- School of Management, Heilongjiang University of Science and Technology, China

This article is based on the mixed ownership reform, with energy enterprises as the research object, and constructs a fuzzy set qualitative comparative analysis game framework for path optimization in complex systems. Using fsQCA and game theory from the perspective of knowledge sharing, reasonable assumptions are made for the sharing of green innovation knowledge between state-owned and non-state-owned shareholders in energy enterprises, providing policy support and institutional guarantee for the sharing of similar green innovation knowledge in multiple industries, to some extent, it facilitates the exchange and flow of green innovation knowledge among different enterprises, providing the optimal path for complex systems. This article can draw the following conclusions: 1. Government led, government enterprise driven, and enterprise led are the three major influencing paths for promoting green innovation knowledge sharing. The final trend of stable gaming among different types of shareholders depends on sharing profits. 3. The fuzzy set qualitative comparative analysis game framework has certain universality.

1 Introduction

The proposal of the reduce carbon emissions goal requires China to take a green development path, develop green and low-carbon industries, advocate green consumption, and promote the formation of green and low-carbon production and lifestyle. With the launch of the carbon emission trading market in China in 2021, the government set a quota for the monthly emissions of carbon and carbon compounds by enterprises. Enterprises exceeding the basic quota need to purchase carbon dioxide quotas in the Carbon emission trading market. Under the constraints of the carbon emission trading market mechanism, enterprises will continue to increase the innovation and development of green technology to seize the green development advantage in the future to meet the carbon emission standards issued by the government. Key industries such as electricity, steel, paper making, non-ferrous metals, petrochemical, chemical, as well as aviation and building materials are the main sources of carbon emissions and key areas for green technology innovation. In these high carbon industries, the state-owned economy is basically the leading force, which determines that state-owned enterprises must take on the responsibility of green technology innovation and play a key role in promoting the achievement of the reduce carbon emissions goal and high-quality economic development (Peng et al., 2022), energy companies play a crucial role.

The reason why this article focuses on energy enterprises is that due to the increasing requirements for environmental protection and the continuous development of technology and the emergence of new energy, energy enterprises must engage in green innovation (Wang et al., 2023). This not only requires energy enterprises to transform themselves, but also due to issues such as equity, knowledge related to green innovation flows among energy enterprises, forming a trend of knowledge sharing. In the process of mixed ownership reform, groups represented by different types of equity can make decisions to choose whether to engage in green innovation knowledge sharing.

In the reform of mixed ownership, energy enterprises face certain challenges in sharing green innovation knowledge. For energy enterprises, green innovation, in addition to institutional and cultural innovation, is mainly manifested in technological innovation (Hao et al., 2023). In the process of technological innovation, it may involve the core technologies of various energy enterprises, which creates difficulties for the knowledge sharing process. Knowledge sharing is a two-way choice and a continuous pursuit of win-win situations. During this process, different possible situations and cooperation paths may arise. This article aims to address the issue by considering as many analysis paths as possible and optimizing them among numerous cooperation paths to choose the optimal win-win path.

Compared to private enterprises, state-owned enterprises are more willing to engage in green technology innovation due to their political attributes and social responsibilities (Lan and Mao, 2020). However, because state-owned enterprises do not take profit maximization as the first goal, the enthusiasm of the company’s employees and the initiative of green transformation are weak in the actual work process, so their innovation motivation and innovation efficiency are naturally insufficient (Yuan et al., 2023). To alleviate these problems, our country proposes that we should actively develop the mixed ownership economy, focus on promoting the mixed reform of state-owned enterprises, and use the best demands of non-state-owned enterprises for Profit maximization to stimulate the innovation vitality of state-owned enterprises. However, in the specific practice of mixed ownership reform, most state-owned enterprises only have the form of mixed and have not undergone substantive reforms. In the process of mixed ownership reform, the goals of various stakeholders are not completely consistent. The first purpose of state-owned shareholders is to fulfill their corporate social responsibilities and political responsibilities in the market. Accordingly, during the course of green innovation, they exhibit a greater willingness to collaborate and engage in dialogue with non-state-owned stakeholders, aiming to embark on the journey of green transformation for their enterprises (Liao et al., 2022). The primary goal of non-state-owned shareholders is to maximize the enterprise’s profit maximization, but the green transformation of enterprises requires a large amount of investment in green technology research and development, and it is difficult for enterprises to obtain reports in the short term, and non-state-owned shareholders are not willing to communicate with state-owned shareholders in the process of green innovation. The exchange of green innovation knowledge between state-owned and non-state-owned enterprises in the process of mixed reform of state-owned enterprises is a dynamic change, and the game behavior of shareholders also determines the potential decision-making and results of green innovation knowledge sharing (Yuan et al., 2021).

The current academic discussion on the mixed ownership of state-owned enterprises mainly revolves around how to carry out mixed ownership. Research (Li, 2014) believes that deepening the reform of state-owned enterprises should first explore a dual track system, granting powers to group subsidiaries, such as board appointment and removal, salary determination, equity incentives, etc. At the same time, executives named by non-state-owned shareholders can overturn the management authority and salary limit set by the administrative department. Research (Xiang, 2018) believes that in the process of mixed ownership reform, it is important to balance the distribution of interests between the executive teams of state-owned enterprises and private enterprises. Research (Qi and Zhang, 2019) believe that the ideal path for the reform of state-owned enterprises in monopolistic industries is effective competition among multiple enterprises, and the reform of mixed ownership should follow the path of state-owned enterprise co governance. In addition, some scholars have studied the impact of mixed ownership reform on innovation performance of state-owned enterprises. Research (Dic et al., 2022) believe that the mixed ownership economy will reshape the innovation capabilities of state-owned enterprises. Through a study of listed companies in China from 2007 to 2018, it was found that the mixed ownership reform significantly increases the innovation advantages of enterprises, especially the state-owned capital holding private enterprises, which improves their innovation autonomy. Research (Zhang et al., 2020), research (Barnabé and Ming, 2020) and research (Wehrheim et al., 2020) have also shown that the institutional advantage of mixed ownership reduces concerns about the risk of innovation behavior in enterprises, greatly improving their innovation capabilities. It is not difficult to find that most scholars believe that after state-owned enterprises introduce private enterprise shareholding, whether it is board appointment or dismissal, salary, or favorable distribution, it is more about the joint operation of state-owned and private enterprises. How to establish a good innovation and entrepreneurship ecology after the mixed reform, achieve knowledge exchange and spillover between state-owned and non-state enterprises, and promote high-quality sustainable development of enterprises is an urgent issue that requires joint attention from academia and industry, in addition to the equity structure.

Regarding the flow and spillover of knowledge, existing research mainly focuses on the knowledge flow generated by collaborative innovation between enterprises and the relationship between knowledge flow outsourcings. Research (Jiang et al., 2016) proposed that partner trust has a positive effect on knowledge acquisition and has different impacts on knowledge leakage. Research (Cheong et al., 2019) studied the relationship between knowledge flow and expatriate purposes under different alliance systems and found that different enterprises have different knowledge flow strategies. Research (Gaur et al., 2019) explored cross-border knowledge flow and proposed a comprehensive knowledge management framework. Research (Rupietta and Backes-Gellner, 2019) explored the emergence of excellent incremental innovation performance based on knowledge creation (KC) systems through knowledge reserves and flow integration. Research (Zhao et al., 2019) established a dynamic system evolution model and analyzed the relationship absorption ability, knowledge potential, and transfer ability of knowledge under different incentive intensities. They found that incentive mechanisms can promote innovation in evolutionary strategic alliances. Research (Li et al., 2019) explored the relationship between knowledge flow, alliances, and clusters in multimedia information, and found that knowledge similarity, complementarity, and spillover are beneficial for the formation of alliances. Research (Zhou and Wu, 2018) used the knowledge flow model in the dynamic Complex network to explore the transmission rate of knowledge in the network. They considered that the average degree of the network, the number of enterprises involved in the transfer and the transmission rate of effective knowledge have a significant impact on the efficiency of knowledge flow. Research (Wensley, 2015) emphasized the value and significance of willingness to share knowledge. The paper explained the willingness to share knowledge from the perspective of a knowledge market, believing that essentially, knowledge sharing can be seen as a knowledge transaction within an enterprise, where participants not only have to pay the cost but also gain some benefits from the transaction. Research (Razak et al., 2016) believed that knowledge sharing is a behavior that actively identifies with the sharing behavior in terms of willingness and is willing to share experience and knowledge with others, helping others solve problems and make decisions, thereby improving work performance and achieving a sense of satisfaction for oneself.

Based on a comprehensive summary of research on mixed ownership enterprises and green innovation knowledge sharing, few scholars have been found to study shareholder behavior games in mixed ownership enterprises, and there are also few studies on the field of knowledge sharing in mixed ownership enterprises. At the same time, existing articles exploring shareholder behavior have conducted less research on green innovation knowledge sharing, Moreover, existing articles on green innovation knowledge sharing mainly focus on the connotation, concept, influencing factors, and mechanism of knowledge sharing, resulting in a lack of connection among mixed ownership, shareholder behavior, and green innovation knowledge sharing research. In this situation, it is necessary to combine the background of China’s mixed ownership reform and the reduce carbon emissions goal, taking energy enterprises that best represent green innovation development as the research object, select listed mixed ownership enterprises as the research object, explore the impact of shareholder behavior decisions on green innovation knowledge sharing, in order to find a decision-making path to improve the innovation ability and knowledge foundation of mixed ownership enterprises in the future high-quality development stage, and provide practical and effective policy recommendations to assist in the implementation of mixed ownership reform.

Existing research on mixed ownership mainly focuses on the necessity and advantages of mixed ownership, mixed forms, corporate governance, and other fields. There is little exploration of the flow and interaction of green innovation knowledge from the perspective of equity structure. Therefore, this article takes energy enterprises as the research object, and from the perspective of equity structure and shareholder roles, constructs a dynamic game model on green innovation knowledge sharing between state-owned and non-state-owned shareholders, exploring the equilibrium and stable state of green innovation knowledge among shareholders in mixed reform state-owned enterprises. Compared with previous researches, the main innovation points of this paper are reflected in the following two aspects, which are: 1) From the perspective of knowledge interaction, analyze the attitude of state-owned and non-state-owned shareholders to green innovation of enterprises, build a dynamic game model of green innovation knowledge sharing among shareholders, analyze the dynamic evolution law of green innovation knowledge sharing in the process of mixed ownership reform of state-owned enterprises, and explore relevant influencing factors and stable Equant. 2) Based on the theory of evolutionary models, the fsQCA method is used to empirically analyze the causal logic relationship of knowledge sharing and test the pathways of relevant influencing factors.

The contributions of this article can be summarized in the following aspects. 1) Enriched the research on green development in the field of mixed transformation of state-owned enterprises. Most scholars study the impact mechanism of mixed reform of state-owned enterprises on green innovation from a macro perspective but overlook the changes in shareholder structure characteristics during the mixed reform process. This article divides shareholders into state-owned and non-state-owned shareholders and explores the dynamic evolution of green innovation knowledge in enterprises at the shareholder level, which to some extent enriches and improves the relevant research content on green innovation knowledge flow in the mixed ownership reform of state-owned enterprises. 2) The combination of qualitative and quantitative analysis has verified the relevant influencing factors of green innovation knowledge sharing between state-owned and non-state-owned shareholders, which not only enriches the theoretical models of green innovation knowledge sharing, but also has been verified in practical practice, greatly enriching the relevant research on the path and mechanism of green innovation knowledge sharing. 3) In order to promote green innovation in mixed transformation enterprises and leverage the leading role of energy enterprises in the national green development transformation, this study systematically studied the influencing factors and mechanisms of knowledge sharing among shareholders. The research results will help provide reasonable suggestions for practice and achieve green innovation development in energy enterprises.

2 Fuzzy set qualitative comparative analysis game framework

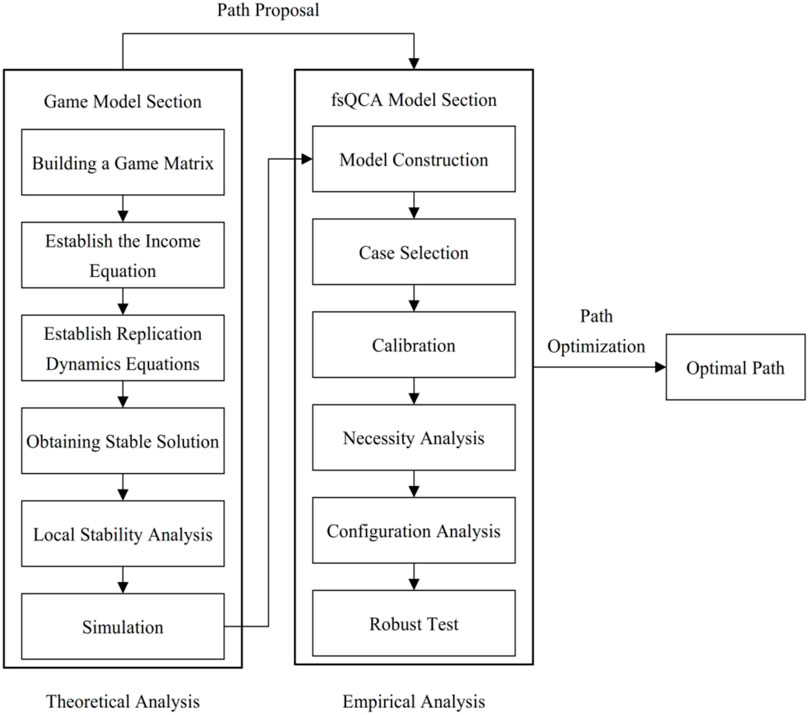

This paper constructs a fuzzy set qualitative comparative analysis game framework for solving optimal strategy formulation methods in complex systems. The framework consists of two main parts, which are the game theory part and the fsQCA part. The game theory part is adopted for theoretical analysis, identifying all possible theoretical paths, and conducting simulation. Specifically, the path here refers to the possible scenarios of all games analyzed from the evolutionary game theory section. fsQCA is employed for empirical analysis to verify and supplement the paths obtained from the game section through real case data. These two parts complement each other with simulation and empirical analysis. The specific process is shown in Figure 1.

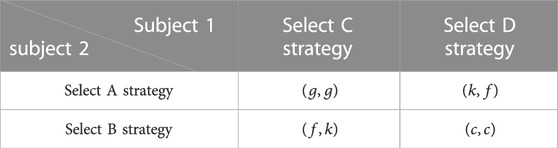

When conducting the game theory section, the first step is usually to construct a game matrix around the benefits of both parties in the game. Due to the diverse types of games, this article takes evolutionary games as an example to construct an evolutionary game model, as shown in Table 1.

Among them,

According to the evolutionary game payment matrix, the respective returns of actor 1 (

According to Formula 1, Formula 2, Formula 3, and Formula 4, the average return can be expressed as:

Based on the concept of evolutionary game, construct a replication dynamic equation of evolutionary game, Obtain the replicated dynamic equation

Through mathematical calculations, it can be concluded that the final form of replicating dynamic equations is:

Make the result of copying the dynamic equation zero and obtain different solutions. Take the derivative of the replicated dynamic equation to obtain the first-order derivative equation of the replicated dynamic equation:

Bring the solution obtained in the above equation to determine whether it is a stable strategy solution.

Construct a Jacobian matrix using Formula 11 and Formula 12 to determine local stability.

The Jacobian matrix is a square matrix, each element of which is a partial derivative, and its function is to describe the local rate of change of a vector function at a certain point. The determinant and trace of the matrix can be obtained:

Then, local stability is tested by comparing the rank of the matrix and the positive and negative traces.

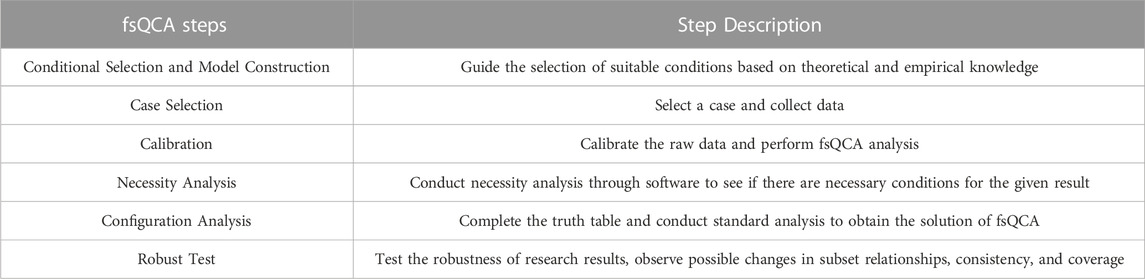

At this point, simulation experiments can be conducted using game models. However, due to the lack of analysis and evidence from examples, the simulation lacks a certain degree of persuasiveness. Therefore, the fsQCA method is introduced to supplement this. The experimental steps of fsQCA are shown in Table 2.

Firstly, clarify the theory of fuzzy sets. Assuming that there are several elements

In Formula 16, 0 represents no inclusion, and 1 represents complete inclusion.

According to the above equation, the complementarity degree function

Based on the above preparation formula, the core formula of fsQCA can be obtained as follows.

The discernment function

The non-membership function

The coverage function

In fsQCA, the coverage function is calculated by combining the membership degrees of different conditions to study the relationship between conditions and their impact on the results.

The advantage of this framework is that it not only includes rigorous theoretical analysis derived from formulas, but also has practical cases to support and analyze, which are interrelated. Moreover, due to the uniqueness of the fsQCA method, this framework is not only suitable for situations with large sample sizes, but also suitable for analysis with small sample sizes, making it more applicable.

3 Game model of mixed ownership reform in state owned energy enterprises

3.1 Basic assumptions and model construction

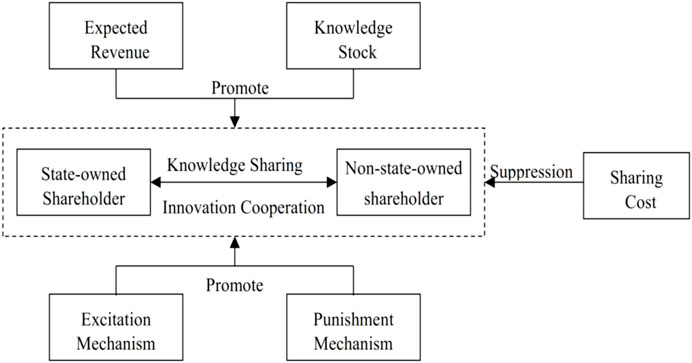

This article takes energy enterprises as the research sample, all enterprises referred to in this article are energy enterprises. In mixed ownership enterprises, “one share dominance” is not conducive to the development of mixed ownership enterprises. This article focuses on discussing the situation of mixed ownership enterprises under competitive equity structures. In this case, in the decision of state-owned and non-state-owned shareholders to share green innovation knowledge, the final decision result is a comprehensive consideration of expected returns, their own knowledge stock, incentive mechanisms, punishment mechanisms, and sharing costs, as shown in Figure 2.

FIGURE 2. Knowledge sharing decision-making mechanism for state-owned and non-state-owned shareholders.

The driving force of green innovation knowledge sharing comes from the excess profits and characteristic benefits formed after the second innovation of knowledge. Therefore, before enterprises decide to share knowledge, they will comprehensively evaluate their own resources (knowledge stock), find suitable cooperative innovation points and knowledge sharing perspectives for both parties, and form a secondary innovation idea based on the innovation knowledge base. At this stage, the more knowledge stock the two companies have, the more likely they are to cooperate successfully, Form secondary innovation. In addition to considering the degree of knowledge matching between both parties and the possibility of secondary innovation, more importantly, the expected benefits generated by green innovation knowledge sharing must exceed the sharing costs. Therefore, for both state-owned and non-state-owned shareholders, if the expected benefits of green innovation knowledge sharing are larger, the sharing costs are smaller, or the benefits are much greater than the sharing costs, enterprises will have sufficient initiative and willingness to share green innovation knowledge.

With the expansion of green innovation knowledge sharing, the relationship between state-owned and non-state-owned shareholders has gradually deepened from equity relations to innovation alliances. The benefits brought by innovation between enterprises continue to increase, and positive benefits continue to emerge. At the same time, government incentive measures provide rewards to enterprises that share green innovation knowledge, greatly strengthening and consolidating the behavior of green innovation knowledge sharing and innovation alliance relationships between enterprises, The positive reinforcement of green innovation knowledge sharing has been formed, and based on government incentive measures, enterprises will actively collect all information including market and internal information, maximize the sharing and sharing of knowledge and information, coordinate all parties to the greatest extent, and complete high-quality and efficient knowledge sharing and collaborative innovation. Of course, although there is an equity relationship after the mixed reform, the controlling and controlled enterprises may adopt different behavioral decisions due to their respective purposes, and may not adopt knowledge sharing, or only one company may choose knowledge sharing. Similarly, under the government’s punishment mechanism, enterprises will consider their punishment costs. When the punishment costs exceed the benefits obtained from not sharing knowledge, the involved enterprises will choose knowledge sharing. The following variables are all related to green innovation, the following sections are abbreviated and do not emphasize green innovation more than their unique features.

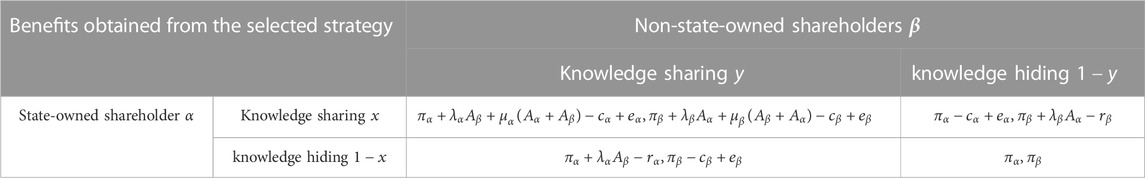

Assumption 1:. In the process of mixed ownership reform, if state-owned and non-state-owned shareholders continuously engage in cooperative activities, there are two strategic options: knowledge sharing and knowledge hiding. Assuming that in the early stages of the game, when state-owned shareholders choose a knowledge sharing strategy, the probability is

Assumption 2:. When state-owned and non-state-owned shareholders do not cooperate with each other and choose knowledge hiding strategies during the mixed ownership reform process, neither party can obtain the additional benefits brought by cooperation. At this point, the additional profits obtained by state-owned and private enterprises are recorded as 0. Therefore, assuming that the game strategy of both parties in the model is {knowledge hiding, knowledge hiding}, the basic benefits of state-owned and non-state-owned shareholders are

Assumption 3:. Assuming that the knowledge stock of both parties during the cooperation process is

Assumption 4:. When either party chooses to cooperate for knowledge sharing, they will incur time costs, energy costs, opportunity costs, etc. In the model, we use

Based on the above assumptions, construct an evolutionary game matrix, as shown in Table 3.

3.2 Evolutionary game analysis of the mixed ownership reform of state-owned shareholders and non-state-owned shareholders in energy enterprises

According to the evolutionary game payment matrix, the expected benefits of knowledge sharing in the process of mixed ownership reform of state-owned shareholders and non-state-owned shareholders are:

The expected benefits of state-owned shareholders and non-state-owned shareholders adopting knowledge hiding strategies are as follows:

According to Formula 21, Formula 22, Formula 23 and Formula 24, the average income of state-owned shareholders and non-state-owned shareholders are:

Therefore, in the process of mixed ownership reform, the replication dynamic equation for collaborative innovation and knowledge sharing between state-owned and non-state-owned shareholders

To obtain a stable strategy for evolutionary games, we need to find the equilibrium point for replicating the dynamic equation, which is equilibrium point

When

When

Therefore, take the derivative of

(a) If

(b) If

Like the above analysis, the same method is now used for analysis. We need to find the equilibrium point for replicating the dynamic equation, which is equilibrium point

When

When

Same as the previous section, take the derivative of

(a) If

(b) If

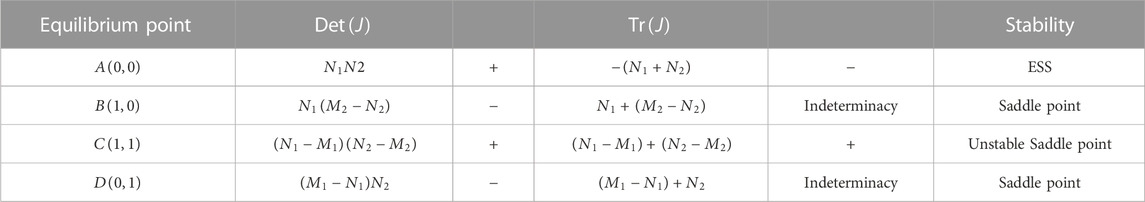

3.3 Discussion on local stability

The above sections separately discuss the ESS of knowledge sharing strategies for non-state-owned and state-owned shareholders in the collaborative innovation process of mixed ownership reform in the organization. However, due to the mutual influence of the knowledge hiding behavior of both parties, and the presence of random disturbance factors in the collaborative innovation process, the knowledge hiding behavior of members is affected. Therefore, this section uses the replication dynamic equation of the two groups of members to obtain the Dynamic equilibrium solution of the knowledge sharing behavior of the two groups of members in the mixed ownership reform innovation cooperation process and analyzes the stability of the balance point through the Jacobian matrix and determinant. The Jacobian matrix and determinant of the evolutionary game model is shown in Equation 31, where the Determinant and trace calculation of each Equant are respectively Equation 32, Eq. 33:

For ease of calculation, we have

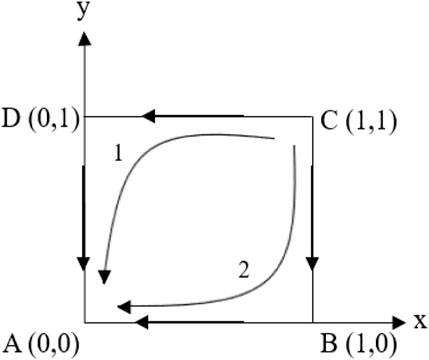

(1) When

According to Table 4, we can get the evolutionary game system of stable strategy. As shown in Figure 3, the evolutionary game system converges to Equant

FIGURE 3. Stability strategy of evolutionary game system when

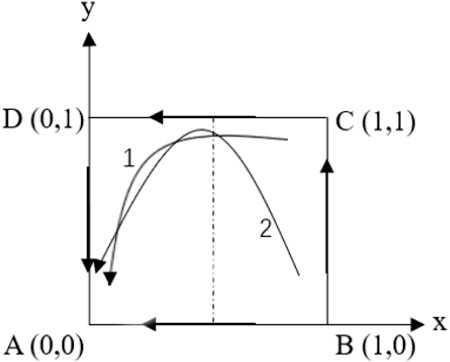

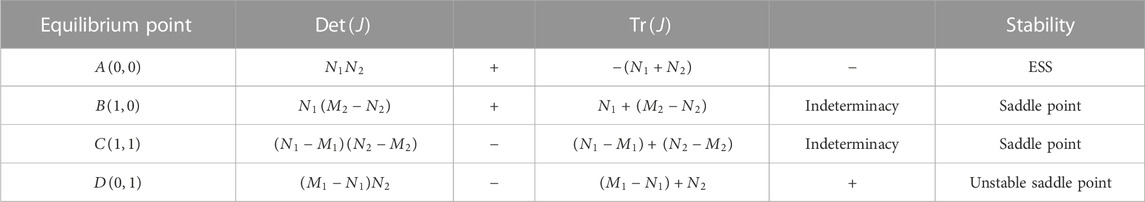

(2) When M1 < N1 and M2 > N2, there are four equilibrium solutions in the equation system between two organizational members, and the stability analysis results of these four equilibrium points are shown in Table 5:

According to Table 5, we can derive the evolutionary game system of two-member stable strategies as shown in Figure 4. The knowledge hiding strategy adopted by state-owned shareholders is superior to the knowledge sharing strategy. However, for non-state-owned shareholders, their enthusiasm for participating in knowledge sharing is influenced by the strategies of state-owned shareholders. When

3) When

According to Table 6, the evolutionary game system of the two stable strategies is shown in Figure 5. The probability of non-state-owned shareholders engaging in knowledge hiding is greater than that of knowledge sharing strategies, and the stable equilibrium strategy of non-state-owned shareholders is to hide knowledge.

FIGURE 5. Stability strategy of evolutionary game system when

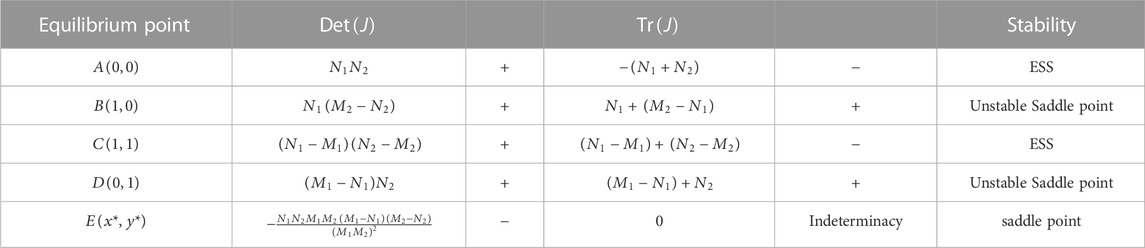

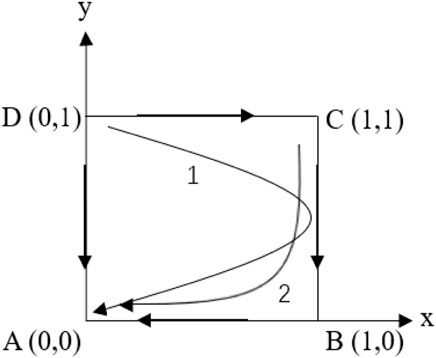

(4) When M1 > N1 and M2 > N2, there are five equilibrium solutions in the dynamic replication equation system between two organizational members: A(0, 0), B(1, 0), C(1, 1), D(0, 1), E(x*, y*), The stability analysis results of the five equilibrium points are shown in Table 7:

However, whether state-owned shareholders adopt knowledge sharing strategies is influenced by the strategies of non-state-owned shareholders. When

The equilibrium strategy of the evolutionary game system between state-owned and non-state-owned shareholders, as shown in Figure 6, has two points:

4 Numerical simulation

The above analysis results indicate that the saddle point and stable equilibrium point are influenced by changes in initial values and related parameters. This section will conduct numerical simulations to analyze the cooperative innovation behavior of state-owned and non-state-owned shareholders in the mixed ownership reform process under the influence of relevant factors. We set the initial parameters as shown in Table 8 and analyze the impact on member equilibrium strategies from several aspects: collaborative benefit coefficient, knowledge sharing cost, knowledge stock, knowledge sharing incentive level, and knowledge hiding penalty level.

4.1 The impact of collaborative benefits

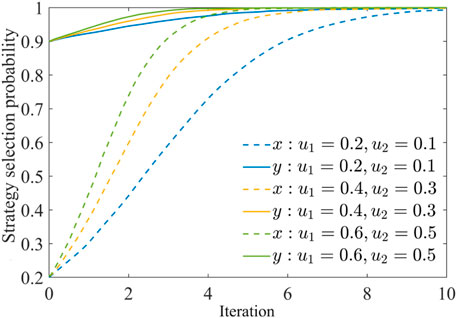

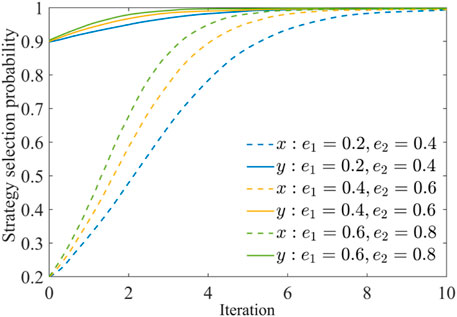

To explore the impact of collaborative benefits on green innovation knowledge sharing behavior among enterprises, the evolutionary game process is analyzed by increasing the value of

4.2 The impact of green innovation knowledge sharing costs

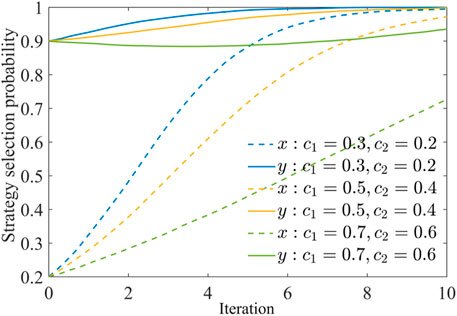

To explore the impact of green innovation knowledge sharing costs on the knowledge sharing strategies of state-owned and non-state-owned shareholders, the evolutionary game process is analyzed by increasing the value of

4.3 The impact of green innovation knowledge stock

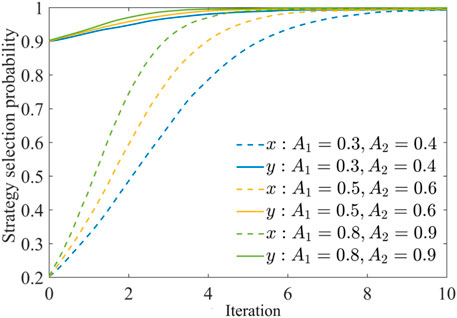

Figure 9 analyzes the impact of the stock level of green innovation knowledge on the sharing behavior of green innovation knowledge among enterprises. When the knowledge stock is small, the equilibrium point gradually converges to

4.4 The impact of incentive levels for green innovation knowledge sharing

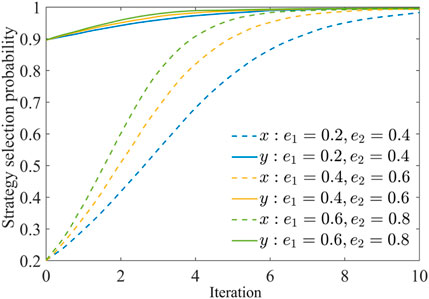

Figure 10 analyzes the impact of green innovation knowledge sharing incentive levels on knowledge sharing behavior among enterprises. When the incentive level is low, the equilibrium point gradually converges to

4.5 The impact of knowledge hiding punishment level

Figure 11 analyzes the impact of knowledge hiding punishment level on knowledge sharing behavior among enterprises. When the punishment level is low, the equilibrium point gradually converges to

Through the above five types of numerical simulation analysis, this article compares the impact of different influencing factors on green innovation knowledge sharing between state-owned and non-state-owned shareholders in the process of innovation cooperation. The results show that four factors, including synergy coefficient, knowledge stock level, knowledge sharing incentive level, and knowledge hiding punishment level, can significantly promote knowledge sharing between state-owned and non-state-owned shareholders, with the larger the value, The higher the probability of choosing knowledge sharing behavior between enterprises, the shorter the time to reach equilibrium steady-state. On the contrary, the increase in knowledge sharing cost hinders the knowledge sharing between the two.

5 Analysis on the path of green innovation knowledge sharing

The above evolutionary modeling results show that whether a mixed-reform enterprise decides to share green innovation knowledge depends on the difference between knowledge sharing cost and benefit, that is, if its knowledge sharing benefit is greater than the knowledge sharing cost. At the same time, the numerical simulation analysis results also show that improving the collaborative income coefficient, knowledge stock level, knowledge sharing incentive level, and reducing the cost of knowledge sharing are conducive to green innovation knowledge sharing in mixed-reform enterprises. However, the previous research did not explain how the expected benefits, sharing costs, knowledge stock, as well as the combination of government incentive and punishment mechanisms, affect the green innovation knowledge sharing between state-owned and non-state-owned shareholders of energy enterprises under mixed ownership reform, that is, what are the paths that drive knowledge sharing between state-owned and non-state-owned shareholders in the context of mixed ownership reform under multiple concurrent conditions.

5.1 Research methods

From the perspective of configuration, this paper analyzes the multiple mechanisms and paths that affect the decision-making of green innovation knowledge sharing of mixed ownership shareholders and uses fuzzy set qualitative comparative analysis to carry out empirical test. Compared with the qualitative comparative analysis of clear sets and the qualitative comparative analysis of multi-value sets, the qualitative comparative analysis of fuzzy sets can better deal with the sample data that cannot be clearly divided according to the standard of “whether belongs to” sets and can also better deal with the problem of partial membership of sample data. So, the fsQCA method is adopted in this paper. At the same time, as far as the research requirements of this paper are concerned, the path research of knowledge sharing decision-making belongs to one effect and multiple causes, and there are multiple concurrent conditional combination variables. fsQCA method can be used to identify the action mechanism of conditional variables internally, reveal the specific ways in which different conditional variables affect the occurrence of outcome variables in the form of combination, and realize the popularization degree of empirical test outwardly. Improve the practical relevance of the theory.

5.1.1 Variable selection

According to the above mechanism analysis and the synthesis of previous research results, this study takes the five variables of expected income, sharing cost, knowledge stock, incentive mechanism and punishment mechanism as the antecedent conditions, and the knowledge sharing as the result variable to carry out a combination analysis.

5.1.2 Result variables

Green innovation knowledge sharing (share). The result variable of this study is whether the enterprise has adopted green innovation knowledge sharing. Therefore, this study investigates whether the mixed-reform enterprise and the shareholder-controlled enterprise have applied for green invention patent cooperation. If the two enterprises have applied for patent jointly, the value of knowledge sharing is 1, and the value of the other value is 0.

5.1.3 Antecedent variables

Expected returns (return). For green innovation knowledge sharing, knowledge sharing parties can form a public technical knowledge pool through knowledge sharing and a platform and network advantage formed by communication and interaction to further carry out secondary innovation. In this case, the expected benefit of green innovation knowledge sharing is that enterprises will increase their own green innovation knowledge output. Therefore, this study uses the number of green patents of enterprises to measure the expected benefits of knowledge sharing.

Share the cost (cost). The dissemination and sharing of knowledge require both the sharer and the receiver to have certain knowledge cognition. Too large knowledge cognition gap will lead to an increase in the cost of green innovation knowledge sharing, and then affect the transfer and output of knowledge. Therefore, in this study, the technology distance between enterprises is used as the proxy variable to measure the sharing cost, and the technology distance is used as the logarithm of the total factor productivity ratio of Frontier enterprises and other enterprises in the previous period of the industry in reference to Research (Bas and Causa, 2013).

Stock of knowledge (shock). The knowledge base of an enterprise will affect the possibility of knowledge sharing. The greater the knowledge stock, the greater the innovation resources, and the easier it is to find suitable cooperative innovation points and green innovation knowledge sharing perspectives. Therefore, this paper uses the number of R&D personnel as a variable to measure the knowledge stock of enterprises.

Incentive mechanism (sti). According to the Research (Lo, 2018), it includes the government’s introduction of a series of tax incentives, subsidies and other policies, and crawler the relevant data of the province where the enterprise is located.

The punishment mechanism (pin). Research (Xu et al., 2016) found that violations disclosed by environmental protection departments have significant punishment effect. This paper conducted crawler screening of ecological violations in the provinces where relevant enterprises are located.

5.1.4 Data sources

This study initially selected energy enterprises that were included in the “Double Hundred Enterprises List” in the reform of state-owned shareholders as research samples, while excluding subsidiaries and controlling shareholder companies that were included in the list and enterprises with severe data deficiencies. Finally, 26 state-owned shareholders participating in the mixed reform in 2021 were selected as the samples for this study. The data used in this article are all from CSMAR Database.

5.2 Result analysis base on fsQCA

5.2.1 Variable calibration

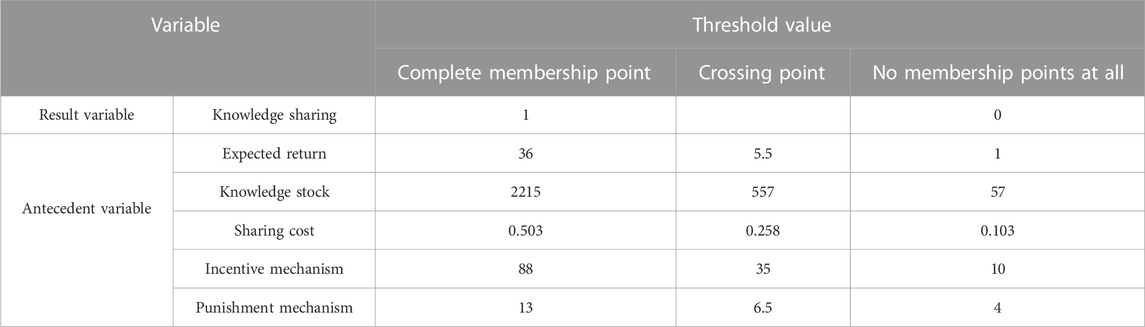

The fsQCA method needs to calibrate the measured variables and convert the absolute number of the result variables and result variables into the fuzzy set membership degree of the corresponding conditions and results. The commonly used calibration methods include direct assignment, direct calibration, and indirect calibration. With reference to the study of Research (Ma and Hou, 2019), the direct calibration method is adopted in this paper to convert the data into membership scores of fuzzy sets, and the full membership points, crossing points and incomplete membership points are 95%, 50% and 5% quantiles of each conditional variable, respectively. Considering the outcome variable of this study, green innovation knowledge sharing is a binary construct that does not require additional calibration. Calibrate using the Calibrate feature in fsQCA3.0 software. The calibration table of specific variables is shown in Table 9.

5.2.2 Univariate necessary condition analysis

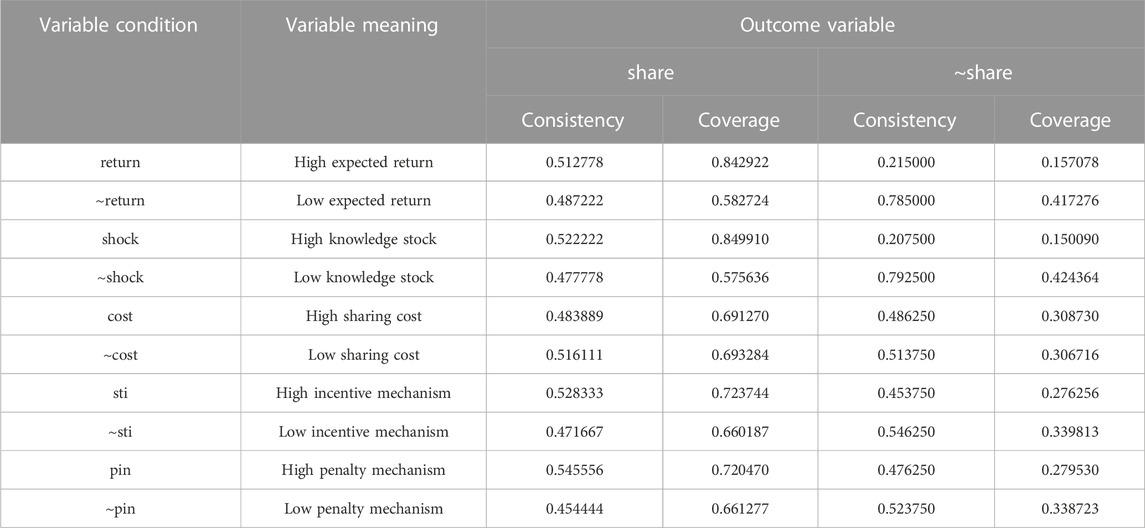

Before conducting configuration analysis, it is first necessary to check whether a particular antecedent condition can be used as one of several paths to compose the result. Therefore, in this part, from the two aspects of consistency and coverage, whether a single condition, that is, increase in expected income, increase in knowledge stock, increase in sharing cost, increase in incentive mechanism, increase in punishment mechanism, and result variable knowledge score constitute sufficient or necessary conditions, the results are shown in Table 10.

From the data in Table 10, it is necessary to analyze a single variable when the result of knowledge sharing exists. The results show that the consistency indicators of the five single conditions are all lower than the critical value (0.9) that constitute the necessary conditions. Moreover, the consistency indicators of each single variable and the coverage indicators of each variable indicate that they have a certain degree of explanation for the generation of results, but they cannot clearly and effectively explain the occurrence conditions when knowledge sharing is taken. This result shows the complexity of green innovation knowledge sharing decision, all factors must be simultaneously linked to make shareholders choose green innovation knowledge sharing. Similarly, the necessity analysis of a single variable when the result of not adopting knowledge sharing exists still finds that the consistency indicators of the five single conditions are all lower than the critical value (0.9) that constitutes the necessary condition, which cannot constitute the necessary condition for not adopting knowledge sharing of green innovation. Through the analysis of consistency and coverage, it is found that whether to adopt green innovation knowledge sharing is determined by many factors, not by a single factor. Therefore, it is necessary to analyze the concurrent linkage effect of comprehensive multi-complex conditions.

5.2.3 Condition combination analysis

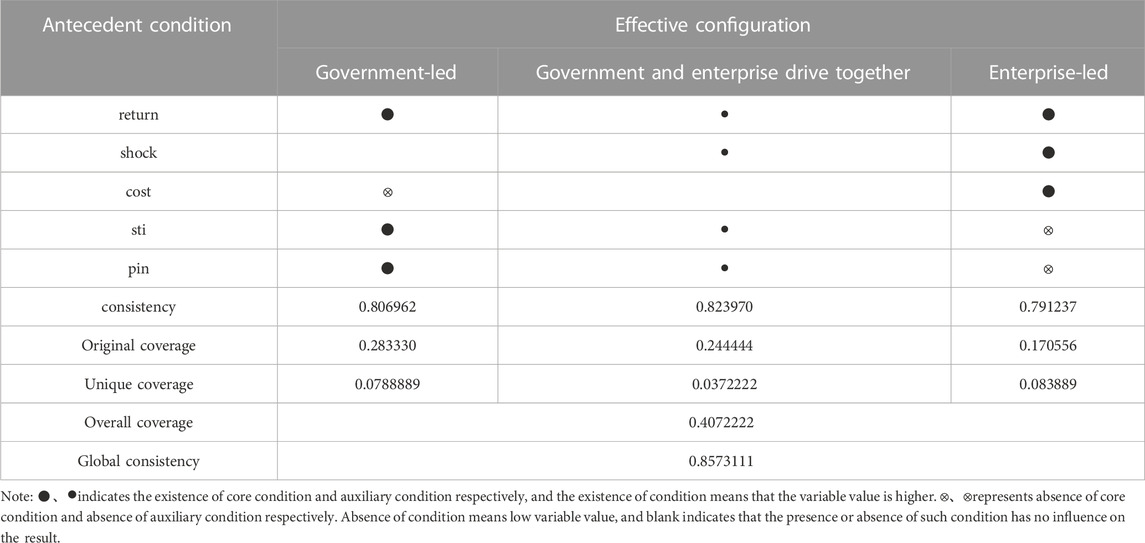

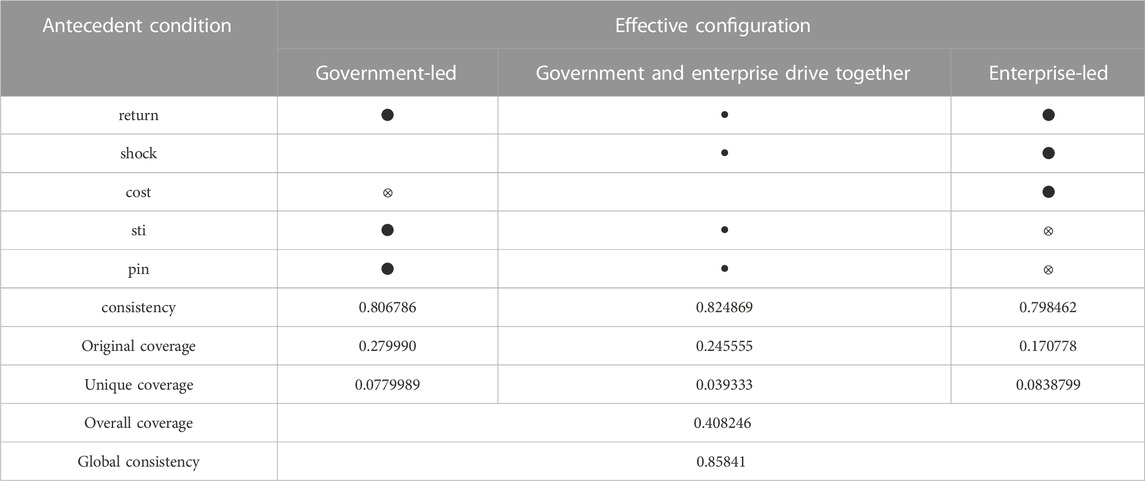

Through univariate necessity analysis, it is determined that no single antecedent condition can explain the outcome variable of green innovation knowledge sharing alone, but a combination of multiple conditional variables is needed to obtain several conditional configurations (multi-factor combination). Therefore, this study further carried out conditional combination analysis on 5 conditional variables to obtain different conditional configurations. This process is generally completed through three steps: constructing truth table, perfecting truth table, and analyzing true index. Among them, case frequency, original consistency score and PRI consistency score are the keys to construct a perfect truth table. Considering the small sample size, the case frequency is set to 1, referring to research (Schneide and Wagemann, 2012), the original consistency threshold and PRI critical value are both set to 0.75. Table 11 is a table of configuration analysis results of detailed green innovation knowledge sharing, where consistency indicates the lowest actual number in the configuration greater than the set consistency threshold; original coverage rate indicates the degree to which the configuration explains green innovation knowledge sharing; unique coverage rate indicates the degree to which the configuration uniquely explains the result; and overall coverage rate indicates the degree to which the overall configuration explains green innovation knowledge sharing. The global consistency indicates the degree of subset relation.

As can be seen from Table 11, three conditional configurations leading to green innovation knowledge sharing are obtained in this study, which are government-led, government-enterprise co-driven, and enterprise-led respectively. It is not difficult to find that the effective conditional configuration obtained in this study can explain 40.722% of green innovation knowledge sharing cases, and the overall coverage rate is 0.857, indicating that 85.731% of all cases meeting the three conditional configurations show green innovation knowledge sharing.

Green innovation knowledge sharing under the government’s leadership. The conditional configuration shows that high expected benefit, non-high sharing cost, high incentive mechanism and high punishment mechanism can lead to green innovation knowledge sharing. Under this path, knowledge sharing of green innovation is mainly subject to strong and effective incentives and penalties from the government. At the same time, under such strong incentives and penalties, enterprises feel that the expected benefits of knowledge sharing of green innovation are extremely high, and only the polar sharing cost can lead to the successful sharing of green innovation knowledge. A typical case is Zhongyuan Environmental Protection Co., LTD. (hereinafter referred to as Zhongyuan Environmental Protection). According to the original data, Zhongyuan Environmental Protection has been committed to the innovation of green technology for a long time. At the same time, Henan Province, where the company is located, has issued a lot of low-carbon and emission reduction policies to promote green innovation of enterprises from two aspects of incentive and punishment. From 2018 to 2021, Zhongyuan Environmental Protection has applied for cooperative patents with shareholder companies. This paper is consistent with the typical characteristics of green innovation knowledge sharing under the leadership of the government.

Knowledge sharing for green innovation driven by government and enterprises. The conditional configuration shows that the four auxiliary conditions of expected benefit, knowledge stock, incentive mechanism and punishment mechanism exist at the same time, which can lead to green innovation knowledge sharing. Under this path, green innovation knowledge sharing is mainly driven by the government and enterprises. Although there is no strong incentive policy or punishment policy to force enterprises to share green innovation knowledge, only if enterprises themselves are willing to share knowledge and their knowledge stock is adequate can green innovation knowledge sharing be successful. A typical case is Hainan Natural Rubber Industry Group Co., LTD. (hereinafter referred to as Hainan Rubber). According to the original data, although Hainan Province, where Hainan Rubber is located, has not promulgated many low-carbon and emission-reduction policies, the expected benefits of Hainan Rubber’s own knowledge base and green innovation knowledge sharing are reasonable, meeting the needs of high-quality development of the rubber industry in the new era. This paper conforms to the typical characteristics of green innovation knowledge sharing driven by the government and enterprises.

Green innovation knowledge sharing under enterprise-led mode. The conditional configuration shows that high expected income, high knowledge stock, high sharing cost, and the absence of government incentive mechanism and punishment incentive can lead to green innovation knowledge sharing. Under this path, knowledge sharing of green innovation mainly involves enterprises matching and searching innovation resources based on their own knowledge stock. In the case of high expected benefits from knowledge sharing, it can still lead to successful sharing of green innovation knowledge despite the premise of high-risk cost. A typical case is NAURA Technology Group Co., LTD. (hereinafter referred to as NAURA). According to the original data, NAURA, as an advanced enterprise of high-end IC process equipment in China, has a strong R & D and design capability, which is matched by its own high knowledge stock. In this case, the expected benefits of successful knowledge sharing between the two parties are huge, despite the uncertainties such as high sharing cost and high risk. However, driven by the dominant factors of the enterprise’s own factors, it can also lead to the successful sharing of green innovation knowledge.

Drawing on the idea of Research (White et al., 2021) to improve the PRI consistency for robustness test, this paper further refers to research (Lewellyn and Muller-Kahle, 2022) to adjust the PRI consistency to 0.76, and then conduct robustness test. The results are shown in Table 9. Comparing the data in Table 12 and Table 9, it is not difficult to find that the robustness test results of this paper only change the cost from the core missing condition to the edge missing condition in the government-led path configuration, and the other configuration types do not change, and the consistency and coverage are only slightly changed, so the results of this study are relatively robust.

6 Research conclusion and countermeasures

Based on the research on the strategy of green innovation knowledge sharing between state-owned shareholders and non-state-owned shareholders under the background of mixed ownership reform, this paper draws the following conclusions: 1) In the process of determining knowledge sharing, the choice of knowledge sharing or knowledge hiding under the influence of factors such as expected benefit, cost and reward of knowledge sharing depends on whether the benefit brought by knowledge sharing is greater than the cost generated by both parties. When the benefit is greater than the cost paid, the result of the game may be stable in that both parties adopt the strategy of knowledge sharing. On the contrary, when the benefit is less than the cost, enterprises tend to adopt a conservative attitude and choose the strategy of knowledge hiding. 2) Under the background of mixed ownership reform, the coefficient of collaborative benefit, the level of knowledge stock, the level of incentive for knowledge sharing and the level of punishment for knowledge hiding significantly affect the strategy choice of enterprises in knowledge sharing, improve the coefficient of collaborative benefit, the level of knowledge stock, the level of incentive for knowledge sharing and the level of punishment for knowledge hiding, and reduce the cost of knowledge sharing at the same time. It can promote state-owned shareholders and non-state-owned shareholders to choose knowledge sharing strategies and promote knowledge sharing and exchange. 3) The five conditions of knowledge sharing, such as expected benefit, sharing cost, knowledge stock, incentive level and punishment level, cannot constitute sufficient or necessary conditions for green innovation knowledge sharing alone. Only the combination of multiple conditions into three paths, including government-led, government-enterprise co-driven and enterprise-led, can green innovation knowledge sharing be realized. Among them, improving expected income, strengthening government incentive and government punishment mechanism as the core existing conditions, and sharing cost as the core missing conditions constitute the government-led green innovation knowledge sharing path. The knowledge sharing path of green innovation driven by government and enterprises is composed of expected income, knowledge stock, government incentives and punishment incentives. With expected income, knowledge stock and sharing cost as the core existing conditions, and government incentive and punishment mechanism as the auxiliary missing conditions, the green innovation knowledge sharing path under the leadership of enterprises is formed.

Based on this, this paper puts forward the following countermeasures and suggestions on strengthening knowledge sharing between state-owned shareholders and non-state-owned shareholders:

First, improve the stock of enterprise knowledge and consolidate the fundamentals of knowledge sharing. In the process of mixed reform, both state-owned enterprises and non-state-owned enterprises should continuously improve their knowledge stock by imitating and learning, improving the flow of human capital, and paying attention to their own innovation and research and development. Knowledge stock determines the possibility of knowledge sharing and cooperation among enterprises to a great extent.

The second is to establish incentive and punishment mechanisms to consolidate and promote green innovation knowledge sharing at a larger level among enterprises. Whether enterprises choose knowledge sharing or not often depends on the difference between expected benefits and costs. Therefore, a sound incentive and promotion mechanism should be established to promote enterprises to share green innovation knowledge by increasing their own sharing rewards and taking appropriate subsidies for green innovation knowledge with large benefits but high sharing costs. We should continuously raise the level of punishment and supervision, severely investigate, and punish behaviors that hinder knowledge sharing, realize efficient sharing and spillover of knowledge among enterprise entities, create a good environment for fair competition and free cooperation, avoid free riding and opportunism in the process of green innovation knowledge sharing, and provide a good institutional environment as far as possible.

The third is to rationally choose knowledge sharing paths according to different subject types to promote the successful sharing of green innovation knowledge. For enterprises with weak demand for knowledge sharing, the government should promulgate more severe punishment mechanism and improve incentive mechanism after comprehensive consideration. For the enterprises with their own knowledge sharing needs, the government can adopt more attractive incentive mechanisms and lenient punishment incentives. At the same time, for the enterprises with strong knowledge sharing needs, the government should not intervene in this aspect.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

ZW: Conceptualization, Data curation, Formal Analysis, Investigation, Methodology, Project administration, Software, Supervision, Writing–original draft, Writing–review and editing. YY: Funding acquisition, Resources, Validation, Visualization, Data curation, Formal Analysis, Methodology, Project administration, Writing–review and editing.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Barnabé, W., and Ming, H. (2020). Technical efficiency and technology gap of the manufacturing industry in China: does firm ownership matter? World Dev. 127, 104769. doi:10.1016/j.worlddev.2019.104769

Bas, M., and Causa, O. (2013). Trade and product market policies in upstream sectors and productivity in downstream sectors: firm-level evidence from China. Post-Print 41 (3), 843–862. doi:10.1016/j.jce.2013.01.010

Cheong, A., Sandhu, M. S., Edwards, R., and Poon, W. C. (2019). Subsidiary knowledge flow strategies and purpose of expatriate assignments. Int. Bus. Rev. 28 (3), 450–462. doi:10.1016/j.ibusrev.2018.11.004

Dic, L., Ling, G., and Lin, Y. C. (2022). State ownership and innovations: lessons from the mixed-ownership reforms of China's listed companies. Struct. Change Econ. Dyn. 60, 302–314. doi:10.1016/j.strueco.2021.12.002

Gaur, A. S., Ma, H., and Ge, B. (2019). MNC strategy, knowledge transfer context, and knowledge flow in MNEs. Knowl. Manage. 23 (9), 1885–1900. doi:10.1108/jkm-08-2018-0476

Hao, X., Wen, S., Sun, Q., Irfan, M., Wu, H., and Hao, Y. (2023). How does the target of green innovation for cleaner production change in management process? Quality targeting and link targeting. Environ. Manage 22 (345), 118832. doi:10.1016/j.jenvman.2023.118832

Jiang, X., Bao, Y., Xie, Y., and Gao, S. (2016). Partner trustworthiness, knowledge flow in strategic alliances, and firm competitiveness: A contingency perspective. Bus. Res. 69 (2), 804–814. doi:10.1016/j.jbusres.2015.07.009

Lan, W., and Mao, L. Q. (2020). “State-owned enterprises participation in private enterprises and innovation investment – based on the moderating effect of government subsidies,” in 2020 2ND INTERNATIONAL CONFERENCE ON ECONOMIC MANAGEMENT, Chongqing, China, 20-22 November 2020.

Lewellyn, K. B., and Muller-Kahle, M. I. (2022). A configurational exploration of how female and male CEOs influence their compensation. J. Manag. 48 (7), 2031–2074. doi:10.1177/01492063211027225

Li, W. (2014). Deepen the reform of state-owned enterprises and develop mixed ownership. Nankai Bus. Rev. 3 (1).

Li, Z., Wang, Z., Liu, C., and Jiang, Z. (2019). The knowledge flow analysis on multimedia information using evolutionary game model. Multimed. Tools Appl. 78 (1), 965–994. doi:10.1007/s11042-018-6025-2

Liao, H. W., Wang, D. Q., Zhu, L., and Zhao, J. (2022). Equity reform and high-quality development of state-owned enterprises: evidence from China in the new era. Front. Psychol. 13, 913672. doi:10.3389/fpsyg.2022.913672

Lo, L. (2018). Understanding knowledge flow dynamics during the pre-implementation phase of an enterprise resource planning project. Conf. Syst. Sci., 4400–4409. doi:10.24251/HICSS.2018.554

Ma, H., and Hou, G. (2019). Dependence and the innovation and upgrading of state-owned enterprises’ innovation: an empirical research based on manufacturing industry. Shanghai Univ. Finance Econ. 21 (2), 30–45. doi:10.16538/j.cnki.jsufe.2019.02.003

Peng, X. Y., Zou, X. Y., Zhao, X. X., and Chang, C. P. (2022). How does economic policy uncertainty affect green innovation? Technol. Econ. Dev. Econ. 29 (1), 114–140. doi:10.3846/tede.2022.17760

Qi, Y., and Zhang, R. (2019). How to start the reform of state-owned enterprises in the new era? Based on the perspective of overall design and path coordination. Manage. World 35, 17–30. doi:10.19744/j.cnki.11-1235/f.2019.0032

Razak, N. A., Pangil, F., M Zin, M. L., M Yunus, N. A., and Asnawi, N. H. (2016). Theories of knowledge sharing behavior in business strategy. Procedia Econ. Finance 37 (37), 545–553. doi:10.1016/s2212-5671(16)30163-0

Rupietta, C., and Backes-Gellner, U. (2019). Combining knowledge stock and knowledge flow to generate superior incremental innovation performance—evidence from Swiss manufacturing. Bus. Res. 94, 209–222. doi:10.1016/j.jbusres.2017.04.003

Schneide, C. Q., and Wagemann, C. (2012). Set-theoretic methods for the social sciences: A guide to qualitative comparative analysis. Cambridge: Cambridge University Press.

Wang, L., Gu, Y., Sha, L., and Guo, F. (2023). How does finch affect green innovation of Chinese heavily polluting enterprises? The mediating role of energy poverty. Environ. Sci. Pollut. Res. 30 (24), 65041–65058. doi:10.1007/s11356-023-26929-y

Wehrheim, D., Dalay, H. D., Fosfuri, A., and Helmers, C. (2020). How mixed ownership affects decision making in turbulent times: evidence from the digital revolution in telecommunications. J. Corp. Finance 64, 101626. doi:10.1016/j.jcorpfin.2020.101626

Wensley, A. (2015). Book review:working knowledge: how organizations manage what they know. Thomas H. Davenport and Laurence Prusak. Harvard Business School Press, 1998. $29.95US. ISBN 0-87584-655-6. Knowl. Process Manag. 5 (1), 65–66. doi:10.1002/(sici)1099-1441(199803)5:1<65:aid-kpm15>3.0.co;2-9

White, L., Lockett, A., Currie, G., and Hayton, J. (2021). Hybrid Context, Management practices and organizational performance: A configurational approach. J. Manag. Stud. 58 (3), 718–748. doi:10.1111/joms.12609

Xiang, A. (2018). Relaunch a new round of substantial and strong state-owned enterprise reforms—Commemorating 40 years of state-owned enterprise reform. Manage. World 34, 95–104. doi:10.19744/j.cnki.11-1235/f.2018.10.009

Xu, X. D., Zeng, S. X., Zou, H. L., and Shi, J. J. (2016). The impact of corporate environmental violation on shareholders' wealth: a perspective taken from media coverage. Bus. Strategy Environ. 25 (2), 73–91. doi:10.1002/bse.1858

Yuan, R., Li, C. L., Sun, X. R., and Khaliq, N. (2023). Mixed-ownership reform and strategic choice of Chinese state-owned enterprises. PLOS ONE 18 (4), e0284722. doi:10.1371/journal.pone.0284722

Yuan, R. S., Li, C. L., Li, N., Khan, M. A., Sun, X. R., and Khaliq, N. (2021). Can mixed-ownership reform drive the green transformation of SOEs? Energies 14 (10), 2964. doi:10.3390/en14102964

Zhang, X. Q., Yu, M. Q., and Chen, G. Q. (2020). Does mixed-ownership reform improve SOEs' innovation? Evidence from state ownership. China Econ. Rev. 61, 101450. doi:10.1016/j.chieco.2020.101450

Zhao, J., Dong, L., and Xi, X. (2019). Research on the strategic alliance innovation system evolution mechanism: the perspective of knowledge flow. Clust. Comput. 22 (S4), 9209–9227. doi:10.1007/s10586-018-2113-3

Keywords: mixed ownership reform, knowledge sharing strategy, evolutionary game theory, energy enterprises, state-owned shareholders, non-state-owned shareholders

Citation: Wang Z and Yang Y (2023) Analysing influence of shareholder decision on green innovation knowledge sharing by fuzzy set qualitative comparative analysis combined evolutionary game theory. Front. Energy Res. 11:1271792. doi: 10.3389/fenrg.2023.1271792

Received: 02 August 2023; Accepted: 11 September 2023;

Published: 25 September 2023.

Edited by:

Ziwei Zhou, Huazhong Agricultural University, ChinaReviewed by:

Wan Qian, Hubei University of Technology, ChinaMengshi Li, South China University of Technology, China

Copyright © 2023 Wang and Yang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yuqi Yang, WWFuZ1l1cWk5Nzk5QDE2My5jb20=

Zhenqing Wang

Zhenqing Wang Yuqi Yang

Yuqi Yang