- 1Graduate School of Business and Advanced Technology Management, Assumption University of Thailand, Samutprakarn, Thailand

- 2Quanzhou Zhixiang Infinite Technology Co., Ltd., Quanzhou, China

- 3Faculty of Humanities and Social Sciences, Macao Polytechnic University, Macao, Macao SAR, China

- 4International College, Ulaanbaatar Erdem University, Ulaanbaatar, Mongolia

- 5Nan’an Branch, Quanzhou Yixing Electrical Engineering Construction Co., Ltd., Quanzhou, China

- 6International Business School, Fuzhou University of International Studies and Trade, Fuzhou, China

Green investment can promote the low-carbon development of energy consumption structure in direct and indirect ways through financial support for new energy industry and pulling effect on environmental protection industry, which is of great significance to the sustainable development of economy and society. Through empirical analysis of the panel data of provinces and municipalities in China, this paper finds that the impact of green investment on the energy consumption structure is highly differentiated between regions: the development of green investment in the eastern region will inhibit the increase of the proportion of coal and other polluting energy sources in the energy consumption structure, which will help the energy consumption structure tend to develop in a decarbonized way; in the central region, the impact of green investment on the energy consumption structure is insignificant; and in the western region, green investment instead promotes the development of the energy consumption structure in a decarbonized way. In the western region, green investment instead promotes the proportion of coal and other polluting energy in the energy consumption structure. The main reason for this is that there are big differences in the level of economic development, characteristics of industrial structure, population size and technological level between the East, the Middle East and the West. It is an important measure to strengthen green investment and improve energy consumption structure to dynamically adjust green development goals, strengthen financial support for energy conservation and environmental protection industries, and narrow the regional development gap in all directions.

1 Introduction

On 31 August 2016, the People’s Bank of China and other seven ministries and commissions in the “Guiding Opinions on Building a Green Financial System” clearly defined green finance as an economic activity that supports the improvement of the environment, the response to climate change and the economical and efficient use of resources. And green investment, as an important hand in the implementation of green finance in China (Li et al., 2022; Yang et al., 2023), can effectively improve the quality of the environment, reduce pollution emissions, and promote China’s economy and society to achieve sustainable development (Hung, 2023; Peng et al., 2023; Zheng and Jin, 2023). Introducing financial services into energy-saving and environmental protection industry and new energy industry through green investment can effectively promote the decarbonization of energy consumption structure.

As the quality of China’s economic and social development continues to improve, under the guidance of the central bank’s policy, strict supervision by the CBRC, and environmental assessment by the Environmental Protection Bureau, the scale of green investment continues to expand, and works on both “emission reduction” and “energy saving” to help China’s enterprises to It helps Chinese enterprises reduce energy consumption and focuses on the long-term interests of human beings. The development of green investment promotes the rapid development of new energy industry and energy-saving and environmental protection industry, and in this way to achieve the purpose of decarbonization of the energy consumption structure, while the energy consumption structure in the state of decarbonization will positively feedback to the green investment, the formation of a benign cycle of ecology and economy.

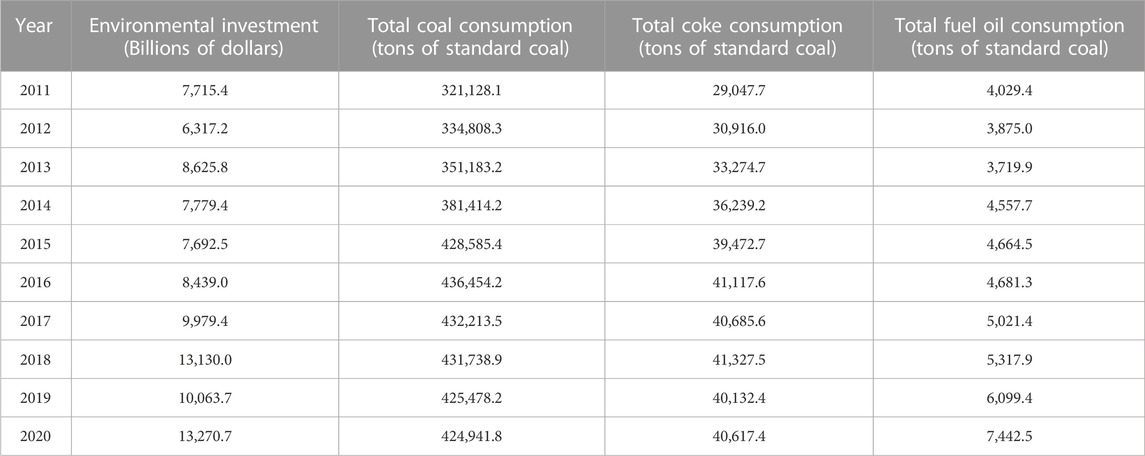

Table 1 shows the total consumption of coal, coke and fuel oil and the total environmental protection investment in China from 2011 to 2020. As can be seen from Table 1, China’s total environmental protection investment increases year by year, from 771.54 billion yuan in 2011 to 1,327.07 billion yuan in 2020, nearly tripling. Green investment in China is mainly used in energy, transportation, construction and industry (accounting for 80%–90%), among which green investment in energy industry ranks first, covering energy supply, manufacturing, terminal consumption and other links, and wind power, photovoltaic and hydrogen energy industries in energy industry have gradually become the important direction of green investment. Usually economic and social development is always accompanied by an increase in the total amount of energy consumption, and the total consumption of coal, coke and fuel oil in China increased rapidly from 2011 to 2016, while the total consumption of coal and coke began to gradually decrease after 2016, and the total consumption of fuel oil continued to maintain growth, mainly due to the fact that the improvement of the structure of energy consumption by green investment has a certain lag in time, and the initial stage of investment is mainly aimed at clean energy replacement of highly polluting coal and coke, while the development of alternative energy sources for fuel oil is relatively slow, but overall the trend of decarbonization of China’s energy consumption structure is gradually coming to the fore.

China acceded to the Paris Climate Change Agreement on 30 September 2016, and as the world’s largest developing country, China has continuously made strategic adjustments to its energy consumption structure in order to achieve the goal of reducing emissions in the global economy. With the rapid advancement of supply-side structural reform in China’s energy sector, the structural adjustment of energy consumption has made sustained progress, with the proportion of polluting energy consumption declining year by year, while the proportion of clean energy consumption has risen, but the consumption of coal, coke, and fuel oil, etc., still occupies a dominant position. The development and growth of green investment can not only bring economic benefits to financial institutions, energy-saving industry and new energy industry, but also promote the virtuous cycle of finance and ecological environment to a certain extent. With the development of the economy, the improvement of urbanization level, the optimization of industrial structure, the whole society’s awareness of energy consumption is gradually improved, and China’s energy consumption structure is also in constant transformation. Adjusting the energy consumption structure is of great strategic significance, helping to alleviate the energy and ecological environment constraints in economic development, and is in line with China’s long-term planning for sustainable economic and social development. At present, China is in the critical stage of the development and expansion of green investment and the low-carbon energy consumption structure, but few scholars have explored the deep-seated relationship between them. Therefore, this paper will discuss the influence of green investment on energy consumption structure and regional differences, so as to reflect the differences in energy consumption structure between different regions, help to grasp the changing trend of energy demand between different regions in the future, and then reduce the consumption of polluting energy such as coal, coke and fuel oil, and promote the sustainable development of energy economy.

2 Literature review and research hypotheses

At this stage, there are fewer studies related to green investment and energy structure, mainly focusing on green investment and renewable energy and clean energy. Lyeonov et al. (2019) analyzed the relationship between green investment and renewable energy in the EU countries, and found that green investment can promote the production and use of renewable energy (Lyeonov et al., 2019; Musibau et al., 2021) took the United States (2021) explored the positive impact of green investment on renewable energy in nine industrialized countries, including the United States, Japan, and France (Musibau et al., 2021; Zahan and Chuanmin 2021) argued that in the long term, green investment will promote the consumption share of renewable energy (Zahan and Chuanmin, 2021; Chen and Ma, 2021), based on the data of listed energy companies in China, found that making green investment will (2021), based on the data of Chinese energy listed companies, found that green investment will improve the financial performance of the company, so environmental investment will be a long-term strategy for energy listed companies (Chen and Ma, 2021; Liu et al., 2022a) measured the efficiency of green investment in China’s energy sector, and found that the overall green investment in China’s energy sector is at an excessively high level (Liu et al., 2022a; Safitri et al., 2022), green investment can help the production of renewable energy, and increase the proportion of clean energy use (Safitri et al., 2022; Zhang and Kong, 2022) point out that green investment and energy policy are important factors in promoting sustainable corporate development (Zhang and Kong, 2022; Siedschlag and Yan, 2023) find that green investment can improve corporate performance and environmental quality in the industrial sector in Ireland (Siedschlag and Yan, 2023; SunLi et al., 2021) demonstrate a two-way causal relationship between green investment and clean energy. (2021) demonstrated the two-way causality between green investment and clean energy (SunLi et al., 2021; Wang and Xu, 2023) studied 15 RCEP countries and explored the positive effects of green investment on renewable energy projects (Wang and Xu, 2023; BelaïdAl and Al, 2023) investigated the enhancement of energy security by green investment (BelaïdAl and Al, 2023). In addition, (Cutcu et al., 2022) takes the top 10 countries in climate risk index as the research object, and discusses the causal relationship between energy consumption and climate change (Cutcu et al., 2022); Subsequently, Cutcu et al., 2023) further explored the internal relationship between ecological footprint and foreign trade in the 10 fastest-growing countries (Cutcu et al., 2023).

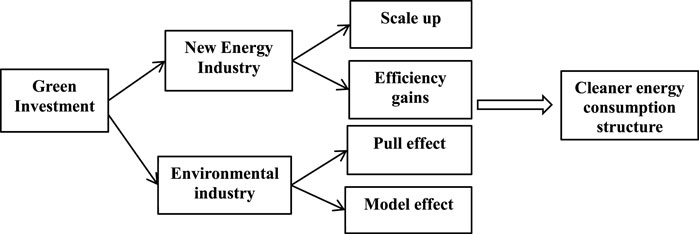

To sum up, the existing research focuses more on the causality test of green investment, renewable energy and clean energy, while ignoring the “structural effect” produced by green investment. Environmental pollution from energy mainly comes from energy terminal consumption. Therefore, on the basis of paying attention to the production of clean energy and renewable energy, it is necessary to explore whether green investment can effectively promote the proportion of clean energy use, thus improving the energy consumption structure. Therefore, this paper will take the energy consumption structure as a dependent variable to explore the impact of green investment on the energy consumption structure. Green investment, as an important hand of green finance, not only has the role of capital support of ordinary financial investment, but also has the nature of a policy instrument, which can be used as a macro-control tool to help the national strategic planning - decarbonization of energy consumption structure. The mechanism of green investment on China’s energy consumption structure mainly exists in two aspects: direct and indirect mechanisms, as shown in Figure 1.

Direct mechanism: Green investment has a financial support role for the new energy industry, which influences the energy consumption demand from the supply side through its role in the production side of energy and promotes the low-carbon development of the energy consumption structure. On the one hand, sufficient funds to promote the rapid development of the new energy industry, expand the scale of production and operation of the new energy industry, and increase the total amount of clean energy production; on the other hand, through financial support can promote the new energy industry to carry out technological research and development and technological innovation, improve the efficiency of the production of the new energy industry, and further increase the proportion of clean energy in the structure of China’s energy consumption, so as to achieve the purpose of the decarbonization of the energy consumption structure.

Indirect mechanism: the development of green investment can have a pulling effect on the environmental protection industry, while the environmental protection industry as the use of energy, its own development and growth will be from the demand side of the perspective of the impact of energy consumption demand, promote the development of China’s energy consumption structure of low-carbon. At the same time, green investment in the process of promoting the rapid development of environmental protection industry, will send signals to the community, and then guide China’s other industry enterprises are more inclined to choose clean energy, in order to obtain the financial support of green investment.

In addition, it is worth noting that the regional development gap in China is obvious, and the economic development level, industrial structure characteristics and energy consumption demand of different regions show great regional differences, so the investment direction and investment focus of green investment in different regions are also different, so the improvement of energy consumption structure by green investment may have regional heterogeneity.

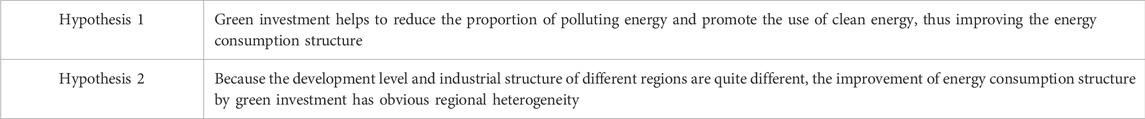

Based on the above theoretical logic, this paper puts forward the research hypothesis, as shown in Table 2. It is expected to provide support for the sustainable development of economy and society, especially for developing countries, through in-depth discussion on the improvement of energy consumption structure by green investment.

3 Research design

3.1 Selection of indicators

Based on established research, this paper selects energy consumption structure as the explanatory variable and green investment as the explanatory variable. The structure of energy consumption (ES) is measured by the share of consumption of coal, coke, gasoline, kerosene, diesel and fuel oil in total energy consumption, and green investment is measured by the share of environmental protection investment in GDP.

In order to make the model more consistent with economic laws, drawing on existing studies, the industrial structure (Liu, 2021; Luan et al., 2021; Kaczmarek et al., 2022; Xue et al., 2022; Zheng et al., 2023), the per capita GDP (Wang et al., 2022a; Aydin et al., 2022; Wang et al., 2022b; Komarova et al., 2022; Chang and Fang, 2023) and population density (Mohammad, 2020; Muhammad et al., 2020; Liu et al., 2022b; Muzayanah et al., 2022; HeYu and Jiang, 2023) are used as control variables to measure the impact on energy consumption structure from the three perspectives of optimization and adjustment of industrial structure, expansion of economic scale and increase in population scale, respectively. Among them, the industrial structure is measured by the ratio of the output value of tertiary industry to the output value of secondary industry, and the population density is expressed by the number of population per unit area.

3.2 Data sources

This paper takes 30 provinces and cities in China (excluding Tibet and Hong Kong, Macao and Taiwan) as the research object, and the research interval of the sample data is set as 2011 to 2020 in consideration of the scientific nature and availability of the data. Among them, the data of green investment comes from wind database; the energy consumption structure comes from China Energy Statistical Yearbook; the industrial structure, GDP per capita and population density come from China Statistical Yearbook.

3.3 Modeling

This paper focuses on the green investment in green finance, the role of the impact on the structure of energy consumption, so based on the theoretical analysis and research hypotheses in the previous paper, the econometric model is constructed as follows:

where ES denotes energy consumption structure; GI denotes green investment; IS denotes industrial structure; PGDP denotes gross domestic product per capita; PD denotes population density; a0 denotes the constant term; uit denotes the error term; i denotes province; and t denotes time.

4 Empirical analysis

4.1 Unit root test

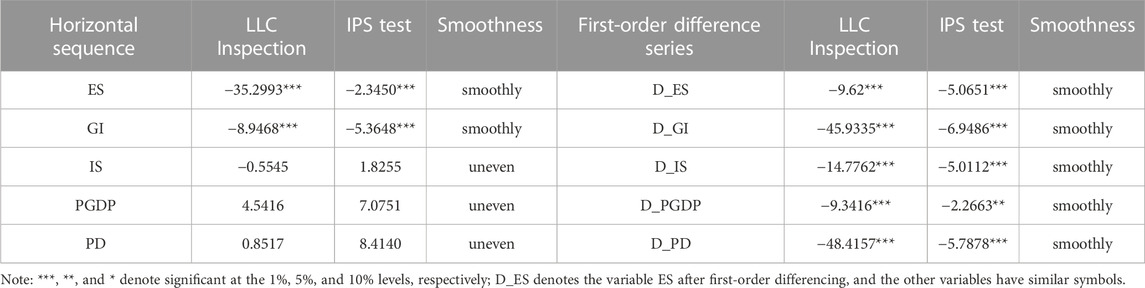

Before the empirical analysis, it is necessary to conduct a smoothness test on the data to exclude the phenomenon of “pseudo-regression” that may be brought by non-smooth data. Therefore, in this paper, the first variable smoothness test, namely, the unit root test, the test methods used are: LLC test and IPS test, the test results are shown in Table 3.

As can be seen in Table 3, in the results of the test of the horizontal series, the variables IS, PGDP and PD fail the unit root test, while all the other variables are shown to be smooth series. Further, the variables after first-order differencing are tested again, and the results show that in the series of variables after first-order differencing, except D_PGDP, which passes the smoothness test at the 5% level, all other variables pass the smoothness test at the 1% level, which indicates that there is a first-order single-integration relationship between the variables, and that the sample data are stable.

4.2 Counteraction test

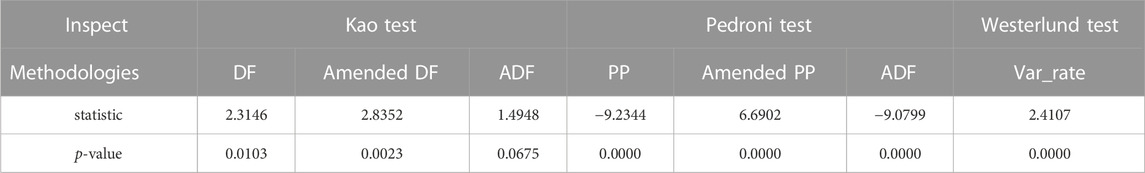

Since there is a first-order single-integration relationship between the variables, a cointegration test can be conducted to determine whether there is a long-term stable equilibrium relationship between the variables. In this paper, Kao test, Pedroni test and westerlund test are selected as three methods to test the cointegration of each variable, and the test results are shown in Table 4.

As can be seen from Table 4, among the three tests Pedroni test and westerlund test both significantly reject the original hypothesis of non-existence of cointegration relationship at 1% level. At the same time, the results of Kao test show that the statistic ADF is not significant, while both DF and modified DF significantly reject the original hypothesis of non-existence of co-integration relationship at 1% level, i.e., in the Kao test of the three statistics, there are two statistic significant rejection of the original hypothesis, then it can be considered that the Kao test is also significant rejection of the original hypothesis of non-existence of co-integration relationship. Therefore, combining the test results of the three methods, it can be seen that there is a long-term stable equilibrium relationship between the variables, and regression analysis can be carried out.

4.3 Modeling

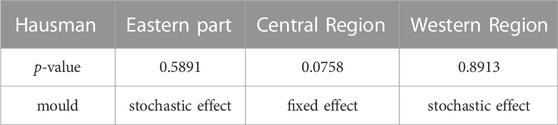

Before the regression analysis of the model, it is necessary to determine the basic type of the model, so this paper carries out the Hausman test on the model, the test results are shown in Table 5, in which the p-value of the east, middle and west are 0.5891, 0.0758 and 0.8913, respectively, which shows that only the central part of the model rejects the original hypothesis of “there is no systematic difference between the fixed effects and the random effects” at the level of 10%. This indicates that only the model in central China rejects the original hypothesis of “there is no systematic difference between fixed effects and random effects” at the 10% level, so the regression analysis in this paper uses the random effects model for eastern and western China, and the regression analysis in central China uses the fixed effects model.

4.4 Regression analysis

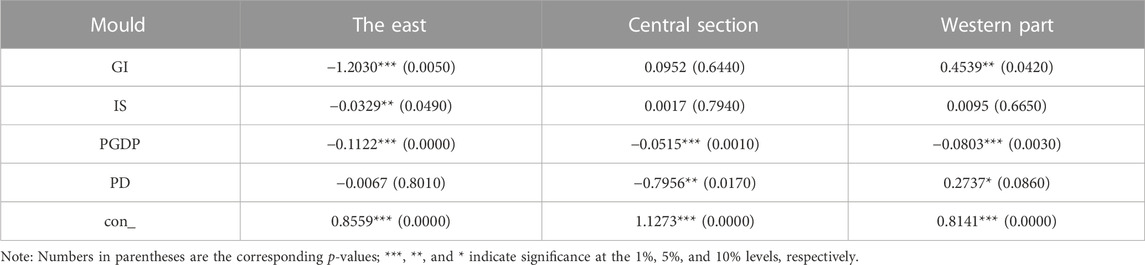

As can be seen from Table 6, the impact of green investment on energy consumption structure has different effects in different regions. In the regression results of the eastern region, green investment is significantly negative at the 1% level, indicating that the development of green investment in the eastern region will inhibit the increase of the proportion of coal and other polluting energy in the energy consumption structure, and will help the energy consumption structure tend to develop in a low-carbon manner; in the regression results of the central region, the green investment is not significant; in the regression results of the western region, the green investment is significantly positive at the 5% level, indicating that the green investment in the western region promotes the proportion of coal and other polluting energy consumption in the energy consumption structure. Is positive, indicating that green investment in the western region promotes the proportion of coal and other polluting energy consumption in the energy consumption structure.

The regional differences in the energy consumption structure affected by green investment mainly come from three aspects: First, in terms of industrial structure, due to the different levels of economic development in China’s eastern, central and western regions, resulting in different characteristics of its industrial structure, the relatively high level of economic development in the eastern region is mainly based on the tertiary industry, while most of the regions in the central and western regions are mainly based on the secondary industry, coupled with the fact that the tertiary industry is mainly based on the service industry with low energy consumption and low pollution, while the secondary industry is mainly based on the industrial and manufacturing industries. Low-energy consumption, low-pollution service industry, while the secondary industry is mainly based on industry, manufacturing, due to the different demand for energy consumption, resulting in the structure of energy consumption in the eastern, central and western regions are also different, which in turn makes the impact of green investment in different regions brought about by the impact of the effect of the differences in the regression results of the IS in Table 6 also proved the existence of this situation. Second, the population size, due to the more developed economy in the eastern region, resulting in a relatively large population size, the total amount of energy consumption with the increase in population size and increase, human daily life in the use of heat, natural gas and other energy sources is relatively more, coal, coke and other energy use is relatively small; while the central and western regions are relatively small in population size, the industry and manufacturing industry and so on the use of energy sources such as coal and other energy sources is relatively more. As the demand proportion of clean energy and polluting energy is different in the east, middle and west, it leads to the improvement effect of green investment on the development of decarbonization of the energy consumption structure, which is also proved by the regression results of PD in Table 6. Thirdly, in terms of technological level, the eastern region has a higher level of economic development, and its level of technological innovation is also relatively strong, leading to the development and promotion of new energy and clean energy in the eastern region is relatively easy; while the central and western regions are relatively backward in terms of economic development, and the technological innovation capacity is relatively weak, resulting in the relatively slow development and utilization of new energy and clean energy, which leads to the improvement effect of green investment on the energy consumption structure of the eastern region is relatively good, while the improvement effect on the energy consumption structure of the eastern region is relatively good. As a result, the effect of green investment on the energy consumption structure of the eastern region is relatively good, while the effect on the central and western regions is relatively poor, which is also proved by the regression results of PGDP in Table 6.

4.5 Robustness test

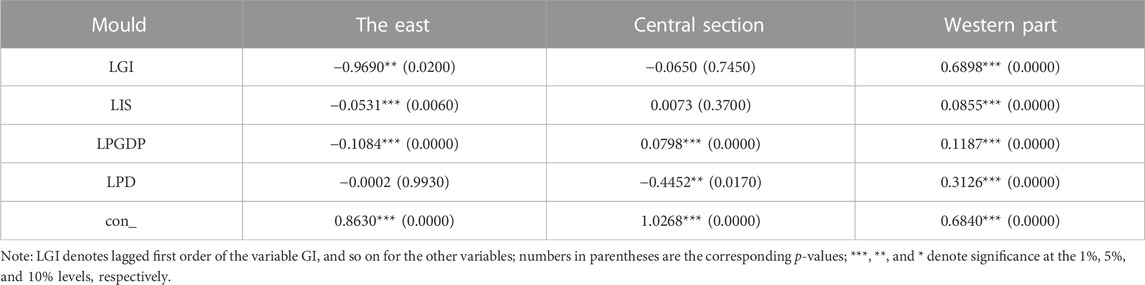

In order to verify whether the regression results are robust, this paper further conducts a robustness test of the model, considering that the impact effect of green investment on energy consumption structure has a certain degree of lag in time, so the regression is carried out again with a lag period of the explanatory variables and control variables in each model, and the results are shown in Table 7. The coefficients, positive and negative relationships and significance of the explanatory and control variables in each model have not changed significantly, and only the positive and negative relationships of the control variable PGDP in the regression results of the central and western regions have changed. Therefore, it can be known that the regression results of this paper are robust. It can be seen that green investment can promote the improvement of energy consumption structure and the use of clean energy, but its positive improvement is limited, especially in areas with high economic development level, high industrial structure (tertiary industry accounts for a relatively high proportion) and large population.

5 Conclusion and recommendations

5.1 Conclusion

China’s green investment will promote the development of the decarbonization of the energy consumption structure through both direct and indirect influence. On the one hand, through the direct financial support to the new energy industry, it acts on the production side of energy, influences the consumption demand of energy from the supply side, and promotes the decarbonization development of energy consumption structure. On the other hand, through the indirect pulling effect on the environmental protection industry, it influences the energy consumption demand from the demand side of energy, and then promotes the development of the decarbonization of China’s energy consumption structure. In addition, empirical analysis also found that there is a correlation between energy consumption structure and green investment, and the impact of green investment on energy consumption structure has different effects in different regions: the development of green investment in the eastern region will inhibit the proportion of coal and other polluting energy sources in the energy consumption structure, which will help the energy consumption structure tends to be decarbonized; in the central region, the impact of green investment on energy consumption structure is not significant; while in the central region, the impact of green investment on energy consumption structure is not significant; in the central region, the impact of green investment on energy consumption structure is not significant. In the central region, the impact of green investment on the energy consumption structure is not significant; while in the western region, green investment instead promotes the proportion of coal and other polluting energy in the energy consumption structure. The main reasons for the regional differences in the impact of green investment on the energy consumption structure are the large differences in the level of economic development, industrial structure, population size and technological level of the East, the Middle East and the West.

The conclusion of this paper is consistent with the existing research on green investment and renewable energy. (Naif, 2023; Zhang and Xie, 2023) found that green investment contributes to renewable energy production, and similar to the existing scholars’ research, scholars pay more attention to the causal relationship between green investment and clean energy and renewable energy, ignoring the structural characteristics of energy consumption. This paper supplements the above research gaps. At the same time, however, there are still some limitations, such as the failure to further explore the nonlinear relationship and spatial correlation between green investment and energy consumption structure on the basis of considering regional heterogeneity, and the failure to consider the impact of green finance-related policies on some areas when selecting samples. The follow-up study will consider the impact of green financial policies on energy consumption structure, and discuss the role of green investment in the development of green finance, as well as the nonlinear and spatial effects of green investment on energy consumption structure.

5.2 Policy recommendations

The prosperous development of green investment can promote the decarbonization of the energy consumption structure, but in order to truly implement it, it is necessary to promote government policies, the financial industry and the environmental protection sector, and at the same time, give full play to the optimization of the structure of energy consumption on the positive role of green investment, to achieve a positive feedback effect. First of all, it is necessary to improve the investment policies of environmental protection industry and new energy industry, formulate dynamic green development goals, strengthen the implementation of quality effect, and jointly promote the low-carbon energy consumption structure from two aspects of “emission reduction” and “energy conservation”. Secondly, it is necessary to realize the connection between government policies and green investment, strengthen the information disclosure policies of environmental protection departments and financial institutions, improve the feasibility of green investment, act on energy supply and consumption ends with larger-scale green investment, and increase the proportion of clean energy use. Finally, the regional development gap exists for a long time, which seriously affects the improvement of energy consumption structure by green investment, and regional coordinated development cannot be achieved overnight. Therefore, green investment in various regions should adjust the direction of green investment according to local energy consumption structure, economic development level, industrial structure and natural environment characteristics, and open up a low-carbon development path of energy consumption in this region.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding authors.

Author contributions

ZL: Conceptualization, Data curation, Formal Analysis, Investigation, Methodology, Software, Validation, Visualization, Writing–review and editing. JL: Formal Analysis, Funding acquisition, Project administration, Supervision. HoC: Conceptualization, Data curation, Investigation, Methodology, Resources, Software, Visualization, Writing–review and editing. GL: Formal Analysis, Investigation, Visualization, Writing–review and editing, Writing–original draft. HuC: Conceptualization, Formal Analysis, Funding acquisition, Project administration, Resources, Supervision, Writing–original draft.

Funding

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. This study was supported by the “Research Project of Macao Polytechnic University”.

Acknowledgments

The authors are grateful to the editor and the reviewers of this paper, especially the professors from the Macau Polytechnic University on the Classical Literature on Public Administration have provided inspiration and guidance for this paper.

Conflict of interest

Author ZL was employed by Quanzhou Zhixiang Infinite Technology Co., Ltd. Author HoC was employed by Quanzhou Yixing Electrical Engineering Construction Co., Ltd.

The remaining authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Aydin, C., Onay, R. D., and Ahin, S. (2022). Does energy intensity matter in the nexus between energy consumption and economic growth regarding capital-energy substitution? Environ. Sci. Pollut. Res. Int. 29 (58), 88240–88255. doi:10.1007/s11356-022-21927-y

BelaïdAl, F. S. A., and Al, M. R. (2023). Balancing climate mitigation and energy security goals amid converging global energy crises: the role of green investments. Renew. Energy 205, 534–542. doi:10.1016/j.renene.2023.01.083

Chang, C. L., and Fang, M. (2023). Impact of a sharing economy and green energy on achieving sustainable economic development: evidence from a novel NARDL model. J. Innovation amp 8, 100297. doi:10.1016/j.jik.2022.100297

Chen, Y., and Ma, Y. (2021). Does green investment improve energy firm performance? Energy Policy 153 (1), 112252. doi:10.1016/j.enpol.2021.112252

Cutcu, I., Beyaz, A., Gerlikhan, G. S., and Kilic, Y. (2023). Is ecological footprint related to foreign trade? Evidence from the top ten fastest developing countries in the global economy. J. Clean. Prod. 413, 137517. doi:10.1016/j.jclepro.2023.137517

Cutcu, I., Keser, A., and Eren, M. V. (2022). Causation between energy consumption and climate change in the countries with the highest global climate risk. Environ. Sci. Pollut. Res. 30, 15585–15598. doi:10.1007/s11356-022-23181-8

HeYu, X. Y., and Jiang, S. (2023). City centrality, population density and energy efficiency. energy Econ. 117, 106436. doi:10.1016/j.eneco.2022.106436

Hung, N. T. (2023). Green investment, financial development, digitalization and economic sustainability in Vietnam: Evidence from a quantile-on-quantile regression and wavelet coherence. United States: Technological Forecasting & Social Change.

Kaczmarek, J., Kolegowicz, K., and Szymla, W. (2022). Restructuring of the coal mining industry and the challenges of energy transition in Poland (1990-2020). Energies 15, 3518. doi:10.3390/en15103518

Komarova, A. V., Filimonova, .I. V., and Kartashevich, A. A. (2022). Energy consumption of the countries in the context of economic development and energy transition. energy Rep. 8 (S9), 683–690. doi:10.1016/j.egyr.2022.07.072

Li, G., Jia, X., Khan, A. A., Khan, S. U., Ali, M. A. S., and Luo, J. (2022). Does green finance promote agricultural green total factor productivity? Considering green credit, green investment, green securities, and carbon finance in China. Finance in China. Environ. Sci. Pollut. Res., 1–17. doi:10.1007/s11356-022-24857-x

Liu, J. (2021). Study on impact of industria1 structure upgrading on energy efficiency in the ye11ow river basin based on the data of 2001 2019. iop Conference Series. Earth Environ. Sci. 687 (1), 012065. (5pp). doi:10.1088/1755-1315/687/1/012065

Liu, L., Zhao, Z., Zhang, M., and Zhou, D. (2022a). Green investment efficiency in the Chinese energy sector: overinvestment or underinvestment? Energy Policy 160, 112694. doi:10.1016/j.enpol.2021.112694

Liu, P., Zhou, H., Chun, X., Wan, Z., Liu, T., Sun, B., et al. (2022b). Characteristics of fine carbonaceous aerosols in Wuhai, a resource-based city in Northern China: Insights from energy efficiency and population Environmental Pollution. PA, 118368.

Luan, B., Zou, H., Chen, S., Huang, J., Lund, H., and Kaiser, M. J. (2021). The effect of industrial structure adjustment on China's energy intensity: Evidence from linear and nonlinear analysis.

Lyeonov, S., Pimonenko, T., Bilan, Y., Štreimikienė, D., and Mentel, G. (2019). Assessment of green investments' impact on sustainable development: linking gross domestic product per capita, greenhouse gas emissions and renewable energy. energies 12 (20), 3891. doi:10.3390/en12203891

Mohammad, M. R. (2020). Exploring the effects of economic growth, population density and international trade on energy consumption and environmental quality in India. Int. J. Energy Sect. Manag. 14, 1177–1203. (ahead-of-print). doi:10.1108/ijesm-11-2019-0014

Muhammad, K., Karim, R., Muhammad, F., and Asghar, A. (2020). Population density, CO2 emission and energy consumption in Pakistan: A multivariate analysis. Int. J. Energy Econ. Policy 10 (6), 250–255. doi:10.32479/ijeep.10341

Musibau, H. O., Adedoyin, F. F., and Shittu, W. O. (2021). A quantile analysis of energy efficiency, green investment, and energy innovation in most industrialized nations. Environ. Sci. Pollut. Res. 28 (5), 19473–19484. doi:10.1007/s11356-020-12002-5

Muzayanah, I. F. A., Lean, H. H., Hartono, D., Indraswari, K. D., and Partama, R. (2022). Population density and energy consumption: A study in Indonesian provinces. Heliyon 8 (9), e10634. doi:10.1016/j.heliyon.2022.e10634

Naif, A. (2023). How environmental policy stringency affects renewable energy investment? Implications for green investment horizons. Util. Policy 83, 101613. doi:10.1016/j.jup.2023.101613

Peng, R., Huang, H., Ge, J., and Yan, W. (2023). Study on the coupling coordination and pattern evolution of green investment and ecological development: Based on spatial econometric model and China Frontiers in Environmental Science.

Safitri, D., Fahrurrozi, A., Dewiyani, L., and Attas, S. G. (2022). The role of environmental degradation and green investment on the renewable energy production in asean countries: evidence using novel mmqr technique. Environ. Sci. Pollut. Res. Int. 30 (12), 33363–33374. doi:10.1007/s11356-022-24302-z

Siedschlag, I., and Yan, W. (2023). Do green investments improve firm performance? Empirical evidence from Ireland. United States: Technological Forecasting & Social Change.

SunLi, Y. H., Zhang, K., and Kamran, H. W. (2021). Dynamic and casual association between green investment, clean energy and environmental sustainability using advance quantile A.R.D.L. framework. R.d.l. Framew. 35 (1), 3609–3628. doi:10.1080/1331677x.2021.1997627

Wang, D., White, B., Mugera, A., and Wang, B. (2022b). Energy transition and economic development in China: A national and sectorial analysis from a new structural economics perspectives. sustainability 14 (24), 16646. doi:10.3390/su142416646

Wang, M., Zeng, S., Wang, Y., and He, Z. (2022a). Does clean energy use have threshold effects on economic development? A case of theoretical and empirical analyses from China. Int. J. Environ. Res. Public Health 19 (15), 9757. doi:10.3390/ijerph19159757

Wang, Y., and Xu, A. (2023). Green investments and development of renewable energy projects: evidence from 15 RCEP member countries. Renew. Energy 211, 1045–1050. doi:10.1016/j.renene.2023.05.034

Xue, L., Li, H., Xu, C., Zhao, X., Zheng, Z., Li, Y., et al. (2022). Impacts of industrial structure adjustment, upgrade and coordination on energy efficiency: empirical research based on the extended STIRPAT model. Energy Strategy Rev. 43, 100911. doi:10.1016/j.esr.2022.100911

Yang, W. E., Lai, P. W., Han, Z. Q., and Tang, Z. P. (2023). Do government policies drive institutional preferences on green investment? Evidence from China. ), 8297–8316.

Zahan, I., and Chuanmin, S. (2021). Towards a green economic policy framework in China: role of green investment in fostering clean energy consumption and environmental sustainability. Environ. Sci. Pollut. Res. 28 (6), 43618–43628. doi:10.1007/s11356-021-13041-2

Zhang, D., and Kong, Q. (2022). Renewable energy policy, green investment, and sustainability of energy firms. Germany: Renewable energy, 192.

Zhang, S., and Xie, G. (2023). Promoting green investment for renewable energy sources in China: case study from autoregressive distributed Lagged in error correction approach. Renew. Energy, 214. doi:10.1016/j.renene.2023.05.131

Zheng, S., and Jin, S. (2023). Can enterprises in China achieve sustainable development through green investment? Int. J. Environ. Res. Public Health 20 (3), 1787. doi:10.3390/ijerph20031787

Keywords: green investment, energy consumption structure, decarbonization, sustainable energy systems, environmental protection industry

Citation: Liu Z, Lam JFI, Chen H, Lin G and Chen H (2023) Can green investment improve China’s regional energy consumption structure? novel findings and implications from sustainable energy systems perspective. Front. Energy Res. 11:1273347. doi: 10.3389/fenrg.2023.1273347

Received: 06 August 2023; Accepted: 18 September 2023;

Published: 03 October 2023.

Edited by:

Michael Carbajales-Dale, Clemson University, United StatesReviewed by:

Ibrahim Cutcu, Hasan Kalyoncu University, TürkiyeOlena Chygryn, Sumy State University, Ukraine

Copyright © 2023 Liu, Lam, Chen, Lin and Chen. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Johnny F. I. Lam, ZmlsYW1AbXB1LmVkdS5tbw==; Huangxin Chen, Y2h4NDE3MTIyQDE2My5jb21jbg==

Zhengyuan Liu1,2

Zhengyuan Liu1,2 Hongxi Chen

Hongxi Chen Huangxin Chen

Huangxin Chen