- 1Department of Economics and Finance, School of Business and Public Administration, University of The Gambia, Kanifing, Gambia

- 2Management Studies Department, Bahria Business School, Bahria University, Islamabad, Pakistan

The circular economy creates a robust system that can combat global concerns like climate change, biodiversity loss, waste, and pollution by decoupling economic activity from the use of natural resources. This study for the first time in European Union (EU) countries, examines the impact of economic growth, urbanization, investment in information technology and communication (IT&C), oil import prices, environmental technology and environmental tax on energy consumption. Additionally, it also examined the impact of oil import prices, urbanization, energy consumption, investment in information technology and communication, environmental technology and environmental tax on economic growth by using panel autoregressive distributed lag (ARDL) model for the estimations over the period 1990–2020. According to the correlation matrix's estimations, findings suggest that the economic expansion of the EU member countries is positively influenced by oil import prices, urbanization, environmental technology and energy consumption, while negatively impacted by investment in IT&C and environmental taxes both in the short and long-run. On the other hand, energy consumption is found to be positively impacted by economic growth, urbanization and oil import prices while negatively influenced by investment in IT&C, environmental taxes and environmental related technologies. In addition, the results of the panel ARDL model indicate that oil import prices positively and significantly influence the economic growth of the EU members. However, results of urbanization reveal a negative influence on economic growth in the short-term, but in the long-run, it has a favorable and considerable influence on the economic growth of the European Union. Finally, the research has implications for policy makers and regulators in the EU.

1. Introduction

The European Union (EU) has set effective strategies to increase the consumption level of renewable energy through the innovation of finance, technology and customer engagement (Anton and Nucu, 2020). In order to achieve sustainable development and tackle environmental setbacks, renewable energy resources should be produced and efficiently utilized (Fan and Hao, 2020). Energy consumption, which is used for social and economic activities, has been seen as a major determinant of economic expansion. It is a vital input to enhance a country's economy and is often regarded as a key indicator of a nation's social and economic progress. Regardless of the European Union's consistent and sound renewable energy policies, the consumption of energy by the households and other sectors of the economy significantly differs as a result of price and energy availability (Tutak and Brodny, 2022). For the past years and as of recent, the EU has been focusing on increasing the renewable energy consumption, particularly in the transport industry. The need for electricity is rapidly increasing in every industrialized and emerging economies particularly in Europe, and as a result, renewable resources are now being considered as an alternative to supply the world's energy demand in the coming years, which will mitigate power shortages and improve environmental standards and livelihoods. It has been considered as the basis for the development and modernization of national economies (Wang et al., 2019). As alluded by Rasheed et al. (2022), the European states are attempting to realize carbon neutrality by 2050.

Oil import prices and the consumption of renewable and non-renewable energy resources in relation to the growth of EU economies is paramount and as a result, the need for energy consumption by all national sectors across the EU is quite different from the rest of the world. The region is heavily dependent on Russia for energy supply, which has affected their economies due to the recent Russia-Ukraine conflict coupled with the outbreak of the COVID-19 pandemic. The consumption of renewable energy is an effective way to mitigate the rising global environmental deterioration, and the manner in which the oil import prices determine the environmental standards and energy consumption patterns in European countries remains obscure (Rasheed et al., 2022). There is a limited number of literatures on the interrelationships among the variables used in our study in the context of European Union. Hence, the undertaken research theme is timely and from the perspective of the EU economies, it concerns a very important subject. Our findings will significantly contribute to the existing literature and pave a new way for further research. According to Brodny and Tutak (2022), there is a significant diversity of the EU economies, enhancement of energy efficiency and strategy of energy used by household and industrial sectors. Lovcha et al. (2022) develops a monitoring model of carbon price dynamics for EU emission trading systems that correlates the economic activities, energy sector and carbon prices. Their study outcome unveiled that 90% of carbon price fluctuations are determined by fundamental market variables.

Our paper explores the impact of economic expansion, urbanization, investment in information technology and communication, oil import prices, environmental technology and environmental tax on energy consumption. Additionally, it also examines the impact of oil import prices, urbanization, energy consumption, investment in information technology and communication, environmental technology and environmental tax on the economic growth by using panel ARDL model for the estimations and analyses over the period 1990–2020. According to the correlation matrix's estimations, our findings suggest that economic growth of the EU member countries is positively influenced by oil import prices, urbanization, environmental technology and energy consumption, while negatively impacted by investment in IT&C and environmental taxes both in the short and long-run. On the other hand, energy consumption is found to be positively impacted by economic growth, urbanization and oil import prices while negatively influenced by investment in IT&C, environmental taxes and environmental related technologies. Other estimations applied by the study include: cross sectional dependency test, panel unit root test, long-run and short-run elasticity test, stability test and Granger causality test.

The main conclusions of our study are in line with previous works of Alper and Oguz (2016), Rafindadi and Ozturk (2017), Gozgor et al. (2018), Baz et al. (2019), Wang et al. (2019), Zafar et al. (2019), Rahman and Velayutham (2020), Islam and Islam (2021), and Jafri et al. (2021). The study meaningfully contributes to the existing limited literature on the nexus among economic growth, energy consumption, urbanization and oil import prices in the European Union. Although, Papież et al. (2019) analyzed the impact of renewable energy sector development in relation to economic expansion and energy consumption in the European Union, with the conclusion that the correlations between electricity consumption and economic expansion rely on the development of renewable energy sector, our study incorporates other relevant variables such as environmental technology, environmental taxes and investment in IT&C in the model to draw better conclusions on the economic growth-energy consumption nexus across the EU. The paper is organized as follows: Section 2 presents the literature review followed by Section 3, which discusses the research framework and estimation methodology. The results and analyses are provided in Section 4. The last section presents the concluding remarks with policy recommendations.

2. Review of literature

Mukhtarov et al. (2022) applied the General to Specific modeling technique to explore the impact of higher oil price, income and CO2 emissions on the consumption of renewable energy in the context of Iran over the period 1980–2019. Their findings suggested that renewable energy consumption is negatively influenced by oil price and CO2 emissions. Gyimah et al. (2022) examines the effects of renewable energy use on economic expansion in Ghana by adopting the mediation model and Granger causality test from 1990 to 2015. The outcome of their investigations revealed that the consumption of renewable energy has a positive and significant influence on Ghana's economic expansion. Ozturk et al. (2022) adopted the DOLS and FMOLS to explore the correlations between GDP growth, energy use, CO2 emissions and pilgrimage tourism in the context of Saudi Arabia between 1968 and 2017. With the exclusion of GDP growth, estimation results unveiled that the emission of CO2 in Saudi Arabia is positively impacted by the influx of pilgrims, energy consumption and oil prices. Mukhtarov (2022) assessed the association between renewable energy use and GDP growth in Azerbaijan over the period 1992–2015. The author applied the ARDL-Toda-Yamamoto causality test method to analyze the correlations among the series. An unidirectional causality emanating from energy use and to renewable energy use was unveiled.

Unidirectional causality from energy consumption to economic growth could negatively affect GDP growth. Although, if unidirectional causality runs from economic growth to energy consumption, then energy conservation strategies may be applied with little or no adverse influence on economic growth (Mahadevan and Asafu-Adjaye, 2007). The discovery of a correlation absence in either direction insinuated that rising energy consumption does not have any impact on GDP growth. Applying the panel ECMs, Mahadevan and Asafu-Adjaye (2007) reassessed the interactions between energy consumption and GDP growth on 20 net energy exporters and importers using annual dataset spanning from 1971 to 2002. Research estimations revealed a short and long-run bidirectional correlation between GDP growth and energy consumption among energy exporters from developed countries. Ocal and Aslan (2013) investigated the causal relationship between renewable energy and economic growth in the context of Turkey. Results from the ARDL methods established a negative effect of renewable energy consumption on economic growth, while Toda and Yamamoto (1995) causality tests revealed a unidirectional correlation emanating from economic growth to renewable energy consumption. Hoshmand et al. (2013) examined the connection between energy consumption, economic growth and prices among OPEC member countries by applying panel data modus operandi from 1978 to 2008. Findings unveiled a long-run bidirectional association between energy consumption and GDP growth and a unidirectional short-run causal relationship from GDP growth to an increase in energy prices.

Payne (2012) analyzed the connection between real GDP, renewable energy consumption, carbon emissions and real oil prices using the Toda-Yamamoto long-causality test methods over the period 1949–2009. Empirical results showed that renewable energy laws and regulations from 1978 had a meaningful impact on renewable energy consumption and suggested on the other hand, that real gross domestic product, real oil prices, and carbon emissions had a zero-causality effect on renewable energy consumption. Bildirici and Ersin (2015) used the ARDL model and other estimations methods to investigate the long-run interactions between biomass energy consumption, oil prices and GDP growth in the U.S, Canada, Germany, Austria, Great Britain, Finland, France, Italy, Mexico and Portugal for the period spanning from 1970 to 2013. A long-run correlation among the series was revealed. Apergis and Payne (2014) analyzed the empirical literature on the factors of renewable energy consumption in 25 OECD countries between 1980 and 2011. The authors applied the ECM and panel cointegration techniques. The outcome of their study revealed the existence of a long-run and a feedback association between real GDP per capita, renewable energy consumption per capita, carbon dioxide emissions per capita and real oil prices.

Applying the cointegration and error correction modeling methods, Asafu-Adjaye (2000) investigated the causal correlations between energy consumption, energy prices and income for the Philippines, India, Indonesia, and Thailand. Evidence from granger causality tests showed a positive connection spanning from energy consumption to income for Indonesia and India. However, for Philippines and Thailand, a bidirectional correlation emanating from energy consumption to income and a mutual causal relationship among the variables observed were founded. Sarwar et al. (2017) examined the connection between GDP growth, electricity consumption, gross fixed capital formation, oil prices, and population using panel data of over 200 countries for the period 1960–2014. The authors applied the panel VECM and other econometric estimations to investigate the relationship between the series. The conclusions drawn revealed a bidirectional interaction between electricity consumption and economic growth, oil price and economic growth, fixed capital formation, population, and economic growth. Talha et al. (2021) used E-views regression model, correlation model, and descriptive analysis with a time-series annual data from 1986 to 2019 to explore the effects of energy consumption, oil prices, and GDP growth on inflation in the context of Malaysia. The estimates showed a positive association among the series and that the rate of oil and renewable energy consumption boosts economic expansion and the inflation rate in Malaysia. These findings are in order with the study of Taghizadeh-Hesary et al. (2019).

Yuan et al. (2010) investigated the link between energy consumption, energy prices, and economic growth using impulse response functions, cointegration equations, variance decomposition, and granger causality test in the context of China. The results suggested that higher energy prices in China lead to a reduction in energy consumption in the industrial sector. However, in the long-term, the economic output steadily expanded despite an increase in energy prices. Brini et al. (2017) studied the connection between renewable energy consumption, oil price, international trade, and economic growth using the ARDL technique and bounds testing method to cointegration in Tunisia over the period 1980–2011. The investigations revealed a short-term bidirectional correlation between international trade and renewable energy consumption and a unidirectional link between renewable energy consumption and oil price in the short-run. In the context of Pakistan, Abbasi et al. (2021) adopted the VECM to assess the interactions between electricity consumption, price and real gross domestic product. A long-run connection between series was found to exist in the industrial sector of Pakistan. Employing the Granger causality test approach and impulse response function analysis, Wang et al. (2019) investigated the effects of energy prices, economic growth and urbanization on per capita energy consumption for 186 high, upper, and lower-middle income countries covering the period 1980–2015. Findings from the Granger causality test exhibit a bidirectional correlation between urbanization and energy consumption in high and lower-middle income countries.

Majeed et al. (2021) adopted the CS-ARDL estimator and advanced econometric approach to explore the effect of economic globalization, natural resource abundance, urbanization, economic growth and disaggregated energy consumption on the environmental quality of GCC nations over the period 1990–2018. A positive correlation between natural resource abundance and environmental quality was unveiled. Renewable energy consumption and economic globalization were found to mitigate emission levels in the GCC economies, and as a result, economic growth, urbanization and non-renewable energy consumption significantly degrade environmental standards. Hsu et al. (2021) investigated the key determinants of China's natural environmental sustainability in the context of carbon emission, greenhouse gas emission, environmental taxes, haze pollution, ecological innovation, globalization, renewable energy. The authors applied the quantile ARDL technique to evaluate the short and long-run interactions between the series. Their findings suggested a significant and negative effect of ecological innovation, renewable energy, and environmental taxes on carbon emissions in China. In contrast, the globalization factor was found to significantly enhance carbon dioxide emissions.

Gozgor (2018) adopted the ARDL model to assess the impact of U.S. renewable energy consumption on economic growth from 1965 to 2016. Results revealed that the use of renewable energy is associated with a higher rate of GDP growth. Gozgor et al. (2018) adopted the ARDL model to study the effect of renewable and non-renewable energy consumption on economic growth in 29 OECD countries from 1990 to 2013. The study outcome unveiled positive impact of energy consumption on GDP growth. Using quarterly data from 1971Q1 to 2013QIV, Rafindadi and Ozturk (2017) used the ARDL and other estimations tools to investigate the impact of renewable energy consumption on GDP growth in Germany and suggested that Germany's renewable energy consumption positively impact economic growth. Alper and Oguz (2016) used the asymmetric causality test and ARDL technique to evaluate data from a subset of EU member states that joined between 1990 and 2009. The investigations suggested that the utilization of renewable energy sources enhance their economic performance.

3. Framework and estimation methodology

There are four primary questions that will be explored during this investigation. The primary purpose of this research is to analyze how oil import prices and energy consumption affect economic growth. A secondary focus of this research is the effect that economic growth has on the amount of energy used in the countries under consideration. Energy consumption in the research countries was also analyzed along with its impacts on urbanization, IT&C investment, environmental technologies, environmental taxes, and economic growth. The study's final objective is to investigate how energy consumption, urbanization, IT&C investment, environmental technology, environmental taxation, and oil import prices affect GDP growth across the EU. Based on these primary goals, the following set of equations has been developed for further analysis.

For the purpose of analyzing the results, this study utilized panel data spanning from 1990 to 2020 for all 27 EU nations. The variables used in this study were chosen after a review of the relevant prior research. EcoGrowth demonstrated the economic growth by following early literature for variable selection, demonstrating that economic growth is used as a proxy for measuring the expansion of the economy. This study used environmental technology and environmental related taxes to check the impact on the energy consumption and economic growth in the study countries. Environmental taxes are utilized in order to regulate the usage of conventional forms of energy and to stimulate economic expansion. Table 1 provides a description of the variables that were used.

3.1. Econometric approach for panel ARDL

The following Panel ARDL (P, Q, Q……, Q1) model is estimated using the panel data set with time periods t = 1, 2, 3, ……….., T and groupings of nations i = 1, 2, 3, ……….., N.

In the above-mentioned panel ARDL (P, Q, Q......, Q1) model, X it (k X 1) represents the vectors of the regressors groups i; μi represents the fixed effect, the coefficients of the lagged regress and, i.e., Economic growth and Energy consumption, λij represents the scalars in the equation, and δij represents the (k X 1) coefficients vector. If cointegration occurs between regressors and regressands, the error correction term is applied to all sets of nations. The key features of cointegrations between regressands and regressors are the responses to deviations from long-term equilibrium. This property of the regressand and regressors reveals the ECM, which specifies how the short-term dynamics of the regressand and regressors in the system are influenced by deviations from equilibrium. The following error corrections equation is described based on the previously stated Panel ARDL (P, Q, Q......, Q1) equation.

Based on the above equations ∅i demonstrate the speed of adjustment to its equilibrium that is known as the error correction speed/model. If the studied error correction speed of adjustment is zero (i.e., ∅i = 0), then there is no correlation between the regressors and the regressand over the long-term. Based on the assumption that the variables used in the equation point toward a long-run equilibrium, a negative and statistically significant error correction term is anticipated; the term in the aforementioned equation represents the long-run correlation between the regressors and the regressand. The following formula is derived from the previously derived formulae for all relevant variables:

4. Results and discussion

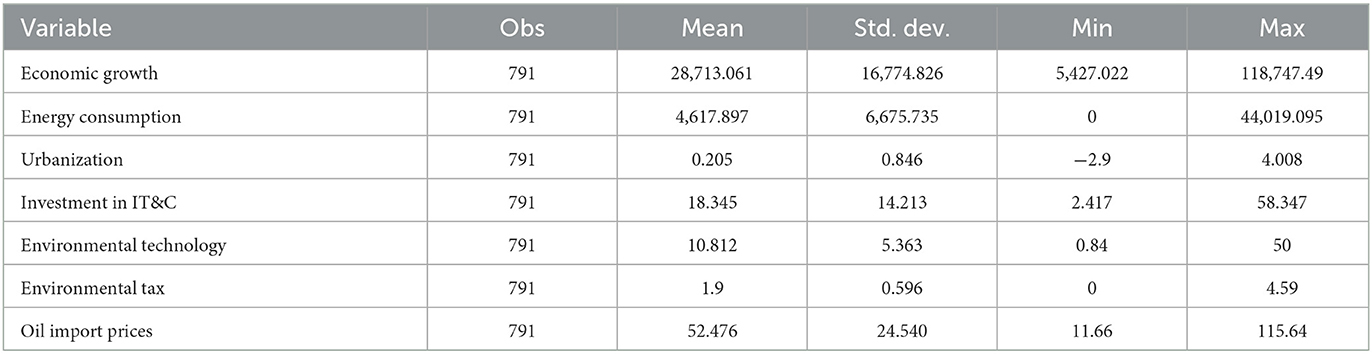

The results of the descriptive statistics are presented in Table 2. Descriptive statistics are used to describe the characteristics of the data that have been utilized. These characteristics include the mean, standard deviation, minimum, and maximum values for the variables that have been used. The findings of the descriptive statistics that were analyzed show that economic growth has a mean value of 28,713 for the EU states, with the minimum value in the range being 5,427 and the largest value in the range being 11,874 accordingly. The findings from the investigation into the consumption of energy indicate that the smallest value is 0 and the maximum value is 44,019, with the mean value being 4,617. In addition, urbanization was employed in this study's descriptive statistics; the mean value is 0.205, and the standard deviation value is 0.846; the minimum value is −2.9, and the maximum value is 4, correspondingly. In addition, the findings indicate that investments in information technology and communication have a mean value of 18, a standard deviation value of 14, and a maximum value of 58 and a minimum value of 2.417. Additional two variables are included for environmental issues, namely environmental technology and environmental tax in the economies that are taken into account. According to the findings, the maximum value of environmental technology is 50, while the maximum value of environmental tax is 4.59. The mean value of environmental technology is 10, while the mean value of environmental tax is 1.9. Findings about oil import prices suggest that the mean value is 52, while the standard deviation value is 24, with the minimum and maximum values, respectively, being 11 and 115.

The results of the correlations matrix are shown in Table 3. In order to investigate the correlations between the variables being employed, a correlation matrix is utilized. According to the findings of the matrix, economic growth has a positive relationship with urbanization, energy consumption, environmental technology, and oil import prices, but a negative relationship with investments in information technology and communication as well as environmental taxes. In addition, the data point to a positive correlation between energy consumption and economic growth, urbanization, and oil import prices. According to the findings, the price of oil imports has a positive correlation with economic growth, energy consumption, urbanization, environmental technology, environmental taxation, as well as investments in information technology and communication.

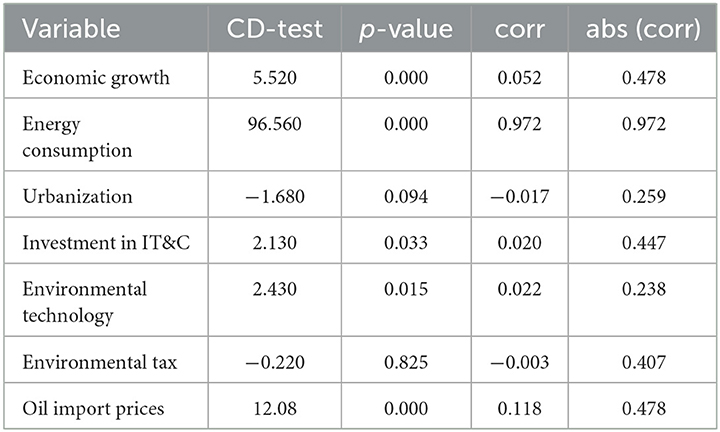

The possibility of a cross-sectional problem exists because of the nature of panel data; hence, this study explores the cross-section dependence in the variable by employing the Pesaran dependency test; the results of this investigation are provided in Table 4. Based on the findings, it appears that there is a cross-sectional dependence in the variables. According to the findings, there is a cross-sectional dependency between economic growth, energy consumption, urbanization, investments in information and communication technology, environmental technology, and oil import prices in the nations that were investigated. In addition, this research investigated whether or not the variables that were employed were stationary by employing the Im-Pesaran Shin and Fisher-type unit root tests, respectively.

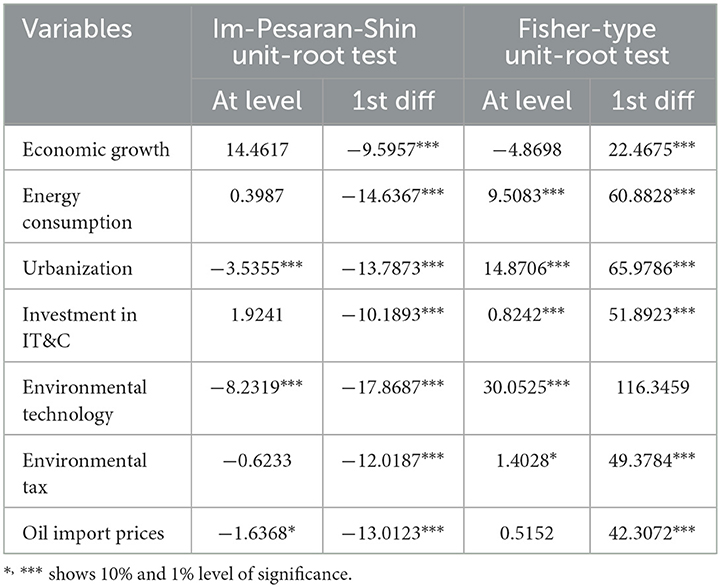

Table 5 displays the results of the panel unit root tests that were conducted. In order to determine whether or not the variables that were utilized in the analyses were stationary, Im-Pesaran Shin and Fisher-type unit root tests were carried out. The findings reveal that GDP growth is not stationary at level; nevertheless, it does become stationary at first difference with both Panel root tests; namely, the Im-Pesaran Shin and Fisher-type tests, respectively. In addition, the results of the Im-Pesaran Shin unit root test indicate that variables such as urbanization, environmental technology and oil prices are stationary at level, whereas variables such as energy consumption, investment in information technology and communication, and environmental tax are not stationary at level. However, the results of this test indicate that these variables become stationary at first difference. In addition, the results of a Fisher-type unit root test indicate that energy consumption, urbanization, investments in information technology and communication, environmental technology, and environmental taxes are stationary at level and first difference, which validates the fact that a panel ARDL model can be utilized with the variables.

In order to investigate whether or not the variables shown in Table 6 exhibit cointegration, we subjected them to three distinct cointegration tests: the Westerlund, Pedroni, and Kao cointegration tests. This study looked at the cointegration in energy consumption, oil import prices, and economic growth in the nations that were studied using the first equation in the equation set. The results of the cointegration experiments conducted by Westerlund, Pedroni, and Kao revealed that cointegration does, in fact, exist in the variables that were studied. In addition, the cointegration between economic growth and energy consumption was investigated in this study using the second equation. Findings from the second equation show that cointegration does exist, as shown by the outcomes of the Westerlund, Pedroni, and Kao cointegration tests in that order. In addition, urbanization, investments in information technology and communication, environmental technologies, and environmental levies were included in this study alongside economic growth in order to investigate the cointegration of these factors with energy consumption. In accordance with the findings of the Westerlund, Pedroni, and Kao cointegration tests, the solutions to the third equation point to the existence of cointegration in the following areas: urbanization; investments in information and communication technology; environmental technology; economic growth; environmental taxes; and energy consumption. In the final step of this investigation, cointegration was investigated through the utilization of Westerlund, Pedroni, and Kao cointegration tests in the areas of energy consumption, urbanization, investment in information technology and communication, environmental technology, environmental taxes, oil import prices, and economic growth. Cointegration in the research variables was shown to exist according to the findings of the Westerlund, Pedroni, and Kao cointegration tests.

The findings of the panel ARDL model illustrated in Table 7 indicate that oil import prices positively and significantly influence the economic expansion of the European Union countries. The examined results of the oil import prices indicate that 1% increase in the prices of oil import causes to increase the economic growth of the EU members countries. On the other hand, the investigated panel ARDL data reveal that economic expansion in EU nations induces an increase in energy consumption. Furthermore, the data show that a 1% rise in economic growth induces an increase in energy consumption of around 2.93, 0.89% in the short-run, and ~0.35, 2.91% in the long-run. Consumption of energy has a positive and substantial effect on economic growth across EU member states, as shown by results from both short and long term pooled mean group estimators. According to the estimations, a one percent rise in energy consumption boosts the economies of the EU member nations by 1.60, 0.96 percent in the short term and by 0.91, 2.03% in the long run. These findings are in line with the estimations of Alper and Oguz (2016), Rafindadi and Ozturk (2017), and Gozgor (2018).

The results of urbanization reveal a negative influence on economic growth in the short-term, but in the long-run, it has a favorable and considerable influence on the economic growth of EU members. Further the findings show investment in information technology and communication, environmental related technologies and environmental taxes causes to increase the economy growth of the EU member countries both in the short-run and the long run-respectively. Findings of the investment information technology and communications causes to increase the economic growth of the European countries about 0.092% in the short-run and 1.80% in the long-run. The findings of environmental technology indicate positive and significant impact on the economic growth in the short and in the long-run, respectively. In the short run, 1% increase in environmental technology causes to increase the economy growth about 3.29%, while in the long-run it causes to boost the economy growth about 0.63%. On the other hand, the results of Panel ARDL indicate that taxes related to environment causes to boost the economy growth by 0.95 and 1.52% both in the short and long-run, respectively.

Findings of the (Equation 4) indicate that urbanization causes to increase the energy consumption both in the short and long-run in the EU countries. The examined results indicate that in the short-run, 1% increase in urbanization causes to increase the consumption of energy by 0.081% while in the long run it causes to boost the use of energy about 1.58%. The findings of the environmental technology and taxes demonstrate negative and significant impact on the energy consumption both in the short and in the long-run. The ECT coefficient is negative and statistically significant, indicating the long-term equilibrium relationship between the research variables. Pooled Mean group estimator is selected based on the examined value of Hausman test.

Table 8 demonstrates the results of different test to check the stability of the used model. The examined findings indicate that there is no problem of serial correlation and heteroscedasticity in the used models.

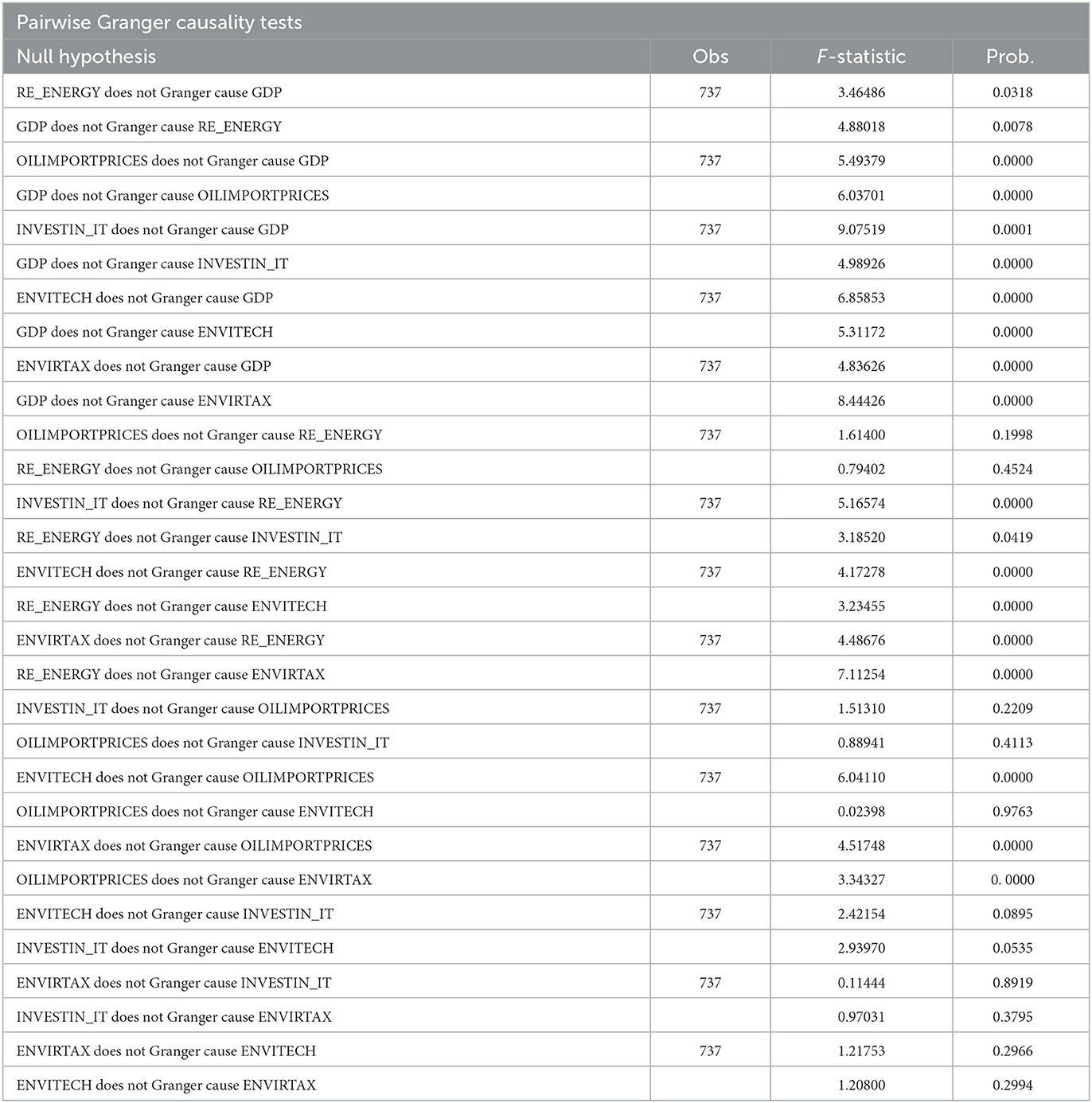

The empirical estimations of the Granger causality test shown in Table 9 indicate that the consumption of renewable energy granger causes economic growth in the EU states, while GDP growth Granger causes the consumption of energy. These findings confirm that there is a bidirectional interaction between the study series. On the other hand, the data shows that growth in the economy causes an increase in oil import prices via granger causality, which confirms that there is a bidirectional correlation between these two variables. In addition, the findings of the pairwise Granger causality test reveal that investments in information technology and communication have a link that is both forward and backward with the expansion of EU economies. Moreover, this research investigated the causality in environmental linked technology and economic growth. The data suggest that there is a connection that goes in both directions between these two factors. Environmental taxes are another important aspect of economic expansion that contribute to the growth of the economy. The findings unveil that there is a link going in both directions between environmental related levies and economic growth.

5. Conclusion and policy implications

The primary purpose of this research is to explore how energy consumption and oil import prices impact economic expansion in the EU. A secondary focus of this research is the effect that economic growth has on the amount of energy consumption. The study's final objective is to analyze how energy use, urbanization, IT&C investment, environmental technology, environmental taxation, and oil import prices, affect GDP growth. For the purpose of analyzing the results, we applied a panel ARDL model with panel data spanning from 1990 to 2020 for all 27 EU nations. According to our econometric estimations, EU's economic expansion has a positive relationship with urbanization, energy consumption, environmental technology and oil import prices, but a negative relationship with investments in information technology and communication as well as environmental taxes. The findings of the panel ARDL model indicate that oil prices positively and significantly influence the EU's economic expansion, which in turns increase energy consumption. This is conformity with the findings of Brini et al. (2017). There is a short-run negative impact of urbanization on economic growth, but in the long-run, it has a favorable and considerable influence on the economic growth of EU members.

Further, the findings show investment in information technology and communication, environmental related technologies and environmental taxes enhances economic expansion in the EU both in the short and longer terms. Accordingly, urbanization leads to an increase in energy consumption among the EU countries. The environmental technology and taxes demonstrate negative and significant impact on energy consumption. Consumption of energy has been discovered to have a short and long-term positive and substantial effect on economic growth across EU as shown by the results of the Pooled Mean Group estimators. According to the results, a one percent rise in energy consumption boosts the economies of the EU member nations by 1.60, 0.96% in the short-term and by 0.91, 2.03% in the long-run. The main estimations of our study are line with the feedback hypothesis, which states a two-way causal link between energy consumption and economic growth and among most of the series analyzed. The studies of Hwang and Gum (1991), Glasure (2002), Wang et al. (2016), and Liu and Hao (2018) drew similar conclusions.

Given the above circumstances, policy makers and regulators should map out sound energy policies across the EU members. The energy infrastructures should be enhanced and sustained. The energy pricing framework should be adopted as this is very vital for the European Union as an oil-dependent region. Since the European Union largely depend on Russia for energy supply and currently termed as consumers of a significant portion of world's energy, there is a need for expansion of research and development (R&D) in all energy sectors. Further, sound policies that minimize the consumption of imported oil and gas, particularly from Russia would stabilize economic expansion across the EU.

Data availability statement

Publicly available datasets were analyzed in this study. This data can be found here: https://www.oecd.org/.

Author contributions

All authors listed have significantly and intellectually contributed to the investigation, development and writing of this article, and approved it for publication.

Acknowledgments

AG thanks the Management of the University of The Gambia (UTG) for their contribution to the article publication fee and for their role in promoting the university's research and publications in world class journals.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Abbreviations

ARDL, Autoregressive Distributed Lag; CO2, Carbon dioxide; CS-ARDL, Cross-Sectional Autoregressive Distributed Lags; DOLS, Dynamic Ordinary Least Squares; ECM, Error Correction Model; GCC, Gulf Cooperation Council; GDP, Gross Domestic Product; FMOLS, Fully-Modified Ordinary Least Squares; OPEC, Organization of the Petroleum Exporting Countries; VECM, Vector Error Correction Model.

References

Abbasi, K. R., Hussain, K., Abbas, J., Adedoyin, F. F., Shaikh, P. A., Yousaf, H., et al. (2021). Analyzing the role of industrial sector's electricity consumption, prices, and GDP: a modified empirical evidence from Pakistan. Aims Energy 9, 29–49. doi: 10.3934/energy.2021003

Alper, A., and Oguz, O. (2016). The role of renewable energy consumption in economic growth: evidence from asymmetric causality. Renew. Sustain. Energy Rev. 60, 953–959. doi: 10.1016/j.rser.2016.01.123

Anton, S. G., and Nucu, A. E. A. (2020). The effect of financial development on renewable energy consumption. A panel data approach. Renew. Energy 147, 330–338. doi: 10.1016/j.renene.2019.09.005

Apergis, N., and Payne, J. E. (2014). The causal dynamics between renewable energy, real GDP, emissions and oil prices: evidence from OECD countries. Appl. Econ. 46, 4519–4525. doi: 10.1080/00036846.2014.964834

Asafu-Adjaye, J. (2000). The relationship between energy consumption, energy prices and economic growth: time series evidence from Asian developing countries. Energy Econ. 22, 615–625. doi: 10.1016/S0140-9883(00)00050-5

Baz, K., Xu, D., Ampofo, G. M. K., Ali, I., Khan, I., Cheng, J., et al. (2019). Energy consumption and economic growth nexus: new evidence from Pakistan using asymmetric analysis. Energy 189, 116254. doi: 10.1016/j.energy.2019.116254

Bildirici, M., and Ersin, Ö. (2015). An investigation of the relationship between the biomass energy consumption, economic growth and oil prices. Proc. Soc. Behav. Sci. 210, 203–212. doi: 10.1016/j.sbspro.2015.11.360

Brini, R., Amara, M., and Jemmali, H. (2017). Renewable energy consumption, international trade, oil price and economic growth inter-linkages: the case of Tunisia. Renew. Sustain. Energy Rev. 76, 620–627. doi: 10.1016/j.rser.2017.03.067

Brodny, J., and Tutak, M. (2022). Analysis of the efficiency and structure of energy consumption in the industrial sector in the European Union countries between 1995 and 2019. Sci. Total Environ. 808, 152052. doi: 10.1016/j.scitotenv.2021.152052

Fan, W., and Hao, Y. (2020). An empirical research on the relationship amongst renewable energy consumption, economic growth and foreign direct investment in China. Renew. Energy 146, 598–609. doi: 10.1016/j.renene.2019.06.170

Glasure, Y. U. (2002). Energy and national income in Korea: further evidence on the role of omitted variables. Energy Econ. 24, 355–365. doi: 10.1016/S0140-9883(02)00036-1

Gozgor, G. (2018). A new approach to the renewable energy-growth nexus: evidence from the USA. Environ. Sci. Pollut. Res. 25, 16590–16600. doi: 10.1007/s11356-018-1858-9

Gozgor, G., Lau, C. K. M., and Lu, Z. (2018). Energy consumption and economic growth: new evidence from the OECD countries. Energy 153, 27–34. doi: 10.1016/j.energy.2018.03.158

Gyimah, J., Yao, X., Tachega, M. A., Hayford, I. S., and Opoku-Mensah, E. (2022). Renewable energy consumption and economic growth: new evidence from Ghana. Energy 248, 123559. doi: 10.1016/j.energy.2022.123559

Hoshmand, M., Daneshnia, M., Sotudeh, A., and Ghezelbash, A. (2013). Causality relationship between energy consumption, economic growth and prices: using panel data OPEC member countries. Monetary & Financial Economics, 20, 233–255.

Hsu, C. C., Zhang, Y., Ch, P., Aqdas, R., Chupradit, S., and Nawaz, A. (2021). A step towards sustainable environment in China: the role of eco-innovation renewable energy and environmental taxes. J. Environ. Manage. 299, 113609. doi: 10.1016/j.jenvman.2021.113609

Hwang, D. B., and Gum, B. (1991). The causal relationship between energy and GNP: the case of Taiwan. J Energy Dev. 16, 219–226.

Islam, M. M., and Islam, M. S. (2021). Energy consumption–economic growth nexus within the purview of exogenous and endogenous dynamics: evidence from Bangladesh. OPEC Energy Rev. 45, 191–216. doi: 10.1111/opec.12195

Jafri, M. A. H., Liu, H., Usman, A., and Khan, Q. R. (2021). Re-evaluating the asymmetric conventional energy and renewable energy consumption-economic growth nexus for Pakistan. Environ. Sci. Pollut. Res. 28, 37435–37447. doi: 10.1007/s11356-021-13131-1

Liu, Y., and Hao, Y. (2018). The dynamic links between CO2 emissions, energy consumption and economic development in the countries along “the Belt and Road”. Sci. Total Environ. 645, 674–683. doi: 10.1016/j.scitotenv.2018.07.062

Lovcha, Y., Perez-Laborda, A., and Sikora, I. (2022). The determinants of CO2 prices in the EU emission trading system. Appl. Energy 305, 117903. doi: 10.1016/j.apenergy.2021.117903

Mahadevan, R., and Asafu-Adjaye, J. (2007). Energy consumption, economic growth and prices: a reassessment using panel VECM for developed and developing countries. Energy Policy 35, 2481–2490. doi: 10.1016/j.enpol.2006.08.019

Majeed, A., Wang, L., Zhang, X., and Kirikkaleli, D. (2021). Modeling the dynamic links among natural resources, economic globalization, disaggregated energy consumption, and environmental quality: fresh evidence from GCC economies. Resources Policy 73, 102204. doi: 10.1016/j.resourpol.2021.102204

Mukhtarov, S. (2022). The relationship between renewable energy consumption and economic growth in Azerbaijan. Int. J. Energy Econ. Policy 12, 416–419. doi: 10.32479/ijeep.11948

Mukhtarov, S., Mikayilov, J. I., Maharramov, S., Aliyev, J., and Suleymanov, E. (2022). Higher oil prices, are they good or bad for renewable energy consumption: the case of Iran? Renew. Energy 186, 411–419. doi: 10.1016/j.renene.2021.12.135

Ocal, O., and Aslan, A. (2013). Renewable energy consumption–economic growth nexus in Turkey. Renew. Sustain. Energy Rev. 28, 494–499. doi: 10.1016/j.rser.2013.08.036

Ozturk, I., Aslan, A., and Altinoz, B. (2022). Investigating the nexus between CO2 emissions, economic growth, energy consumption and pilgrimage tourism in Saudi Arabia. Econ. Res. Ekonomska IstraŽivanja 35, 3083–3098. doi: 10.1080/1331677X.2021.1985577

Papież, M., Śmiech, S., and Frodyma, K. (2019). Effects of renewable energy sector development on electricity consumption-Growth nexus in the European Union. Renew. Sust. Energ. Rev. 113, 109276.

Payne, J. E. (2012). The causal dynamics between US renewable energy consumption, output, emissions, and oil prices. Energy Sources Part B Econ. Plan. Policy 7, 323–330. doi: 10.1080/15567249.2011.595248

Rafindadi, A. A., and Ozturk, I. (2017). Impacts of renewable energy consumption on the German economic growth: evidence from combined cointegration test. Renew. Sustain. Energy Rev. 75, 1130–1141. doi: 10.1016/j.rser.2016.11.093

Rahman, M. M., and Velayutham, E. (2020). Renewable and non-renewable energy consumption-economic growth nexus: new evidence from South Asia. Renew. Energy 147, 399–408. doi: 10.1016/j.renene.2019.09.007

Rasheed, M. Q., Haseeb, A., Adebayo, T. S., Ahmed, Z., and Ahmad, M. (2022). The long-run relationship between energy consumption, oil prices, and carbon dioxide emissions in European countries. Environ. Sci. Pollut. Res. 29, 24234–24247. doi: 10.1007/s11356-021-17601-4

Sarwar, S., Chen, W., and Waheed, R. (2017). Electricity consumption, oil price and economic growth: global perspective. Renew. Sustain. Energy Rev. 76, 9–18. doi: 10.1016/j.rser.2017.03.063

Taghizadeh-Hesary, F., Yoshino, N., Rasoulinezhad, E., and Chang, Y. (2019). Trade linkages and transmission of oil price fluctuations. Energy Policy 133, 110–127. doi: 10.1016/j.enpol.2019.07.008

Talha, M., Sohail, M., Tariq, R., and Ahmad, M. T. (2021). Impact of oil prices, energy consumption and economic growth on the inflation rate in Malaysia. Cuadernos de Economía 44, 26–32.

Toda, H. Y., and Yamamoto, T. (1995). Statistical inference in vector autoregressions with possibly integrated processes. J. Econom. 66, 225–250. doi: 10.1016/0304-4076(94)01616-8

Tutak, M., and Brodny, J. (2022). Renewable energy consumption in economic sectors in the EU-27. The impact on economics, environment and conventional energy sources. A 20-year perspective. J. Cleaner Product. 345, 131076. doi: 10.1016/j.jclepro.2022.131076

Wang, Q., Su, M., Li, R., and Ponce, P. (2019). The effects of energy prices, urbanization and economic growth on energy consumption per capita in 186 countries. J. Clean. Prod. 225, 1017–1032. doi: 10.1016/j.jclepro.2019.04.008

Wang, S., Li, Q., Fang, C., and Zhou, C. (2016). The relationship between economic growth, energy consumption, and CO2 emissions: empirical evidence from China. Sci. Total Environ. 542, 360–371. doi: 10.1016/j.scitotenv.2015.10.027

Yuan, C., Liu, S., and Wu, J. (2010). The relationship among energy prices and energy consumption in China. Energy Policy 38, 197–207. doi: 10.1016/j.enpol.2009.09.006

Keywords: investment in IT&C, oil import prices, energy consumption, economic growth, environmental technologies and taxes, panel ARDL model

Citation: Gibba A and Khan MK (2023) Modeling the causal dynamics among energy consumption, economic growth, and oil import prices: A panel co-integration analysis for EU economies. Front. Environ. Econ. 2:1114175. doi: 10.3389/frevc.2023.1114175

Received: 02 December 2022; Accepted: 08 February 2023;

Published: 28 February 2023.

Edited by:

Ramazan Sari, Technical University of Denmark, DenmarkReviewed by:

Dervis Kirikkaleli, European University of Lefke, TürkiyeRaufhon Salahodjaev, Tashkent State Economic University, Uzbekistan

Copyright © 2023 Gibba and Khan. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Alieu Gibba, YWdpYmJhMUBnbWFpbC5jb20=

Alieu Gibba

Alieu Gibba Muhammad Kamran Khan

Muhammad Kamran Khan