- Business School, Nanjing Xiaozhuang University, Nanjing, China

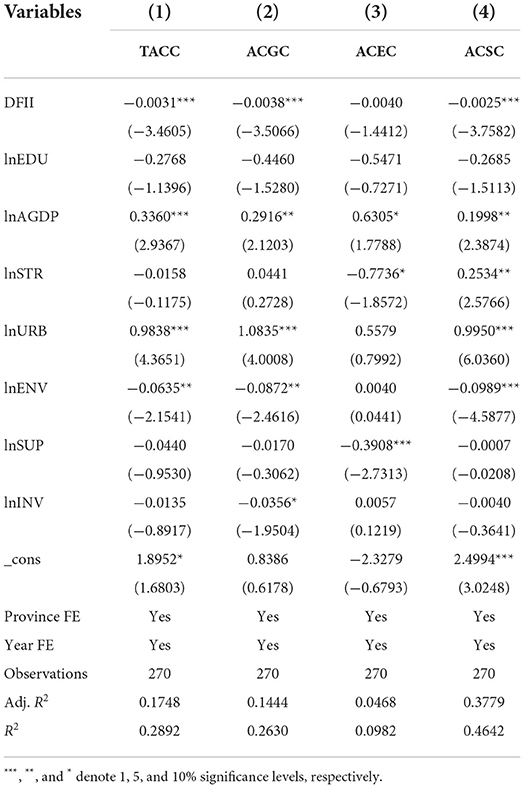

Digital inclusive finance can help to achieve agricultural carbon reduction through effective resource allocation, financial innovation, and digital networks. This study empirically tested the role of digital inclusive finance in agricultural carbon emissions reduction using a two-way fixed-effects model that was based on panel data of 30 provinces from 2011 to 2019 in China. The data and statistics showed that China's total agricultural carbon emissions were still growing and had not yet reached their peak. This empirical study found that digital inclusive finance had a significant effect on the reduction in agricultural carbon emissions. Specifically, for every one-level increase in the digital financial inclusion development (DFII) level, the province's total agricultural carbon emissions (TACC), agricultural greenhouse gas carbon emissions (ACGC), and agricultural carbon source carbon emissions (ACSC) decreased by 0.31, 0.38, and 0.25%, respectively, but there was no significant decrease in agricultural energy use carbon emissions (ACEC)1. Furthermore, the first- and second-order lagged terms of digital inclusive finance still had significant agricultural carbon reduction effects, reducing TACC by 0.30 and 0.29%, respectively. To better utilize the agricultural carbon emissions reduction effect of digital inclusive finance, we should further support the development of digital inclusive finance; promote education on, and the breadth and depth of digital inclusive finance; encourage cooperation between digital inclusive finance and low-carbon enterprises to reduce the financing constraints of agricultural low-carbon enterprises; and stimulate the R&D and sales of low-carbon technologies.

Introduction

With global warming, the melting of Arctic glaciers, and the outbreak of epidemics in various countries, the human living environment is deteriorating. A report entitled “Climate Change 2022: Mitigating Climate Change” was released by the United Nations Intergovernmental Panel on Climate Change (IPCC)2. It shows that the annual average global greenhouse gas emissions once again reached a record high of 59 billion tons in 2019. If global warming exceeds 1.5°C in the next few decades or later, humans themselves, natural systems, and biodiversity will all face additional serious risks. From 2007 to 2016, the global agricultural system accounted for 25–30% of global carbon emissions, which shows that greenhouse gas (GHG) emissions from the agricultural sector are a significant component of global GHG emissions. As a largely agricultural country with a large population, China made a solemn commitment at the 75th UN General Assembly to “peak carbon by 2030 and be carbon neutral by 2060”3. Obviously, the agricultural sector cannot stay out of the picture, and the issue of reducing agricultural carbon emissions needs to be addressed urgently.

Agricultural carbon emissions refer to the greenhouse gas emissions generated by humans during social and agricultural economic activities, such as the production of agricultural products and agricultural scientific research. Unlike the carbon emission characteristics of the secondary and tertiary sectors, agriculture is unique in that it both contributes to greenhouse gas emissions and functions as a carbon sink. For example, rice paddies themselves both emit CO2 through respiration and consume CO2 through photosynthesis, and they consume much more than they emit (Dai et al., 2022). Therefore, the agricultural sector can consider both emissions reduction and sink enhancement to achieve the “double carbon” goal of the agricultural sector.

To our knowledge, whether the level of agricultural carbon emissions can be reduced depends on the level of agricultural economic development, the direct influence of agricultural mechanization, and the internal structure of agriculture (Li et al., 2011; He and Dai, 2016). Agricultural economic development is the main driver of agricultural carbon emissions, while the improvement of energy use efficiency and the optimization of the internal structure of agriculture contribute to agricultural carbon emissions reductionn (Pang, 2014). As the agricultural economy is still developing, the agricultural structure and energy consumption will be the biggest influencing factors that affect the carbon peak in China (Jin et al., 2021). Therefore, improving the efficiency of agricultural energy use and coordinating the internal composition of the agricultural industry, and thus, contributing to the application of low-carbon agricultural technologies, is the key to effectively reducing agricultural carbon emissions.

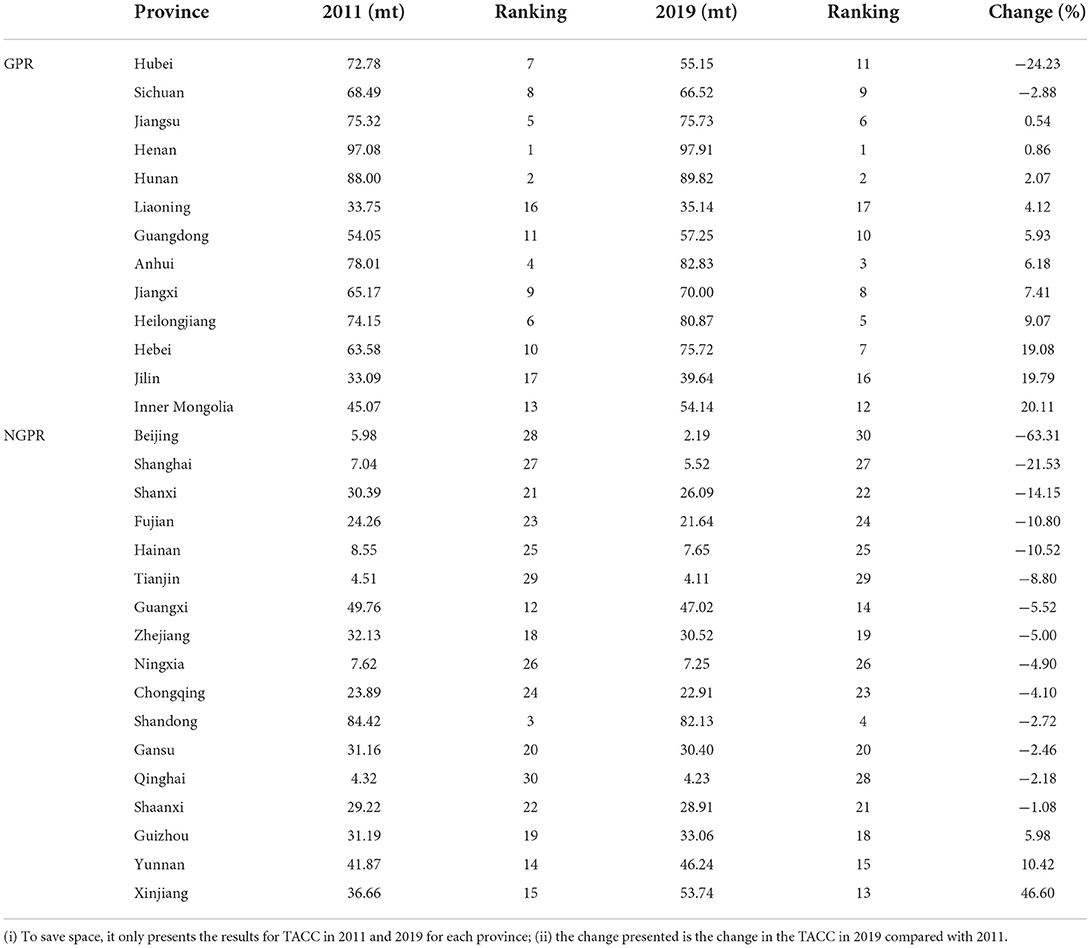

Table 1 shows the total agricultural carbon emissions for 30 Chinese provinces and territories in 2011 and 2019, as well as the differences between them. To explain the evolutionary trends of agricultural carbon emissions, we subsequently divided the 30 provinces into 13 major grain-producing regions (GPR) and 17 non-grain-producing regions (NGPR). On the whole, the carbon emissions were characterized as “high in the GPR”4. For example, the total agricultural carbon emissions (TACC) was led by Henan, with 97.91 million tons, and Beijing was last with 2.19 million tons in 2019. Compared with 2011, 16 provinces showed a decreasing trend, with an average decrease of 11.51%, and the largest decrease of 63.31% in Beijing, while other provinces showed an increasing trend, with an average increase of 11.30%, and the largest increase of 46.60% in Xinjiang. Overall, the average of the 30 provinces fell slightly by 0.87%.

It was found that financial development can reduce energy consumption by directing capital flows to energy-efficient and resource-allocating enterprises through the financial resource allocation function (Ge et al., 2018). From the production perspective, financial development reduces the risk of financial innovation and allows producers to increase investment expenditure into advanced production technologies, promoting technological progress and eventually replacing outdated production with clean technologies that are high in energy consumption and emissions. From the consumption perspective, financial development can enable consumers to purchase innovative products with low-energy or clean energy technologies, such as low-energy agricultural machinery and organic production materials, thus promoting lower energy consumption. Therefore, theoretically, rural financial development can not only boost the development and utilization of low-carbon technologies in agriculture, but also play an important role in the improvement of agricultural production efficiency and the optimization of agricultural industrial structure, and is an important stimulator for achieving carbon emissions reduction in agriculture. The key mechanism behind this is to reduce the cost of identifying, monitoring, and financing agricultural project technologies, and technology-dependent agricultural carbon reduction cannot be achieved without a coordinated flow of adequate and balanced rural financial resources. This necessitates that rural-oriented financial services be inclusive and accessible (Dong et al., 2022), and these are the core features of digital inclusive finance.

Digital inclusive finance is a kind of financial service provider that relies on innovative digital technologies, such as big data and cloud computing, and provides a possible means to overcome the information mismatch and high-cost and low-return problems of inclusive finance. The key to this approach is digital technology, which, on the one hand, can be attached to hundreds of millions of mobile terminals to create social or transactional scenarios through internet platforms, and on the other hand, can be based on using network platforms to capture big data resources from online shopping malls and social media to analyze and evaluate the credit of individuals or enterprises. This can expand the breadth of coverage and depth of service of finance (Guo et al., 2020). There have been studies that also use the concept of digital finance, and the study of digital finance is mainly to explore digital financial inclusion, and from this perspective, digital finance is digital financial inclusion. Domestic and foreign countries attach great importance to the digital construction of financial institutions, and digital inclusive finance not only has the advantages of reducing service costs, expanding service boundaries, and improving service quality and efficiency (Demir et al., 2022) but also has the popularization effects of changing the behavior of financial service consumers, increasing financial accessibility, and promoting poverty reduction (Siddik et al., 2020). Digital inclusive finance in China has made great strides and has had a great impact globally (Huang and Huang, 2018). We sought to explore the following question of whether digital inclusive finance will further affect agricultural carbon emissions, and specifically, whether the development of digital inclusive finance had a facilitating or inhibiting effect on agricultural carbon emission.

Figure 1 shows the levels and trends of digital financial inclusion development (DFII) in 30 Chinese provinces and regions in 2011, 2015, and 2019. Blue, orange, and gray correspond to the digital financial inclusion development levels of 450, 225, and 0, respectively. As time evolved, the level of digital financial inclusion development improved in all provinces, with coastal provinces in the lead. Specifically, the average level of digital inclusive finance development in China was 52.31, 221.37, and 318.50 in 2011, 2015, and 2019, respectively. These values in coastal areas of Zhejiang Province were 77.39, 264.85, and 387.48, respectively; in Fujian Province they were 61.76, 245.21, and 360.50, respectively; and in Guangdong Province, they were 69.48, 240.95, and 360.60, respectively, which were all above average. Regarding the inland provinces, in Jilin Province the values were 24.51, 208.20, and 292.77, respectively; in Yunnan Province, they were 24.91, 203.76, and 303.46, respectively; and in the Xinjiang region, they were 20.34, 205.49, and 294.34, respectively, all of which were below the average level. It can be seen that although the level of digital inclusive finance development in inland provinces grew year by year, there was still a big gap between them and the coastal provinces. In summary, due to the limitations of factor endowment, location factors, and development foundation, the digital inclusive finance development patterns of Beijing–Tianjin–Hebei, Yangtze River Delta, and the Guangdong–Hong Kong–Macao coastal areas were the core.

This study aimed to explore the path of carbon reduction in the agricultural sector against the backdrop of China's “double carbon” target, i.e., to study the practical role of digital inclusive finance from the perspective of agricultural carbon emissions. This study provided three main marginal contributions. First, compared with the existing literature, which used a single method to measure the level of agricultural carbon emissions (Zhang et al., 2016; Deng et al., 2021; Li and Xu, 2022), this study used TACC, agricultural greenhouse gas carbon emissions (ACGC), agricultural energy use carbon emissions (ACEC), and agricultural carbon source carbon emissions (ACSC) as the four indicators to measure the level of agricultural carbon emissions in detail and help to identify possible barriers to carbon peaking and carbon neutrality in the agricultural sector. Second, unlike previous studies that more often explored macro factors (industrial agglomeration, policy intervention, technological innovation; Garbach et al., 2012; Carauta et al., 2018; Li and Xu, 2022) and micro factors (limited rationality, degree of part-time work; Zamasiya et al., 2017; Tian, 2019; Liu et al., 2021), this study innovatively explored the role of digital inclusive finance development from the perspective of agricultural carbon emissions to verify the extent of the impact of digital inclusive finance and its lags on agricultural carbon emissions reduction, providing empirical evidence for the inclusion of the agricultural sector in the economic development framework of China's carbon emissions reduction process. Third, the subject of this study was China, which is an emerging economy whose rapid development over the past decade or so was accompanied by unevenness, with large provincial differences and annual policy differences. The methodological use of a two-way fixed-effects model allowed for controlling individual and time-fixed effects, thus helping to obtain valid and unbiased estimation results.

The remaining parts of this paper are organized as follows: Section 2 presents the literature review, Section 3 describes the data and methodology, the empirical results are provided in Sections 4, 5 contains the conclusions and policy recommendations.

Literature review and research theory

Literature review

Previous studies generally used a single indicator, such as agricultural carbon sources, to estimate the total agricultural carbon emissions (Chen et al., 2018; Deng et al., 2021; Li and Xu, 2022). The total carbon emissions of agricultural production in China generally maintained an upward trend but showed a decreasing rate in this upward trend in recent years, tending toward reaching a peak (Li et al., 2011; Wu et al., 2021). Meanwhile, agricultural carbon emissions showed significant regional variability (Tian and Zhang, 2013; Tian et al., 2015; Deng et al., 2021). If measured using the Gini coefficient method, the overall gap in the spatial distribution of agricultural carbon emissions nationwide first gradually widened and then gradually decreased (Wu et al., 2021); if estimated using the Kernel density, the regional gap in agricultural carbon emissions in China showed a decreasing trend for 1993–2010, but the decrease was relatively limited (Liu et al., 2013). It is worth noting that the national and provincial agricultural sectors can use agricultural low-carbon technologies to reduce carbon emissions by more than 5 million tons per year to achieve the dual carbon target (Li and Xu, 2022). According to the definition of agricultural carbon emissions, the agricultural carbon source is not the only component of agricultural carbon emissions (Deng et al., 2021); agricultural greenhouse gas, agricultural energy, and agricultural carbon sources play equal roles (Tian, 2019). Therefore, this study used four indicators to measure agricultural carbon emissions, which allowed us to reflect the levels of agricultural carbon emissions more comprehensively.

Scholars launched a rich discussion based on a series of macro-level and micro-level factors, pointing out that agricultural carbon emissions reduction can rely on pathways such as scientific and technological innovation, industrial development, and policy intervention (Hu and Hu, 2016; Liu et al., 2019; Lv et al., 2021; Tian and Yin, 2022), which can be summarized in four specific aspects. First, the use of agricultural technologies, such as drip irrigation, biogas fermentation, and soil testing and fertilization, can reduce total carbon emissions (Wei et al., 2018; Qian et al., 2021; Li and Xu, 2022). Second, industrial agglomeration will cause an increase in farming scale, the economy of scale, and energy factor saving; the total carbon emissions will show an inverted U-shaped characteristic of increasing and then decreasing; and the carbon emissions intensity and net carbon effect will show a positive N-shaped characteristic of increasing, then decreasing, and then increasing (Hu and Hu, 2016; Tian and Yin, 2022). Third, the policy of increasing the proportion of food cultivation is an effective mechanism for agricultural carbon emissions reduction (Yang et al., 2021), and government subsidies can change the costs and benefits of low-carbon cultivation for farmers, prompting them to choose low-carbon agricultural technology strategies (Liu et al., 2019). Fourth, the degrees of low-carbon cognition, social network embedding, reputation, and expectation all influence farm households' agricultural low-carbon production behavior (Wei et al., 2018; Tian, 2019; Liu et al., 2021); taking pesticide use and fertilizer application as examples, farmers that have a higher degree of cognition of low-carbon agriculture and membership in farmers' professional cooperative organizations are more inclined to choose low-carbon production standards for fertilizer application, while farmers with cadre status were more likely to choose low-carbon production standards for pesticide application (Tian et al., 2015). Based on the existing studies, this study aimed to explore the impact of digital financial inclusion development on agricultural carbon emissions innovatively, considering that China, which is an emerging economy, has the highest level of digital financial inclusion development in the world.

Regarding the carbon emissions reduction effect of financial development, scholars' research findings can be summarized at two levels. One level is from the perspective of traditional financial development, focusing on whether financial development can produce a carbon reduction effect through energy-saving and technology innovation. Specifically, financial development can reduce carbon emissions by promoting industrial structure optimization and the efficient use of resources through technological progress (Tamazian et al., 2009; Yan et al., 2016; He et al., 2020; Shahbaz et al., 2022). The financial structure, especially a market-based financial structure, can help to enhance innovative emissions reduction mechanisms, and thus, reduce the carbon emissions intensity (Maji et al., 2017; Ye and Ye, 2019). Some scholars also believe that there is no correlation between financial development and carbon emissions, and even that financial development will significantly increase carbon emissions (Ozturk and Acaravci, 2013; Omri et al., 2015; Xiong and Qi, 2016; Cai et al., 2017). Specifically, the banking-dominated financial structure has multiple negative effects on CO2 emissions, significantly increasing CO2 emissions across regions (Chen et al., 2018; Chen, 2020). A possible reason for this is that financial development may increase energy consumption and carbon emissions by reducing the cost of corporate financing, enabling firms to expand their production and attracting foreign direct investment (Crépon et al., 2011; Javid and Sharif, 2016; Shahbaz et al., 2016). On the other hand, credit decisions by Chinese financial institutions can significantly influence the quality of economic growth (Liu and Wen, 2019), and the relaxation of financing restrictions did not improve the quality of firms' green innovation technologies (Wu and You, 2022). Therefore, to a certain extent, financial development inhibits the technological progress of enterprises and cannot effectively reduce carbon emissions (Zhang, 2011).

Another approach is to focus on whether digital financial development has carbon emissions reduction effects from the perspective of emerging financial development. Similar to traditional finance, digital inclusive finance was found to affect carbon emissions through economic growth, industrial structure, and technological innovation effects (Deng et al., 2021; Xu et al., 2021; Wang X. et al., 2022; Wang Y. B. et al., 2022). In addition, following the logic of using digital finance to improve the efficiency of the financial system and the accessibility and cost of financial services for the “long tail”5, digital finance can promote regional technological progress and total factor productivity, and reduce regional carbon emissions by enhancing the efficiency of financial services (Deng and Zhang, 2021; He and Yang, 2021). Further, carbon emissions trading based on digital finance innovation can also accelerate the reduction in carbon emissions and carbon intensity (Ji and Yang, 2021). However, at the same time, the rapid development of information and communication technology (ICT), which is one of the industries closely related to digital finance, has led to a rapid increase in electricity consumption, which drives an increase in carbon emissions (Hamdi et al., 2014; Salahuddin and Alam, 2015). The good thing is that, in the long run, ICT development will enhance environmental quality by reducing GHG emissions. For example, increased investment in ICT infrastructure, internet use, and internet penetration significantly reduce carbon emissions in the long run (Haseeb et al., 2019; Bhujabal et al., 2021). Thus, financial development has both carbon-reduction effects and drives carbon emissions (Salahuddin and Alam, 2015; Bhujabal et al., 2021; Zhao et al., 2021). A comprehensive understanding of the role of digital inclusive finance development in carbon emissions cannot be obtained if the study of the impact of digital inclusive finance on agricultural carbon emissions is ignored (Shahbaz et al., 2022). Based on existing studies, this study added the direction and magnitude of the role of digital inclusive finance development in agricultural carbon emissions in China. In addition, unlike existing studies that were conducted mainly through evolutionary game models, structural equations, and fixed-effects models (Liu et al., 2019, 2021; Ma and Jin, 2022), this study constructed a two-way fixed-effects model for empirical testing.

Research theory

Theoretically, the agricultural carbon emissions reduction path of digital inclusive finance can be summarized in terms of resource allocation, financial innovation, and digital network effects.

First, the development of digital inclusive finance can promote low-carbon agricultural technology innovation through better financial resource allocation, including the development and use of low-carbon agricultural technologies, such as drip irrigation, biogas fermentation, soil testing, and fertilization, and the use of more efficient financial services to change the costs and benefits of low-carbon farming for farmers, leading to improved agricultural energy efficiency and lower levels of agricultural carbon emissions.

Second, digital inclusive finance can accelerate the development of carbon sink trading markets, such as agricultural carbon emission rights through financial innovation; support the transformation of green ecological resources into high-value assets, thus upgrading the agricultural industrial structure, securing rural financial resources, and developing rural economic strength; and promote the further development of low-carbon agriculture.

Furthermore, digital inclusive finance builds a service platform for the rural areas based on digital networks, helping the rural groups to enjoy financial services. On the one hand, it broadens the breadth and depth of rural financial services through the penetration of mobile payments, network lending, and mobile banking in rural areas; on the other hand, it raises the low-carbon awareness of the three rural groups through the dissemination of network knowledge and fundamentally improves the environmental awareness of the three rural groups, thus motivating the adjustment of the agricultural industry structure and improving the efficiency of agricultural energy utilization to achieve long-term agricultural carbon emissions reduction.

Methodology

Data source and processing

Due to missing data for Tibet and Taiwan, this study used the panel data of 30 provinces across China from 2011 to 2019 to assess the agricultural carbon reduction effect of digital inclusive finance6. Among them, the original data of the digital inclusive finance index were obtained from the Digital Inclusive Finance Index of Peking University (2011–2019). The raw data for the agricultural carbon emissions measurements were obtained from the China Rural Statistics (2011–2019) and the China Statistical Yearbook (2011–2019). The data on agricultural fiscal expenditure; the amount of investment in fixed assets in agriculture, forestry, animal husbandry, and fisheries; investments in environmental pollution control; and regional GDP were mainly from the China Financial Yearbook (2011–2019), the China Statistical Yearbook of Fixed Asset Investment (2011–2019), and the statistical yearbooks or statistical bulletins of each province (2011–2019). Among them, the missing data regarding the level of environmental regulation were filled in using linear interpolation and mean interpolation. Finally, a total sample size of 270 observations was obtained.

Empirical models

The factors that affect agricultural carbon emissions include not only observable factors, such as regional human capital stock, physical capital stock, market level, and policy intervention, but also regional unobservable factors, such as the regional development philosophy. Neglecting the role of unobservable factors will lead to bias in the model estimation results. The fixed-effects model can control for regional unobservable factors by differentiating, which solves the endogeneity problem caused by factors that do not change over time and are unobservable. To analyze the impact of digital inclusive finance on agricultural carbon emissions, we first established a baseline fixed-effects model.

where ACC is the explained variable, DFII is the core explanatory variable, X denotes a series of control variables, β represents the area effect that does not change over time, μ is the perturbation term with a normal distribution, represents the different provinces, and represents the year, and α and γ are coefficients to be determined.

In addition to the area effects that do not change with time, there are also time effects that do not change between areas. The two-way fixed effects model can obtain regression results with unbiased consistency not only by controlling for unobservable factors in the region by differentiating but also by introducing time-fixed effects, especially those factors (such as the economic environment) that change only with time but not between regions. To be specific, Equation (1) can be extended as follows:

where represents the time effect that does not change with the region; the other variables are kept consistent with Equation (1).

Description of variables

The explanatory variable: ACC (agricultural carbon emissions)

This study took agriculture in a broad sense as the research object. Based on Tian's (2019) agricultural carbon emissions measurement method, agricultural carbon emissions were measured in three dimensions and summed to obtain TACC.

The three measurement methods were as follows: First, ACGC. Agricultural carbon emissions were measured according to the calculation method of agricultural production's GHG emissions used by Min and Hu (2012). Here, the planting species mainly included rice (early, middle, and late rice), wheat (spring and winter wheat), corn, soybeans, vegetables, and other dryland crops (except tobacco). Livestock species mainly included dairy cattle, buffalo, cattle, horses, donkeys, mules, camels, hogs, sheep, and poultry. Second, ACEC. Referring to the relevant carbon emissions coefficient calculation method used by Chen (2020), the sum of carbon emissions generated from 12 types of energy, such as raw coal, washed coal, gasoline, diesel, and electricity, consumed in the development of agriculture, forestry, animal husbandry, and fisheries was examined. Third, ACSC. Based on the corresponding carbon emission coefficients (Li et al., 2011), the carbon emissions from fertilizer application, pesticide use, agricultural film use, diesel fuel use, effective irrigation area, and total crop sowing area were examined in the formation process of their products and the subsequent utilization process. The respective carbon emissions factors in these measurements were derived from the IPCC (Tian and Yin, 2022).

Accordingly, we constructed an equation for measuring the agricultural carbon emissions as follows:

In Equation (3), C represents the total agricultural carbon emissions, CC represents the carbon emissions caused by various specific carbon sources, TC refers to the actual quantity of each type of carbon source, and δC represents the corresponding carbon emission factor. In this study, we referred to Tian Yun's study and converted all types of greenhouse gases into standard carbon dioxide in the actual calculation7.

Core explanatory variable: Digital inclusive finance development level (DFII)

The Peking University Digital Inclusive Finance Index (PUDIFI) was selected as a proxy variable for the level of digital inclusive finance development at the provincial level in this study. It provides an important quantitative tool for the study of digital inclusive finance, and has attracted widespread attention and become widely used in the academic community in China. Increasingly more scholars are using the index to identify problems and make significant contributions to the healthy development of the market, together with industry and regulatory colleagues (Guo et al., 2020).

Digital inclusive finance, with its characteristics of being paperless and convenient, reduces the transaction costs of the rural groups' participation in the financial market and reduces carbon emissions. To test whether digital inclusive finance can reduce the level of agricultural carbon emissions in each province, this study used the digital inclusive finance index of each province from 2011 to 2019 to test the role of digital inclusive finance in agricultural carbon emission reduction.

Control variables

Various aspects of economic and social development can have a significant impact on carbon emissions. Therefore, according to the available papers (He and Yang, 2021; Wu et al., 2021; Ma and Jin, 2022), this study used the agricultural human capital level, agricultural industrial structure, policy support level, and so on as control variables in the model.

The macro-market-level factors included the following. Rural human capital (EDU)—previous studies found that publicity and promotion education can effectively intervene the adoption of low-carbon technologies by influencing farmers' attitudes and behavioral efficacy toward low-carbon production, thus reducing agricultural carbon emissions. Therefore, this study used the average years of education of the rural population over the age of 6 (Jiang et al., 2022). Agricultural development level (AGDP)—most studies mainly verified the environmental Kuznets hypothesis (EKC), and observe that there was an inverted U-shaped relationship between economic development level and environmental quality. At present, the relationship has been still on the left side of the inflection point, and the development of agricultural economy has significantly promoted the growth of agricultural carbon emissions in China (Grossman and Krueger, 1995; Gavrilova et al., 2010). And then, this study used the number of people employed in the primary sector to measure the level of agricultural development (Li et al., 2011; Jiang and Wang, 2019). Agricultural industry structure (STR)—an increase in the share of agricultural farming was an effective mechanism for agricultural carbon emission reduction (Yang et al., 2021), this study used the share of agricultural value added in the primary industry to measure the agricultural industry's structure (Tian, 2019). Urbanization level (URB)—when urbanization reached a certain stage, it would lead to increased energy consumption, aggravated environmental pollution and traffic congestion. In general, urbanization has not achieved the most conducive standard for carbon emission reduction (Wang, 2010; Zhang et al., 2016). Therefore, this paper used the ratio of urban population to rural population to represent the urbanization level (Lin and Liu, 2010).

The macro-level factors included the following. The level of environmental regulation (ENV)—according to Porter Hypothesis, proper environmental regulation could stimulate the innovation activities of enterprises, enhanced product competitiveness, and reduced carbon emissions (Lanoie et al., 2008; Zhang and Wang, 2020), so this study took the proportion of local fiscal environmental protection expenditure in regional GDP as the representative of environmental supervision level (Zhang and Wang, 2014). Agricultural financial support (SUP)—recognized as an important source of funds for energy conservation and emission reduction, and it had a restraining effect on carbon emissions. With the continuous development of agriculture and the change of external environment, whether the inhibitory effect would continue to exist still needs to be discussed (Tian and Yin, 2022). Therefore, this study used the proportion of agriculture, forestry and water expenditure in the total fiscal expenditure to measure the level of environmental supervision. Agricultural fixed investment (INV)—previous studies have pointed out that agricultural fixed investment has a feedback effect on agricultural carbon emissions, nevertheless the effect is weak (Zhang and Wang, 2014). This study used the amount of investment in fixed assets in agriculture, forestry, animal husbandry, and fisheries in each region to reflect agricultural investment intensity (Tian and Yin, 2022).

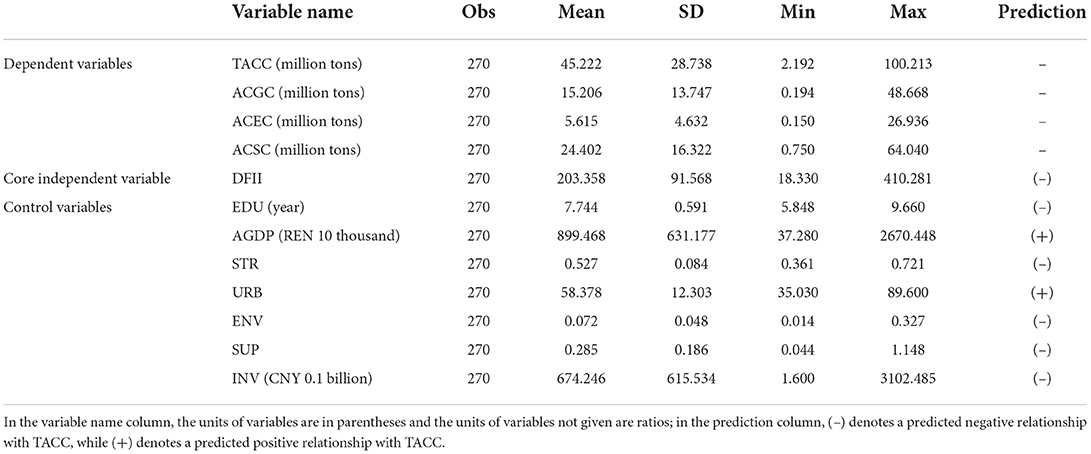

The descriptive statistics of each variable are shown in Table 2.

Results

Diagnostic tests

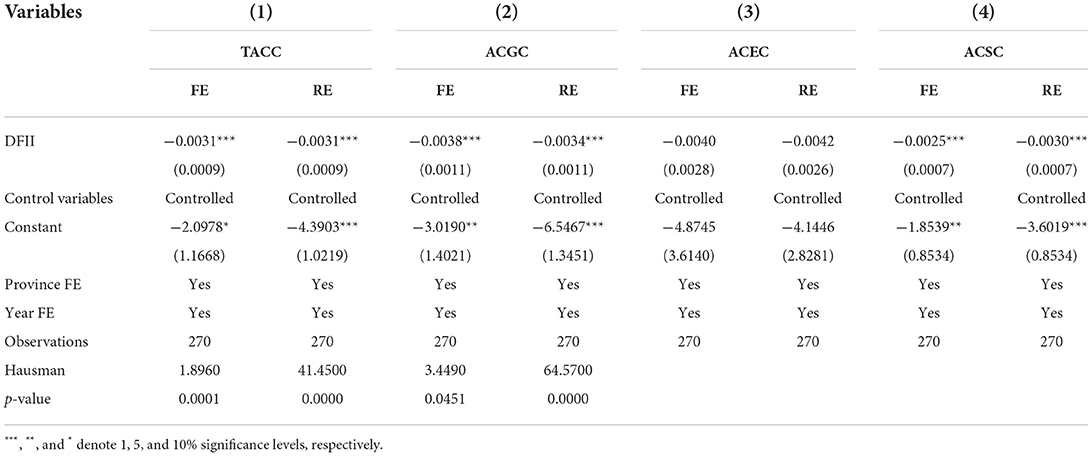

To determine whether to choose a two-way fixed-effects model or a random-effects model when analyzing the panel data, the Hausman test was used. Due to the presence of heteroskedasticity and serial correlation, a modified Hausman test was used in this study. Table 3 shows the results of the modified Hausman test. Columns (1), (2), (3), and (4) show that the p-values were below 0.050; therefore, the original hypothesis of “the random-effects model is better” was rejected. Therefore, this study adopted a two-way fixed-effects model.

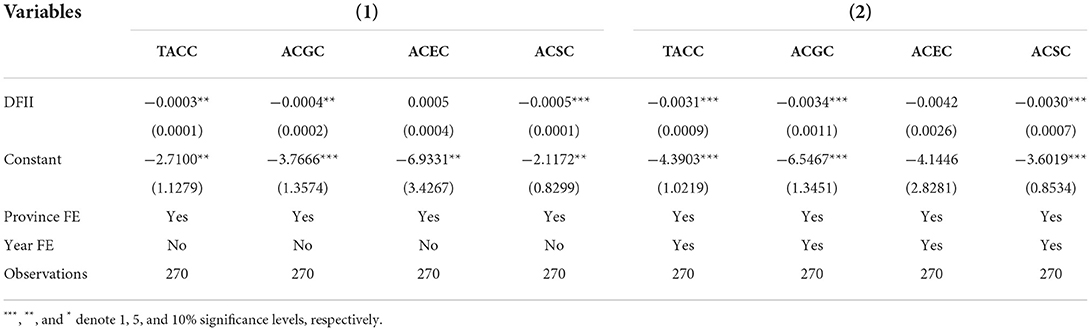

It was pointed out that in an analysis of panel data, if only a panel data model considering individual effects is used, the estimated results will have a large bias, and this bias will increase with the increase in time effects (Liu et al., 2011).

Table 4 shows the regression results of the fixed-effects model. Column (1) shows the results of considering only individual effects and column (2) shows the results of considering both individual and time effects. The results shown in columns (1) and (2) suggest that the regression coefficients of the core explanatory variables DFII deviated by a large order of magnitude. Therefore, this study considered not only the effect of individual effects but also the effect of time effects when setting up the research model.

Benchmark regression test

The estimation results for model (2) are presented in Table 5. Columns (1)–(4) show that the impact coefficients of the level of digital inclusive finance development on agricultural carbon emissions varied. The results showed that when considering the control variables, the level of digital inclusive finance development had a significant negative impact on TACC, ACGC, and ACSC, although the impact on ACEC was not significant. Specifically, for every one-level increase in the DFII, the TACC, ACGC, and ACSC decreased by 0.31, 0.38, and 0.25%, respectively. The development of digital inclusive finance was conducive to the gradual penetration of the internet of things and big data, which caused the allocation of rural resources to be more effective such that agricultural production efficiency and technology use efficiency could be optimized and adjusted while generating economic externalities (Li et al., 2011; Pang, 2014; He and Dai, 2016), and had a reduction effect on ACGC and ACSC. At the same time, the development process of digital inclusive finance also drove the modernization of agricultural production and promoted the use of agricultural machinery (Hamdi et al., 2014; Salahuddin and Alam, 2015), which would lead to the increase of ACEC and offset with the reduction of it, thus unable to significantly reduced ACEC. Since the carbon reduction in agriculture was greater than the increase, digital inclusive finance as a whole had a significant carbon emissions reduction effect, which supported the research conclusion that the development of digital financial inclusion has carbon emission reduction effect (Deng et al., 2021; He and Yang, 2021; Xu et al., 2021; Wang X. et al., 2022). However, ACEC caused by the use of agricultural machinery would be the biggest uncertain factor to achieve the agricultural carbon peak in China, which is consistent with the research conclusion of Jin et al. (2021).

In terms of the control variables, the coefficient of rural human capital was negative but insignificant, which could indicate that the effect of the human capital improvement on carbon reduction in agriculture may have lagged. As expected, the agricultural development level showed a significant increase in agricultural carbon emissions in the province under all four measures. The agricultural industry structure negatively affected ACEC and had a positive effect on ACSC, indicating that the role of changes in agricultural structure on agricultural carbon emissions reduction was uncertain. The urbanization level showed consistent estimation results under all measurement methods except for ACEC, and all of them significantly increased agricultural carbon emissions in the province, indicating that urbanization increased the inflow of population from foreign provinces to the given province and the rural population of the province to the cities in the province, which, in turn, increased the area of cash crop cultivation and the total power of agricultural machinery use, as well as the level of agricultural carbon emissions.

The level of environmental regulation could reduce TACC, ACGC, and ACSC to some extent, and the strengthening of environmental remediation had a dampening effect on agricultural carbon emissions. Financial support for agriculture and agricultural fixed investment could reduce ACEC and ACGC, respectively. A possible explanation for this was that the current efficiency gains in productive public investment in agriculture, such as the increased efficiency of new harvesting machinery and irrigation equipment, offset the energy consumption to some extent, producing a carbon reduction effect. Overall, the effects of the control variables on TACC were exactly in the expected direction.

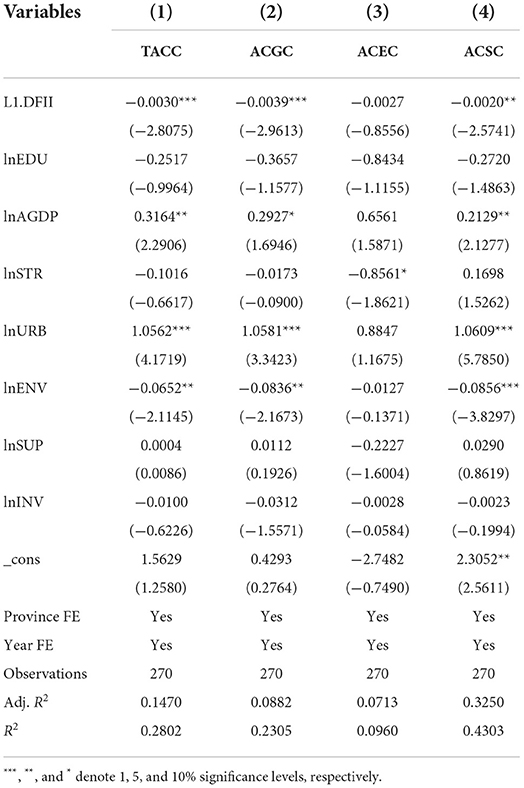

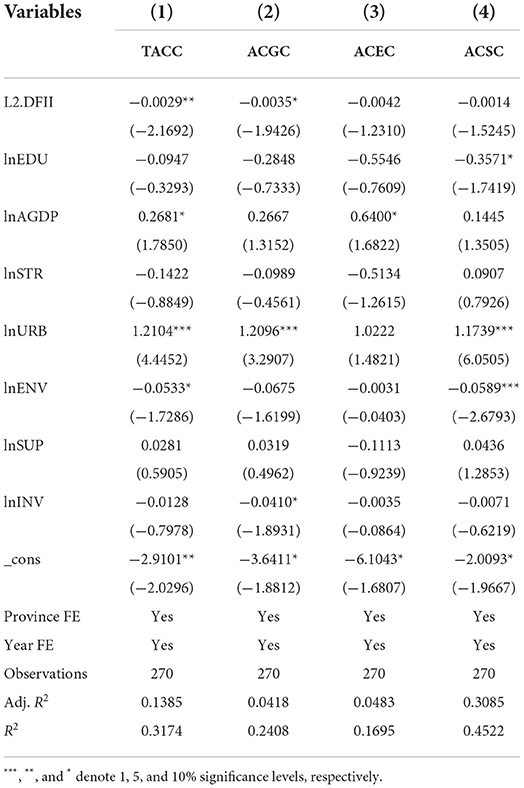

Robustness test

This study used the first-order and second-order lagged terms of digital inclusive finance as explanatory variables to test the robustness of the model. The robustness test results shown in Table 6 demonstrated that the first-order lagged term of digital inclusive finance had reduction effects on TACC, ACGC, and ACSC, which were consistent with the baseline regression. Meanwhile, the results shown in Table 7 reflected the fact that the second-order lagged term also had reduction effects on TACC and ACGC. However, the impact of two lags in the development level of digital financial inclusion was lower than that of one lag. In general, the carbon reduction effect of digital inclusive finance in agriculture was not just felt in the current period but continued for the next 2 years. The existing studies have mainly focused on the digital inclusive finance (He and Yang, 2021; Ji and Yang, 2021) has current period effect on agricultural carbon emissions or not, while our findings complemented the lagged period effect.

According to the results above, we concluded that digital inclusive finance had a positive effect on agricultural carbon emissions reduction, and the development of digital inclusive finance would be an effective path to help agricultural carbon emission reduction in China.

Conclusions

In this study, we first measured the multidimensional agricultural carbon emissions in China based on relevant data from 30 provinces from 2011 to 2019 and created a provincial distribution map to analyze the dynamic trends of agricultural carbon emissions in China. Second, the impact of digital inclusive finance on agricultural carbon emission was empirically tested using a two-way fixed-effects model. The following main research conclusions were drawn.

First, the development pattern of digital inclusive finance developed comprehensively with coastal provinces as the core, and the level of digital inclusive finance development in all provinces increased. Certainly, the southeastern coastal provinces, such as Zhejiang, Fujian, and Guangdong, led the way in the development of digital inclusive finance, whether in 2011, 2015, or 2019.

Second, China's TACC has not yet peaked, and agricultural machinery will be the main uncertainty for agricultural carbon peaking. Based on the three methods of measuring agricultural carbon emissions, it was found that both ACGC and ACSC significantly decreased, while ACEC significantly increased. The interprovincial differences in the total and fractional agricultural carbon emissions were obvious, and TACC was characterized as “high in the main grain-producing areas”. In 2019, for example, TACC was the highest in Henan and the lowest in Beijing. Compared with 2011, 16 provinces showed a decreasing trend, where Hubei showed the largest decrease, while other provinces showed an increasing trend and Xinjiang underwent the largest increase.

Third, digital inclusive finance had a carbon emissions reduction effect in agriculture, as shown by the fact that for every one-level increase in DFII, TACC was reduced by 0.31%. Of the three agricultural carbon emissions measurement dimensions, digital inclusive finance could effectively reduce the levels of ACGC and ACSC, but it had no inhibitory effect on ACEC.

Fourth, agricultural carbon emissions were also influenced by a combination of both macro-market and macro-policy factors. Among the macro-market-level factors, the level of agricultural development significantly suppressed the increase in agricultural carbon emissions, while the level of urbanization played the same role. Among the macro-policy-level factors, the increase in the level of environmental regulation contributed to the reduction in agricultural carbon emissions. However, agricultural fiscal support and fixed investment affected ACEC and ACGC, respectively.

Based on the above findings, we provide the following policy implications: Digital inclusive finance as an emerging financial tool based on digital technology reduced information asymmetry; served the three rural areas; played a suppressing role in China's agricultural carbon emissions; and had a carbon emissions reduction effect, which could be considered a positive externality to a certain extent. In the face of a solemn commitment to the “dual carbon” goal, we can further design inclusive financial products with the help of digital technology to balance rural revitalization and carbon neutrality in the process of supporting agriculture. First, we can develop digital inclusive finance using financial subsidies and diversified digital inclusive financial products to promote the breadth and depth of the development of digital inclusive finance in each province and to further strengthen the carbon emissions reduction effect of digital inclusive finance. Second, in provinces with major grain-producing areas, we can promote education on digital inclusive finance and strengthen farmers' knowledge and understanding so that digital inclusive finance can better contribute to the optimization and modernization of the agricultural industry structure and help to realize the high-efficiency transformation of the agricultural industry. Third, we can innovate digital inclusive finance products and help green enterprises in the agricultural industry chain to develop and sell low-carbon agricultural materials and products through digital inclusive finance, enabling this approach to affect agricultural carbon emissions reduction via the technical path.

This study had potential limitations that need to be addressed in future research. First, in our empirical study, we considered China as a whole rather than the differences in carbon reduction effects between the eastern, middle, and western provinces. Second, we selected a sample of Chinese provinces for empirical testing in our study and did not conduct a comparative study with developed or underdeveloped countries or regions. Therefore, there is a need for further research when more abundant data are available.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

GW: conceptualization, formal analysis, and supervision. KS: data curation, methodology, project administration, resources, software, and visualization. LL: funding acquisition, investigation, validation, writing—original draft preparation, and writing—review and editing. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported by the Humanities and Social Science Fund of Ministry of Education of China (Grant No. 20YJC630004), Social Science Foundation of Jiangsu Province (Grant No. 20EYC013), General Project of Philosophy and Social Sciences in Jiangsu Universities (Grant No. 2019SJA0415).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1. ^TACC, ACGC, ACEC, and ACSC are the four indicators that measured agricultural carbon emissions in this study.

2. ^The IPCC is an intergovernmental body that was jointly established in 1988 by the World Meteorological Organization (WMO) and the United Nations Environment Programme (UNEP), which shared the Nobel Peace Prize with former U.S. Vice President Albert Gore in 2007. Its main task is to assess the current state of scientific knowledge on climate change, the potential impacts of climate change on society and the economy, and possible responses regarding how to adapt to and mitigate climate change.

3. ^Peak carbon dioxide emissions refers to a point in time when carbon dioxide emissions stop growing and reach a peak, and then gradually fall back. Carbon neutral means that the total amount of carbon dioxide or greenhouse gas emissions produced directly or indirectly by a country, enterprise, product, activity or individual within a certain period of time, can be offset by afforestation, energy conservation and emission reduction to achieve a positive or negative offset to achieve relative “zero emissions”. This is collectively referred to as the “dual carbon” goal in the following paragraphs.

4. ^The main grain-producing areas were the 900 million mu of functional grain production areas that were designated nationwide. Specifically, with a focus on the Northeast Plain, Yangtze River Basin and the Southeast Coastal Advantage Zone, 340 million mu of functional rice production areas were designated; in the Yellow Huaihai region, the middle and lower reaches of the Yangtze River, as well as the Northwest and Southwest Advantage Zones, 320 million mu of functional wheat production areas were designated. In the Songnun Plain, the Three Rivers Plain, the Liaohe Plain, the Yellow Huaihai region, and the Fen River and Weihe River basins, 450 million mu of maize production functional areas were designated.

5. ^The long-tail customer was originally proposed by Chris Anderson, editor-in-chief of Wired. In his article, he refers to the fact that banks focus most of their operations on deposit-taking, wealth management, and lending to large corporate customers, hoping to reduce operating costs and increase operating income.

6. ^The 30 provinces include four municipalities directly under the central government, namely Beijing, Tianjin, Shanghai and Chongqing.

7. ^The conversion factors of carbon dioxide for carbon, methane, and nitrous oxide are 44/12, 25, and 298, respectively.

References

Bhujabal, P., Sethi, N., and Padhan, P. C. (2021). ICT, foreign direct investment and environmental pollution in major Asia Pacific countries. Environ. Sci. Pollut. Res. 28, 42649–42669. doi: 10.1007/s11356-021-13619-w

Cai, D. L., Cheng, S. L., and Chen, J. D. (2017). Study on the impact of financial energy conservation and financial development on carbon emission changes. China Popul. Res. Environ. 27, 122–130.

Carauta, M., Latynskiy, E., Mössinger, J., Gil, J., Libera, A., and Hampf, A., et al. (2018). Can preferential credit programs speed up the adoption of low-carbon agricultural systems in Mato Grosso, Brazil? Results from bioeconomic microsimulation. Reg. Environ. Change. 18, 117–128. doi: 10.1007/s10113-017-1104-x

Chen, R., Yao, S. B., and Jiang, Z. D. (2018). Analysis on performance valuation and influencing factors of low carbon agriculture joint production. J. Huazhong Agric. Univ. 3, 44–155. doi: 10.13300/j.cnki.hnwkxb.2018.03.006

Chen, X. (2020). Financial structure, technological innovation and carbon emissions: With additional studies on the development of green financial system. Soc. Sci. Guangdong 37, 41–50. doi: 10.3969/j.issn.1000-114X.2020.04.004

Crépon, B., Devoto, F., Duflo, E., and Pariente, W. (2011). Impact of microcredit in rural areas of Morocco: evidence from a randomized evaluation. MIT Working paper.

Dai, R., Zhao, L., Tang, J., Zhang, T., Guo, L., Luo, Q., et al. (2022). Characteristics of carbon sequestration and methane emission in rice-fish system. Chin. J. Eco-Agric. 30, 616–629. doi: 10.12357/cjea.20210811

Demir, A., Pesqué-Cela, V., Altunbas, Y., and Murinde, V. (2022). Fintech, financial inclusion and income inequality: a quantile regression approach. Eur. J. Finance 28, 86–107. doi: 10.1080/1351847X.2020.1772335

Deng, R. R., and Zhang, A. X. (2021). The impact and mechanism of digital financial development on carbon performance in Chinese cities. Res. Sci. 43, 2316–2330. doi: 10.18402/resci.2021.11.14

Deng, Y., Cui, Y., Lu, W. N., and Zhao, M. J. (2021). Spatial heterogeneity and factors influencing the level of low-carbon agricultural development in China at the municipal scale: a test from the plantation sector. Yangtze River Basin Res. Environ. 30, 147–159. doi: 10.11870/cjlyzyyhj202101014

Dong, X. L., Liu, J. N., and Wang, Y. Q. (2022). A study on the spatial effect of financial agglomeration on farmers' consumption in rural China. Quant. Econ. Tech. Econ. Res. 39, 64–83. doi: 10.13653/j.cnki.jqte.2022.02.007

Garbach, K., Lubell, M., and DeClerck, F. A. J. (2012). Payment for ecosystem services: the roles of positive incentives and information sharing in stimulating adoption of silvopastoral conservation practices. Agric. Ecosyst. Environ. 156, 27–36. doi: 10.1016/j.agee.2012.04.017

Gavrilova, O., Jonas, M., Erb, K., and Haberl, H. (2010). International trade and Austria's livestock system: direct and hidden carbon emission flows associated with production and consumption of products. Ecol. Econ. 69, 920–929. doi: 10.1016/j.ecolecon.2009.11.015

Ge, P. F., Huang, X. L., and Xu, Z. Y. (2018). Financial development, innovation heterogeneity and green total factor productivity enhancement-empirical evidence from “one belt, one road”. Finance Econ. Sci. 1, 1–14.

Grossman, G. M., and Krueger, A. B. (1995). Economic growth and the environment. Q. J. Econ. 110, 353–377. doi: 10.2307/2118443

Guo, F., Wang, J. Y., Wang, F., Kong, T., Zhang, X., and Cheng, Z. Y. (2020). Measuring the development of digital inclusive finance in China: indexing and spatial characteristics. Economics 9, 1401–1418. doi: 10.13821/j.cnki.ceq.2020.03.12

Hamdi, H., Sbia, R., and Shahbaz, M. (2014). The nexus between electricity consumption and economic growth in Bahrain. Econ. Model. 38, 227–237. doi: 10.1016/j.econmod.2013.12.012

Haseeb, A., Xia, E., Saud, S., Ahmad, A., and Khurshid, H. (2019). Does information and communication technologies improve environmental quality in the era of globalization? An empirical analysis. Environ. Sci. Pollut. Res. 26, 8594–8608. doi: 10.1007/s11356-019-04296-x

He, M. B., and Yang, X. W. (2021). Digital inclusive finance, carbon emissions and total factor productivity. Financ. Forum 26, 18–25. doi: 10.16529/j.cnki.11-4613/f.2021.02.004

He, Y. Q., and Dai, X. W. (2016). Study on the spatial and temporal characteristics of the drivers of agricultural carbon emissions in China. Res. Sci. 38, 1780–1790. doi: 10.18402/resci.2016.09.15

He, Y. X., Xu, T., and Zhong, L. X. (2020). The effect of financial development on carbon dioxide emissions and its path of action. Comput. Econ. Soc. Syst. 133, 1–10.

Hu, Z. Y., and Hu, H. (2016). The impact of industrial agglomeration on China's agricultural carbon emissions. Shandong Soc. Sci. 260, 135–139. doi: 10.14112/j.cnki.37-1053/c.2016.06.018

Huang, Y. P., and Huang, Z. (2018). Digital financial development in China: present and future. Economics 17, 1489–1502. doi: 10.13821/j.cnki.ceq.2018.03.09

Javid, M., and Sharif, F. (2016). Environmental Kuznets curve and financial development in Pakistan. Renew. Sustain. Energy Rev. 54, 406–414. doi: 10.1016/j.rser.2015.10.019

Ji, X. L., and Yang, Z. (2021). Does carbon emissions trading “accelerate” the reduction of carbon emissions and intensity? Bus. Res. 2, 46–55. doi: 10.13902/j.cnki.syyj.2021.02.006

Jiang, L., Huang, H., Zhang, J., and Luo, Y. (2022). Study on dual intervention strategy of rice farmers' low-carbon production behavior: Grounded theory analysis based on in-depth interview data of more than five hundred thousand words. World Agric. 42, 76–86. doi: 10.13856/j.cn11-1097/s.2022.01.007

Jiang, L., and Wang, X. J. (2019). EKC hypothesis verification between rural environmental quality and agricultural economic growth in China: an empirical analysis based on panel data of 31 provinces. Issues Agric. Econ. 12, 43–51. doi: 10.13246/j.cnki.iae.2019.12.005

Jin, S. Q., Lin, Y., and Niu, K. Y. (2021). Low-carbon driven green transformation of agriculture: characteristics of China's agricultural carbon emissions and its emission reduction path. Reform 5, 29–37.

Lanoie, P., Patry, M., and Lajeunesse, R. (2008). Environmental regulation and productivity: testing the porter hypothesis. J. Prod. Anal. 30, 121–128. doi: 10.1007/s11123-008-0108-4

Li, B., Zhang, J. B., and Li, H. P. (2011). Spatial and temporal characteristics of agricultural carbon emissions in China and decomposition of influencing factors. China Popul. Res. Environ. 21, 80–86. doi: 10.3969/j.issn.1002-2104.2011.08.013

Li, J., and Xu, J. T. (2022). Analysis of emission reduction potential of low-carbon technologies in China's agriculture. Agric. Econ. Issues 3, 117–135. doi: 10.13246/j.cnki.iae.2022.03.001

Lin, B., and Liu, X. (2010). China's carbon dioxide emissions under the urbanization process: Influence factors and abatement policies. Econ. Res. J. 45, 66–78.

Liu, H. J., Bao, Z., and Yang, Q. (2013). Regional disparity of agricultural carbon emissions in China and its dynamic evolution of distribution: an empirical study based on Dagum Gini coefficient decomposition and non-parametric estimation method. Agric. Tech. Econ. 3, 72–81. doi: 10.13246/j.cnki.jae.2013.03.002

Liu, L., Ding, J. P., Qin, X., and Dai, F. (2011). A comparative study on the adaptability of panel data econometric models. J. Manag. Sci. 14, 86–96.

Liu, X., and Wen, S. (2019). Should financial institutions be environmentally responsible in China? Facts, theory and evidence. Econ. Res. J. 54, 38–54.

Liu, Y., Zhang, L., Liang, Z. H., and Zhang, J. J. (2019). Limited rationality, low: carbon agricultural technology and farmers' strategic choice—a game analysis based on farmers' perspective. World Agric. 9, 59–68. doi: 10.13856/j.cn11-1097/s.2019.09.008

Liu, Z., Qi, Z. H., Yang, C. Y., and Chen, X. T. (2021). A study on the effects of network embedding and reputation incentives on farmers' pro-environmental behavior. Yangtze River Basin Res. Environ. 30, 1982–1991. doi: 10.11870/cjlyzyyhj202108019

Lv, J., Liu, H., Xue, Y., and Han, X. Y. (2021). Risk aversion, social networks and farmers' fertilizer overapplication behavior: research data from maize farmers in three northeastern provinces. Agric. Tech. Econ. 7, 4–17. doi: 10.13246/j.cnki.jae.2021.07.001

Ma, H., and Jin, Y. (2022). Environmental regulation,industrial agglomeration and industrial green development in the Yangtze River Economic Belt: Analysis based on moderating effect and threshold effect. Sci. Technol. Manag. Res. 42, 201–210. doi: 10.3969/j.issn.1000-7695.2022.6.024

Maji, I. K., Habibullah, M. S., and Saari, M. Y. (2017). Financial development and sectoral CO2 emissions in Malaysia. Environ. Sci. Pollut. Res. 24, 7160–7176. doi: 10.1007/s11356-016-8326-1

Min, J., and Hu, H. (2012). Calculation of greenhouse gases emission from agricultural production in China. China Popul. Resour. Environ. 22, 21–27. doi: 10.3969/j.issn.1002-2104.2012.07.004

Omri, A., Daly, S., Rault, C., and Chaibi, A. (2015). Financial development, environmental quality, trade and economic growth: what causes what in MENA countries. Energy Econ. 48, 242–252. doi: 10.1016/j.eneco.2015.01.008

Ozturk, I., and Acaravci, A. (2013). The long-run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Econ. 36, 262–267. doi: 10.1016/j.eneco.2012.08.025

Pang, L. (2014). Analysis of regional differences and influencing factors of agricultural carbon emissions in China. Arid Zone Res. Environ. 28, 1–7. doi: 10.13448/j.cnki.jalre.2014.12.001

Qian, C., Li, F., Li, X. D., and Hao, J. H. (2021). Simulation analysis of chemical fertilizer application optimization based on farmers' economic and environmental objectives in the main grain producing areas: an example of wheat production in Handan. J. Nat. Res. 36, 1481–1493. doi: 10.31497/zrzyxb.20210610

Salahuddin, M., and Alam, K. (2015). Internet usage, electricity consumption and economic growth in Australia: a time series evidence. Telemat. Inf. 32, 862–878. doi: 10.1016/j.tele.2015.04.011

Shahbaz, M., Shahzad, S. J. H., Ahmad, N., and Alam, S. (2016). Financial development and environmental quality: the way forward. Energy Policy 98, 353–364. doi: 10.1016/j.enpol.2016.09.002

Shahbaz, M., Sinha, A., Raghutla, C., and Vo, X. V. (2022). Decomposing scale and technique effects of financial development and foreign direct investment on renewable energy consumption. Energy 238, 121758. doi: 10.1016/j.energy.2021.121758

Siddik, M., Alam, N., and Kabiraj, S. (2020). “Digital inclusive finance for financial inclusion and inclusive growth,” in Digital Transformation in Business and Society, eds B. George, and J. Paul (Cham: Palgrave Macmillan), 155–168. doi: 10.1007/978-3-030-08277-2_10

Tamazian, A., Chousa, J. P., and Vadlamannati, K. C. (2009). Does higher economic and financial development lead to environmental degradation: evidence from BRIC countries. Energy Policy 37, 246–253. doi: 10.1016/j.enpol.2008.08.025

Tian, Y. (2019). Cognitive level, future expectations and farmers' willingness to produce low carbon in agriculture–based on survey data from farmers in Wuhan. J. Huazhong Agric. Univ. 1, 77–166. doi: 10.13300/j.cnki.hnwkxb.2019.01.009

Tian, Y., and Yin, M. H. (2022). Re-measurement of agricultural carbon emissions in China: basic status, dynamic evolution and spatial spillover effects. China Rural Econ. 3, 104–127.

Tian, Y., and Zhang, J. B. (2013). Study on the divergence of net carbon effect of agricultural production in China. J. Nat. Res. 28, 1298–1309. doi: 10.11849/zrzyxb.2013.08.003

Tian, Y., Zhang, J. B., He, K., and Feng, J. H. (2015). Analysis of farmers' agricultural low-carbon production behavior and its influencing factors: fertilizer application and pesticide use as an example. China Rural Obs. 4, 61–70.

Wang, X., Wang, X., Ren, X., and Wen, F. (2022). Can digital inclusive finance affect CO2 emissions of China at the prefecture level? Evidence from a spatial econometric evidence from a spatial econometric approach. Energy Econ. 109, 105966. doi: 10.1016/j.eneco.2022.105966

Wang, X. L. (2010). Urbanization path and city scale in China: an economic analysis. Econ. Res. J. 45, 20–32.

Wang, Y. B., Zhang, Y., Li, J. G. (2022). Digital inclusive finance and carbon emissions: a study based on micro data and machine learning models. China Popul. Res. Environ. 32, 1–11. doi: 10.12062/cpre.20220422

Wei, W., Wen, C. C., Cui, Q., and Xie, W. (2018). Impact of agricultural technology advancement on agricultural energy use and carbon emissions: analysis based on GTAP-E model. Agric. Tech. Econ. 2, 30–40. doi: 10.13246/j.cnki.jae.20180116.002

Wu, G. Y., Liu, J. D., and Yang, L. S. (2021). Dynamic evolution of agricultural carbon emission intensity and carbon offset potential in China. China Popul. Res. Environ. 31, 69–78. doi: 10.12062/cpre.20210606

Wu, G. Z., and You, D. M. (2022). Can financing and financing promote corporate green innovation? China Soft Sci. 29, 172–182. doi: 10.3969/j.issn.1002-9753.2022.04.017

Xiong, L., and Qi, S. Z. (2016). Financial development and carbon emissions in China's provinces and regions—based on STIRPAT model and dynamic panel data analysis. J. China Univ. Geosci. 16, 63–73. doi: 10.16493/j.cnki.42-1627/c.2016.02.007

Xu, Z., Gao, Y., and Huo, Z. F. (2021). Pollution reduction effect of digital inclusive finance. Finance Econ. Sci. 4, 28–39. doi: 10.3969/j.issn.1000-8306.2021.04.003

Yan, C. L., Li, T., and Lan, W. (2016). Financial development, innovation and carbon dioxide emissions. Financ. Res., 1, 14–30.

Yang, C., Hu, P. Q., Diao, B. D., Cheng, J. H., and Cui, H. Y. (2021). Environmental performance of policies in major grain producing areas: based on the perspective of agricultural carbon emissions. China Popul. Res. Environ. 31, 35–44. doi: 10.12062/cpre.20210804

Ye, C. S., and Ye, Q. (2019). Is financial structure irrelevant to carbon emissions–based on the perspective of financial supply—side structural reform. Econ. Theory Econ. Manag. 10, 31–44. doi: 10.3969/j.issn.1000-596X.2019.10.003

Zamasiya, B., Nyikahadzoi, K., and Mukamuri, B. B. (2017). Factors influencing smallholder farmers' behavioural intention towards adaptation to climate change in transitional climatic zones: a case study of Hwedza District in Zimbabwe. J. Environ. Manag. 198, 233–239. doi: 10.1016/j.jenvman.2017.04.073

Zhang, G. S., and Wang, S. S. (2014). Structure, efficiency and its determination mechanism of agricultural carbon emissions in China. Agric. Econo. Issues 35, 18–110. doi: 10.13246/j.cnki.iae.2014.07.003

Zhang, J. X., and Wang, H. L. (2020). Analysis on environmental planning, agricultural technological innovation and agricultural carbon emission. J. Hubei Univ. 47, 147–156. doi: 10.13793/j.cnki.42-1020/c.2020.04.018

Zhang, T. F., Yang, J., and Sheng, P. F. (2016). The impacts and channels of urbanization on carbon dioxide emissions in China. China Popul. Res. Environ. 26, 47–57. doi: 10.3969/j.issn.1002-2104.2016.02.007

Zhang, Y. J. (2011). The impact of financial development on carbon emissions: an empirical analysis in China. Energy Policy 39, 2197–2203. doi: 10.1016/j.enpol.2011.02.026

Keywords: digital inclusive finance, agricultural carbon emission reduction, carbon emission measure, two-way fixed-effects model, China

Citation: Liu L, Wang G and Song K (2022) Exploring the role of digital inclusive finance in agricultural carbon emissions reduction in China: Insights from a two-way fixed-effects model. Front. Environ. Econ. 1:1012346. doi: 10.3389/frevc.2022.1012346

Received: 05 August 2022; Accepted: 28 October 2022;

Published: 15 November 2022.

Edited by:

Pratap Birthal, National Institute for Agricultural Economics and Policy Research (NIAP), IndiaReviewed by:

Noraina Mazuin Sapuan, Universiti Malaysia Pahang, MalaysiaAysen Sivrikaya, Hacettepe University, Turkey

Copyright © 2022 Liu, Wang and Song. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Lingyun Liu, bGx5QG5qeHpjLmVkdS5jbg==

Lingyun Liu

Lingyun Liu Guolin Wang

Guolin Wang