- Accounting, Audit and Finance Department, Stefan Cel Mare University, Suceava, Romania

Prior to the outbreak of the conflict in Ukraine, the European energy markets had already been in a profound state of crisis with prices reaching top levels and with minimum supplies. The cost of the energy has had a significant impact on the performance and the sustainability of the majority of the economic operators, most of them considering the overgrowth of the price of the energy and the raw materials as the main risks in terms of the short - term development of the operational activity. Given the current situation, the aim of the study is to identify new solutions to reduce the negative effects of the present day crisis on the Romanian economic operators. In this context, the study focuses on the following objectives: O1—estimating the social and economic effects on the economic operators as a result of the energy crisis; O2—identifying the key factors which make the economic operators switch from the traditonal resources consumption to the renewable energy consumption and O3 - analyzing the influence factors in stimulating the investments in the renewable energy. The research methods that have been used are based on the quantitative analysis with the help of a questionnaire applied to 264 Romanian production companies. The final results of the present study refer to designing an overall profile of the industrial consumers given the escalation of the energy crisis worldwide. The findings of the study can be useful both for the final energy consumers and for the producers and distributors alike and ultimately for the European and national legislators whose decisions are closely related to the very future of these economic entities.

Introduction

As a result of the difficulties and the turmoils on the global energy market generated by the invasion of Ukraine by Russia, the European Commission submitted the REPower EU plan which is meant to ensure Europe’s independence in terms of the Russian fossil fuels long before 2030 taking into account the invasion of Ukraine by Russia. The design of this plan represents an answer to the request of 85% of the Europeans who believe that the European Union should reduce its reliance on the Russian petrol and gas as soon as possible in order to support Ukraine. The main objectives of this plan are as follows: energy saving; the production of clean energy; the diversification of their own sources of energy. No doubt that this particular plan is backed up by certain financial and legal measures and decisions which are meant to facilitate the rapid building of a new infrastructure and of a new energy system for Europe.

Consequently, it is of an utmost importance the analysis of the issues with which the Romanian economic operators have to deal with as a result of the impact of the overlapping crises during the last 2 years and especially of the increase in the energy and raw materials prices. Thus, the amount of energy that already comes from renewable sources in Romania should be quantified. The term renewable source stands for that particular type of energy which is produced from using the natural resources. Given this fact, it is important to analyze if these particular resources have the capacity to regenerate - at least at the same speed they are used–or if they are not depleted on the timescale of geological eras. This means that their present use would not have a significant impact on the future generations’ possibility to benefit from them too.

According to the data provided by the Initiative for Competitivity, Romania registered in 2015 a degree of coverage of the energy needs from imports of only 17.1%, thus occupying a third place in terms of energy independence within the European Union where there was a 54% average. Romania is the thrid state within the European Union in terms of its energy independence following Estonia (7.4%) and Denmark (13.1%).

The Romanian economic operators have suffered from a strong negative impact of the sanitary crisis, yet the conflict in Ukraine has increased the negative effects on the performance and the sustainability of their activity even more, especially due to the expensive energy and the lack of the raw materials whose value has gone up tremendously in the last few months. However, it is very important that the investments and the innovation regarding the transition processes to a green energy becomes a new opportunity and not a danger for these companies.

The reason for undergoing the present study lies in the fact that the industrial energy consumers from Romania have found themselves unprepared for the effects of the energy crisis, as very many of them have been forced to stop their manufacturing process. The shocks of the pandemic crisis as well as of the war in Ukraine have basically managed to rewrite the entire future of the energy sector in the whole Europe. In Romania, there has been a series of bankruptcies of many companies. Since so far, the environmental objectives have been a top priority, but now the focus point refers to the energetic security. For all these consumers, energy supply used to be perceived as an ordinary activity, but today this security is completely threatened, which is why it is very important that even the industrial consumers to ask themselves questions whether Romania is able to satisfy the energy needs and from what sources, while limiting the increase in emissions. Nowadays, it is vital for all the economic operators to actively get involved into solving all these issues generated by the energy crisis, which means that there is a general need for more flexibility and a mix of techologies based on more or less exploited existing resources. Consequently, the present research has been determined by the need of identifying the demands and by the difficulties faced by the industrial consumers who have been lured to be part of an unstoppable race in terms of the prices for the raw materials and for the energy itself, given the fact that the inflation reached a 10% value according to the National Bank of Romania, whereas the value of the products and/or the services offered by these operators have become unsustainable themselves. In other words, it can be appreciated that nowadays there is an emergency situation that compresses the operating margins which have already been reduced by several economic operators and which risks to lead to the slowing down or even to the foreclosure of many business activities. The main objectives of the study are as it follows: O1—evaluating the economic and social effects on the economic operators as a result of the energy crisis; O2—identifying the key factors in making the economic operators switch from the consumption of the traditional resources to the renewable energy and O3—analyzing the influence factors in stimulating the investments in the renewable energy.

The final results of the present study refer to designing an overall profile of the industrial consumers given the worldwide escalation of the energy crisis, as well as testing the opinions of the managers, the investors and of the specialized personnel in some manufacturing entities in terms of the production and the renewable energy consumption. Given the fact that the costs will not be the same as they were before the crisis due to the existing political priority to continue towards a green transition - considered to be essential in order to reduce the dependency on the Russian fossil fuels - it can be considered as necessary to design a profile of the energy consumers, in order to identify their major issues and to be able to consolidate their resilience step by step.

Regarding the limitations of the study, it is important to highlight the fact that they are the result of a lack of a realistic strategy to reduce the carbon emissions in all the sectors of activity which can be put into place in a short period of time by the national governement, by the political decison-makers, as well as by the industries’ representatives, considering the significant direct impact of this matter on the industrial consumers. This is the reason why their theoretical background, as well as their answers may contain certain amount of subjectivity. Another setback of the research itself refers to the fact that the national energy system is not properly equipped for outside shocks and other unusual combinations of events, especially in the energy production sector which is a key part of the energy system itself and which has generated a chain reaction for the industrial consumers, especially the ones in the manufacturing sector. It is unlikely and prematurely for this type of consumers to be able to identify the possible opportunities which are presented by this crisis, as this thing can only be possible when Romania will have a real chance of rethinking its whole energy system in order to adjust it to the transition process and to the climate change measures, by maintaining the supply security as its top priority. In this particular situation, the industrial consumers have faced an unexpected crisis which has led to a fair amount of unwillingness to respond to the questionnaire. They have been extremely concerned with the future of their business, they constantly felt threatened and without any protection against the consumption government policies and energy prices.

The novelty of this topic resides in designing the profile of the Romanian industrial consumer in the times when the energy crisis has significantly influenced the profitability and the sustainability of their businesses, whereas their concern for identifying and use of alternative green energy resources seems to become less important in comparison with the energetic security. The need for outlining a new profile of the energy consumer is of a significant importance for the economic and social environment, due to the fact that it provides the means to counterbalance all these effects and to avoid the risk of the companies’ bankruptcy, based on a whole range of solutions and suggestions which the government needs to be well aware of, take into account and implement as soon as possible because they would facilitate further focus on renewables and capping gas prices. The final results indicate the fact that the confidence of the industrial consumers is influenced by the acquired knowledge in terms of the renewable energy sources, by the level of social awareness and by their willingness to acquire and extend their knowledge in this particualr field according to their position within the company (i.e. manager, investor or specialized personnel).

Regarding the structure of this paper, the first section comprises the literature review on the evaluation of the effects of the energy crisis on the industrial consumers and of the interest for the green investments in the sustainable energy, in order to overcome the dependancy on the fossil fuels. This section it is followed by the research methodology which presents a descriptive and an analytical approach, aiming at developing a model for counteracting the latest profile of the industrial energy consumers given the uncontrolled crisis. In this particular section the selected dependent and the independent variables are described, too. There is also the results section that presents the empirical results, the objectives and the validation of the results. The study concludes with a conclusion section where a number of recommendations for the government are substantiated and policy implications are highlighted in the context of a severely affected economic cycle.

Literature review

The present-day energy crisis has relaunched the chance for a certain number of European companies in the sense that, on the one hand, they need to observe the European and the national policties and on the other hand, to become more proactive, to protect their competitiveness better and to consolidate their resilience. Regarding the vision of the European Union in terms of the energy sector, it is based on the energy efficiency and the renewable energy, while the Green European Agreement also makes reference to specific aspects such as the energy affordability, the market integration, the market connectivity and digitalization. The use of the green energy techologies (GET) represents an essential step towards a sustainable future from the European point of view, fact that calls for a close study of the factors influencing the wish of the final consumers to make use of a renewable energy (Jabeen et al., 2021). During the last decades, the energy demand has been continuously increasing worldwide which, given the current dependence of power generation on fossil fuels, has resulted in a continuous increase of the carbon emissions (Pradhan et al., 2021). This is the reason why the main trajectory of the energy sector in Europe relies on the transition to an economy based on low carbon emissions and on increased energy efficiency, even stressing the need for fiscal and financial incentives for research and development of renewable technologies (Bersalli et al., 2020). Last but not the least, the development of the resilience in terms of the energy constraints may give way to an increase of the effectiveness and the improvement of the results of the research-development activity, whereas by encouraging the investments in the energy production may be a solution for diminishing the negative effects of the present energy crisis (Löffler et al., 2022; Saadaoui, 2022).

In the face of the vulnerabilities, threats and risks faced by Romania as an EU country, in the new turbulent and unpredictable geopolitical context of global security, amplified by the global energy crisis, the Romanian state should have a strategy to strengthen the resilience of critical energy infrastructures, based on predictability, flexibility, continuity, adaptability and resilience. (Fîță et al., 2022). The energy markets have obviously gone through significant turmoils since the COVID-19 outbreak. For example, at the end of 2021, the increase of the cost of the natural gases has caused a new type of crisis which has led to certain risks in terms of the lack of energy supply worldwide and gave way to the issue of the energy security as a key factor (Berahab, 2022). As far as Romania is concerned, as in all the rest of the European Union countries, the monetary policy has changed by becoming more restrictive, whereas the emergence of the limitations imposed by the national debt will call for more “cautious” fiscal policies according to the recommendations of the European Commission. The unprecedented growth of the energy costs in the European Union shows that no matter what the energy supply sources there are, the majority of the state members face an energy crisis, leading to a decrease in their capacity for economic development, fact that highlights that there exists a close relationship between the energy crisis and the development outcomes. Energy constraints could therefore negatively influence development outcomes (Adom et al., 2021). At the same time, the volatility of the costs of the natural resources has become more and more important due to the fact that their costs plays a key role in the economic growth. Thus, their volatility, as well as their influence on the economic performance has established new research tendencies and streamlines (Thanh and Linh, 2022; Wen et al., 2022). Most of the costs for the energy resources have an impact on both the producers and the consumers. Consequently, the understanding of the energy transition is crucial for predicting the future business, societal and ecological trends. The future economic, environment and social changes depend on the means that the energy policy will shape the energy transition and will adjust to the connected changes (Gatto, 2022). Based on the empirical findings, the studies that are mentioned in this section of the study suggest the capping of the costs and the promotion of the ecological innovation. There could be corrective actions in order to continuously improve the economic and financial performance, as well as to reduce the volatility of the cost for the natural resources. Unlike the present study which focuses on the profile of the renewable energy industrial consumer, other studies (Żywiołek et al., 2022) have focussed on measuring the confidence level of the household consumers in terms of the renewable energy sources. The findings have shown that the confidence of the people in charge with the household energy is influenced by the knowledge of renewable energy, the level of social awareness and their willingness of acquiring and expanding their knowledge in this field. The importance of identifying the profile of the renewable energy consumer is supported by other studies too, they analyzing some factors that are more or less similar to the ones that are discussed in this study. For example, in a group of 28 research articles on the topic of the renewable energy, there are three factors that have been identified as supporting - in a near future - the changes in terms of the renewable energy industrial consumers such as: sustainable techologies for the local energy systems, energy storage and the breakthroughs in terms of flexibility, as well as the use of the solar energy in several sectors of activity (Kılkış et al., 2019). In spite of the fact that the findings of the above-mentioned study are more than agreed by the law-makers, they do not take into account the uncertain conditions generated by a series of crises in which industrial consumers no longer have predictable policies and are unable to ensure the sustainability of their activity. On the other hand, there are also studies according to which during an economic crisis, the investements in a clean energy are highly likely to take place as a result of the need to protect the environment and to preserve a clean air (Shaikh et al., 2022), therefore the industrial consumers should have a stronger voice in terms of the importance hierarchy of using the renewable energy sources and ensuring the energy security.

The review of the above mentioned literature has shown that many studies have already looked into the environment crisis which is generated by the consumption of the traditional energy resources and by identifying ways to reduce the carbon footprint and stimulate renewable energy production without taking into account the negative effects of an unforseen energy crisis. There are no specific studies which can provide predictable policies regarding the present and future effects of the energy crisis on the sustainability and profitability of the industrial energy consumers’ businesses by outlining a proper economic development framework. Consequently, the present study fills in the existing gaps by shaping up a profile of the industrial consumers during an overlapping crisis. This provides an opportunity to test the industrial consumers’ perceptions of uncertain and unpredictable conditions in a context of multiple crises and to determine their level of confidence in renewable energy sources.

Materials and methods

The research methodology has initially relied on the review of the specialty literature and on its content analysis. The second stage refers to the questioning of the Romanian industrial energy consumers. The questions have been thus formulated so that they could evaluate the opinion of the managers, the investors and of the specialized personnel regarding the effects of the present energy crisis and of the consumption of greeen energy, too.

Based on both the descriptive analyses and on the use of the thinking energy system, the cognitive model of the industrial renewable energy consumption and the evaluation of the effects of the present crisis and the stakeholders’interests (such as, for example, the managers, the investors and the specialized personnel) have been described and analyzed. The comparative analyses of the three mentioned above categories of stakeholders have been used in order to study the existing general and specific knowledge on the analyzed matter that significantly has been influenced by the recent changes in the consumption patterns of the industrial consumers.

Discriptive statistics

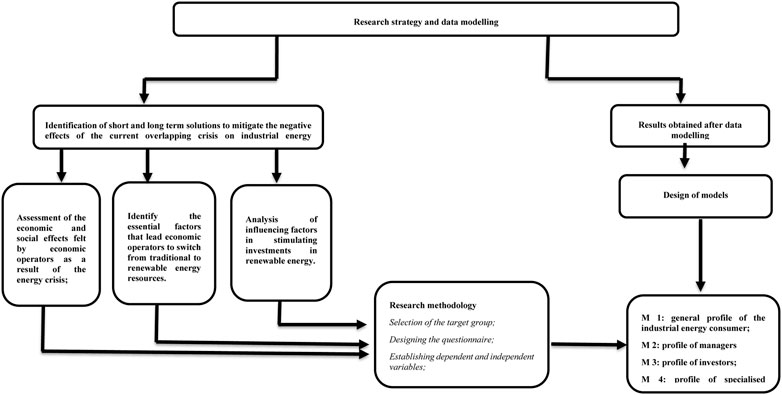

The study is based on the quantitative research (see Figure 1), namely on the questionnaire method. The survey comprises 19 questions out of which 17 are open questions and two are matrix type questions and it was applied only to production companies from Romania, registering 264 responses of which 104 were managers, 96 were investors and 64 were specialised employees.

The inclusion criteria regarding the selection of the companies are the following: production companies, companies which have an ongoing activity or which have registered a downsize during the last 5 years, companies whose financial reporting can be checked and which have responded to all the questions of the questionnaire. Moreover, only the answers of the managers, stakeholders or the specialized personnel have been taken into account. The exclusion criteria are as follows: the companies carrying out another type of activity apart from manufacturing; the companies which failed to answer all the questions as well as the companies which have gone bankrupt or have registered a decrease of their activity during the last 5 years.

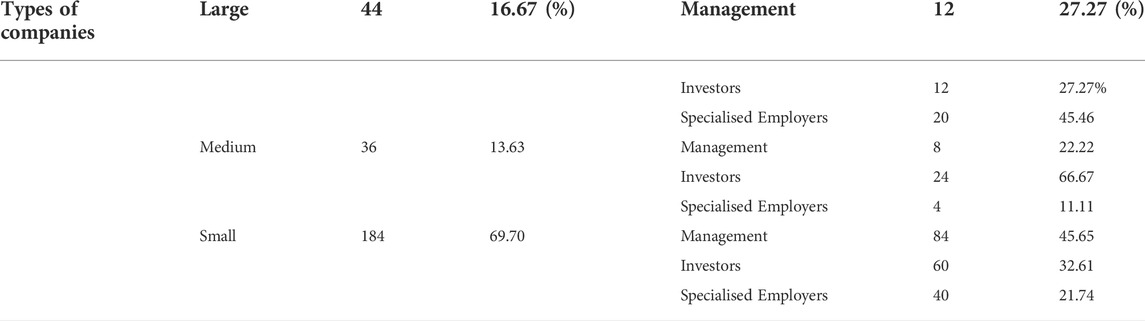

According to Table 1, there are large companies which answered the questions (16.67%), the medium ones (13.63%) and the small ones (69.70%), the ones which have the employees who are concerned with the threats of the present multiple crises and which are, ate the same time, willing to focus mainly on the green energy. These are the companies which activate in Romania, with a Romanian capital and which do not rely on a foreign support. Most of the companies belong to the manufacturing and processing sectors and have a small revenue and assets below 700.000 euros.

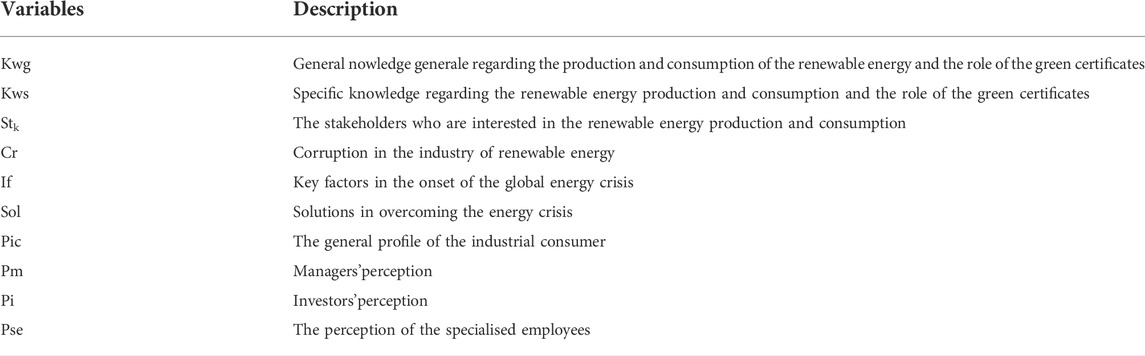

In order to design the general profile of the companies which are renewable energy consumers, there were six independent variables which were set in place displaying the specific and general knowledge about the green certificates and the renewable energy, the key factors for the onset of the global energy crisis and the solutions for overcoming the crisis as well as the level of the corruption and the profiteering in the energy sector. The dependent variable identified with the general profile of the industrial consumer (Pic) which has been designed based on the previous data comprises economic, financial and social data regarding the respondents (see Table 2). As far as the other three secondary models are concerned, they have been developed in relationship with the position or the status of the respondents within the company (i.e. managers, investors or specialized personnel).

In order to design the particular models referring to the profile of the managers of these companies, of the investors or of the specialized personnel, the study has resorted to the use of the same independent variables as in the case of the general profile of the small, medium and large industrial consumers (see Table 2).

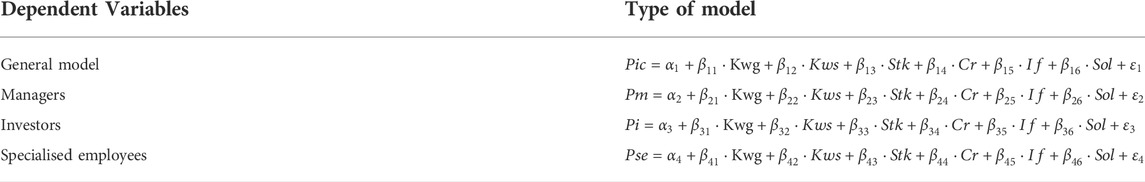

The linear regression model was defined based on the function:

where n stands for the size of the sample which was tailored for each and every model.

In designing the profiles of the renewable energy industrial consumer and the three secondary models which have been described above, the reasearch relied on the multiple linear regression model (see Table 3).

One of the most important advantages in estimating a multiple linear regression model refers to the fact that it allows the forecast on the changes of the independent variables in relationship with the dependent variable. The regression model facilitates getting the parameters corresponding to the formulated set of variables when the data series are recorded in the statistical units for a period of time or for just a moment as well as to highlight the reliance among the variables during a specific timeframe. The other factors influencing the resulting variable have been grouped in the residual variable.

The reason for using the multiple regression analysis relies on the fact that it deals with the relationships among a dependent variable and one or several independent variables implying, at the same time, the causality relationship. This means that the independent variables are the cause and the dependent variable represents the effect of the cause. In the event that there is a causality relationship between an independent and a dependent variable, it needs to be justified by some economic theory.

The limitations of the study and comparative analysis with other similar studies

One of the most significant downsize of the empiric research refers to the fact that in designing the model on the estimation of the behavior of the renewable energy industrial consumer the law of demand implying that there is a relationship between the requested/consumed energy quantity and its price, provided the rest of the variables influencing the request are constant, there is not enough data to support the causality relationship (between the price which can be the very reason for it and the demended quantity/consumption which could be considered as the effect itself). This the reason why the causality needs to be reinforced in its turn by the economic theory referring to the phonomenon which has been tested empirically.

As it was mentioned above, one of the most common forecast method that is used in order to design the profile of the energy consumer is the use of the multiple linear regression model. Hence, according to the present study, the perception of the managers, the investors and of the specialised personnel as part of the group of the Romanian economic operators, the who are renewable energy consumers and who have been suffering as a result of the present energy crisis, have been estimated based on a regression model including as follows: the general knowledge on the production and the consumption of renewable energy and the role of the green certificates; the stakeholders who interested in the production and the consumption of renewable energy; the corruption in the renewable energy industry; the key factors in the onset of the global energy crisis; the solutions in overcoming the energy crisis. According to these models, the forecast of a variable, for example the Y variable, has to do not only with its previous values, but also with the present and previous values of the variables influencing this particular variable.

In order to support the functionality of the studied model, there will be mentioned certain studies which have shown significant results based on a similar research logic. For example, by using an analysis of the price tendency (Bianchini et al., 2022) certain market options with the highest chance of reducing the costs or profit making have been researched. The final results have shown that on the German market the consumers have the highest chances of reducing their energy supply costs based on the market options related to the network tariffs and the energy market. Bianchini et al. (2022) have shown that the flexible use of the energy itself allows the reduction of the energy costs as well as some extra cost benefits. The findings of Sun and Nie (2014) have indicated that the standard renewable portfolio policy is more efficient for cutting down the carbon emissions as well as for improving the extra consumers. They have demosntrated that there is an inversely proportional relationship between the investment in the research and development and the cost reduction. The Sadorsky (2009) model has demonstrated that the capital gains bought per unit in the renewable energy sector are higher than the labor gains, thus indicating the capital-intensive characteristics of the renewable energy sector which is a very important aspect for the management, the specialised personnel and for other categories of stakeholders alike. The empirical results of Abeliotis et al. (2010) based on the linear regression method as part of a survey which took part in Greece has launched the hypothesis that income is the strongest predictor variable of 3R (reduce–reuse–recycle) activities and affects the eco-friendly behaviour negatively.

Unlike the nature of the independent variables which have been used in the above-mentioned studies, in the model suggested in the present study the variables comprise the following:

The interaction among the model’s variables also takes place within the evaluation models of the perceptions of the managers, the investors and of the specialised personnel regarding the renewable energy consumption and the effects of the energy crisis. The variables of the model have been established in such a way so as the oversight of the direct, indirect and of the global effects on the renewable energy industrial consumers should be possible.

Results and discussion

The economic situation of many countries shows that there are small or medium energy producers who are not fully aware of the importance of the production and the consumption of renewable energy. It is the energy which is mentioned on their bill in the form of green certificates. A proper training of the management of such companies, of the stakeholders and of the specialised personnel in terms of the renewable energy production and consumption could have a significant impact on the escalation of certain negative effects that are generated by the present energy and geopolitical crisis. In this context, the profile of the industrial renewable energy consumer can provide a series of key data both to the legislator and to the renewable energy producers and suppliers.

Designing the general profile of the small, medium and large industrial consumers

The present study shows the findings as a result of processing the responses of the small, medium and large industrial consumers. In designing the general profile of the small, medium and large industrial consumers a series of the most relevant influential variables for the present energy crisis have been establishes such as: general and specific knowledge regarding the production and consumption of renewable energy and the role of the green certificates; identifying the key stakeholders who are directly involved in the production and the renewable energy consumption; identifying the corruption level in the renewable energy industry from the perspective of the small and medium industrial consumers; ranking the key factors in the onset of the global energy crisis as well as the solutions regarding the means of overcoming the energy crisis.

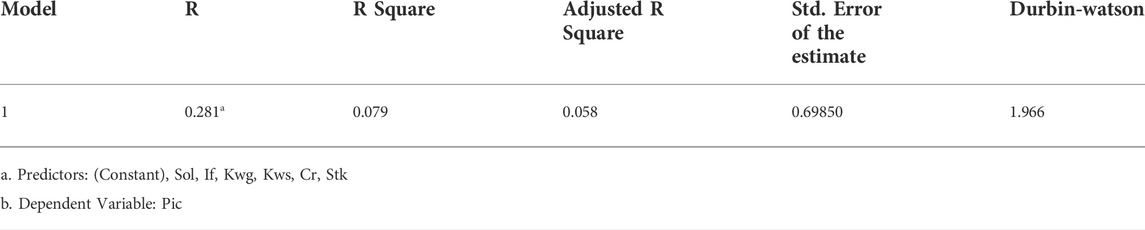

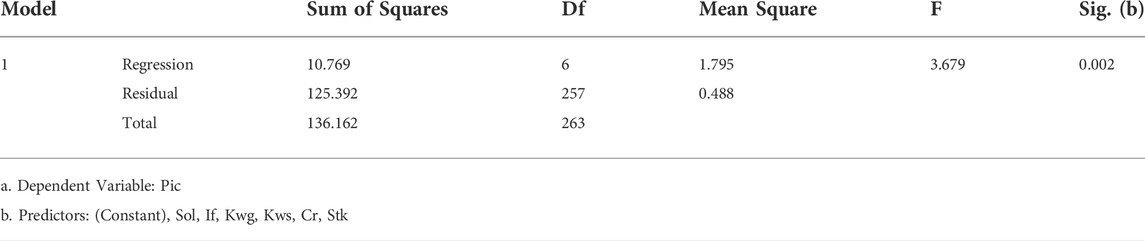

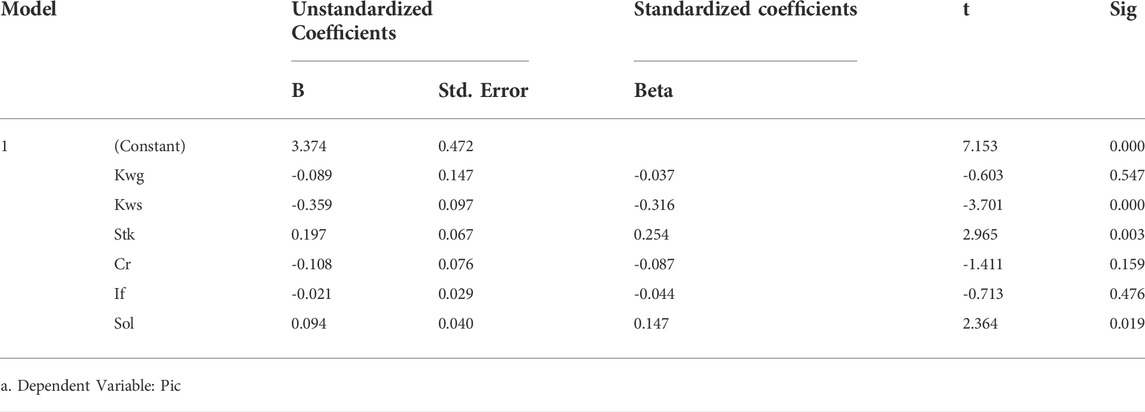

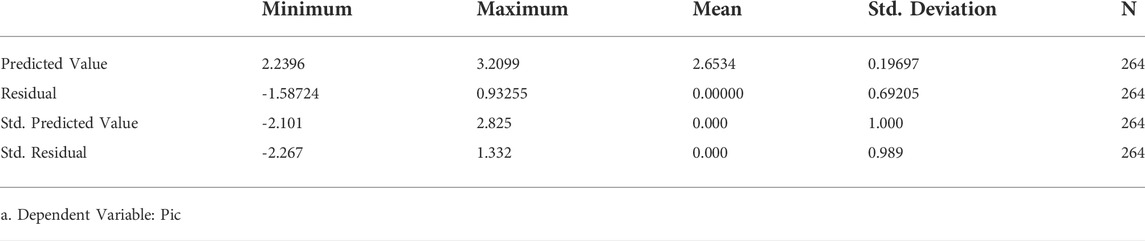

According to Table 4, it can be noticed that there is a relationship among the dependent varible Pic and the Kwg, Kws, Stk, Cr, If and Sol independent variables with a 0.281 value. By analyzing the ratio of determinacy, it can be observed that the variables’ change influences by 7.9% the Pic variable. The findings resulting from the analysis of the answers provided by the 264 representatives of the small, medium and large industrial consumers highlight the fact the lack of the educated industrial consumers from the point of view of the opportunities that are offered by the renewable energy consumption.

As a result of taking into account the value of the Sig. = 0.002 significance threshold under, hence, the resulted model is validated (see Table 5).

As a result of testing out the model, the following regression equation is as follows:

Consequently, according to the regression quotients, the order of influence on the general profile of the (Pic) renewable energy industrial consumer is as follows: Kws, Stk, Sol, Cr, If și Kwg (see Table 6). Hence, according to the above mentioned model, it can be noticed that the general profile of the small, medium and large industrial consumers is most significantly influenced by the specific knowledge regarding the renewable energy production and consumption and by the role of the green certificates, too, which means that the gathering of such information may persuade the renewable energy consumers to give up the traditonal energy. However, both the costs and the time for achieving this target fail to convince them. From this point of view, the study done by Gambardella & Pahle (2018) has reached the conclusion that the purchase of an increased amount of renewable energy will not necessarily lead to a decrease of the amount paid by them.

Another key factor refers to the stakeholders who are interested in the renewable energy production and the consumption such as: the renewable energy producers and suppliers, the civil society, the investors or other private entities.

Out of the personal respondent categories, the most interested in the renewable energy are the managers and the investors of the companies from the urban environment who have a total assets of 350.000–1.999.999 euros, a turnover of approximate 700.000–999.999 euros and a number of employees ranging between 10—29 and a gearing ration of under 60% (see Table 7).

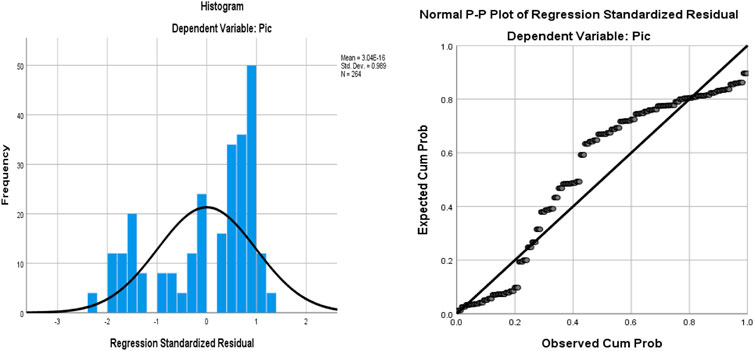

The histogram distribution of the Pic dependent variable (see Figure 2) is weak towards the left which means that the profile of the industrial consumers is more uncertain given the manifestation of the energy crisis. However, once the negative effects on the activity of these economic entities escalate, it will be possible to outline a more stable and consistent profile which is situated on the maximum point of the Gaussian curve which means within the median range on the ascending path.

FIGURE 2. The histogram and the digrama Q–Plot flowchart corresponding to the Pic dependent variable.

The distribution of the trend line on the Q-Q Plot chart of the dependent varible is inhomogeneous which means that the deviations in terms of the predicted right are significant and inherent for the energy crisis timeframe (the fact that this observational study focuses on the activity of the economic entities from the beginning of the energy crisis up to the present, needs to be highlighted).

On the same theme line as the present study, the study of Singh et al. (2019) highlights the fact that the respond to the demand programs and those of energy saving have been adjusted based on the electirc energy consumption models of the consumers, yet they disregard in an exhaustive manner the data ralted to the social and demographic as well as the social and economic chracteristics, the specific features of the demand facility and the behavior of its dweller in terms of the energy consumption. The very same factors can have a significant influence on the energy consumption and can facilitate a better understanding of the consumer’s behavior.

Testing the managers perception

This section of the study analyzes the perception of the managers from the economic entities on which the reasearch was focused.

Managers have a key role in setting the organizational objectives and in using the resources effeciently. The latest energy crisis has had managers identify the solutions to improve their production activity and to reach the level of performance in order to meet their goals. According to Belous et al. (2022), as a result of price increase lately, the managers of the large energy consumer companies have designed alternative energy supply plans such as the transition towards the renewable enrgy, for example. Consequently, it ca be stated that the managers are demanded to develop and implement a new organizational goal such as the energy management of production activities in order to optimize the expenses. In this respect, in order to analyze the Romanian managers’ perception regarding the energy consumption based on the above mentioned variables, the following econometric model has been designed:

where Pm stands for the managers’perception, the rest of the variables have been previously described.

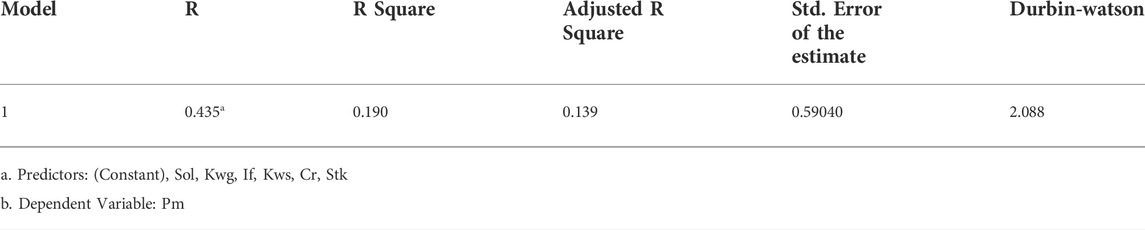

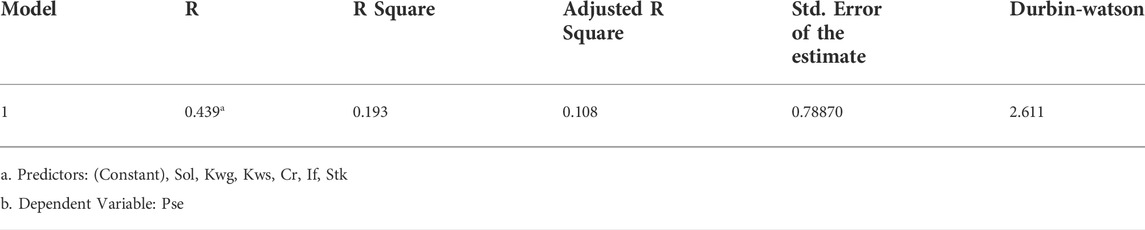

By analyzing the data in Table 8, it can be noticed that when comparing the Pm dependent variable and the independent variables, the value of the ratio of correlation is 0.435, whereas the analysis of the determinacy report shows that the variation of the independent varibles has a 19.0% on the variance of the Pm variable. The analysis of the responses of the managers shows their particular interest in the general profile of the industrial consumer from the point of view of the opportunities provided by the renewable energy production and consumption.

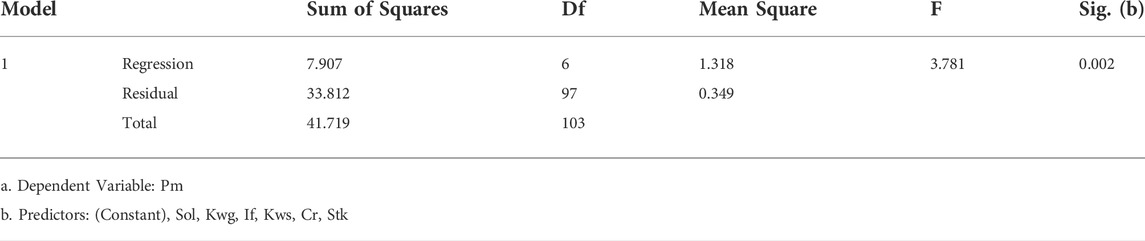

As for the general profile of the industrial consumer, the model as a result of the answers of the managers will be validated. The value of the Sig. = 0.002 significance threshold is situated under the value of 0.05 (see Table 9).

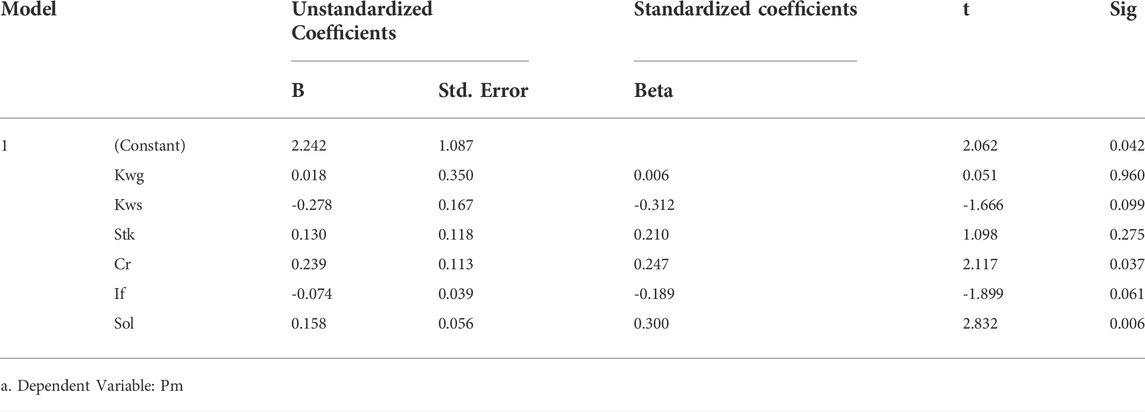

Unlike the general profile of the industrial consumers, it can be observed that the managers of these companies are more interested in acquiring general knowledge regarding the production and the consumption of renewable energy and less interested in the specific knowledge, yet they have no interest at all on the issue of the corruption in this field (see Table 10). The study of Herbes et al. (2017) which has been done on a sample of German managers from renewable energy groups identified the obstacles in terms of the implementation that these entities faced. They mainly refer to the unwillingness to take risks of both the managers and the other members, the concerns related to the impact on the environment or to the ethics of certain models which, in spite of the fact that they are legal, they fail to correspond to the requirements of the lawmaker. At the same time, they lack the specifications of the competences and of the time devoted by the managers which is mostly not paid for at all. Thus, their study, in the same manner as the present study alike, highlights the fact that it is important for the managerial competences and knowledge to be present in this relatively new field of renewable energy. The authors Żywiołek et al. (2022) have shown that confidence is a key factor itself and that it has an impact on the perception of the energy sources whereas the acquired knowledge allow the proper management of the waste energy by thus reducing the costs. The authors have also emphasized the fact that the confidence of the people managing the household energy is influenced by the reliability of the renewable energy sources which refer to knowledge, i.e. the level of social awareness and their willingness of acquiring and extending their knowledge in this field. Thus, it was spotted the need to highly promote the benefits of using the renewable energy sources which have significant effects in terms of cost reduction and the protection of the. It also can be considered that the renewable energy sources are a legit option to the global energy crisis that manifests in almost every country.

The managers’interest in the requirements and the policies promoted by the stakeholders that are involved in the renewable energy production and consumption as well as finding reliable solutions for the implementation of the renewable energy sources exert a considerable amount of influence upon the managers as they are less concerned with the external factors that are responsible for the outbreak of the energy crisis. Consequently, managers are interested in implementing these renewable energy sources due to their impact on the decrease of the energy cost which has direct implications on the performance of their organizations. The same conclusion has also been drawn by Drosos et al. (2021) as a result of questioning 510 Greek managers, 97.6% of them stating that it is mandatory for these measures to be taken and which will lead to energy savings according to the legal requirements on the environment protection.

The influence ranking on the managers’perception regarding the renewable energy production and consumption in relationship with the general profile (Pm) is the following: Sol, Cr, If, Kws, Stk și Kwg.

It can also be noticed that managers that are the most interested in the renewable energy consumption are those of the companies from urban areas with a total assets ranging between 350.000 and 1,999.999 euros and a turnover ranging between 700.000 and 999.999 euros, with a number of employees ranging between 10 and 29 and a gearing ratio of over 60%. The less interested managers are those managing the small companies that have a turnover under 700.000 euros, with few employees and a high gearing ratio as well as the managers of the large companies with lots of employees and large debts (see Table 11).

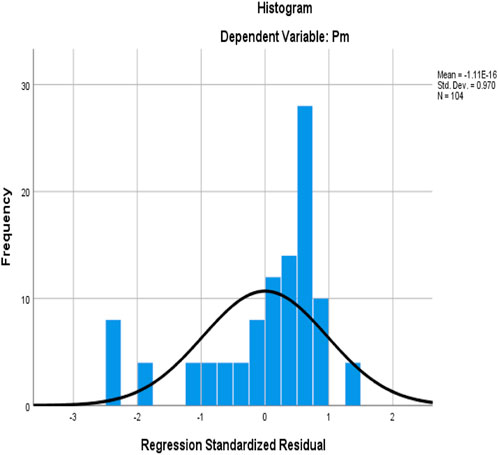

In the case of the Pm analysis, the histogram is asymmetrical and does not follow the Gaussian curve, yet it has a shift to the left which means that there is a residual variation of the managers’perception in relationship with the regression variable on the downward slope (i.e. the 1.5–2.5 range) as shown in Figure 3. By analyzing the managers’responses, it can be stated that they are interested in the energy consumption and in the identifying the solutions for switching to renewable energy in order to cut down on their production costs.

Investors perception

As a rule, investors are considered the most important category of stakeholders for a company due to the fact that they invest their own assets in that particular business. No doubt that, in their turn, they will pursue their interests, namely the chance of making big profits and of investing in sustainable businesses.

No doubt that investors will be highly interested in the renewable energy costs and in the way they will affect their profits, yet, at the same time, the concern for ensuring the sustainability of their investments will become a top priority when it comes to the protection of the environment and to setting in place of the organisational policies which will show the community their best intentions (Socoliuc et al., 2018; Socoliuc et al., 2020; Ciubotariu et al., 2021). Consequently, the findings of this paper reinforce the ideea that the investments in the renewable energy depend on the stability and the dependability of the regulatory framework characterizing the renewable energy investments.

The work as a result of the processing and interpretation of the data has shown that the investors, unlike the managers, are not interested in acquiring general and specific knowledge about the renewable energy and the green certificates even if they are well aware of the fact that it is the only way of ensuring them the sustainability of their businesses. It is worth mentioning the fact that they more concerned with the external factors which are responsible for the outbreak of the energy crisis and with the existence of the soultions which can diminish their effects as they are concerned with the fact that their invested capital may undergo inherent, uncontrollable management risks.

As a result of the analysis of the answers of the investors and based on the correlation factors among the Pi dependent variable and the independent variables, the equation for the model can be expressed as follows:

where Pi which stands for the dependent variablevariabila expresses the investors’perception.

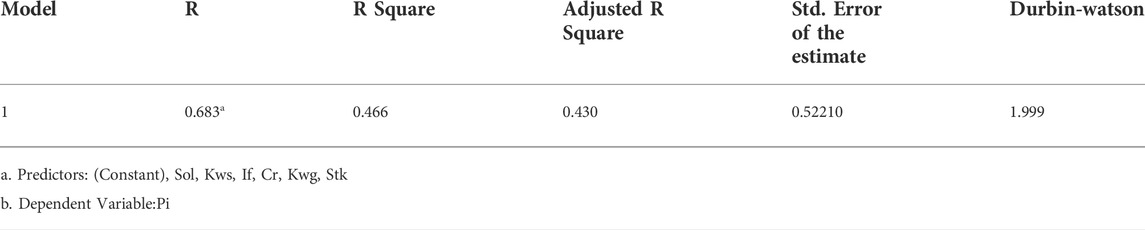

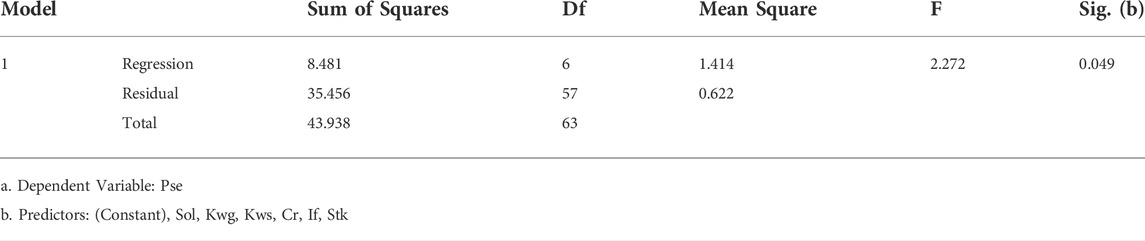

As the investors represent the most important category of stakeholders for any company and the ones investing their own capital in that particular business, it is no doubt that, in their turn, they will pursue their own interests. One can notice that there is a 0.683 correlation among the Pi variable and the Kwg, Kws, Stk, Cr, If și Sol independent variables which are very close to the threshold of a significant correlation. The same tendency has been observed in terms of the determinacy ratio which leads to the conclusion that the change of the independent variables will influnce with 46.6% the change of the Pi variable. The investors’answers and the intepretation of the data show that the investors, unlike the managers, are much more interested in the opportunities related to the renewable energy production and consumption (see Table 12).

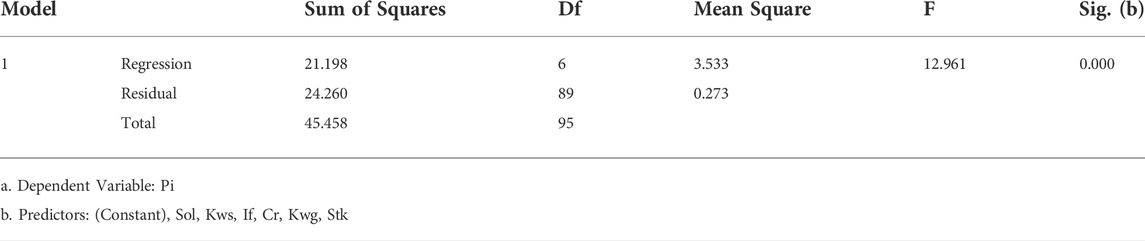

Given the fact that for the general profiles of the industrial consumer and the managers the models which have been generated as a result of the respondents’answers have been validated with a significance 0.002 threshold, in the case of the investors the significance threshold Sig. = 0.000. This fact is a clear indication of the fact that it is the best validation of the model itself and that the investors are the most interested in the renewable energy production and consumption (see Table 13).

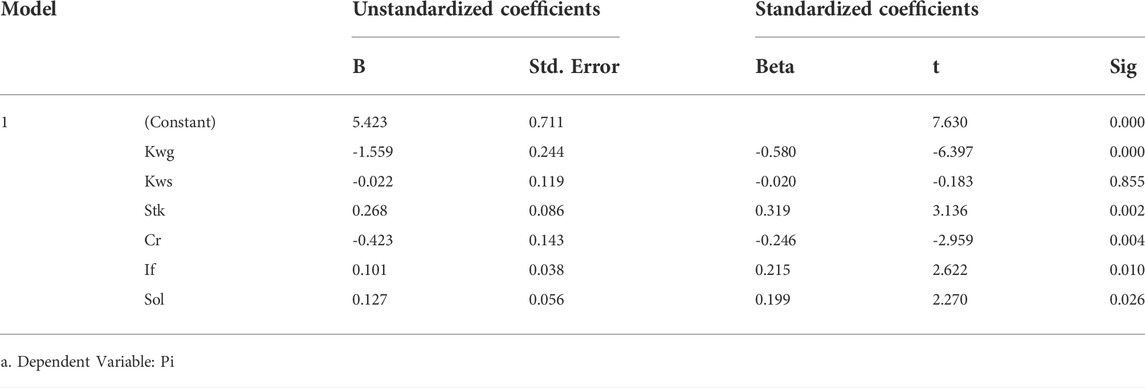

The influence order in terms of the investors’perception for the Pi dependent variable is as follows: Kwg, Stk, Cr, If, Sol and Kws (see Table 14).

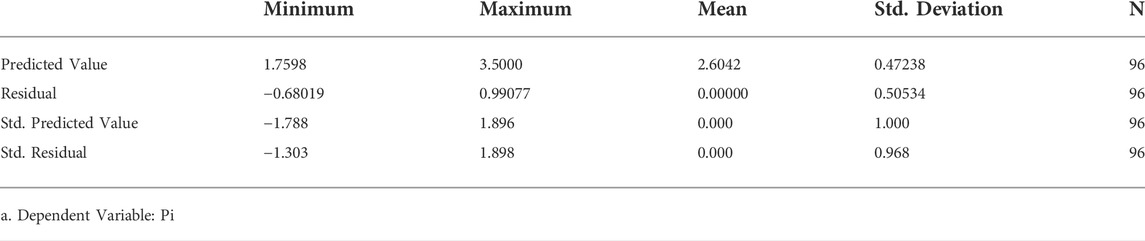

According to the model 5) and to the residual statistics (see Table 15), it is observed that the investors in large companies which have a turnover of over 8.000.000 euros and over 50 employees and which have the gearing ratio of under 60%, are much more interested in the general and specific information regarding the renewable energy production and consumption, the social, economic, political and environmental factors that are responsible for the outbreak of the energy crisis and the solutions to eradicate it. In contrast, the investors in the smalll companies with a turnover between 700.000 and 999.999 euros, with a numebr of employees ranging between 30 and 50 and with a high gearing ratio as well as the investors in large companies with lots of employees and a huge debts are less interested in acquiring the knowledge on the renewable energy production and consumption or on the causes of the energy crisis and the means to address it.

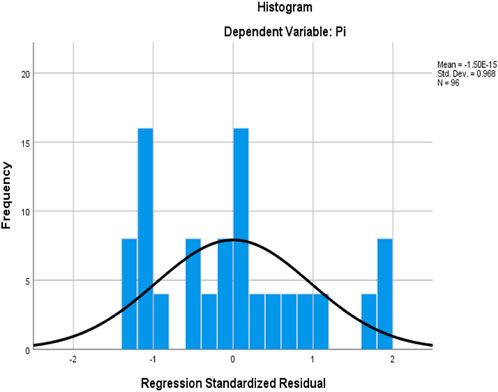

The case of the Pi analysis, the histrogram does not follow the Gaussian curve which means that there is a resudual variation of the investors’perception in relationship with the regression variable on a descendant slope in the 1–2.5 range as shown in Figure 4. Basically, apart from the fact that the investors are interested in investing in the development of the renewable energy projects, they are also concerned with both a short-term and a long-term investment gains.

The perception of the specialized personnel

In spite of the fact that nowadays the concept of digitalization is a very popular one, there are still many industry branches which have been affected by the lack of a high demand of specialized personnel. This has taken the toll on the any business turnover in general (Chew & Entrekin, 2011). Their value and uniqueness rely on the “silent expertise” which could be valuable for the competition whereas these abilities and knowledge have to do with the core internal developed processes which have been shaped throughout time (Entrekin & Court 2001). For example, one can establish a direct relationship between the perceived organizational support and the organizational results, especially in terms of the organizational citizenship behavior and the work performance (Shen et al., 2014). A dependable employee who is specialized in his activity represents the human resource whose knowledge and performances contribute significantly to the organizational performance and sustainability and to a consistent creation of a competitive advantage for that particular company. In the field of the renewable energy, studies have shown that the employees’high level of knowledge may have a significant impact on the entities’sustainable development. Thus, the study of Nasirov et al. (2021) has shown the impact of the renewable enrgy technologies on the creation of new jobs at a more sustained pace than in the traditional energy sector. This is the reason why the opinion of this particular group of employees regarding the renewable energy production and consumption is tested, considering also the fact that it may be a key factor in designing the profile of the industrial consumers. The equation of the model as a result of testing the perception of the specialised employees is as follows:

where Pse, as the dependent variable, stands for the perception of the specialised personnel.

Consequently, it can be noticed a growing interest for the general knowledge regarding the renewable energy production and consumption, matter that can be explained by the fact that this is a relatively new and dynamic field of activity. This means updating the general knowledge as the specialised personnel believes that they are not responsible for the accumulation of specific knowledge.

Studies have shown that in 2025, the employees of the hydropower industry would represent the biggest proportion of the average total number of the employees in the renewable energy production sector in Romania (74.68%), whereas the employees in the solar energy production sector will represent 14.31%, the ones in the energy production from biomass sector will represent 5.8% and the ones in the wind energy production sector will represent 5.2% (Tănasie et al., 2022).

Given this context, the renwable energy is essential factor which can lead to the decrease of Europe’s dependency on the imported energy. Moreover, the stimulation of the use of renewable energy sources in Europe needs to have in place a “New Energy Pact” which is based on a coordinated effort in the entire Europe in order to build a larger capacity of renewable energy (Tănasie et al., 2022).

As in the case of the management and of the investors, the specialised personnel is also reluctant to the manifestation of corruption in the energy field and less concerned with the direct causes of the present energy crisis.

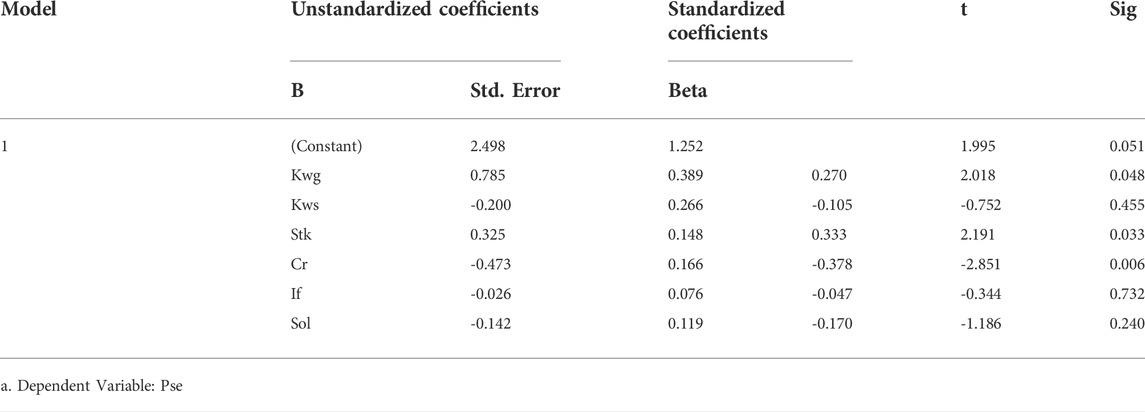

As a result of the increasing demand of specialised personnel in many industry branches, it can ne noticed that there is a 0.439 correlation between the PSE dependent variable and the analysed independent variables. The value is below a significant correlation. A similar perception with the one of the managers has also been highlighted by the ratio of determinacy which refers to the fact that the variation of the independent varibles exert a 19.3% influence on the Pse variable. The responses of the specialised personnel indicate the fact that the employees’high level of knowledge may significantly influence the entities’sustainable development, whereas the interpretation of the data suggests the fact that the specialised personnel, unlike the investors, are less interested in the opportunities offered by the renewable energy producrion and consumption which is the same with the managers’perception and above the general profile (see Table 16).

If in the case of the investors the significance threshold (Sig.) had the value of 0,00 - showing therefore the best validation of the model–in the case of the specialised personnel the Sig. value is 0.049, fact that places it at the validation limit. This situation indicates that the specialised personnel is the least interested in the renewable energy production and consumption (see Table 17).

The influence order in terms of the specialsed personnel’s perception (Pse) is as follows: Cr, Stk, Kwg, Sol, Kws and If (see Table 18).

Moreover, it has been noticed that the specialsed personnel in the companies with a turnover ranging from 700.000 to 999.999 euros, with over 50 employees and with a gearing ration of over 60% are interested in the renewable energy production and consumption, while the specialised personnel in the small companies are not interested in these information at all (see Table 19).

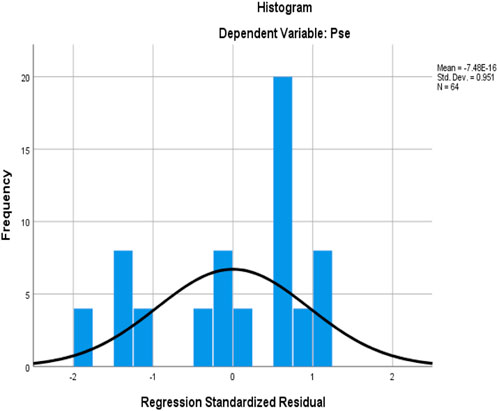

As far as the Pse analysis is concerned, the histogram does not follow the Gaussian curve. This means that there is a residual variation of the specialised personnel’s perception in terms of the regression variable on the descending slope in the 1.25–2.5 range as shown in Figure 5. Thus, it can be stated that the specialised personnel is not interested in the renewable energy as it is more focussed on the duties listed in the job description. Consequently, in spite the fact that at present there is a continuous growth of the energy prices in all the European countries, the industrial gas and energy consumers will inevitably experience significant loses which will force them to reduce their production. As a result of this situation, testing the opinions of the management, of the investors and of the specialised personnel from these production entities can be an information resource for the lawmaker and for those that are involved in the production and consumption of renewable energy which shows that there are practical and long-lasting solutions to their problems. The significant carelessness of the national and European policies in terms of the other energy sources have made the energy system even more vulnerable with paradoxical consequences from the point of view of the environment, too (Fanelli and Ortis, 2022). However, according to a study by Deloitte România (2021), Romania has invested one billion euros in wind parks which are expected to generate 2,17 billion euros in the country’s economy with an additional direct impact of 2,95 billion euros between 2021 and 2030. The possible benefits are not limited to the energy production. According to the same study, the energy transition can have positive effects in construction, transportation, energy services, in the industrial production and in the automotive industry alike, a total investments of 82,5 billion euros in these sectors could have an impact of 364,6 billion euros in Romania’s GDP in the period of 2021–2030. All these accomplishments could bring about benefits especially for the industrial consumers.

Limitations of the study

It is important to highlight the fact that one of the obstacles of this research has been the low number of respondents as the energy industrail consumers from Romania are reluctant to the possibility of being questioned as such. The economic, financial and social issues have had serious consequences on the operational activity of these operators who mostly reduced their activity or went bankrupt. The lack of a coherent legislation and of certain predictable government policies is another downsize of the present study due to the fact that the industrial consumers are not protected and become vulnerable. This is the reason why most of them have been biased in answering the questions which could influence the cause-effect relationship that has been estimated based on the regression model. Another downsize of the present study reffers to the fact that the area where these consumers operate has been overlooked as there is an informational asymmetry in the interpretation of the answers which characterizes especially the consumers from the monoindustrial areas that rely on carbon consumption. They are more interested in perceiving the impact of the current crisis in relation to green energy consumption policy, thus being able to assess the resilience of these operators and mitigate the social impact which will be difficult to ignore.

Conclusion

In a market economy, any kind of crisis is bound to have an impact on the final consumer. This situation manifests itself nowadays as a result of the energy crisis, the electricity and gas bills which have gone up and it seems that the situation tends to escalate from month to month. It seems that the most affected of all are, as always, the producers of goods and services due to the fact that the supply of raw materials, materials, fuels, salaries etc. that are necessary for the ongoing functioning of the manufacturing processes are closely connected with the increase of the energy costs. The energy crisis refers not only to the costs increases for all the consumers, but also to a specualtive reaction of the market, the final consumer becoming the only victim of this process. No doubt that apart from the undisputed economic effects, there are also certain social and political consequences which cannot be overlooked such as: the geopolitical imbalance created by the war in Ukraine (Romania’s neighbour) that has determined obvious effects on the national economy, hindering both the creation of a strategy and the effective production of green energy from renewable resources, or the government took the wrong approach by not regulating the energy market, which led to an energy price formation that determined a series of negative knock-on effects, materialized by extremely high prices for both household and industrial consumers.

On the other hand, the economic measures that are urgently needed to deal with the current energy crisis must be implemented, but both companies and governments must take into account and distinguish between short-term and long-term measures. It is essential to emphasise this aspect, as the effects of these measures are interdependent, in the sense that short-term measures will have an immediate effect on prices and quantities of consumed energy (managers and specialised staff being directly involved and responsible for the decisions and actions taken), while long-term measures, which mainly concern investments, will have a direct impact on investors’ interests, even contributing to their total or partial discouragement. In conclusion, the general model of optimising measures and decisions affecting industrial energy consumers should help the legislator to understand the real problems faced by producers in his country and to direct his governmental decisions and policies to support them.

Data availability statement

The raw data supporting the conclusion of this article will be made available by the authors, without undue reservation.

Ethics statement

Ethical review and approval was not required for the study on human participants in accordance with the local legislation and institutional requirements. Written informed consent from the (patients/ participants OR patients/participants legal guardian/next of kin) was not required to participate in this study in accordance with the national legislation and the institutional requirements.

Author contributions

Conceptualization, VG and MS; methodology, MC, MT, and EH; data curation, AM, MS, and AGM; writing—original draft preparation, EH, MT, and AM; formal analysis, investigation, visualization, VG and MC supervision, validation, MS, MC, and AGM. All authors have read and agreed to the published version of the manuscript.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abeliotis, K., Koniari, C., and Sardianou, E. (2010). The profile of the green consumer in Greece. Int. J. Consum. Stud. 34, 153–160. doi:10.1111/j.1470-6431.2009.00833.x

Adom, P. K., Amuakwa-Mensah, F., Agradi, M. P., and Nsabimana, A. (2021). Energy poverty, development outcomes, and transition to green energy. Renew. Energy 178, 1337–1352. doi:10.1016/j.renene.2021.06.120

Belous, I., Konti, D., Delevegos, D., and Manifava, D. (2022). Firms resort to energy crisis management. Greece, Balkans: Economy Business. Available at: https://www. ekathimerini.com/economy/1193176/firms-resort-to-energy-crisis-management/ (Accessed September 20, 2022).

Berahab, R. (20222022). The energy crisis of 2021 and its implications for africa. Policy Brief 06/22.

Bersalli, G., Menanteau, P., and El-Methni, J. (2020). Renewable energy policy effectiveness: A panel data analysis across Europe and Latin America. Renew. Sustain. Energy Rev. 133, 110351. doi:10.1016/j.rser.2020.110351

Bianchini, I., Zimmermann, F., Torolsan, K., and Sauer, A. (2022). Market options for energy-flexible industrial consumers. The 6th international Conference on Energy and environmental science. IOP Conf. Ser. Earth Environ. Sci. 1008, 012015. doi:10.1088/1755-1315/1008/1/012015

Chew, J., and Entrekin, L. (2011). Retention management of critical (core) employees – a challenging issue confronting organisations in the 21st century. Int. Bus. Econ. Res. J. 3 (2), 3660. doi:10.19030/iber.v3i2.3660

Ciubotariu, M. S., Socoliuc, M., Grosu, V., Mihaila, S., and Cosmulese, C. G. (2021). Modeling the relationship between integrated reporting quality and sustainable business development. J. Bus. Econ. Manag. 22, 1476–1491. doi:10.3846/jbem.2021.15601

Drosos, D., Kyriakopoulos, G. L., Ntanos, S., and Parissi, A. (2021). School managers perceptions towards energy efficiency and renewable energy sources. Int. J. Renew. Energy Dev. 10 (3), 573–584. doi:10.14710/ijred.2021.36704

Entrekin, L., and Court, M. (2001). Human resource management practices: Analysis of adaptation and change in an age of globalisation. Geneva, Switzerland: International Labour Office Working Paper 2.

Fanelli, T., and Ortis, A. (2022). Crisi energetica: Le cause, ambientalismo irrazionale e mercato selvaggio. Rivista energia. Available at: https://www.rivistaenergia.it/2022/01/crisi-energetica-ambientalismo-irrazionale-e-mercatoselvaggio-le-cause/ (Accessed July 25, 2022).

Fîță, D., Radu, S. M., and Păsculescu, D. (2022). The resilience of critical infrastructures within the national energy system in order to ensure energy and national security. Bucharest, Romania: Bulletin of “Carol I” National Defence University. doi:10.53477/2284-9378-22-75

Gambardella, C., and Pahle, M. (2018). Time-varying electricity pricing and consumer heterogeneity: Welfare and distributional effects with variable renewable supply. Energy Econ. 76, 257–273. doi:10.1016/j.eneco.2018.08.020

Gatto, A. (2022). The energy futures we want: A research and policy agenda for energy transitions. Energy Res. Soc. Sci. 89, 102639. doi:10.1016/j.erss.2022.102639

Herbes, C., Brummer, V., Rognli, J., Blazejewski, S., and Gericke, N. (2017). Responding to policy change: New business models for renewable energy cooperatives–Barriers perceived by cooperatives’ members. Energy Policy 109, 82–95. doi:10.1016/j.enpol.2017.06.051

Jabeen, G., Ahmad, M., and Zhang, Q. (2021). Factors influencing consumers’ willingness to buy green energy technologies in a green perceived value framework. Energy Sources, Part B Econ. Plan. Policy 16 (7), 669–685. doi:10.1080/15567249.2021.1952494

Kılkış, Ș., Krajačić, G., Duić, N., Montorsi, L., Wang, Q., Rosen, M. A., et al. (2019). Research frontiers in sustainable development of energy, water and environment systems in a time of climate crisis. Energy Convers. Manag. 199, 1119. doi:10.1016/j.enconman.2019.111938

Löffler, K., Burandt, T., Hainsch, K., Oei, P. Y., Seehaus, F., and Wejda, F. (2022). Chances and barriers for Germany's low carbon transition - quantifying uncertainties in key influential factors. Energy 239, 121901. doi:10.1016/j.energy.2021.121901

Nasirov, S., Girard, A., Peña, C., Salazar, F., and Simon, F. (2021). Expansion of renewable energy in Chile: Analysis of the effects on employment. Energy 226, 120410. doi:10.1016/j.energy.2021.120410

Pradhan, A., Marence, M., and Franca, M. J. (2021). The adoption of seawater pump storage hydropower systems increases the share of renewable energy production in small island developing states. Renew. Energy 177, 448–460. doi:10.1016/j.renene.2021.05.151

România, D. (2021). The energy transition has begun. How will Romania approach it? Available at: https://www2.deloitte.com/ro/en/pages/energy-andresources/articles/tranzitia-energetica-a-inceput-cum-o-va-aborda-romania.html (Accessed July 25, 2022).

Saadaoui, H. (2022). The impact of financial development on renewable energy development in the MENA region: The role of institutional and political factors. Environ. Sci. Pollut. Res. 29, 39461–39472. doi:10.1007/s11356-022-18976-8

Sadorsky, P. (2009). Renewable energy consumption, CO2 emissions and oil prices in the G7 countries. Energy Econ. 31 (3), 456–462. doi:10.1016/j.eneco.2008.12.010

Shaikh, Z. A., Datsyuk, P., Baitenova, L. M., Belinskaja, L., Ivolgina, N., Rysmakhanova, G., et al. (2022). Effect of the COVID-19 pandemic on renewable energy firm’s profitability and capitalization. Sustainability 14 (11), 6870. doi:10.3390/su14116870

Shen, Y., Jackson, T., Ding, C., Yuan, D., Zhao, L., Dou, Y., et al. (2014). Linking perceived organizational support with employee work outcomes in a Chinese context: Organizational identification as a mediator. Eur. Manag. J. 32 (3), 406–412. doi:10.1016/j.emj.2013.08.004

Singh, S., Yassine, A., and Benlamri, R. (2019). “Consumer segmentation: Improving energy demand management through households socio-analytics,” in 2019 IEEE Intl Conf on Dependable, Autonomic and Secure Computing, Intl Conf on Pervasive Intelligence and Computing, Intl Conf on Cloud and Big Data Computing, Intl Conf on Cyber Science and Technology Congress (DASC/PiCom/CBDCom/CyberSciTech)IEEE), 1038.

Socoliuc, M., Grosu, V., Cosmulese, C., and Kicsi, R. (2020). Determinants of sustainable performance and convergence with EU agenda 2030: The case of Romanian forest enterprises. Pol. J. Environ. Stud. 29, 2339–2353. doi:10.15244/pjoes/110757

Socoliuc, M., Grosu, V., Hlaciuc, E., and Stanciu, S. (2018). Analysis of social responsibility and reporting methods of Romanian companies in the countries of the European union. Sustainability 10, 4662. doi:10.3390/su10124662

Sun, P., and Nie, P. (2014). A comparative study of feed-in tariff and renewable portfolio standard policy in renewable energy industry. Renew. Energy 74, 255–262. doi:10.1016/j.renene.2014.08.027

Tănasie, A. V., Năstase, L. L., Vochița, L. L., Manda, A. M., Boțoteanu, G. I., and Sitnikov, C. S. (2022). Green economy—green jobs in the context of sustainable development. Sustainability 14 (8), 4796. doi:10.3390/su14084796

Thanh, T. T., and Linh, V. M. (2022). An exploration of sources of volatility in the energy market: An application of a TVP-VAR extended joint connected approach. Sustain. Energy Technol. Assessments 53, 102448. doi:10.1016/j.seta.2022.102448

Wen, J., Mughal, N., Kashif, M., Jain, V., Meza, C. S. R., and Cong, P. (2022). Volatility in natural resources prices and economic performance: Evidence from BRICS economies. Resour. Policy 75, 102472. doi:10.1016/j.resourpol.2021.102472

Keywords: renewable energy, investments, green certificate, energy crisis, sustaianability

Citation: Grosu V, Socoliuc M, Ciubotariu MS, Hlaciuc E, Tulvinschi M, Macovei AG and Melega A (2022) Designing the profile of industrial consumers of renewable energy in Romania under the impact of the overlapping crisis. Front. Energy Res. 10:1016075. doi: 10.3389/fenrg.2022.1016075

Received: 10 August 2022; Accepted: 26 October 2022;

Published: 14 November 2022.

Edited by:

Xiaoqi Sun, Shenzhen University, ChinaReviewed by:

Jean Vasile Andrei, Universitatea Petrol Si Gaze Ploiesti, RomaniaCiprian Cristea, Technical University of Cluj-Napoca, Romania

Copyright © 2022 Grosu, Socoliuc, Ciubotariu, Hlaciuc, Tulvinschi, Macovei and Melega. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Veronica Grosu, dmVyb25pY2EuZ3Jvc3VAdXNtLnJv

Veronica Grosu*

Veronica Grosu* Marian Socoliuc

Marian Socoliuc Marius Sorin Ciubotariu

Marius Sorin Ciubotariu Anatol Melega

Anatol Melega