- 1School of Business, Zhengzhou University, Zhengzhou, China

- 2Business School of Yulin Normal University, Yulin, China

China’s power system will face more constraints of the carbon emission reduction policy under the goal of “double carbon”, it is particularly important to study the impact of carbon constraints on the capital structure of power enterprises. Commencing the viewpoint of static and dynamic, this research regards the implementation of China’s carbon pilot policy as a quasi-natural experiment, using DID method, sys-GMM model and some robustness tests to examine how the carbon constraint affects the capital structure of power companies from 2008 to 2020. The empirical results show that the financial leverage is significantly reduced after the implementation of China’s carbon pilot policy. Moreover, the mandatory implementation of carbon emission trading mechanism makes heavy emission enterprises such as power enterprises face greater pressure on emission reduction, resulting in an increase in the risk of financial distress, reducing debt financing and equity financing of power enterprises, which promotes enterprises to decrease financial leverage. In addition, the article verifies another possibility, the enhancement of carbon constraints leads to the reduction of carbon-intensive investment rather than the increase of financial distress risk, so as to reduce the asset-liability ratio. However, the coefficient of interactive items is not significant. Further analysis indicates that the decline of financial leverage is unlikely to be caused by changes in investment.

1 Introduction

In recent years, environmental problems are prominent and environmental pollution is serious. It is particularly important to solve the problem of carbon dioxide emissions. Carbon market is currently recognized as one of the most effective tools to reduce carbon dioxide emissions (Lu et al., 2020). By 2014, China’s seven carbon pilot projects have been launched. China’s national carbon market was officially launched in 2017 (Duan et al., 2018; Pizer and Zhang, 2018). Pilot carbon market and national carbon market all put the power industry as the focus first into the projects (Li and Jia, 2016; Liu and Zhang, 2021). The reasons can be summarized as follows: First, China’s power structure is still dominated by thermal power generation. Besides, it is easier to establish a carbon emission trading system for quota determination, quota allocation and supervision than other industries (Zhang N et al., 2015; Yin et al., 2018). Unlike other bulk commodity markets, the carbon market makes emission rights “scarce” by establishing laws and regulations to control the total amount of GHG emissions and mandatory emission reduction constraints on emitters. Therefore, in the context of the “double carbon”, it is particularly important to study the impact of carbon constraints on the capital structure of power enterprises.

Capital structure has always been the research focus and hot spot in the field of corporate finance. Analyzing the factors that affect the company’s capital structure can help enterprises find the best capital structure ratio, so as to maximize the value of the company (Gomez-Gonzalez et al., 2022). The existing literature is based on macroeconomic fluctuations, economic policy uncertainty, monetary policy, fiscal policy, economic cycle and corporate characteristics, few literatures study the impact of carbon constraints on the capital structure of power enterprises (Yang et al., 2021; Avezum et al., 2022; Cuevas-Vargas et al., 2022). For instance, Graham et al. (2015) find that changes in the economic and institutional environments play a more prominent role in explaining capital structure trends.

Considering the increasingly close relationship between carbon emission trading mechanism and power industry, many researchers began to study topics related to the carbon and electricity market (Lin and Jia, 2019; Hu et al., 2020). Most of the research on carbon emission trading mechanism is from the macro-perspective (Pan et al., 2014; Zhang Y et al., 2015) and rarely has literature analyzed from the micro perspective, such as the enterprise level. In addition, the research on the micro level also focuses on the impact of carbon constraints on enterprise performance, enterprise innovation, enterprise operating efficiency, product pricing and so on, and there are few articles on the impact of enterprise capital structure. For instance, Zhang N et al. (2015) explore the optimal product pricing policy for enterprises under the constraint of carbon allowance allocation rules. Use the DID method and some robustness tests to conclude that the carbon pilot policy has significantly promoted the operating efficiency level of power listed companies.

In order to explore how the implementation of the carbon emissions trading mechanism will affect the capital structure of the power generation industry under the background of China’s “double carbon” goal? What will happen to the investment and financing of power generation enterprises under the background of enhanced carbon constraints, promoting or inhibiting? What is the impact mechanism? The answers to these questions are unclear ex-ante, our research will fill the gaps in these questions. Therefore, this paper selects the power generation enterprises of China’s A-share listed companies as samples to analyze the relationship between the carbon pilot policy and the capital structure. It is hoped to provide reference for the optimization of the capital structure and energy structure of the power generation industry first included. It also provides a reference for other industries to be included in the national unified carbon market.

The contributions of this paper are as follows: First, existing research on capital structure mostly considers the impact of macroeconomic conditions, institutional characteristics and enterprise characteristics on enterprise capital structure, few studies have taken into account the impact of enhanced carbon constraints on the corporate capital structure. Therefore, this paper takes the enhancement of carbon constraints into account when studying the capital structure of power enterprises. In particular, in order to increase the accuracy of quasi-natural experiments, experiments need to be carried out many times, this paper creatively three different capital structure measurement methods to examine the impact of carbon constraints on capital structure of Chinese power enterprises. Second, the research on the micro level of carbon emission trading mechanism mainly focuses on the enterprise innovation, industrial efficiency and financing constraints of environmental regulation, this paper directly establishes a direct connection between carbon emission trading mechanism and enterprise capital structure under the background of “double carbon” goals. Moreover, this article further verifies the two possible influence channels of carbon constraints on the capital structure of power enterprises. Third, in this paper, the implementation of carbon emissions trading mechanism in China is regarded as a signal of enhanced carbon constraints faced by power enterprises, using DID model, taking the carbon emission trading mechanism as a quasi-natural experiment to test the causal impact of carbon constraints on the capital structure of power enterprises. In addition, using the sys-GMM model to further estimate and test from a dynamic perspective, which avoids the endogenous problem to a great extent.

2 Literature review

In the era of globalization, there are many factors affecting carbon dioxide emissions, such as ICTs, foreign direct investment, globalization and green investment (Usman et al., 2022a; Ke et al., 2022; Li et al., 2022). It is urgent to solve environmental problems and reduce carbon dioxide emissions. Since the Chinese government proposed the “double carbon” goal in 2020, the power industry, as a major energy consumer and carbon dioxide emitter, has become the focus of emission reduction, and the carbon constraints faced by power enterprises have also been increasing (Jiang et al., 2022). Previous studies have shown that there is a two-way causal relationship among financial development, non-renewable energy, renewable energy and ecological footprint (Usman et al., 2022b). Therefore, under the background of the “double carbon” goal, the research on the impact of the enhancement of carbon constraints on the capital structure of the power industry has emerged. In the study of the factors affecting the capital structure of the power industry, factors such as corporation size, profitability, corporation growth, non-debt tax shield, liquidity are generally considered (Yildirim et al., 2018; Ramli et al., 2019; Orlova et al., 2020). Besides, some macroeconomic factors also affect the capital structure, such as gross domestic products, inflation rate, interest rate (Bilgin and Dinc, 2019; Li and Islam, 2019). As an external environmental factor, how will the enhancement of carbon constraints affect the capital structure of listed power companies? Few scholars have conducted research.

To investigate the impact of carbon constraint enhancement on capital structure, we should first analyze its impact on enterprise investment and financing. At present, there is no consensus on the research of environmental regulation on corporate financing constraints. One view is that environmental regulation will strengthen the financing constraints of enterprises. Studies that hold this view believe that environmental regulation policies are enforced by government departments, and forcing enterprises to upgrade their industrial structure in a green way may increase their production costs (Harris et al., 2002; Cagatay and Mihci, 2006). On the contrary, another view holds that environmental regulation will weaken the financing constraints of enterprises. Studies that hold this view believe that the state’s strong support for enterprises that respond to the call for low-carbon development, increasing the subsidy rate, reducing the financing cost of enterprises, and improving the allocation of enterprise capital flow, enhance the financing ability of enterprises (Wang et al., 2020; Zhang and Xie, 2020).

2.1 Carbon constraints and debt financing of power enterprises

2.1.1 Transmission channel of financial distress

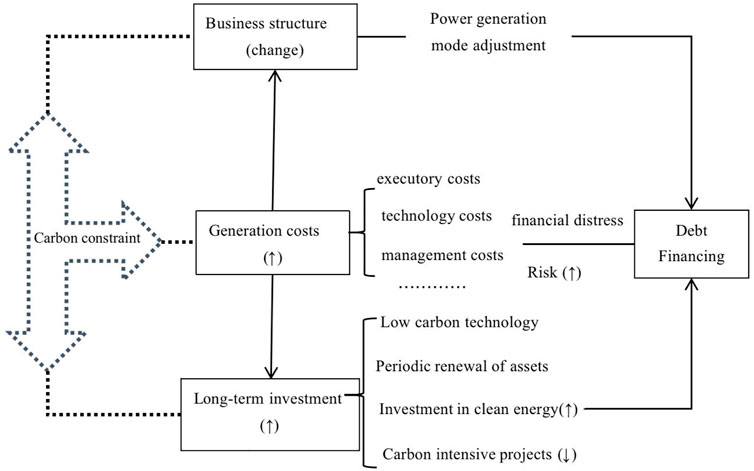

Based on the fact that debt financing is the main choice for power enterprises when financing, this paper focuses on the impact of the implementation of carbon emission trading mechanism on debt financing of power enterprises. One possible channel is that the enhancement of carbon constraints increases the risk of financial distress of enterprises. In order to avoid financial distress, enterprises will reduce debt financing. Under the new background of carbon constraints, the power generation costs faced by the power generation industry mainly include contract performance costs, management costs and technology costs (Yang et al., 2022). First, carbon trading will increase the performance cost of power enterprises. Secondly, carbon trading will also increase the management costs of enterprises, including human resources costs, transaction costs and verification costs. For enterprises, the carbon market is an emerging market, and the original talents of the enterprise are not enough to manage these emerging businesses. In addition, carbon trading will also increase the technology cost of power enterprises (Nguyen et al., 2020).

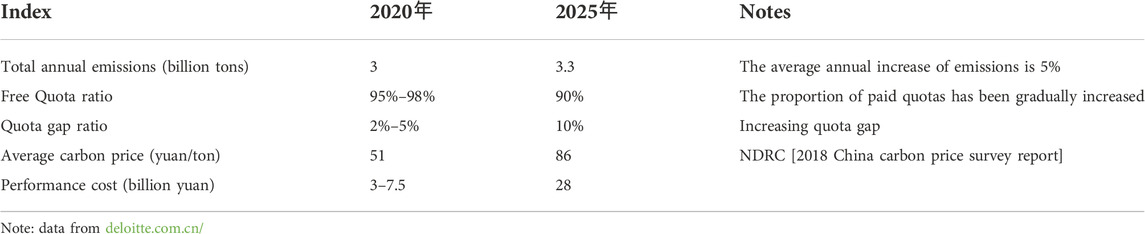

Enterprises need to fulfill the emission quota index and achieve the emission reduction target while ensuring the power supply and realizing the enterprise benefits. The realization of these goals requires the introduction of new technologies such as clean energy power generation technology and carbon capture technology, which will cost power generation enterprises a lot of money and increase their costs. Finally, carbon trading may also increase the cost of debt financing for enterprises (Caldera et al., 2018; Koiwanit et al., 2020). Generally speaking, the debt capital market classifies high polluting enterprises as high-risk investments; Creditors will require a moderate increase in the rate of return to compensate for environmental risks, resulting in higher debt financing costs for highly polluting enterprises. From Table 1, It can be seen that the total carbon emissions, the proportion of paid quotas and the quota gap of enterprises are gradually increasing, so the carbon cost that enterprises need to bear is increasing.

Compared with foreign countries, there are still serious resource mismatches in China’s power market. Veith et al. (2009) believe that although carbon trading will increase the cost of power enterprises, power enterprises can transfer the cost to downstream consumers by raising the electricity price, or even make profits by excessive transfer. However, for China, the electricity price is not determined by the market but mainly by the government. It is difficult for the carbon price to be transmitted to the downstream, and it is difficult to determine the pressure of power generation independently. Therefore, most of the carbon cost is borne by enterprises (Du and Li, 2021; Zhang et al., 2022).

To sum up, after the mandatory implementation of carbon emission trading mechanism in the power industry, power generation costs of power enterprises will increase, mainly including contract performance costs, management costs, technology costs and financing costs. The substantial increase in carbon costs will increase the probability of enterprises falling into financial difficulties, thus prompting power enterprises to reduce debt financing and reduce asset-liability ratio. Accordingly, we hypothesize:

2.1.2 Transmission channel of enterprise investment

Another possible channel is the impact of carbon constraints on debt financing through investment channels. The implementation of carbon emission trading mechanism has brought uncertainty to power enterprises, and the “carbon risk” faced by power enterprises has increased. At present, there are few studies on the relationship between carbon risk enhancement and enterprise investment, and no consensus conclusion has been reached (Nguyen et al., 2020; Phan et al., 2021). It is mainly divided into two factions. One is based on Porter hypothesis. Porter and van der Linde (1995) believe that the impact of reasonable environmental regulation on enterprises is positive, that is, environmental regulation can stimulate enterprises to innovate. Barney (1991) believes that if internal competitiveness is positively correlated with profitability, investment will increase. Due to extensive media coverage and the company’s disclosure requirements in the annual report, society and consumers pay more attention to environmental issues (Gallego-Álvarez et al., 2015; Velte et al., 2020). Many studies have shown that companies willing to increase investment to reduce pollution and carbon emissions have higher profits (Wang et al., 2014; Ganda and Milondzo, 2018).

The other is that “carbon constraints” will inhibit enterprise investment, especially for carbon intensive-enterprises (Phan et al., 2021). The main reason is that when the risk faced by the enterprise increases, the stability of its cash flow and income will be greatly reduced. When the information of enterprise profit and income is reflected in the stock and bond markets, investors believe that the increased risk of investing in the enterprise will increase the return rate of investors, and the enterprise will bear higher debt costs and equity costs (Ho, 2015; Jung et al., 2018). Under a series of pressures, enterprises will adopt more rigorous financial decisions and reduce enterprise investment. As the investment in low-carbon technology may not achieve significant results in the short term, it needs a long-term process. For power enterprises with tight finances, the possible measure to achieve the carbon emission reduction goal is to reduce the original carbon-intensive project investment, rather than increase the investment in clean energy to achieve emission reduction. Figure 1 shows the impact mechanism of carbon constraints on debt financing of power enterprises. Accordingly, we hypothesize:

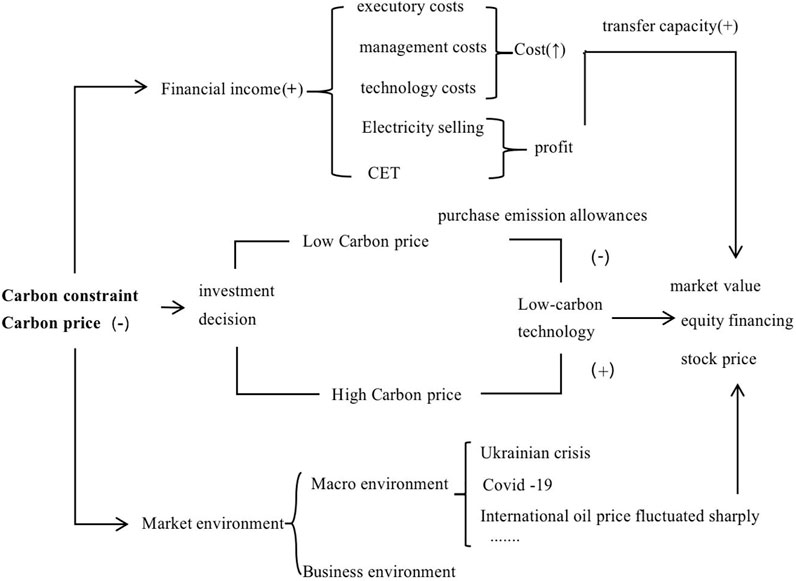

2.2 Carbon constraints and equity financing of power enterprises

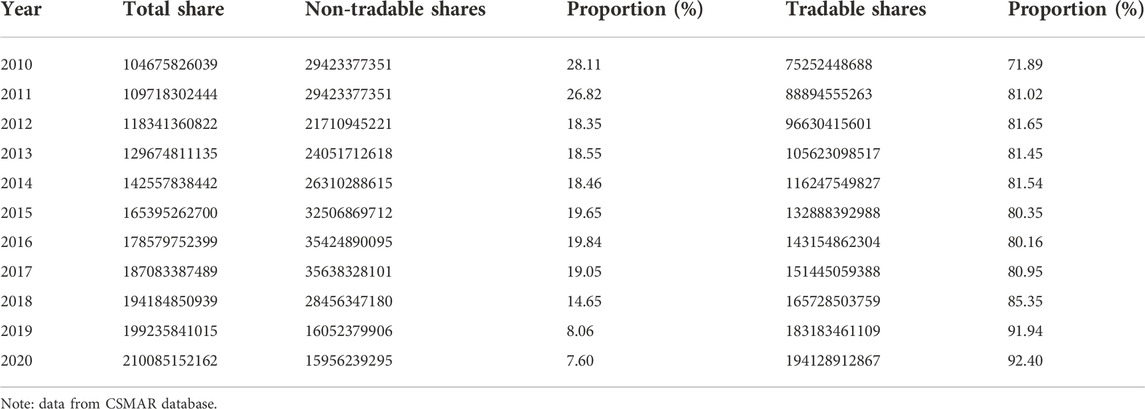

From Table 2, it can be seen that in recent years, the proportion of tradable shares in the total capital stock has been increasing, the proportion of non-tradable shares has been decreasing year by year, and the tradable shares account for the majority of the total capital stock. The tradable shareholders pay more attention to the value of enterprise shares. Therefore, the implementation of carbon emission trading provides another idea for the study of the impact of carbon constraints on equity financing through the impact of carbon price fluctuations on the market value of power enterprises. According to the existing literature, carbon trading can affect the company value through financial returns, market environment and investment decisions (Clarkson et al., 2015; Griffin et al., 2017; Brouwers et al., 2018), and then affect the stock price. With the national support for carbon emission reduction and the rising trend of carbon price in the future, the company’s carbon emission cost will increase, which will reduce the company’s operating profit and cash flow, and then reduce the company’s stock price and market price (Krishnamurti and Velayutham, 2018; Nguyen, 2018). On the other hand, the rise of carbon price will also affect the expectations of the stock market, reducing investors’ future profit forecasts for carbon emission businesses and planned projects, so that some investors sell relevant shares to avoid risks, resulting in a negative impact on the market value of the company. Figure 2 shows the impact mechanism of carbon constraints on equity financing of power enterprises. Therefore, we hypothesize:

3 Methodology

3.1 The DID function

The research method of this paper is the difference-in-difference method. It is widely used in the econometric evaluation of the implementation effect of projects or public policies. Policy factors are exogenous to micro subjects, so there is no reverse causality problem, this method avoids the problem of endogenous problems to a great extent, and the result is robust. Based on this method, this paper constructs the impact model of carbon emissions trading system on the capital structure of China’s power listed enterprises:

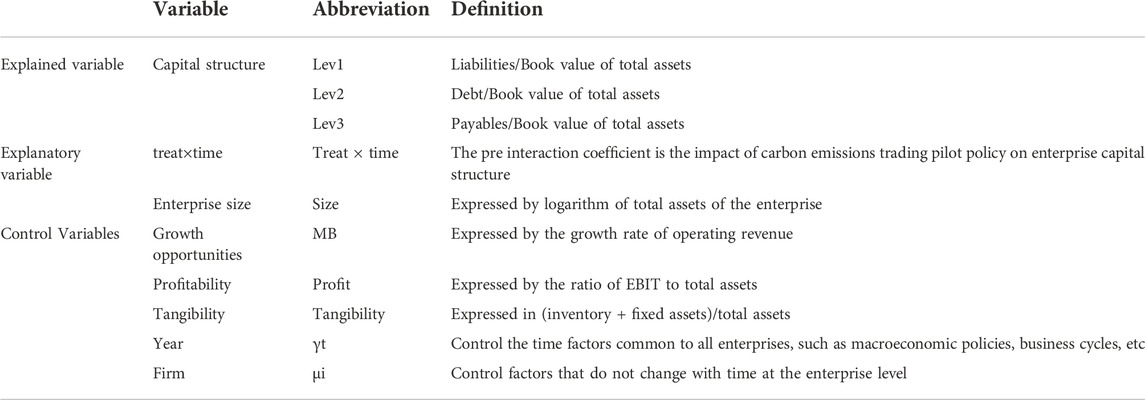

Levit is a measure of the financial leverage of enterprise i in year t. Establishing a carbon market is a very effective means of carbon constraint (Li et al., 2022). Referring to the research of Nguyen (2018) and Nguyen and Phan (2020), this paper uses the interaction term treat * time to measure the carbon constraint degree of power enterprises. Treat is a dummy variable that equals one if enterprise i is located in the pilot area, and zero otherwise. Time is a dummy variable that equals one if time t is in 2013 and later, and zero otherwise. X is a set of control variables, including company size, growth opportunities, profitability and tangibility.

This paper further extends the model 1) to test whether the samples of the pre-treatment group and the control group meet the parallel trend hypothesis. The model is as follows:

3.2 The sys-GMM model

Arellano and Bover (1995) and Richard and Bond (1998) proposed an effective method system GMM (sys-GMM), which will overcome the influence of weak instrumental variables. The main advantage of these methods over other methods is that they rely on internal instruments for estimation. In the case of a reverse causal relationship, external instruments are the best. However, finding external tools is a difficult task, which varies across units and periods. Fortunately, Farhadi et al. (2015) concluded that the internal tools used in different sys-GMM are the best choice to control the endogenous nature of explanatory variables.

Because the capital structure adjustment of the company often requires a certain period of time, and the capital structure of the current year is often affected by the asset-liability ratio of the previous year, this paper adds the asset-liability ratio level that lags behind the first period to the model to control its internal impact. Therefore, the following dynamic panel regression model is established:

Among them, levit-1 is the first-order lag term of asset-liability ratio, and other indicators are the same as above.

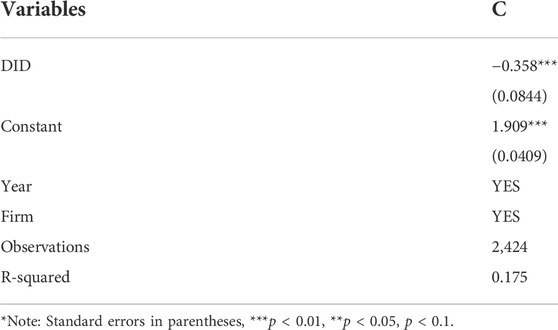

3.3 The financial distress model

Financial distress mainly refers to the financial obstruction of enterprises in performing their business obligations. Many scholars regard the Z-score model (Mackie-Mason, 1990; Nguyen and Phan, 2020) as a substitute index for the financial distress of enterprises. According to the research of Zheng et al. (2013), it is unreasonable to directly use this model to analyze the financial distress of Chinese enterprises. Therefore, this paper uses the financial distress model of the power industry proposed by Cao (2013), and the study believes that when C > 0, it proves that the company’s financial operation is good, and the probability of falling into financial difficulties is low; When C < 0, the company is in financial trouble. Financial distress model of power industry:

C is the linear combination of each comprehensive factor; Z1 mainly refers to the capital operation ability and asset management ability of the company; Z2 reflects the short-term solvency and asset management ability of enterprises; Z3 mainly refers to the asset management capability of an enterprise; X1 cash ratio of main business; X2 is the growth rate of net cash flow from operating activities; X3 is the cash ratio; X4 is the asset-liability ratio; X5 is the turnover rate of accounts receivable.

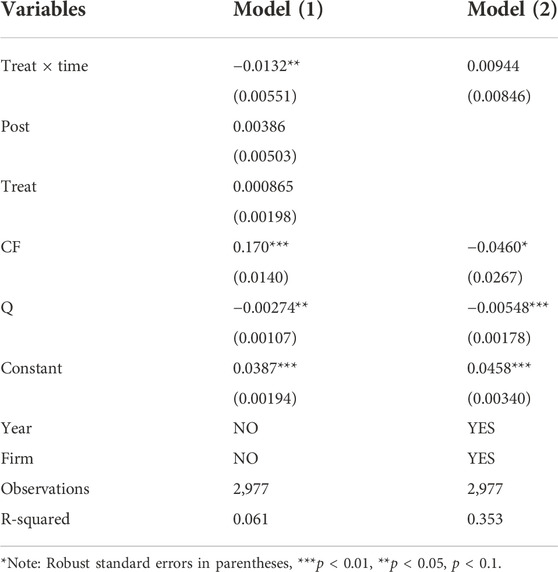

3.4 The investment model

This paper conducted DID regression on the direct relationship between virtual carbon policy variables and investment level. The investment model refers to Peters and Taylor (2017) and Han et al. (2021), where Inv refers to the enterprise investment, which is equal to the cash paid by the enterprise for the purchase and construction of fixed assets, intangible assets and other long-term assets divided by the total assets at the end of the period; Q refers to the Tobin Q value of the enterprise, which measures the growth opportunities of the enterprise; CF refers to the operating cash flow, which represents the net operating cash flow, and is standardized by the total assets at the end of the period. Table 8 reports the investment regression results.

4 Results

4.1 Data source

This paper selects China’s listed power companies from 2008 to 2020 as a sample. The screening process of selecting research samples is as follows: Eliminate *ST Companies in the reporting period; Eliminate companies with incomplete data or financial data problems; Eliminate lingyun B-share and other non-A-share companies. The final sample involves 59 listed companies, a total of 767 companies’ annual observation data. The financial index data of listed companies in this paper are from CAMAR database. In order to increase the accuracy of quasi natural experiments, experiments need to be carried out many times, so this paper uses three measures of financial leverage. First of all, using the book asset-liability ratio to measure the capital structure of listed companies, Lev1 = Total Liabilities/Total asset book value. In addition, based on the methods of Zeng and Su (2010), this paper adds two other methods to measure the capital structure: Lev2 = Interest bearing debt/Total asset book value; Lev3 = Accounts payable/Book value of total assets.

4.2 The results of the DID function

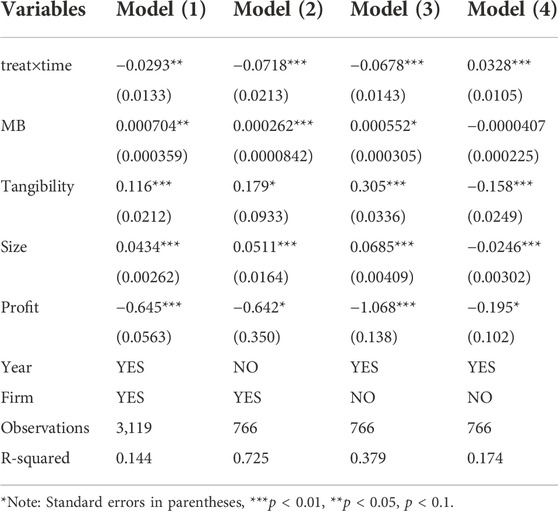

Based on the benchmark DID model, the regression results are shown in Table 4. When the capital structure measurement method adopts lev1, after controlling the time and individual control effects at the same time, the first column of regression results show that the coefficient of treat*time is significantly negative at the 95% level; When the capital structure measurement method adopts lev2, the results show that the coefficient of treat*time is significantly negative at the level of 99%, which indicates that after strengthening of carbon constraints faced by power enterprises, the funds obtained by power enterprises from the banking system are significantly reduced; When lev3 is used for capital structure measurement, the empirical results are shown in the fourth column, the coefficient of treat*time is significantly positive at the level of 99%, indicating that after strengthening of carbon constraints faced by power enterprises, power enterprises may use payable financing to replace loans from the banking system.

For other control variables, the first three empirical results show that there is a significant positive correlation between the growth rate of operating revenue, tangibility and company size and the asset-liability ratio, while the smaller the ratio of EBIT to total assets, the lower the asset-liability ratio. As mentioned above, the empirical results of this paper support the negative correlation between capital structure and profitability of power enterprises. The possible reason is that due to the improvement of the profitability of the enterprise, its surplus funds are large, which can meet the capital needs of enterprises and no longer need external financing. Therefore, the asset-liability ratio of power enterprises is low.

4.3 The results of sys-GMM function

In order to deal with the possible endogenous problems in the basic regression results, the estimation test is further carried out from a dynamic perspective. The lag period of the enterprise’s capital structure is introduced into the model, and the carbon pilot policy is used as an endogenous explanatory variable for sys-GMM estimation. Table 5 shows the estimation results of the sys-GMM model of the carbon emission trading mechanism affecting the capital structure of the power industry. According to the characteristics of the dynamic panel model, the endogenous explanatory variables in this paper include the lag term of the explained variable. In order to enhance the reliability of regression results, the rationality of model setting and the effectiveness of instrumental variables are tested.

The results in Table 5 show that: Firstly, the three different forms of capital structure variables are significantly positive with the lagged capital structure variables at a significant level of 99%, which indicates that the endogenous nature of the carbon pilot policy may make the capital structure variables have inertia; Secondly, in the autocorrelation test, the test statistics p values of AR 1) are all less than 0.1, indicating that there is a first-order autocorrelation in the difference of the disturbance term, while the test statistics p values of AR 2) are all greater than 0.1, indicating that there is no second-order autocorrelation, so the assumption that the disturbance term has no autocorrelation is accepted; Thirdly, carry out over-identification test. The p values of Hansen test statistics are greater than 0.1, indicating that there is no-over identification in the regression results. The above results show that it conforms to the basic assumptions of sys-GMM, so it is reasonable to use sys-GMM model to estimate.

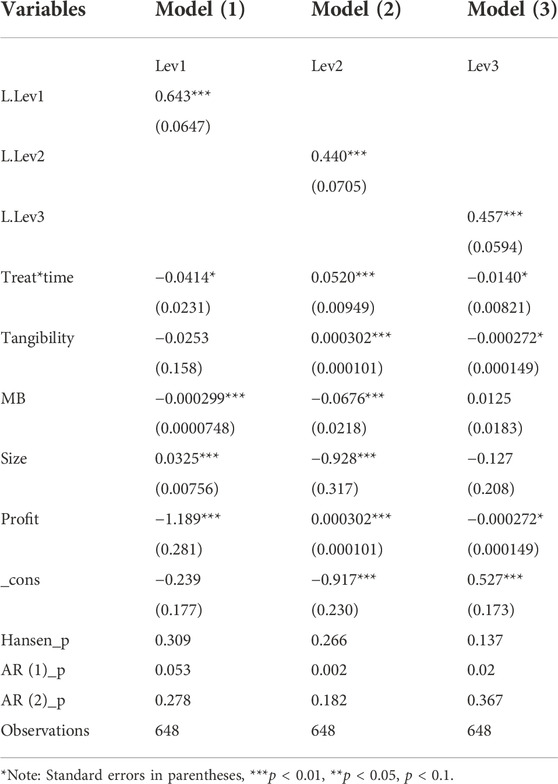

4.4 Robustness checks

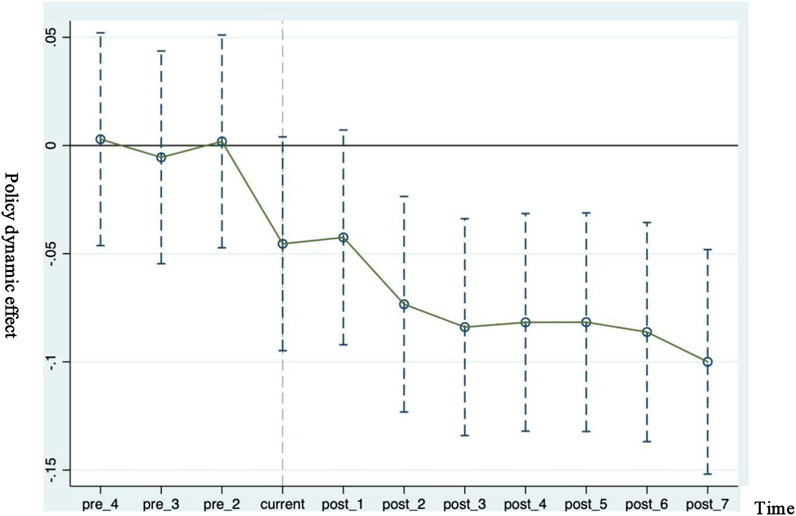

In order to make the estimation results of DID model have certain reliability and enhance the logic of the article, parallel trend hypothesis test and stabilizer test are added in this part. Table 6 can intuitively reflect that before the implementation of the pilot carbon market policy in 2013, the interaction coefficient was not significant, indicating that the asset-liability ratio of enterprises in the pilot carbon market area and the control group had the same trend before the implementation of the policy. At the same time, in order to visualize the experimental results, the parallel trend test results are drawn into a graph, as shown in Figure 3. Referring to (Topalova, 2010), this paper conducts a placebo test by changing the time point of the policy to test the impact of the implementation of the carbon emission trading mechanism on the financial leverage of power enterprises after changing the time point of the implementation of the policy. The specific operation is to assume that the pilot carbon market policy was issued in 2010, 2011 and 2012, and remove the samples from 2013 and later. Finally, regression is carried out separately. The results are shown in the second to fourth columns of Table 6. It can be found that the results are not significant, indicating that the above conclusion is robust.

4.5 Additional analyses of influence mechanism

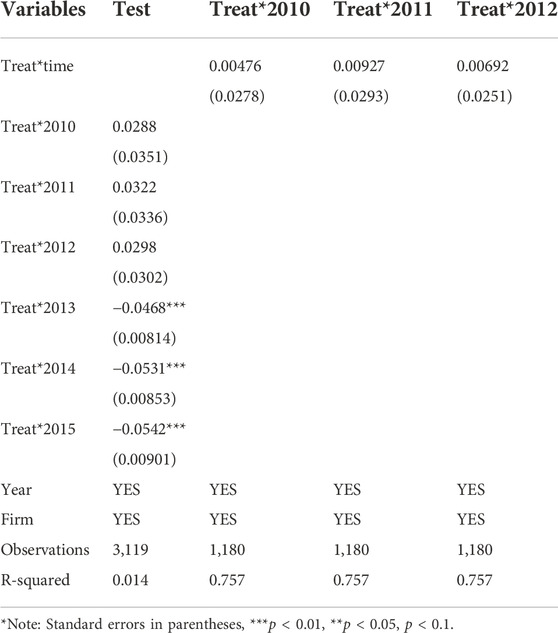

Based on the above regression results, this paper further analyzes the transmission channels of carbon emissions trading mechanism affecting corporate financial leverage. According to the previous research results, the implementation of carbon emissions trading mechanism will lead to the reduction of financial leverage of power enterprises. This chapter conducted two tests in this chapter with reference to Nguyen et al. (2020) to test whether financial distress risk is a channel for carbon constraints to affect capital structure. In the first test, we use the DID model to test the direct relationship between the virtual carbon policy variables and financial distress. In the second test, we study another explanation, that is, the implementation of the carbon emissions trading mechanism leads to a reduction in enterprise investment rather than an increase in the risk of financial distress, leading to a reduction in debt financing. This paper expects that there is a positive correlation between “carbon constraint” and financial distress, while for enterprises with a high risk of financial distress, there is a strong negative correlation between “carbon constraint” and financial leverage.

4.5.1 Carbon constraints and financial distress

Table 7 shows that in the case of fixed time effect and enterprise individual effect, the financial distress index C of power enterprises is significantly negatively correlated with the interaction term, that is, the implementation of carbon emission trading mechanism will reduce the size of index C. when the value of C is smaller, the possibility of financial distress will be greater. When the value of C is less than 0, the enterprise will fall into financial distress (Cao, 2013). Therefore, this empirical result proves that the implementation of carbon emissions trading mechanism brings about “carbon constraints” that increase the possibility of financial distress of enterprises. When the risk of financial distress increases, the enterprise will reduce financial leverage and the asset-liability ratio will decrease. In general, the test results can show that the assumption that carbon risk increases the risk of financial distress and urges enterprises to reduce financial leverage is correct.

4.5.2 Carbon constraints and enterprise investment

After the implementation of the carbon emission trading mechanism, the new strict environmental policies may make the carbon intensive investment projects of power enterprises infeasible, thus prompting them to reduce investment (Peters and Taylor, 2017; Han et al., 2021). In this chapter, we will study another explanation, that is, carbon constraints lead to reduced investment in power enterprises, rather than the increased risk of financial distress, which in turn leads to reduced debt financing and reduced financial leverage.

According to Table 8, the data in the first column is that without controlling the time effect and individual effect, taking the investment level as the explanatory variable, and taking the interaction item, time item, place item, operating cash flow and Tobin Q value as the explanatory and control variables, the results show that the interaction item is significant. The second data is the test results under the control of time effect and individual effect. At this time, the interaction term is not significant. This result shows that when we control the influencing factors that change with time and individuals in the experimental objects, carbon risk has no significant impact on the investment of power enterprises. This result eliminates the possibility that carbon constraints lead to reduced investment in power enterprises, which in turn leads to reduced debt financing and reduced financial leverage.

5 Conclusion and policy implications

5.1 Conclusion

The empirical analysis draws the following conclusions: 1) When lev1 and lev2 are used as the capital structure measurement methods, the coefficient of treat*time is significantly negative at the level of 95%, which indicates that the main reason for the decrease of the asset liability ratio of power enterprises may be the decrease of funds obtained from the banking system; When lev3 is used for capital structure measurement, the coefficient is significantly positive at the level of 99%, which indicates that power enterprises may use accounts payable financing to replace loans from the banking system. 2) The regression results of carbon constraint and financial distress show that the Financial Distress Index C of power enterprises is significantly negatively correlated with the interaction term in the case of both fixed time effect and enterprise individual effect. When the C is smaller, the possibility of financial distress will be greater. Therefore, the results show that it is reasonable to assume that financial distress is the channel through which carbon constraints affect the financial leverage of enterprises. 3) We have verified another possibility, the reduction of investment caused by carbon risk rather than the increase of financial distress risk will lead to the reduction of debt financing. The empirical results show that the coefficient treat*time interaction is not significant. This evidence further shows that the decline in leverage of power enterprises is unlikely to be caused by changes in investment. This result is further confirmed that financial distress is the channel for carbon constraint to affect the financial leverage of enterprises.

5.2 Policy implications

Based on the above empirical results, the policy implications from the government level and power enterprises are as follows:

1) The strengthening of carbon constraint has significantly reduced the asset-liability ratio of power enterprises. Therefore, power enterprises should broaden financing channels, actively look for other financing methods, such as asset securitization and commercial paper, reduce their dependence on bank loans, and make full use of the opportunity of the country to vigorously develop green finance to attract private scattered funds to the power industry. In addition, enterprises also need to constantly adjust the capital structure, reduce the cost of capital.

2) Financial distress is the channel for carbon risk to affect the financial leverage of enterprises. Therefore, power enterprises should constantly adjust the capital structure, optimize the proportion of long-term and short-term debt in the debt structure, and reduce the cost of capital. In addition, power enterprises should enhance R&D intensity, accumulate core competitiveness, and then mitigate the adverse effects of enhanced carbon constraints. Due to the low degree of power marketization in China, the power to set electricity prices is in the hands of the state, so it is difficult for power enterprises to pass on the increased carbon costs to downstream consumers through electricity prices. For the government, the electricity price mechanism should be improved, so that the electricity price is determined by market supply and demand, and it is reasonable to allow a certain degree of fluctuation of electricity price.

3) The regression between carbon constraint and investment is not significant, but the investment will have an increasing impact on the capital structure. Therefore, power enterprises should seize the opportunity of double carbon and actively carry out carbon trading; optimize the energy structure of enterprises, vigorously develop clean energy and reduce dependence on fossil fuels. Power enterprises should choose more low-carbon power generation equipment and technology, update the original assets, set up new power stations and so on. The government should vigorously encourage the scientific and technological innovation of power enterprises and promote the application of carbon technology.

This study also has some limitations. Firstly, this paper only discusses the impact of the implementation of the carbon pilot policy on the capital structure of 59 power enterprises through financial distress and investment channels. There are still many transmission channels that have not been considered. In addition, considering that different types of power enterprises are subject to different degrees of carbon constraints, the follow-up study should refine the power enterprises according to different power generation modes. In the future research, this study will subdivide the power industry into thermal power and clean energy power generation to examine the impact of carbon constraints on the capital structure of different types of power generation enterprises.

Data availability statement

Publicly available datasets were analyzed in this study. This data can be found here: https://www.gtarsc.com/.

Author contributions

MH: Conceptualization, Data curation, Methodology. ZG: Investigation, Project administration, Resources, Software. YD: Investigation, Data curation, Resources. TL: Formal analysis, Project administration, Writing—review and editing.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Arellano, M., and Bover, O. (1995). Another look at the instrumental variable estimation of error-components models. J. Econom. 68 (1), 29–51. doi:10.1016/0304-4076(94)01642-d

Avezum, L., Huizinga, H., and Raes, L. (2022). The impact of bank regulation on firms’ capital structure: Evidence from multinationals. J. Bank. Finance 138, 106459. doi:10.1016/j.jbankfin.2022.106459

Barney, J. (1991). Firm resources and sustained competitive advantage. J. Manag. 17 (1), 99–120. doi:10.1177/014920639101700108

Bilgin, R., and Dinc, Y. (2019). Factoring as a determinant of capital structure for large firms: Theoretical and empirical analysis. Borsa Istanb. Rev. 19 (3), 273–281. doi:10.1016/j.bir.2019.05.001

Brouwers, R., Schoubben, F., and Van Hulle, C. (2018). The influence of carbon cost pass through on the link between carbon emission and corporate financial performance in the context of the European Union Emission Trading Scheme. Bus. Strategy Environ. 27 (8), 1422–1436. doi:10.1002/bse.2193

Cagatay, S., and Mihci, H. (2006). Degree of environmental stringency and the impact on trade patterns. J. Econ. Stud. 33 (1), 30–51. doi:10.1108/01443580610639884

Caldera, H. T. S., Desha, C., and Dawes, L. (2018). Exploring the characteristics of sustainable business practice in small and medium-sized enterprises: Experiences from the Australian manufacturing industry. J. Clean. Prod. 177, 338–349. doi:10.1016/j.jclepro.2017.12.265

Cao, Y. B. (2013). Research on the financial distress of China's power industry. J. Friends of Account. (20), 24–27. [in Chinese]. doi:10.3969/j.issn.1004-5937.2013.20.008

Clarkson, P. M., Li, Y., Pinnuck, M., and Richardson, G. D. (2015). The valuation relevance of greenhouse gas emissions under the European union carbon emissions trading scheme. Eur. Account. Rev. 24 (3), 551–580. doi:10.1080/09638180.2014.927782

Cuevas-Vargas, H., Cortés-Palacios, H. A., and Lozano-García, J. J. (2022). Impact of capital structure and innovation on firm performance. Direct and indirect effects of capital structure. The 8th International Conference on Information Technology and Quantitative Management (ITQM 2020 & 2021). Dev. Glob. Digit. Econ. after COVID-19 199, 1082–1089. doi:10.1016/j.procs.2022.01.137

Du, W., and Li, M. (2021). The impact of land resource mismatch and land marketization on pollution emissions of industrial enterprises in China. J. Environ. Manag. 299, 113565. doi:10.1016/j.jenvman.2021.113565

Duan, H., Mo, J., Fan, Y., and Wang, S. (2018). Achieving China's energy and climate policy targets in 2030 under multiple uncertainties. Energy Econ. 70, 45–60. doi:10.1016/j.eneco.2017.12.022

Farhadi, M., Islam, M. R., and Moslehi, S. (2015). Economic freedom and productivity growth in resource-rich economies. World Dev. 72, 109–126. doi:10.1016/j.worlddev.2015.02.014

Gallego-Álvarez, I., Segura, L., and Martínez-Ferrero, J. (2015). Carbon emission reduction: The impact on the financial and operational performance of international companies. J. Clean. Prod. 103, 149–159. doi:10.1016/j.jclepro.2014.08.047

Ganda, F., and Milondzo, K. (2018). The impact of carbon emissions on corporate financial performance: Evidence from the South African firms. Sustainability 10 (7), 2398. doi:10.3390/su10072398

Gomez-Gonzalez, J. E., Hirs-Garzón, J., and Uribe, J. M. (2022). Interdependent capital structure choices and the macroeconomy. North Am. J. Econ. Finance 62, 101750. doi:10.1016/j.najef.2022.101750

Graham, J. R., Leary, M. T., and Roberts, M. R. (2015). A century of capital structure: The leveraging of corporate America. J. Financial Econ. 118 (3), 658–683. doi:10.1016/j.jfineco.2014.08.005

Griffin, P. A., Lont, D. H., and Sun, E. Y. (2017). The relevance to investors of greenhouse gas emission disclosures. Contemp. Acc. Res. 34 (2), 1265–1297. doi:10.1111/1911-3846.12298

Han, Y. L., Zhao, Z. X., and Shi, B. (2021). Financial development, monetary policy changes and enterprise investment efficiency—an empirical study based on the perspective of corporate financing constraints. Rev. Econ. Manag. (04), 30–43. [In Chinese]. doi:10.13962/j.cnki.37-1486/f.2021.04.003

Harris, M. N., Konya, L., and Matyas, L. (2002). Modelling the impact of environmental regulations on bilateral trade flows: OECD, 1990-1996. World Econ. 25 (3), 387–405. doi:10.1111/1467-9701.00438

Ho, S. (2015). Firm-value effects of carbon emissions and carbon disclosures. Soc. Environ. Account. J. 35 (2), 126–127. doi:10.1080/0969160X.2015.1068565

Hu, Y., Ren, S., Wang, Y., and Chen, X. (2020). Can carbon emission trading scheme achieve energy conservation and emission reduction? Evidence from the industrial sector in China. Energy Econ. 85, 104590. doi:10.1016/j.eneco.2019.104590

Jiang, T., Yu, Y., Jahanger, A., and Balsalobre-Lorente, D. (2022). Structural emissions reduction of China’s power and heating industry under the goal of “double carbon”: A perspective from input-output analysis. Sustain. Prod. Consum. 31, 346–356. doi:10.1016/j.spc.2022.03.003

Jung, J., Herbohn, K., and Clarkson, P. (2018). Carbon risk, carbon risk awareness and the cost of debt financing. J. Bus. Ethics 150 (4), 1151–1171. doi:10.1007/s10551-016-3207-6

Ke, J., Jahanger, A., Yang, B., Usman, M., and Ren, F. (2022). Digitalization, financial development, trade, and carbon emissions; implication of pollution haven hypothesis during globalization mode. Front. Environ. Sci. 10, 873880. doi:10.3389/fenvs.2022.873880Available at: https://www.frontiersin.org/articles/10.3389/fenvs.2022.873880.

Koiwanit, J., Riensuwarn, F., Palungpaiboon, P., and Pornchaloempong, P. (2020). Business viability and carbon footprint of Thai-grown nam dok mai mango powdered drink mix. J. Clean. Prod. 254 (2), 119991. doi:10.1016/j.jclepro.2020.119991

Krishnamurti, C., and Velayutham, E. (2018). The influence of board committee structures on voluntary disclosure of greenhouse gas emissions: Australian evidence. Pacific-Basin Finance J. 50, 65–81. doi:10.1016/j.pacfin.2017.09.003

Li, F., Zhang, D., Zhang, J., and Kou, G. (2022). Measuring the energy production and utilization efficiency of Chinese thermal power industry with the fixed-sum carbon emission constraint. Int. J. Prod. Econ. 252, 108571. doi:10.1016/j.ijpe.2022.108571

Li, L., and Islam, S. Z. (2019). Firm and industry specific determinants of capital structure: Evidence from the Australian market. Int. Rev. Econ. Finance 59, 425–437. doi:10.1016/j.iref.2018.10.007

Li, W., and Jia, Z. (2016). The impact of emission trading scheme and the ratio of free quota: A dynamic recursive cge model in China. Appl. Energy 174, 1–14. doi:10.1016/j.apenergy.2016.04.086

Lin, B., and Jia, Z. (2019). What will China's carbon emission trading market affect with only electricity sector involvement? A cge based study. Energy Econ. 78, 301–311. doi:10.1016/j.eneco.2018.11.030

Liu, X., and Zhang, X. (2021). Industrial agglomeration, technological innovation and carbon productivity: Evidence from China. Resour. Conserv. Recycl. 166, 105330. doi:10.1016/j.resconrec.2020.105330

Lu, C., Li, W., and Gao, S. (2020). Driving determinants and prospective prediction simulations on carbon emissions peak for China’s heavy chemical industry. J. Clean. Prod. 251, 119642. doi:10.1016/j.jclepro.2019.119642

Mackie-Mason, J. K. (1990). Do taxes affect corporate financing decisions? J. Finance 45 (5), 1471–1493. doi:10.1111/j.1540-6261.1990.tb03724.x

Nguyen, J. H. (2018). Carbon risk and firm performance: Evidence from a quasi-natural experiment. Aust. J. Manag. 43 (1), 65–90. doi:10.1177/0312896217709328

Nguyen, J. H., and Phan, H. V. (2020). Carbon risk and corporate capital structure. J. Corp. Finance 64, 101713. doi:10.1016/j.jcorpfin.2020.101713

Nguyen, J. H., Truong, C., and Zhang, B. (2020). The price of carbon risk: Evidence from the kyoto protocol ratification. SSRN Electron. J. doi:10.2139/ssrn.3669660

Orlova, S., Harper, J. T., and Sun, L. (2020). Determinants of capital structure complexity. J. Econ. Bus. 110, 105905. doi:10.1016/j.jeconbus.2020.105905

Pan, X., Teng, F., Ha, Y., and Wang, G. (2014). Equitable Access to Sustainable Development: Based on the comparative study of carbon emission rights allocation schemes. Appl. Energy 130, 632–640. doi:10.1016/j.apenergy.2014.03.072

Peters, R. H., and Taylor, L. A. (2017). Intangible capital and the investment-q relation. J. Financial Econ. 123 (2), 251–272. doi:10.1016/j.jfineco.2016.03.011

Phan, D. H. B., Tran, V. T., Ming, T. C., and Le, A. (2021). Carbon risk and corporate investment: A cross-country evidence. Finance Res. Lett. 46, 102376. doi:10.1016/j.frl.2021.102376

Pizer, W. A., and Zhang, X. (2018). China's new national carbon market. AEA Pap. Proc. 108, 463–467. doi:10.1257/pandp.20181029

Porter, M. E., and van der Linde, C. (1995). Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 9 (4), 97–118. doi:10.1257/jep.9.4.97

Ramli, N. A., Latan, H., and Solovida, G. T. (2019). Determinants of capital structure and firm financial performance—a PLS-SEM approach: Evidence from Malaysia and Indonesia. Q. Rev. Econ. Finance 71, 148–160. doi:10.1016/j.qref.2018.07.001

Richard, B., and Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. J. Econ. 87, 115–143. doi:10.1016/S0304-4076(98)00009-8

Topalova, P. (2010). Factor immobility and regional impacts of trade liberalization: Evidence on poverty from India. Am. Econ. J. Appl. Econ. 2 (4), 1–41. doi:10.1257/app.2.4.1

Usman, M., Balsalobre-Lorente, D., Jahanger, A., and Ahmad, P. (2022a). Pollution concern during globalization mode in financially resource-rich countries: Do financial development, natural resources, and renewable energy consumption matter? Renew. Energy 183, 90–102. doi:10.1016/j.renene.2021.10.067

Usman, M., Jahanger, A., Makhdum, M. S. A., Balsalobre-Lorente, D., and Bashir, A. (2022b). How do financial development, energy consumption, natural resources, and globalization affect arctic countries’ economic growth and environmental quality? An advanced panel data simulation. Energy 241, 122515. doi:10.1016/j.energy.2021.122515

Veith, S., Werner, J. R., and Zimmermann, J. (2009). Capital market response to emission rights returns: Evidence from the European power sector. Energy Econ. 31 (4), 605–613. doi:10.1016/j.eneco.2009.01.004

Velte, P., Stawinoga, M., and Lueg, R. (2020). Carbon performance and disclosure: A systematic review of governance-related determinants and financial consequences. J. Clean. Prod. 254, 120063. doi:10.1016/j.jclepro.2020.120063

Wang, L., Li, S., and Gao, S. (2014). Do greenhouse gas emissions affect financial performance? – an empirical examination of Australian public firms. Bus. Strategy Environ. 23 (8), 505–519. doi:10.1002/bse.1790

Wang, S., Wang, H., Wang, J., and Yang, F. (2020). Does environmental information disclosure contribute to improve firm financial performance? An examination of the underlying mechanism. Sci. Total Environ. 714, 136855. doi:10.1016/j.scitotenv.2020.136855

Yang, B., Gan, L., and Wen, C. (2021). Moral hazard, debt overhang and capital structure. North Am. J. Econ. Finance 58, 101538. doi:10.1016/j.najef.2021.101538

Yang, J., Shi, D., and Yang, W. (2022). Stringent environmental regulation and capital structure: The effect of NEPL on deleveraging the high polluting firms. Int. Rev. Econ. Finance 79, 643–656. doi:10.1016/j.iref.2022.02.020

Yildirim, R., Masih, M., and Bacha, O. I. (2018). Determinants of capital structure: Evidence from Shari’ah compliant and non-compliant firms. Pacific-Basin Finance J. 51, 198–219. doi:10.1016/j.pacfin.2018.06.008

Yin, G., Zhou, L., Duan, M., He, W., and Zhang, P. (2018). Impacts of carbon pricing and renewable electricity subsidy on direct cost of electricity generation: A case study of China's provincial power sector. J. Clean. Prod. 205, 375–387. doi:10.1016/j.jclepro.2018.09.108

Zeng, H. J., and Su, D. W. (2010). Credit policy and corporate capital structure. J. World Econ. (08), 17–42. [In Chinese].

Zhang N, N., Zhou, P., and Kung, C.-C. (2015). Total-factor carbon emission performance of the Chinese transportation industry: A bootstrapped non-radial malmquist index analysis. Renew. Sustain. Energy Rev. 41, 584–593. doi:10.1016/j.rser.2014.08.076

Zhang, T., and Xie, L. (2020). The protected polluters: Empirical evidence from the national environmental information disclosure program in China. J. Clean. Prod. 258, 120343. doi:10.1016/j.jclepro.2020.120343

Zhang Y, Y.-J., Wang, A.-D., and Tan, W. (2015). The impact of China's carbon allowance allocation rules on the product prices and emission reduction behaviors of ETS-covered enterprises. Energy Policy 86, 176–185. doi:10.1016/j.enpol.2015.07.004

Zhang, Y., Wu, C., Gu, N., and Yu, Y. (2022). The robustness of low-carbon policies during China’s electricity reform. Energy Econ. 111, 106037. doi:10.1016/j.eneco.2022.106037

Keywords: carbon constraint, power enterprises, quasi-natural experiment, capital structure, DID and sys-GMM models

Citation: Han MX, Guo ZX, Dang YJ and Long TZ (2023) Examining the impact of carbon constraints on the capital structure of Chinese power enterprises. Front. Energy Res. 10:1011322. doi: 10.3389/fenrg.2022.1011322

Received: 04 August 2022; Accepted: 31 October 2022;

Published: 25 January 2023.

Edited by:

Daniel Balsalobre-Lorente, University of Castilla-La Mancha, SpainCopyright © 2023 Han, Guo, Dang and Long. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Tang Zhan Long, bG9uZ3Rhbmd6aGFuMjAyMkAxNjMuY29t

Ming Xue Han1

Ming Xue Han1 Zi Xin Guo

Zi Xin Guo Tang Zhan Long

Tang Zhan Long