- School of Economics, Henan University, Kaifeng, Henan, China

Introduction: Based on the microdata of 36 A-share new energy vehicle (NEV) enterprises from 2015 to 2021, this study empirically investigates whether the introduction of the double credit policy (DCP) promoted the innovation of NEV enterprises.

Methods: The propensity score matching difference-in-differences (PSM-DID) method was used.

Results: The following results were found. First, the introduction of the DCP inhibits the innovation of NEV enterprises. However, as the DCP stabilizes, the inhibitory effect gradually decreases and shows a tendency to turn into a facilitating effect. Second, the DCP affects the innovation output of enterprises by influencing their research and development (R&D) investment. R&D investment has a mediating role in the DCP, affecting the innovation of new energy vehicle enterprises. Third, at the firm level, the inhibitory effect of the DCP is more evident in non-state-owned enterprises (non-SOE) and insignificant for state-owned enterprises (SOE), while at the regional level, the inhibitory effect of the DCP is more evident for non-eastern regions and insignificant for eastern regions.

Discussion: This study finds the inhibitory effect of the implementation of the DCP on the innovation of NEV enterprises and have potential guiding significance for the future formulation of NEV market development policies and the promotion of high-quality development of the NEV industry.

1. Introduction

The world faces severe climatic and resource issues, with clean energy development becoming a global trend. Owing to the unique externalities of new energy vehicles (NEVs) in combating climate change and reducing fossil fuel dependence (Gu et al., 2018; Tan et al., 2022), this emerging industry has gradually become one of the world's strongest influencers in clean energy consumption. The development in this industry aims to gain an advantage in scientific and technological innovation and dominate the powerful national environmental protection discourse (Vidadili et al., 2017; Akintande et al., 2020). However, unlike traditional industries, NEV enterprises, as part of a high-tech industry, face high production costs, significant investments in research and development (R&D), and considerable market uncertainty (Liu, 2022; Li et al., 2023; Wang et al., 2023). Additionally, it requires policy support from the government through macro-control in the early stage of its development. China began the development of NEVs in 2001 with the launch of the “863” program and has introduced many subsidies to support its development. Thanks to a series of supportive policies, such as government subsidies and tax reductions, the development of NEVs in China has generally shown positive growth compared to traditional fuel vehicles, with cumulative sales rising significantly from 331,000 units in 2015 to 3.521 million units in 2021. This 10-fold increase over 7 years makes it the world's largest producer and seller of energy vehicles.

Although the subsidy-oriented policy has gradually increased the number of NEV users over a short period, the issues regarding “subsidy dependence” and “subsidy cheating” remain. Unfortunately, NEVs' core technology has not yet made a breakthrough. Policy dependence has become an essential factor that restricts the technological innovation of this industry (Qin and Xiong, 2022; Yao et al., 2022), with a “market-driven” trend. In the process of transition from “subsidy-driven” to “market-driven,” the weakening of government subsidies will become the norm (Zheng-xia et al., 2022), with market-driven resulting in the NEV enterprises facing more market uncertainty. In order to alleviate the “painful period” of policy transition, reasonably adjust the supply of the NEV industry, optimize the industrial structure, and promote industrial innovation, the double credit policy (DCP) was created as an essential alternative for the supply side of the enterprise (Jin et al., 2022).

The DCP is also known as the Parallel Management Measures for Average Fuel Consumption of Passenger Vehicle Enterprises and New Energy Vehicle Credits. It was officially promulgated in September 2017 and formally implemented in April 2018, drawing on fuel policies similar to the United States corporate average fuel economy (CAFE) and zero emission vehicle (ZEV). The policy consists of two main types of credit: (1) the Corporate Average Fuel Consumption (CAFC) credits, which are used to improve the utilization rate of fuel vehicles and (2) the number of NEVs used to improve credits to combine the traditional fuel policy with the NEV production policy. The policy limits NEV production and the technical threshold for all passenger car companies to promote R&D and the production of NEVs. It also establishes a credit trading system, an attempt to replace government subsidies with credit revenue, which reflects an important shift from being policy-driven to being market-driven. One of its primary purposes is to promote the technological innovation of NEV enterprises and optimize and upgrade the entire NEV industry through policy transformation.

Since the official implementation of the DCP in April 2018, its effects have attracted extensive attention from the government, enterprises, and various scholars. One of the questions asked is whether the DCP has promoted the innovation of NEV enterprises. Owing to the short implementation time of the DCP, very few related studies exist.

Two major shortcomings exist in current research. First, most studies are based on the ZEV credit system in the United States. However, due to the different national conditions and market structure, it is difficult to apply the relevant studies on ZEV to China. Second, most research focuses on the feasibility analysis of the policy, with less focus on enterprise innovation.

Since few studies have examined the DCP on the innovation of NEV enterprises, this study examines that issue from a quantitative perspective, filling the research gap. Using the empirical PSM-DID method to avoid sample selection bias, which is more reliable than traditional DID, 36 NEV enterprises were selected for research. This sample is richer and more representative than previous studies. In addition, most of the existing literature lacks an examination of enterprise and regional heterogeneity, while this study includes a detailed classification and more diverse perspectives in examining heterogeneity. The study's practical significance includes further optimization of the national DCP, improvement of the technological innovation level of enterprises, and the realization of high-quality development in the NEV industry.

2. Literature review and theoretical hypotheses

2.1. DCP and corporate innovation

Current research, domestic and foreign, on the DCP primarily focuses on examining the effect of policy implementation and does not have dominant opinions regarding the evaluation of the policy. In terms of its positive impacts, a ZEV credit policy can help the market and consumers maintain preferences (Bakker and Farla, 2015), improve the product positioning of NEVs, motivate enterprises to reduce costs through innovation and facilitate the technological innovation of NEV enterprises (Van Der Vooren et al., 2013). At the enterprise level, the ZEV credit system can facilitate the strategic shift of enterprises (Wesseling et al., 2015), assist in the growth of enterprise R&D patents, and promote the commercialization of NEVs. In addition, effectively integrating environmental regulations and industrial support policies and alleviating the difficulty in choosing the timing of enterprise R&D investment (Li and Yongqing, 2021) are also impacted. Most current literature believes that with the mandatory policy constraint, enterprises will choose to upgrade and innovate according to their status as an “economic man”. When the compensating effect of the DCP is greater than the internal cost of corporate governance, enterprises will have sufficient incentive to innovate (i.e., the so-called “Porter's hypothesis”). Enterprises will improve their innovation ability through the DCP.

There is also literature on the negative impacts of the DCP on the development of enterprises. An essential prerequisite for implementing the DCP is the government's need to have accurate information about all enterprises. However, because of information asymmetry, the government is continuously disadvantaged. When the government releases a policy signal in advance, corresponding strategic behavior is generated (Porter, 1996). When the technology level of NEV enterprises is low, they produce products according to the change in credit price to adapt to the credit requirement; however, this production does not realize the substantial technological innovation of enterprises (Li et al., 2022; Yu et al., 2022). Moreover, because of the enterprises' size, production structure, and technology, not all of them can adjust their appropriate production decision-making behaviors in a timely manner according to the policy. The requirements (point-system) to meet policy requirements may force enterprises to make production cuts and layoffs, and limit R&D costs, thus “squeezing out” the few innovation funds that they already have, leading to lower innovation (Bansal and Roth, 2000). In addition, similar to ZEV, points for mandatory technical features will lead to NEV enterprises not prioritizing innovation policies. Rather, they will avoid higher costs through strategic adjustments (Anderson and Sallee, 2011). If the points ratio or policy orientation is not clear, the universality of the policy will be reduced, discouraging NEV enterprises from developing and producing (Yue, 2017). Moreover, the single policy of ZEV also makes it challenging to end market failure behaviors such as innovation spillover (Weber and Rohracher, 2012).

Simultaneously, considering the short implementation time of the DCP, the credit trading platform's credit price fluctuates greatly, and the credit trading market is often dysfunctional (Clarkson et al., 2004). In addition, as a high-tech industry, implementing the DCP may alter the original production structure of enterprises. This reduces the scale of enterprises to increase the production of NEVs. This also reduces enterprise R&D expenditures for NEV credit trading, makes technological adjustments ahead of time, crowds out the original innovation resources, and disrupts the average production and innovation activities because of the NEV credit requirement (Murray et al., 2009). Based on this, the following hypothesis is proposed:

Hypothesis 1: The DCP inhibits the innovation of NEV enterprises.

2.2. DCP, R&D investment, and corporate innovation

Enterprise R&D investment reflects the level of innovation investment, R&D intensity, and innovation stability. This will directly affect the R&D investment of NEV enterprises, affecting their innovation decisions (Ding and Zhu, 2023). Jinya et al. (2022) found that R&D investment mediates NEV enterprises' innovation in three dimensions after introducing the DCP: R&D scale, intensity, and structure. The trading nature of the DCP may lead to the trading of credits for NEVs that were spent initially on R&D, and R&D investment is consumed in market trading to the detriment of enterprises' innovation activities (Chen et al., 2017). Compulsory credit assessment will force enterprises to actively adjust production factors and R&D investment to achieve other factors (Huajing et al., 2017). Enterprises will choose other R&D models to arbitrage according to the actual situation, particularly when the credit price is high (Huang et al., 2015). However, new R&D models are difficult to apply over a short period of time, and R&D investment may become a costly trial-and-error process for enterprises. After the introduction of the DCP, NEV enterprises may adapt to the new production strategy by adjusting their R&D investment, which, in turn, will affect their innovation output. Thus, we propose the following hypothesis:

Hypothesis 2: R&D investment has a mediating role in the DCP, influencing innovation of NEV enterprises.

3. Materials and methods

3.1. Research sample

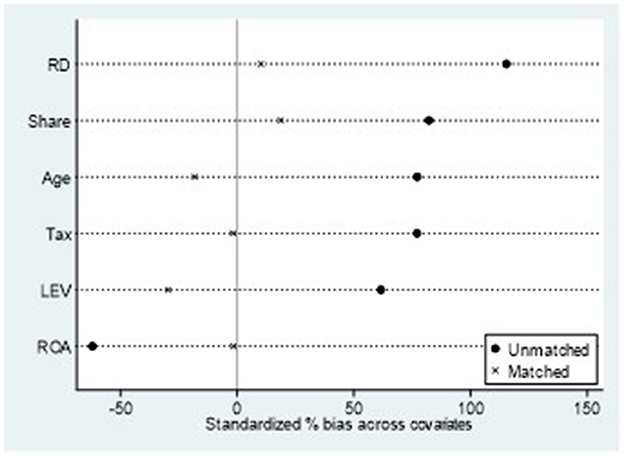

In this study, NEV enterprises in Shanghai and Shenzhen A-shares from 2015 to 2021 were selected as the research sample, ensuring its representativeness. The sample of NEV enterprises was selected to occupy a large share of the Chinese NEV market and are leading enterprises in the industry chain. This was combined with the disclosure of the annual reports of the companies to exclude ST and ST* for more than 2 consecutive years and the sample period data missing enterprises. The final panel data included 11 firms in the experimental group and 25 firms in the control group (See Appendix for more information), totaling 36 sample enterprises formed through PSM and matched by K (K = 5). The matching results are shown in Figure 1, where it can be seen that the error of each variable is reduced by matching. After matching, the standardized deviation of both the experimental and control groups remained <10%, indicating a better matching result. In addition, the t-value of the average treated effect (ATT) before treatment was 8.69, and after treatment was 5.32, both significant at α = 1%, again indicating a better matching effect.

3.2. Model setting

The implementation of the DCP can be approximated as a quasi-natural experiment. The enterprises that appeared on the DCP list every year since its implementation was selected as the experimental group. The control group was taken from the NEV enterprises that have never appeared on the DCP list. PSM can solve the issues of sample selection bias and non-conformity to the parallel trend hypothesis. Conversely, traditional DID can solve some issues with endogeneity but cannot completely solve the problem of sample endogeneity selection. Therefore, this study combined the two methods and used PSM to construct enterprises that were similar to the experimental group and the control group. We then conducted the DID method to estimate the policy effect. The PSM-DID model was set as follows.

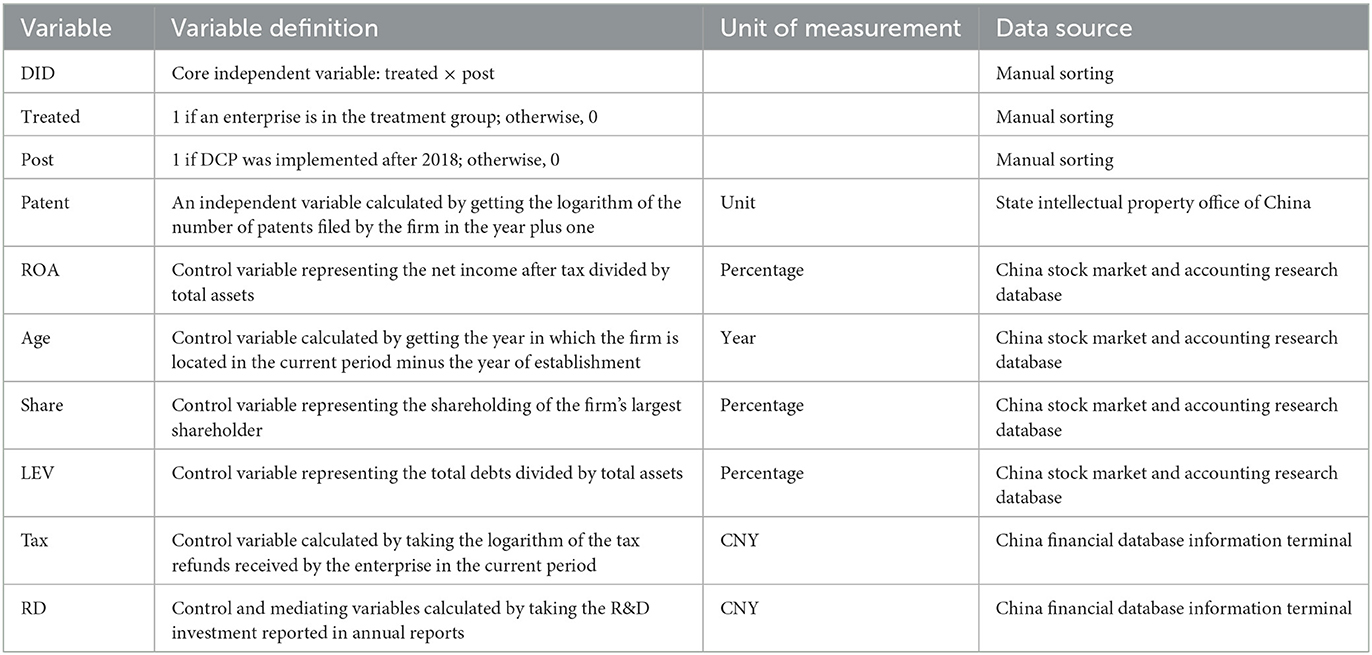

Where, Patentit is the number of patent applications of enterprise i in year t. It also indicates the enterprise's innovation output in that period, which is an important criterion for measuring an enterprise's innovation capability. Treated represents whether it is a treatment group, post represents whether the DCP is implemented. Notably, the DCP were officially set up in April 2018. X represents a set of control variables, including return on net assets (ROA), firm age (Age), top shareholder ownership ratio (Share), firm R&D investment (RD), tax refund (Tax), and debt-to-assets ratio (LEV). We focus on the coefficient β1, which represents the effect of policy implementation.

3.3. Variable description

3.3.1. Independent variables

Two common indicators for measuring firm innovation were used: (1) the number of patents, including applications, grants, and patent citations (Cornaggia et al., 2015) and (2) sales revenue from new products (Lin et al., 2011). Since the sales revenue of new products was not published in the enterprises' annual reports, based on the availability of data, this study used the number of patent applications to indicate the innovation capability of enterprises. These applications include invention, utility model, and design patents and searches for the patent applications of sample enterprises on NEVs in the State Intellectual Property Office of China (SIPO) and the 2010 World Intellectual Property Organization. The number of NEV-related patents filed by enterprises annually was obtained by matching the IPC classification numbers of NEV-related patents with enterprise-level patents obtained from the SIPO search.

3.3.2. Control variables

The intensity of enterprise R&D innovation activities increase with the scale of enterprise R&D investment (Levin et al., 1985), and enterprises with larger R&D scales may achieve economies of scale with better R&D innovation capability. Older firms are more likely to engage in innovative behavior than those with fewer years of establishment (Czarnitzki, 2006), and younger enterprises do not have a significant advantage in receiving subsidies. Innovation activities are characterized as long-period and high-risk activities for enterprises. When an enterprise's financial situation is poor, its innovation behavior is significantly affected. Corporate governance can influence the innovation activities of enterprises by affecting the enthusiasm of employees. Therefore, the concentration of equity can better reflect the governance of enterprises (Lu et al., 2014), represented by the shareholding ratio of the first largest shareholder in this study. The fundamental motive of corporate innovation is to obtain excess profit and a higher return on capital. The profitability and financial status of the company itself greatly determine its innovative behavior. Therefore, this study controls the debt-to-assets ratio and return on assets. Additionally, as taxation is an important factor affecting corporate innovation and development (Wang et al., 2017), this study includes corporate taxation as a control variable.

The measures and sources of each variable are described in Table 1. To reduce noise from extreme data, all data were winsorized at the 1 and 99% quartiles to remove potential outliers. The software used for data processing and regression analysis were Excel and Stata17.

4. Results

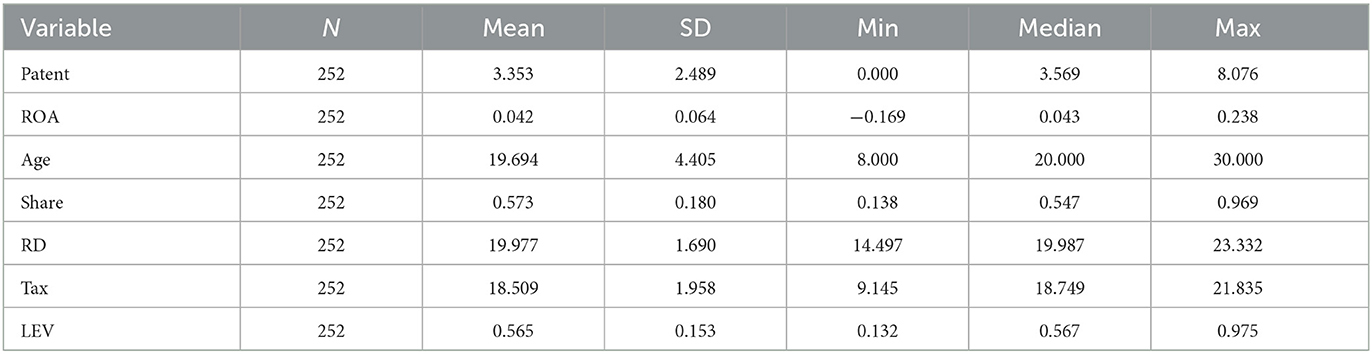

4.1. Descriptive statistics

The descriptive statistics for each variable (some variables were logarithmically processed) are shown in Table 2. The variation in NEV enterprises was from 0 to 8.076, with a mean of 3.353 and a standard deviation of 2.489. This indicates a significant difference between the innovation output of different NEV enterprises. Therefore, the sample was more informative, and the remainder of the variables were within a reasonable range of values. To avoid pseudo-regression, a correlation coefficient test was conducted for each variable. The correlation between most variables was significant at α = 1% with a high degree of correlation, which reduced the probability of pseudo-regression to a greater extent. In addition, all variables passed the VIF test, and the coefficients were <10, indicating no multicollinearity among the variables, which provided the basis for the empirical study.

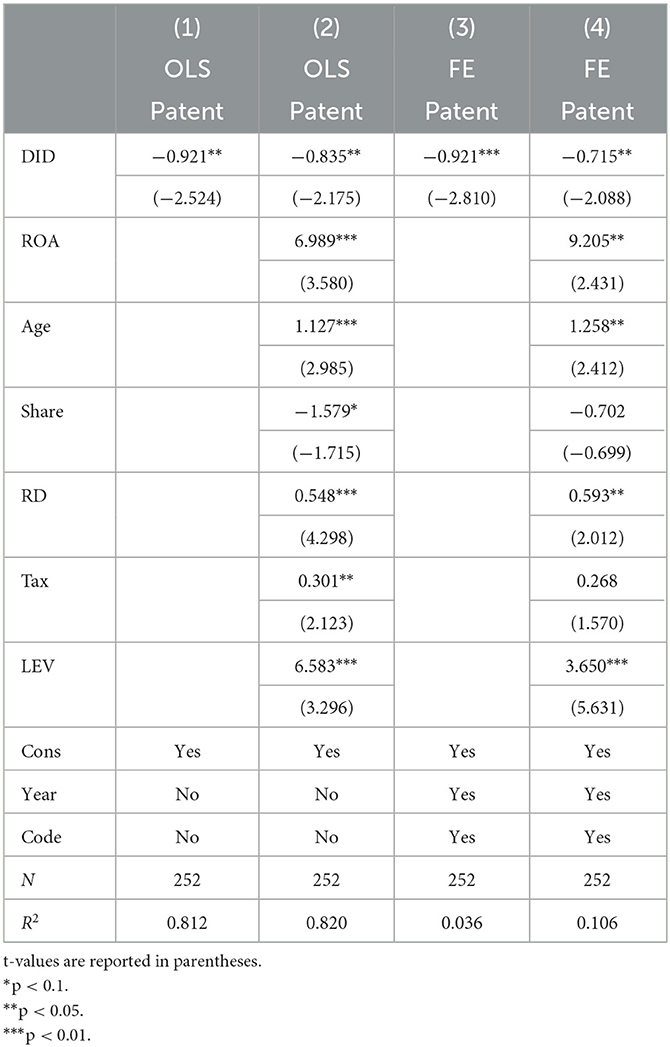

4.2. Basic regression results

The results of the basis of regression, focusing on the coefficients of the core independent variable DID, are shown in Table 3. Two estimation methods, ordinary least squares (OLS) and fixed effect (FE) regression, were used to determine the robustness of the results, where Equations (1) and (3) did not include control variables, and Equations (2) and (4) included control variables. From Equations (1) to (4), the coefficients of the core independent variable DID were always significant and negative. The FE estimation results were −0.912 and −0.715, significant at α = 1% and α = 5%, respectively; this indicated that the DCP inhibits the innovation output of NEV enterprises to a certain extent, confirming Hypothesis 1. This finding was consistent with Wagner (2007) and Chintrakarn (2008). The implementation time of China's DCP is relatively short, and the intensity of regulation is high, making it impossible for enterprises to adapt to the cost and technology pressures brought about by transition in a short period. This leads to an increase in the cost of innovation and, thus, creates a crowding-out effect on enterprise innovation.

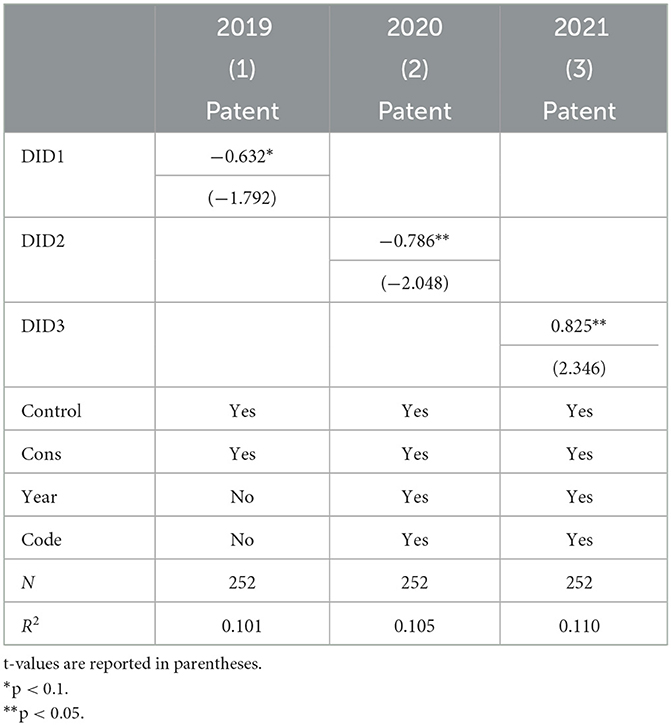

It has been proven through the previous basic regression that the DCP inhibits the innovation of NEV enterprises. We examine the marginal dynamic effect of the innovation output of NEV enterprises since the implementation of the DCP in 2018. This study generated new variables DID1 (Treated × Post2019), DID2 (Treated × Post2020), and DID3 (Treated × Post2021) based on a previous study and then examined their marginal effects separately. The results are summarized in Table 4.

From Table 4, the coefficients of the core explanatory variables, DID1 and DID2, in Equations (1)–(3) were −0.632 and −0.786, respectively, which were significant at α = 10% and α = 5%, respectively. The coefficient of DID3 was 0.825, which was significant at α = 5%. This shows that the DCP have a lagging effect on the inhibitory effect of NEV enterprises that gradually decrease and show a negative to positive trend. A possible reason for this is that the early stages of the DCP implementation require enterprises to readjust the production scale and ratio of traditional fuel vehicles and NEV to meet the point requirements. Consequently, the enterprises constantly update technical equipment, which generally encompasses a significant investment and long production cycle, resulting in excessive capital intensity over a short period. As a result, the original cost of innovation is squeezed and takes some time to be converted into innovation output. However, with the smooth transition from the gestation to the implementation period of the DCP, the market signals become more apparent, and the production structure and R&D expenditure of NEV enterprises effectively adjust and the identity of NEV enterprise, as “economic men”, and the positive effect of the DCP begins to emerge.

4.3. Robustness text

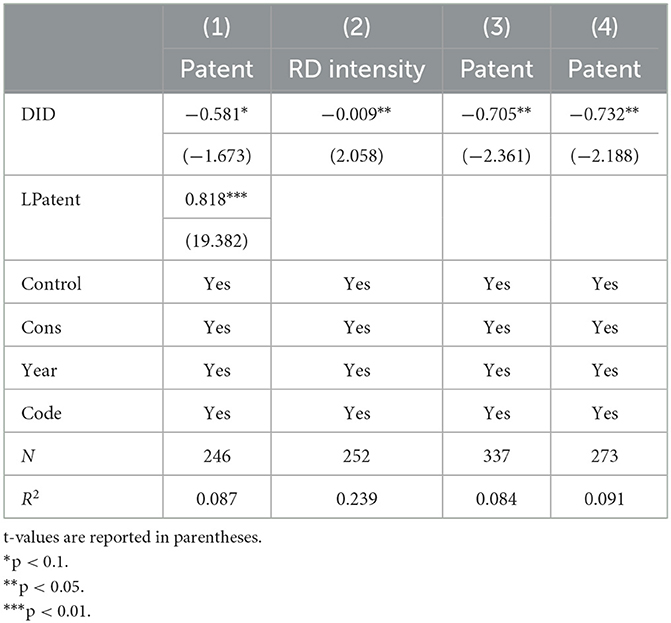

Using a dynamic panel estimation, a lagged independent variable was added to the regression. The results are presented in Table 5, Column (1). The coefficient of the core independent variable DID was −0.581, which was significant at α = 10%; this again confirms the results of the basic regression. Its coefficient was 0.818, which is significant at α = 1%, indicating that the innovation output of the previous period has a catalytic effect on the innovation output of the current period, consistent with most findings.

Replacing the explanatory variables, enterprise innovation was divided into two processes: input and output. Corporate innovation can also be measured from two perspectives: input and output. In this section, the number of patent applications from the output perspective was replaced by R&D input intensity, which reflects the size of an enterprise's innovation capabilities (Hagedoorn and Cloodt, 2003). It was calculated by dividing the enterprise's RD investment by its total assets. The regression results are shown in Table 5, Column (2), where the coefficient of DID is −0.009. This is significant at α = 5%, and the conclusion remains, which is proof of robustness of the basic regression.

The results of the full-sample regression using the full-sample data without PSM matching are shown in Table 5, Column (3). The coefficient of the core explanatory variable DID was −0.705, which was significant at α = 5%, confirming the basic regression findings. The results of replacing the matching method and changing the K-nearest neighbor matching method in the basic regression to a 1:5 kernel matching between the experimental and controls groups before PSM-DID are shown in Table 5, Column (4), where the coefficient of its core independent variable DID under the matching method of kernel matching was −0.732. It was significant at α = 5% and confirms results of the basic regression.

4.4. Mechanism analysis

This study found that the DCP inhibits the innovation output of NEV enterprises to a certain extent. However, the transmission mechanism of this effect remains unknown.

Based on previous studies, R&D investment may have a mediating effect on the DCP. Therefore, it is necessary to further analyze the mechanisms of the DCP that affects NEV enterprises' innovation. More specifically, it is important to investigate the moderating effect of government subsidies and the mediating effect of R&D investment.

4.5. Mediating effect of R&D

In this section, we refer to Wen Zhonglin's three-step method of mediating effects and empirically tested the mediating effects of R&D investment. The model was set up as follows, with the same variables previously described.

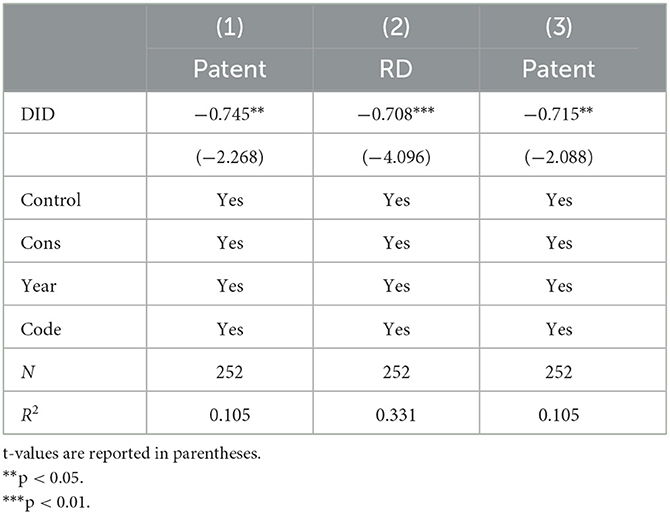

The results are shown in Table 6, where the coefficients of DID are −0.745 and −715, respectively, which are significant at α = 5%. To ensure the reliability of the mediating mechanism, we also conducted a Sobel Test and found that the coefficients were significant at α = 1%. In addition, the mediating effect accounted for ~21% of the total utility. The results of the bootstrap test, simulated 500 times, show that the confidence interval of bs_1 does not include zero, indicating that R&D investment plays a mediating role in the innovation of NEV enterprises; thus, Hypothesis 2 was confirmed. A possible reason is the effect of credit pressure. NEV enterprises must squeeze R&D investment to adjust the production scale or use part of the R&D investment for NEV credit trading. As a result, this reduction in R&D investment leads to a decrease in the innovation output of the enterprises.

4.6. Heterogeneity test

There were differences in the degree of development and resource endowment between the sample enterprises at the enterprise and regional levels. This study analyzed the heterogeneity of the DCP and NEV innovation relationship at both the enterprise and regional levels.

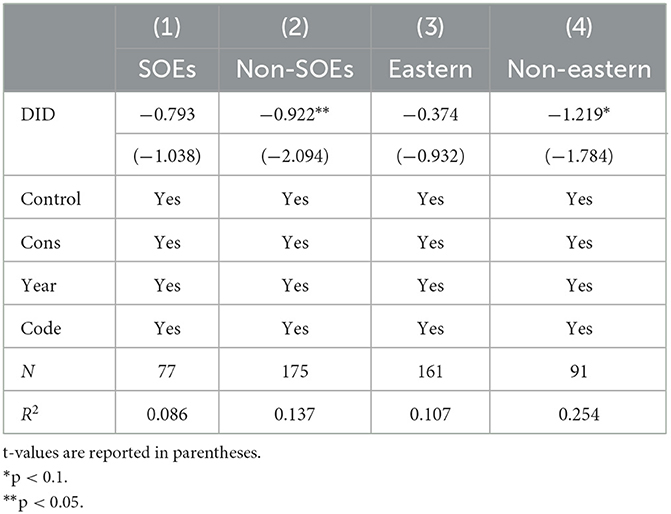

Columns (1) and (2) of Table 7 present the regression results. The DID coefficient −0.922 is significant at α = 5% for non-state-owned enterprises (non-SOEs), and −0.793 is statistically insignificant for state-owned enterprises (SOEs). This may be because the actual controller of SOEs is the government. Thus, the special agent status results in soft budget constraints (Dong et al., 2014). Consequently, compared to non-SOEs, SOEs have more funds to invest in innovation. Additionally, non-SOEs may need to innovate more to gain government attention and support, increasing the cost of innovation for non-SOEs that need to be self-sustainable.

Referring to Han and Hu (2015), the regression results of dividing the sample firms into eastern and non-eastern firms based on the address of each enterprise's registered office are shown in Table 7, Columns (3) and (4), where the DID coefficient of −1.219 is significantly negative at α = 10% in the non-eastern region. The DID coefficient −0.374 is statistically insignificant in the eastern region, indicating that the non-eastern region enterprises are more significantly inhibited. A possible reason for this is that the economic development level in the eastern region is higher, with the technology level of enterprises also relatively higher. As a result, enterprises in the eastern region are more likely to meet the credit requirements of the DCP than those in the non-eastern region. The non-eastern region may find it more challenging to meet the credit requirements due to the backwardness of the economy and technology. In addition, the economic development level in the eastern region is generally higher, along with policy implementation and the transparency of government departments (Xiao-qi et al., 2020).

5. Discussions

5.1. Conclusions

This study used the PSM-DID method to empirically investigate the impact of the DCP on the innovation of NEV enterprises using A-share NEV enterprises from 2015 to 2021 as a sample. The study found the following. First, the DCP has a suppressive effect on the innovation of NEV enterprises that tends to decrease but shifts to a promotional effect gradually after a certain period. Second, the DCP suppresses the innovation output of NEV enterprises by compressing their R&D investment (i.e., enterprise R&D investment has a mediating effect). Third, regarding heterogeneity, the DCP has a more significant inhibitory effect on enterprise innovation for non-SOEs; it has an insignificant effect for SOEs; it has a more significant inhibitory effect on enterprise innovation for non-eastern firms; and it has an insignificant effect for eastern firms.

5.2. Policy implications

Based on the above research and the current state of China's NEV market development, the following policy implications are proposed.

First, the rationality of the DCP must be strengthened. Given the current implementation status of the DCP, relevant departments can appropriately consider reducing the credit requirements for CAFC and NEV (Yibang et al., 2022) until the market is relatively stable and mature before gradually raising the requirements. At the same time, NEV enterprises should adjust their R&D strategies according to their own development characteristics and R&D capabilities. This ensures that R&D investments can be used rationally, steadily advance key technologies, fundamentally improve the R&D capabilities of enterprises, form a “scale effect”, attract consumers with high-quality products, and grow based on improving technology levels. To strengthen themselves based on improving technology level, enterprises must realize the virtuous cycle of “R&D-sales- R&D again”.

Second, the subsidy system for NEV enterprises should be optimized. The purpose of the DCP is to stimulate the innovation enthusiasm of NEV enterprises and promote innovation. However, this study found that the DCP inhibited the innovation of NEV enterprises. In addition, the market for the DCP is prone to “market failure”, which leads to greater innovation pressure on NEV manufacturers. Therefore, considering various factors, a combination of the DCP and government subsidies should be considered in the future (Li et al., 2018) to spread risk through government subsidies and provide enterprises with more confidence to relieve R&D pressure.

Third, the DCP should be implemented. The implementation effect of the DCP varies greatly between enterprises of different types and regions. Therefore, relevant departments should strictly follow standards when implementing the DCP to form a demonstration effect. This will enhance the transparency of law enforcement and strengthen the endogenous motivation of enterprises' R&D and innovation (Li and Xiong, 2021). Additionally, the implementation of the DCP will relax after 2019, which may lead to its failure. The government should fully understand the current technical level and technological frontier of new energy passenger cars and continuously track their development in domestic and international markets to adjust the DCP promptly and make the policy operation more flexible and efficient.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

JS: conceptualization, writing original draft, writing-review and editing, supervision, project administration, and funding acquisition. MT: methodology, software, validation, formal analysis, investigation, data curation, writing original draft, and visualization. All authors contributed to the article and approved the submitted version.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/frevc.2023.1173925/full#supplementary-material

References

Akintande, O. J., Olubusoye, O. E., Adenikinju, A. F., and Olanrewaju, B. T. (2020). Modeling the determinants of renewable energy consumption: evidence from the five most populous nations in Africa. Energy 206, 117992. doi: 10.1016/j.energy.2020.117992

Anderson, S. T., and Sallee, J. M. (2011). Using loopholes to reveal the marginal cost of regulation: the case of fuel-economy standards. Am. Econ. Rev. 101, 1375–1409. doi: 10.1257/aer.101.4.1375

Bakker, S., and Farla, J. (2015). Electrification of the Car–Will the Momentum Last?: Introduction to the Special Issue. Elsevier.

Bansal, P., and Roth, K. (2000). Why companies go green: a model of ecological responsiveness. Acad. Manag. J. 43, 717–736. doi: 10.2307/1556363

Chen, S., Ni-Sha, J., and Xuan-Yu, L. (2017). Environmental regulation and industrial green total factor productivity—empirical analysis based on CAC and MBI environmental regulations. RandD Manag. 29, 144–154.

Chintrakarn, P. (2008). Environmental regulation and US states' technical inefficiency. Econ. Lett. 100, 363–365. doi: 10.1016/j.econlet.2008.02.030

Clarkson, P. M., Li, Y., and Richardson, G. D. (2004). The market valuation of environmental capital expenditures by pulp and paper companies. Account. Rev. 79, 329–353. doi: 10.2308/accr.2004.79.2.329

Cornaggia, J., Mao, Y., Tian, X., and Wolfe, B. (2015). Does banking competition affect innovation? J. Finan. Econ. 115, 189–209. doi: 10.1016/j.jfineco.2014.09.001

Czarnitzki, D. (2006). Research and development in small and medium-sized enterprises: The role of financial constraints and public funding. Scottish J. Polit. Econ. 53, 335–357. doi: 10.1111/j.1467-9485.2006.00383.x

Ding, L., and Zhu, X. (2023). The impact of the dual-credit policy on production and cooperative RandD in the automotive supply chain. Sustainability 15, 1302. doi: 10.3390/su15021302

Dong, L., Yan, S., Wei, Z., and Dan, Y. (2014). Political achievement demands of local government, goverment control right and corporate value. Econ. Res. J. 45, 56–59.

Gu, J., Renwick, N., and Xue, L. (2018). The BRICS and Africa's search for green growth, clean energy and sustainable development. Energy Policy 120, 675–683. doi: 10.1016/j.enpol.2018.05.028

Hagedoorn, J., and Cloodt, M. (2003). Measuring innovative performance: is there an advantage in using multiple indicators? Res. Policy 32, 1365–1379. doi: 10.1016/S0048-7333(02)00137-3

Han, C., and Hu, H. (2015). How does clean production standards regulation dynamically affect TFP-A quasi-natural experiment analysis with policy interference eliminated. Chin. Ind. Econ. 326, 70–82.

Huajing, L., Juan, Z., and Yaxian, H. (2017). Relationship between R&D investment and performance of new energy automobile enterprises: based on the perspective of green technology innovation. Forum Sci. Technol. China 249, 71–81+93.

Huang, K.-F., Lin, K.-H., Wu, L.-Y., and Yu, P.-H. (2015). Absorptive capacity and autonomous RandD climate roles in firm innovation. J. Bus. Res. 68, 87–94. doi: 10.1016/j.jbusres.2014.05.002

Jin, J., Jia, S., Wang, J., and Li, Y. (2022). Development strategy of new energy business for traditional car manufacturers under the dual-credit policy. Technol. Invest. 13, 121–143. doi: 10.4236/ti.2022.134009

Jinya, L., Yumeng, M., and Xinxin, L. (2022). The Impact of Dual-Credit Policy on Technological Innovation of New Energy Vehicle Enterprises. Studies in Science of Science.

Levin, R. C., Cohen, W. M., and Mowery, D. C. (1985). RandD appropriability, opportunity, and market structure: new evidence on some schumpeterian hypotheses. Am. Econ. Rev. 75, 20–24.

Li, J., Ku, Y., Li, L., Liu, C., and Deng, X. (2022). Optimal channel strategy for obtaining new energy vehicle credits under dual credit policy: purchase, self-produce, or both? J. Clean. Prod. 342, 130852. doi: 10.1016/j.jclepro.2022.130852

Li, X., and Xiong, Q. Y. (2021). Phased impacts of China's dual-credit policy on RandD. Front. Energy Res. 9, 694338. doi: 10.3389/fenrg.2021.694338

Li, X., and Yongqing, X. (2021). Characteristics of the impact of corporate average fuel consumption-new energy vehicle credits (CAFC-NEV) mandate on the new energy vehicle industry: From the perspective of business and environmental performances. Resour. Sci. 43, 1–11. doi: 10.18402/resci.2021.01.01

Li, Y., Zhang, L., Liu, J., and Qiao, X. (2023). Can the dual-credit policy help China's new energy vehicle industry achieve corner overtaking? Sustainability 15, 2406. doi: 10.3390/su15032406

Li, Y., Zhang, Q., Liu, B., Mclellan, B., Gao, Y., and Tang, Y. (2018). Substitution effect of new-energy vehicle credit program and corporate average fuel consumption regulation for green-car subsidy. Energy 152, 223–236. doi: 10.1016/j.energy.2018.03.134

Lin, C., Lin, P., Song, F. M., and Li, C. (2011). Managerial incentives, CEO characteristics and corporate innovation in China's private sector. J. Comp. Econ. 39, 176–190. doi: 10.1016/j.jce.2009.12.001

Liu, Q. (2022). “The impact of relaxing foreign equity ratio restriction on RandD of new energy automotive industry—empirical analysis based on micro enterprise data,” in Applications of Decision Science in Management: Proceedings of International Conference on Decision Science and Management (ICDSM 2022), Springer, 207-218.

Lu, G., Wang, Z., and Zhang, C. (2014). Research on the performance of government innovation subsidies for strategic emerging industries in China. Econ. Res. J. 49, 44–55.

Murray, B. C., Newell, R. G., and Pizer, W. A. (2009). Balancing cost and emissions certainty: an allowance reserve for cap-and-trade. Rev. Environ. Econ. Policy. doi: 10.1093/reep/ren016

Qin, S., and Xiong, Y. (2022). Differential impact of subsidised and nonsubsidized policies on the innovation of new energy vehicle enterprises: evidence from China. Asian J. Technol. Innov. 1–24. doi: 10.1080/19761597.2022.2044871

Tan, Q., Wang, Z., Fan, W., Li, X., Li, X., Li, F., et al. (2022). Development path and model design of a new energy vehicle in China. Energies 16, 220. doi: 10.3390/en16010220

Van Der Vooren, A., Alkemade, F., and Hekkert, M. (2013). Environmental performance and firm strategies in the Dutch automotive sector. Transp. Res. Part Policy Pract. 54, 111–126. doi: 10.1016/j.tra.2013.07.005

Vidadili, N., Suleymanov, E., Bulut, C., and Mahmudlu, C. (2017). Transition to renewable energy and sustainable energy development in Azerbaijan. Renew. Sustain. Energy Rev. 80, 1153–1161. doi: 10.1016/j.rser.2017.05.168

Wagner, M. (2007). On the relationship between environmental management, environmental innovation and patenting: evidence from German manufacturing firms. Res. Policy 36, 1587–1602. doi: 10.1016/j.respol.2007.08.004

Wang, Y., Yi, Y., Fu, C., and Li, Y. (2023). Price competition and joint energy-consumption reduction technology investment of new energy and fuel vehicles under the double-points policy. Manag. Decis. Econ. doi: 10.1002/mde.3817

Wang, Z., Zhao, C., Yin, J., and Zhang, B. (2017). Purchasing intentions of Chinese citizens on new energy vehicles: how should one respond to current preferential policy? J. Clean. Prod. 161, 1000–1010. doi: 10.1016/j.jclepro.2017.05.154

Weber, K. M., and Rohracher, H. (2012). Legitimizing research, technology and innovation policies for transformative change: Combining insights from innovation systems and multi-level perspective in a comprehensive ‘failures' framework. Res. Policy 41, 1037–1047. doi: 10.1016/j.respol.2011.10.015

Wesseling, J., Farla, J., and Hekkert, M. (2015). Exploring car manufacturers' responses to technology-forcing regulation: The case of California's ZEV mandate. Environ. Innov. Soc. Trans. 16, 87–105. doi: 10.1016/j.eist.2015.03.001

Xiao-qi, W., Shuang-guang, H., and Jun-Min, Z. (2020). New Environmental Protection Law and corporate green innovation: forcing or forcing out? China Popul. Resour. Environ. 30, 107–117.

Yao, X., Ma, S., Bai, Y., and Jia, N. (2022). When are new energy vehicle incentives effective? Empirical evidence from 88 pilot cities in China. Transp. Res. A Policy Pract. 165, 207–224. doi: 10.1016/j.tra.2022.09.003

Yibang, R., Yongqing, X., and Wen, X. (2022). Research on the heterogeneous impact of the dual-credit policy on the financial performance of upstream and downstream enterprises of new energy vehicles. Syst. Eng. Theory Pract. 42, 2408–2425.

Yu, L., Jiang, X., He, Y., and Jiao, Y. (2022). Promoting the diffusion of new energy vehicles under dual credit policy: asymmetric competition and cooperation in complex network. Energies 15, 5361. doi: 10.3390/en15155361

Yue, W. (2017). Research on China's Policy Package of Corporate Average Fuel Consumption and New Energy Vehicle Credits. Master of Science Tsinghua University.

Keywords: double credit policy, new energy vehicles, corporate innovation, R&D investment, PSM-DID

Citation: Sun J and Tian M (2023) Did China's dual-credit policy promote innovation in new energy vehicle enterprises? An empirical study based on the PSM-DID method. Front. Environ. Econ. 2:1173925. doi: 10.3389/frevc.2023.1173925

Received: 25 February 2023; Accepted: 26 April 2023;

Published: 22 May 2023.

Edited by:

Fengtao Guang, China University of Geosciences Wuhan, ChinaReviewed by:

Hui Nee Au Yong, Tunku Abdul Rahman University, MalaysiaYating Deng, China University of Geosciences Wuhan, China

Copyright © 2023 Sun and Tian. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Mingfu Tian, dGlhbm1pbmdmdUBoZW51LmVkdS5jbg==

Jianguo Sun

Jianguo Sun Mingfu Tian

Mingfu Tian