- 1College of International Economics and Trade, Ningbo University of Finance and Economics, Ningbo, China

- 2Ningbo Philosophy and Social Science Key Research Base “Regional Open Cooperation and Free Trade Zone Research Base”, Ningbo, China

- 3Climate Change and Energy Economics Study Center, Wuhan University, Wuhan, China

Whether green credit promotes heavily polluting enterprises’ energy efficiency is indeed of great practical significance for China to early achieve the “double carbon” goal. This paper uses the green credit guideline issued in 2012 as a natural experiment drawing on the relevant data of Chinese listed enterprises from 2009 to 2020. It adopts a difference-in-differences model to assess the effect of green credit guideline on energy efficiency. The research finds green credit guideline improve the energy efficiency level of pilot enterprises by 0.0141 compared to non-pilot enterprises, and green credit guideline can improve energy efficiency by encouraging enterprises to increase research and development investment. Further, trade credit promotes the positive impact of green credit guideline on the energy efficiency. Moreover, green credit guideline plays a role in stimulating energy efficiency in enterprises in regions with high marketization degree, enterprises with high liquidity ratio and state-owned enterprises.

1 Introduction

Several countries have been sacrificing the environment for economic benefits to achieve rapid economic development in the short term. China has been no exception. In the early stage of economic construction, China paid special attention to the development of heavy industry. It failed to take into account the detrimental impacts on the environment and ignored the importance of environmental protection and sustainable development. A consequence, China’s carbon emissions are huge due to its heavy reliance on an extensive economic development model. In 2021, China’s carbon emissions have rose sharply to 12.04 billion tons, accounting for nearly 30% of the world’s total carbon emissions (IEA, 2022). In order to address environmental and climate problems, Chinese has adopted a number of environmental regulation (ER) measures. Green finance is an important part of ER (Li et al., 2022). The Chinese 14th Five-Year Plan calls for building a green development policy system and vigorously developing green finance. At the Chinese Central Economic Work Conference at the end of 2021, it was emphasized that financial institutions should be guided to increase their support for green development. As an important part of green finance, the green credit policy is essentially based on the environmental risks of the production and operation of enterprises as an important basis for loan issuance, thereby forming credit restrictions on heavily polluting enterprises, guiding funds to flow to green enterprises, and forcing polluting enterprises to transform and upgrade in the direction of high-quality development (Dong et al., 2020). The China Banking Regulatory Commission (CBRC) issued the green credit guideline (GCG) to develop special credit guidelines for heavily polluting industries in 2012. After 2012, the scale of green credit in China’s banking industry has shown an obvious growth trend in general. The growth rate of green credit scale has also remained above 14% all the year round. By 2021, the balance of green credit has exceeded 15 trillion.

China’s coal energy consumption has generated a large number of emissions of pollutants such as sulfur dioxide. At present, the problem of environmental pollution has seriously affected people’s daily life and has become the focus of attention of all social circles. The extensive development model with long-term high investment and energy consumption also consumes a large amount of energy, which makes the contradiction between energy supply and demand increasingly prominent (Jiang et al., 2022; Wen et al., 2022). Adopting reasonable and effective environmental governance policies to improve energy efficiency and environmental quality of enterprises is an important issue faced by China’s high-quality economic development (Carolyn, 2017; Natalia, 2019; Wang and Li, 2021). The GCG’s implementation will increase the financing pressure of enterprises, affect their normal business activities, and force them to make green transformation. Improving energy efficiency is the key to achieving the goals of carbon peak and carbon neutral. GCG aims to guide the Investment funds to the ecological environment industry. It helps to promote the progress of green technology and the ecologicalization of industrial structure. Ultimately it has an important impact on improving energy efficiency. Therefore, vigorously developing green credit will help promote traditional industries to reduce carbon emissions and improve production efficiency. The development of GCG is also the core of China’s economic and social low-carbon transformation. As an important participant in our country’s economy, the sustainable growth of enterprises in the future is related to our country’s economic development and residents’ employment (Jiang et al., 2023). Considering that the implementation of the GCG is affected by many restrictive factors such as the imperfect corporate environmental information disclosure mechanism and the imperfect legal and regulatory system, whether the GCG can have a substantial impact on the future energy efficiency of enterprises? It remains to be analyzed and demonstrated. Few studies have conducted an in-depth analysis of the relationship between GCG and energy efficiency, so it is necessary to further study the impact of GCG on energy efficiency, as well as its mechanism.

The exogenous shock of the implement of the GCG provides a quasi-natural experiment, based on which we construct a DID specification to investigate the causal relationship between GCG and energy efficiency, as well as its impact mechanism. The study’s findings show that compared with non-green credit restrictive enterprises, the implementation of GCG promotes the energy efficiency of green credit restrictive enterprises. GCG can improve the energy efficiency of heavily polluting enterprises by increasing R&D investment. In addition, trade credit promotes the positive impact of GCG on the energy efficiency.

Our marginal contributions are as follows. 1) We use the energy consumption data at the level of listed companies for the first time to empirically study the impact of GCG on energy efficiency. This way expands the impact of green finance on energy efficiency from the macro regional level to the micro enterprise level. To some extent, we have supplemented the deficiencies of the existing research in the analysis of the transmission mechanism of GCG at the micro level. We have also filled the research gap in the field of green finance and energy efficiency. 2) Trade credit, as an alternative financing method of bank loans, is rarely studied in the same framework as GCG, trade credit, and energy efficiency. We investigate the moderating effect of trade credit on GCG and energy efficiency to test the policy effect of GCG when heavily polluting enterprises have alternative financing. The research enriches the existing studies on the micro-effectiveness of green credit policies. 3) We discuss the differential impact of GCG on energy efficiency on the basis of the marketization level, enterprise ownership, and liquidity ratio. Then, targeted suggestions for Chinese industrial enterprises to improve energy efficiency are provided.

2 Policy background

Green credit is the earliest Chinese green financial product launched. To mitigate the environmental problems caused by the blind development of highly polluting enterprises, in 2007, CBRC propose that environmental protection departments and financial institutions should cooperate with each other to strengthen environmental supervision and management on credit granting standards. Banks are not allowed to provide credit support to enterprises whose environmental protection facilities are not up to standard or whose environmental governance is not up to standard. Financial institutions must implement differentiated credit restriction policies for pollution projects that have been completed and cannot be rectified, pollution projects with controllable risks and can be rectified, and new pollution projects. This policy is generally seen as the beginning of the construction of a GCG.

The GCG formulated by the CBRC in 2012 provide guidance on the organization, process management, evaluation standards, and other aspects of green credit. It requires banks to clarify the direction in which green credit should be supported in, and strengthen the implementation of differentiated credit management systems for restricted projects and industry enterprises with significant environmental risks. The GCG includes the following key points: First, use credit thresholds and interest rate differences to implement differentiated credit policies for polluting and green enterprises, thereby forming a constraint mechanism for polluting enterprises and an incentive mechanism for green enterprises; The second is to establish and improve the evaluation index system for the implementation of green credit in banks, and promote the implementation of GCG; Third, improve the green credit statistical system of banks to provide quantitative basis for banks to formulate GCG and innovate green credit products.

Before the implementation of the GCG, although green credit’s scale was showing a gradual increase, but the growth was relatively slow. In 2011, the scale of green credit only increased by 0.895 trillion yuan from 2008. After the implementation of the GCG, green credit’s has grown at an annual growth rate of 14%. This reflects the rapid expansion of the scale of green credit after the issuance of the GCG, indicating that relevant banking and financial institutions are seriously implementing this policy and promoting the development of environmental protection through credit. Similarly, the policy also requires banks to impose credit restrictions on heavily polluting enterprises, whose development will be greatly affected by the policy.

3 Literature review and research hypothesis

3.1 Literature review

3.1.1 Research on green credit

Two kinds of literature are closely related to research questions. The first kind’ of literature mainly studied the connotation and impact effects of green credit. When defining green credit, Labatt and Maclaren (1998) believed that green credit is ER in which the government uses financial tools to govern environmental problems. Claessens and Laeven (2004) believed that green credit could combine ER with bank credit. Thus, it not only could use financial instruments to mitigate environmental risks but also could enhance the business performance of commercial banks. Ultimately, their competitiveness could be improved. Green credit could encourage borrowers to engage in green investment activities by guiding currency funds. An et al. (2021) compared the difference between green credit and traditional credit. They found that traditional credit is a credit fund allocation that focuses on economic benefits, whereas green credit is a credit fund allocation that focuses on environmental benefits. The two are the same in essence, but their essential connotation and policy objectives differ.

The impact of green credit on the social macro economy has been studied by the existing literature. Nandy and Lodh (2012) found that green credit require commercial banks to attach importance to factors such as resources and resource protection, and pay attention to factors such as pollutant emission control and environmental protection when granting loans. He et al. (2019) discussed the theoretical significance of China’s green credit policy, which strictly restricts high pollution and high emission enterprises, and effectively promotes the transformation to a low energy consumption and low emission industrial structure. Xing et al. (2020) found that GCG can significantly reduce the credit risk of commercial banks. The expansion of the scale of green credit in commercial banks can improve the operational efficiency of commercial banks (Yang and Zhang, 2022).

To better support sustainable economic development, green credit needs the support of micro enterprise entities. With the active participation and transformation of micro entities can the implementation and practice of relevant policies be effectively carried out. Based on which, existing research has conducted a wealth of research on the micro impact of GCG. Liu et al. (2019) evaluated the implementation effect of GCG and found that GCG can better inhibit the investment of highly polluting enterprises, which can guide the transformation of industrial structure. In addition, Chen et al. (2022) found that GCG only affects short-term financing borrowings of enterprises, while banks and other financial institutions still pay attention to the repayment ability of enterprises for long-term borrowings. Due to the high interest rate of long-term loans, the increase in the financing cost of green credit for enterprises will reduce the credit support of financial institutions such as banks for enterprises (Zhang et al., 2022). Scholars have also paid attention to whether GCG can bring positive environmental effects. GCG can internalize the external costs of highly pollution enterprises, enable them to make environmentally sound and social decisions, and ultimately reduce the negative external effects (Wen et al., 2021; Zhou et al., 2023a). GCG can force enterprises to increase investment in research and development to carry out innovative activities through differentiated loan rates (Wang et al., 2022), thereby reducing pollution emissions (Guo et al., 2022).

3.1.2 The impact of ER on energy efficiency

The second kind of literature investigated the impact of ER on energy efficiency. Anderson et al. (2010) found that carbon trading can improve environmental innovation and energy efficiency in pilot areas. Based on national panel data of seven major economies in the world, Roula (2017) found that R&D investment is conducive to promoting energy efficiency under the influence of environmental policies. Curtis and Lee (2019) found that ER can significantly positively impact total factor energy efficiency. Dirckinck-Holmfeld (2015) found that the Danish government’s environmental permit is relatively vague and cannot effectively improve energy efficiency. Xie et al. (2017) studied the effect of ER measures on total factor energy efficiency in the industrial sector and found a nonlinear relationship between command control ER and total factor energy efficiency. Scholars have also explored the effect of green finance on energy efficiency based on the data of Chinese provinces or cities, and found that green finance can promote the improvement of energy efficiency (Zhou and Qi, 2022; Zhou et al., 2022; Su et al., 2022).

The above mentioned research indicates that the existing literature pays less attention to the effect of GCG on the energy efficiency. Although some literature has analyzed the impact of green finance on energy efficiency and energy intensity, these studies are based on industry or regional level data and do not use data from listed companies. Compared to micro data, conclusions and policy implications based on macro level data may be biased, which is not conducive to targeted improvement of enterprises’ energy efficiency. In China’s quest to alleviate the pressure of carbon emission reduction and achieve the “double carbon” goal, the energy efficiency level remains of great significance. Enterprises are the micro entities of social and economic activities, and only by evaluating the impact of green credit on enterprises’ energy efficiency can effectively provide guidance for enterprises’ green production activities. Therefore, the impact of GCG on energy efficiency and its impact mechanism need to be explored.

3.2 Research hypothesis

3.2.1 Impact of GCG on energy efficiency

The credit control of GCG on heavily polluting enterprises will directly affect the efficiency of capital allocation (Wen et al., 2021). The connotation of the GCG suggests that the GCG will continue to extend credit to enterprises that meet the environmental protection standards for supporting their normal production and operation. Banks shall not provide new loans and shall take reasonable measures to recover existing credit for enterprises with backward production capacity and prominent pollution problems. Meanwhile, banks can provide loans with lower interest rates for enterprises conducting green projects. The differentiated credit control measures will lead to the differentiated capital formation process of enterprises, which affects capital arrangement of enterprises. If enterprises do not conduct green transformation, then they may withdraw from the market because they do not adapt to the constraints of credit regulation (Zhou et al., 2023a). Enterprises will change their investment and production decisions to gain market competitive advantage and stakeholder trust (Wang et al., 2022). The enterprise has finally improved the energy efficiency by reducing the production of polluting products, improving the production process, and increasing the investment in green and clean projects under the constraint of GCG.

GCG not only directly restricts heavily polluting enterprises through credit control but also influences the production decisions of enterprises through market information transmission (Wang et al., 2022). Banking financial institutions allocate more funds to energy conservation and green projects in the process of environmental risk management by strictly screening environmental information of enterprises. This initiative effectively conveys the signal to investors in the market to strengthen the green allocation of funds. The credit flow of the banking industry has increased the investment risk of investors to heavily polluting enterprises, which guides social funds away from heavily polluting enterprises and more to energy conservation and green production projects (Zhou et al., 2023b). Therefore, heavily polluting enterprises will accelerate green transformation and upgrading and improve energy efficiency under the pressure of GCG. Therefore, we put forward the following hypotheses.

Hypothesis 1. China’s GCG can improve enterprises’ energy efficiency.

3.2.2 Impact mechanism of GCG on energy efficiency

Environmentally friendly investment behavior in the production activities of enterprises is conducive to obtaining sustainable competitive advantages, especially R&D investment behavior (Porter, 1991). R&D investment helps promote technological development and improve its production efficiency and energy efficiency, especially the R&D of high-performance intelligent devices and machines, which helps improve production and operation efficiency and reduce energy consumption (Niu, 2011). R&D of enterprises helps promote the development and utilization of clean technologies. These technologies help promote enterprises to transform from traditional high pollution to clean energy consumption, which improves the energy efficiency (Kazi et al., 2015). Alam et al. (2019) confirmed that R&D investment can reduce the energy consumption intensity on the basis of the micro enterprise data of G6 countries. The transformation pressure imposed by the GCG on heavily polluting enterprises through credit constraints will enable enterprises to increase their investment in R&D, which can cause improvement in production efficiency, which enhances the energy efficiency. Therefore, we put forward the following hypotheses.

Hypothesis 2. GCG mainly affects energy efficiency through R&D investment.

3.2.3 Moderating role of trade credit

Trade credit, as an informal financing method of enterprises, has a close relationship with bank loans (Nilsen, 2002). Fisman and Love (2003) found that companies in areas with low level of financial marketization would take trade credit as a new way of financing. Enterprises will turn to alternative financing methods when they face the financing constraints brought by the GCG. On the one hand, trade credit can help enterprises surmount the capital threshold, provide alternative financing methods for enterprises impacted by GCG, and enable them to have more adequate financial security when conducting green innovation activities. On the other hand, enterprises with a high level of trade credit generally maintain a long-term and stable cooperative relationship with other enterprises, and the level of information asymmetry is low. This way can also reduce the survival pressure of enterprises under the GCG. Enterprises can calmly conduct green innovation activities without worrying on whether they will squeeze production and operation funds, which will make enterprises face survival difficulties. Companies with a high level of trade credit, generally in good operating condition, can also transmit benign operating signals to the outside world. This way reduces the obstacles faced by financing through other financing methods. Enterprises with high trade credit are more capable of conducting green transformation by increasing R&D investment. Therefore, we put forward the following hypotheses.

Hypothesis 3. Trade credit promotes the positive effect of GCG on the energy efficiency.

4 Methodologies

4.1 Difference-in-differences model

To describe the policy impact and effectively overcome the related endogenous problems, we use the DID methodology to analyze the effect of GCG on energy efficiency. Take the polluting and non-polluting enterprises as the treated and control groups, respectively, and add other variables that have an impact on the energy efficiency effect. By comparing the differences between the control and treated group prior and subsequent to the implementation of the policy, the net effect of GCG on energy efficiency is measured. According to the classification standard of classified management directory of environmental protection verification industry of listed enterprises issued by the Ministry of Environmental Protection in 2008, listed firms in 16 sectors such as thermal power, steel and cement are classified as heavy polluting industry enterprises (treatment group), and firms in other industries are regarded as non-heavily polluting industry enterprises (control group). To test Hypothesis 1, based on the GCG implemented in 2012, this paper constructs the following model to test the impact of GCG on enterprises’ energy efficiency.

Where, EE is the dependent variable, indicating the energy efficiency level of the enterprise i in the year t. The key explanatory variables Pollute × Time, Pollute is a dummy variable of the treatment group, representing the heavily polluting enterprises. We assign 1 as the treatment group, and 0 as the rest. Time is the time dummy variable before and after the implementation of the GCG. The value of the Time is 1 after the implementation of the GCG. The value of the Time is 0 before the implementation. We are most concerned about the double difference term Pollute × Time, whose estimated coefficient represents the net impact on the energy efficiency of enterprises before and after the implementation of the GCG.

4.2 Mediation effect model

Eqs 2, 3 are constructed to test the influence mechanism of GCG in promoting energy efficiency to verify Hypothesis 2. The specific models are set as follows.

In Eqs 2, 3, RD represents R&D investment. The mediating effect of R&D investment can be tested by the significance of β1, λ1, and λ2.

4.3 Moderating effect model

To verify the moderating effect of trade credit on GCG and the energy efficiency, the following model is constructed:

Variable TC refers to enterprise’s trade credit in Eq. 4. Through the significance of θ1, we can test the moderating effect of trade credit.

4.4 Data and variable

4.4.1 Data source

This study selected Chinese A-share listed firms from 2009 to 2020 as the research object and processed the data as follows: 1) excluding firms with abnormal status; 2) excluding the firms in non-industrial industries; 3) excluding firms that have been listed for less than 1 year; 4) excluding firms with serious lack of control variables. The firm data come from the Wind database. This paper obtains data of the consumption of electricity, crude oil, heat, and other energy consumption by listed companies through their social responsibility reports and annual reports. Then, referring to Su et al. (2022), based on energy emission factors, these data are calculated as the energy consumption of the enterprise.

4.4.2 Variable definition

GCG: This paper constructs an interaction term for the dummy variable enterprise type and implemented time of GCG. We investigate the relationship between these two variables. Pollute × Time measures the net effect of GCG on energy efficiency. Pollute is used to define heavily polluting enterprises, setting Pollute of polluting enterprises to 1 and Pollute of non-polluting enterprises to 0. Time is used to identify the time of GCG on the basis of the time point of policy occurrence.

Energy efficiency: According to Chen and Chen (2019), the energy efficiency of enterprises is expressed by the industrial output value per unit energy consumption, that is, the ratio of an enterprises’ industrial output to its energy consumption. We use operating income as the proxy indicator of industrial output. For comparison purpose, referring to Su et al. (2022), we convert all types of energy consumption into tones of standard coal and the energy efficiency of enterprises are measured accordingly.

RD: RD is the enterprises’ R&D investmen, which is the logarithm of R&D expenditure.

TC: Trade credit is the credit provided by suppliers who sell products or provide services to enterprises who buy products or receive services during the transaction between enterprises. Trade credit is the value that accounts payable minus the ratio of prepayments to operating costs.

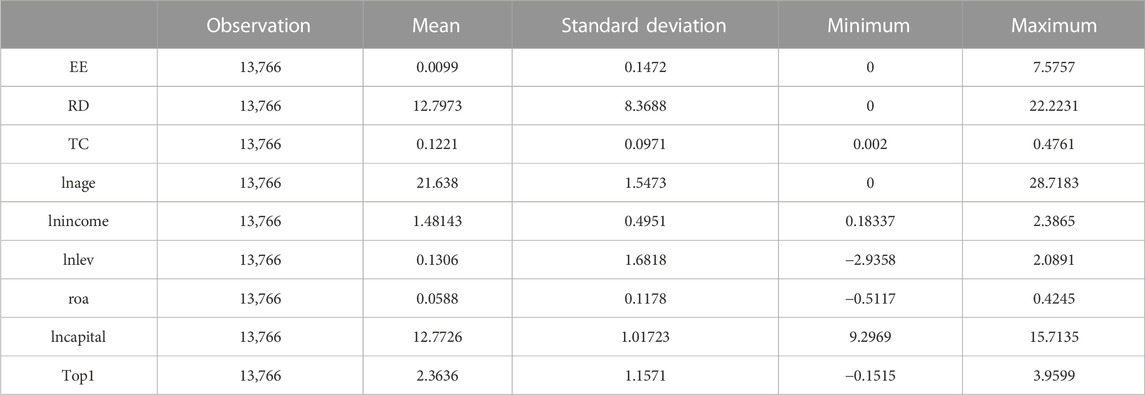

Control variables: The control variables of this paper include firm level indicators. Age of enterprise (lnage) is calculated by the logarithm of the enterprise’ age. Operating income (lnincome) is calculated by the logarithm of operating income. Asset liability ratio (lnlev) is calculated by the logarithm of ratio of total liabilities to total assets. Return on assets (roa) is calculated by the ratio of the total profit to the total assets. Capital stock per capita (lncapital) is calculated by the logarithm of ratio of net fixed assets to number of regular employees. Ownership concentration (Top1) is calculated by the logarithm of the shareholding ratio of the largest shareholder. The descriptive statistics of the above variables are shown in Table 1.

5 Empirical results

5.1 Difference-in-differences results

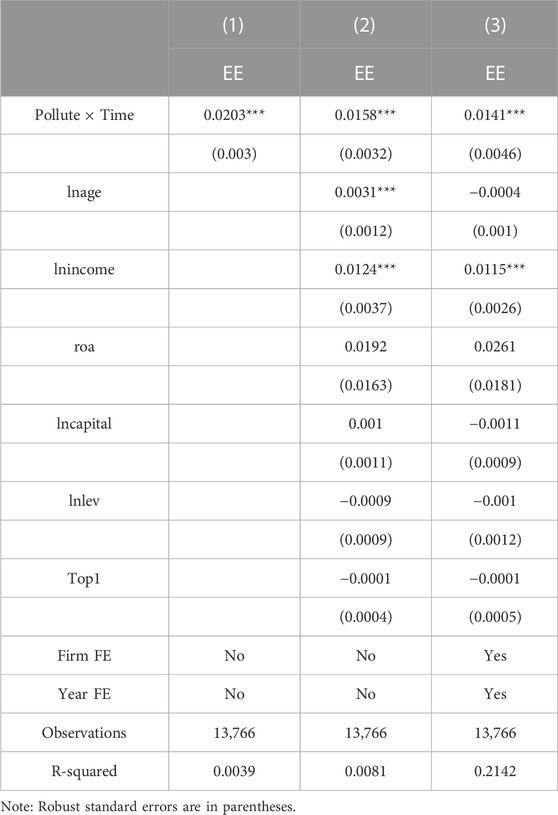

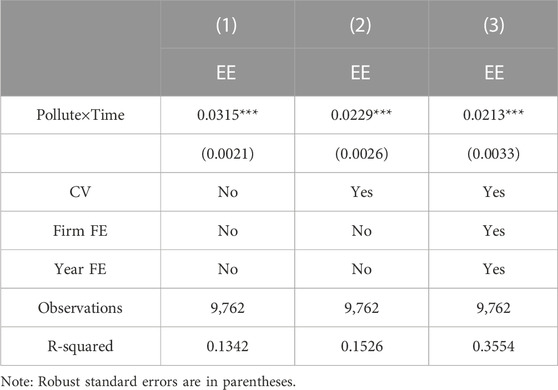

Table 2 shows the regression results of GCG on energy efficiency. Results of mixed regression without control variables, with control variables, with control variables and year and firm fixed effects are shown in column 1 to column 3. As column 1 to column 3 in Table 2 shows, the coefficients of Pollute × Time are 0.0203, 0.0158, and 0.0141, respectively (significant at the 1% level), indicating that GCG encourages energy efficiency of enterprises. Therefore, Hypothesis 1 is verified. In terms of the economic implications of the main regression results, the coefficient of Pollute × Time in column (3) is 0.0141, indicating that the implementation of GCG can improve the energy efficiency level of pilot enterprises by 0.0141 compared to non-pilot enterprises. GCG can effectively improve the energy efficiency of heavily polluting enterprises, indicating that GCG can force enterprises to undergo green transformation, which is consistent with the evaluation results of existing literature about green credit (Su et al., 2022; Wang et al., 2022; Zhou et al., 2023a).

5.2 Robustness test

5.2.1 Parallel trend and placebo test

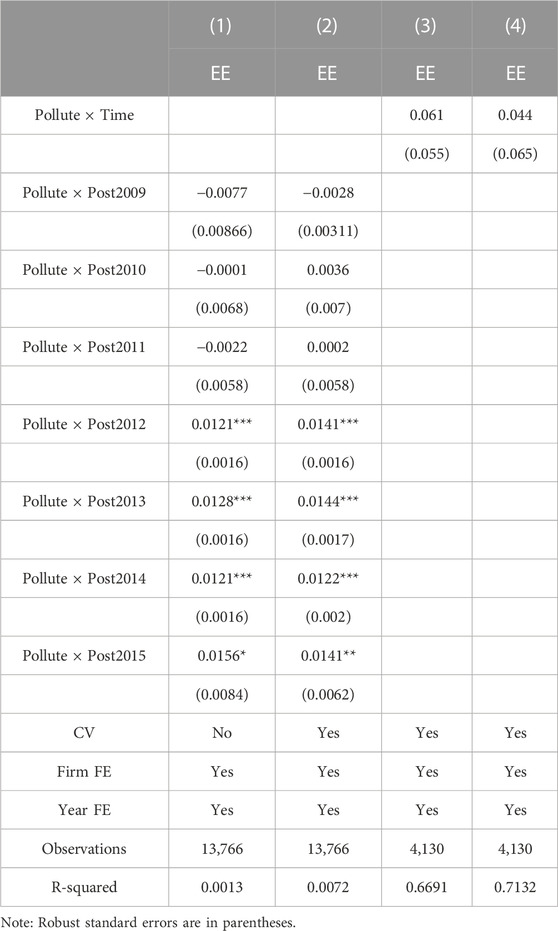

We set seven dummy variables indicating seven periods around the GCG event: Pollute×Post 2009, Pollute×Post 2010, Pollute×Post 2011, Pollute×Post 2012, Pollute×Post 2013, Pollute×Post2014 and Pollute×Post 2015. We expect the insignificant coefficients for Pollute×Post 2009, Pollute×Post2010 and Pollute×Post 2011. As column 1 to column 2 in Table 3 shows, the coefficients on Pollute×Post 2009, Pollute×Post2010 and Pollute×Post2011 are statistically insignificant, which supports parallel trends assumption. Subsequently, a placebo test was took. It was assumed that the GCG was established in 2011 and 2010, and the samples in 2012 and later was were deleted. As column 3 to column 4 in Table 3 shows, the cross-term of the results are not significant, indicating that the effects are robust.

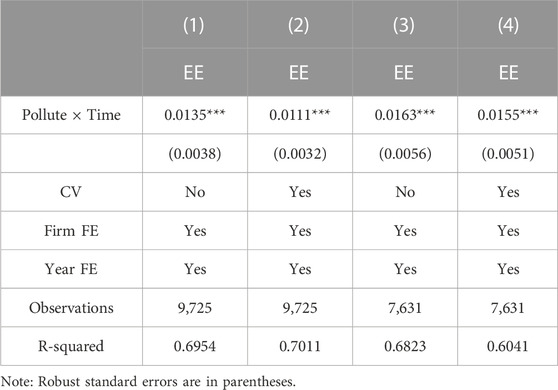

5.2.2 Excluding the effect of environmental regulation

During the research period of this study, some ER implemented in China may interfere with the results of this study, and it is necessary to eliminate the interference of these ER. In 2017, China implemented the green finance pilot policy (GFPP) and carried out green finance innovation in seven provinces, including Zhejiang, Guangdong and Guizhou et al. The GFPP may affect the energy efficiency of enterprises in the pilot area through financial means. In this regard, we removed the samples in green finance pilot areas and later conducted regression. As column 1 to column 2 in Table 4 shows, the DID coefficients are positive, which proves that the effect is still robust. In 2013, China has launched a carbon trading pilot policy (CTPP) in seven provinces, including Beijing, Hubei, and Guangdong et al. The CTPP aims to encourage enterprises to reduce carbon emissions through market-oriented means, which is likely to have an impact on energy efficiency of enterprises. In this regard, the samples in pilot areas are removed and re-estimated. The DID coefficients in column 3 and column 4 are significantly positive.

5.2.3 Propensity score matching method

Due to the extreme imbalance in sample size between the treatment group and the control group, as well as potential differences in company and market characteristics, it may lead to bias in the estimation of the DID model. We selected control variables as identifying characteristics of the sample and used propensity score matching method (PSM) to match heavily polluting firms and non-heavily polluting firms to eliminate sample selection bias and obtain bias-free estimates. Specifically, based on the sample from the year before the implementation of the GCG, we use the nearest neighbor matching method to match a non-pilot enterprise with similar characteristics for a pilot enterprise. The matching variables are all control variables, year fixed effect, and enterprise fixed effect in model (1). After obtaining the matched sample, the DID model is used to regress the matching results. As Table 5 shows, the DID coefficients are positive, suggesting that the conclusion of this study has good robustness.

5.3 Impact mechanism test

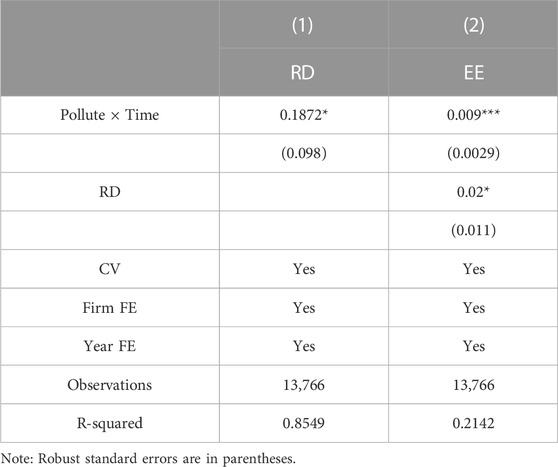

This study analyzes whether GCG affects the energy efficiency through R&D investment by using the mediating effect model constructed in Eqs 2, 3. The DID and RD coefficients in Table 6 are significant at 10%, which implies that R&D investment plays a mediating effect between GCG and energy efficiency. In other words, GCG promotes the energy efficiency of enterprises by promoting R&D investment. This result verifies Hypothesis 2.

5.4 Moderating effect test

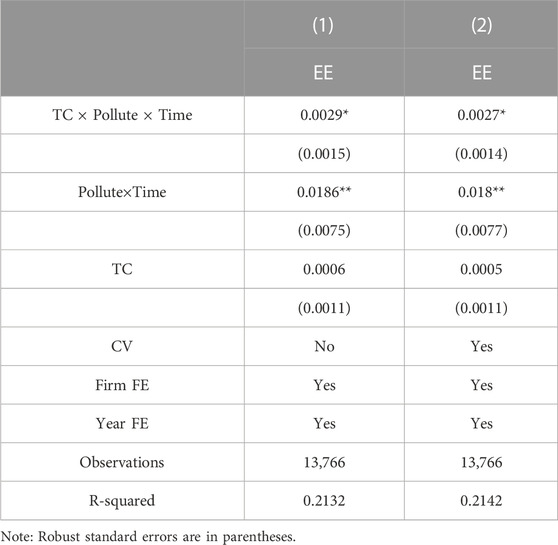

This study makes a regression on Eq. 4 to test the moderating effect of trade credit on GCG and energy efficiency. The coefficients of TC × Pollute × Time in Table 7 are significant, which means that trade credit promotes the positive impact of GCG on energy efficiency. This finding verifies Hypothesis 3.

5.5 Heterogeneity analysis

5.5.1 Heterogeneity of marketization degree

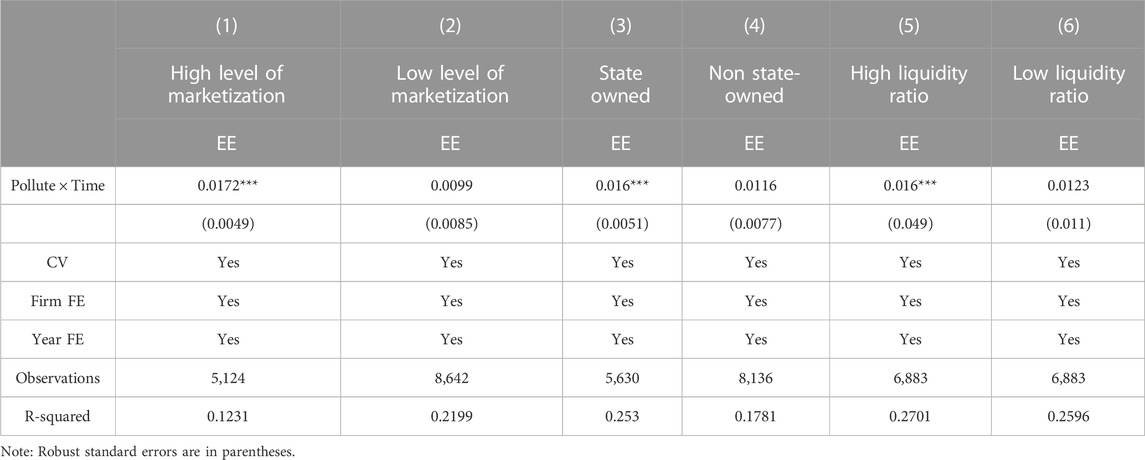

Based on research of Wang et al. (2019), this study divides samples into high level of marketization regions and low level of marketization regions. Then, the two sets of samples are subsequently regressed according to Eq. 1. As Table 8 shows, the coefficients of Pollute × Time show that GCG has a relatively large role in promoting the energy efficiency in areas with high level of marketization. The improvement in marketization level will increase the consumption demand of green products in the region, and the investment risk of the banking industry to the polluting enterprises will also rise accordingly. Banks will improve their internal risk management systems and control the direction of credit investment to reduce the environmental and reputational risks brought by polluting enterprises. In areas with high marketization degree, the infrastructure construction is more adequate, and the access to market information is more diversified and convenient. As a result, the cost of bank risk management is reduced. In addition, the competition will be better when the marketization level is higher. This situation will promote innovation ability and sustainable development level of enterprises (Matthys et al., 2020). For heavily polluting enterprises, more developed financial markets have higher capital allocation efficiency, which can effectively enhance energy efficiency under the synergy of green credit rationing with the banking industry.

5.5.2 Heterogeneity of enterprise property rights

The DID coefficient in column 3 is significantly greater than that in column 4 of Table 8, which indicate that compared to non-state owned enterprises, GCG can significantly improve the energy efficiency of state-owned enterprises. The equity nature of an enterprise can significantly affect its financing constraints. Unlike non-state-owned enterprises that are prone to credit discrimination, state-owned enterprises typically enjoy government guarantees and financial facilities, and therefore have more resources, especially for heavily polluting industries. However, the GCG requires banks to evaluate the environmental performance of enterprises, and unqualified enterprises are not allowed to borrow. Due to the fact that state-owned enterprises borrow more than non-state-owned enterprises, the potential losses after implementing the GCG will be greater. Therefore, the credit constraints of state-owned enterprises in heavily polluting industries are greater than those of non-state-owned enterprises. Therefore, GCG can affect energy efficiency by influencing the credit constraints of enterprises, so the impact of GCG on state-owned enterprises is more obvious.

5.5.3 Heterogeneity of liquidity ratio

To investigate the heterogeneous impact of GCG on energy efficiency from different liquidity ratios, this study sets a dummy variable with a value of 1 when enterprise liquidity ratio is above the median value and a value of 0 otherwise. The DID coefficients in columns 5 is significantly greater than that in column 6 of Table 8, which indicate that GCG plays a stronger role in improving the energy efficiency of enterprises with high liquidity ratio. Green project is usually characterized by long period. Thus, heavy polluting enterprises need to maintain high liquidity in capital flow for conducting green business. The enterprises with high liquidity can cope with maturity mismatch at a lower cost to obtain a higher maturity mismatch premium and interest margin. The enterprises with low liquidity may have insufficient and unstable funds to support green investment business and need to roll short-term wholesale financing more frequently from the financial market. These factors will increase their debt cost and liquidity risk. Therefore, the effect of GCG on the energy efficiency of enterprises with high liquidity ratio is more significant.

6 Conclusion, policy implications and limitations

6.1 Conclusion

Developing low-carbon economy is an inevitable choice for many countries. Under the current economic situation in China, traditional industries are still an important component of the national economy, and some heavily polluting enterprises cannot be completely replaced. However, environmental protection is urgent. Therefore, it is particularly important to find a method that can not only improve the level of environmental protection, but also achieve economic restructuring. Based on China’s GCG program, we use a DID method to investigate the impact of green credit on firms’ energy efficiency. Our empirical results show that the GCG improves the energy efficiency of enterprises. GCG can improve energy efficiency by encouraging enterprises to increase R&D investment. Trade credit promotes the positive impact of GCG on the energy efficiency. Compared to non-state-owned enterprises, GCG can effectively improve the energy efficiency of state-owned enterprises. Compared to enterprises in regions with low marketization degree, GCG can effectively improve the energy efficiency of enterprises in regions with high marketization degree. Compared to enterprises with low liquidity ratio, GCG can effectively improve the energy efficiency of enterprises with high liquidity ratio. The results of this paper provide solid theoretical support for the Chinese government to further deepen the structural reform of the financial supply side, and provide important policy implications for promoting financial support for high-quality economic growth and establishing sustainable economic models.

6.2 Policy implications

The conclusion of this study shows that the GCG has curbed the survival and development of heavily polluting enterprises from the source of funds, promoted their change and adjustment, and provided new ideas for improving environmental economic policies and encouraging enterprise environmental governance. First, the government should fully consider and predict the role of market forces in formulating and implementing environmental economic policies, and they should also utilize them. Second, GCG do not improve the energy efficiency of enterprises with weak commercial credit financing capacity, and enterprises still lack the motivation to improve environmental performance. Therefore, environmental protection policies for these enterprises need to be improved. Third, the formation of green credit constraints causes heavily polluting enterprises to seek other financing methods or increase environmental protection investment. The government needs to strengthen the supervision of commercial banks for enabling them to effectively screen corporate environmental risks, strictly controlling the amount of credit for enterprises with poor environmental performance, and reducing credit constraints for enterprises that effectively improve their environmental performance to support their green transformation. With the gradual strengthening of public awareness of environmental protection and the gradual improvement of environmental policies, the long-term development direction of polluting enterprises is to complete the green transformation as soon as possible. Fourthly, the government needs to improve the external incentive mechanism for banking and financial institutions to practice GCG, so that commercial banks have more motivation to practice GCG and set green credit goals. It is also necessary to provide relevant training to relevant personnel of commercial banks to improve their green credit evaluation capabilities.

6.3 Limitations

Financing constraint is an important variable that affects the level of energy efficiency, and green credit can alleviate the financing constraint problem of enterprises by guiding the funds of external investors. Therefore, green credit may also improve energy efficiency by easing enterprise financing constraints. This study does not examine this impact channel because of data availability. We will empirically test this intermediary channel in the future. Owing to the lack of indicator data to measure green credit at the enterprise level, this study can only investigate the effect of GCG on energy efficiency. This study will look for proxy variables of enterprise green credit in the future to better verify the impact of green credit on energy efficiency and ensure the robustness of the research conclusions.

Data availability statement

The raw data supporting the conclusion of this article will be made available by the authors, without undue reservation.

Author contributions

CgZ: Conceptualization; writing–original draft preparation; methodology; writing–review and editing. CbZ: Funding acquisition; supervision. All authors contributed to the article and approved the submitted version.

Funding

This paper is supported by Ningbo Natural Science Foundation Youth Doctoral Innovation Research Project (No. 2023J368).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Alam, M. S., Atif, M., Chien-Chi, C., and Soytaş, U. (2019). Does corporate R&D investment affect firm environmental performance? Evidence from G-6 countries. Energy Econ. 78, 401–411. doi:10.1016/j.eneco.2018.11.031

An, S., Li, B., Song, D., and Chen, X. (2021). Green credit financing versus trade credit financing in a supply chain with carbon emission limits. Eur. J. Operational Res. 292 (1), 125–142. doi:10.1016/j.ejor.2020.10.025

Anderson, B. J., Convery, F., and Maria, C. D. (2010). Technological change and the EU ETS: the case of Ireland. J. SSRN E-lectronic 216 (1), 233–238. doi:10.2139/ssrn.1855495

Carolyn, F. (2017). Environmental protection for sale: Strategic green industrial policy and climate finance. Environ. Resour. Econ. 66 (3), 553–575. doi:10.1007/s10640-016-0092-5

Chen, Z., and Chen, Q. Y. (2019). Energy use efficiency of Chinese enterprises: Heterogeneity, influencing factors and policy implications. China Ind. Econ. 12, 78–82. doi:10.3760/cma.j.issn.0253-2727.2019.01.017

Chen, Z. G., Zhang, Y. Q., Wang, H. S., Ouyang, X., and Xie, Y. (2022). Can green credit policy promote low carbon technology innovation? J. Clean. Prod. 359, 132061. doi:10.1016/j.jclepro.2022.132061

Claessens, S., and Laeven, L. (2004). What drives bank competition? Some international 460 evidence. J. Money, Credit Bank. 36 (3), 563–583. doi:10.1353/mcb.2004.0044

Curtis, E. M., and Lee, J. M. (2019). When do environmental regulations backfire? Onsite industrial electricity generation, energy efficiency and policy instruments. J. Environ. Econ. Manag. 96, 174–194. doi:10.1016/j.jeem.2019.04.004

Dirckinck-Holmfeld, K. (2015). The options of local authorities for addressing climate change and energy efficiency through environmental regulation of companies. J. Clean. Prod. 98, 175–184. doi:10.1016/j.jclepro.2014.12.067

Dong, Q. M., Wen, S. Y., and Liu, X. L. (2020). Credit allocation, pollution, and sustainable growth: Theory and evidence from China. Emerg. Mark. Finance Trade 56, 2793–2811. doi:10.1080/1540496x.2018.1528869

Fisman, R., and Love, I. (2003). Trade credit, financial intermediary development and industry growth. J. Finance 58 (1), 353–374. doi:10.1111/1540-6261.00527

Guo, L., Tan, W., and Xu, Y. (2022). Impact of green credit on green economy efficiency in China. Environ. Sci. Pollut. Res. 29, 35124–35137. doi:10.1007/s11356-021-18444-9

He, L. Y., Zhang, L. H., Zhong, Z. Q., Wang, D., and Wang, F. (2019). Green credit, renewable energy investment and green economy development: Empirical analysis based on 150 listed companies of China. J. Clean. Prod. 208, 363–372. doi:10.1016/j.jclepro.2018.10.119

Jiang, H. D., Purohit, P., Liang, Q. M., Dong, K., and Liu, L. J. (2022). The cost-benefit comparisons of China's and India's NDCs based on carbon marginal abatement cost curves. Energy Econ. 109, 105946. doi:10.1016/j.eneco.2022.105946

Jiang, H. D., Purohit, P., Liang, Q. M., Liu, L. J., and Zhang, Y. F. (2023). Improving the regional deployment of carbon mitigation efforts by incorporating air-quality co-benefits: A multi-provincial analysis of China. Ecol. Econ. 203, 107675. doi:10.1016/j.ecolecon.2022.107675

Kazi, S., Rawshan, A. B., Sharifah, M., and Jaafar, M. (2015). Dynamics of energy use, technological innovation, economic growth and trade openness in Malaysia. Energy 90, 1497–1507. doi:10.1016/j.energy.2015.06.101

Labatt, S., and Maclaren, V. W. (1998). Voluntary corporate environmental initiatives: A typology and preliminary investigation. Environ. Plan. C Gov. Policy 16 (2), 191–209. doi:10.1068/c160191

Li, K., Tan, X. J., Yan, Y. X., Jiang, D., and Qi, S. (2022). Directing energy transition toward decarbonization: The China story. Energy 261, 124934. doi:10.1016/j.energy.2022.124934

Liu, X., Wang, E., and Cai, D. (2019). Green credit policy, property rights and debt financing: Quasi-natural experimental evidence from China. Finance Res. Lett. 29, 129–135. doi:10.1016/j.frl.2019.03.014

Matthys, T., Meuleman, E., and Vander, V. R. (2020). Unconventional monetary policy and bank risk taking. J. Int. Money Finance 109, 102233. doi:10.1016/j.jimonfin.2020.102233

Nandy, M., and Lodh, S. (2012). Do banks value the eco-friendliness of firms in their corporate lending decision? Some empirical evidence. International Review of Financial Analysis 25 (6), 83–93.

Natalia, Z. S. (2019). Trade in environmental goods and air pollution: A mediation analysis to estimate total, direct and indirect effects. Environ. Resour. Econ. 74 (3), 1125–1162. doi:10.1007/s10640-019-00363-6

Nilsen, J. H. (2002). Trade credit and the bank lending channel. J. Money Credit Bank. 34 (1), 226–253. doi:10.1353/mcb.2002.0032

Niu, Y. (2011). The economic thinking on low carbon economy. Energy Procedia 5 (1), 2368–2372. doi:10.1016/j.egypro.2011.03.407

Roula, I. L. (2017). Social rate of return to R&D on various energy technologies: Where should we invest more? A study of G7 countries. Energy Policy 101, 521–525. doi:10.1016/j.enpol.2016.10.043

Su, Z. F., Guo, Q. Q., and Lee, H. T. (2022). Green finance policy and enterprise energy consumption intensity: Evidence from a quasi-natural experiment in China. Energy Econ. 115, 106374. doi:10.1016/j.eneco.2022.106374

Wang, H., and Li, S. (2021). Asymmetric volatility spillovers between crude oil and China's financial markets. Energy 233, 121168. doi:10.1016/j.energy.2021.121168

Wang, H. T., Qi, S. Z., Zhou, C. B., Zhou, J., and Huang, X. (2022). Green credit policy, government behavior and green innovation quality of enterprises. J. Clean. Prod. 331, 129834. doi:10.1016/j.jclepro.2021.129834

Wang, X. L., Fan, G., and Hu, L. P. (2019). China’s marketization index report by province (2018). Beijing: Social Sciences Literature Press.

Wen, H. W., Jiang, M., and Zheng, S. F. (2022). Impact of information and communication technologies on corporate energy intensity: Evidence from cross-country micro data. J. Environ. Plan. Manag. 11, 1–22. doi:10.1080/09640568.2022.2141104

Wen, H. W., Lee, C. C., and Zhou, F. X. (2021). Green credit policy, credit allocation efficiency and upgrade of energy-intensive enterprises. Energy Econ. 94, 105099. doi:10.1016/j.eneco.2021.105099

Xie, R. H., Yuan, Y. J., and Huang, J. J. (2017). Different types of environmental regulations and heterogeneous influence on “green” productivity: Evidence from China. Ecol. Econ. 132, 104–112. doi:10.1016/j.ecolecon.2016.10.019

Xing, C., Zhang, Y. M., and Wang, Y. (2020). Do banks value green management in China? The perspective of the green credit policy. Finance Res. Lett. 35, 101601. doi:10.1016/j.frl.2020.101601

Yang, Y., and Zhang, Y. L. (2022). The impact of the green credit policy on the short term and long-term debt financing of heavily polluting enterprises: Based on PSM DID method. Int. J. Environ. Res. Public Health 18, 11287–11319. doi:10.3390/ijerph191811287

Zhang, A. X., Deng, R. R., and Wu, Y. F. (2022). Does the green credit policy reduce the carbon emission intensity of heavily polluting industries? -Evidence from China's 17 industrial sectors. J. Environ. Manag. 331, 114815. doi:10.1016/j.jenvman.2022.114815

Zhou, C. B., Li, Y. K., and Zheng, S. K. (2022). Has the carbon trading pilot market improved enterprises’ export green-sophistication in China? Sustainability 14, 10113.

Zhou, C. B., and Qi, S. Z. (2022). Has the pilot carbon trading policy improved China's green total factor energy efficiency? Energy Econ. 114, 106268. doi:10.1016/j.eneco.2022.106268

Zhou, C. B., Zheng, X. S., Qi, S. Z., Li, Y., and Gao, H. (2023a). Green credit guideline and enterprise export green-sophistication. J. Environ. Manag. 336, 117648. doi:10.1016/j.jenvman.2023.117648

Keywords: green credit, energy efficiency, research and development investment, trade credit, state-owned, liquidity ratio

Citation: Zhang C and Zhou C (2023) Does green credit affect enterprises’ energy efficiency?. Front. Energy Res. 11:1224270. doi: 10.3389/fenrg.2023.1224270

Received: 17 May 2023; Accepted: 26 July 2023;

Published: 07 August 2023.

Edited by:

Xiaofeng Xu, China University of Petroleum, ChinaReviewed by:

Hong-Dian Jiang, China University of Geosciences, ChinaJosé Moleiro Martins, Instituto Politécnico de Lisboa, Portugal

Huwei Wen, Nanchang University, China

Copyright © 2023 Zhang and Zhou. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Chaobo Zhou, emhvdWNoYW9ib0B3aHUuZWR1LmNu

Chong Zhang1,2

Chong Zhang1,2 Chaobo Zhou

Chaobo Zhou