- 1Department of Electrical and Electronics Engineering, Birla Institute of Technology, Ranchi, India

- 2School of Electrical Science, IIT Bhubaneswar, Bhubaneswar, Odisha, India

In isolated microgrids, distributed energy resources (DERs) such as small-scale generators, energy storage systems, and flexible loads operate independently from the main grid. The challenge is to optimize these resources to minimize user costs while ensuring microgrid stability and efficiency. This paper presents an optimization framework for DERs, leveraging a game-theoretical approach to demand-side management (DSM) in an isolated microgrid environment. Each participant aims to minimize their total cost by strategically managing renewable energy generation, storage, and consumption. The framework models the DSM problem as a noncooperative game, identifying equilibrium points where no user can unilaterally reduce costs. The proximal decomposition algorithm is employed to iteratively update user strategies, ensuring convergence to a Nash equilibrium. Furthermore, a blockchain-based system with smart contracts is integrated to automate critical processes, including registration, event detection, DSM actions, and incentive distribution. This integration enhances transparency, security, and efficiency in the microgrid. During the registration phase, all devices are authenticated and authorized through a secure, transparent blockchain ledger. Event detection is managed by the microgrid Energy Management System (EMS), which continuously monitors voltage and frequency levels, triggering predefined smart contract responses to maintain stability. DSM actions are automatically executed by smart contracts, adjusting energy loads, generation, and storage to balance supply and demand dynamically. The smart contracts also manage the economic incentives that drive participant engagement. They calculate and distribute incentives based on predefined criteria, ensuring accurate and prompt allocation. This process is recorded on the blockchain, providing an immutable and auditable trail of actions and rewards. By leveraging blockchain technology and a game-theoretical approach, the proposed framework ensures continuous optimal operation despite fluctuations in energy demand and renewable generation. This dynamic and adaptive model promotes decentralized and efficient energy management within the microgrid, fostering a resilient and sustainable energy ecosystem.

1 Introduction

1.1 Motivation and background

The modern energy landscape is undergoing a significant transformation, driven by the increasing adoption of renewable energy sources and the decentralization of energy systems. Traditional centralized energy management approaches face numerous challenges in integrating distributed energy resources (DERs) such as solar panels, wind turbines, and energy storage systems, particularly in isolated or islanded microgrids where connectivity to the main grid is limited or nonexistent. These challenges necessitate the development of advanced energy management strategies that ensure grid stability, optimize energy usage, and facilitate efficient peer-to-peer (P2P) energy trading among prosumers. The motivation for this study stems from the pressing need to address these challenges and harness the potential of decentralized energy management. Isolated microgrids, which operate independently from the main grid, are particularly vulnerable to fluctuations in energy supply and demand. The integration of renewable energy sources, while environmentally beneficial, introduces variability and unpredictability in power generation. This variability can lead to grid instability if not managed effectively. Traditional centralized energy management systems often struggle to cope with the dynamic nature of DERs and the complex interactions among multiple energy producers and consumers.

Blockchain technology, with its inherent features of security, transparency, and decentralization, offers a promising solution to these challenges. By enabling secure and transparent P2P energy trading, blockchain can facilitate the efficient integration of DERs into isolated microgrids. Smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, are a key enabler of blockchain-based energy trading. This automation reduces the need for manual intervention, enhances operational efficiency, and ensures that all transactions are recorded in an immutable and transparent manner. Moreover, the application of non-cooperative game theory in DSM provides a robust framework for modeling the interactions among prosumers. In a non-cooperative game, each prosumer aims to minimize their costs or maximize their benefits independently, while considering the actions of other prosumers. This decentralized decision-making process leads to a Nash equilibrium, where no prosumer can unilaterally improve their outcome by changing their strategy (Cui et al., 2023). By leveraging game theory, we can develop DSM strategies that optimize energy usage, balance supply and demand, and maintain grid stability in isolated microgrids.

1.2 Literature review

The concept presented in this paper leverages blockchain technology for the Microgrid Energy Management System (MEMS), enabling peer-to-peer energy transactions at the distribution level. This approach aims to deliver affordable and high-quality energy to local consumers through microgrids. One significant challenge in microgrid network design is automating the accounting and management of electricity production and consumption (Xu et al., 2015). Blockchain technology provides an effective solution for automated peer-to-peer transactive management through Smart Contracts. Blockchain, a form of distributed ledger technology, is composed of a series of blocks that contain information and hashes. The first block, known as the genesis block, is succeeded by subsequent blocks linked through hashes (Wen et al., 2021). Each block contains its hash and the hash of the previous block, enhancing the security of the blockchain. Any modification to a block’s information will change its hash but not the hash of the subsequent block, ensuring the immutability of stored transaction information. Blockchain data is organized in a Merkle tree. Another essential feature of blockchain is the consensus process, wherein miners use a nonce to validate transactions. The most commonly used consensus algorithm is Proof of Work (PoW), which is utilized in platforms like Bitcoin and Ethereum (Liang, 2020; Umar A. et al., 2022).

Blockchain technology is increasingly being adopted in microgrids to facilitate peer-to-peer energy transactions and manage demand-side power. In (Junaidi et al., 2023), blockchain is used for Demand Side Management (DSM), enabling energy trading among prosumers. Instant trading between prosumers and consumers reduces transaction time by optimizing block size and node number. Blockchain’s decision-making capability through Smart Contracts is emphasized, with transactions initiated by either a generator or a consumer (Zhang et al., 2018; Efanov and Roschin, 2018). These studies focus on developing peer-to-peer networks that allow sellers and buyers to finalize deals instantly. Blockchain networks, known for their high security, when combined with Demand Response (DR) programs, can improve system load profiles and reduce overall electricity costs. Smart meters, IoT devices, and sensors connected over ICTs provide automated solutions for DSM programs that are user-friendly and easily manageable. This research utilizes secured DR programs coded in Ethereum blockchain to offer better solutions for the effective control, monitoring, and secure operation of the entire microgrid energy system.

Microgrids comprise components such as RES sources, critical and non-critical loads, smart meters, Human-Machine Interfaces (HMIs), protective relays, circuit breakers, home appliances, communication networks, and IoT devices. These components work together to operate, monitor, and control power flow and measurements. Traditional cybersecurity techniques are insufficient to meet the security needs of smart grids or microgrids. Researchers and industry experts now believe that blockchain applications can enhance grid security (Musleh et al., 2019). Control and operational aspects of RES integration, battery storage, and electric vehicles in the power grid are broad research areas (Jha et al., 2022). Blockchain technology can address operational aspects of microgrids, including demand-side control and optimized operation, which are emerging research areas. Blockchain technology was integrated for Distributed Energy Resources (DERs) scheduling, providing a secure and transparent platform for all DERs (Zhou et al., 2023; Danzi et al., 2017). Munsing et al. developed a model for scheduling mixed DERs in microgrids based on decentralized optimal power flow (OPF) to optimize and control DERs (Münsing et al., 2017).

Application of blockchain technology for DSM is proposed in (Junaidi et al., 2023), demonstrating how to reduce the Peak-Average ratio (PAR) and smooth load profile dips by supply constraints. A novel approach in (Thomas et al., 2019) uses blockchain for medium voltage DC application control, sharing responsibilities between system operators and the energy system. Blockchain can be implemented by creating a cyber layer into different parts of the smart grid, with each part having its blockchain. Integrating these blockchains can enhance smart grid performance (Agung and Handayani, 2020; Yan et al., 2023). Energy trading with microgrids and distributed generation has become a significant research area. Blockchain has been crucial in peer-to-peer (P2P) energy transactions, providing cyber-physical security and eliminating fraudulent behaviours (Khaqqi et al., 2018). Energy trading using blockchain is secure, reliable, and beneficial for all stakeholders. In P2P systems, transactions are recorded in blocks instantly and independently, without third-party involvement, allowing energy buyers and sellers to choose preferences (Otjacques et al., 2018). Optimization processes have been used in OPF for P2P trading in blockchain (Münsing et al., 2017). Several use cases of blockchain exist worldwide, notably the Brooklyn micro-grid. Power Ledger, an Australian company, facilitates the transfer of excess generation by prosumers to nearby consumers or prosumers. Grid+, SIEMENS, and LO3 Energy are other companies implementing power trading between peers in microgrid systems using blockchain technology (Musleh et al., 2019).

Recent research has shown increasing interest in optimization techniques for DSM in microgrids, including dynamic programming (DP), mixed integer linear programming (MILP), evolutionary algorithms, and game theory (Thirunavukkarasu et al., 2022; Topa et al., 2023; Wang et al., 2015; Jin et al., 2017). A paper formulates multi-objective optimization for load flexibility trade-offs (Chen et al., 2019). A game-theoretical approach to analyze incentive schemes to motivate microgrid consumers is presented in (Li et al., 2022). A non-cooperative game explores solar PV system integration in microgrids for different consumer sets (Wang G. et al., 2017). A study investigated hybrid PV and wind systems integrated into microgrids for size optimization (Amrollahi and Bathaee, 2017). Various frameworks aim at PAR and cost reduction using pricing-based incentive schemes. Other studies incorporate battery storage into DSM frameworks (Wang et al., 2014; Mulleriyawage and Shen, 2021). Many authors have also proposed and investigated DER integration in demand-side energy management (Bakare et al., 2023; Wang X. et al., 2017).

To summarize, upgrading LV/MV distribution systems is necessary to transition from passive to active distribution systems. In such conditions, DR programs are one of the best solutions to help microgrid operators balance generation and load. DR Programs encourage customers to change their electricity usage based on tariffs and incentives, participating in competitive environments and business transactions for better DSM, PAR, and cost reduction. However, challenges remain, such as introducing market concepts in LV/MV systems, coordinating between LV/MV and HV operators, and creating a user-friendly platform to encourage mass participation in market operations.

Moreover, the increasing internet connectivity in smart grid infrastructures has led to various cyber-attacks, such as Advanced Persistent Threats (APT), Denial of Service (DoS), Stuxnet, and Black Energy. A recent cyber-attack on Ukraine’s power grid caused an outage affecting over two hundred thousand consumers, linked to a new variant of Black Energy Trojan named Disakil (Leszczyna, 2018). Securing this complex infrastructure from cyber-attacks is a significant challenge. Blockchain is considered a highly secure and reliable network that can automate transactions using smart contracts in microgrid operations in a cyber-secure manner through encryption technology.

1.3 Research gaps and contributions

Despite the advancements in blockchain technology and game theory, there remains a need for an integrated approach that combines these technologies to enhance DSM in isolated microgrids. Previous studies have focused on either blockchain for P2P energy trading or game theory for DSM. However, they have not fully addressed the combined potential in optimizing DERs and ensuring grid stability. For instance, the paper (Mengelkamp et al., 2018) highlighted the benefits of blockchain in energy markets, but they did not consider the dynamic interactions modelled through game theory. Similarly, the authors of the paper (Hupez et al., 2023) applied game theory to DSM but did not incorporate blockchain for transaction security and transparency.

Additionally, while existing literature has demonstrated the use of blockchain for secure transactions, the detailed design and implementation of smart contracts tailored for energy management in isolated microgrids are often underexplored. Smart contracts in the context of energy trading require a meticulous approach to ensure automated and efficient handling of DSM actions, event detection, incentive distribution, and compliance with grid stability requirements. For example, existing work (Noor et al., 2018) describes the general use of smart contracts but lacks a comprehensive framework that integrates these contracts into a dynamic and adaptive DSM system.

Furthermore, there is a lack of critical evaluation in the literature concerning the automation of complex demand-side management (DSM) actions using smart contracts. These actions include load adjustments, generation modulation, and storage management in response to real-time grid conditions. It is essential to have a discussion on the practical challenges and solutions for implementing detailed smart contracts for maintaining grid stability and optimizing resource utilization.

This paper has the following important contributions:

1. Integration of Blockchain and Smart Contracts for Energy Management: The paper demonstrates the integration of blockchain technology and smart contracts into the microgrid energy management system. This ensures secure, transparent, and tamper-proof transactions, enhancing reliability and efficiency. Smart contracts automate critical processes like device registration, event detection, DSM actions, and incentive distribution, reducing manual intervention.

2. Game-Theoretical Approach to Demand-Side Management: The study applies game theory to the DSM problem in an isolated microgrid environment, modeling it as a non-cooperative game and using the proximal decomposition algorithm to find Nash equilibrium points. This approach ensures decentralized, adaptive, and efficient management of DERs, optimizing the microgrid’s performance.

3. Automated and Transparent DSM Actions: Automated execution of DSM actions through smart contracts is highlighted. These actions adjust energy loads, generation, and storage in response to voltage or frequency deviations, with all actions recorded on the blockchain for transparency and auditability, enhancing trust and compliance.

4. Economic Incentive Mechanism: The study presents a mechanism for calculating and distributing economic incentives based on participants’ DSM actions. Smart contracts evaluate responses and handle incentive distribution, ensuring prompt and accurate allocation. This incentivization encourages active participation and compliance with DSM strategies.

5. Comprehensive Data Analysis and Performance Insights: Detailed analysis of performance data from five prosumers over various DR events provides valuable insights into the benefits of active DSM participation. The analysis covers RES generation, storage, P2P trading, net profit, and maximum demand during DR events, emphasizing strategic energy management and adaptive decision-making in decentralized energy markets.

The paper is organized as follows: Section 2 discusses Demand Side Management (DSM) in isolated microgrids using non-cooperative game theory. It highlights the importance of DSM for maintaining grid stability and optimizing energy usage, and explains how non-cooperative game theory models the interactions among prosumers, leading to a Nash equilibrium. Section 3, Methodology, details the steps involved in implementing DSM using blockchain technology and smart contracts. Section 3.1, Registration Phase, describes how devices are integrated into the blockchain-based system, ensuring proper registration, authentication, and authorization. Section 3.2, Event Detection, explains the continuous monitoring of voltage and frequency by the microgrid EMS, which triggers smart contracts to automate corrective actions. Section 3.3, DSM Actions, outlines the execution of DSM strategies through smart contracts, adjusting energy loads, generation, and storage, and recording these actions on the blockchain. Section 3.4, Incentive Distribution, discusses the calculation and distribution of economic incentives via smart contracts, promoting participant engagement and compliance with DSM strategies. Section 4, Results and Discussions, presents the simulation results, including performance metrics such as RES generation, storage, P2P trading, net profit, and demand during DR events, along with an analysis of these results. Section 5, Conclusions, summarizes the key findings, emphasizing the effectiveness of using non-cooperative game theory and blockchain technology in DSM for isolated microgrids, and suggests potential future research directions.

2 Demand side management in isolated microgrids using non-cooperative game theory

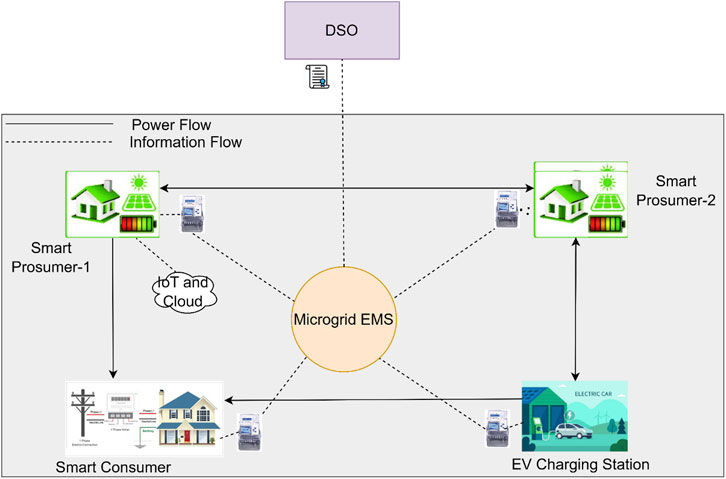

Figure 1 illustrates the operation of an islanded microgrid with various smart components interacting through a central Microgrid Energy Management System (EMS). The main components include Smart Prosumers (Prosumers 1 and 2), a Smart Consumer, and an EV Charging Station, all managed by the Microgrid EMS, with oversight from a Distributed System Operator (DSO). The Smart Prosumers are entities that both consume and produce energy, equipped with renewable energy sources such as solar panels and energy storage systems like batteries. They generate their own electricity, store any excess for future use, or sell it to other participants in the microgrid. The Smart Consumer, on the other hand, is an entity that solely consumes energy, relying on power from other prosumers or the grid. The EV Charging Station provides charging facilities for electric vehicles and acts as a flexible load within the microgrid, drawing power when needed and supplying power to the microgrid participants through P2P energy trading. The Microgrid EMS manages the balance of supply and demand, voltage and frequency regulation, and optimization of energy flows. It interacts with all other components to ensure efficient and reliable operation. The DSO oversees the broader electricity distribution network and interfaces with the microgrid for regulatory and operational purposes. In islanded mode, the microgrid operates independently from the main grid managed by the DSO. IoT and cloud technologies facilitate communication and data exchange between the microgrid components. Smart meters collect and transmit data such as energy production, consumption, and storage levels to the Microgrid EMS. Power flow in the system, represented by solid lines, denotes the actual transfer of electrical energy between different entities in the microgrid. For example, energy generated by Smart Prosumers can be directly used by the Smart Consumer or stored in the EV Charging Station’s batteries. Information flow, depicted by dashed lines, signifies the exchange of data and control signals, essential for the coordination and management of the microgrid. The Microgrid EMS collects data from all connected devices, processes it, and sends control commands to ensure optimal operation. The operation begins with the registration and communication phase, where Smart Prosumers, Consumers, and EV Charging Stations are registered in the microgrid system. These entities continuously communicate their operational status, energy production, consumption, and storage levels to the Microgrid EMS through IoT and cloud services. In the energy management phase, the Microgrid EMS analyzes the data received and determines the optimal energy distribution strategy, considering factors such as energy demand, supply, and storage levels.

During high demand periods, the Microgrid EMS implements demand response strategies by reducing non-critical loads or shifting them to off-peak periods. It can also incentivize Smart Prosumers to increase their energy production or release stored energy to balance the load. In islanded mode, the microgrid operates independently of the main grid, with the Microgrid EMS ensuring stability by managing local generation and consumption. The system must maintain voltage and frequency within acceptable limits, necessitating real-time adjustments based on dynamic conditions. In an isolated microgrid, distributed energy resources (DERs) such as small-scale generators (e.g., solar panels, wind turbines), energy storage systems (e.g., batteries), and flexible loads (e.g., controllable appliances) are integrated to operate independently from the main grid. These resources are managed locally by individual users but need to be coordinated to ensure the optimal operation of the entire microgrid. The challenge lies in optimizing the use of these distributed resources to minimize costs for the users while maintaining the stability and efficiency of the microgrid. This involves complex decision-making processes where users determine when to generate, store, or consume energy based on factors such as local energy demand, the availability of renewable energy, and the state of charge of storage systems. Given the lack of connection to the main grid, it is crucial to balance generation and consumption within the microgrid to prevent outages and ensure a reliable power supply.

2.1 Objective function

Each participant

where

Constraints:

Energy Balance is shown in Equation 2:

where

Storage Constraints are shown in Equations 3.a, 3.b, 3.c, 3.d:

where

Generation Constraint is shown in Equation 4:

where

Demand Response Constraint is shown in Equation 5:

where

Voltage and Frequency Stability Constraints are shown in Equations 6 and 7:

2.2 Cost and incentive calculations

2.2.1 Cost of generating renewable energy

To provide a more realistic representation of the cost associated with renewable energy generation, we use a quadratic cost function as mostly adopted in the literature (Atzeni et al., 2013). This approach reflects the increasing marginal cost of energy production as the output level increases, which is common in many energy generation systems.

The quadratic cost function is expressed in Equation 8 as:

where:

2.2.2 Storage cost

The cost associated with charging or discharging the energy storage system (ESS) for each prosumer i at time t is indeed modeled as a convex function. This cost includes the expenses incurred during the charging and discharging processes.

The battery ESS cost function is defined in Equation 9 as follows:

where:

2.2.3 Blockchain service costs

In our decentralized energy management system, blockchain technology is utilized for recording transactions, verifying energy exchanges, and maintaining a transparent and tamper-proof ledger. The costs associated with blockchain services include transaction fees, smart contract execution costs, and infrastructure maintenance costs. These costs are an integral part of the overall cost calculation for each prosumer.

2.3 Cost components

1. Transaction Fees,

Each transaction recorded on the blockchain incurs a fee, which is proportional to the size and complexity of the transaction.

For prosumer i at time t, the transaction fee is calculated as in Equation 10:

where:

2. Smart Contract Execution Cost,

Smart contracts are executed for various operations such as energy trading, incentive distribution, and demand response actions.

For prosumer i at time t, the smart contract execution cost is calculated as in Equation 11:

where:

3. Infrastructure Maintenance Costs,

These costs include maintaining the blockchain network infrastructure, such as nodes, servers, and storage.

For simplicity, we assume a fixed infrastructure maintenance cost for each prosumer i as in Equation 12:

Where:

Total Blockchain Service Cost.

The total cost of blockchain services for each prosumer i at time t is the sum of the transaction fees, smart contract execution costs, and infrastructure maintenance costs as defined in Equation 13:

2.3.1 Incentive calculations

Incentives for Load Shifting and Reductions,

Prosumers receive incentives for shifting their energy consumption to off-peak periods or reducing their overall energy consumption as shown in Equation 14:

Where

Nash Equilibrium Game Theory: It provides a powerful framework for analyzing scenarios where multiple decision-makers (players) interact. In the context of an isolated microgrid, each user (or household) with DERs can be considered a player in a game. Each player’s decisions regarding energy generation, storage, and consumption affect not only their own costs but also the overall operation of the microgrid and the costs incurred by other players. By modeling the demand-side management (DSM) problem as a noncooperative game, we can analyze and find equilibrium points where no user can reduce their costs by unilaterally changing their strategy (Noor et al., 2018; Atzeni et al., 2013; Pilz and Al-Fagih, 2020). This equilibrium is known as the Nash equilibrium, representing a state where no player can improve their payoff by unilaterally changing their strategy, given the strategies of all other players. Decentralized decision-making is a fundamental aspect of an isolated microgrid. Each user makes decisions based on local information and personal objectives, reducing the need for centralized control and enhancing user privacy. This approach ensures that users retain control over their energy resources while contributing to the overall efficiency of the microgrid. The interdependency of strategies plays a critical role in this framework. The decisions made by one user affect the outcomes of others, creating a complex interdependency that must be accounted for in the optimization process. This interconnectedness necessitates careful analysis of each user’s actions and their impact on the microgrid’s overall performance.

Moreover, the game-theoretical model is dynamic and adaptive, capable of responding to changes in the environment. Fluctuations in energy demand or variations in renewable energy generation are common in isolated microgrids, and the model can adjust to these changes, ensuring continuous optimal operation. To apply game theory to DSM in an isolated microgrid, several key elements need to be defined. The players in this game are the users with DERs. Each player has a set of strategies, which include the possible actions they can take, such as the amount of energy to generate, store, or consume at different times.

The payoff functions for each player are critical as they represent the cost incurred based on their strategy and the strategies of others. These functions include the operational costs of DERs, the benefits of utilizing stored energy, and the savings from optimized energy usage.

The payoff function for each user

where:

The payoff function

Players: All participants (prosumers).

Strategies:

where:

The strategy

By modeling the DSM problem as a noncooperative game, it is possible to analyze and find equilibrium points where no user can reduce their costs by unilaterally changing their strategy, ensuring efficient and stable operation of the isolated microgrid. To achieve this, the proximal decomposition algorithm can be employed to iteratively update each user’s strategy in response to the aggregate strategy of all other users, incorporating a regularization term to ensure convergence. This algorithm helps to find the Nash equilibrium, thus enabling decentralized, adaptive, and efficient management of the microgrid’s distributed resources.

2.4 Optimization problem

Each participant

where

The strategy sets

Compactness: The strategy sets are bounded and closed as shown in Equation 18:

Convexity: The strategy sets are convex.

Convexity of the Payoff Function: The convexity of the payoff function

Hessian Matrix of

For

Algorithm 1.Proximal Decomposition Algorithm for Nash Equilibrium.

The proximal decomposition algorithm can be used to find the Nash equilibrium in this P2P energy trading setup.

1. Initialization: Set initial strategies

2. Initialize the regularization parameter

Iterative steps:

For each participant

1. Proximal Update is shown in Equation 20:

2. Update the centroid using the average of the strategies as defined in Equation 21:

3. Convergence Check:

Terminate the iteration when the relative change in strategies is below a predefined threshold

2.4.1 Steps to calculate equilibrium price and volume

1. Initial Setup:

• Collect initial data on energy generation, storage, and consumption for each prosumer.

• Define the cost coefficients for generation (

• Set the incentive rates (

2. Iterative Calculation Using Proximal Decomposition Algorithm 1

3. Market-Clearing Condition:

• Solve for the equilibrium price

2.5 Model assumptions

Firstly, we assume that all users act rationally, aiming to minimize their costs or maximize their benefits. This is a reasonable assumption as prosumers are incentivized to reduce their energy expenses and optimize their energy usage, especially in a decentralized energy market where individual actions have direct economic implications. Additionally, we assume that users have complete information about the game’s structure, including costs, benefits, and potential actions of other users. This assumption simplifies the model by ensuring that all players make decisions based on the same data set, facilitated by blockchain technology that provides transparent communication. Furthermore, users are assumed to be strategic, considering the actions of others in their decision-making processes. This aligns with the decentralized nature of microgrids, where the actions of one prosumer can affect the outcomes for others and is essential for achieving a Nash equilibrium. Regarding market conditions, we assume perfect competition, ensuring that no single prosumer can influence market prices or outcomes, which is a reasonable approximation for microgrids with numerous small-scale prosumers. The model also assumes relatively stable market conditions, allowing for the use of static game models. While real-world conditions can fluctuate, this assumption helps focus on the core dynamics of DSM and simplifies the analytical process. Consistent availability of renewable energy sources, which can be forecasted with reasonable accuracy, is also assumed. This is supported by advancements in renewable energy forecasting technologies, enabling more predictable energy generation patterns crucial for effective DSM. Technological limitations are addressed by assuming known and constant efficiencies for energy storage systems, which simplifies the model and reflects the current state of technology where efficiency parameters are well-documented. Finally, for model feasibility, we assume homogeneous prosumers, which helps simplify the analysis while providing general insights. Although real-world prosumers have diverse characteristics, this assumption allows for a manageable and clear model that can be extended to more complex scenarios in future research. We also assume a deterministic environment, which simplifies the model by removing uncertainties and allows for a focus on core mechanisms. This assumption can be relaxed in future studies to incorporate stochastic elements.

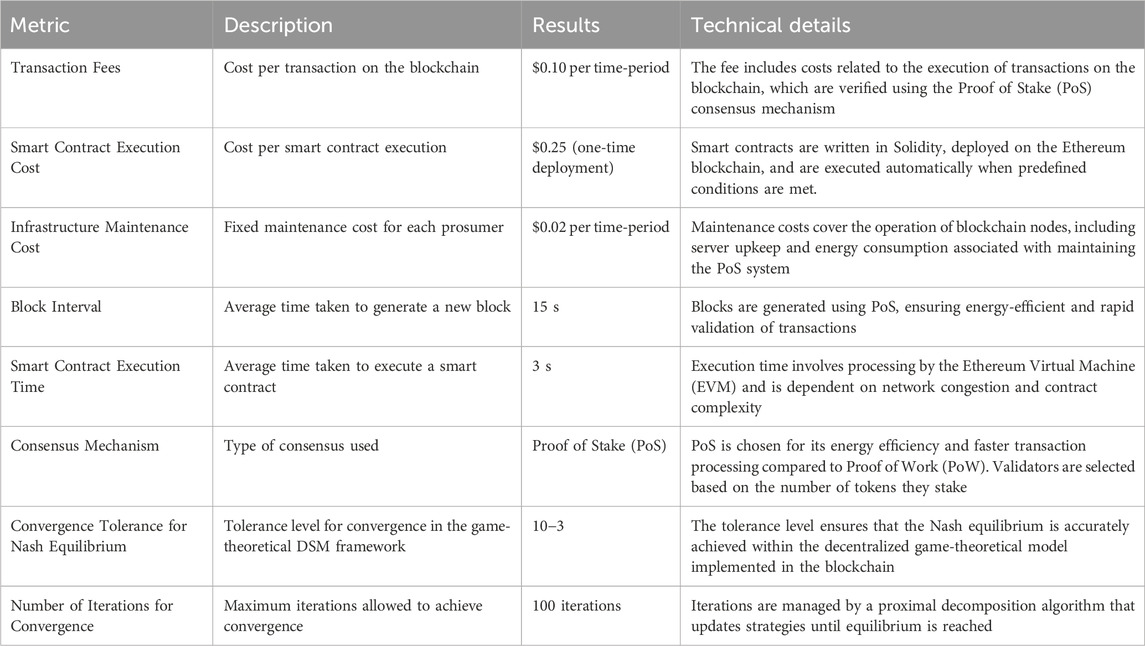

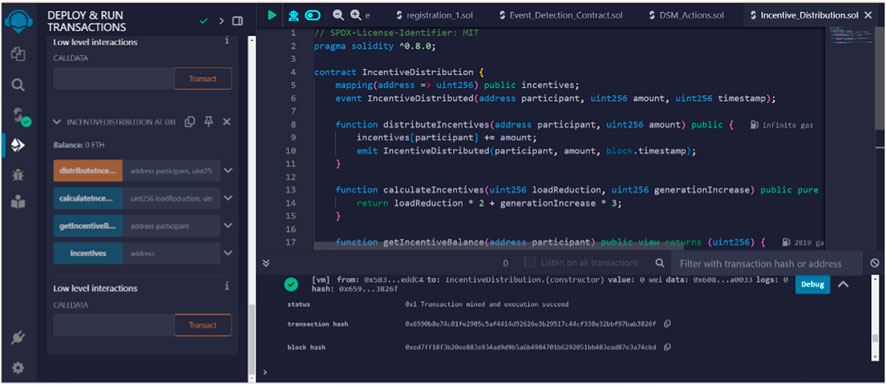

3 Demand side management implementation using blockchain smart contracts

The blockchain system employed in this study utilizes a decentralized ledger to record all transactions related to energy trading, DSM actions, and incentive distributions. The architecture comprises multiple interconnected nodes, each representing a participant in the microgrid, such as prosumers, renewable energy sources (RES) owners, and the microgrid Energy Management System (EMS) as shown in Figure 2. The blockchain operates on the Ethereum platform, which supports smart contract functionality through the Solidity programming language. Each node maintains a copy of the blockchain ledger, ensuring transparency and security. Transactions are validated through a consensus mechanism, specifically the Proof of Stake (PoS) algorithm. PoS was chosen over Proof of Work (PoW) due to its energy efficiency and faster transaction processing times. In PoS, validators are chosen based on the number of tokens they hold and are willing to “stake” as collateral, which significantly reduces the computational resources required for transaction validation.

Figure 2. Blockchain-based P2P transaction system for the Microgrid Energy Management System (MEMS).

To ensure the large-scale participation of prosumers, medium-scale renewable energy source (RES) owners, and customers in the Demand Response (DR) program, several steps are necessary to achieve the objective of reducing dependency on thermal units and extensive transmission networks. These steps include the registration of microgrid participants, such as RES owners, prosumers, and consumers. Once participants have submitted their credentials, the system verifies and validates these credentials, accepting or rejecting participation based on predefined criteria. All transaction requests from participants are stored in a cloud-based system for processing. Following the storage of transaction requests, the Microgrid Energy Management System (MEMS) runs the Optimal Power Flow (OPF) to evaluate system constraint parameters and ensure the feasibility of transactions. In the next phase, validated transaction requests are broadcasted to the peer-to-peer (P2P) network. Smart contracts are then deployed to manage these transactions using consensus algorithms, ensuring agreement among network participants. These transactions are subsequently validated by miners to ensure authenticity and accuracy. Once validated, a new block is created containing the validated transactions, and this new block is added to the blockchain, ensuring a secure and immutable record of transactions. The overall process is demonstrated in Figure 2.

Figure 2 illustrates these steps, from transaction initiation to completion. In Step 1, all microgrid participants send requests to the registration authority (RA). Step 2 ensures that only registered participants can engage in transactions, verified through their public keys. In Step 3, all transaction requests are stored in the cloud. Following this, the MEMS runs the OPF on the generation and load data provided by RES producers, consumers, and prosumers to verify system parameters and achieve cost minimization, as outlined in Step 4. In case of a generation shortfall, transaction requests are sent to consumers with an initial incentive rate to solicit DR resources. This cycle continues with updated incentive rates, employing elasticity-based DR modeling to simulate events. If no violations are found, the requested transaction is broadcasted to all peers, as depicted in Step 5. The smart contract is then deployed with DSM using Nash equilibrium game theory to calculate the price for the transaction volume using a consensus algorithm. Subsequently, the transaction is validated by a miner in Step 6. Upon validation, a new block is created in Step 7 and added to the existing blockchain with a new hash, as shown in Step 8.

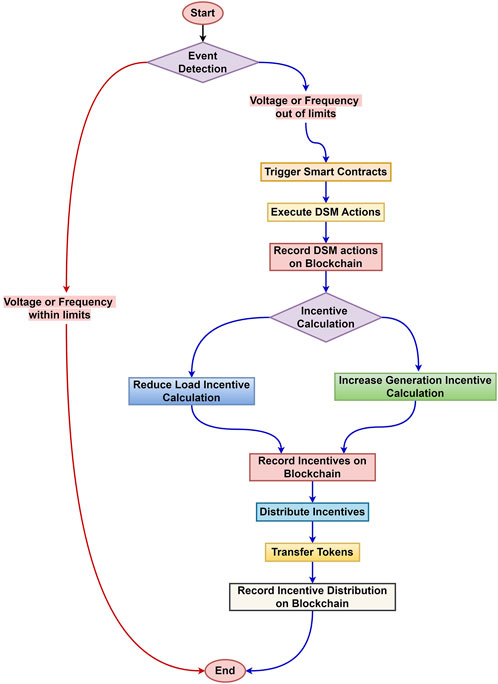

The Flowchart shown in Figure 3 illustrates a detailed process within a blockchain-based energy trading system, focusing on event detection, demand-side management (DSM) actions, and incentive distribution. The process starts with the event detection phase, where the system continuously monitors voltage and frequency levels within the microgrid. If these parameters remain within predefined limits, the process concludes. However, if deviations are detected, indicating potential instability, the system triggers smart contracts to initiate corrective actions. These smart contracts automate DSM actions, such as adjusting energy loads, modifying generation levels, and managing energy storage systems to restore balance within the microgrid. Once the DSM actions are executed, they are meticulously recorded on the blockchain, ensuring transparency and providing an immutable trail of activities. Following this, the system proceeds to calculate incentives for the participants based on their contributions to the DSM actions. This calculation is divided into two paths: one for reducing load incentives and the other for increasing generation incentives. Both paths lead to recording these incentives on the blockchain. The next step involves the distribution of these calculated incentives, where tokens or credits are transferred to the participants’ accounts. This distribution process is also recorded on the blockchain to maintain transparency and accuracy. Finally, the process concludes with the recording of the incentive distribution on the blockchain, ensuring a comprehensive and verifiable record of all transactions. If no deviations were initially detected, the system directly moves to the end. This flowchart effectively demonstrates a robust, automated system for managing energy distribution, maintaining grid stability, and incentivizing participants, leveraging the security and transparency offered by blockchain technology.

Figure 3. Flowchart for event detection, DSM actions, and incentive distribution in a blockchain-based energy trading system.

Smart contracts are automated programs written in solidity language on Ethereum blockchain platform and it executes when the agreements conditions between the peers are met without third party’s involvement. Here smart contract is used to define the energy flexibility profiles of each user (consumers, prosumers, and RES aggregators) for taking part in DR programs and the rules for assuring the demand and generation balance at the grid level in automated manner. The set of rules here describe the behaviour of each participant during DR events while keeping the constraints within limits to maintain the grid parameters within the limits, therefore maintaining the stability and reliability intact of the system. These smart contracts are stored in the blockchain, and they are triggered when new energy transactions are taking place. Blockchain nodes keep updating its state after execution of each smart contract. The smart contract works as an agent in the blockchain that has state variables, enforces the associated rules, and it can be triggered at any point after its successful deployment. The voluntary enrolment of each user in a DR event is automatically regulated through smart contracts. Smart contract defines each individual baseline load demand profile, current load profile, expected load profile, and adjustments values in energy flexibility that is required to shift during DR event time. These contracts automate various processes, such as device registration, event detection, DSM actions, and incentive distribution. Below is a detailed description of the key smart contracts used in this study:

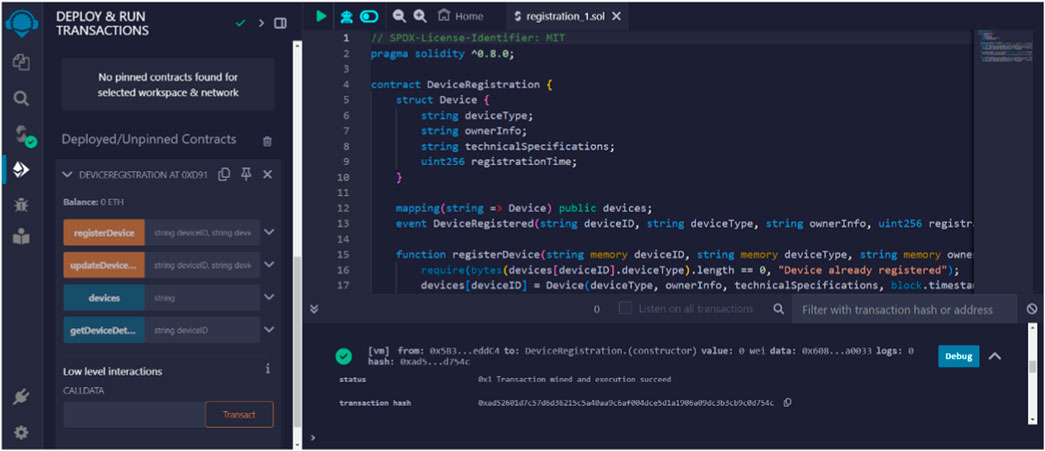

3.1 Registration phase

The registration phase is the foundational step in integrating devices into a blockchain-based energy trading and management system. This phase ensures that all devices participating in the microgrid are properly registered, authenticated, and authorized to interact with the network. The use of blockchain technology and smart contracts in this phase provides a secure, transparent, and tamper-proof method for device registration and management. During this phase, participants begin by identifying the devices they wish to register on the blockchain, which can include renewable energy generators, energy storage systems, and flexible loads. Each device must have a unique identifier, such as a serial number or digital certificate, to ensure it can be distinctly recognized within the network. Participants use a blockchain interface to initiate the registration process by submitting device information, including the unique identifier, technical specifications, and ownership details. This information is then packaged into a transaction and sent to the blockchain network.

A smart contract as shown in Algorithm 2, specifically designed for device registration, processes the incoming transaction. It performs several critical functions: validation to check the completeness and correctness of the provided information, authentication by interacting with external systems to verify device credentials, and authorization to ensure the participant is allowed to register the device based on identity and compliance checks. Once verified and authenticated, the smart contract records the device’s details on the blockchain, creating a new record on the blockchain ledger that includes the device’s unique identifier, technical specifications, ownership details, and a timestamp of the registration. It also generates a unique blockchain address or token associated with the device. After storing the device information on the blockchain, the system provides feedback to the participant, including a confirmation of successful registration and relevant details such as the blockchain address or token assigned to the device. Participants receive this confirmation through the blockchain interface, ensuring they have a verifiable record of the registration. The registration phase also includes mechanisms for updating device information. Participants can submit updates, such as changes in ownership, technical upgrades, or maintenance activities, through the blockchain interface. Smart contracts verify and authenticate these updates before recording them on the blockchain, ensuring the ledger remains accurate and up-to-date.

Algorithm 2.Pseudo code for registration phase.

procedure RegisterDevice(deviceID, deviceType, ownerInfo)

transaction = createTransaction(deviceID, deviceType, ownerInfo)

sendToBlockchain(transaction)

end procedure

procedure SmartContract_Verification(transaction)

if validateInformation(transaction) and authenticateDevice(transaction.deviceID) then

authorizeParticipant(transaction.ownerInfo)

recordOnBlockchain(transaction)

generateBlockchainAddress(transaction.deviceID)

sendConfirmation(transaction.ownerInfo)

else

rejectTransaction(transaction)

end if

end procedure

procedure UpdateDeviceInfo(deviceID, updatedInfo)

transaction = createTransaction(deviceID, updatedInfo)

sendToBlockchain(transaction)

end procedure

procedure SmartContract_UpdateVerification(transaction)

if validateUpdateInformation(transaction) and authenticateDevice(transaction.deviceID) then

recordUpdateOnBlockchain(transaction)

sendUpdateConfirmation(transaction.ownerInfo)

else

rejectTransaction(transaction)

end if

end procedure

Using blockchain and smart contracts for device registration offers several benefits: security through blockchain’s cryptographic nature, transparency of all transactions and records, decentralization that eliminates the need for a central authority, efficiency through automated processes, and immutability ensuring that once recorded, information cannot be altered or deleted. In conclusion, the registration phase is a critical step in integrating devices into a blockchain-based energy trading and management system. Leveraging blockchain technology and smart contracts ensures secure, transparent, and efficient device registration and management, laying the groundwork for reliable and optimized operation of the microgrid. This robust framework supports the integrity and functionality of the entire energy trading ecosystem, facilitating seamless interaction between distributed energy resources and enhancing overall grid stability.

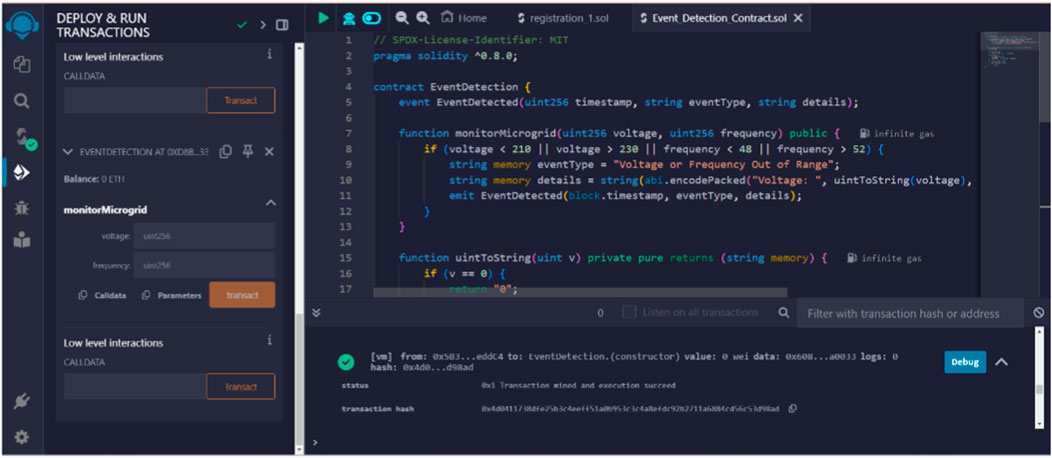

3.2 Event detection

The microgrid EMS plays a vital role in maintaining the stability and reliability of the energy trading system. It continuously monitors critical parameters such as voltage and frequency to ensure they remain within predefined thresholds essential for safe and efficient microgrid operation. This real-time monitoring involves collecting data from various distributed energy resources (DERs) and connected devices, allowing the controller to have an up-to-date overview of the microgrid’s operational status. When the microgrid EMS detects that voltage or frequency levels are approaching or exceeding the set thresholds, indicating potential instability or inefficiency, it triggers a pre-programmed response via smart contracts deployed on the blockchain as outlined in Algorithm 3. These smart contracts are designed to automate corrective actions without the need for manual intervention. Upon activation, the smart contracts execute predefined rules to adjust the operation of DERs, such as redistributing loads, adjusting generation levels, or engaging energy storage systems to balance supply and demand.

Algorithm 3.Pseudo code for event detection.

procedure MonitorMicrogrid ()

while true do

voltage = getVoltage ()

frequency = getFrequency ()

if voltage < V_min or voltage > V_max or frequency < f_min or frequency > f_max then

triggerSmartContract (voltage, frequency)

end if

sleep (interval)

end while

end procedure

procedure SmartContract_EventResponse (voltage, frequency)

if voltage < V_min then

adjustLoad (“increase”)

adjustGeneration (“decrease”)

else if voltage > V_max then

adjustLoad (“decrease”)

adjustGeneration (“increase”)

end if

if frequency < f_min then

engageStorage (“discharge”)

else if frequency > f_max then

engageStorage (“charge”)

end if

recordEventOnBlockchain (voltage, frequency, actions)

end procedure

This automated process ensures timely and precise responses to any deviations in voltage or frequency, thereby preventing potential outages and maintaining the overall stability of the microgrid. By leveraging smart contracts, the microgrid controller not only enhances operational efficiency but also provides a secure and transparent mechanism for implementing real-time adjustments, ensuring continuous optimal performance of the energy trading system.

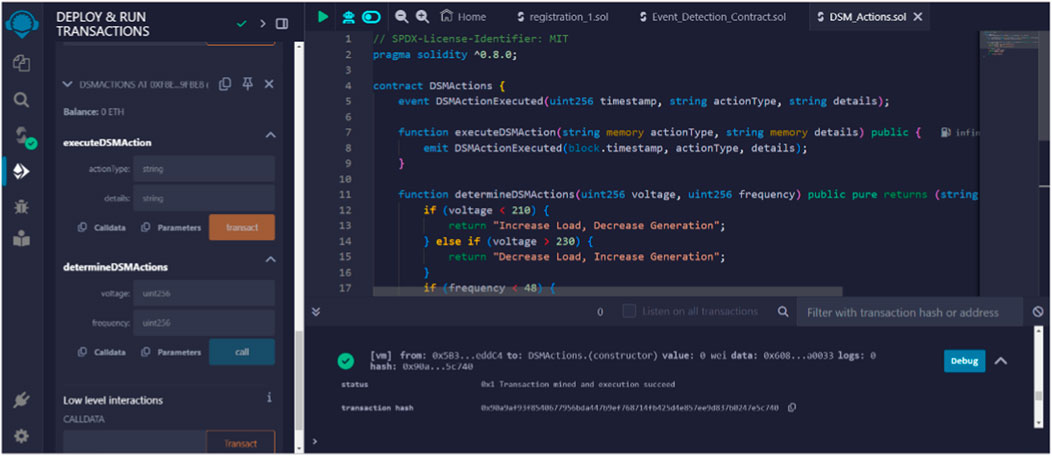

3.3 DSM actions

Smart contracts play a pivotal role in executing Demand-Side Management (DSM) actions within a blockchain-based energy trading system. Once activated by the microgrid controller in response to voltage or frequency deviations, these smart contracts automatically implement various DSM strategies to restore balance and maintain optimal operation of the microgrid. The DSM actions involve adjusting energy loads, generation, and storage. For instance, the smart contract as outlined in Algorithm 4 reduce the energy consumption of non-critical loads during peak demand periods, shift energy usage to off-peak times, or increase the output from renewable energy sources like solar panels or wind turbines when needed. Additionally, the smart contract can manage energy storage systems by charging batteries during times of surplus generation and discharging them when there is a deficit, ensuring a continuous and reliable power supply.

Algorithm 4.Pseudo code for DSM actions.

procedure SmartContract_DSM (voltage, frequency)

if voltage < V_min or voltage > V_max or frequency < f_min or frequency > f_max then

dsmActions = determineDSMActions (voltage, frequency)

executeDSMActions (dsmActions)

recordDSMActionsOnBlockchain (dsmActions)

end if

end procedure

procedure determineDSMActions (voltage, frequency)

actions = []

if voltage < V_min then

actions.append (reduceNonCriticalLoad())

actions.append (increaseGeneration())

else if voltage > V_max then

actions.append (increaseNonCriticalLoad())

actions.append (decreaseGeneration())

end if

if frequency < f_min then

actions.append (dischargeStorage())

else if frequency > f_max then

actions.append (chargeStorage())

end if

return actions

end procedure

procedure executeDSMActions (dsmActions)

for action in dsmActions do

performAction (action)

end for

end procedure

All these adjustments are meticulously recorded on the blockchain, providing a transparent, immutable, and auditable trail of actions taken. This recording process includes detailed information such as the specific DSM actions executed, the time of execution, the devices involved, and the outcomes achieved. By logging every action on the blockchain, the system ensures accountability and transparency, allowing all stakeholders to verify that the DSM measures are performed as intended and to assess their effectiveness in real-time. This capability not only enhances trust among participants but also facilitates compliance with regulatory requirements and supports continuous improvement of the DSM strategies.

3.4 Incentive distribution

Smart contracts in a blockchain-based energy trading system are not only crucial for executing Demand-Side Management (DSM) actions but also for managing the economic incentives that drive participant engagement. Once DSM actions are triggered and participants respond by adjusting their energy usage, generation, or storage, the smart contracts evaluate these responses to determine the corresponding incentives. The smart contracts are programmed with algorithms that calculate incentives based on predefined criteria such as the amount of load shifted, the degree of energy consumption reduction during peak times, or the extent of energy contributed back to the grid as shown in Algorithm 5. For example, a participant who reduces their energy consumption significantly during a peak demand period might receive a higher incentive compared to one who makes a smaller adjustment. Similarly, those who increase their renewable energy generation or optimize their energy storage usage during critical periods may also earn additional rewards.

Algorithm 5.Pseudo code for incentive distribution.

procedure SmartContract_IncentiveDistribution (dsmActions)

incentives = calculateIncentives (dsmActions)

distributeIncentives (incentives)

recordIncentivesOnBlockchain (incentives)

end procedure

procedure calculateIncentives (dsmActions)

incentives = []

for action in dsmActions do

if action.type == “reduceLoad” then

incentives.append (calculateReductionIncentive (action))

else if action.type == “increaseGeneration” then

incentives.append (calculateGenerationIncentive (action))

end if

end for

return incentives

end procedure

procedure distributeIncentives (incentives)

for incentive in incentives do

transferTokens (incentive.participant, incentive.amount)

end for

end procedure

After calculating the incentives, the smart contracts automatically handle the distribution process. This automated system ensures that incentives are allocated accurately and promptly without the need for manual intervention, thereby reducing administrative overhead and the potential for errors or delays. The distribution process typically involves transferring digital tokens or credits to participants’ blockchain wallets, which they can use for future transactions or convert into other forms of value within the energy trading ecosystem. By automating the calculation and distribution of incentives, smart contracts not only streamline the operational processes but also enhance transparency and trust. Participants can easily verify their actions and corresponding rewards on the blockchain, fostering a fair and motivating environment. This transparency encourages greater participation and compliance with DSM strategies, ultimately contributing to the overall efficiency and stability of the microgrid.

The reliability of blockchain-based smart contracts is assumed to ensure they function as intended, as blockchain technology is inherently secure and tamper-proof. A robust IoT and communication infrastructure is assumed for real-time monitoring and control, justified by the increasing deployment of IoT devices and advanced communication networks in smart grid systems, enabling efficient data exchange and control. Behavioral economics assumptions include the predictable response of users to economic incentives, based on well-established principles. Prosumers are likely to alter their energy usage in response to financial incentives, crucial for DSM strategies’ success. User compliance with smart contracts is assumed due to the secure and transparent nature of blockchain technology, which ensures fairness and trust.

Transactions within the blockchain are verified through the Proof of Stake (PoS) consensus mechanism, which ensures their authenticity and accuracy. The PoS process includes several steps. First, prosumers create transactions for energy trading, DSM actions, or incentive claims. These transactions are submitted to the blockchain network. Submitted transactions then enter a transaction pool where they await validation by validators. Validators are selected based on the number of tokens they hold and are willing to “stake” as collateral. Validators are chosen to create new blocks and validate transactions proportionally to their staked tokens. The selected validator validates the transactions and creates a new block, which is then broadcast to the network. Other nodes verify the correctness of the block, and once verified, the new block is added to their copy of the blockchain, ensuring consensus across the network. Once added, the block and its transactions become immutable, providing a transparent and tamper-proof record of all actions taken.

Therefore, the approach for blockchain-driven demand-side management (DSM) in peer-to-peer (P2P) energy markets is articulated through a structured process that ensures the secure and efficient management of energy resources within a microgrid, as detailed in Algorithm 6. The process begins with the initialization phase, where the blockchain network is set up, and the microgrid system is configured with N prosumers, each equipped with Distributed Energy Resources (DERs) such as photovoltaic (PV) systems and Battery Energy Storage Systems (BESS). Each prosumer is registered on the blockchain, and all associated devices are authenticated and authorized using smart contracts to ensure secure transactions and interactions within the network.

Following the initialization, the game-theoretical DSM framework is established. This involves the initialization of cost functions, and strategy sets

During the operational phase of the microgrid, the Energy Management System (EMS) is initialized to monitor key grid parameters such as voltage and frequency continuously. The EMS is designed to detect events like load changes or generation fluctuations in real time. Upon detection of such events, corresponding DSM actions are triggered via smart contracts. These actions involve dynamic adjustments to energy loads, generation, and storage to maintain the balance between supply and demand within the microgrid. All DSM actions are securely recorded on the blockchain, providing a transparent and auditable trail of decisions and outcomes.

Finally, the system includes an incentive distribution mechanism, where economic incentives are calculated for each prosumer based on predefined criteria, such as their contribution to load adjustments or energy production. These incentives are distributed through smart contracts, and the transactions are recorded on the blockchain. This mechanism not only promotes active participation in the DSM process but also ensures that prosumers are fairly rewarded for their contributions. The simulation ends after all DSM actions and incentives have been processed, providing a comprehensive framework for blockchain-driven DSM in P2P energy markets. This approach ensures a secure, efficient, and equitable management of energy resources, leveraging the transparency and trust inherent in blockchain technology.

Algorithm 6.Pseudo-code for Blockchain-Driven Demand Side Management in P2P Energy Markets.

//Initialization Phase

Initialize blockchain network

Initialize the microgrid system with N prosumers, each with its own DERs (PV systems, BESS, etc.).

For each prosumer i in the microgrid:

Register prosumer i on the blockchain

Authenticate and authorize all devices of prosumer i using smart contracts

//Game-Theoretical DSM Framework

Initialize cost functions for each prosumer i

Initialize strategy set

Set convergence tolerance epsilon

//Iterative DSM Algorithm

Repeat until convergence:

For each prosumer i:

//Strategy Update

Calculate the best response strategy by minimizing the cost function

Update strategy

//Blockchain Transaction

Record updated strategy on the blockchain using smart contract

//Check for Nash Equilibrium

If change in strategies for all prosumers is less than epsilon:

Convergence achieved

Break loop

//Event Detection and DSM Actions

Initialize Energy Management System (EMS) to monitor grid parameters (voltage, frequency)

While microgrid is operational:

For each detected event (e.g., load change, generation fluctuation):

Trigger corresponding DSM action via smart contract

Adjust energy loads, generation, and storage dynamically to balance supply and demand

Record all actions on the blockchain

//Incentive Distribution

For each completed DSM action:

Calculate economic incentives for prosumers based on predefined criteria

Distribute incentives using smart contracts

Record incentive distribution on the blockchain

//End of Simulation

4 Results and discussions

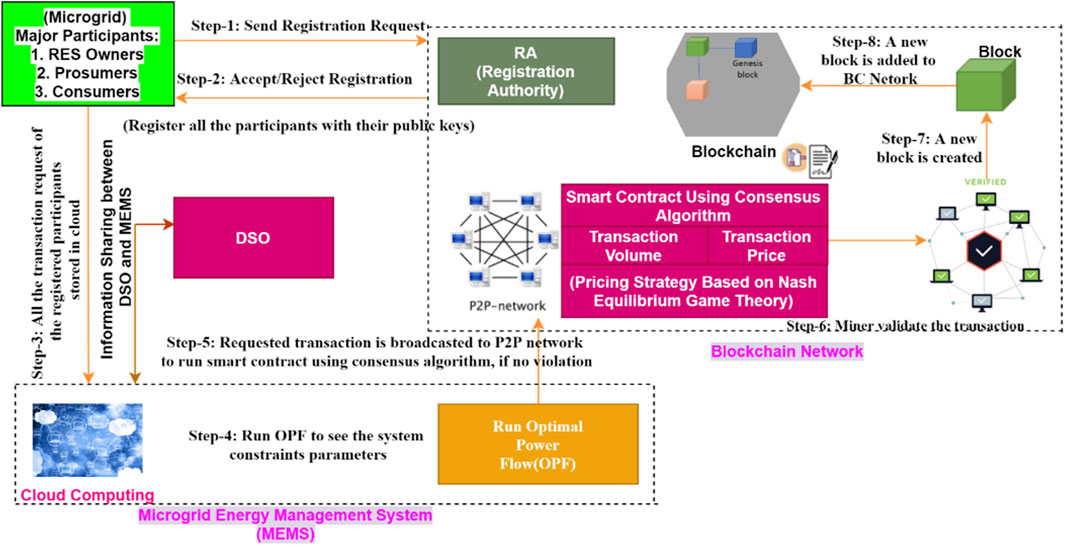

In this study, we analyzed the performance of a decentralized energy management system involving five prosumers over five distinct demand response (DR) events T1, T2, T3, T4, and T5. During Event T1, the system begins with a baseline energy demand and generation scenario, focusing on the initial performance of the energy management system in handling typical energy demands. Prosumers generate renewable energy based on available resources, energy storage systems balance supply and demand, and initial P2P trading activities distribute excess energy among participants. In Event T2, there is a moderate increase in energy demand, and the objective is to evaluate the system’s ability to maintain stability. This period sees increased renewable energy generation, enhanced use of energy storage systems to store excess energy during low-demand periods, and intensified P2P trading activities to optimize energy distribution. Event T3 represents the peak demand period where energy demand is at its highest, testing the system’s resilience and efficiency. Maximum utilization of renewable energy sources, strategic use of stored energy to meet peak demand, incentives for load shifting and reduction, and active P2P trading are key actions to dynamically balance energy supply and demand. Following the peak, Event T4 focuses on the system’s capability to adjust to a decrease in demand. There is a gradual reduction in renewable energy generation, controlled discharge of energy storage systems, and continued P2P trading to manage residual demand and supply. Finally, Event T5 is a stabilization period where demand returns to a moderate level. The objective is to evaluate the system’s performance in maintaining stability and optimizing energy usage. Steady renewable energy generation meets moderate demand, optimal management of energy storage prepares for future demand fluctuations, and sustained P2P trading ensures efficient energy distribution among participants.

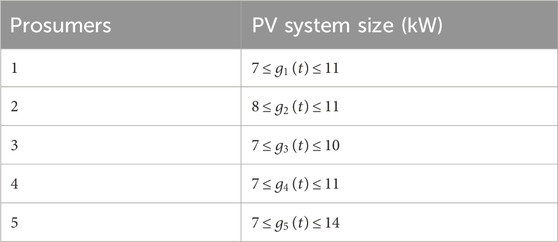

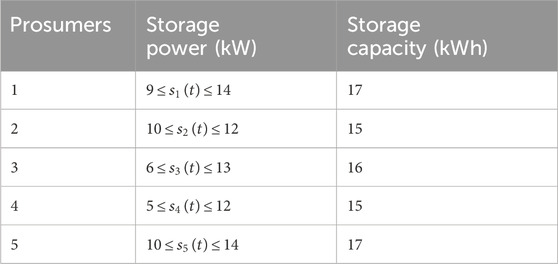

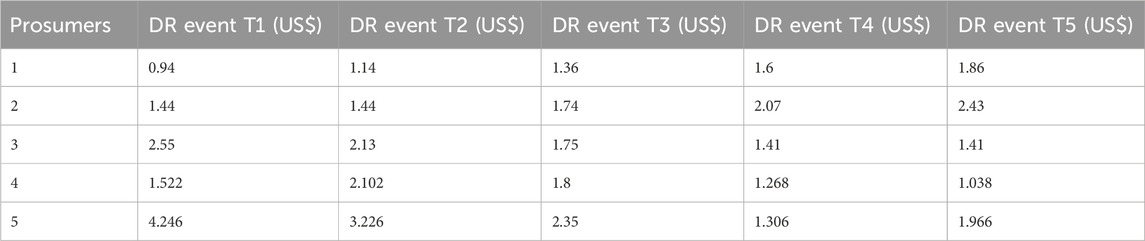

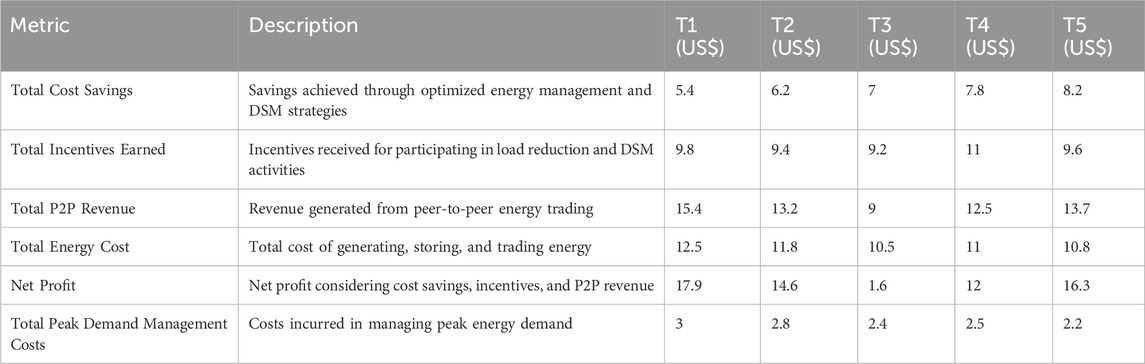

To evaluate the performance of the decentralized energy management system, we consider specific configurations for each prosumer, including the sizes of their photovoltaic (PV) systems and energy storage systems (ESS). The system configuration for the study involves a microgrid setup comprising 5 prosumers. The dataset utilized for this study is sourced from the Pecan Street Project, which includes energy usage and generation records from residential households in Austin, Texas. This dataset provides real-world consumption and generation patterns, making it highly representative and reliable for the purposes of this study. The use of such empirically measured data ensures that the load profiles and generation patterns are both accurate and reflective of actual residential energy behavior. This data has been used in multiple studies (pecanstreet, 2024; Umar Abdullah et al., 2022; Afzalan and Jazizadeh, 2021; Umar et al., 2024) and is well-recognized within the research community, further validating its appropriateness for this analysis. The Distributed Energy Resources (DERs) integrated within the microgrid include Solar PV systems and Battery Energy Storage Systems (BESS). The sizes of the PV systems range from 7 kW to 14 kW, as shown in Table 1, while the BESS specifications include power ratings from 5 kW to 14 kW and storage capacities ranging from 15 kWh to 17 kWh, as detailed in Table 2. For the blockchain parameters, the network is built on a Remix Ethereum Virtual machine blockchain platform. The consensus mechanism employed is the Proof of Stake (PoS). The block interval, which represents the time taken to generate a new block, was around 15 s, and the smart contract execution time was 3 s on average. Additionally, the smart contract parameters, such as the deployment cost measured in Gas/Wei and the transaction fees converted into USD, are provided in Blockchain Cost Coefficients. In the game-theoretical Demand Side Management (DSM) framework, the cost functions for each prosumer RES generation and BESS and incentive are characterized by coefficients provided in Tables 3, 4. These coefficients are standardized, with typical values or ranges provided for each prosumer. The strategy update method utilized is the proximal decomposition algorithm, with a convergence tolerance of ϵ = 10–3 and a maximum of 100 iterations allowed for achieving convergence.

The Energy Management System (EMS) monitors grid parameters such as voltage and frequency, maintaining them within specified thresholds (e.g., voltage thresholds between 0.95 p.u. to 1.05 p.u. and frequency thresholds from 49.9 Hz to 50.1 Hz). DSM actions include load adjustments within ±10% of the baseline load and generation curtailment by 5% during overproduction scenarios. BESS operations are managed within an operational range of 20%–80% state of charge (SoC). Incentive mechanisms are designed to reward prosumers based on their energy contributions or load adjustments, with Equation 14 used to calculate these rewards. The assumptions made during the study include the consistency of load profiles with historical data from the Pecan Street Project and the use of typical solar irradiance data for Austin, Texas. Economic assumptions are based on dynamic energy prices on specific market conditions, and no degradation of BESS performance is considered over the simulation period. The primary focus was on the generation, storage, and peer-to-peer (P2P) trading of energy, with each prosumer aiming to optimize their net profit by minimizing costs and maximizing incentives. The simulations were conducted using various software tools. The blockchain simulation environment includes platforms like Truffle Suite or Remix. Game-theoretical modelling was carried out using tools like a Python environment (version 3.12), utilizing libraries such as NumPy for numerical computations, Pandas for data manipulation, Matplotlib for data visualization, and SciPy for optimization tasks. The computations were performed on a system equipped with an Intel Core i7 processor, 16 GB of RAM, and running on a Windows 10 operating system.

Each prosumer is equipped with a photovoltaic (PV) system. The sizes of these PV systems are as follows:

Each prosumer also has a battery energy storage system (BESS) with specific power and capacity sizes:

These configurations represent typical setups for prosumers participating in a decentralized energy management system. The PV system sizes reflect the generation capacity available to each prosumer, while the storage power and capacity sizes indicate their ability to store and manage energy. This data is crucial for analyzing the performance of the system under different demand response (DR) events (T1-T5).

By incorporating these blockchain service costs into the overall cost calculation, we provide a comprehensive and realistic analysis of the energy management framework.

Blockchain Cost Coefficients:

1. Transaction Fee Coefficient (β): $0.001 per transaction.

2. Smart contract execution cost coefficient (

3. Infrastructure maintenance cost (δ): $0.02 per time-period

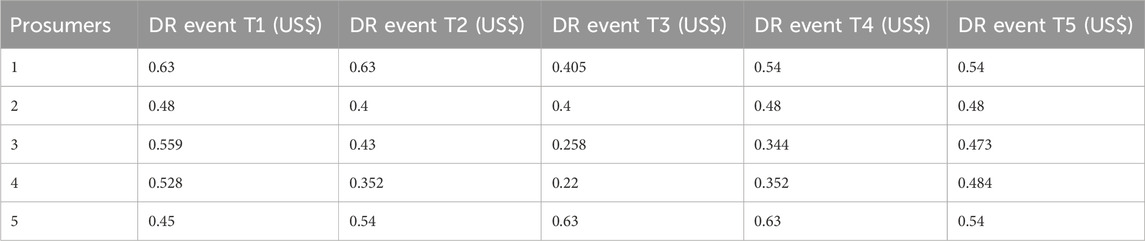

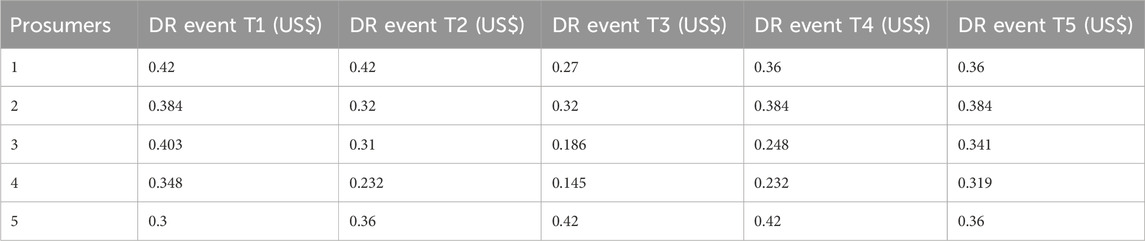

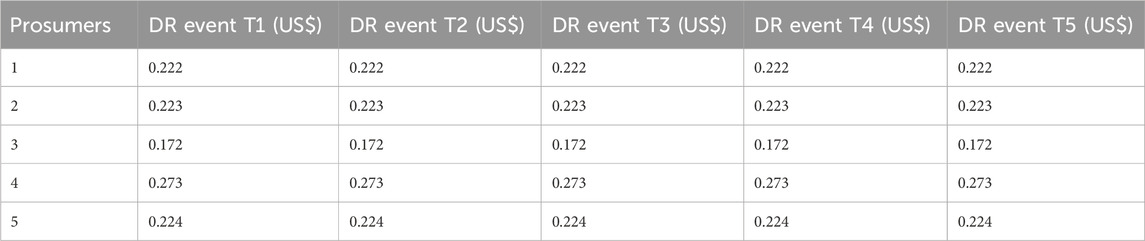

The costs associated with renewable energy generation, storage, and incentives , as well as the blockchain service for each prosumer, are summarized in Tables 5–8 respectively.

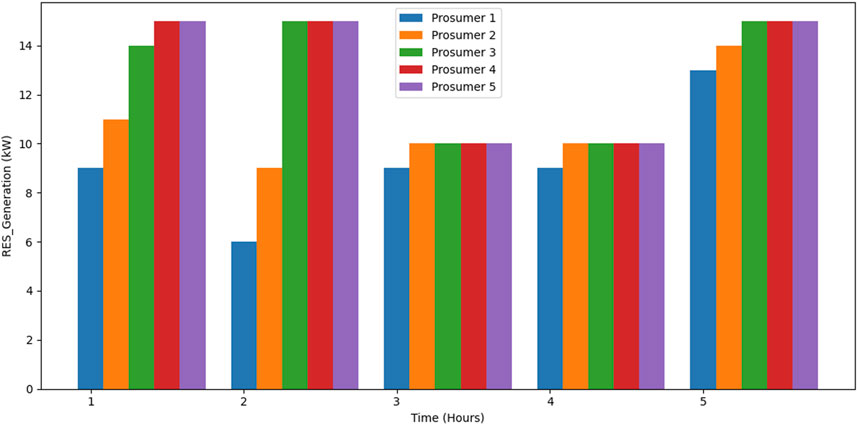

The bar chart as shown in Figure 4 depicts the Renewable Energy Source (RES) generation in kilowatts (kW) for five prosumers across five distinct time periods (1–5 h). The chart provides a comparative analysis of each prosumer’s generation capabilities during these intervals. Prosumer 1’s generation starts at 7 kW at Time 1 and increases progressively, peaking at 11 kW at Time 5, indicating a steady improvement in RES output. Similarly, Prosumer 2 begins with 8 kW at Time 1 and reaches 11 kW at Time 5, maintaining a consistent generation profile with minimal fluctuations between Time 2 and Time 4. Prosumer 3 exhibits the highest initial generation at 10 kW at Time 1 but experiences a slight dip to 7 kW at Time 4 before stabilizing. Prosumer 4 starts strong with 9 kW at Time 1, peaks at 11 kW at Time 2, and shows minor reductions mid-way but remains stable overall. Prosumer 5 consistently demonstrates the highest RES generation, starting at 14 kW at Time 1, with a slight drop to 7 kW at Time 4, but quickly recovering to maintain high generation values through Time 5. The comparative insights reveal that Prosumers 1, 2, and 5 exhibit stable and progressively increasing or consistently high generation values, whereas Prosumers 3 and 4 show slight fluctuations indicating potential variability in their RES generation. The steady increase observed in Prosumers 1 and 2 suggests more consistent renewable energy sources, while Prosumer 5’s robust and reliable output underscores its leading position in RES generation. These findings highlight the varying levels of RES generation capabilities among the prosumers, with Prosumer 5 leading in terms of maximum output across most time periods. The stability and reliability in RES generation, as demonstrated by Prosumers 1, 2, and 5, are crucial for effective participation in decentralized energy markets. Prosumers 3 and 4, while competitive, may need to address their generation variability to ensure more consistent performance.

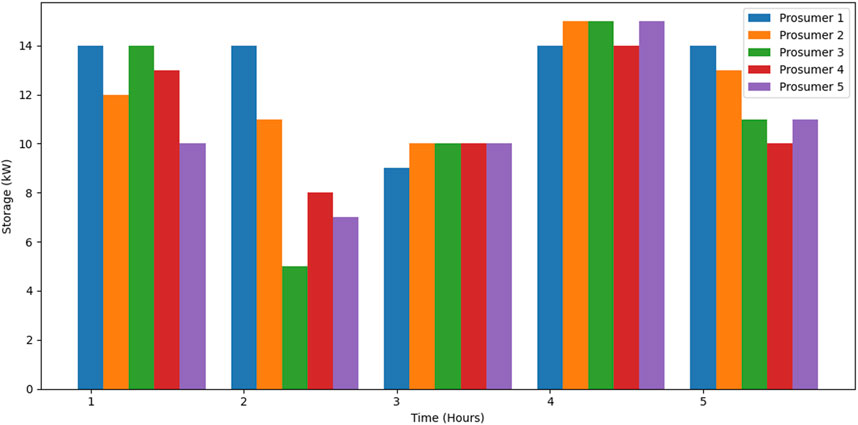

The bar chart in Figure 5 illustrates the energy storage in kilowatts (kW) for five prosumers across five distinct time periods (1–5 h). The chart provides a comparative analysis of each prosumer’s energy storage capabilities during these intervals. Prosumer 1 exhibits high storage values at Time 1 and Time 2, each approximately 14 kW. There is a notable drop at Time 3 to around 9 kW, followed by an increase to around 12 kW at Time 4 and Time 5. This pattern indicates Prosumer 1’s ability to manage storage effectively, with some variability at Time 3. Prosumer 2 starts with 12 kW at Time 1, decreases slightly to around 10 kW at Time 2 and Time 3, then increases back to around 12 kW at Time 4 and Time 5, suggesting stable storage management with minor fluctuations. Prosumer 3 begins with 13 kW at Time 1, drops significantly to around 6 kW at Time 3, and recovers to approximately 11 kW by Time 5. This significant drop and subsequent recovery indicate variability in storage, potentially reflecting changes in storage usage or generation needs. Prosumer 4 shows a high initial storage value of 12 kW at Time 1, which decreases to 8 kW by Time 2 and drops further to 5 kW at Time 3. However, storage levels increase again to 11 kW by Time 5, demonstrating a considerable range of fluctuations and suggesting that Prosumer 4 may be adjusting storage in response to generation or consumption demands. Prosumer 5 starts with the lowest storage value of around 10 kW at Time 1 but increases steadily to 14 kW by Time 4, followed by a slight decrease to 12 kW at Time 5. This steady increase followed by a small drop indicates a generally stable storage pattern with minor adjustments. The comparative analysis of energy storage highlights that Prosumers 1 and 2 have relatively stable storage patterns with minor fluctuations, indicating effective storage management. Prosumer 3 exhibits significant variability, which might be due to dynamic adjustments in storage based on generation and consumption needs. Prosumer 4 shows the most fluctuations, suggesting responsive adjustments to varying energy demands. Prosumer 5 maintains a generally stable pattern with a steady increase, indicating robust storage capabilities.

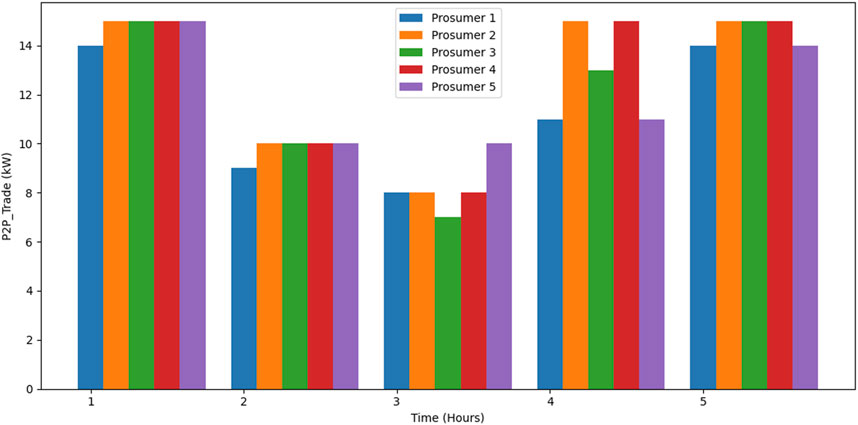

The bar chart shown in Figure 6 depicts the peer-to-peer (P2P) energy trade in kilowatts (kW) for five prosumers across five distinct time periods (1–5 h). The chart provides a comparative analysis of each prosumer’s P2P trading activities during these intervals. Prosumer 1 shows a gradual increase in P2P trade, starting at around 13 kW at Time 1, decreasing to 9 kW at Time 3, and peaking at approximately 12 kW at Time 5. This indicates Prosumer 1’s active participation in P2P trading with fluctuations that might be aligned with energy generation and storage dynamics. Prosumer 2, on the other hand, maintains a high level of P2P trading, starting at around 14 kW at Time 1 and sustaining similar levels through Time 4, before a slight decrease to 11 kW at Time 5. This consistent high-level trading suggests Prosumer 2’s strong engagement in the P2P energy market. Prosumer 3 also begins with a high trading value of around 14 kW at Time 1, drops to approximately 9 kW at Time 3, and then increases again to 13 kW by Time 5. This pattern indicates variability in trading activities, likely driven by changing energy demands and generation capabilities. Prosumer 4 shows similar high trading levels at Time 1 and Time 4, with values around 14 kW, but experiences a notable decrease to 8 kW at Time 3, before recovering to around 12 kW at Time 5. This fluctuation suggests Prosumer 4’s adaptive trading strategies in response to market conditions and internal energy needs. Prosumer 5 starts with a high trading value of around 14 kW at Time 1, similar to other prosumers, but exhibits a significant drop to approximately 9 kW at Time 2, and then fluctuates around 13 kW by Time 5. The overall trading activity for Prosumer 5 indicates strong engagement with some variability, reflecting responsive adjustments based on energy availability and market dynamics. The comparative analysis of P2P trading highlights that Prosumers 2 and 4 have consistent high-level trading activities, suggesting robust engagement in the P2P energy market. Prosumers 1, 3, and 5 exhibit more variability, with significant fluctuations that indicate responsive adjustments to changing energy conditions and market opportunities. Consistent and high-level trading, as seen with Prosumers 2 and 4, can significantly contribute to overall performance in decentralized energy markets. The variability observed in Prosumers 1, 3, and 5 highlights the need for adaptive strategies to effectively balance energy generation, storage, and trading.

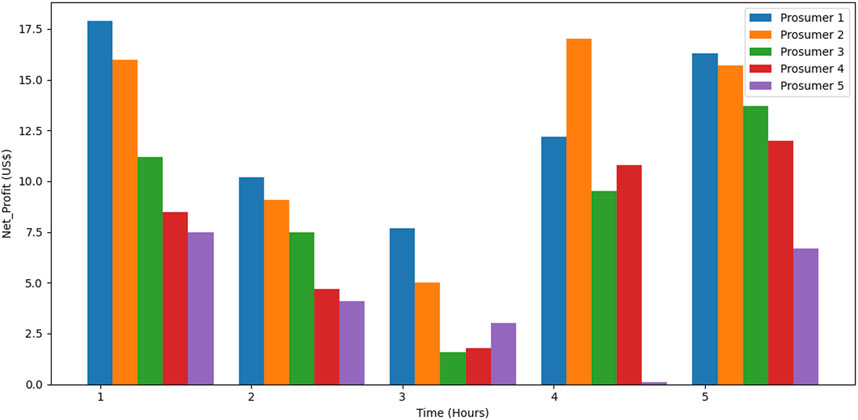

The bar chart depicted in Figure 7 illustrates the net profit in US dollars (US$) for five prosumers across five distinct time periods (1–5 h). The chart provides a comparative analysis of each prosumer’s profitability during these intervals. Prosumer 1 achieves the highest net profit at Time 1, with approximately $17.5, indicating strong initial performance. However, there is a noticeable drop at Time 2 to around $10, followed by a dip at Time 3 and a recovery to around $13 at Time 5. This fluctuation suggests that Prosumer 1’s profitability is influenced by varying levels of energy generation, storage, and trading activities. Prosumer 2 also shows high net profit at Time 1, reaching around $16, with a gradual decline to approximately $10 at Time 3. The profitability peaks again at Time 4 with about $15, and stabilizes at $12 at Time 5, indicating consistent high performance with minor fluctuations. Prosumer 3 starts with a moderate net profit of approximately $11 at Time 1, decreasing to around $7 at Time 3, and then increasing again to about $13 by Time 5. This pattern reflects Prosumer 3’s adaptive strategies in energy management, leading to varying profitability. Prosumer 4 shows a lower net profit at Time 1, with around $8, decreasing further at Time 3, but recovering to approximately $12 at Time 5. The variability in Prosumer 4’s net profit suggests responsiveness to changing energy market conditions and internal energy management. Prosumer 5 starts with the lowest net profit of around $7 at Time 1, maintaining a consistent low level through Time 3 but showing a significant increase to $13 at Time 4 and stabilizing at around $9 at Time 5. This pattern indicates Prosumer 5’s initial struggles in profitability, followed by improved performance in later periods. The comparative analysis of net profit highlights that Prosumers 1 and 2 achieve the highest profitability, particularly at Time 1, indicating strong initial performance. Prosumer 3 exhibits moderate but stable profitability with some fluctuations, while Prosumers 4 and 5 show lower initial profits with significant variability.

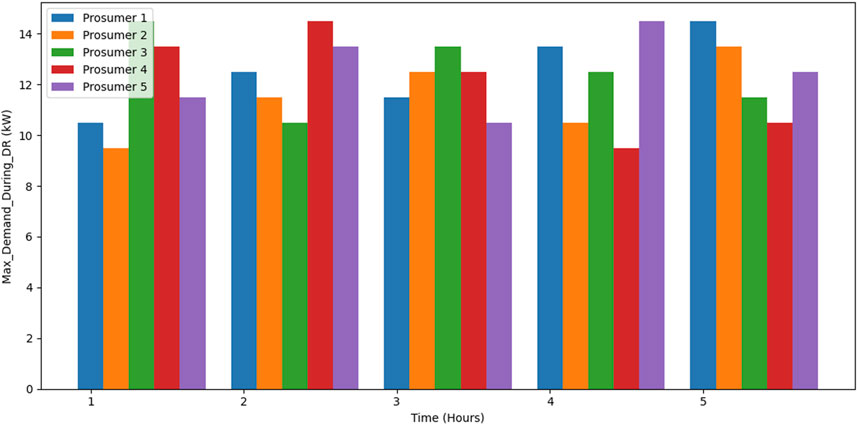

The bar chart shown in Figure 8 illustrates the maximum demand during Demand Response (DR) events in kilowatts (kW) for five prosumers across five distinct time periods (1–5 h). The chart provides a comparative analysis of each prosumer’s peak demand during these intervals. Prosumer 1 shows a consistent maximum demand, starting at around 11 kW at Time 1, peaking at approximately 13 kW at Time 2, and maintaining similar levels through Time 5. This indicates stable demand patterns during DR events. Prosumer 2 also demonstrates steady demand, beginning at around 10 kW at Time 1, peaking at 13 kW at Time 3, and stabilizing around 11 kW by Time 5. This suggests effective demand management during DR events. Prosumer 3 starts with the highest initial demand of approximately 14 kW at Time 1, decreasing to around 12 kW at Time 3, and then stabilizing at about 13 kW by Time 5. This pattern reflects Prosumer 3’s variable but high demand during DR events. Prosumer 4 shows significant demand variability, with peaks at around 13 kW at Time 1, decreasing to 12 kW at Time 3, and stabilizing at 11 kW by Time 5. The fluctuations indicate a dynamic approach to managing peak demand. Prosumer 5 exhibits a steady demand pattern, starting at around 12 kW at Time 1, peaking at 14 kW at Time 4, and maintaining around 12 kW by Time 5. This consistent demand pattern highlights Prosumer 5’s stable energy needs during DR events. The comparative analysis of maximum demand during DR events reveals that Prosumers 1 and 2 maintain stable and moderate peak demand levels, indicating effective demand management strategies. Prosumer 3 consistently shows the highest peak demand, reflecting high energy needs during DR events. Prosumer 4’s significant variability suggests a responsive approach to managing peak demand, while Prosumer 5 maintains a stable demand pattern with slight fluctuations. These findings emphasize the importance of managing peak demand effectively during DR events to optimize energy usage and enhance system reliability. Stable demand patterns, as seen with Prosumers 1, 2, and 5, contribute to efficient energy management, while the variability observed in Prosumer 3 and 4 highlights the need for adaptive strategies to balance energy needs and availability.

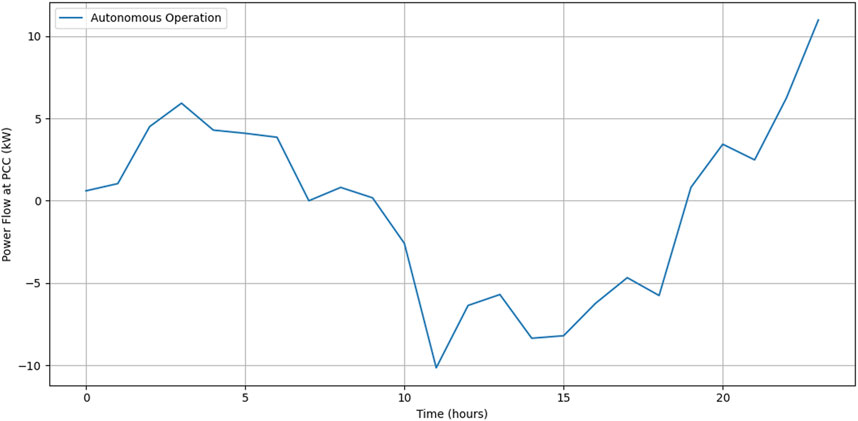

4.1 A case study conducted to minimize the power flow at the point of common coupling (PCC)

To provide numerical evidence of the convenience for users to operate autonomously and maximize self-consumption, we conducted a simulation for prosumers by regulating the batteries to minimize the power flow at the point of common coupling (PCC).

Simulation results:

Total cost (Autonomous Operation): $ 43.09.

Total power flow at PCC (Autonomous Operation): 107.33 kWh.