- Urban Real Estate Research Unit (URERU), Sustainability Oriented + Cyber Research Unit for Built Environment (S⊕CUBE), Department of Construction Economics and Management, University of Cape Town, Cape Town, South Africa

Renewable energy generation, especially in the form of rooftop solar photovoltaic (PV) systems, is expected to play an important role in South Africa's future energy mix. The national government, along with various municipalities at local government level, are introducing regulatory incentives to promote the uptake of solar PV systems in the private sector. These incentives include feed-in tariffs, capital subsidies and tax benefits. In addition to the regulatory incentives, there are non-regulatory drivers that motivate private property owners to pursue solar PV systems. These drivers include environmental considerations, cost savings, energy security, tenant requirements, and green-energy finance. This study examines the various regulatory incentives to pursue solar PV systems available to private property owners located in the City of Cape Town Metropolitan Municipality. The City of Cape Town is selected as a single case-study area as the municipality creates a conducive environment through its regulatory framework for private property owners to pursue private embedded generation systems. The study examines the different incentives applicable to residential and non-residential property owners. The research also establishes to what extent the regulatory incentives influence private property owners to pursue solar PV systems compared to non-regulatory drivers and benefits. The study reveals that the various regulatory incentives differ for residential and non-residential property owners. These differences impact the extent to which the regulatory incentives motivate particular private property owners to pursue solar PV systems. The research suggests that, although regulatory incentives play a role in private property owners' decision-making process, the non-regulatory drivers are the main motivating factors for private property owners pursuing solar PV systems.

1 Introduction

Since 2007, South Africa has been experiencing severe electricity supply and distribution constraints (Roff et al., 2022; Folly, 2021). These constraints are due to ageing infrastructure, a lack of maintenance and limited funds to invest in new capacity (De Ruyter, 2023). This can mainly be ascribed to mismanagement and systemic corruption in the state-owned utility company, Eskom, which is responsible for the generation, transmission and distribution of electricity in South Africa (Muller, 2023; De Ruyter, 2023; Mathebula and Masiya, 2022). These challenges resulted in regular power cuts, known as load shedding. There is a need to reduce the demand for electricity generated nationally by Eskom, and for private property owners to invest in energy solutions to provide a more reliable energy supply and greater energy security (Mathebula and Masiya, 2022).

Recently, existing regulatory incentives were enhanced to assist private property owners, along with Eskom, in combating the impact of the energy crisis. At the beginning of 2023, the national government announced temporary regulatory incentives for property owners to instal private energy generation systems (Minister of Finance, 2023). Various municipalities at the local government level have followed suit and announced additional incentives for private energy generation (Poorun and Radmore, 2023). These incentives are expected to promote the installation of grid-tied solar photovoltaic (PV) systems by private property owners. However, it is unclear whether these incentives are effective, and whether the move towards solar PV energy is driven by regulatory incentives or other factors. This study investigates the regulatory incentives and non-regulatory drivers for property owners to pursue private embedded generation through solar PV systems in South Africa. It compares the regulatory incentives with the non-regulatory drivers to establish the deciding factors for private property owners to pursue solar PV systems.

The scope of this study is limited to private embedded generation in the residential and non-residential property sectors. For the purposes of this study, non-residential property is used as an umbrella term that includes privately owned office, retail, agricultural and industrial properties. Large-scale power producers and the wheeling of electricity are not included in this study. The area of research only focuses on the regulatory incentives and non-regulatory drivers relating to electricity generation via solar PV systems. Although some of these incentives or drivers could apply to other renewable energy sources, these sources are not considered in this study. The term “solar PV system” refers to a grid-tied, rooftop solar energy system consisting of solar panels and inverters only and excludes backup batteries. Backup battery systems do not form part of solar PV systems, as they are not used to generate power, and are not relevant to the regulatory incentives relating to private embedded generation or solar PV systems.

2 Literature review and regulatory framework

This section is divided into three main parts. It begins with an overview of South Africa's energy landscape, which includes the energy crisis and the drive towards renewable energy. Thereafter, the regulation of renewable energy in South Africa, as well as the regulatory incentives for private energy generation is examined. Finally, the non-regulatory drivers relating to the implementation of solar PV systems by private property owners are discussed.

2.1 South Africa's energy landscape

2.1.1 The energy crisis

South Africa is heavily reliant on conventional power generation, which represents over 80% of the country's generation capacity (Mirzania et al., 2023; Pierce and Ferreira, 2022). Eskom, which owns and operates all coal-fired power plants, supplies approximately 95% of the country's total electricity demand. The remainder is met through municipalities, imports and independent power producers (Poorun and Radmore, 2022). South Africa's dependence on a single-operator model has decreased over the past decade. This is due to the model's inefficiencies and rising costs of electricity, together with the introduction of new and cost-effective technologies that lower carbon emissions and are capable of being decentralised (Mkhwebane and Ntuli, 2019; Poorun and Radmore, 2022).

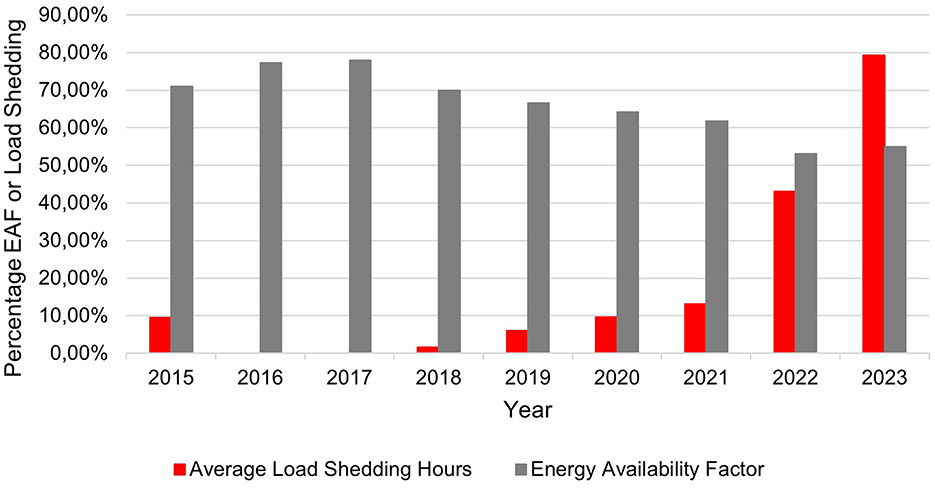

Eskom faces severe challenges of delayed commissioning and underperformance of new-build coal generation capacity, as well as the dilapidation of the existing coal fleet (Mirzania et al., 2023; Lawson, 2022; Folly, 2021). These challenges have led to declines in the energy availability factor and increasing levels of the unplanned capability loss factor, which have a detrimental impact on the country's energy security (Kock and Govender, 2021; Poorun and Radmore, 2022). The energy availability factor refers to the percentage of maximum energy generation that a plant can supply to the national electricity grid (Das et al., 2018). Eskom has an installed electricity generating capacity of 48,186 MW (Eskom, 2023a). Eskom needs to shed between 1,000 and 6,000 MW of the national load, depending on the stage of load shedding implemented (Eskom, 2024a). The severity of load shedding has increased substantially and corresponds with the decrease in the energy availability factor from 2018 onwards (Erero, 2023). Figure 1 illustrates the correlation between the energy availability factor and the imposed load shedding hours as a percentage of total annual hours per year from 2015 until 2023.

Figure 1. Correlation between energy availability factor in South Africa and load shedding hours as a percentage of total annual hours from 2015 to 2023 (Cowling, 2024; Eskom, 2024c; South African Government, 2024a,b).

Frequent and prolonged periods of load shedding threaten economic growth and have led to an energy crisis in South Africa (Mirzania et al., 2023; Roff et al., 2022; Folly, 2021; Akpeji et al., 2020). The energy crisis triggered the announcement of a national state of disaster in February 2023 (Department of Co-operative Governance, 2023a). However, this state of disaster was terminated 2 months later, on 5 April 2023 (Department of Co-operative Governance, 2023b).

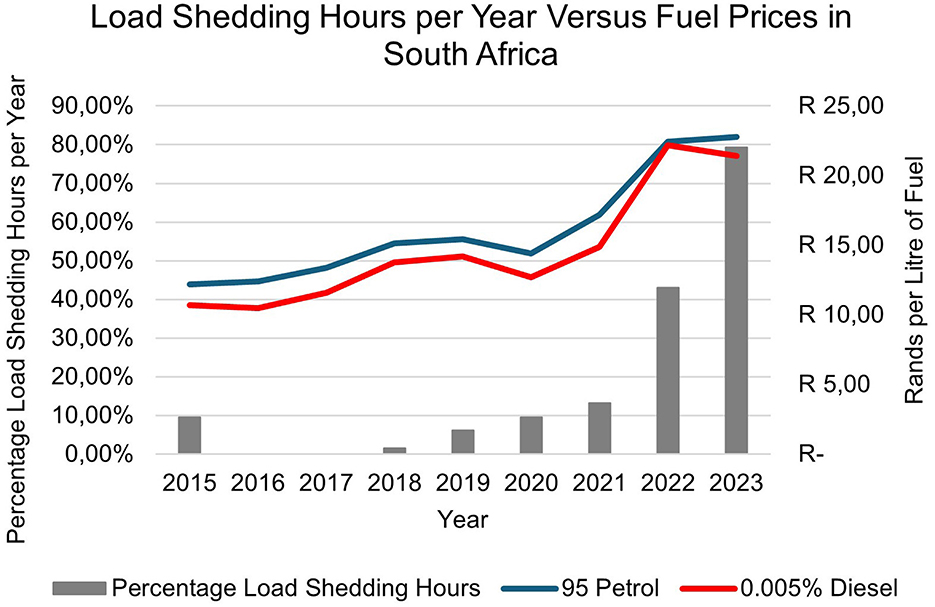

The greatest challenges for households during load shedding include safety, security, and cooking; productivity is arguably businesses' greatest concern (Poorun and Radmore, 2023). Load shedding has caused businesses to have even greater capital spending compared to households, as businesses need to purchase diesel generators (and fuel) to maintain operations in the short term. Generators are generally considered relatively affordable to purchase. However, given the prolonged and frequent power cuts, the demand for fuel is high. Effectively, this makes generator systems expensive in the medium to long term. As seen in Figure 2, the cost of diesel has increased significantly from 2021 to 2023 and coincides clearly with the increase in the hours of load shedding. High utility costs and fuel prices therefore cause private property owners to consider alternative energy solutions.

Figure 2. Increasing hours of load shedding and fuel prices in South Africa (South African Petroleum Industry Association, 2024; Cowling, 2024).

2.1.2 South Africa's drive towards renewable energy

As a party to the United Nations Framework Convention on Climate Change, the South African government ratified the Paris Agreement in November 2016, whereby they agreed to achieve net zero carbon emissions by 2050 to combat climate change (United Nations, 2024). In September 2021, the government issued an update to the first Nationally Determined Contribution under the Paris Agreement which reflects the Government's “highest possible level of ambition…in light of our national circumstances” (Department of Forestry Fisheries and the Environment, 2021). The finalised targets of the Nationally Determined Contribution intend to limit greenhouse gas emissions by 2025, and even more so by 2030.

In 2020, Eskom introduced the concept of the Just Energy Transition Investment Plan, which encompasses the transformation of South Africa's energy system in a socially, economically and environmentally reasonable and inclusive manner (Eskom, 2024b). The Just Energy Transition Investment Plan concept recognises that the transformation to a sustainable and low-carbon energy system should not worsen the existing disparities such as access, distribution and benefits to vulnerable communities, but rather promote social justice and equality by protecting these communities against the impact of load shedding as a result of the ongoing energy crisis (Eskom, 2024b; Mirzania et al., 2023). The Just Energy Transition Investment Plan is mainly focused on managing the decommissioning of retiring coal power plants whilst increasing renewable energy generation, strengthening the national transmission grid infrastructure and enhancing the electricity distribution system (The Presidency, 2022).

South Africa's energy crisis and its coal-intensive energy sector highlight the need to move towards a more sustainable energy mix. During the State of the Nation Address in February 2023, the President noted that rooftop solar PV systems play an increasingly important role in the country's efforts to restore energy security in the short term. Accordingly, the President announced the roll-out of temporary regulatory incentives to promote the implementation of renewable energy in the private sector (South African Government, 2024a,b). The temporary expansions to the regulatory incentives relating to rooftop solar PV systems are discussed below in Section 2.2.3. The regulatory incentives not only benefit private property owners but also contribute to the country's sustainability goals due to the resultant increase in the uptake of solar PV systems.

2.2 Regulation of renewable energy in South Africa

2.2.1 National regulatory framework

The regulatory framework of South Africa's energy sector is shaped by the Integrated Energy Plan (IEP) (Department of Minerals and Energy, 2003) and the Integrated Resource Plan (IRP) (Department of Energy, 2019). The IEP takes a holistic perspective on the country's energy needs to project future energy requirements. It creates a coherent energy plan, which takes the entire energy system into account and allows for the alignment and optimisation of the respective energy sources (Department of Minerals and Energy, 2003). The IRP sets out the country's electricity capacity plan based on the energy mix and generation capacity targets. It provides a regulatory framework for renewable energy projects and contains capacity allocations for renewable energy technologies such as solar PV, as well as detailed decommissioning schedules of existing coal-fired plants (Department of Energy, 2019). An updated IRP was expected during 2023, given the national energy security context and regulatory movement (Creamer, 2022). However, the updated IRP has not been released at the time of this study.

Combined, the IEP and IRP provide guidance for energy planning and development as well as the integration of renewable energy sources such as solar PV energy. These documents also affect and benefit private property owners pursuing solar PV energy as they influence regulatory incentives and support mechanisms, which include renewable energy targets, grid connexions, as well as compliance with technological standards (Department of Energy, 2015). An enabling environment is created for private property owners to pursue solar PV systems, as the IEP and IRP allow these systems to be more economically viable and environmentally sustainable, which is in line with the country's energy goals (Poorun and Radmore, 2022).

There is no overarching national legislation relating specifically to renewable energy in South Africa; this is currently dealt with in disparate pieces of legislation. Relevant legislation includes the National Energy Act 34 of 2008, the National Energy Regulator Act 40 of 2004, the Electricity Regulation Act 4 of 2006, and the Carbon Tax Act 15 of 2019.

The National Energy Act 34 of 2008 generally embodies South Africa's energy law. The Act supports energy planning and the availability of diverse energy sources and promotes the increased generation and consumption of renewable energy. Private property owners pursuing solar PV energy must comply with the National Energy Act's provisions and abide by the regulations relating to grid connexions.

The National Energy Regulator Act 40 of 2004 established the National Energy Regulator of South Africa (NERSA) and provides a framework for renewable energy regulation in the country. It allows NERSA to approve electricity tariffs and to issue, amend and revoke electricity generation licences. In this respect, the act operates alongside other legislation such as the Electricity Regulation Act 4 of 2006.

The Electricity Regulation Act 4 of 2006 provides for the issuing of licences to generate, transmit, distribute, trade, import and export electricity. Schedule 2 of the Electricity Regulation Act 4 of 2006 was amended in October 2021 to increase the threshold for private embedded generation from 1 MW to 100 MW (Department of Mineral Resources and Energy, 2021). The increased threshold meant that a generation licence was not required for a system generating up to 100 MW. This threshold was removed entirely in December 2022, which means that private property owners no longer have to acquire generation licences, and that their embedded generation systems only need to be registered with NERSA (Department of Mineral Resources and Energy, 2022). The removal of the threshold has motivated numerous private property owners to pursue solar PV systems due to the improved accessibility and reduced legal measures relating to private embedded generation (Poorun and Radmore, 2023). Apart from embedded generation systems having to be registered with NERSA, these systems also require approvals from the relevant distributors, such as the local municipality or Eskom, before connecting to the national electricity grid (Poorun and Radmore, 2023).

The Carbon Tax Act of 2019 is implemented in two phases. The first phase ended on 31 December 2022 with phase 2 being implemented from 2023 to 2030. Phase 1 included a relatively low tax rate per tonne of carbon dioxide emitted with a range of tax-free thresholds used to incentivize large emitters to decrease their carbon profile before the start of phase 2. Changes to rates and tax-free thresholds are applied in phase 2. Carbon tax for solar PV and other renewable energy sources are yet to be determined but are good sources for carbon offsetting (Poorun and Radmore, 2022). In general, the Carbon Tax Act may lead to an increase in operating costs for businesses that rely on energy-intensive processes. When viewed from a different perspective, the implementation of green practises such as the installation of solar PV systems may reduce the property owner's carbon tax liability.

2.2.2 Regulatory context at provincial and municipal level

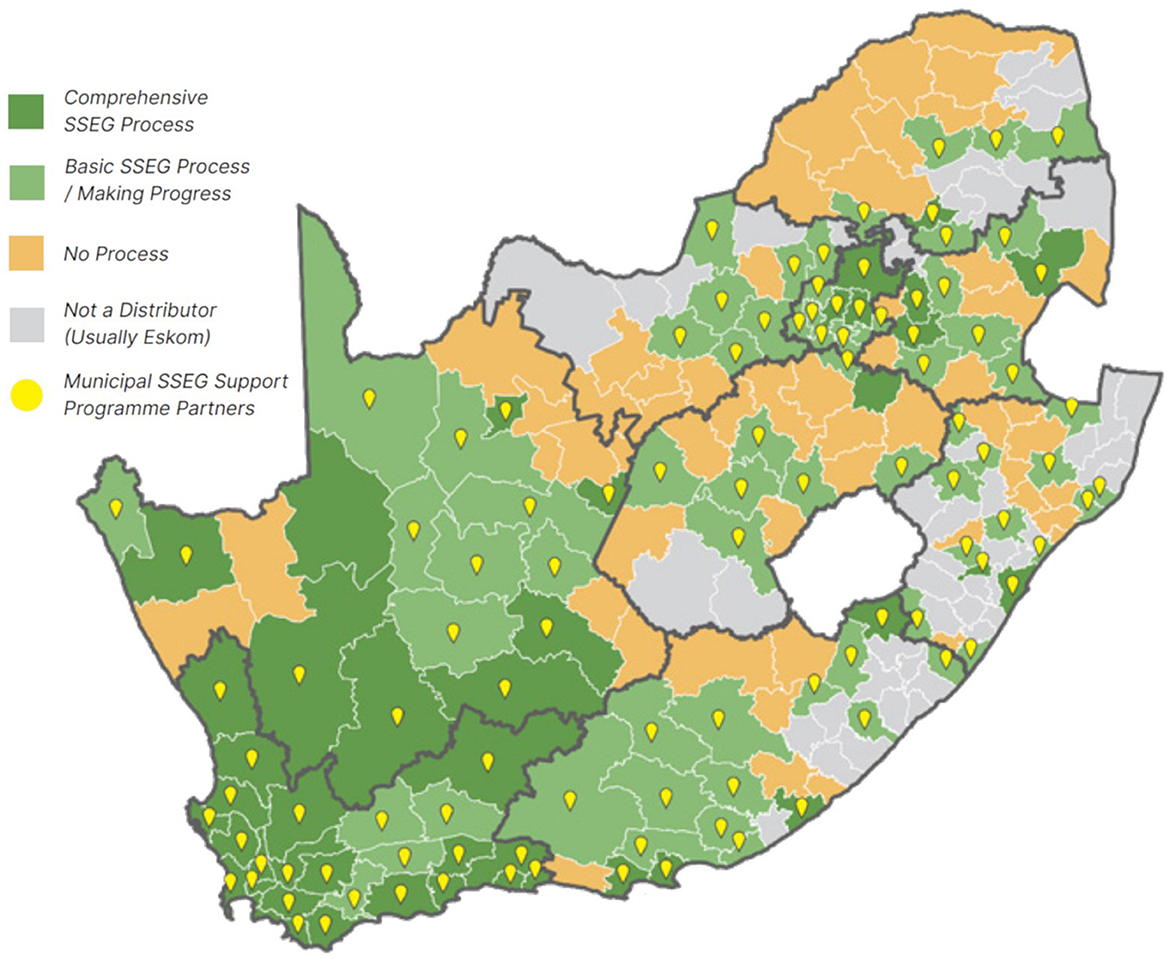

Various provincial governments are working towards reducing their reliance on the national utility and are taking an alternative approach to providing energy security to households and businesses at a provincial level. In terms of the national uptake of private embedded generation, municipalities in the Western Cape Province stand out. As of 2023, the Western Cape province leads with 24 (out of 25) municipalities that allow the connexion of private embedded generation onto the municipal electricity network. This amounts to a provincial uptake of 96%, compared to 66% of the second-best province, Gauteng. Furthermore, 20 Western Cape municipalities offer NERSA-approved feed-in tariffs. This represents 80% of municipalities in the Western Cape, compared to Gauteng's 44% (South African Local Government Association, 2023). Compared to the other eight provinces in the country, the Western Cape accounts for approximately 34% of municipalities nationwide that allow small-scale embedded generation installations and 47% that have approved feed-in tariffs in place (South African Local Government Association, 2023). The Western Cape provincial government plays a crucial role in managing the electricity crisis in the province. It enables municipalities in the province to compensate businesses and households for installing rooftop solar PV systems and feeding excess electricity back into the grid (Maynier, 2020). Figure 3 is a map of South Africa illustrating the status of each municipality regarding the progress made to implement regulatory processes applicable to small-scale embedded generation (SSEG).

Figure 3. Map of South African municipalities reflecting progress with small-scale embedded generation processes (South African Local Government Association, 2023, p. 11).

In terms of private embedded generation installations, municipal regulations can complement the national legislative framework. For example, the City of Cape Town Metropolitan Municipality (CoCT) in the Western Cape has amended its regulations to encourage investment in private embedded generation. By July 2023, the CoCT had approved more than 5 700 grid-tied and off-grid systems (City of Cape Town, 2023a). The CoCT is at the forefront of becoming less reliant on Eskom for generating electricity and offers the greatest regulatory incentives of the Western Cape's municipalities for private energy generators (Maynier, 2020). These incentives generally differ for non-residential and residential properties and are discussed in more detail below.

2.2.3 Regulatory incentives available for private energy generation

This section discusses the temporary regulatory incentives introduced at national government level in February 2023 to promote the use of renewable energy in the private sector (Minister of Finance, 2023). Furthermore, municipal regulatory incentives available to private property owners located in the CoCT to pursue private embedded generation by utilising solar PV systems are examined. The discussion is divided into two main categories. The first category focuses on regulatory incentives applicable to non-residential property owners. The second category relates to regulatory incentives available to residential property owners.

2.2.3.1 Regulatory incentives for non-residential property owners

2.2.3.1.1 Feed-in tariffs

A feed-in tariff (FIT) is a mechanism used by many countries worldwide to encourage renewable energy generation (Ndiritu and Engola, 2020). This mechanism allows producers of renewable energy to feed that energy into the electricity grid and sell it to an off-taker at a determined tariff (Meya and Neetzow, 2021; Zhao et al., 2021; Ndiritu and Engola, 2020). Investing in a solar PV system and selling surplus electricity back to the grid enables private property owners to offset some of the initial investment costs of these systems.

Private property owners must meet certain requirements in order to sell electricity back to the grid and benefit from the FIT incentive. Apart from private embedded generation systems having to be registered with NERSA, these systems also require approvals from the relevant distributors, such as the local municipality, before connecting to the grid (Poorun and Radmore, 2023). Furthermore, an approved metering system must be installed at the property. This system consists of advanced metering infrastructure which is installed by the municipality and accurately reports the customer's electricity consumption and generation (Burger, 2023).

In February 2023, it was announced that Eskom is in the process of developing a FIT for residential and non-residential customers (Minister of Finance, 2023). However, Eskom-supplied customers nationwide cannot currently benefit from FITs. Nevertheless, they still need to register their grid-tied solar PV systems with NERSA if the system is larger than 100 kW. The registration process is lengthy and involves converting to a time-of-use tariff, conducting a capacity study, paying a quotation fee to Eskom and providing proof of registration with NERSA to Eskom. Once the grid connexion application is approved, an Embedded Generation Installation compliance test report must be submitted along with a Certificate of Compliance for the wiring of the installation, an inverter certificate and the NERSA registration certificate (Eskom, 2023b). The potential costs associated with feeding electricity back into the grid as an Eskom-supplied customer will include a service and administration charge, a monthly transmission network or distribution network capacity charge and an urban low voltage subsidy charge (Eskom, 2023c). When viewed over the period of a year, for example, the net benefit of feeding back into the grid is minimal (when this option becomes available), as the charges outweigh the potential savings generated by the FIT incentive (Brewis et al., 2024).

The above situation applicable to Eskom-supplied customers must be distinguished from the position of customers who receive electricity directly from the municipality. For example, CoCT-supplied customers must apply to the municipality for a grid connexion and register their systems with NERSA, however, they do not require generation licences (City of Cape Town, 2023b). The supporting documents are not nearly as time-consuming to compile, and the overall process is more streamlined and user-friendly than that of Eskom (Burger, 2023). Furthermore, the CoCT municipality received an exemption from the National Treasury regarding FITs. This allows the municipality to provide grid-tied non-residential customers with a NERSA-approved FIT of 73.87 c/kWh (City of Cape Town, 2023c)—equal to USD0.0384/kWh, using the exchange rate of USD1.00 = ZAR19.2155 on 29 February 2024 (South African Reserve Bank, 2024). Non-residential CoCT-supplied customers receive an additional incentive of 25 c/kWh (USD0.0130/kWh) to feed electricity back into the grid. This additional incentive was implemented in June 2023 and will end in June 2025 (City of Cape Town, 2023c).

2.2.3.1.2 Capital allowance: Section 12B of the Income Tax Act of 1962

The Income Tax Act provides an incentive for businesses in the form of a capital expenditure deduction for assets used in the generation of renewable energy. This provision is found in Section 12B of the Act Income Tax Act 58 of 1962. On 1 March 2023, an amendment to the Income Tax Act came into operation, which provides for a temporary expansion of the Section 12B allowance (Taxation Laws Amendment Act 17 of 2023). From 1 March 2023 until 28 February 2025, the 1MW threshold on generation capacity stated in the Act is removed. Furthermore, businesses can reduce their taxable income by 125% of the cost of their renewable energy investment in the 1st year after installation. This temporary incentive therefore provides a greater saving for businesses compared to the structure of the incentive before March 2023.

It is worth noting that Section 12L of the Income Tax Act 58 of 1962 forms part of a government program that provides a tax incentive to private property owners who invest in energy-efficient technologies. This allows property owners and developers to claim a tax deduction when reducing their overall energy consumption through the implementation of energy efficiency measures. This incentive, however, falls outside the scope of this study, as it is not directly related to the implementation of solar PV systems.

2.2.3.2 Regulatory incentives for residential property owners

2.2.3.2.1 Feed-in tariffs

As is the case with non-residential properties, FITs are not currently available to Eskom-supplied residential customers. Only customers supplied directly by their municipality may benefit from FITs, and then only if the specific municipality has a FIT scheme.

The CoCT, for example, received approval from NERSA to implement a residential FIT of 78.98 c/kWh (USD0.0411/kWh) (City of Cape Town, 2023c). The additional 25 c/kWh incentive provided for non-residential property owners in the CoCT also applies to residential customers. The implementation of this additional incentive was delayed for residential customers, but it also expires at the end of June 2025 (City of Cape Town, 2023c). Given the high cost of living, residential private property owners can often only afford to instal solar PV systems that match their electricity demand. Alternatively, they choose to instal a backup battery system only (Schulte et al., 2022). Therefore, very few residential customers generate excess electricity to feed back into the municipal grid.

2.2.3.2.2 Solar energy tax credit: Section 6C of the Income Tax Act 58 of 1962

On 1 March 2023, an amendment to the Income Tax Act came into operation (Taxation Laws Amendment Act 17 of 2023). Section 6C of the Act now provides a temporary tax incentive for residential property owners who instal solar PV panels at their property between 1 March 2023 and 29 February 2024. These owners can claim an income tax credit of 25% of the cost of the solar PV panels to a maximum amount of R15,000 (USD780.62). The tax credit does not apply to portable solar panels, inverters, batteries or other energy storage systems. In the residential sector, solar PV panels are typically installed with an inverter and are, in most cases, coupled with backup batteries, the cost of which is not covered by this tax incentive. Given the high initial cost associated with the installation of solar PV systems, the tax credit is very low and provides no real incentive for residential property owners to pursue rooftop solar systems. The limitations and restrictions negate this incentive (Schulte et al., 2022).

As with non-residential property owners, residential property owners who invest in energy-efficient technologies can benefit from Section 12L of the Income Tax Act 58 of 1962. Residential property owners can claim a tax deduction when reducing their overall energy consumption through the implementation of energy efficiency measures. This incentive falls outside the scope of this study, as it is not directly related to the implementation of solar PV systems.

2.3 Non-regulatory drivers of private embedded generation

The literature identifies five main non-regulatory drivers that motivate private property owners to pursue solar PV systems. These drivers are environmental considerations, cost savings, energy security, tenant requirements and green-energy finance (Creamer, 2022; Poorun and Radmore, 2022).

2.3.1 Environmental considerations

Various environmental benefits are associated with the increased implementation of solar PV systems. The generation of electricity through solar PV systems reduces greenhouse gas emissions, minimises pollution, aids in decarbonisation, improves health and wellbeing, and increases sustainability (Hansen et al., 2013; Poorun and Radmore, 2022). This consideration is especially relevant in a country such as South Africa which is heavily reliant on coal for electricity generation (Mirzania et al., 2023; Pierce and Ferreira, 2022).

Environmental considerations are one of the main drivers of private embedded generation (Poorun and Radmore, 2022; Creamer, 2022). This is especially true for non-residential property owners, as the implementation of renewable energy sources reduces the potential impact of carbon tax levies on businesses (Hansen et al., 2013). Furthermore, listed funds and Real Estate Investment Trusts (REITs) are expected to report on their environmental and social governance (ESG) performance to their investors. Their ESG performance demonstrates a commitment to responsible governance and forward-thinking decision-making (Cheruiyot et al., 2023). Real Estate Investment Trusts and other listed funds are therefore motivated either to acquire properties with green-building certification (such as the Green Star Certificate awarded by the Green Building Council of South Africa) or attain this certification on existing buildings by pursuing solar PV energy (Green Building Council South Africa, 2023).

2.3.2 Cost savings

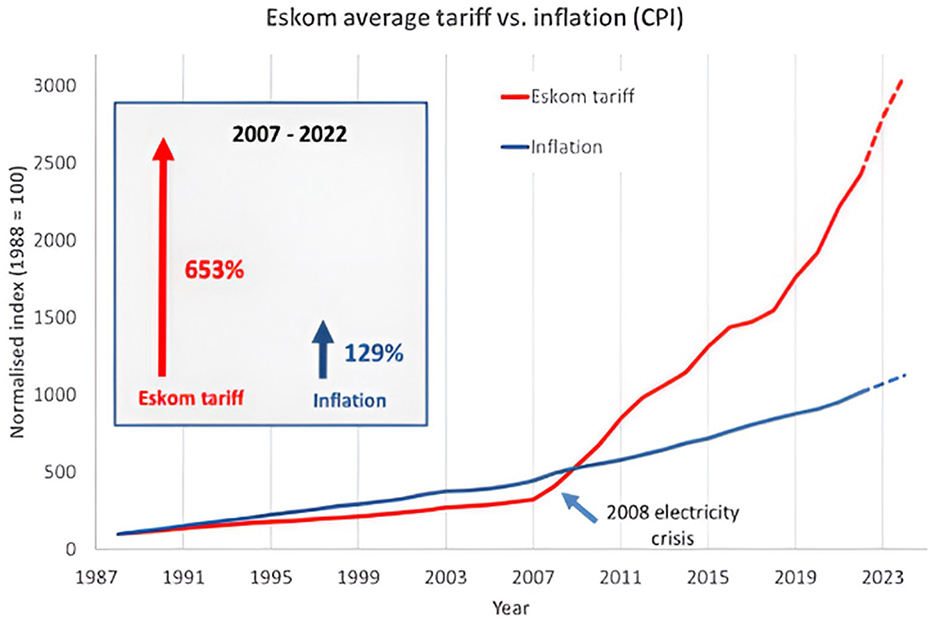

Rising electricity prices create a strong business case for private property owners to invest in renewable energy solutions, as this provides resilience to electricity tariff hikes (Poorun and Radmore, 2023). Electricity prices in South Africa have been increasing rapidly over the past few years. Eskom's tariffs were generally lower than inflation during the 1990s and early 2000s, as the government kept these tariffs as low as possible to accommodate poor communities, especially since the state-owned utility had an oversupply of electricity. With the onset of the electricity crisis in 2007, Eskom's tariffs exceeded inflation for the first time and have quadrupled over the past 15 years (Moolman, 2022). Figure 4 shows a clear inflexion point for electricity tariffs from the 2007 electricity crisis onwards.

Figure 4. Eskom Tariff Increases vs. Inflation Since 1988, with projections to 2024 (Moolman, 2022).

Solar PV currently dominates the private embedded generation market due to its competitive prices, favourable weather conditions in South Africa, technical maturity and simple implementation (Creamer, 2022). Although solar PV systems have high initial costs, they have become economically viable for residential and non-residential property owners. This is due to the reduction of payback periods for self-consumption systems given the high cost of electricity (Okunlola et al., 2019).

2.3.3 Energy security

Energy generation via a solar PV system (coupled with a generator or battery storage) allows private property owners to continue powering their buildings or operations during daytime load shedding. It is important to note that inverters require power to convert solar panels' direct current (DC) into alternating current (AC) and therefore need to be connected to a power source such as a generator or battery system during periods of load shedding (Schulte et al., 2022; Poorun and Radmore, 2023). Coupling a generator with the solar PV system allows property owners to use solar energy during the day while there is load shedding.

In comparison, battery systems also fulfil this function but provide backup power when the sun is not shining. The combination of solar PV systems coupled with a generator or backup battery system therefore provides private property owners with greater energy security than conventional sources and allows them to be self-sufficient (Schulte et al., 2022). However, the focus of this paper does not include battery storage.

2.3.4 Tenant requirements

In both the residential and non-residential property sectors, utility costs are typically paid by the tenants. The savings derived from a rooftop solar PV system that reduces the property's utility bill are very attractive to tenants. Therefore, property owners who instal solar PV systems are more likely to retain their tenants.

Furthermore, the installation of a solar PV system is often a requirement of the tenant, especially in the non-residential property sector. Not only does the solar PV system offer the tenant a saving on their operating costs, it also provides them with energy security, as they typically connect these systems to a generator (Sakeliga, 2022). Solar PV systems also allow tenants to lower the potential impact of carbon taxes, which would otherwise lead to an increase in operating costs for businesses that rely on energy-intensive processes (Creamer, 2022).

2.3.5 Green-energy finance

Green-energy finance is considered one of the main drivers for implementing private embedded generation systems as financing renewable energy solutions has become imperative given the global growth of this sector over the past decade (Mavlutova et al., 2023; Du et al., 2023). In South Africa, commercial banks have started providing tailored finance solutions for rooftop solar PV systems over the past 3 to 5 years with specific portfolios supporting private embedded generation projects (Poorun and Radmore, 2023). These tailored solutions are aimed at solar PV installations in both the residential and non-residential markets, covering 70% to 100% of capital costs with a 5- to 10-year loan repayment period (Poorun and Radmore, 2022).

3 Methodology

There is limited qualitative data regarding the regulatory incentives and non-regulatory drivers that exist for private property owners to pursue solar PV systems in South Africa. This study therefore comprises a single case study of a specific municipal jurisdiction within the Western Cape province in the Republic of South Africa, namely the City of Cape Town Metropolitan Municipality (CoCT). The research focuses on the regulatory incentives and non-regulatory drivers that motivate private property owners to pursue solar PV systems on a national level and within this specific municipal area. This case study is unique and the findings may inform decision-making and improve future practises (Saunders et al., 2019).

In order to gather detailed data and insights, semi-structured interviews were conducted with private property owners and solar practitioners within the case-study area. The interviews were conducted with various participants that represent both the residential (freehold and sectional title) and non-residential property sectors, which include agricultural, commercial (offices), retail and industrial properties. All properties represented or owned by the participants are located within the CoCT. The participants were expected to produce trustworthy feedback during the interviews from which their perspectives were compared and contrasted. To ensure the reliability and validity of the data, multiple data sources were triangulated to enhance the credibility of the study (Creswell and Creswell, 2018).

An interview schedule with predetermined questions guided the interview discussions, ensuring they remained focused and covered all necessary topics (Wilson, 2016). The structure of the interviews included a combination of open- and close-ended questions which allowed for clear answers from each participant. The closed-ended questions included yes-no questions, as well as selection and identification questions. In some instances, the participants were asked to elaborate on their answers, which provided a greater understanding of the reasoning behind these answers. As open-ended questions are often time-consuming, only a few were included in the schedule to evaluate the participants' outlook towards a specific topic.

Two sets of interview schedules were used: one tailored for private property owners or their representatives, and another designed for solar practitioners. The questions were adapted to the participant's role as either a private property owner (residential or non-residential), their representative, or an industry professional such as a solar practitioner. For some of the questions, it was necessary to inquire as to the individual's profession to determine their role and expertise within the solar energy market. The interview schedules are included as Appendixes A, B respectively. The information required for the research includes the participants' knowledge of the solar PV and private embedded generation markets, along with their knowledge of regulations that govern this sector and any incentives that are available to property owners pursuing private embedded generation through solar PV systems within the CoCT.

To qualify for participation in this study, private property owners needed to represent property funds (listed or unlisted) or own at least five properties within the CoCT and possess knowledge of solar PV systems and related regulatory incentives, regardless of whether they had solar PV systems installed at their properties. The properties owned by the participants could include residential, retail, office, industrial, and agricultural properties. During data collection and analysis, a distinction was made between residential and non-residential properties. Solar practitioners operating within the CoCT were also selected as participants to gain insights from a different perspective. To qualify for participation in this study, the solar practitioners needed to have knowledge of the regulatory incentives offered at both the national level and by the CoCT, as well as the processes involved in pursuing these incentives. They were also selected based on their involvement and experience in the residential, office, retail, industrial, or agricultural property sectors. These practitioners generally held senior positions within their companies, which ensures the credibility of the information provided.

A total of 11 private property owners and 9 solar practitioners were contacted to participate in the study. From the 20 potential participants who were contacted, 8 were available and willing to participate in the study. The participants included 5 private property owners and two solar practitioners. The 8th participant, initially contacted as a private property owner, also provided insights as a solar practitioner due to their professional involvement with agricultural properties.

As the study involves human participants, the University of Cape Town's Faculty of Engineering and Built Environment Ethics in Research Committee (EBE EiRC) granted ethical clearance before empirical data was collected for this study (Ref: EBE/00243/2023). After giving free and informed consent, research participants voluntarily took part in the research process. Participants were free to withdraw at any stage without any consequences.

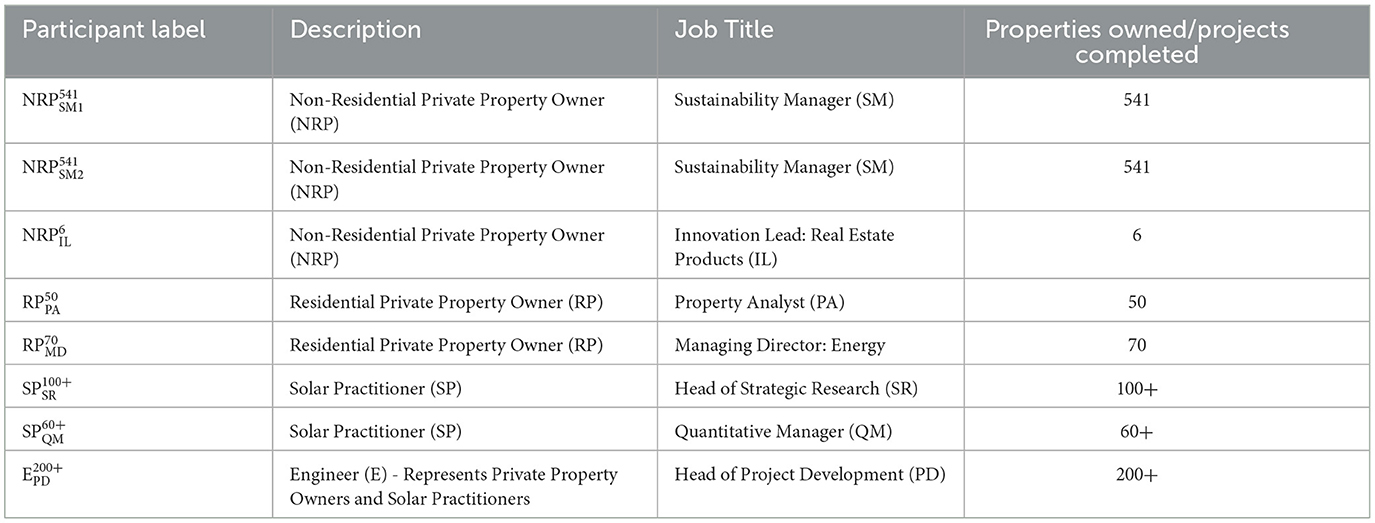

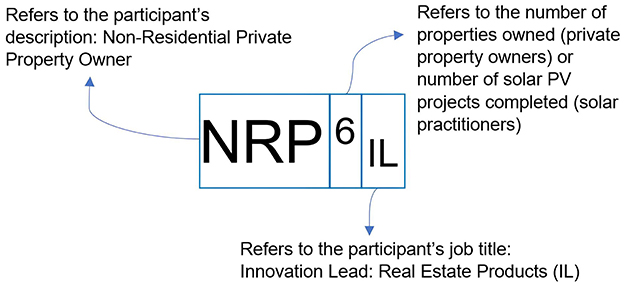

Participants were given the option of in-person or virtual interviews based on their availability. All interviews were conducted virtually using Microsoft Teams and were recorded. The interviews typically lasted between thirty and 40 min and were conducted over 3 months from July to September 2023. To ensure participant anonymity and encourage an open discussion during the interviews, the participants were labelled as part of the data analysis process. Table 1 categorises the participants as residential or non-residential private property owners or solar practitioners, detailing their job titles and the number of properties owned or solar PV projects completed.

The participants representing non-residential private property owners in this study each own between 6 and 541 properties, while the residential private property owners each own between 50 and 70 properties. Among the solar practitioners interviewed, one has completed over 200 solar PV projects, another has completed more than 100 projects, and the third has completed at least 60 projects. This diverse range of property ownership and extensive experience in solar PV projects provide valuable insights for the analysis, as the participants reflect the diverse landscape of the Cape Town property market.

The participants feature a major real estate investment trust with a varied portfolio, a leading residential developer, and a non-profit organisation dedicated to low-income housing. Significant contributions were also made from participants with notable holdings in the retail, industrial and agricultural sectors. Furthermore, several solar practitioners offer innovative renewable energy solutions, playing a crucial role in advancing sustainability for both residential and commercial clients in the City of Cape Town. Figure 5 provides an explanatory example of how the participants are labelled.

The nature of qualitative data is flexible and systematic, and methods such as theme identification and coding were therefore used to analyze the data collected in this study (Schreier, 2013). The themes in this study were identified by coding the interview results using the NVivo 14 software and can be broken down into organising and basic themes (Kiger and Varpio, 2020). The coding process in NVivo 14 required interpretative decisions, making the process somewhat subjective. To promote transparency and consistency, coding guidelines were established and applied uniformly throughout the analysis. The organising themes of this study include the outlook on the country's energy landscape, demand for solar energy/private embedded generation, regulatory incentives and non-regulatory drivers associated with solar PV systems as well as the constraints relating to private embedded generation. The basic themes representing the regulatory incentives for solar PV systems include the Section 12B capital allowance for non-residential property owners, the Section 6B solar energy tax credit for residential property owners, and feed-in tariffs. The non-regulatory drivers of private embedded generation are environmental considerations, cost savings, energy security, tenant requirements, and green-energy finance.

4 Findings

This section presents the findings from the empirical data collected from the research participants during the semi-structured interviews. The discussion of the findings is structured around the five themes identified during the analysis, namely, the research participants' outlook on the country's energy landscape, the demand for solar energy, regulatory incentives, non-regulatory drivers, and the constraints to implementing private embedded generation systems.

As stated, this study comprises a single case-study analysis of the CoCT. To provide context, the CoCT is the only metropolitan municipality in the Western Cape province and it covers an area of 2,441 km2 (Main, 2024). The CoCT has a population of 4,772 846 (7.69% of the national population) made up of 1,452,825 households (City of Cape Town, 2023d). It comprises South Africa's second-largest economic hub (Main, 2024). Based on the area's latitude and prevailing weather conditions, it has an average PV power potential of 4.5 kWh/kWp, making it well-suited for the generation of solar energy (World Bank Group, 2019).

4.1 Outlook on South Africa's energy landscape

Despite the availability of renewable energy sources, the energy crisis in South Africa negatively affects economic growth (Mirzania et al., 2023; Roff et al., 2022; Folly, 2021; Akpeji et al., 2020). Participants and compared the crisis to a “gold rush,” noting an influx of foreign investment in South Africa's renewable energy sector. Participant stated that this influx places further strain on the electricity grid, making grid stability the “next big focus area.” Participants and are concerned that the outcome of studies such as this one may halt existing or future regulatory incentives aimed at promoting private embedded generation. Furthermore, participants also noted that private generation might be disincentivised if peak electricity tariffs become more affordable.

Participant criticised Eskom for being poorly run and politically motivated to continue the country's reliance on coal or fossil fuels to generate electricity. According to participants , and , the use of coal is a cheaper option compared to investing in renewable energy in the long term. The participants added that Eskom will invest in the optimisation of existing power stations instead of investing in renewable energy. Nevertheless, the participants are optimistic that the country will move towards a more sustainable energy mix, despite potential increases in electricity costs to fund renewable projects.

The participants expressed the hope that NERSA and the relevant government departments will continue to create an increasingly conducive environment for pursuing renewable energy generation. At the same time, however, participant fears that the increased implementation of renewable energy in the private sector may affect Eskom's bottom line, causing renewable energy to be disincentivised by the national government, and possibly by some provincial and local governments.

4.2 Demand for solar energy

Given the participants' views on South Africa's energy landscape and the shift towards renewable energy, various participants confirmed a substantial increase in the demand for solar PV and private embedded generation systems. This demand coincides with the increase in load shedding. The participants' views are consistent with the literature, which suggests that rooftop solar PV systems are essential for restoring energy security and have led to the introduction of temporary regulatory incentives (South African Government, 2024a,b; Schulte et al., 2022).

Participants and noted that the demand has shifted from installing solar PV panels only to installing systems integrating diesel generators or batteries. Although backup systems do not fall within the scope of this study, it is important to note that solar PV systems require batteries or generators to function during load shedding. These systems are otherwise shut down during periods of load shedding, which impacts the potential solar savings and energy security. Integrating an inverter with a battery or generator allows the system to provide a stable baseload power source that can instantly respond to changes in user demand for electricity. This allows an inverter to operate the PV system at its peak operating point, which is independent of the load and dictated by solar and environmental conditions (Mohamed et al., 2022). Participant estimates a 15% to 20% loss in solar production due to load shedding, emphasising the necessity of backup systems in manufacturing and supply-chain industries, data centres and healthcare facilities, as the properties' loads can be managed and the power generated can be used for prolonged periods. In the agricultural sector, the demand for new energy systems is limited due to seasonal requirements, with agricultural property owners often opting for short-term solutions such as diesel generators. The current demand for new systems therefore stems from dairy farms and those properties that require uninterrupted power supply year-round. These agricultural properties see long-term solar PV investments as more cost-effective given rising fuel prices and frequent power cuts. According to Participant , a large percentage of agricultural property owners are considering second-phase installations and expansions. This could mainly be ascribed to favourable green-energy financing conditions and the financial implication of the combination of high fuel prices and frequent power cuts, as seen in Figure 2.

The office sector has the lowest demand for solar PV energy compared to the retail, industrial, and agricultural sectors. This is especially true for high-rise office buildings. Participant commented that roof space is often limited in these buildings and “the solar energy generated is between 20% and 35% of the actual need, which is insufficient.” In comparison, retail properties with large roofs and daytime peak usage are ideal for solar PV installations.

In terms of the residential property sector, participants and commented that the installation of solar PV panels with backup battery systems at sectional title schemes or apartment blocks would be beneficial to supply electricity to common areas for security purposes. Homeowners, however, prefer solar PV systems with backup batteries to power essential appliances, as peak residential demand is in the evening and early morning. According to participants and , the integration of batteries with a solar PV system is considered the best way to harness the energy generated during the day. However, the high cost of these integrated systems lowers the demand for solar PV systems in the residential sector due to cost constraints (Schulte et al., 2022).

4.3 Regulatory incentives for solar PV systems

The participants commented that supportive energy policies and regulations also drive the implementation of private embedded generation systems. The participants argued that the current policy and regulatory environment is more favourable than in the past, making investments in solar PV systems more attractive. Participant highlighted that current policies and regulations promote embedded generation, benefiting residential and non-residential property owners.

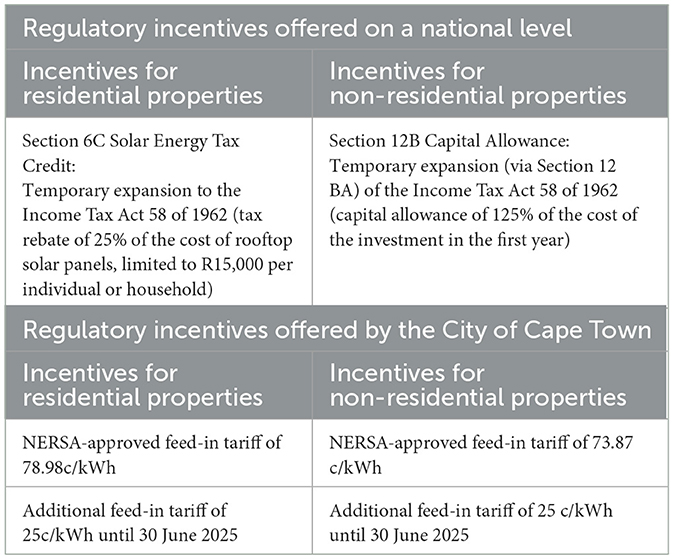

Table 2 provides a summary of the regulatory incentives available to residential and non-residential property owners pursuing solar PV systems in the CoCT. Residential private property owners benefit from a solar energy tax credit (Income Tax Act of 1962), a NERSA-approved FIT and an additional FIT provided by the CoCT (City of Cape Town, 2023c). Incentives for non-residential property owners include the Section 12B capital allowance Income Tax Act 58 of 1962, NERSA-approved FITs and an additional FIT provided by the CoCT (City of Cape Town, 2023c). The solar energy tax credit and the Section 12B capital allowance are incentives offered at a national level, while FITs are offered on a local government level by the CoCT.

4.3.1 Section 12B capital allowance for non-residential property owners

The demand for solar PV installations increased substantially in 2022, with an even greater increase at the beginning of 2023. This not only coincides with the increase in load-shedding events but also with the announcement of the temporary increase in the Section 12B capital allowance (Minister of Finance, 2023). This capital allowance enables non-residential property owners or businesses to reduce their taxable income on the cost of the investment by 125% in the 1st year, resulting in a saving on the cost of the solar PV system (Taxation Laws Amendment Act 17 of 2023).

The participants generally agree that the timing of the temporary increase in the Section 12B capital allowance is promoting the short-term adoption of solar PV systems. However, they anticipate a decline in demand once the temporary allowance expires at the end of February 2025. When comparing the incentive provided by the Section 12B capital allowance to FITs, the participants commented that they prefer the former as it is much more viable than FITs.

4.3.2 Section 6C solar energy tax credit for residential property owners

The Section 6C solar energy tax credit is available to households and individuals. This temporary incentive enables them to claim a tax rebate of 25% of the cost of the rooftop solar panels to a maximum of R15,000 for installations taking place from 1 March 2023 to 29 February 2024 (Taxation Laws Amendment Act 17 of 2023; Minister of Finance, 2023). This rebate is limited to the installation of solar panels and excludes backup battery systems.

Participants , , , and noted that households' electricity use peaks in the early mornings and late afternoons or evenings. Therefore, they often instal backup battery systems along with, or instead of, solar panels to ensure power throughout the day and night, as their peak usage times do not align with peak solar energy generation. Although the Section 6C tax credit incentivises the installation of solar panels, participants , , , and believe the rebate “is not worth it” as it is “too small.”

Several participants also argued that households who can afford solar PV systems with backup batteries are generally not motivated by the tax credit. Instead, they pursue solar energy for reasons such as energy security or savings on their utility bill. Thus, the solar energy tax credit is not seen as a primary driver of demand for solar PV systems in the residential sector.

4.3.3 Feed-in tariffs

The FIT incentive essentially allows residential and non-residential property owners to sell any surplus power they generate back to the grid whereafter their electricity bill is credited. The CoCT offers a NERSA-approved FIT (78.98 c/kWh for residential and 73.87 c/kWh for non-residential property owners) together with an additional 25 c/kWh (City of Cape Town, 2023c). The additional FIT for residential and non-residential customers is available until the end of June 2025.

In terms of the residential property sector, the participants commented that embedded generation systems are expensive and they would rather instal solar PV systems that meet their demand than instal larger systems for feeding power back to the grid. The majority of participants do not plan on feeding electricity into the grid at this stage. Participant stated that the current FIT is insufficient to provide real savings, suggesting it needs to double to be feasible. According to Schulte et al. (2022), residential private property owners would either match their demand with a solar PV system or instal a backup battery system instead. The potential savings from feeding back into the grid are unreliable as the tariffs can change annually.

Non-residential property owners represented by participants , , , and also confirmed that they do not include the credits received from FITs as part of their cashflow projections or feasibility studies. The participants noted that the projected credits can only be considered once the government commits to a FIT for a fixed period of 10 to 20 years. Participant , however, commented that some of their planned embedded generation systems will feed as much as 20% of the generated capacity back to the grid and that the credits received will result in a saving on their utility bill. Although there are contradictory opinions about the benefit of the FIT incentive, this does not mean that FITs do not play a role in the decision-making process when installing solar PV systems.

During the interviews, solar practitioners and CoCT-supplied property owners mentioned that the CoCT is ahead of most municipalities in terms of renewable energy generation. The additional 25 c/kWh FIT implemented by the CoCT makes a noteworthy difference when added to the NERSA-approved FIT of 78.98 c/kWh for residential customers and 73.87 c/kWh for commercial customers respectively. The participants commented that Eskom-supplied customers are less inclined to instal solar PV systems due to fewer incentives and a complex registration process (Eskom, 2023b), unlike the streamlined processes offered by the CoCT (City of Cape Town, 2023b). Participant commented that “the big hurdle at the moment is getting feed-in tariffs implemented across the country,” which highlights that FITs are not offered on a national level and are unavailable in numerous other municipalities across the country.

4.4 Non-regulatory drivers of private embedded generation

In terms of the implementation of private embedded generation systems, the participants identified environmental considerations (especially in the non-residential property sectors), cost savings, energy security, tenant requirements, and favourable financing solutions as the main non-regulatory drivers influencing private property owners during decision-making processes. These drivers are consistent with those identified in the literature.

4.4.1 Environmental considerations

Various participants in both the residential and non-residential property sectors commented that they have become more aware of their carbon footprint. Private embedded generation systems therefore provide a good starting point to lower their carbon emissions. For example, Participants and represent a listed fund that owns a large and diversified property portfolio and is required by their investors to reduce their negative environmental impact. Listed funds' investors typically require them to publish public reports regarding the status of their ESG requirements (Liang et al., 2021). Participant stated that they have self-imposed targets to acquire green building certificates from the Green Building Council of South Africa for their developments (Green Building Council South Africa, 2023). These certificates rate each development's performance from an environmental sustainability perspective and can improve the marketability of the building (Simpeh and Smallwood, 2023). The non-residential property owners that were interviewed consider the environmental sustainability aspect of implementing a solar PV system for embedded generation purposes as a major driver.

4.4.2 Cost savings

In terms of cost savings, Participants , , and commented that grid-tied systems only allow for cost savings during the day when there is no load shedding. Solar energy is therefore wasted during periods of load shedding as the energy generated cannot be used or stored. Large industrial and retail properties often do not integrate solar PV installations with battery systems due to cost constraints, time of use, and the size or output of the installations. According to the participants, integrating a backup battery system or existing diesel generator can save on diesel costs during load shedding, especially given South Africa's high fuel prices. While sufficient battery systems can eliminate the need for diesel generators and provide a saving on fuel costs in the long term, they are expensive to instal. Furthermore, stored electricity from a solar PV system can be used at any time, providing a further saving on electricity costs (Poorun and Radmore, 2023).

Participants and commented that they had experienced a saving in their operating costs after installing solar PV systems. This saving is generally attributed to the relatively low cost of solar PV systems compared to high electricity costs in the medium- to long term. The participants also argued that the saving in operating costs offsets the cost of diesel when a generator is used to keep grid-tied systems running during load shedding. According to participant , “an embedded generation solar system is a savings measure…driving energy savings.”

Furthermore, the move towards renewable energy appears to be naturally driven by the cost of electricity, and vice versa, as the increase in private embedded generation may result in tariff arbitrage or an increase in electricity tariffs. Participant explained that the CoCT relies on the income generated from the sale of electricity to maintain the electricity grid in the municipality and to provide good quality service delivery.

4.4.3 Energy security

Integrating a diesel generator or battery system into an embedded generation system enables grid-tied systems to operate during load shedding, providing private property owners and tenants with greater energy security and cost savings (Schulte et al., 2022). Participants and argued that residential property owners and owners of smaller industrial and retail properties typically instal solar PV systems to reduce their reliance on Eskom. The same applies to the agricultural sector, which requires uninterrupted power supply during certain seasons or for certain operations.

In contrast, non-residential property owners with larger retail or industrial properties are driven more by cost savings than energy security. The participants mentioned that the CoCT is encouraging private embedded generation and collaborating with customers to reduce the municipality's reliance on Eskom (Maynier, 2020).

4.4.4 Tenant requirements

According to Participant , “tenants are really driving the speed of the rollout,” indicating that tenant requirements are a key driver for implementing private embedded generation (typically coupled with a diesel generator) in the non-residential property sector. Tenants require operational continuity, which accelerates the adoption of these systems. Installing solar PV systems also helps mitigate rising electricity costs and minimises productivity losses due to load shedding (Creamer, 2022). Participant emphasised that owners of tenanted properties are not significantly impacted by load shedding, as tenants bear the costs of running diesel generators or pay the owner for solar power.

In the residential sector, tenanted developments are requesting the property owners to provide power to common areas at night. Participants and , representing residential property owners, are installing solar PV systems at some of their properties. Safety, security, and convenience during load shedding are major drivers of the demand for solar PV installations in the residential property sector. Participant also commented that “there is greater demand for housing units within developments that offer alternative energy solutions.”

4.4.5 Green-energy finance

In terms of green-energy financing solutions, South Africa's major banks offer loan products specifically tailored to solar energy (Poorun and Radmore, 2023). Participants noted that the accessibility of solar financing, due to the streamlined application process, plays a crucial role in their decision-making processes. The participants agreed that favourable financing conditions, short payback periods, and high returns motivate them to finance solar PV installations.

According to Poorun and Radmore (2023), these loans cover 70% to 100% of the capital costs of a solar PV installation and offer a 5- to 10-year repayment period. For non-residential properties, roof replacements are often included in the financial feasibility calculation of a solar PV system. Given high electricity prices and favourable weather conditions, Participant added that loans can be repaid within 3 to 5 years, while the lifespan of a solar PV panel is approximately 25 years.

4.5 Ranking of regulatory incentives and non-regulatory drivers

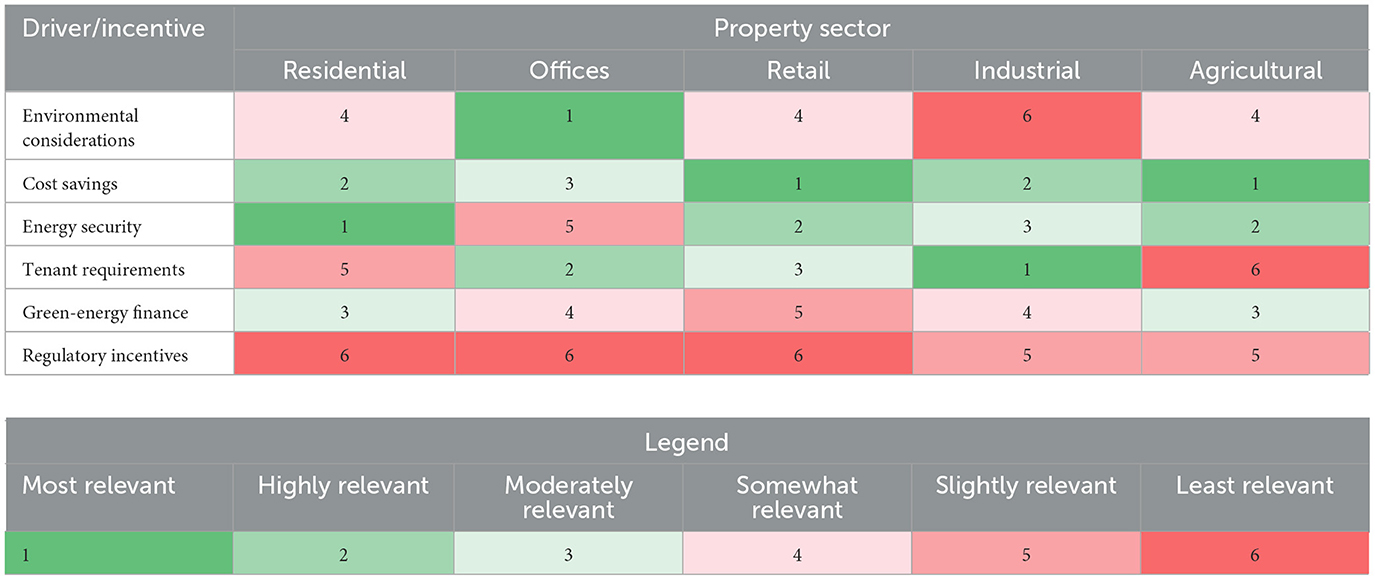

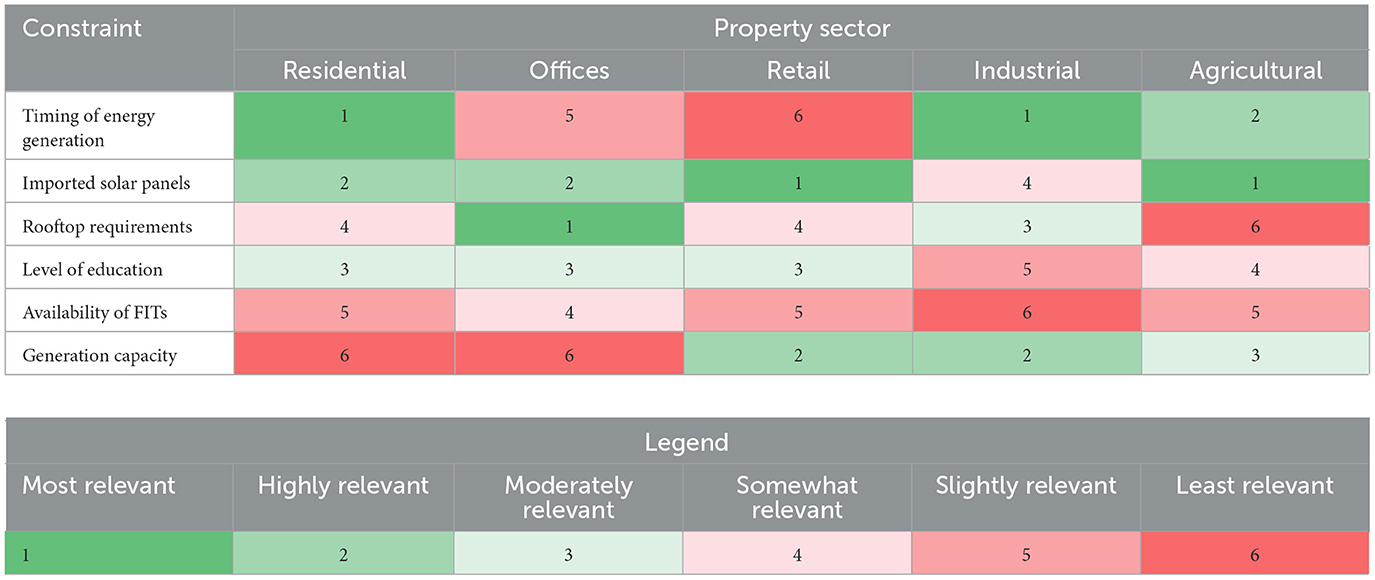

The participants identified five non-regulatory drivers, as discussed in Section 4.4. These drivers can be ranked according to their relevance and importance for each property sector included in this study. The regulatory incentives (discussed in Section 4.3) are regarded as a collective, rather than focusing on distinct incentives. The incentives and drivers were ranked from one (most relevant/important) to six (least relevant/important) based on the participants' feedback. The results are reflected in Table 3, with green indicating the most relevant drivers/incentives and red the least.

The relevance and importance of each driver vary by property sector and are based on the participants' opinions. In terms of the residential sector, households are typically motivated by energy security, followed by cost savings and energy financing solutions. They are less motivated by environmental considerations, tenant requirements and regulatory incentives.

In terms of the non-residential property sectors (offices, retail, industrial, and agricultural properties), the office sector is mainly driven by environmental considerations and tenant requirements. This is particularly true for office properties owned by listed funds that must report on their ESG requirements. Regulatory incentives are the least relevant due to the small roof areas of office buildings. In comparison, retail properties often have large roof areas that can be filled with solar panels and are therefore primarily driven by cost savings and energy security. Tenant requirements and environmental considerations also influence the retail sector, while green-energy finance solutions and regulatory incentives are less significant.

In the industrial sector, tenant requirements are the most important driver, followed by cost savings and energy security. Industrial tenants, especially in the manufacturing industry, require an uninterrupted power supply and a more cost-effective way of operating during load shedding. The remaining drivers are considered beneficial but are less influential in decision-making processes. For the agricultural sector, cost savings and energy security are the top drivers, followed by green-energy finance and environmental considerations. Agricultural operations, being labour- and capital-intensive, prioritise cost savings. Energy security is also a big driver in the agricultural sector, as these properties are reliant on uninterrupted power supply for certain aspects of their operations such as cold storage, packhouses and pumphouses. Tenant requirements are the least relevant, as agricultural properties are usually owner-operated. Regulatory incentives, though not the primary motivator, provide additional benefits such as tax incentives and FITs.

4.6 Constraints to private embedded generation systems

Various constraints relating to private embedded generation systems were identified during the interviews. The constraints broadly include the timing of peak energy generation using solar PV systems, the cost of importing solar panels, rooftop requirements and the low level of education regarding solar PV systems amongst private property owners. Further constraints include the availability of FITs and the generation threshold, although the latter was removed in December 2022 (Department of Mineral Resources and Energy, 2022).

One of the constraints emphasised by the interviews is that solar panels can only generate power when the sun is shining, thereby impacting energy consumption patterns and not benefiting those operating at night. This is particularly true for households, data centres, and the manufacturing and supply-chain sectors. Offices, retail, and agricultural properties, however, can utilise solar energy during the day. Participants and added that the cost of solar PV system components, often imported and sensitive to currency exchange rates, affects the financial feasibility of these systems.

In addition, Participant stated that many private property owners “want to instal an embedded generation system, but their roofs don't allow for it.” Some of the issues include the incorrect orientation of the roof (a northern orientation is required in South Africa), limited roof space (which is often the case with high-rise office buildings), asbestos roof sheeting, or inadequate roof structures. Participant highlighted the abundance of contractors selling and installing solar PV systems and the low level of education around these systems, making private property owners reliant on contractors' advice, with no easy way to ensure they are paying the right price.

Furthermore, solar PV systems also need to comply with Eskom or the CoCT's requirements (Eskom, 2023b; City of Cape Town, 2023b). According to Participants and , the administrative process to register private embedded generation systems and connect them to the grid is inefficient, expensive, and time-consuming. This slows down the move towards a more sustainable energy mix. The inefficient and slow approval processes for the installation of solar PV systems also appear to drive the demand for backup battery systems instead, especially in the residential sector, as these systems do not require any approvals. Participant argued that private property owners often mistakenly believe they can become self-sufficient with solar panels alone, while participant emphasised the need for backup battery systems or generators to achieve energy security.

Participant highlighted the need for the regulation of installation contractors, as contractors typically “do not take responsibility for their installations.” Participant agrees and adds that contracts relating to the installation of solar PV systems are often complex and that private property owners do not necessarily understand where the risk is passed.

Various participants emphasised that FITs are limited and only offered by some municipalities such as the CoCT. The FITs are therefore not available across the country. Furthermore, the participants commented that the threshold for private embedded generation (without a licence) was too low in the recent past before the removal of the threshold in December 2022 (Department of Mineral Resources and Energy, 2022). According to , the threshold was previously regarded as a big constraint as generation licences for embedded generation systems were “nearly unattainable.”

The constraints discussed above can be ranked according to their relevance for each property sector. In Table 4, each constraint is ranked from one (most relevant) to six (least relevant), with green indicating the most relevant and red the least.

The timing of peak energy generation is the greatest constraint in the residential and industrial sectors. This is mainly due to residents being at home during the early mornings, late afternoons and at night. Various industrial properties operate 24 h per day and the energy generated during the daytime can only be used whilst generated, regardless of whether this coincides with the property's peak operation times. The retail and agricultural sectors are mostly impacted by the cost of solar PV systems, being sensitive to currency exchange rates. Apart from the industrial sector, the retail and agricultural sectors often require large-scale solar PV installations. Rooftop requirements are the biggest constraint for the office sector due to small building footprints and limited roof space. Rooftop requirements are also a main constraint for the industrial sector due to the presence of asbestos roofs. The low level of education surrounding private embedded generation systems is relevant in the residential, office, and retail sectors, where customers rely heavily on the advice of installation contractors. The availability of FITs is not a major constraint for any sector, though the absence of national FITs is a constraint for Eskom-supplied customers. The threshold for private embedded generation (without a licence) was a major constraint before being removed in December 2022, especially for the retail, industrial, and agricultural sectors generating more than the historical 1 MW threshold.

5 Conclusion

The regulatory incentives available to non-residential property owners on a national level are more favourable than those available to individuals or households in the residential sector. Furthermore, the Section 6C residential tax credit only applies for 1 year whilst the temporary expansion of the Section 12B capital allowance for non-residential properties applies for 2 years. From the research undertaken, it is evident that both residential and non-residential private property owners in South Africa are mostly driven by the non-regulatory benefits that solar PV systems offer, especially compared to the regulatory incentives that are currently available. The regulatory incentives are generally too small compared to the cost of installing a solar PV system and therefore play an insignificant role in private property owners' decision to pursue solar PV energy. The Section 12B capital allowance for non-residential properties is the only regulatory incentive that is noted to influence the decision-making process. Private property owners are more motivated by non-regulatory drivers such as environmental considerations, cost savings, energy security, tenant requirements, and green-energy finance. These considerations are especially relevant, given South Africa's current energy landscape.

As a single municipal case study is analysed, the findings of this study are context-specific and may not be universally applicable across all areas of the country. Similar studies can be conducted in other municipal areas for comparison of regulatory incentives at a local government level in South Africa. However, it is anticipated that the conclusion will be the same. The financial rewards in the form of tax incentives and FITs are not the most significant motivating factors for private property owners to instal solar PV systems.

Data availability statement

The datasets presented in this article are not readily available because the participants of this study did not give written consent for their data to be shared publicly. Requests to access the datasets should be directed to Louie van Schalkwyk, bG91aWUudmFuc2NoYWxrd3lrQHVjdC5hYy56YQ==.

Ethics statement

The studies involving humans were approved by the University of Cape Town's Faculty of Engineering and Built Environment Ethics in Research Committee. The studies were conducted in accordance with the local legislation and institutional requirements. The participants provided their written informed consent to participate in this study.

Author contributions

LvS: Writing – original draft, Writing – review & editing. MS: Writing – original draft, Writing – review & editing.

Funding

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. The Urban Real Estate Research Unit (URERU) and the Sustainability Oriented + Cyber Research Unit for Built Environment (S⊕CUBE) hosted by the Department of Construction Economics and Management, University of Cape Town provided financial support for the authorship and publication of this article.

Acknowledgments

This article includes material from an unpublished master's thesis (Scholtz, 2024). We thank URERU and S⊕CUBE for their generous funding support.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/frevc.2024.1463241/full#supplementary-material

References

Akpeji, K. O., Olasoji, A. O., Gaunt, C. T., Oyedokun, D. T., Awodele, K. O., and Folly, K. A. (2020). Economic impact of electricity supply interruptions in South Africa. SAIEE Africa Res. J. 111, 73–87. doi: 10.23919/SAIEE.2020.9099495

Brewis, T., Werner, M., Brink, J., and Pienaar, A. (2024). Renewable Energy 2024, 4th edition. London: Global Legal Group.

Burger, S. (2023). City of Cape Town to Pay Businesses, Residents Cash for Electricity. Engineering News 24 January 2023.

Carbon Tax Act 15 of 2019 as amended. (2023). Available at: https://sars.mylexisnexis.co.za/#/content-view;domainId=6q77f (accessed December 6, 2024).

Cheruiyot, K., Martell, K., and Motani, K. (2023). Exploring the effects of green portfolio on REITs' return performance in South Africa. J. Sustain. Real Estate. 15:2268959. doi: 10.1080/19498276.2023.2268959

City of Cape Town (2023a). Wondering what inverter to get? Check out the City's list of approved, safe inverters. 28 July 2023. Available at: https://bit.ly/4cw2DSX (accessed June 19, 2024).

City of Cape Town (2023b). Requirements for small-scale embedded generation: Application and approval process for small-scale embedded generation in the City of Cape Town. September 2023. Cape Town.

City of Cape Town (2023c). City of Cape Town 2023/2024 tariffs, fees and charges. May 2023. Cape Town.

City of Cape Town (2023d). Census 2022: Cape Town Trends and Changes. Research Analytics, Policy and Strategy Department. October 2023. Cape Town, South Africa.

Cowling, N. (2024). Number of load shedding hours in South Africa 2015-2023. Statista. Available at: http://bit.ly/3Rtneiw (accessed June 16, 2024).

Creamer, K. (2022). “Shaping a new economic growth model for South Africa: the role of a well-managed energy transition,” in A just transition to a low carbon future in South Africa, eds. N. Nqobile and S. Fakir (Johannesburg: MISTRA), 89–116. doi: 10.2307/j.ctv2z6qdv5.10

Creswell, J. W., and Creswell, J. D. (2018). Research Design: Qualitative, Quantitative, and Mixed Methods Approaches, 5th edition. Thousand Oaks, United States: SAGE.

Das, P., Mathur, J., Bhakar, R., and Kanudia, A. (2018). Implications of short-term renewable energy resource intermittency in long-term power system planning. Energy Strat. Rev. 22, 1–15. doi: 10.1016/j.esr.2018.06.005

Department of Co-operative Governance (2023a). Classification of national disaster: impact of severe electricity supply constraint. Government Gazette 48009. 9 February 2023. Government notice no. 3019.

Department of Co-operative Governance (2023b). Termination of the national state of disaster (impact of severe electricity supply constraint). Government Gazette 48400. 5 April 2023. Government notice no. R3265.

Department of Energy (2015). State of Renewable Energy in South Africa 2015. September 2015. Pretoria.

Department of Energy (2019). Integrated Resource Plan (IRP2019). Government Gazette 42778. 18 October 2019. Government notice no. 1359.

Department of Forestry Fisheries and the Environment (2021). South Africa: First nationally determined contribution under the Paris agreement - updated September 2021. Pretoria.

Department of Mineral Resources and Energy (2021). Licensing Exemption and Registration Notice. Government Gazette 45266. 5 October 2021. Government notice no. 1000.