- 1School of Culture and Tourism, Zhejiang International Studies University, Hangzhou, China

- 2School of Business, Hohai University, Nanjing, China

In the past two decades, China’s government subsidy policy has promoted the rapid development of the photovoltaic industry. Concerns have been raised about how the financial performance of China’s photovoltaic firms changes with the gradual cancellation of subsidies. Taking the “531 New Policy” of China’s photovoltaic industry as an exogenous shock, based on the sample of listed companies in Shanghai and Shenzhen A-share photovoltaic industry from 2015 to 2023, this paper uses the diference-in-diferences model to study the impact of the phasing out subsidy on the financial performance of photovoltaic enterprises from the micro level. The study found that the implementation of the “531 New Policy” significantly reduced the financial performance of photovoltaic enterprises in general. Considering the difference of industrial chain links, the negative impact of decreasing subsidies on the financial performance of downstream photovoltaic enterprises is more significant, among which R&D investment plays a partially intermediary role. In addition, the phasing out subsidy has a more significant negative impact on the financial performance of senior and eastern enterprises than young and midwest enterprises. The conclusions of this study have important practical implications for photovoltaic enterprises’ decision-making under the changing external policy environment.

1 Introduction

The growing availability of renewable energy, especially the rapid growth of the photovoltaic (PV) industry, is deemed essential for promoting climate change mitigation and decreasing carbon dioxide emissions within the framework of energy conservation, emission reduction, and sustainable development (Abbasi et al., 2021; Qi et al., 2022). Numerous nations, including Japan and Germany, have enacted various industrial and economic policies to guide the development of the PV industry. China, a major carbon emitter, has pledged to reach carbon peaking by 2030 and carbon neutrality by 2060 (Cai et al., 2024). In recent years, China’s PV industry has experienced rapid growth and held its status as a global leader. The International Energy Agency (IEA) reports that China’s new solar PV installations in 2023 was comparable to the total global solar PV installations of the preceding year. As a crucial part of China’s new energy industry, the rapid development of PV enterprises benefits from a series of industrial subsidy policies introduced by the Chinese government (Xiong and Yang, 2016; Wang and Fan, 2021).

Nonetheless, these subsidies have engendered some issues, including a widening subsidy gap that has adversely affected the sustainable and systematic growth of the PV industry, culminating in challenges such as abandonment the electricity generated by PV power stations, limiting power output, and overcapacity (Dong et al., 2021; Liu et al., 2021; Zhang H. et al., 2021; Chen and Wang, 2022; Luan and Lin, 2022). In 2015, China’s PV abandonment rate was 12%, decreasing to 11% in 2016. The cumulative installed capacity of PV power generation was 43.18 GW in 2015, 77.42 GW in 2016, and 130.02 GW in 2017. The cessation of subsidies signifies the advanced maturation of a developing sector, as all industries ultimately require firms to engage in market competition independently of subsidies. The Chinese government has commenced the reduction of financial subsidies for the PV industry to promote its healthy, high-quality, and sustainable development (Liu et al., 2021). In 2013, China reduced the benchmark on-grid energy price for financial subsidies to the PV industry for the first time and initiated a fiscal subsidy strategy for PV that decreased annually starting in 2016. On 31 May 2018, the National Development and Reform Commission (NDRC), the Ministry of Finance (MOF), and the National Energy Administration (NEA) collaboratively released the “Notice on Matters Related to Photovoltaic (PV) Power Generation in 2018” (“531 New Policy”), which explicitly mandates the expedited reduction of subsidies for PV power generation. The “531 New Policy” seeks to redirect the PV industry’s development emphasis from scale expansion to enhancements in quality and efficiency. This policy aims to transition the PV industry from the “subsidy era” to the “market era,” enabling its evolution. Compared to prior subsidy reductions, the “531 New Policy” had a significantly greater impact than anticipated. Investments in terrestrial PV power stations have practically ceased, and PV concept stocks have experienced a substantial drop. The “531 New Policy” indicates a pronounced acceleration in subsidy reduction within China’s PV industry, resulting in significant repercussions for the sector.

The prolonged government subsidies for firm development have led to the need for an examination of the impact mechanisms and effects of China’s “531 New Policy” on the financial performance of PV companies. The PV industry is a sector characterized by a tightly interlinked supply chain. Variations in electricity rates for downstream enterprises can immediately influence the expenses and earnings of upstream PV companies. This paper also discusses the disparities in financial performance among PV enterprises situated at various stages of the industry chain in response to the “531 New Policy.” The research findings can furnish theoretical support for the advancement of PV enterprises and provide empirical references for governmental policy formulation in the PV industry.

The paper is organized as follows: Section 2 presents the literature review, Section 3 outlines the theoretical analysis and research hypotheses, and Section 4 explains the data and research methodology. Section 5 provides the empirical results and discussion, while the final section offers conclusions and policy recommendations.

2 Literature review

Three predominant viewpoints exist in current research about the influence of government industrial subsidy on the financial performance of PV firms. One perspective is that government subsidies can significantly improve the financial performance of PV firms. The feed-in tariff subsidy diminishes power generation expenses and enhances inventory turnover and profitability (Wang et al., 2016). Research and development subsidies can alleviate the adverse effects of innovation spillovers, while expanding funding avenues and fostering the sustainable growth of Chinese PV companies (Jiang et al., 2021). Against the backdrop of subsidy reduction, the decrease in government subsidies forces enterprises to break away from their past development model reliant on subsidies, shifting their focus towards innovation and sustainable development, thereby enhancing the overall performance of the companies (Luan and Lin, 2022). It is anticipated that following the elimination of these subsidies, the capacity utilization rate of Chinese PV module manufacturers will attain 80% by 2030, thereby resolving the overcapacity problem (Zhang et al., 2024). The second viewpoint contends that government subsidies negatively affect the PV firms. During the initial phases of the industry’s evolution, numerous companies increased production to obtain additional subsidies, so intensifying the risk of overcapacity and negatively impacting the growth of PV firms (Wang et al., 2014; Zhang H. et al., 2016). Large-scale government subsidies have led to a lack of innovation in the industry, resulting in outdated PV technology, and Chinese PV companies have low competitiveness in the international market (Xiong and Yang, 2016). The reduction in subsidy policies has put pressure on the costs and benefits of PV power generation companies (Liu et al., 2021). The third perspective posits that government subsidies exert a threshold influence on the financial performance of PV firms. The influence of subsidies is a dynamic adjustment process, and the effects of industrial subsidies are varied. In the initial phases of development, substantial government subsidies can facilitate swift expansion in the solar sector. However, during the semi-maturity and maturity phases, persistent government subsidies may hinder the market adjustment mechanism and intensify overcapacity (Xiong and Yang, 2016). From the perspective of the industry life cycle, there is an inverted U-shaped relationship between subsidies and firms’ output, driven by the resource allocation effect of subsidies and the signaling effect of investment (Du et al., 2023).

Research has explored the impact of subdivided industrial policies on the financial performance of PV firms. However, previous studies have yielded conflicting results. Some scholars argue that government subsidies enhance the financial performance of PV firms, while others contend that the effect may not be as straightforward (Zhao et al., 2023). Certain experts believe that government subsidies enhance the financial performance of PV enterprises (Zhao et al., 2023), while others argue that the impact of these subsidies is negative (Wang et al., 2017). A common limitation of the above studies is that the impact of subsidy reductions on PV enterprises is rarely considered from the perspective of the industrial chain.

Various methods have been used to study the impact of PV industry policies on firm performance. The DEA-Tobit model has been applied to demonstrate that government subsidies positively affect the innovation performance of PV firms (Lin and Luan, 2020). Additionally, the PSM-DID methodology was employed to examine the impact of subsidy redistribution policies on innovation in China’s PV industry. The study concluded that the transition in subsidy policies generally improved the innovation performance of PV firms (Zhang and Wang, 2023). The game model of the PV supply chain under different power structures suggested that reasonable government subsidies have an incentive effect and can increase PV firms’ profits (Zhao et al., 2023). The Stochastic dynamic model was used to find that the important factor driving PV adoption is technology, and although subsidy policies help PV adoption and diffusion, policies such as financial subsidies gradually become ineffective in the face of accelerated technological change (Torani et al., 2016).

Compared to existing studies, this paper makes three main contributions: 1) The solar energy sector has a wide range of incentive programs. The influence of subsidizing retreat policies on the financial performance of PV firms is the main subject, which divides the subsidy programs. There are few studies on the effects of subsidy retreat policy, and the majority of studies that are now available concentrate on the advantages of government subsidies for business performance. 2) This paper exceeds the limited scope of prior studies by thoroughly investigating various segments of the PV industry chain, encompassing upstream raw material supply, midstream battery module manufacturing, and downstream system integration and application. The paper clarifies the distinct effects of the subsidy withdrawal policy on different segments of the PV industry by comparing the financial performance alterations of firms across these segments under the policy. The outcome provides a persuasive rationale for the adoption of more precise and targeted subsidy policies in the future, while also aiding in the reconciliation of the contradictory findings from previous studies about the effects of subsidy policies. 3) This study analyzes the effects of the subsidy retreat strategy on the financial performance of enterprises by affecting their R&D investment behaviour from the essential viewpoint of R&D investment. This research enhances the theoretical understanding of the policy implications of the PV sector and provides policymakers with valuable insights on promoting increased company investment in R&D and improving technological innovation capabilities through adjustments to subsidy programs.

3 Theoretical analysis and research hypothesis

3.1 Impact of phasing out subsidy on the financial performance of PV enterprises

The market failure and externalities theories say that the new energy industry needs help and protection from the government in its early stages of growth. The main way the government helps the business is through financial subsidy policies, which come in many forms (Yu et al., 2020). Just like many other industries in the new energy field, the PV industry has gotten a lot of assistance from the government as it has grown. These supports make the industry grow quickly by making businesses more financially stable, lowering the risks of new technologies, and encouraging the “learning by doing” effect (Lin and Luan, 2020; Jiang et al., 2021). Nevertheless as the industry evolved into its middle and later stages, overcapacity and huge subsidy gaps force the government to start cutting back on subsidies. Given this, the PV industry’s financial subsidy strategy goes into a phase where subsidies are cut.

According to the theory of externalities, enterprises’ actions to research and develop new ideas have considerable positive impacts on society. The PV business is riskier when it comes to innovation, more capital-intensive, and policy-sensitive than traditional industries. Its innovation activities exhibit more pronounced positive externalities and uncertainties (Zhang and Wang, 2023). Subsidy reductions can reduce firms’ non-operating revenue and cash flow, worsening their financial position and raising their financial burden (Cai et al., 2024). The subsidy retreat policy can also, in accordance with the signal transmission theory, transmit a negative signal to the market, make it harder for companies to attract investment, and tighten their financing constraints. Accordingly, the financial strain brought on by the reduction in subsidies may, to some extent, raise the risk associated with R&D and innovation, impede these activities within businesses, and consequently harm those businesses’ ability to develop sustainably. Additionally, some PV enterprises may over-rely on subsidies to maintain their profitability and market position. These enterprises may be under more market pressure when subsidies are cut, and they might be forced to use aggressive tactics like price wars to fight for market share. Enterprises may be more likely to prioritize short-term goals above long-term technical innovation and knowledge acquisition in the midst of intense market competition. This weakens the impact of “learning by doing,” which is detrimental to the long-term growth of enterprises.

Based on the above analysis, the following hypothesis is proposed:

Hypothesis 1:. The phasing out subsidy negatively affects the financial performance of PV firms.

3.2 Impact of phasing out subsidy on the financial performance of PV enterprises in different industrial chain links

The industrial chain of the PV industry comprises various stakeholders across different segments. As a typical technology-intensive industry, the upstream polysilicon segment is distinguished by a challenging raw material gathering procedure, a high entrance threshold, and a complex production process. The midstream sector, which produces thin-film PV modules, is a typical labor-intensive enterprises with a lower entrance threshold, lower costs, and reduced hazards. With a concentration on PV power generation, the downstream industry boasts enormous production scales, excellent production efficiency, and ongoing technological advancements. This industry fits the description of a typical capital-intensive industry because it has a longer production cycle and requires relatively significant investment (Yu and Lv, 2015; Bao et al., 2022; Wang H. et al., 2022). Owing to substantial variations in capital and technological thresholds, production cycles, and profit margins among these segments, same policies have disparate effects on various sectors of the industry chain (Zhang and He, 2013; Wang et al., 2016; Zou et al., 2017).

The upstream polysilicon process is highly developed, with manufacturing capacity and technology at a global forefront, allowing enterprises to efficiently manage costs. Despite diminished government subsidies, some firms can sustain robust profitability. The scale advantage of the polysilicon enterprises confers enhanced resilience to these enterprises in the face of market instability. As a technology-intensive sector, the decline in government subsidies can be mitigated by policies such as green finance and support for technical innovation, which can incentivize upstream firms to enhance R&D investment and facilitate industrial upgrading. The midstream sector enjoys comparatively cheap production expenses because to minimal entry barriers and its labor-intensive characteristics. Moreover, advancements in technology and economies of scale can substantially diminish production expenses. This cost advantage makes midstream enterprises more resilient to the impacts of subsidy reductions. Therefore, the effect of subsidy reductions on the financial performance of PV enterprises in the upstream and midstream sectors is insignificant.

The downstream PV power generation sector entails the establishment and operation of PV power stations, typically necessitating extensive land, equipment, and capital investment, hence imposing significant fixed and sunk costs on firms. The persistent emergence of new technologies, materials, and processes in the downstream sector necessitates that firms consistently spend in research and development to maintain a competitive edge in technology. This technological advancement enhances manufacturing efficiency while simultaneously elevating the operational expenditures for firms. While elevated production efficiency diminishes the per-unit production cost, in light of decreasing subsidies, enterprises must enhance production efficiency to compensate for the revenue loss resulting from subsidy reductions. Nonetheless, enhancing manufacturing efficiency frequently necessitates greater financial expenditure and technical assistance. The revenue of PV power generation plants under the subsidy program mostly derives from two sources: electricity sales and government subsidies. Following the reduction of the subsidy, government support is either diminished or entirely revoked, leading to a decrease in the project’s overall revenue. The reduction in subsidies can adversely affect the financial performance of downstream photovoltaic companies.

Based on the above analysis, the following hypothesis is proposed:

Hypothesis 2:. The impact of phasing out subsidy on the financial performance of PV firms in the downstream segment of the industrial chain is stronger than that on firms in the midstream and upstream segments.

3.3 The mediating role of R&D investment

The PV industry, being a high-tech sector, inherently requires substantial upfront investments, extended recovery periods, and faces information asymmetry, resulting in significant financing constraints that can hinder technological innovation within enterprises. This suggests that government subsidies during the start-up phase of the PV industry are essential for enterprises to engage in innovative activities. When the phasing-out of subsidies is introduced, the external liquidity of PV enterprises is affected, leading to financing difficulties and a reduction in innovative R&D activities. China’s PV industry starts late, and there remains a gap between the level of technological innovation in the PV industry and the international advanced standards. For instance, significant room for improvement remains in the research, development, and application of high-efficiency PV technologies. Moreover, PV enterprises often develop an excessive dependence on government subsidies, which can weaken their motivation and pressure to innovate. Consequently, they may choose to reduce R&D activities to adjust to the new operating environment. From these perspectives, the level of R&D investment in PV enterprises is highly sensitive to policy changes, and the introduction of phasing-out subsidies may significantly reduce R&D investment in PV enterprises.

Research on the relationship between R&D investment and corporate financial performance has been relatively comprehensive. The mainstream view of scholars in recent years is that R&D investment has a significant positive impact on enterprise performance (Lee and Min, 2015; Qi et al., 2022; Wang X. H. et al., 2022; Baek and Lee, 2023). On one hand, increasing the intensity of R&D investment can help enhance the ability to resist potential risks, improve sensitivity to market development trends, and thus improve financial performance. On the other hand, enterprises engaged in innovation activities can release positive signals to society, attract investment and R&D talent, achieve technological innovation, and thus improve financial performance. According to Schumpeter’s theory of technological innovation, innovation is the driving force behind economic development. Technological innovation not only enhances the core competitiveness of enterprises but also promotes sustainable profit generation. The PV industry has a long technological innovation cycle and rapidly changing markets. In the context of subsidy reductions, a decrease in R&D investment and lack of technological innovation can exacerbate the disconnect between products and market demand, reduce the core competitiveness of enterprises, and negatively impact the revenue of PV enterprises.

Based on the above analysis, the following hypothesis is proposed:

Hypothesis 3:. R&D investment has a significant mediating effect on the relationship between the phasing out subsidy and financial performance of PV enterprises.

4 Method and data

4.1 Data source and processing

The financial data of PV companies listed on China’s Shanghai and Shenzhen A-shares from 2015 to 2023 were used as the sample data. The criteria for identifying PV enterprises are as follows: First, companies were screened from the “photovoltaic” concept sector in the Flush Finance and Sina Finance platforms. Second, the main business and products of these companies were examined by searching for keywords such as “polysilicon, monocrystalline silicon, silicon wafers, solar photovoltaic cells, battery modules, photovoltaic modules, photovoltaic mounts, photovoltaic glass, and optical film” in their annual reports from the previous year (Wang et al., 2016; Zou et al., 2017; Lin and Luan, 2020; Cai et al., 2024). A total of 192 listed PV companies were selected.

When categorizing these companies according to the industry chain, the definition provided by the China Photovoltaic Industry Association (CPIA) is used: polysilicon materials and related sectors are classified as upstream, thin-film photovoltaic modules and related sectors as midstream, and photovoltaic power generation applications and related sectors as downstream. Based on this classification, the 192 companies are divided into 134 upstream and midstream enterprises and 58 downstream enterprises.

Considering that the vast majority of listed companies in the PV industry belong to six major manufacturing sectors under the SEC Industry Classification (2012 edition)—namely, the electric power, heat production and supply industry; general equipment manufacturing industry; special equipment manufacturing industry; non-metallic mineral manufacturing industry; electrical machinery and equipment manufacturing industry; and computer, telecommunications, and other electronic equipment manufacturing industry—this paper initially screens 1,695 listed companies in these industries as the original control group sample. Using propensity score matching (PSM) with return on total assets (ROA), gearing ratio (Lev), enterprise size (Size), and total revenue (Lnoi) as matching covariates, the nearest-neighbor 1:1 matching method is applied. As a result, 164 PV firms and 161 non-PV firms are selected as the full sample. To avoid the impact of the major event of the 2020 COVID-19 pandemic on the empirical results, the 2020–2022 data are excluded. Additionally, firms with missing values and ST firms are removed. This process yields a final total of 973 observations, including 657 observations in the experimental group and 316 in the control group.

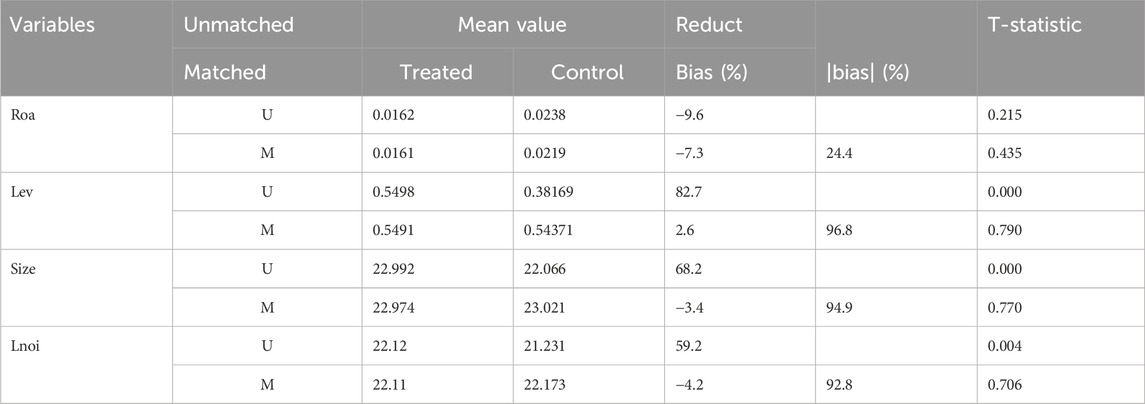

To ensure the accuracy of the PSM results, a balance test on the matched sample data is necessary. This test verifies that the propensity scores of the matched covariates are not significantly different between the experimental and control groups under the assumption of conditional exogeneity. As shown in Table 1, the balance test results indicate that the covariates are significantly different between the experimental and control groups before matching. However, after matching, the deviation rate for each covariate is less than 10%, demonstrating that the selected matching covariates and the matching method are reliable. Therefore, it can be concluded that the observable variables selected in this paper are appropriate and that the matching method is estimated reliably.

4.2 Model setting

Difference-in-Differences (DID) model is one of the most commonly used non-experimental methods for policy evaluation, allowing for the assessment of the micro effects of macro policies. Following Zhang and Wang (2023) and Cai et al. (2024), we treat the introduction of the “531 New Policy” in 2018 as a quasi-natural experiment to investigate the impact of phasing out subsidy on the financial performance of PV enterprises. The following initial model is constructed:

In Equation 1, ROEit represents the financial performance of enterprises, DIDit represents the interaction term of policy variables, Xit represents a set of control variables, γ is the time fixed effect, μ is the individual fixed effect, and ε is the residual term. The coefficient of DIDit measures the impact of the “531 New Policy” on the financial performance of PV companies.

Additionally, following the reference by Cai et al. (2024), an interaction term containing industry chain dummy variables is added to the model to estimate the moderating effects of different industry chain segments on PV firms. The DID model is then obtained as follows:

In Equation 2, Chainit represents the industry chain dummy variable, where downstream enterprises are denoted by 1, and upstream and midstream enterprises are denoted by 0. The coefficients of the interaction term DIDit × Chainit, which combines the policy dummy variable and the industry chain dummy variable, reflect the impact of the subsidy degradation policy on downstream PV enterprises. A significantly positive coefficient indicates that the policy promotes the financial performance of downstream PV enterprises, while a significantly negative coefficient suggests that it is detrimental to their development. The coefficient of the policy dummy variable DIDit reflects the impact of the policy on upstream and midstream PV enterprises.

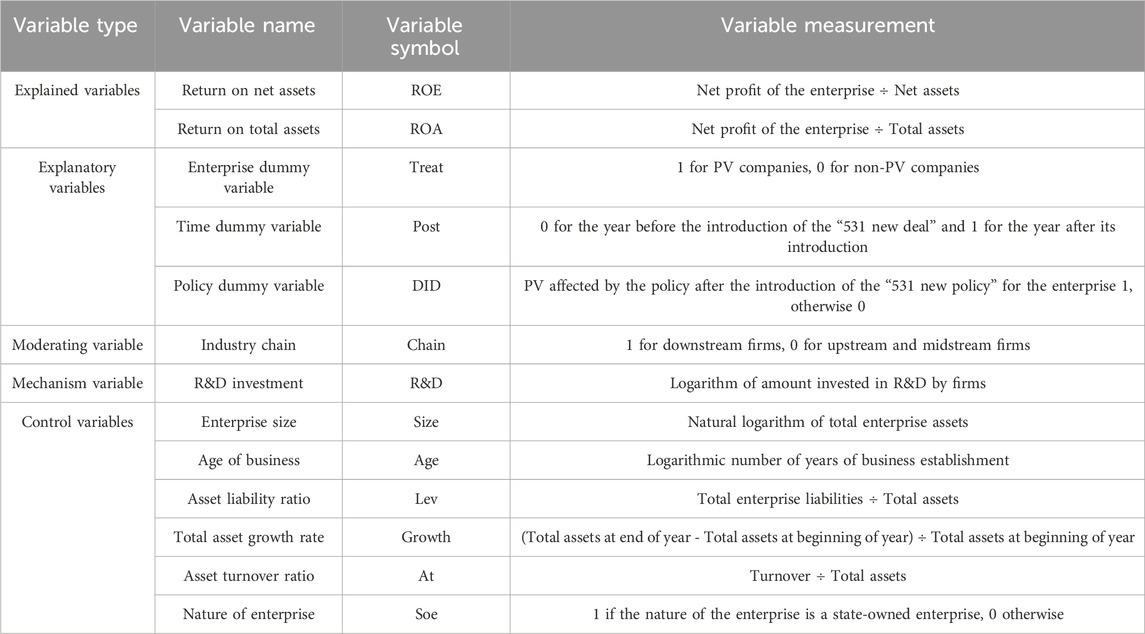

4.3 Variables description

4.3.1 Explained variables

The explained variable is return on equity (ROE). Various indicators can reflect the economic performance of enterprises, including return on equity (ROE), return on assets (ROA), and TobinQ. However, considering that China’s capital market is not fully developed and TobinQ is less representative of enterprise performance compared to the first two, this paper empirically analyzes the model using return on equity (ROE) and includes return on assets (ROA) in robustness testing (Xu et al., 2021; Zhang X. B. et al., 2021; Rao et al., 2023).

4.3.2 Explanatory variables

The explanatory variables include a time dummy, a firm dummy, and a policy dummy. The time dummy variable, Post, is set to 0 before the implementation of the “531 New Policy” and to 1 afterward. The firm dummy variable, Treat, indicates whether a firm is a policy target, with a value of 1 for PV enterprises and 0 for non-PV enterprises. The policy dummy variable, DID, is the interaction term Treat × Post, used to determine whether PV enterprises are affected by the “531 New Policy.”

4.3.3 Moderating variable

The moderating variable in this paper is the industry chain dummy variable, Chain, where downstream enterprises are coded as 1 and upstream and midstream enterprises as 0. The industry chain is classified based on the definition provided by the China Photovoltaic Industry Association (PVIA), with upstream and midstream PV enterprises primarily engaged in the production of silicon materials, battery cells, and photovoltaic modules, while downstream PV enterprises are mainly involved in PV power generation, including installation, operation, and maintenance.

4.3.4 Mechanism variable

R&D investment tends to play an important role in the relationship between government subsidies and financial performance. Therefore this paper takes R&D investment as an intermediary variable.

4.3.5 Control variables

Previous studies have shown that both firm characteristics and financial status are key factors influencing business performance (Wang et al., 2016; Zhang L. et al., 2016; Hu et al., 2020; Pang et al., 2022; Cai et al., 2024). Therefore, this study selects firm size (Size), firm age (Age), gearing ratio (Lev), growth rate of total assets (Growth), asset turnover (At), and nature of the firm (Soe) as control variables. The specific definitions of each variable are shown in Table 2.

5 Results and discussion

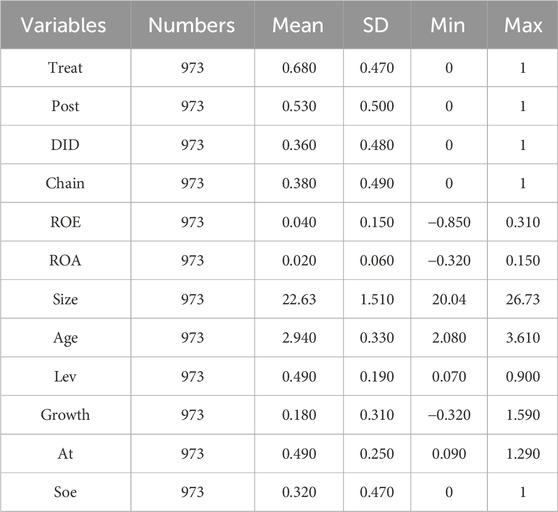

5.1 Descriptive statistics

As shown in Table 3, each continuous variable exhibits significant dispersion. To mitigate the impact of extreme values on the model estimation results, this paper applies the Winsorization method to handle the extreme values of continuous variables below the 1st percentile and above the 99th percentile.

5.2 Baseline regression results

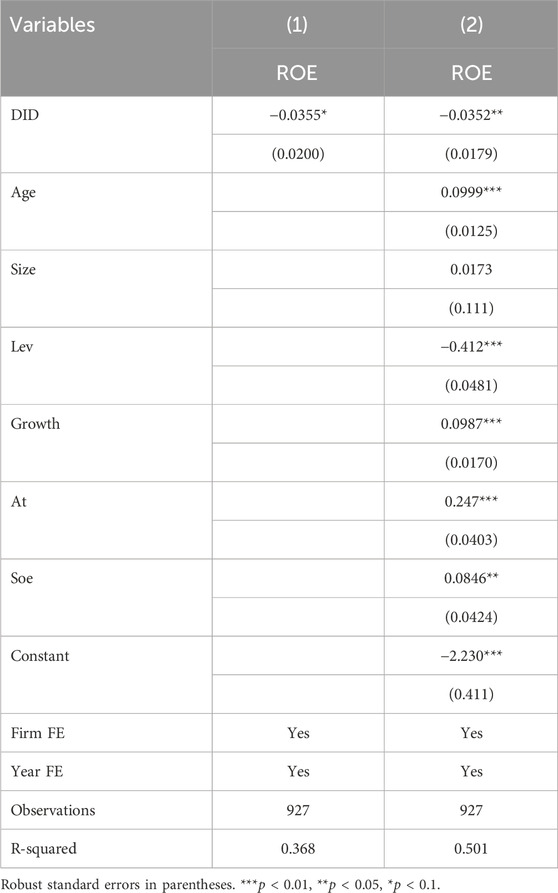

To assess the impact of the phasing out subsidy on the financial performance of PV enterprises, this paper first conducts a regression based on Equation 1 without considering control variables, and the results are reported in column (1) of Table 4. The estimated coefficient of the core explanatory variable, DID, is significantly negative at the 10% statistical level, initially indicating that the promulgation of the “531 New Policy” is not conducive to improving the financial performance of PV enterprises. Further, after adding control variables to the model, as shown in column (2) of Table 4, it can be seen that although the estimated coefficient of DID fluctuates, its significance does not change substantially. This also suggests that the introduction of the “531 New Policy” inhibits the improvement of the financial performance of PV enterprises. As mentioned above, the promulgation of the “531 New Policy” has generally reduced the financial performance of PV enterprises by directly reducing their non-operating income, increasing the difficulty and cost of financing, raising the risks associated with R&D and innovation, and inducing short-term behaviors.

Table 4. Main effects test: regression results of phasing out subsidy and financial performance of PV firms.

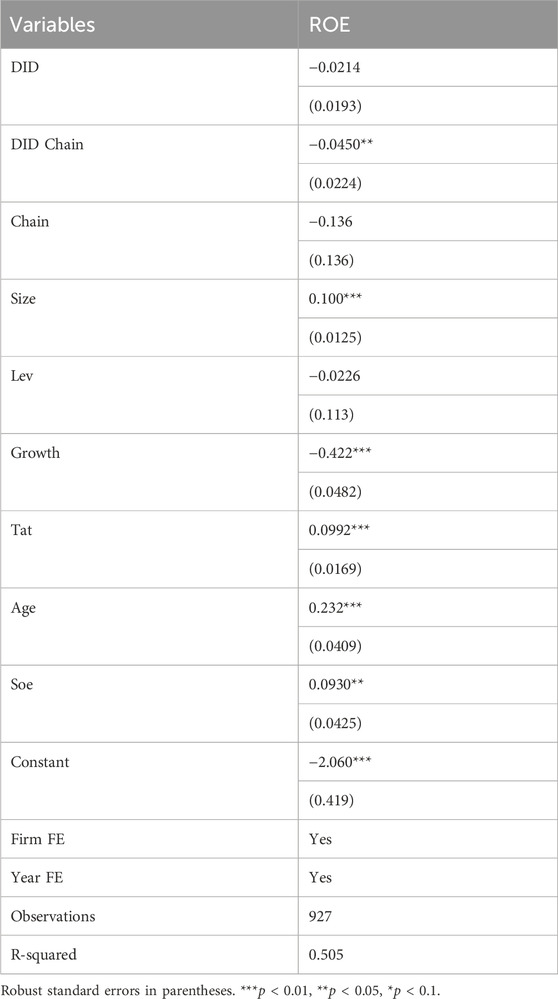

5.3 The moderating role of industrial chain

Due to the heterogeneity of the industrial chain, the same policy may produce different effects across various segments of the industrial chain. Therefore, this paper further examines the effect of the phasing out subsidy on PV companies in different industry chain segments. This paper estimates Equation 2, and the results are reported in Table 5. The coefficient of DID × Chain is −0.045, which is significantly negative at the 5% level, indicating that the effects of the phasing out subsidy on PV enterprises vary significantly across different positions within the industrial chain, markedly inhibiting the financial performance of downstream enterprises. As mentioned earlier, the upstream polysilicon segment is not considerably affected by the subsidy reduction due to its mature technology, scale advantage, and green financial support. The midstream thin-film PV module segment remains stable due to its low costs and economies of scale. However, the downstream PV power generation segment, being capital-intensive, fast in technology updating, and subsidy-dependent, is eminently affected by the subsidy reduction, leading to a notable decline in financial performance.

5.4 Robustness tests

5.4.1 Parallel trend test

The DID model is constructed under the premise that the parallel trend assumption holds, meaning there should be only slight differences between the treatment group and the control group before the implementation of the “531 New Policy”. If this condition is met, the estimation results of causal effects are considered valid. Accordingly, this paper refers to the relevant literature (Li et al., 2016) and uses event analysis to verify whether the study sample satisfies the parallel trend assumption, constructing the following model:

In Equation 3, Treat × Post is a dummy variable indicating whether the study sample is affected by the subsidy reduction policy policy. Here, n denotes the number of years relative to the policy implementation: when n is negative, it represents the years before the policy implementation; when n is positive, it represents the years after the policy implementation. In this paper, we take the year before the policy implementation as the base year, setting n = −1. Therefore, βn represents the difference in policy shocks experienced by the treatment group compared to the corresponding control group in the first n years.

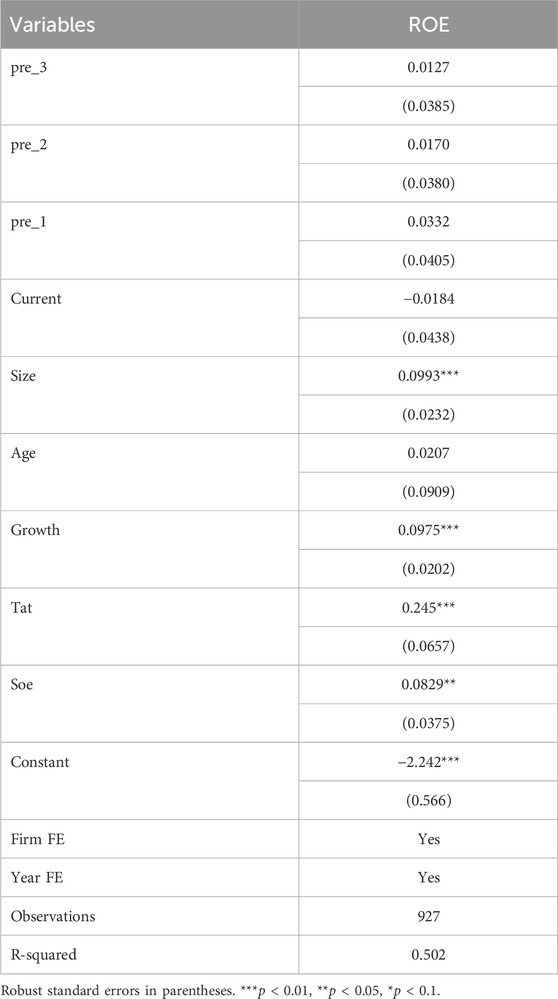

The interaction terms of the experimental group and year dummy variables for 2015, 2016, 2017, and 2018 are added to Equation 3. The regression results, shown in Table 6, indicate that the coefficients of the interaction terms pre_3, pre_2, pre_1, and current for each year are not significant, suggesting that there is a parallel trend in the return on equity of the experimental group and the control group prior to the implementation of the policy.

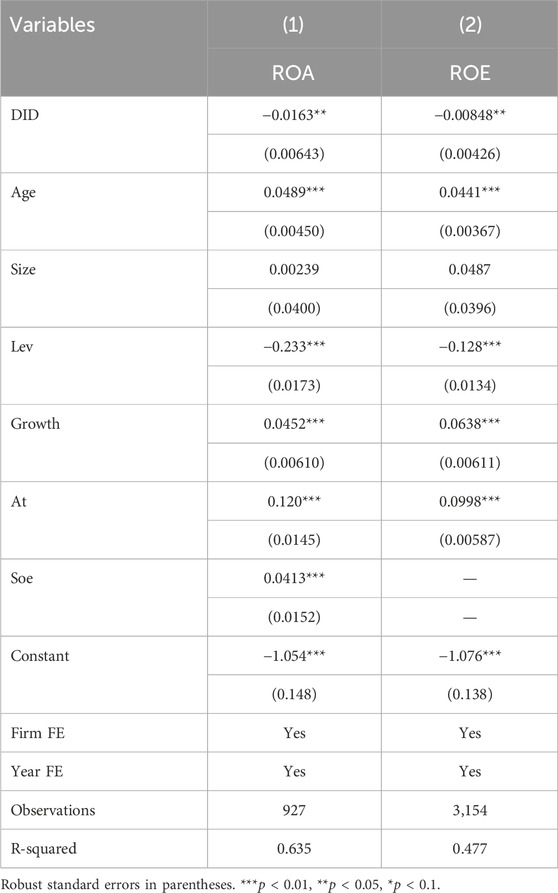

5.4.2 Replacement of explained variable

Generally, ROE and ROA are indicators of corporate profitability. To improve the reliability of the findings, ROA is used as the explained variable for the robustness test. Column (1) in Table 7 reports the regression results after replacing the explained variable, and the regression coefficient of DID is significantly negative at the 5% level, indicating that the phasing out subsidy inhibits the improvement of firms’ financial performance. The reported results are consistent with the baseline regression results.

5.4.3 Replacement of samples

The time series of the original sample in the benchmark regression covers 2015–2023, with data from 2020–2022 excluded to avoid the impact of the COVID-19 pandemic on the empirical results. To further improve the reliability of the empirical findings, this paper selects data from the first quarter of 2015 to the fourth quarter of 2019 to form a new sample, replacing the original sample. Column (2) in Table 7 reports the regression results using the replacement sample, and the regression coefficient of DID is significantly negative at the 5% level, supporting the conclusion that the phasing out subsidy inhibits the financial performance of PV firms.

5.5 Mechanism test

According to the theoretical analysis above, this paper holds that the policy of accelerating the decline of subsidies may weaken the financial performance of PV enterprises by reducing the R&D investment. Based on this, this section will attempt to examine the above potential influence. Drawing on the mediating effects approach proposed by Jiang and Luo (2022), this paper further assesses the mediating role of R&D investment (Zhang et al., 2014; Yu et al., 2020; Cui et al., 2021). We first test whether the core explanatory variable acts on the mediating variable. The mediating effect is modeled as follows:

In Equation 4, if the coefficient β1 of Equation 4 is significant, it indicates that the phasing out subsidy impacts the R&D investment intensity of overall PV enterprises. Additionally, if the coefficient β2 of Equation 4 is significant, it suggests that the phasing out subsidy specifically affects the R&D investment intensity of downstream PV enterprises.

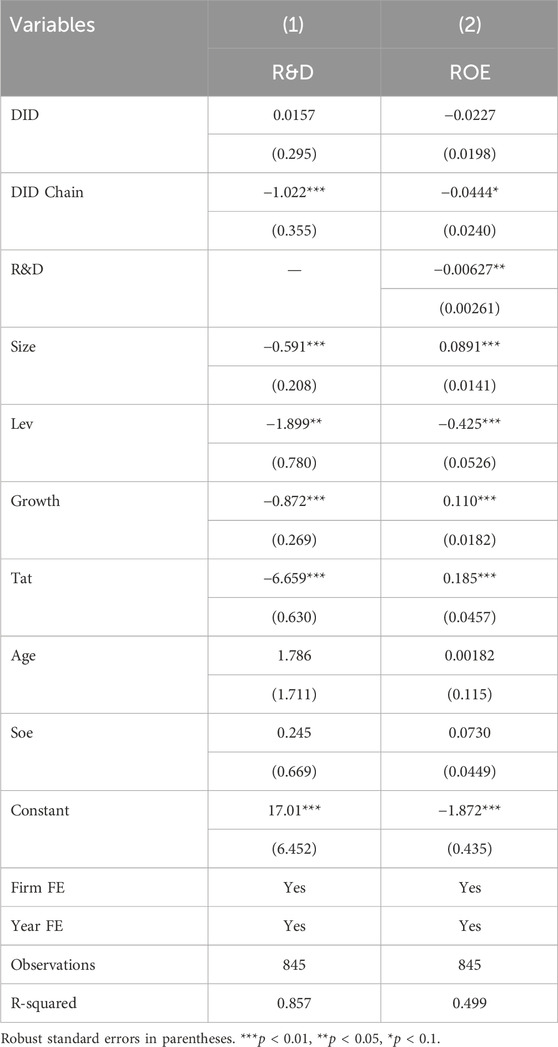

From the regression results in column (1) of Table 8, it can be seen that the coefficient of DID × Chain is −1.022, which is significantly negative at the 1% level, indicating that the “531 New Policy” significantly inhibits the R&D investment of downstream PV enterprises.

In order to avoid the problem that the causal effect of the intermediary variable on the explained variable may not be sufficient, we further test the influence of the intermediary variable on the explained variable, so as to supplement the correlation evidence support. From the regression results in column (2) of Table 8, it can be seen that the coefficient of R&D is −0.00627, which is significantly negative at the 5% level, indicating that the reduction in R&D investment by downstream enterprises is not conducive to improving corporate financial performance.

Based on the preceding analysis, it is evident that R&D investment mediates the relationship between the phasing-out of subsidies and the financial performance of downstream enterprises. The reduction in subsidies decreases cash flow and tightens financing constraints, prompting enterprises to actively or passively reduce their R&D investment and technological innovation. As a high-tech industry, the PV sector’s technological innovation capability is closely tied to its core competitiveness. When innovation is insufficient, enterprises are likely to face product obsolescence, decreased profitability, and other issues. Additionally, the mediating role of R&D investment between the phasing-out of subsidies and the financial performance of PV enterprises is not evident. This may be due to the influence of the industrial chain, where upstream and midstream enterprises, primarily PV raw material producers and module manufacturers, are less directly affected by the subsidy reduction.

5.6 Heterogeneity analysis

5.6.1 Heterogeneity of firm age

The age of an enterprise influences its management system, business model, and other operational aspects. Consequently, enterprises of varying ages may make different decisions when faced with environmental changes. Senior enterprises, which have often operated in the PV industry for many years, may have business models and profit structures that are more reliant on government subsidies. Their established business models may hinder their ability to quickly adapt to market changes and policy adjustments. In the context of subsidy reductions, such enterprises may experience a greater decline in revenue and a more significant impact on their financial position. Additionally, senior enterprises may have accumulated higher levels of debt, and the reduction in revenues due to the subsidy cuts could further exacerbate their debt burden. This financial pressure may impede their ability to maintain normal operations and growth. Du and Mickiewicz (2016) also found that uncertainty in subsidy allocation does not significantly affect young firms.

To verify the heterogeneity of firm age, this study categorizes the sample of listed firms into two groups based on the median age: senior firms and young firms. The subsamples of senior and young firms are used to examine whether there is a differential impact of the phasing-out subsidy on PV firms of different ages. This study re-estimates Equation 1. As shown in Table 9, column (1) indicates that the regression coefficient between the phasing-out subsidy and senior enterprises is −0.0605, which is significantly negative at the 5% level. Column (2) indicates that the regression coefficient between the phasing-out subsidy and young enterprises is −0.0256, which is not statistically significant. This indicates that the enactment of the phasing-out subsidy has a more significant inhibitory effect on the financial performance of senior PV enterprises, whereas its effect on the financial performance of young PV enterprises is not evident. It is found that senior enterprises that have operated in the PV industry for many years tend to rely more on government subsidies, and their relatively rigid business models and profit structures make it difficult for them to quickly adjust to market changes following the introduction of the phasing-out subsidy. Therefore, the inhibitory effect of the phasing-out subsidy on the financial performance of senior PV enterprises is more pronounced.

5.6.2 Heterogeneity of regional location

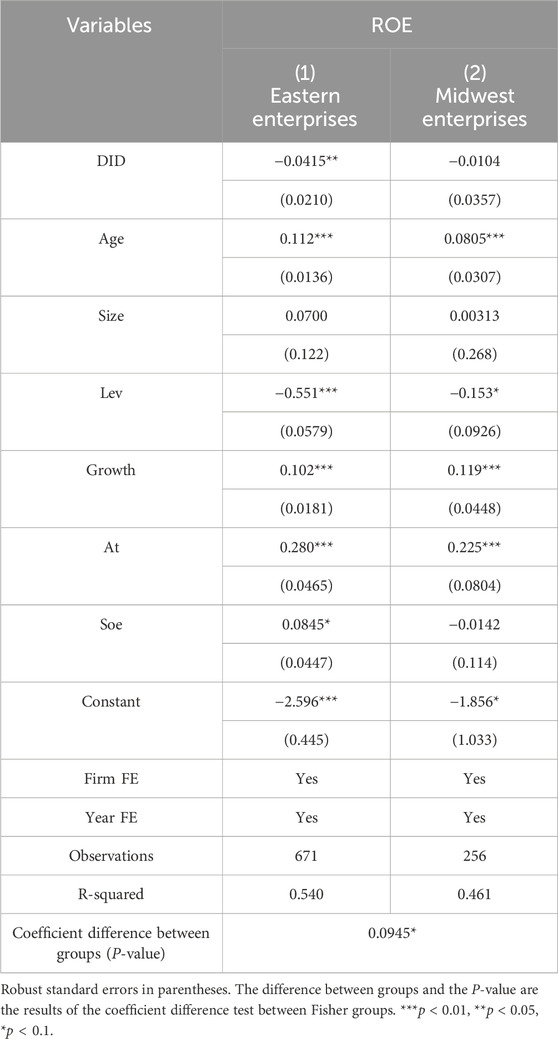

China’s economic development, institutional environment, and openness exhibit significant regional differences. These factors influence firms’ effective use of resources and, consequently, the impact of subsidies on firm performance (Wang et al., 2015; Lim et al., 2018). For instance, scholars have found that government subsidies have a greater positive impact on new energy enterprises in the eastern region compared to the western region (Liu et al., 2019). In the PV industry, the eastern region often attracts numerous PV enterprises due to its developed economy and advanced technology, resulting in a strong industrial agglomeration effect. These enterprises may rely heavily on government subsidies to reduce costs and enhance competitiveness during the early stages of development. Additionally, the PV industry in the eastern region is larger, and the government often implements more generous subsidy policies to support its rapid growth. Therefore, when subsidies are reduced, the direct impact on eastern enterprises is more significant. PV companies in the eastern region generally possess higher levels of technology and R&D capabilities. However, the reduction of subsidies necessitates that these enterprises accelerate the pace of technological innovation to reduce costs and improve conversion efficiency. For enterprises with insufficient technological innovation, this undoubtedly increases financial pressure.

As shown in the regression results in Table 10, column (1) indicates that the regression coefficient between the phasing-out subsidy and eastern enterprises is −0.0415, which is significantly negative at the 5% level. Column (2) indicates that the regression coefficient between the phasing-out subsidy and western enterprises is −0.0104, which is not statistically significant. This suggests that the inhibitory effect of the phasing-out subsidy on the financial performance of eastern PV enterprises is more pronounced. This may be because the PV industry in the eastern region attracts enterprises to cluster due to economic and technological advantages and benefits from generous government subsidies that promote development. However, with the reduction of subsidies, the highly subsidy-dependent eastern enterprises face greater impacts and need to accelerate technological innovation to meet the challenges of rising costs and efficiency improvements. This is particularly challenging for those with insufficient technological innovation capacity, creating additional financial pressure.

6 Conclusion and recommendations

The development of the PV industry is a crucial initiative for reducing greenhouse gas emissions. In its early stages, China promotes the rapid growth of the PV industry through the implementation of various subsidy policies. However, in the middle and later stages of development, the Chinese government recognizes the problems of overcapacity in the PV industry and initiates the process of subsidy reduction. Despite this, research on the impact of subsidy reduction policies on the financial performance of PV companies remains relatively scarce. This paper examines the “531 New Policy” in the PV industry, analyzing the impact of the phasing out subsidy on the financial performance of PV enterprises using the PSM and DID model. Through empirical analysis, four key findings are obtained: (1) The phasing out subsidy generally inhibits the financial performance of PV enterprises. (2) For enterprises at different levels of the PV industry chain, the negative impact of the phasing out subsidy on downstream enterprises is greater than its impact on upstream and midstream enterprises. (3) The phasing out subsidy indirectly weakens the financial performance of downstream PV enterprises by reducing R&D investment, while the mediating effect of R&D investment is not significant for PV enterprises as a whole. (4) The effects of the phasing out subsidy on PV enterprises vary by region and age. The negative impact on enterprises in the eastern region is greater than in the central and western regions, and the negative impact on older enterprises is greater than on younger enterprises.

In response to the above findings, this paper offers the following recommendations: Firstly, it is recommended that the government optimize the design of the PV phasing out subsidy, carefully control the pace of subsidy reductions, minimize the negative impact of large-scale subsidy reductions on the PV industry within a short period, and stabilize PV enterprises’ expectations regarding the subsidy policy. At the same time, the direction of PV industry subsidies should be appropriately adjusted. In addition to the traditional method of subsidizing based on electricity generation, the government could increase subsidies for R&D innovation, raise the threshold for receiving subsidies, and guide enterprises to strengthen technological innovation. This would enhance the core competitiveness of PV enterprises and promote the orderly and healthy development of the industry. Secondly, given the varying negative impacts of the phasing out subsidy on the financial performance of enterprises at different levels of the PV industry chain, it is suggested that the government implement a more precise and differentiated subsidy policy. For upstream and midstream enterprises, moderate subsidy support should be maintained to stabilize the supply chain and raw material supply. Meanwhile, for downstream enterprises, the focus should be on providing incentives for technological innovation and market expansion, such as low-interest loans and tax exemptions, to alleviate financial pressure and encourage transformation and upgrades. Finally, a differentiated subsidy policy should be implemented based on the age and geographical location of PV enterprises. The government should promote synergistic development across regions and optimize the layout of the PV industry. For the eastern region, with its developed economy, strong market demand, but limited land resources, the focus should be on developing PV technology R&D, high-end manufacturing, and intelligent operation and maintenance. Meanwhile, the central and western regions can leverage their abundant land and solar resources to develop PV power plant construction, operation, and other industrial segments. Additionally, to address the transition difficulties faced by senior enterprises, the government could provide appropriate support to help them smoothly transition to a new development model and mitigate the negative impact of subsidy withdrawal. At the same time, young enterprises should be encouraged to actively participate in market competition and lead the industry’s development through technological and business model innovation.

Data availability statement

Publicly available datasets were analyzed in this study. This data can be found here: https://data.csmar.com/.

Author contributions

LY: Data curation, Investigation, Supervision, Writing–review and editing. HH: Data curation, Methodology, Writing–original draft, Writing–review and editing. JZ: Conceptualization, Formal Analysis, Funding acquisition, Writing–review and editing.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abbasi, K. R., Adedoyin, F. F., Abbas, J., and Hussain, K. (2021). The impact of energy depletion and renewable energy on CO2 emissions in Thailand: fresh evidence from the novel dynamic ARDL simulation. Renew. Energ. 180, 1439–1450. doi:10.1016/j.renene.2021.08.078

Baek, S., and Lee, D. H. (2023). Can R&D investment be a key driver for sustainable development? Evidence for Korean industry. Corp. Soc. Resp. Env. Ma. 31, 838–853. doi:10.1002/csr.2607

Bao, H., DU, Y., and Liu, Z. (2022). The gains and losses of supply-side regulation of “dry learning” photovoltaic industry. Stud. Sci. Sci. 40 (10), 1778–1787. doi:10.16192/j.cnki.1003-2053.20220314.001

Baron, R. M., and Kenny, D. A. (1986). The moderator-mediator variable distinction in social psychological research: conceptual, strategic, and statistical considerations. J. Pers. Soc. Psychol. 51 (6), 1173–1182. doi:10.1037/0022-3514.51.6.1173

Cai, X., Zhou, B., Cai, C., Pu, T., and Wang, Q. (2024). Impacts of decreasing subsidies for photovoltaic enterprises in China: a perspective from industrial chain segments. Environ. Dev. Sustain. doi:10.1007/s10668-024-04553-1

Chen, Z., and Wang, T. (2022). Photovoltaic subsidy withdrawal: an evolutionary game analysis of the impact on Chinese stakeholders’ strategic choices. Sol. Energy. 241, 302–314. doi:10.1016/j.solener.2022.04.054

Cui, Y., Khan, S. U., Li, Z., and Zhao, M. (2021). Environmental effect, price subsidy and financial performance: evidence from Chinese new energy enterprises. Energ. Policy 149, 112050. doi:10.1016/j.enpol.2020.112050

Dong, C., Zhou, R., and Li, J. (2021). Rushing for subsidies: the impact of feed-in tariffs on solar photovoltaic capacity development in China. Appl. Energ. 281, 116007. doi:10.1016/j.apenergy.2020.116007

Du, H., Hu, J., Wu, H., Li, T., and Chen, L. (2023). Analysis of the threshold effect of renewable energy industry subsidies based on the perspective of industry life cycle. Sustainability 15 (21), 15199. doi:10.3390/su152115199

Du, J., and Mickiewicz, T. (2016). Subsidies, rent seeking and performance: being young, small or private in China. J. Bus. Ventur. 31 (1), 22–38. doi:10.1016/j.jbusvent.2015.09.001

Hu, H., Tang, P., Zhu, Y., Hu, D., and Wu, Y. (2020). The impact of policy intensity on overcapacity in low-carbon energy industry: evidence from photovoltaic firms. Front. Energy. Res. 8. doi:10.3389/fenrg.2020.577515

Jiang, C., Liu, D., Zhu, Q., and Wang, L. (2021). Government subsidies and enterprise innovation: evidence from China′s photovoltaic industry. Dyn. Nat. Soc. 2021 (1), 1–9. doi:10.1155/2021/5548809

Jiang, T., and Luo, Z. B. (2022). LOC102724163 promotes breast cancer cell proliferation and invasion by stimulating MUC19 expression. China Ind. Econ. 23 (05), 100–120. doi:10.3892/ol.2022.13220

Lee, K. H., and Min, B. (2015). Green R&D for eco-innovation and its impact on carbon emissions and firm performance. J. Clean. Prod. 108, 534–542. doi:10.1016/j.jclepro.2015.05.114

Li, P., Lu, Y., and Wang, J. (2016). Does flattening government improve economic performance? Evidence from China. J. Dev. Econ. 123, 18–37. doi:10.1016/j.jdeveco.2016.07.002

Lim, C. Y., Wang, J., and Zeng, C. (2018). China’s “mercantilist” government subsidies, the cost of debt and firm performance. J. Bank. Financ. 86, 37–52. doi:10.1016/j.jbankfin.2017.09.004

Lin, B., and Luan, R. (2020). Do government subsidies promote efficiency in technological innovation of China's photovoltaic enterprises?. J. Clean. Prod. 254, 120108. doi:10.1016/j.jclepro.2020.120108

Liu, D., Liu, Y., and Sun, K. (2021). Policy impact of cancellation of wind and photovoltaic subsidy on power generation companies in China. Renew. Energ. 177, 134–147. doi:10.1016/j.renene.2021.05.107

Liu, M., Liu, L., Xu, S., Du, M., Liu, X., and Zhang, Y. (2019). The influences of government subsidies on performance of new energy firms: a firm heterogeneity perspective. Sustainability 11 (17), 4518. doi:10.3390/su11174518

Luan, R., and Lin, B. (2022). Positive or negative? Study on the impact of government subsidy on the business performance of China’s solar photovoltaic industry. Renew. Energ. 189, 1145–1153. doi:10.1016/j.renene.2022.03.082

Pang, R., Shi, M., and Zheng, D. (2022). The moderating role of firm heterogeneity on the performance of environmental regulation in China. Environ. Dev. Sustain. 24 (5), 6302–6326. doi:10.1007/s10668-021-01703-7

Qi, X., Guo, Y., Guo, P., Yao, X., and Liu, X. (2022). Do subsidies and R&D investment boost energy transition performance? Evidence from Chinese renewable energy firms. Energ. Policy 164, 112909. doi:10.1016/j.enpol.2022.112909

Rao, A. M., Dagar, V., Sohag, K., Dagher, L., and Tanin, T. I. (2023). Good for the planet, good for the wallet: the ESG impact on financial performance in India. Financ. Res. Lett. 56, 104093. doi:10.1016/j.frl.2023.104093

Torani, K., Rausser, G., and Zilberman, D. (2016). Innovation subsidies versus consumer subsidies: a real options analysis of solar energy. Energ. Policy 92, 255–269. doi:10.1016/j.enpol.2015.07.010

Wang, C., Yi, J., Kafouros, M., and Yan, Y. (2015). Under what institutional conditions do business groups enhance innovation performance?. J. Bus. Res. 68 (3), 694–702. doi:10.1016/j.jbusres.2014.08.002

Wang, H., Zheng, S., Zhang, Y., and Zhang, K. (2016). Analysis of the policy effects of downstream Feed-In Tariff on China’s solar photovoltaic industry. Energ. Policy 95, 479–488. doi:10.1016/j.enpol.2016.03.026

Wang, H., Zhu, X., and Yin, C. (2022). Research on the development of photovoltaic industry and the impact of electricity price subsidy policy in China. J. Quantitative and Tech. Econ. 39 (07), 90–112. doi:10.13653/j.cnki.jqte.2022.07.001

Wang, P., Yuan, L., and Kuah, A. T. H. (2017). Can a fast-expanding market sustain with supply-side government aid? An investigation into the Chinese solar photovoltaics industry. Thunderbird. Int. Bus. 59 (1), 103–114. doi:10.1002/tie.21771

Wang, X. H., Fan, M., Fan, Y. J., Li, Y., and Tang, X. H. (2022). R&D investment, financing constraints and corporate financial performance: empirical evidence from China. Front. Env. Sci-switz 10. doi:10.3389/fenvs.2022.1056672

Wang, Y. H., Luo, G. L., and Guo, Y. W. (2014). Why is there overcapacity in China's PV industry in its early growth stage?. Renew. Energ. 72, 188–194. doi:10.1016/j.renene.2014.07.008

Wang, Z., and Fan, W. (2021). Economic and environmental impacts of photovoltaic power with the declining subsidy rate in China. Environ. Impact 87, 106535. doi:10.1016/j.eiar.2020.106535

Xiong, Y., and Yang, X. (2016). Government subsidies for the Chinese photovoltaic industry. Energ. Policy 99, 111–119. doi:10.1016/j.enpol.2016.09.013

Xu, Q., Lu, Y. J., Lin, H., and Li, B. Y. (2021). Does corporate environmental responsibility (CER) affect corporate financial performance? Evidence from the global public construction firms. J. Clean. Prod. 315, 128131. doi:10.1016/j.jclepro.2021.128131

Yu, D., and Lv, Y. (2015). Improper government intervention and overcapacity in strategic emerging industries: a case study of China’s photovoltaic industry. China Ind. Econ. (10), 53–68. doi:10.19581/j.cnki.ciejournal.2015.10.005

Yu, F., Wang, L., and Li, X. (2020). The effects of government subsidies on new energy vehicle enterprises: the moderating role of intelligent transformation. Energ. Policy 141, 111463. doi:10.1016/j.enpol.2020.111463

Zhang, H., Li, L., Zhou, D., and Zhou, P. (2014). Political connections, government subsidies and firm financial performance: evidence from renewable energy manufacturing in China. Renew. Energ. 63, 330–336. doi:10.1016/j.renene.2013.09.029

Zhang, H., Xu, Z., Zhou, Y., Zhang, R., and Cao, J. (2021). Optimal subsidy reduction strategies for photovoltaic poverty alleviation in China: a cost-benefit analysis. Resour. Conserv. Recy. 166, 105352. doi:10.1016/j.resconrec.2020.105352

Zhang, H., Zheng, Y., Ozturk, U. A., and Li, S. (2016). The impact of subsidies on overcapacity: a comparison of wind and solar energy companies in China. Energ 94, 821–827. doi:10.1016/j.energy.2015.11.054

Zhang, L., Wang, J., Wen, H., Fu, Z., and Li, X. (2016). Operating performance, industry agglomeration and its spatial characteristics of Chinese photovoltaic industry. Renew. Sust. Energ. Rev. 65, 373–386. doi:10.1016/j.rser.2016.07.010

Zhang, Q., Zhao, J., and Zhou, D. Q. (2024). Can the cancellation of government subsidies alleviate the phenomenon of overcapacity in the photovoltaic module industry? From a dynamic perspective. Environ. Dev. Sustain. 26 (3), 6419–6441. doi:10.1007/s10668-023-02969-9

Zhang, S., and He, Y. (2013). Analysis on the development and policy of solar PV power in China. Renew. Sust. Energ. Rev. 21, 393–401. doi:10.1016/j.rser.2013.01.002

Zhang, W., and Wang, Y. (2023). Impacts of subsidy reallocation policy on the innovative performance: empirical evidence from photovoltaic industry in China. Financ. Res. Lett. 58, 104447. doi:10.1016/j.frl.2023.104447

Zhang, X. B., Duc, T. P., Mutuc, E. B., and Tsai, F. S. (2021). Intellectual capital and financial performance: comparison with financial and pharmaceutical industries in vietnam. Front. Psychol. 12, 595615. doi:10.3389/fpsyg.2021.595615

Zhao, S., Yu, L., and Zhang, Z. (2023). Photovoltaic supply chain and government subsidy decision-making based on China’s industrial distributed photovoltaic policy: a power perspective. J. Clean. Prod. 413, 137438. doi:10.1016/j.jclepro.2023.137438

Keywords: China’s photovoltaic industry, financial performance, phasing out subsidy, photovoltaic enterprises, difference-in-differences model

Citation: Yang L, Hua H and Zhang J (2024) The impact of phasing out subsidy for financial performance of photovoltaic enterprises: evidence from “531 new policy” on China’s photovoltaic industry. Front. Energy Res. 12:1486351. doi: 10.3389/fenrg.2024.1486351

Received: 26 August 2024; Accepted: 04 October 2024;

Published: 16 October 2024.

Edited by:

Gang Liu, Tianjin University, ChinaReviewed by:

Meilian Liu, Guilin University of Electronic Technology, ChinaDongying Sun, Jiangsu University, China

Lan Luo, Nanjing University, China

Copyright © 2024 Yang, Hua and Zhang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jie Zhang, emhhbmdqaWVfamllQDEyNi5jb20=

Lianfen Yang1

Lianfen Yang1 Hongyan Hua

Hongyan Hua Jie Zhang

Jie Zhang