95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Energy Res. , 13 November 2024

Sec. Carbon Capture, Utilization and Storage

Volume 12 - 2024 | https://doi.org/10.3389/fenrg.2024.1463076

This article is part of the Research Topic Carbon Neutrality and High-quality Development View all 5 articles

With the prevalence of green supply chains, the government has basic requirements for companies’ green investments and outcomes while consumers increasingly favor green products. Thus, green degree decision has garnered significant attention from manufacturers. This paper incorporates green degree decisions into a dual-channel supply chain and adopts a Stackelberg model to analyze the green degree and pricing strategies under centralized and decentralized decisions. We find that, when the manufacturer only decides on price, dual-channel choice is always the optimal strategy under centralized decision-making; however, under decentralized decision-making, the dual-channel choice will be chosen only when the wholesale price is low. Considering green degree decision, both direct and indirect channel prices increase with the green degree, and the indirect channel price is more sensitive to changes in the green degree under centralized decision-making; and higher green degrees are always advantageous for the retailer, but the manufacturer’s profit initially decreases and then increases as the green degree rises under decentralized decision-making. Moreover, the wholesale price is used as a strategic tool for the manufacturer to control the distribution channel, particularly when the green degree is not introduced, the manufacturer can always ensure the introduction of dual channels. Besides, higher consumers’ environmental awareness is always beneficial to channel members, as it promotes channel prices and green degree. This study provides strategic insights for optimizing pricing and green degree decisions in dual-channel supply chains to achieve better economic and environmental outcomes.

Environmental issues have long been one of the most important and widely discussed topics around the world, especially in recent years as we suffered from increasing environmental crises. The international community has reached a certain consensus on promoting green trade. In 2021, the United Nations Environment Programme released “Green International Trade: Pathways Forward,” which extensively discusses green trade and proposes building an Agenda 2.0 for environment and trade. This includes strengthening trade-related environmental policies, promoting upgraded environmental regulations in trade policies and agreements, and advancing cooperation between environment and trade. Green trade encompasses measures for green trade practices and the trade of green products. Some sustainable development concepts, including low-carbon economy and green GDP, have been widely accepted, and thereby promoting research into green products.

Environmental concerns have compelled manufacturers and retailers to rethink various aspects such as inventory decisions, product innovation, returns management, reverse logistics design, and coordination among channel participants. For instance, Pepsi, a large-scale manufacturer, uses reusable transport containers instead of corrugated materials for shipping to protect the environment1. Adidas, a globally renowned sports goods manufacturer, has greened its products from sourcing raw materials to manufacturing and packaging to reduce environmental impact2. Retailing giant Walmart is dedicated to retailing green products. One of the three major corporate goals set by Walmart’s CEO in October 2005 is to sell green products that balance corporate resources with environmental protection3. Apart from Walmart, another major retailer, Best Buy, sells appliances certified by “Energy Star,” which enhances competitiveness and significantly contributes to environmental protection4.

For today’s manufacturers, the green degree decision of products has been a key focus. On the one hand, manufacturers have to reach the green standards required by the government; on the other hand, more and more consumers also prefer green products to regular ones. Generally speaking, the green degree refers to the environmental protection level of a green product throughout its lifecycle. Sometimes, it also represents a comprehensive indicator of the technical, economic, and environmental harmony of green products. Products with higher green degrees usually attract more consumers with environmental concerns but tend to cost manufacturers more to produce them. Research on green degree mainly focuses on two areas: constructing evaluation indicators for green degree, using methods such as grey system decision-making, weighted scoring, Topsis method, expert consultation, etc.; and regarding the green degree as a decision variable to incentivize and coordinate green supply chains.

Nowadays, most products are sold through multi-channels or dual channels. A dual-channel refers to a channel structure combining direct and indirect channels (Beck and Rygl, 2015). With the emergence of the Internet, dual-channel become common practices for manufacturers. For example, Pepsi and Adidas sell their products through both retail partners and their websites. Retail giants such as Wal-Mart and Amazon also expanded their channels that Wal-Mart introduced its online channel Walmart. Com in 2000, while Amazon launched an offline strategy by opening a physical bookstore in 2015. This trend further promotes the manufacturers’ adoption of dual-channel.

This paper incorporates green product decisions into the dual-channel supply chain. Based on the Stackelberg game model, we analyze manufacturers’ green degree and pricing strategies with decentralized and centralized decisions to provide optimal pricing and green degree references for green product manufacturers. This paper aims to address the following questions: (1) When the manufacturer jointly decides on pricing and green degree, how do the manufacturer and retailer coordinate their decision to maximize their profits? (2) How does the green degree affect the indirect channel price and direct channel price? (3) How does the manufacturer influence a retailer by controlling the wholesale price in a dual-channel framework? (4) How external factors such as potential channel market share and consumers’ environmental awareness in different channels influence the optimal decision-making of manufacturer and retailer?

Our study is closely related to three research streams: green product, dual-channel, and green supply chain management.

Existing literature regarding green products has examined green products with and without the consideration of recyclability, the measurement of green transition, the optimization of green degree, and so on (Ghosh and Shah, 2012; Sheu and Chen, 2012; Zhai et al., 2022; Guo et al., 2020). Recently, Dong et al. (2021) analyze the coupling coordination relationship between green urbanization and green finance using the data in China during 2010–2017.

From a corporate perspective, the price of green products may be higher, and consumers are willing to pay a premium for higher environmental performance (Dangelico and Vocalelli, 2017). Dangelico and Vocalelli (2017) pointed out that positioning green features as one of many product attributes is more advantageous than solely targeting green products. Companies should also establish and market a unique green brand image, as consumers are more likely to purchase green products when they are more familiar with green brands (Mohd Suki, 2016). Furthermore, successful green brand positioning can differentiate products and create additional demand (Mohd Suki, 2016). Through studying the quality and satisfaction of guests’ experiences at green hotels, Wu et al. (2016) find that a hotel’s green image can enhance customers’ trust and satisfaction with the green hotel, thereby reducing their intention to switch. Additionally, companies that implement green process innovation and green product innovation can improve their financial performance by enhancing resource utilization efficiency, reducing costs, and increasing market competitiveness (Xie et al., 2019). Green et al. (2012) find that a company’s green supply chain management (GSCM) positively impacts both environmental and economic performance, as well as operational and organizational performance.

A concept related to green products is green innovation, which is a broad concept often intertwined with sustainable development, aiming to balance economic growth with sustainability. Kemp and Arundel (1998) introduce a widely accepted definition of green innovation, defining it as the development of new systems, technologies, and products aimed at reducing environmental damage. This definition transcends mere product innovation, encompassing systemic innovation within organizations. Driessen et al. (2013) provide a pragmatic definition of green innovation, emphasizing its goal of generating significant environmental benefits rather than merely reducing environmental harm. Karakaya et al. (2014) conduct a literature review on green innovation using the Google Scholar database from 1990 to 2012. They find over a thousand highly cited publications, with a notable increase in high-quality green innovation research starting around 2006, peaking significantly by 2008. Zhao et al. (2022) explore the relationship between the academic experience of executives and green innovation and find that the academic experience of senior managers significantly affects firms’ green innovation in emerging markets. Moreover, governments are also promoting corporate green innovation. Government-promoted carbon emission trading pilot policies have significantly facilitated intercity green innovation cooperation and elevated the level of regulated firms’ green innovation (Yu et al., 2022; Xiaobao et al., 2024). Mazzarano (2024) find that decarbonization policies can help companies reduce costs, improve efficiency, enhance brand image, increase market value, and achieve sustainable development, while also bringing more positive externalities to society. These decarbonization policies are driven both by government initiatives and by companies’ strategic development choices (Mazzarano, 2024).

Research on dual-channel has long been a popular topic since it offers opportunities to serve different segmented customers, create synergies, and develop economies of scale. However, Agatz et al. (2008) point out that, to successfully implement dual-channel distribution, dual-channel distribution systems require a continuous balance between integration and separation across the two channels. Considering consumer preferences, Hua et al. (2010) analyze the impact of customer acceptance and delivery times on pricing strategies for decision-makers. Melis et al. (2015) find that when consumers try online shopping, they tend to choose the online stores of the same chain as their offline stores, especially when the product varieties are highly integrated between the dual channels. Considering retail risk preference in dual channels, Jiang et al. (2017) analyze the effects on channel strategies based on retail risk aversion or risk preference. Some recent research about dual channels incorporates consumer service, agency selling, store brand introduction, and so on into consideration to generate new insights for dual channel literature (Amankou et al., 2024; Matsui, 2024; Xiao et al., 2023).

Omni-channel is a relevant concept to dual-channel, which integrates physical store sales, online sales, and mobile e-commerce channels to meet consumers’ needs for purchasing products anytime, anywhere, and providing a seamless consumer experience. However, unlike dual-channel emphasizes the simultaneous use of direct and distribution channels, omni-channel emphasizes integration and complementarity across different channels. Saghiri et al. (2017) propose a concept framework for an omni-channel system based on three dimensions: channel stage, channel type, and channel agent, discussing key factors—integration and visibility—that support the implementation of an omni-channel framework. Manufacturer encroachment is also an important topic related to dual-channel, Gao et al. (2021) show if cost information asymmetry is considered in dual-channel, cannot hurt but benefit the retailer.

Research on green supply chain management includes studies on influencing factors, supply chain decisions, supply chain design, and coordination. The influencing factors of green supply chain management contain internal and external factors. Sarkis (2003) identifies numerous factors affecting green supply chain management, including product green degree, corporate market advantage, and investments in environmental innovation. Testa and Iraldo (2010) highlight those internal factors of green supply chain management stem from enterprise-led strategic processes, while external factors primarily involve stakeholder pressures. Green et al. (2012) find that, in addition to their own interests, customer demand and government regulations are also key drivers for companies to implement green supply chain management practices. Govindan et al. (2014) conduct field surveys on supply chain management and its related departments, identifying numerous barriers during implementation. He et al. (2024) investigate how tax enforcement affects corporate environmental investment, and reveal that tougher tax enforcement significantly lowers corporate environmental investment.

Many scholars utilize game theory to study decision-making in green supply chain management (Nagurney and Toyasaki, 2003; Altintas et al., 2008; Atasu et al., 2008; Ghosh and Shah, 2012; Ala-Harja and Helo, 2015). Dey and Saha (2018) analyze manufacturers’ green degree decisions and wholesale pricing decisions using Stackelberg game models under three procurement modes, concluding that retailer procurement decisions are pivotal but not entirely motivating for manufacturers to produce green products. Xi and Lee (2015) study green degree decision-making in manufacturer-led Stackelberg game models of green products in traditional retail channels. Li et al. (2016) investigate decision-making on pricing and green degree by manufacturers and retailers under uniform pricing strategies using Stackelberg models, showing that the decision of manufacturers to sell green products through direct channels depends on the magnitude of green costs. Wang et al. (2023) incorporate demand forecast information sharing between the retailer and the manufacturer in the green supply chain and examine three cases: centralized decision, decentralized decision with and without demand forecast information sharing. They find that demand forecast information sharing benefits the manufacturer while hurting the retailer.

Some scholars discuss the design of green supply chains using multi-objective optimization methods (Kadziński et al., 2017; Liou et al., 2016). To coordinate the green supply chain, Bernstein and Federgruen (2005) explore the decentralized decisions for manufacturers based on stochastic demand functions in a three-tier supply chain, and find that retailers and manufacturers can maximize profits through contract design. Swami and Shah (2013) study channel conflicts in green supply chain management, and concludes that resolving conflicts between manufacturers and retailers improves the management of green supply chains. Jian et al. (2021) consider the manufacturer’s fairness concern based on the consideration of the retailer’s sales effort, and design of a green closed-loop supply chain with profit-sharing contract coordination fairness. Wang et al. (2020) also incorporate green manufacturers’ fairness concerns to explore the decisions and coordination of green e-commerce supply chain, and find that unlike traditional offline and dual-channel supply chains, the manufacturer’s behavior in response to fairness concerns can result in the decline both in product green degree and system efficiency but has no impact on service level.

There has been a trend to consider green factors in dual-channel in recent years such as green technologies, green innovation, and government monitoring (Gao et al., 2020; Pa and Sarkar, 2021; Mahmoudi et al., 2020). However, few literatures have incorporated green degree decisions into dual-channel and studied the coordination of dual-channel supply chains through green degree decision and pricing strategies.

We consider a dual-channel supply chain consisting of a green product manufacturer and a retailer. The manufacturer produces one type of green product, which is sold either through the retailer or via its direct channel. We discuss two cases: The manufacturer makes the pricing decision only (P), and the manufacturer jointly decides the price and the green degree of the product (PG). Both cases include decentralized and centralized decision scenarios. In the decentralized decision scenario (D), the manufacturer decides the direct channel price (and the green degree in case PG) first, and then the retailer decides the indirect channel price. We assume the wholesale price is exogenously given, and relax this assumption in Section 5. In the centralized decision scenario (C), the manufacturer decides the direct channel price and the indirect channel price (and also the green degree in case PG) together. In total, we consider four subgames: P-D, PG-D, P-C, and PG-C. The supply chain structure is shown in Figure 1.

We have the following assumptions:

a. The demand functions for both channels are linear functions of the green degree and the price. As environmental awareness increases, consumers show a preference for products with a higher green degree. If the green degree is not considered, the demand functions for the direct and indirect channels are Equations 1, 2:

If the green degree is considered, the demand functions for the direct and indirect channels are Equations 3, 4:

Where

b.

c. Green products do not alter the manufacturer’s traditional marginal cost, but the manufacturer must invest additional green costs, which is denoted as

d. At the same green degree, green products have a greater impact on customers in the indirect channel than on customers in the direct channel. This is because customers usually have a deeper understanding of the product’s green degree in the indirect channel, making them more attracted by the green degree of the product compared to the direct channel, i.e.,

e. The potential market demand

Furthermore, the model must satisfy two constraints simultaneously: the demand in both the direct and indirect channels must be non-negative, and the profits in both the direct and indirect channels must be non-negative, and the green degree must also be non-negative. In other words, this is represented by (Equation 5):

When the manufacturer only decides on the price in the decentralized decision scenario, the manufacturer chooses the direct channel price

By applying the backward induction method of Stackelberg game, we can derive the optimal solutions for subgame P-D as stated in the following proposition.

Proposition 1. In subgame P-D, we have:

(I) When

(II) When

Proposition 1 indicates that when the wholesale price (

When the manufacturer only decides on the price in the centralized decision scenario, both parties jointly decide on the direct channel price

By employing the method of backward induction, we can derive the equilibrium solutions for subgame P-C described in Proposition 2.

Proposition 2. In subgame P-C, the optimal prices and demands for direct and indirect channel are

Proposition 2 indicates that, in subgame P-C, as the potential market share of indirect channel (

In subgame PG-D, the manufacturer decides the direct channel price

By employing the method of backward induction, we can derive the equilibrium solutions for subgame PG-D described in Proposition 3.

Proposition 3. In subgame PG-D, we can obtain the equilibrium solutions for the game as follows (the expression of

(I) When

(i) When

(ii) When

(iii) When

(II) When

(i) When

(ii) When

The above result is shown in Figure 2.

Proposition 3 (I) indicates that when potential market demand is low (

Corollary 1. In subgame PG-D, when dual-channel exist (

(I)

(II)

Corollary 1 indicates that, in the dual-channel scenario of subgame PG-D, when the green cost coefficient

In subgame PG-C, both parties jointly decide on the direct channel price

By employing the method of backward induction, we can derive the equilibrium solutions for subgame PG-C as described in the following proposition.

Proposition 4. In subgame PG-C, we can obtain the equilibrium solutions for the game as follows (the expression of

(I) When (a)

(II) When

(III) When

The above result is shown in Figure 3.

Proposition 4 indicates that when the green cost coefficient

Corollary 2. In subgame PG-D, when dual-channel exist (

(I) Compare subgame PG-C and subgame PG-D, we have:

(II) In subgame PG-D, we have:

(III) In subgame PG-C, we have:

Corollary 2 (I) indicates that, as the potential market share of indirect channel (

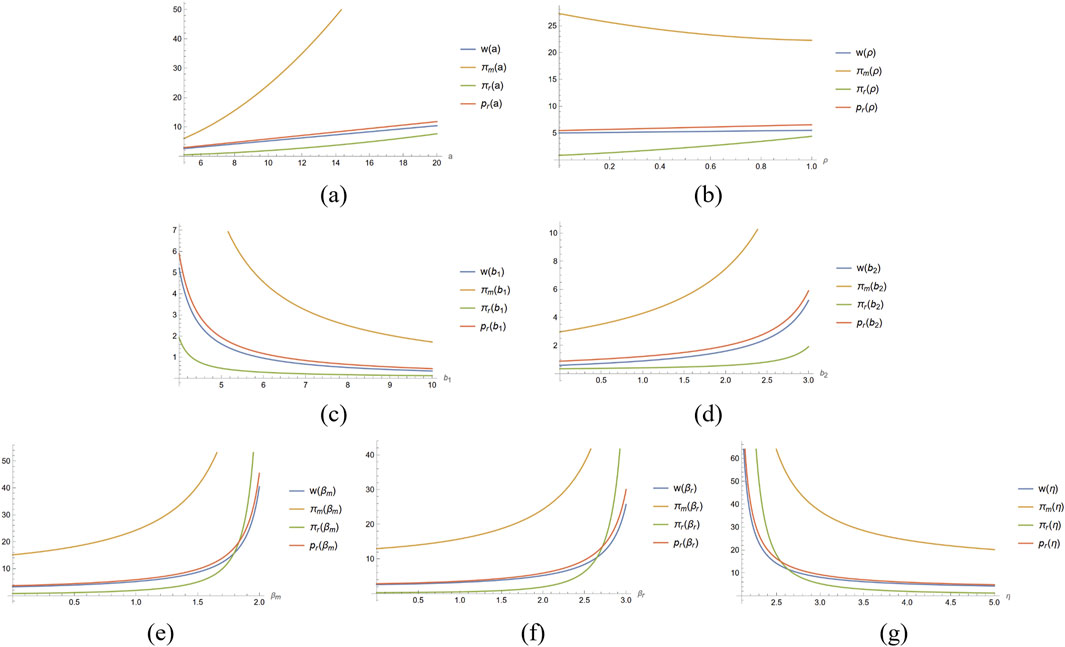

In this section, we conduct a numerical analysis to compare the profits and prices of the manufacturer and retailer in case P and case PG, respectively, which illustrates the impact of the green cost coefficient (

By analyzing the optimal prices and profits of the manufacturer and retailer under decentralized and centralized decision-making, we can identify the effects of the potential market share of indirect channel (

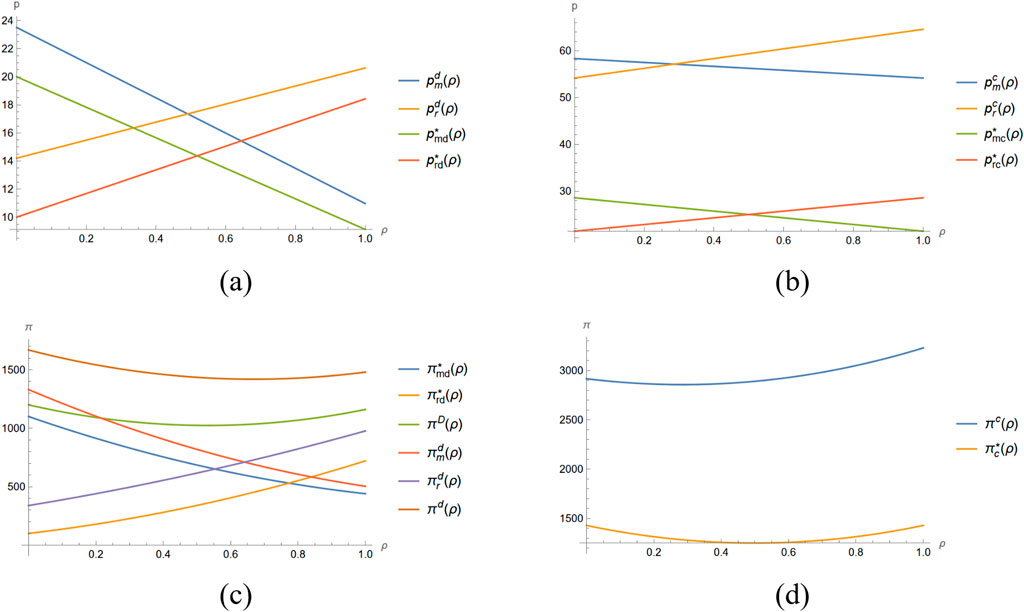

Figure 4. The effects of the potential market share of indirect channel on prices and profits, where

In Figure 4,

Figure 4A, B show that, as the potential market share of indirect channel (

Regarding whether the manufacturer decides on green degree (

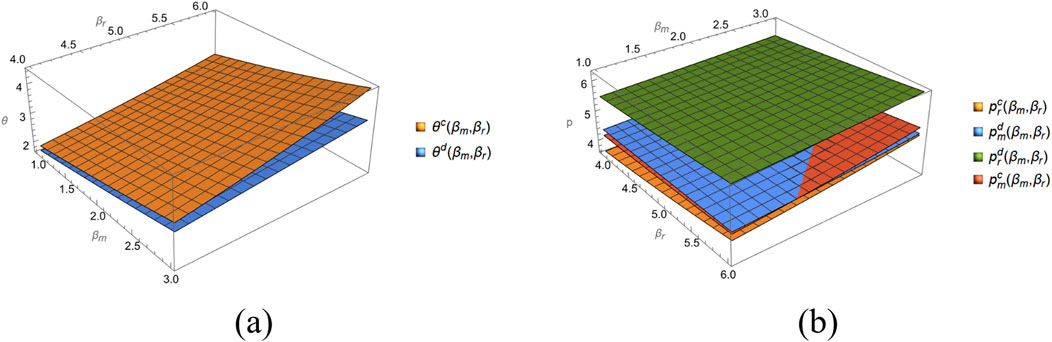

We illustrate the effects of the green cost coefficient (

In Figure 5,

In Figure 6,

Figures 5, 6 illustrate the impact of

We illustrate the effects of consumers’ environmental awareness in different channels (

Figure 7. The impact of consumers’ environmental awareness in different channels on green degree and prices, where

The demand functions indicate that consumers’ environmental awareness in different channels (

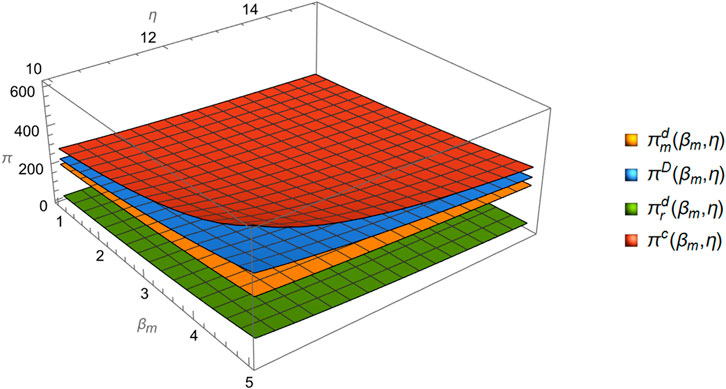

We illustrate the combined effects of green cost coefficient (

Figure 8. The combined impact of consumers’ environmental awareness in direct channel and green cost coefficient on profit, where

Figure 8 indicates that manufacturer’s profit (

In this section, we consider the wholesale price (

In subgame P-D, the manufacturer first determines the direct channel price and the wholesale price for the indirect channel, and then the retailer decides the indirect channel price (if this channel is introduced). By employing the method of backward induction, we can derive the equilibrium solutions in Proposition 5.

Proposition 5. In subgame P-D, we can obtain the equilibrium solutions as follows:

The optimal price for the direct and indirect channels and the optimal wholesale price are

Proposition 5 indicates that, in subgame P-D, when the manufacturer can determine the optimal wholesale price, both direct and indirect channels will always exist in the market, regardless of the potential market share of indirect channel. This is because when the manufacturer can determine the optimal wholesale price, it is possible to balance the profitability of both channels under any potential market share of indirect channel, ensuring the coexistence of dual-channel. Moreover, the dual-channel strategy increases demand in both channels simultaneously, further enhancing the profitability of all channel members. Therefore, we can draw the following insights:

Corollary 3. In subgame P-D, we have:

(I)

(II) when

(III)

(IV)

Corollary 3 indicates that, when the expansion of potential market demand (

In subgame PG-D, the manufacturer first determines the green degree of the product, the direct price, and the wholesale price for the indirect channel. Then the retailer decides the indirect channel price. By employing the method of backward induction, we can derive the equilibrium solutions as described in Proposition 6.

Proposition 6. In subgame PG-D, we can obtain the equilibrium solutions as follows (the expression of

(I) When (a)

(II) When

(III) When

The above result is shown in Figure 9.

Proposition 6 indicates that when the green cost coefficient

Figure 10 illustrates that in subgame PG-D, the wholesale price (

Figure 10. The impact of different coefficient on wholesale price

This paper proposes a dual-channel supply chain model to study the green degree and pricing strategies of manufacturers under centralized and decentralized decisions. We also analyze the strategic role of the wholesale price setting by the manufacturer to control the distribution channels of the product, and the impacts of the green degree decision on prices and profits of different channels. The results show that, dual channels will always be introduced under centralized decision-making; while dual channels will be introduced only when the wholesale price is relatively low under decentralized decision-making. When the green degree decision is involved, prices and profits in all scenarios and channels increase, with higher increases in prices and profits and a higher optimal green degree under centralized decision-making. When the potential market share of indirect channel increases, the manufacturer, who bears the green costs under decentralized decision-making, will reduce the green degree and price; while the manufacturer will continue to increase the green degree under centralized decision-making. Moreover, when potential market demand is low and the green cost coefficient is high, the manufacturer prefers a single direct channel strategy rather than a dual-channel strategy which would benefit all channels. As the green degree increases, the prices in all channels will increase under centralized decision-making; while the indirect channel price will decrease under decentralized decision-making. This indicates that, without the impact of double marginalization, channel members can better leverage the advantages brought by green degree; however, under decentralized decision-making, manufacturers often make decisions that are detrimental to the long-term development of the dual-channel in an effort to compensate for their own costs. Furthermore, the wholesale price can always be acted as a strategic tool for the manufacturer to control the distribution channels and guarantee total profits. Without the introduction of the green degree, the manufacturer always prefers dual-channel strategy. Once the green degree is introduced, the manufacturer tends to set a high wholesale price to “drive away” the indirect channel when the potential market share of the indirect channel and the green cost coefficient are both low; Otherwise, the manufacturer will depend on the indirect channel to guarantee the channel profits. At last, enhancing consumers’ environmental awareness and updating technologies to reduce green costs will always benefit channel members. This approach will simultaneously increase the green degree, channel prices and profits, creating a positive cycle, especially under centralized decision-making. The limitations of this paper are as follows: we ignore other factors such as consumers’ preferences for different channels, sales efforts, information asymmetry, etc. Also, we do not consider the cooperation between the manufacturer and the retailer to share the green costs.

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

XL: Writing–original draft, Writing–review and editing. YW: Writing–review and editing. YZ: Writing–original draft. CL: Writing–review and editing.

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. The work was jointly supported by the National Natural Science Foundation of China (No. 72101210) and Dalian Commodity Exchange “Bai Xiao Wan Cai” Project DECYJ202301.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenrg.2024.1463076/full#supplementary-material

1http://www.pepsico.com.cn/purpose/Sustainable-Food-System-Key.html

2https://www.adidas.com/us/go/campaign/sustainability/reduce-footprint

3http://www.wal-martchina.com/community/community.htm

4https://corporate.bestbuy.com/energy-star-partner-of-the-year-2024/

Agatz, N. A., Fleischmann, M., and Van Nunen, J. A. (2008). E-fulfillment and multi-channel distribution–A review. Eur. J. Operational Res. 187 (2), 339–356. doi:10.1016/j.ejor.2007.04.024

Ala-Harja, H., and Helo, P. (2015). Reprint of “Green supply chain decisions–Case-based performance analysis from the food industry”. Transp. Res. Part E Logist. Transp. Rev. 74, 11–21. doi:10.1016/j.tre.2014.12.005

Altintas, N., Erhun, F., and Tayur, S. (2008). Quantity discounts under demand uncertainty. Manag. Sci. 54 (4), 777–792. doi:10.1287/mnsc.1070.0829

Amankou, K. A. C., Guchhait, R., Sarkar, B., and Dem, H. (2024). Product-specified dual-channel retail management with significant consumer service. J. Retail. Consumer Serv. 79, 103788. doi:10.1016/j.jretconser.2024.103788

Atasu, A., Sarvary, M., and Van Wassenhove, L. N. (2008). Remanufacturing as a marketing strategy. Manag. Sci. 54 (10), 1731–1746. doi:10.1287/mnsc.1080.0893

Beck, N., and Rygl, D. (2015). Categorization of multiple channel retailing in Multi-Cross-and Omni-Channel Retailing for retailers and retailing. J. Retail. Consumer Serv. 27, 170–178. doi:10.1016/j.jretconser.2015.08.001

Bernstein, F., and Federgruen, A. (2005). Decentralized supply chains with competing retailers under demand uncertainty. Manag. Sci. 51 (1), 18–29. doi:10.1287/mnsc.1040.0218

Dangelico, R. M., and Vocalelli, D. (2017). “Green Marketing”: an analysis of definitions, strategy steps, and tools through a systematic review of the literature. J. Clean. Prod. 165, 1263–1279. doi:10.1016/j.jclepro.2017.07.184

Dey, K., and Saha, S. (2018). Influence of procurement decisions in two-period green supply chain. J. Clean. Prod. 190, 388–402. doi:10.1016/j.jclepro.2018.04.114

Dong, G., Ge, Y., Zhu, W., Qu, Y., and Zhang, W. (2021). Coupling coordination and spatiotemporal dynamic evolution between green urbanization and green finance: a case study in China. Front. Environ. Sci. 8, 621846. doi:10.3389/fenvs.2020.621846

Driessen, P. H., Hillebrand, B., Kok, R. A., and Verhallen, T. M. (2013). Green new product development: the pivotal role of product greenness. IEEE Trans. Eng. Manag. 60 (2), 315–326. doi:10.1109/TEM.2013.2246792

Gao, L., Guo, L., and Orsdemir, A. (2021). Dual-channel distribution: the case for cost information asymmetry. Prod. Operations Manag. 30 (2), 494–521. doi:10.1111/poms.13278

Ghosh, D., and Shah, J. (2012). A comparative analysis of greening policies across supply chain structures. Int. J. Prod. Econ. 135 (2), 568–583. doi:10.1016/j.ijpe.2011.05.027

Govindan, K., Kaliyan, M., Kannan, D., and Haq, A. N. (2014). Barriers analysis for green supply chain management implementation in Indian industries using analytic hierarchy process. Int. J. Prod. Econ. 147, 555–568. doi:10.1016/j.ijpe.2013.08.018

Green, K. W., Zelbst, P. J., Meacham, J., and Bhadauria, V. S. (2012). Green supply chain management practices: impact on performance. Supply chain Manag. Int. J. 17 (3), 290–305. doi:10.1108/13598541211227126

Guo, J., Yu, H., and Gen, M. (2020). Research on green closed-loop supply chain with the consideration of double subsidy in e-commerce environment. Comput. and Industrial Eng. 149, 106779. doi:10.1016/j.cie.2020.106779

He, L., Xu, L., Duan, K., Rao, Y., and Zheng, C. (2024). Does tax enforcement reduce corporate environmental investment? evidence from a quasi-natural experiment. Front. Environ. Sci. 12, 1374529. doi:10.3389/fenvs.2024.1374529

Hua, G., Wang, S., and Cheng, T. E. (2010). Price and lead time decisions in dual-channel supply chains. Eur. J. Operational Res. 205 (1), 113–126. doi:10.1016/j.ejor.2009.12.012

Jian, J., Li, B., Zhang, N., and Su, J. (2021). Decision-making and coordination of green closed-loop supply chain with fairness concern. J. Clean. Prod. 298, 126779. doi:10.1016/j.jclepro.2021.126779

Jiang, Y., Li, B., and Song, D. (2017). Analysing consumer RP in a dual-channel supply chain with a risk-averse retailer. Eur. J. Industrial Eng. 11 (3), 271–302. doi:10.1504/EJIE.2017.084877

Kadziński, M., Tervonen, T., Tomczyk, M. K., and Dekker, R. (2017). Evaluation of multi-objective optimization approaches for solving green supply chain design problems. Omega 68, 168–184. doi:10.1016/j.omega.2016.07.003

Karakaya, E., Hidalgo, A., and Nuur, C. (2014). Diffusion of eco-innovations: a review. Renew. Sustain. Energy Rev. 33, 392–399. doi:10.1016/j.rser.2014.01.083

Kemp, R., and Arundel, A. (1998). Survey indicators for environmental innovation. Available at: http://hdl.handle.net/11250/226478.

Li, B., Zhu, M., Jiang, Y., and Li, Z. (2016). Pricing policies of a competitive dual-channel green supply chain. J. Clean. Prod. 112, 2029–2042. doi:10.1016/j.jclepro.2015.05.017

Liou, J. J., Tamošaitienė, J., Zavadskas, E. K., and Tzeng, G. H. (2016). New hybrid COPRAS-G MADM Model for improving and selecting suppliers in green supply chain management. Int. J. Prod. Res. 54 (1), 114–134. doi:10.1080/00207543.2015.1010747

Matsui, K. (2024). Should competing suppliers with dual-channel supply chains adopt agency selling in an e-commerce platform? Eur. J. Operational Res. 312 (2), 587–604. doi:10.1016/j.ejor.2023.06.030

Mazzarano, M. (2024). Financial markets implications of the energy transition: carbon content of energy use in listed companies. Financ. Innov. 10 (1), 33. doi:10.1186/s40854-023-00546-7

Melis, K., Campo, K., Breugelmans, E., and Lamey, L. (2015). The impact of the multi-channel retail mix on online store choice: does online experience matter? J. Retail. 91 (2), 272–288. doi:10.1016/j.jretai.2014.12.004

Mohd Suki, N. (2016). Green product purchase intention: impact of green brands, attitude, and knowledge. Br. Food J. 118 (12), 2893–2910. doi:10.1108/bfj-06-2016-0295

Nagurney, A., and Toyasaki, F. (2003). Supply chain supernetworks and environmental criteria. Transp. Res. Part D Transp. Environ. 8 (3), 185–213. doi:10.1016/S1361-9209(02)00049-4

Saghiri, S., Wilding, R., Mena, C., and Bourlakis, M. (2017). Toward a three-dimensional framework for omni-channel. J. Bus. Res. 77, 53–67. doi:10.1016/j.jbusres.2017.03.025

Sarkis, J. (2003). A strategic decision framework for green supply chain management. J. Clean. Prod. 11 (4), 397–409. doi:10.1016/S0959-6526(02)00062-8

Sheu, J. B., and Chen, Y. J. (2012). Impact of government financial intervention on competition among green supply chains. Int. J. Prod. Econ. 138 (1), 201–213. doi:10.1016/j.ijpe.2012.03.024

Swami, S., and Shah, J. (2013). Channel coordination in green supply chain management. J. Operational Res. Soc. 64 (3), 336–351. doi:10.1057/jors.2012.44

Testa, F., and Iraldo, F. (2010). Shadows and lights of GSCM (Green Supply Chain Management): determinants and effects of these practices based on a multi-national study. J. Clean. Prod. 18 (10-11), 953–962. doi:10.1016/j.jclepro.2010.03.005

Wang, W., Lin, W., Cai, J., and Chen, M. (2023). Impact of demand forecast information sharing on the decision of a green supply chain with government subsidy. Ann. Operations Res. 329 (1), 953–978. doi:10.1007/s10479-021-04233-7

Wang, Y., Fan, R., Shen, L., and Jin, M. (2020). Decisions and coordination of green e-commerce supply chain considering green manufacturer's fairness concerns. Int. J. Prod. Res. 58 (24), 7471–7489. doi:10.1080/00207543.2020.1765040

Wu, H. C., Ai, C. H., and Cheng, C. C. (2016). Synthesizing the effects of green experiential quality, green equity, green image and green experiential satisfaction on green switching intention. Int. J. Contemp. Hosp. Manag. 28 (9), 2080–2107. doi:10.1108/IJCHM-03-2015-0163

Xi, S., and Lee, C. (2015). A game theoretic approach for the optimal investment decisions of green innovation in a manufacturer-retailer supply chain. Int. J. Industrial Eng. 22 (1), 1291.

Xiao, Y., Niu, W., Zhang, L., and Xue, W. (2023). Store brand introduction in a dual-channel supply chain: the roles of quality differentiation and power structure. Omega 116, 102802. doi:10.1016/j.omega.2022.102802

Xiaobao, P., Jian, W., Yuhui, C., Ali, S., and Qijun, X. (2024). Does the carbon emission trading pilot policy promote green innovation cooperation? Evidence from a quasi-natural experiment in China. Financ. Innov. 10 (1), 14. doi:10.1186/s40854-023-00556-5

Xie, X., Huo, J., and Zou, H. (2019). Green process innovation, green product innovation, and corporate financial performance: a content analysis method. J. Bus. Res. 101, 697–706. doi:10.1016/j.jbusres.2019.01.010

Yu, H., Jiang, Y., Zhang, Z., Shang, W. L., Han, C., and Zhao, Y. (2022). The impact of carbon emission trading policy on firms’ green innovation in China. Financ. Innov. 8 (1), 55. doi:10.1186/s40854-022-00359-0

Zhai, X., An, Y., Shi, X., and Liu, X. (2022). Measurement of green transition and its driving factors: evidence from China. J. Clean. Prod. 335, 130292. doi:10.1016/j.jclepro.2021.130292

Keywords: dual channel, green degree, pricing strategy, green product, stackelberg game

Citation: Luo X, Wang Y, Zhong Y and Liu C (2024) Green degree decision and pricing strategy of dual-channel supply chains. Front. Energy Res. 12:1463076. doi: 10.3389/fenrg.2024.1463076

Received: 11 July 2024; Accepted: 01 October 2024;

Published: 13 November 2024.

Edited by:

Yanchu Liu, Sun Yat-sen University, ChinaReviewed by:

Chaocheng Gu, Jinan University, ChinaCopyright © 2024 Luo, Wang, Zhong and Liu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Chen Liu, MTgyODE2MTA4MDFAMTYzLmNvbQ==

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.