- Department of Energy and Climate Change, Asian Institute of Technology Bangkok, Bangkok, Thailand

Adapting to horizontal market structures faces several drivers and challenges in the context of sustainable energy transition. The inherently decentralized nature qualifies blockchain technology as the major technical driver in the transition to peer-to-peer (P2P) energy market models. One major technical challenge encountered in the transition process is the active power loss associated with transactions, which can cause network congestion and economic loss. A review of existing research on the P2P transaction active power loss problem, examining the potential role of blockchain and the consequent additional costs incurred by blockchain transactions, is presented in this article. Consolidating major points and guiding observations for future research are provided to address the challenges while adapting to the potential driving blockchain technology. A conceptual peer-to-peer trading framework that considers blockchain transaction cost and active power loss compensation is also presented.

1 Introduction

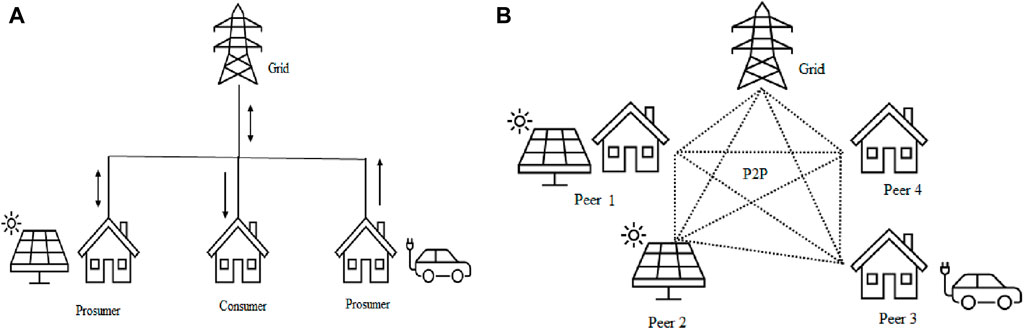

Distributed generators (DGs), energy storage systems (ESSs), and flexible demands are considered “carbon-positive” choices in the energy transition pathway (IRENA, 2024). A number of countries throughout the world have facilitated peer-to-peer (P2P) power trading, where the role of passive consumers in the conventional power system is changed to active prosumers (Khare Bhatia, 2024). Transition to such competitive markets, as opposed to oligopolistic wholesale markets controlled by large producers, becomes more user-centric by facilitating even small amounts of energy (Figure 1). Australia, Bangladesh, Columbia, Germany, Japan, Malaysia, Thailand, the Netherlands, the United Kingdom, and the US have started trials on P2P energy trading (Takkabutra et al., 2021; Lawan Bukar et al., 2023). As a consequence of the transition, challenges are posed to the current market design, operation, and protection due to the bidirectional power flow and intermittent nature of renewable energy sources of local energy markets (Li. Q et al., 2022).

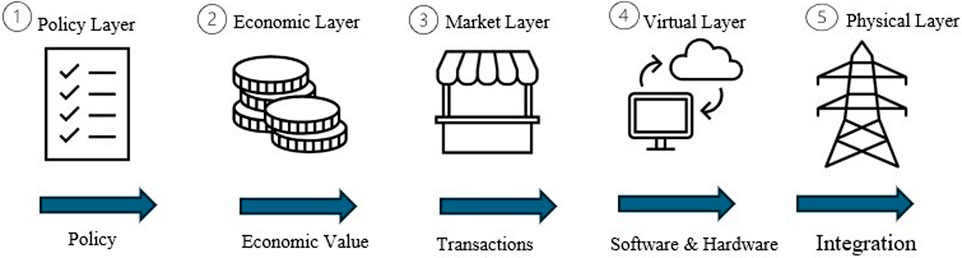

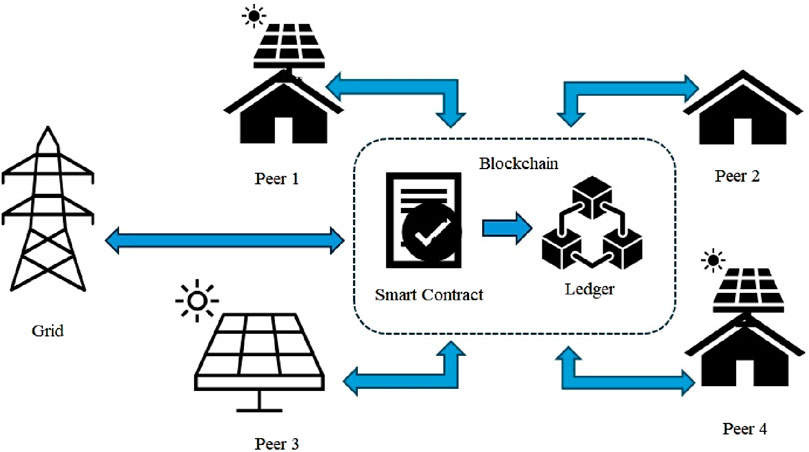

The transition is accelerated by grid digitization with Internet of Things (IOT), machine learning (ML),sensors, and blockchain (BC) (Ohanu et al., 2024). Consequently, the conventional grid has undergone restructuring into a five-layer market, as shown in Figure 2. The physical layer consists of the infrastructure, while the required information and communication technologies for market coordination are housed in the virtual layer. The market layer consists of suitable models satisfying different economic and technical objectives, formulated by applying game theory, optimization, distributed computing techniques, and latest digital technologies (Zhang et al., 2024). For improved financial performance, different pricing and incentive schemes are used in the economic layer (Das et al., 2023). The governing regulations and policies, which enable the trading process, forms the fifth layer (Dudjak et al., 2021). Notably, blockchain in the virtual layer is effective in decentralized, immutable, and tamper-proof ledger keeping of market transactions (Alam et al., 2024). As shown in Figure 3, blockchain can act as an orchestrator or energy coordinator, avoiding the requirement of a third-party regulator as in a conventional market (Huang et al., 2021).

Nash game theory, a fundamental concept in non-cooperative game theory where each player’s strategy is optimal given the strategies of all other players, can be used to model the interactions between multiple players (e.g., consumers, producers, and prosumers) who each try to maximize their own utility without cooperating with one another. Nash negotiation theory was used by Cai et al. (2024) to design a multi-area photovoltaic energy transmission trading mechanism, which decomposes the trading problem into two sub-problems: maximizing the overall benefit and allocating the cooperative benefit among areas. The Nash bargaining approach was used by Xuanyue et al. (2022) to construct cooperative transactive energy control that prioritizes P2P energy trade. Stackelberg game theory, which follows a hierarchical decision-making process in the leader–follower game, can be applied to model interactions between market participants with different levels of information. A Stackelberg game theoretic bi-level optimization model designed by Zou et al. (2023) decides energy scheduling prices at the upper level and trading strategy optimization in the lower level, with day-ahead and intraday market coordination by adaptive stochastic optimization. Dual Stackelberg game-based trading under uncertain demand response and carbon trading to address the challenges within hierarchical integrated energy markets is explained by Zhang et al. (2024). To incorporate social attributes that influence decision-making, prospect theory is applied with the Stackelberg game market model presented by Chen et al. (2021).

Along with the trading, sharing of energy for future benefits supported by blockchain and federated learning is proposed by Bouachir et al. (2022). A distributed solution using an alternating direction method of multipliers (ADMMs) with continuous double auction is discussed by Jia et al. (2023). A secure framework considering the export–import limit (dynamic operating envelope) of the network was attempted by Hoque et al. (2024) for addressing line congestion and voltage issues. A joint market model with double-sided auction was used by Zhang et al. (2024) for trading, in which battery cycle degradation, voltage issues, and line congestion are addressed in the physical layer.

One of the popular blockchains used in the P2P trading domain include Ethereum, which supports smart contracts and decentralized applications; Hyperledger Fabric, known for its enterprise-grade and permissioned network capabilities; and IOTA, designed for the Internet of Things with feeless transactions (Alam et al., 2024). Additionally, the Energy Web Chain, tailored specifically for the energy market, and platforms like Corda, EOS, and Stellar, which offer high scalability and low transaction costs, play significant roles. These blockchains provide the necessary infrastructure to enable transparent, efficient, and automated energy trading systems.

Ethereum plays a pivotal role in P2P energy trading by providing a decentralized platform that leverages smart contracts to automate and secure energy transactions (Sahih et al., 2024). These smart contracts enable transparent and trustless exchanges between energy producers and consumers without intermediaries. Ethereum’s blockchain ensures the immutability and verifiability of transaction records, enhancing security and trust in the system. Additionally, Ethereum’s scalability and interoperability support the integration of various energy devices and systems, facilitating the widespread adoption of P2P energy trading solutions, as demonstrated by projects like Power Ledger and Grid (Rudd and Stapleton, 2022).

1.1 Motivation and research questions

The economic and environmental advantages of the trading methods are attractive, but possible violation of network constraints can challenge the stability and reliability of the grid. As the number of users increases, a trade-off between grid overloading and self-sustainability occurs. Participants of a recent P2P regulatory sandbox program in Thailand emphasize that power loss due to local market transactions is a barrier to the transition pathway (Junlakarn et al., 2022). Dudjak et al. (2021) reported that transaction power loss can impact the performance of the market, recommending further research on the topic. The power consumption and the cost associated with the blockchain can potentially slow down the adaptation of the new technology (Junlakarn et al., 2022). Failing to meet the cost can result in the denial-of-service (DoS) attack on the blockchain, risking energy security of the market (Raikwaret al., 2022). Hence, the accurate estimation and allocation of blockchain usage cost is essential for reliable operation and cost effectiveness by proper pricing/incentive schemes.

In this article, a review of the latest literature on the above-mentioned challenges—transaction loss associated with P2P transactions and blockchain transaction cost—is presented. Three research questions are framed to analyze the literature for developing insights and directives for future research.

1) What are the knowledge gaps in the research on power loss associated with P2P transactions?

2) How can blockchain technology (BCT) be used in addressing transaction power loss?

3) How are P2P transactions linked with the blockchain usage cost?

1.2 Methodology

To identify the knowledge gaps, latest research articles are collected, and information is categorized into three focal areas: review on power loss in P2P transactions, review on the role of blockchain in energy trading, and review on the cost incurred by blockchain usage by trading transactions. Insights are developed into how blockchain can address the active power loss problem associated with trading transactions. In reverse, the impact of P2P transactions on blockchain usage cost is also analyzed, establishing the need for a clever linkage between the features of blockchain and aspects of the market.

The article is organized as follows: Section 2 presents an overview of various approaches related to P2P transaction power loss. The impact of loss in trading, loss estimation and fair allocation, loss reduction, and methods for recovering the loss are explained in subsections; Section 3 reviews the role of blockchain in P2P energy trading. Specifically, attempts to apply blockchain to address the transaction power loss are summarized in Subsection 3.1; the impact of cost incurred by blockchain transaction loss in the context of energy trading is explained in Section 4; insights and future work are discussed in Section 5; furthermore, a conceptual framework for a smart contract that can be used for P2P energy trading is proposed in Section 5.5, which incorporates blockchain transaction cost and active power loss compensation; and the discussion is concluded in Section 6.

2 P2P transaction power losses: overview

Active power loss in peer-to-peer energy trading transactions refers to the energy dissipated as heat due to the resistance in electrical components and transmission lines during the exchange of electricity between participants. Minimizing these losses is crucial for improving the overall efficiency and sustainability of the energy network as it ensures that more of the generated energy is effectively utilized. Advanced technologies and optimized grid management strategies are often used to estimate, allocate, and mitigate active power loss, enhancing the viability of P2P energy trading systems.

2.1 Impact of transaction power loss on the grid

In a P2P network, where multiple small-scale producers and consumers trade energy directly, the losses can be significant due to the decentralized nature of the grid and the varying distances that electricity must travel. Power loss caused by P2P transactions can have several implications for the efficiency, reliability, and environmental sustainability of the power system. The cumulative effect of power losses on multiple nodes in the network can result in a significant voltage decrease (Suthar et al., 2024). The voltage decrease reduces the economic viability and the quality of power delivered to consumers and can potentially lead to equipment malfunction or damage. Consequently, additional investments would be demanded in infrastructure upgrades for replacing aging equipment with more efficient components, optimizing the layout of transmission and distribution networks or implementing technologies such as voltage regulation devices and power factor-correction systems. Addressing these challenges requires a combination of technological innovation, infrastructure investments, and regulatory frameworks to optimize the operation of the grid while accommodating the evolving dynamics of decentralized energy transactions (Kim et al., 2022).

2.2 Estimation of transaction power loss

To calculate and allocate the transaction loss to individual transactions, several methods are tried out in the literature. The pro rata-based method, proportional sharing method, and marginal procedure for the estimation of power loss are explained by Kim et al. (2022). Authors propose a new loss management system based on the continuous double auction. Network power loss calculation methods are reviewed by Dudjak et al. (2021). Although graph-based loss allocation approaches simplify the network, they often lead to errors. Authors emphasize the need to devise the best possible balancing methods between acceptable error levels and computational and information overhead.

2.3 Fair allocation of transaction power loss

Power flow equations are used by Bhand et al. (2022) for loss calculation and allocation through an exact method-based loss allocation (EMLA). The performance of the proposed scheme is compared with that of graph-based loss allocation (GBLA) to ensure better loss allocation and effective cost recovery. A detailed analysis on the physical-layer network loss was presented by Azim and Tushar (2021), who revealed that due to network topography, the separation of loss due to P2P transactions and that from normal grid operations is a very complex problem. The concept of an effective node area is introduced to trace the transaction loss and grid-contributed loss. This approach is particularly suitable for radial feeders. Authors have demonstrated that P2P transactions do not increase network loss compared to non-P2P scenarios if prosumers have no power flexibility. With the power flexibility of prosumers, network loss is changed at certain time instances, but it is insignificant for large-sized distribution networks. Moret et al. (2021) explained distance-based loss calculation with two different ways of allocation—either distributed among all the peers or as per the geographical location based on the topology of the network.

Lilla et al. (2020) presented a distributed procedure to calculate the scheduling of available energy and allocated the internal network loss to various power transactions. This approach helps the prosumer with increased revenue and the consumer with reduced cost. Nikolaidis et al. (2019) used a graph-based loss allocation framework to match the physical attributes of the grid with financial transactions. The network is represented as multilayer radial graphs. The total loss incurred is calculated with the contribution of each transaction on the part of the network under use.

2.4 Reduction in transaction power loss

The artificial bee colony (ABC) algorithm and backward/forward sweep power flow-based framework were used by Suthar et al. (2024) for the optimal reconfiguration of the distribution network to minimize the impact of power loss. Lyapunov-based transmission loss-aware energy trading that integrates energy control and energy bidding for interconnected microgrids (MGs) was presented by Zhu et al. (2022). Each microgrid independently controls its energy objective, considering the uncertainties in renewable energy production and demands, along with the operational constraints of energy storage and transmission losses. This approach yields better results than the centralized transmission loss minimization algorithm.

Thompson et al. (2022) used a score-based algorithm considering the price, location, generation type, and quantity of energy traded. The optimal transaction pathway is pre-evaluated based on the cumulative score. This information is used in the market model to decide on P2P behavior. This approach is effective in reducing power loss to reduce the cost of energy by 25% in the case study considered. Prosumers were found to obtain 50% increased revenue. This approach was implemented with the Ethereum blockchain with smart contracts. Scalability is tested up to 20,000 transactions to establish that the number of prosumers is a deciding factor. No analysis is done explicitly on transaction loss.

Azizi et al. (2021) focused on the cross-subsidization problem in the existing loss allocation methods. In the method proposed by the authors, loss allocated to each transaction as the criterion to match peers encourages the trade between nearby peers. This approach diminishes the cross-subsidization problem. In the algorithm proposed by Guerrero et al. (2021), the electrical distance is based on a preference list prepared by the distribution system operator (DSO) for peer matching. Reduced network loss and line congestion that resulted in every match is considered by continuous double auction and fixed mutual match methods. A regression model based on power loss data was derived by Dynge et al. (2021) to frame an additional constraint to update the cost minimization objective function. A small reduction in loss (5%) is achieved with local transaction volume reduction, whereas grid operations remain unaffected. A location-based matchmaking method to reduce system overhead supported by a lightweight blockchain for privacy preservation was presented by Khorasany et al. (2021a).

2.5 Recovery of the cost of transaction power loss

Recovery of the cost of transaction loss is often implemented as network usage fees. Noorfatima et al. (2022) used the Z-bus method to calculate the network fees for better profit allocation with improved computational cost. Yang et al. (2022) devised a method to compute optimal network fees by preparing a tradeoff with revenue and transmission loss. Parameters are calculated based on the electrical distance. The incentive scheme explained by Kim et al. (2022) aims to alleviate the burden of loss costs of the first trader in the market. Authors compare a loss-guided trading framework with a price-guided framework to observe that the former compromises prosumer welfare, whereas the latter ensures network efficiency, social welfare, and prosumer welfare. Electrical distance-based computation of network fees by Khorasany et al. (2021b) encourages peers with low network fees, which, in turn, reduces transaction loss.

3 Role of blockchain in P2P trading

Blockchain technology revolutionizes P2P energy trading by creating a decentralized, secure, and transparent platform for transactions. In summary, blockchain applications in the P2P market can be classified as follows: decentralization of the market, trading enhancement by consensus mechanisms, privacy protection of peers, and optimum resource allocation. A few researchers have applied BCT to tackle transaction power loss as well.

Fully decentralized and semi-decentralized energy markets supported by blockchain can be designed based on the application. Such market designs redefine the role of intermediaries, reducing costs and increasing the efficiency (Moniruzzaman et al., 2023). The performance of a tokenized, semi-decentralized market model supported by permissioned blockchain is assessed by Jamil et al. (2021) for throughput, latency, and other resource usage. In addition to web application attempted by many, the design of a mobile application for a semi-decentralized P2P market, built on Ethereum, is presented by El-Sayed et al. (2020). The impact on scalability while moving toward a decentralized market is explored by Thompson et al. (2022). The number of prosumers affects the model stability. Authors have also proposed a scheme that can process up to 20,000 transactions in the chosen scenario. In a comparative study of the centralized and decentralized implementation of the same market model, Zade et al. (2022) demonstrated the huge computational requirements and insufficient data security features of blockchain. There are socio–legal limitations to blockchain application in P2P markets, as explained by Borges et al. (2022) and Schneiders et al. (2022).

Blockchain is an immutable ledger that ensures transparency and auditability by various consensus mechanisms for the decentralized verification of transactions. Fast and secured P2P energy trading using block alliance consensus (BAC) based on a hash graph is proven to be effective in resisting Sybil attacks while preserving the throughput of a very large P2P network (Wang et al., 2022). Two consensus mechanisms—proof of work (PoW) and proof of elapsed time (PoET)—are studied by Pradhan and Singh (2021) for latency and throughput. It is observed that PoET can handle up to 946 transactions, whereas PoW can handle up to 627 transactions with the selected case. Network security is enhanced through cryptographic techniques used in blockchain, protecting the privacy of participants and data. Specifically designed Ethereum smart contracts are used for privacy preservation and scalability by Buccafurri et al. (2023).

Blockchain also supports the integration of microgrids by the optimal allocation of resources, promoting the inclusivity of small-scale prosumers in the energy market (Doan et al., 2021). A mixed-integer nonlinear program (MINLP) is applied to carbon trading to determine individual buy/sell quantities, investment on carbon capture, and their response to carbon prices, making the decisions simultaneously by generalized Nash equilibrium. Thus, real-time data from blockchain can optimize grid management by balancing supply and demand, leading to improved energy efficiency. The ADMM provides a powerful framework for decentralized optimization and ensuring efficient and fair energy distribution among prosumers (Aminlou et al., 2024). Complex optimization problems are decomposed into manageable subproblems to solve the trading problem in a dynamic and distributed way. A bi-level distributed optimization framework is discussed by Zou et al. (2023) to solve network-constrained P2P energy trading problems for multiple MGs under uncertainty. A nested bi-level distributed algorithm including a parallel analytical target cascading algorithm and an alternating direction multiplier method and adaptive updating method is employed. Acceptable power flow schemes for network are obtained in the upper level and optimal energy trading schemes among multiple MGs in the lower level simultaneously. The adaptive updating method is introduced into the ADMM to reduce sensitivity to the initialization of different MGs. A completely decentralized tokenized model for the P2P market with user privacy preservation, as discussed by Khorasany et al. (2021a), employs a lightweight blockchain. An advertisement database is used for managing bids and asks to reduce the overhead on the blockchain. The algorithm is fully decentralized with the privacy preservation of the peer details. Multiple side chains in the design for payments, meter certification, and market operations are other suggested solutions (Strepparava et al., 2022).

Sustainability analysis based on resources needed by blockchain to operate is presented in this article with a summary of the hardware and software requirements for various blockchain implementations. Yu et al. (2022) proposed a double blockchain for computationally intense tasks and another for storing data with a market model—ensuring the cooperation between the two chains by an executor-validator mechanism. Smart contracts automate and enforce trading conditions, minimizing the risk of disputes and further lowering transaction costs. A trading scheme for an industrial system in which individual policies are determined and fair allocation of costs to meet an environmental target is explained by Kazi and Hasan (2024). The functionality and effectiveness of smart contracts in the field of P2P trading are reviewed by Guo et al. (2023). Authors consider deploying smart contracts as another type of transaction. The destination address is empty before deployment, and a new address is automatically generated for the contract. The validation index and condition adaptation index are used for the verification of smart contracts. The five parameters considered by authors for verifying effectiveness and efficiency are as follows: 1) whether the contract could accurately and adequately express the mutual intent of both parties; 2) whether the contract compilation has errors; 3) whether it could do what it was supposed to do; 4) whether it only does what it was designed to do; and 5) whether the parallel running of multiple programs operates only as expected without errors. In conclusion, the security of running the contract could be confirmed by the verification framework.

3.1 Application of blockchain to address P2P transaction loss

Recent research has attempted to recoup the costs incurred due to loss and equitably allocate and minimize transaction loss. In the research projects, different consensus algorithms are applied to both permission and public blockchains. A proof-of-energy generation (PoEG) consensus model is used in the cooperative game theory-based trading model by Moniruzzaman et al. (2023). Winners of coalition would be selected as miners for creating the next block. A two-level distributed optimization framework—a conditional optimal power flow to minimize power losses and P2P trading optimization—is proposed by Wang et al. (2023).

The attempt to reduce transmission loss by a distance-based trading method is explained by Alskaif et al. (2022) in order to encourage close peers to transact. The authors have also attempted to link the rate of block creation based on the volume of transaction by running a smart contract on a fully decentralized, permissioned blockchain. By considering the location in peer matching, Thompson et al. (2022) claimed to obtain a 50% gain in revenue and a 25% reduction in energy costs.

The anonymous proof-of-location (A-PoL)-based algorithm is illustrated by Khorasany et al. (2021a), in which agents can declare the location in the consensus process. Although authors have not specifically attempted to minimize transaction loss, A-PoL can also be helpful in this regard. Better stakes are awarded to miners as an incentive to compensate for transaction loss (Yang et al., 2022) in a proof-of-stake (PoS) consortium blockchain. Trading and mining roles are flexible during various time periods. This method uses the consensus feature of the blockchain (virtual layer). Given that miners rotate during various time periods, the trading and mining model is adaptable. This method uses the consensus feature of the blockchain to compensate for losses by controlling the behavior at the physical layer through a virtual-layer feature to compensate for losses (physical-layer feature).

4 Blockchain transaction costs

Blocks of data are linked into an un-editable digital chain. These data are kept in a decentralized, open-source environment where every participating computer can verify the information in any given block. It is intended to have decentralized management, as opposed to our conventional hierarchical systems. Trust, authenticity, and usability are enhanced by a distributed framework such as the blockchain.

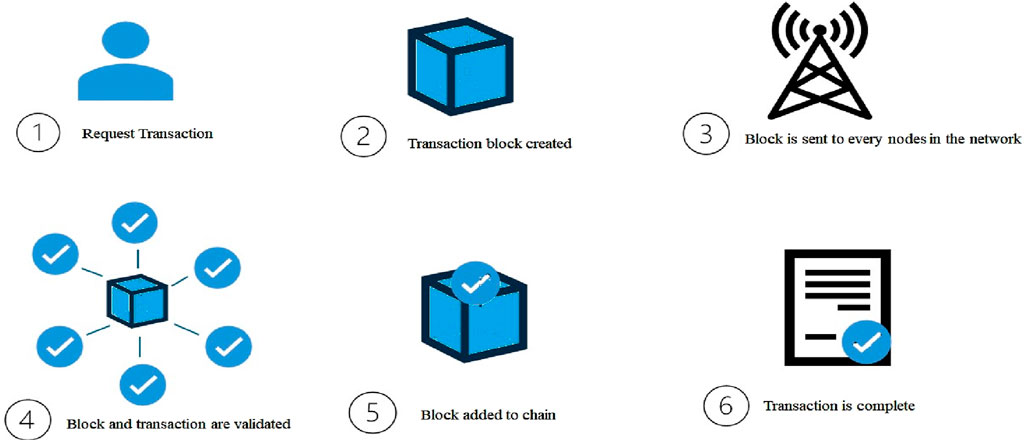

The transaction life cycle in a blockchain involves several stages, from initiation to final confirmation. A user initiates a transaction using a blockchain wallet or application, specifying the details such as the recipient’s address, the amount to be transferred, and any other necessary data. The transaction is digitally signed by the sender’s private key (cryptographic signature) to ensure that the transaction is authentic and has not been tampered with. The signed transaction is broadcast to the network of nodes participating in the blockchain. Nodes receive the transaction and perform initial checks, such as verifying the signature and ensuring the sender has sufficient balance. Valid transactions are temporarily held in a memory pool (mempool) of nodes until they are picked up by miners (in proof-of-work blockchains) or validators (in proof-of-stake blockchains). Miners/validators select transactions from the mempool to include in the next block. Transactions are prioritized based on the fee offered by the sender.

Miners/validators create a new block that includes the selected transactions. In proof-of-work blockchains, miners compete to solve a cryptographic puzzle. In proof-of-stake blockchains, validators are chosen based on their stake. Once a miner/validator successfully creates a block, it is proposed to the network. The new block is broadcasted to the network. Other nodes receive the block and verify its validity by checking the proof-of-work/proof-of-stake and ensuring all included transactions are valid to reach a consensus on the new block. Different consensus algorithms (like PoW and PoS) have different methods for agreeing on the validity and order of blocks.

After the block gets accepted, the transactions it contains are considered confirmed. The number of confirmations a transaction receives refers to the number of blocks added to the blockchain after the block containing the transaction. In some blockchains, finality is achieved after a certain number of confirmations, meaning the transaction cannot be reversed. The transaction becomes a permanent part of the blockchain ledger. It is recorded in the distributed ledger and can be viewed by anyone. Depending on the blockchain protocol, once a transaction is finalized, it becomes extremely difficult (if not impossible) to reverse. The complete life cycle is shown in Figure 4.

Although not universal, many blockchains (like Ethereum) have transaction costs, where users who initiate transactions must pay a predetermined amount (called “gas fee” in Ethereum) for each transaction pro rata to the complexity. This is to support capping and pricing the system resources that each transaction may use, as well as resource constraints. Different gas prices apply to the same transaction depending on the urgency, frequency, bid, type, and crypto challenges. Transactions costs are important as 15% of the overall costs of a BCT-enabled platform are related to deployment and operational cost.

Accurately assessing and allocating the cost among stakeholders who gain from the transactions is crucial for fairness in local energy markets (LEMs) powered by blockchain. If the preset maximum transaction gas limit (TGL) is exceeded, out-of-gas exemption results in a DoS attack and adds systemic risk in the form of money loss, resource waste, and other vulnerabilities. The security of energy supply is at risk if the P2P network fails. In addition to that, it is not possible to track the malicious node in a decentralized public BC environment. Every new node that receives a copy of a transaction that fails causes the issue to recur. Consequently, DoS attacks on the blockchain pose a security risk to BCT applications used in the trading of power. In order to lessen the impact of this additional cost component, researchers apply technology-level, generic solutions in the design of smart contracts.

A middleware system to save gas cost by enabling the secure batching of smart contract invocations against an untrusted relay server off-chain is proposed by Wang et al. (2023). The process is carried out in a lower overhead by validating the batched invocation of the server in smart contracts without additional states of user nonces, according to configured policies supporting conservative to aggressive batching.

Donmez and Karaivanov (2022) contended that over 90% utilization, there is a strong nonlinear behavior in the demand for services, increasing with the unit charge. The article also shows that conventional transactions, as opposed to smart contract transactions, are linked to higher gas prices in the endogenous mix of blockchain transactions. Contracts are created by complex transactions, which often need the highest gas—more than 10% of the allotted amount. For certain transactions, contract calls can be utilized in place of ordinary calls. The study also considered the exchange rate between the US dollar and Ether, the native currency of the Ethereum blockchain environment.

The authors also highlight the connection between blockchain economics and transaction heterogeneity. In reference to mining costs, the authors explain that in a proof-of-stake system, miners do not face costly competition among themselves, while in a proof-of-work consensus, miners must solve difficult cryptographic puzzles as fast as possible in order to be selected for the creation of the next block and qualified to receive associated transaction fees and block rewards. Miners collect the transactions, arrange them in descending order of gas price, and then include them into a block. This can also be compared to a bidding process in which users are the buyers, miners are the sellers, and the space in the block being mined and exchanged is the commodity.

Experimental analysis on blockchain transactions and computing cost is explained by Jabbar and Dani (2020). To keep track of transaction prices, frequency, and intensity, an experimental system is employed for storage, validation, and maintenance. From a cost standpoint, the authors assert that they offer an insight into supply chain smart contract transactions. In their two research topics, the authors analyze the relationship between computational costs and blockchain-based operational transaction costs, as well as the impact of transaction frequency and intensity on calculations. From the data analysis, the authors conclude that how transactions are perceived, or executed, or deployed has a potential impact on cost. The designer of supply chain operations in the blockchain should be careful enough to absorb the cost by savings in other operational areas. The authors identify the emergence of computational costs as a new direction of research in the public blockchain as these costs have the potential to disrupt business and revenue models which were not conceived in earlier blockchain iterations.

Furthermore, the authors argue to have variables reflect the influence of frequency, transaction, and intensity in the formula to compute the cost than considering a simple product of gas price and gas cost. The authors conclude from the data analysis that there may be a cost impact related to how transactions are seen, carried out, or implemented. The blockchain designer of the supply chain operations needs to be cautious enough to offset the expense by making savings in other operational domains. Because computational costs have the potential to upend business and revenue models that were not considered in previous blockchain iterations, the authors identify this as a new area of research in public blockchain. Moreover, the authors contend that rather than taking a straightforward approach and multiplying the price of gas by the cost of gas, the calculation should consider factors that represent the impact of frequency, transaction, and intensity.

Sooksomsatarn et al. (2021) reported that the computational cost of signing and verifying digital wallets with millions of replicated tokens in blocks increases as the blockchain network grows. Hence, a protocol is suggested to lower the cost and complexity. The suggested protocol is evaluated for various lengths up to 512-digit RSA private key length. Authors suggest testing the Goldwasser–Micali cryptosystem and other RSA-like algorithms, as well as other arithmetical transformations (Fermat’s little theorem and the Chinese remainder theorem), for their efficacy with longer private keys or 512. According to the authors, further studies may explore the linkage between transaction speed and cost in a blockchain environment.

In the cost analysis of BCT, enabled P2P energy trade was implemented in Python by Thakur and Breslin (2020). A tradeoff among the cost of the blockchain network, the appropriate throughput of the blockchain, and the profit from the energy price were investigated and the factors leading to profitable blockchain-based P2P trade markets. The mining cost for the network in terms of the throughput needed to support the trade operations. The authors suggest using game theory to formulate the blockchain parameter and extend the research to consensus mechanisms other than proof-of-work. Kállay et al. (2020) reviewed how game theory can be used to calculate transaction costs. The link between blockchain transactions and computational cost is investigated by Jabbar and Dani. (2020), concluding that how the blockchain perceives/executes the transaction also decides the transaction cost, implying a potential increase.

Ochôa et al. (2019) experimentally examined the processing cost in a private Ethereum network. Because of high time requirement, data processing (for example, 4 s to sort an array of 128 positions) activities are inefficient. Parallel data processing may be an effective solution, although more research is needed to confirm this point. Changing a single character in a string variable is four times more complex than changing integers. The cost of manipulating a string of 128 characters is six times greater than that of manipulating a single character, requiring at least 2,000 units of gas. The inability of the network to handle a limited number of intricate activities points to a scalability problem. The processes involving significant data processing and storage are not appropriate for the blockchain environment. The relationship between the intricacy of the transactions and Ethereum’s fundamental architecture is also indicated by the investigation.

5 Discussion and future work

5.1 Knowledge gaps observed

Analysis of the power loss associated with energy market transactions is complex, and a comprehensive approach for loss calculation, allocation, reduction, and cost recovery is yet to be devised. The estimation of loss in view of active power alone, as attempted by many researchers, is sub-optimal. Loss compensation strategies should be evaluated based on the reduction of loss, energy cost reduction, savings/loss to the grid, and the environmental impact. It is challenging to make a fair comparison because other factors such as the efficiency of the peer matching mechanism influence the outcome significantly.

5.2 Role of blockchain in the P2P market and power loss compensation

The market mechanism decides the degree of decentralization, although blockchain supports complete decentralization. Fully decentralized and semi-decentralized models are tried in the literature both with public and permissioned blockchains. Various blockchain models and tools are available, the application of which is resource-intensive. The system design should be scalable as the P2P market may have any number of transactions. Technically, the blockchain addresses this issue by a double blockchain, side chains, lightweight blockchain, and secondary database. A tokenized market model and usage of smart contracts as energy quotes are widely accepted in blockchain-based P2P models. Immutability and security are two features inherent to blockchain, which get translated in P2P models as user privacy preservation, protection from double spending, and data alteration. Performance analysis of technical aspects of blockchain-based implementations is carried out in terms of latency, throughput, and resource utilization. There is no bias toward any implementation platform, although the most popular is Ethereum and Hyperledger. Generic comparison among different platforms in terms of resource utilization is available in the literature, but seemingly, selection is based on the market model.

The potential of blockchain in addressing the challenge of transaction loss management is yet to be fully tapped. New methodologies are to be devised to match the physical layer and virtual layer with the blockchain.

5.3 Linkage between transactions and the usage cost of blockchain

There are very few attempts to estimate, allocate, and recover blockchain cost as a part of the P2P market mechanism. Insights into designing cost-efficient smart contracts, linking the transaction volume and the usage cost, setting a proper gas limit for every transaction, and allocating the costs to different players involved in the trading are yet to be developed. Furthermore, cost analysis of other blockchains should be conducted with different cost calculation models to find the best option. The tradeoff between the speed of execution and cost of transaction is yet to be explored, and best mechanisms are to be developed.

The risk aspect related to blockchain transactions is of critical importance but has not yet been explored in the literature. If the “gas limit” set by the user is not sufficient, the transaction may not be even included in the block creation, which defeats the very purpose of the smart contract and may lead to system failure. Methods are to be designed and developed to propose an optimum gas limit for each application.

5.4 Future works

To estimate power losses, sophisticated models considering various factors such as network configuration, distance between nodes, and load variations are yet to be developed. Advanced optimization algorithms that aim to minimize power losses during energy transaction algorithms can leverage artificial intelligence to predict and respond to patterns in energy demand and supply. Extensive research on different network topologies is needed to understand their impact on power losses, analyzing the effects of various grid configurations, such as meshed, radial, and hybrid networks, on energy distribution efficiency. Investigating the integration of distributed renewable energy sources like solar and wind to impact power losses can be carried out by studying the variability and intermittency of these energy sources and their effects on the stability and efficiency of the P2P network. It is important to develop scalability solutions to accommodate the growing number of prosumers, ensuring the robustness of the network against failures and the ability to handle large-scale integration without significant losses. Examining the role of ESSs in reducing power losses would be impactful for load balancing by storing energy during low-demand periods and releasing during peak times.

The decentralized structure of blockchain makes it beneficial for tracking and allocating losses by creating market mechanisms that precisely connect transactions at the virtual layer to power flows at the physical layer. The market model should assess the suitability of loss calculation approaches in light of the network geometry and level of decentralization. The supply and demand dynamics of the Ethereum network can cause large fluctuations in gas fees. High-profile events, like token launches or popular decentralized finance (DeFi) activities, might induce gas price increases. Models that include gas fee estimators and transaction planners can help cut transaction costs during off-peak hours. Engaging with applications that use layer 2 solutions can significantly reduce transaction costs.

5.5 Conceptual design: P2P electricity trading framework

The suggested approach, as shown in Figure 5, allows peers in the local energy market to register and submit bids specifying quantity, price, and trade window. Tokens are created in the prosumer account for each bid placed. After matching the peers, based on the amount of energy available for trade, the maximum number of blockchain transactions required are computed for each time window (Thakur and Breslin, 2020), which are thought to be benign. Any attempt to transact above this limit would be deemed a malicious attack aimed at generating out-of-gas exceptions. To defend this, Chen et al. (2017) proposed an adaptive gas method, in which hostile transactions are charged a high gas cost, while benign transactions are charged a normal gas tax. The active power loss is then calculated by solving for optimal power flow. To offset the loss, more energy tokens generated by any market or grid peer should be traded. Both types of tokens are merged to produce a basket of tokens for each trade, the composition of which can be determined by game theoretic models.

6 Conclusion

The integration of blockchain technology into P2P energy markets offers substantial promise but also poses several challenges that require thorough investigation. Key areas of focus include addressing physical-layer difficulties, assessing the economic impact of blockchain implementation, and managing the risks associated with service disruption. Effective mitigation strategies, such as utilizing high gas fees to deter low-value transactions and implementing layer-2 solutions to reduce Mainnet congestion, are crucial for enhancing network resilience. Additionally, developing a comprehensive pricing system that includes active power loss costs, blockchain usage fees, and risk adjustments is essential for the successful adoption of blockchain in P2P electricity markets.

By exploring these areas, researchers and industry practitioners can unlock the full potential of blockchain technology, leading to more efficient, transparent, and resilient P2P energy markets. Continued research and innovation will be critical in overcoming the existing barriers and ensuring that blockchain can meet the demands of modern energy trading systems, ultimately contributing to a more sustainable and decentralized energy future.

Author contributions

MP writing–original draft. AS: writing–review and editing.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Alam, K. S., Kaif, A. M. A. D., and Das, S. K. (2024). A blockchain-based optimal peer-to-peer energy trading framework for decentralized energy management within a virtual power plant: lab scale studies and large scale proposal. Appl. Energy 365, 123243. doi:10.1016/j.apenergy.2024.123243

AlSkaif, T., Crespo-Vazquez, J. L., Sekuloski, M., van Leeuwen, G., and Catalão, J. P. S. (2022). “Blockchain-Based Fully Peer-to-Peer Energy Trading Strategies for Residential Energy Systems,” IEEE Trans. Ind. Inform. 18 (1), 231–241. doi:10.1109/TII.2021.3077008

Aminlou, A., Hayati, M. M., and Zare, K. (2024). ADMM-based fully decentralized Peer to Peer energy trading considering a shared CAES in a local community. Research Article Journal of Energy Management and Technology (JEMT) 8 (2). doi:10.22109/JEMT.2023.394182.1444

Azim, M. I., and Tushar, W. (2021). “P2P negawatt trading: a potential alternative to demand-side management,” in 2021 IEEE PES Innovative Smart Grid Technologies - Asia, ISGT Asia 2021, Brisbane, Australia, 5-8 Dec. 2021. doi:10.1109/ISGTASIA49270.2021.9715612

Azizi, A., Aminifar, F., Moeini-Aghtaie, M., and Alizadeh, A. (2021). Transactive energy market mechanism with loss implication. IEEE Trans. Smart Grid 12 (2), 1215–1223. doi:10.1109/TSG.2020.3028825

Bhand, I., Debbarma, S., and Roy, S. D. (2022). Loss allocation in distribution network involving peer-to-peer energy transactions. Piscataway, New Jersey: IEEE, 1–6. doi:10.1109/icepe55035.2022.9798075

Borges, C. E., Kapassa, E., Touloupou, M., Legarda Macón, J., and Casado-Mansilla, D. (2022). Blockchain application in P2P energy markets: social and legal aspects. Connect. Sci. 34 (1), 1066–1088. doi:10.1080/09540091.2022.2047157

Bouachir, O., Aloqaily, M., Ozkasap, O., and Ali, F. (2022). FederatedGrids: federated learning and blockchain-assisted P2P energy sharing. IEEE Trans. Green Commun. Netw. 6 (1), 424–436. doi:10.1109/TGCN.2022.3140978

Buccafurri, F., Lax, G., Musarella, L., and Russo, A. (2023). An Ethereum-based solution for energy trading in smart grids. Digital Commun. Netw. 9 (1), 194–202. doi:10.1016/j.dcan.2021.12.004

Cai, Y., Xiao, X., Li, Y., He, X., He, X., and Huang, B. (2024). Energy sharing transactions of wind and solar microgrids considering network topology: a game analysis based on Nash negotiation. J. Electr. Eng. Technol. 19, 2889–2902. doi:10.1007/s42835-023-01769-5

Chen, L., Liu, N., Li, C., and Wang, J. (2021). Peer-to-Peer energy sharing with social attributes: a stochastic leader-follower game approach. IEEE Trans. Industrial Inf. 17 (4), 2545–2556. doi:10.1109/TII.2020.2999328

Chen, T., Li, X., Wang, Y., Chen, J., Li, Z., Luo, X., et al. (2017). “An adaptive gas cost mechanism for Ethereum to defend against under-priced DoS attacks,” in International conference on information security practice and experience (ISPEC). Berlin, Germany: Springer Nature.

Das, A., Peu, S. D., Akanda, Md. A. M., and Islam, A. R.Md. T. (2023). Peer-to-Peer energy trading pricing mechanisms: towards a comprehensive analysis of energy and network service pricing (NSP) mechanisms to get sustainable enviro-economical energy sector. Energies 16 (5), 2198. doi:10.3390/en16052198

Doan, H. T., Cho, J., and Kim, D. (2021). Peer-to-peer energy trading in smart grid through blockchain: a double auction-based game theoretic approach. IEEE Access 9, 49206–49218. doi:10.1109/ACCESS.2021.3068730

Donmez, A., and Karaivanov, A. (2022). Transaction fee economics in the Ethereum blockchain. Econ. Inq. 60 (1), 265–292. doi:10.1111/ecin.13025

Dudjak, V., Neves, D., Alskaif, T., Khadem, S., Pena-Bello, A., Saggese, P., et al. (2021). Impact of local energy markets integration in power systems layer: a comprehensive review. Appl. Energy 301, 117434. doi:10.1016/j.apenergy.2021.117434

Dynge, M. F., Crespo del Granado, P., Hashemipour, N., and Korpås, M. (2021). Impact of local electricity markets and peer-to-peer trading on low-voltage grid operations. Appl. Energy 301, 117404. doi:10.1016/j.apenergy.2021.117404

El-Sayed, K., Khan, X., Dominguez, , and Arboleya, P. (2020). “A Real Pilot-Platform Implementation for Blockchain-Based Peer-to-peer Energy Trading,” in 2020 IEEE Power & Energy Society General Meeting (PESGM), Montreal, QC, 1–5. doi:10.1109/PESGM41954.2020.9281855

Guerrero, J., Sok, B., Chapman, A. C., and Verbič, G. (2021). Electrical-distance driven peer-to-peer energy trading in a low-voltage network. Appl. Energy 287, 116598. doi:10.1016/j.apenergy.2021.116598

Guo, M., Zhang, K., Wang, S., Xia, J., Wang, X., Lan, L., et al. (2023). Peer-to-peer energy trading and smart contracting platform of community-based virtual power plant. Front. Energy Res. 10, 1007694. doi:10.3389/fenrg.2022.1007694

Hoque, M. M., Khorasany, M., Azim, M. I., Razzaghi, R., and Jalili, M. (2024). A framework for prosumer-centric peer-to-peer energy trading using network-secure export–import limits. Appl. Energy 361, 122906. doi:10.1016/j.apenergy.2024.122906

Huang, Q., Amin, W., Umer, K., Gooi, H. B., Eddy, F. Y. S., Afzal, M., et al. (2021). A review of transactive energy systems: concept and implementation. Energy Rep. 7, 7804–7824. Elsevier Ltd. doi:10.1016/j.egyr.2021.05.037

IRENA (2024). Decarbonising hard-to-abate sectors with renewables: perspectives for the G7. Available at: www.irena.org.

Jabbar, A., and Dani, S. (2020). Investigating the link between transaction and computational costs in a blockchain environment. Int. J. Prod. Res. 58 (11), 3423–3436. doi:10.1080/00207543.2020.1754487

Jamil, F., Iqbal, N., Imran, S., Ahmad, S., and Kim, D. (2021). “Peer-to-Peer Energy Trading Mechanism based on Blockchain and Machine Learning for Sustainable Electrical Power Supply in Smart Grid,” IEEE Access 9, 39193–39217. doi:10.1109/ACCESS.2021.3060457

Jia, Y., Wan, C., and Li, B. (2023). Strategic peer-to-peer energy trading framework considering distribution network constraints. J. Mod. Power Syst. Clean Energy 11 (3), 770–780. doi:10.35833/MPCE.2022.000319

Junlakarn, S., Kokchang, P., and Audomvongseree, K. (2022). Drivers and challenges of peer-to-peer energy trading development in Thailand. Energies 15 (3), 1229. doi:10.3390/en15031229

Kállay, L., Takács, T., and Trautmann, L. (2020). A game theory-based model of transaction costs. Available at: https://www.pdfonline.com/convert-pdf/.

Kazi, M. K., and Hasan, M. M. F. (2024). Optimal and secure peer-to-peer carbon emission trading: a game theory informed framework on blockchain. Comput. Chem. Eng. 180, 108478. doi:10.1016/j.compchemeng.2023.108478

Khare, V., and Bhatia, M. (2024). Renewable energy trading: assessment by blockchain. Clean. Energy Syst. 8, 100119. doi:10.1016/j.cles.2024.100119

Khorasany, M., Dorri, A., Razzaghi, R., and Jurdak, R. (2021a). Lightweight blockchain framework for location-aware peer-to-peer energy trading. Int. J. Electr. Power Energy Syst. 127 (December 2020), 106610. doi:10.1016/j.ijepes.2020.106610

Khorasany, M., Paudel, A., Razzaghi, R., and Siano, P. (2021b). A new method for peer matching and negotiation of prosumers in peer-to-peer energy markets. IEEE Trans. Smart Grid 12 (3), 2472–2483. doi:10.1109/TSG.2020.3048397

Kim, S., Chu, Y., Kim, H., Kim, H., Moon, H., Sung, J., et al. (2022). Analyzing various aspects of network losses in peer-to-peer electricity trading. Energies 15 (3), 686. doi:10.3390/en15030686

Lawan Bukar, A., Fatihu Hamza, M., Ayup, S., Kikki Abobaker, A., Modu, B., Mohseni, S., et al. (2023). Peer-to-Peer electricity trading: a systematic review on currents development and perspectives. Renew. Energy Focus 44, 317–333. doi:10.1016/j.ref.2023.01.008

Lilla, S., Orozco, C., Borghetti, A., Napolitano, F., and Tossani, F. (2020). Day-ahead scheduling of a local energy community: an alternating direction method of multipliers approach. IEEE Trans. Power Syst. 35 (2), 1132–1142. doi:10.1109/TPWRS.2019.2944541

Moniruzzaman, M., Yassine, A., and Benlamri, R. (2023). Blockchain and cooperative game theory for peer-to-peer energy trading in smart grids. Int. J. Electr. Power Energy Syst. 151, 109111. doi:10.1016/j.ijepes.2023.109111

Moret, F., Tosatto, A., Baroche, T., and Pinson, P. (2021). Loss allocation in joint transmission and distribution Peer-to-peer markets. IEEE Trans. Power Syst. 36 (3), 1833–1842. doi:10.1109/TPWRS.2020.3025391

Nikolaidis, A. I., Charalambous, C. A., and Mancarella, P. (2019). A graph-based loss allocation framework for transactive energy markets in unbalanced radial distribution networks. IEEE Trans. Power Syst. 34 (5), 4109–4118. doi:10.1109/TPWRS.2018.2832164

Noorfatima, N., Choi, Y., Lee, S., and Jung, J. (2022). Development of community-based peer-to-peer energy trading mechanism using Z-bus network cost allocation. Front. Energy Res. 10, 920885. doi:10.3389/fenrg.2022.920885

Ochôa, I. S., Piemontez, R. A., Martins, L. A., Leithardt, V. R. Q., and Zeferino, C. A. (2019). Experimental analysis of the processing cost of Ethereum blockchain in a private network.

Ohanu, C. P., Rufai, S. A., and Oluchi, U. C. (2024). A comprehensive review of recent developments in smart grid through renewable energy resources integration. Heliyon 10 (3), e25705. Elsevier Ltd. doi:10.1016/j.heliyon.2024.e25705

Pradhan, N. R., and Singh, A. P. (2021). “Performance analysis of a blockchain based peer-to-peer energy trading framework,” in 2021 IEEE 4th International Conference on Computing, Power and Communication Technologies, GUCON 2021, Kuala Lumpur, Malaysia, Sep. 24-26, 2021. doi:10.1109/GUCON50781.2021.9573668

Rudd, S., and Stapleton, L. (2022). The transformation of peer-to-peer energy markets meta-analysis of state of the art and future trends. IFAC-PapersOnLine 55 (39), 1–8. doi:10.1016/j.ifacol.2022.12.001

Sahih, A. Z., Abbasi, A., and Ghasri, M. (2024). Blockchain-enabled solutions for fair and efficient peer-to-peer renewable energy trading: an experimental comparison. J. Clean. Prod. 455, 142301. doi:10.1016/j.jclepro.2024.142301

Schneiders, A., Fell, M. J., and Nolden, C. (2022). Peer-to-peer electricity trading and the sharing economy: social, markets and regulatory perspectives. Energy Sources, Part B Econ. Plan. Policy 17, 2050849. doi:10.1080/15567249.2022.2050849

Sooksomsatarn, K., Welch, I., Mekruksavanich, S., and Srihirun, J. (2021). Computational cost reduction of transaction signing in blockchain. Psychol. Educ. 58 (1), 1496–1500. doi:10.17762/pae.v58i1.935

Strepparava, D., Nespoli, L., Kapassa, E., Touloupou, M., Katelaris, L., and Medici, V. (2022). Deployment and analysis of a blockchain-based local energy market. Energy Rep. 8, 99–113. doi:10.1016/j.egyr.2021.11.283

Suthar, S., Cherukuri, S. H. C., and Pindoriya, N. M. (2024). Power loss reduction in peer-to-peer energy trading-enabled distribution network. Electr. Power Syst. Res. 229, 110161. doi:10.1016/j.epsr.2024.110161

Takkabutra, A., Chupong, C., and Plangklang, B. (2021). “Peer-to-peer energy trading market: a review on current trends, challenges and opportunities for Thailand,” in Proceedings ECTI-CON 2021 - 2021 18th International Conference on Electrical Engineering/Electronics, Computer, Telecommunications and Information Technology: Smart Electrical System and Technology, Chiang Mai, Thailand, May, 19-22, 2021, 1076–1079. doi:10.1109/ECTI-CON51831.2021.9454828

Thakur, S., and Breslin, J. G. (2020). “Cost analysis of blockchains-based peer to peer energy trade,” in Proceedings - 2020 IEEE International Conference on Environment and Electrical Engineering and 2020 IEEE Industrial and Commercial Power Systems Europe, EEEIC/I and CPS Europe 2020, Madrid, Spain, 9-12 June, 2020. doi:10.1109/EEEIC/ICPSEurope49358.2020.9160550

Thompson, M. J., Sun, H., and Jiang, J. (2022). Blockchain-based peer-to-peer energy trading method. CSEE J. Power Energy Syst. 8 (5), 1318–1326. doi:10.17775/CSEEJPES.2021.00010

Wang, L., Wang, Z., Li, Z., Yang, M., and Cheng, X. (2023). Distributed optimization for network-constrained peer-to-peer energy trading among multiple microgrids under uncertainty. Int. J. Electr. Power Energy Syst. 149, 109065. doi:10.1016/j.ijepes.2023.109065

Wang, Y., Li, K., Tang, Y., Chen, J., Zhang, Q., Luo, X., et al. (2023). Towards saving blockchain fees via secure and cost-effective batching of smart-contract invocations. IEEE Trans. Softw. Eng. 49 (4), 2980–2995. doi:10.1109/TSE.2023.3237123

Wang, Y., Li, Y., Zhao, J., Wang, G., Jiao, W., Qiang, Y., et al. (2022). A fast and secured peer-to-peer energy trading using blockchain consensus. Conference record - IAS annual meeting. IEEE Industry Applications Society. doi:10.1109/IAS54023.2022.9939776

Xuanyue, S., Wang, X., Wu, X., Wang, Y., Song, Z., Wang, B., et al. (2022). Peer-to-peer multi-energy distributed trading for interconnected microgrids: a general Nash bargaining approach. Int. J. Electr. Power Energy Syst. 138, 107892. doi:10.1016/j.ijepes.2021.107892

Yang, Y., Chen, Y., Hu, G., and Spanos, C. J. (2022). Optimal network charge for peer-to-peer energy trading: a grid perspective. Available at: http://arxiv.org/abs/2205.01945.

Yu, T., Luo, F., Pu, C., Zhao, Z., and Ranzi, G. (2022). Dual-blockchain-based P2P energy trading system with an improved optimistic rollup mechanism. IET Smart Grid 5, 246–259. doi:10.1049/stg2.12074

Zade, M., Feroce, M., Guridi, A., Lumpp, S. D., and Tzscheutschler, P. (2022). Evaluating the added value of blockchains to local energy markets—comparing the performance of blockchain-based and centralised implementations. IET Smart Grid 5, 234–245. doi:10.1049/stg2.12058

Zhang, C., Qiu, J., and Yang, Y. (2024a). A peer-to-peer joint kilowatt and negawatt trading framework incorporating battery cycling degradation. IEEE Trans. Power Syst., 1–12. doi:10.1109/TPWRS.2024.3360606

Zhang, M., Yang, J., Yu, P., Tinajero, G. D. A., Guan, Y., Yan, Q., et al. (2024b). Dual-Stackelberg game-based trading in community integrated energy system considering uncertain demand response and carbon trading. Sustain. Cities Soc. 101, 105088. doi:10.1016/j.scs.2023.105088

Zhang, Y., Robu, V., Cremers, S., Norbu, S., Couraud, B., Andoni, M., et al. (2024c). Modelling the formation of peer-to-peer trading coalitions and prosumer participation incentives in transactive energy communities. Appl. Energy 355, 122173. doi:10.1016/j.apenergy.2023.122173

Zhu, H., Ouahada, K., and Abu-Mahfouz, A. M. (2022). Transmission loss-aware peer-to-peer energy trading in networked microgrids. IEEE Access 10, 126352–126369. doi:10.1109/ACCESS.2022.3226625

Keywords: decentralization, peer-to-peer energy trading, blockchain technology, peer-to-peer active power losses, blockchain usage cost

Citation: P M and Salam PA (2024) A review of peer-to-peer transaction loss and blockchain: challenges and drivers in the roadmap to a low-carbon future. Front. Energy Res. 12:1397975. doi: 10.3389/fenrg.2024.1397975

Received: 08 March 2024; Accepted: 02 July 2024;

Published: 25 July 2024.

Edited by:

Haris M. Khalid, University of Dubai, United Arab EmiratesCopyright © 2024 P and Salam. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Maya P, bWF5YS5wQGFpdC5hYy50aA==

Maya P

Maya P P. Abdul Salam

P. Abdul Salam