- 1School of Economics and Management, Southwest Petroleum University, Chengdu, Sichuan, China

- 2Sichuan Oil and Natural Gas Development Research Center, Chengdu, China

- 3Shale Gas Research Institute, Southwest Oil and Gas Field Company, PetroChina, Chengdu, Sichuan, China

- 4PetroChina Nanchong Gas Company Co., Ltd., Nanchong, Sichuan, China

This study examines the quantitative conditions under which an energy metering pricing model is proposed to increase both gas merchant profits and gas customer consumer surplus compared to a volumetric pricing model. The quantitative condition is found to be related to factors such as the standard unit calorific value of natural gas prescribed by the National Development and Reform Commission (NDRC) and other relevant government departments under the energy metering pricing model. This paper establishes a mathematical model based on optimization theory to explore the operational decisions of city gas suppliers in the volumetric and energy metering and pricing modes, respectively, under the condition of relatively stable natural gas sales price. The results of the study show that DAC and other authorities can regulate the standard unit calorific value of natural gas under the energy metering and pricing model by regulating the standard unit calorific value of natural gas. This affects the incentives of gas dealers to produce and operate, guides the preference of gas users for natural gas energy metering and pricing, and results in the derivation of formulas for a reasonable range of standard unit calorific values for natural gas. The findings of this paper provide theoretical support to promote the reform of natural gas energy measurement and pricing, and contribute to the development of the natural gas industry.

1 Introduction

Unlike most countries in the world that use energy metering for natural gas trading and settlement, China is so far one of the few countries that have adopted the volumetric pricing model. As one of the main energy sources, pipeline natural gas, the fairness of its transactions is particularly important. Natural gas energy measurement and pricing refers to the calorific value of natural gas as the basis for measurement and pricing, which better reflects the differences in the quality of different natural gas, and is more scientific and fairer than volumetric measurement and pricing. To promote the high-quality development of the oil and gas industry and to more closely match the value of natural gas with its price. In May 2019 the National Development and Reform Commission (NDRC) issued the Measures for the Regulation of Fair Opening of Oil and Gas Pipeline Network Facilities, which explicitly proposes the implementation of natural gas energy metering and pricing. In April 2022, the Central Committee of the Communist Party of China and the State Council issued the Opinions of the Central Committee of the Communist Party of China and the State Council on Accelerating the Construction of a National Unified Big Market. It emphasized the steady advancement of natural gas market-oriented reforms and the accelerated establishment of a unified natural gas energy measurement and pricing system. As reported by China Quality News Network in June 2022, the National Pipe Network Group (NPNG) has basically completed the energy metering renovation of its natural gas pipeline network, and can start to pilot the implementation of the energy metering and pricing system. Therefore, the urgency of natural gas energy metering and pricing reform is obvious. This reform will not only involve hardware and software upgrades at all stages of the natural gas supply chain, but will also have a significant impact on the operational decisions of participants (Lu et al., 2019).

Since the State Council issued the “Opinions on Promoting the Coordinated and Stable Development of Natural Gas” in 2018, city gas operators have been setting their natural gas sales prices based on the “gas price linkage” mechanism under the guidance of the local development and reform commissions. This mechanism allows gas suppliers to adjust end-user sales prices in response to changes in the cost of gas purchases. However, the prerequisite for the implementation of the mechanism by gas merchants around the world is to meet the activation conditions set by the local NDRC. For example, price changes range from RMB 0.05 to RMB 0.15 per cubic meter and are subject to the requirements of the relevant adjustment cycles, ceilings and procedures. While safeguarding the needs of people’s livelihood, local development and reform commissions are more cautious and stricter in regulating the price linkage for residential gas users (Hauser et al., 2016). As a result, natural gas price adjustments for residential gas users are usually subject to a hearing process, and as a result, prices for residential gas users are relatively stable across the region. Based on this, with natural gas prices remaining relatively stable, how city gas providers will adapt to the new metering and pricing method, energy metering and pricing, is a question worth examining.

The sales price of natural gas in the energy metering pricing model is generally converted from the sales price under the volumetric pricing model based on the standard unit calorific value of natural gas prescribed by the NDRC. The unit of natural gas sales price has changed from

The focus of this paper is to explore how city gas suppliers will determine the optimal unit calorific value of natural gas sold under the natural gas energy metering and pricing model in order to maximize profits. It also further discusses how NDRC and other departments can influence the production and operation motivation of gas suppliers and guide the preference of city gas users to the natural gas energy metering and pricing model by regulating the standard unit calorific value of natural gas under the energy metering and pricing model. It is intended to provide theoretical references for promoting the implementation of natural gas energy metering and pricing reform.

2 Relevant literature

Regarding the implementation of natural gas energy metering and pricing, it has been subjected to continuous attention by scholars in the industry. More literature has been carried out in-depth research based on the conditions for the implementation of natural gas energy metering and pricing at home and abroad, the implementation program and recommendations, and the key issues. A group of scholars have discussed the conditions for the implementation of natural gas energy meters in China. For example (Zhang and Zhang, 2023), emphasize the importance of regulation and policy support of government departments for the implementation of natural gas energy metering and pricing. Lu et al. (2019) suggest that the standard unit calorific value of natural gas stipulated by the NDRC plays an important role in guiding the smooth promotion of natural gas energy metering and pricing reform. Ros and Sai (2023) study the demand for residential rooftop solar energy based on energy metering and billing, providing support for countries struggling with energy metering and billing reforms and tariff design improvements. A subset of scholars made recommendations based on the energy metering and pricing implementation program. For example (Dong et al., 2017), propose policies and recommendations for the future development of China’s natural gas industry. Burlinson et al. (2024) propose that targeted energy interventions can have wider societal benefits. Another part of scholars analyzes the problems that may be encountered during the implementation of energy measurement pricing and put forward relevant suggestions. For example (Sun and Sun, 2018), suggest that the energy metering pricing program may face the problems of equipment technology, transaction price, and policy system, and gives suggestions from the perspective of fairness and justice. Under the volumetric metering pricing model, the sales price of natural gas is the main factor affecting the market demand, and scholars have paid more attention to the influencing factors and adjustment strategies of the sales price of natural gas. For example (Zakeri et al., 2023), argue that in the context of the energy transition, natural gas has become a major influence on electricity price setting in Europe, and that fluctuations in natural gas supply and natural gas prices are highly susceptible to geopolitical risks in the European electricity market. Favero and Grossi (2023) find that the price elasticity of natural gas energy demand is critical for evaluating energy policy and consumption forecasts. (Goodell et al. (2024) contribute to the literature on energy prices and price controls by exploring whether the gas price cap announced by the EU in December 2022 affects the price of title transfer facilities and provides important guidance for policymakers. However, under the energy metering pricing model, in addition to the sales price, the calorific value of natural gas is also a major factor affecting the demand for natural gas. In this paper, we will study the optimal decision making of gas suppliers under the energy metering pricing model based on the heating value of natural gas and other factors.

In order to ensure the feasibility of the implementation of natural gas energy measurement and pricing in China, scholars have conducted research on the key technologies for constructing the natural gas energy measurement and pricing system. Regarding the measurement method of natural gas flow rate and heating value under the energy metering and pricing mode. Ulbig and Hoburg (2002) propose that the determination of the calorific value of natural gas is economically important in gas supply and describe different methods of calorific value determination. Yang et al., 2023 propose a graph neural network based calorific value metering method for natural gas. Motalo and Motalo (2021) propose an accuracy estimation method for measuring the gross and net specific calorific value of natural gas by calorimetry. The method is valid for up-to-date natural gas metering. Regarding the assignment method of natural gas calorific value. Sun et al. (2023) proposed the calculation method of natural gas flow time in pipeline and established a calorific value assignment model to lay the foundation of the software for the indirect determination of calorific value assignment. Rui et al. (2022) proposed a measurement method to improve the accuracy of energy measurement, taking into account the topology of the natural gas transmission and distribution pipeline network and combining with the principle of gas balance. Yan et al. (2021) proposed a simulation model of calorific value calculation, and suggested that the lower-level metering stations use this simulation method to assign the value to the calorific value of natural gas to achieve the purpose of reducing the investment and maintenance costs. Tsochatzidis and Karantanas (2012) evaluate gas calorific value data from different chromatographic systems in the northern part of the Greek gas transmission system using the method of determining the calorific uncertainty of multiple chromatographic systems. It is found that this uncertainty estimation method can be applied to gas transmission systems in different regions and time periods.

However, there is little literature on the impact of natural gas energy metering and pricing reform on the operational strategies of gas supply chain participants and the welfare of gas users. Based on optimization theory, this paper investigates the changes in the operational decisions of gas suppliers in the volumetric and energy metering and pricing modes, and discusses the impacts of the standard unit calorific value of natural gas set by the NDRC on the profits of gas suppliers and the surplus of gas user consumers in the energy metering and pricing mode. Finally, with the orientation of maximizing social welfare, we provide suggestions for the NDRC to set the standard unit calorific value of natural gas in a rational manner.

3 Model settings

The steps of model construction in this paper are as follows. First, the parameter symbols and related initial assumptions are introduced, see Table 1. Second, the objective functions under the two measurement and pricing models are constructed separately to determine the decision variables. Then, the optimal solution of the model is derived to obtain the optimal unit calorific value, the maximized profit level and the consumer surplus of the gas users under the two metering and pricing models. Next, a sensitivity analysis is performed based on the optimal solution to determine the extent to which each parameter in the model affects the optimal solution. Finally, numerical simulations were performed using Maple software to analyze the operational patterns and trends revealed by the model. To provide city gas suppliers with operational strategies under the energy metering and pricing model, as well as a reference for government departments to formulate policies.

This section considers a city gas supplier

3.1 Optimal unit calorific value decision for gas merchants under the volumetric pricing model

Under the volumetric pricing model, assume that the gas demand function of gas users is

The above equation shows that the profit function for gas merchant

According to the extreme value theory and the KKT condition, the optimal unit calorific value decision

Proof: the second-order derivative of

The above results show that the optimal unit calorific value decision of gas supplier

3.2 Optimal unit calorific value decision for gas merchants under the energy metering and pricing model

This section considers city gas supplier

To ensure that the model is meaningful, it is assumed that the standard unit calorific value of natural gas specified by the NDRC satisfies

The above equation shows that unlike volumetric pricing, the profit level of gas merchant

According to the extreme value theory and KKT condition, the optimal unit calorific value

Proof: the second order derivative of

The above results indicate that the optimal unit calorific value decision

4 Comparison of optimal decisions and profits

In the process of shifting natural gas from a volumetric pricing model to an energy metering model, it is appropriate to set the natural gas standard unit calorific value,

4.1 Comparison of optimal unit calorific value decisions

First, we analyze the impact of the reform of the metering and pricing model on gas suppliers’ optimal unit calorific value decisions. By comparing the optimal calorific value per unit of gas merchant

The above results firstly show that government departments such as the NDRC can guide gas suppliers to adjust the unit calorific value

4.2 Comparison of maximized profit levels

Further analyze the impact of the two metering and pricing models on the profit level of gas suppliers. By comparing the maximized profit of gas trader

The above results indicate that under the energy metering pricing model, the standard unit calorific value of natural gas, which is set by the NDRC, directly affects the profit level of gas suppliers. If the standard unit calorific value of natural gas under the energy-metered pricing model is low (below the threshold

4.3 Comparative consumer surplus

This section analyzes the consumer surplus of gas customers under two metered pricing models and compares the relationship between their magnitudes. Under the volumetric pricing model, the consumer surplus function the consumer surplus function in Eq. 9 that a unit of natural gas with a calorific value of

Substituting into

Under the energy pricing model, the consumer surplus function in Eq. 11 that a unit of natural gas with a calorific value of

Substituting into

By comparing the relationship between consumer surplus

The above results indicate that the change of natural gas metering and pricing model will directly affect the consumer surplus of city gas users. When the standard unit calorific value of natural gas in the energy-metered pricing model is low (below the threshold

5 Numerical analysis

This section uses numerical experiments to explore more about the regulatory implications of the natural gas volumetric pricing model and the natural gas energy metering pricing model. The following simulation process and study results are realized by Maple software.

5.1 Optimal unit calorific value and profit for gas merchants under the volumetric pricing model

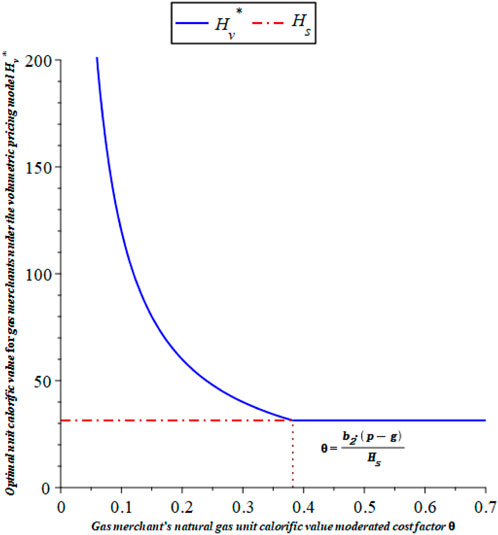

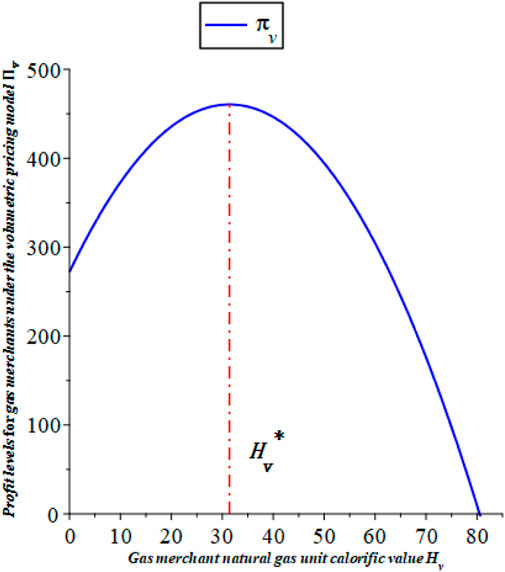

Verify how the gas supplier sets the optimal unit calorific value and the effect of unit calorific value on the gas supplier’s profit under the volumetric pricing model. By assigning values to the parameters

5.2 Optimal unit calorific value and profit for gas suppliers under the energy metering and pricing model

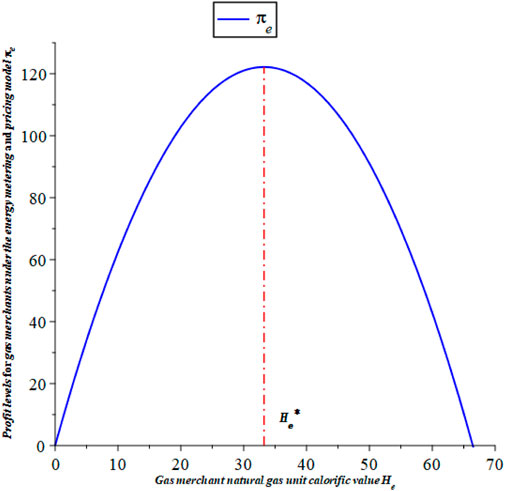

Under the energy metering and pricing model, verify how gas suppliers set the optimal unit calorific value and the impact of the unit calorific value on the profitability of gas suppliers. By assigning values to the parameters

By assigning values to the parameters

5.3 Comparison of optimal decision-making and profitability of gas suppliers under the two metering and pricing models

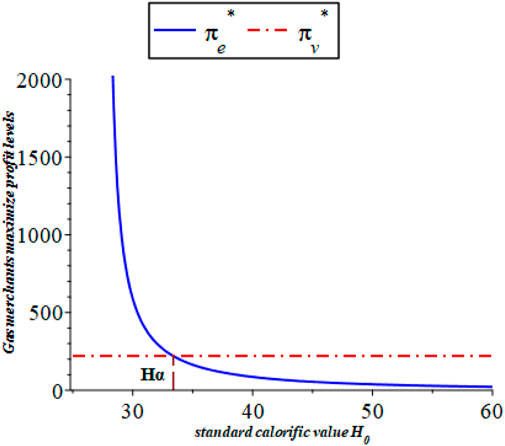

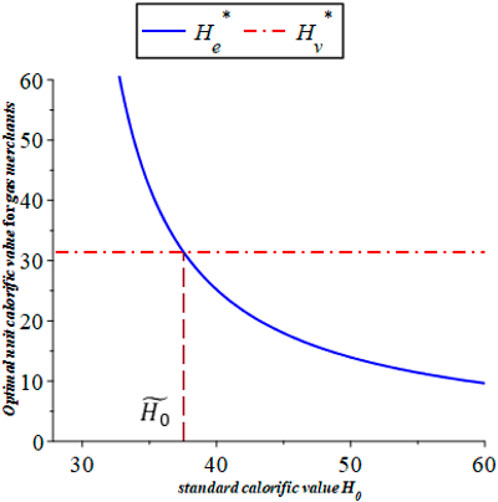

The following verifies the optimal unit calorific value decision and the change in profit level of the gas supplier under the two metering and pricing models. By assigning values to the parameters

Figure 5. Optimal unit calorific value decisions for gas suppliers under two metered pricing models.

Figure 5 shows the optimal unit calorific value decision of the gas supplier under the two metered pricing models. Firstly, it is shown that the optimal unit calorific value of natural gas sold by gas suppliers under the energy metering pricing model decreases as the standard unit calorific value

Figure 6 shows the maximized profit levels for gas suppliers under the two metered pricing models. Firstly, it shows that the profit level of gas suppliers in the energy metering and pricing mode decreases with the increase of the standard unit calorific value

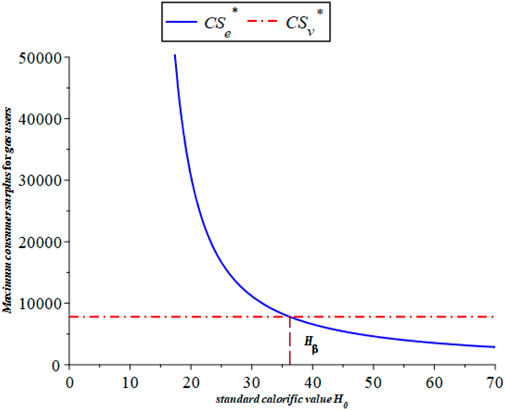

5.4 Comparison of consumer surplus under the two measurement and pricing models

In order to verify the effect of the two metering and pricing models of natural gas on the consumer surplus of gas users, the parameters are assigned the values

Figure 7 first shows that under the energy metering pricing model, the consumer surplus of gas users will be affected by the standard unit calorific value of natural gas

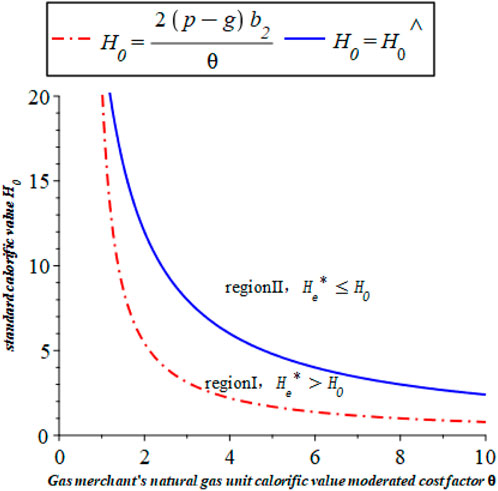

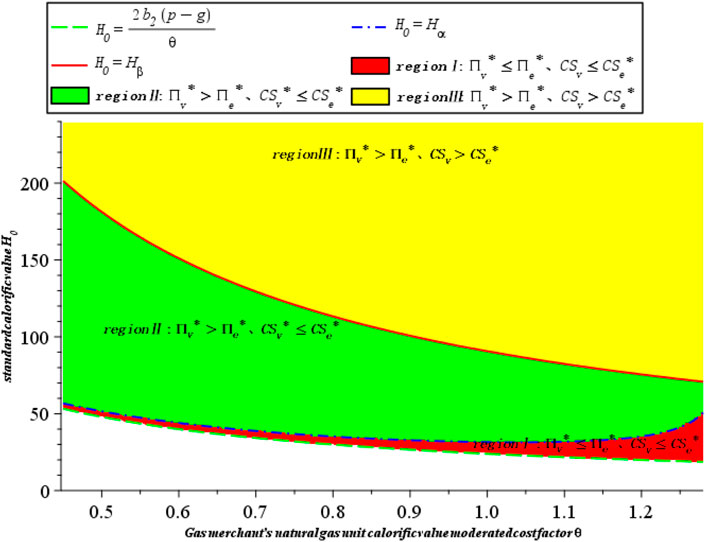

Finally, based on the conditions related to the energy metering and pricing model to increase the profit level of gas merchants as well as the consumer surplus of gas users in Section 4, the strategy-oriented diagram for setting the standard unit calorific value of natural gas under the energy metering and pricing model of the Development and Reform Commission (DRC) and other governmental departments is plotted by assigning the values of the parameters

Figure 8. Standard unit calorific value strategy orientation chart in energy metering and pricing models.

As can be seen from Figure 8, the government should set the standard unit calorific value of natural gas,

6 Summaries and prospects

6.1 Research summaries

This paper establishes a mathematical model based on optimization theory to explore the operational decisions of city gas suppliers under volumetric and energy metering pricing models. In the volumetric pricing mode, the gas supplier only needs to set the unit calorific value of the natural gas sold in accordance with the national standard GB17820-2012, and the study found that due to the cost of regulating the unit calorific value of natural gas, the gas supplier lacks the incentive to increase the calorific value of the natural gas sold, and only ensures that the high level of heat generation is not lower than that of the GB17820-2012 standard, which is

In addition, the reform of the gas metering and pricing model may have both positive and negative impacts on the profits of gas suppliers as well as on the consumer surplus of gas users. This paper shows that compared to the volumetric pricing model, the energy metering pricing model can increase both the gas provider’s profit and the consumer’s surplus for the user. This finding correlates with the government-mandated standard unit calorific value of natural gas. Theoretically, it has been demonstrated that the NDRC can influence the operations of gas suppliers by adjusting the standard unit calorific value of natural gas and induce customers to prefer the energy metering pricing model. Meanwhile, a formula for deriving a reasonable range of standard unit calorific values for natural gas is proposed.

6.2 Research contributions

The results of this study may contribute to the existing literature on natural gas pricing modeling in the following ways: On the one hand, prior to this study, there were few systematic studies in the literature on the impacts of gas energy metering and pricing reforms on the operational strategies of gas supply chain participants and the welfare of gas users. Therefore, the study fills the research gap in this field to a certain extent and provides a new perspective and theoretical framework for related research. On the other hand, related scholars can improve or extend the model based on it to provide additional support or challenge the validity of the model. Of course, this will help researchers to better understand the limitations and strengths of existing models and the extent of their applicability in different contexts. In addition, the study may provide policymakers and the industry with strategic recommendations on how to design and implement natural gas energy metering and pricing reforms. These proposals may help optimize the functioning of the gas market, improve the operational efficiency of supply chain participants and increase the welfare of gas users. Overall, this study may provide important theoretical and empirical support for the academic and practical communities in the field of natural gas market reform, and help to advance the progress of research and practice in this area.

6.3 Research limitations

However, the model also has some limitations. First of all, this paper is based on the condition that the natural gas sales price is relatively stable. However, in the actual market, natural gas prices may be affected by supply and demand, geopolitical factors, seasonal factors, technological advances, environmental policies and market competition. Thereby, the actual market price fluctuates and the model’s pricing results may deviate from the actual situation, leading to inaccurate operational decisions. Second, natural gas may have non-uniformities in the transmission pipeline, including temperature, pressure, and compositional inhomogeneities. Non-uniformity may lead to errors in metered billing, as gas characteristics at different times or locations may affect the accuracy of the actual energy value. On the one hand, a variety of contracts and regulations may be involved in the natural gas trading process. The complexity of these contracts and regulations may make it impossible for the energy measurement and pricing model to fully comply with the actual legal and contractual requirements, which may lead to disputes or legal problems. On the other hand, natural gas markets may have different market structures and operate differently in different regions and countries. Models may not adequately account for these geographic differences and the effects of market structure, which can affect measurement results.

6.4 Policy implications

(1) Accelerate the reform of natural gas energy measurement and pricing, not only to promote China’s international trade in natural gas convergence, but also to ensure the fairness of natural gas transactions. On the one hand, China’s natural gas dependence on foreign countries has reached 43%–45%, the vast majority of energy-exporting countries have energy measurement and pricing, and China’s energy companies use energy measurement and pricing for settlement when they purchase natural gas. The implementation of energy metering and pricing in China is more conducive to natural gas price diversion and international harmonization. On the other hand, since most of the natural gas sold by city gas suppliers is a mixture of gas from different pipeline sites, there are some differences in the heating value. Therefore, under an energy-metered pricing model, gas suppliers will respond more aggressively to the regulation of the calorific value of the gas they sell than they would under a volumetric pricing model. This effectively avoids gas traders from adulterating piped natural gas with nitrogen and other substandard behaviors, successfully eliminates defects in volumetric metering, better protects the interests of gas users, returns natural gas to its value attributes, and makes natural gas trading fairer.

(2) To give full play to the “guiding role” of the standard calorific value of natural gas under the energy metering and pricing model, so as to maximize social welfare. Based on the quantitative conditions obtained in this paper, the NDRC and other governmental departments can set the standard unit calorific value of natural gas under the energy metering and pricing model within a reasonable range, so as to effectively promote the gas suppliers to take the initiative to increase the unit calorific value of the natural gas sold, and indirectly increase the sales of natural gas, which will improve the profits of the gas suppliers as well as the surplus of the gas users at the same time.

(3) Emphasize the cost of regulating the unit calorific value of natural gas for gas suppliers, and reasonably set the standard unit calorific value of natural gas under the energy metering and pricing model. Setting a higher standard unit calorific value of natural gas by ignoring the cost of regulating the unit calorific value of natural gas for gas suppliers may lead to a loss of incentive for gas suppliers to increase the unit calorific value of natural gas they sell. If the unit calorific value of natural gas is low, it will cause the sales volume to shrink, the profits of gas merchants to decline and the consumer surplus of gas users to be damaged, which is not conducive to the healthy development of China’s natural gas market.

6.5 Policy recommendations

(1) City gas operators should be supported to integrate renewable energy sources, such as biogas or hydrogen, in order to reduce dependence on non-renewable sources and promote sustainable energy development.

(2) Promote the adoption of smart metering and monitoring systems by city gas suppliers to more accurately measure and manage energy use. This helps to improve the effectiveness of data visualization, monitoring and analysis, providing more targeted information for decision-making.

(3) Sound risk management mechanisms should be established and contingency plans should be developed to deal with energy market fluctuations, supply disruptions or other unforeseen risks. This helps to improve the resilience of city gas suppliers to uncertainty.

(4) City gas suppliers should be encouraged to collaborate with relevant stakeholders to promote innovation in the energy sector. This may include collaboration with technology providers, government agencies and research institutions to facilitate the application and development of new technologies.

(5) Emphasize the environmental and social responsibility of city gas suppliers and encourage them to adopt sustainable business practices that promote social acceptance of renewable and clean energy.

6.6 Future prospects

In the future, case studies of city gas supply companies using energy metering and pricing will be planned for further research and validation of the model. The first step is to collect the actual operational data of the company over a period of time. In the second step, the actual data are input into the energy metering pricing model to generate the optimal unit calorific value and profit of the company predicted by the model under the energy metering pricing model. In the third step, the model predictions are analyzed against the actual data to compare the company’s operational decisions in both scenarios. This is to verify whether the model can accurately reflect the actual operation situation and can provide effective support and guidance for decision-making. Finally, based on the results of the model validation, necessary adjustments and improvements are made to the energy metering and pricing model. This may include adjusting model parameters, improving model algorithms, or adding additional influences.

Data availability statement

The datasets presented in this study can be found in online repositories. The names of the repository/repositories and accession number(s) can be found in the article/Supplementary material.

Author contributions

WQ: Data curation, Methodology, Conceptualization, Funding acquisition, Writing–original draft. SY: Data curation, Methodology, Software, Validation, Writing–review and editing. WL: Formal Analysis, Investigation, Visualization, Writing–review and editing. QC: Investigation, Writing–review and editing. YC: Funding acquisition, Resources, Validation, Writing–review and editing.

Funding

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. This work was supported by the National Natural Science Foundation of China (72001182), the National Natural Science Foundation of Sichuan Province (24NSFC5919, 2023NSFSC1043), the Open Fund of Sichuan Oil and Gas Development Research Center (SKZ22-03).

Conflict of interest

Author WL was employed by Southwest Oil and Gas Field Company, PetroChina. Author QC was employed by PetroChina Nanchong Gas Company Co., Ltd.

The remaining authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Burlinson, A., Davillas, A., Giulietti, M., and Price, C. W. (2024). Household energy price resilience in the face of gas and electricity market crises. Energy Econ. 132, 107414. doi:10.1016/j.eneco.2024.107414

Dong, X. C., Pi, G. L., Ma, Z. W., and Dong, C. (2017). The reform of the natural gas industry in the PR of China. Renew. Sust. Energ. Rev. 73, 582–593. doi:10.1016/j.rser.2017.01.157

Favero, F., and Grossi, L. (2023). Analysis of individual natural gas consumption and price elasticity: evidence from billing data in Italy. Energy Econ. 118, 106484. doi:10.1016/j.eneco.2022.106484

Goodell, J. W., Gurdgiev, C., Paltrinieri, A., and Piserà, S. (2024). Do price caps assist monetary authorities to control inflation? Examining the impact of the natural gas price cap on TTF spikes. Energy Econ. 131, 107359. doi:10.1016/j.eneco.2024.107359

Gurnani, H., and Erkoc, M. (2008). Supply contracts in manufacturer-retailer interactions with manufacturer-quality and retailer effort-induced demand. Nav. Res. Logist. 55, 200–217. doi:10.1002/nav.20277

Hauser, P., Schmidt, M., and Moest, D. (2016). “Gas markets in flux: analysis of components and influences for natural gas pricing in Europe,” in 13th international conference on the European energy market (EEM) (Porto: PORTUGAL).

Lu, H. F., Wu, X. N., and Liu, Q. (2019). Energy metering for the urban gas system: a case study in China. Energy Rep. 5, 1261–1269. doi:10.1016/j.egyr.2019.09.001

Motalo, A., and Motalo, V. (2021). Analysis of calorimetric method of measurment of natural gas calorific value. Measur. Equip. and Metrol. 67, 2141–2147.

Ros, A. J., and Sai, S. S. (2023). Residential rooftop solar demand in the U.S. and the impact of net energy metering and electricity prices. Energy Econ. 118, 106491. doi:10.1016/j.eneco.2022.106491

Rui, X. T., Yu, W. C., Liu, Z. Y., Shi, F., Huang, B. L., Liu, H. F., et al. (2022). An optimal flow allocation model of the natural gas pipeline network considering user characteristics. J. Pipel. Syst. Eng. Pract. 13, 9. doi:10.1061/(asce)ps.1949-1204.0000665

Sun, J. F., and Sun, X. L. (2018). China's natural gas reform: why and how. Energy Sources Part B 13, 176–182. doi:10.1080/15567249.2017.1422054

Sun, Y. G., Ding, T., and Shahidehpour, M. (2023). A multi-variable analytical method for energy flow calculation in natural gas systems. IEEE Trans. Power Syst. 38, 1767–1770. doi:10.1109/tpwrs.2022.3222669

Tsochatzidis, N. A., and Karantanas, E. (2012). Assessment of calorific value at a gas transmission network. J. Nat. Gas Sci. Eng. 9, 45–50. doi:10.1016/j.jngse.2012.05.009

Ulbig, P., and Hoburg, D. (2002). Determination of the calorific value of natural gas by different methods. Thermochim. Acta 382, 27–35. doi:10.1016/s0040-6031(01)00732-8

Yan, F., Zhang, Y. C., Fu, X. B., and Mi, S. T. (2021). Establishment of calculation model for the viscoplastic heat production in friction stir welding process. Weld. World 65, 1473–1481. doi:10.1007/s40194-021-01126-y

Yang, Z., Liu, Z., Zhou, J., Song, C., Xiang, Q., He, Q., et al. (2023). A graph neural network (GNN) method for assigning gas calorific values to natural gas pipeline networks. Energy 278, 127875. doi:10.1016/j.energy.2023.127875

Zakeri, B., Staffell, I., Dodds, P. E., Grubb, M., Ekins, P., Jääskeläinen, J., et al. (2023). The role of natural gas in setting electricity prices in Europe. Energy Rep. 10, 2778–2792. doi:10.1016/j.egyr.2023.09.069

Keywords: energy pricing, energy metering, unit calorific value, operational decisions, consumer surplus

Citation: Wan Q, Sun Y, Wen L, Qi C and Yu C (2024) A study of operational decisions of city gas operators under the energy metering and pricing model. Front. Energy Res. 12:1384351. doi: 10.3389/fenrg.2024.1384351

Received: 09 February 2024; Accepted: 18 March 2024;

Published: 02 April 2024.

Edited by:

Maria Cristina Piccirilli, University of Florence, ItalyReviewed by:

Hamid Reza Rahbari, Aalborg University, DenmarkBożena Gajdzik, Silesian University of Technology, Poland

Copyright © 2024 Wan, Sun, Wen, Qi and Yu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Cuiting Yu, MTgyODAyNDA1MzJAMTYzLmNvbQ==

Qin Wan

Qin Wan Yang Sun

Yang Sun Li Wen3

Li Wen3 Cuiting Yu

Cuiting Yu