- 1School of Accounting, Hainan Vocational University of Science and Technology, Haikou, China

- 2School of Economics, Lanzhou University, Lanzhou, China

This study explores the impact of ESG ratings on corporate performance, focusing on achieving sustainable development and corporate sustainability through innovation within the context of high-quality global economic growth. In recent years, ESG ratings have garnered significant attention in the financial sector, influencing corporate strategy and performance management. While some argue that ESG activities might detract from profitability, others highlight that firms with strong ESG performance can access low-cost capital, thereby enhancing overall performance. Using a sample of China’s A-share listed companies from 2009 to 2021, this research examines the influence and mechanisms of ESG ratings on corporate performance. The findings indicate a significant positive relationship between ESG ratings and corporate performance, which remains robust after rigorous testing. Mediation analysis reveals that ESG ratings improve corporate performance by alleviating financing constraints and enhancing corporate reputation. Furthermore, the performance-enhancing effects of ESG ratings are more pronounced in firms with robust internal controls and private enterprises. This research provides empirical evidence to support stronger ESG investment and the refinement of the ESG rating system.

1 Introduction

Under the guidance of high-quality global economic development, how to achieve sustainable development at the corporate level and achieve corporate sustainability based on innovation has become an important topic of concern in academia in recent years (Lozano, 2015; Guo et al., 2024a). In recent years, Environmental, Social, and Governance (ESG) factors have increasingly become essential considerations in corporate operations and investment decisions (Friede et al., 2015). ESG ratings, as a comprehensive assessment method, aim to measure a company’s performance in environmental, social, and governance domains, offering investors and stakeholders a more holistic view of corporate sustainability (Kotsantonis et al., 2016). With the growing societal awareness of corporate social responsibility and environmental consciousness, ESG ratings have garnered widespread attention in the financial sector, playing an increasingly pivotal role in corporate strategy and performance management (Giese et al., 2019). For instance, in the investor decision-making process for businesses, ESG has reshaped the investment philosophies of institutional investors (Clark et al., 2015). Gradually, ESG factors are incorporated into investment decision analyses and behaviors. Institutional investors are more inclined to focus on companies with standout ESG performances (Li et al., 2021; Zhou et al., 2020; Feng et al., 2024). Additionally, ESG advantages can significantly and robustly enhance the likelihood and scale of listed companies’ foreign investments, positively impacting international direct investment (Xie and Lu, 2022). As the importance of ESG grows, an increasing amount of capital flows into ESG-related areas, indicating a long-term trend that compels companies to strengthen their ESG foundations (Hu et al., 2023). In Western markets, ESG investment has become mainstream. According to the official website of the United Nations Principles for Responsible Investment, since the introduction of the “Principles for Responsible Investment (PRI)” in 2006, the number of signatories has increased from 734 in 2010 to 1,384 in 2015 and 5,022 in June 2022, with the signatories managing assets that account for over 50% of the global professional asset management scale.

As the integration of ESG principles into corporate development strategies and operational management gradually strengthens, scholars have conducted extensive theoretical and empirical research on ESG (Tarmuji et al., 2016). Numerous studies have found that good ESG performance helps reduce the cost of equity capital (El Ghoul et al., 2011), debt costs (Goss and Roberts, 2011), alleviates financing constraints (Qiu and Yin, 2019), and assists companies in risk avoidance (Albuquerque et al., 2019). However, the research on the impact of ESG performance on corporate performance has not yet reached a unified conclusion. Most studies have found a positive correlation between ESG ratings and corporate financial performance. Chen et al. (2023), based on data from 3,332 listed companies from 2011 to 2020, found a significant positive correlation between ESG ratings and corporate performance. Wang et al. (2023) also confirmed that a 1% increase in ESG ratings would improve the performance of manufacturing enterprises by 0.124%. Zeng and Jiang (2023) analyzed Chinese agricultural and forestry listed companies and found that ESG ratings have a significant positive impact on corporate performance.

Some studies have compared the impacts of the three dimensions of ESG. Zeng and Jiang (2023) found that social and governance performance have a more substantial effect on improving corporate performance. Baek and Lee (2024) discovered that environmental and social performance can enhance corporate performance, but the impact of governance performance is not significant. Wang and Yang (2023) revealed that environmental, social, and governance performance all help reduce corporate credit risk. Additionally, Yang et al. (2024) pointed out that the impacts of the three dimensions of ESG exhibit a phased nature.

Some research indicates a non-linear relationship between ESG ratings and corporate performance. Yang et al. (2024), based on the corporate life cycle theory, found that the impact of ESG on corporate performance is strongest during the growth stage but may become negative during the decline stage. Gao et al. (2023) also confirmed that there is a U-shaped relationship between ESG ratings and corporate performance. When ESG ratings are low, companies tend to focus on their operational conditions, neglecting long-term investments such as green innovation, leading to a decline in performance. However, when ESG ratings reach a certain level, companies start to emphasize sustainable development, resulting in improved performance.

Existing literature has also explored the moderating factors in the relationship between ESG ratings and corporate performance. On the one hand, the positive impact of ESG ratings on performance is more pronounced for companies that are highly polluting, state-owned, or located in eastern regions (Wang et al., 2023; Zhang et al., 2023). On the other hand, the higher the quality of ESG information disclosure and the greater the analyst attention, the more significant the impact of ESG ratings on corporate performance (Cao et al., 2023; Gao et al., 2023). Additionally, Jin et al. (2023) found that ESG ratings help mitigate the negative impact of the pandemic on the performance of tourism companies.

Previous research has provided valuable insights into the relationship between ESG ratings and corporate performance. However, there are still some academic divisions in understanding this relationship, and many studies have not deeply examined the specific mechanisms through which ESG ratings affect corporate performance, leading to gaps in the logical chain. Future research could further explore the differences in the impact of ESG ratings across various industries and ownership structures, as well as the determinants of ESG information disclosure quality.

Considering the above, this paper embarks from the perspective of ESG as an informal environmental regulation. Using the sample of A-share listed companies in China from 2009 to 2021, it empirically investigates the impact of ESG ratings on corporate performance and its underlying mechanisms. The main contributions of this study are threefold. First, it enriches research on the economic consequences of corporate ESG. By focusing on their ESG performance, companies not only contribute to environmental protection and governance but also foster their own value, promoting their long-term development. Second, it enhances the literature in the domain of corporate performance. While past studies have explored the relationship between ESG ratings and corporate performance without arriving at a consistent conclusion (Li et al., 2018), this paper’s findings deepen the understanding of the relationship between the two. Lastly, it advances the study on the specific mechanisms through which ESG ratings impact corporate performance, deepening the research methodology on how ESG ratings influence corporate outcomes. Empirically, using a comprehensive dataset of listed companies, this study provides solid evidence on the effect of ESG ratings on corporate performance and its causal pathways. Moreover, it extends research on the heterogeneity of companies’ fulfillment of ESG responsibilities. The conclusions of this study highlight the significance of ESG ratings on corporate performance, offering empirical evidence that could guide relevant departments to further enhance ESG investments and refine ESG rating systems. Such insights will assist in steering companies towards a more sustainable and responsible direction, fostering sustainable growth and prosperity in the global economy.

2 Theoretical analysis and research hypothesis

2.1 The impact of ESG rating on firm performance

The ESG rating represents a company’s performance in three aspects: environmental, social, and corporate governance (Junius et al., 2020). In recent years, ESG factors have evolved from purely moral and ethical considerations to significant factors influencing long-term business performance. As global attention to sustainability issues increases, investors, consumers, and regulators are placing increasing emphasis on corporate ESG performance, making it crucial to understand how ESG ratings impact business performance (Yu and Xiao, 2022).

Firstly, environmental factors are one of the key considerations in ESG ratings, and there is a positive correlation between a company’s environmental management and performance and its financial performance. When companies adopt more environmentally friendly strategies, they often reduce risks associated with environmental compliance (Guo et al., 2024c) and benefit from more efficient resource management, thereby enhancing profitability (Horváthová, 2010). A company that places a high emphasis on the environment may lead in energy efficiency, resource utilization, and innovative product development, thus reducing costs and increasing revenues (Friede et al., 2015). Furthermore, they can avoid fines and litigations due to non-compliance, thereby bolstering confidence among shareholders and investors (Gao et al., 2023).

Secondly, social factors are also a critical consideration in ESG ratings. Social performance involves employee relations, customer satisfaction, and supply chain management. The way a company treats its employees often directly impacts employee loyalty and productivity, thus affecting the company’s long-term performance (Huang and Qiu, 2023). For instance, treating employees well can increase their satisfaction and productivity, thereby reducing employee turnover and recruitment costs (Edmans, 2011). Moreover, establishing healthy relationships with suppliers and communities can lead to better supply chain stability and market reputation, and strong customer relationships and supply chain management can offer a competitive edge, improving market share and profitability (Espinosa-Méndez et al., 2023).

Lastly, ESG ratings require companies to have sound governance structures and transparency. Effective corporate governance mechanisms can enhance decision-making efficiency, leading to better financial performance. There is often a positive relationship between the quality of corporate governance and business performance (Gompers et al., 2003). For instance, an independent board, clear governance guidelines, and transparent financial reporting are all associated with high business performance (Bebchuk et al., 2013). Transparent and fair decision-making processes can not only boost the confidence of internal staff but also attract external investment, creating more growth opportunities for the company (Carnini Pulino et al., 2022).

From the perspective of Schumpeter’s innovation theory and stakeholder theory, when companies proactively fulfill their environmental, social, and governance (ESG) responsibilities, it signifies that these firms are breaking through and innovating beyond traditional development models. They are no longer solely pursuing economic growth. By acting in this manner, companies send trustworthy signals to their stakeholders, potentially reducing transaction costs between the enterprise and its stakeholders and enhancing the firm’s value (Freeman and Evan, 1990).

In general, there is a positive correlation between good ESG ratings and high business performance. This suggests that prioritizing ESG factors is not just a matter of ethics and morality but also pertains to a company’s profitability and competitive edge. Based on this, the following research hypothesis, H1, is proposed:

H1. ESG ratings have a positive impact on business performance.

2.2 ESG rating, financing constraints and firm performance

Financing constraints are difficulties and limitations that enterprises face when obtaining external financing, typically caused by information asymmetry and market imperfections (Song and Deng, 2023). The impact of financing constraints on corporate performance is significant and multifaceted. Firstly, financing constraints limit investment opportunities, preventing firms from fully capitalizing on favorable investment projects, particularly those requiring substantial capital investment, thus potentially causing missed growth opportunities due to insufficient funds (Yu, 2023). Secondly, financing constraints increase financial costs, as firms need to pay higher interest rates or provide more collateral to secure funds, directly impacting profit margins (Hu, 2023). Additionally, financing constraints lead to more conservative business decisions, reducing investment in R&D and market expansion, thereby affecting long-term competitiveness and innovation capabilities (Tang, 2022).

ESG ratings alleviate financing constraints through various channels, thereby enhancing corporate performance. Firstly, a good ESG rating can improve market image and boost the confidence of investors and financial institutions, making it easier for firms to obtain financing in capital markets (Wu, 2023). As investors increasingly emphasize sustainable development performance, firms with high ESG ratings, perceived as lower risk and having better long-term returns, attract more investors and lower-cost capital (Song and Deng, 2023). Secondly, excellent ESG performance reduces information asymmetry, thereby lowering financing costs (Zhou et al., 2022). Comprehensive and transparent ESG information disclosure helps investors and financial institutions better understand the firm’s operational status, reducing the risk premium caused by information asymmetry (Liu, 2023). Additionally, firms with high ESG ratings typically possess better corporate governance structures and risk management capabilities, making financial institutions more optimistic in their credit risk assessments and more willing to offer favorable financing conditions (Yu, 2023). Lastly, ESG ratings improve internal control mechanisms and enhance financial health, thereby alleviating financing constraints (Tang, 2022). Firms with high ESG ratings operate more efficiently and are financially more robust, enhancing their bargaining power in financing negotiations and reducing default risk (Zhang and Liu, 2022).

In summary, this paper proposes the following research hypothesis H2:

H2. ESG ratings can alleviate financing constraints and thereby improve corporate performance.

2.3 ESG rating, corporate reputation and firm performance

Corporate reputation refers to the comprehensive evaluation of a company’s overall image and behavior by the public, customers, employees, investors, and other stakeholders (Belayeva et al., 2021). A good corporate reputation has a significant impact on corporate performance. Firstly, corporate reputation can enhance customer loyalty and attract new customers, thereby increasing sales revenue and market share (Liu, 2022). Customers are more willing to purchase and support products and services from companies with a good reputation because they believe these companies can provide high-quality products and excellent services (Kim and Li, 2021). Secondly, a good corporate reputation helps attract and retain talented employees. Employees are more willing to work for companies with a good reputation, which not only increases their job motivation and productivity but also reduces the costs of recruitment and training (Huang and Qiu, 2023). Additionally, corporate reputation can boost investor and financial institution confidence, making it easier for companies to obtain financing in capital markets, thereby reducing financing costs and improving financial performance (Zhan, 2023).

ESG ratings can enhance corporate reputation in several ways, thereby promoting improved corporate performance. Firstly, good ESG performance can highlight a company’s efforts and achievements in environmental protection, social responsibility, and corporate governance, helping to establish a positive image among the public and stakeholders (Chen and Shen, 2022). Consumers and investors increasingly value sustainable development performance, and companies with high ESG ratings are perceived as more responsible and reliable, making it easier to gain public trust and support (Gao et al., 2023). Secondly, companies with high ESG ratings are typically more transparent in information disclosure, able to convey ESG information accurately and promptly to stakeholders, reducing information asymmetry and enhancing corporate credibility and transparency (Odriozola and Baraibar-Diez, 2017). Furthermore, good ESG performance can improve employee satisfaction and loyalty, strengthen internal cohesion and commitment, making employees more willing to contribute to the company’s long-term development (Landi and Sciarelli, 2019). Lastly, companies with high ESG ratings have greater attractiveness and competitiveness in capital markets, attracting more investors and lower-cost capital, further enhancing financial performance and market position (Aouadi and Marsat, 2018).

In summary, this paper proposes the following research hypothesis H3:

H3. ESG rating can improve corporate performance by enhancing corporate reputation.

3 Data, variables, and estimation strategy

3.1 Estimation strategy

Based on previous studies (Chen et al., 2023), this paper constructs the following model to test the relationship between ESG rating and firm performance, considering that firm and year factors may affect the regression results.

In Formula 1, subscript i is the enterprise and t is the year. ROA represents firm performance, ESG represents ESG ratings, and X represents control variables. For the company fixed effect, for the time fixed effect.

To further empirically examine whether financing constraints and corporate reputation are the pathways through which ESG ratings affect corporate performance, drawing on the research of Guo et al. (2024b), this paper establishes the following mediation effect model:

Formula 2 is the same as Formula 1. In Formula 3, 4, the middle term refers to the mediating variables such as financing constraints (KZ) and corporate reputation (Rep).

3.2 Variable selection

3.2.1 Dependent variable

The dependent variable in this study is firm performance (ROA). Generally, scholars tend to use metrics such as return on assets and net profit margin from sales to measure it. Drawing upon the research of Wang et al. (2022), this paper employs the total asset return rate to gauge firm performance. Additionally, for robustness, this study recalibrates firm performance using the net profit margin from sales in the robustness tests.

3.2.2 Key independent variable

The core explanatory variable of this paper is the ESG rating (ESG). Drawing from the research of Cai et al. (2023), this study utilizes the annual ESG rating data published by the Wind database, specifically the Huazheng ESG ratings, as the measure for corporate ESG performance. The Huazheng ESG ratings are categorized from highest to lowest as AAA, AA, A, BBB, BB, B, CCC, CC, C. In this paper, these ratings are assigned values from 9 to 1, respectively, to quantify the ESG performance. A higher score indicates better ESG performance of the company.

3.2.3 Mediating variable

The mediating variables in this article are financing constraints (KZ) and corporate reputation (Rep). Drawing from the research of Yang and Shen (2020), we adopt the KZ index as the measure for financing constraints. A higher KZ index indicates more severe financing constraints. Moreover, inspired by the studies of Guan and Zhang (2019), this article comprehensively considers the evaluations of various stakeholders regarding corporate reputation. We select 12 evaluation indicators for corporate reputation: company size, market share, level of advertising expenditure, capability for sustainable development, years since listing, beta coefficient, corporate nature, net debt ratio, long-term debt ratio, return on total assets, price-to-book ratio, and Tobin’s Q. We employ factor analysis to compute the reputation score based on these 12 indicators. A higher score implies a better corporate reputation.

3.2.4 Control variables

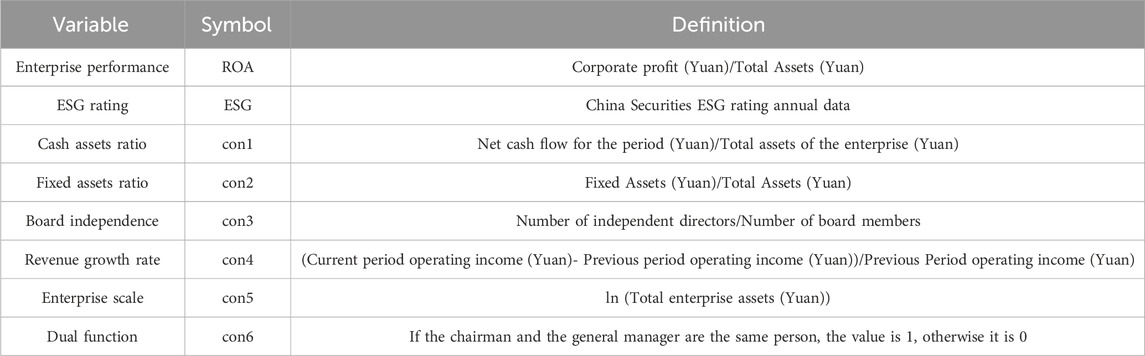

According to the existing literatures, this paper selects factors at the firm level, such as cash-to-assets ratio (con1), fixed assets ratio (con2), board independence (con3), growth rate of operating income (con4), enterprise size (con5), integration of two jobs (con6), as the control variables of the main regression model. To eliminate the influence of heterogeneity factors on firm performance. The main variables selected to perform this study are shown in Table 1 below.

3.3 Sample selection and data source

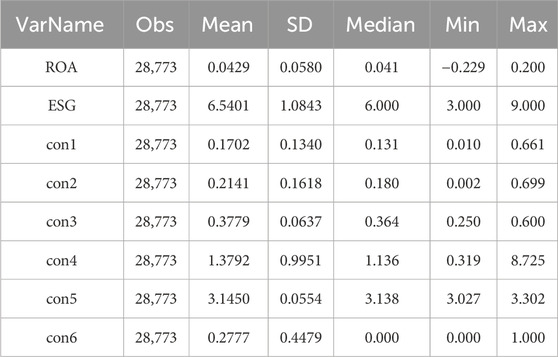

This paper takes the financial data of China’s A-share listed companies from 2009 to 2021 as research samples to study the impact of ESG rating on corporate performance. Before the empirical analysis, this paper processed the initial data as follows: 1) Remove the delisted and non-operating enterprises, and remove the samples of ST and *ST companies; 2) Excluding financial industry samples; 3) Remove the missing value of the main variable; 4) In order to avoid the influence of extreme values, winsor2 command in Stata17.0 was used to indent all continuous variables at the 1st and 99th percentiles, and 28,773 sample observations were finally obtained. The data in this paper are mainly from Wind and CSMAR databases. Table 2 shows descriptive statistics of the main variables.

4 Empirical results

4.1 Regression results

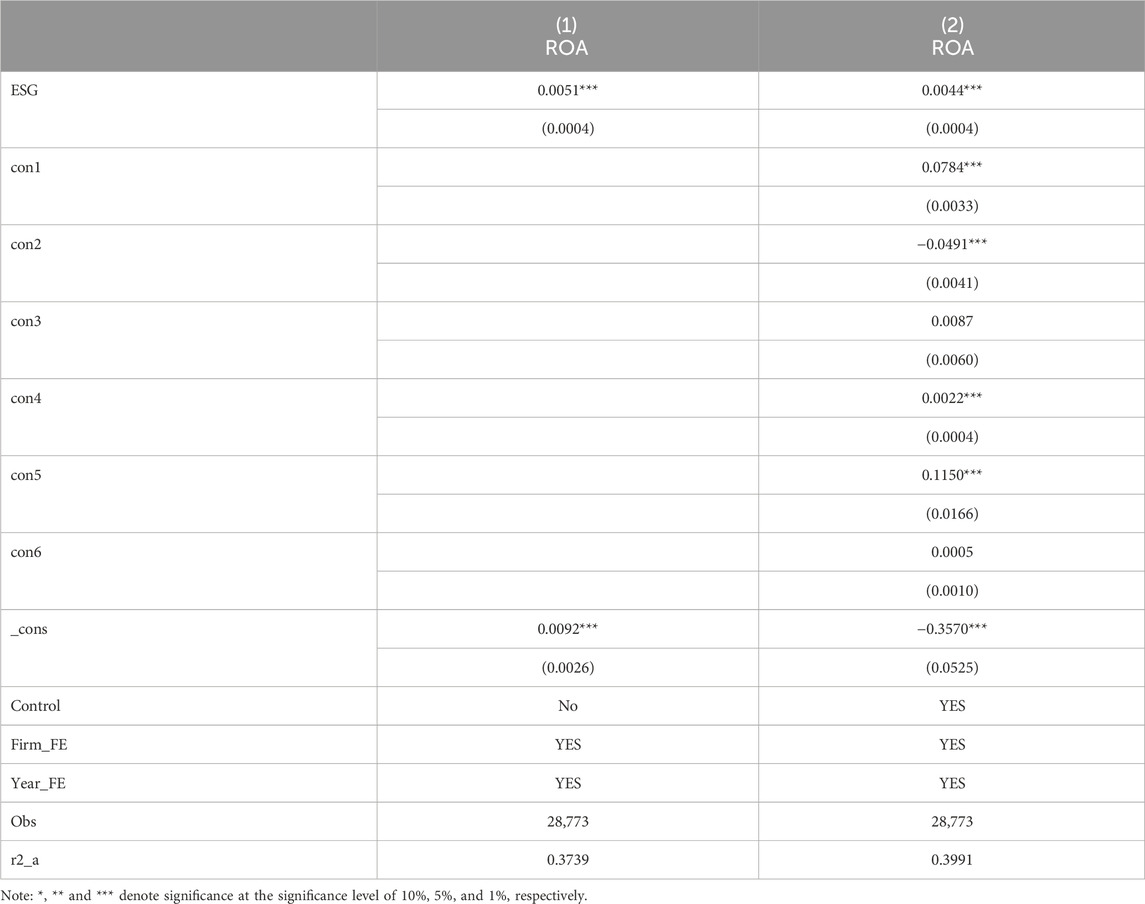

Table 3 presents the benchmark regression results of ESG ratings on firm performance. In column (1), without controlling for firm fixed effects, year fixed effects, and additional control variables, the coefficient of ESG rating is 0.0051, significant at the 1% level. In column (2), after controlling for these factors, the coefficient of ESG rating is 0.0044, also significant at the 1% level. These results indicate a significant positive impact of ESG ratings on firm performance, supporting the hypothesis H1 that ESG ratings can enhance firm performance.

4.2 Robustness test

4.2.1 Replace the explained variable

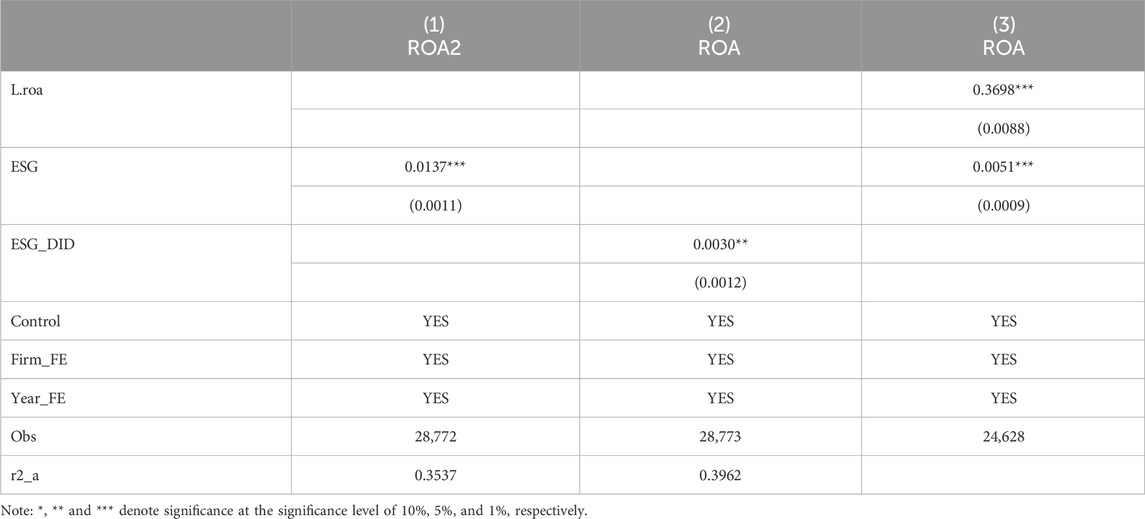

Drawing inspiration from the research by Wang and Yang (2022), this study adopts the net sales profitability (ROA2) to re-evaluate corporate performance and conducts a regression again. The regression results are shown in column (1) of Table 4, with the coefficient of ESG at 0.0137, significant at the 1% level. This suggests that ESG ratings can still effectively enhance corporate performance, consistent with the conclusions earlier in the paper, indicating the robustness of our findings.

4.2.2 Difference-in-differences (DID) model test

To better mitigate endogeneity issues, this paper employs a multi-period difference-in-differences model to build a quasi-natural experiment for regression. Drawing from the studies of Hu et al. (2023) and Tan and Zhu (2022), we re-construct the core explanatory variable (ESG_DID) based on the ESG ratings data from Shangdao Ronglu. In 2015, Shangdao Ronglu began evaluating ESG for constituents of the CSI 300 Index and released an ESG rating index. Subsequently, with the increasing disclosure of ESG information by listed companies, more and more companies have been incorporated into Shangdao Ronglu’s ESG rating system, covering 1043 listed companies by 2020. This ESG rating data facilitated the construction of treatment and control groups in the multi-period DID. Specifically, if Shangdao Ronglu releases rating data for company i in year t, it belongs to the treatment group with ESG_DID = 1; otherwise, it's categorized as the control group with ESG_DID = 0. The regression results, as shown in column (2) of Table 4, indicate a coefficient of 0.0030 for ESG_DID, significant at the 5% level. Although the magnitude and significance of the coefficient have decreased slightly, it still shows that ESG ratings can enhance corporate performance, further validating the robustness of the baseline regression conclusions.

4.2.3 GMM regression

To further effectively mitigate the endogeneity issues in this study, we employ the efficient System GMM method, using the first lag of the ESG rating as an instrumental variable for the ESG rating to conduct the regression again. The regression results are displayed in column (3) of Table 4, with the coefficient of ESG at 0.0051, significant at the 1% level. This result also suggests that ESG ratings can effectively enhance corporate performance. The conclusions of this research still hold.

4.3 Mediation effect analysis

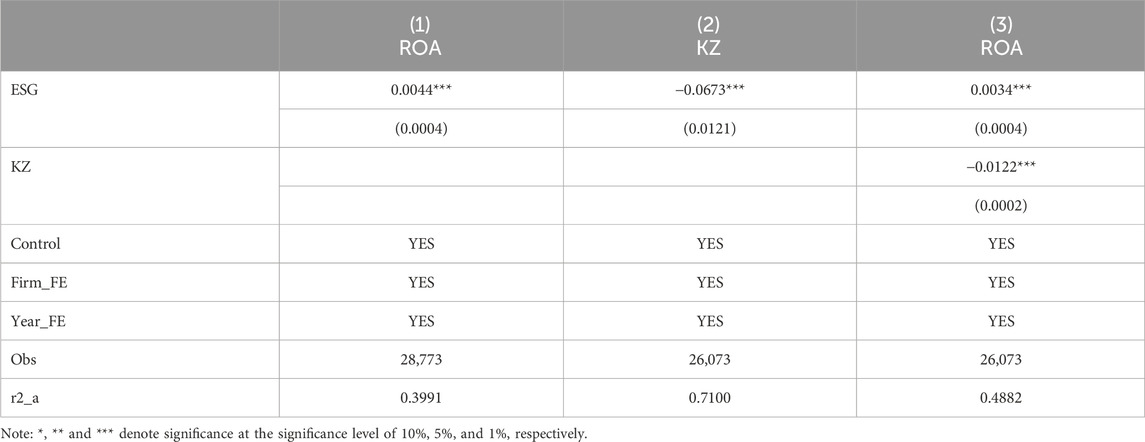

4.3.1 ESG ratings, financing constraints, and corporate performance

With financing constraints as the mediating variable, a regression was performed on the mediation effect model, and the results are presented in Table 5. The column (2) displays the regression results corresponding to Equation 3. The coefficient of ESG is −0.0673, significant at the 1% level. This indicates that ESG ratings can significantly alleviate the financing constraints faced by firms, effectively easing the financial stress of enterprises. Column (3) represents the regression results corresponding to Equation 4, where the coefficient of ESG is 0.0034 and the coefficient of KZ is −0.0122; both are significant at the 1% level. It can be observed that ESG ratings have a significant positive impact on corporate performance. Furthermore, ESG ratings can enhance corporate performance by alleviating financing constraints. This validates the research hypothesis H2.

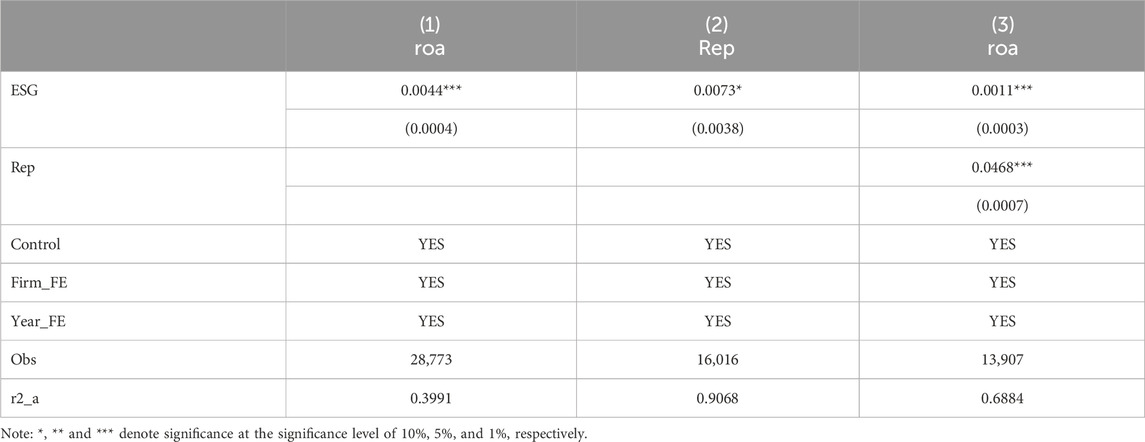

4.3.2 ESG ratings, financing constraints, and corporate performance

With corporate reputation as the mediating variable, a regression was performed on the mediation effect model, and the results are showcased in Table 6. Column (2) presents the regression results corresponding to Equation 3. The coefficient of ESG is 0.0073, significant at the 10% level. This suggests that ESG ratings can notably enhance a company’s reputation, effectively disseminating positive information about the company. Column (3) displays the regression results corresponding to Equation 4, where the coefficient of ESG is 0.0011 and the coefficient of KZ is 0.0468; both are significant at the 1% level. It can be observed that ESG ratings have a significant positive impact on corporate performance. Moreover, ESG ratings can elevate corporate performance by enhancing its reputation. This confirms the research hypothesis H3.

4.4 Heterogeneity analysis

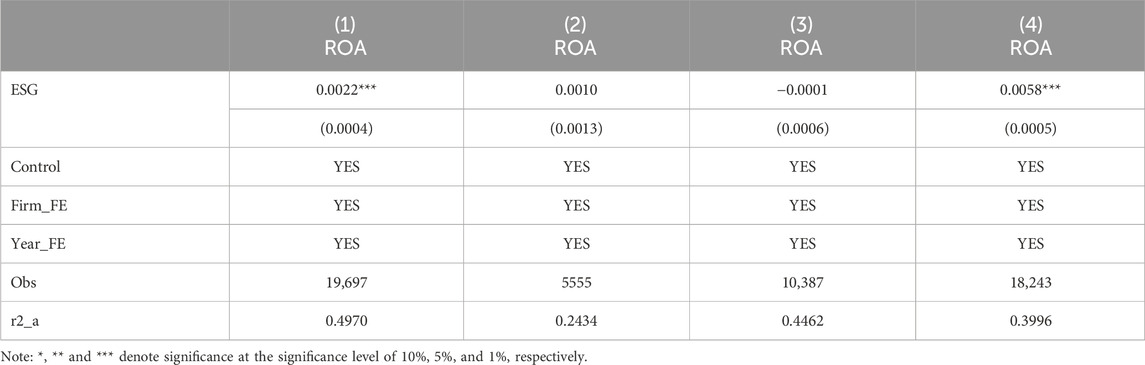

4.4.1 ESG rating, internal controls, and corporate performance

Internal control represents a set of systems and processes that enterprises use to ensure compliance, mitigate risks, and enhance governance efficiency. Robust internal control contributes to excellent performance in the ESG domain. For instance, effective internal controls can ensure that enterprises accurately report environmental and social performance, adhering to relevant regulations and standards. Moreover, sound internal control also helps enhance an enterprise’s economic and social performance, facilitating comprehensive business growth and sustainable development (Ioannou and George, 2015). As a result, it is anticipated that robust internal controls can amplify the positive impact of ESG ratings on corporate performance. To verify this hypothesis, drawing from the research by Li et al. (2022a), this paper uses the natural logarithm of the internal control index (incremented by one) from the Debo database to measure the quality of internal controls of listed companies and further conducts a grouped regression. Specifically, companies with an internal control index exceeding the industry average are considered to have robust internal controls, while others are viewed as not having robust controls. The regression results are shown in Table 7. Column (1) presents the regression results for enterprises with robust internal controls, where the coefficient of ESG is 0.0022, significant at the 1% level. Column (2) displays the regression results for enterprises without robust internal controls, where the coefficient of ESG is 0.0010, though not significant. It can be observed that the ESG rating has a more pronounced positive impact on the performance of enterprises with robust internal controls, validating the aforementioned hypothesis.

4.4.2 ESG rating, property rights, and corporate performance

Under different ownership structures, corporate governance and business decisions are influenced to varying extents. For instance, privately-owned enterprises usually place more emphasis on market-oriented operations and the pursuit of short-term profits, while state-owned enterprises might be more influenced by government policies and social responsibilities, paying less attention to corporate performance (Megginson and Netter, 2001). Therefore, it is expected that in state-owned enterprises, the positive effect of ESG ratings on corporate performance may no longer be evident. To validate this hypothesis, the overall sample was divided into state-owned and privately-owned enterprise samples for grouped regression analysis. The regression results are shown in Table 7. Column (3) presents the regression results for state-owned enterprises, where the coefficient of ESG is −0.0001, though not significant. Column (4) displays the regression results for privately-owned enterprises, where the coefficient of ESG is 0.0058, significant at the 1% level. It can be observed that the ESG rating has a more pronounced positive impact on the performance of privately-owned enterprises, validating the aforementioned hypothesis.

5 Discussion

The results of this study indicate a significant positive correlation between ESG ratings and the performance of Chinese A-share listed companies. This finding is consistent with previous research (Yu and Xiao, 2022). Specifically, companies with high ESG ratings exhibit superior financial performance and market competitiveness. Empirical analysis reveals that ESG ratings enhance corporate performance by improving corporate reputation and optimizing financing conditions. Firstly, good ESG ratings help elevate a company’s reputation among investors and consumers, thereby attracting more investments and increasing market share. Secondly, superior ESG performance enables companies to secure financing at lower costs, reducing financial risks. Moreover, our study reveals that ESG ratings have a more pronounced impact on the performance of companies with strong internal controls and private enterprises, indicating that robust internal control mechanisms effectively promote adherence to ESG principles, thereby enhancing overall corporate performance.

The benchmark regression analysis uncovers the direct impact of ESG ratings on corporate performance, carrying significant implications. Firstly, it demonstrates that focusing on environmental, social, and governance (ESG) factors alongside financial goals can yield substantial financial returns. This finding supports the stakeholder theory, which posits that by addressing the needs of various stakeholders, companies can achieve better financial performance (Zhu et al., 2023). Secondly, this result underscores the critical role of policymakers and regulatory bodies in promoting corporate sustainability. By establishing and implementing effective ESG standards and policies, they can encourage companies to enhance their ESG performance, creating a win-win situation (Li et al., 2022b). Furthermore, the findings from the benchmark regression analysis offer valuable insights for investors. Companies with high ESG ratings not only possess stronger market competitiveness and lower financing costs but also provide more stable returns for investors (Wu et al., 2022).

The findings of the mechanism examination reveal the intrinsic mechanisms through which ESG ratings impact corporate performance, underscoring their profound significance. Firstly, research indicates that ESG ratings enhance corporate performance by improving corporate reputation (Gao et al., 2023). A good corporate reputation not only strengthens the trust of customers and investors but also attracts high-quality employees, boosting their loyalty and work enthusiasm, thereby enhancing overall corporate efficiency and innovation capacity (Huang and Qiu, 2023). This further suggests that in the process of improving ESG ratings, companies should emphasize transparency and information disclosure, enabling stakeholders to fully understand their efforts and achievements in environmental, social, and governance areas (Albitar et al., 2020). Secondly, the mechanism examination results show that ESG ratings improve corporate performance by optimizing financing conditions (Song and Deng, 2023). Specifically, companies with high ESG ratings are typically able to secure financing at lower costs, primarily because these companies are viewed as lower-risk and more stable (Hou, 2023). The reduction in financing costs not only helps alleviate financial pressure and increase profit margins but also provides more capital to support corporate development and expansion (Zou, 2023). This finding holds significant implications for corporate management and financial institutions; corporate management should actively promote ESG practices to secure more favorable financing conditions, while financial institutions should emphasize ESG performance as a key indicator in assessing corporate credit risk (Michalski and Low, 2021). However, we must interpret these results with caution. Firstly, these mechanisms may exhibit different effects across various types of enterprises and industries. For instance, in certain high-risk industries, the impact of ESG ratings on financing costs may not be as significant as in other industries (Bin-Feng et al., 2024). Secondly, enterprises of different scales and structures may face distinct challenges and opportunities when implementing ESG strategies (Chen and Shen, 2022). Therefore, future research should further explore the applicability and effectiveness of these mechanisms in different contexts. Overall, the mechanism examination results of this study provide new perspectives for understanding how ESG ratings influence corporate performance, while also offering practical guidance for companies in formulating and implementing ESG strategies (Gao, 2023). Nevertheless, to comprehensively verify the universality and robustness of these mechanisms, more empirical research and cross-industry comparative analyses are needed to ensure that our conclusions hold in a broader context (Liu, 2023).

The findings from the heterogeneity analysis reveal the differential impact of ESG ratings on the performance of various types of firms, highlighting profound implications. Firstly, research indicates that ESG ratings have a more significant impact on the performance of companies with strong internal controls and private enterprises. For companies with robust internal control mechanisms, the implementation of ESG practices is more standardized and effective, allowing these firms to better adhere to ESG guidelines and thereby enhance overall performance (Yu and Xiao, 2022). This finding emphasizes the critical role of internal control in achieving corporate sustainability goals and suggests that companies should focus on building and improving their internal control mechanisms when formulating and implementing ESG strategies (Liu, 2023). Secondly, private enterprises demonstrate greater flexibility and efficiency in adopting and implementing ESG strategies, making the positive impact of ESG ratings on their performance more pronounced. Private enterprises typically have faster decision-making processes and higher execution capabilities, enabling them to swiftly respond to market demands and environmental changes, effectively implement ESG strategies, and achieve corresponding performance improvements (Billio et al., 2021). This result provides important insights for the management of private enterprises, indicating that enhancing ESG practices not only helps improve corporate social responsibility and market image but also brings substantial financial returns (Limkriangkrai et al., 2017).

The results further underscore the pivotal role of ESG ratings in contemporary corporate management and strategic decision-making. ESG ratings are not only crucial indicators of corporate sustainability but also key factors in assessing long-term success and market competitiveness. This is particularly relevant in today’s economic environment, where businesses face increasing challenges in social responsibility and environmental sustainability. The study indicates that companies effectively integrating ESG standards into their business strategies are more likely to achieve long-term financial and market success. This not only guides corporate management in formulating long-term strategies but also provides valuable indicators for investors to assess a company’s potential. Hence, businesses should place greater emphasis on ESG ratings as essential tools for enhancing corporate value and social responsibility.

6 Conclusion

6.1 Conclusion

In recent years, with the rise of the high-quality development orientation of the global economy, the focus on sustainable development and innovation at the corporate level has become a research hotspot in academia. ESG ratings, as a comprehensive evaluation method, aim to measure a company’s performance in the fields of environment, social, and governance, offering investors and stakeholders a more comprehensive view of corporate sustainability. Through empirical research on Chinese A-share listed companies from 2009 to 2021, this study finds that ESG ratings have a positive impact on corporate performance, a conclusion that remains valid after robustness checks. Good ESG performance can not only reduce the cost of equity capital, debt costs, and financing difficulties but also helps enterprises avoid risks. Although past research on the impact of ESG performance on corporate performance has been divided, the results of this study support the positive role of ESG in enhancing corporate performance. In the analysis of the impact mechanism, this article found that ESG ratings could promote an improvement in corporate performance by alleviating financing constraints and enhancing corporate reputation. By focusing on ESG performance, enterprises not only strengthen their financing capabilities but also earn a good reputation, thereby achieving a higher return on investment and performance level. Furthermore, the study also found that the performance-enhancing effect of ESG ratings is more pronounced for companies with robust internal controls and private enterprises.

6.2 Policy suggestion

Based on the findings of this study, we propose the following policy recommendations to further promote corporate practices in environmental, social, and governance (ESG) aspects, thereby enhancing overall performance. Firstly, governments and regulatory agencies should establish stricter and clearer ESG standards, develop unified assessment standards and indicator systems, and set corresponding compliance requirements for different types and sizes of enterprises. These standards should be regularly reviewed and updated to adapt to market and environmental changes. Implementing mandatory policies and regulations can compel companies to prioritize ESG performance, thereby improving their market competitiveness and financial performance.

Secondly, enhancing the transparency and accuracy of ESG information disclosure is crucial. Regulatory agencies should require companies to regularly disclose their performance in environmental, social, and governance areas, providing standardized disclosure formats and templates to facilitate comparison and evaluation by investors and stakeholders. Additionally, the supervision and auditing of ESG information disclosure should be strengthened to ensure the authenticity and completeness of the information, thereby reducing information asymmetry.

Thirdly, encouraging companies to establish robust internal control mechanisms and providing appropriate guidance and support is essential. Governments can develop guidance manuals and training materials to help companies understand and implement effective internal control measures. They can also establish dedicated consulting service agencies to provide customized advice on building internal control systems, ensuring these mechanisms are effectively implemented, thereby enhancing the ESG performance and overall efficiency of companies.

Furthermore, providing ESG investment incentives to reduce corporate investment costs is necessary. Specific measures include offering tax reductions, subsidies, and green loans to companies that meet ESG standards, encouraging investments in environmental protection, social responsibility, and corporate governance. Governments can also establish special funds to support companies in carrying out ESG-related projects and technological innovations, promoting continuous improvement and development in the ESG field.

Promoting ESG education and training is another crucial step. Governments and relevant institutions should regularly organize ESG-themed seminars, training sessions, and promotional activities to help corporate management and employees understand the specific requirements and implementation methods of ESG standards. Collaborations with universities and research institutions can be pursued to develop ESG-related courses and materials, enhancing corporate knowledge and practical abilities in ESG.

Finally, supporting in-depth research and innovation projects on the relationship between ESG and corporate performance is vital. Governments can encourage academic and corporate sectors to explore the best ESG practices by funding research projects and establishing research awards. By promoting scientific research and technological innovation, policymakers can obtain more precise decision-making bases to formulate more effective ESG policies and measures.

Through these specific policy recommendations, governments and regulatory agencies can effectively promote corporate ESG performance, drive sustainable development, and contribute to high-quality global economic growth and prosperity.

6.3 Limitations and future directions

This study has several limitations. The sample is confined to companies listed on the Chinese A-share market, which may not fully represent firms in other markets or regions. Additionally, not all potential variables influencing ESG ratings and corporate performance were considered. Although various control variables were included, there may still be unmeasured factors affecting the results. Furthermore, the ESG rating data used in this study were sourced from third-party rating agencies, which may pose issues related to data quality and rating consistency. Different rating agencies may use varying standards and methodologies for ESG evaluation, potentially impacting the findings.

To address these limitations, future research could validate the findings of this study across different markets and regions to assess the generalizability and external validity of the impact of ESG ratings on corporate performance. Incorporating more potential influencing factors, such as corporate culture, governance structure, and market competition, would provide a more comprehensive understanding of the mechanisms through which ESG ratings affect corporate performance. Additionally, exploring the evaluation standards and methodologies of different rating agencies could enhance the consistency and reliability of ESG data. Conducting longitudinal studies over more extended periods could also reveal the long-term effects of ESG ratings on corporate performance. Furthermore, examining the impact of ESG ratings across various industries and ownership structures would shed light on the unique effects of ESG ratings on different types of firms. Through these efforts, future research will offer more robust theoretical foundations and empirical evidence to support businesses, investors, and policymakers.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

SC: Conceptualization, Formal Analysis, Investigation, Methodology, Validation, Writing–original draft. MF: Conceptualization, Data curation, Methodology, Software, Supervision, Writing–original draft.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Acknowledgments

The author would like to thank the reviewers and the editors.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Albitar, K., Hussainey, K., Kolade, N., and Gerged, A. M. (2020). ESG disclosure and firm performance before and after IR: the moderating role of governance mechanisms. Int. J. Account. and Inf. Manag. 28 (3), 429–444. doi:10.1108/ijaim-09-2019-0108

Albuquerque, R., Koskinen, Y., and Zhang, C. (2019). Corporate social responsibility and firm risk: theory and empirical evidence. Manag. Sci. 65 (10), 4451–4469. doi:10.1287/mnsc.2018.3043

Aouadi, A., and Marsat, S. (2018). Do ESG controversies matter for firm value? Evidence from international data. J. Bus. ethics 151, 1027–1047. doi:10.1007/s10551-016-3213-8

Baek, S., and Lee, D. H. (2024). Can R&D investment be a key driver for sustainable development? Evidence from Korean industry. Corp. Soc. Responsib. Environ. Manag. 31 (2), 838–853. doi:10.1002/csr.2607

Bebchuk, L. A., Cohen, A., and Wang, C. C. (2013). Learning and the disappearing association between governance and returns. J. Financial Econ. 108 (2), 323–348. doi:10.1016/j.jfineco.2012.10.004

Belayeva, I., Kozlova, N., and Danilova, O. (2021). ESG factors as tool for forming business reputation. Vestnik Astrakhan State Tech. Univ. Ser. Econ. 2021, 15–21. doi:10.24143/2073-5537-2021-4-15-21

Billio, M., Costola, M., Hristova, I., Latino, C., and Pelizzon, L. (2021). Inside the ESG ratings:(Dis) agreement and performance. Corp. Soc. Responsib. Environ. Manag. 28 (5), 1426–1445. doi:10.1002/csr.2177

Bin-Feng, C., Mirza, S. S., Ahsan, T., and Qureshi, M. A. (2024). How uncertainty can determine corporate ESG performance? Corp. Soc. Responsib. Environ. Manag. 31 (3), 2290–2310. doi:10.1002/csr.2695

Cai, W., Deng, L., and Liu, Y. (2023). ESG performance and corporate financial performance under dual carbon goals — based on the moderating role of external pressure. Finance Theory and Pract. (06), 69–81.

Cao, M., Duan, K., and Ibrahim, H. (2023). Local government debt and its impact on corporate underinvestment and ESG performance: empirical evidence from China. Sustainability 15 (14), 11116. doi:10.3390/su151411116

Carnini Pulino, S., Ciaburri, M., Magnanelli, B. S., and Nasta, L. (2022). Does ESG disclosure influence firm performance? Sustainability 14 (13), 7595. doi:10.3390/su14137595

Chen, S., and Shen, T. (2022). Does ESG rating affect corporate innovation? Front. Bus. Econ. Manag. 4 (1), 94–99. doi:10.54097/fbem.v4i1.510

Chen, S., Song, Y., and Gao, P. (2023). Environmental, social, and governance (ESG) performance and financial outcomes: analyzing the impact of ESG on financial performance. J. Environ. Manag. 345, 118829. doi:10.1016/j.jenvman.2023.118829

Clark, G. L., Feiner, A., and Viehs, M. (2015). From the stockholder to the stakeholder: how sustainability can drive financial outperformance.

Edmans, A. (2011). Does the stock market fully value intangibles? Employee satisfaction and equity prices. J. Financial Econ. 101 (3), 621–640. doi:10.1016/j.jfineco.2011.03.021

El Ghoul, S., Guedhami, O., Kwok, C. C., and Mishra, D. R. (2011). Does corporate social responsibility affect the cost of capital. J. Bank. Finance 35 (9), 2388–2406. doi:10.1016/j.jbankfin.2011.02.007

Espinosa-Méndez, C., Maquieira, C. P., and Arias, J. T. (2023). The impact of ESG performance on the value of family firms: the moderating role of financial constraints and agency problems. Sustainability 15 (7), 6176. doi:10.3390/su15076176

Feng, Y., Guo, B., Wang, X., and Hu, F. (2024). Facilitating or inhibiting? The impact of environmental information disclosure on enterprise investment value. Environ. Sci. Pollut. Res. 31 (5), 7793–7805. doi:10.1007/s11356-023-31583-5

Freeman, R. E., and Evan, W. (1990). Corporate governance: a stakeholder interpretation. J. Behav. Econ. 19 (4), 337–359. doi:10.1016/0090-5720(90)90022-y

Friede, G., Busch, T., and Bassen, A. (2015). ESG and financial performance: aggregated evidence from more than 2000 empirical studies. J. Sustain. Finance and Invest. 5 (4), 210–233. doi:10.1080/20430795.2015.1118917

Gao, S. (2023). ESG performance and capital investment. Acad. J. Manag. Soc. Sci. 2 (1), 119–123. doi:10.54097/ajmss.v2i1.6501

Gao, S., Meng, F., Wang, W., and Chen, W. (2023). Does ESG always improve corporate performance? Evidence from firm life cycle perspective. Front. Environ. Sci. 11, 1105077. doi:10.3389/fenvs.2023.1105077

Giese, G., Lee, L. E., Melas, D., Nagy, Z., and Nishikawa, L. (2019). Foundations of ESG investing: how ESG affects equity valuation, risk, and performance. J. Portfolio Manag. 45 (5), 69–83. doi:10.3905/jpm.2019.45.5.069

Gompers, P. A., Ishii, J. L., and Metrick, A. (2003). Corporate governance and equity prices. Q. J. Econ. 118 (1), 107–156. doi:10.1162/00335530360535162

Goss, A., and Roberts, G. S. (2011). The impact of corporate social responsibility on the cost of bank loans. J. Bank. Finance 35 (7), 1794–1810. doi:10.1016/j.jbankfin.2010.12.002

Guan, K., and Zhang, R. (2019). Corporate reputation and earnings management: effective contract perspective or rent-seeking perspective? Account. Res. (01), 59–64.

Guo, B., Feng, W., and Lin, J. (2024b). The effect of industrial upgrading on energy consumption. Energy Strategy Rev. 54, 101451. doi:10.1016/j.esr.2024.101451

Guo, B., Feng, W., and Lin, J. (2024c). Does market-based environmental regulation improve the residents’ health: quasi-natural experiment based on DID. Inq. J. Health Care Organ. Provis. Financing 61, 00469580241237095. doi:10.1177/00469580241237095

Guo, B., Hu, P., and Lin, J. (2024a). The effect of digital infrastructure development on enterprise green transformation. Int. Rev. Financial Analysis 92, 103085. doi:10.1016/j.irfa.2024.103085

Horváthová, E. (2010). Does environmental performance affect financial performance? A meta-analysis. Ecol. Econ. 70 (1), 52–59. doi:10.1016/j.ecolecon.2010.04.004

Hou, X. (2023). Corporate ESG performance and financing constraints: empirical evidence from Chinese listed companies. J. Appl. Finance Bank. 13 (5), 77–96. doi:10.47260/jafb/1354

Hu, J., Yu, X., and Han, Y. (2023). Can ESG rating promote green transformation of enterprises? — Based on the difference-in-differences method at multiple time points. Quantitative and Tech. Econ. Res. (07), 90–111. doi:10.13653/j.cnki.jqte.20230517.002

Hu, X. (2023). ESG and financial constraints. SHS Web Conf. 169, 01071. doi:10.1051/shsconf/202316901071

Huang, B., and Qiu, X. (2023). The impact of ESG ratings on employee performance in companies. Acad. J. Manag. Soc. Sci. 3 (2), 89–92. doi:10.54097/ajmss.v3i2.10255

Ioannou, I., and George, S. (2015). The impact of corporate social responsibility on investment recommendations: analysts' perceptions and shifting institutional logics. Strategic Manag. J. 36 (7), 1053–1081. doi:10.1002/smj.2268

Jin, C., Cong, Z., Dan, Z., and Zhang, T. (2023). COVID-19, CSR, and performance of listed tourism companies. Finance Res. Lett. 57, 104217. doi:10.1016/j.frl.2023.104217

Junius, D., Adisurjo, A., Rijanto, Y. A., and Adelina, Y. E. (2020). The impact of ESG performance to firm performance and market value. J. Apl. Akunt. 5 (1), 21–41. doi:10.29303/jaa.v5i1.84

Kim, S., and Li, Z. (2021). Understanding the impact of ESG practices in corporate finance. Sustainability 13 (7), 3746. doi:10.3390/su13073746

Kotsantonis, S., Pinney, C., and Serafeim, G. (2016). ESG integration in investment management: myths and realities. J. Appl. Corp. Finance 28 (2), 10–16. doi:10.1111/jacf.12169

Landi, G., and Sciarelli, M. (2019). Towards a more ethical market: the impact of ESG rating on corporate financial performance. Soc. Responsib. J. 15 (1), 11–27. doi:10.1108/srj-11-2017-0254

Li, J., Yang, Z., Chen, J., and Cui, W. (2021). Mechanism study of ESG promoting corporate performance — from the perspective of corporate innovation. Sci. Sci. Technol. Manag. (09), 71–89.

Li, R., Dang, S., Li, B., and Yuan, R. (2022a). CEO's information technology background and internal control quality of enterprises. Audit Res. (01), 118–128.

Li, S., Yin, P., and Liu, S. (2022b). Evaluation of ESG ratings for Chinese listed companies from the perspective of stock price crash risk. Front. Environ. Sci. 10, 933639. doi:10.3389/fenvs.2022.933639

Li, Y., Gong, M., Zhang, X., and Koh, L. (2018). The impact of environmental, social, and governance disclosure on firm value: the role of CEO power. Br. Account. Rev. 50 (1), 60–75. doi:10.1016/j.bar.2017.09.007

Limkriangkrai, M., Koh, S., and Durand, R. B. (2017). Environmental, social, and governance (ESG) profiles, stock returns, and financial policy: Australian evidence. Int. Rev. Finance 17 (3), 461–471. doi:10.1111/irfi.12101

Liu, D. (2022). The impact of ESG on financial performance of listed companies-an analysis based on corporate reputation perspective.

Liu, X. (2023). Corporate ESG performance and accounting information quality. Bus. Manag. Res. 3, 229–244. doi:10.62051/pr6x9r17

Lozano, R. (2015). A holistic perspective on corporate sustainability drivers. Corp. Soc. Responsib. Environ. Manag. 22 (1), 32–44. doi:10.1002/csr.1325

Megginson, W. L., and Netter, J. M. (2001). From state to market: a survey of empirical studies on privatization. J. Econ. Literature 39 (2), 321–389. doi:10.1257/jel.39.2.321

Michalski, L., and Low, R. K. Y. (2021). Corporate credit rating feature importance: does ESG matter?. SSRN J. doi:10.2139/ssrn.3788037

Odriozola, M. D., and Baraibar-Diez, E. (2017). Is corporate reputation associated with quality of CSR reporting? Evidence from Spain. Corp. Soc. Responsib. Environ. Manag. 24 (2), 121–132. doi:10.1002/csr.1399

Qiu, M., and Yin, H. (2019). ESG performance and financing cost under the background of ecological civilization construction. Quantitative and Tech. Econ. Res. (03), 108–123. doi:10.13653/j.cnki.jqte.2019.03.007

Song, S., and Deng, M. (2023). The impact of firms' ESG performance on financing constraints. Int. J. Manag. Sci. Res. 6 (5), 60–72. doi:10.53469/ijomsr.2023.6(05).10

Tan, Y., and Zhu, Z. (2022). The effect of ESG rating events on corporate green innovation in China: the mediating role of financial constraints and managers' environmental awareness. Technol. Soc. 68, 101906. doi:10.1016/j.techsoc.2022.101906

Tang, H. (2022). The effect of ESG performance on corporate innovation in China: the mediating role of financial constraints and agency cost. Sustainability 14 (7), 3769. doi:10.3390/su14073769

Tarmuji, I., Maelah, R., and Tarmuji, N. H. (2016). The impact of environmental, social, and governance practices (ESG) on economic performance: evidence from ESG score. Int. J. Trade, Econ. Finance 7 (3), 67–74. doi:10.18178/ijtef.2016.7.3.501

Wang, B., and Yang, M. (2022). The impact mechanism of ESG performance on corporate value: evidence from listed companies in China's A-share market. Soft Sci. (06), 78–84. doi:10.13956/j.ss.1001-8409.2022.06.11

Wang, H., Jiao, S., Bu, K., Wang, Y., and Wang, Y. (2023). Digital transformation and manufacturing companies’ ESG responsibility performance. Finance Res. Lett. 58, 104370. doi:10.1016/j.frl.2023.104370

Wang, L., and Yang, L. (2023). Environmental, social and governance performance and credit risk: moderating effect of corporate life cycle. Pacific-Basin Finance J. 80, 102105. doi:10.1016/j.pacfin.2023.102105

Wang, X., Fan, M., Fan, Y., Li, Y., and Tang, X. (2022). R&D investment, financing constraints and corporate financial performance: empirical evidence from China. Front. Environ. Sci. 10, 1056672. doi:10.3389/fenvs.2022.1056672

Wu, S., Li, X., Du, X., and Li, Z. (2022). The impact of ESG performance on firm value: the moderating role of ownership structure. Sustainability 14 (21), 14507. doi:10.3390/su142114507

Wu, X. (2023). The impact of ESG ratings on trade credit financing. SHS Web Conf. 169, 01068. doi:10.1051/shsconf/202316901068

Xie, H., and Lu, X. (2022). Responsible international investment: ESG and China's OFDI. Econ. Res. (03), 83–99.

Yang, C., Zhu, C., and Albitar, K. (2024). ESG ratings and green innovation: AU-shaped journey towards sustainable development. Bus. Strategy Environ. 33, 4108–4129. doi:10.1002/bse.3692

Yang, L., and Shen, Z. (2020). Financing constraints, bank loans, and corporate financialization. Finance and Account. Commun. 23, 60–64. doi:10.16144/j.cnki.issn1002-8072.2020.23.012

Yu, X., and Xiao, K. (2022). Does ESG performance affect firm value? Evidence from a new ESG-scoring approach for Chinese enterprises. Sustainability 14 (24), 16940. doi:10.3390/su142416940

Yu, Z. (2023). Can corporate ESG performance ease financing constraints. Highlights Bus. Econ. Manag. 16, 600–607. doi:10.54097/hbem.v16i.10671

Zeng, L., and Jiang, X. (2023). ESG and corporate performance: evidence from agriculture and forestry listed companies. Sustainability 15 (8), 6723. doi:10.3390/su15086723

Zhan, S. (2023). ESG and corporate performance: a review. SHS Web Conf. 169, 01064. doi:10.1051/shsconf/202316901064

Zhang, D., and Liu, L. (2022). Does ESG performance enhance financial flexibility? Evidence from China. Sustainability 14 (18), 11324. doi:10.3390/su141811324

Zhang, J., Li, Y., Xu, H., and Ding, Y. (2023). Can ESG ratings mitigate managerial myopia? Evidence from Chinese listed companies. Int. Rev. Financial Analysis 90, 102878. doi:10.1016/j.irfa.2023.102878

Zhou, F., Pan, W., and Fu, H. (2020). ESG performance and institutional investor shareholding preference of listed companies — empirical evidence from Chinese A-share listed companies. Sci. Decision-Making (11), 15–41.

Zhou, G., Liu, L., and Luo, S. (2022). Sustainable development, ESG performance and company market value: mediating effect of financial performance. Bus. Strategy Environ. 31 (7), 3371–3387. doi:10.1002/bse.3089

Zhu, Y., Yang, H., and Zhong, M. (2023). Do ESG ratings of Chinese firms converge or diverge? A comparative analysis based on multiple domestic and international ratings. Sustainability 15 (16), 12573. doi:10.3390/su151612573

Keywords: ESG rating, firm performance, financing constraints, corporate reputation, internal control, property right nature

Citation: Chen S and Fan M (2024) ESG ratings and corporate success: analyzing the environmental governance impact on Chinese companies’ performance. Front. Energy Res. 12:1371616. doi: 10.3389/fenrg.2024.1371616

Received: 16 January 2024; Accepted: 16 August 2024;

Published: 26 August 2024.

Edited by:

Michael Carbajales-Dale, Clemson University, United StatesReviewed by:

Sarat Chandra Mohapatra, University of Lisbon, PortugalMaham Furqan, Oregon State University, United States

Copyright © 2024 Chen and Fan. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Min Fan, MTE2MDUyOTg4MUBxcS5jb20=

Sidi Chen1

Sidi Chen1 Min Fan

Min Fan