- Division Future Energy and Industry Systems, Wuppertal Institute for Climate, Environment and Energy, Wuppertal, Germany

Hydrogen plays a pivotal role in global efforts to decarbonize energy and industrial sectors. The European Union, particularly Germany, anticipate a significant reliance on hydrogen imports in the medium to long term, identifying the Middle East and North Africa (MENA) region as a key potential producer and exporter of green hydrogen and its downstream products. Yet, investment risks pose significant challenges to advancing the region’s green hydrogen and synthetic fuel industries. However, systematic comparative risk analyses for these sectors across MENA countries remain limited. This study addresses the research gap by conducting a comparative risk assessment for renewable energy and green hydrogen and synthetic fuel development in 17 MENA countries. A comprehensive framework evaluating macro and micro risks was applied, along with two contrasting risk scenarios to explore future developments under different risk conditions. The findings reveal that while MENA countries hold promise, most face at least moderate risks, underscoring the complexity of fostering these industries regionally.

1 Introduction

In line with the decarbonisation targets set out in the 2015 Paris Climate Agreement, many countries have decided to aim for net-zero emissions by 2050. To accomplish this target, hydrogen is increasingly being recognised as a key strategic element to drive the energy transition forward (IRENA and RMI 2023). Hydrogen and the subsequent production of synthetic fuels and feedstocks is expected to provide solutions to some of the major challenges arising from the shift from a fossil fuel-based energy system to a renewable energy-based system. Accordingly, many countries have or are in the process of publishing hydrogen strategies. This includes the European Union (EU) who published the first European Hydrogen Strategy in 2020 (EHS 2020) and also a number of its member states who published national strategies like for example France, the Netherlands, Spain or Germany (IRENA 2022). These strategies underline the importance of a rapid development of hydrogen and synthetic fuels for the energy transition. Especially renewable-based so called “green hydrogen” is projected to play an important role to ensure a low-carbon emission development according to these strategies. But already today it seems clear that the domestic generation potential of green hydrogen in Europe will not be sufficient to cover the predicted demand. Therefore, the strategies of the EU as a whole and member states, particularly Germany, foresee that in the medium to long term, substantial quantities of hydrogen will need to be imported (EC 2022; BMWi 2020). In order to serve these developing markets, countries with high renewable energy potential are expected to become the leading producers and exporters of green hydrogen. Against this background, the Middle East and North Africa (MENA) are frequently highlighted as potential future producers and exporters of green hydrogen due to their favourable solar and wind energy potential and geographic proximity to Europe (Braun et al., 2022).

However, the development of green hydrogen and synthetic fuel sectors will not only be determined by the renewable energy potential and the transport distances but also to a large extent by the question of the risk associated with investments and business activities in these sectors in the individual countries. This applies both to the development of the sector to meet domestic demand and to the development of export capacities for synthetic fuels and/or their precursors, including green hydrogen. Until now however, the complexity of the risks surrounding the development of green hydrogen and synthetic fuel projects is not yet sufficiently understood and the challenges are therefore widely underestimated (Wietschel et al., 2020). In order to determine as to where the development could be most beneficial because the sector faces lower risks compared to other countries, it is necessary to compare the conditions in different countries. Such comparative analyses of country risks for the renewable energy sector for the entire MENA region, as well as country risk assessments for the development of a green hydrogen and downstream synthetic fuel sectors do not exist to date to the best of the authors’ knowledge. This is where the present study comes in and conducts a comparative analysis of risks for the (further) development of the renewable energy sector and the green hydrogen and synthetic fuel sector in 17 MENA countries. The group of countries analysed includes Algeria, Bahrain, Egypt, Iraq, Iran, Jordan, Kuwait, Lebanon, Libya, Morocco, Oman, Qatar, Saudi Arabia, Syria, Tunisia, the United Arab Emirates (UAE) and Yemen. By elucidating the complex risk landscape associated with the development of green hydrogen and synthetic fuels, this study provides critical insights that contribute to a more nuanced understanding of the factors influencing sector development.

2 State of the art: assessing country risks for green hydrogen and synthetic fuel development

The general importance of country risk assessments, is underlined for instance by the existence of several major country risk rating agencies. Recent geopolitical events, such as the war in Ukraine, have furthermore renewed the attention paid to country risk analysis. Because despite the fact that globally most countries welcome foreign investments and companies, these are today often exposed to a broader range of risks than during the nationalisation wave in the 1960s and 1970s (Jakobsen, 2010). Moreover, reputational risks are also becoming increasingly important when investing in other countries (Stephens 2015). However, while country risks play an important role in the context of international business activities, there is no definite answer to the question of how country risks can be defined and assessed. Accordingly, to date, there is no uniform definition of what exactly the term “country risk” encompasses (Bouchet et al., 2018). Moreover, the terms country risk, political risk or sovereignty risk are sometimes used in parallel, although they actually describe different risks (Moosa 2002). Originally, country risk was defined mainly in economic terms, as the risk that a government (sovereignty risk) or another contracting party cannot or will not meet their obligations (Kosmidou et al., 2008; Timurlenk and Kaptan 2012).

But country risks cannot only be of economic nature. Moreover, risks today can no longer emanate only from state actors, but also from non-state actor groups. In order to better reflect the multidimensional nature of country risks, the term country risk is often defined more broadly as the sum of risks associated with investments in another country (Kosmidou et al., 2008; Sottilotta 2013). This can include economic as well as political, social or ecological drivers.

A distinction can be made between “macro risks”, which can universally affect all sectors and business activities in a country, and “micro risks”, which specifically affect one sector, project or business activity (Fitzpatrick 1983; Kobrin 1982; Kosmidou et al., 2008; Oetzel et al., 2001). Macro risks can be, for example, political unrest, general tax increases or nationwide strikes, while micro risks can include, for example, import or export duties on certain technologies or products or specific licensing processes. Different sectors, industries, projects or companies can accordingly face significantly different risks within a given country (Al Khattab et al., 2008). The perspective from which the risk assessment is conducted is therefore crucial and has an impact on the methods chosen and the risks that need to be assessed (Sottilotta 2013). In addition to the perspective, risk perception - the subjective interpretation of risks - varies not only between stakeholders but also across countries, depending on their respective roles in the future hydrogen economy. The way in which risks are perceived and managed is influenced by a country’s position - whether as an energy importer or exporter - and its specific interests and priorities within the developing hydrogen sector. For this reason, it is important that risk assessments are always specific to the context or question under consideration.

There are a number of publications on the general risks or barriers for renewable energy, such as the overview studies by the International Renewable Energy Agency (IRENA 2018), which summarises the most important challenges for the expansion of investments in renewable energy and its development, or the study by Michelez et al. (2011) for the International Energy Agency (IEA) on risks for projects with different renewable energy technologies. Risk mitigation tools for renewable energy investments have also been summarised by IRENA (2016) and Waissbein et al. (2013) developed a methodology to compare different derisking tools and their impact on risks. However, analyses of the specific country risks associated with the development and expansion of the renewable energy sector and a synthetic fuel sector, which also includes the green hydrogen economy, have so far only been available in very limited numbers in the academic and grey literature. For Europe, for example, Egli (2020) has studied the investment risk of wind and solar plants in Germany, Italy and the United Kingdom, providing valuable insights on the five most relevant investment risks related to renewable energies in the given context. Noothout et al. (2016) analysed the impact of renewable energy investment risk in the EU. Jankauskas et al. (2014) look at the risk drivers for renewable energy investment projects from a stakeholder perspective in Gatzert and Kosub (2016) have categorised the main risk drivers of political risks associated with renewable energy projects in developed countries. For developing and emerging countries, political risks are modelled by Trotter et al. (2018) for electrification in Southern Africa, highlighting the role of socio-political factors. While Rambo (2013) who considers market risks in financing projects in Kenya, showed the relevance of off-taker and demand risks. Chawla et al. (2018) examine the risks of investment in Indonesia and South Africa, showing that demand and transmission risks but also land acquisition risks pose significant challenges. Spyrou et al. (2019)) highlight the challenges of planning energy infrastructures in fragile states, noting difficulties in data collection in developing countries and the complexity of assessing societal risks globally. In the MENA region, Shimbar and Ebrahimi (2019) explore political risk and investment, using Iran as a case study to evaluate renewable energy investments in a high-risk political environment. In addition, the RES4MED (2016) analyses project financing risks for renewable energy systems in Egypt, listing a wide number of potential risks. For North Africa, Schinko and Komendantova (2016) have analysed the impact of risk reduction on electricity generation with solar thermal energy. Labordena et al. (2017) studied the impact of political and economic barriers to solar thermal energy in Southern Africa. The latter two studies show that country risks can significantly influence costs and ultimately the investment decision. Comparative analyses of country risks for the renewable energy sector for the entire MENA region as well as country risk assessments for the development of a green hydrogen and downstream synthetic fuels are missing to date.

3 Methods

In order to address this research gap, the present study conducted a comparative analysis of country risks for the (further) development of the renewable and green hydrogen and synthetic fuels sectors in 17 MENA countries. Country risk is understood here as the risk of strategic, financial or personnel related losses resulting from country-specific differences in the political and economic environment, socio-economic conditions, institutional structures, currency aspects, natural conditions and geographical location. In terms of perspective, the risks were assessed from a German or European viewpoint for the development of the export sectors of renewable energies, green hydrogen and synthetic fuels in the individual MENA countries.

To assess country risks, a wide range of approaches exists. Today, country risk assessments are predominantly conducted by private institutions, such as credit rating agencies, insurance companies, or professional intelligence firms, as well as public entities like government ministries or multilateral development banks. A common feature of these assessments is that, in most cases, the methodologies used for evaluating risks are either not disclosed or are shared only to a very limited extent. In many cases, also the results are not freely available (Sottilotta, 2013). This lack of transparency can impede a comprehensive understanding of these risk evaluations. Accordingly, it is difficult to assess the different methods and compare the results (Timurlenk and Kaptan, 2012). Moreover, a certain degree of subjectivity is always inherent in the assessment of risks (Stephens, 2015) and the results can only be as good as the information they incorporate (Sottilotta, 2013). Furthermore, it is important to note that risk ratings are not intended to predict, for example, political crises, because so-called black swan events are defined precisely by the fact that they cannot be predicted. Thus, even leading rating agencies can misjudge the creditworthiness of sovereign states and companies (Stephens, 2015).

Nevertheless, country risks can be evaluated fairly well with systematised assessments. In terms of analytical methods for country risks, a general distinction can be made between qualitative or quantitative methods. The range extends from fully qualitative methods (e.g. in the form of country reports) to semi-structured studies (e.g. indicator assessments) to fully quantitative analyses (e.g. computer-based early warning systems). However, most country risk analyses combine both qualitative and quantitative information into one assessment (Timurlenk and Kaptan, 2012).

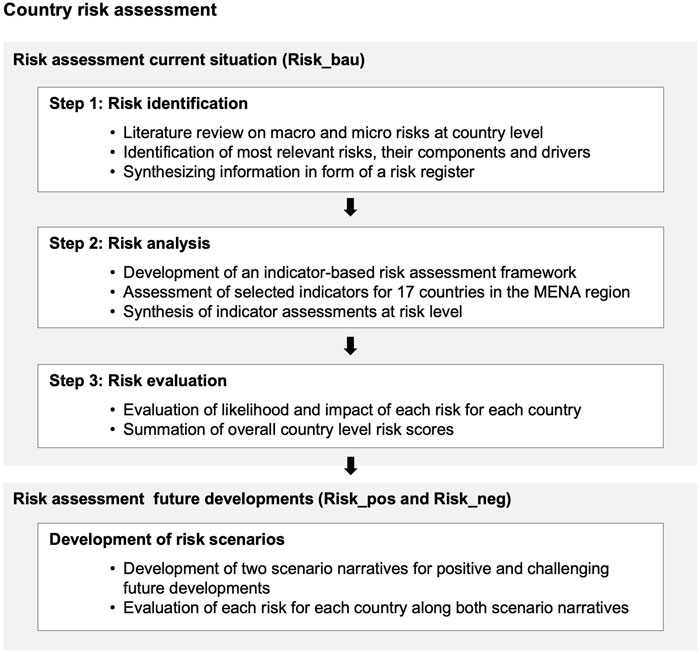

This is also the case in the present study. A risk assessment framework was developed that comprises both quantitative and qualitative variables which were combined to evaluate the country risks. Following the structure of the EU general risk assessment methodology (EU, 2016), which is in line with the ISO 31000:2018 process, the country risk assessment was conducted in three steps: risk identification, risk analysis and risk evaluation (Figure 1). The resulting assessment is considered as base case risk scenario (Risk_bau). In order to account for possible future developments the risk assessment was followed by the development of two additional risk scenarios, outlining a positive (Risk_pos) and a challenging (Risk_neg) development of country risks.

In the following, the methodological approach within the framework of these three steps and for the development of the two additional risk scenarios is described in more detail.

3.1 Country risk assessment

3.1.1 Risk identification

In this first step the relevant risks were identified and described. This requires answering the questions of what can happen, why, and what the consequences are for the development of the renewable energy and green hydrogen and synthetic fuel sectors. In the literature on renewable energy, a number of methods are used to identify risks, including literature reviews (e.g., Gatzert and Kosub, 2016; Noothout et al., 2016; Trotter et al., 2018), expert interviews or stakeholder consultations (e.g., in Egli, 2020; Jankauskas et al., 2014; Schinko and Komendantova, 2016). Using a selection of these techniques, risks were identified in a three-stage process.

(1) It starts with a literature review of (a) macro risks at country level, (b) on barriers and micro risks associated with the renewable energy sector development and implementation, and (c) on risks in the fossil energy sector and other relevant industries that have similar preconditions or infrastructure needs as the green hydrogen and synthetic fuel sectors.

(2) Based on the literature review the risks were screened regarding their relevance for the renewable and synthetic fuel sector development as well as for the comparison of countries.

(3) Finally, a risk register containing information about each identified risk, such as risk drivers, main actors, relevance in different project implementation phases and consequences for the renewables or synthetic fuel sector was developed.

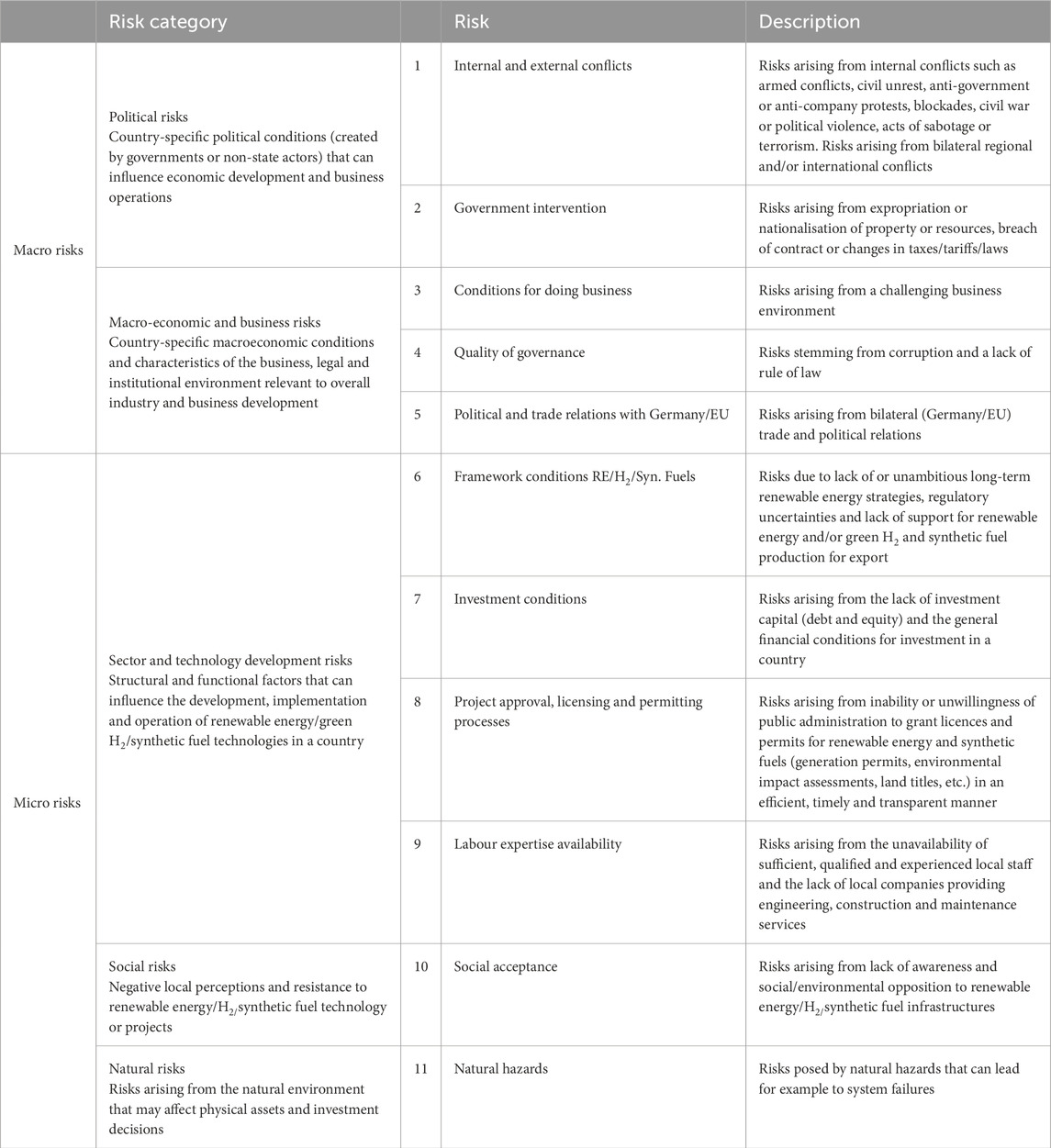

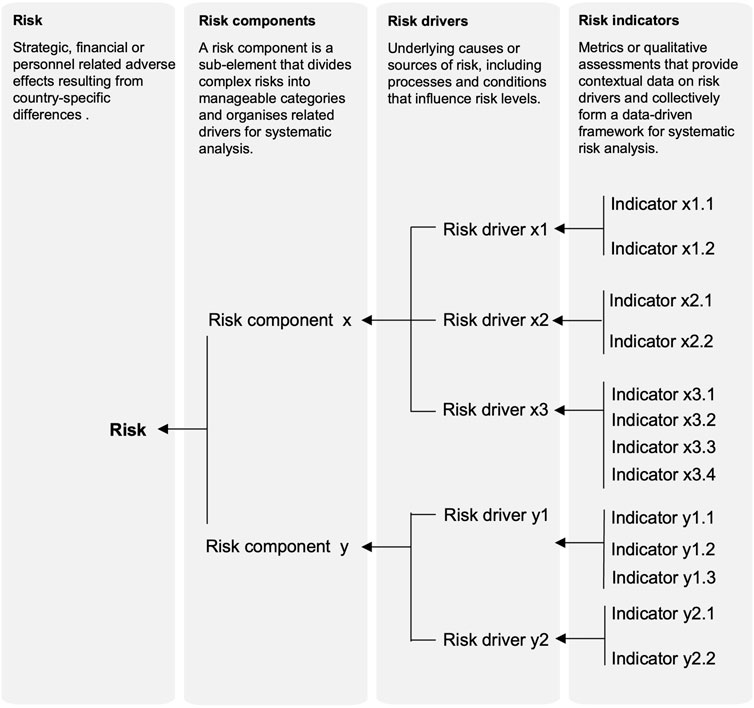

In total, eleven risks were identified in this process, which can be divided into five categories. Two categories with a total of five risks belong to the macro risks, and three categories with a total of six risks belong to the micro risks that specifically affect the development of the renewable and green hydrogen and synthetic fuel sectors (Table 1). The risks are composed of a varying number of risk drivers. Risk drivers refer to the underlying causes or sources of risk, including processes and conditions that influence risk levels. These drivers can be either internal or external and impact the overall risk exposure of a country or region (Qazi and Simsekler, 2022). The macro risk of internal and external conflicts, for example, is composed of the components political stability, social stability, economic stability and the geopolitical situation. These individual components are in turn influenced by various drivers. The risk component “social stability”, for example, is influenced by risk drivers such as unemployment, income disparities, population growth and the rate of urbanisation. Risks that were not taken into account in the present comparative country risk analysis are pure technology risks that do not vary between different countries (e.g., failure of technical components).

3.1.2 Risk analysis

After the risks were identified the second step was to analyse the risks considering the characteristics, sources and consequences of risk. To this end an indicator-based analytical framework was developed to investigate and assess the risks (Figure 2). More than 100 indicators were identified for assessing the different risk drivers based on their informative value and data availability. These include, for example, for the risk component “social instability”, indicators for risk drivers such as unemployment rate (especially youth unemployment), income inequality, unequal wealth distribution, degree of gender equality, urbanisation or population growth rate (a detailed list of risk components, drivers and associated indicators can be found in the Supplementary Material). The indicators were then assessed at country level. They include quantitative data and indices as well as qualitative information. Data was not available for every indicator in every country, however the range of the indicator set used ensured an assessment of all risks for all countries. After the assessment of the risk drivers with the help of the indicators, the information was qualitatively assessed and synthesised at risk level. This qualitative synthesis of the indicators was supplemented by further literature research, if necessary, in order to ensure the most comprehensive assessment of the risks.

3.1.3 Risk evaluation

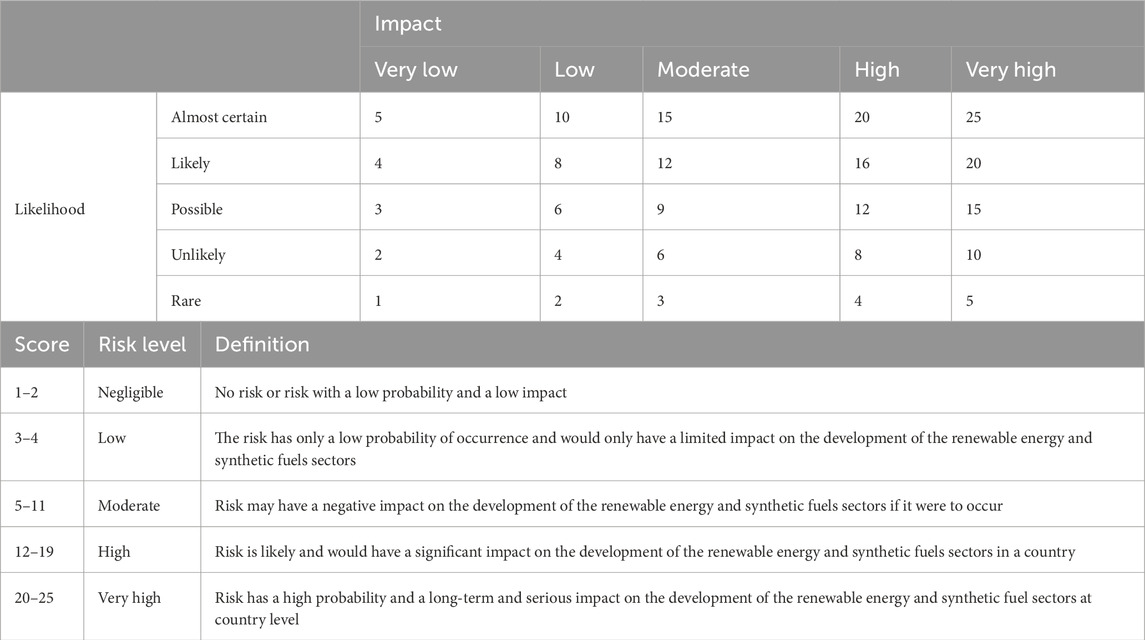

Based on the indicator assessment the risks were evaluated along the two dimensions of likelihood and potential impact. Likelihood is defined according to ISO 31000:2018 as the chance that something will happen, regardless of whether it is defined, measured or determined objectively or subjectively, qualitatively or quantitatively. Impact is defined as the consequence of events. These impacts can be certain or uncertain, positive or negative, direct or indirect (ISO, 2018). Both dimensions can be combined into one product, the risk value (Aven, 2017). In the present study, likelihood and impact were each recorded on a five-point scale and multiplied to a risk value presented in the form of a risk matrix (Table 2). The risk values are categorised into five risk levels (negligible, low, moderate, high, very high). This assessment was carried out for the macro risks jointly for renewable energy as well as the green hydrogen and synthetic fuel development. The micro risks, on the other hand, were assessed separately, for the renewable sector on the one hand and for a potential green hydrogen and synthetic fuel sector on the other hand. The result is an assessment of each risk for each country and for both sectors. The individual risk scores were further combined into an overall country risk score in order to be able to compare the overall risk between countries. This summary of the risk assessment is compensatory, which means that a favourable assessment in one area can compensate for a negative assessment for another risk. The range of possible overall risk scores is between a minimum of 11 and a maximum of 275 points.

3.2 Risk scenarios

The risk assessment carried out maps the risks from a current perspective, which in the following analysis is considered as a business-as-usual scenario (Risk_bau). However, recognizing that risks are not static and can evolve over time, it becomes essential to consider how they may shift in the future, particularly given the region’s volatility and complex dynamics. In order to meet the objective of assessing the risks to the longer-term development of the sector, it is therefore necessary to examine how these risks may change. In view of the complexity and the multitude of possible events, uncertainty plays a central role, as it is difficult to predict how international, national, regional, or local developments will unfold and how these interconnected factors might influence risk (Clark, 2000; Oetzel et al., 2001). In regions like North Africa and the Middle East, where political, economic, and social structures are often vulnerable to rapid change, this uncertainty is even more pronounced.

To address this uncertainty, scenario building is used as a tool to explore a range of possible futures (Stephens, 2015). In risk assessment, scenarios are therefore used in various forms to show different futures and consider the implications for decision-making (Catenazzi, 2012.; Dunn Cavelty et al., 2011). In this study, three scenarios are employed to map the future risk landscape: the current risk assessment as the base scenario (Risk_bau) and two further contrasting scenario narratives. One scenario describes a positive development in which the risks are reduced, which would thus be beneficial for the development of the renewable and green hydrogen sectors (Risk_pos). The other scenario shows challenging developments that could increase the risks in both sectors (Risk_neg). These scenarios are designed to capture the range of uncertainties and are adapted to the specific situations of each of the seventeen countries studied. Subsequently, for the different scenarios, each risk was assessed individually for each country. Although real-world trajectories may differ or integrate aspects of both scenarios, this approach allows for a broader exploration of the possibility space. The Risk_pos scenario shows what positive effects de-risking efforts could have, and in the opposite case, the Risk_neg scenario shows how negative developments could increase risks. Realistically, different countries may take distinct paths, with risks evolving in opposing directions or following more moderate courses. nuanced paths.

4 Analysis and results

4.1 Analysis of individual risks

In the following, the results of the detailed macro and micro risk assessments from the current perspective (Risk_bau) are compared at country level. The assessment presented herein results from a systematic series of evaluation steps detailed in Section 3. The data originate from the analysis of over 100 indicators assessed through the developed indicator-based analytical framework, which were subsequently synthesized in the analytical phases to provide clear insights into both micro and macro risks.

4.1.1 Macro risks

A major macro risk is the risk of (1) internal and external conflicts. These can result from political, social and economic instability as well as the general geopolitical situation in the region. They can affect the development of renewable energies as well as green hydrogen and synthetic fuels, for example by leading to delays and cost increases in the implementation phase and even the termination of the project. Later, they can also have an impact on operations, for example through physical damage to the plants, interruptions to operations or loss of revenue (Belaîd et al., 2021). The assessment of this risk shows that, as expected, the highest risk is in countries with ongoing conflicts, such as Libya, Syria and Yemen followed by Iran and Iraq. But Algeria, Bahrain, Egypt, Lebanon and Saudi Arabia are also considered to have a higher risk. Algeria faces a variety of political, economic and social struggles. The economy and the state in Algeria are highly dependent on oil and gas exports and their revenues, which declined sharply during the worldwide economic downturn as result of the Corona pandemic (World Bank 2023). And also, the current high price level cannot hide the fact that by 2050, in a decarbonising world, this dependence on revenues from the fossil sectors will be a high economic risk. Egypt also faces multiple economic challenges due to high inflation, declining economic activity, increasing poverty and unemployment, and dependence on foreign financial assistance to stabilise the economy (Agarwal and Mazarei 2024). Coupled with political repression from the military-backed political system, the risk in Egypt is considered high. The risk of conflict in Saudi Arabia, in turn, is increased by regional tensions with Iran, but also by the country’s direct involvement in the Yemen war. At the same time, the already high unemployment rate (ILOSTAT 2020) and high population growth (World Bank 2020c), combined with the heavy dependence on oil and gas revenues (IMF-International Monetary Funf, 2022) and the monopolisation of power, represent political risk drivers for Saudi Arabia’s long-term future stability.

Like conflicts, unforeseen and adverse (2) government interventions pose a risk to the development of the renewable energy and green hydrogen sector. They can lead to cost increases, delays in project implementation, interruptions or instability in business operations, or the complete loss of revenues. In countries where the economy is strongly controlled by the state, but also in countries with weak institutions, foreign investments may be exposed to the risk of expropriation in case of disputes with the government. In addition to conflicting countries, the likelihood of this happening extends to countries such as Algeria, Egypt, Iran and Lebanon (TGE-The Global Economy, 2020).

Besides these political risks, macroeconomic and business risks such as (3) conditions for doing business are also of major importance for the development of the renewable energy and green hydrogen sector. These include operational risks such as a high level of bureaucracy and difficulties in enforcing contracts, but also trade barriers, as the green technology will have to be imported on a large scale, at least initially, and green hydrogen and synthetic fuel are to at least partially be exported. In conflict ridden countries like Libya, Syria and Yemen the conditions of doing business are difficult, the same holds true for countries in economic crisis like Lebanon and economically isolated Iran (World Bank 2020a). But also, in Algeria the business environment can be challenging, with limited private sector opportunities and difficulties in setting up a business (ibid.). In Egypt the condition for doing business have improved (ibid.) but, the country still lags behind other countries due to high level of bureaucracy and also the military’s involvement in the economy poses significant challenges for private sector companies. In addition, cross-border trade in Egypt is still a major obstacle, as is the currency risk (TGE-The Global Economy, 2020) due to the strong currency devaluation of recent years. In the Gulf States, but also in Jordan and Morocco, the conditions for doing business are considered more favourable, which reduces the risks for the development of the renewable energy and hydrogen sector. Economic free trade zones, tax incentives and simplified procedures are factors that help attract foreign investment. In most countries of the MENA region, however, the bureaucratic processes remain associated with considerable effort, yet this also applies to many other countries including Germany.

The (4) quality of governance relating to risks arising from corruption and poor rule of law is another macro-risk that can influence the development of a new hydrogen-related economic sector. Here, Jordan, Oman, Qatar, Saudi Arabia and the UAE are ranked as the lowest risk countries in the region, but even for these countries the risk is in the medium range (Figure 3). In Jordan, for example, the rule of law is rated good in terms of discrimination, corruption and impartial and effective application compared to other countries in the region (WJP-World Justice Project, 2020). The risk arising from legal and regulatory uncertainties, on the other hand, is still moderate. In Oman, enforcement of contracts is generally considered less costly and faster than in most other MENA countries (GAN 2020). In Qatar, international trade laws are applied in the economic sphere, which can be advantageous for foreign companies (NYU Law 2020). In addition to the rule of law, corruption also poses a significant risk to the business environment. While corruption and bribery are illegal in most countries, there is often a lack of enforcement of anti-corruption laws. As a result, corruption, middlemen and nepotism in the economic and social spheres remain a problem for doing business. Only in Oman do anti-corruption laws appear to be largely enforced effectively, and corruption and bribery are assessed to be less prevalent compared to other countries in the region (GAN 2020). In Qatar, corruption is also assessed to be relatively low and considered to be among the lowest in the MENA region (ibid.). Risks related to the quality of governance are assessed as high in countries affected by conflicts and crises, such as Lebanon, Libya, Syria and Yemen, but also in countries like Kuwait, where informal monopolies and oligopolies exist and links between the administration and private companies have led to unequal competition in the market (ibid.). And also in Morocco, the insufficiencies of the legal system and the lack of transparency (WJP-World Justice Project, 2020) can pose a risk for investments in the renewable energy and green hydrogen sector.

As far as (5) political and trade relations with Germany/EU are concerned, the risks are assessed as lower in countries with which good and reliable partnerships have been established over a longer period of time, for example in the form of bilateral agreements and treaties, existing energy partnerships or institutional relations. The risk resulting from the low quality of political and trade relations is correspondingly higher for countries affected by conflicts, economic crises and sanctions, such as Iran, Iraq, Libya, Syria or Yemen. Countries such as Morocco, Jordan, Tunisia, Qatar and the UAE, on the other hand, are considered to be less exposed to the risks arising from poor political and trade relations. However, diplomatic relations between Germany and Morocco, for example, have been severely affected in 2022 by the opposing positions in the context of the Western Saharan conflict. This shows that even seemingly stable relations can be subject to unforeseen changes that affect the development of green hydrogen.

4.1.2 Micro risks

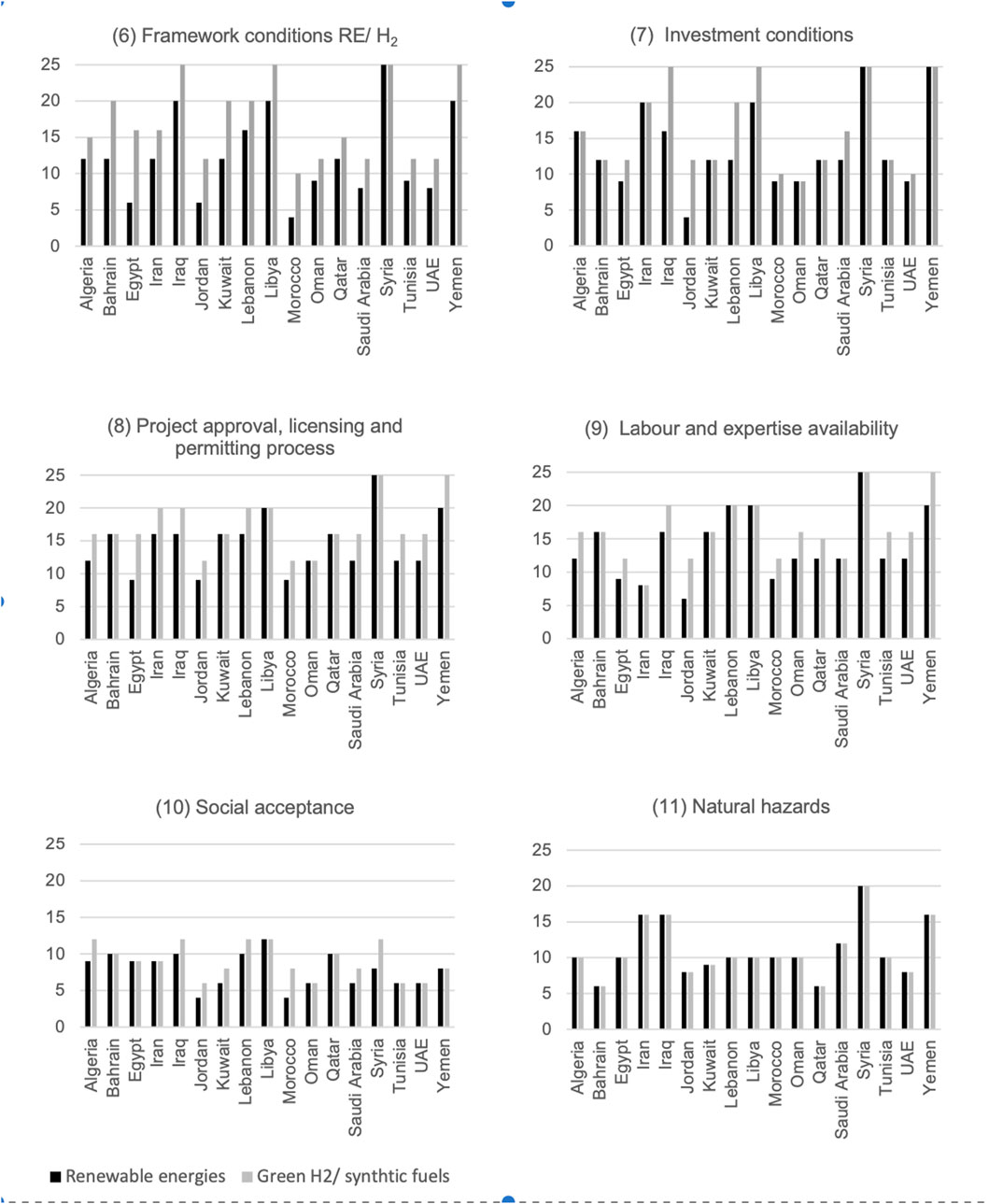

At the micro level, one of the risks affecting development are the (6) framework conditions for renewable energies and for green hydrogen and synthetic fuels. These framework conditions include the strategic role that a country assigns to decarbonisation as a whole and to renewable energies and increasingly also to green hydrogen and synthetic fuels in particular, e.g., in the form of set targets. It also considers, how seriously these targets are pursued, for example by setting the appropriate regulatory framework. Moreover, existing energy infrastructures such as pipelines, storage facilities and ports, which could be converted, can also play a role in the development of a green hydrogen and synthetic fuel sector. Here, gas and oil exporting countries such as Algeria, Egypt and the Gulf states could have a head start in developing this sector due to the existing infrastructure, but also the associated know-how. However, if we look at the renewable energy sector, almost all the countries studied have set ambitious targets (IEA/IRENA 2020). Yet, in terms of implementation and the share of renewables in the electricity mix, it is mainly countries such as Morocco or Jordan, that are the most advanced (World Bank 2020c). Therefore, these countries can draw on a larger pool of experience and know-how when it comes to the expansion of renewable energies, which are the backbone for the development of green hydrogen. The risks for the green hydrogen and synthetic fuels sector are generally higher, as the framework conditions have not yet been established and strategies and regulatory frameworks are only in the process of being developed in countries like Egypt, Morocco, Oman, Saudi Arabia, Tunisia or the UAE (Figure 4).

Another important risk stems from the (7) investment conditions, which include the availability of finance, but also financial incentives and market accessibility. Countries affected by conflicts but also by economic sanctions, such as Iran, obviously have the highest risks (Figure 4). Additionally, in countries where investment conditions remain restrictive for foreign investors, such as Algeria, even with the introduction of new laws aimed at improving the investment climate (USDoS-United States Department of State Publication and Bureau of Counterterrorism, 2024), lead to limited availability of finance for new infrastructure developments. In addition, the lack of or insufficient guarantees, as for example in Tunisia (IRENA 2021), but also the hesitation of national banks to finance renewables in the first place, are an obstacle to investments in the renewable and green hydrogen sector. For green hydrogen, the risks are generally higher as it is a new technology. In some countries, however, risks for the development of renewables and green hydrogen are considered to be similar. This may be the case if the conditions for renewable energies are not yet particularly attractive today or if the renewable energy sector is still just as much in its infancy as the green hydrogen sector. Consequently, the country-specific investment conditions for both sectors are similar as for example in Oman. On the other hand, in some countries such as Jordan, the investment conditions for renewable energies are favourable, but for the green hydrogen sector, no significant developments have been initiated to date, leading to a greater discrepancy between the risk assessments for renewable energy and green hydrogen. Moreover, the potential for exporting green hydrogen and synthetic fuels could become more challenging due to various risks, further increasing the uncertainty for investors and making large-scale investments in these sectors significantly riskier. Countries that are estimated to have lower risks for the green hydrogen development are those most advanced in the process of setting financial frameworks and creating incentives, such as for example Morocco, Oman or the UAE.

In terms of the risks arising from (8) project approval, licensing and permit procedures, the risks for renewable energies in all countries are lower than in the green hydrogen sector (Figure 4). Here, the procedures are only just being developed and international norms and standards are still largely lacking. Overall, however, the risks arising from the approval and licensing procedures are also to be estimated in the medium to high range for renewable energies. Due to the complexity of the procedures, low transparency and inefficient bureaucracy, approval, authorisation and licensing procedures are complex and time-consuming in almost all countries. This can cause delays in project development and implementation, thereby increasing the risk. Even in countries like Jordan, which have a well-developed renewable energy sector, the permitting and approval processes are not streamlined (OECD 2016). In other countries, such as Saudi Arabia, only limited information is available about the procedures (), which makes it difficult for project developers to plan the process and estimate the time frame, which increases the risks. Such risks can be reduced, for example, by establishing one-stop shops where all the necessary documents can be obtained. But risks can also be reduced by simplifying the procedures for project developers, as for example in Egypt, where authorities issue land permits and prepare general environmental impact assessments that only need to be supplemented by plot-specific planning questions without public consultation (NREA-New and Renewable Energy Authority, 2016).

In order to drive the energy transition (9) availability of labour and expertise is an important factor. Countries with an advanced renewable energy sector, such as Jordan and Morocco, have lower risks, as there is already access to a solid pool of expertise (Figure 4). Other countries with a high level of education and training, especially in technical disciplines such as engineering and chemistry, such as Iran or Tunisia (World Bank 2020b), and countries with existing oil and gas production sectors, such as Oman, Saudi Arabia or the UAE, also have a lower risk. On the other hand, countries that rely heavily on a foreign labour force, such as Kuwait and Bahrain (GLMM 2020), may have greater difficulties in ensuring the availability of labour and expertise for the development of new renewable energy and green hydrogen sectors. Especially as in the field of renewable energies, but also in the developing hydrogen sector, there is a massive shortage of skilled workers worldwide, which also represents a high-risk factor for the global energy transition.

The risks arising from the lack of (10) social acceptance are estimated as moderate to low for most countries (Figure 4). On the one hand, this is because the development of a new economic sector also promises new employment opportunities, which increases acceptance. On the other hand, however, this is not only because there might be no opposition, but also because public participation and the possibilities to prevent projects from being implemented are very limited in almost all countries. In addition, it is often marginalised groups who are affected and who do not have the power or the means to actually prevent projects from being implemented. This state of affairs is of course in no way to be supported, but it is unfortunately the reality in many of the countries studied. Thus, while selective protests are to be expected, the risk for the overall development of the sector is not considered to be very high. However, it must be said that in general there is very little information on the social acceptance of renewable energies and other green technologies in the MENA region therefore the assessments are associated with a high degree of uncertainty.

The risks arising from (11) natural hazards, such as extreme weather conditions for example sandstorms, extreme heat, thunderstorms or floods, were assessed jointly for renewable energies and green hydrogen. These natural events can damage or even destroy the infrastructures for renewable energies as well as for green hydrogen or synthetic fuels, but also reduce the production of electricity and fuels. With climate change, these risks from extreme weather events are expected to increase. While the risks in most countries are assessed to be overall moderate (Figure 4), the conflict-affected countries of Libya, Syria and Yemen were rated to have higher risks (IFHV and Bündnis Entwicklung Hilft, 2019). This is not necessarily because the risks posed by natural disasters are higher, but because the countries have no adaptation measures planned and often do not have the capacities and resources to repair the potential damages. In addition, it is assumed that new renewables and hydrogen production facilities are likely to include climate proofing considerations to protect the investments, so that the risk level is expected to remain overall moderate.

When comparing the results at risk level, it can be observed that there are general differences in the importance of macro risks and sector-specific micro risks between countries. Countries with higher risk scores tend to be characterised more by poorer macro risk scores. This are, for example, internal and external conflicts or overall unfavourable business conditions, which can have a strong impact on sector performance. In addition, it can be assumed that the reduction of macro risks will be much more difficult for countries than improvements in the area of micro risks. In concrete terms, for example, the economic situation of a country cannot be improved as quickly as regulations for the implementation of projects can be introduced or optimised.

4.2 Comparison of overall country risks and risk scenarios

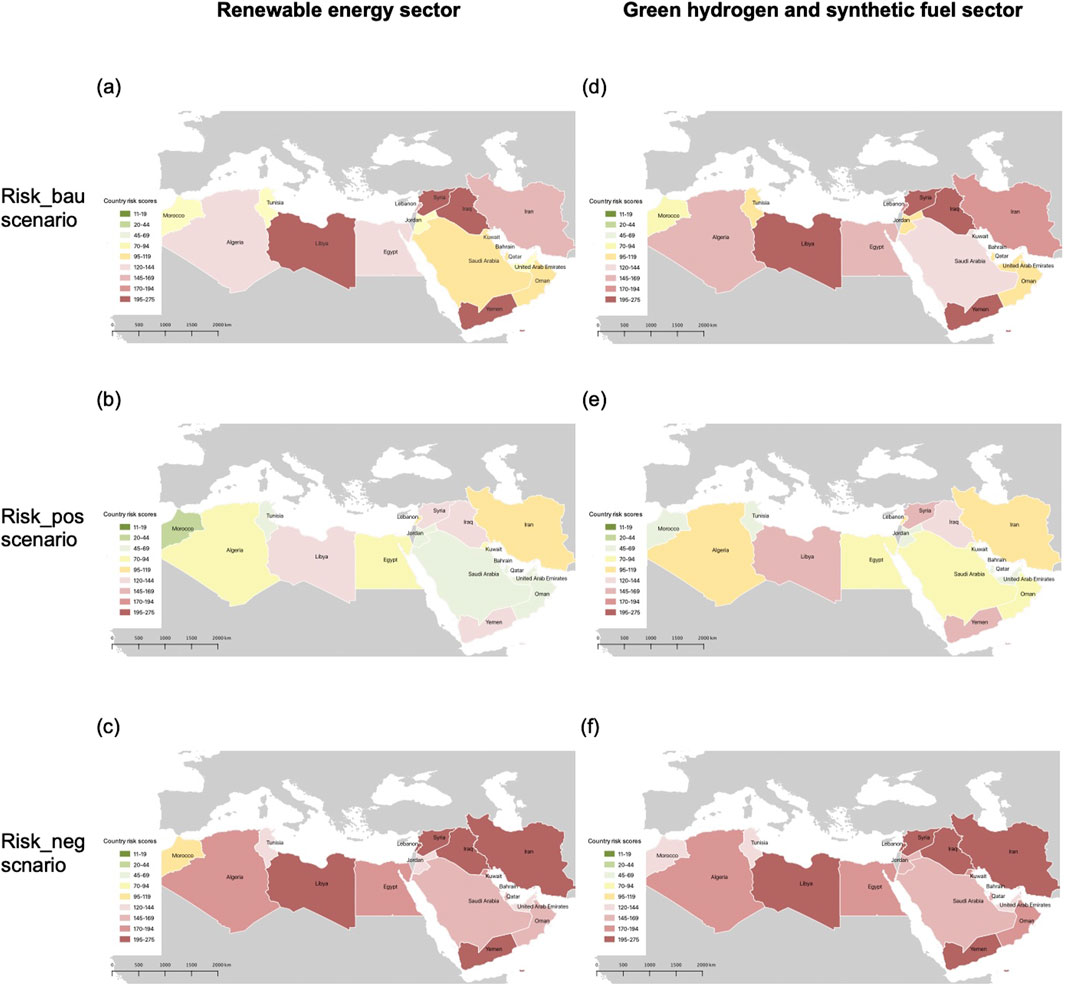

The evaluation of the individual country risks has been combined for each country into an overall country risk score. The overall risk scores allow for a comparison between the countries but also between the three risk scenarios as well as between the renewable energy development and the downstream green hydrogen and synthetic fuel sector. The results have been graphically summarized in form of maps for the renewable energy sector in Figures 5A–Cand for the green hydrogen and synthetic fuel sector in Figures 5D–F. The macroeconomic risks are considered to be the same for renewable energies and synthetic fuels. However, when comparing the micro risks for the renewable energy sector with the green hydrogen and synthetic fuel sector, obviously differences exist due to the different maturity of these sectors. In the following the results on the overall risks for the two sector developments are presented for the base case scenario and for the two risk scenarios outlining a positive or a challenging development.

Figure 5. Scenario-based mapping of country risk scores for renewable energy (A–C) and green hydrogen/synthetic fuel sectors (D–F): Risk_bau, Risk_pos and Risk_neg scenarios. Country risks renewable energy sector Risk_bau scenario.

4.2.1 Renewable energy sector

Figure 5A presents the regional comparison of the overall risks for the renewables sector in the Risk_bau scenario. It can be seen that Morocco, Jordan, the UAE and Tunisia have a moderate overall risk for the development of the renewables sector and thus perform better than other countries in the MENA region. The reasons for the better performance are on the one hand the lower sector-specific risks. Particularly, Morocco, Jordan and the UAE already have solid regulatory frameworks and large-scale projects have been implemented in these countries, such as the NOORo solar power plant in Ouarzazate, Morocco, with a capacity of 580 MW (Masen, 2024), or the Noor Abu Dhabi photovoltaic power plant with a capacity of 1.2 MW in the UAE (Noor Abu Dhabi 2024). Other large-scale projects have been announced like the 2 GW solar power plant in Al Dhafra south of Abu Dhabi (ADPV2 2024) or are in the construction phase like the solar power complex in Midelt, Morocco, which is expected to reach a capacity of 800 MW upon completion (MASEN 2024). Another special feature is the low levelised costs of electricity (LCOE) in the solar power plants in Morocco and the UAE, which are among the lowest in the world (Braun et al., 2022; WEC–World Energy Council, 2022). For countries such as Kuwait, Oman, Qatar or Saudi Arabia, the risk is higher, but still assessed as moderate. The majority of these countries have largely monopolistic electricity market structures, which can hinder competition and thus also the expansion of renewables (Poudineh et al., 2018). In Algeria and Egypt, meanwhile, the risk for the development of an export structure for renewables is considered higher. Although both countries have formulated ambitious expansion targets and Egypt has announced a large number of large-scale projects (IEA 2024), the macro risks, especially the political situation, represent an uncertainty factor for the sector’s development. Iran or Lebanon are classified as very risky in the overall assessment due to the existing political tensions and the very unstable economic situation. In Iraq, the political situation also remains critical and so far, there has been little movement in the renewable energy sector (Ersoy and Terrapon-Pfaff 2022). In the conflict countries Libya, Syria and Yemen, the risks are expected to be the highest and the development of a renewable energy sector, with a focus on exports, is assessed as less likely in a business-as-usual scenario, even in the longer term.

Compared to the base case scenario, Figure 5B shows the results of the country risk assessment for the renewable sector for the positive scenario narrative (Risk_pos). It is shown that the lowest risk is assumed for Morocco in this scenario. This is based on the assumption that the already positive development in the field of renewable energies will continue and that the framework conditions will keep improving so that the country can achieve its ambitious goals. Besides Morocco, Jordan, Oman, Qatar, Saudi Arabia, Tunisia and UAE are rated be at the lower end of the risk spectrum. In the 2030 strategies of most of these countries, renewable energy is a high priority (IEA/IRENA 2020). In this scenario, it is assumed that these strategies will be implemented and planned project schemes, such as the Saudi “Neom” project, will be successfully realised. This will increase local experience with renewables, which in turn will drive the further development of the sector. This increases visibility and - through the associated economic impact - local acceptance, which also benefits the development of the sector. For countries such as Algeria, Egypt or Iran, it is assumed that the domestic and foreign political situation will stabilise, thereby also reducing the risk for the implementation of renewable energy projects. For current war-torn areas such as Syria, Libya or Yemen, the risk remains elevated, because even if peace can be achieved, the long-term economic, social and societal impact of the conflicts is likely to delay the development of the renewable sector.

In the scenario presenting a more challenging environment for the renewable sector (Risk_neg), shown in Figure 5C, Morocco is still one of the countries with the lowest, but increased moderate risk for the development of the renewable sector. So far, Morocco has seen steady growth in project development and implementation, but in this scenario this growth could stagnate. In Jordan, Tunisia and UAE, the renewable energy deployment is not expected to be realised as planned due to various factors such as lack of funding, expertise, political support or infrastructural constraints. In addition to these sector-specific aspects, the development of macro risks such as political and economic instability in the countries but also the region as a whole also contribute to the increase in risk. In Algeria and Egypt, for example, a corresponding deterioration of the situation is anticipated in this scenario. For instance, an even stronger role of the military in the economy or increased control by the state could lead to more difficult conditions for investors. In addition, inefficient administrative structures can slow down the issuing of licenses and project permits and ultimately hinder the development of the sector. In already conflict-ridden states such as Syria, Libya or Yemen, the challenging scenario assumes that the situation does not genuinely improve and the risk remains correspondingly high. The renewable energy sector in these countries can therefore not develop on a larger scale, and in this scenario, renewables mainly play a role in the decentralised supply of households and small businesses, but are not available for export.

4.2.2 Green hydrogen and synthetic fuel sector

The production of green hydrogen and synthetic fuels will depend on electricity from renewable energy sources. Therefore, the rapid and widespread development of renewable energy will be a critical factor for the development of these sectors. In addition, however, further framework conditions, policy support and incentives are also needed to develop the technical infrastructures and value chains for green hydrogen and subsequent synthetic fuel production. Figure 5D shows the risk level for the development of the green hydrogen and synthetic fuel sector in the individual countries in the base case scenario (Risk_bau). Morocco has the lowest risk compared to the other countries, but still moderate risk levels. Jordan, Oman, Saudi Arabia, Tunisia and the UAE, the risk to the development of the green hydrogen and synthetic fuels sector is also estimated to be in the moderate range. Either green hydrogen is already being discussed at the political level in these countries and/or the first pilot plants are announced or already in the planning stage. For example, different plans are underway for electrolysis plants in Oman close to the port of Duqm (IEA 2024). In the UAE the first green hydrogen demonstration plant in the region was established during the Expo 2022 and the government owned renewable energy company Masdar aims to produce up to one million tonnes of green hydrogen per year by 2030 (Siemens 2021; Masdar 2023). Saudi Arabia aspires to become the world’s largest hydrogen producer and the first green hydrogen projects have been announced under the Neom project, such as the construction of a green hydrogen-based ammonia production plant with a capacity of 600 tonnes per day (IEA 2024). The other Gulf states such as Bahrain Kuwait and Qatar have a higher risk. In general, for the natural gas-exporting countries, there is also a risk that instead of renewable energy sources, fossil fuels will be used for the production of hydrogen and synthetic fuels. In comparison, Algeria and Egypt, but also Lebanon and Iran show higher risks. (Former) war zones such as Iraq, Yemen, Libya or Syria often have more pressing problems and the development of a green hydrogen economy is not a priority in these areas; accordingly, the overall risks for the development of the sector are assessed as significantly higher.

In the positive scenario (Risk_pos) for the development of a green hydrogen and synthetic fuel sector in the MENA region, as shown in Figure 5E, the UAE has the lowest risk for the development and realisation of green hydrogen and synthetic fuel projects, closely followed by Morocco. In this scenario, the global market for green hydrogen and synthetic energy derivatives is expected to grow rapidly, which will also drive development in the region. Thus, the risk for Bahrain, Egypt, Kuwait, Oman and Saudi Arabia is also assessed to be rather modest in this scenario. On the one hand, risks at the micro level are expected to be reduced and investor trust to be increased due to the successful implementation of pilot projects Furthermore, it is assumed that the regulatory framework and laws for the production of green hydrogen and synthetic fuels in these countries will develop favourably. Overall, the region and especially countries such as Egypt and Iraq also benefit in this scenario from political stabilisation and a decline in external and internal conflicts at the macro level. This would have a beneficial effect on the development of the sector and lead to a reduction in country risks. In the current conflict countries Libya, Syria, and Yemen, however, this development is not yet foreseeable, so that the risks here remain elevated even in a positive scenario. Likewise, the risks in Iran and Lebanon remain elevated in this scenario. The political situation and the rather slow expansion of renewable energies in these countries are the main reasons for this. The chances for a rapid development of the green hydrogen and synthetic fuels sectors are therefore estimated to be lower for these countries.

The results of the risk assessment for the challenging scenario (Risk_neg) are summarised in Figure 5F. In this scenario, it is assumed that the current positive initial trends in countries such as Morocco, Oman and UAE do not lead to the development of suitable framework conditions for the large-scale expansion of green hydrogen and synthetic fuel infrastructures. Under these assumptions, it is to be expected that the announced projects will not or only partially be realised. In addition, political instability is expected to increase further due to the economic, political and social situation in the individual countries, but also due to tensions between countries and within the region as a whole. The UAE has the lowest risk level in this scenario compared to the other MENA countries. However, macro risks play an important role here as well. In this scenario, UAE is affected by the increasing tensions and conflicts between Saudi Arabia, Iran and Qatar and is also actively involved in other conflicts in the region, which ties up resources and also increases the risk for investments in the country itself. The other Gulf states also have a higher risk. In addition to the influence of macro risks, the continued importance of the gas and oil sectors plays a role in this context. In the fossil sectors, resources could be tied up in the long term due to lock-in effects and the development of a green hydrogen and synthetic fuel sector could be hindered as a result. Developments in the green hydrogen sector in this scenario therefore often fall short of the ambitious announcements made by these countries. Egypt and Algeria are also expected to continue prioritising fossil fuels under this scenario. Another hindering factor is expected to be water scarcity and, in this context, the possible competition between green hydrogen production and other sectors, such as agriculture. As rural populations increasingly face major problems with agricultural irrigation, this scenario assumes that the risk of protests against large-scale projects could also increase. In the countries with the highest risks, such as Libya, Iraq, Syria and Yemen, there are already no stable political conditions. This is a major obstacle to the emergence of a green hydrogen and synthetic fuels sector and the implementation of large-scale projects. It is assumed that the situation will not genuinely improve or will even worsen due to regional escalations. Overall, the risks in this scenario are thus high to very high in the entire MENA region, which would make large-scale investments in the production and export of green hydrogen and synthetic fuels more expensive and thus less likely.

5 Discussion and conclusion

The risk assessment has shown that the development of the green hydrogen and synthetic fuels sectors, as well as the renewable energy sector as a prerequisite, is associated with at least moderate risks in almost all 17 MENA countries studied. The region presents a heterogeneous risk landscape shaped by varying political, economic, and infrastructural conditions. Stability and robust regulatory frameworks emerge as critical factors for advancing both renewable energy and green hydrogen development, with the growth of the green hydrogen sector being inextricably linked to renewable energy expansion. While countries such as Morocco and the UAE are relatively well-positioned for positive developments, nations facing unresolved political and economic challenges remain at heightened risk. In adverse scenarios, existing instabilities may significantly hinder even initially promising projects, particularly in conflict-affected areas, while fossil fuel-exporting nations risk a “lock-in” effect, where continued reliance on traditional energy sources could delay the transition to renewables. Moreover, regional geopolitical tensions further compound investment risks, even for relatively stable nations.

In a more optimistic “positive scenario” (Risk_pos), countries like Morocco and the UAE are projected to continue advancing their renewable energy sectors, supported by favorable regulatory environments, growing investor confidence, and the successful implementation of pilot projects. This scenario envisions accelerated growth compared to the baseline (Risk_bau), driven by enhanced policy support and technological progress, with political stabilization and economic reforms reducing risks in several countries. However, high-risk environments will likely persist in conflict zones such as Libya, Syria, and Yemen. Conversely, in the “challenging scenario” (Risk_neg), the outlook deteriorates significantly, with political instability, economic downturns, and infrastructural limitations potentially stalling or halting progress in even the better-performing countries.

Although this risk assessment provides a concise overview of the various risks, the individual risk evaluations are subject to uncertainties and could be challenged. However, this is not a specific shortcoming of the risk assessments carried out here, but a general characteristic of risk assessments, as the assessment of risks is always associated with a certain degree of uncertainty and subjectivity. Moreover, Abba et al. (2022) noted that many risk studies focus only on techno-economic factors or one main risk driver without conducting a more comprehensive analysis. In addition, many commercial country risk assessments do not take into account detailed sector-specific characteristics. In order to reduce these uncertainties and reflect a broad range of sector-specific risks, the authors developed and applied a very broad indicator-based analytical framework with over 100 indicators, complemented by qualitative research. In addition, the results were discussed with stakeholders from the industry and representatives from the MENA region. Compared to other studies, the risk assessment is thus very broad in terms of the number of indicators. A study on geopolitical risks in global hydrogen trade, for example, considered 23 indicators (EWI-Institute of Energy Economics at the University of Cologne, 2023). Duan et al. (2021) used 25 indicators to assess the risk of oil and gas investments in ten overseas countries. Abba et al. (2022) also pointed out that many studies do not take into account that risks can change over time. Here, the present study offers added value with the development of risk scenarios that show how the assessed risks could develop if either risk-reducing measures are taken or the predominantly positive expectations for the green hydrogen economy are not fulfilled and the political and economic situation in the countries does not improve or even deteriorates. In the Risk_bau scenario, a mixed landscape emerges, revealing moderate risks in Jordan, Morocco, Oman, Tunisia and UAE. In contrast, significant uncertainties persist in Algeria and Egypt, where macro risk factors complicate ambitious project targets. The Risk_pos scenario highlights the growth potential in countries like Jordan and the UAE, driven by strategic investments and proactive policy frameworks. Conversely, the Risk_neg scenario serves as a stark reminder that without sustained political and economic stability, growth may stall, particularly in conflict-affected areas. Collectively, these insights underscore that the future of the green hydrogen sector hinges on a delicate balance between capitalizing on opportunities and effectively mitigating risks.

In terms of the results, there are no directly comparable scientific assessments of the risks of developing the green hydrogen sector in the MENA region. Nevertheless, the results of studies that focus on renewable energy or on specific aspects or individual countries show similar tendencies. Humphery-Smith and Kinnear (2021) conclude for North African countries that while the region has the potential to be the continent’s most competitive sub-region for green hydrogen production, political factors combined with an often poor regulatory environment can deter foreign investment. Khan and Al-Ghamdi (2022), who conducted a SWOT analysis for the development of the hydrogen economy in the Gulf States, also point out that the lack of private sector participation in the current hydrogen market and the absence of a framework or supportive legislation could discourage private investors, given the planning complexity involved in building the infrastructure. However, their analysis did not consider political factors, which were identified as a relevant risk in this study. Awijen et al. (2022) who analysed the deployment of renewable energy in the MENA region, argued that quality of governance, political stability and financial development are the most important drivers for renewable energy deployment. This is in line with the findings in the present study that show that these type of macro risks can have a major impact on the overall risk assessment.

In terms of the overall evaluation, this analysis looks at the development of the green hydrogen sector as a whole and not at the development of individual projects. However, recent announcements of renewable energy and green hydrogen projects in countries that rank at the higher end of the risk spectrum in our analysis raise the question of whether a particularly favourable micro-risk environment, for example in the form of attractive incentives for renewables, green hydrogen and synthetic fuels, can contribute to the development of the sector even in an economically or politically more unstable country. In other words, the challenge is whether it is theoretically possible for the green hydrogen sector to develop in similar ways to mining, gas and oil sectors, which are also active in crisis regions of the world. While this is conceivable for individual projects, e.g. through external risk mitigation instruments such as institutional financing or guarantees, or balance sheet financing mechanisms within large companies, there are structural differences between extractive and renewable sectors. Renewables are more capital intensive and therefore rely on a larger supply of financial capital at low cost. Country risks can significantly increase the cost of capital. Renewable energies and the subsequent production of green hydrogen and synthetic fuels are therefore generally more affected by country risks than the fossil energy sectors.

It therefore remains to be seen whether the announced projects will be implemented as planned and whether the green hydrogen sectors will develop away from individual flagship projects in these countries despite the higher general risks involved.

This is especially true in light of the findings of Zhang et al. (2022), who found that the performance of private companies is more sensitive to country risks than the performance of state-owned companies. This underlines the importance of country risk assessments for the development of the green hydrogen sector, which is expected to be to a large extent be financed by the private sector.

The risk assessment carried out as presented here can therefore only be a first step. Further studies on how the risks affect the capital costs and thus the (export) costs of green hydrogen and synthetic fuels in the long term are needed. Here, further analyses on the impact of the risks on the costs have been carried out within the framework of the MENA Fuels project (Braun et al., 2022; Doré et al., 2022). In addition, more detailed investigations on the ground are required to verify the indicator-based assessments. To this end, three short country studies were carried out within the framework of the MENA Fuels project, the results of which are documented in Ersoy et al. (2024). Besides these further analyses, which have already been carried out, additional research is still needed. On the one hand, the green hydrogen industry is developing dynamically, so the data and risk assessments should be kept up to date and aligned with current realities. As the hydrogen economy is expected to become a global economy, this type of assessment should also be extended to other potential exporting countries to allow for comparison and benchmarking. In addition, there is a need for detailed further investigation of the risks that arise from the perspective of the potential export countries, for example with regard to sustainability aspects. Given that this study was conducted from the perspective of German and European actors, it only reflects a one-sided view that urgently needs to be broadened in order to paint a holistic picture of the risks on both sides of the green hydrogen economy.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

JT-P: Conceptualization, Formal Analysis, Investigation, Methodology, Project administration, Supervision, Writing–original draft, Writing–review and editing. SE: Writing–review and editing, Formal Analysis, Investigation. MP: Writing–review and editing, Formal Analysis, Investigation, Methodology. PV: Funding acquisition, Project administration, Supervision, Writing–review and editing.

Funding

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. The authors gratefully acknowledge the financial support of the German Federal Ministry for Economic Affairs and Climate Action (grant no. 3EIV181A). The sole responsibility for the content of this paper lies with the authors. We acknowledge financial support by Wuppertal Institute for Climate, Environment and Energy within the funding programme Open Access Publishing.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

The author(s) declared that they were an editorial board member of Frontiers, at the time of submission. This had no impact on the peer review process and the final decision.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenrg.2024.1466381/full#supplementary-material

References

Abba, Z. Y. I., Balta-Ozkan, N., and Hart, P. (2022). A holistic risk management framework for renewable energy investments. Renew. Sustain. Energy Rev. 160, 112305. doi:10.1016/j.rser.2022.112305

ADPV2 (2024). Empowering the UAE. Available at: https://www.adpv2.ae/solar-project.

Agarwal, R., and Mazarei, A. (2024). Egypt's 2023-24 economic crisis: will this time be different? Peterson Institute for International Economics. Policy Briefs (PB24-6).

Al Khattab, A., Anchor, J. R., and Davies, E. M. M. (2008). The institutionalisation of political risk assessment (IPRA) in Jordanian international firms. Int. Bus. Rev. 17 (6), 688–702. doi:10.1016/j.ibusrev.2008.09.007

Aven, T. (2017). Improving risk characterisations in practical situations by highlighting knowledge aspects, with applications to risk matrices. Reliab. Eng. and Syst. Saf. 167, 42–48. doi:10.1016/j.ress.2017.05.006

Awijen, H., Belaïd, F., Zaied, Y. B., Hussain, N., and Lahouel, B. B. (2022). Renewable energy deployment in the MENA region: does innovation matter? Technol. Forecast. Soc. Change 179, 121633. doi:10.1016/j.techfore.2022.121633

Belaîd, F., Elsayed, A., and Omri, A. (2021). Key drivers of renewable energy deployment in the MENA Region: empirical evidence using panel quantile regression. Struct. Change Econ. Dyn. 57, 225–238. doi:10.1016/J.STRUECO.2021.03.011

BMWi (2020). “Die nationale wasserstoffstrategie,” in Bundesministerium für Wirtschaft und Energie (BMWi). Berlin, Germany.

Bouchet, M. H., Fishkin, C. A., and Goguel, A. (2018). Managing country risk in an age of globalization: a practical guide to overcoming challenges in a complex world. Springer.

Braun, J., Kern, J., Scholz, Y., Hu, W., Moser, M., Schillings, C., et al. (2022). Technische und risikobewertete Kosten-Potenzial-Analyse

Braun, J., Kern, J., Scholz, Y., Hu, W., Moser, M., Schillings, C., et al. (2022). MENA-Fuels: Teilbericht 10 des Deutschen Zentrums für Luft-und Raumfahrt (DLR) und des Wuppertal Instituts an das Bundesministerium für Wirtschaft und Klimaschutz (BMWK). Stuttgart, Saarbrücken: Wuppertal.

Catenazzi, G. (2012). Advances in techno-economic energy modeling. Abgerufen 9. Oktober. Available at: http://e-collection.library.ethz.ch/view/eth:41888. doi:10.3929/ethz-a-005830048

Clark, E. (2000). Valuing political risk. Soc. Sci. Res. Netw. Available at: https://papers.ssrn.com/abstract=93608.

Doré, L., Krüger, C., and Janßen, T. (2022). “Weitere Szenarioanalysen: Berücksichtigung von Investitionsrisiken und Sensitivitäten der Basisszenarien,” in MENA-Fuels: Teilbericht 7 des Wuppertal Instituts an das Bundesministerium für Wirtschaft und Klimaschutz (BMWK). Köln, Saarbrücken: Wuppertal.

Duan, X., Zhao, X., Liu, J., Zhang, S., and Luo, D. (2021). Dynamic risk assessment of the overseas oil and gas investment environment in the big data era. Front. Energy Res. 9, 638437. doi:10.3389/fenrg.2021.638437

Dunn Cavelty, M., Brunner, E., Giroux, J., Doktor, C., and Brönnimann, G. (2011). “Focal report 5: using scenarios to assess risks: examining trends in the public sector,” in CSS risk and resilience reports [report] (Zürich, Switzerland: ETH Zurich). Available at: https://www.research-collection.ethz.ch/handle/20.500.11850/55379.

EC (2022). Communication from the commission to the European parliament, the European council, the council, the European economic and social committee and the committee of the regions. Brussels, Belgium: European Commission: REPowerEU Plan.

Egli, F. (2020). Renewable energy investment risk: an investigation of changes over time and the underlying drivers. Energy Policy 140, 111428. doi:10.1016/j.enpol.2020.111428

EHS (2020). “Communication from the commission to the European parliament, the European council, the council, the European economic and social committee and the committee of the regions,” in European Commission: a hydrogen strategy for a climate-neutral Europe. Brussels, Belgium.

Ersoy, S. R., and Terrapon-Pfaff, J. (2022). Sustainable transformation of Iraq's energy system: development of a phase model. Amman Jordan: Friedrich-Ebert-Stiftung Jordan. Available at: https://nbn-resolving.org/urn:nbn:de:bsz:wup4-opus-78914.

Ersoy, S. R., Terrapon-Pfaff, J., Pregger, T., Braun, J., Jamea, E. M., Al-Salaymeh, A., et al. (2024). Industrial and infrastructural conditions for production and export of green hydrogen and synthetic fuels in the MENA region: insights from Jordan, Morocco, and Oman. Sustain. Sci. 19 (1), 207–222. doi:10.1007/s11625-023-01382-5

Ersoy, S. R., Terrapon-Pfaff, J., Ribbe, L., and Alami Merrouni, A. (2024). Water scenarios modelling for renewable energy development in Southern Morocco. J. Sustain. Dev. Energy, Water Environ. Syst. 9 (1), 0. doi:10.13044/j.sdewes.d8.0335

EU (2016). EU general risk assessment methodology Action 5 of Multi-Annual Action Plan for the surveillance of products in the EU COM(2013)76. Bruxelles/Brussel, BELGIQUE/BELGIË: European Commission.

EWI - Institute of Energy Economics at the University of Cologne (2023). H2 Geopolitics -Geopolitical risks in global hydrogen trade. Available at: https://www.ewi.uni-koeln.de/cms/wp-content/uploads/2023/02/230110_EWI_H2_Geopolitik_EN.pdf.

Fitzpatrick, M. (1983). The definition and assessment of political risk in international business: a review of the literature. Acad. Manag. Rev. 8 (2), 249–254. doi:10.5465/amr.1983.4284734

GAN (2020). GAN business anti-corruption portal—country profiles. GAN Integr. Available at: https://www.ganintegrity.com/portal/country-profiles/.

Gatzert, N., and Kosub, T. (2016). Determinants of policy risks of renewable energy investments. Int. J. Energy Sect. Manag. 11, 28–45. doi:10.1108/IJESM-11-2015-0001

GLMM (2020). Gulf labour markets, migration, and population (GLMM) programme. Available at: https://gulfmigration.grc.net/glmm-database/demographic-and-economic-module/.

Humphery-Smith, E., and Kinnear, H. (2021). Political risk to curb African green hydrogen potential. Available at: https://www.maplecroft.com/insights/analysis/political-risk-to-curb-african-green-hydrogen-potential/.

IEA (2024). Hydrogen production and infrastructure projects database. Available at: https://www.iea.org/data-and-statistics/data-product/hydrogen-production-and-infrastructure-projects-database#license.

IEA/IRENA (2020). Global renewable energy policies and measures database. Available at: https://www.iea.org/policies?source=IEA%2FIRENA%20Renewables%20Policies%20Database.

IFHV and Bündnis Entwicklung Hilft (2019). World risk report 2019. Available at: https://weltrisikobericht.de/english-2/.

ILOSTAT (2020). ILOSTAT database. ILOSTAT Database. Available at: https://ilostat.ilo.org/data/.

IMF - International Monetary Fund (2022). Saudi Arabia: selected issues. Middle East Central Asia Dept 2022 (275), 1. doi:10.5089/9798400217548.002

IRENA (2016). Unlocking renewable energy investment: the role of risk mitigation and structured finance. Abu Dhabi: IRENA. Available at: https://www.irena.org/publications/2016/Jun/Unlocking-Renewable-Energy-Investment-The-role-of-risk-mitigation-and-structured-finance.

IRENA (2018). Renewable energy outlook: Egypt. Abu Dhabi: International Renewable Energy Agency IRENA. Available at: https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2018/Oct/IRENA_Outlook_Egypt_2018_En.pdf.

IRENA (2022). Geopolitics of the energy transformation: the hydrogen factor. Int. Renew. Energy Agency.

IRENA and RMI (2023). Creating a global hydrogen market: certification to enable trade. Int. Renew. Energy Agency.

ISO (2018). ISO 31000:2018(en), Risk management—Guidelines. Available at: https://www.iso.org/obp/ui/#iso:std:iso:31000:ed-2:v1:en.

Jankauskas, V., Rudzkis, P., and Kanopka, A. (2014). Risk factors for stakeholders in renewable energy investments. Energetika 60. doi:10.6001/energetika.v60i2.2935

Jakobsen, J. (2010). Old problems remain, new ones crop up: Political risk in the 21st century. Business Horizons 53 (5), 481–490. doi:10.1016/j.bushor.2010.04.003

Khan, M. I., and Al-Ghamdi, S. G. (2023). Hydrogen economy for sustainable development in GCC countries: a SWOT analysis considering current situation, challenges, and prospects. Int. J. Hydrogen Energy 48 (28), 10315–10344. doi:10.1016/j.ijhydene.2022.12.033

Kobrin, S. J. (1982). Managing political risk assessment: strategic response to environmental change. University of California Press.

Kosmidou, K., Doumpos, M., and Zopounidis, C. (2008). Country risk evaluation: methods and applications softcover reprint of hardcover. 1st ed. 2008 Edition. Springer.

Labordena, M., Patt, A., Bazilian, M., Howells, M., and Lilliestam, J. (2017). Impact of political and economic barriers for concentrating solar power in Sub-Saharan Africa. Energy Policy 102, 52–72. doi:10.1016/j.enpol.2016.12.008

Masdar (2023). Masdar and Hy24 sign strategic framework agreement to explore Co-development and Co-investment opportunities in international large-scale green hydrogen production projects. Available at: https://www.hy24partners.com/assets/5d39ddaf-a46d-4094-96ba-7a26188ecb82.pdf.

MASEN (2024). RE projects map. Available at: https://www.masen.ma/en/projects.

Michelez, J., Rossi, N., Blázquez, R., Martín, J. M., Mera, E., Christensen, D., et al. (2011). Risk quantification and risk management in renewable energy projects.

Moosa, I. A. (2002). “Country risk and political risk,” in Foreign direct investment: theory, evidence and practice. Editor I. A. MoosaHrsg. (Palgrave Macmillan UK), 131–160. doi:10.1057/9781403907493_5

Noor Abu Dhabi (2024). One of the world’s largest stand-alone operational solar plant in Abu Dhab. Available at: https://noorabudhabi.ae/.

Noothout, P., Jager, D. de, and Tesnière, L. (2016). The impact of risks in renewable energy investments and the role of smart policies. European Commission.

NREA - New and Renewable Energy Authority (NREA) (2016). Strategic environmental and social impact assessment benban 1.8 GW photovoltaic solarPark (NREA), Egypt. New Renew. Energy Auth. (NREA).

NYU Law (2020). Global lex. Available at: https://www.nyulawglobal.org/globalex/index.html.

OECD (2016). OECD clean energy investment policy review of Jordan. Paris: OECD. doi:10.1787/9789264266551-en

Oetzel, J. M., Bettis, R. A., and Zenner, M. (2001). Country risk measures: how risky are they? J. World Bus. 36 (2), 128–145. doi:10.1016/S1090-9516(01)00049-9

Poudineh, R., Fattouh, B., and Sen, A. (2018). Electricity markets in MENA: adapting for the transition era. Oxford: Oxford Institute for Energy Studies. doi:10.26889/9781784671112

Qazi, A., and Simsekler, M. C. E. (2022). Prioritizing interdependent drivers of financial, economic, and political risks using a data-driven probabilistic approach. Risk Manag. 24 (2), 164–185. doi:10.1057/s41283-022-00092-z

Rambo, C. M. (2013). Renewable energy project financing risks in developing countries: options for Kenya towards the realization of vision 2030.

RES4MED (2016). Survey on the main barriers affecting investments in RE capacity in the mediterranean: focus on southern and eastern mediterranean countries (SEMCs). Renew. Energy Solutions Mediterr. (RES4Med).

Schinko, T., and Komendantova, N. (2016). De-risking investment into concentrated solar power in North Africa: impacts on the costs of electricity generation. Renew. Energy 92, 262–272. doi:10.1016/j.renene.2016.02.009