- 1College of Information Science and Engineering, Northeastern University, Shenyang, China

- 2State Grid Liaoning Electric Power Company Limited, Shenyang, China

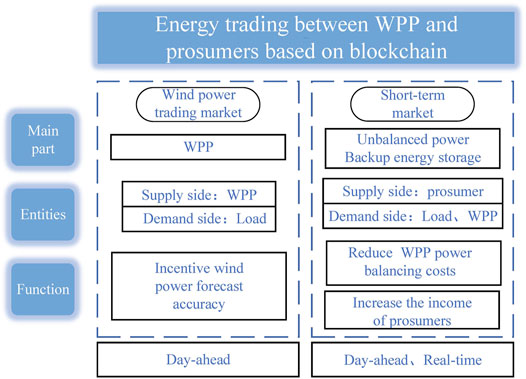

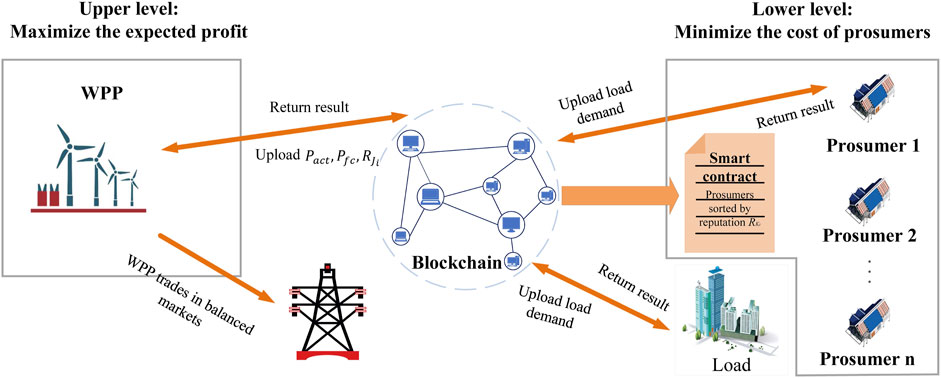

With the increase of wind power penetration, the deviation caused by its volatility and intermittency poses a growing threat to the grid. Energy trading in short-term markets for wind power and backup storage helps compensate for the deviations. Furthermore, the introduction of peer-to-peer (P2P) energy trading can effectively reduce the risk of centralized market management. However, the higher cost of energy storage are not conducive to wind power producers (WPPs). And P2P trading also suffers from trust and efficiency problems. This paper provides a blockchain based short-term energy trading market, which resolves generation deviations through efficient and trusted real-time transactions between WPP and prosumers. The blockchain-based energy trading market is a trustless P2P structure, and the trading is triggered by smart contracts to ensure efficiency. Furthermore, a reputation mechanism is designed to incentivize WPP’s generation forecasts to be accurate and prosumers to participate in the market. A bilevel optimization method is designed to increase the revenue of WPP and reduce the costs of prosumers. The market can effectively balance the deviation of wind power generation, increase the revenue of WPP by 9.55%, and reduce the costs for consumers by 5.6%.

1 Introduction

With the increasing penetration of wind power, its volatility make the impact on power quality and grid stability more critical (Shin et al., 2018). Wind power producers (WPPs) should take measures to ensure the stability of wind power generation to avoid power generation deviation between the actual and the forecasted caused by the above conditions. Researchers believe that WPP’s participation in the electricity market is one of the effective ways to address wind power deviation and promote wind power consumption (Skajaa et al., 2015).

Electricity markets in many countries have established the short-term market. For example, the European short-term market determines the energy clearing price based on the positive or negative energy adjustment. Many researchers focus on WPPs for electricity energy trading on the short-term market trading floor including day-ahead (DA) and real-time (RT) markets. The RT market has attracted the growing attention of researchers, which may provide possible solutions addressing the above challenges because it can compensate for the high uncertainty of generation forecasts in DA markets (Homa et al., 2017). The independent system operator (ISO) is responsible for regulating the energy for the deviating wind producers, ISO imposespenalties on WPP when it fails to deliver power as promised. H. Shin et al. (Shin et al., 2018) built an advanced offer curve that considers correlations between wind power and RT price under the hypothesis that the wind power and RT price follow the bivariate normal distribution. Compared with the typical offering curve, this curve can slightly increase the expected profit. Although the offering curve can increase the expected profit of WPP, penalties for mispredicted wind power producers are expensive in RT markets (Fabbri et al., 2005). The centralized power transaction conducted by the system operator has disadvantages such as high information management cost, insufficient communication transmission capacity, and single point of failure when dealing with the above scenarios.

In addition, researchers propose to combine wind energy with other power generation methods to solve the volatility of wind energy. On the one hand, reserves are provided by the supply side, these power generation methods are pumped-storage hydroplanes, thermal energy, compressed air energy storage (Al-Awami and El-Sharkawi 2011; Sánchez de la Nieta et al., 2013; Cheng et al., 2019). However, some thermal units have high generation costs which reduce the revenue of WPP. Moreover, purchasing reserves from the demand side can also balance the deviation of wind power. Demand response (DR) and electric vehicle (EV) were proposed by relevant researchers as more economical reserve energy. In the face of the intermittent wind energy, N. Mohammad et al. (Mohammad and Mishra 2018) aimed to design a plan in which market operators seek suitable DR as reserve energy to cope with the deviation of wind power. EV aggregators are applied as entities to balance the deviation from the uncertainty of renewable energy (Cheng et al., 2019). However, the greater deviation of wind power consumption in RT markets, the more prominent the problems caused by the high adjustment cost. Consequently, higher frequency transactions help balance wind power generation deviation better.

Two-way information flow and peer-to-peer (P2P) mechanisms of the distributed system contribute to the development of energy trading. In the P2P energy trading mechanism, operators do not need to play the role of energy dispatching, a win-win result with direct electricity trading between consumers (Zhou et al., 2018). E. Sorin et al. (Sorin et al., 2018) introduced the variable economic dispatch to build a P2P energy trading market and proposed a method that considers Consensus and Innovation to address the problems in the market in a distributed manner. This plan shared the power trading information well handled and improved social welfare and user satisfaction. C. Zhang et al. (Zhang C. et al., 2018) proposed a hierarchical system architecture model to identify the relevant content involved in P2P energy trading and simulated P2P energy trading using game theory. Experimental tests showed that P2P energy trading can promote consumption balance. H. Rashidizadeh-Kermani et al. (Rashidizadeh-Kermani et al., 2021) considered a P2P transaction framework in which WPP can conduct P2P transactions with the main grid and rival load-serving entities. Through P2P direct transactions, WPP can offset part of the energy deviation and maximize its interests. H. Rashidizadeh-Kermani et al. (Rashidizadeh-Kermani et al., 2020) explored that WPP purchased reserves from energy storage aggregators on the P2P trading floor to compensate for the volatility of wind power, and at the same time introduced conditional value at risk (CVaR) to hedge the randomness of wind energy. Previous work has shown that prosumers take crucial roles in P2P trading. A prosumer is a flexible role that can consume and generate electricity in the meantime (Luo et al., 2019). As shown is Figure 1, in conventional models of power systems, only energy consumers existed. However, renewable energy generation technologies are developing rapidly. Its construction cost and equipment size are gradually decreasing and coming into homes (Li et al., 2021). For example, in recent years, solar panels have been installed on the roof of a building and supply it with electricity. Because of the small capacity and fast regulation of prosumers, they are suitable for small-scale regulation of electricity in decentralized mechanism. As a result, WPP can engage in P2P transactions with prosumers to better cover their uncertainty due to their responsiveness and flexibility, but their data on the transaction process lack a transparent management method.

In recent years, blockchain has been proposed as a distributed ledger technology, and its characteristics of trustlessness, traceability, transparency, and irreversibility make it widely used in the energy trading field (Li et al., 2017). Energy trading based on blockchain is not similar to the traditional centralized power trading mechanism with poor information trading. More specifically, blockchain technology can realize the decentralization of electricity (Zhang T. et al., 2018). Each user can realize distributed automatic verification, transmission, and management of transaction information, so as to quickly respond to market information and formulate the most excellent bidding strategy to promote P2P trading of electric energy (Cui et al., 2020).

In summary, we propose a blockchain-based P2P energy trading short-term market between the WPP and prosumers. The market includes the DA market, RT market, and balancing (BL) market. Prosumers regulate deviations in the RT market. The BL market is responsible for regulating the remaining energy after the RT market transaction. The blockchain-based wind energy trading market can realize the decentralization of transactions and ensure data transparency and information security, so it does not require the management of a third-party trust mechanism and reduces the cost of adjusting the market. In addition, we introduce the concept of prosumers into the system, which can directly trade with the WPP when there is a deviation, balancing the real-time power of the system. When there is a deviation in WPP power generation, the smart contract on the blockchain is triggered. After that, the smart contract will arrange for prosumers with high reputation value to give priority to energy trading and publish preferential balancing price to WPP with high reputation value (Huang et al., 2022a). Given that fact, the behavior of prosumers affects the stability of power system. To ensure the accuracy of the real-time transaction balance between prosumers with WPP, we design a reputation mechanism for prosumers and WPP to regulate their trading behavior, respectively.

The main contributions and organization are given as follows:

• A blockchain-based energy trading market is established, which supports real-time direct transactions between WPP and prosumers without a central authority or third parties. It reduces transaction costs and increases the effectiveness of power balancing. Furthermore, blockchain guarantees trustworthiness, transparency, and traceability in the transaction process.

• The reputation mechanism is proposed. The mechanism allows prosumers who actively participate in the transaction to obtain more profits in the RT market, and reward accurate forecasted WPP in the BL market. It facilitates real-time wind energy trading in the market and rationalizes costs.

• A bilevel optimization method is used to maximize WPP revenue and prosumer gains. WPP manages the uncertainty of wind energy by buying and selling electricity to prosumers. In the process, WPP lowers the cost of direct transactions from the BL market while prosumers also get relatively low energy prices.

The rest of our article is organized as follows. Section 2 describes the mathematical model of trading entities in the market. In section 3, a bilevel stochastic problem is proposed to construct optimal trading strategies (Yang et al., 2019). Section 4 gives the result of the digital simulation. Finally, section 5 summarizes the main work of this article.

2 System Framework

In this section, we model the relevant entities in P2P power trading in a bilevel framework.

2.1 Wind Power Producer

Wind power generation is subject to the uncertainty of wind energy and therefore is greatly affected by environmental factors (Wang et al., 2018). WPP makes a profit by selling the total electricity generated by the turbines in their jurisdiction. And from the viewpoint of the understudy WPP, it participates in the market to maximize its own interests. Let

where

WPP’s trading volume range in DA and RT markets is given by

2.2 Prosumer

The prosumers are the integration of producer and consumer. They play the role of consumers when buying electric energy, and they become producers when selling electricity. Taking our model as an example, users make themselves a prosumer by installing solar power on top of the house, home energy storage and other facilities. Let

where,

2.3 Load

Unlike the prosumers, there are many loads that cannot store energy. As a consumer, it purchases energy to provide its own needs. In this paper, this type of load is not the focus of the study, so this part of the load is simplified to data.

2.4 Power System Operator

The operator is the power system dispatcher, which holds and operates the network that delivers electricity. In the traditional model, it implements market trading plans and is responsible for the operational scheduling of the power system and the real-time balancing of the power system to ensure the safe and stable operation of the power system. In this paper, WPP prefers to trade energy under a P2P mechanism, followed by trading in an operator-operated trading floor, due to the high cost of regulation under operator-based scheduling and WPP’s loss of profit.

3 Design Goals of the Bilevel Problem

In this section, we propose a bilevel model (Wang et al., 2022), which can maximize WPP’s profits, reduce prosumers’ costs, and provide WPP with a reasonable trading strategy.

3.1 Design Goals of the Bilevel Problem

3.1.1 The Objective Function of the Upper-Level Problem

From perspective of WPP, the objective function at this level is to maximize WPP’s profit as follows:

In the above model, the first item represents WPP’s revenue from selling energy in DA market. The second item stands for WPP makes profits from selling to prosumers. The third item presents cost from purchasing energy from prosumers. Also, WPP needs to take the cost of penalties in the regulation market.

3.1.2 The Objective Function of the Lower-Level Problem

The objective fuction of lower level is defined as

where, the first item represents the costs of purchasing energy from WPP. The second and third items represent the costs of charging and discharging for prosumers. The last item is the revenue from prosumers selling energy to WPP.

3.1.3 Combination of Upper and Lower Levels

The lower level objective function (10), and constraints (5)-(8) are replaced by their Karush-Kuhn-Tucker (KKT) conditions. The dual theorem of linear programming considers that the objective function of the dual problem is equal to the objective function of the original problem, and the value of this objective function is also optimal (Song et al., 2017). Subject to KKT condition, the upper-layer objective function formula becomes a formula that is linear with respect to the decision variables, and finally, the upper-level optimization process is transformed into the optimal solution problem of solving a single-level mixed integer linear programming.

3.2 Reputation Design

In order to stimulate the accuracy of WPP’s forecasted generation and regulate the behavior of the prosumers to participate in the P2P mechanism, we propose their reputation mechanism. The blockchain-based distributed energy trading system has a reputation value for both WPP and prosumers to ensure the proper operation of trading. For WPP, the balancing penalty cost is changed accordingly to its reputation value. For prosumers, the system ranks the prosumers with good reputation value according to the real-time reputation value to motivate them to trade firstly and removes the inactive or malicious prosumers to ensure the regular operation of the distributed energy trading system.

3.2.1 Reputation of Wind Power Producer

The WPP reputation value consists of two parts, one is the generation accuracy and the other is generation efficiency of the wind turbine.

where,

3.2.2 Reputation of Prosumer

where,

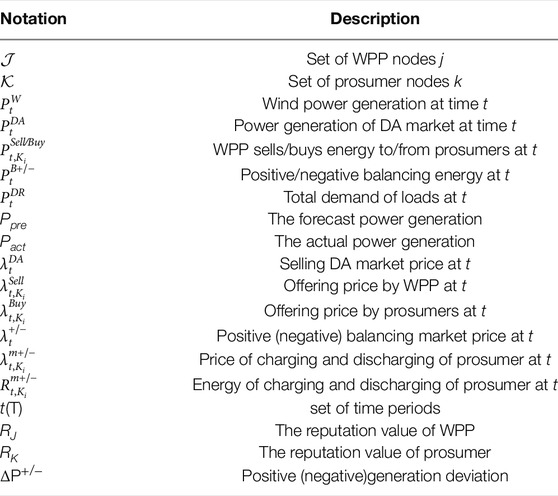

4 Blockchain Network Implementation

The proposed market consists of four phases: upload initial information, manage real-time information, publish RT market transaction plans and BL market transaction. The frame is shown in Figure 2. The figure shows that blockchain is a platform for trading between buyers and sellers, which contains the real-time reputation value of WPP and prosumers, real-time generation, forecasted generation of WPP, and demand of prosumers and loads. Blockchain can realize trustless, decentralized, and efficient P2P transactions between nodes through data encryption, time stamps, and smart contracts (Gong et al., 2020). The blockchain-based real-time trading market supports trustless P2P direct transactions between WPP and prosumers, and the results of the transactions can be published on the chain.

Blockchain acts as a distributed database system that acts as an open ledger to store and manage transactions. It contains the historical records of all transactions (Shan et al., 2019). Before the transaction, the buyer and seller must upload the transaction information to the blockchain. The detail of the algorithm is shown in Algorithm 1.

Algorithm 1. Real-time market energy trading algorithms.

• Phase 1: Upload initial information.

Before the DA market opens, WPP uploads its electricity generation forecast data, while the load also uploads the demand forecast information. WPP submits energy bidding on the trading floor of the wholesale market. WPP buys energy at certain times and sells energy at certain times, depending on WPP’s forecast accuracy and load demand. After DA market is cleared, the day-ahead prices are uploaded to the blockchain. Finally, the above-mentioned on-chain data are stored and used as the basis for RT market trading.

• Phase 2: Manage real-time information.

At the retail level, WPP trades real-time energy with the electric loads in its jurisdiction. WPP uploads the actual output to the blockchain, and the deviation between the actual generation and the predicted generation will cause a high adjustment price. As a result, WPP has an incentive to participate in a RT market with a P2P mechanism to trade energy with prosumers. Under the P2P trading mechanism, the interaction between WPP and prosumers provides a new solution for the management of renewable energy consumption. Understudy WPP submits energy bid to RT market, let the difference between the actual and forecast generation be the generation deviation (ΔP), which is positive (ΔP+), and vice versa. According to the positive or negative value of ΔP, WPP will enter the positive or negative RT market under the P2P mechanism, respectively. At this point, WPP uploads the latest reputation value to the blockchain information system, which is determined by the accuracy of WPP’s forecasts and the efficiency of its wind turbines. The prosumers upload their real-time power information: up and down reserves, reputation value

• Phase 3: Publish RT market transaction plans.

At the beginning of a period, the smart contract generates specific transaction results for prosumers based on on-chain data and algorithms. Based on the positive/negative deviation of the WPP, the producers or prosumers who need to purchase power/have excess power generation will be ranked from highest to lowest reputation value and will be calculated to match a series of prosumers for WPP. The prosumers will trade in order with the WPP, and the blockchain will then return the scheduling results to the WPP. After the prosumers finish the scheduling task, they update the remaining capacity and reputation value on the chain. If WPP has questions about the scheduling assignment, they can get all the data of that scheduling task from the blockchain.

• Phase 4: BL market transaction.

After completing the RT market tradings, there are still deviated WPPs entering the trading floor managed by BL market to receive punishment. Such punishments are costly. We often hope that minimize the number of penalties to increase WPP’s profits. During several of the above tradings, if WPP’s reputation value decreases, it will affect the balancing price. For WPP to gain a higher profit, WPP should improve the forecast accuracy and timely attention to the generation efficiency of wind turbines to ensure their proper operation during their life cycle. The updated WPP reputation value will be uploaded to the blockchain after the trading.

5 Numerical Results

5.1 Input Data

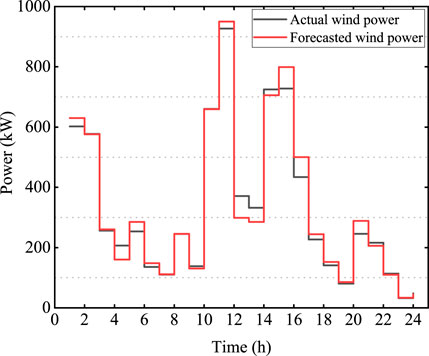

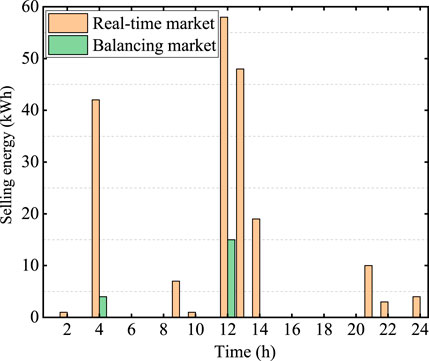

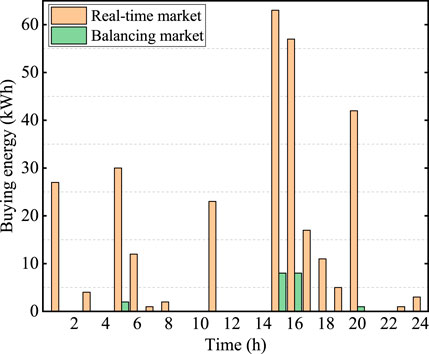

The proposed energy market design is implemented based on realistic data to give the optimal bidding strategy of WPP. The predicted wind output power and actual power of WPP are shown in Figure 3. Due to changing weather conditions, WPP’s forecasts deviation significantly from actual generation during some time periods. Drastic wind speed changes will affect the accuracy of wind power prediction. The generation offset caused by forecast errors impacts the active power balance of the power system. In a power system where wind power is the dominant source of power, the above phenomenon will cause a significant impact on the frequency of the grid and thus affect the stable operation of the system. At 4:00 a.m., 12:00, 1:00 p.m., WPP’s actual generation significantly exceeds forecasted generation, When the wind speed fluctuates greatly, the wind turbine will output active power fluctuations. If large-scale electric energy is injected into grid during the wind power generation process, it will not only affect the transient stability of the power grid, but also affect the stability of the power grid frequency. bring serious impact. To solve the above phenomenon, WPP trades with prosumers in RT market to reduce fluctuations on the grid. Figure 4 shows the excess of generation, prosumers and operator use the RT and BL markets to repurchase the energy. Figure 5 shows the deficit of generation, WPP purchase energy from prosumers and operator. Furthermore, DA and balancing prices are generated according to scenarios. The data mentioned above is uploaded to the blockchain. Simulations were operated with an Intel Core CPU i7-9750H @ 2.6 GHz, 16 GB RAM to verify the performance of model. Also, we use Ethereum Geth client to build a blockchain system to simulate our energy trading system, and calculate the overhead in the chain.

5.2 Results and Discussions

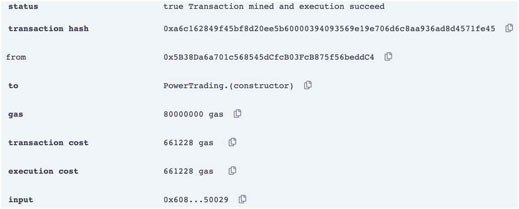

5.2.1 Blockchain Test

Figure 6 shows a prototype of the P2P trading platform implemented using the Ethereum Geth client, which supports direct transactions between prosumers and wind power producers. It also shows the transaction accounts of WPP and prosumers, that is, the Ethereum address. The address is represented by a hash value and has privacy protection. The gas consumption of the operation is also included.

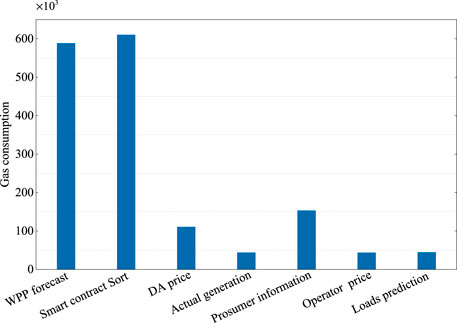

In Ethereum’s smart contracts, each data transfer requires a certain amount of gas, gas consumption implies the overhead of performing operations on the blockchainLiu et al. (2020) Usually, this is an important criterion for measuring whether a blockchain network design is reasonable. Figure 7 illustrates the gas overhead for the operation of entities in our framework structure. In the process of energy trading based on blockchain, WPP and prosumers need to upload information and operate on the chain. Moreover, we can see how much gas is mainly consumed by the smart contract by sorting the reputation value of the prosumers. As shown in Figure 7, due to the large amount of information that WPP needs to upload, the reputation ranking of prosumers by smart and contract processing information is relatively large, consuming about 600,000 units of gas. The rest of the operations are mainly to store data on the blockchain. Their gas consumption is less than 150,000, which is acceptable to all nodes in the system.

5.2.2 Trading Result

Assuming that a trading cycle T = 24 h, Figure 3 shows the deviation between the predicted output and the actual output of WPP during some periods (for example during 4 a.m..–6 a.m., 11 a.m..-2 p m. and 7 p.m..–9 p.m.). For mentioned wind forecast errors, WPP conducts P2P tradings with prosumers to decrease the size of the value of ΔP.

As shown in Figure 4, as it can be seen, when wind power production is high, WPP sells surplus energy. At 4 a.m., Prosumers consume most of the electricity, and WPP sells a small portion to the operator. At 12:00, WPP tends to sell more energy to prosumers, however, there is a limit to the amount of electricity that can be consumed by prosumers under WPP’s jurisdiction. So WPP sells the rest of its energy at a lower price positive BL market. At 2 p.m., there is enough surplus energy in the energy storage of the prosumers, and WPP sells all the surplus energy to the prosumers. In fact, Prosumers make WPP avoid selling all excess energy to BL market. Without using our model, WPP’s profits are lower due to the fact that the revenue from selling to consumers is greater than the revenue from selling to the BL market. To be more specific, prosumers promote the consumption of wind power.

As shown in Figure 5, in some periods, deviation represents a deficit of production. The producer sells electricity to WPP, and since the amount of electricity sold by the producer is not enough to reach the amount of electricity that WPP wants to buy, WPP buys a small portion of the electricity from the operator at 4 a.m. At 3 p.m. Prosumers’ power generations are within a certain range, if prosumers cannot supply WPP, then WPP buys from the BL market at a high price. At 6 p.m., the power generated by the prosumers is sufficient to supply the offset of the WPP, as a result, the WPP purchases all the required power from the prosumers. Generally, the prosumers sell to WPP at a price below the BL market, which reduces WPP’s losses.

In our P2P trading mechanism, prosumers cover most of the uncertainty of wind power generation, which not only improves WPP’s earnings but also reduces its power purchase costs, thereby reducing the impact of wind power on the grid, ensuring that the stable operation of the power grid.

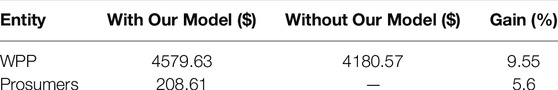

Table 2 is added to show the profit of WPP and prosumers with and without our model. Compared with the previous trading model, due to the introduction of the real-time market with prosumers, the profit of WPP under our model has increased by 9.55%. In this paper, we consider that the benefits of the prosumers are divided into two aspects, on the one hand, the proceeds from selling to WPP, and on the other hand, the savings from the producer and consumer’s direct dealings with WPP, noting that the above earnings minus the discharge costs of the prosumers.

5.2.3 Reputation Experiment

Finally, we test the effect of reputation value about prosumers and WPP. we set 20 prosumers, these prosumers buy and sell electricity in the RT market to compensate for generation deviations, and if the prosumers are unable to cover deviations, then the WPP will trade electricity with the main grid in BL market. For prosumers, We set two scenarios to simulate situation. For WPP, we set two scenarios and three situations to simulate. For WPP, we set up one scenario with three situations.

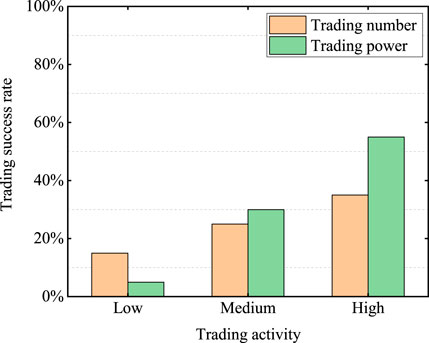

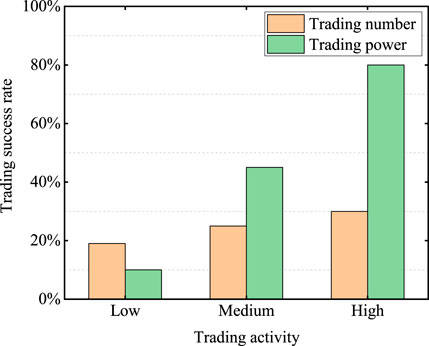

We track the impact of changes in one prosumer’s reputation value on the success rate of a transaction. we set up two scenarios to highlight the influence of the weight factors β1 and β2 on the weight terms where they are located. In scenario 1, both β1 and β2 are 0.5. In scenario 2, β1 is 0.8, β2 is 0.2. In scenario 1, as shown is Figure 8, varying the magnitude of the value of the corresponding term of

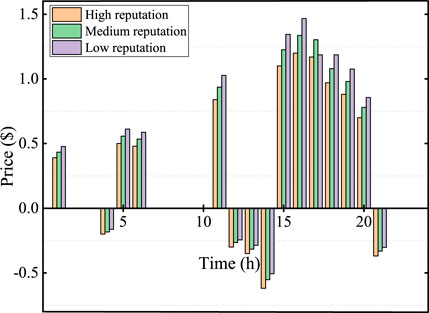

Figure 10 shows that the price of electricity traded in the BL market differs when the WPP has different reputation values. WPP trades power with the main grid to compensate for generation deviations. We compared WPP’s balancing prices at low, medium and high reputation values. The higher the reputation value of WPP, the lower the price of electricity it buys from the main grid in the BL market, the higher the price of electricity it sells, and the higher the profit it earns. Therefore, WPP has to increase the forecast accuracy to increase the reputation value to increase its profit.

6 Conclusion and Future Work

In this study, a blockchain-based P2P energy trading short-term market is proposed. It supports direct transactions between WPP and prosumers without the third parties or the central agency while ensuring efficient and trustless. In the blockchain-based energy trading market, the participation of prosumers reduces WPP’s balancing costs due to generation deviation caused by inaccurate forecasts. At the same time, the benefits of prosumers in the real-time market reduce their electricity purchase costs. In addition, we designed a reputation mechanism to promote more active participation of prosumers in the market and more accurate forecasts of WPP. This mechanism ensures that professional consumers with a high number of participants and a high historical trading capacity will receive more benefits. The pricing of energy transactions is determined by a two-level optimization algorithm, which makes the optimal solution satisfy the maximum WPP revenue and the lowest electricity purchase cost for prosumers. Through numerical simulation experiments, in a given scenario, our scheme can effectively increase the revenue of WPP by 9.55%, reduce its adjustment cost, and increase the profit of prosumers by 5.6%. In the future, we intend to expand the use cases of our solution. On the power generation side, the trading environment of WPPs is complicated, and competition among WPPs is introduced. Seek mutual transactions between WPPs to compensate for power generation deviations and further reduce balancing costs. In addition, we will introduce a variety of renewable energy into the market pricing to promote the consumption of a variety of renewable energy. On the demand side, we will incorporate electric vehicles into our market and participate in transactions to balance wind energy fluctuations.

Data Availability Statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author Contributions

Conceptualization, PD, BH and ZL; methodology, PD; software, PD; validation, PD, GJ and LF; formal analysis, PD, ZL and CY; investigation, PD and CY; resources, CY; data curation, PD, GJ and LF; writing—original draft preparation, PD and ZL; writing—review and editing, ZL; visualization, ZL and BH; supervision, BH; project administration, BH and CY; funding acquisition, BH and CY. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported in part by the National Key Technologies Research and Development Program of China (2018YFA0702200) and the Liaoning Revitalization Talents Program of China (XLYC2007181), in part by the Fundamental Research Funds for the Central Universities (N2204010).

Conflict of Interest

Author CY is employed by State Grid Liaoning Electric Power Company Limited. The remaining authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Al-Awami, A. T., and El-Sharkawi, M. A. (2011). Coordinated Trading of Wind and Thermal Energy. IEEE Trans. Sustain. Energy 2, 277–287. doi:10.1109/TSTE.2011.2111467

Cheng, J., Li, R., Choobineh, F. F., Hu, Q., and Mei, S. (2019). Dispatchable Generation of a Novel Compressed-Air Assisted Wind Turbine and its Operation Mechanism. IEEE Trans. Sustain. Energy 10, 2201–2210. doi:10.1109/tste.2018.2883068

Cui, S., Wang, Y.-W., Li, C., and Xiao, J.-W. (2020). Prosumer Community: A Risk Aversion Energy Sharing Model. IEEE Trans. Sustain. Energy 11, 828–838. doi:10.1109/tste.2019.2909301

Fabbri, A., GomezSanRoman, T., RivierAbbad, J., and MendezQuezada, V. H. (2005). Assessment of the Cost Associated with Wind Generation Prediction Errors in a Liberalized Electricity Market. IEEE Trans. Power Syst. 20, 1440–1446. doi:10.1109/tpwrs.2005.852148

Gong, D., Song, S., Lopez, M., and Sanchez, E. N. (2020). Synchronous Analysis for Fuzzy Coupled Neural Networks with Column Pinning Controllers. Theory Appl. Complex Cyber-Physical Interact. 2020, 1397069. doi:10.1155/2020/1397069

Homa, R. K., Mostafa, V. D., Hamid, N., Amjad, A. M., and Josep, G. (2017). A Stochastic Bi-level Scheduling Approach for the Participation of Ev Aggregators in Competitive Electricity Markets. Appl. Sci. 7, 1100.

Huang, B., Li, Y., Zhan, F., Sun, Q., and Zhang, H. (2022a). A Distributed Robust Economic Dispatch Strategy for Integrated Energy System Considering Cyber-Attacks. IEEE Trans. Ind. Inf. 18, 880–890. doi:10.1109/TII.2021.3077509

Huang, B., Zheng, S., Wang, R., Wang, H., Xiao, J., and Wang, P. (2022b). Distributed Optimal Control of DC Microgrid Considering Balance of Charge State. IEEE Trans. Energy Convers Early Access. doi:10.1109/TEC.2022.3169462

Li, Y., Gao, D. W., Gao, W., Zhang, H., and Zhou, J. (2021). A Distributed Double-Newton Descent Algorithm for Cooperative Energy Management of Multiple Energy Bodies in Energy Internet. IEEE Trans. Ind. Inf. 17, 5993–6003. doi:10.1109/TII.2020.3029974

Li, Z., Kang, J., Yu, R., Ye, D., Deng, Q., and Zhang, Y. (2017). Consortium Blockchain for Secure Energy Trading in Industrial Internet of Things. IEEE Trans. Ind. Inf. 2017, 2786307. doi:10.1109/tii.2017.2786307

Liu, Z., Wang, D., Wang, J., Wang, X., and Li, H. (2020). A Blockchain-Enabled Secure Power Trading Mechanism for Smart Grid Employing Wireless Networks. IEEE Access 8, 177745–177756. doi:10.1109/ACCESS.2020.3027192

Luo, F., Dong, Z. Y., Liang, G., Murata, J., and Xu, Z. (2019). A Distributed Electricity Trading System in Active Distribution Networks Based on Multi-Agent Coalition and Blockchain. IEEE Trans. Power Syst. 34, 4097–4108. doi:10.1109/TPWRS.2018.2876612

Mohammad, N., and Mishra, Y. (2018). Coordination of Wind Generation and Demand Response to Minimise Operation Cost in Day‐ahead Electricity Markets Using Bi‐level Optimisation Framework. IET Gener. Transm. & Distrib. 12, 3793–3802. doi:10.1049/iet-gtd.2018.0110

Rashidizadeh-Kermani, H., Vahedipour-Dahraie, M., Shafie-Khah, M., and Catalao, J. (2020). Joint Energy and Reserve Scheduling of a Wind Power Producer in a Peer-To-Peer Mechanism. IEEE Syst. J. 15, 1–10.

Rashidizadeh-Kermani, H., Vahedipour-Dahraie, M., Shafie-Khah, M., and Siano, P. (2021). A Peer-To-Peer Energy Trading Framework for Wind Power Producers with Load Serving Entities in Retailing Layer. IEEE Syst. J. 16, 1–10.

Sanchez de la Nieta, A. A., Contreras, J., and Munoz, J. I. (2013). Optimal Coordinated Wind-Hydro Bidding Strategies in Day-Ahead Markets. IEEE Trans. Power Syst. 28, 798–809. doi:10.1109/TPWRS.2012.2225852

Shan, Q., Chen, Z., Li, T., and Chen, C. (2019). Consensus of Multi-Agent Systems with Impulsive Perturbations and Time-Varying Delays by Dynamic Delay Interval Method. Commun. Nonlinear Sci. Numer. Simul. 78, 104890.1–104890.11. doi:10.1016/j.cnsns.2019.104890

Shin, H., Lee, D., and Baldick, R. (2018). An Offer Strategy for Wind Power Producers that Considers the Correlation between Wind Power and Real-Time Electricity Prices. IEEE Trans. Sustain. Energy 9, 695–706. doi:10.1109/TSTE.2017.2757501

Skajaa, A., Edlund, K., and Morales, J. M. (2015). Intraday Trading of Wind Energy. IEEE Trans. Power Syst. 30, 3181–3189. doi:10.1109/tpwrs.2014.2377219

Song, R., Lewis, F. L., and Wei, Q. (2017). Off-policy Integral Reinforcement Learning Method to Solve Nonlinear Continuous-Time Multiplayer Nonzero-Sum Games. IEEE Trans. Neural Netw. Learn. Syst. 28, 704–713. doi:10.1109/tnnls.2016.2582849

Sorin, E., Bobo, L., and Pinson, P. (2018). Consensus-based Approach to Peer-To-Peer Electricity Markets with Product Differentiation. IEEE Trans. Power Syst. 34, 994.

Wang, X., Gao, D. W., Wang, J., Yan, W., Gao, W., Muljadi, E., et al. (2018). Implementations and Evaluations of Wind Turbine Inertial Controls with Fast and Digital Real-Time Simulations. IEEE Trans. Energy Convers. 33, 1805–1814. doi:10.1109/TEC.2018.2849022

Wang, X., Zhao, T., and Parisio, A. (2022). Frequency Regulation and Congestion Management by Virtual Storage Plants. Sustain. Energy, Grids Netw. 29, 100586. doi:10.1016/j.segan.2021.100586

Yang, T., Yi, X., Wu, J., Yuan, Y., Wu, D., Meng, Z., et al. (2019). A Survey of Distributed Optimization. Annu. Rev. Control 47, 278–305. doi:10.1016/j.arcontrol.2019.05.006

Zhang, C., Wu, J., Zhou, Y., Cheng, M., and Long, C. (2018a). Peer-to-peer Energy Trading in a Microgrid. Appl. Energy 220, 1–12. doi:10.1016/j.apenergy.2018.03.010

Zhang, T., Pota, H., Chu, C.-C., and Gadh, R. (2018b). Real-time Renewable Energy Incentive System for Electric Vehicles Using Prioritization and Cryptocurrency. Appl. Energy 226, 582–594. doi:10.1016/j.apenergy.2018.06.025

Keywords: wind power producer, blockchain, bilevel, energy trading, short-term market

Citation: Du P, Liu Z, Huang B, Jing G, Feng L and Yang C (2022) Blockchain Based Peer-To-Peer Energy Trading Between Wind Power Producer and Prosumers in Short-Term Market. Front. Energy Res. 10:923292. doi: 10.3389/fenrg.2022.923292

Received: 19 April 2022; Accepted: 19 May 2022;

Published: 08 July 2022.

Edited by:

Xiao Wang, Wuhan University, ChinaReviewed by:

Qihe Shan, Dalian Maritime University, ChinaDawei Gong, University of Electronic Science and Technology of China, China

Ruizhuo Song, University of Science and Technology Beijing, China

Copyright © 2022 Du, Liu, Huang, Jing, Feng and Yang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Bonan Huang, SHVhbmdib25hbkBpc2UubmV1LmVkdS5jbg==

Pengbo Du

Pengbo Du Ziming Liu1

Ziming Liu1 Bonan Huang

Bonan Huang