- 1Economic Research Institute, Jiangxi Electric Power Comany, State Grid, Jiangxi, China

- 2School of Electric Power Engineering, South China University of Technology, Guangzhou, China

The new energy storage, referring to new types of electrical energy storage other than pumped storage, has excellent value in the power system and can provide corresponding bids in various types of electricity markets. As the scale of new energy storage continues to grow, China has issued several policies to encourage its application and participation in electricity markets. It is urgent to establish market mechanisms well adapted to energy storage participation and study the operation strategy and profitability of energy storage. Based on the development of the electricity market in a provincial region of China, this paper designs mechanisms for independent energy storage to participate in various markets. Then, its current and future operation strategies by division time or capacity for participation in each type of market are analyzed, and the profitability under various scenarios is calculated. Finally, based on the calculation results, the theoretical analysis basis for developing independent energy storage in the province and the policy formulation of participation in the market is provided.

1 Introduction

As early as September 2020, China proposed the goal of “carbon peak” and “carbon neutrality” (Xinhua News Agency, 2020). As a result, a new power system construction plan with renewable energy as the primary power source came into being (Xin et al., 2022). With the large-scale access to renewable energy with greater randomness and volatility to the grid, the balance of power supply and demand, system regulation, control and protection will all undergo significant changes (Xiao et al., 2021; Zhang et al., 2021). As one of the most valuable flexibility resources, energy storage (ES) is essential in maintaining system power balance (Boicea, 2014).

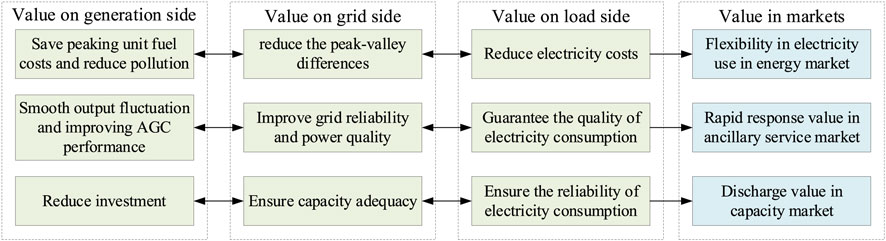

Currently, ES technology has a wide range of applications on the generation side, the grid side and the user side respectively. Essentially, these applications highlight the flexibility value of ES for the power system. On the generation side, the effect of joint participation of thermal units and ES in frequency regulation is far better than that of separate thermal units; ES can help renewable energy units reduce power fluctuations and power abandonment and increase the revenue in the electricity energy market and reduce deviation assessment fees (Toledo et al., 2010; Zhao et al., 2015; De Siqueira and Peng, 2021). On the grid side, ES can help reduce transmission and distribution losses, ensure the safety of system operation and ease the pressure of peak regulation (Nazemi et al., 2019; Nguyen et al., 2019). On the user side, it can help to consume distributed energy, reduce electricity costs, and participate in demand response (Bradbury et al., 2014; Harsha and Dahleh, 2014; Bitaraf and Rahman, 2017).

According to the statistics of the Energy Storage Committee of China Energy Research Society, by the end of September 2021, the cumulative installed capacity of pumped hydro storage in the world reached 172.5 GW, accounting for 89.3% of all ES. The cumulative installed capacity of electrochemical ES, a representative of new energy storage (NES) that includes other forms of ES in addition to pumped hydro storage, ranked second with 16.3 GW, accounting for 8.5%. Among all kinds of electrochemical ES, lithium batteries have the largest cumulative installed capacity, accounting for 92.8%. While in the past 20 years, the installed capacity of electrochemical batteries has shown explosive growth and has gradually occupied an essential position in developing ES applications (Ralon et al., 2017). In this context, there is an urgent need for a market environment and rational planning that supports the operation and development of NES.

In order to incorporate ES into the market framework, academics have proposed some amendments to the market’s trading model. In the energy market model, the state of charge constraints of ES were added to the clearing model to ensure the feasibility of the results in (De Vivero-Serrano et al., 2019). For the capacity value of ES in the capacity market, a simple approach was suggested to be used, where the capacity value is approved based on the historical capacity support performance of ES during peak load periods of the system in (Opathella et al., 2018). For the participation of ES in the ancillary services market, fast frequency response products were designed in (Chen et al., 2021), which are faster than primary frequency regulation response and can effectively address the low inertia of the system, for which ES is an important provider.

In the study of the practical mechanism of ES participation in the electricity market, the United States (Konidena, 2019), Europe (Barbour et al., 2016), Australia (Yu et al., 2019) and other countries have made excellent exploration. In the CAISO model of spot market, ES can submit price bids, the initial state of charge for a single day, and desired final state of charge. The state of charge constraint of ES is considered by ISO in the clearing model, which ensures the feasibility of the clearing result for ES (CAISO, 2021). In the PJM model of spot market, energy storage must submit price bids and its working state including four types: charging, discharging, continuous, and unavailable. ES will be responsible for managing the state of charge to ensure the feasibility of the charging and discharging plan (PJM, 2019). Considering the fast response characteristics of ES, PJM allows ES without primary energy output to provide auxiliary services such as frequency regulation (Xiao et al., 2020). Regarding analyzing the value of ES capacity, the ISOs have adopted more straightforward rules, requiring ES to meet a continuous discharge time and discounting the discharge power if it cannot. In the United Kingdom market model, there are two ways for ES to participate in the energy market: the first is to buy or sell power in advance through bilateral negotiations or exchange trading and to submit a power plan in advance; the second is to participate in the real-time balancing market, relying on its flexibility to provide upward volume to meet potential power shortages and low volume to help renewable energy consumption (Energy Storage News, 2021). In terms of auxiliary services, the United Kingdom has also established various products, including enhanced fast frequency regulation, fast frequency regulation, short-term operation backup, and fast backup (National Grid, 2016). Like the US market, Australia also has trading targets for energy and ancillary services for ES to realize value. In China, the 14th Five-Year Plan for Renewable Energy Development clearly states that it is necessary to promote the large-scale application of NES, clarify the status of the independent market entity of NES, which is called independent energy storage (IES), and improve the trading mechanism and technical standards for ES to participate in various power markets. The National Development and Reform Commission and the National Energy Administration jointly issued a notice on further promoting the participation of new energy storage in the electricity market and dispatching applications (Document 475), which specifies the technical, dispatching and operational conditions that IES should have and encourages the NES that exists in the form of co-construction with new energy generation unit, to turn into IES through technical transformation. In response to the call, Shandong, Guangdong, Fujian, and other provinces have made meaningful attempts in ES market participation, among which Shandong’s ES market participation mechanism is at the forefront of the country.

For the province studied in this paper, by the end of April 2022, the total scale of NES that has been put into operation is 111 MW, of which 93 MW/1 h of ES is built for renewable energy stations. Its 14th Five-Year Plan for Energy Development proposes further improving the energy storage and transportation network and making several centralized electrochemical ES power plants. However, there is currently no way in the province to enable IES to participate in the electricity market. Establishing a corresponding market mechanism and analyzing the operation strategy and profitability is urgent.

In response to the national policy and strategy of encouraging the development of NES, this paper studies how IES participates in the market based on the growth of the electricity market in a provincial region in China. IES’s profitability is calculated, and the operation strategy is analyzed to provide a theoretical basis for developing IES in this province. The main contributions are as follows.

(1) Based on the current and future development of the electricity market in a province in China, Mechanisms for IES to participate in various types of electricity markets are designed.

(2) According to the situation and model of the IES in the province, the costs required to be recovered are calculated. The strategies for the current and future participation of IES in various types of markets by division time or capacity are developed, and the profits for each participation scenario are calculated.

(3) The numerical simulation results provide theoretical analysis for the development and formulation of policies of IES in the province.

The remainder of this paper is organized as follows. Section 2 describes the designed participation mechanisms of IES in current and future electricity markets. Section 3 presents the detailed calculation method of the profitability in every market. Section 4 presents the numerical simulation results, and the policy recommendations are proposed in Section 5.

2 Participation mechanism of independent energy storage in electricity market

2.1 Value and role in electricity market

Based on its physical characteristics, NES realizes many potential values in power systems. The exact value has different manifestations for market entities, as shown in Figure 1. Therefore, it can provide corresponding bids in several types of electricity markets in the province. Because of its storage capacity, it can reduce the peak-valley differences in the system, thus saving fuel and start/stop costs of peak load units. Since ES can discharge, it can act as capacity support and reduce a portion of the investment in the generation units. NES has the advantages of fast response, flexible configuration and short construction cycle, which can play various roles in power system operation such as peak, peak regulation, frequency regulation, ramp climbing and black start, and is an essential part of the new power system. Therefore, the conclusion of the above is that IES can participate in the energy market, the ancillary service market, and the capacity compensation of the province and bring into play the integrated value of ES to obtain multiple revenues.

2.2 Unified principles for design of participation mechanism

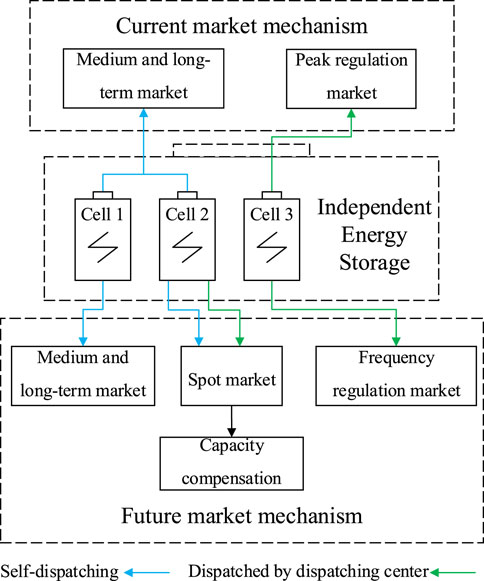

In terms of participation time, based on the actual development of the electricity market in the province, the participation mechanism is designed according to the current and future market mechanisms and the types of markets are shown in Figure 2, respectively.

In terms of dispatching, IES can be designed to participate in the medium and long-term market and spot market in the self-dispatching mode, and can also be designed to participate in the spot market, peak regulation market and frequency regulation market in the mode that is dispatched by dispatching centre of the province.

IES can independently choose the type of market to participate in. When choosing to participate in multiple types of markets at the same time, it is required to partition its total capacities, the initial state of charge according to the number of metering and control devices and the capabilities of individual cells, and submit and participate in different markets as different market entities, respectively.

For the co-constructed NES configured off-site in the province, when it meets the technical conditions and requirements of IES, it can participate in the electricity market as IES.

2.3 Current mechanism design for independent energy storage participation

Document 475 pointed out that to accelerate the participation of IES in the electricity market for peak regulation and to accelerate the involvement of IES in the medium and long-term market and spot market. Currently, the province’s medium and long-term market and peak regulation market are well developed, and the market system is mature, which provides a favourable market environment for the participation of IES.

Currently, the call of ES in the province is for administrative services only, and the electricity purchase and generation prices align with the large industrial and benchmark electricity prices, respectively.

2.3.1 Mechanism design for participation in medium and long-term market

As one of the new market entities to participate in intra-provincial trading, IES can be involved in monthly and D-3 trading, required to follow the rights and obligations of new market entities within the medium and long-term market rules. In addition, when IES declares power for each period in self-dispatch mode, it is required to be responsible for managing the state of charge by itself. The declared power for all periods must meet the physical constraints of the ES equipment.

2.3.1.1 Monthly trading

In principle, IES can only declare the amount of charging or discharging in the same trading period. IES does not participate in the first 30 minutes of the call auction phase. If the call auction phase is over and trading prices for electricity are formed, IES can only be listed operationally. Otherwise, it needs to wait for the matchmaking phase after. IES takes priority over the grid entity to participate in the market as a price taker by quoting electricity without quoting the price. The units in the market bear the uncontracted charging amount in equal proportion to their remaining capacities, and the grid entity takes the uncontracted discharging amount. Generation entities and users delist the listed charging and discharging amounts of IES during trading hours.

2.3.1.2 D-3 trading

IES only conducts listing operations and can act as either additional listing or reduced listing, which means that it is given priority to participate in the market clearing as a price taker by quoting electricity without quoting a price in the D-3 trading. Generation entities and users do delisting operations on the listed electricity of IES within trading hours.

2.3.2 Mechanism design for participation in peak regulation market

This mechanism applies to independent electrochemical energy storage stations with a power capacity of 5 MW and a continuous discharge time of 1 h or more, which the provincial power dispatching centre directly dispatches. Other NES (flywheel, compressed air, etc.) stations can refer to this standard. IES is subject to the rights and obligations of market entities.

IES only declares the electricity, which is dispatched preferentially when the coal-fired units run below 50% for peak regulation. The charging electricity of IES is compensated according to the upper limit of the second level of the quotation of coal-fired units in deep peak regulation. When there are multiple IESs for declaration, the day-ahead clearing is carried out according to the order of charging rates from high to low. When the actual deep peak regulation demand of the system is higher (or lower) than the day-ahead clearing result, IES is dispatched (or stopped) in order of charging rate from high to low (or from low to high). When the charging rates of IESs are the same, these IESs will be sorted according to the order of declaration.

The provincial power dispatching centre shall dispatch the IESs discharge before 17:00 the next day on each dispatch day to restore it to the initial states of charge. The IESs shall not participate in other market operations on the next day.

2.4 Future mechanism design for independent energy storage participation

In the future market mechanism, IES will participate in the medium and long-term market in the same way as in the current market mechanism.

2.4.1 Mechanism design for participation in spot market

IES is subject to the rights and obligations of market entities in the spot market, which consists of day-ahead and real-time trading floors (Philpott and Pettersen, 2006; Xiao and Chen, 2020). The charging power is tentatively set at no less than 5 MW, and the continuous charging time is not less than 1 h. There are two optional participation methods for IES. One is to prioritize clearing by self-dispatching, and the other is to completely hand over the operation control and the unified dispatching method to the dispatching centre.

2.4.1.1 Day-ahead spot trading

When the self-dispatching method is selected, IES declares the working day’s self-dispatching curve without quoting, gives priority to clearing, and accepts the spot market price.

When the unified dispatching method is selected, the power dispatching centre formulates an IES charging and discharging plan according to the pre-clearing price after the optimization calculation by the Security Constrained Unit Combination (SCUC) program and adds the plan to the Security Constrained Economic Dispatch (SCED) program as a boundary condition optimization calculation, and clears to get the trading result.

2.4.1.2 Real-time spot trading

IES, which chooses the unified dispatching method, can participate in real-time spot trading. During real-time operation, the power dispatching centre formulates the IES charging and discharging plan based on the real-time market nodal price curve and the real-time state of charge and adds the plan to the SCED program as one of the operating boundary conditions for rolling market clearing calculation.

2.4.2 Mechanism design for participation in frequency regulation market

Similar to the market above participation requirements, IES is subject to the rights and obligations of market entities in the frequency regulation market. The charging power is set at not less than 5 MW and the continuous charging time is not less than 1 h.

When the spot market is operating, IES, which participates in both the frequency regulation market and the spot market, can obtain the frequency regulation mileage compensation and the frequency regulation capacity compensation. In contrast, IES, which only participates in the frequency regulation market, can only get the frequency regulation mileage compensation. The ranked prices of each market entity are equal to its declared price divided by its comprehensive performance indicator on the previous trading day.

2.4.3 Mechanism design for participation in capacity compensation

At the early stage of spot market operation, the capacity compensation mechanism is implemented for the non-constructed IES to ensure reasonable cost recovery of ES equipment. The participation requirements for IES are the same as those for the spot market.

At this stage, IES is treated as a power generation source and enjoys the same capacity compensation unit price as the generation units, which is taken as the average of the capacity compensation price of each unit.

3 Operation strategy and profit ability analysis of independent energy storage

3.1 Cost of new energy storage system

In the actual use of the ES system, it is necessary to support critical systems such as the power conversion system (PCS), energy management system (EMS) and monitoring system. Among them, PCS, as the vital part of the ES system, can realize the bidirectional energy flow between the ES device and the AC power grid; EMS is responsible for monitoring the operating of the ES system and determining the optimal charging and discharging strategy of the ES.

Therefore, the cost of an NES system is divided into two categories: the first is the initial investment cost, including the cost of configuring a specific capacity of ES, called capacity cost, and the cost of including PCS, EMS and other monitoring hardware equipment, called the power cost; the second is the operation and maintenance cost during the annual operation.

3.1.1 Initial investment cost

The initial investment cost of IES (

where

3.1.2 Annual operation and maintenance cost

The annual operation and maintenance cost (

where

3.1.3 Annual cost

Considering the service life and benchmark rate of return (

3.2 Parameter processing

In this paper, the most widely used electrochemical ES in NES is taken as the main research object, and the following parameters are calculated.

3.2.1 Average annual available capacity

The impact of the capacity decay of the ES batteries is evenly spread over the life cycle to obtain the average annual available capacity (

where

3.2.2 Average annual continuous discharge time

The continuous discharge time represents the capacity value of ES to a certain extent. After considering the battery capacity decay and the depth of discharge (

where

3.2.3 Average annual operation and maintenance cost

The battery replacement cost is spread over the life cycle and as part of the annual operation and maintenance cost to obtain the average annual operation and maintenance cost, as follows.

where

3.2.4 Revenue conversion ratio

Considering the planned downtime due to maintenance and the unplanned downtime due to failure during the life cycle of ES, the revenue conversion ratio (

where

3.3 Current operation strategy and profit ability analysis

3.3.1 Participation in peak regulation market

IES is prioritized for dispatch in the peak regulation market, resulting in the following expression for the peak regulation amount of IES on day

where

According to the designed mechanism for IES to participate in the peak regulation market, the upper limit of the second level of the quotation of coal-fired units in deep peak regulation is taken as the compensatory unit price (

where

3.3.2 Participation in medium and long-term market

IES has a minimal capacity relative to other market entities and is prioritized for clearing as a price taker in the province, so it is assumed that its participation does not affect the clearing price in the energy market. When IES is fully charged and fully discharged, The expression for the annual profit of participation in the medium and long-term market (

where

IES can be set to charge in the valley hours and discharge in the sharp or peak hours. When IES participates in the energy market in the self-dispatching mode, its charging price is not exempt from transmission and distribution prices, governmental funds and surcharges. Therefore, the expressions of charging and discharging price of IES in the medium and long-term market can be obtained as follows.

where

3.4 Future operation strategy and profit ability analysis

3.4.1 Participation in spot market

Consistent with the relevant analysis of participation in the medium and long-term market, the expression for the annual profit of participation in the spot market (

where

It can be assumed that IES is charged during the lowest price hours and discharged during the highest price hours in the spot market. Document 475 states that when the dispatching centre dispatches ES, its charging power does not bear transmission and distribution price and governmental funds and surcharges. Therefore, the expressions of charging prices for participating in the spot market in the self-dispatching mode (

where

The discharge price expression for participating in the spot market is shown below.

where

3.4.2 Participation in frequency regulation market

Given that the ranked price is formed in favour of frequency regulation resources with a highly comprehensive performance indicator, it is assumed that IES can be cleared.

The annual profit of participation in the frequency regulation market (

When IES only participates in frequency regulation simultaneously, the frequency regulation mileage compensation can be obtained, but no frequency regulation capacity compensation and the corresponding expressions are as follows.

where

When IES participates in both the frequency regulation market and the spot market, additional frequency regulation capacity compensation can be obtained, and the expression is as follows.

where

3.4.3 Participation in capacity compensation

When the non-constructed IES participates in the spot market, capacity compensation can be obtained. The expression for the annual profit of participation in the capacity compensation (

where

where

4 Numerical simulations

4.1 Parameter setting and cost calculation of independent energy storage

4.1.1 Parameter setting

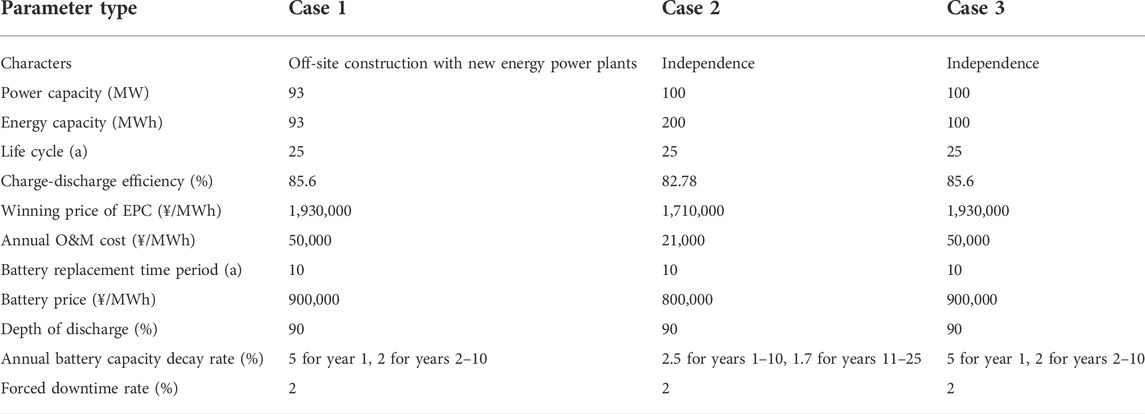

In this paper, three cases of IES are analyzed respectively, and the corresponding basic parameters are shown in Table 1. Case 1 represents all the co-constructed NES that was configured off-site in the province; Case 2 represents the first demonstration of IES in Shandong Province participating in the spot market; Case 3 is set as a comparison with most of the same parameter types as Case 1, while the characters and power capacity are the same as those of Case 2, and the energy capacity is less than that of Case2. The benchmark rate of return is taken as 8%.

4.1.2 Parameter processing and cost calculation

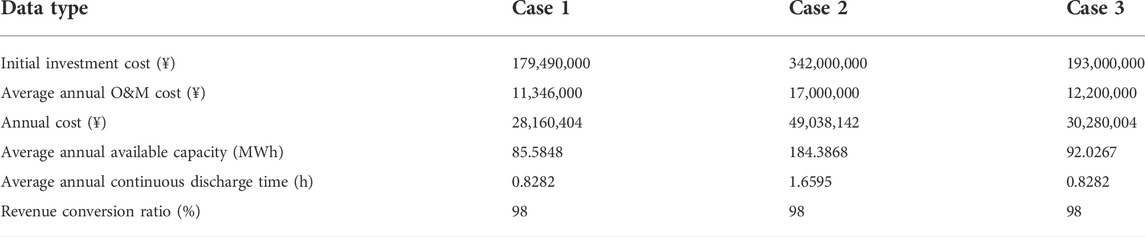

According to Eqs. 1–8, the costs and parameters used for the subsequent calculations of the three cases can be obtained, as shown in Table 2.

For Case 1, the initial investment cost is included in the cost of the corresponding new energy plant, so when the annual profit is greater than the average annual O&M cost, the IES of Case 1 is considered profitable. Case 2 or Case 3 is considered profitable when its annual profit exceeds the annual cost.

4.2 Current profit calculation and analysis

4.2.1 Participation in peak regulation market only

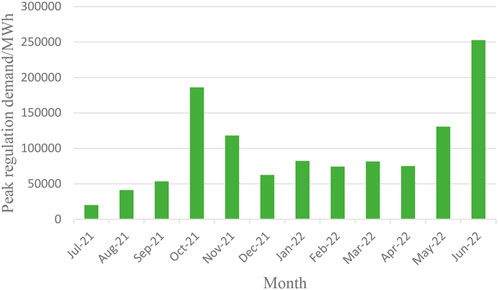

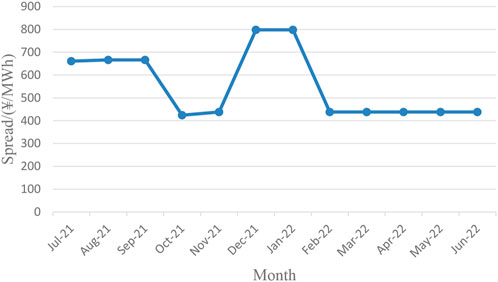

From July 2021 to June 2022, the annual statistical results of the peak regulation market profile in the province are shown in Figure 3. According to the mechanism above of participation in the peak regulation market, the peak regulation compensatory unit price is 300¥/MWh, and IES is given priority to clear.

FIGURE 3. Monthly peak regulation demand of the provincial power system from July 2021 to June 2022.

For Case 1, the annual profit is about 5,313,193¥, which is less than its average annual O&M cost of 11,346,000¥. Therefore, only participating in peak regulation throughout the year is not profitable. The critical value of the compensatory unit price that can be profitable is 640.63¥/MWh.

For Case 2, the annual profit is about 11,304,578¥, less than its annual cost of 49,038,142¥. It is not profitable to only participate in peak regulation throughout the year. The critical value of the compensatory unit price that can be profitable is 1,301.4¥/MWh, and the number of years required to recover the initial investment cost is 6.9742.

For Case 3, the annual profit is about 5,705,232¥, less than its annual cost of 30,280,004¥. It is also not profitable to only participate in peak regulation throughout the year. The critical value of the compensatory unit price that can be profitable is 1,592.2¥/MWh, and the number of years required to recover the initial investment cost is 6.3738.

4.2.2 Participation in medium and long-term market only

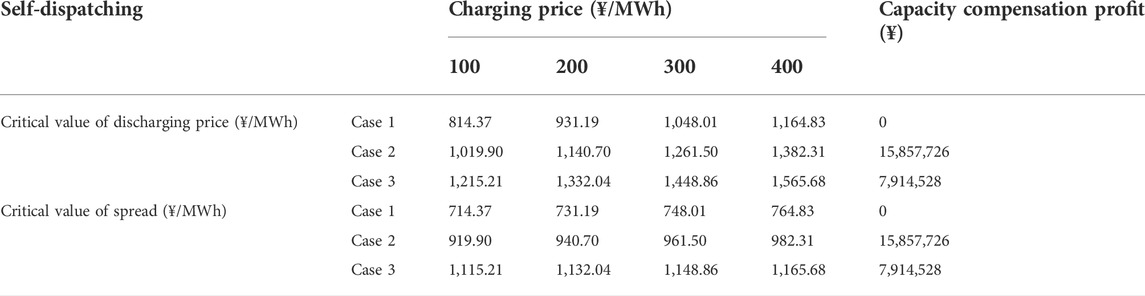

According to the statistics of the average monthly settlement electricity price of the province for four periods from July 2021 to June 2022, the 5 months containing the sharp periods are January, July, August, September and December, and the sharp and valley spread or peak-valley spread for the 12 months is shown in Figure 4. The annual average peak price and peak-valley spread are about 836.48¥/MWh and 553.49¥/MWh, respectively.

FIGURE 4. Average monthly sharp and valley or peak-valley spread for the province from July 2021 to June 2022.

As with the relevant data of large industrial power supply of 35 kV level, the transmission and distribution price and the governmental funds and surcharges for IES are set at 0.1585¥/kWh and 0.0268¥/kWh, respectively.

For Case 1, the annual profit is about 6,863,694¥, which is less than its average annual O&M cost of 11,346,000¥. Therefore, it is not profitable to only participate in medium and long-term market throughout the year. The annual average peak price that can be profitable when the annual average valley price is constant is 1,028.1¥/MWh.

For Case 2, the annual profit is about 13,384,642¥, less than its annual cost of 49,038,142¥. It is not profitable to only participate in medium and long-term market throughout the year. The annual average peak price that can be profitable when the annual average valley price is constant is 1,563.7¥/MWh, and the number of years required to recover the initial investment cost is 6.9742.

For Case 3, the annual profit is about 7,380,317¥, less than its annual cost of 30,280,004¥. It is also not profitable to only participate in medium and long-term market throughout the year. The annual average peak price that can be profitable when the annual average valley price is constant is 1,741.1¥/MWh, and the number of years required to recover the initial investment cost is 6.3738.

4.2.3 Participation in medium and long-term and peak regulation markets

4.2.3.1 Participation by division time

IES is set to participate in the medium and long-term market in the 5 months that contain sharp periods and in the peak regulation market in the other months. Given the above calculation results are not profitable and there is a particular gap between profitability, the compensatory unit price is set to the upper limit of the fifth level of the quotation of coal-fired units, which is 600¥/MWh, to calculate the profitability and the conditions required for profitability in the medium and long-term market.

For Case 1, the annual profit is about 11,936,084¥, which is greater than its average annual O&M cost of 11,346,000¥. Therefore, participating in the medium and long-term market and peak regulation by division time throughout the year is profitable. The profit in the medium and long-term market is about 4,483,851¥, and the profit in the peak regulation market is about 7,452,234¥.

For Case 2, the annual profit is about 24,929,462¥, less than its annual cost of 49,038,142¥. Participating in the medium and long-term market and peak regulation by division time throughout the year is not profitable. The average peak price that can be profitable when the average valley price is constant is 2,164.9¥/MWh. The profit in the medium and long-term market is about 8,972,242¥, and the profit in the peak regulation market is about 15,957,220¥.

For Case 3, the annual profit is about 12,829,252¥, less than its annual cost of 30,280,004¥. Participating in the medium and long-term market and peak regulation by division time throughout the year is also not profitable. The average peak price that can be profitable when the average valley price is constant is 2,639.2¥/MWh. The profit in the medium and long-term market is about 4,821,345¥, and the profit in the peak regulation market is about 8,007,907¥.

4.2.3.2 Participation by division capacity

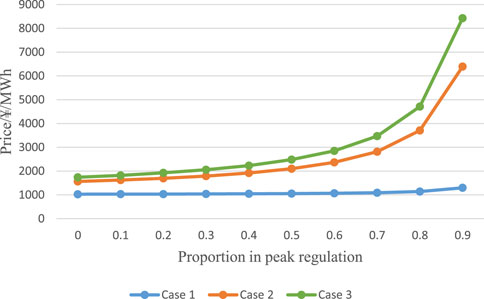

IES will participate in peak regulation and medium and long-term markets throughout the year. The proportion of participation in peak regulation, whose value is from 0 to 0.9, and the regulation accuracy is 0.1. The compensatory unit price is still set at 600¥/MWh.

The annual average of the sharp or peak prices that can be profitable for the three cases at a constant annual average valley price (263¥/MWh) is shown in Figure 5.

For the three cases, IESs are not profitable, and as the value of

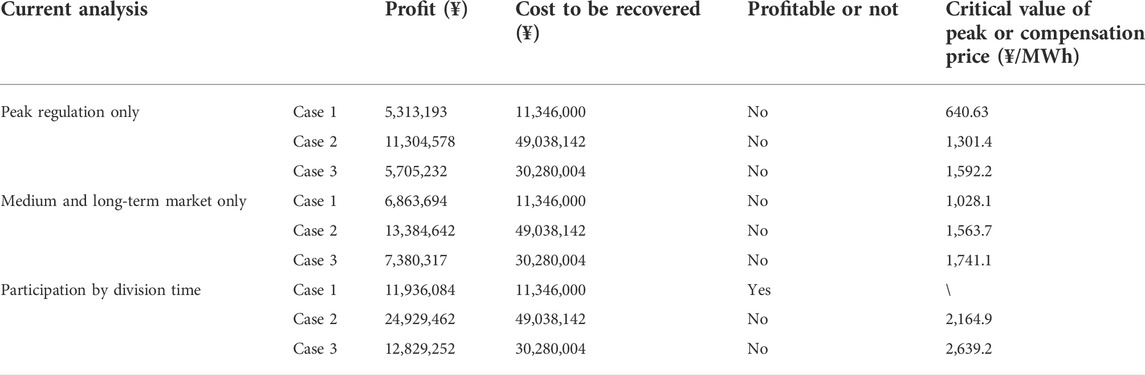

4.2.4 Results analysis

The above-mentioned situations of only participating in the medium and long-term market, peak regulation market, and participating by division time are summarized as shown in Table 3.

Case 1 can only be profitable when participating in the markets by division time, but all the calculation results in the other two cases are not profitable. Therefore, the participation by division time can take advantage of the characteristics of the respective time distributions of the medium and long-term and peak regulation markets, which is most beneficial for IES.

According to the current development of the medium and long-term market in the province, when participating in the medium and long-term market only, the annual average peak prices that can be profitable are significantly higher than the actual annual average peak price in all three cases. The reason is that the peak-valley spread is not large enough and that the transmission and distribution price and the governmental funds and surcharges occupy a particular profit margin.

According to the current development of the peak regulation market in the province, the number of trades conducted throughout the year is small, and the daily peak regulation demand varies greatly, resulting in a low utilization rate of IES in the peak regulation market. Therefore, when Cases 2 and 3 only participate in peak regulation, significantly high compensatory prices (1,301.4¥/MWh, 1,592.2¥/MWh) is required to recover the cost.

According to the results of participation by division capacity, it is clear that the annual medium and long-term market is more favourable to IES than the annual peak regulation market. The higher the sharp or peak price that can be profitable when participating in the medium and long-term market only, the faster the sharp or peak price that can be profitable increases with the increase of

4.3 Future profit calculation and analysis

4.3.1 Participation in medium and long-term market only

For the future medium and long-term market that has not yet been carried out in the province, the prices for the sharp, peak and valley periods are taken as their latest price ceilings, respectively, and the valley price is 161.8¥/MWh. The values of the sharp and peak prices are taken in two ways depending on the implementation scheme: 1) with a peak-to-valley price ratio of 3:1, the sharp price is 1,033.6¥/MWh, and the peak price is 832.4¥/MWh; 2) with a peak-to-valley price ratio of 4:1, the sharp price is 1,435.9¥/MWh, and the peak price is 1,167.7¥/MWh.

4.3.1.1 Peak-to-valley price ratio of 3:1

For Case 1, the annual profit is about 12,070,679¥, which is greater than its average annual O&M cost of 11,346,000¥. Therefore, it is profitable to only participate in medium and long-term market throughout the year.

For Case 2, the annual profit is about 24,469,976¥, which is less than its annual cost of 49,038,142¥. It is not profitable to only participate in medium and long-term market throughout the year. The annual average peak price that can be profitable when the annual average valley price is constant is 1,417.3¥/MWh.

For Case 3, the annual profit is about 12,979,225¥, less than its annual cost of 30,280,004¥. It is also not profitable to only participate in medium and long-term market throughout the year. The annual average peak price that can be profitable when the annual average valley price is constant is 1,599.5¥/MWh.

4.3.1.2 Peak-to-valley price ratio of 4:1

For Case 1, the annual profit is about 20,645,367¥, which is greater than its average annual O&M cost of 11,346,000¥. Therefore, it is profitable to only participate in medium and long-term market throughout the year.

For Case 2, the annual profit is about 42,334,973¥, which is less than its annual cost of 49,038,142¥. It is not profitable to only participate in medium and long-term market throughout the year. The annual average peak price that can be profitable when the annual average valley price is constant is 1,417.3¥/MWh.

For Case 3, the annual profit is about 22,199,320¥, less than its annual cost of 30,280,004¥. It is also not profitable to only participate in medium and long-term market throughout the year. The annual average peak price that can be profitable when the annual average valley price is constant is 1,599.5¥/MWh.

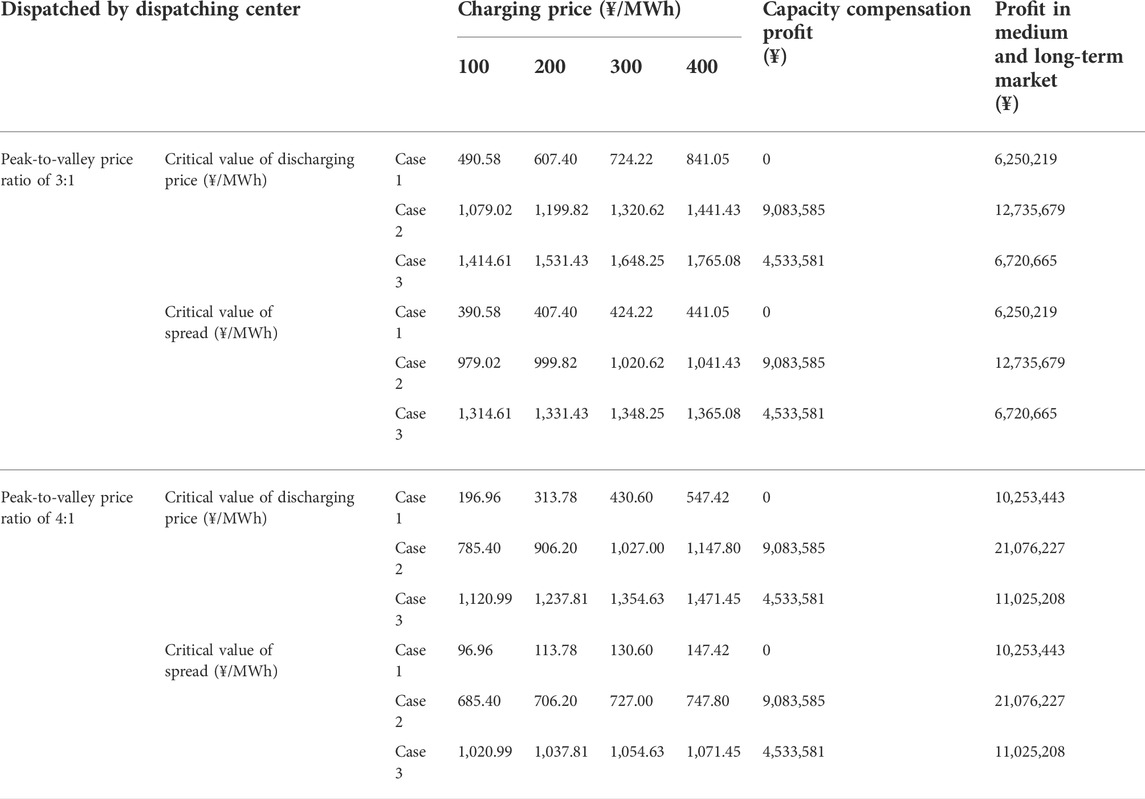

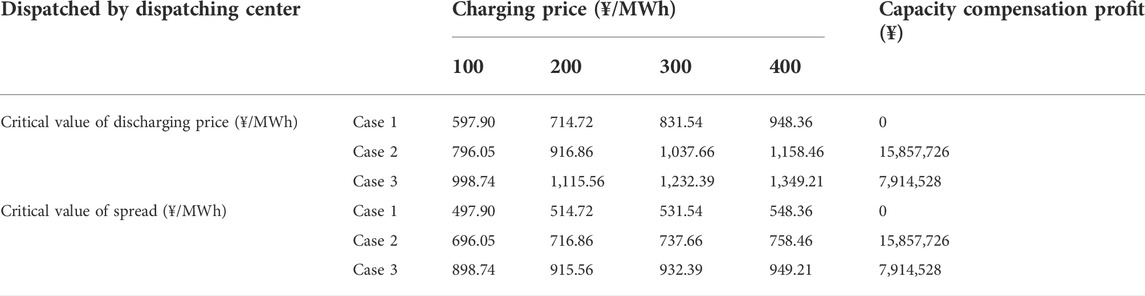

4.3.2 Participation in spot market only

Given that the spot market has not yet been developed at this time, the average discharging price is set as a variable. If the charging price is fixed and the cost can be recovered, the critical value the average discharging price needs to reach is calculated in the following. The upper and lower price limits of the spot market are 0¥/MWh and 1,500¥/MWh, respectively, so the charging price is set between 100¥/MWh and 400¥/MWh, and the regulation accuracy is 100¥/MWh.

For the self-dispatching mode, the calculation results of the critical values of the discharging price and the charging-discharging spread for the three cases are shown in Table 4. For the mode dispatched by the dispatching centre, the relevant calculation results are shown in Table 5.

TABLE 4. Critical values of discharging price and charging-discharging spread in self-dispatching mode.

TABLE 5. Critical values of discharging price and charging-discharging spread in the mode of dispatched by the dispatching center.

4.3.3 Participation in medium and long-term and spot markets

IES is set to participate in the medium and long-term market in the months containing the sharp period and in the spot market in the remaining months in the mode dispatched by the dispatching centre. The calculation results of the critical values of the discharging price and the charging-discharging spread in the spot market are shown in Table 6.

4.3.4 Results analysis

Since the valley price ceiling for the future medium and long-term market set by the provincial government is low and the sharp and peak price ceilings are high, the peak-valley spread is widened compared to the current situation, thus making it more favourable for IES. However, Cases 2 and 3 still do not recover their costs by only participating in the medium and long-term market.

When participating in the spot market, as the set charging price increases, the cost corresponding to the charging and discharging loss increases, so the critical value of the charging and discharging spread required for profitability increases.

When IES participates in the medium and long-term and spot markets by division time, compared to the case where IES only participates in the spot market, the medium and long-term profit increases, while the time and capacity compensation for participation in the spot market decreases. For Case 1, the increased medium and long-term profit is more, and the reduced capacity compensation is 0, so the critical values are lower. Conversely, for Cases 2 and 3, the increase in medium and long-term profit is less while the decrease in capacity compensation is more, such that the critical values are higher.

Given that the frequency regulation market in the province has not yet been developed, the regulation mileage and the effect of IES cannot be reasonably estimated. Therefore, the profit calculation of IES participating in the frequency regulation market needs to be studied according to the actual operation and trading situation.

5 Conclusion

Based on the actual development of IES and electricity markets in the province, this paper designs a mechanism for IES to participate in various types of markets in the province and conducts modelling and numerical simulations on the operation strategy and profitability. The analyses and results can provide a theoretical analysis basis for developing IES and formulating policies related to IES participation in the market in the province and other regions of China. The main conclusions are as follows.

(1) The technical cost of electrochemical IES power plants is still very high. Further research should be conducted on low-cost, high-efficiency, high-reliability and high-safety ES technologies based on different technical routes.

(2) There is currently only the peak regulation variety in the province’s auxiliary service market, and only the frequency regulation variety has been designed for the future in the province. The development of other auxiliary service trading varieties should be gradually promoted to improve the construction of the auxiliary service market while expanding the space for IES to participate in the market.

(3) The peak-valley price spread is the key factor that dominates the profitability of ES participation in the electricity energy market and the development of user-side ES. The province should moderately widen the peak-valley price spread according to the actual situation to further support the development of user-side ES.

(4) IES operation mechanism needs to be further optimized, and the dispatching centre needs to study the application scenarios of ES in the power system. The IES entity needs to strengthen maintenance to improve the utilization rate of the ES.

In future research, the values of ES in electricity markets can be further explored by considering other types of participants and optimization techniques. For instance, virtual bidders can utilize energy storage to increase their profits in electricity markets (Xiao and Qiao, 2021), and stochastic dominance-based stochastic optimization (AlAshery et al., 2020) and information gap decision theory-based optimization (Li et al., 2019) can be adopted to manage the market risks for ES.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

Conceptualization, JG; methodology, JC; original draft preparation, JG, JC, and YX; review and editing, HW, HC, and DX; supervision, DX; project administration, JG, and YX; funding acquisition, JG All authors have read and agreed to the published version of the manuscript.

Funding

National Natural Science Foundation of China (51937005).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

AlAshery, M. K., Xiao, D., and Qiao, W. (2020). Second-order stochastic dominance constraints for risk management of a wind power producer’s optimal bidding strategy. IEEE Trans. Sustain. Energy 11 (3), 1404–1413. doi:10.1109/tste.2019.2927119

Barbour, E., Wilson, I. G., Radcliffe, J., Ding, Y., and Li, Y. (2016). A review of pumped hydro energy storage development in significant international electricity markets. Renew. Sustain. energy Rev. 61, 421–432. doi:10.1016/j.rser.2016.04.019

Bitaraf, H., and Rahman, S. (2017). Reducing curtailed wind energy through energy storage and demand response. IEEE Trans. Sustain. Energy 9 (1), 228–236. doi:10.1109/tste.2017.2724546

Boicea, V. A. (2014). “Energy storage technologies: The past and the present,” in Proceedings of the IEEE, vol. 102, 1777–1794. doi:10.1109/jproc.2014.2359545

Bradbury, K., Pratson, L., and Patiño-Echeverri, D. (2014). Economic viability of energy storage systems based on price arbitrage potential in real-time US electricity markets. Appl. Energy 114, 512–519. doi:10.1016/j.apenergy.2013.10.010

CAISO (2021). California Independent system operator corporation order [EB/OL].[2021-05-26]. Avaliable at: http://www.caiso.com/Documents/May1-2019-Response-DeficiencyLetter-Compliance-OrderNo841-ElectricStorageParticipation-ER19-468.pdf.

Chen, Y., Zhuo, Y., Liu, Y., Guan, L., Lu, C., and Xiao, L. (2021). Development and recommendation of fast frequency response market for power system with high proportion of renewable energy. Automation Electr. Power Syst. 45 (10), 174–183.

De Siqueira, L. M. S., and Peng, W. (2021). Control strategy to smooth wind power output using battery energy storage system: A review. J. Energy Storage 35, 102252. doi:10.1016/j.est.2021.102252

De Vivero-Serrano, G., Bruninx, K., and Delarue, E. (2019). Implications of bid structures on the offering strategies of merchant energy storage systems. Appl. Energy 251, 113375. doi:10.1016/j.apenergy.2019.113375

Energy Storage News (2021). UK battery storage will be allowed to stack revenues in key grid-balancing markets [EB/OL]. Avaliable at: https://www. energy-storage. news/news/uk-battery-storage-will-be-allowed-to-stack-revenues-in-key-grid-balancing.

Harsha, P., and Dahleh, M. (2014). Optimal management and sizing of energy storage under dynamic pricing for the efficient integration of renewable energy. IEEE Trans. Power Syst. 30 (3), 1164–1181. doi:10.1109/tpwrs.2014.2344859

Konidena, R. (2019). FERC Order 841 levels the playing field for energy storage. MRS Energy & Sustain. 6, 5. doi:10.1557/mre.2019.5

Li, B., Wang, X., Shahidehpour, M., Jiang, C., and Li, Z. (2019). DER aggregator’s data-driven bidding strategy using the information gap decision theory in a non-cooperative electricity market. IEEE Trans. Smart Grid 10 (6), 6756–6767. doi:10.1109/tsg.2019.2911023

Nazemi, M., Moeini-Aghtaie, M., Fotuhi-Firuzabad, M., and Dehghanian, P. (2019). Energy storage planning for enhanced resilience of power distribution networks against earthquakes. IEEE Trans. Sustain. Energy 11 (2), 795–806. doi:10.1109/tste.2019.2907613

Nguyen, H. T., Muhs, J. W., and Parvania, M. (2019). Assessing impacts of energy storage on resilience of distribution systems against hurricanes. J. Mod. Power Syst. Clean. Energy 7 (4), 731–740. doi:10.1007/s40565-019-0557-y

Opathella, C., Elkasrawy, A., Mohamed, A. A., and Venkatesh, B. (2018). A novel capacity market model with energy storage. IEEE Trans. Smart Grid 10 (5), 5283–5293. doi:10.1109/tsg.2018.2879876

Philpott, A. B., and Pettersen, E. (2006). Optimizing demand-side bids in day-ahead electricity markets. IEEE Trans. Power Syst. 21 (2), 488–498. doi:10.1109/tpwrs.2006.873119

PJM (2019). PJM energy storage participation model:energy market [EB/OL].[2021-2-18]. Avaliable at: https://www.pjm.com/-/media/committees-groups/committees/mic/20190315-special-esrco/20190315-item-03a-electric-storage-resource-model.ashx.

Ralon, P., Taylor, M., Ilas, A., Diaz-Bone, H., and Kairies, K. (2017). Electricity storage and renewables: Costs and markets to 2030. Abu Dhabi, United Arab Emirates: International Renewable Energy Agency, 164.

Toledo, O. M., Oliveira Filho, D., and Diniz, A. S. A. C. (2010). Distributed photovoltaic generation and energy storage systems: A review. Renew. Sustain. Energy Rev. 14 (1), 506–511. doi:10.1016/j.rser.2009.08.007

Xiao, D., and Chen, H. (2020). Stochastic up to congestion bidding strategy in the nodal electricity markets considering risk management. IEEE Access 8, 202428–202438. doi:10.1109/access.2020.3015025

Xiao, D., Chen, H., Wei, C., and Bai, X. (2021). Statistical measure for risk-seeking stochastic wind power offering strategies in electricity markets. J. Mod. Power Syst. Clean Energy 10, 1437–1442. doi:10.35833/mpce.2021.000218

Xiao, D., and Qiao, W. (2021). Hybrid scenario generation method for stochastic virtual bidding in electricity market. CSEE J. Power Energy Syst. 7 (6), 1312–1321. doi:10.17775/CSEEJPES.2021.00890

Xiao, D., Sun, H., and Nikovski, D. (2020). “CVaR-constrained stochastic bidding strategy for a virtual power plant with mobile energy storages[C],” in 2020 IEEE PES Innovative Smart Grid Technologies Europe (ISGT-Europe), The Hague, Netherlands, 26-28 October 2020 (IEEE), 1171–1175.

Xin, B., Chen, M., Zhao, P., Sun, H., Zhou, Q., and Qin, X. (2022). Research on coal power generation reduction path considering power supply adequacy constraints under carbon neutrality target in China. Proc. CSEE 19, 6919–6931. doi:10.13334/j.0258-8013.pcsee.221673

Xinhua News Agency (2020). Xi Jinping's important speech at the general debate of the 75th session of the UN General Assembly [EB/OL]. Avaliable at: http://www.gov.cn/xinwen/2020-591 09/22//content_5546168.htm.

Yu, Y., Jing, Z., Chen, Y., Ji, T., and Zhang, L. (2019). Typical generation resource adequacy mechanism in electricity market and enlightenment to China. Power Syst. Technol. 43 (8), 2734–2741. doi:10.13335/j.1000-3673.pst.2019.0539

Zhang, S., Jing, Z., and Xiao, D. (2021). “Cross-provincial/regional transmission pricing mechanism to facilitate regional integration development in China: Analyses and suggestions[C],” in 2021 5th International Conference on Smart Grid and Smart Cities (ICSGSC), Tokyo, Japan, 18-20 June 2021 (IEEE), 134–140.

Keywords: independent energy storage, electricity market, machanism, provincial case, operation strategy, Profitability

Citation: Gong J, Xiong Y, Wu H, Chen H, Chen J and Xiao D (2022) Operation strategy and profitability analysis of independent energy storage participating in electricity market: A provincial case study in China. Front. Energy Res. 10:1044503. doi: 10.3389/fenrg.2022.1044503

Received: 14 September 2022; Accepted: 31 October 2022;

Published: 14 November 2022.

Edited by:

Bin Zhou, Hunan University, ChinaReviewed by:

Tianyang Zhao, Jinan University, ChinaTao Chen, Southeast University, China

Qihui Yang, Kansas State University, United States

Copyright © 2022 Gong, Xiong, Wu, Chen, Chen and Xiao. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jianrun Chen, ZXBqcmNoZW5AbWFpbC5zY3V0LmVkdS5jbg==

Jiawei Gong1

Jiawei Gong1 Jianrun Chen

Jianrun Chen Dongliang Xiao

Dongliang Xiao