- School of Economics and Management of Mianyang Teachers’ College, Mianyang, Sichuan, China

Reducing energy consumption, pollution and waste emissions are the basic elements of the concept of low-carbon economy. There is an inseparable link between low-carbon economy and financial work in enterprises. In terms of financial work, it is an indispensable element in the development of enterprises. In order to help enterprises improve their financial performance with pertinence, comparability and applicability, this paper selects clear enterprise performance evaluation indicators for analysis from the financial perspective. It aims to help enterprises save energy in a low-carbon economic environment. In this study, the performance evaluation system and financial allocation method of Anhui enterprises’ financial expenditure are studied. In the empirical analysis, 10 ordinary enterprise undergraduate colleges in Anhui Province are selected as samples. This model covers the performance evaluation scope of most financial expenditures of general enterprises in Anhui Province, and is analyzed in the process of DEA model analysis. In the process of DEA model analysis, it can better explain the input-output performance of Anhui enterprises. In this paper, financial expenditure performance evaluation indicators designed based on principal component analysis, data envelopment analysis and other analysis methods can focus on reflecting the input and output of enterprises. It can realize the standardization of evaluation results and better compare the efficiency of financial capital expenditure between enterprises. In other words, the concept of low carbon in enterprises has given a certain standard for the development of financial work. The financial department of the enterprise must fully implement the concept of low carbon during the budget period. Only in this way can we effectively promote the development of enterprises towards low-carbon and environmental protection. Finally, it will lay a solid foundation for the sustainable development of the enterprise.

Introduction

In order to improve the development benefits under the low-carbon economy, enterprises should implement the concept of low-carbon economy on the basis of environmental protection and emission reduction, so as to promote the innovative development of financial management. Environmental quality will affect the promotion of local government officials, which is more prominent in low-carbon pilot cities, while political promotion incentives will significantly improve the carbon reduction performance of enterprises (Chen et al., 2022). The basic concept of low-carbon economy At present, one of the most critical development paths in the process of developing our country’s socio-economic model is low-carbon economy. Climate change mitigation measures directly affect most sustainable development goals and objectives, mainly through common interests. Improving energy efficiency, reducing the demand for energy services and shifting to renewable energy provide the greatest common economic benefits (Iacobuţă et al., 2021). Through the innovation of the development structure of the supplier, the industry will be promoted to complete the transformation of the integrated mode, and the energy consumption and the emission of pollutants will be reduced. Although climate change has brought huge economic consequences, the current climate response is still dominated by economic logic, which is the reason for taking limited action. In addition, although accounting technology has great potential, it is not widely used in the design of stimulus plans. Clearly integrate accounting techniques into the design, delivery and review of the stimulus package to achieve economic growth and social equity while responding to the crisis (Bui and de Villiers, 2021). The main idea of low carbon economy is to realize the peaceful coexistence of man and nature. This concept brings new high standard requirements for the current form of economic development. During operation, major enterprises should not only focus on the immediate economic benefits, but also ignore energy conservation and environmental protection. For a sustainable future, green certification, e-commerce and environmental education can promote a low-carbon economy by reducing carbon emissions, but there is little research on hotels and other enterprises (Chen, 2019). Especially since 2020, the interference brought by the greenhouse effect has been increasing, and more and more countries attach importance to the development benefits and value of low-carbon economy. Therefore, enterprises in our country should constantly add the concept of low-carbon economy to promote the unified development of social economy and natural ecology.

Low carbon economy has brought changes in consumption concept to enterprise investment. From the perspective of marketing, the profit opportunities of enterprises are all based on consumer demand. Therefore, the change of consumption content affects the direction of enterprise investment. Low carbon economy effectively supports the development of energy-saving and emission reduction SMEs. The Bank gives priority to supporting customers’ green credit projects in the fields of new energy, energy conservation, environmental protection and comprehensive utilization of resources. Obviously, the future financial resources will focus on enterprises that actively develop low-carbon economy. The government is brewing and formulating a series of policy tools to promote the development of low carbon economy in China and even the world. These tools include: formulation of emission reduction targets, issuance of emission reduction instructions to enterprises, imposition of carbon taxes, etc. In the process of capital raising by enterprises, the interference brought by low-carbon economy mainly includes two aspects. First, it will improve the difficulty of raising funds for enterprises, and may not be able to prepare sufficient funds for the work when carrying out low-carbon transformation (Semieniuk et al., 2021). This is mainly due to the moderate improvement and supplement of the original credit system by the government under the influence of the development of low-carbon economy. Then the new policy of green credit was formed, which led to the restriction of the financing work in enterprises and had an impact on the initial financing situation of enterprises. Second, the amount of funds that enterprises need to raise on a low-carbon basis is increasing, which to some extent increases the high-risk of debt repayment. In detail, in order to reach the standard of low-carbon economy, some enterprises must improve the intensity of capital investment in the application of low-carbon facilities and technologies (Louche et al., 2019). At this time, the amount of capital that the enterprise needs to prepare will also increase, which indirectly increases the risk of the enterprise in repaying its debts.

The concept of “performance evaluation” in Western countries originated from the civil service system in the United Kingdom, and then it was widely applied to business management with the development of society. Evidence supports more and more practical literature, emphasizing the transformation risk of financial markets. This suggests that policy intervention may be required to address market failures and related potential risk pricing errors (Thomä and Chenet, 2017). In the late 1970s, the concept of “performance evaluation” was introduced into the functional management of government departments in order to improve government management and enhance the efficiency of government management and service level. Since the 1980s, the “New Public Management Movement” has been launched in Western countries such as the United Kingdom, the United States, Australia and New Zealand, whose main content is to adopt theories, methods and techniques of business management (Baranova and Paterson, 2017), introduce market competition mechanisms, and improve the level of public management and the quality of public services by taking the performance of inputs and outputs as the guide. In the field of fiscal expenditure, the establishment of “fiscal expenditure performance evaluation” has played a very important role in the efficiency of the use of government funds, the optimization of the structure of fiscal expenditure and the allocation of resources (Zhu et al., 2019). In China, with the establishment and development of the market economy system, the scale of fiscal revenue and expenditure has been maintaining a stable and rapid growth, but there is a limit to the fiscal revenue, and if the fiscal expenditure is not managed reasonably and effectively, its demand will be unlimited. Therefore, the performance evaluation of fiscal expenditures and the effective improvement of the efficiency of the limited fiscal funds have become the key to improve the current situation of fiscal expenditures (Tong et al., 2019). In recent years, China has been paying attention to the performance evaluation of fiscal expenditures and performance appropriation methods, and has repeatedly and explicitly proposed to establish a performance evaluation system and optimize the budget allocation mode. Report and performance evaluation report, performance evaluation results and their application, etc. The introduction of this measure has provided a useful guarantee to standardize the behavior of financial expenditure performance evaluation, establish a scientific and reasonable performance evaluation management system, and improve the efficiency of financial funds use (Ho, 2018).

The innovative contribution of this paper lies in the design of new financial expenditure performance evaluation indicators, which can focus on reflecting the input and output of enterprises. It can standardize the evaluation results and better compare the efficiency of financial capital expenditure between enterprises. In other words, the low carbon concept of enterprises provides a certain standard for the development of financial work. The results of this empirical study reflect the differences between enterprises in the implementation of education costs, transfer payment and reward and punishment mechanisms. From the perspective of performance allocation, for enterprises with large business scale but still able to meet the basic needs of enterprise project expenditure, the purpose of deducting some funds is to improve the efficiency of fund use, clarify the performance orientation and gradually improve the management level from the perspective of financial expenditure optimization. Reflected on the past financing management mode, innovated and reformed the new financial financing management mode. Ensure the liquidity of funds, improve the anti risk ability of enterprises and promote the sustainable development of enterprises.

The first section introduces the research background and main structure of this paper. It shows that there is an inseparable relationship between low carbon economy and enterprise financial work. The second section introduces the research status of relevant fields at home and abroad, citing the theoretical research of different researchers in performance evaluation indicators. The third section introduces the construction of financial expenditure performance evaluation standard system and financial allocation model through theoretical research. This paper studies the performance of university financial expenditure by using principal component analysis (PCA) and data envelopment analysis (DEA), and explores a new performance allocation model on this basis. This paper puts forward the principles of the enterprise financial expenditure performance evaluation system, and selects the relevant indicators. The fourth section tests and analyzes the scheme proposed in this paper. The fifth section summarizes the research content of this paper and looks forward to the future research direction. The financial department of the enterprise must fully implement the low-carbon concept within the budget period. Only in this way can we effectively promote the development of enterprises towards low-carbon and environmental protection. Finally, it will lay a solid foundation for the sustainable development of enterprises.

Related work

The risk of investment return has been improved, which is the most direct and critical impact of low-carbon economy on major enterprises. Based on the low-carbon economic development model, enterprises need to gradually improve from the initial high carbon to low carbon. To achieve this goal, major enterprises will invest a lot of money in low-carbon facilities and technologies. When the government creates state-owned enterprises (SOEs), one of the main purposes is to reduce their financial burden in the long run, also known as financial sustainability. The relationship between the financial sustainability of state-owned enterprises and government intervention. Lee et al. (2022) has taken a novel approach, using equity to measure government intervention. The results show that only when the government ownership is lower than the threshold, the state-owned enterprises in emerging economies can achieve financial sustainability. No matter where the enterprise invests its capital, it must get a return. All major enterprises are analyzing and exploring whether low carbon can be integrated into enterprise development. Due to unreasonable investment research, insufficient real-time information and data, it is easy for enterprises to blindly invest in developing low-carbon projects. In turn, this has greatly reduced the return on investment of enterprises and hidden greater capital risk for enterprises. Hsu et al. (2021) research shows that green financing reduces short-term loans, thus limiting the over investment in clean energy, while long-term loans have little impact on the over investment in renewable energy, and the intermediate effect is unsustainable. At the same time, the growth of green finance will reduce excessive investment in renewable energy to a certain extent, and improve the productivity of renewable energy investment. In terms of theoretical research, system and appropriation design of performance evaluation indexes, Heinicke pointed out that in the design of performance evaluation system, the administrators of all levels of government and enterprise in the United States should jointly develop performance evaluation reports, so that the design of performance evaluation system of fund expenditures will produce real and reliable results, and the specific assessment indexes should be more inclined to measurable quantitative indexes, too many qualitative indicators will affect the authenticity of the final appraisal. It aims to provide a comprehensive insight into the research of performance measurement system (PMS) for SMEs. Therefore, a systematic literature review of management accounting, small and medium-sized enterprises and general management is conducted to build existing knowledge (Heinicke, 2018). Nazari et al. (2020) determines the university’s priorities through importance performance analysis (IPA) to improve performance and policy formulation. Therefore, in order to achieve educational income, the growth of the number of students should be regarded as one of the most important stages in improving university performance in the future. In addition, guidelines for universities and higher education institutions were proposed to identify key factors for implementation and improvement of performance.

Grossi et al. (2019) combines previous accounting, performance measurement (PM) and accountability studies on the emerging field of knowledge intensive public organizations (KIPO). It reviews the academic analysis and insights on changes in accounting, PM and accountability in enterprises, and paves the way for future research in this field. The domestic research on the performance evaluation of financial expenditures and reform of budget management methods in enterprise started late, and it is mainly attributed to the following aspects: First, the research on the performance evaluation index system of enterprise. Levytska et al. (2020) believes that financial performance analysis can find opportunities to improve the financial situation of enterprises. Effectively control the income and expenditure indicators, and make economic and reasonable decisions based on the calculation results. The characteristics of profit generation and accounting profit are different, and these characteristics should be taken into account when analyzing the financial performance of business entities that do not always ensure the accuracy of information. New public management initiatives have prompted municipalities to evaluate SOEs based on multidimensional performance reports. However, little is known about the pre decision information search and weighing process between different performance dimensions when decision-makers evaluate the performance of state-owned enterprises. When Lindermüller et al. (2022) assessed the allocation budget of state-owned enterprises, participants considered multiple performance dimensions and focused on financial and customer performance information. The results show that when municipal financial resources are scarce, participants will devote more energy to the performance evaluation process. Islami et al. (2018) pointed out the importance of target management in enterprise performance budget. And on this basis, the paper discusses the importance of applying MBO as a performance assessment (PA) method in improving employee efficiency. Econometric results show that with the improvement of staff efficiency, MBO method should be used as a performance appraisal method. In addition, the research results show that the evaluation of employees’ individual performance and the clear definition of results are the largest parameters in all other activities of the MBO method. Jiang et al. (2018) examined the impact of positive corporate environmental responsibility on the financial performance of Chinese energy industry enterprises through panel data multivariable regression analysis. The results show that positive corporate environmental responsibility has a positive impact on the financial performance of enterprises that pass the endogenous test. The results also show that private ownership has a stronger role in promoting the relationship between positive corporate environmental responsibility and corporate financial performance. This study will help to increase the knowledge of corporate environmental responsibility in emerging economies, and provide insights into corporate environmental responsibility practices and government environmental regulation and policies.

A study of previous literature reveals that the research on the performance evaluation system of financial expenditures is in continuous progress, with a variety of research directions and methods, and many high-quality research results have been applied in the practical work of the performance evaluation system. However, the following problems still exist in the relevant work: first, the performance evaluation indexes lack purpose. Secondly, the status of performance evaluation is too high. Third, the performance evaluation of financial expenditures should be linked with performance appropriation and performance budget.

Design of enterprise financial system and financial allocation under the background of low-carbon economy

The goal of enterprise financial management directly determines the basic direction and purpose of enterprise management. From the historical experience of financial management, we can see that the development of financial management objectives has also gone through several specific stages. So far, the most widely accepted goal is to maximize the value of enterprises. Under the traditional economic conditions, the actual responsibilities undertaken by enterprises are all economic responsibilities, not social responsibilities, which means that investors themselves really need to make rational choices. However, under the condition of low-carbon economy, China has different responsibilities. To be specific, the enterprise bears more than economic responsibility. To a greater extent, it is social responsibility. This means that the disclosure of financial management is no longer limited to financial information, but also includes resource and environmental information.

From the perspective of low-carbon economy, the internal control mechanism of major enterprises plays a key role in the operation and supervision. Therefore, enterprises must attach importance to the efficiency of internal control mechanism to fully improve the high quality and high level of enterprise supervision, and China can also effectively improve the speed and quality of enterprise development. On the contrary, if an effective internal control mechanism is not developed, it will easily lead to various adverse problems, such as unclear distribution of department responsibilities, low work efficiency, and unreasonable internal supervision of enterprises. Under the influence of these problems, the financial management crisis in enterprises will be enhanced under the background of low-carbon economy. Therefore, it can be concluded that from the perspective of low-carbon economy, the efficiency of enterprise internal control mechanism must be improved. In view of various serious problems arising during the operation of the enterprise, we must fully follow the relevant norms of internal control system to better rectify them. And then fully prevent the emergence of strategic mistakes and various undesirable problems. As the scale of enterprise is expanding, the demand for funding is increasing, and the government’s financial spending capacity is limited, China’s enterprise is facing a shortage of funding, therefore, China has started to explore the diversification of enterprise investment bodies to change the situation of a single source of enterprise funding structure in China. However, due to the real situation, the government financial allocation still accounts for the main source of enterprise funding. In Anhui Province, the basic situation of enterprise funding shows that financial allocation is absolutely dominant, business income is supplementary and other channels are complementary. From the data of 2016, the state financial education funding accounted for 66.34% of the total education funding income of general enterprise in that year, the career income accounted for 30.01% of the total income, and the percentage of other income was only 3.65%.

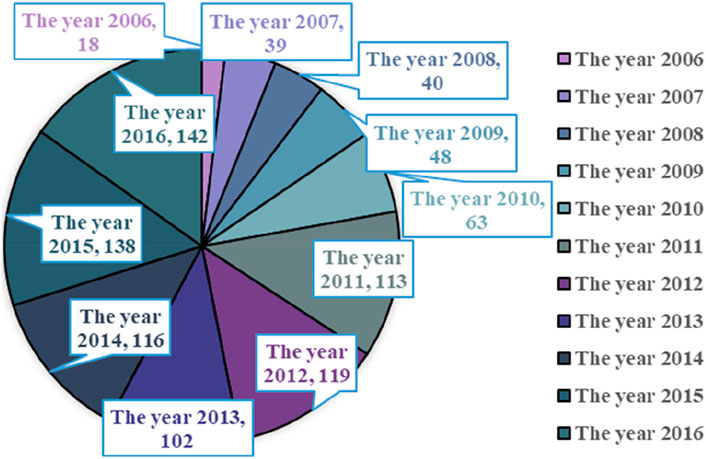

The amount of government financial investment into enterprise will directly affect the operation efficiency of colleges and universities, thus affecting the quality of talent cultivation and the sustainable development of society, Anhui Province also recognizes the importance of developing enterprise and keeps increasing the volume of financial expenditure on enterprise. During this period, the annual financial expenditure on education has maintained a continuous growth momentum, with the most significant growth rate in 2016. The relative scale of enterprise expenditure in Anhui province can be seen from the proportion of enterprise expenditure to GDP as shown in Figure 1.

From the above data, it can be seen that the demand for enterprise funds in Anhui Province is increasing as the popularization and massization of enterprise continues to deepen, but the contradiction between the demand and supply of enterprise funds in enterprise is very acute due to the limited support of government financial expenditures to enterprise. Therefore, to change this situation, it is necessary to improve the efficiency of the use of enterprise financial funds, reduce the waste of educational resources, and optimize the allocation of resources, thus it is urgent to improve the financial expenditure of enterprise to implement the reform of performance evaluation system and implement the performance-oriented financial allocation.

DEA was proposed by three American statisticians and operational research researchers. It mainly solves the specific technical efficiency problems of input and output through the non-parametric technical efficiency method. Technical efficiency mainly solves the problem of calculating the technical efficiency in actual production by measuring the output index when the input is known. On the micro level, the DEA model mainly analyzes the ratio of each output to each input of the decision-making unit (DMU). The input and output indicators multiplied by a certain weight can reflect the comprehensive technical efficiency and scale technical efficiency.

CCR model is the first input-output model in the development history of DEA. It is a DEA model that calculates the technical efficiency of the decision-making unit of the target unit through objective data analysis under the condition that the return on scale remains unchanged. It can evaluate the technical efficiency of any decision-making unit with input and output. The technical efficiency of any decision-making unit with input and output can be evaluated. In a large number of experiments, the most prominent applications are military, medical and educational undertakings.

Suppose, according to the CCR output-oriented model, the number of decision-making units (DUMs) to be calculated is

Since

Then the new equivalence planning model is:

The integrated combination coefficient of the linearity of the pairwise model

When

When

The output-oriented

In the CCR input and output model, the calculation of the combined efficiency of inputs and outputs becomes possible, and the redundancy analysis of input or output indexes can be performed according to the DEA model, which provides the direction to suggest the optimization of each input or output.

Suppose, according to the CCR output-oriented model to calculate the target decision unit, the number of decision units (DUM) is

Input model

As a model with variable returns to scale

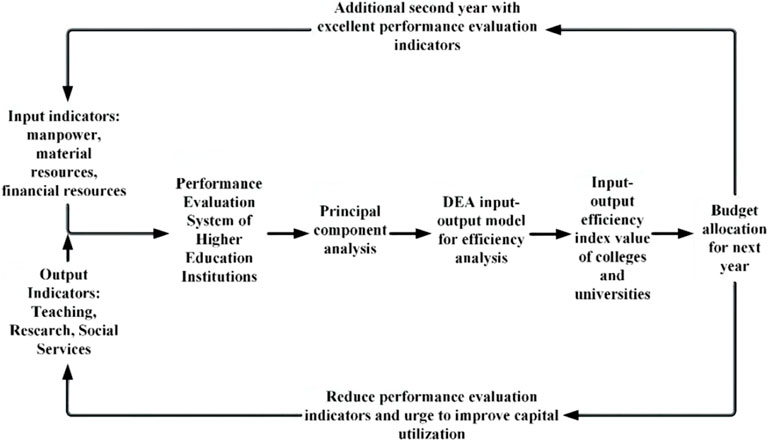

The input of enterprise can be considered from “human, financial and material,” and the output can be considered from “teaching, scientific research and social service,” because the input and output of enterprise have a certain periodicity, especially scientific research, from the establishment of projects, funds to the output of scientific research. The results of financial performance evaluation are very unstable, and the specific indicators should be selected in 3 years or more to analyze the effectiveness of the use of funds in enterprise on a rolling basis. The specific process of performance evaluation work and performance appropriation work can be shown in Figure 2.

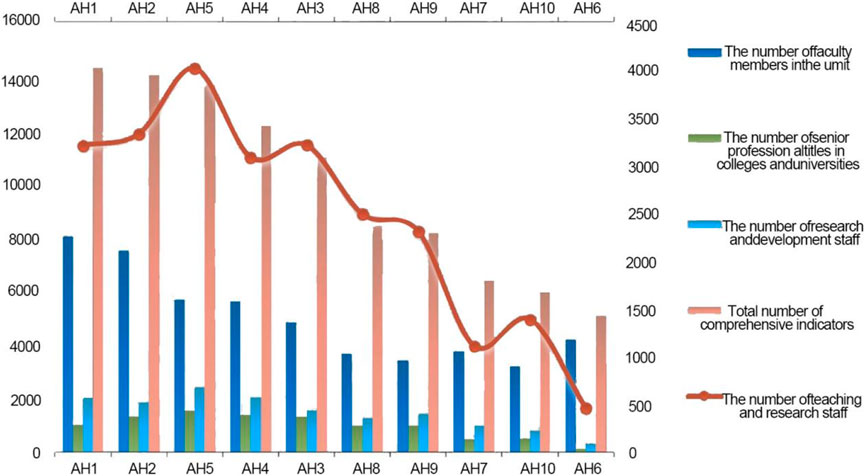

The input of enterprise in Anhui Province is diversified and complex, and the evaluation system of financial expenditure of enterprise is based on the principles of index design and the inherent requirements of performance appropriation, the design of input indexes should conform to the principles of clarity, comparability, importance and economic availability, and the efficiency can be calculated in detail to provide a basis for the next year’s appropriation. In the “input-output” model, input indicators are generally set with X as the variable. The relevant indicators are shown in Figure 3.

FIGURE 3. The investment system of financial expenditure performance evaluation of colleges and universities in Anhui Province.

From the viewpoint of economic units, the economic activities of enterprise are complex, and there are multiple inputs and multiple outputs, such as input and output for comparison, and there is ambiguity in their input weights and output weights. In the performance evaluation system of enterprise, there are analysis methods such as Deffel method and hierarchical analysis method. The analysis is carried out by the experience and subjective judgment of relevant experts, and the judgment results are often subjective. To address this problem, the use of objective analysis methods in the field of statistics can often solve this problem, so that the final evaluation results can be standardized and the inputs and outputs of enterprise can be treated objectively.

Financial performance indicators provide investors with data information for investment decisions. However, there are many indicators reflecting financial performance, so it is necessary to find a few indicators that can reflect many indicators. Using the principal component analysis method, the empirical analysis of the financial performance indicators of listed companies from the aspects of profitability, operating capacity, solvency and development capacity has certain advantages. Principal component analysis is used to reduce the dimensionality of input indicators and output indicators established in the financial fund performance evaluation index system of enterprise. The purpose of data dimensionality reduction is to find out the indicators with higher substitution to explain the other indicators based on the understanding of the correlation of indicator data. The substitution indicators can be used to obtain the comprehensive evaluation score of principal components with the standardized data and variance contribution rate, and replace more original variables with a small number of variables. The main steps of the principal component analysis method are as follows.

(1) It is assumed that there are

(2) Since the unit of measurement of each index is different from the extraction standard, it is not possible to compare them, so the mean of the calculated sample should be standardized by

(3) Based on the correlation coefficients of the indicators

(4) Based on the equation

(5) The main idea of principal component analysis is to reflect the original large number of original variables with fewer variables, therefore, it is necessary to calculate the cumulative contribution of the variance of a few variables, let the variance calculated contribution is

(6) Based on the eigenvectors and eigenvalues, the loadings of each principal component can be calculated, which reflect the correlation between the principal components and the original variables and are calculated as follows:

(7) The principal component scores can be converted based on the eigenvectors and the standardized indicator variables.

(8) Based on the final scores of the principal components, the overall score H of the principal component analysis can be converted according to the weighted average of their contributions.

After the indicator classification and dimensionality reduction analysis of PCA, the values of the original higher school performance evaluation indicators can be reduced from the initial 15 indicators to 4 indicators, which has a greater advantage for the substitution of input and output models, so that the input model of the BCC model with actual data substituted into the input-output has a better explanation for the input and output of specific indicators.

Input

In the performance evaluation system of financial expenditures of enterprise, the technically effective analysis and several chirping analysis of DEA are used to find out the problems of comprehensive evaluation and technical efficiency. According to the performance evaluation report, the final evaluation results can be applied to the final financial allocation.

Let the sample of participating enterprise be

The above formula can only convert the actual allocation of enterprise for the current year, but cannot reward enterprise with good performance evaluation. After converting the actual project expenditure allocation of each enterprise institution in the above formula, the sum of

Effective performance appraisal will play a good role in promoting enterprise performance. It will effectively improve the positive performance of each employee, enable the strong to win higher status and interests, enable the weak to have pressure and upward momentum, and ultimately promote the realization of enterprise goals. For enterprises, the growth of talents is an indispensable part of enterprises. The ultimate goal of the performance test is to promote the common growth of enterprises and employees. Through the continuous discovery and improvement of problems in the assessment process, we can promote the improvement to achieve a win-win situation for individuals and enterprises.

Analysis of simulation results

In view of the new environmental situation of low-carbon economy, this paper proposes the following financial management measures for enterprises through full understanding and experience of its characteristics and opportunities. In order to play a due role in the actual application process. During the operation period, enterprises must give higher support to low-carbon projects. For those safe and reliable low-carbon projects, more efforts can be made in the investment of funds to promote the full operation of the project. In addition, we should also build a reasonable regulatory mechanism according to the actual situation, so that the operation of low-carbon projects has corresponding pillars. Second, when carrying out low-carbon projects, people first must be taken as the basic concept, so human resources can be put in the first place in the allocation work. The authority and effectiveness of each link must be well demonstrated. Under the influence of the current low-carbon economy, the benefits brought by human resources to enterprises are continuously improving. Therefore, the human resources work must be well handled to ensure that the allocation of benefits can meet the actual requirements.

Through theoretical thinking on the performance evaluation system, performance allocation and performance budget management, this research constructs the financial expenditure performance evaluation system of Anhui Province’s colleges and universities. Collect quantifiable actual input and output indicators of colleges and universities, and convert the data into the input-output model to calculate the actual performance score through the dimension reduction idea of principal component analysis. On this basis, we will explore the fund allocation mode of Anhui Province’s higher education projects. Through the empirical research of colleges and universities in Anhui Province, the correctness and operability of the ideas are tested, so as to provide a way of thinking for the connection between performance appraisal and budget allocation. In this study, as a research on the financial expenditure performance evaluation system and financial allocation method of enterprise in Anhui Province, 10 general enterprise undergraduate institutions in Anhui Province were selected as samples in the empirical analysis, accounting for 84.61% of the total number of general undergraduate enterprise in Anhui Province, which covers the performance evaluation scope of most of the financial expenditures of general enterprise in Anhui Province, and in the process of DEA model analysis. In the process of DEA model analysis, it can best explain the performance of input-output of Anhui enterprise.

In order to maintain the homogeneity of DMU in the reference set, this paper classifies DMU before DEA evaluation. The existing researches either only give abstract solutions or only solve some problems. In order to get a more comprehensive solution, a qualitative and quantitative classification method for DMU is proposed according to the evaluation purpose. The applicability of qualitative and quantitative classification methods is also given. The selection of the sample in this study was based on the following considerations.

Selection of DMU samples

In this study, the principle of comparability was considered in the design of the performance evaluation system, and for the sample selection of DMU, the “inputs” and “outputs” of the analyzed indicators are highly comparable. The consistency of performance evaluation indexes of enterprise can be a basic guarantee from the perspective of performance evaluation and improving the efficiency of financial resources. In this study, the 10 enterprise in Anhui Province are all undergraduate colleges and universities, and some of them have been deleted, as follows: First, the average per capita allocation of undergraduate colleges and universities in Anhui Province from 2013 to 2015 has reached RMB 12,000, while the average per capita allocation of enterprise is only RMB 0.8 million. The “input” is not in the same standard. Secondly, four medical schools and art colleges in Anhui Province were deleted from the sample. Anhui Medical University, Anhui University of Traditional Chinese Medicine, Wannan Medical College and Bengbu Medical College not only include the per capita allocation of enterprise, but also include the presence of hospitals and other institutions in the form of per bed allocation, which is completely different in terms of allocation and volume. In terms of output, the social service functions of medical schools include not only the output of enterprise in terms of teaching, research and conversion of research results, but also the related contribution to the provision of medical services and the improvement of local medical standards. The output of art institutions includes compositions and works, which are also deleted because of the inconsistent assessment index system. The financial expenditure performance evaluation index of colleges and universities should have a clear direction. In ¨ Input production ˆ This model considers the use efficiency of financial expenditure funds of colleges and universities. To put it simply, it is how to get a higher output when the current year’s input is fixed, and how to evaluate the performance. The results of performance evaluation will be used as the basis for performance fund allocation in the next year. Units with good evaluation results will receive more financial support. Units with poor evaluation results will continue to provide financial support in the previous year. Improve the quantity and quality of various indicators in the output, and improve the overall score of performance evaluation.

The selection of DMU sample data year

Teaching output, scientific research output and social services of enterprise are cyclical, especially in scientific research, a subject often has a long annual cycle from the establishment to the end of the project, and there are not many scientific research projects that obtain scientific research papers and technical results by making human and financial investment in the same year, and the use of input and output data of a certain year to assess enterprise lacks fairness. 2014, the Ministry of Finance in the institutions The reform of the budgeting system of institutions proposed to prepare budgets in the form of three-year rolling budget for provincial and municipal institutions, which strengthened the medium and long-term role of budget control, while some national and provincial projects were also established in the context of three-year rolling budgeting in terms of annual allocation and annual output. Under the specification of performance assessment and evaluation system of enterprise, 3 years of data from 10 provincial undergraduate institutions in Anhui Province were selected for analysis, and the data index data were taken as the sum of 3 years to reflect the actual performance of the use of funds in enterprise. In the process of data collection, due to the recent years, only some of the “input” data are available for 2016–2017 in 10 Anhui undergraduate institutions, and most of the “output” data are being counted by national departments and institutions of enterprise. In this study, some data of 2016–2017 were used for reference.

From the data of the 10 undergraduate institutions selected in Figure 4, the combined indexes of the number of faculty members in AH1, AH2, AH3, AH4 and AH5 are all above 10,000 in Anhui enterprise, and the number of faculty members and research and development personnel is also relatively high, and the scale of faculty members is in the first echelon of universities in Anhui province.

From the data of 10 undergraduate institutions selected in Figure 5, the total combined indexes of AH1 and AH2 financial and material resources input costs among Anhui enterprise are above 10 billion RMB, and the total combined indexes of financial and material resources input costs are in the first echelon of Anhui enterprise.

FIGURE 5. Financial and material resources input cost indicators for financial expenditure performance evaluation.

The currently evaluated DMU is the case of low technical efficiency, which is represented by the marginal maximum limit value of input reduction. That is, under the current technical efficiency, without reducing the output, the input can be reduced in a linear and equal proportion. When the evaluated DMU is in the best technical effective state, the indicators of each input are in the best state without reducing the output, so there is no need to reduce the input. According to the research of this actual data, a total of 15 indicators were selected to reflect the financial performance evaluation of enterprise well. In the process of actual DEA model analysis, since the number of DMUs in this study has been determined as 22, if the number is less than the overall converted indicators, it is very easy to have the result that all DMUs are valid, which makes the final performance appraisal model distorted. Therefore, the selected indicators must be processed for dimensionality reduction. In this empirical study, PCA is used, and SPSSV22 software is applied to reduce the correlation between the data, and the most representative indicators are selected for analysis, among which: 4 indicators of human cost input, 5 indicators of financial capital input, 3 indicators of teaching category output and 3 indicators of research category output.

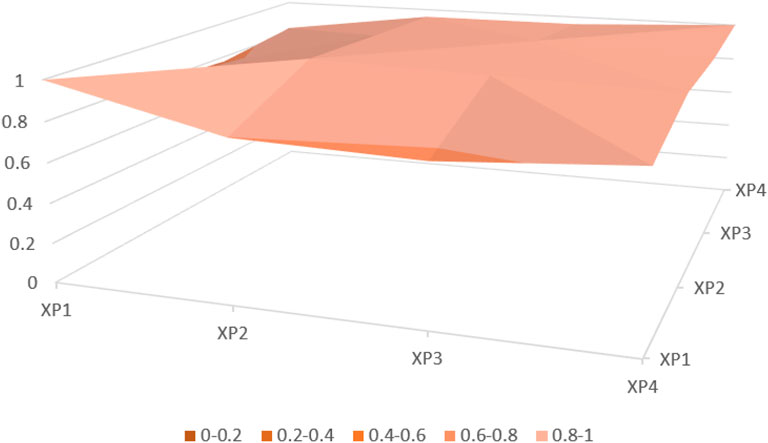

From the Figure 6, the number of unit faculty members (XP1), the number of teaching and research staff (XP2), the number of senior titles in the institution (XP3), and the number of research and development staff (XP4) have relatively close correlation coefficients, and are suitable for the principal component analysis method.

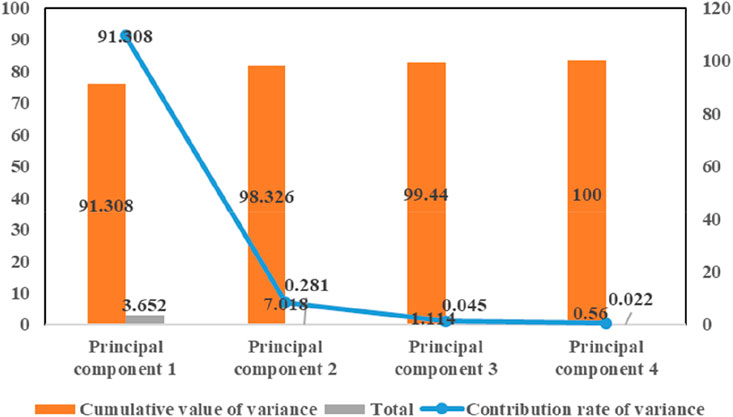

Using the data standardization method and principal component analysis method in SPSS, the “total variance of interpretation” and “component matrix” are obtained. It can be seen from the test results that, at the level of significance α If it is 0.05, the sample p-value is 0, obviously less than 0.05, so the sample data is suitable for principal component analysis. From Figure 7, it is observed that the cumulative percentage of variance of the first three components has reached at least 91.308%, and the general standard is more than 85%, so it is appropriate to extract the first three principal components here. The cumulative index of eigenvalue is greater than 1, and the contribution of variance should be greater than 80%. The extracted sum of squares is loaded with 3.652 indicators. This better reflects the overall variable information, and the other four repeated partial variables can be replaced.

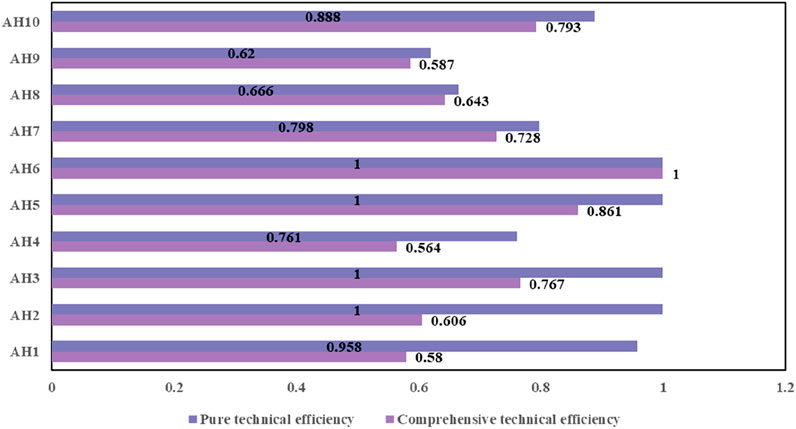

In this paper, the input-output factors of 10 undergraduate institutions in Anhui standardized after data dimensionality reduction are substituted into DEA input-output model using MAXDEAbasic software, where: DMU = 22, input indicators are X1 and X2, output indicators are Y1 and Y2, and the analysis results of input-oriented BCC model are selected as shown in Figure 8.

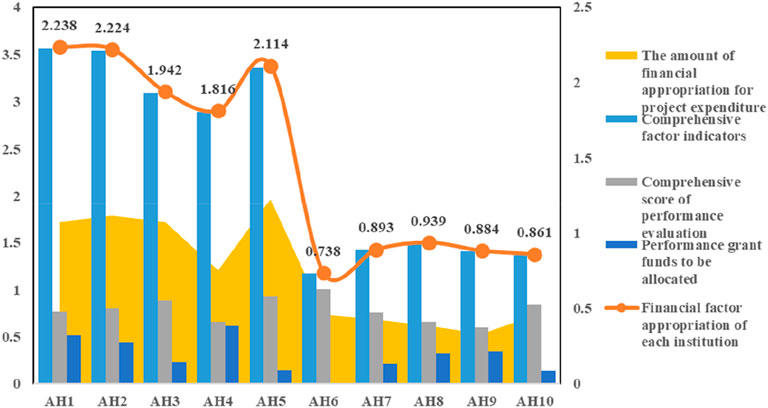

Based on the component factors and performance evaluation indicators, the projected appropriation of $2.1 billion for the 2016 budgeted financial allocation for project expenditures, the actual appropriation for each university can be calculated, taking AH1 as an example, and setting the actual appropriation for AH1 in 2016 as C. The appropriation for AH1 in 2016 is as follows

According to the financial allocation factor and performance, the allocation of Anhui provincial institutions is shown in Figure 9.

FIGURE 9. Performance Appropriation funds for provincial institutions of higher learning in Anhui province.

In summary, the results of this empirical study reflect the differences in the cost of schooling among enterprise, the realization of transfer payments, and the implementation of reward and punishment mechanisms. Anhui provincial enterprise have great differences in the combined volume of teachers’ resources, financial capital investment, teaching and research output, and reflecting the indicators by comprehensive factor indicators can well solve the inconsistency of data. From the perspective of performance appropriation, deducting part of the funds for enterprise with larger scale of operation but still meeting the basic needs of project expenditures of enterprise is to promote them to improve the efficiency of fund use, clarify the performance orientation and gradually improve the management level from the perspective of financial expenditure optimization. At the same time, from the perspective of rewarding performance appropriation, enterprise with excellent performance can get rewarding funds, and institutions with large comprehensive volume get more performance appropriation, more investment and wider range of financial expenditure, which can promote further development of enterprise with excellent performance appropriation.

Extensive financial management mode has caused resource waste and environmental pollution. In order to change this situation, enterprises must establish the concept of low-carbon economic development and build a new model of financial management. However, the overall implementation is very difficult, so enterprises must eliminate some outdated technologies and outdated equipment. Formulate a scientific and modern financial management system for low-carbon economy to enable enterprises to effectively adapt to the development requirements of low-carbon economy and achieve high-quality and comprehensive development. In recent years, China has attached great importance to environmental protection and has been promoting the low carbon economy development model. However, the actual effect has not reached the expected goal, one of which is financing management. To implement the low-carbon economic model, enterprises need to seriously study this issue. At the same time, reflect on the past financing management model, and innovate and reform the new financial financing management model. To ensure the liquidity of funds and improve the anti risk ability of enterprises, so as to promote the continuous development of enterprises.

In view of the new environmental situation of low carbon economy, this paper fully understands its characteristics and opportunities. The following financial management measures are proposed to play a due role in the actual application process. (1) People first is the most fundamental condition for any work. The same is true in financial management. Therefore, under the general situation of low-carbon economy, the primary task is to improve the professional quality and professional quality of relevant managers, and gradually form a good green corporate culture in the enterprise. (2) Innovate the content of financial management. It mainly means that the green financing plan should be formulated accordingly when financing. The formulation and implementation of this plan is to pave the way for the funds needed to protect the environment in the follow-up work. To avoid greater risks to itself due to insufficient or idle funds. (3) Establish green management system. The enterprise shall establish a set of green management system, and the provisions of this system shall be stipulated according to the relevant regulations in the national financial management system and the industrial financial management system. And specifically formulate the governance and protection measures that the enterprise needs to take against the ecological environment problems.

Summary and outlook

Under the background of low carbon economy, enterprises can achieve better and long-term development only by quickly adapting to the current policy environment. The performance evaluation of financial expenditures of enterprise and the change of performance appropriation method are the most concerned issues for financial departments, education authorities and decision makers of enterprise. From the grand strategy of national economic system reform, the appropriation of financial funds will gradually change from increasing the input of total amount of funds to increasing the evaluation of the effectiveness of using funds. From the actual situation of financial expenditure performance evaluation in Anhui enterprise, the performance evaluation of financial funds is still in the initial stage, and there is no mature theoretical system and outstanding excellent working effect.

This study constructs the financial expenditure performance evaluation system of enterprise in Anhui Province through theoretical consideration of performance evaluation system, performance appropriation and performance budget management. The actual input and output indicators that can be quantified by each enterprise institution are collected, and the actual performance scores are converted by substituting the data into the input-output model through the dimensionality reduction idea of principal component analysis, and this is used as a basis to explore the project expenditure fund allocation model of enterprise in Anhui Province. Through the empirical study of 10 institutions of enterprise in Anhui Province, we test the correctness and operability of the idea, and provide an idea to link performance evaluation and budget allocation. At present, the reform of financial management under the low-carbon economy is still a relatively new theoretical concept. That is to say, its progress and development are still at a basic stage, lacking not only the necessary theoretical support, but also the support of practical experience. However, This paper takes the total number of enterprise teachers in Anhui Province as an example. This is not a good representative of all low-carbon enterprises, so it has certain limitations. It is also necessary to expand the data surface for analysis. After all, financial management under the low-carbon economy is a scientific and sustainable concept, which aims to improve the living environment, that is, to lay the foundation for the harmonious coexistence of human and nature, which is an inevitable choice after our economic development to a certain extent. In the future, we have every reason to believe that with the continuous development and exploration of science and technology and the continuous progress of the times, the financial management under the low-carbon economy will be further developed and optimized. This will greatly help enterprises to improve their green competitiveness, and will make great contributions to their own scientific and sustainable development.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

HLJ wrote the manuscript and approved its submission to Frontiers in Psychology.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Baranova, P., and Paterson, F. (2017). Environmental capabilities of small and medium sized enterprises: Towards transition to a low carbon economy in the East Midlands. Local Econ. 32 (8), 835–853. doi:10.1177/0269094217744494

Bui, B., and de Villiers, C. (2021). Recovery from covid-19 towards a low-carbon economy: A role for accounting technologies in designing, implementing and assessing stimulus packages. Account. Finance 61 (3), 4789–4831. doi:10.1111/acfi.12746

Chen, L. F. (2019). Green certification, e-commerce, and low-carbon economy for international tourist hotels. Environ. Sci. Pollut. Res. 26 (18), 17965–17973. doi:10.1007/s11356-018-2161-5

Chen, S., Mao, H., and Sun, J. (2022). Low-carbon city construction and corporate carbon reduction performance: Evidence from a quasi-natural experiment in China. J. Bus. Ethics 180 (1), 125–143. doi:10.1007/s10551-021-04886-1

Grossi, G., Kallio, K. M., Sargiacomo, M., and Skoog, M. (2019). Accounting, performance management systems and accountability changes in knowledge-intensive public organizations: A literature review and research agenda. Account. Auditing Account. J. 33 (1), 256–280. doi:10.1108/aaaj-02-2019-3869

Heinicke, A. (2018). Performance measurement systems in small and medium-sized enterprises and family firms: A systematic literature review. J. Manag. Control 28 (4), 457–502. doi:10.1007/s00187-017-0254-9

Ho, A. T. K. (2018). From performance budgeting to performance budget management: Theory and practice. Public Adm. Rev. 78 (5), 748–758. doi:10.1111/puar.12915

Hsu, C. C., Quang-Thanh, N., Chien, F. S., Li, L., and Mohsin, M. (2021). Evaluating green innovation and performance of financial development: Mediating concerns of environmental regulation. Environ. Sci. Pollut. Res. 28 (40), 57386–57397. doi:10.1007/s11356-021-14499-w

Iacobuţă, G. I., Höhne, N., Van, S. H. L., and Leemans, R. (2021). Transitioning to low-carbon economies under the 2030 agenda: Minimizing trade-offs and enhancing co-benefits of climate-change action for the sdgs. Sustainability 13 (19), 10774. doi:10.3390/su131910774

Islami, X., Mulolli, E., and Mustafa, N. (2018). Using Management by Objectives as a performance appraisal tool for employee satisfaction. Future Bus. J. 4 (1), 94–108. doi:10.1016/j.fbj.2018.01.001

Jiang, Y., Xue, X., and Xue, W. (2018). Proactive corporate environmental responsibility and financial performance: Evidence from Chinese energy enterprises. Sustainability 10 (4), 964. doi:10.3390/su10040964

Lee, C. L., Ahmad, R., Lee, W. S., Khalid, N., and Karim, Z. A. (2022). The financial sustainability of state-owned enterprises in an emerging economy. Economies 10 (10), 233. doi:10.3390/economies10100233

Levytska, S., Akimova, L., Zaiachkivska, O., Karpa, M., and Gupta, S. K. (2020). Modern analytical instruments for controlling the enterprise financial performance. Financial credit activity problems theory Pract. 2 (33), 314–323.

Lindermüller, D., Sohn, M., and Hirsch, B. (2022). Trading off financial and non-financial performance information to evaluate state-owned enterprise performance–a process tracing-experiment. Int. Public Manag. J. 25 (5), 639–659. doi:10.1080/10967494.2020.1799888

Louche, C., Busch, T., Crifo, P., and Marcus, A. (2019). Financial markets and the transition to a low-carbon economy: Challenging the dominant logics. Organ. Environ. 32 (1), 3–17. doi:10.1177/1086026619831516

Nazari, S. S., Mousakhani, S., Tavakoli, M., Dalvand, M. R., Šaparauskas, J., and Antuchevičienė, J. (2020). Importance-performance analysis based balanced scorecard for performance evaluation in higher education institutions: An integrated fuzzy approach. J. Bus. Econ. Manag. 21 (3), 647–678. doi:10.3846/jbem.2020.11940

Semieniuk, G., Campiglio, E., Mercure, J. F., Volz, U., and Edwards, N. R. (2021). Low-carbon transition risks for finance. WIREs Clim. Change 12 (1), e678. doi:10.1002/wcc.678

Thomä, J., and Chenet, H. (2017). Transition risks and market failure: A theoretical discourse on why financial models and economic agents may misprice risk related to the transition to a low-carbon economy. J. Sustain. Finance Invest. 7 (1), 82–98. doi:10.1080/20430795.2016.1204847

Tong, P., Zhao, C., and Wang, H. (2019). Research on the survival and sustainable development of small and medium-sized enterprises in China under the background of low-carbon economy. Sustainability 11 (5), 1221. doi:10.3390/su11051221

Keywords: fiscal expenditure, performance evaluation, financial allocation method, data envelopment analysis, low-carbon economy

Citation: Jiang H (2023) Discussion on key technologies of big data in financial budget performance management in low-carbon economy. Front. Energy Res. 10:1080595. doi: 10.3389/fenrg.2022.1080595

Received: 26 October 2022; Accepted: 29 November 2022;

Published: 20 January 2023.

Edited by:

Wen-Tsao Pan, Hwa Hsia University of Technology, TaiwanReviewed by:

Shuo Xing, Hunan University, ChinaWantian Cui, Liaoning University, China

Lichun Zhou, Shangqiu Normal University, China

Copyright © 2023 Jiang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Honglan Jiang, MTk5MDE0QG10Yy5lZHUuY24=

Honglan Jiang

Honglan Jiang