: Evidence from Stock price Crash Risk. J. Bus Ethics 157 (3), 775–796. doi:10.1007/s10551-017-3686-0

Chen, Y.-C., Hung, M., and Wang, Y. (2018). The Effect of Mandatory CSR Disclosure on Firm Profitability and Social Externalities: Evidence from China. J. Account. Econ. 65 (1), 169–190. doi:10.1016/j.jacceco.2017.11.009

Clarkson, P. M., Li, Y., Richardson, G. D., and Vasvari, F. P. (2008). Revisiting the Relation between Environmental Performance and Environmental Disclosure: An Empirical Analysis. Account. Organizations Soc. 33 (4), 303–327. doi:10.1016/j.aos.2007.05.003

Dai, J., Lu, C., Yang, Y., and Zheng, Y. (2018). Is the Social Responsibility Information Disclosed by the Companies Really Valuable?—Evidence from Chinese Stock price Synchronicity. Sustainability 10 (10), 1–22. doi:10.3390/su10103578

Defond, M. L., Hung, M., Li, S., and Li, Y. (2015). Does Mandatory IFRS Adoption Affect Crash Risk? Account. Rev. 90 (1), 265–299. doi:10.2308/accr-50859

Dejan, L., Jane, P., Violeta, J., and Vesna, K. (2019). Environmental and Social Responsibility of Companies Cross EU Contries-Panel Data Analysis. Sci. Total Environ. 657 (20), 287–296. doi:10.1016/j.scitotenv.2018.11.482

Dhaliwal, D. S., Li, O. Z., Tsang, A., and Yang, Y. G. (2011). Voluntary Nonfinancial Disclosure and the Cost of Equity Capital: The Initiation of Corporate Social Responsibility Reporting. Account. Rev. 86 (1), 59–100. doi:10.2308/accr.00000005

Didar, H., Abdi, S., and Mostafazade, V. (2018). Voluntary Disclosure and Informational Content of Share price: Evidence from Tehran Stock Exchange. Iranian J. Manag. Stud. 11 (1), 185–208. doi:10.22059/IJMS.2018.238032.672751

Du, X. (2018). A Tale of Two Segmented Markets in China: The Informative Value of Corporate Environmental Information Disclosure for Foreign Investors. Int. J. Account. 53 (2), 136–159. doi:10.1016/j.intacc.2018.05.001

Durnev, A., Morck, R., and Yeung, B. (2004). Value-Enhancing Capital Budgeting and Firm-specific Stock Return Variation. J. Finance 59 (1), 65–105. doi:10.1111/j.1540-6261.2004.00627.x

Farooq, O., and Hamouda, M. (2016). Stock price Synchronicity and Information Disclosure: Evidence from an Emerging Market. Finance Res. Lett. 18 (8), 250–254. doi:10.1016/j.frl.2016.04.024

Fisman, R., and Wang, Y. (2015). The Mortality Cost of Political Connections. Rev. Econ. Stud. 82 (4), 1346–1382. doi:10.1093/restud/rdv020

Fonseka, M., Rajapakse, T., and Richardson, G. (2019). The Effect of Environmental Information Disclosure and Energy Product Type on the Cost of Debt: Evidence from Energy Firms in China. Pacific-Basin Finance J. 54 (4), 159–182. doi:10.1016/j.pacfin.2018.05.001

Gleason, C. A., Ling, Z., and Zhao, R. (2020). Selective Disclosure and the Role of Form 8-K in the post-Reg FD Era. J. Business Finance Account. 47 (3-4), 365–396. doi:10.1111/jbfa.12416

Habib, A., Hasan, M. M., and Jiang, H. (2018). Stock price Crash Risk: Review of the Empirical Literature. Account. Finance 58 (S1), 211–251. doi:10.1111/acfi.12278

Habib, A., and Hasan, M. M. (2017). Managerial Ability, Investment Efficiency and Stock price Crash Risk. Res. Int. Business Finance 42 (12), 262–274. doi:10.1016/j.ribaf.2017.07.048

He, G., Zhang, L., Mol, A. P. J., Wang, T., and Lu, Y. (2014). Why Small and Medium Chemical Companies Continue to Pose Severe Environmental Risks in Rural China. Environ. Pollut. 185 (1), 158–167. doi:10.1016/j.envpol.2013.10.041

Hemingway, C. A., and Maclagan, P. W. (2004). Managers' Personal Values as Drivers of Corporate Social Responsibility. J. Business Ethics 50 (1), 33–44. doi:10.1023/b:busi.0000020964.80208.c9

Heng, A., and Ting, Z. (2011). Crash Risk, and Institutional Investors. J. Corporate Finance 21 (1), 1–15. doi:10.1016/j.jcorpfin.2013.01.001

Huang, W., Jiang, F., Liu, Z., and Zhang, M. (2011). Agency Cost, Top Executives' Overconfidence, and Investment-Cash Flow Sensitivity - Evidence from Listed Companies in China. Pacific-Basin Finance J. 19 (3), 261–277. doi:10.1016/j.pacfin.2010.12.001

Hutton, A. P., Marcus, A. J., and Tehranian, H. (2009). Opaque Financial Reports, R2, and Crash Risk☆. J. Financial Econ. 94 (1), 67–86. doi:10.1016/j.jfineco.2008.10.003

Jenkins, H., and Yakovleva, N. (2006). Corporate Social Responsibility in the Mining Industry: Exploring Trends in Social and Environmental Disclosure. J. Clean. Prod. 14 (3), 271–284. doi:10.1016/j.jclepro.2004.10.004

Jiang, C., Zhang, F. A., and Wu, C. A. (2021). Environmental Information Disclosure, Political Connections and Innovation in High-Polluting Enterprises. Sci. Total Environ. 764 (10), 144248. doi:10.1016/j.scitotenv.2020.144248

Jin, L., and Myers, S. (2006). R2 Around the World: New Theory and New Tests☆. J. Financial Econ. 79 (2), 257–292. doi:10.1016/j.jfineco.2004.11.003

Jin, X., Chen, Z., and Yang, X. (2019). Economic Policy Uncertainty and Stock price Crash Risk. Account. Finance 58 (5), 1291–1318. doi:10.1111/acfi.12455

Jin, Y., Yan, M., Xi, Y., and Liu, C. (2016). Stock price Synchronicity and Stock price Crash Risk. China Finance Rev. Int. 6 (3), 230–244. doi:10.1108/cfri-05-2015-0047

Jung, T., Kim, N. K. W., Kim, Y. J., and Na, H. J. (2019). Bad News Withholding and Stock price Crash Risk of banks. Asia Pac. J. Financ. Stud. 48 (6), 777–807. doi:10.1111/ajfs.12279

Kim, E.-H., and Lyon, T. P. (2011). Strategic Environmental Disclosure: Evidence from the DOE's Voluntary Greenhouse Gas Registry. J. Environ. Econ. Manag. 61 (3), 311–326. doi:10.1016/j.jeem.2010.11.001

Kim, J.-B., Wang, Z., and Zhang, L. (2016). CEO Overconfidence and Stock price Crash Risk. Contemp. Account. Res. 33 (4), 1720–1749. doi:10.1111/1911-3846.12217

Kim, J.-B., and Zhang, L. (2016). Accounting Conservatism and Stock Price Crash Risk: Firm-Level Evidence. Contemp. Account. Res. 33, 412–441. doi:10.1111/1911-3846.12112

Kim, Y., Li, H., and Li, S. (2014). Corporate Social Responsibility and Stock price Crash Risk. J. Banking Finance 43 (6), 1–13. doi:10.1016/j.jbankfin.2014.02.013

King, B. G. (2008). A Political Mediation Model of Corporate Response to Social Movement Activism. Administrative Sci. Q. 53 (3), 395–421. doi:10.2189/asqu.53.3.395

Lev, B., Petrovits, C., and Radhakrishnan, S. (2010). Is Doing Good Good for You? How Corporate Charitable Contributions Enhance Revenue Growth. Strateg. Manag. J. 31 (2), 182–200. doi:10.1002/smj.810

Li, Y., Zhang, X., Yao, T., Sake, A., Liu, X., and Peng, N. (2021). The Developing Trends and Driving Factors of Environmental Information Disclosure in China. J. Environ. Manage. 288 (2), 112386. doi:10.1016/j.jenvman.2021.112386

Liu, X., and Anbumozhi, V. (2009). Determinant Factors of Corporate Environmental Information Disclosure: an Empirical Study of Chinese Listed Companies. J. Clean. Prod. 17, 593–600. doi:10.1016/j.jclepro.2008.10.001

Luo, J., Meier, S., and Oberholzer-Gee, F. (2012). No News Is Good News: CSR Strategy and Newspaper Coverage of Negative Firm Events. Cambridge: Harvard Business School Working Paper.

Lyon, T. P., and Maxwell, J. W. (2011). Greenwash: Corporate Environmental Disclosure under Threat of Audit. J. Econ. Manag. Strategy 20 (1), 3–41. doi:10.1111/j.1530-9134.2010.00282.x

Marquis, C., Toffel, M. W., and Zhou, Y. (2016). Scrutiny, Norms, and Selective Disclosure: A Global Study of Greenwashing. Organ. Sci. 27 (2), 483–504. doi:10.1287/orsc.2015.1039

Martínez-Ferrero, J., Ruiz-Cano, D., and García-Sánchez, I.-M. (2016). The Causal Link between Sustainable Disclosure and Information Asymmetry: The Moderating Role of the Stakeholder protection Context. Corp. Soc. Responsib. Environ. Mgmt. 23 (5), 319–332. doi:10.1002/csr.1379

Martins, A., and Gomes, D. (2021). Managing Social and Environmental Accountability: An Impression Management Perspective. Sustainability 13, 296. doi:10.3390/su13010296

Meng, X. H., Zeng, S. X., and Tam, C. M. (2013). From Voluntarism to Regulation: a Study on Ownership, Economic Performance and Corporate Environmental Information Disclosure in China. J. Bus Ethics 116 (1), 217–232. doi:10.1007/s10551-012-1462-8

Merkl-Davies, D. M., and Brennan, N. M. (2007). Discretionary Disclosure Strategies in Corporate Narratives: Incremental Information or Impression Management? J. Account. Lit. 26, 116–194.

Morck, R., Yeung, B., and Yu, W. (2000). The Information Content of Stock Markets: Why Do Emerging Markets Have Synchronous Stock price Movements?. J. Financial Econ. 58 (1), 215–260. doi:10.1016/s0304-405x(00)00071-4

Neu, D., Warsame, H., and Pedwell, K. (1998). Managing Public Impressions: Environmental Disclosures in Annual Reports. Account. Organizations Soc. 23 (3), 265–282. doi:10.1016/s0361-3682(97)00008-1

Ni, J. (2016). Environmental Information Disclosure Quality and Bank Credit Decisions: Evidence from the Listed Heavy Polluting Industries of A-Shares in Shanghai Stock Market and Shenzhen Stock Market. Collected Essays Finance Econ. 231 (3), 37–45. in Chinese.

Nor, N. M., Bahari, N. A. S., Adnan, N. A., Kamal, S. M. Q. A. S., and Ali, I. M. (2016). The Effects of Environmental Disclosure on Financial Performance in Malaysia. Proced. Econ. Finance 35 (35), 117–126. doi:10.1016/s2212-5671(16)00016-2

Peng, B., Tu, Y., Elahi, E., and Wei, G. (2018). Extended Producer Responsibility and Corporate Performance: Effects of Environmental Regulation and Environmental Strategy. J. Environ. Manage. 218 (4), 181–189. doi:10.1016/j.jenvman.2018.04.068

Petrovits, C. M. (2006). Corporate-sponsored Foundations and Earnings Management. J. Account. Econ. 41 (3), 335–362. doi:10.1016/j.jacceco.2005.12.001

Plumlee, M., Brown, D., Hayes, R. M., and Marshall, R. S. (2015). Voluntary Environmental Disclosure Quality and Firm Value: Further Evidence. J. Account. Public Pol. 34 (4), 336–361. doi:10.1016/j.jaccpubpol.2015.04.004

Prior, D., Surroca, J., and Tribó, J. A. (2008). Are Socially Responsible Managers Really Ethical? Exploring the Relationship between Earnings Management and Corporate Social Responsibility. Corporate Governance 16 (3), 160–177. doi:10.1111/j.1467-8683.2008.00678.x

Qiu, Y., Shaukat, A., and Tharyan, R. (2016). Environmental and Social Disclosures: Link with Corporate Financial Performance. Br. Account. Rev. 48 (1), 102–116. doi:10.1016/j.bar.2014.10.007

Richardson, S. (2006). Over-Investment of Free Cash Flow. Rev. Acc. Stud. 11 (2), 159–189. doi:10.1007/s11142-006-9012-1

Shi, X., and Xu, Z. (2018). Environmental Regulation and Firm Exports: Evidence from the Eleventh Five-Year Plan in China. J. Environ. Econ. Manag. 89 (3), 187–200. doi:10.1016/j.jeem.2018.03.003

Si, L., and Zhan, X. (2019). Product Market Threats and Stock Crash Risk. Manag. Sci. 65 (9), 4011–4031. doi:10.1287/mnsc.2017.3016

Song, L. (2015). Accounting Disclosure, Stock price Synchronicity and Stock Crash Risk. Int. J. Acc. Info Manag. 23 (4), 349–363. doi:10.1108/ijaim-02-2015-0007

Trumpp, C., Endrikat, J., Zopf, C., and Guenther, E. (2015). Definition, Conceptualization, and Measurement of Corporate Environmental Performance: a Critical Examination of a Multidimensional Construct. J. Bus Ethics 126 (2), 185–204. doi:10.1007/s10551-013-1931-8

Wang, Q., Zhao, Z., Shen, N., and Liu, T. (2015). Have Chinese Cities Achieved the Win-Win between Environmental protection and Economic Development? from the Perspective of Environmental Efficiency. Ecol. Indicators 51 (7), 151–158. doi:10.1016/j.ecolind.2014.07.022

Wang, S., Wang, H., Wang, J., and Yang, F. (2020). Does Environmental Information Disclosure Contribute to Improve Firm Financial Performance? an Examination of the Underlying Mechanism. Sci. Total Environ. 714 (20), 136855. doi:10.1016/j.scitotenv.2020.136855

Wang, X. L., Fan, G., and Hu, L. P. (2019). Marketization index of China’s Provinces: Neri Report 2018. Beijing: Economy Science Press.

Wu, C.-M., and Hu, J.-L. (2019). Can CSR Reduce Stock price Crash Risk? Evidence from China's Energy Industry. Energy Policy 128 (5), 505–518. doi:10.1016/j.enpol.2019.01.026

Wu, H. J., Liu, Q. R., and Wu, S. N. (2017). Corporate Environmental Disclosure and Financing Constraints. J. Word Econ. 40 (05), 124–147.

Wurgler, J. (2000). Financial Markets and the Allocation of Capital. J. Financial Econ. 58 (1-2), 187–214. doi:10.1016/s0304-405x(00)00070-2

Xu, F., Yang, M., Li, Q., and Yang, X. (2020). Long-term Economic Consequences of Corporate Environmental Responsibility: Evidence from Heavily Polluting Listed Companies in China. Business Strategy Environ. 29 (3), 1–15. doi:10.1002/bse.2500

Xu, Y., Xuan, Y., and Zheng, G. (2021). Internet Searching and Stock price Crash Risk: Evidence from a Quasi-Natural experiment. J. Financial Econ. in press. doi:10.1016/j.jfineco.2021.03.003

Yan, Y.-H., Kung, C.-M., Fang, S.-C., and Chen, Y. (2017). Transparency of Mandatory Information Disclosure and Concerns of Health Services Providers and Consumers. Ijerph 14 (1), 53–64. doi:10.3390/ijerph14010053

Zeira, J. (1999). Informational Overshooting, Booms, and Crashes. J. Monetary Econ. 43 (1), 237–257. doi:10.1016/s0304-3932(98)00042-7

Zeng, S. X., Xu, X. D., Dong, Z. Y., and Tam, V. W. Y. (2010). Towards Corporate Environmental Information Disclosure: An Empirical Study in China. J. Clean. Prod. 18 (12), 1142–1148. doi:10.1016/j.jclepro.2010.04.005

Zhang, L., Mol, A. P., and He, G. (2016a). Transparency and Information Disclosure in China’s Environmental Governance. Curr. Opin. Environ. Sustainability 18 (2), 17–24. doi:10.1016/j.cosust.2015.03.009

Zhang, M., Xie, L., and Xu, H. (2016b). Corporate Philanthropy and Stock price Crash Risk: Evidence from China. J. Bus Ethics 139 (3), 595–617. doi:10.1007/s10551-015-2647-8

Zhou, D., Zhao, Y., Lin, P. T., Li, B., and Cheung, A. (2019). Can Microblogging Information Disclosure Reduce Stock price Synchronicity? Evidence from China. Aust. J. Manag. 44 (2), 282–305. doi:10.1177/0312896218796884

Zhu, W. (2016). Accruals and price Crashes. Rev. Account. Stud. 21 (2), 349–399. doi:10.1007/s11142-016-9355-1

Keywords: selective environmental disclosure, stock price crash risk, polluting listed companies, corporate social responsibility, stock price synchronization

Citation: Xu F, Ji Q and Yang M (2021) The Pitfall of Selective Environmental Information Disclosure on Stock Price Crash Risk: Evidence From Polluting Listed Companies in China. Front. Environ. Sci. 9:622345. doi: 10.3389/fenvs.2021.622345

Received: 28 October 2020; Accepted: 11 May 2021;

Published: 16 June 2021.

Edited by:

Alex Oriel Godoy, Universidad del Desarrollo, ChileReviewed by:

Jens Rommel, Swedish University of Agricultural Sciences, SwedenSevda Kuşkaya, Erciyes University, Turkey

Copyright © 2021 Xu, Ji and Yang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Mian Yang, yangmian909@163.com

Fei Xu

Fei Xu