94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Econ. , 08 January 2025

Sec. Energy Economics

Volume 3 - 2024 | https://doi.org/10.3389/frevc.2024.1486650

Introduction: This study investigates the role of geographic proximity to local environmental protection agencies (EPAs) in enhancing firms' energy efficiency. It explores how environmental pressure and green innovation are influenced by spatial dynamics, providing new insights into the Porter hypothesis.

Methods: The analysis utilizes energy consumption and geographic data from Chinese industrial firms. A combination of statistical and econometric methods is employed to evaluate the relationship between proximity to EPAs and energy efficiency, including heterogeneity analysis across firm ownership types.

Results: The findings reveal that firms located closer to EPAs exhibit higher energy efficiency, primarily due to increased regulatory pressure that fosters green innovation. This positive effect is most pronounced within a 60 km radius, diminishing beyond this range. Heterogeneity analysis indicates stronger effects for private and mixed-ownership firms compared to state-owned and multinational firms.

Discussion: The study underscores the nuanced interplay between geographic proximity, regulatory frameworks, and green innovation. It highlights how targeted environmental policies can drive corporate energy efficiency improvements, offering valuable implications for optimizing regulatory designs.

Improving the efficiency of energy use is not only a key element in achieving sustainable economic growth, but also a strategic approach to mitigating the effects of global climate change (Della Valle and Bertoldi, 2022). Amidst the escalating energy demand for energy and the worsening problems of environmental pollution and climate change, the efficient use of energy resources, the minimization of energy waste, and the reduction of greenhouse gas emissions have become the focus of international attention (Coyle and Simmons, 2014). In this milieu, enterprises, as significant energy consumers and key actors in economic activities, play a crucial role in promoting the global energy transition and environmental protection. By improving their energy use efficiency, companies can not only reduce production costs and strengthen their market competitiveness, but also make a significant contribution to the societal goals of energy conservation and emissions reduction (Pan et al., 2020). However, achieving these goals presents a range of challenges that require technological innovation, improvements of market mechanisms, and the provision of effective policy support and regulatory frameworks (Coyle and Simmons, 2014; Wang et al., 2021; Zahraoui et al., 2023; Safarzadeh et al., 2020). Government policies and regulatory initiatives are crucial in guiding firms toward more efficient production modalities and catalyzing the greening of the entire sector. Therefore, this study is focuses on examining the influence of the geographical distance between firms and government agencies on firms' energy efficiency, and the role that government regulation and green innovation play in this dynamic.

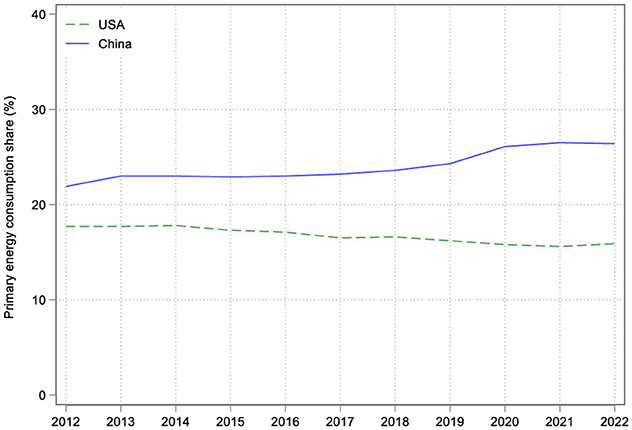

As the world's preeminent developing country and second largest global economy, China occupies a pivotal position in the international environmental and energy landscape. As shown in Figure 1, China's primary energy consumption shows a significant upward trend, escalating from 117.45 million tons of oil equivalent in 2012 to 159.39 million tons in 2022, securing its top global ranking. In particular, China's share of global primary energy consumption consistently exceeds 20%, with a clear upward trend. In stark contrast, the United States, in second place, shows a declining trend in energy consumption, as shown in Figure 2. In parallel with its rapid economic expansion, China faces many environmental challenges. These include escalating energy consumption, worsening air pollution, and suboptimal energy efficiency. These issues transcend national boundaries and have a profound impact on both global climate dynamics and environmental protection, underscoring the importance of China's role in sustainable development.

Figure 1. China and U.S. shares in global primary energy Consumption (2012–2022). Data from Statistical Review of World Energy (2012–2022).

Figure 2. China's primary energy consumption (2012–2022). Data from Statistical Review of World Energy (2012–2022).

To address these environmental challenges, the Chinese government has enacted a number of legislative measures, most notably the Environmental Protection Law and the Emission Permit System. These initiatives are designed to modulate the operational behavior of companies by establishing strict legal standards and requirements. In particular, they place greater emphasis on improving energy efficiency within firms and impose stricter environmental requirements on industries known for high levels of pollution (Shao et al., 2020). However, legislation alone is not enough to effectively reduce emissions. Research suggests that tangible improvements in the energy-use efficiency of firms are only possible when environmental laws are coupled with rigorous enforcement mechanisms (Wang and Liang, 2022). In this sense, the government's approach to regulating firms and the effectiveness of its enforcement play a critical role in incentivizing firms to optimize their energy use. While existing research extensively examines the influence of government policies on firms' energy efficiency (Backlund and Thollander, 2015; Du et al., 2022; Chen and Li, 2023; Chen et al., 2024), it generally overlooks the potential impact of the geographic distance between firms and government agencies.

Geographic distance is a critical factor influencing economic activity, as demonstrated by seminal works such as those of Marshall (2009) and Krugman (1991). In geo-economics, the “distance attenuation effect” postulates that the impact of a phenomenon or interaction diminishes as the distance between the entities involved increases (Xiong et al., 2024). This principle is particularly relevant in examining how proximity to government agencies affects firms' energy efficiency through two main mechanisms: regulatory and rent-seeking effects. From a regulatory perspective, proximity to government agencies facilitates the reduction of government regulatory costs, which may lead to more stringent environmental regulations (Kubick et al., 2017; Hu et al., 2021). This dynamic forces firms to adopt greener, more energy-efficient production technologies and methods to meet stricter environmental standards, thereby reducing pollutant emissions and increasing energy efficiency. Conversely, the rent-seeking perspective suggests that closer geographic ties to government agencies reduce rent-seeking costs and increase opportunities for firms, potentially undermining the effectiveness of regulation (Espinosa et al., 2021; Damania, 2001; Chen et al., 2022). Firms may seek to circumvent environmental regulations as a cost-saving measure rather than adopt cleaner technologies, leading to increased pollution and reduced energy efficiency. Thus, geographic proximity to government agencies exerts a multifaceted influence on firms' energy efficiency. It shapes firms' production and environmental management decisions through the interplay of regulatory and rent-seeking effects. The net effect of such proximity on firms' energy efficiency depends on the relative strength of these opposing positive and negative forces.

This study, which is based on micro-level data from Chinese industrial firms, uses a fixed-effects model in order to examine the impact of geographic proximity to government agencies on firms' energy efficiency. The goal of the analysis is to elucidate the intricate relationships between geographic location, environmental regulatory pressure, green innovation, and corporate energy management. The potential marginal contributions of this paper are as follows:

Firstly, this study extends the existing literature on the factors influencing corporate energy efficiency by considering the perspective of geographic proximity. This study introduces the variable of geographic distance between firms and local environmental protection agencies (EPAs), thereby broadening the scope of research on the factors influencing corporate energy efficiency. In the existing literature, energy efficiency is typically conceptualized as being influenced by factors such as technological innovation, policy intensity, and market competition (Coyle and Simmons, 2014; Wen et al., 2022; Wang et al., 2021). The existing literature on the topic is limited in its consideration of the spatial dimension of environmental regulation. For example, Paramati et al. (2022), Zahraoui et al. (2023), Safarzadeh et al. (2020), and Shabalov et al. (2021) have all contributed to the field, but there is a dearth of research that incorporates the geographic proximity of firms and local environmental protection agencies (EPAs) into its analysis. By analyzing geographical distance, this study sheds light on the distinctive impact of environmental regulation from a spatial perspective on the energy efficiency of firms.

Secondly, the study empirically tests the mechanism by which geographic proximity to EPAs improves firms' energy efficiency. In addition to examining the direct effect of geographic proximity on energy efficiency, this study also empirically tests the underlying mechanism. Specifically the study finds that firms located closer to EPAs are subject to increased environmental regulatory pressure, which motivates them to invest more in environmental protection and green innovation. This ultimately results in improved energy efficiency. Moreover, this mechanism confirms the central tenet of the Porter hypothesis, which posits that more stringent environmental regulations can stimulate corporate innovation and competitive advantage (Porter, 1991; Porter and van der Linde, 1995).

Thirdly, this study quantifies the geographic range within which proximity to EPAs improves firms' energy efficiency is quantified. This study is the first to quantify the geographic range within which proximity to EPAs improves firm energy efficiency through empirical analysis. The research finds that the positive effect of geographic proximity on energy efficiency is most significant within a 60-kilometer radius. This finding provides important quantitative evidence for understanding the spatial effects of environmental regulation and clarifies the boundaries of how regulatory proximity affects firm behavior as the distance increases.

The rest of the paper is organized as follows. Section 2 presents the research hypotheses. Section 3 outlines the research design, including the model, variables, and data. Section 4 presents the baseline results, mechanisms, and heterogeneity analysis of the impact of geographic proximity on firms' energy efficiency. Finally, Section 5 summarizes the main findings, addresses their implications for policy, and highlights the limitations of this study along with directions for future research.

The geographic proximity of firms to local environmental protection agencies (EPAs) my have a dual effect on their energy efficiency. On the one hand, proximity to the EPA may expose firms to more frequent on-site inspections and greater compliance pressure, forcing them to increase investments in energy-saving measures and green innovations (Porter, 1991; Porter and van der Linde, 1995), thereby improving their energy efficiency. On the other hand, proximity to the EPA may make it easier for firms to engage in rent-seeking activities, using relationships with regulators to reduce environmental pressures, which could hinder improvements in energy efficiency. Thus, the effect of geographic proximity to the EPA on firms' energy efficiency is uncertain and warrants further investigation. We, therefore, propose a set of competing hypotheses to explore the relationship in greater depth.

Porter (1991) first introduced the well-known Porter hypothesis in his paper “America's Green Strategy”. The Porter hypothesis argues that stringent environmental regulations, rather than hindering firm growth, can serve as a driver for innovation and enhanced competitiveness (Porter and van der Linde, 1995). Specifically, stringent environmental regulations force firms to optimize resource allocation and improve technological innovation, leading to increased resource efficiency and reduced costs.

Geographic proximity between firms and local environmental protection agencies (EPAs) directly affects the effectiveness and intensity of regulation (Chen and Golley, 2014). Firms located closer to EPAs are more likely to be subject to frequent inspections and monitoring, and face greater compliance pressures. This high-intensity regulatory environment forces firms to adopt proactive environmental measures to meet regulatory requirements and avoid fines and other legal risks (Gray et al., 1995; Glaeser et al., 2023; Kubick et al., 2017; Hu et al., 2021). Therefore, geographic proximity increases the visibility and deterrent effect of regulation, encouraging firms to proactively improve their environmental performance.

According to the Porter hypothesis, stringent environmental regulations can stimulate technological innovation within firms to cope with the pressures imposed by these regulations. Such innovation is not limited to pollution control technologies but also includes the optimization of overall production processes and improvements in energy management (Ambec and Barla, 2006; Trevlopoulos et al., 2021; Aragòn-Correa et al., 2020; Murshed et al., 2021). In the process of developing new technologies and optimizing production processes, firms can achieve more efficient energy use, reduce energy consumption, and lower production costs. For example, by introducing energy-saving equipment or improving production processes, firms can reduce energy consumption while increasing production efficiency (Hart and Dowell, 2011; Mahmood et al., 2022; Tian and Feng, 2022).

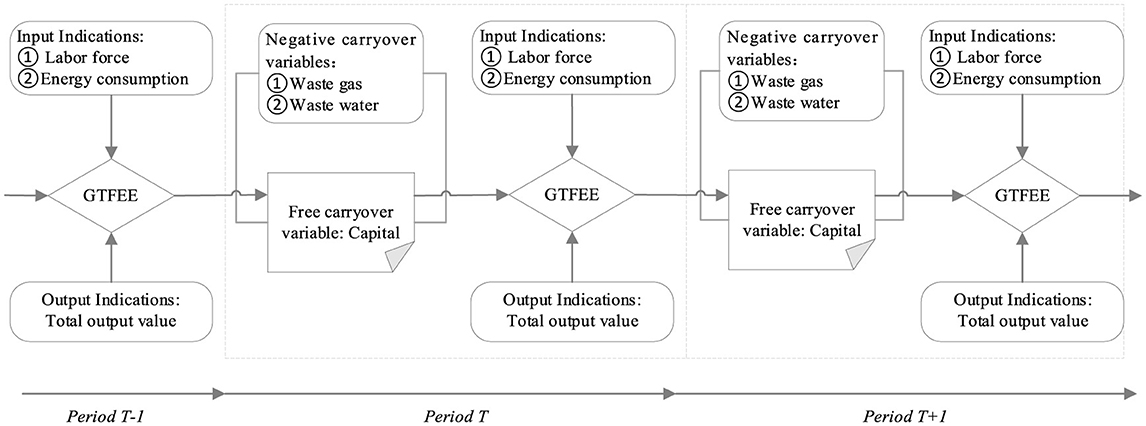

Overall, firms located closer to local EPAs are subject to stricter regulatory pressures, which incentivizes them to increase environmental investments and foster technological innovation to improve energy efficiency (as shown in Figure 3). This process aligns with the theoretical framework of the Porter Hypothesis. Therefore, we propose the following research hypothesis:

Figure 3. Mechanisms by which proximity to local EPAs is conducive to improving the energy efficiency of industrial enterprises.

Hypothesis 1 (H1): Proximity to local EPAs is conducive to improving the energy efficiency of industrial enterprises.

The implications of geographic proximity for rent-seeking behavior are profound. According to public choice theory, a firm's geographic proximity to regulatory agencies may increase opportunities for interaction, making it easier for firms to engage in rent-seeking behavior by establishing networks of influence (Tullock, 1967; Tian and Feng, 2022; Tang et al., 2024). Such behavior includes bribery, lobbying, or other forms of non-market competition to secure favorable policies or regulatory exemptions (Stigler, 1971; Kim, 2021). Firms that are located closer to regulators, due to more frequent contact, are often better positioned to access information through informal channels or to influence policy decisions, thereby undermining formal regulatory mechanisms (Hiatt and Kim, 2023; Lu et al., 2024). This phenomenon is particularly evident in environments with low regulatory effectiveness and limited institutional transparency.

Rent-seeking behavior can have a significant negative impact on firms' green innovation and energy efficiency. When firms can secure a more lenient regulatory environment through rent-seeking, their motivation to invest in green innovation decreases (Tang et al., 2024; Wang et al., 2023; Espinosa et al., 2021). This is because the short-term economic benefits of reducing environmental compliance costs may outweigh the long-term benefits from improving energy efficiency through innovation (Krueger, 1974). This not only weakens the firm's willingness to improve energy efficiency but may also lead to inefficiencies and waste in resource allocation (Angelopoulos et al., 2021; Munemo, 2022; Dincă et al., 2021). Firms are more likely to rely on rent-seeking activities to maintain competitive advantage, rather than achieving sustainable development through technological innovation and improved resource efficiency (Shleifer and Vishny, 1994). This tendency is particularly pronounced in regions with weak institutional environments and low regulatory transparency, where firms are more likely to deviate from the path of green development.

In the context of China's institutional and business environment, the effect of geographic proximity between firms and regulators on rent-seeking behavior and energy efficiency is particularly noteworthy. China's market regulatory system varies significantly across regions, and firms under the supervision of local environmental protection agencies (EPAs) often reduce compliance costs by fostering close relationships with regulators. These relationships may include influencing the implementation of environmental regulations through social networks or local protectionism (Frye and Shleifer, 1997). Research has shown that in China, firms reduce investment in environmental technologies through rent-seeking behavior, leading to lower energy efficiency (Jiang et al., 2021; Tang et al., 2024). This phenomenon is particularly prevalent in regions with strong government intervention and low regulatory transparency, suggesting that geographic proximity may be an important means for firms to circumvent stringent environmental regulations, thereby hindering green innovation and energy efficiency improvements.

Overall, firms located closer to local EPAs may engage rent-seeking behavior to obtain a more lenient regulatory environment, which in turn reduces their environmental investments and innovation, ultimately leading to lower energy efficiency (as shown in Figure 4). Based on this reasoning, we propose the following research hypothesis:

Figure 4. Mechanisms by which proximity to local EPAs is not conducive to improving the energy efficiency of industrial enterprises.

Hypothesis 2 (H2): Proximity to local EPAs is not conducive to improving the energy efficiency of industrial enterprises.

The effect of geographic proximity between firms and local environmental protection agencies (EPAs) on energy efficiency is uncertain. Firms located closer to EPAs may either increase green investment and innovation due to regulatory pressure, leading to improved energy efficiency, or decrease their focus on environmental concerns due to easier rent-seeking opportunities, leading to decreased energy efficiency. To examine the relationship between geographic proximity and energy efficiency, we set up a fixed effects model, as specified below.

i, j, t and c represent firm, industry, year, and city, respectively. EEit is the dependent variable in the model, representing the firm's energy efficiency. We use firms' green total factor energy efficiency (GTFEE) to measure energy efficiency. This metric combines energy inputs with outputs and environmental costs, providing a comprehensive assessment of firms' energy utilization efficiency, and has been widely applied in previous studies (Ren et al., 2022; Zhou et al., 2023; Hao et al., 2020). The main independent variable, Distanceic, represents the geographic distance between the firm and the EPA in its city. CVit is a set of firm characteristics used to control for factors at the firm level that may influence energy efficiency. γct represents city-year fixed effects to control for time-varying factors at the city level, while μjt represents industry-year fixed effects to control for time-varying factors at the industry level. εijct is the random error term.

Using Model (1), we can recognize the impact of the neighboring local environmental protection bureau on the energy efficiency of enterprises. However, it is unclear what range of proximity to the bureau is significant. To address this issue, we draw upon the research of Partridge and Rickman (2008), which groups companies according to their distance from the local EPA. This generates a set of dummy variables that reflect the distance range, which we then include in the regression model to test the validity of our findings. The empirical model is shown in Equation 2.

Specifically, we group all firms in the jurisdiction according to their distance to the local EPA. D0_15 = 1 if the distance from the firm to the EPA is between 0–15 kilometers and 0 otherwise, D15_30 = 1 if the distance from the firm to the EPA is between 15–30 kilometers and 0 otherwise, and so on to generate D30_45, D45_60, D60_75.

The dependent variable in Model (1) is the energy efficiency of the firms, which we measure using Green Total Factor Energy Efficiency (GTFEE). GTFEE takes into account the relationship between resource inputs and outputs, particularly incorporating environmental factors into the efficiency assessment. In addition to considering the production efficiency of traditional factors such as labor and capital, GTFEE also includes energy and environmental emissions, reflecting the firm's overall efficiency of the company's use of energy and other resources while taking into account environmental costs. As a result, GTFEE provides a more comprehensive assessment of a firm's energy efficiency and sustainability.

In this study, we use the current cutting-edge non-radial and non-angle dynamic-SBM model to measure GTFEE of enterprises. In previous studies, data envelopment analysis (DEA) and the Malmquist-Luenberger productivity index are the more commonly used methods to measure the intertemporal efficiency of decision-making units (Bansal and Mehra, 2022). However, traditional static DEA requires inputs and outputs to vary in the same proportion, and the choice of window width is mostly based on empirical selection, which is somewhat arbitrary (Zhang et al., 2022). The Malmquist-Luenberger productivity index (MPI) does not properly reflect the characteristics of technological progress, resulting in a biased efficiency growth index (Oh and Heshmati, 2010).

Therefore, this paper adopts the non-radial and non-angle dynamic-SBM model proposed by Tone and Tsutsui (2010) to measure the energy utilization efficiency of enterprises, which has the following improvements over the traditional static DEA method: (i) it is divided into two categories of free inter-period variables and bad inter-period variables based on the consideration of the influence of inter-period variables; (ii) the measurement process is not restricted by the unit of measurement of input and output indicators and each input/output indicator is monotonically increasing in the radial direction; and (iii) the measured efficiency is a dynamic indicator and has inter-period comparability. Based on this, the selection of reasonable input/output variables and inter-period variables is the key to the measurement of indicators.

Specifically, the input indicators selected in this study include labor and energy consumption. Labor is measured by the average number of employees per year, while energy consumption is measured by the amount of standard coal (tons) converted from the firm's various energy inputs. The freely carryover input is capital, represented by the net value of the firm's fixed assets, which is deflated using the appropriate fixed investment price index. The negative carryover outputs are the firm's emissions of air and water pollutants, including sulfur dioxide, nitrogen dioxide, particulate matter, ammonia nitrogen, and chemical oxygen demand (COD). Figure 5 illustrates the calculation process of GTFEE.

Figure 5. Calculation process of GTFEE. This figure illustrates the calculation process of Green Total Factor Energy Efficiency (GTFEE) using a non-radial, non-angle Dynamic-SBM model. The input indicators include labor force (measured by the average number of employees per year) and energy consumption (measured in tons of standard coal equivalent). Capital is treated as a freely disposable input variable, represented by the net value of the firm's fixed assets. Undesirable outputs include emissions of waste gas and wastewater, such as sulfur dioxide and chemical oxygen demand (COD). The time periods (T−1, T, T+1) represent different stages in the production cycle, highlighting the dynamic nature of energy efficiency evaluation across consecutive periods.

The independent variable in the model is the geographic distance between firms and local environmental protection agencies (EPAs). In China, local EPAs refer to the ecological and environmental bureaus in the cities where the firms are located. These agencies are responsible for urban environmental protection and ecological management. Their main functions include formulating and implementing local environmental policies, supervising and managing corporate environmental behavior, monitoring and improving air and water quality, handling environmental complaints, and promoting green development. Local EPAs are usually affiliated with local governments and cooperate with the Ministry of Ecology and Environment (formerly the Ministry of Environmental Protection) to enforce national and local environmental regulations and standards (Huang and Lei, 2021). We manually collected latitude and longitude data from the ecological and environmental bureaus of various Chinese cities. Our sample of firms was obtained from the China Industrial Enterprise Database, which provides address information for industrial firms. Using this address information, we employed geocoding tools (Baidu Maps API) to obtain the latitude and longitude data for the firms. We then imported the latitude and longitude data for both the local EPAs and the industrial firms into ArcGIS software to calculate the geographic distance between them.

To account for economic, market, and institutional constraints that may affect the ability of firms to adopt cleaner technologies, we include control variables such as firm size, financial leverage, and return on assets. As noted by Porter (1991) and Porter and van der Linde (1995), while stricter environmental regulations can spur innovation, adoption may be limited by factors such as the high cost of green technologies (Horbach, 2008), competitive pressures that prioritize short-term profits, and weak regulatory enforcement (Johnstone et al., 2010). Controlling for these variables allows us to isolate the effect of geographic proximity to environmental protection agencies (EPAs) on energy efficiency, ensuring that external constraints are included in the analysis. The specific calculations for these control variables as shown in Table 1.

Two databases are used in this study. (1) China Industrial Enterprise Database. This database contains all state-owned industrial enterprises and industrial enterprises above-scale (with main business revenue of more than 5 million yuan). This database provides a wealth of firm-level information, including basic characteristics such as enterprise name, legal person code, specific address, and ownership type, as well as corporate financial indicators such as employment, production profit, and assets and expenses. We use this database to collect firm-level control variables and identify the location of firms. (2) Pollution Emission Database of Industrial Enterprises in China. This database provides detailed statistical information on the energy consumption and pollution emission of industrial enterprises, including coal consumption, oil consumption, natural gas consumption, wastewater emission, sulfur dioxide emission, and so on. This database is currently the most detailed database on energy consumption and pollution emission of industrial enterprises in China.

We merge the two databases based on the unique identifiers of the firms in the two databases. Then, we organize the merged data into a mixed panel dataset following the method propose by Brandt et al. (2012). We delete samples with obvious recording errors, such as samples with < 0 industrial output value, total assets, and fixed assets of enterprises, samples with missing key indicators, and samples with < 8 average annual employment. A total of 133,430 samples from 1999 to 2010 were finally obtained. To reduce the impact of outliers on the estimation, we also shrink the data set by 1%.

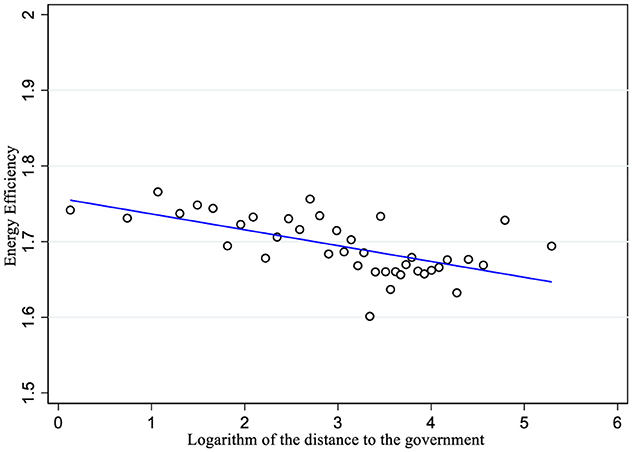

Prior to the empirical analysis, we used a bin-scatter graph to illustrate the relationship between distance to the local EPA and firm energy efficiency, as shown in Figure 6. The graph shows a more pronounced negative correlation between distance to the local EPA and firms' energy efficiency, i.e., the closer the firms are to the government, the more energy efficient they are; the farther the firms are from the government, the less energy efficient they are. Table 2 lists the variables used in our empirical study and their statistical characteristics.

Figure 6. Distance to the local EPA and energy efficiency. The horizontal axis is the energy efficiency of the firms. The horizontal axis is the logarithm of distance between the firm and the local environmental protection agency (EPA).

Table 2 shows the descriptive statistics of the key variables of this study. First, Energy Efficiency (EE) has a mean value of 1.7001 and a maximum value of 8.5783, indicating that there is a large heterogeneity in energy use among the sample firms. The mean value of geographical distance (Distance) is 3.2431 and the standard error is 1.4377, indicating that the distance between firms and local environmental protection departments varies significantly in the sample, and this difference provides a basis for testing the effect of geographical proximity on energy efficiency. The control variables reflect the differences in firm characteristics across dimensions. The mean of firm size (Size) is 10.1243, indicating that firms have an uneven distribution of resources, which may affect their ability to respond to environmental protection policies. Financial leverage (Lev) is 0.5121, which shows the general characteristics of firms in terms of leverage, which may affect their green investment decisions. Return on assets (Roa) and capital-labor ratio (RatioKL) also reveal the diversity of firms' profitability and factor input structure. The mean value of Export is 4.7811, reflecting the degree of participation of some firms in the international market, which may affect their response to environmental requirements.

There are two competing hypotheses when examining the impact of geographic proximity between firms and local environmental protection agencies (EPAs) on firms' energy efficiency, two competing hypotheses exist in theory. On the one hand, firms located closer to EPAs may face stricter and more frequent environmental regulations, forcing them to increase environmental investments and engage in green innovation, thereby improving energy efficiency. On the other hand, geographic proximity may make it easier for firms to engage in rent-seeking behavior to alleviate regulatory pressure, which could reduce their energy efficiency. Therefore, the effect of geographic proximity to EPAs on firms' energy efficiency remains uncertain. To address this theoretical debate, we conducted an empirical study, and the results are presented in Table 3.

Column (1) does not include any control variables or fixed effects. In this case, the regression coefficient for the Distance variable is −0.0130, which is significant at the 5% level. This indicates a significant negative correlation between geographic proximity to EPAs and energy efficiency, suggesting that the closer a firm is to the EPA, the higher energy efficiency it has. This result supports the Hypothesis 1 (H1) that “geographic proximity increases firms' energy efficiency,” possibly due to stricter environmental regulations resulting from closer proximity. In column (2), after adding a number of control variables (such as firm size, financial leverage, capital-labor ratio, etc.) based on the previous column, the coefficient for the Distance variable becomes −0.0097 and remains significant at the 1% level. Even after including these firm characteristics that may affect energy efficiency, the coefficient of Distance remains negative and significant, further confirming the positive impact of geographic proximity on firms' energy efficiency. Column (3) further adds city-year and industry-year fixed effects based on the previous column. In this case, the coefficient for the Distance variable is −0.0094 and remains significant at the 1% level. This indicates that even after controlling for time-varying factors at the city and industry levels that may influence the relationship between geographic proximity and energy efficiency, the positive impact of proximity on energy efficiency remains significant.

The results in Table 3 show that despite increasing model complexity, the negative impact of the Distance variable remains significant, confirming that geographic proximity between firms and EPAs can effectively improve firms' energy efficiency, supporting Hypothesis 1 of this study. Overall, the results are consistent with the Porter hypothesis, which suggests that stringent environmental regulations can incentivize firms to innovate and improve resource efficiency (Porter, 1991; Galeotti et al., 2020; Porter and van der Linde, 1995). Proximity to EPAs means that firms face higher regulatory intensity, leading them to increase environmental investments and technological innovation, thereby improving energy efficiency.

We conducted three robustness checks to ensure the reliability of our findings: replacing the measurement of the independent variable, accounting for the impact of policy shocks, and excluding firms that have undergone relocation. The corresponding results are presented in Table 4.

In the baseline regression, we used the distance between firms and local Environmental Protection Agencies (EPAs) as the primary independent variable. However, under China's localized environmental regulation system, local EPAs are subject to the personnel appointments and budget constraints set by the local governments, which compromises their independence. Considering this, the distance between firms and local governments may have a significant impact on firms' energy efficiency. Therefore, we replaced the independent variable with the distance from firms to local governments as a robustness check. As shown in Column 1 of Table 4, the coefficient of the alternative variable, Distance, remains significantly negative, validating the robustness of our estimates, and further demonstrating the consistent impact of geographical proximity on firms' energy efficiency.

During the study period, the Chinese government implemented a series of “energy-saving and emission-reduction” policies that could potentially influence the estimation of firms' energy efficiency. For instance, to enhance the elimination of outdated production capacity and control the rapid growth of high-pollution and high-energy-consuming industries, the government launched an industrial intervention policy in 2005 aimed at reducing energy consumption. This policy was further reinforced by the clear mandate to eliminate outdated production capacities by the end of 2006. Such policy interventions may have significantly affected firms' production behavior, thereby interfering with the estimated impact of geographical distance. To address this issue, we excluded the sample data for the years 2005 and 2006 and re-ran the regression analysis. The results in Column 2 of Table 4 show that the coefficient of Distance remains significantly negative, consistent with the baseline regression, indicating that the effect of policy shocks on the conclusions is limited.

Firm relocation is typically a strategic decision driven by considerations of policy, market conditions, and cost structures. Particularly when facing stringent environmental regulations, some firms may choose to relocate to regions with more lenient environmental standards to reduce compliance costs. This self-selection behavior can directly influence firms' energy efficiency and compliance strategies, leading to significant changes in the impact of geographical distance on these firms. As a result, the sample of relocating firms may introduce additional endogeneity issues, making it difficult to accurately estimate the relationship between geographical distance and firms' energy efficiency. To mitigate this concern, we excluded all firms that had undergone relocation in our robustness check. The results in Column 3 of Table 4 demonstrate that the coefficient of Distance remains significantly negative, consistent with the baseline results, further confirming the reliability and robustness of our estimates.

These robustness checks collectively strengthen the validity of our findings, showing that our conclusions hold under various alternative conditions and data treatments.

In the study of distance to the local EPA and energy efficiency of firms, the independent variable (Distance) may be endogenous because firms are proactive in their location decisions and can decide for themselves whether to locate near the local EPA. If firms with lower energy efficiency are more likely to choose locations farther from the local EPA, then we would overestimate the effect of geographic distance on energy efficiency. In addition, because a firm's geographic distance from the local EPA is usually fixed, we cannot control for firm fixed effects, which also creates an omitted variable problem. Therefore, when using geographic distance as a core explanatory variable, we need to use appropriate methods to address the endogeneity problem.

We use the instrumental variable approach to test whether endogeneity seriously undermines the benchmark results. Specifically, in the regressions in Table 5, we use the average of the geographic distance (Distmean) of all firms in the municipality to the local EPA as the instrumental variable for distance. This is justified by the fact that, first, there is no significant correlation between a firm's energy efficiency and the geographic distance between other firms and the local EPA in the jurisdiction, which meets the requirement of “exogeneity” of the instrumental variable. Second, firms' choice of geographic location of firms is influenced by regional factors such as economic development, environmental protection, transportation conditions, and so on. Therefore, there may be some similarity in the geographic location of firms within the jurisdiction, which meets the “correlation” requirement of the instrumental variable.

The results of the instrumental variables regressions are reported in Table 5. Column (1) presents the results of the first stage, where the coefficient on Distmean is significantly positive and the Kleibergen-Paaprk Wald F-value is 336, indicating that there is no weak instrumental variables problem. Column (2) shows the results of the second stage, where the coefficient remains significantly negative, consistent with the benchmark results. This suggests that the address “self-selection” problem and the omitted variable problem posed by firms' location choices do not materially affect the estimation results of this paper. Proximity to the local EPA increases firms' energy efficiency, and the regulatory effect dominates. Table 5 shows that the conclusions of this paper remain reliable after controlling for possible endogeneity issues.

The results presented earlier indicate that firms located closer to local environmental protection agencies (EPAs) experience enhanced energy efficiency. Figure 3 visually illustrates the underlying mechanism: proximity to EPAs increases environmental pressure on firms, which in turn induces them to increase environmental investments and engage in green innovation, ultimately leading to improved energy efficiency. To empirically test this mechanism, we can proceed with the following steps:

Step 1: We first need to examine how the geographic distance between firms and EPAs affects the environmental pressures they face. By constructing a regression model with geographic distance serves as the independent variable and environmental pressure as the dependent variable, while controlling for other influencing factors, we can determine whether there is a significant negative relationship exists between geographic distance and environmental pressure. If the results show a significant negative relationship, it suggests that firms located closer to EPAs face greater environmental pressure.

Step 2: After confirming the effect of environmental pressure, we need to further examine its impact on firms' green innovation. By constructing a regression model with environmental pressure as the independent variable and green innovation as the dependent variable, we can assess whether environmental pressure significantly promotes green innovation activities. A positive and significant coefficient for environmental pressure would indicate that it effectively drives green innovation within firms.

Step 3: To gain a deeper understanding of how geographic distance influences green innovation through environmental pressure, we introduce an interaction term, “Geographic Distance × Environmental Pressure,” into the regression model for green innovation. By analyzing the coefficient of this interaction term, we can test the interactive effect of geographic distance and environmental pressure on green innovation. If the coefficient of the interaction term is significantly negative, it would suggest that geographic proximity strengthens the positive impact of environmental pressure on green innovation.

Step 4: The final step is to examine the impact of green innovation on firms' energy efficiency. By constructing a regression model where green innovation is the independent variable and energy efficiency is the dependent variable, while controlling for other variables, we can assess whether green innovation has a significant positive effect on energy efficiency. A significant positive coefficient would indicate that green innovation is an important way to improve firms' energy efficiency.

Through these four analytical steps, we can comprehensively validate the logical chain of Hypothesis 1, revealing how geographic proximity enhances firms' energy efficiency through the mediating effects of environmental pressure and green innovation.

To conduct the above tests, we need to construct indicators of environmental pressure and green innovation, as follows, (1) Environmental pressure: To measure the environmental pressure on firms, we collected data on environmental penalties from the National Enterprise Credit Information Publicity System. Specifically, we counted the number of penalties or the amount of fines imposed on firms for violating environmental regulations within a certain period, and used these metrics as indicators of environmental pressure (EnvPressure). A higher number of penalties or higher fines indicate greater environmental pressure on the firm. (2) Green Innovation: For green innovation, we selected patents related to green innovation from the national patent database, using the “Y02” category of the International Patent Classification (IPC). These patents were assigned to the sample firms according to their unique identifiers. We then counted the number of green innovation patents held by each firm during the study period to generate an annual patent count. Finally, these variables were standardized (Z-scores) to facilitate compariresulting in the green innovation indicator (GreInnovation).

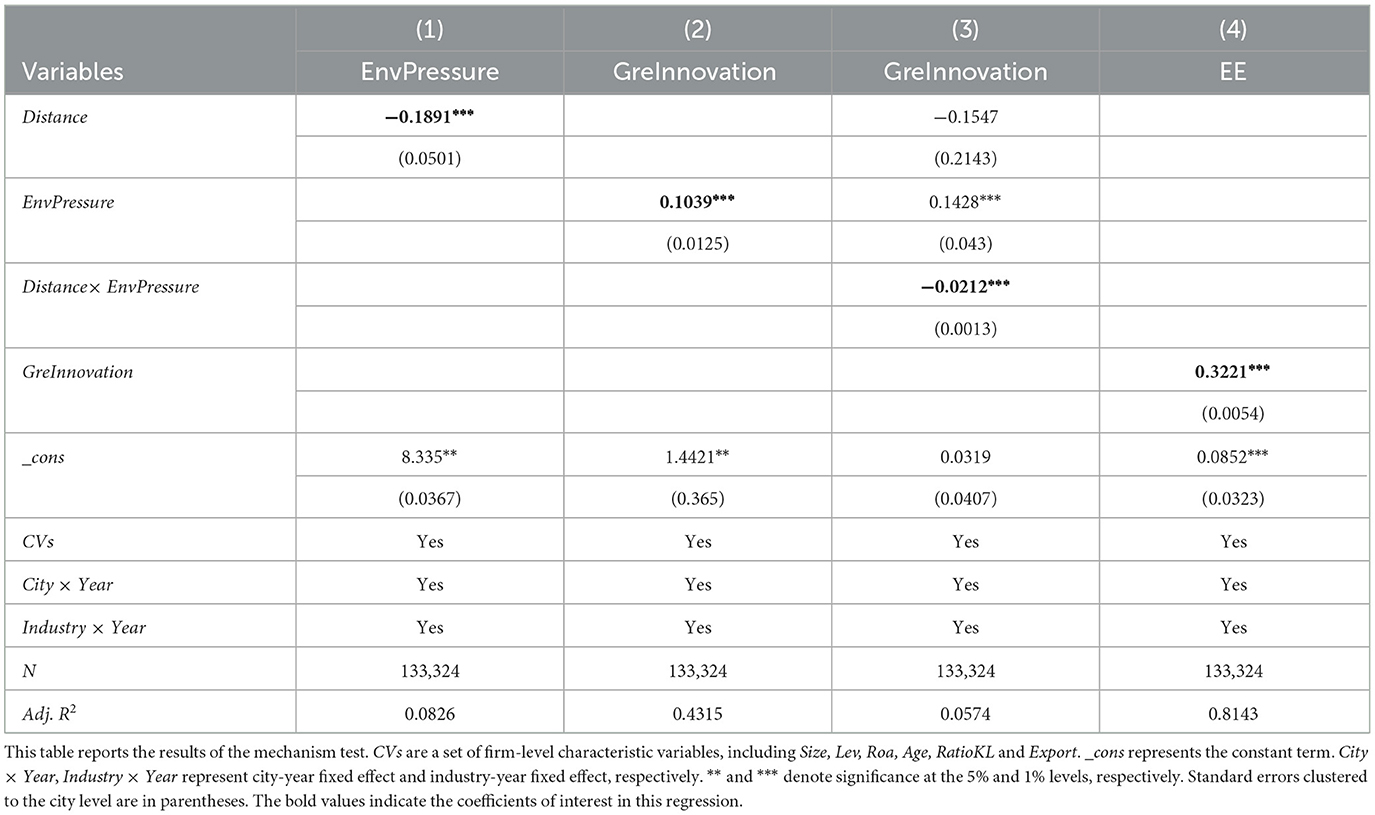

Column (1) of Table 6 presents the regression results of environmental pressure on geographic distance (the distance between firms and local environmental protection agencies). The coefficient for geographic distance is −0.1891, which is significant at the 1% level, indicating that the shorter the distance between firms and local EPAs, the greater the environmental pressure faced by the firms. Column (2) shows the regression of green innovation on environmental pressure, where the coefficient for environmental pressure is 0.1039, which is also significant at the 1% level, suggesting that environmental pressure promotes green innovation within firms. Column (3) builds on Column (2) by including an interaction term between geographic distance and environmental pressure. The coefficient for the interaction term is −0.0212, indicating that the effect of environmental pressure on green innovation is stronger under conditions of higher geographic proximity (shorter distance). This suggests that when firms are closer to EPAs, environmental pressure is more likely to drive green innovation. Column (4) presents the regression of energy efficiency on green innovation, where the coefficient for green innovation is 0.3221, significant at the 1% level, demonstrating that green innovation significantly improves firms' energy efficiency. By examining theses four steps, we confirm that proximity to local EPAs increases environmental pressure on firms, which, in turn, leads to increased environmental investment and green innovation, which ultimately resulting in improved energy efficiency.

Table 6. Mechanism analysis of proximity and regulatory pressure on green innovation and energy efficiency.

These findings are consistent with the core tenets of the Porter hypothesis. The Porter hypothesis posits that stringent environmental regulations not only do not hinder the economic performance of firms', but also enhance their competitiveness by stimulating innovation (Porter and van der Linde, 1995). The empirical results of this study indicate that environmental pressures do indeed drive green innovation within firms and ultimately improve energy efficiency, consistent with the expectations of the Porter hypothesis. Moreover, our findings are supported by related literature. For example, the study by Xie et al. (2023) found that environmental regulations can stimulate technological innovation, which ultimately leads to improved production efficiency. Furthermore, Hart and Ahuja (1996) pointed out that firms' innovative responses to environmental regulations not only improve environmental performance but also increase overall firm value.

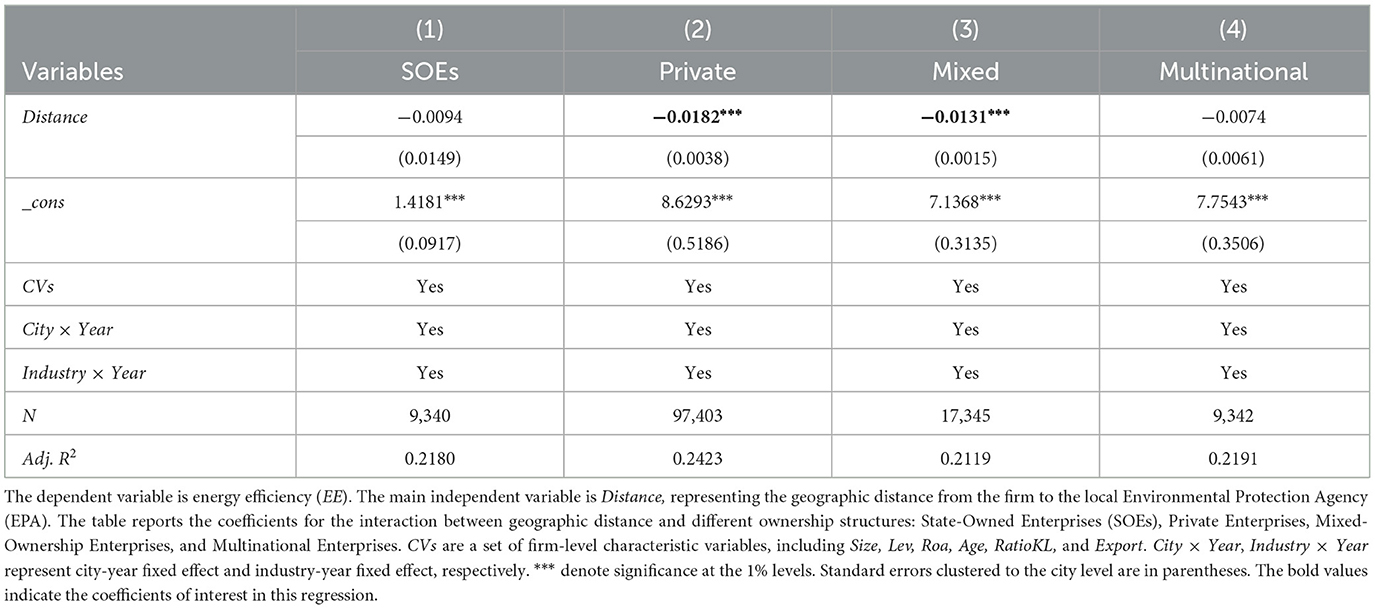

In the previous analysis, we confirmed that the closer a firm is to the local Environmental Protection Agency (EPA), the higher its energy efficiency. This is because the intensity of environmental regulation decreases with increasing distance, so firms closer to government agencies to face greater environmental pressure, which forces them to increase environmental investment and engage in green innovation, which ultimately leads to improved energy efficiency. However, to gain a deeper understanding of the applicability of this relationship and the complex mechanisms behind it, we conducted further heterogeneity analyses. Specifically, we explored the heterogeneity of this relationship from three perspectives: first, we analyzed the effectiveness of the impact of geographic proximity to EPAs on firms' energy efficiency across different distance ranges; second, we examined how different ownership structures (such as state-owned enterprises, private enterprises, mixed-ownership enterprises, and multinational enterprises) exhibit differences in response to this relationship; and finally, we investigated how geographic characteristics (such as coastal vs. inland regions and proximity to energy sources) influence this relationship. Through these analyses, we aim to provide more nuanced insights into how environmental regulation affects firm behavior.

In column (1) of Table 7, the coefficients on the dummy variables D0_15, D15_30, D30_45, and D45_60 are significantly positive until the coefficient on D60_75 is insignificant. This indicates that the effect of proximity to the EPA on firms' energy efficiency is significant up to 60 km, and beyond 60 km, the effect of proximity to the EPA on firms' energy efficiency is no longer significant. Column (2) further controls for city-year fixed effects and industry-year fixed effects based on column (1), and the results are similar to those in column (1), i.e., the effect of distance to the local EPA on firms' energy efficiency is no longer significant when the distance exceeds 60 km.

When analyzing the energy efficiency of firms, ownership structure is considered a key factor of heterogeneity. Firms with different ownership types show significant differences in their responses to environmental regulation, resource allocation, and technological innovation (Fan et al., 2011; Wang et al., 2022; Megginson and Netter, 2001). Therefore, conducting a regression analysis by categorizing firms based on ownership type can provide a deeper understanding of the differences in how firms with different ownership structures respond to the impact of geographic distance on energy efficiency. This analysis not only helps uncover the heterogeneous responses of firms with different ownership structures to environmental policy implementation but also provides a basis for developing more targeted policies.

Next, we categorize the sample firms into four groups: (1) State-owned enterprises (SOEs), which are wholly state-owned, with 100% of shares held by the government, and business decisions directly controlled by the government; (2) Private enterprises, which are wholly privately owned, with 100% of the shares held by private individuals or entities, and business decisions made independently of the government, typically with a focus on profit maximization; (3) Mixed-ownership enterprises, which are jointly controlled by state and private capital, with both parties holding significant shares and participating in decision-making; and (4) Multinational enterprises, in which are foreign-owned, with foreign investors holding the majority or all shares, and exercise control over business decisions. This classification allows for a more precise analysis of the differences in how firms with different ownership structures respond to environmental pressures and engage in green innovation.

Table 8 reports the relationship between firms' distance from local regulators and their energy efficiency across the four types of firms. In Column (1), the regression results show that the coefficient for geographic distance is not significant for state-owned enterprises. This suggests that SOEs are subject to strong government oversight, and even if they are located further from EPAs, their energy efficiency is insignificantly affected. This is consistent the existing literature, which suggests that SOEs tend to maintain high levels of compliance and environmental investment due to policy-driven incentives (Huang and Lei, 2021). In Column (2), the regression results show that the coefficient for private enterprises is significantly negative, suggesting that private enterprises closer to EPAs have higher energy efficiency, which is consistent with the baseline results.

Table 8. Heterogeneous effects of geographic proximity on energy efficiency across different ownership structures.

In Column (3), the regression results show that the coefficient is also significantly negative for mixed-ownership enterprises, but the effect is less pronounced than for private enterprises. This reflects the dual nature of mixed-ownership enterprises: on the one hand, the presence of state capital may encourage environmental investment, while on the other hand, the influence of private capital may lead to cost-cutting measures that reduce environmental expenditures. Therefore, the performance of mixed-ownership enterprises in response to environmental pressure lies between that of state-owned and private enterprises (Ren and Ren, 2024). In Column (4), the regression results show that the coefficient for multinational enterprises is insignificant, indicating that geographic distance has little impact on the energy efficiency of multinational enterprises (MNEs). MNEs tend to have higher technological capabilities and global resource allocation, which allows them to effectively manage environmental compliance even when located farther from EPAs, thus maintaining high energy efficiency (Javorcik and Wei, 2003). Additionally, MNEs may be subject to both domestic and global regulatory oversight, which further helps them maintain high standards of environmental management.

To further understand how geographic characteristics affect the relationship between firms' energy efficiency and their geographic proximity to local environmental protection agencies (EPAs), this study conducts two heterogeneity analyses. First, we examine whether the relationship between firms' energy efficiency and geographic proximity to EPAs differs between coastal and inland regions. Second, we analyze the effect of proximity to energy sources on this relationship. Through these two angles of analysis, we aim to reveal how geographic characteristics affect firms' responses to environmental regulation, thereby providing more precise empirical support for policy formulation.

The results in columns (1) and (2) of Table 9 indicate that the pattern of the relationship between geographic proximity to EPAs and energy efficiency is similar in both coastal regions (which typically face higher international market standards and stricter environmental regulations) and inland regions. This finding may reflect the consistency and broad applicability of China's environmental policies across different regions. Particularly in the context of increasingly stringent environmental regulations, firms in all regions face similar environmental pressures, making the impact of geographic proximity on energy efficiency less dependent on geographic location.

Columns (3) and (4) examine the heterogeneity based on firms' proximity to energy sources (e.g., power plants). We find that the relationship between geographic distance and energy efficiency remains consistent regardless of whether firms are close to energy sources. This finding suggests that, although energy costs and the stability of supply may vary depending on a firm's proximity to energy sources, these differences do not significantly alter the pattern of the impact of geographic proximity to EPAs on energy efficiency. This may be because in China's industrial environment, electricity supply is already highly accessible and relatively balanced, meaning that geographic factors related to energy access have a minimal impact on firms' operating costs and efficiency. Instead, environmental regulation remains the primary driver of improvements in firms' energy efficiency.

Geographic proximity between governments and firms has long been recognized as a factor that can significantly influence all aspects of economic activity (Bagella and Becchetti, 2002; Caniëls and Romijn, 2003; Kubick et al., 2017; Hu et al., 2021). The relationship between this proximity and the energy efficiency of firms is particularly important in the context of sustainable development and environmental responsibility. Geographic distance plays an important role in shaping the energy efficiency of firms by influencing the regulatory pressures and green innovations in which they operates. On the one hand, the closer a firm is to the local EPA, the more environmental inspections it may experience, forcing the firm to increase its environmental investments and green innovations, leading to an increase in its energy efficiency. On the other hand, the closer a firm is to the local EPA, the more opportunities it has to lobby government regulators and the higher the likelihood of rent-seeking, which in turn reduces the environmental constraints faced by the firm and leads to a decrease in the firm's energy efficiency. Therefore, it is worthwhile to examine in detail how proximity to the EPA ultimately affects firms' energy efficiency.

Based on empirical analysis, this study draws the following main conclusions: First, geographic proximity to local environmental protection agencies (EPAs) significantly improves firms' energy efficiency. Firms located closer to EPAs are subject to greater regulatory pressure, which induces them to increase environmental investments and engage in green innovation, thereby improving energy efficiency. Second, the study finds that this effect is most pronounced within a 60-kilometer radius, beyond which the effect gradually diminishes and eventually becomes insignificant. Moreover, heterogeneity analysis shows that the impact of geographic proximity on energy efficiency is more pronounced in private and mixed-ownership firms, while it is not significant in state-owned and multinational firms. These conclusions provide new empirical support for understanding the role of geographic factors in environmental regulation and firm behavior and offer valuable insights for the formulation and implementation of environmental policies.

The policy implications of these findings are clear: improving the geographic accessibility of regulatory agencies can improve the energy efficiency of firms, especially for private firms that are more sensitive to regulatory pressures. However, to fully capitalize on the benefits of regulatory proximity, it is important to address the potential for rent-seeking behavior that may undermine environmental goals. Policymakers should focus on improving regulatory transparency and enforcement to ensure that firms are truly to improve their energy efficiency.

Although this study reveals the impact of geographic proximity on firms' energy efficiency and its underlying mechanisms through empirical analysis, there are still some research limitations. This study primarily focuses on the effect of the geographic distance between individual firms and local environmental protection agencies (EPAs) on energy efficiency, without fully considering the potential spatial spillover effects of environmental regulation. That is, environmental policies and regulatory intensity in one region may influence the behavior of firms in neighboring areas, leading to interactions between firms in different regions that were not captured. Future research could further explore the interregional interactions of environmental regulation by examining how spillover effects from environmental policies affect firms' energy efficiency both within and beyond the region. This would provide a more comprehensive perspective for understanding the overall impact of environmental policies and for optimizing their implementation.

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

RZ: Supervision, Writing – review & editing. KN: Conceptualization, Writing – original draft. LT: Data curation, Writing – original draft.

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Ambec, S., and Barla, P. (2006). Can environmental regulations be good for business? An assessment of the Porter hypothesis. Energy Stud. Rev. 14, 42–62. doi: 10.15173/esr.v14i2.493

Angelopoulos, A., Angelopoulos, K., Lazarakis, S., and Philippopoulos, A. (2021). The distributional consequences of rent-seeking. Econ. Inq. 59, 1616–1640. doi: 10.1111/ecin.13009

Aragòn-Correa, J. A., Marcus, A. A., and Vogel, D. (2020). The effects of mandatory and voluntary regulatory pressures on firms' environmental strategies: a review and recommendations for future research. Acad. Manag. Ann. 14, 339–365. doi: 10.5465/annals.2018.0014

Backlund, S., and Thollander, P. (2015). Impact after three years of the Swedish energy audit program. Energy 82, 54–60. doi: 10.1016/j.energy.2014.12.068

Bagella, M., and Becchetti, L. (2002). The “geographical agglomeration-private RandD expenditure” effect: empirical evidence on Italian data. Econ. Innov. New Technol. 11, 233–247. doi: 10.1080/10438590210902

Bansal, P., and Mehra, A. (2022). Malmquist-Luenberger productivity indexes for dynamic network DEA with undesirable outputs and negative data. RAIRO-Oper. Res. 56, 649–687. doi: 10.1051/ro/2022023

Brandt, L., Van Biesebroeck, J., and Zhang, Y. (2012). Creative accounting or creative destruction? Firm-level productivity growth in Chinese manufacturing. J. Dev. Econ. 97, 339–351. doi: 10.1016/j.jdeveco.2011.02.002

Caniëls, M. C. J., and Romijn, H. A. (2003). Firm-level knowledge accumulation and regional dynamics. Industr. Corpor. Change. 12, 1253–1278. doi: 10.1093/icc/12.6.1253

Chen, H., Liu, S., Wang, J., and Wu, Z. (2022). The effect of geographic proximity on corporate tax avoidance: evidence from China. J. Corpor. Finance 72:102131. doi: 10.1016/j.jcorpfin.2021.102131

Chen, S., and Golley, J. (2014). ‘Green' productivity growth in China's industrial economy. Energy Econ. 44, 89–98. doi: 10.1016/j.eneco.2014.04.002

Chen, Y., Chen, S., and Miao, J. (2024). Does smart city pilot improve urban green economic efficiency: accelerator or inhibitor. Environ. Impact Assess. Rev. 104:107328. doi: 10.1016/j.eiar.2023.107328

Chen, Y., and Li, L. (2023). Differential game model of carbon emission reduction decisions with two types of government contracts: green funding and green technology. J. Clean. Prod. 389:135847. doi: 10.1016/j.jclepro.2023.135847

Coyle, E. D., and Simmons, R. A. (2014). Understanding the Global Energy Crisis. West Lafayette: Purdue University Press. doi: 10.26530/OAPEN_469619

Damania, R. (2001). When the weak win: the role of investment in environmental lobbying. J. Environ. Econ. Manage. 42, 1–22. doi: 10.1006/jeem.2000.1147

Della Valle, N., and Bertoldi, P. (2022). Promoting energy efficiency: barriers, societal needs and policies. Front. Energy Res. 9:804091. doi: 10.3389/fenrg.2021.804091

Dincă, G., Dincă, M. S., Negri, C., and Bărbuţă, M. (2021). The impact of corruption and rent-seeking behavior upon economic wealth in the European Union from a public choice approach. Sustainability 13:6870. doi: 10.3390/su13126870

Du, W., Li, M., and Wang, Z. (2022). The impact of environmental regulation on firms' energy-environment efficiency: concurrent discussion of policy tool heterogeneity. Ecol. Indic. 143:109327. doi: 10.1016/j.ecolind.2022.109327

Espinosa, V. I., Peña-Ramos, J. A., and Recuero-López, F. (2021). The political economy of rent-seeking: evidence from Spain's support policies for renewable energy. Energies 14:4197. doi: 10.3390/en14144197

Fan, J. P. H., Wei, K. C. J., and Xu, X. (2011). Corporate finance and governance in emerging markets: a selective review and an agenda for future research. J. Corpor. Financ. 17, 207–214. doi: 10.1016/j.jcorpfin.2010.12.001

Frye, T., and Shleifer, A. (1997). The invisible hand and the grabbing hand. Am. Econ. Rev. 87, 354–358. doi: 10.3386/w5856

Galeotti, M., Salini, S., and Verdolini, E. (2020). Measuring environmental policy stringency: approaches, validity, and impact on environmental innovation and energy efficiency. Energy Policy 136:111052. doi: 10.1016/j.enpol.2019.111052

Glaeser, C. K., Glaeser, S., and Labro, E. (2023). Proximity and the management of innovation. Manage. Sci. 69, 3080–3099. doi: 10.1287/mnsc.2022.4469

Gray, R., Kouhy, R., and Lavers, S. (1995). Corporate social and environmental reporting: a review of the literature and a longitudinal study of UK disclosure. Account. Audit. Account. J. 8, 47–77. doi: 10.1108/09513579510146996

Hao, Y., Gai, Z., and Wu, H. (2020). How do resource misallocation and government corruption affect green total factor energy efficiency? Evidence from China. Energy Policy 143:111562. doi: 10.1016/j.enpol.2020.111562

Hart, S. L., and Ahuja, G. (1996). Does it pay to be green? An empirical examination of the relationship between emission reduction and firm performance. Bus. Strat. Environ. 5, 30–37. doi: 10.1002/(SICI)1099-0836(199603)5:1<30::AID-BSE38>3.0.CO;2-Q

Hart, S. L., and Dowell, G. (2011). A natural-resource-based view of the firm: fifteen years after. J. Manage. 37, 1464–1479. doi: 10.1177/0149206310390219

Hiatt, S. R., and Kim, J. H. (2023). Does location matter for winning government contracts? An examination of us defense awards. Thesis paper. An Examination of US Defense Awards.

Horbach, J. (2008). Determinants of environmental innovation—New evidence from German panel data sources. Res. Policy 37, 163–173. doi: 10.1016/j.respol.2007.08.006

Hu, C., Mao, J., Tian, M., Wei, Y., Guo, L., Wang, Z., et al. (2021). Distance matters: Investigating how geographic proximity to ENGOs triggers green innovation of heavy-polluting firms in China. J. Environ. Manage. 279:111542. doi: 10.1016/j.jenvman.2020.111542

Huang, L., and Lei, Z. (2021). How environmental regulation affect corporate green investment: evidence from China. J. Clean. Prod. 279:123560. doi: 10.1016/j.jclepro.2020.123560

Javorcik, B. S., and Wei, S. J. (2003). Pollution havens and foreign direct investment: dirty secret or popular myth? Contrib. Econ. Anal. Policy 3. doi: 10.2202/1538-0645.1244

Jiang, X. F., Zhao, C. X., Ma, J. J., Liu, J. Q., and Li, S. H. (2021). Is enterprise environmental protection investment responsibility or rent-seeking? Chinese evidence. Environ. Dev. Econ. 26, 169–187. doi: 10.1017/S1355770X20000327

Johnstone, N., Ivan, H., and David, P. (2010). Renewable energy policies and technological innovation: evidence based on patent counts. Environ. Resour. Econ. 45, 133–155. doi: 10.1007/s10640-009-9309-1

Kim, D. S. (2021). Essays on the Political Environment as an Institutional Force: Nonmarket and Market Strategies. Doctoral dissertation.

Krueger, A. O. (1974). The political economy of the rent-seeking society. Am. Econ. Rev. 64, 291–303.

Krugman, P. (1991). Increasing returns and economic geography. J. Polit. Econ. 99, 483–499. doi: 10.1086/261763

Kubick, T. R., Lockhart, G. B., Mills, L. F., and Robinson, J. R. (2017). IRS and corporate taxpayer effects of geographic proximity. J. Account. Econ. 63, 428–453. doi: 10.1016/j.jacceco.2016.09.005

Lu, S., Sun, Y., Tian, H., and Zhao, Y. (2024). Geographical proximity to government and corporate litigation behavior: evidence from China. China Econ. Rev. 85:102170. doi: 10.1016/j.chieco.2024.102170

Mahmood, N., Zhao, Y., Lou, Q., and Geng, J. (2022). Role of environmental regulations and eco-innovation in energy structure transition for green growth: evidence from OECD. Technol. Forecast. Soc. Change 183:121890. doi: 10.1016/j.techfore.2022.121890

Megginson, W. L., and Netter, J. M. (2001). From state to market: a survey of empirical studies on privatization. J. Econ. Lit. 39, 321–389. doi: 10.1257/jel.39.2.321

Munemo, J. (2022). Do African resource rents promote rent-seeking at the expense of entrepreneurship? Small Bus. Econ. 58, 1647–1660. doi: 10.1007/s11187-021-00461-0

Murshed, M., Rahman, M. A., Alam, M. S., Ahmad, P., and Dagar, V. (2021). The nexus between environmental regulations, economic growth, and environmental sustainability: linking environmental patents to ecological footprint reduction in South Asia. Environ. Sci. Pollut. Res. 28, 49967–49988. doi: 10.1007/s11356-021-13381-z

Oh, D., and Heshmati, A. (2010). A sequential Malmquist–Luenberger productivity index: environmentally sensitive productivity growth considering the progressive nature of technology. Energy Econ. 32, 1345–1355. doi: 10.1016/j.eneco.2010.09.003

Pan, X. X., Chen, M. L., Ying, L. M., and Zhang, F. F. (2020). An empirical study on energy utilization efficiency, economic development, and sustainable management. Environ. Sci. Pollut. Res. 27, 12874–12881. doi: 10.1007/s11356-019-04787-x

Paramati, S. R., Shahzad, U., and Dogan, B. (2022). The role of environmental technology for energy demand and energy efficiency: Evidence from OECD countries. Renew. Sustain. Energy Rev. 153:111735. doi: 10.1016/j.rser.2021.111735

Partridge, M. D., and Rickman, D. S. (2008). Distance from urban agglomeration economies and rural poverty. J. Reg. Sci. 48, 285–310. doi: 10.1111/j.1467-9787.2008.00552.x

Porter, M. E. (1991). America'8 green strategy. Sci. Am. 4:168. doi: 10.1038/scientificamerican0491-168

Porter, M. E., and van der Linde, C. (1995). Toward a new conception of the environment - competitiveness relationship. J. Econ. Perspect. 9, 97–118. doi: 10.1257/jep.9.4.97

Ren, S., Hao, Y., and Wu, H. (2022). The role of outward foreign direct investment (OFDI) on green total factor energy efficiency: does institutional quality matters? Evidence from China. Resour. Policy 76:102587. doi: 10.1016/j.resourpol.2022.102587

Ren, X., and Ren, Y. (2024). Public environmental concern and corporate ESG performance. Financ. Res. Lett. 61:104991. doi: 10.1016/j.frl.2024.104991

Safarzadeh, S., Rasti-Barzoki, M., and Hejazi, S. R. (2020). A review of optimal energy policy instruments on industrial energy efficiency programs, rebound effects, and government policies. Energy Policy 139:111342. doi: 10.1016/j.enpol.2020.111342

Shabalov, M. Y., Zhukovskiy, Y. L., Buldysko, A. D., Gil, B., and Starshaia, V. V. (2021). The influence of technological changes in energy efficiency on the infrastructure deterioration in the energy sector. Energy Rep. 7, 2664–2680. doi: 10.1016/j.egyr.2021.05.001

Shao, S., Hu, Z., Cao, J., Yang, L., and Guan, D. (2020). Environmental regulation and enterprise innovation: a review. Bus. Strat. Environ. 29, 1465–1478. doi: 10.1002/bse.2446

Shleifer, A., and Vishny, R. W. (1994). Politicians and firms. Quart. J. Econ. 109, 995–1025. doi: 10.2307/2118354

Stigler, G. J. (1971). The theory of economic regulation. Bell J. Econ. Manag. Sci. 2, 3–21. doi: 10.2307/3003160

Tang, C., Tan, L., and Liu, X. (2024). Regulatory distance and corporate environmental performance: From the perspective of rent-seeking distance. J. Environ. Manage. 365:121580. doi: 10.1016/j.jenvman.2024.121580

Tian, Y., and Feng, C. (2022). The internal-structural effects of different types of environmental regulations on China's green total-factor productivity. Energy Econ. 113:106246. doi: 10.1016/j.eneco.2022.106246

Tone, K., and Tsutsui, M. (2010). Dynamic DEA: a slacks-based measure approach. Omega 38, 145–156. doi: 10.1016/j.omega.2009.07.003

Trevlopoulos, N. S., Tsalis, T. A., Evangelinos, K. I., Tsagarakis, K. P., Vatalis, K. I., Nikolaou, I. E., et al. (2021). The influence of environmental regulations on business innovation, intellectual capital, environmental and economic performance. Environ. Syst. Decis. 41, 163–178. doi: 10.1007/s10669-021-09802-6

Tullock, G. (1967). The welfare costs of tariffs, monopolies, and theft. Western Econ. J. 5, 224–232. doi: 10.1111/j.1465-7295.1967.tb01923.x

Wang, L., Long, Y., and Li, C. (2022). Research on the impact mechanism of heterogeneous environmental regulation on enterprise green technology innovation. J. Environ. Manage. 322:116127. doi: 10.1016/j.jenvman.2022.116127

Wang, L., Shao, Y., Sun, Y., and Wang, Y. (2023). Rent-seeking, promotion pressure and green economic efficiency: evidence from China. Econ. Syst. 47:101011. doi: 10.1016/j.ecosys.2022.101011

Wang, M., Pang, S., Hmani, I., Hmani, I., Li, C., He, Z., et al. (2021). Towards sustainable development: How does technological innovation drive the increase in green total factor productivity? Sustain. Dev. 29, 217–227. doi: 10.1002/sd.2142

Wang, P., and Liang, S. (2022). Environmental regulations and energy efficiency: the mediating role of climate change and technological innovation. Front. Environ. Sci. 10:909082. doi: 10.3389/fenvs.2022.909082

Wen, J., Okolo, C. V., and Ugwuoke, I. C. (2022). Kolani K. Research on influencing factors of renewable energy, energy efficiency, on technological innovation. Does trade, investment and human capital development matter? Energy Policy 160:112718. doi: 10.1016/j.enpol.2021.112718

Xie, P., Xu, Y., and Tan, X. (2023). How does environmental policy stringency influence green innovation for environmental managements?. J. Environ. Manag. 338:117766. doi: 10.1016/j.jenvman.2023.117766

Xiong, Z., Liu, J., Yan, F., and Shi, D. (2024). Corporate ESG performance when neighboring the environmental protection agency. J. Environ. Manage. 349:119519. doi: 10.1016/j.jenvman.2023.119519

Zahraoui, Y., Korõtko, T., and Rosin, A. (2023). Agabus H. Market mechanisms and trading in microgrid local electricity markets: a comprehensive review. Energies 16:2145. doi: 10.3390/en16052145

Zhang, B., Yu, L., and Sun, C. (2022). How does urban environmental legislation guide the green transition of enterprises? Based on the perspective of enterprises' green total factor productivity. Energy Econ. 110:106032. doi: 10.1016/j.eneco.2022.106032

Keywords: energy efficiency, regulation, geographic proximity, green innovation, GTFEE

Citation: Zhang R, Ni K and Tan L (2025) Geographic proximity to local governments and corporate energy efficiency: evidence from Chinese industrial enterprises. Front. Environ. Econ. 3:1486650. doi: 10.3389/frevc.2024.1486650

Received: 26 August 2024; Accepted: 13 December 2024;

Published: 08 January 2025.

Edited by:

Jinyu Chen, Central South University, ChinaReviewed by:

Claude Njomgang, University of Yaoundé II, CameroonCopyright © 2025 Zhang, Ni and Tan. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Rui Zhang, ZWNvbjIzMDIwODc1NWVkdUAxNjMuY29t

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.