- 1Department of Economics, The Women University Multan, Multan, Pakistan

- 2School of Economics, Bahauddin Zakariya University, Multan, Punjab, Pakistan

Contingent upon the empirical work done, the current study seeks to investigate the environmental load capacity factor (LCF) consequences of financial development in three different ways for 48 Asian economies. We used the two-step system generalized method of moments (GMM) technique to analyze the data from 1996 to 2020. Initially, we investigated the environmental consequences of financial development by considering six dimensions of financial development. Then, we modified the original environmental Kuznets curve (EKC) into the financial market-based EKC (FM-EKC) to compare short- and long-run environmental consequences of financial development. Ultimately, the study explores the intersecting marginal effects of financial development and institutional quality on environmental quality. Our results show that foreign direct investment (FDI), financial development, economic growth, and environmental quality (LCF) exhibit statistically significant long-run co-integrating relationships in the studied economies. This study demonstrated how FDI, financial development, and economic expansion contribute to environmental deterioration in 48 Asian countries. The nexus between finance and sustainability is moderated by the institutional quality and the regulatory environment, resulting in the FM-EKC idea. The key findings of system GMM analysis confirmed that Asian countries have an inverted U-shaped FM-EKC, which we attempt to explain with three different justifications. This study showed that the strong institutional structure in an economy guarantees the favorable environmental consequences of financial development in the long run. It also suggested that a healthier education structure of an economy can help improve the environmental quality of an economy.

1 Introduction

Over time, it has become clear that changes in the financial sector have a ripple impact on the overall economy. The financial crisis of 2007–2008 is a prime example of how developments in the financial sector can trigger an international economic crisis. It demonstrates the vital influence of the financial sector on the economy’s state. The financial market is responsible for making money available to economic agents to seize chances in the real estate sector, promoting growth and development. Financial market reforms are implemented during economic downturns to address these economic oddities. The global movement toward sustainable growth emphasizes green economics and finance. In order to drive economic and financial development while minimizing pollution and other environmental degradation, green economics and finance focus on more than just boosting economic and financial sector growth. The relationship between the environment and economic growth has received much attention in the current literature. The environmental Kuznets curve (EKC) effect and its most recent adaptations have contributed to this (Nasir et al., 2019; Ntow-Gyamfi et al., 2020; Fakher et al., 2021; Shahbaz et al., 2022).

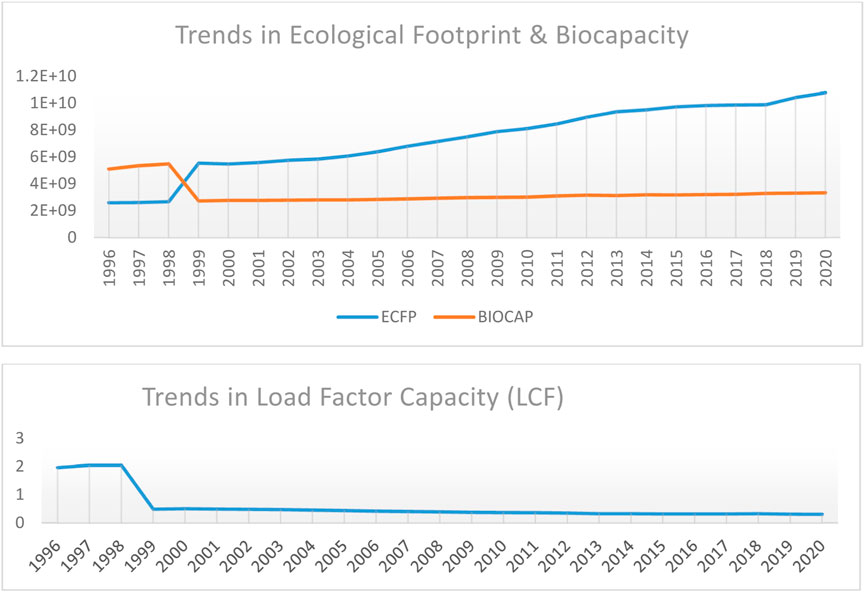

The 21st century has been commemorated as the Asian century, and its revelation is evident from the fact that Asia’s emerging economies have been growing globally since the 2008 global financial crisis (GFC). In this context, Asian countries have emerged as an essential economic block. It comes in the form of a market worth more than $ 761.8 billion and residents of over 83 million, with a remarkable growth rate of approximately 6.1% and 7.5% in 2015 and 2017, respectively. Furthermore, the forecast shows the economy can expand by 5.8% in 2021 (Focus Economics, 2020). The trends in load capacity factor (LCF), biocapacity, and ecological footprint are reported in Figure 1. The estimates indicate that the supply of the environment cannot cover the demand side of the economy over time, which creates a deficit in the ecosystem (Global Footprint Network). However, the projection indicates sustainable growth in the future for the Asian economies. It was projected in the McKinsey Global Institute report (GIR) that the Asian economies are among the best-performing emerging economies in the world with positive long-term growth prospects. While social and economic growth in this region is creditable, it is essential to contemplate financial development’s environmental and ecological implications in detail. The empirical literature provided mixed, contrasting, and inconclusive evidence on the environmental consequences of financial development and economic growth.

The mismatch was observed in several empirical studies regarding the short- and long-run environmental consequences of economic growth. Economic growth can enhance the environmental quality in the long run, which may cause short-term environmental deterioration. This sensation is widely accorded as the EKC. However, the empirical evidence on the environmental consequences of economic growth and the shape of EKC are contrasting, mixed, and inconclusive. Sencer Atasoy (2017), Haseeb et al. (2018), Destek and Sarkodie (2019), Fakher (2019), Nasir et al. (2019), and Seetanah et al. (2019) have shown blended outcomes in various nations. One could contend that the country’s economic position would affect the relationship between economic growth and the environment. Nonetheless, such a declaration would be a misrepresentation because detailed empirical findings suggest crucial differences between developing and developed nations (Nasir et al., 2019; Ntow-Gyamfi et al., 2020; Fakher et al., 2021). Simultaneously, it requires a detailed analysis of the economy before drawing an inference about the environmental implication of economic growth in Asian economies.

Practically equivalent to economic growth, financial development is an essential perspective. Shahbaz et al. (2013), Danish and Wang (2019), Khan et al. (2019), Nasir et al. (2019), and Omri et al. (2019) stated that financial development and economic growth are considered to be cut out of the same cloth. However, various researchers have considered the financial development and economic growth association (Shahbaz et al., 2018; Fakher, 2019; Omri et al., 2019; Ntow-Gyamfi et al., 2020; Fakher et al., 2021). In parallel, a few researchers (Katircioğlu and Taşpinar, 2017; Baloch et al., 2019; Charfeddine and Kahia, 2019; Imamoglu, 2019; Khan et al., 2019) contended that the detailed and in-depth analysis required determining the environmental consequences of financial development and growth. Some researchers (Dar and Asif, 2018; Charfeddine and Kahia, 2019; Omri et al., 2019; Seetanah et al., 2019) pointed out that another more significant aspect of financial sector development ought to be considered along with its effect on economic growth, which is its ecological implication (Nasir et al., 2019; Ntow-Gyamfi et al., 2020; Fakher et al., 2021). It is more critical to investigate the environmental implications of financial development by considering an inclusive indicator of environmental quality (LCF), one of the attributes the subject analysis focuses on, especially in 48 Asian countries.

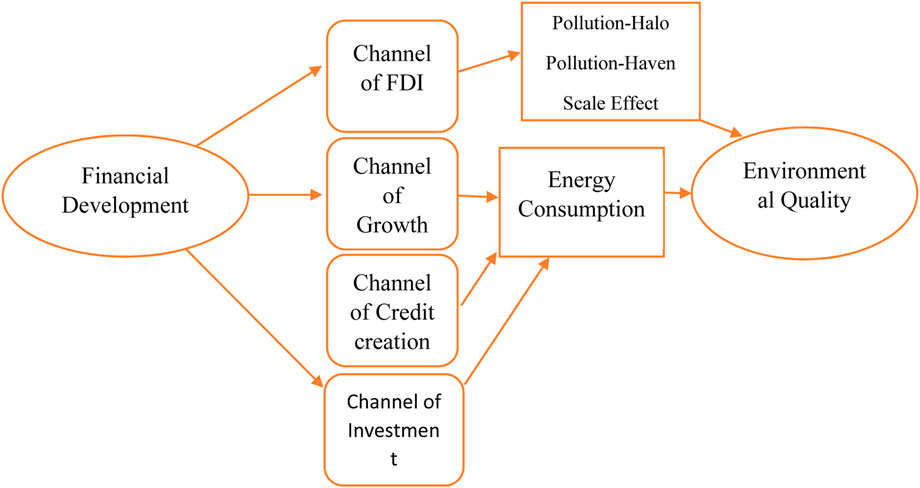

The empirical literature on the ecological implications of financial development confirmed that there is no consensus regarding the direction of the relationship between financial development and environmental quality (Riti et al., 2017; Dar and Asif, 2018; Salahuddin et al., 2018; Destek and Sarkodie, 2019; Imamoglu, 2019; Seetanah et al., 2019). According to Zhang (2011), there could be three different perspectives by which financial development can affect environmental degradation. The primary viewpoint indicates that financial development extends energy consumption through the development and foreign direct investment (FDI) channel. According to the second channel, financial development would increase energy-intensive goods and services by allocating investment resources to their most efficient use and credit creation (financial intermediation). According to the third view, financial development encourages investment that would result in environmental degradation due to increased energy consumption (Zhang, 2011). The environmental consequences of financial development were believed to derive from the supply-leading hypothesis of the finance–growth nexus (Dar and Asif, 2018; Baloch et al., 2019; Charfeddine and Kahia, 2019; Cheng et al., 2019; Destek and Sarkodie, 2019; Nasir et al., 2019; Zafar et al., 2019; Zaidi et al., 2019; Ntow-Gyamfi et al., 2020; Fakher et al., 2021). This would indicate that financial development has ecological implications, which is vital to the empirical literature. It was argued that financial development might impact environmental degradation by boosting real income growth, which would raise demand and supply for energy-intensive goods and services (Charfeddine and Kahia, 2019; Ntow-Gyamfi et al., 2020; Fakher et al., 2021). Furthermore, the empirical literature suggested that financial development can improve environmental quality by providing financial assistance to modern firms and the renewable energy sector (Cheng et al., 2019; Nasir et al., 2019). In this study, we are confined to checking which financial channel would dominate the other and whether the financial development will improve the environmental quality or cause deterioration under the analysis of Asian economies.

According to the original EKC, there is an inverted U-shaped link between environmental deterioration and a nation’s income level. Due to the focus on expanding output, even at a high cost in terms of environmental pollution, environmental deterioration increases quickly during the early phases of expansion. However, there is a point beyond which governments focus more on cleaner air and water concerns than on growth, jobs, and economic progress (Ntow-Gyamfi et al., 2020). Early financial market development pays little attention to its environmental impacts, much like the original EKC thesis. However, environmental concerns become an issue once the industry evolves significantly. Based on empirical work in this study, an attempt is being made to examine the relationship between financial development and environmental quality (LCF) in three ways for 48 Asian economies. We used the two-step generalized method of moment (GMM) technique to analyze data from 1996 to 2020. Initially, the study investigated the environmental consequences of financial development and institutional quality by considering six dimensions [domestic credit to the private sector (DCP), market capitalization (MCAPG), listed companies (LISTC), bank capital-to-assets ratio (BCD), liquid liability (M3), and Financial Development Index (FDIN)]. Subsequently, we modified the original EKC into the financial market-based EKC (FM-EKC) to examine the environmental consequences of financial development over the long and short run. Finally, the study considered the marginal effect of financial development on the quality of the environment, moderated by the role of institutional quality. Furthermore, the study’s uniqueness lies in checking the effect of education on environmental quality in Asian economies. The study endeavors to consider both types of financial development, bank-based and market-based, to capture the independent effect of financial development on environmental quality. The key findings of system GMM analysis confirmed that Asian countries have an inverted U-shaped FM-EKC. A strong institutional structure in an economy guarantees the favorable environmental consequences of financial development in the long run. A healthier education structure in an economy was also suggested to improve its environmental quality. Our findings implied that the policymaker should make appropriate policies for the improved economic position, well-established financial sector, influx of FDI, strong institutional quality, and improved education structure in a manner that does not deteriorate Asia’s environmental quality.

This study proceeds as follows: The Section 2 offers a brief review of the existing evidence on the ecological consequences of financial development. The empirical framework and conceptual background are presented in Section 3. Section 4, Section 5, and Section 6 present and discuss the data, methodology, empirical findings, and robustness, culminating in the conclusion and policy recommendations in Section 7. Section 8 presents limitations and avenues for future research.

2 Literature review

This study is designed to investigate the environmental implications of financial sector development. Therefore, sensibly, the empirical literature can be split into three categories. First, we examine the evidence suggesting environmental consequences of financial sector development. The empirical evidence on the impact of growth and FDI is subsequently considered.

2.1 Environmental consequences of financial development

Empirical evidence on the environmental impacts of financial development is diverse, divergent, and debatable (ŞAHBUDAK, 2016; Maji et al., 2017; Xu et al., 2018; Ahmad et al., 2019; Fakher, 2019; Imamoglu, 2019; Omri et al., 2019; Seetanah et al., 2019; Shahbaz and Balsalobre, 2019; Destek et al., 2021; Shahbaz et al., 2021; Akif et al., 2022; Liu et al., 2022). The empirical literature confirms that the development of a well-performing financial sector can reduce environmental degradation (Katircioğlu and Taşpinar, 2017; Dar and Asif, 2018; Fakher, 2019; Zaidi et al., 2019). For instance, considering the BRICS economies, Tamazian and Bhaskara Rao (2010) suggested that financial sector development can enhance ecological quality. Analogously, by taking the group of CEE economies, Thangaiyarkarasi and Vanitha (2021) confirmed that financial liberalization could improve environmental quality by reducing carbon dioxide emissions. Later on, by considering the Chinese economy, empirical estimates reported that financial development could improve environmental quality (Jalil and Feridun, 2011). Furthermore, by considering different developing, developed, and emerging economies such as Pakistan, South Africa, and Malaysia, some researchers (Abbasi and Riaz, 2016; Riti et al., 2017; Saud et al., 2018; Baloch et al., 2019; Khan et al., 2019; Ntow-Gyamfi et al., 2020) confirmed that financial sector development improves the environmental quality. Most recently, empirical studies confirmed the favorable ecological implications of financial sector development (Fakher et al., 2021).

Contrary to the favorable environmental implication of financial sector development, several empirical works exhibit the unfavorable environmental implication of financial development (Katircioğlu and Taşpinar, 2017; Xu et al., 2018; Fakher, 2019; Imamoglu, 2019). Empirical evidence suggests that the increasing energy consumption and production become responsible for unfavorable environmental implications of financial development (Baloch et al., 2019; Charfeddine and Kahia, 2019; Imamoglu, 2019; Javid and Sharif, 2016; Ntow-Gyamfi et al., 2020; Shahbaz et al., 2018; Zhang and Zhou, 2016). Furthermore, several empirical works proposed no significant association between financial sector development and environmental quality (Abbasi and Riaz, 2016; Riti et al., 2017; Cheng et al., 2019; Omri et al., 2019; Seetanah et al., 2019). These empirical findings indicate that it will not be coherent enough to oversimplify existing literature outcomes to emerging Asian economies under analysis, which have also been developing the financial sector and economic growth.

2.2 Environmental consequences of economic growth

Ravorth (2017) confirmed that since World War 2, policymakers have heavily stressed economic growth achievement. The same situation holds for emerging Asian economies. Over the past few decades, the most crucial economic growth aspect that gained more attention in the empirical literature is its environmental consequences. Following this view, several studies considered the observed association between economic growth and ecological quality and explicitly checked the EKC’s validity. According to this phenomenon, growth practices will initially increase the environment’s degradation and then starts falling with other economic growth practices after reaching a stable point. Since then, several empirical works have been devoted to checking the significance of the EKC. For example, Katircioglu (2012), Xu et al. (2018), Charfeddine and Kahia (2019), Fakher (2019), Imamoglu (2019), Khan et al. (2019), Nasir et al. (2019), Omri et al. (2019), Zafar et al. (2019), Ntow-Gyamfi et al. (2020), and Naqvi et al. (2021) prescribed significant support concerning the EKC by considering the UK economy.

Furthermore, they believed that the strong environmental policies in the UK economy bring about adjustment and, in the long run, EKC (Abbasi and Riaz, 2016; Maji et al., 2017; Riti et al., 2017; Allard et al., 2018; Ntow-Gyamfi et al., 2020). Using different sample economies, it was suggested that there is no meaningful association between economic growth and environmental quality in the short run (Salahuddin et al., 2018; Xu et al., 2018; Charfeddine and Kahia, 2019; Imamoglu, 2019). Nonetheless, a positive long-term relationship was proven between environmental degradation and economic growth. Analogously, focusing on different economies, Fakher (2019), Nasir et al. (2019), Ntow-Gyamfi et al. (2020), and Fakher et al. (2021) provided evidence in favor of an inverted U-shaped EKC. Interestingly, Ghosh (2010) derived empirical conclusions on the Indian economy. Concerning the Indian and Chinese economies, Pal and Mitra (2017) reported no significant empirical relationship between growth and environmental quality in the long and short run. More recently, Ntow-Gyamfi et al. (2020) suggested that the development stage can affect the EKC’s shape.

Furthermore, empirical work (Jamel and Maktouf, 2017; Maji et al., 2017; Sinha and Shahbaz, 2017; Allard et al., 2018; Masron and Subramaniam, 2018; Ulucak and Bilgili, 2018) concluded that the environmental quality and economic growth association was divergent and inadequate and heavily dependent on the choice of proxies used, the quantitative technique chosen, and data frequency. Therefore, it is crucial to conduct an in-depth analysis of the emerging Asian economies in terms of their remarkable progress and expected achievements in the coming years. Hence, the present work addresses the knowledge gap in the existing literature.

2.3 Impact of foreign direct investment on the environment

The third important feature of this review is the ecological implications of FDI. According to Pao and Tsai (2011), theoretically, there could be three different ways FDI can affect environmental quality. The positive and negative impacts of FDI depend on which dimension of FDI would dominate (Pao and Tsai, 2011): whether pollution halo, pollution haven, or scale-effect hypothesis would prevail. The existing empirical literature provided contrasting results related to the positive and negative environmental implications of FDI. For instance, by considering BRICS countries, GCC countries, and the Chinese economy, Pao and Tsai (2011), Al-mulali and Foon Tang (2013), and Zhang and Zhou (2016) argued the existence of an environment-friendly implication of FDI.

Contrary to the favorable environmental consequences of FDI, by taking a different sample of countries, empirical studies confirmed the existence of the unfavorable impact of foreign direct investment on environmental quality (He, 2006; Solarin et al., 2017; Paramati et al., 2018; Fakher, 2019; Nasir et al., 2019; Ntow-Gyamfi et al., 2020). Some of the existing literature also reported evidence of the insignificant impact of foreign direct investment on environmental quality (Kivyiro and Arminen, 2014; Lee, 2013). However, the existing literature ignores the critical aspect of financial and economic development in concurrence with foreign direct investment. The subject study is designed to capture the environmental quality (LCF), financial sector development, economic growth, and FDI association for 48 Asian economies. We, therefore, use a series of empirical methods in the following section.

3 Theoretical background

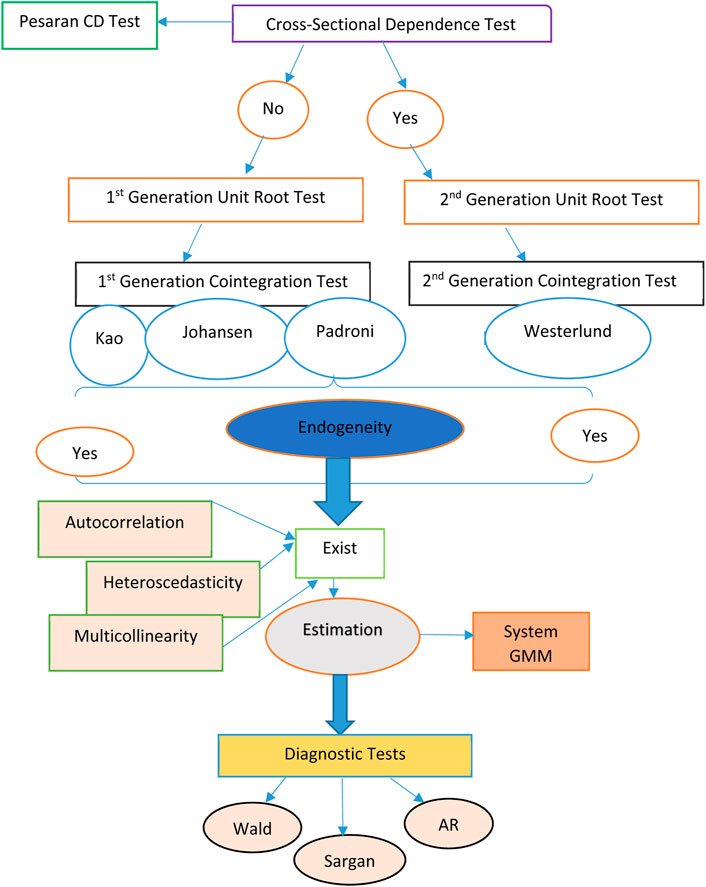

Zhang (2011) claimed that there are three different channels through which financial development can influence the environment. These are investment, credit creation, foreign direct investment, and growth channels. These channels are shown in Figure 2. The first channel linked the impact of financial development on the environment through foreign direct investment and growth channels. The second channel was focused on credit creation combined with efficient financial intermediation. Meanwhile, the third channel highlighted the investment channel connecting financial development and environmental quality. The supply-side financial development hypothesis is required to determine the impact of financial development on environmental quality. Soukhakian (2007) and Katircioglu (2012) confirmed that empirical evidence suggests that financial development is an essential indicator of economic growth. Therefore, the environmental impacts of financial development must be considered. Previous research (Bekhet et al., 2017; Baloch et al., 2019; Khan et al., 2019; Nasir et al., 2019; Omri et al., 2019; Ntow-Gyamfi et al., 2020) explained that financial development affects environmental quality by increasing income, energy demand, and investment in the energy sector.

3.1 Empirical framework

The study’s conceptual framework is a modified EKC related to financial development and environmental quality. As a result, our empirical model is based on the FM-EKC, where financial development takes the place of income in the original EKC model. The EKC model is amended to reflect the moderating impact of financial development and the environment by introducing the interaction term of financial development and institutional quality. Then, in the presence of institutional quality, we estimate the environmental quality–financial development relationship while adjusting for factors from the environmental quality literature. The investigation of the financial development-based environmental Kuznets curve is followed according to the work of Bokpin (2017). Considering data on the Sub-Saharan countries, Kwabena Twerefou et al. (2017) modified the usual environmental Kuznets curve to validate the persistence of environmental quality. By following Fakher (2019), Ntow-Gyamfi et al. (2020), and Fakher et al. (2021), we estimate the impact of financial development on environmental quality as follows:

The baseline model is expressed in Eq. 1 to investigate the relationship between financial development and environmental quality, where LCF means load capacity factor index; FD, financial development indicators; IQ, institutional quality index; GDP, the growth rate of the gross domestic product; FDI, foreign direct investment;

Here, all variables are expressed logarithmically for interpretation as elasticities. Having established a linear relationship between financial development and the quality of the environment, we switch to a non-linear relationship by introducing the square term of financial development in the original model described as follows:

The turning point (T) of the financial development-based environmental Kuznets curve (FM-EKC) can be found as

The turning point is when the effect of financial development on the load capacity factor index shifts from positive to negative:

We further proceeded to include the interaction term of institutional quality and financial development to explore the moderating role of institutional quality in determining the impact of financial development on the load capacity factor index by following Ntow-Gyamfi et al. (2020). We estimated the following model by adding the interaction term of financial development and institutional quality index (IQ):

It would be incorrect to interpret

Eq. 6 indicates that the role of financial sector development and institutional quality structure affect the marginal effect of financial development on environmental quality.

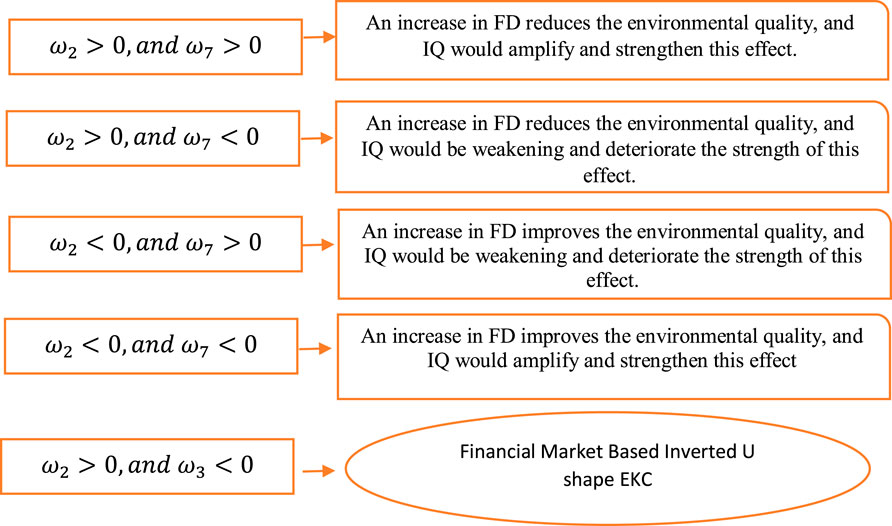

We used the information about the mean, minimum, and maximum value of institutional quality to trace the marginal effect of the variables in Eq. 6. The five probabilities are shown in Figure 3, based on Eq. 6.

4 Data and methodology

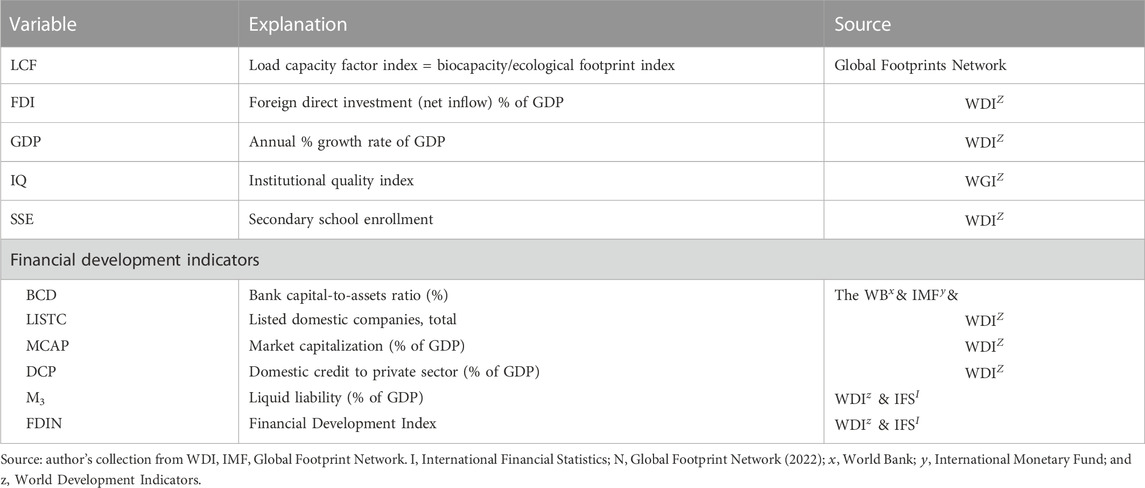

Although much empirical work is devoted to investigating the environmental implications of economic growth, FDI, and financial development, there is yet to be a consensus regarding the direction of the relationship. However, empirical work is yet to be done to explore the environmental consequences of financial development by taking the LCF index to measure the environmental quality of an economy. The indicators of environmental quality adopted in the existing literature only focus on the demand side of the ecosystem, but the LCF index considers both the demand and supply side of an ecosystem. As a result, the current study explores the relationship between financial development and the LCF index for Asian economies from 1996 to 2020. The list of 48 Asian economies is in Table A1. The description of all included variables, their definitions, and data sources are reported in Table 1.

5 Results and discussion

5.1 Descriptive statistics

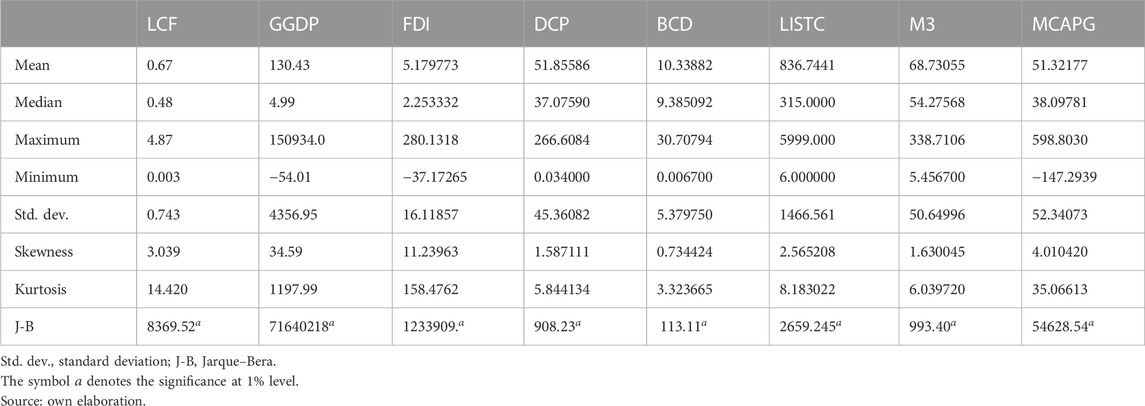

Many studies have focused on the relationship between greenhouse gas emissions, economic growth, and financial development, but the conclusions have varied. However, no work on the effects of financial development on the LCF index of environmental indices from institutional quality can be identified in the existing literature. As a result, the purpose of this article is to investigate the relationship between financial development and the LCF index for Asian economies from 1996 to 2020. To acquire a better understanding of the dataset’s properties, we used summary statistics analysis, as shown in Table 2.

Results of the summary statistics reported that the skewness value for all variables is positive and more significant than zero. As a result, all variables have displayed signs of rightward skewness. Furthermore, the fat-tailed phenomena are evident in all variable distributions because excess kurtosis is more prominent than zero. Based on the skewness and kurtosis findings, all variables are ruled out as being normally distributed. The J-B test later validated the results. These findings justify using the quantitative methodologies described in the following section.

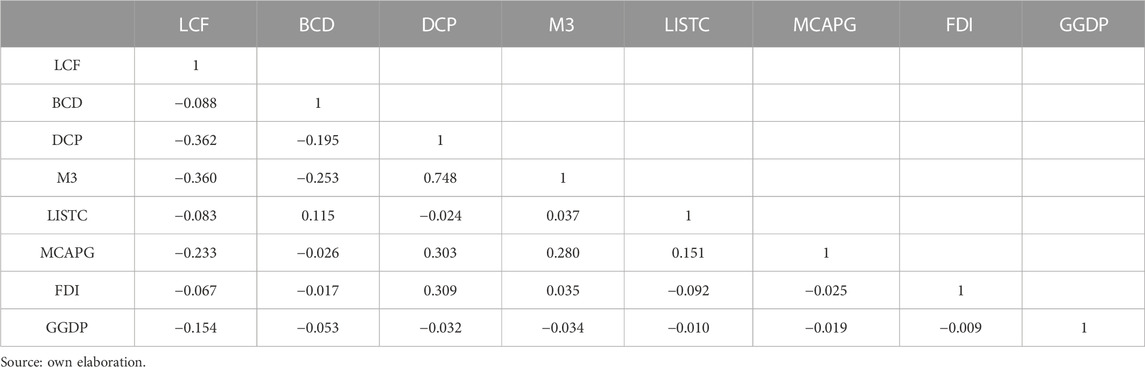

5.2 Correlation matrix

The results of the correlation matrix of the indicators are reported in Table 3. Results indicated that both bank- and market-based financial development indicators negatively correlated with environmental quality. Furthermore, the results show low, medium, and higher correlations among different indicators. BCD, FDI, GGDP, and LISTC indicate a lower correlation with LCF. At the same time, the rest of the indicators show a moderate correlation among the variables. The results indicated the existence of a higher correlation between DCP and M3.

Figure 3 depicts the research strategy and estimation roadmap for this study’s financial development-Environment nexus.

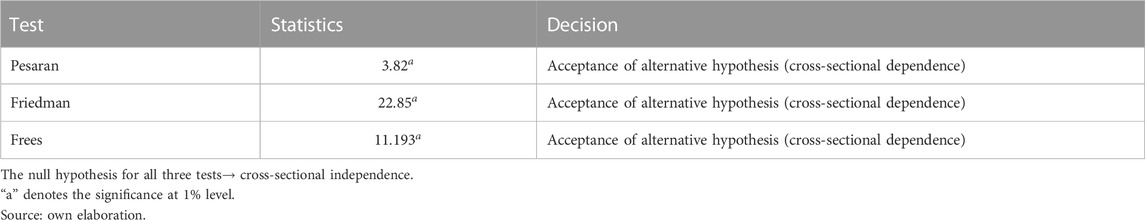

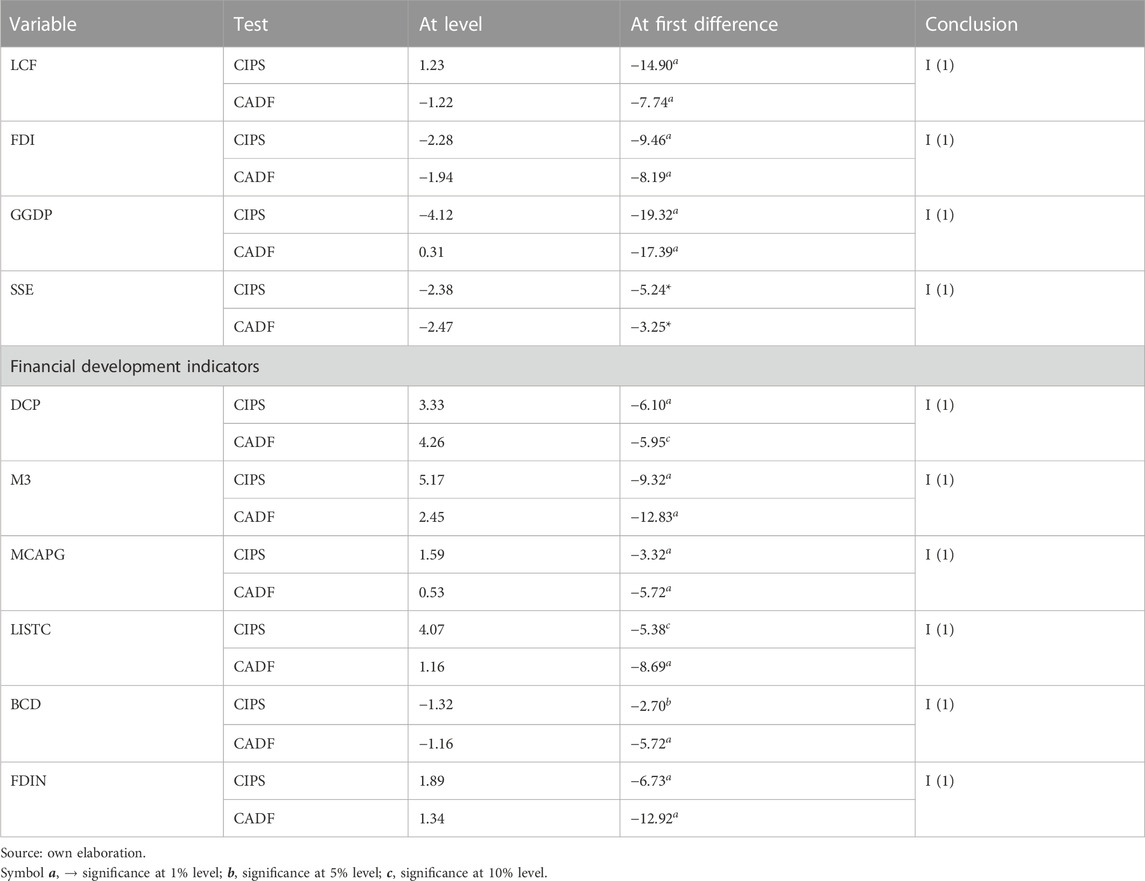

5.3 Panel unit root test

As the non-stationary variables can produce misleading regression problems, testing the stationarity of all studies would be required before model estimation. The selection of the unit root test type is the first step in analyzing panel data (first/second-generation unit root test), and determining whether the research variables are cross-sectionally dependent or independent is required. The cross-sectional dependence (CD) test results are reported in Table 4.

The data in Table 4 will be used to confirm the presence of cross-sectional dependence. The second-generation CIPS and CADF tests will assess the stationery variables to produce realistic findings. Table 4 presents the results of the second-generation unit root (CIPS and CADF) testing (Figure 4).

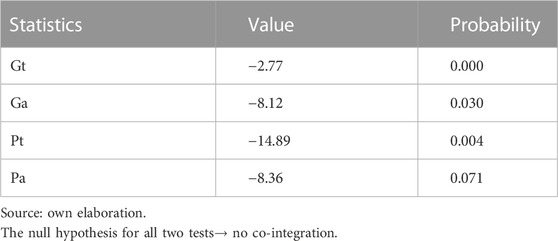

According to the outcomes in Table 5, the null hypothesis of the unit root will be rejected at the first difference. As a result, these results indicate that these variables will remain stationary at their first difference I (1). As a result, econometric theory suggests that co-integration testing be carried out. Because standard panel co-integration tests no longer consider the presence of cross-sectional dependence among the variables and offer inaccurate co-integration findings, Westerlund’s (2007) co-integration test is used to identify co-integration’s presence. It considers the existence of cross-sectional dependence among the panel. Results of the Westerlund co-integration test are reported in Table 6.

5.4 Cointegration & Pre-Estimation Diagnostic Test

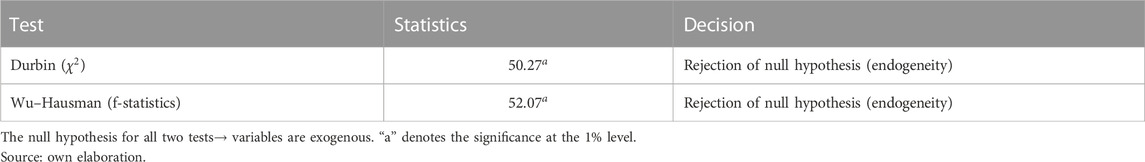

Table 6 provides the results of Westerlund checks, which display that based on the critical values offered by bootstrapped sturdy, three out of four tests reject the null hypothesis. These results confirmed the existence of a long-run relationship among the variables. Before proceeding further, it was crucial to test for endogeneity. The outcome from the endogeneity test is reported in Table 7.

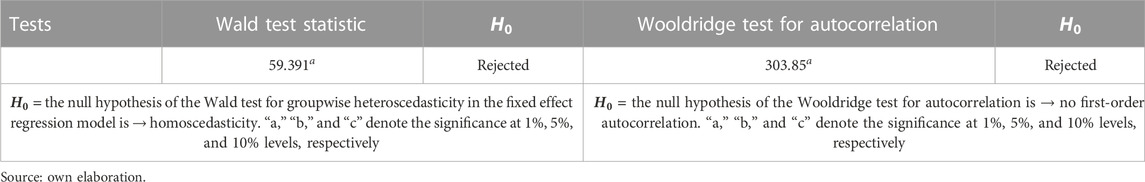

Both tests for endogeneity (Durbin & Hausman) in Table 7 show that the null hypothesis is rejected at a 1% significance level. This means that endogeneity exists in the panel. Before proceeding further, it was crucial to test for autocorrelation, heteroscedasticity, and multicollinearity. The outcomes from the autocorrelation and heteroscedasticity tests are reported in Table 8.

The Wooldridge test was used to check for the existence of autocorrelation for the panel dataset. The results of the test in Table 8 confirmed the existence of autocorrelation. Table 8 indicates that the F-statistics of the Wooldridge panel autocorrelation test is 59.391 with a probability of 0.0000, indicating the rejection of the null hypothesis on no first-order panel autocorrelation. Then, the Wald test was applied to check for groupwise heteroscedasticity in panel data. The results of the Wald test for groupwise heteroscedasticity confirmed the existence of heteroscedasticity, as indicated in Table 8. The null hypothesis for Wald groupwise heteroscedasticity is the existence of homoscedasticity. Here, the F-test that all ui = 0: F (47, 1145) is equal to 303.85 with probability greater than F statistics significant at a 1% significance level (prob > F = 0.0000) causes the rejection of the null hypothesis of homoscedasticity.

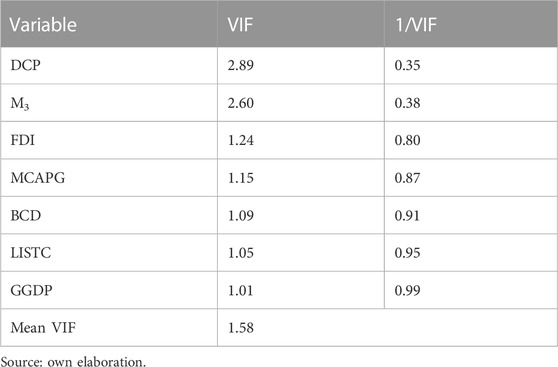

Next, to test for multicollinearity, the variance inflation factor (VIF) was used. The results of VIF are reported in Table 9.

Results of the VIF test identified that the mean value of VIF is 1.58, indicating that multicollinearity was not an issue here.

5.5 Empirical Estimation

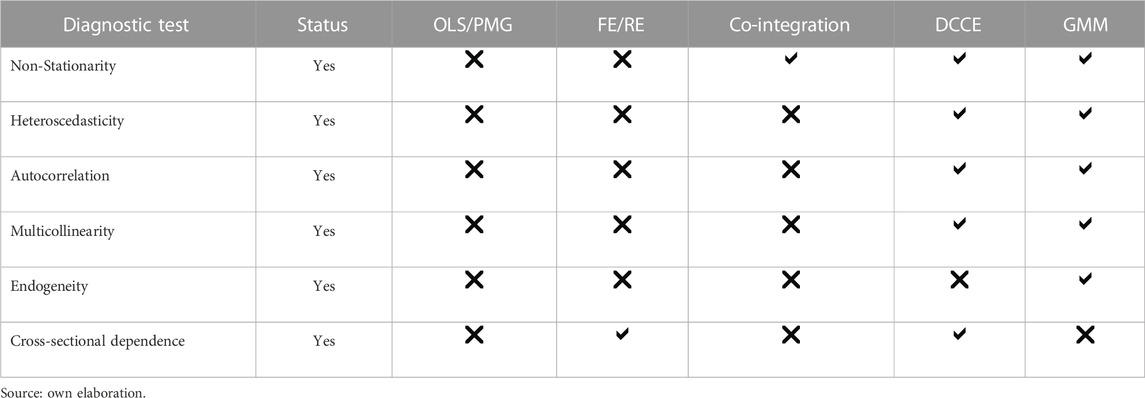

Using all the results of pre-estimation diagnostic tests will provide further direction to choosing the best econometrics techniques to quantify the relationship between financial development and environmental quality. The results of diagnostic tests and the choice of techniques are compiled in Table 10.

Results of all diagnostic tests are compiled in Table 10 to select the appropriate estimation technique. Here, the results indicate that in the presence of cross-sectional dependence, stationarity, heteroscedasticity, autocorrelation, and endogeneity, the technique proceeds with the GMM. Based on co-integration for each of the Asian countries, the results of two-step panel GMM system estimations are presented in Table 11.

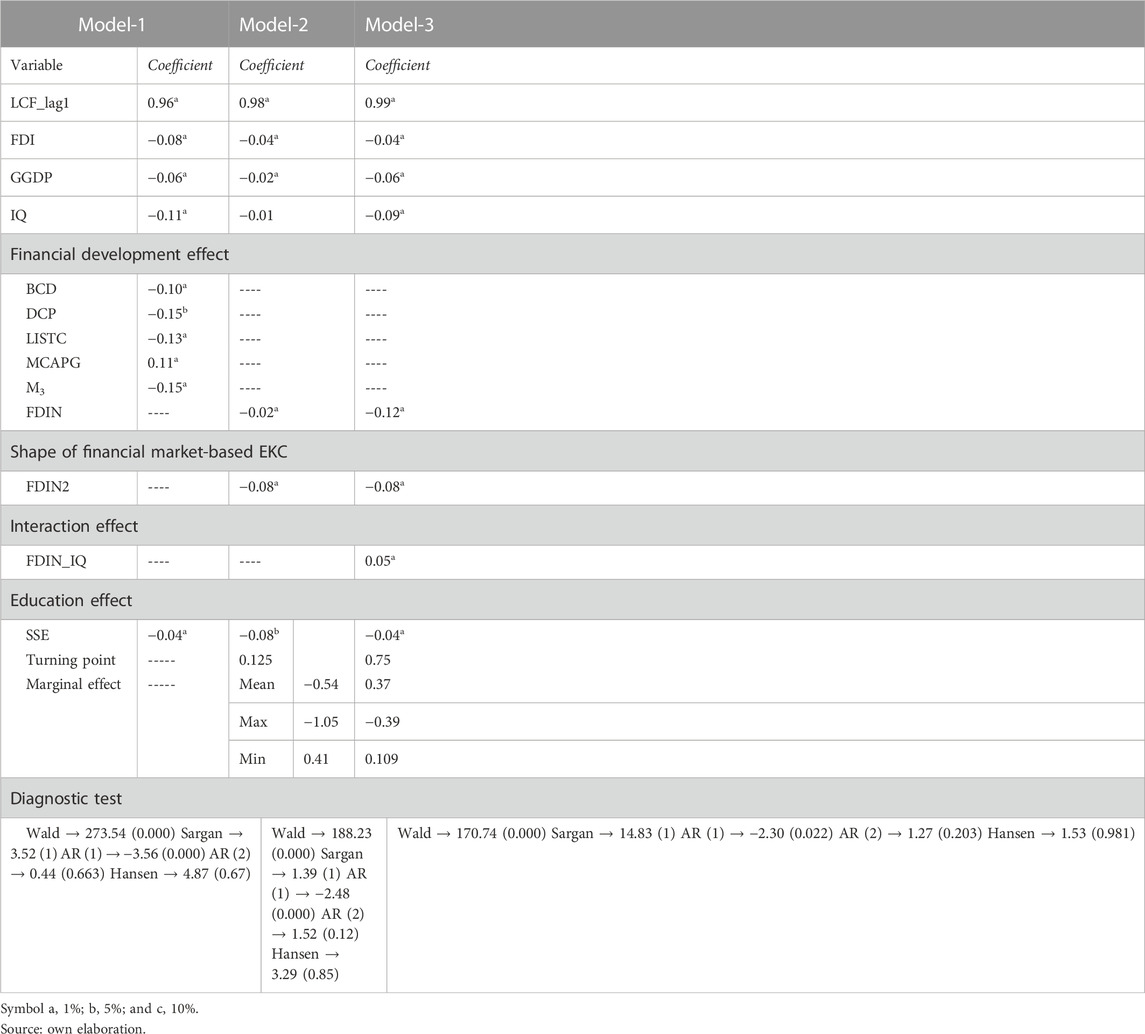

Five significant variables, namely, GGDP, BCD, DCP, M3, and LISTC, negatively influence LCF in 48 Asian countries (at 1% and 5% significance levels). As a result, increased financial development entails environmental quality deterioration. BCD shows that a 1% change results in a 0.10% change in the load capacity factor index for our sample of 48 Asian countries. Furthermore, considering the results, a 1% rise in the DCP and the number of LISTC lead to a 0.17% and 0.13% decrease in the LCF, respectively. Interestingly, MCAPG improves the load capacity factor index, suggesting that the impact of the different components of financial development on environmental quality varies considerably. These results indicate that the quality of the environment is not adversely affected by all forms of financial development. These findings, which emphasize the use of credit creation as an indicator of financial development, align with those from previous research on the topic, which suggested negative environmental consequences of financial development (Omri et al., 2015; Salahuddin et al., 2018; Xu et al., 2018; Charfeddine & Kahia, 2019; Cheng et al., 2019; Imamoglu, 2019; Khan et al., 2019; Nasir et al., 2019; Seetanah et al., 2019).

FDI results indicated that FDI hurts environmental quality. It is noted that a 1% change in FDI brings 0.08% deterioration in environmental quality by reducing the load capacity factor index. These results are in line with the findings of previous studies (Pao and Tsai, 2011; Danish and Wang, 2019; Nasir et al., 2019; Ntow-Gyamfi et al., 2020; Fakher et al., 2021).

Furthermore, the findings indicate the presence of a statistically significant long-term co-integration between LCF and GGDP. When GGDP increases by 1%, LCF increases by only 0.06%. The findings are in line with those of previous research studies (Bekhet et al., 2017; Shahbaz et al., 2018; Fakher, 2019; Nasir et al., 2019; Zaidi et al., 2019; Ntow-Gyamfi et al., 2020).

We added the quadratic of FD (i.e., FDIN2) to examine the long-term influence of financial sector development on environmental quality (LCF). Table 11 depicts the association in long-run estimation using a two-step system GMM analysis (see the column of Table 11). The rest of the findings are like the model without the quadratic term of financial development. It is predicted that a 1% rise in FDIN would result in a 0.02% (at a 1% significance level) increase in LCF. According to this study, there is strong evidence of EKC based on financial markets. The findings confirmed that as financial development moves forward, environmental quality improves with financial development (Fakher, 2019; Nasir et al., 2019; Ntow-Gyamfi et al., 2020).

Furthermore, we established the non-linear relationship between FDIN2 (squared term of financial development) and LCF to determine the turning point at which the relationship between the variables switches from positive to negative. Table 11 illustrates that while the unfavorable impact of finance on the environment may turn at later stages of financial development, the turning points in model 3 (over 75%) in comparison to model 2 are excessively enormous (above 12%). According to the findings, actions to accelerate financial development should be implemented as soon as possible to reach the financial development turning point. The key findings of the relationship between institutional quality on the environment (LCF) indicated a significant positive relationship between IQ and LCF. Our findings suggest that having a strong institutional framework can help regulate economic agents’ conduct toward a greener environment (Ntow-Gyamfi et al., 2020; Fakher et al., 2021). Ultimately, the marginal impact of financial development on environmental quality was established to trace institutional quality’s moderating role. We found that even when we used institutions to moderate the relationship between financial development and environmental quality, financial development had a detrimental effect on environmental quality. Our findings reveal that even in robust institutions, the inverse association between financial development and environmental quality is so strong that environmental quality deteriorates with financial development. This means that the authorities will be powerless to prevent financial development from causing environmental damage.

The subsequent natural step was to perceive the marginal impact of financial development on LCF, mitigated through institutional quality. Then, we calculated the marginal impact of financial development on the environment by incorporating institutional quality and financial development values at their mean, maximum, and minimum levels in the partial derivative equation. Results in Table 11 report that the marginal effect of financial development is regularly damaging from its minimum to maximum levels. It is worth noting that the value of the marginal impact climbs from minimum to maximum and then decreases, indicating that the relationship remains unfavorable, although the strength of the association declines when the institutional quality is combined with financial improvement. We demonstrate that secondary school education (SSE) and environmental quality have a strong positive relationship. Because education has a significant positive impact on environmental quality, having a more educated population may help improve it (Ntow-Gyamfi et al., 2020).

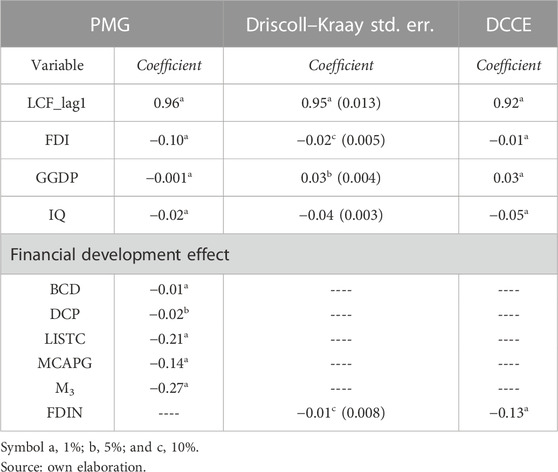

6 Robustness check

To check the robustness of the estimates, we have used the Driscoll–Kraay standard error method, dynamic common correlated effect (DCCE) estimation, and pooled mean group estimation for all Asian countries (AACs). The results of all these techniques are presented in Table 12. Here, we have again estimated a model that explores the independent effect of financial development and institutional quality on environmental quality by using the PMG, Driscoll–Kraay standard error, and DCCE methodology to check the robustness of the estimates.

To guarantee the reliability of the results, Table 12 presents the findings from pooled OLS, Driscoll–Kraay standard error, and DCCE estimate. The primary outcomes remain the same, as can be observed.

7 Conclusion and policy recommendations

Based on empirical work in this study, an attempt was made to examine the relationship between financial development and environmental quality (LCF) in three different ways for 48 Asian economies. We used the two-step system GMM technique to analyze the data from 1996 to 2020. Initially, the study investigated the environmental consequences of financial development by considering six dimensions (DCP, MCAPG, LISTC, BCD, M3, and FDIN). Then, we modified the original EKC into the financial market-based EKC (FM-EKC) to examine the environmental consequences of financial development over the long and short run. Finally, the study considered the marginal effect of financial development on the quality of the environment, moderated by the role of institutional quality. The key findings of system GMM analysis confirmed that Asian countries have an inverted U shape FM-EKC. It was observed that the strong institutional structure in an economy guarantees the favorable environmental consequences of financial development in the long run. It was also observed that continued improvement in the financial industry might lead to a more stable environment in the future. A strong institutional structure in an economy guarantees the favorable environmental consequences of financial development in the long run. It was also suggested that a healthier education structure of an economy could help improve the environmental quality of an economy. The current study also pioneers in establishing the relationship between education structure (secondary school enrollment) and environmental quality (LCF) for Asian economies. A healthier education structure of an economy could help improve its environmental quality. Our findings implied that the policymaker should make appropriate policies regarding the improved economic position, well-established financial sector, influx of FDI, strong institutional quality, and improved education structure in a manner that does not deteriorate Asia’s environmental quality.

The policy implication of these findings is that financial development-driven policies should be encouraged by the first adverse effects of financial development on the environment. However, ongoing financial market development can eventually create a more stable atmosphere. Nevertheless, building robust and resilient institutions could significantly lessen the environmental damage brought on by the early stages of financial development. It is essential to adopt new technology carefully so as not to harm the environment. Because post-primary education has been demonstrated to lessen deterioration and increase sustainability, policymakers should also invest in it. Aiming to deepen financial development in macro policies, information transparency in the market, adoption of national and international laws to improve environmental quality, facilitating the transfer of clean technologies from developed countries to other countries, and increasing energy efficiency in countries with high energy consumption are some of the critical policy implications suggested by this research.

8 Limitations and avenues for future research

The study’s limitations should be discussed in subsequent research, although it offers significant new understandings of the relationship between economic variables and environmental indicators.

1) The Asian nations were not considered when comparing the data because of the study’s limited size.

2) Due to space constraints, it is necessary to compare the results for each panel of AACs, low-income Asian countries (LIACs), and high-income Asian countries using the EKC hypothesis (HIACs).

3) It is noteworthy that the causal relationship between the research variables is yet to be examined due to the short space in this paper.

Some recommendations are made for future researchers by considering the research findings. Future researchers can use a comprehensive environmental performance index (CEPI) to determine the relationship between financial development and environmental quality. In other words, for more instructive policy implications, future researchers can investigate the influencing role of financial development in the correlation of economic growth, renewable energy use, energy consumption, and trade openness with environmental indicators. Future studies can further this work by examining the relationship between financial development and the Global Panel’s composite environmental quality indicator. Future research can be extended by applying the panel causality test to check for the direction of the relationship between financial development and environmental quality.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material; further inquiries can be directed to the corresponding author.

Author contributions

NL: writing completion, data analysis, software work, econometric modeling, and methodology. MF: supervision.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abbasi, F., and Riaz, K. (2016). CO2 emissions and financial development in an emerging economy: An augmented VAR approach. Energy Policy 90, 102–114. doi:10.1016/j.enpol.2015.12.017

Ahmad, M., Zhao, Z. Y., Irfan, M., and Mukeshimana, M. C. (2019). Empirics on influencing mechanisms among energy, finance, trade, environment, and economic growth: A heterogeneous dynamic panel data analysis of China. Environ. Sci. Pollut. Res. 26, 14148–14170. doi:10.1007/s11356-019-04673-6

Akif, M., Kazi, D., Sercan, S., and Gamze, A. (2019). Foreign direct investment, stock market capitalization, and sustainable development: Relative impacts of domestic and foreign capital. Environ. Sci. Pollut. Res. (1). doi:10.1007/s11356-022-24066-6

Al-mulali, U., and Foon Tang, C. (2013). Investigating the validity of pollution haven hypothesis in the gulf cooperation council (GCC) countries. Energy Policy 60, 813–819. doi:10.1016/j.enpol.2013.05.055

Allard, A., Takman, J., Uddin, G. S., and Ahmed, A. (2018). The N-shaped environmental Kuznets curve: An empirical evaluation using a panel quantile regression approach. Environ. Sci. Pollut. Res. 25 (6), 5848–5861. doi:10.1007/s11356-017-0907-0

Baloch, M. A., Zhang, J., Iqbal, K., and Iqbal, Z. (2019). The effect of financial development on ecological footprint in BRI countries: Evidence from panel data estimation. Environ. Sci. Pollut. Res. 26 (6), 6199–6208. doi:10.1007/s11356-018-3992-9

Bekhet, H. A., Matar, A., and Yasmin, T. (2017). CO2 emissions, energy consumption, economic growth, and financial development in GCC countries: Dynamic simultaneous equation models. Renew. Sustain. Energy Rev. 70, 117–132. doi:10.1016/j.rser.2016.11.089

Bokpin, G. A. (2017). Foreign direct investment and environmental sustainability in Africa: The role of institutions and governance. Res. Int. Bus. Finance 39, 239–247. doi:10.1016/j.ribaf.2016.07.038

Charfeddine, L., and Kahia, M. (2019). Impact of renewable energy consumption and financial development on CO2 emissions and economic growth in the mena region: A panel vector autoregressive (pvar) analysis. Renew. Energy 139, 198–213. doi:10.1016/j.renene.2019.01.010

Cheng, Z., Li, L., and Liu, J. (2019). The effect of information technology on environmental pollution in China. Environ. Sci. Pollut. Res. 26 (32), 33109–33124. doi:10.1007/s11356-019-06454-7

Danish, , and wang, Z. (2019). Investigation of the ecological footprint’s driving factors: What we learn from the experience of emerging economies. Sustain. Cities Soc. 49, 101626. doi:10.1016/j.scs.2019.101626

Dar, J. A., and Asif, M. (2018). Does financial development improve environmental quality in Turkey? An application of endogenous structural breaks based cointegration approach. Manag. Environ. Qual. Int. J. 29 (2), 368–384. doi:10.1108/MEQ-02-2017-0021

Destek, M. A., Sarkodie, S. A., and Asamoah, E. F. (2021). Does biomass energy drive environmental sustainability? An SDG perspective for top five biomass consuming countries. Biomass Bioenergy 149 (2020), 106076. doi:10.1016/j.biombioe.2021.106076

Destek, M. A., and Sarkodie, S. A. (2019). Investigation of environmental Kuznets curve for ecological footprint: The role of energy and financial development. Sci. Total Environ. 650, 2483–2489. doi:10.1016/j.scitotenv.2018.10.017

Fakher, H. A. (2019). Investigating the determinant factors of environmental quality (based on ecological carbon footprint index). Environ. Sci. Pollut. Res. 26 (10), 10276–10291. doi:10.1007/s11356-019-04452-3

Fakher, H. A., Panahi, M., Emami, K., Peykarjou, K., and Zeraatkish, S. Y. (2021). Investigating marginal effect of economic growth on environmental quality based on six environmental indicators: Does financial development have a determinative role in strengthening or weakening this effect? Environ. Sci. Pollut. Res. 28 (38), 53679–53699. doi:10.1007/s11356-021-14470-9

Ghosh, S. (2010). Examining carbon emissions economic growth nexus for India: A multivariate cointegration approach. Energy Policy 38 (6), 3008–3014. doi:10.1016/j.enpol.2010.01.040

Haseeb, A., Xia, E., DanishBaloch, M. A., and Abbas, K. (2018). Financial development, globalization, and CO2 emission in the presence of EKC: Evidence from BRICS countries. Environ. Sci. Pollut. Res. 25 (31), 31283–31296. doi:10.1007/s11356-018-3034-7

He, J. (2006). Pollution haven hypothesis and environmental impacts of foreign direct investment: The case of industrial emission of sulfur dioxide (SO2) in Chinese provinces. Ecol. Econ. 60 (1), 228–245. doi:10.1016/j.ecolecon.2005.12.008

Imamoglu, H. (2019). The role of financial sector in energy demand and climate changes: Evidence from the developed and developing countries. Environ. Sci. Pollut. Res. 26 (22), 22794–22811. doi:10.1007/s11356-019-05499-y

Jalil, A., and Feridun, M. (2011). The impact of growth, energy and financial development on the environment in China: A cointegration analysis. Energy Econ. 33 (2), 284–291. doi:10.1016/j.eneco.2010.10.003

Jamel, L., and Maktouf, S. (2017). The nexus between economic growth, financial development, trade openness, and CO2 emissions in European countries. Cogent Econ. Finance 5 (1), 1341456–1341525. doi:10.1080/23322039.2017.1341456

Javid, M., and Sharif, F. (2016). Environmental Kuznets curve and financial development in Pakistan. Renew. Sustain. Energy Rev. 54, 406–414. doi:10.1016/j.rser.2015.10.019

Katircioglu, S. T. (2012). Financial development, international trade and economic growth: The case of sub-saharan Africa. Ekon. N. R. 1, 117–127.

Katircioğlu, S. T., and Taşpinar, N. (2017). Testing the moderating role of financial development in an environmental Kuznets curve: Empirical evidence from Turkey. Renew. Sustain. Energy Rev. 68 (2016), 572–586. doi:10.1016/j.rser.2016.09.127

Khan, M. K., Teng, J. Z., Khan, M. I., and Khan, M. O. (2019). Impact of globalization, economic factors and energy consumption on CO2 emissions in Pakistan. Sci. Total Environ. 688, 424–436. doi:10.1016/j.scitotenv.2019.06.065

Kivyiro, P., and Arminen, H. (2014). Carbon dioxide emissions, energy consumption, economic growth, and foreign direct investment: Causality analysis for Sub-Saharan Africa. Energy 74 (C), 595–606. doi:10.1016/j.energy.2014.07.025

Kwabena Twerefou, D., Danso-Mensah, K., and Bokpin, G. A. (2017). The environmental effects of economic growth and globalization in sub-saharan Africa: A panel general method of moments approach. Res. Int. Bus. Finance 42, 939–949. doi:10.1016/j.ribaf.2017.07.028

Law, S. H., Kutan, A. M., and Naseem, N. A. M. (2018). The role of institutions in finance curse: Evidence from international data. J. Comp. Econ. 46 (1), 174–191. doi:10.1016/j.jce.2017.04.001

Lee, J. W. (2013). The contribution of foreign direct investment to clean energy use, carbon emissions and economic growth. Energy Policy 55, 483–489. doi:10.1016/j.enpol.2012.12.039

Liu, H., Sinha, A., Destek, M. A., Alharthi, M., and Zafar, M. W. (2022). Moving toward sustainable development of sub-Saharan African countries: Investigating the effect of financial inclusion on environmental quality. Sustainable Development. 1–10. doi:10.1002/sd.2367

Maji, I. K., Habibullah, M. S., and Saari, M. Y. (2017). Financial development and sectoral CO2 emissions in Malaysia. Environ. Sci. Pollut. Res. 24 (8), 7160–7176. doi:10.1007/s11356-016-8326-1

Masron, T. A., and Subramaniam, Y. (2018). The environmental Kuznets curve in the presence of corruption in developing countries. Environ. Sci. Pollut. Res. 25 (13), 12491–12506. doi:10.1007/s11356-018-1473-9

Naqvi, S. A. A., Shah, S. A. R., Anwar, S., and Raza, H. (2021). Renewable energy, economic development, and ecological footprint nexus: Fresh evidence of renewable energy environment Kuznets curve (RKC) from income groups. Environ. Sci. Pollut. Res. 28 (2), 2031–2051. doi:10.1007/s11356-020-10485-w

Nasir, M. A., Duc Huynh, T. L., and Xuan Tram, H. T. (2019). Role of financial development, economic growth & foreign direct investment in driving climate change: A case of emerging asean. J. Environ. Manag. 242, 131–141. doi:10.1016/j.jenvman.2019.03.112

Ntow-Gyamfi, M., Bokpin, G. A., Aboagye, A. Q. Q., and Ackah, C. G. (2020). Environmental sustainability and financial development in Africa; does institutional quality play any role? Dev. Stud. Res. 7 (1), 93–118. doi:10.1080/21665095.2020.1798261

Omri, A., Daly, S., Rault, C., and Chaibi, A. (2015). Financial development, environmental quality, trade and economic growth: What causes what in MENA countries. Energy Econ. 48, 242–252. doi:10.1016/j.eneco.2015.01.008

Omri, A., Euchi, J., Hasaballah, A. H., and Al-Tit, A. (2019). Determinants of environmental sustainability: Evidence from Saudi arabia. Sci. Total Environ. 657, 1592–1601. doi:10.1016/j.scitotenv.2018.12.111

Pal, D., and Mitra, S. K. (2017). The environmental Kuznets curve for carbon dioxide in India and China: Growth and pollution at crossroad. J. Policy Model. 39 (2), 371–385. doi:10.1016/j.jpolmod.2017.03.005

Pao, H. T., and Tsai, C. M. (2011). Multivariate Granger causality between CO2 emissions, energy consumption, FDI (foreign direct investment) and GDP (gross domestic product): Evidence from a panel of BRIC (Brazil, Russian Federation, India, and China) countries. Energy 36 (1), 685–693. doi:10.1016/j.energy.2010.09.041

Paramati, S. R., Alam, M. S., and Apergis, N. (2018). The role of stock markets on environmental degradation: A comparative study of developed and emerging market economies across the globe. Emerg. Mark. Rev. 35, 19–30. doi:10.1016/j.ememar.2017.12.004

Ravorth, K. (2017). Doughnut economics: Seven ways to think like a 21st-century economist - kate raworth - google books. Chelsea Green Publ. 38 (1), 298,doi:10.5195/JWSR.2018.854

Riti, J. S., Yang, Shu, Song, Deyong, and Kamah, M. (2017). The contribution of energy use and financial development by source in climate change mitigation process: A global empirical perspective. J. Clean. Prod. 148, 882–894. doi:10.1016/j.jclepro.2017.02.037

Şahbudak, E. (2016). Relationship between energy consumption, economic growth and trade openness in Turkey. J. Int. Soc. Res. 9 (42), 1648. doi:10.17719/jisr.20164216272

Salahuddin, M., Alam, K., Ozturk, I., and Sohag, K. (2018). The effects of electricity consumption, economic growth, financial development and foreign direct investment on CO2 emissions in Kuwait. Renew. Sustain. Energy Rev. 81, 2002–2010. doi:10.1016/j.rser.2017.06.009

Saud, S., Chen, S., and Haseeb, A. (2018). Impact of financial development and economic growth on environmental quality: An empirical analysis from belt and road initiative (BRI) countries. Environ. Sci. Pollut. Res. 17, 2253–2269. doi:10.1007/s11356-018-3688-1

Seetanah, B., Sannassee, R. V., Fauzel, S., Soobaruth, Y., Giudici, G., and Nguyen, A. P. H. (2019). Impact of economic and financial development on environmental degradation: Evidence from small island developing States (SIDS). Emerg. Mark. Finance Trade 55 (2), 308–322. doi:10.1080/1540496X.2018.1519696

Sencer Atasoy, B. (2017). Testing the environmental Kuznets curve hypothesis across the U.S.: Evidence from panel mean group estimators. Renew. Sustain. Energy Rev. 77 (), 731–747. doi:10.1016/j.rser.2017.04.050

Shahbaz, M., and Balsalobre, D. (2019). “Energy and environmental strategies in the era of globalization,” in Midtown Manhattan, New York City Springer.

Shahbaz, M., Destek, M. A., Dong, K., and Jiao, Z. (2021). Time-varying impact of financial development on carbon emissions in G-7 countries: Evidence from the long history. Technol. Forecast. Soc. Change 171, 120966. doi:10.1016/j.techfore.2021.120966

Shahbaz, M., Kumar Tiwari, A., and Nasir, M. (2013). The effects of financial development, economic growth, coal consumption and trade openness on CO2 emissions in South Africa. Energy Policy 61, 1452–1459. doi:10.1016/j.enpol.2013.07.006

Shahbaz, M., Nasir, M. A., and Lahiani, A. (2022). Role of financial development in economic growth in the light of asymmetric effects and financial efficiency. Int. J. Finance Econ. 27 (1), 361–383. doi:10.1002/ijfe.2157

Shahbaz, M., Nasir, M. A., and Roubaud, D. (2018). Environmental degradation in France: The effects of FDI, financial development, and energy innovations. Energy Econ. 74, 843–857. doi:10.1016/j.eneco.2018.07.020

Sinha, Avik, and Shahbaz, Muhammad (2017). Estimation of environmental Kuznets curve for CO2 emission: Renewable Energy.119, 703-711. doi:10.1016/j.renene.2017.12.058

Solarin, S. A., Al-Mulali, U., Musah, I., and Ozturk, I. (2017). Investigating the pollution haven hypothesis in Ghana: An empirical investigation. Energy 124, 706–719. doi:10.1016/j.energy.2017.02.089

Soukhakian, B. (2007). Financial development, trade openness and economic growth in Japan: Evidenvce from granger causality test. Int. J. Econ. Perspect. 1 (3), 118–127.

Tamazian, A., and Bhaskara Rao, B. (2010). Do economic, financial and institutional developments matter for environmental degradation? Evidence from transitional economies. Energy Econ. 32 (1), 137–145. doi:10.1016/j.eneco.2009.04.004

Thangaiyarkarasi, N., and Vanitha, S. (2021). The impact of financial development on decarbonization factors of carbon emissions: A global perspective. Int. J. Energy Econ. Policy 11 (6), 353–364. doi:10.32479/ijeep.11872

Ulucak, R., and Bilgili, F. (2018). A reinvestigation of EKC model by ecological footprint measurement for high, middle and low income countries. J. Clean. Prod. 188, 144–157. doi:10.1016/j.jclepro.2018.03.191

Xu, Z., Baloch, M. A., DanishMeng, F., Zhang, J., and Mahmood, Z. (2018). Nexus between financial development and CO2 emissions in Saudi arabia: Analyzing the role of globalization. Environ. Sci. Pollut. Res. 25 (28), 28378–28390. doi:10.1007/s11356-018-2876-3

Zafar, M. W., Saud, S., and Hou, F. (2019). The impact of globalization and financial development on environmental quality: Evidence from selected countries in the organization for economic co-operation and development (OECD). Environ. Sci. Pollut. Res. 26 (13), 13246–13262. doi:10.1007/s11356-019-04761-7

Zaidi, S. A. H., Zafar, M. W., Shahbaz, M., and Hou, F. (2019). Dynamic linkages between globalization, financial development and carbon emissions: Evidence from Asia Pacific Economic Cooperation countries. J. Clean. Prod. 228, 533–543. doi:10.1016/j.jclepro.2019.04.210

Zhang, C., and Zhou, X. (2016). Does foreign direct investment lead to lower CO2 emissions? Evidence from a regional analysis in China. Renew. Sustain. Energy Rev. 58, 943–951. doi:10.1016/j.rser.2015.12.226

Keywords: ecological footprint, biocapacity, load capacity factor, financial development, secondary school enrollment, institutional quality, pollution halo hypothesis

Citation: Latif N and Faridi MZ (2023) Examining the impact of financial development on load capacity factor (LCF): System GMM analysis for Asian economies. Front. Energy Res. 10:1063212. doi: 10.3389/fenrg.2022.1063212

Received: 06 October 2022; Accepted: 30 December 2022;

Published: 25 January 2023.

Edited by:

Guo Wei, University of North Carolina at Pembroke, United StatesReviewed by:

Najabat Ali, Hamdard University, PakistanMehmet Akif Destek, University of Gaziantep, Türkiye

Copyright © 2023 Latif and Faridi. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Nazia Latif, bmF6aWFsYXRpZjExMUBnbWFpbC5jb20=

Nazia Latif

Nazia Latif Muhammad Zahir Faridi2

Muhammad Zahir Faridi2